- Technical Support

- Find My Rep

You are here

Journal of Travel Research

Preview this book.

- Description

- Aims and Scope

- Editorial Board

- Abstracting / Indexing

- Submission Guidelines

The Journal of Travel Research ( JTR ) is the premier, peer-reviewed research journal focusing on the business of travel and tourism development, management, marketing, economics and behavior. JTR provides researchers, educators, and professionals with up-to-date, high quality research on behavioral trends and management theory for one of the most influential and dynamic industries. Founded in 1961, JTR is the oldest of the world’s top-ranked scholarly journals focused exclusively on travel and tourism, reflecting the worldwide importance of tourism, both economically and socially.

Published by SAGE, an international leader in social science and business publishing, JTR publishes the most current and influential scholarship on travel and tourism.

The Journal of Travel Research publishes state-of-the-art research on the most important trends and issues in travel and tourism. JTR offers an international and multidisciplinary perspective on the best development and management practices by publishing research which enhances knowledge of important travel and tourism phenomena. JTR thereby contributes to the development of theory which enables improvements in tourism development policy and strategy; managerial practice; economic, social and environmental outcomes; and education and training programs.

All manuscripts submitted to the Journal of Travel Research are double-blind, peer-reviewed by leading tourism scholars. The JTR editorial review board includes top tourism scholars identified on the basis of their current research and scholarly contributions. This journal is a member of the Committee on Publication Ethics (COPE).

The mission of the Journal of Travel Research is to be the premier, peer-reviewed research journal focused on the business of travel and tourism development, management, marketing, economics and behavior. Given the multifaceted, multidisciplinary and multi-stakeholder character of the tourism economy, this focus implies a concern for both the public and private sector spheres of interest as well as economic, socio-cultural, political, environmental, legal, technological, and demographic issues. Specific goals are to be international in scope with geographic diversity, to be multidisciplinary with diversity in research topics and methodologies, and to be germane to the needs of the travel and tourism industry and its stakeholders.

All manuscripts published in the Journal of Travel Research are double-blind, peer-reviewed by accomplished scholars in the topical area. The standard for publication in the Journal of Travel Research is that a paper must make a substantive contribution, either theoretically or methodologically, to the travel and tourism research literature. Additionally, a paper should specify its contribution to pragmatic tourism management concerns and practice.

Published manuscripts must be on research of the highest standards, on topics of major significance and widespread interest, and relevant to the progress of this important global sector.

- A Matter of Fact

- CAB Abstracts Database

- CABI: Forestry Abstracts

- CABI: Global Health

- CIRET - Centre International de Recherches et d'Etudes Touristiques

- CRN: Business & Industry

- Cambridge Scientific Abstracts

- Clarivate Analytics: Current Contents - Physical, Chemical & Earth Sciences

- Corporate ResourceNET - Ebsco

- Current Citations Express

- EBSCO: Business Source - Main Edition

- EBSCO: Vocational & Career Collection

- Geographical Abstracts: Human Geography

- Land, Life & Leisure

- Leisure, Recreation and Tourism Abstracts (in CAB Abstracts Database)

- MasterFILE - Ebsco

- OmniFile: Full Text Mega Edition (H.W. Wilson)

- Rural Development Abstracts

- Social Sciences Citation Index (Web of Science)

- Soils and Fertilizers

- TOPICsearch - Ebsco

- Wilson Business Periodicals Index/Wilson Business Abstracts

- World Agricultural Economics and Rural Sociology Abstracts (in CAB Abstracts Database)

The Journal of Travel Research publishes articles examining the business of travel and tourism development, management, marketing, economics and behavior. Its purpose is to serve as a medium through which those with research interests can exchange ideas and keep abreast of the latest theoretical, methodological and best practices research.

This Journal is a member of the Committee on Publication Ethics .

Please read the guidelines below then visit the Journal’s submission site https://mc.manuscriptcentral.com/jotr to upload your manuscript. Please note that manuscripts not conforming to these guidelines may be returned or rejected.

Only manuscripts of sufficient quality that meet the aims and scope of the Journal of Travel Research will be reviewed.

There are no fees payable to submit or publish in this Journal. Open Access options are available - see section 6.3 below.

As part of the submission process you will be required to warrant that you are submitting your original work, that you have the rights in the work, that you are submitting the work for first publication in the Journal and that it is not being considered for publication elsewhere and has not already been published elsewhere, and that you have obtained and can supply all necessary permissions for the reproduction of any copyright works not owned by you.

1. What do we publish?

1.1 Aims & Scope

Before submitting your manuscript to the Journal of Travel Research , please ensure you have read the Aims & Scope .

1.2 Article types

Three types of manuscripts can be submitted to the Journal of Travel Research .

1.2.1 Empirical Research Articles

The Journal of Travel Research encourages data-based articles which describe, explain, or predict a tourism phenomenon. Articles using quantitative, qualitative or mixed-methods data are encouraged. These articles should be “problem based”, focusing on a practical tourism development, management, marketing or economics problem. The standard for acceptance is that a paper must make a substantive theoretical and/or methodological contribution to the tourism research literature.

1.2.2 Foundations of Tourism Research Conceptual Articles

The Journal of Travel Research encourages the development of high-quality articles which are broadly conceptual with the goal of building theory and/or reviewing and evaluating the body of research in a substantive and important area. The goals of these papers should be improved conceptual clarity, holistic review of the current research, theory building and expansion, and innovation with forward looking outcomes that propose new opportunities and ideas. These articles may be wholly conceptual or conceptual/empirical with meta-analytic data. Authors of such articles must be invited, or commissioned by the Editor. Lead authors will be internationally leading experts in the field. Researchers who feel they may be in a position and have an interest in writing such an article must first contact the Editor directly with a detailed proposal (not a manuscript at this stage) including a detailed case as author demonstrating a leading international reputation and expertise to be able to write such an article. If the proposed article potentially meets the above goals and the author demonstrates a clear capacity to produce the article, the Editor will then invite the author(s) to proceed. Articles in this series will nevertheless be evaluated through the normal double-anonymize review process.

1.2.3 Letters to the Editor

The Journal of Travel Research encourages conversation. The purpose of these letters will be to provoke conversation, review our research endeavors, and commentary on our research problems, assumptions, methodologies and evaluation. Also included are comments about our publication process and expectations. Finally, constructive commentary concerning research publications is encouraged.

All Empirical Research Articles and Foundations of Tourism Research Conceptual Articles submitted to the Journal of Travel Research are first assessed by the Editor to determine their suitability for potential publication in JTR . Subsequently, selected manuscripts are then double-anonymize, peer reviewed by accomplished scholars in the topical area. Acceptance of Letters to the Editor will be the prerogative of the Editor. In all cases, the standard for publication in the Journal of Travel Research is that a paper must make a substantive theoretical and/or methodological contribution to the tourism research literature.

1.3 Writing your paper

The Sage Author Gateway has some general advice and on how to get published , plus links to further resources. Sage Author Services also offers authors a variety of ways to improve and enhance their article including English language editing, plagiarism detection, and video abstract and infographic preparation .

1.3.1 Make your article discoverable

When writing up your paper, think about how you can make it discoverable. The title, keywords and abstract are key to ensuring readers find your article through search engines such as Google. For information and guidance on how best to title your article, write your abstract and select your keywords, have a look at this page on the Gateway: How to Help Readers Find Your Article Online .

1.4 Coronavirus (COVID-19) requirements for manuscripts

COVID-19 has fundamentally affected travel and tourism and therefore impacted the way in which travel and tourism research is conducted and reported. Consequently, manuscripts submitted to the Journal of Travel Research must acknowledge the effect of COVID-19. For this reason, JTR has introduced some additional manuscript submission requirements. Please carefully read the following requirements and ensure you have addressed these appropriately:

- The relevance and usefulness of research conducted pre-COVID-19 will, in general, have declined and in some cases may now be obsolete. How we make use of pre-COVID-19 research to inform post-COVID-19 research design must recognize this reality. A thorough review of the relevant literature is still required, but authors must now acknowledge and discuss the relevance and usefulness of this earlier research in light of COVID-19 developments.

- Researchers who have already collected or used pre-COVID-19 primary data (on or before January 31, 2020) but are yet to finalize their analysis and complete the writing of their manuscript must consider how they may need to address the effect of COVID-19 on their interpretations and conclusions.

- For research involving the collection of data, in part or in whole, after January 31, 2020, during dramatically changing circumstances, will be difficult to analyse and interpret leading to potentially false assumptions and erroneous conclusions. For example, research dealing with tourism consumer behavior cannot ignore how tourism consumers are seeing the world differently. The design, analysis and writing of such research must not ignore this seismic change. Because research topics and circumstances vary so widely, it is not possible to provide prescriptive advice on how researchers must address these challenges; suffice to say that manuscript reviewers will want to clearly see and understand that authors have convincingly addressed such issues in their manuscripts.

- We are of course seeing a large influx of COVID-19-related travel and tourism research. Descriptive research which simply confirms what is already largely known does not meet JTR publication requirements. Hence, when researchers are thinking about potential post-COVID-19 research topics, it would be most helpful if they reflected on this likelihood so that: a) certain topics are not over-researched, and b) the research is not merely descriptive (the what) but is also explanatory (the why) and prescriptive (the how) thereby contributing to theory..

2. Editorial Policies

2.1 Peer review policy

Sage does not permit the use of author-suggested (recommended) reviewers at any stage of the submission process, be that through the web-based submission system or other communication. Reviewers should be experts in their fields and should be able to provide an objective assessment of the manuscript. Our policy is that reviewers should not be assigned to a paper if:

• The reviewer is based at the same institution as any of the co-authors

• The reviewer is based at the funding body of the paper

• The author has recommended the reviewer

• The reviewer has provided a personal (e.g. Gmail/Yahoo/Hotmail) email account and an institutional email account cannot be found after performing a basic Google search (name, department and institution).

2.2 Review criteria

As a leading journal in travel and tourism research, the standards for publication in JTR are very high. There are five primary criteria which determine whether a manuscript is suitable for publication, as follows:

- Relevant - the manuscript must be directly relevant to the stated aims and scope of the journal.

- Significant - the subject and outcomes of the research must make a significant, important, and valuable contribution to travel and tourism knowledge and theory.

- Original - the research must be original, new, and leading-edge such that it adds new knowledge to a topic of importance to JTR readership.

- Rigorous - the research design and methodology must be of a very high standard.

- Articulate - the manuscript must achieve a very high standard of English grammar and expression and must communicate all important aspects of the research in a very clear manner.

JTR receives several hundred submissions per year. The page budget for the journal permits us to publish only a small portion of these (around 114 articles per year currently). Hence, the competition for a publication slot is quite high. JTR is therefore unable to publish many of the manuscripts it receives. So, to provide authors with some further guidance on the factors which have the greatest impact on manuscript acceptance/rejection, the following additional points may be helpful as a general guide. JTR is not primarily a hospitality/hotel management, leisure and recreation management, or even management research journal. Yet, JTR does publish some research which blends into these fields of research providing the focus of the research has a strong travel and tourism aim.

- JTR publishes papers which are on the ‘leading edge of the wave’ or are breaking new and important ground that will become the foundation for interest in tourism research into the future. JTR seeks to lead travel and tourism research and to help shape the tourism research agenda rather than serving merely as a follower. Many studies are undertaken on topics for which there is already a major body of literature. JTR welcomes further research on these well-established research issues providing they lead to important, new results. This might occur if the research advances findings further into new important situations or helps to fill important gaps. It might also occur if the findings challenge orthodox assumptions and paradigms, or revolutionize knowledge on the issue. But if work on already heavily-researched issues simply adds yet one further similar study to the mix, JTR is unlikely to be interested in publishing the manuscript.

- JTR does not have a bias towards or away from any particular methodologies. What matters is whether the research is designed and executed well, and the research topic is of significant interest. It is important to explain and justify why the selected methodology is the most appropriate from among the various approaches available, given the research aims and objectives.

- Many studies are undertaken with a focus on addressing a particular local situation or context. The results from such studies need to have broader relevance and the context itself should be of widespread interest. The findings may indeed be of great interest and relevance to the local tourism sector, but if findings cannot be generalized to other populations, JTR is probably not the right target journal.

- Minor English grammar and expression problems can be potentially addressed by the author through the manuscript review process, but major problems will result in rejection. Only manuscripts with a high standard of English in the final manuscript version are publishable. It is always the author’s responsibility to ensure a high English standard.

- Finally, every manuscript is competing for a limited number of publications slots per year. So sometimes very good research can miss out on a place in JTR simply because there are other more deserving manuscripts.

Reviewers are asked to consider and assess each manuscript on a 5-point scale for each of the following 14 items:

- Is the topic directly relevant to the stated aims and scope of JTR ?

- Does the research make a valuable contribution to travel and tourism knowledge and theory?

- Is the research substantially original and leading-edge for publication in JTR ?

- Is the research design rigorous, methodologically sound, and of a high standard?

- Is the manuscript highly articulate and clear? Does it contain a high standard of English grammar and expression?

- Is the literature review appropriate up-to-date?

- Is there a significant theoretical contribution to the literature?

- Is there a significant methodological contribution to the literature?

- Is the methodology sufficiently explained for future research to follow/replicate?

- Are there clearly stated and significant practical and applied contributions in the conclusions of the manuscript?

- Are there clearly stated and significant theoretical contributions in the conclusions of the manuscript?

- Are there clearly stated and significant methodological contributions in the conclusions of the manuscript?

- Are there clearly stated and exhaustive limitations in the conclusions of the manuscript?

- Are conclusions warranted?

2.3 Authorship

All parties who have made a substantive contribution to the article should be listed as authors. Principal authorship, authorship order, and other publication credits should be based on the relative scientific or professional contributions of the individuals involved, regardless of their status. A student is usually listed as principal author on any multiple-authored publication that substantially derives from the student’s dissertation or thesis.

2.3.1 Writing assistance

Individuals who provided writing assistance, e.g. from a specialist communications company, do not qualify as authors and so should be included in the Acknowledgements section. Authors must disclose any writing assistance – including the individual’s name, company and level of input – and identify the entity that paid for this assistance.

It is not necessary to disclose use of language polishing services.

Please supply any personal acknowledgements for writing assistance separately to the main text on the title page only to facilitate anonymous peer review.

Please note that AI chatbots, for example ChatGPT, should not be listed as authors. For more information see the policy on Use of ChatGPT and generative AI tools .

2.4 Acknowledgements

All contributors who do not meet the criteria for authorship should be listed in an Acknowledgements section. Examples of those who might be acknowledged include a person who provided purely technical help, or a department chair who provided only general support. Please supply any personal acknowledgements separately to the main text and only as part of the title page to facilitate anonymous peer review.

2.4.1 Third party submissions

Where an individual who is not listed as an author submits a manuscript on behalf of the author(s), a statement must be included in the Acknowledgements section of the manuscript and in the accompanying cover letter. The statements must:

- Disclose this type of editorial assistance – including the individual’s name, company and level of input

- Identify any entities that paid for this assistance

- Confirm that the listed authors have authorized the submission of their manuscript via third party and approved any statements or declarations, e.g. conflicting interests, funding, etc.

Where appropriate, Sage reserves the right to deny consideration to manuscripts submitted by a third party rather than by the authors themselves .

2.5 Funding

The Journal of Travel Research requires all authors to acknowledge their funding in a consistent fashion under a separate heading. Please visit the Funding Acknowledgements page on the Sage Journal Author Gateway to confirm the format of the acknowledgment text in the event of funding, or state that: This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors. Funding details should be added to the title page only in order to facilitate the anonymous review process.

2.6 Declaration of conflicting interests

The Journal of Travel Research encourages authors to include a declaration of any conflicting interests and recommends you review the good practice guidelines on the Sage Journal Author Gateway .

For guidance on conflict of interest statements, please see the ICMJE recommendations here .

3. Preparing your manuscript for submission

3.1 Online submission system

Before submitting your manuscript, please ensure you carefully read and adhere to all the guidelines and instructions to authors provided herein. The Journal of Travel Research (JTR) is hosted on SageTRACK: a web-based online submission and peer review system powered by ScholarOne™ Manuscripts. Please read the guidelines below, and then simply visit https://mc.manuscriptcentral.com/jotr to login and submit your article online.

Important note: If you are submitting to your journal via Sage Track, please check whether you already have an account in the system before trying to create a new one. If you have reviewed or authored for the journal in the past year it is likely that you will have had an account created. For further guidance on submitting your manuscript online, please visit ScholarOne Online Help .

3.2 File formatting

The preferred format for your manuscript is Word. LaTeX files are also accepted. Word and (La)Tex templates are available on the Manuscript Submission Guidelines page of our Author Gateway.

Manuscripts are submitted as two or more files. The first file is the title page containing the manuscript title, author names, affiliations, any acknowledgments and declarations, and both postal and e-mail addresses. The other file(s) should contain no information which might reveal the identity of the authors. These files provide the body of the article including the title, abstract, text body, and references. Tables and figures may also be included in this file on separate pages at the end of the manuscript or uploaded as separate files.

3.3 Manuscript preparation

To be considered for publication in the Journal of Travel Research, manuscripts must meet the following standards:

- Everything is double spaced.

- Everything is left justified, with a ragged right-hand margin (no full justification)

- Format is one inch margins on all sides. Minimum print size is 12 point, except in tables and figures where 10 pt may be used.

- Manuscripts are submitted as two files: The cover page and the manuscript body.

- The cover page should include the manuscript title, ALL authors’ name, position, affiliation, address, telephone numbers, fax numbers, e-mail addresses, and any acknowledgements. Please use title case when entering the article title into the submission form.

- The manuscript file should contain the title, abstract, 4 to 5 keywords, text, appendices, notes, references, each table, and each figure.

- Authors’ names are to appear only on the cover page. There should be nothing in the manuscript file that identifies the authors either by name or institution.

- Tables and figures are not to be embedded in the manuscript – each table and figure should be provided as a separate page at the end of the manuscript. Tags should be inserted in the manuscript indicating approximately where tables and figures should be located.

- Within the manuscript file, Title, Abstract and keywords should be on one page. After that, each section is to begin with a new page.

- Abstract is to be 150 words or less

- Manuscripts must be 10,000 words or less. This 10,000 word limit includes everything in the manuscript except the title, abstract, keywords, tables, figures and references. Due to page limitations and the desire to accommodate as many authors as possible, this should be considered a hard limit.

- Acronyms are only allowed in the following circumstances: where they represent universally recognised organisations, e.g. UNWTO, NATO, or internationally recognised classifications such as ISO, GDP, or for well recognised scientific methodological terms such as ANOVA, LISREL, PLS and so on. Acronyms are not allowed for field specific terms in any circumstances.

- American English spellings are used in all sections except references. Sage Publications requires English translations of all reference citations.

- Endnotes are to be grouped on a separate page. There are to be no footnotes.

- All in-text citations should be included in the reference list, and all references should have in-text citations.

3.4 Reference style

The Journal of Travel Research uses APA 7th edition formatting. Information on APA reference examples can be found here: https://apastyle.apa.org/ .

3.5 English language editing services

Authors seeking assistance with English language editing, translation, or figure and manuscript formatting to fit the journal’s specifications should consider using Sage Language Services . Visit Sage Language Services on our Journal Author Gateway for further information.

3.6 Artwork, figures and other graphics

For guidance on the preparation of illustrations, pictures and graphs in electronic format, please visit Sage’s Manuscript Submission Guidelines

Figures supplied in color will appear in color online regardless of whether or not these illustrations are reproduced in color in the printed version. For specifically requested color reproduction in print, you will receive information regarding the costs from Sage after receipt of your accepted article.

Figures are to be camera ready – they must appear exactly as they should in the journal. The Journal of Travel Research is published in black and white. Figures should be black and white with gray and pattern shading if necessary. Any color requirements for the printed manuscript version will incur a charge to the author(s).

Tables should not have cells or lines dividing the different elements. Preferably, each element should be separated by a tab.

3.7 Supplementary material

This journal is able to host additional materials online (e.g. datasets, podcasts, videos, images etc) alongside the full-text of the article. For more information please refer to our guidelines on submitting supplementary files

As part of our commitment to ensuring an ethical, transparent and fair peer review process Sage is a supporting member of ORCID, the Open Researcher and Contributor ID . ORCID provides a unique and persistent digital identifier that distinguishes researchers from every other researcher, even those who share the same name, and, through integration in key research workflows such as manuscript and grant submission, supports automated linkages between researchers and their professional activities, ensuring that their work is recognized.

The collection of ORCID iDs from corresponding authors is now part of the submission process of this journal. If you already have an ORCID iD you will be asked to associate that to your submission during the online submission process. We also strongly encourage all co-authors to link their ORCID ID to their accounts in our online peer review platforms. It takes seconds to do: click the link when prompted, sign into your ORCID account and our systems are automatically updated. Your ORCID iD will become part of your accepted publication’s metadata, making your work attributable to you and only you. Your ORCID iD is published with your article so that fellow researchers reading your work can link to your ORCID profile and from there link to your other publications.

If you do not already have an ORCID iD please follow this link to create one or visit our ORCID homepage to learn more.

3.9 Information required for completing your submission

You will be asked to provide contact details and academic affiliations for all co-authors via the submission system and identify who is to be the corresponding author. These details must match what appears on your manuscript. At this stage please ensure you have included all the required statements and declarations and uploaded any additional supplementary files (including reporting guidelines where relevant).

3.10 Permissions

Please also ensure that you have obtained any necessary permission from copyright holders for reproducing any illustrations, tables, figures or lengthy quotations previously published elsewhere. For further information including guidance on fair dealing for criticism and review, please see the Copyright and Permissions page on the Sage Author Gateway .

4. Manuscript revision requirements

To enable you to revise your manuscript so as to give it the best chances of reaching a successful outcome, please carefully read these guidelines and follow them meticulously. It is essential that you understand that the invitation to revise and resubmit a paper is not a commitment on the part of the Journal of Travel Research to eventually accept and publish the paper. Even if the author addresses the concerns raised in the initial review, the further review of the revised manuscript must determine whether the paper then meets the standards required for publication in JTR .

As you revise your paper for resubmission to the Journal of Travel Research , please make sure it meets the following guidelines. If the paper is ultimately accepted, you will receive the list of formatting requirements again with a “it must meet…” statement. It is critical that you take care to ensure you meet these requirements as it can save a great deal of your time and our time at the typesetting stage.

Please submit your revised paper via the Journal of Travel Research Manuscript Central process. It is important that the paper be submitted as a revision of your first submission. Specifically, this means it would be submitted under the same manuscript number and be treated both by Manuscript Central and by the Editorial Office as a revised paper. This will result in a much faster review process.

Include with your submission a supplementary file indicating how the paper has been revised relative to the substantive comments made by the reviewers of the original version as well as any additional comments or requirements indicated by the Editor as contained in the decision email. It is important that this file be submitted together with the revised manuscript so that it can be forwarded it to the reviewers. This paper must explain how the authors have addressed the concerns raised in the initial review. Subsequent reviews focus specifically on this response. When you finish with your resubmission, you can review a pdf file of the complete submission – make sure the supplementary file is included. Also, since it is potentially going back to the reviewers, please be sure not to include your name or identity in the supplementary file.

To create this supplementary file you should:

- Cut and paste all comments by each reviewer, as well any requirements indicated by the Editor in the decision email.

- For each substantive comment, provide a detailed explanation and justification of your response.

- Your response to each comment should clearly indicate whether or not a change has occurred in the manuscript and, if so, what that change is and precisely where it can be found.

- If you are in disagreement with the reviewer comments or suggestions, or prefer an alternative approach to address an issue they have raised, this is quite acceptable. However, in such cases, you need to discuss and explain your views and justify your preferred approach either not to change the manuscript, or to change it in a different manner. Again, any change should be clearly explained and its location in the manuscript specified.

Attending to these points adequately will significantly benefit the further review of revised manuscripts.

In addition to responding to the reviewer comments, it is important to make sure the paper is current in its review of the literature. Often the manuscript process, from inception to completion, can take many months. It is important that, during each revision process, you update the review of literature, including, as appropriate, how this paper fits within the related papers published in the tourism literature and JTR over the past few years. Please also make sure to check for relevant manuscripts in the JTR Online First ( http://jtr.sagepub.com/content/early/recent ) listing as that is the most current papers that will be published in advance of your paper.

5. On acceptance and publication

5.1 Sage Production

Your Sage Production Editor will keep you informed as to your article’s progress throughout the production process. Proofs will be sent by PDF to the corresponding author and should be returned promptly. Authors are reminded to check their proofs carefully to confirm that all author information, including names, affiliations, sequence and contact details are correct, and that Funding and Conflict of Interest statements, if any, are accurate.

5.2 Online First publication

Online First allows final articles (completed and approved articles awaiting assignment to a future issue) to be published online prior to their inclusion in a journal issue, which significantly reduces the lead time between submission and publication. Visit the Sage Journals help page for more details, including how to cite Online First articles.

5.3 Access to your published article

Sage provides authors with online access to their final article.

5.4 Promoting your article

Publication is not the end of the process! You can help disseminate your paper and ensure it is as widely read and cited as possible. The Sage Author Gateway has numerous resources to help you promote your work. Visit the Promote Your Article page on the Gateway for tips and advice.

6. Publishing Policies

6.1 Publication ethics

Sage is committed to upholding the integrity of the academic record. We encourage authors to refer to the Committee on Publication Ethics’ International Standards for Authors and view the Publication Ethics page on the Sage Author Gateway

6.1.1 Plagiarism

The Journal of Travel Research and Sage take issues of copyright infringement, plagiarism or other breaches of best practice in publication very seriously. We seek to protect the rights of our authors and we always investigate claims of plagiarism or misuse of published articles. Equally, we seek to protect the reputation of the journal against malpractice. Submitted articles may be checked with duplication-checking software. Where an article, for example, is found to have plagiarised other work or included third-party copyright material without permission or with insufficient acknowledgement, or where the authorship of the article is contested, we reserve the right to take action including, but not limited to: publishing an erratum or corrigendum (correction); retracting the article; taking up the matter with the head of department or dean of the author's institution and/or relevant academic bodies or societies; or taking appropriate legal action.

6.1.2 Prior publication

If material has been previously published it is not generally acceptable for publication in a Sage journal. However, there are certain circumstances where previously published material can be considered for publication. Please refer to the guidance on the Sage Author Gateway or if in doubt, contact the Editor at the address given below.

6.2 Contributor's publishing agreement

Before publication, Sage requires the author as the rights holder to sign a Journal Contributor’s Publishing Agreement. Sage’s Journal Contributor’s Publishing Agreement is an exclusive licence agreement which means that the author retains copyright in the work but grants Sage the sole and exclusive right and licence to publish for the full legal term of copyright. Exceptions may exist where an assignment of copyright is required or preferred by a proprietor other than Sage. In this case copyright in the work will be assigned from the author to the society. For more information please visit the Sage Author Gateway

6.3 Open access and author archiving

The Journal of Travel Research offers optional open access publishing via the Sage Choice programme and Open Access agreements, where authors can publish open access either discounted or free of charge depending on the agreement with Sage. Find out if your institution is participating by visiting Open Access Agreements at Sage . For more information on Open Access publishing options at Sage please visit Sage Open Access . For information on funding body compliance, and depositing your article in repositories, please visit Sage’s Author Archiving and Re-Use Guidelines and Publishing Policies .

7. Further information

Any correspondence, queries or additional requests for information on the manuscript submission process should be sent to the Co-Editors Nancy Gard McGehee at [email protected] or James Petrick at [email protected] .

- Read Online

- Sample Issues

- Current Issue

- Email Alert

- Permissions

- Foreign rights

- Reprints and sponsorship

- Advertising

Individual Subscription, Print Only

Institutional Subscription, E-access

Institutional Subscription & Backfile Lease, E-access Plus Backfile (All Online Content)

Institutional Subscription, Print Only

Institutional Subscription, Combined (Print & E-access)

Institutional Subscription & Backfile Lease, Combined Plus Backfile (Current Volume Print & All Online Content)

Institutional Backfile Purchase, E-access (Content through 1998)

Individual, Single Print Issue

Institutional, Single Print Issue

To order single issues of this journal, please contact SAGE Customer Services at 1-800-818-7243 / 1-805-583-9774 with details of the volume and issue you would like to purchase.

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Research & industry impact.

Monthly Insights

The U.S. Travel Insights Dashboard ›

New & Featured

INTERACTIVE TRAVEL DATA The U.S. Travel Insights Dashboard

FACT SHEET Our Impact

REPORT Quarterly Consumer Insights

Browse Full Research Catalog

The u.s. travel insights dashboard.

The most comprehensive and centralized source for high-frequency intelligence on the U.S. travel industry and the broader economy. Updated monthly.

Economic Impact

Search by state or congressional district and download a detailed PDF of the essential role travel plays in stimulating economic growth, cultivating vibrant communities, creating quality job opportunities and inspiring new businesses. It is indispensable to our nation’s global competitiveness.

The Latest Travel Data

Monthly member-exclusive summary of the latest economic, consumer and travel indicators, trends and analysis featuring key highlights from the U.S. Travel Insights Dashboard.

Lodging Levies: Rates and Allocations

An in-depth examination of lodging levies and taxes across 105 diverse destinations, designed to shed light on how governments allocate tax revenue from the travel industry.

Semi-Annual Travel Forecast and Global Competitiveness Overview

U.S. Travel hosted a two-part webinar featuring a deep dive into the latest travel forecast and an overview of a new global competitive analysis report, conducted by Euromonitor.

Travel Forecast

The latest forecast shows that international inbound and domestic business travel are still far from a full recovery. Although international travel to the U.S. is increasing, it remains below pre-pandemic levels. Business travel is expected to grow in 2024 but at a slower pace. Domestic leisure growth slowed due to reduced consumer spending amid higher borrowing costs, tighter credit conditions and the restart of student loan repayments.

- Travel, Tourism & Hospitality ›

- Leisure Travel

Online travel market - statistics & facts

How big is the online travel market, what are the leading online travel agencies (otas), what travel products do consumers book online, key insights.

Detailed statistics

Online travel market size worldwide 2017-2028

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Most popular travel and tourism websites worldwide 2024

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Online Travel Market

Market cap of leading online travel companies worldwide 2023

Related topics

Online travel trends.

- Artificial intelligence (AI) use in travel and tourism

- Mobile travel trends

- Digitalization of the travel industry

- Impact of technology on travel and tourism

Online travel companies

- Booking Holdings Inc.

- Expedia Group, Inc.

Trip.com Group

Tripadvisor, travel and tourism worldwide.

- Tourism worldwide

- Travel agency industry

- Hotel industry worldwide

- Cruise industry worldwide

Recommended statistics

Industry overview.

- Premium Statistic Market size of the tourism sector worldwide 2011-2024

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Revenue of the travel apps industry worldwide 2017-2027

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Market size of the tourism sector worldwide 2011-2024

Market size of the tourism sector worldwide from 2011 to 2023, with a forecast for 2024 (in trillion U.S. dollars)

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Revenue of the travel apps industry worldwide 2017-2027

Revenue of the travel apps market worldwide from 2017 to 2027 (in billion U.S. dollars)

Estimated EV/Revenue ratio in the online travel market 2024, by segment

Estimated enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide as of April 2024, by segment

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Online bookings

- Premium Statistic Travel product online bookings in the U.S. 2023

- Premium Statistic Travel product online bookings in Canada 2023

- Premium Statistic Travel product online bookings in the UK 2023

- Premium Statistic Travel product online bookings in China 2023

- Premium Statistic Travel product online bookings in India 2023

- Premium Statistic Importance to book a trip fully online among travelers worldwide 2023, by generation

Travel product online bookings in the U.S. 2023

Travel product online bookings in the U.S. as of December 2023

Travel product online bookings in Canada 2023

Travel product online bookings in Canada as of December 2023

Travel product online bookings in the UK 2023

Travel product online bookings in the UK as of December 2023

Travel product online bookings in China 2023

Travel product online bookings in China as of December 2023

Travel product online bookings in India 2023

Travel product online bookings in India as of December 2023

Importance to book a trip fully online among travelers worldwide 2023, by generation

Share of travelers who think it is important to be able to book their trip entirely online worldwide as of July 2023, by generation

Market leaders

- Premium Statistic Revenue of leading OTAs worldwide 2019-2022

- Premium Statistic Marketing expenses of leading OTAs worldwide 2019-2022

- Premium Statistic Marketing/revenue ratio of leading OTAs worldwide 2019-2022

- Premium Statistic Number of employees at leading travel companies worldwide 2022

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Premium Statistic Most popular travel and tourism websites worldwide 2024

Revenue of leading OTAs worldwide 2019-2022

Leading online travel agencies (OTAs) worldwide from 2019 to 2022, by revenue (in million U.S. dollars)

Marketing expenses of leading OTAs worldwide 2019-2022

Marketing expenses of leading online travel agencies (OTAs) worldwide from 2019 to 2022 (in million U.S. dollars)

Marketing/revenue ratio of leading OTAs worldwide 2019-2022

Marketing to revenue ratio of leading online travel agencies (OTAs) worldwide from 2019 to 2022

Number of employees at leading travel companies worldwide 2022

Number of employees at selected leading travel companies worldwide in 2022

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Most visited travel and tourism websites worldwide as of April 2024 (in million visits)

Booking Holdings

- Basic Statistic Revenue of Booking Holdings worldwide 2007-2023

- Premium Statistic Number of bookings through Booking Holdings worldwide 2010-2023, by segment

- Premium Statistic Operating income of Booking Holdings worldwide 2007-2023

- Premium Statistic Net income of Booking Holdings worldwide 2007-2023

Revenue of Booking Holdings worldwide 2007-2023

Revenue of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Number of bookings through Booking Holdings worldwide 2010-2023, by segment

Number of bookings through Booking Holdings worldwide from 2010 to 2023, by business segment (in millions)

Operating income of Booking Holdings worldwide 2007-2023

Operating income of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Net income of Booking Holdings worldwide 2007-2023

Net income of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Expedia Group

- Premium Statistic Revenue of Expedia Group, Inc. worldwide 2007-2023

- Premium Statistic Revenue of Expedia Group, Inc. worldwide 2017-2023, by business model

- Premium Statistic Operating income of Expedia Group, Inc. worldwide 2007-2023

- Premium Statistic Net income of Expedia Group, Inc. worldwide 2007-2023

Revenue of Expedia Group, Inc. worldwide 2007-2023

Revenue of Expedia Group, Inc. worldwide from 2007 to 2023 (in billion U.S. dollars)

Revenue of Expedia Group, Inc. worldwide 2017-2023, by business model

Revenue of Expedia Group, Inc. worldwide from 2017 to 2023, by business model (in million U.S. dollars)

Operating income of Expedia Group, Inc. worldwide 2007-2023

Operating income of Expedia Group, Inc. worldwide from 2007 to 2023 (in million U.S. dollars)

Net income of Expedia Group, Inc. worldwide 2007-2023

Net income of Expedia Group, Inc. worldwide from 2007 to 2023 (in million U.S. dollars)

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb revenue worldwide 2019-2023, by region

- Premium Statistic Airbnb operations income worldwide 2017-2023

- Premium Statistic Airbnb net income worldwide 2017-2023

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb revenue worldwide 2019-2023, by region

Revenue of Airbnb worldwide from 2019 to 2023, by region (in billion U.S. dollars)

Airbnb operations income worldwide 2017-2023

Income from operations of Airbnb worldwide from 2017 to 2023 (in million U.S. dollars)

Airbnb net income worldwide 2017-2023

Net income of Airbnb worldwide from 2017 to 2023 (in million U.S. dollars)

- Premium Statistic Total revenue of Trip.com Group 2012-2022

- Premium Statistic Revenue of Trip.com 2012-2022, by product

- Premium Statistic Revenue of Trip.com 2017-2022, by region

- Premium Statistic Net profit of Trip.com 2012-2022

Total revenue of Trip.com Group 2012-2022

Total revenue of Trip.com Group Ltd. in China from 2012 to 2022 (in billion yuan)

Revenue of Trip.com 2012-2022, by product

Revenue of Trip.com Group Ltd. from 2012 to 2022, by product (in million yuan)

Revenue of Trip.com 2017-2022, by region

Revenue of Trip.com Group Ltd. from 2017 to 2022, by region (in million yuan)

Net profit of Trip.com 2012-2022

Net profit of Trip.com Group Ltd. from 2012 to 2022 (in million yuan)

- Premium Statistic Revenue of Tripadvisor worldwide 2008-2023

- Premium Statistic Revenue of Tripadvisor worldwide 2017-2023, by business segment

- Premium Statistic Revenue of Tripadvisor worldwide 2012-2023, by region

- Premium Statistic Operating income of Tripadvisor worldwide 2008-2023

- Premium Statistic Net income of Tripadvisor worldwide 2008-2023

Revenue of Tripadvisor worldwide 2008-2023

Revenue of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Revenue of Tripadvisor worldwide 2017-2023, by business segment

Revenue of Tripadvisor, Inc. worldwide from 2017 to 2023, by business segment (in million U.S. dollars)

Revenue of Tripadvisor worldwide 2012-2023, by region

Revenue of Tripadvisor, Inc. worldwide from 2012 to 2023, by region (in million U.S. dollars)

Operating income of Tripadvisor worldwide 2008-2023

Operating income of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Net income of Tripadvisor worldwide 2008-2023

Net income of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Enhancing destination image through virtual reality technology: the role of tourists’ immersive experience

- Published: 27 April 2024

Cite this article

- Davood Ghorbanzadeh ORCID: orcid.org/0000-0003-3238-8241 1 ,

- Ahmad Qasim Mohammad AlHamad ORCID: orcid.org/0000-0002-7083-5375 2 ,

- Kuicthok Yak Deng 3 ,

- Ahmed Alaa Hani Alkurdi 4 , 5 ,

- K. D. V. Prasad 6 &

- Mohsen Sharbatiyan ORCID: orcid.org/0000-0002-7941-7655 7

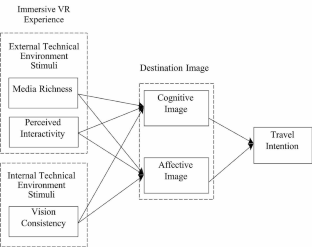

This study investigates the relationship between the immersive VR experience, destination cognitive image, destination affective image, and tourists’ travel intention. The sample of this research is 167 visitors of three tourist attractions of Isfahan Province in Iran, through 360-degree virtual reality videos. In order to collect research data, an online survey and convenience sampling methods were used. PLS-SEM was utilized to assess both the measurement and structural models. The findings indicated that among factors of external technical environment stimuli, media richness has a stronger effect on the formation of the destination’s cognitive image than the affective image. Also, perceived interactivity compared to media richness has a significant impact on the formation of the destination’s affective image. In addition, vision consistency as an internal technical environment stimulus has a positive effect on the formation of the cognitive and affective image of the destination. Finally, the affective image of the destination resulting from the immersive VR experience has a stronger effect on travel intention than the cognitive image.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Akgün, A. E., Senturk, H. A., Keskin, H., & Onal, I. (2020). The relationships among nostalgic emotion, destination images and tourist behaviors: An empirical study of Istanbul. Journal of Destination Marketing & Management , 16 , 100355.

Article Google Scholar

An, S., Choi, Y., & Lee, C. K. (2021). Virtual travel experience and destination marketing: Effects of sense and information quality on flow and visit intention. Journal of Destination Marketing & Management, 19 , 100492.

Assaker, G. (2020). Age and gender differences in online travel reviews and user-generated-content (UGC) adoption: Extending the technology acceptance model (TAM) with credibility theory. Journal of Hospitality Marketing & Management , 29 (4), 428–449.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social research: Conceptual, strategic, and statistical considerations. Journal of personality and social psychology, 51 (6), 1173–1182.

Chang, H. H., & Chiang, C. C. (2022). Is virtual reality technology an effective tool for tourism destination marketing? A flow perspective. Journal of Hospitality and Tourism Technology , 13 (3), 427–440.

Chen, C. C., & Chang, Y. C. (2018). What drives purchase intention on Airbnb? Perspectives of consumer reviews, information quality, and media richness. Telematics and Informatics , 35 (5), 1512–1523.

Chew, E. Y. T., & Jahari, S. A. (2014). Destination image as a mediator between perceived risks and revisit intention: A case of post-disaster Japan. Tourism Management, 40 (1), 382–393.

Chu, Q., Bao, G., & Sun, J. (2022). Progress and prospects of destination image research in the last decade. Sustainability , 14 (17), 10716.

de Amorim, I. P., Guerreiro, J., Eloy, S., & Loureiro, S. M. C. (2022). How augmented reality media richness influences consumer behaviour. International Journal of Consumer Studies , 46 (6), 2351–2366.

Dincelli, E., & Yayla, A. (2022). Immersive virtual reality in the age of the Metaverse: A hybrid-narrative review based on the technology affordance perspective. The Journal of Strategic Information Systems , 31 (2), 101717.

Elbedweihy, A. M., Jayawardhena, C., Elsharnouby, M. H., et al. (2016). Customer relationship building: The role of brand attractiveness and consumer–brand identification. Journal of Business Research , 69 (8), 2901–2910.

Flavián, C., Ibáñez-Sánchez, S., & Orús, C. (2021). Impacts of technological embodiment through virtual reality on potential guests’ emotions and engagement. Journal of Hospitality Marketing & Management , 30 (1), 1–20.

Gartner, W. C. (1994). Image formation process. Journal of Travel & Tourism Marketing , 2 (2–3), 191–216.

Ghorbanzadeh, D. (2022). Relationships between virtual reality experiences, experiential relationship quality and experiential advocacy: The case of virtual reality park. Journal of Relationship Marketing , 21 (3), 169–193.

González-Rodríguez, M. R., Díaz-Fernández, M. C., & Pino-Mejías, M. Á. (2020). The impact of virtual reality technology on tourists’ experience: A textual data analysis. Soft Computing , 24 (18), 13879–13892.

Guerreiro, J., Rita, P., & Trigueiros, D. (2015). Attention, emotions and cause-related marketing effectiveness. European Journal of Marketing , 49 (11/12), 1728–1750.

Guo, K., Fan, A., Lehto, X., & Day, J. (2023). Immersive digital tourism: The role of multisensory cues in digital museum experiences. Journal of Hospitality & Tourism Research , 47 (6), 1017–1039.

Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review , 31 (1), 2–24.

Hyun, M. Y., & O'Keefe, R. M. (2012). Virtual destination image: Testing a Telepresence model, Journal of Business Research, 65 (1), 29–35.

Ijsselsteijn, W. A. (2002). Elements of a multi-level theory of presence: Phenomenology, mental processing and neural correlates. Proceedings of presence, 2002 , 245–259.

Google Scholar

Kaushik, A. K., Mohan, G., & Kumar, V. (2020). Examining the antecedents and consequences of customers’ trust toward mobile retail apps in India. Journal of Internet Commerce , 19 (1), 1–31.

Kim, M. J., Lee, C. K., & Jung, T. (2020). Exploring consumer behavior in virtual reality tourism using an extended stimulus-organism-response model. Journal of Travel Research , 59 (1), 69–89.

Lee, S. A., Lee, M., & Jeong, M. (2021). The role of virtual reality on information sharing and seeking behaviors. Journal of Hospitality and Tourism Management , 46 , 215–223.

Lin, L. P. L., Huang, S. C. L., & Ho, Y. C. (2020). Could virtual reality effectively market slow travel in a heritage destination? Tourism Management , 78 , 104027.

Loureiro, S. M. C., Guerreiro, J., Eloy, S., et al. (2019). Understanding the use of virtual reality in marketing: A text mining-based review. Journal of Business Research , 100 , 514–530.

Makransky, G., & Mayer, R. E. (2022). Benefits of taking a virtual field trip in immersive virtual reality: Evidence for the immersion principle in multimedia learning. Educational Psychology Review , 34 (3), 1771–1798.

Article PubMed PubMed Central Google Scholar

McLean, G., & Wilson, A. (2019). Shopping in the digital world: Examining customer engagement through augmented reality mobile applications. Computers in Human Behavior , 101 , 210–224.

Moon, J. H., Kim, E., Choi, S. M., et al. (2013). Keep the Social in Social Media: The role of Social Interaction in Avatar-based virtual shopping. Journal of Interactive Advertising , 13 (1), 14–26.

Mütterlein, J., & Hess, T. (2017). Exploring the impacts of virtual reality on business models: the case of the media industry.

Nazir, M. U., Yasin, I., Tat, H. H., Khalique, M., & Mehmood, S. A. (2022). The influence of international tourists’ destination image of Pakistan on behavioral intention: The roles of travel experience and media exposure. International Journal of Hospitality & Tourism Administration , 23 (6), 1266–1290.

Pan, X., Rasouli, S., & Timmermans, H. (2021). Investigating tourist destination choice: Effect of destination image from social network members. Tourism Management , 83 , 104217.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: a critical review of the literature and recommended remedies. Journal of Appelied Psychology, 88 (5), 879–903.

Qu, H., Kim, L. H., & Im, H. H. (2011). A model of destination branding: Integrating the concepts of the branding and destination image. Tourism Management , 32 (3), 465–476.

Rahimizhian, S., Ozturen, A., & Ilkan, M. (2020). Emerging realm of 360-degree technology to promote tourism destination. Technology in Society , 63 , 101411.

Rainoldi, M., Driescher, V., Lisnevska, A., Zvereva, D., Stavinska, A., Relota, J., & Egger, R. (2018). Virtual reality: an innovative tool in destinations' marketing. The Gaze: Journal of Tourism and Hospitality, 9 (1), 53–68.

Russell, J. A., Ward, L. M., & Pratt, G. (1981). Affective quality attributed to environments: A factor analytic study. Environment and Behavior , 13 (3), 259–288.

Tahyudin, I., Saputra, D. I. S., & Haviluddin, H. (2015). An interactive mobile augmented reality for tourism objects at Purbalingga district. TELKOMNIKA Indonesian Journal of Electrical Engineering , 16 (3), 559–564.

Tiusanen, P. (2017). Virtual reality in destination marketing.

Vishnevskaya, E. V., Klimova, T. B., Slinkova, O. K., & Glumova, Y. G. (2017). The influence of virtual information spaces on tourism development. Espacios , 38 (49), 22.

Woyo, E., & Nyamandi, C. (2022). Application of virtual reality technologies in the comrades’ marathon as a response to COVID-19 pandemic. Development Southern Africa , 39 (1), 20–34.

Wu, X., & Lai, I. K. W. (2021). Identifying the response factors in the formation of a sense of presence and a destination image from a 360-degree virtual tour. Journal of Destination Marketing & Management , 21 , 100640.

Yang, S., Carlson, J. R., & Chen, S. (2020). How augmented reality affects advertising effectiveness: The mediating effects of curiosity and attention toward the ad. Journal of Retailing and Consumer Services , 54 , 102020.

Yang, R,. Khloo-Lattimore, C., & Potter, L. E. (2021). Virtual reality and tourism marketing: Conceptualizing a framework on presence, emotion, and intention. Current Issues in Tourism, 24 (11), 1505–1525.

Yilmaz, Y., & Yilmaz, Y. (2020). Pre-and post‐trip antecedents of destination image for non‐visitors and visitors: A literature review. International Journal of Tourism Research , 22 (4), 518–535.

Ying, T., Tang, J., Ye, S., Tan, X., & Wei, W. (2022). Virtual reality in destination marketing: Telepresence, social presence, and tourists’ visit intentions. Journal of Travel Research , 61 (8), 1738–1756.

Zhang, C. (2020). The why, what, and how of immersive experience. Ieee Access , 8 , 90878–90888.

Zhang, M., Zhang, G. Y., Gursoy, D., & Fu, X. R. (2018). Message framing and regulatory focus effects on destination image formation. Tourism Management , 69 , 397–407.

Download references

Author information

Authors and affiliations.

Department of Management and Social Science, Islamic Azad University of Tehran North Branch, Tehran, Iran

Davood Ghorbanzadeh

Department of Business Administration, University of Sharjah, Sharjah, UAE

Ahmad Qasim Mohammad AlHamad

Department of Business Management, Lincoln University College, Petaling Jaya, Selangor Darul Ehsan, Malaysia

Kuicthok Yak Deng

Department of Information Technology, Duhok Technical College, Duhok Polytechnic University, KRG, Duhok, Iraq

Ahmed Alaa Hani Alkurdi

Department of Computer Science, College of Science, Nawroz University, Duhok, KRG, Iraq

Symbiosis Institute of Business Management, Hyderabad, India

K. D. V. Prasad

Department of Executive Master of Business Administration, Faculty of Management, Islamic Azad University of Tehran Central Branch, Tehran, Iran

Mohsen Sharbatiyan

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Davood Ghorbanzadeh .

Ethics declarations

Conflict of interest.

No potential conflict of interest was reported by the author(s).

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Ghorbanzadeh, D., AlHamad, A.Q.M., Deng, K.Y. et al. Enhancing destination image through virtual reality technology: the role of tourists’ immersive experience. Curr Psychol (2024). https://doi.org/10.1007/s12144-024-06007-3

Download citation

Accepted : 11 April 2024

Published : 27 April 2024

DOI : https://doi.org/10.1007/s12144-024-06007-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Immersive experience

- Destination image

- Travel intention

- Virtual reality

- Find a journal

- Publish with us

- Track your research

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Most Americans have traveled abroad, although differences among demographic groups are large

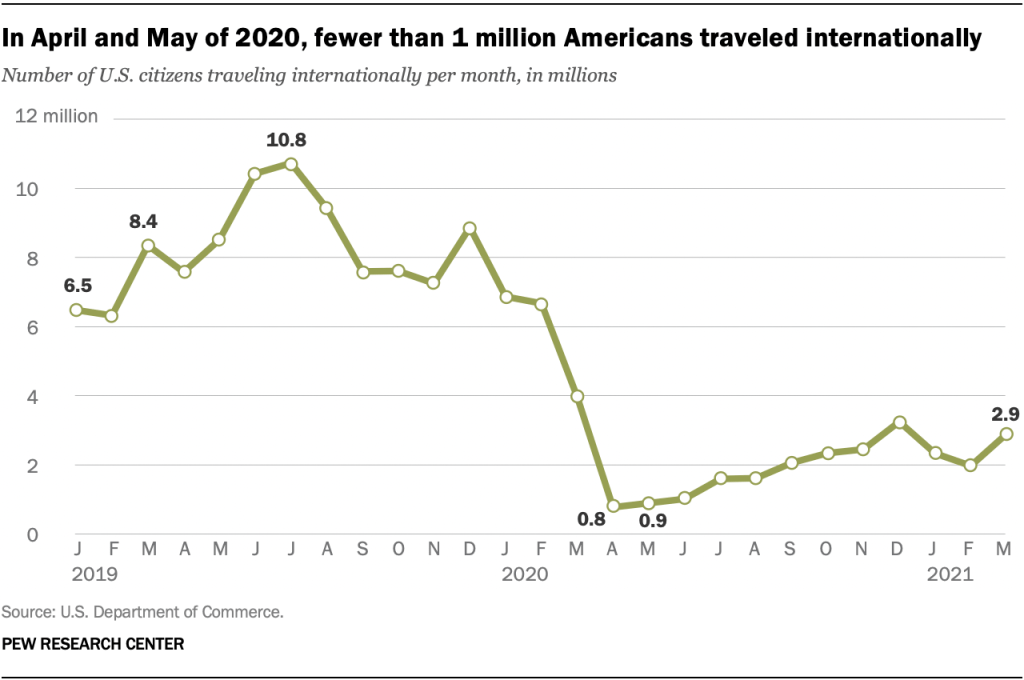

Americans are gradually returning to international travel, though international travel restrictions remain in place in many countries.

In March 2021 – the most recent month for which data is available – around 3 million American citizens traveled outside of the country. This is shy of the nearly 4 million U.S. citizens who traveled abroad in March 2020 as the coronavirus pandemic unfolded and far below the roughly 8 million who did so in March 2019, according to U.S. Department of Commerce data . But it represents a significant uptick over the low point in the late spring of 2020, when only around 1 million Americans or fewer left the United States. Still, international travel by Americans remains far below pre-pandemic levels.

To provide context for the impact of the COVID-19 pandemic on international travel, this post looks at the habits of Americans when it comes to who most frequently goes abroad, as well as those groups in the U.S. who have been less likely to do so. To do this, we analyzed I-92 data from the International Air Travel Statistics Program at the U.S. Department of Commerce. This data includes all flights in and out of the U.S. and reports the total volume of air traffic as well as the number of U.S. citizens traveling.

The post also uses findings from a Pew Research Center survey conducted June 14-27, 2021. The survey sampled 10,606 adults who are part of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology .

Here are the questions used for the report, along with responses, and its methodology .

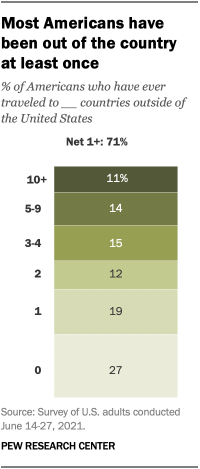

Whether before or during the pandemic, international travel is something a 71% majority of U.S. adults have done at some point in their lives, according to a June Pew Research Center survey. By contrast, around a quarter (27%) have not traveled abroad.

Still, the degree to which Americans have traveled around the globe varies widely: 19% have been to only one foreign country, 12% to two countries, 15% to three or four countries, and 14% to five to nine countries. Only 11% of Americans have been to 10 or more countries.

Who travels – and how much – also differs substantially across demographic groups. Income plays a decided role: Almost half (48%) of those earning less than $30,000 a year have not left the country, compared with 28% of those who earn between $30,000 and $79,999 a year and 10% of those earning $80,000 or more. These highest earners are also significantly more likely to have visited multiple countries.

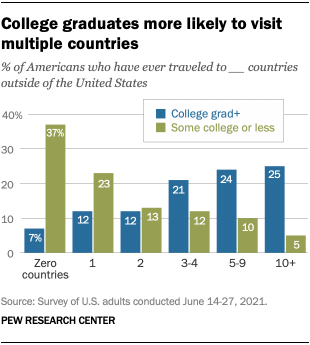

Americans with lower levels of education are much less likely to have traveled widely than those with more schooling. For example, 37% of those with just some college education or less have not left the country, compared with only 7% of those who have graduated college. College graduates are also more likely to have been to multiple countries: A quarter have been to 10 or more countries.

Women (32%) are more likely than men (22%) to have never traveled outside the country. Men, for their part, are much more likely than women to have been to five or more countries (30% vs. 22%). Still, men and women are equally likely to have been to only one country.

Black Americans are much less likely to have ever traveled abroad (49%) than White (75%) or Hispanic Americans (73%). White adults are also more likely to have been to five or more countries (30%) than Black (13%) or Hispanic (15%) adults.

When it comes to party affiliation, there are no significant differences in the share of Republicans and Democrats who have traveled internationally or in the number of countries they have visited.

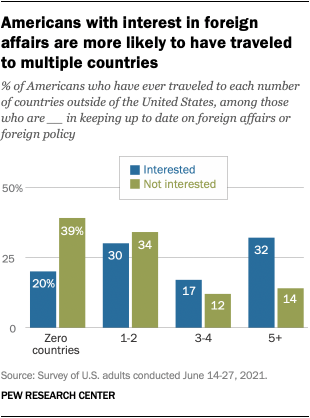

The 64% of Americans who say they are at least somewhat interested in keeping up to date on foreign affairs or foreign policy are much more likely to have traveled abroad at some point in their lives than those who say they have limited or no interest. They are also more likely to have been to many countries. For example, 32% of those who are interested in foreign affairs or foreign policy have been to at least five foreign countries, compared with 14% who are less focused on keeping up to date on foreign affairs.

Note: Here are the questions used for the report, along with responses, and its methodology .

- COVID-19 & the Economy

- Global Image of Countries

Laura Silver is an associate director focusing on global attitudes at Pew Research Center

Wealth Surged in the Pandemic, but Debt Endures for Poorer Black and Hispanic Families

Key facts about the wealth of immigrant households during the covid-19 pandemic, 10 facts about u.s. renters during the pandemic, after dropping in 2020, teen summer employment may be poised to continue its slow comeback, in the u.s. and around the world, inflation is high and getting higher, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

Opportunities for industry leaders as new travelers take to the skies

Travel fell sharply during the COVID-19 pandemic—airline revenues dropped by 60 percent in 2020, and air travel and tourism are not expected to return to 2019 levels before 2024. 1 “ Back to the future? Airline sector poised for change post-COVID-19 ,” McKinsey, April 2, 2021; “ What will it take to go from ‘travel shock’ to surge? ” McKinsey, November 23, 2021. While this downturn is worrisome, it is likely to be temporary. McKinsey’s latest survey of more than 5,500 air travelers around the world shows that the aviation industry faces an even bigger challenge: sustainability.

The survey results indicate emerging trends in passenger priorities:

About the survey

We asked about 5,500 people in 13 countries, half of them women, to answer 36 questions in July 2021. Each had taken one or more flights in the previous 12 months. More than 25 percent took at least half of their flights for business reasons; 5 percent had taken more than eight flights in the previous 24 months. They ranged in age from 18 to over 75 and hailed from the US and Canada, the UK, Sweden, Spain, Poland, Germany, Saudi Arabia, India, China, Japan, Australia, and Brazil.

Topics included concerns about climate change and carbon emissions, carbon reduction measures, and factors influencing tourism stays and activities.

We compared the results to those of a survey asking the same questions that we conducted in July 2019.

- Most passengers understand that aviation has a significant impact on the environment. Emissions are now the top concern of respondents in 11 of the 13 countries polled, up from four in the 2019 survey. More than half of respondents said they’re “really worried” about climate change, and that aviation should become carbon neutral in the future.

- Travelers continue to prioritize price and connections over sustainability in booking decisions, for now. This may be partly because no airline has built a business system or brand promise on sustainability. Also, some consumers may currently be less concerned about their own impact because they’re flying less frequently in the pandemic. That said, almost 40 percent of travelers globally are now willing to pay at least two percent more for carbon-neutral tickets, or about $20 for a $1,000 round-trip, and 36 percent plan to fly less to reduce their climate impact.

- Attitudes and preferences vary widely among countries and customer segments. Around 60 percent of travelers in Spain are willing to pay more for carbon-neutral flights, for example, compared to nine percent in India and two percent in Japan.

This article outlines steps that airlines, airports, and their suppliers could take to respond to changing attitudes and preferences. The survey findings suggest that airlines may need to begin with gaining a deeper understanding of changes across heterogenous customer segments and geographies. With those insights in hand, they could tailor their communications, products, and services to differentiate their brands, build awareness among each passenger segment, and better connect with customers.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

The survey findings point to fundamental and ongoing changes in consumer behavior.

After a decade of steady growth in passenger traffic, air travel was hit hard by the pandemic. International air travel immediately fell by almost 100 percent, and overall bookings declined by more than 60 percent for 2020, according to Airports Council International. At the time of writing, revenue passenger miles have returned to close to pre-pandemic levels in the United States, but still lag behind in other markets. 2 “COVID-19: October 2021 traffic data,” International Air Transport Association (IATA), December 8, 2021. In its October 2021 report, before the Omicron variant emerged, the International Air Transport Association (IATA) forecast that the industry’s losses would be around $52 billion in 2021 and $12 billion in 2022. 3 “Economic performance of the airline industry,” IATA, October 4, 2021.

Furthermore, travelers’ preferences and behaviors have changed sharply during the pandemic, particularly around health and safety requirements. An Ipsos survey for the World Economic Forum found that, on average, three in four adults across 28 countries agreed that COVID-19 vaccine passports should be required of travelers to enter their country and that they would be effective in making travel and large events safe. 4 “Global public backs COVID-19 vaccine passports for international travel,” Ipsos, April 28, 2021. And a 2021 survey by Expedia Group found that people buying plane tickets now care more about health, safety, and flexibility than previously. But, there is also renewed interest in travel as nearly one in five travelers expected travel to be the thing they spent the most on in 2021, one in three had larger travel budgets for the year, and many were looking for new experiences such as once-in-a-lifetime trips. 5 “New research: How travelers are making decisions for the second half of 2021,” Skift, August 26, 2021.

Comparing McKinsey’s 2019 and 2021 survey results, sustainability remains a priority as respondents show similar levels of concern about climate change, continue to believe that aviation must become carbon neutral, and want their governments to step in to reduce airline emissions. Some changes were more striking. The share of respondents who say they plan to fly less to minimize their environmental impact rose five percentage points to 36 percent. In 2021 half of all respondents said they want to fly less after the pandemic. Changes in opinion varied across markets. Passengers in the UK, US, and Saudi Arabia, for example, were more likely to feel “flygskam,” (shame about flying) while those in Spain, Poland, and Australia felt significantly less guilty about flying.