Using the Post Office Travel Money Card: Pros and Cons

Table of Contents

What is the post office travel money card, pros of the post office travel money card, cons of the post office travel money card, user experiences and reviews, how to get and use the card, best practices for cardholders, alternatives to the post office travel money card.

T he Post Office Travel Money Card is a convenient and secure way for UK residents to manage their finances while traveling abroad. This prepaid card allows travelers to load funds in multiple currencies, offering a practical alternative to carrying cash or using credit cards overseas. It’s particularly popular among those who seek a controlled and budget-friendly travel spending method.

The Post Office Travel Money Card is a prepaid, multi-currency card that can be loaded with up to 23 different currencies. It functions similarly to a debit card but is specifically designed for international travel. The card can be used to make purchases at millions of locations worldwide where MasterCard is accepted and to withdraw money from ATMs.

- Convenience and Ease of Use : The card is straightforward to obtain and use. Travelers can easily load funds onto the card online or at a Post Office branch.

- Security Features : The card is not linked to a bank account, reducing the risk of fraud. Additionally, if lost or stolen, it can be easily replaced.

- Wide Acceptance : Being a MasterCard product, it’s accepted at a vast number of outlets and ATMs worldwide.

- Currency Exchange Rates : Users benefit from competitive exchange rates compared to traditional currency exchange services.

- Budget Control : The prepaid nature allows travelers to manage their spending effectively, avoiding the risk of debt.

- Fees and Charges : Although the card offers free purchases, there are fees for certain transactions, such as ATM withdrawals and inactivity.

- Limitations in Usage : Some countries and establishments may not accept the card, limiting its utility in certain situations.

- Reloading Issues : Adding more funds to the card can be less straightforward, especially in remote areas or during non-business hours.

- Customer Service Concerns : Some users have reported issues with customer service, particularly in resolving card-related problems quickly.

- Comparison with Other Travel Money Options : While the card has many benefits, it may not always be the best option compared to other travel money products, like credit cards with no foreign transaction fees.

Feedback from users generally highlights the convenience and security of the card. However, some have noted the fees and reloading issues as drawbacks. It’s essential to consider both the positive and negative aspects to make an informed decision.

Obtaining the card is a simple process, either online or at a Post Office branch. Users need to load the card with the desired amount and can start using it immediately. For reloading, options include online transfers or visiting a Post Office.

To maximize the benefits of the card:

- Keep track of spending and remaining balance.

- Be aware of the fees for different transactions.

- Have an alternative payment method as a backup.

Other options include other brands of travel money cards, credit cards with no foreign transaction fees, and traditional cash exchange. Each has its pros and cons, depending on individual travel needs and spending habits.

The Post Office Travel Money Card is a valuable tool for travelers seeking a secure and convenient way to manage their funds abroad. While it has several advantages, potential users should also be aware of its limitations and fees.

Q: How does the Post Office Travel Money Card work? A: It’s a prepaid card that you load with currency before traveling. You can use it for purchases and ATM withdrawals anywhere MasterCard is accepted.

Q: Are there any fees associated with the card? A: Yes, there are fees for certain transactions like ATM withdrawals, and there may be inactivity fees if the card is not used for a prolonged period.

Q: How do I load money onto the card? A: You can load money online or at any Post Office branch. The process is simple and can be done in multiple currencies.

Q: What should I do if my card is lost or stolen? A: Contact the Post Office immediately to report the lost or stolen card. They will arrange for a replacement and transfer the balance from the old card.

Q: Can I use the card in any country? A: The card is accepted in most countries worldwide. However, it’s always best to check the specific country’s acceptance before traveling.

Q: How does the card compare to using a regular debit or credit card abroad? A: Unlike regular cards, the Travel Money Card is prepaid, which helps in budget management. However, some regular cards might offer better exchange rates or lower fees, so it’s worth comparing options.

Q: Is the Post Office Travel Money Card a good option for all travelers? A: It depends on individual needs. The card is excellent for those who want a secure, budget-friendly way to carry money abroad. However, for those who travel frequently or to less common destinations, other options might be more suitable.

Related Posts

Expert Tips for Managing Hays Travel Money Effectively

Navigating TUI Travel Money for Better Holiday Finance

John Lewis Travel Money: Convenience and Value Combined

Marks & Spencer Travel Money : Maximizing Value with M&S Travel Money on Your Trips

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

create unique & memorable travel experiences with VOLodge

About volodge.

1325 Derry Rd E Suite 3, 2nd Floor, Mississauga, ON L5S 0A2, Canada

Sign up for the exclusive offers and best deals from us

© 2023 | VOLodge.com | All Rights Reserved

Post Office Travel Card Review

Travelling is one of the most exciting and liberating experiences out there. Whether you’re jetting off to a far-off destination or just exploring your own country, having the right travel card can make the whole experience easier and more enjoyable.

Are you planning a trip? If so, you may be wondering if the Post Office Travel Money Card is a good option for you. In this article, we’ll take a close look at the Post Office Travel Money Card, how it works, and what you need to know before using it.

By the end of this guide, you’ll have all the information you need to make an informed decision about whether or not the Post Office Travel Money Card is right for your next trip.

Table of Contents

Benefits of Having a Travel Card

First and foremost, travel cards are an excellent way to earn miles and points. This can be incredibly valuable if you are a frequent traveller or want to visit somewhere far off where you’ll have to pay high airfare. Plus, you can use these miles and points to book travel, hotels, flights, vacation packages, and more.

Another major advantage of travel cards is their versatility. As you travel, you’ll have the ability to withdraw cash from ATMs using your card, pay for purchases using your card, and even get roadside assistance on select cards. You’ll also have access to excellent trip cancellation and travel insurance.

Plus, travel cards are typically easier to qualify for than other types of credit cards. This is because many companies view travel cards as a “safe” type of credit. However, having a travel card can also help to improve your credit score.

Post Office Travel Cards: What Are They?

The Post Office Travel card is a Mastercard prepaid card, which can be loaded with a choice of 23 currencies. ATMs are available in more than 200 countries where you can spend and withdraw money.

You can load your account with any currency before travelling and then use it abroad without having to convert your currency.

Post Office Travel offers a contactless card that can be accessed through its app.

Post Office Travel Cards Benefits and Features

Here’s a quick look at the Post Office Travel card’s main features and benefits:

- Payments for low-value items can be made quickly and conveniently using contactless technology

- Compatible with Apple Pay and Google Pay

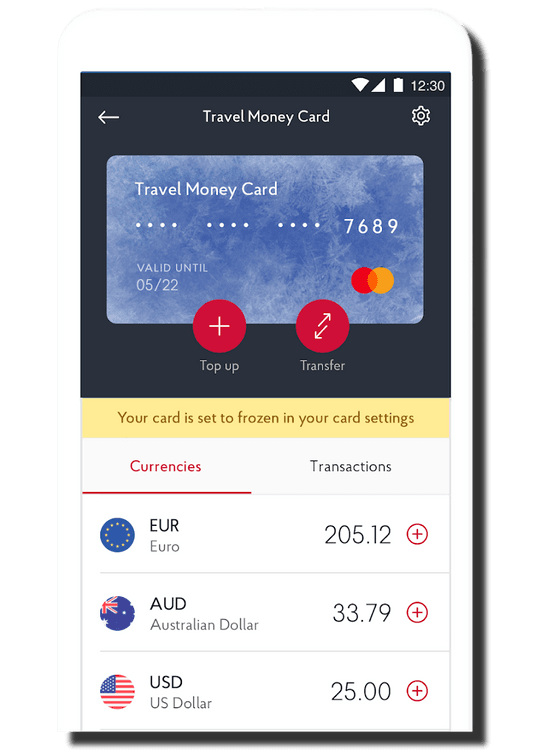

- With the Travel app, you can manage your card, top it up, transfer currencies, as well as freeze it.

- You can choose from 23 different currencies and top it up whenever you need it

- Accepted everywhere Mastercard is accepted

- Call centre assistance is available 24/7

- Whenever there is currency left over, it can be transferred into another currency by using the wallet-to-wallet feature

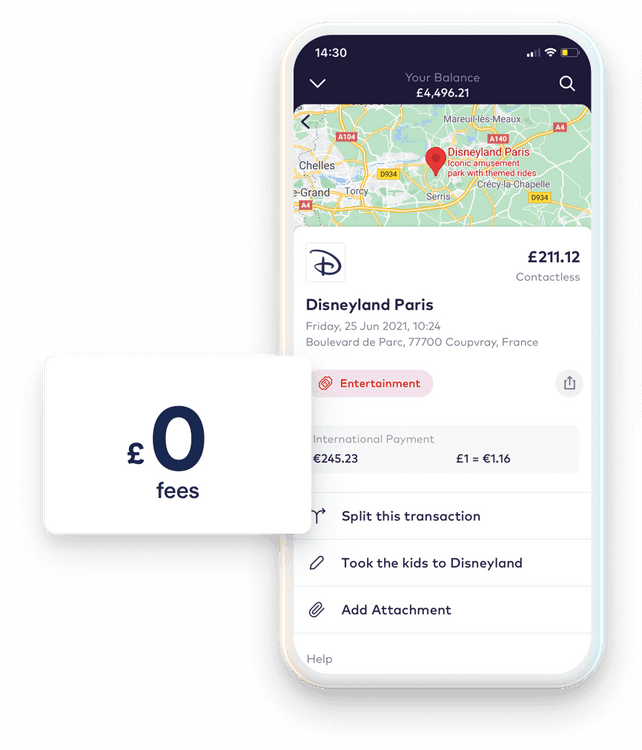

- If you use a local currency supported by your card to spend abroad, there are no fees

Post Office Travel Card Costs

Travel money cards from the Post Office cost nothing to order and no fees apply when you pay for purchases using the currency you hold. Provided your available balance is in a currency accepted by the card, you can shop, dine, and drink without any charges.

When using your card in a country that doesn’t support the currency of your card, you will have to pay a 3% foreign transaction fee. Using your card in Brazil, for example, will result in a 3% foreign transaction fee since the Brazilian Real isn’t a supported currency.

Despite the card’s currency support, you’ll still have to pay ATM withdrawal fees. Each currency has a different ATM fee.

An example would be:

- Euro – 2 Euros

- Canadian Dollar – 3 Canadian Dollars

- US Dollar – 2.5 United States Dollars

- Swiss Franc – 2.5 Switzerland Francs

- Australian Dollar – 3 Australian Dollars

- Pound Sterling – 1.5 Pounds Sterling plus 1.5% commission

Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Exchange Rates

Exchange rates fluctuate based on the demand for currencies at the Post Office. Thus, you’ll receive a particular amount of travel money depending on the current exchange rate.

For travel money cards, you can get exchange rates at Post Office branches and on the website. Be sure to remember that rates may differ whether you are purchasing online, by phone, or in person.

In addition to the margin, the exchange rate at the Post Office will probably include a markup. When you search for the rate on Google or currency websites, you’ll most likely get an accurate one. Consequently, a margin will reduce the amount you receive when exchanging EUR, USD, or another currency.

A Post Office Travel Money company profits by offering its customers a better rate than the base rate. U.K. pounds are converted into U.S. dollars at a rate of 1.23 dollars per pound, for example.

If you exchange £400 through Post Office Travel Money, you can get 1.18 USD per pound. In this case, there is a difference of £16 or 4%. Exchange rates are better when you exchange large sums of money .

Exchange Rates for In-Branch Travel Money

According to the Post Office, in-branch exchange rates are determined by many factors, including branch location, competitor pricing, convenience, etc. The company will always strive to offer the best possible rate within these parameters. Online orders/distribution is the cheapest method for many retailers, as they can use centralised packing costs. Because of this, online exchange rates are always better than branch rates.

Comparing Post Office Travel Money Rates to Other Providers

There are several new services that it’s worth comparing directly to Post Office Travel Money.

Online-Only Banks

There have been several purely mobile banks launched in recent years both in the UK and across Europe. With services like Monzo, N26, Revolut, Monese, or Bunq, consumers can access a wide range of banking options.

Each of these modern financial institutions provides services such as money transfer agencies and international travel cards, and it makes sense to compare them with Post Office Travel Money.

For example, Monzo facilitates international money transfers through the popular exchange company Wise. For example, when sending a thousand pounds to a Swedish account using Monzo/Wise, the recipient receives 12,103 Swedish crowns versus 11,546 with Western Union, a difference of around 5%.

Other Currency Providers

It may also be possible to transfer money at a better rate in some countries. Using Xendpay, you could send 500 pounds to Saudi Arabia, and the beneficiary would receive 2,289 Saudi Riyals instead of 2,158 Saudi Riyals with Post Office Travel Money.

Supported Currencies

Prepaid travel cards from Post Office can be loaded with any of the following 23 currencies:

- CAD – Canadian dollar

- JPY – Japanese yen

- USD – US dollar

- AUD – Australian dollar

- CHF – Swiss franc

- AED – UAE dirham

- CNY – Chinese yuan

- DKK – Danish kroner

- PLN – Polish zloty

- CZK – Czech koruna

- ZAR – South African rand

- GBP – Pound sterling

- TRY – Turkish lira

- HKD – Hong Kong dollar

- THB – Thai baht

- HRK – Croatian kuna

- SGD – Singapore dollar

- HUF – Hungarian forint

- SEK – Swedish kronor

- SAR – Saudi riyal

- NOK – Norwegian krone

- NZD – New Zealand dollar

Sending Money With the UK Post Office

Many Post Office branches and their website offer Post Office Travel Money. They offer convenient and quick foreign exchange services. They are useful for local currency exchanges because they are so widely available. Post Office services like international money transfers and travel cards offer additional options for sending and spending overseas.

How to Get and Use a Post Office Travel Card?

Post Office travel cards are only available to UK residents over 18 years old.

Ordering Your Card

To order a Post Office Travel card, you can do one of three things:

- You can order through the Post Office Travel app

- Visit the Post Office website to apply online

- Get your card at your local Post Office. It will be necessary to bring photo identification, like a passport or driver’s licence

Your card should be available immediately if you apply at a branch. Your card will be delivered within two to three days after you apply online or via the app.

Card Activation

It’s necessary to activate your travel card before you can use it. You’ll find detailed instructions in your welcome letter.

Using Your Card

ATMs and online sites that accept MasterCard accept Post Office travel cards, too. If you are buying something in person, you’ll need your PIN to verify your purchase and possibly your signature if the Chip and PIN system is not widely available in the country.

In some countries, contactless payments are also allowed for small amounts, although the rules and limitations vary.

According to its terms and conditions, you should not use your Post Office card in certain situations.

Some of them include:

- Tolls on the road

- Petrol pumps with self-service

- Deposits for car rentals or hotels

- Airline or cruise ship transactions

Adding Money to Your Card

With the Post Office Travel app, you can add money to your card easily. Additionally, you can add money at a local branch or on the Post Office website.

Buying Back Currencies

Having unused currency on your card gives you a few options. You may be able to withdraw cash at your local Post Office branch or ATM, but there may be a fee.

Wallet-to-wallet transfers are also available in the app. You can transfer unused balances from one currency to another. In preparation for your next trip to Europe, you can convert unused USD into EUR.

Each currency listed above can be topped up for between fifty pounds and five thousand pounds on your card. Your card can hold up to ten thousand pounds, as well as carry out transactions of up to thirty thousand pounds annually.

Different currencies have different limitations on cash withdrawals. For example, in a single transaction, you may withdraw up to 450 euros or 500 dollars.

App Overview

On Google Play and the App Store, you can download the Post Office Travel app for free. With the app, you can activate and order your card, check your balance, add money to it, and more.

In addition to transferring leftover currency between wallets, it’s possible to convert it to another currency you prefer by using the new wallet-to-wallet feature.

Furthermore, you can book airport parking, purchase travel insurance through the app, and use other features.

Contacting the Post Office

If you need assistance, you may reach the contact centre by dialling 0344 335 0109 in the United Kingdom or 0044 20 7937 0280 from abroad. Customer service is available each day of the week at any time of the day.

In addition, you can reach Customer Services at the Post Office in the following ways:

- Postal mail at PO Box 3232, Cumbernauld, G67 1YU, Post Office Travel Card

- Send an email to [email protected]

Post Office Travel Card: FAQs

Here are some common travel card problems you might encounter.

When I lose or damage a card, what do I do?

Post Office currency cards are easy to replace if lost or damaged. Your card will be blocked, and another one will be sent to you. App users can also freeze their cards.

How should I deal with a declined or blocked card?

The first thing you need to do is ensure that you have enough money in your account via the app. If you don’t have enough money in your account to purchase your item, call the customer care centre.

If I forget my PIN, what should I do?

Call the customer service centre if you cannot remember your travel money card PIN. If you need a new one, they can issue it for you.

My card is about to expire. What should I do?

A new card should automatically be sent to you. You can call the contact centre if it hasn’t arrived after the expiration date, and they’ll issue you another.

Post Office Prepaid Travel Card Summary

Travel cards from the Post Office are handy if you want to keep your money safe while you’re away from home. The convenience of not carrying cash around with you and not having to change money during your trip will make your trip much more enjoyable.

Because it’s a contactless card, you can pay in local currencies quickly and easily. This helps you budget because you can only spend what’s on it.

If you travel frequently or take multi-destination holidays, the card is convenient since you can store 23 currencies on it. A card that supports a variety of currencies might be more useful if you love exploring far-flung areas.

The exchange rate is a drawback to take into account. Post Office rates may be competitive (compared to airport exchange rates, for example), but they will likely include a margin or markup. ATMs also charge fees when you use your card.

Comparing other travel money cards could help you find a better deal, so make sure to shop around.

by Matt Woodley

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Post Office Travel Card review

The Post Office Travel Card is a prepaid travel card you can load in cash or online, to switch to the currency you need for spending and withdrawals. It’s not linked to your regular bank account, and can be managed from your smartphone, for secure spending across 23 currencies.

Before you order a Post Office Travel Card check out this full review - we’ll look at what the card can do , how to order your card and how much it’ll cost .

And to help you compare we’ll also touch on Post Office Travel Card alternatives like Wise and Starling, which may offer cheaper and more flexible options for taking travel money abroad.

TL;DR - it's a solid prepaid card

- The card supports most major currencies for holidays, including Euros (Europe), Lira (Turkey) and UAE Dirhams (Dubai)

- Several top-up methods , with the option of doing so online or in-store

- Only convert what you want to spend; good for holiday budgeting

However, there are some downsides.

- There are better exchange rates available with other travel cards

- You'll get a worse exchange rate (a.k.a "buy-back rates") when converting leftover foreign currency to pounds

Find out more about the card on the Post Office website or click the button below to purchase a card. Order a card

Not sure yet? Continue reading to decide whether this is the right prepaid card for you.

What's in this guide?

What is the post office travel money card, how does it work.

- Fees & limits

How do I get a Post Office Travel Money Card?

What happens when the card expires, what are the alternatives.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies.

Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There’s no fee to spend currencies you hold on your card, although other transaction fees do apply depending on how you use the account.

Use your Post Office card to buy travel money before you head off on holiday, or top up as you go online.

As pictured, you can also manage, view and freeze your card in the Post Office app for security.

- Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies

- If you choose to top up in GBP and convert later, you’ll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP

- Exchange rates are shown in the Post Office app, and may include a markup on the market exchange rate - but rates often improve if you top up more

- It’s free to spend currencies you hold. You can also spend unsupported currencies, but a foreign transaction fee of 3% will apply

It’s worth noting that the Post Office exchange rates are shown in the Post Office app before you convert your funds. They may include a markup, which is an extra fee added into the rate applied to switch to the currency you need.

Another thing worth noting is that the exchange rate gets better for higher top up amounts - meaning you’ll pay a smaller markup the more you add to your card.

Using a markup is pretty common but does make it tricky to see what you’re really paying for your foreign currency transactions.

Spending limits and card fees

Before you order a Post Office Travel Card it’s good to know a bit about the fees and limits that apply to card usage.

When you transact with your Post Office Travel Money Card, there are also fees to pay.

While these do vary slightly by currency, they’re roughly similar.

It’s easy to get your Post Office Travel Card online or in person by calling into a Post Office near you. Here’s what you’ll need to do.

- Head to the Post Office website

- Select "Order Your Card >"

- Top up in your preferred currency - there’s a minimum top up of 50 GBP, through to a maximum of 5,000 GBP

- Input personal details following the prompts

- Delivery of your card will take 2-3 days by post

- Head to your local Post Office branch

- Show a valid form of ID (driving licence, passport or EEA ID card)

- Apply in branch and load your card

The expiry date for your card will be printed on the back of the card - usually it’s valid for 3 years from the point you order it.

Once your card has expired you’ll pay a monthly inactivity fee of £2 per month if you don’t redeem your balance within 12 months of the card expiring. This fee continues until there’s no remaining balance, at which point your account will be closed.

If you’re not sure whether the Post Office Card is right for you, check out a few alternatives to see which gives you the best balance of cost and convenience.

The Wise card allows you to hold and exchange 50+ currencies, and spend in 170+ countries. It's a fully-fledged debit card, meaning it works at home just as well as it does abroad.

There’s no markup on the exchange rate, and they are super transparent about the fees (usually around 0.4% for foreign spending) they'll charge you.

Starling card

The Starling debit card is a good option for international spending as there are no foreign transaction fees and no ATM fees .

You can sign up entirely online for an account with no monthly fees which you can manage from your phone, with instant notifications and a whole range of banking features. Get a Starling Card

Frequently Asked Questions

Post Office is a trusted institution and will keep customer funds safe according to all applicable legal requirements.

When it comes to travel money, the Post Office works in partnership with First Rate Exchange Services, which is a registered business and holds a Money Services Business License in the UK.

You can hold up to 23 different currencies:

- Australian dollars

- Canadian dollars

- New Zealand dollars

- Croatian kuna

- Turkish lira

- South African rand

- Swiss francs

- Polish zloty

- Pounds sterling

- Chinese yuan

- Czech koruna

- Danish kroner

- Hong Kong dollars

- Hungarian forint

- Japanese yen

- Norwegian krone

- Saudi riyal

- Singapore dollar

- Swedish kronor

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Help & Support

- Travel Insurance - FAQs

Help and support Travel Insurance FAQs

Common questions about our cover and optional add-ons.

- About our travel insurance

- Flight cancellations, delays and missed departures

- Medical Assistance Plus and Flight Delay Assistance Plus

- Gadget Cover optional add-on

- Claims, cancellations, renewals and complaints

Buying travel insurance

Can i buy travel insurance at my local post office branch.

Yes, you can buy our travel insurance at over 3,800 Post Office branches. If your nearest branch can’t issue travel insurance, you can buy travel cover online . Or call 0330 123 3690 (1)

I don't live in the UK. Can I take out a Post Office Travel Insurance policy?

We’re sorry, but no. Our policies cover UK residents only (including those in the Channel Islands and Isle of Man).

My partner and I live at separate addresses. Can we still buy family cover?

Family cover is available on Post Office Travel Insurance single-trip and annual multi-trip policies.

It covers a person and their husband, wife, civil partner or Common Law Partner (who must be residing with them). It also covers any dependent, adopted or fostered children or grandchildren aged under 18.

Family cover is not available on our backpacker policies.

Is there an age limit for single-trip and annual multi-trip travel insurance policies?

There’s no upper age limit for single-trip policies. For annul multi-trip policies you need to be 75 or under.

Is there an age limit for backpacker travel insurance policies?

Yes, you must be aged between 18 and 60 years of age when your policy starts.

Backpacker policies are only available on our economy level cover.

Covid-19 cover and trip durations

Does post office travel insurance include coronavirus cover.

All new Post Office Travel Insurance policies include a degree of cover against Covid-19 related disruptions, such as cancellation, curtailment and medical costs in some circumstances.

You can find out more about what's covered for coronavirus on our policies on our travel insurance Covid-19 FAQs page.

We also offer a trip disruption cover option that provides protection in other scenarios. These include missed departures or changes in testing and quarantine rules.

How long can I travel for on my Post Office Travel Insurance policy?

It depends on the level of cover.

Policies sold from 31 March 2022 to 27 March 2024

Single-trip travel insurance covers you for trips of up to:

- 365 days (for persons aged up to and including 70 years)

- 90 days (aged 71 to 75)

- 31 days (aged 76 and above).

Annual multi-trip policies cover you for:

- 17 days per trip (with economy and standard cover levels)

- 31 days per trip (premier cover).

If you pay the appropriate extra premium, this can be extended to:

- 31, 45 or 60 days (economy, standard)

- 45 or 60 days (premier)

You can take as many trips as you like as long as you’re not away for more than 183 days in the policy year.

Our backpacker travel insurance policy covers you for trips lasting anything from 31 days to 18 months.

Policies sold from 28 March 2024

Trip durations for policies sold from 28 March 2024 are the same as for those sold before that date.

The maximum trip duration annual multi-trip policies will cover is 31 days. This can be extended to 45 or 60 days with optional trip extension upgrades.

How long must a UK trip be to be covered by my travel insurance?

For your Post Office Travel Insurance policy to cover you for trips in England, Scotland, Wales or Northern Ireland, the following rules apply.

- For multi-trip policies, 1 nights’ pre-booked accommodation must be in place, and can’t be a stay with family or friends, or your stay must be at least 100 miles from your home, or you must have at least 1 sea crossing

For example, if you fly from Scotland to Cornwall to stay with friends and family in their home or second home and your baggage was lost or damaged on the way it wouldn’t be covered. Similarly, if you have a second home of your own this doesn’t class as pre-booked.

This doesn’t apply to trips taken overseas, outside your country of residence.

Having flight problems?

This section covers flight disruptions that are not related to Covid-19. If your question relates to the impact of coronavirus on your trip and whether it’s covered, please check our travel insurance Covid-19 FAQs .

Are flight cancellations covered on my policy?

There’s no cover for flight cancellation on your Post Office Travel Insurance policy if you have not already started your trip. If the airline cancels your flight before you arrive at your departure point you should always discuss this with your airline or travel provider to see what options are available to you.

Regulation EU261

This is a regulation that protects passengers in the event of inconvenience caused by long flight delays or cancellations of European flights. It allows up to £520 compensation per passenger in the event of such disruptions.

Entitlements are only in force if the delay or cancellation is within the airline’s control and has not been deemed an “extraordinary circumstance.”

However, if you’re delayed at the airport on your outbound or inbound journey, several of our cover levels provide cover for the delay, any missed departure it causes and, if the delay is of a longer duration, abandoning your trip if you decide to do so. Please read the answers below for details.

What flight delay scenarios aren’t covered?

We will be unable to process claims for delayed flights if:

- You don’t arrive at your departure point in the recommended time for your scheduled departure

- You claim for delays having already made a claim for missed departure

- You’ve travelled against a non-essential travel advisory from the FCDO – and the cause of the delay is related to that advice

- You claim for a delay less than 4 hours

- You haven’t provided written confirmation from your travel provider of the duration of and reason for the delay

- You were aware of the strike/industrial action (or any other listed peril) prior to buying your travel insurance policy or booking your trip

- You haven’t provided any written confirmation of the vehicle breakdown/traffic delays

While at the airport my departure from the UK was delayed. Is that covered?

If you bought our standard, premier, max or extra cover levels, you’re covered if you arrive at the airport and your flight is delayed due to one of the following – including if this will impact a further connecting flight or flights to your final destination:

- Industrial action

- Bad weather not including anything listed as a natural catastrophe

- Technical fault of transportation including bird strikes

- Shortage of crew

If a flight you’re booked on is delayed for 4 hours or more for one of these reasons and you have a standard, premier, max or extra policy, you can claim for each 4-hour delay, up to a maximum of 12 hours, upon your return to the UK. Please check the policy wording for the delay benefit amount depending on the level of cover chosen.

If it’s a premier policy, you can also make use of Flight Delay Assistance Plus if you’ve registered for it. This means that, upon a delay of 1 hour or more, you can receive either a lounge access voucher or a £25 payment into your PayPal account. (For policies sold from 31 March 2022 to 27 March 2024 the amount was £50.)

All flights must be registered in advance. Please check your emails for confirmation and the link/web address needed to register your flights.

You must plan to leave enough time between arriving at your connection point and departing for the next leg of your journey, which should be at least the minimum time recommended for transfer by your transport provider.

If your flight delay totals 12 or more hours and you abandon your trip you can make a claim – see the question on abandoning your trip below.

What if delayed departure leads to me abandoning my trip?

If you’re a standard, premier, extra or max policy holder, we provide abandonment cover if you arrive at the airport and your flight is delayed by 12 hours or more due to:

If that happens, and you aren’t offered an alternative flight within 12 hours or provided with a refund, and you hold one of the cover levels listed, then cover is provided for your unused travel and accommodation costs.

This policy is designed to provide a refund of your unused travel and accommodation costs, at the point we are satisfied that these expenses cannot be refunded elsewhere. If your trip has been booked or paid for via one or more of the following, you must contact them to discuss a refund before claiming from us: a tour operator; an airline; any other travel, accommodation, or service provider; a credit or debit card provider or other payment providers such as PayPal.

There is no cover for delay or abandonment for trips taken solely within the UK

Am I covered if I miss a departure from the UK?

If you have our Standard, Premier, Extra or Max level cover and are delayed on your way to your departure point in the UK due to one of the following reasons, and this causes you to miss your pre-booked transportation (such as an outbound flight), we’ll cover it:

Delay or cancellation of public transport due to:

- Bad weather not including anything listed as a natural catastrophe

- The vehicle you are travelling in is involved in an accident, breaks down, or is delayed by an incident that causes traffic jams or road closures

- The flight you are travelling on is diverted

Please note: Public transport includes flights

You’ll be covered up to the sum insured for either additional travel and accommodation costs to get you to your destination. Or, if the only reasonable alternative transport means you’ll lose more than 50% of your trip, you can claim for unused travel and accommodation costs.

Am I covered for travel delay outside of the UK?

You are at the airport abroad, and there is a delay in your flight leaving to return to the UK.

On Standard, Premier, Extra and Max policies, there’s cover if you arrive at the airport abroad and your flight back to the UK is delayed or cancelled due to:

- Mechanical fault of transportation including bird strikes

If you’re delayed by at least 24 hours beyond your original return date, there is cover for additional transport costs to return you home when these aren’t paid for by your travel provider, up to the limit for your level of cover.

We’ll pay a delay benefit for each full 4-hour delay up to a maximum of 12 hours for the sum insured for your level of cover.

If your trip has been booked or paid for via one or more of the following, you must contact them to discuss a refund before claiming from us: a tour operator; an airline; any other travel, accommodation, or service provider; a credit or debit card provider or other payment providers such as PayPal.

Am I covered if I miss a departure from outside the UK?

What if you are delayed on your way to the airport abroad and miss your pre-booked return flight home, or you have no travel documents and are delayed in obtaining them, so are unable to make your flight?

If you are delayed on your way to the airport and subsequently miss your return flight home, stranding you abroad, for Standard, Premier, Extra and Max policy holders, we provide cover for delay or cancellation of public transport due to:

We’ll also cover if you’re delayed travelling home if:

- The vehicle you’re travelling in is involved in an accident, breaks down or is delayed by an incident that causes traffic jams or road closures

- Your flight gets diverted

- Your travel documents are lost or stolen while you’re outside the UK

Please note: Public transport includes flights

You’re also covered if you arrive at the airport and a delay to your flight for one of these reasons will impact a further connecting flight/s to return back home to the UK.

You must have a pre-booked return journey for cover to apply. And you must plan to leave enough time between arriving at your connection point and departing for the next leg of your journey, which should be at least the minimum time recommended for transfer by your transport provider.

Medical Assistance Plus

Does my policy include medical assistance plus.

If you bought your Post Office Travel Insurance on or after 3 July 2023 it includes Medical Assistance Plus.

How much does Medical Assistance Plus cost?

Nothing. Medical Assistance Plus is included in all policies sold from the 3 July 2023, no matter the type or level of Post Office Travel Insurance you’ve purchased. It applies whether you bought your insurance on the Post Office website, in branch, via our contact centre, on the app, or even through a comparison website.

How do I access the Medical Assistance Plus service?

Within 48 hours we'll send you an email with a unique link to launch the service. This has all of your details. Just enter your date or birth to validate and the service will launch for you.

If you’re traveling within 48 hours of purchase you can launch the service directly from our Medical Assistance Plus page on the Post Office website, then choose to continue in browser or open in app on your mobile device.

As an extra reminder, we’ll also send you a reminder SMS message the day before you travel (for single-trip and backpacker insurance) or the day before your start date of your policy (for annual multi-trip insurance). This will include links to launch the Medical Assistance Plus service.

What illnesses and situations can I use Medical Assistance Plus for?

Medical Assistance Plus is for outpatient medical care only. This includes any non-emergency medical services, including:

- GP (general Practitioner)

- Orthopaedist

- Paediatrician

- Gynaecologist

If an online or in-person consultation concludes that in-patient care is required, your medical case will then be handed over to the Emergency Medical team in the UK to be managed for wherever you are.

When shouldn’t I use the Medical Assistance Plus service?

If you require immediate emergency care, you should go directly to a hospital or an emergency clinic.

You can get further support by calling our emergency medical assistance line any time, 24/7.

If your policy number starts with TA or TC call 0208 865 3074 . If you’re calling from abroad dial 44 in place of the first zero.

There is no cover for trips taken within the UK.

Are there any limitations to the service?

This service is not available for trips taken in the UK, only for international travel. The service allows up to 3 separate medical events per person and for each medical event up to 3 appointments per person listed on the policy.

I’m having trouble registering my policy for the service. What should I do?

If you’re having difficulty registering your policy, please check:

- Your policy number is entered correctly

- You’ve entered all the verification details needed

If you’re still having trouble, please go to the “Contact us” section in the app. Here you can get help from our customer care team.

How can I contact Medical Assistance Plus customer support?

The customer care team is available 24 hours a day, 7 days per week, 365 days per year and offers multi-lingual support.

The customer care team can provide assistance via phone, email, WhatsApp, and live chat – available online or via app.

What languages can I receive my medical care in?

The global network has over 20,000 doctors in 75 countries, including the most popular destinations such as the US, UK, France, Germany, Italy, China, Japan, Canada, India, Australia, New Zealand, Israel, Thailand, and Nepal.

The doctors in the network speak a wide range of languages, so travellers can find one locally who speaks either their native language or one in which they are comfortable conducting a consultation.

When browsing for doctors in the app, simply filter your search by your preferred language. When scheduling video consultations, you can also select your preferred language when you make the appointment request.

If you’re unable to find a doctor who speaks your preferred language, please head to the “Contact Us” section in the app to get assistance from our customer care team.

Will I have to pay for any support or treatment I receive while I'm away?

No, Medical Assistance Plus is covered by your Post Office Travel Insurance policy. There are no upfront fees or extra payments required. You automatically get access to Medical Assistance Plus, no matter what type or level of insurance you’ve purchased from us. All appointment charges are covered by your travel insurance policy under Medical Assistance Plus. You won’t need to pay any excess fees for this service. For any online appointments or where the appointment was held at your accommodation, where a prescription is issued, you’ll need to pay for any medication and claim upon your return home.

No excess will be applied for any prescription charges. If your appointment takes place at a clinic and they have a dispensing chemist, you won’t need to pay for your prescription and all charges will be covered by your policy at the point of appointment.

If there’s no dispensing chemist at the clinic, you’ll either be given a prescription or the prescription will be sent to a chemist by the treating doctor and you’ll need to pay for any medication and claim upon your return home.

If your medical situation needs to be handed over from an outpatient case to an inpatient case and requires hospital admission, you will be handed over to our emergency medical assistance team in the UK. For any inpatient cases, no excess will apply.

Is my electronic prescription valid anywhere in the world?

You’ll be able to check with your doctor if they can prescribe a valid prescription in your current location. Make sure with the selected doctor before your consultation if they can provide a prescription based on your electronic prescription.

There’s no cover for trips made in the UK and you should see your GP practise you’re registered with in the UK for any appointments or prescriptions.

Flight Delay Assistance Plus

Registering your flights, how do i register a flight.

We'll send you an email with details of how to register for the service online as soon as you buy our premier travel insurance. If you arranged your policy in a Post Office branch or don't have an email address, all the information you need will be in your policy confirmation pack.

To register your flight you’ll need to set up self-service for your account and add your flight details there.

Can all flights be registered?

Flight Delay Assistance Plus is built to track almost all major commercial airline flights, but there are limitations against airlines/airports that do not report data regularly. You can register any flight where the airline accurately reports the announcement to FlightStats. If you try to register a flight that does not meet these conditions, the system will inform you of this and you will not be able to register.

Where the flight is departing from an airport with a lounge that's part of the LoungeKey network you’ll be offered the choice of a lounge voucher, or PayPal payout in the event of a delay Not every airport has a lounge and if this is the case the PayPal option will be selected for you.

Can I register more than one person?

Yes, you can include up to four additional passengers who are named on your Post Office Travel Insurance policy when you register. Make sure the names you register match exactly those included on your flight booking or boarding passes and travel insurance.

Why has my flight registration failed?

Registering your flights could fail for two reasons:

- You’re attempting to register less than 24 hours before your scheduled departure time

- Not all airlines provide timely and accurate flight tracking data which is necessary for us to trigger compensation and issue your benefit

As such, we restrict registrations for airlines that do not provide reliable tracking data. This is done to ensure the best possible experience for customers.

Can I cancel a flight registration?

Yes, you can cancel a flight registration up to two hours before your scheduled departure time. Please do this via the link in your registration confirmation email.

LoungeKey lounge access

What is loungekey.

It's a global network of over 1,100 airport lounges .

How will I know if free lounge access is available to me?

During your flight registration you’ll be provided with the lounge access option at the "Select Your Benefit" stage. If you have selected this option and a qualifying delay is met, we'll send an SMS text and email message with a PDF voucher attached, so you'll need a mobile device with you that can accept them. These messages are sent if:

- You register the flight online at least 24 hours before its scheduled departure time

- There's an announcement about a minimum one-hour delay (either a single delay or an accumulation of multiple shorter delays amounting to two or more hours)

- You selected lounge as your benefit option

How will I receive free LoungeKey access?

You'll need a mobile device that can receive SMS texts and emails with PDF attachments. If your flight's delayed by one hours or more, we'll automatically send you:

- A text notification, which includes a link to your PDF LoungeKey voucher

- An email with a PDF attachment containing your free LoungeKey voucher

- The SMS and emails will also contain the vouchers for any other passengers you registered

Please see our terms of use .

How do I find the lounge at the airport?

We'll let you know how to locate your lounge when we email your access information. The voucher itself will also contain a link to the lounge finder and access information.

Other lounge access questions

Are children welcome in the lounges.

Not all lounges are open to younger passengers. You can check out the lounge policies at your departure airport .

Why can't I gain access to a lounge?

There are a number of reasons why you might not be able to access a lounge, even if you have a valid voucher:

- If the lounge is closed when the delay occurs – during the night, for instance

- If the lounge is at full capacity

- If the passenger names on the boarding passes don't exactly match those on the LoungeKey voucher

- If you or a member of your group doesn't meet the lounge terms and conditions, such as dress code or minimum age

How can I find out about lounge policies and other services?

Although lounges at different airports have their own policies and services, most have free Wi-Fi. Discover more about the lounge at your departure airport.

About PayPal

What is paypal.

PayPal is a payment platform for payments and money transfer. It’s a secure way to send and receive money online.

PayPal allows any individual with an email address to securely send and receive payments online without having to enter your financial details.

You can use PayPal to shop online, or to send money quickly to anyone with an email address or transfer money to your bank account. You can also use PayPal on the high street where the number of shops accepting PayPal is growing.

Once you’ve linked your card or bank account to your PayPal account, you won’t need to provide all of your card details every time you shop online. PayPal remembers all your financial details, so you don’t have to, and they do not share them with sellers.

PayPal is available worldwide and in all major currencies.

How does PayPal work?

If you’ve selected PayPal as your benefit during the registration journey, in the event that you experience a qualifying flight delay, we’ll compensate you with a PayPal payout to use at your leisure.

We’ll pass your email address to PayPal, who will then instantly credit your wallet with your compensation.

If you don’t have a PayPal account linked to the email address you used for registration, PayPal will send you a link to register for an account.

Do I need to have an existing PayPal account?

You don’t need to have an existing PayPal account. A wallet will be credited with your compensation and an email will be sent to you with a link to PayPal to register and create an account. Your PayPal account will need to be linked to the email address you used to register your flight.

How can I get in contact with PayPal?

You can contact PayPal by text, email, on the phone or via the PayPal help page .

About PayPal payouts

How much will i receive.

We’ll provide a compensation payment of £25 per passenger into your PayPal account.

Will additional passengers receive a payout?

All eligible additional passengers that were registered will also receive a PayPal payout, but the payout will be made to the main customer.

Will I be notified before the PayPal payout is sent to me?

Yes, we’ll send you an email and SMS to let you know the PayPal payout has been issued.

What we share with PayPal

When will my information be shared with paypal.

We’ll pass your email address to PayPal when we trigger the PayPal payout request.

What information will be shared with PayPal?

We’ll send PayPal the email address you used to register your flight. They will use your email address as the account to credit with the payout. PayPal will also send out communications to this address to confirm the payout.

Do you cover mobile or smart phones within a travel insurance policy?

Mobile and smartphones are covered under the personal possessions of our travel insurance policies up to £100.

If you need more cover for your phone, you could add our gadget cover add on for an extra premium and increase the cover up to £1,000 per policy for theft, damage or loss during your trip

Cover for mobile phones is now up to the single-article limit:

Economy: £150

Standard: £250

Premier: £400

If you need more cover for your phone, you could add our gadget cover add on for an extra premium and increase the cover up to £2,000 per person per policy for theft, damage, or loss during your trip.

What gadgets do you cover within the gadget cover extension?

Mobile phones, smart phones, tablets, computers, laptops, smart watches, drones, games (including handheld) consoles, all accessories of these items, plus wearable activity trackers. Cover is up to £1,000 per policy.

Mobile phones, smart phones, laptops (including custom-built), tablets, digital cameras, games consoles, video cameras, camera lenses, Bluetooth headsets and speakers, satellite navigation devices, e-readers, head/earphones, smart watches and wrist-worn health and fitness trackers. Cover is up to £2,000 per person, per policy.

Claims and emergency medical assistance

How do i make a claim on my travel insurance policy.

The easiest way is to make a claim online . It’s secure and available 24/7. There’s a handy checklist of everything you’ll need. And, for some claims, you’ll get a decision straight away. You can also call us 0333 333 9702 (1).

What should I do if I need emergency medical assistance while on a trip my policy covers?

Please call the emergency medical assistance line that’s correct for your policy as soon as possible. It’s open 24/7. The number to call is 0203 865 3074 .

How do I renew or cancel the renewal of my Travel Insurance policy?

When you buy an annual multi-trip policy, it’s your reassurance of continuous cover for all the trips you’ll take in a year. For reassurance that extends beyond that, your policy can be renewed automatically or manually. You can also make sure your policy doesn’t renew if you don’t need it to. Whatever you choose, we’ll write to you around 28 days before your current policy’s end date with details of any changes we’ll make should you wish to renew it and a quote for the next year’s cover.

Automatic renewal: if you buy an annual multi-trip policy, it will be set to renew automatically at the end of its term to keep you covered. If you prefer to opt out of this, you can do so then or any time during the policy. You can also turn auto renewal on later. Just call our contact centre. If you’ve declared medical conditions for anyone listed on the policy, it can’t be set to auto renew.

Manual renewal: if you’ve opted out of auto renewal, you can opt in manually later, such as when we send your renewal reminder or by calling our contact centre to set this up. It’s easy to renew through your online account or by calling our contact centre. If you miss the renewal date, you can still take out a new policy later. You’ll need to start a new quote, as the renewal quote is only valid until your current policy’s expiry date. This may also mean a gap in your cover until the new policy starts.

Turning off auto-renewal: if your policy’s set to renew automatically but you change your mind later, you can turn it off at any point during the life of the policy. You can do this yourself in your online account or call our contact centre team. If you’re within the last 8 days of your policy, you’ll need to call our contact centre to do so. The later you do this the greater the chance a renewal payment will be taken by the bank. If this happens before your renewal cancellation is processed, we’ll make sure your payment is refunded.

What if I have a complaint about my travel insurance?

For complaints about the sales literature or information about your policy, how it was sold to you on the phone or online, or the Medical Screening Service, please call 0330 123 1382 (1), e-mail [email protected] or write to:

Post Office Travel Insurance 67 Hope Street Glasgow G2 3AE

Please head any written correspondence 'COMPLAINT' and include copies of supporting material.

For complaints about a claim or assistance you received while travelling, please email [email protected] or write to:

Quality Department Collinson Insurance Services Limited Sussex House Perrymount Road Haywards Heath West Sussex RH16 1DN

If you’re still not satisfied or don’t get a final answer from us within eight weeks of us receiving your complaint, you may have the right to refer your complaint to the Financial Ombudsman Service (FOS) for consideration. You can contact the FOS here:

Financial Ombudsman Service Exchange Tower Harbour Exchange Square London E14 9SR

Call: 0800 0234 567 or 0300 1239 123 (1) Email: [email protected]

- Other sections:

Need more help and support with travel insurance?

If you didn’t find what you need these other pages may help.

For emergency assistance, to make a claim, complaint or manage your policy online: Visit our travel insurance support page

For questions about the coronavirus cover on our policies: Visit our travel insurance Covid-19 FAQs page

(1) Calls to 03 numbers will cost no more than calling a standard geographic number starting with 01 or 02 from your fixed line or mobile and may be included in your call package dependent on your service provider. Calls may be monitored or recorded for training and compliance purposes.

Frequently Asked Questions

Information on mailing potentially hazardous material may be found in Publication 52 , Hazardous, Restricted, and Perishable Mail on the Postal Explorer home page.

Section 451.22 of Pub 52 - Cremated Remains, are permitted to be mailed provided they are packaged as required in Packaging Instruction 10B . The identity of the contents should be marked on the address side. Mailpieces sent to domestic addresses must be sent via Priority Mail Express only.

If mailed to an international address, the individual country listing in the International Mail Manual (IMM) must show that cremated remains are permitted and Priority Mail Express International service must be available for that country.

Postage prices for international mail are based on weight, shape, dimensions, and destination country. Each country has different maximum weight and size dimensions.

The International Price Calculator is available in the upper left frame of the Postal Explorer home page. Select the country, follow the prompts and provide the information on your package, and the available options to the country you choose will be shown.

Notice 123 – Price List is also a handy reference tool for all domestic and international shipping.

Additionally, you can find other information about restrictions and extra services in the Individual Country Listings .

To determine customs requirements you can use the Customs Form Indicator which is also in the left frame of the Postal Explorer home page.

Notice 123 – Price List is a handy reference tool for all domestic and international shipping. On the Quick Reference pages are graphics showing the domestic and international minimum and maximum sizes for letters, flats, and packages. Along with the graphics are the accompanying prices.

Controlled substances and prescription drugs are mailable only by "registered distributors" with the Drug Enforcement Administration such as medical practitioners, pharmacists, etc. who may mail such substances to the patients under their care.

Publication 52 , Hazardous, Restricted, and Perishable Mail, section 453 , Controlled Substances and Drugs, may be of some assistance to you.

It is worth noting that the majority of mail sent by the public is transported via commercial passenger airlines. You may have seen airline ramp agents loading tubs and sacks of U.S. Mail into the cargo hold of the passenger airline.

The sending of hazardous materials domestically is strictly limited in scope and quantity. Publication 52 , Hazardous, Restricted, and Perishable Mail, must be used to determine if (a) the item is mailable, (b) quantity limitations, (c) packaging and labeling requirements, and (d) if a specific class of mail must be used.

Many mailable hazardous materials must be shipped via ground transportation only – meaning it cannot fly on commercial airlines.

The mailing of hazardous materials internationally is even more restrictive because only commercial airlines are used. Only certain items in Hazard Classes 6.2, 7, and 9 are permitted, and the item has to be permitted by the destination country as well.

Again, only Publication 52 will provide the accurate descriptions and mailability of any potentially hazardous items.

While it is theoretically possible to send a suitcase through the postal system (as long as it meets the size requirements for a parcel) you cannot insure the suitcase, only the contents.

The suitcase would be subjected to the rigors of mail processing equipment here in the United States and overseas if sending internationally. If the suitcase has wheels and handles, it is possible that these could be damaged in equipment. The choice would be yours.

Anyone can use Media Mail, but the contents of Media Mail are restricted for all mailers. The Domestic Mail Manual (DMM) requirements for Media Mail can be found in section 173.3 .

Media Mail is often referred to as "book rate." It is generally used for books (at least eight pages), film (16 mm or narrower), printed music, printed test materials, sound recordings, play scripts, printed educational charts, loose-leaf pages and binders consisting of medical information, and computer-readable media. Advertising restrictions apply. Packages must measure 108 inches or less in combined length and girth. Mark each package "Media Mail" in the postage area. Media Mail has no minimum weight; the maximum weight is 70 pounds.

Please note that Media Mail packages may be opened for inspection at either the originating or destination Post Office.

International mail does not have Media Mail rate like domestic does; however, they do have a product call "M-bags" which are defined as direct sacks of printed matter sent to a single foreign addressee at a single address. The standards for M-bags can be found in Section 261 of the International Mail Manual.

The maximum weight of an M-bag is 66 pounds unless lower limits apply by country. Each M-bag that weighs 11 pounds or less is charged the applicable 11-pound price as the minimum charge.

The contents for M-bags are restricted and, regardless of physical closure, M-bags are not sealed against inspection.

The most current source of information about restrictions to APO/FPO/DPO destinations is found in the Postal Bulletin . Each issue has a section devoted to listing the current restrictions for Overseas Military/Diplomatic Mail. It can be found under Pullout Information>>Other Information>>Overseas Military/Diplomatic Mail.

It is important that every business use the right services for their needs. Send Postal Explorer an email and be sure to include the name, address, phone number, and contact person at the business and we'll make sure that a representative in your area contacts you at their earliest opportunity.

The Postal Service supports e-commerce Internet applications through Application Program Interface (APIs) for Rate Calculators and more.

For a Developers Tool Kit go to: www.usps.com/webtools and click on "Get Started with Price Calculator" under "View API Technical Documentation."

The APIs will automatically compute postage and zone information and return the result to your web shopping cart program.

That depends. With commercial mail you must meet volume requirements. First-Class Mail minimum volume is 500 pieces, and USPS Marketing Mail is 200 pieces for each mailing.

You must ask yourself some questions. How much work do you want to do? The finer you sort the mail, the bigger the discount. How many mailings will you do each year? Will the commercial mail application fee and the annual mailing fee, still enable you to realize a savings? Is it important to you to receive your mail back if it is undeliverable for any reason?

The Business Mail 101 internet site will provide basic information for preparing a commercial mailing including information about:

- Is commercial mail right for your business?

- The minimum volume required for a commercial mailing.

- The difference between First-Class Mail and USPS Marketing Mail.

- How to sort commercial mail.

- How size and weight affects prices.

- How to pay for postage.

- How to apply for a mailing permit.

- And much more.

Business Mail 101 can be accessed from the Postal Explorer home page by selecting "Business Mail 101" in the top drop-down under Publications.

Quick Service Guides (QSG) provides a 2-page summary of the standards for each type of commercial mail. All of the Quick Service Guides are available on Postal Explorer.

After you have had an opportunity to explore Business Mail 101 you can then contact your local Business Mail Entry unit with any specific questions you might have. Be sure to ask Business Mail Entry for any commercial mail classes they may have scheduled for new mailers. A lookup tool for your local Business Mail Entry is available in the top drop-down of Postal Explorer under "Business Solutions."

Every Door Direct Mail (EDDM) is a simplified mailing process that permits a mailer to reach potential customers in nearby neighborhoods based on a geographic ZIP Code area.

EDDM allows you to design flats-size mailpieces and deposit your mail at a local Post Office, using a simplified address format, for delivery to the carrier routes you choose.

If you wish to mail to areas outside your local Post Office delivery area there is a commercial version of this service that you can use with your mailing permit or you can hire a letter shop or mailing service to prepare and enter your mailings using their mailing permit

Learn more about EDDM mail at: www.usps.com/business/every-door-direct-mail.htm

Track a package at usps.com by clicking on Tracking in the left frame of the website and adding the tracking number. For other questions regarding tracking, contact the USPS Help Desk .

The current cost to mail a one-ounce letter can be found in Notice 123 – Price List . Click on the link for First-Class Mail International under International Retail Prices.

Customs officials use the shipment's declared value, along with the description of the items, to determine applicable duties and taxes. These charges are not assessed by the Postal Service and are dependent on the destination country's customs requirements.

The Forever Stamp will always equal the price of the current one-ounce First-Class Mail stamp regardless of its price when you purchased it. Additional stamps would only be needed if the letter exceeds one ounce

See the first page of the current Price List for First-Class Mail prices.

For a complete list of the non-denominated stamps along with corresponding pictures and their value, see Quick Service Guide 604a , Nondenominated Postage.

The maximum weight for a First- Class Mail letter is 3.5 ounces. The maximum weight for a First-Class Mail large envelope (flat) and First-Class Package Service - Retail is 13 oz.; after that it is classified as Priority Mail and you would pay Priority Mail prices.

Retail Ground prices are only available when shipping to Zones 5-8 (furthest from you). Zones 1-4 (closest to you) have the same prices as Priority Mail, therefore, only Priority Mail prices are shown.

Information about qualifying for nonprofit prices is available in Publication 417, Nonprofit USPS Marketing Mail Eligibility . You can access this publication on the Postal Explorer home page. Please note that having IRS-exempt status does not automatically qualify mailings for nonprofit prices. Organization type and content of the piece plays a big part in USPS approval for nonprofit privileges.

With commercial mail you must meet volume requirements. First-Class Mail minimum volume is 500 pieces, and USPS Marketing Mail is 200 pieces for each mailing.

If you do not currently hold a mailing permit, you must ask yourself some questions. How much work do you want to do? The finer you sort the mail, the bigger the discount. How many mailings will you do each year? Will the commercial mail application fee and the annual mailing fee still enable you to realize a savings? Is it important to you to receive your mail back if it is undeliverable for any reason?

- How to obtain address lists.

- How to apply for nonprofit prices.

Business Mail 101 can be accessed from the Postal Explorer home page by selecting "Business Mail 101" in the left frame.

After you have had an opportunity to explore Business Mail 101 you can then contact your local Business Mail Entry unit with any specific questions you might have. Be sure to ask Business Mail Entry for any commercial mail classes they may have scheduled for new mailers. A lookup tool for your local Business Mail Entry is available in the left frame of Postal Explorer under "Postal Links."

Postage meters may be purchased or leased through an approved USPS vendor. Quick Service Guide 604c , Postage Meters and PC Postage Systems, provides basic information. The lease/purchase terms and agreement are between you and the vendor, however, the use of the meter must comply with all Domestic Mail Manual requirements in section 604.4 .

For specific delivery issues, please contact your local Post Office directly as they would be best suited to resolve any problems. If you are unable to do so, you may contact the USPS.com Help Desk at: www.usps.com/help/contact-us.htm

Packaging provided by the USPS must be used only for the class of mail stated. Regardless of how the packaging is reconfigured or how markings may be obliterated, any matter mailed in USPS-produced packaging is charged the appropriate Priority Mail Express or Priority Mail price. ( Domestic Mail Manual 125.1.1 )

Additionally, only USPS-produced Flat Rate packaging is eligible for flat rate prices. Each envelope or box is charged a flat rate price regardless of the actual weight (up to 70 pounds). Lower weight limits apply to international destinations. ( Domestic Mail Manual 123.1.5 )

Domestic mail is mail transmitted within, among, and between the United States of America, its territories and possessions, Army Post Offices (APOs), fleet Post Offices (FPOs), and the United Nations, NY. The current list of "territories and possessions" can be found in the Domestic Mail Manual (DMM) section 608.2

- American Samoa (Manua Island, Swain's Island, Tutuila Island)

- Northern Mariana Islands, Commonwealth of the (Rota Island, Saipan Island, Tinian Island)

- Puerto Rico, Commonwealth of

- U.S. Virgin Islands (St. Croix Island, St. John Island, St. Thomas Island)

- Wake Atoll (Wake Island)

Although, most territories and possessions on the list do not require a customs form, Priority Mail weighing 16 ounces or more sent from the United States to certain ZIP Codes, must bear customs Form 2976-A. The current ZIP Code list can be found in DMM 608.2.4.1

Please contact the USPS.com Help Desk at: www.usps.com/help/contact-us.htm or for Click-N-Ship at 800-344-7779, option 3.

Please contact the Click-N-Ship Help Desk at: 1-800-344-7779 - option 3 . The hours of operation are:

- Monday thru Friday: 8:00 AM to 8:30 PM ET

- Saturday: 8:00 AM to 6:00 PM ET

- Sundays/Holidays: Closed

In addition, there is a Click-N-Ship® email account that customers can use for questions, concerns, or issues. The Click-N-Ship® email account is: [email protected] . Your email will be responded to within 24-36 hours.

When sending an email to the Click-N-Ship email account, please be sure to include the following information:

- Account Number

- Label Number

- Transaction Number

- First/Last Name

- Brief explanation of the issue or concern

- Your preferred contact information

For domestic mail: if the appropriate time has passed (see chart below), go to www.usps.com/help/claims.htm to start the claims process.

For international mail: international claims require coordination with a foreign postal administration and are handled differently than domestic claims. The process begins with filing an inquiry that only the U.S. sender can initiate.

Inquiries can be initiated for Global Express Guaranteed (GXG) items, Priority Mail Express International items, registered items, and insured and ordinary parcels. Inquiries are not accepted for ordinary letters, Priority Mail International Flat Rate Envelopes, Priority Mail International Small Flat Rate Priced Boxes, or M-bags. Customers must wait a reasonable amount of time for an international item to be delivered in the foreign country before initiating an inquiry.

Go to: www.usps.com/help/claims.htm and click on "International Shipments" to begin the inquiry process.

Go to the USPS.com Postal Store and click on Shipping Supplies.

- Credit cards

- Personal Finance

What is a travel money card?

How does a travel money card work?

Why use a travel money card, how to compare travel money cards, how to get a travel money card, are travel money cards worth it.

A travel money card, also called a prepaid travel card, is a type of card that can hold foreign currencies. It’s intended for overseas travel, and you can use one to withdraw foreign cash from ATMs and to make purchases in a local currency.

Think of a travel money card as a debit card that uses local currency. Before you use a travel money card, you’ll preload a set amount of a specific international currency onto the card at the day’s exchange rate. For example, if you’re travelling to Italy and France for two weeks, you’d load Euros (€) onto the card and use it instead of your regular debit or credit card during your trip.

You can continue reloading money onto the card via an app or website as you spend your funds. So, if you blow through your Euros in Rome, you can top off your card’s balance before arriving in Paris.

Available currencies

The available currencies will depend on the card, but you’ll generally find the following options:

- United States Dollars (USD)

- Europe Euros (EUR)

- Great British Pounds (GBP)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED)

Know that the number of currencies available will also vary. For example:

- The CommBank Travel Money Card offers 13 currencies.

- The Westpac Travel Money Card has 11 currencies.

- The Qantas Travel Money Card has ten currencies.

The value of your exchange

The value you exchange currency for will depend on when you load your funds. Rates change from day to day, but you’ll lock in the rate used at the time you exchange currency. So, you’ll know the exact worth of the foreign currency in Australian dollars every time you use your preloaded card.

On the one hand, a locked-in rate protects you from volatile currencies with fluctuating values. However, if the rate drops, you could be stuck with devalued foreign funds. So, while you can’t predict the future, try to coordinate the load when the exchange rate is most valuable — even if that means waiting a few days.

- Provides access to multiple currencies. Most options allow you to convert Australian dollars into several different currencies simultaneously. That means you can have secure access to a handful of foreign funds during your next multi-country adventure.

- Saves on ATM fees. Credit card holders won’t usually be charged the standard 3% foreign transaction fee or pay extra for in-network ATM withdrawals, loading, and topping up their cards. However, these are just generalisations — each credit card company or bank will have its own fee structure.

- Exchange rates are locked. You’ll pay for the local currency using the exchange rate available when you load funds, which locks in the rate. Having dependable value for your funds goes a long way for peace of mind, especially when travelling.

- Fewer risks when lost. Losing a prepaid card while travelling is undoubtedly a hassle. However, a lost or stolen credit card can mean more risks, like thieves potentially accessing your personal banking details and account funds. Since a lost travel money card is unlikely to result in a stolen identity and fraud , some travellers find it a safer choice while abroad.

- Helps with budgeting. Trying to keep to preloaded funds may help you stick to a budget while on vacation. Plus, you see the value of money in the local currency, which can help you manage your finances while travelling.

- May come with rewards and perks. Some travel money cards earn frequent flyer points or come with other special travel perks, like overseas customer service. For example, the Qantas Travel Money Card earns Qantas points, and the Westpac Travel Money Card offers airport lounge access to the cardholder and one companion access when a flight is delayed.

Disadvantages

- There are delays when reloading. If you need to top up your balance, you may need to wait up to a few days before funds are available to use.

- Other fees. Some travel money cards may levy typical credit card fees for reloading funds, emergency card replacement, account maintenance, closures, inactivity and more. For example, Travelex and the Australia Post Travel Platinum Mastercard charge a $10 account closing fee.