Cheapest Travel Insurance (April 2024)

Travel insurance typically costs between 4% and 10% of your total trip cost. the cheapest travel insurer for total trip protection is nationwide..

)

Founder of personal finance site TomorrowsDollar.com

Candidate for CFP® certification

Stephanie is a DC-based freelance writer specializing in personal finance. Her work covers insurance, loans, real estate investing, retirement, and more.

Read Editorial Guidelines

Featured in

)

Licensed auto and home insurance agent

4+ years in content creation and marketing

As Insurify’s home and pet insurance editor, Danny also specializes in auto insurance. His goal is to help consumers navigate the complex world of insurance buying.

)

Corporate communications director for Insurance Information Institute

20+ years in insurance and communications

As Director, Corporate Communications for Triple-I, Mark serves as the non-profit’s national spokesperson, sharing information and education on a wide array of insurance issues.

Updated December 11, 2023

)

Table of contents

- Cost of insurance

- Find cheap insurance

- What’s covered

Travel isn’t cheap; unexpected expenses or plan changes can be very costly. Travel insurance provides financial protection if you cancel your trip, experience a delay, or get sick or injured while on your trip. [1]

Nationwide, Travel Insured, and Berkshire Hathaway offer some of the cheapest total trip protection policies. Some plans are more expensive than others and may not be suited for you, so it’s crucial to compare plans from multiple companies to find the best coverage. Here’s a look at some of the best travel insurance prices and what these insurers offer.

Where to find the cheapest insurer

The right travel insurance plan for you is one that protects your travel investment at the most affordable price. Here’s a look at some of the cheapest travel insurance policies and what each offers. The quotes below are for a $4,000 trip to Mexico for two 30-year-olds.

Travel Insurance International

Policies with Travel Insurance International ranged from $144 to $176, with many possible add-ons and additional coverage options. And if you change your mind about the travel insurance policy, you can cancel within two weeks and get a full refund. [2]

Baggage delay coverage kicks in after only three hours

14-day cancel period (full premium refund)

Event ticket reimbursement only applies to non-refundable registration fees

Many coverages only offered as optional riders (for an additional cost)

Berkshire Hathaway Travel Insurance

Berkshire Hathaway offers multiple policy options ranging from flight-only insurance to full trip protection, with robust coverage and an affordable price tag. Quotes ranged from $88 for flight-only coverage to $188 for premier trip insurance. [3]

Provides options to insure your entire trip or just the travel portion

Trip interruption reimbursement of up to 150% of your trip's total cost

Must provide email address to get a quote

Baggage delay reimbursement coverage kicks in after 24 hours

Nationwide is a top-rated all-lines insurance company in the U.S., offering everything from auto and home insurance to travel coverage. Trip insurance through Nationwide comes in two tiers, and quotes we received were $97 and $163, respectively. It provides travelers with trip, baggage, and medical protection while away from home. [4]

Baggage delay only needs to be 12 hours

10-day premium refund policy

Strict medical requirements for trip protection benefits (policy includes 60-day pre-existing condition clause)

No rental car collision or loss coverage

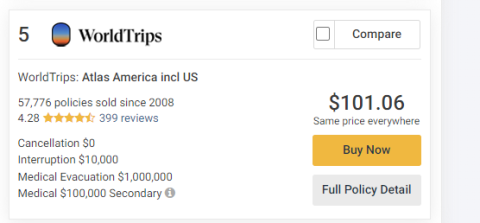

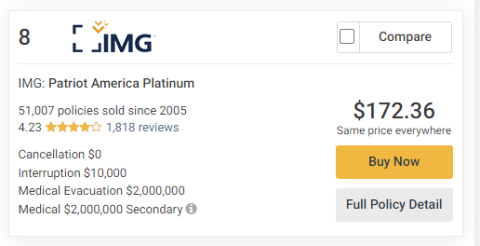

Through IMG, you can choose coverage that’s based on either medical insurance or travel insurance. Costs can vary dramatically depending on the type of coverage you choose (our quotes ranged from $19 to $271), but this gives you the flexibility to build a policy based on your travel protection preferences. [5]

Medical coverage limits as high as $8 million

Up to 36 months of continuous coverage

Longer requirement for delayed baggage coverage

Low emergency dental coverage

Travelex offers five types of travel insurance coverage, depending on whether you want comprehensive, post-departure, or flight-only coverage. Quotes ranged anywhere from $38 for flight insurance to $200 for total trip protection, with the option to pay more for upgrades like the ability to cancel for any reason or doubling your medical coverage limits. [6]

Strong consumer ratings

15-day free preview period (full refund offered)

Not available in all states

Doesn't offer excess trip interruption coverage (limited to 100% of trip cost)

How to find the cheapest travel insurance

Finding the most affordable travel insurance is a great way to protect your trip and your budget at the same time. Here are some tips to consider if you’re looking for the cheapest travel insurance:

Shop around

As with any insurance product, you’ll find the most affordable travel insurance coverage by getting quotes from multiple insurers. Luckily, most travel insurers provide online quotes in minutes after just a few questions. Be sure to read the limits, privacy policy, and options that each offers so you’re comparing apples to apples.

Decide what’s most important

What are you worried about most when it comes to your trip? What would be the most financially devastating? If you have a refundable trip and are only worried about medical coverage, your coverage needs differ from those of someone who wants a cancel for any reason (CFAR) policy.

Adjust your policy details

Many companies will allow you to adjust coverage options, such as your deductible and medical limits. By taking on more risk, you’ll usually reduce your overall cost, and vice versa.

Capitalize on other coverage you might have

Many credit cards offer trip delay and cancellation coverage, medical emergency coverage, and even lost or delayed baggage reimbursement. If you book your trip with one of these travel credit cards, you might not need as much trip insurance as travelers without those protections.

)

How Much Is Travel Insurance?

What travel insurance covers.

Vacations can be expensive, especially if you’re planning a long-distance trip, going to an exotic location, or traveling with a group. No matter how well you plan, your trip can easily be derailed by illness, injury, travel delays, or even a simple change of plans.

Travel insurance provides financial protection if and when your travel plans change, either before you depart or while you’re away from home. This coverage can also offer you financial reimbursement if you experience flight delays, lost baggage, and more. And if you get sick or hurt while traveling, it can provide you with the care you need, regardless of where.

A few different travel insurance coverages are available to choose from, depending on which insurer you buy your policy through and how much you’re willing to spend. You can typically choose coverage that provides one or more of the following:

Medical and dental care (especially important since your medical insurance policy typically won’t apply outside the U.S.), including medical evacuation back to the U.S.

Trip or baggage delay and interruption coverage

Trip cancellation coverage

Pet travel and fees

Accidental death or dismemberment

These policies may also be issued for a single trip, such as a planned cruise or vacation, or can provide you with blanket coverage for multiple trips over an extended period of time. For example, frequent travelers may want to buy a policy that covers them for 12 to 36 months.

What travel insurance doesn’t cover

Your travel insurance coverage will depend on the policy you purchase. If you buy a medical-based policy, you may not have coverage for things like lost luggage or pet kennel charges. And depending on the company and plan you choose, you might not have options like canceling your trip for any reason.

In general, though, travel insurance typically doesn’t protect you against losses related to:

Named tropical cyclones

Pre-existing medical conditions or known illnesses

Acts of war and terrorism

Epidemics and pandemics

Dangerous or high-risk activities

Cheap travel insurance FAQs

Below, you’ll find answers to a few commonly asked questions about how to find the cheapest travel insurance for your next trip.

Which factors determine the cost of travel insurance?

The cost of your travel insurance depends on the type of coverage you buy (medical, cancel for any reason, trip interruption/delay), as well as the deductible, coverage limits, age of those covered, and optional features you choose. Your policy price will also be affected by your country of travel, travel dates, and the total cost of your trip.

What is the cheapest travel insurance?

The cheapest travel insurance plan is flight-only protection, which offers financial compensation if someone is killed or injured on a common airline. It may also offer protection against delays and lost bags, depending on which additional coverage options you choose.

What is the average cost of travel insurance?

On average, travel insurance costs between 4% and 10% of your total trip cost. This price tag can be further affected by the coverage options you choose, the duration of your trip, and your destination.

Methodology

Quotes for this article were sourced directly from each insurance company’s website. The travel insurance plan costs are for two 30-year-olds traveling from the United States to Mexico with a trip cost of $4,000.

Related articles

- Airbnb Travel Insurance: What Guests Should Know

- Does Travel Insurance Cover Pre-Existing Conditions?

Travel Medical Insurance: What to Know

Visitor insurance for parents: what to know.

- What Is Cancel For Any Reason (CFAR) Travel Insurance?

- Do You Need Group Travel Insurance?

What Does Cruise Insurance Cover?

- Centers for Disease Control and Prevention . " Travel Insurance ."

- Travel Insured International . " Travel Insurance ."

- Berkshire Hathaway Travel Protection . " Travel Insurance ."

- Nationwide . " Travel Insurance ."

- International Medical Group . " Travel Insurance ."

- Travelex . " Travel Insurance ."

)

Stephanie is a DC-based freelance writer. She primarily covers personal finance topics such as insurance, loans, real estate investing, and retirement. Her work can be found on CBS, FOX Business, MSN, Yahoo! Finance, Business Insider, and more. When she isn't helping people plan for their financial futures, she is traveling, hiking with her kids, or writing for her own website, TomorrowsDollar.com. She can be reached on Twitter @stephcolestock

Latest Articles

)

Travel insurance can be beneficial, especially for people traveling to risky areas and people with health concerns.

)

How to Find the Best Travel Insurance for Seniors

Travel insurance can be beneficial for senior travelers, especially those with health concerns. Find out how you can secure your next trip.

)

Cruise insurance is a type of travel insurance that can include international medical insurance, trip delays, and complete cancellation of your trip.

)

Learn how to find visitor insurance for parents, why you need it, and the best companies offering medical coverage for visitors from abroad.

)

Is Flight Insurance Worth It?

Is flight insurance worth it? Weigh the pros, cons, typical costs, and coverage options to decide whether it’s worth purchasing.

)

Travel medical insurance can provide financial protection in case of unforeseen circumstances while traveling, such as illness or medical emergencies.

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Travel Insurance

Get a travel insurance quote and protect your next trip

For flight insurance protection:

Aircare Flight Quote

For all-in-one trip insurance protection:

ExactCare Travel Quote

Manage Your Travel And Flight Insurance

Manage your policy online

Need a travel insurance quote?

Existing policyholder?

Take the worry out of your travels with affordable flight or trip insurance.

Looking to plan the vacation of a lifetime or flying home for the holidays? Trip insurance and flight insurance can provide the peace of mind you need for your next journey. The GEICO Insurance Agency, with Berkshire Hathaway Travel Protection (BHTP), offers comprehensive travel insurance coverage, with prompt service and global assistance. Get an online travel insurance quote today and confidently protect your next adventure.

AirCare Flight Insurance

If you only need to protect your travel costs for a flight, AirCare may be what you need. With affordable coverage for both domestic and international flights, AirCare flight insurance helps you plan with peace of mind.

ExactCare Travel Insurance

If you want to cover your flight and other trip arrangement's ExtraCare can help. An ExactCare Travel Insurance policy can help with the unexpected like:

- Trip Cancellations/Interruptions/Delays

- Lost/Stolen travel documents

- Unexpected medical expenses

What's the difference between flight insurance and travel insurance?

The main difference is that a flight insurance policy only covers your airfare. On the other hand, a travel insurance policy helps protect your flight as well as other parts of your trip. While you're planning your next trip, think about where you're going and what you'll be doing. Once you have that, it'll be easier to choose which policy works best for your trip.

What does a flight insurance policy cover?

AirCare Flight Insurance has a variety of benefits including emergency travel assistance, 24/7/365. Some common flight coverages are:

- Airfare incase flights are cancelled or you miss a connection

- Personal items like lost or delayed luggage

- Flight delays in your departure (at the gate or on the tarmac)

AirCare Quote

What does a travel insurance policy cover?

ExactCare Travel Insurance provides all-in-one travel protection, with family friendly pricing and worldwide emergency travel assistance 24/7/365. Common things covered by travel insurance are:

- Trip cancellation or interruption

- Personal items like passports and luggage

- Medical costs like hospital and doctor expenses, medical evacuations, and more

ExactCare quote

What is not covered by travel insurance?

Your coverage is based on the plan you choose. However, in general some things that aren't normally covered by travel insurance are:

- Action and team sports, for example auto racing, pro sports travel, or other extreme sport activities

- Travel to get medical care

- Trip Cancellation because you changed your mind

For more information, please check your policy.

Is travel or trip insurance worth the cost?

Travel insurance can help protect your vacation or trips from unexpected things happening. You can travel without trip insurance but doing so brings greater risk if something goes wrong or you encounter unexpected delays. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and more. Learn more about travel insurance and why you should get a travel insurance quote today!

How much does travel insurance cost?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that can be influenced by several things.

- The cost of the trip

- The length of your trip and destination

- The amount of coverage selected

- The number of travelers covered under the policy

Worldwide service and claims information.

It's easy to manage your travel insurance..

Berkshire Hathaway Travel Protection (BHTP) has made it easy to manage your travel insurance. You can:

- Visit Berkshire Hathaway Travel Protection's website

- Email [email protected]

Is travel insurance worth it?

Yes. Things happen that are out of your control. Whether it's your flight being cancelled or delayed to a family emergency. Life happens and that's how travel insurance can help. Plan for the unexpected with a travel insurance policy so you can rest easy knowing you're covered.

Travel Insurance: Get the answers you're looking for.

- What travel insurance plans are available? BHTB offers AirCare (flight only) and 3 main plans: ExactCare Value, ExactCare, and ExactCare Extra. ExactCare Value provides great traveling insurance coverage for budget minded travelers. You can rest easy knowing you're covered for things like trip cancellation, trip interruption, and medical expenses. The main difference is the maximum amount that will be covered. ExactCare and ExactCare Extra's insurance cover the same things as ExactCare Value and add coverage for missed connections and accidental death & dismemberment. The overall amount covered is also increased for each plan respectively.

- Can I get trip insurance for an extended overseas stay? Yes. We can help you with getting insurance for overseas. Please visit our overseas insurance page for information about all the options we have for you!

- Is there travel insurance that can cover my vehicle while traveling to Mexico? Your US auto insurance policy won't cover your vehicle when you drive into Mexico. We're here to help you find the Mexico car insurance you need to insure your car.

- Tips for saving money on your next vacation. No one wants to overpay things. We're here to help. Check out our 5 ways to save your money on your next family vacation.

- Where you're going

- Number of days you're traveling

- Cost of your overall trip

- Coverage you pick

- Number of people covered under your policy

If you choose to get a rate quote or service your policy online, you will be taken to the Berkshire Hathaway Travel Protection website which is owned by Berkshire Hathaway Specialty Insurance Company, not GEICO. Any information that you provide directly to Berkshire Hathaway Specialty Insurance Company on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

ExactCare is provided through Berkshire Hathaway Global Insurance Services, LLC. ExactCare and AirCare are underwritten by Berkshire Hathaway Specialty Insurance Company. Both coverages are secured through the GEICO Insurance Agency, LLC.

Benefits may vary by jurisdiction. Please contact a representative to confirm availability.

Please note:

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

- Search Search Please fill out this field.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Personal Finance

Best Travel Insurance Companies for April 2024

:max_bytes(150000):strip_icc():format(webp)/EricRosenberg-2023-Square-0224d594cbdc4555900b9c356d7b60b9.jpg)

According to our research, Travelex is the best travel insurance company because its comprehensive coverage comes at a relatively low cost. We chose the best travel insurers in our list based on an analysis of 31 travel insurance companies across several areas that are most important to travelers, including options available for your coverage, claim and policy limits, what the policy does and doesn't cover, and typical policy costs. We took time to research insurance coverage limits and what the policies covered and rank companies accordingly.

Travel insurance is an important product to consider when booking a trip, especially if it's a pricy one or you believe there's a chance it could be canceled. If you're like the 40% of people who told Nationwide Travel Insurance they plan to travel more in 2024 than in 2023, then travel insurance could be key to making those plans a reality.

Our list of top travel insurance companies can help you choose the right provider, but you should also do your research to make sure the policy covers your particular trip. And if general travel insurance isn't enough, you may be able to add cancel for any reason (CFAR) travel insurance to your policy to ensure an unexpected situation comes up, like a last-minute work or family obligation, or safety concern.

- Best Overall: Travelex

- Runner-Up, Best Overall: Allianz Travel Insurance

- Best Value: InsureMyTrip

- Most Comprehensive Coverage: World Nomads

- Best for Older Adults: HTH Travel Insurance

- Best for Cruises: Nationwide

- Best for Medical Coverage: GeoBlue

- Our Top Picks

Allianz Travel Insurance

InsureMyTrip

World Nomads

HTH Travel Insurance

- See More (4)

The Bottom Line

- Compare Providers

- What Is Travel Insurance?

How to Get Travel Insurance

What does travel insurance cover.

- How Much Does Travel Insurance Cost?

- What Happens When You Cancel a Trip?

Best Overall : Travelex

- Number of Policy Types: 3

- Coverage Limit: Up to 100% up to $50,000 for cancellations

- Starting Price: $24

Travelex offers coverage (up to 150% for interruptions) for you or your family members at a competitive price—and kids are included at no extra charge. A relatively low price for the high levels of coverage made it our top choice. Look for the Travel Select plan for the best coverage.

Competitive pricing for comprehensive coverage

Multiple plan options with customizable features

Children younger than 21 covered at no extra cost

Mixed pre-existing medical condition coverage depending on the policy purchase date

No annual plan available

Basic coverage plan features minimal coverage

Travelex Insurance Services is a well-known travel insurance provider based in Omaha, Nebraska. Founded in 1996, Travelex offers several insurance packages depending on the coverage you need for your trip. Policies are underwritten by Berkshire Hathaway Specialty Insurance, which earns an A++ rating from AM Best and AA+ from Standard & Poor’s. Coverage is available to customers worldwide.

The Travel Select plan starts at about $36 and includes trip cancellation insurance, trip interruption, and emergency medical and evacuation, but there also are several ways to customize and upgrade coverage.

Travel is covered up to 100% up to $50,000 for cancellations. You can receive up to 150% of the trip cost, up to $75,000, for trip interruptions. Emergency medical limits are $50,000, and emergency evacuation coverage is good for up to $500,000.

In addition, Travel Select has a 15-day pre-existing medical condition exclusion waiver. If you purchase your policy within 15 days of paying for your trip and insure the full cost of the trip, your pre-existing injury or illness is likely covered.

Runner-Up , Best Overall : Allianz Travel Insurance

- Number of Policy Types: 10

- Coverage Limit: Up to $10,000 per insured, per year for trip cancellation

- Starting Price: $138

Allianz gets the runner-up spot because it offers coverage for frequent travelers with a low cost per trip. Get the best coverage from the AllTrips Executive Plan. Individual trip coverage is also available.

Annual- or single-trip plans are available

Many policy types fit varying needs

Cover yourself and your household all year even if you’re not traveling together

Does not cover extended travel periods

Some annual plans have per-trip limits while others have annual limits

Limit for emergency medical transportation coverage is only $250,000

Allianz Travel is a subsidiary of Allianz, which traces its history back to 1890 in Germany. Travel policies are underwritten by insurers with AM Best ratings of A to A+ and are available only to legal U.S. residents.

Travelers who want to hit the road many times per year should consider annual travel insurance rather than individual per-trip policies. Allianz Travel offers four different annual plans with varying benefit levels. We particularly like its AllTrips Executive Plan, which has the highest limits and coverage.

The AllTrips Executive Plan provides tiered limits starting at $5,000 for trip cancellation insurance or interruption coverage. It also offers $50,000 for emergency medical and $250,000 for emergency transportation per insured per trip. There is a lengthy list of exclusions, including extreme sports, so make sure to read the fine print before jumping into adventure activities.

Quotes for a single traveler, a couple, and a family of four had a price point of $500 per traveler per year. If you pay for comprehensive coverage at $120 per person per trip and are going to travel at least five times per year, you will break even with this plan. If you’re looking for lower costs, the AllTrips Basic, Premier, and Prime options are also available from Allianz.

Best Value : InsureMyTrip

- Number of Policy Types: Multiple options from over 20 providers

- Coverage Limit: Varies

- Starting Price: $25 to $100

Compare policies from more than 20 different travel insurance providers with one form so you know you’re getting a good deal for the coverage you need. You can find low-cost trip coverage or customize a plan to meet your needs so you don’t overpay for coverage you won’t use.

Search for quotes from multiple reputable insurers

Shop around with one application for multiple trip types

View multiple plans from eligible insurers for your planned trip

Many popular insurers are not included in listings

Initial listing pages don’t show policy limits

Includes some policies with low coverage limits

Founded in 2000, InsureMyTrip is a travel insurance comparison website that searches from more than 20 insurers using one intake form. It offers an easy-to-use sign-up tool to quickly compare multiple policies based on your specific needs. Filters are available to pick policies that cover adventure sports, higher limits, increased medical coverage, and more.

A quote for a family of four taking a 14-day trip that costs $4,000 and includes plane and hotel expenses resulted in three suggested plans with costs of around $100 to around $400 for varying levels of travel protection. Basic features included luggage coverage, travel delay, and medical care. Note that rates will differ based on where customers are originating from and where they are vacationing, as well as other variables.

The insurers you'll find while using InsureMyTrip have earned a variety of industry ratings and are generally considered reputable and financially stable. Still, as with policies bought directly from insurers, it’s a good idea to read the policy details before clicking the buy button. Each underlying insurer has different claims processes, exclusions, and limits. InsureMyTrip makes it easier, however, to be an informed travel insurance buyer.

Most Comprehensive Coverage : World Nomads

- Number of Policy Types: 2

- Coverage Limit: Up to $10,000 for trip cancellation

- Starting Price: $100 to $200

Adventure travelers and digital nomads receive good trip protection from this plan, which offers coverage of up to $100,000 for accidents for some of the most extreme adventures.

Extensive coverage with high limits for medical and emergency evacuation

Protects your bags, computers, and sports equipment when traveling

Explorer plan covers adventure sports

Only single-trip plans are available

Most pre-existing medical conditions are not covered

Not all policies cover adventure sports

World Nomads is a good insurer for those looking for adventure. The Australia-based provider was founded in 2000 and is a solid choice for worldwide travel with few excluded activities. Policies are underwritten by various insurers including the financially strong and well-known Nationwide Mutual Insurance Company, Generali Global, AIG, and Lloyd’s.

Coverage includes terrorist attacks, assault, medical repatriation, equipment and baggage, and overseas medical and dental. The high-end Explorer Plan covers activities including snow sports, water sports, aviation, motorsports, athletics, and high-adventure experiences. It names more than 200 activities, many of which other insurers specifically exclude.

For the Explorer Plan, a solo 35-year-old would pay around $200, depending on inputs like state of origin, for a month in Thailand, which is reasonable for such extensive coverage. The Standard Plan costs around $100 for the same trip, but it makes sense to choose higher coverage levels if you’re worried about something going wrong.

This U.S.-based policy is underwritten by Nationwide (rated A by AM Best) with a $100,000 limit for emergency accidents and illnesses, $500,000 for emergency evacuation, $10,000 for trip cancellation insurance (or interruption), and much more.

Though it doesn’t have the same insurance reputation as some other providers, it works with reputable companies to underwrite policies.

Best for Older Adults : HTH Travel Insurance

- Number of Policy Types: 5

- Coverage Limit: Up to $50,000 for trip cancellation

- Starting Price: Varies

Medical coverage may be important to older adults who need excellent travel protection with flexible options while on a budget. This is where HTH Worldwide stands out. Older adults can get high levels of medical coverage.

High levels of medical coverage for adults up to 95 years old

Up to a $1,500 allowance for someone to visit you in the hospital

May be expensive depending on your needs

Best plan for older adults requires existing health insurance

Lowest policy has a $50,000 maximum benefit per person

Headquartered in Pennsylvania, HTH Worldwide was founded in 1997, and HTH Travel Insurance offers plans with high levels of medical coverage. That’s a big concern for older adults leaving the country , as they could end up in a doctor’s office or hospital with an expensive bill to follow. HTH Travel Insurance offers up to $1 million in total coverage for medical.

Policies for travelers with existing primary insurance enjoy 100% coverage for typical hospital charges, including surgery, tests, office visits, inpatient hospital stays, and prescription drugs outside of the U.S., among other coverage.

Medical evacuation is available up to $500,000, but trip interruption and baggage coverage are pretty light. Most people will choose this plan for medical rather than travel benefits. This policy is available to applicants who are 95 years old or younger.

Travel insurance is also available for people without existing health coverage. Most older adults in the U.S. are covered by some existing coverage, such as Medicare, but Medicare doesn’t work outside of the United States, leaving people uninsured when abroad. HTH Travel Insurance provides policies for those without existing medical coverage. The age limit is 95, but there is a 180-day pre-existing medical condition exclusion.

Best for Cruises : Nationwide

- Number of Policy Types: 8

- Coverage Limit: Up to $30,000 for trip cancellation

- Starting Price: $100

Multiple options protect your cruise vacation with tailored coverage for common cruise trip issues. This makes Nationwide a good pick for those who take to the high seas for their vacations. Make sure to review the benefit levels so you pick the right coverage for your needs.

Large insurer with a strong reputation

Three different cruise insurance plans to choose from

Coverage for common cruise issues like missed connections and itinerary changes

Some plans have low coverage levels for some incidents

Benefit limits are low for trip interruption for any reason

Pre-existing medical conditions may not be covered

Nationwide has been around since 1925. The Columbus, Ohio-based insurance company offers the most popular types of insurance including auto, home, and life. It also offers a few types of travel insurance coverage for individual trips, multi-trips, and cruises.

For single trip protection, Nationwide offers trip cancellation insurance of up to $10,000 with its Essentials plan and $30,000 with its Prime plan. Travelers may also get an annual travel insurance package for just $59 a year to cover delays, medical expenses, medical evacuation, lost luggage, and travel assistance.

Its custom-tailored plans for cruises, however, are what landed it in this category. The Universal Cruise plan, Choice Cruise plan, and Luxury Cruise plan make it easy to pick the right coverage for your individual needs. The cost for a couple on a 10-day cruise to Mexico, for example, was quoted at around $200 for both the Universal and Choice plans.

Cruise insurance from Nationwide covers what you worry about most with a cruise. Things like broken-down ships and itinerary changes can lead to missed excursions and flights or other costs. For the Universal Cruise plan, emergency medical expenses are covered up to $75,000 with medical evacuation benefits up to $250,000.

Additionally, all plans include coverage for the weather, an extension of school sessions, work emergencies, and terrorism. The luxury plan also covers the Centers for Disease Control and Prevention warnings in effect at your destination.

Travelers in 2024 have concerns over trip cancelations due to unprecedented events. Nationwide's survey showed that 51% are still worried about a resurgence of COVID-19, while 54% worry about weather-related delays or cancellations. Other worries include technology issues (38%), unruly fellow travelers (37%), and employee strikes (25%). Travel insurance can help alleviate some stress about a trip being canceled.

Best for Medical Coverage : GeoBlue

GeoBlue offers multiple options to buy travel medical insurance coverage for a lower price than a full travel insurance package. It offers medical coverage on its own if you don’t want or need additional travel coverage.

Up to $1 million in medical coverage

Gives a la carte medical coverage when other trip costs are already covered

Different policies allow you to cover various needs and pre-existing medical conditions

Primarily covers medical costs

Additional primary medical coverage required

GeoBlue, headquartered in Pennsylvania, is part of Worldwide Insurance Services, and policies come with a license from Blue Cross Blue Shield Association. Policies are issued by 4 Ever Life International Limited, a company with a history of more than 60 years and an A rating (Excellent) from AM Best.

If you just need coverage for medical needs, GeoBlue is a good choice. This insurer offers only travel medical coverage. Paying for medical coverage means you aren't paying for the rest of your travel insurance, which you already may have covered. If you already have a credit card with travel insurance included, your card's terms likely protect things like lost luggage and missed flights, for example. Instead, you get covered just for medical, and the costs for that are as low as a few dollars per day.

Because you’re mostly getting travel medical coverage, you will pay a lot less than most other insurers on this list. Just make sure you completely understand what it does and doesn't cover. You will receive only minimal luggage protection and travel interruption coverage with GeoBlue's plans.

GeoBlue has two general plans for single trips, multiple trips, and long-term travel. Additionally, there are five specialty policies for niche travel medical insurance needs, like study abroad. It doesn’t cover everything related to your trip, but it makes medical coverage much more affordable.

Travelex is the best travel insurance company because it offers competitive pricing for comprehensive travel insurance. Policies from Travelex cover everything from canceled or interrupted trips to medical emergencies and evacuations. It also features a 15-day pre-existing medical conditions waiver, which means that as long as you book your trip several weeks in advance, you and your family members will likely still be covered.

There are many options to choose from when it comes to travel insurance. It can provide you with peace of mind and save you thousands of dollars if your travel plans are canceled or interrupted at the last minute. With world events like pandemics, natural disasters, and wars that could easily throw an unexpected wrench in your travel plans, travel insurance helps you to stay prepared. Overall, our top choice for travel insurance is Travelex.

Why You Can Trust Our Expert Recommendations for the Best Travel Insurance

Investopedia collected several key data points from over 30 travel insurance companies to identify the most important factors for readers choosing a travel insurance company for their trips. We used this data to review each company for cost, coverage limits, exclusions, customer service, and other features to provide unbiased, comprehensive reviews to ensure our readers make the right decision for their needs. Investopedia launched in 1999, and has been helping readers find the best travel insurance companies since 2020.

Compare the Best Travel Insurance Companies

Travel insurance covers common problems when traveling. From trip interruptions to full cancellations, it can help protect the money you put down for your travel experience.

Common coverage includes more than just an unexpected trip stoppage. It can also cover lost or damaged luggage and changes to your itinerary for covered reasons, among other benefits.

Medical coverage is an important factor to consider because your current health insurance may not work away from home. The best travel insurance includes coverage for medical treatment, dental emergencies, and medical transportation. If you have any pre-existing medical conditions or are at risk, it’s important to make sure your policy covers these, too.

Tips for Picking the Best Travel Insurance for You

When picking the best travel insurance policy, there are a few things you should consider. Here are some tips and factors to think about:

- Look for low pricing and good coverage : Pricing is one of the most significant factors when comparing travel insurance policies. Look for a provider that offers low rates and doesn’t skimp on coverage.

- Don't settle for the first policy type : Depending on where you’re traveling and how long you’re staying there, different types of travel insurance policies may work best for your situation. For instance, you may need a different policy for a weeklong trip than you would if you plan to travel abroad for several months.

- Match your coverage limits to your travel costs : Travel insurance plans have coverage limits for trip cancellation, interruption, and medical expenses. Look for a plan whose coverage limit matches the amount you’ve spent on your travel plans.

- Don't forget to look at the exclusions : Some travel insurance plans come with exclusions. If you’re worried about a particular event or accident, make sure it’s covered before you pay for a plan.

- Look for high customer satisfaction ratings : Customer satisfaction is also an important factor when purchasing a travel insurance plan. Look for a provider with high customer satisfaction ratings and a history of good customer service.

"As someone who is always purchasing travel insurance, and has been for years, the thing that matters to me the most is mainly coverage and customer service. I want to know what my policy will cover, especially if I am taking a trip that involves a lot of activities, as well as how easy it will be to contact the company should I need to do so.I have found in the past that the price is always very reasonable and you can shop around, so it has never been the biggest concern for me." -Alice Morgan, Senior Digital Art Director, Dotdash Meredith

- Select a travel insurance company.

- Apply for the travel insurance plan of choice on the company's website or over the phone.

- Provide basic info about who is traveling and travel plans, like name, age, location of trip, and travel expenses and costs like hotels or airfare.

- Wait to be approved.

- Create an online account for easy access while you travel. Some companies may have an app, too.

- Enjoy your trip, and file a claim online or over the phone if needed.

When you’ve selected a travel insurance plan that meets your needs, the next step is to apply for travel insurance. You’ll need to provide the insurance company with some basic information about yourself and your travel plans, including your age, where you live, the date and location of your trip, and your total travel expenses, including things like flights and hotel stays.

Many insurance companies let you apply for a policy entirely online. When your application has been approved, you can typically manage your account online and add details about your trip. If you do need to file a claim, you can typically complete the process online.

Travel insurance may include many different benefits. Here’s a look at some common situations covered by many travel insurance plans:

- Trip cancellation

- Trip interruption

- Missed connection

- Baggage and possession loss, damage, and theft

- Delayed luggage

- Emergency medical treatment

- Emergency medical evacuation

- Accidental death and dismemberment (AD&D)

Emergency medical treatment may include things like ambulance services, x-rays, doctor bills, dental work, lab work, and more. It'll depend on the travel insurance company, so be sure to ask before paying for the insurance and/or additional benefits.

There are additional specialty coverages as well, such as customized policies for cruises. It’s a good idea to shop around and compare before making a final decision.

What Does Travel Insurance Not Cover?

Just as homeowners insurance often excludes damage from things like earthquakes and floods, travel insurance has common exclusions you need to know about. Here are some types of coverage you may not get with travel insurance:

- Weather-related cancellations and delays

- Trip cancellations or changes due to acts of terrorism

- Trip cancellations or changes due to a pandemic

- Injuries from extreme sports and high-adventure activities

Though most policies have limits and exclusions around these circumstances, not all do. Some insurers on this list have special coverage for these exact causes or include them in standard plan terms. Again, this is why it’s so important to read your policy documents before paying for and locking in your policy.

Best Cancel-for-Any-Reason Travel Insurance

The best cancel-for-any-reason (CFAR) travel insurance company is USI Affinity because it offers seven different insurance plans at the lowest premiums of all CFAR insurance companies we researched.

Travel insurance costs vary widely by coverage and insurer. You can expect to pay anywhere from a few dollars a day to more than $10 a day for short-term and single-trip coverage. The cost of your trip is another major factor in the insurance rate.

That means insurance for a single trip could cost anywhere from around $20 to hundreds of dollars. Annual policies cost around $500 per year for high levels of coverage.

There are many inexpensive travel insurance plans available, but most travelers are best protected with comprehensive coverage. It costs a bit more, but if you need to file a claim, you’ll be glad you have it.

Is Travel Insurance Worth the Cost?

If you pay a lot for a trip or vacation, then travel insurance should be worth the cost because you don't want to lose out on that investment. It won't always be necessary, but if travel insurance costs just a fraction of what you paid for the trip, then you'll be happy you had it if you have to cancel a trip worth hundreds or thousands of dollars. For example, if you book a European vacation worth $4,000 and your travel insurance costs just $400, it might be worth it so that if anything happens and you need to cancel, you still get $3,600 back in your pocket.

How Does Travel Insurance Work When You Cancel Your Trip?

When canceling your trip, you'll want to contact the travel insurance company right away. The policy and travel insurance company you selected will cover certain parts of your trip. It's important to review this policy and details to understand exactly what you need to do to get your money back for your trip.

Don't cancel your trip until you read your policy and know what is required for your claim.

For example, if you are ill and a doctor tells you not to travel, you may need to get a written note from the doctor and submit it with your trip cancellation claim.

Before you submit a claim and cancel your trip, consider if you can delay it and reschedule it instead. If you can't, then make sure you have all the required documents (receipts, proof of hotel booking, airline ticket confirmation, etc.). Once you submit your claim, it could take days (Allianz says up to 10 business days, sometimes) for you to receive notice that the claim was processed.

Frequently Asked Questions

In which countries is travel insurance required.

Travel insurance is not mandatory or required by all countries, but some do. For example, Cuba requires people traveling from the U.S. to Cuba to have non-U.S. medical insurance, which may be covered through travel insurance or an airline. Other countries that may require or strongly encourage travel insurance include Antarctica, Egypt, Chile, Turkey, and more. Check a country's specific travel requirements before booking your trip to understand if travel insurance is required.

Does Travel Insurance Really Pay?

Travel insurance might not be worth the cost for lower-cost trips and low-risk vacations. However, expensive international trips or large family vacations can make additional travel insurance a reasonable investment.

If you spend thousands of dollars on a trip, it is probably worth spending a couple of hundred more to make sure you get your money back if the trip doesn’t go as planned. If something goes wrong, which can lead to expenses valued at tens of thousands of dollars, it’s good to have a financial backstop so you don’t have to pay for everything out of pocket.

That said, you should check to see what coverage is already available to you through other venues. For instance, many credit cards cover the cost of lost or delayed luggage if you purchase your airfare using that card. Your primary health insurance may cover your medical insurance needs, especially for domestic travel.

Do I Need Travel Insurance for a Cruise?

Just as with any kind of trip, whether you need cruise insurance largely depends on the cost of the trip, and where you're going. If you're paying more than $1,000 for a cruise, travel insurance is probably worth it. For instance, you may want international medical insurance if you're traveling to other countries because some health insurance policies do not cover international travel—Medicare and Medicaid in particular.

Just be aware that if you buy cruise insurance (as opposed to a general travel insurance policy), it may not cover travel before and after the cruise, such as your flight to the port and any hotel expenses you may have pre- or post-trip.

Does State Farm Offer Travel Insurance?

State Farm does not offer travel insurance. State Farm offers car insurance, motorcycle insurance, boat insurance, motorhome insurance, off-road vehicle insurance, homeowners insurance, renters insurance, condo insurance, life insurance, liability insurance, small business insurance, and more.

Can You Buy Travel Insurance After Booking a Flight?

Yes, you can book travel insurance after booking a flight. This may be a great time to book travel insurance because you'll know what coverage you need in case something happens and your trip is canceled. Signing up for travel insurance as soon as possible will always be your best bet.

Which Travel Insurance Is Best?

The best travel insurance company is Travelex because it offers comprehensive coverage at a relatively low price. Travelex has multiple plan options and family members younger than 21 are covered at no extra cost. Another perk is Travelex's Travel Select plan which has a 15-day pre-existing medical condition exclusion waiver. If you purchase your policy within 15 days of paying for your trip and insure the full cost of your trip, your pre-existing injury or illness is likely covered.

Does Travel Insurance Cover Canceled Flights?

Most travel insurance covers canceled flights, as well as delayed flights. If your flight is delayed by a certain number of hours, your travel insurance may reimburse you for the additional money you spent as a result of that delay or cancelation.

What Is the Best Rate for Travel Insurance?

The best rate for travel insurance will be whatever it costs for comprehensive coverage for your trip. While you can get travel insurance that costs just $10 per day, it may not come with the coverage you need for your trip—especially if it's an expensive trip or if you're worried it could be canceled or interrupted.

How We Found the Best Travel Insurance Companies

To come up with this list of the top travel insurance providers, we looked at more than 30 different travel insurance companies and plans. Major areas of focus included coverage options, claim and policy limits, what’s covered, and typical insurance policy costs.

The biggest focus was on insurance coverage limits and what each policy covers. Cost is important, but a difference of $20 for much better coverage is often negligible. The most important features examined in this review are the ones that make your policy valuable and easy to use if you ever need it.

Your Guide to Travel Insurance

- Do I Need Travel Insurance?

- How to Get the Cheapest Travel Insurance

- Best Travel Insurance Options for Older Adults

- Best Cancel for Any Reason (CFAR) Travel Insurance

- How Much Is Cancel for Any Reason Travel Insurance?

- How to Buy Cancel for Any Reason Travel Insurance

Nationwide. " Survey: U.S. Consumer Travel to Surge in 2024 ."

Travelex. " About Travelex ."

S&P Global Market Intelligence. " Insurance Ratings Actions: S&P Acts on Berkshire Hathaway’s Insurance Segment ."

AM Best. " AM Best Affirms Credit Ratings of Berkshire Hathaway Life Ins Co of Nebraska and First Berkshire Hathaway Life Ins Co ."

Travelex. " Travel Select ."

Allianz. " History of Allianz ."

AM Best " AM Best Upgrades Credit Ratings of BCS Financial Group Members ."

AM Best. " AM Best Affirms Credit Ratings of Allianz SE and Rated Subsidiaries ."

Allianz Travel. " AllTrips Executive ."

InsureMyTrip. " About ."

World Nomads. " About World Nomads ."

World Nomads. " What's Covered for Americans? "

World Nomads. " Summary of Plan Benefits: Explorer Plan ."

AM Best. " AM Best Downgrades Credit Ratings of Nationwide Mutual Insurance Company and Its Property/Casualty Subsidiaries; Affirms Credit Ratings of Life Affiliates ."

HTH Travel Insurance. " About Us ."

U.S. Centers for Medicare and Medicaid Services. " Travel Outside the U.S. "

HTH Travel Insurance. " Options for Travelers Without a Primary Plan ."

Nationwide. " About Nationwide ."

Nationwide. " Nationwide Single-Trip Insurance ."

Nationwide. " Nationwide Annual Travel Insurance ."

Nationwide. " Cruise Travel Insurance ."

4 Ever Life. " About Us ."

AM Best. " AM Best Upgrades Credit Ratings of BCS Financial Group Members ."

GeoBlue. " Travel Medical Insurance Plans ."

Squaremouth Travel Insurance. " Emergency Medical ."

Allianz. " Trip Cancellation Checklist ."

U.S. Embassy in Cuba. " Medical Assistance ."

InsureMyTrip. " Which Countries Require Travel Insurance? "

State Farm. " Types of Insurance Coverage ."

Travelers. " When to Get Travel Insurance ."

Travelex. " Trip Delay Coverage ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1298119759-22e222fecf2b40e796b160171147c13f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Personal Finance Accounts Best Credit Cards Best Financial Advisors Best Savings Accounts Apps Best Banking Apps Best Stock Trading Software Robinhood Alternatives TurboTax Alternatives Brokers Brokerage Account Taxes Brokers for Bonds Brokers for Index Funds Brokers for Options Trading Brokers for Short Selling Compare Online Brokers Forex Brokers Futures Brokers High-Leverage Forex Brokers MetaTrader 5 Brokers Stock Brokers Stock Brokers For Beginners

- Insurance Car Best Car Insurance Rental Car Insurance Motorcycle Best Motorcycle Insurance Seasonal Insurance Vision Best Vision Insurance Types of Vision Insurance Vision Insurance For Kids Vision Insurance For Seniors Health Affordable Health Insurance Best Health Insurance Companies Individual Health Insurance Self-employed Health Insurance House Earthquake Insurance Flood Insurance Homeowners Insurance Mobile Homes Moving Insurance Renters Insurance Sewer Line Dental Affordable Dental Insurance Best Dental Insurance Dental Insurance With No Annual Maximum Dental Insurance With No Waiting Period Kids Dental Insurance Medicare Compare Medicare Plans Cost of Hospital Stays Life Term Life Insurance Business Best Business Insurance Pet Best Pet Insurance

- Investing Penny Stocks Best EV Penny Stocks Best Penny Stocks Penny Stocks Under 10 Cents Penny Stocks With Dividends Futures Best Futures Trading Software Futures to Trade Futures Trading Courses Strategies Trading Platforms for E-Mini Futures Stocks Best Stock Charts Best Stocks Under $50 Best Stocks Under $100 Best Swing Trade Stocks Best Time to Trade Cash App Stocks How to Invest Stock Market Scanners Stock Market Simulators Stocks to Day Trade Forex Forex Demo Accounts Forex Robots Forex Signals Forex Trading Apps Forex Trading Software How to Trade Forex Making Money Trading Forex Trading Courses Trading Strategies Options Options to Buy Options Trading Apps Options Trading Books Options Trading Courses Paper Trading Swing Trading Options Trading Examples Trading Simulators Trading Software Trading Day Trading Apps Day Trading Books Day Trading Courses Day Trading Software Day Trading Taxes Prop Trading Firms Trading Chat Rooms Trading Strategies Alternative investing Alternative Investment Platforms Best REITs Best Alternative Investments Best Cards to Collect Best Gold IRAs Investing in Precious Metals Investing in Startups Real Estate Crowdfunding ETFs Commercial Real Estate ETFs International ETFs Monthly Dividing ETFs

- Mortgage Best Mortgage Companies FHA Lenders First Time Buyers HELOC & Refinancing Lenders for Self-Employed People Lenders That Do Not Require Tax Returns Online Mortgage Lenders

- Crypto Best Crypto Apps Business Crypto Accounts Crypto Day Trading Crypto Exchanges Crypto Scanners Crypto Screeners Earning Interest on Crypto Get Free Crypto How to Trade Crypto Is Bitcoin a Good Investment?

Best Cheap Travel Insurance

- Complete Guide to Insurance

- Complete Guide to Travel Insurance

- Is Travel Insurance Worth It?

- Cheap Travel Insurance

- Best Travel Insurance

- Travel Health Insurance

Think you don’t need travel insurance? What if the unthinkable happens and suddenly, you’re out thousands of dollars? Cheap travel insurance can protect you and members of your family.

Just like it’s now easier than ever to find affordable health insurance , there are also plenty of affordable travel insurance options that can enhance your trip without breaking the bank. Before you head out on your next adventure, consider contacting one of our top cheap travel insurance providers.

- Quick Look: Best Cheap USA Travel Insurance

- Best for International Travel: Faye Travel Insurance

- Best for Frequent Travelers : Arch RoamRight

- Best for Packages: Travelex Insurance Services

- Best Travel Insurance for Backpackers: World Nomads

- Best for Long Trips: Allianz Global Assistance

This provides a broad overview of your policy provisions and does not revise or amend the policy. Insurance coverages are underwritten by Arch Insurance Company, NAIC #11150, under policy series LTP 2013 and amendments thereto. Plans are offered and disseminated by registered travel retailers on behalf of Arch Insurance Solutions Inc., a licensed travel insurance producer* (CA License #0I18111, TX License #1787195). Both the travel insurance producer and the underwriter referenced above may be reached at 1-844-872-4163. Your policy is the contract that specifically and fully describes your coverage. Certain terms, conditions, restrictions and exclusions apply and coverages may vary in certain states. Please refer to your policy for detailed terms and conditions. Consumer Disclosures can be found at: https://www.roamright.com/disclosures/. Privacy policy can be found at: https://www.roamright.com/roamright-website-privacy-policy/ *Plans are solicited by licensed producers in NY and HI.

World Nomads offers simple, flexible coverage options to travels in more than 130 countries. Choose from either the Standard Plan or the Explorer Plan. Protections include emergency accident and sickness medical expense (including dental) coverage, emergency evacuation coverage, repatriation of remains coverage, accidental death and dismemberment, lost or stolen goods coverage and trip cancellation or interruption reimbursement.

World Nomads also offers 24-hour travel assistance services.

5 Best Affordable Travel Insurance Companies

1. best for international travel: faye travel insurance, 2. best for frequent travelers: arch roamright, 3. best for cheap rates: travelex insurance services, 4. best travel insurance for backpackers: world nomads, 5. best for long trips: allianz global assistance, what does travel insurance cover, what to look for in a company, low deductible, high claim limits, 24/7 claims reporting, multilingual assistance, protect yourself when you travel, frequently asked questions.

Benzinga chose the best travel insurance companies based on the criteria above.

Faye Travel Insurance is a quality choice for travelers who need to work within a budget. The carrier offers competitive pricing for things like trip cancellation, trip interruption, trip delay, missed connections, baggage delay, emergency accident and sickness medical expenses and medical and non-medical evacuation coverage.

For example, did you know that a young couple of 30 years old could spend a week in Mexico and only spend around $300 for travel insurance through Faye?

Faye’s online platform or app are easy to use and allow you to purchase a policy and/or file a claim in mere moments, along with 24/7 assistance and up-to-date travel alerts.

- Pre-existing medical conditions can be covered under your policy

- Includes coverage for lost or stolen luggage,irrespective of the mode of travel

- Offers add-on coverage for rental car damage and pet care so that you can cover all aspects of your trip

- Just 1 style of policy

- Claims documentation can be quite extensive

Arch RoamRight Travel Insurance provides extensive options for trip insurance, including medical travel coverage. RoamRight offers a comprehensive mobile app and online platform that makes purchasing and managing a policy super easy. Travelers can quickly purchase a policy online, and policy details can be monitored on the company’s app. Policies are available with coverage for trip cancellations, baggage delays, emergency evacuations and more.

RoamRight offers its users a comprehensive mobile app and online portal they can use to plan their trip. The app is equipped with everything from safety warnings to travel documents. Though the company’s plan options may be overwhelming for those who have never bought travel insurance before, RoamRight offers a policy choice for every traveler.

Parents can purchase the Pro Plus plan, which includes 1 child per each adult.

- Comprehensive mobile app and online platform

- Multi-policy coverage options available for frequent travelers

- 1 child included on Pro Plus plan for every adult plan purchased

- Some (but very few) geo restrictions on product

- Comparing plans can be overwhelming

One of your cheapest insurance options for traveling with children is Travelex . The company’s Travel Select package includes coverage for children 17 and under for no additional cost. This protection isn’t included with the Travel Basic package, so it’s cheaper for families with even a single child to opt for more coverage.

Select plans are affordable from the outset but you can also customize your plan with add-ons for as little as $10 each. You can get upgrades for almost anything, including coverage for rental car collisions, an additional $50,000 worth of medical coverage and even coverage for extreme sports. Select plans from Travelex start at just $28 per family and include up to $50,000 worth of emergency medical coverage. You can get 100% of your trip reimbursed if you need to cancel thanks to an emergency and Select plans even include cancellation reimbursements if you need to skip your trip for business reasons.

Emergency medical evacuation coverage extends to $500,000 and 24/7 travel insurance is also included. Though Travelex’s Basic packages leave something to be desired, its Select plans are affordable and worth the upgrade — especially if you’re traveling with children.

- Instant quote online

- COVID-19 coverage (restrictions apply)

- 24/7 assistance

- Less plan options than some other providers

Plans from World Nomads are comprehensive and affordable. A 25-year-old who travels to Indonesia for a week will pay between $70 to $110 to ensure his trip. World Nomads’ plans come in two packages — Standard and Explorer — and both include coverage for extreme sports. Standard packages include coverage for injuries stemming from rock climbing to indoor river boarding and from gymnastics to deep-sea fishing. Explorer plans cover almost any physical activity you can think of, from running with the bulls in Spain to hang gliding over the city of Rio de Janeiro.

Both plans include up to $100,000 worth of coverage for emergency medical coverage, making World Nomads a great choice for active explorers. One of the most unique features of World Nomads’ plans is its compassionate and proactive multilingual travel assistance. When you call its 24/7 hotline, a team member will do more than help you file a claim. He or she will assist you in locating local physicians and dentists, arrange and pay for transportation to a hospital, including an escort if you’re seriously injured and even arrange for transportation home if you need it.

Policies from World Nomads are recommended for particularly active adventurers or those who are traveling to an area in which English isn’t commonly spoken.

- Flexible coverage for adventure activities

- Easy online claims process

- Coverage for trip cancellations and interruptions

- Emergency medical and evacuation coverage

- Ability to extend coverage while traveling

- Limited coverage for pre-existing medical conditions

- Some adventure activities may not be covered

- Limited coverage for electronics and valuables

Choosing a plan from Allianz Global Assistance can save you both time and money. Unlike most other competitors whose policies max out at 90 days abroad, Allianz has coverage options for trips up to 180 days long. If you’re planning a multi-leg backpacking trip or you’re studying abroad, Allianz might be your first choice for insurance coverage.

Like Travelex, Allianz Global Assistance OneTrip Premier plan includes free coverage for children age 17 and under, though it’s important to note that this coverage isn’t included in cheaper Allianz low-tier plans. Even Premier plans are exceptionally affordable — single traveler Basic plans begin at just $50 and a family of 4 can get a week-long Premier plan for just under $120. Allianz Global Assistance is also one of the only travel insurance providers that offer annual multi-trip plans under a single renewable policy, which makes it a convenient choice for travelers who visit international destinations more than once a year.

Allianz’s website and quote process are intuitive and quick, and you can protect your trip in as little as 10 minutes. Allianz’s Premier plan only covers up to $50,000 in emergency medical coverage per insured, but travelers exploring with children or those who need protection for longer trips might opt for Allianz’s lower prices and convenience.

- Coverage provided by Allianz Global Assistance

- Covers trips up to 365 days

- Wide range of plans

- Low coverage limits

Travel insurance adds financial protection to your trip by helping you get some or all of your money back if you have to cancel your trip. Depending on the specifics of your policy, you can be reimbursed for missed flights, hotel stays, down payments on excursions and more. You may be protected from a few scenarios:

- Missing a connecting flight

- Having to cancel your entire vacation in light of an emergency

- Getting sick during your trip and returning home early

- Weather causing the delay or cancellation of your flight or cruise

- Lost baggage

- Losing a passport, visa or other important travel documents

Your insurance company could provide you with compensation to cover return flights or make up for lost bookings.

It’s important to do your research and make sure you’re choosing the best policy for you. Here are some of the things that you should look for when you compare travel insurance plans.

When you’re looking for an affordable travel insurance plan, one of the first things you should look at is your deductible . The deductible is the amount that you have to pay when you file a claim before your insurance kicks in and covers the rest of the cost. Make sure you can afford both the deductible and the premium before you choose a policy.

You’ll see that your policy includes a limit on how much you can get back maximum for a single claim when you buy travel insurance. Look for policies with at least $50,000 in coverage, especially for medical emergencies.

You might not be able to wait 12 hours for your insurance provider’s office to open when you’re traveling. Look for insurance providers who offer 24/7 claims reporting and assistance for emergencies.

Look for claims reporting line that offers assistance in both English and the native language of the country you’re visiting. This can help make it easier to communicate with the local emergency service and medical professionals.

No matter where you roam or which travel insurance plan you choose, read every policy thoroughly before you sign to be sure you're getting the best cheap travel insurance. Know what is and isn’t covered before you leave. For example, make sure you choose a policy that covers extreme sports If you know you want to go skydiving or hang gliding. Double-check to make sure that your plan includes coverage for business cancellations if you work in an industry that may need you at a moment’s notice.

Safety doesn’t end with getting a travel insurance policy. Consider enrolling your trip on the State Department’s Travel Registry website. Use the Department of State’s catalog of travel advisories to research your destination, noting any areas where travel is forbidden or regulated. Write down the address of the United States’ embassy in both English and the local language and keep copies on your person. With insurance and a little planning, you’ll be prepared for a safe and secure trip abroad.

Does travel insurance cover my medical expenses?

This depends on your plan, but some travel insurance offers coverage for medical expenses. Be sure to review the terms of your policy to know for sure.

Is travel insurance worth it?

Oftentimes, yes. Insuring your trip and related expenses can be extremely useful when plans get cancelled or changed last minute.

Can I purchase cheap travel insurance for a single trip or multiple trips?

Many cheap travel insurance providers offer options for both single trip and multiple trip coverage. Multiple trip coverage is often more cost-effective for frequent travelers, while single trip coverage may be more affordable for occasional travelers.

About Sarah Horvath

Sarah is an expert in the insurance, investing for retirement and cryptocurrency space.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Safer travel starts with travel protection

If you are a travel agent or were referred by one, enter the ACCAM number below.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

At Allianz, we continue to show our commitment to sports through our sponsorship with the International Olympic Committee and the International Paralympic Committee. Read More >>

Entry Requirements & COVID-19 Travel Resources

Confused about entry requirements for your destination? Our interactive map shows current travel rules and restrictions for each destination, including info on COVID-19 testing, necessary travel documents and quarantine periods.

Find out how our Epidemic Coverage Endorsement can protect your next trip from certain losses related to COVID-19.

Why do I need travel insurance?

Because sometimes..., you have to cancel a trip last-minute..

Travel insurance can reimburse you for your prepaid, non-refundable trip costs — including vacation rentals, car rentals, hotels and flights — if you have to cancel for a covered reason.

Travel delays leave you stranded.

Travel insurance can reimburse you for eligible meals, accommodation and transportation expenses during a covered delay.

You get sick or hurt when you're far from home.

Travel insurance can reimburse you for care following a covered medical emergency while traveling. We can even arrange and pay for a medical evacuation if needed.

Fender-benders are unavoidable.

Renting a car means taking on a big financial risk; even a tiny scrape can cost you hundreds. Low-priced rental car insurance lets you drive worry-free.

You need help in a hurry.

Whether you're planning a week-long road trip or a weekend getaway, you never know what might happen. Travel insurance gives you access to our 24-Hour Assistance hotline for expert, personalized support in a crisis.

Why go with Allianz Travel Insurance?

As a world leader in travel protection, we help more than 70 million people answer the call of adventure with confidence every year.

We're Protecting You

From protection for trip cancellation to medical bills abroad, our benefits are designed to help you explore reassured.

We're There For You

We've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care.

We're Built For You

From our Allyz ® TravelSmart app to proactive SmartBenefits, we innovate for the way you travel today - and tomorrow.

TRAVEL RESOURCES

How Travel Insurance Works

How the Cancel Anytime Upgrade Works

What Does Rental Car Insurance Cover?

Is It Too Late to Buy Travel Insurance?

The Comprehensive Guide to Annual Travel Insurance

5 Ways the Allyz ® TravelSmart App Can Help During Winter Travels

Travel Insurance with Emergency Medical Benefits

Destination Guide: Croatia

Travel Insurance & COVID-19: The Epidemic Coverage Endorsement Explained

More Travel Resources »

LATEST COVERAGE ALERTS

The events listed below are considered "known and foreseeable" for travel insurance purposes on the date listed next to the event. Please consult your policy for more information.

More Coverage Alerts »

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance