Book Summaries

Book Collections

Articles: Wisdom Collected from Interviews, Books, and More

This page shares my best articles to read on topics like creativity, decision making, strategy, and more. The central questions I explore are, “How can we learn the best of what others have mastered? And how can we become the best possible version of ourselves?”

Humankind progresses by adding to our shared body of knowledge. We all benefit from the insights of our ancestors. I like the idea of leaving a great “intellectual inheritance” and I’m trying to add a little bit of knowledge to the pile by curating the best ideas throughout history.

Ready to dive in? You can use the categories below to browse my best articles.

Self-improvement tips based on proven scientific research . No spam. Just the highest quality ideas you'll find on the web.

Thanks for subscribing! You’re all set.

You’ll be notified every time I share a new post.

Craftsmanship

Decision making, life lessons, money & investing, peak performance, self mastery, 30 days to better traction & results: a simple step-by-step guide for achieving more each day..

- Take the guesswork out of achieving more . 11 email lessons walk you through the first 30 days of peak performance practices step-by-step, so you know exactly what to do.

- Get the tools and strategies you need to take action . The course includes a 20-page PDF workbook (including templates and cheatsheets), plus new examples and applications that you won’t find elsewhere.

- Learn a framework that works for any goal . You can use this course to help you achieve any goal — from getting fit to daily meditation. Everything I share is time tested and science backed.

Enroll in the free email course. Get your first lesson today.

You will get one short email every three days for a month. You can unsubscribe any time.

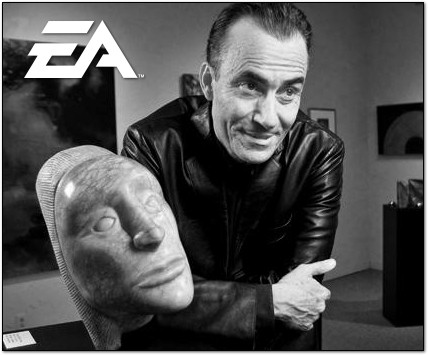

Interview with Trip Hawkins of EA (Electronic Arts) on "Creativity, The Ultimate Game"

"A true entrepreneur is a creative person, who doesn't do things to make money—he does them because he has no alternative." — Trip Hawkins, EA (Electronic Arts)

By 1985 Atari was in financial ruin. ActiVision’s once popular game system was passé and hundreds of developers worked in a flea market environment desperately trying to sell their games to a customer, and market, that didn't exist. Prudence would judge it a dumb place to start a video game cartridge company. Trip Hawkins did just that and clawed his way past 135 other competitors to make Electronic Arts the undisputed leader in video game software development.

By all accounts, Hawkins has for many years been both an entrepreneur and game aficionado. As a Harvard undergraduate he created a fantasy football game that nonetheless folded, and with it his father's seed capital of $5,000. Apparently unfazed, Hawkins immersed himself in the study of games, graduating with a custom degree in strategy and applied game theory. His thesis: a computer model for World War III.

Hawkins came across Mike Markkula while researching the video game market as a Stanford MBA student. Markkula, looking to build a solid team for his startup venture, Apple Computer, persuaded Hawkins to join after graduating from business school. As employee number 68, his charter was to gain entry for Apple products in the business market.

Despite Apple's commercial success, Hawkins chafed and left the company in 1982 to start up his own as soon as his $7.5 million worth of stock options vested.

Taking good measure of the imploding game industry, Hawkins set out to create a company different from the one-hit wonders that pervaded the marketplace. His company, Electronic Arts, borrowed from the Hollywood studio model of media production: project managers were called producers and software game programmers were called artists and given the tools, respect, and freedom to work as the talented, creative people they were.

A stream of successful products spewed forth. Though the market was cluttered with dozens of different hardware standards, two emerged to dominate the industry: Nintendo and Sega. Hawkins bet heavily on the latter and reaped the bene-fits. Electronic Arts boasts yearly revenues in excess of $600 million—a behemoth in the software game industry. Hawkins' own personal fortune has swelled to the neighborhood of $200 million.

A successful entrepreneur, a captain of industry before age 40, Hawkins might have felt content to ride his company toward comfortable revenue growth, new markets, and industry respect. But in 1993, Hawkins took the highly unusual move of appointing a successor at EA and promptly leaving to start his next venture in home computer gaming, The 3DO Company. The firm's ambitious charter was to develop its own game-playing machine and leverage the technology by licensing it to companies around the world.

Hawkins' try at a veritable double dip is complicated by the presence of several large companies including Nintendo, Sega, Sony, and Philips, not all of whom care to see Hawkins promulgate a hardware standard for the industry and capture the profits from doing so.

An excellent dealmaker, Hawkins initially enlisted support from companies like AT&T, Matsushita, Goldstar, MCA, and Time-Warner. Nonetheless, young 3DO's success is far from assured.

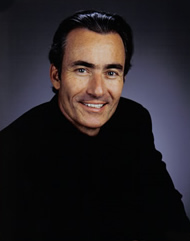

In the months prior to our interview, Hawkins' notoriety had extended to the popular press; Billboard magazine anointed him "the guru of interactivity" and, in a less scientific study, People magazine judged him to be one of the 50 most beautiful people in the world.

Perhaps as a backlash to the adulation, business reporters' coverage of 3DO became more aggressive, criticizing 3DO's nonexistent profits despite the company having already gone public. Some predicted imminent doom for the company.

It was at this time that we met with Hawkins at his corporate headquarters, just a stone's throw from Steve Jobs' company, NeXT, to understand the creative drive behind the biggest name in games.

Interview Transcript

How important is it to have a completely original idea in order to start a business?

I guess there are two ways to look at businesses: you can start one that is based on a big, new idea or you simply start one that works on an established idea. But even if it is something like starting a restaurant—obviously, there are other restaurants—the big idea may be why your restaurant is different from the rest. Yours may have a comPletely different approach to some common aspect of the business.

But there is nothing novel about starting a restaurant.

Exactly. One unseen aspect of business is that we all know about the success stories but never hear about the failures. I know what the batting averages look like in my industry because l've seen the turnover of companies for a long period of time. These batting averages are pretty poor. Some of them get lucky—there's a one-in-a-hundred chance. Sounders will get lucky and bootstrap there way to success. Perhaps one in one hundred times the product happens to be really good and original. But if you look at the failures—the 99 out of 100 that fail—many also have original product ideas. With entertainment media it's hard to tell in advance what's a hit and what isn't. This is generally believed to be true about all entertainment media.

The bootstrap approach to starting a business has never appealed to me. I wouldn't want to start a company unless the idea was a big one and then I'd ensure that everything was first class-first-class money, first-class advisers, and a first-class management team.

There's no reason to take a lot of risk in those areas. Creating a startup in a first-class way dramatically improves your chances.

Okay. Let's talk about your big idea for Electronic Arts (EA). The idea was to treat computer game programmers like artists.

Actually, EA was about three big ideas. That was one of them. The business was more than simply treating programmers as artists—as creative people. It would be more accurate to say that we brought a methodology for managing a creative process to what had traditionally been an engineering methodology. This translated into a certain style of recruiting, managing, and rewarding creative people. It also translated into a production process methodology that more consistently, like a cookie cutter, cranked out good titles and products. In the music profession you can't buy a record and hear a single chord played out of tune. In the software business almost everything you buy has mediocre product value. What we did was to say, "Why not treat the talent like they're treated in other professional entertainment fields?" That was the first idea. The second idea was direct distribution. Until then nobody had ever done direct distribution—it was all done through distributors. Frankly, nobody who is anybody in entertainment doesn't do their own distribution. This way we could get shelf space for every product and therefore minimize our dependency on having a hit product.

So the trick was to leverage the retail channel by providing a broad assortment of products?

Yes. Our third big idea was technology leverage. At that time nobody had a planned approach to technology development. We were the first to invest in building a system—almost like a studio. Try to imagine what life in the music business would be like if you had no recording equipment, no professional studio gear, no synthesizers, no nothing. We built what we called the artist's workstation, which was the system we used for creating products for multiple formats. Doing so made us efficient in dealing with the lack of standardization.

So, EA was really a combination of three things—a creative process methodology, direct distribution, and technology leverage. If you think about that combination as a strategy youll realize that you must apply more capital and commit to achieving a certain market share. Otherwise the whole model fails. It's like getting a 747 off the ground; with enough thrust and enough lift you can fly. Once off the ground the plane is passenger-mile efficient. Most of our competitors hadn't incorporated any of our three aspects of strategy—much less two or three of them. Had we done only one part of our three-pronged strategy we might have failed from simply being out of balance.

It is an interesting approach. Did you understand all these points of leverage at the outset? You already had 135 competitors and were relatively late in the game.

We clearly laid it out in our business plan. What I'm saying is that the key to risk reduction is to figure out the right strategy. The right strategy for us was combining those three elements and determining the amount of money we needed to implement that strategy. We raised more money than our competitors raised. Most of our competitors were bootstrapped companies. Broderbund was one of the few that raised any venture capital—a couple of million dollars by 1982—but they sat on the money. We were the first company to use capital as a strategy. What's interesting is that people frequently say that the way to manage risk is to spend less money, to take on fewer initiatives, to do less.

So, the fact that there were so many competitors demonstrated to you that there existed real opportunity for a well-funded company?

Yes. Now we're coming back to entrepreneurship. Here's a key thing to remember about being an entrepreneur: a true entrepreneur is a creative person. Creative people don't do things to make money. They do them because they have no alternative. They have to do it. They have to get it out. So, as an entrepreneur, you don't sit there looking at the number of competitors and think about whether you can beat them or not. You don't have an objective, rational process. You need a certain amount of confidence in your invention. To an extent you're insulated because there are many things that you don't know will go wrong. If you knew in advance of all the things that could go wrong, as a rational person you wouldn't go into business in the first place.

Did you do any market research before starting EA?

I did enough. I had the idea for Electronic Arts when I was in college. I worked at Apple as a means to an end. I knew I wasn't going to stay at Apple forever, but I knew that before I could start a software company there first needed to exist hardware to run it on. So I helped build the market for this equipment and learned from others about running a business. I'm surprised that I stayed at Apple as long as I did-four years. It was such a rocket ship ride. In 1975 I told myself that I would start my own company in 1982. When 1982 rolled around, I felt like I was a bit late because there were other compa-nies, like Broderbund, already out there. They weren't doing very much, but I was definitely behind. Fortunately, I was able to meet anybody in the industry I wanted to meet. I helped start another little game company called SSI with a young game fanatic. I went to game industry trade shows, like the West Coast Computer Fair. That's when I was able to test the hypothesis for Electronic Arts. It was clear to me that many creative people didn't have a clue about how to handle the business side of things—I knew I could offer that to them.

What things, in retrospect, would you have done differently?

A paradigm shift occurred in the industry. Atari was collapsing, this was pre-Nintendo. It was a very tough time because many people wrote off the game business due to Atari's collapse.

Atari was synonymous with games.

Yes. It's unusual for a consumer product company's economic struggles to be so well known. It poisoned the well for many consumers because games suddenly became unfashionable. It wiped out the industry for a couple of years. We should have started the company two years earlier when the tide was in. We built a boat and launched it just as the tide had gone out. It would have been easier if we had launched two years earlier or two years later, but that kind of thing is hard to anticipate.

Let's focus on this. The market is drying up, you've just launched a company and you're sitting there in your office. What do you do?

This is the difference between an entrepreneur and an operating executive: most entrepreneurs don't understand how to operate a business. There is a huge amount of common sense and courage involved in operating a business. You don't need too much more than those qualities.

Most entrepreneurs lack common sense. They may be courageous about their inventions but they're not courageous about things like layoffs because most entrepreneurs are optimists. What you're really looking for in a management team is the right balance between optimism and pessimism. You've got to conserve resources very carefully. Generally, the typical entrepreneur is optimistic to a fault and always has forecasts with hockey stick projections—"We're about to take off....hang in there another couple of months and we'll take off”—it's bullshit. No entrepreneur ever even comes close to the forecast. Once you've been through this a few times you know it, the venture capitalists know it, and pretty much everybody knows how to deal with it.

I'm very satisfied knowing that I'm a good operating executive because of what I did in a series of crisis situations. I'm not interested in being labeled as an entrepreneur in the classic sense. Most of these new companies either come out of the chute and fail or they start growing and the entrepreneur gets the ax because he doesn't manage the growth. Or the company may grow nicely for a while, but the entrepreneur doesn't know how to build the management team. Often when these young companies start to go fast it feels like a World War I biplane trying to go Mach II: the canvas peels off the wings.

Do you think having an M.B.A. gave you the necessary skills?

Probably the most valuable course I took as an M.B.A. was Interpersonal Dynamics. The second most valuable was finance, which explained net present value. I'm not sure there was anything else. I certainly learned technical details about cost accounting and how the accounting system works, but I could have learned that in college. In retrospect, had I not gone to Stanford, I could have gotten started in the industry two years sooner and wouldn't have been any worse off, because those were two pretty interesting years. As it was, I practically worked full time my second year in business school—I just couldn't wait. Everything was happening and I wanted to be there. I did market research and consulting projects pretty much from the spring quarter of my first year.

So the M.B.A. didn't help?

Like I said, entrepreneurship is about being creative. You must be able to think big. You must be able to see things differently and come up with big ideas—not just the product and company concepts, but creative ways of managing the business. If you're going to run a business successfully there are many general skills you need, but much of it comes down to common sense and courage. You've got to face reality.

If you took a hundred middle managers, you would find that the majority of them wouldn't be able to tell a subordinate he or she wasn't performing. Another thing very few managers can figure out is when a workforce reduction is needed. People are generally unable to deal with confrontation or bad news, but frankly, if you're not dealing with the bad news, you're going to fail. I don't mean to say that you should have a culture based around criticism, per se, but if you don't know what's going on, you won't learn very much. These are not things that you must, or can, be taught in school.

Business schools are incredibly arrogant. At Stanford I took a course in sales force management that tried to teach me how to manage a sales force of 400 people, but I could not take a course in how to sell. I had to go to an outside school, like the American Management Association, to get a course in selling. The same applies to public speaking. There are basic skills that are fundamental to doing almost anything in life that a place like Stanford Business School won't teach you.

Then what are business schools' value?

They'll teach you esoteric things. I would never hire a Stanford or Harvard M.B.A. from a consulting firm like McKinsey or Bain & Company. It's just total bullshit. It's absolute, total bullshit. They can't help me. Maybe they can help a Fortune 500 company that is completely clueless about its business. But you can't tell me that some kid fresh out of school is going to teach me something about my business that I haven't observed myself. If that's the case, boy, I've really screwed up. If that's the kind of help I really need, how screwed up must I be?

Some say it's the hand-holding and reassurance they provide management.

Right. Sometimes it's just politics. Sometimes big companies have to line up outside credentialed resources to justify what they want to do.

You mentioned the need for courage to survive a difficult business climate. Can you give us an example of a serious threat that almost put EA under?

It happened continuously. The first seven years were like that.

And how did you handle it?

For example, we had three layoffs on three different occasions in that seven-year period. A couple of times we reorganized and shut down a couple of companies we started. Managing these crises is the most important skill I, as a business person, have. It's probably the most important one for many people. You've got to be resourceful.

Common sense and courage, combined with creativity, is resourcefulness. It's the ability to recognize what is really happening. The first step is: collect the data. You'd better have your finger on the pulse. The second step is: analyze and figure out what's wrong and why it's wrong. Then you'd better have the courage to fix it, and fix it now. Some companies fail because they don't study what's going on, and don't have a reasonable picture of what's happening. Others have a reasonable picture of what's happening but don't want to believe it—they're in disbelief. At others, people may understand what's happening, but are afraid to deal with it.

To me, that is what resourcefulness is all about—collecting information, analyzing it, figuring out what's wrong, and coming up with creative ways to fix problems right away—and pulling the trigger. It's incredibly scary and incredibly stressful. It's not much fun having a layoff. It's not much fun shutting down a business that you started. We shut down our first business in Japan after a year. It was almost like Dunkirk. It was something like, "Whoa man, we don't have a clue here. Let's get the hell off this island. Let's get out of here. Pull up stakes! Get out! Get out! And let's not come back until we figure things out."

If your executives are not doing the job, you must be able to pull the trigger. We brought in someone to be our lead marketing guy. I thought he was great. He thought he was great. He had great credentials, yet we had to fire him three months later. Again, you must have the ability to figure out what is really going on.

So, given EA's poor start, how did you turn it around?

Like I said, the tide had gone out. We hit our forecast the first month. The second month we were off. The third month we were off by more. The fourth month we had a layoff. We cut back spending, hunkered down, and tried to conserve cash. That improved things quite a bit. We looked at the executives who weren't really cutting it and got rid of them. We regrouped. We fired sales reps who didn't produce. CEOs in companies like this one will spend a certain amount of time running every department. You probably can't afford a full team at any one time anyway. So, at any given point in time, the CEO is running more than one department anyway.

You can't afford a full team?

That's the way I look at it because you can't afford to spend the money. I would say that EA is pretty typical; I usually did three jobs aside from what I was supposed to do. When you're small and grow-ing, that's the way it is. Later, when the company gets big and there is an asset to protect, you can afford to keep the CEO in a purely strategic role figuring out how to grow and defend the asset. In the beginning, you're just paddling as fast as you can. There is a benefit to doing the job yourself because you learn how things get done. It makes it much easier to hire people for those jobs because you really understand the different requirements and it's easier to manage them. One of the more valuable aspects to a startup situation is that you've had your hands in every part of the business. I'm not talking about being autocratic or looking over people's shoulders. It's a matter of not being disconnected and out of touch.

At EA, we had issues in sales and marketing. We had to figure out how to generate more revenue. That's another phase you go through as a small company: learning to be really creative with revenue generation. You can come up with literally dozens of ideas for making money.

You've been able to create alliances with many large companies. Is being a dealmaker a talent of yours?

I don't think of myself as a dealmaker. I consider that more a means to an end.

You've given equity stakes to Matsushita and AT&T in your new venture, 3DO. Has this hurt you in terms of preserving autonomy?

No. Company control doesn't, in the end, have that much to do with ownership. Certainly, if you are a subsidiary and one company owns a controlling interest, then they'll feel like they own you and will cast a pretty long shadow. But if nobody has that kind of position, then the question is whether or not these corporate partners can gang up to disagree with management. This situation applies to any CEO at any company. If you're off your rocker they can get rid of you. That's the main thing the board is supposed to do. If you're doing a good job and you're managing an effective process, the board will support you. It's not really an issue.

So in 3DO's case it's not that big an issue?

That's right. Ironically, with the 3DO board, even though most of the board members have a corporate agenda, they've helped more in developing a company strategy than the EA board did.

The EA board was just a bunch of independent board members. It was more difficult to get them to support what the company needed to do. Perhaps it was harder for that particular group of people to understand the business and accept what needed to be done. A classic example: It took me a while to convince the EA board that we needed to move to the Sega platform. Again, conventional wisdom would say, "That sounds very risky, they're going to sue you." Where would EA be today if we hadn't moved to Sega? It would be a pretty small, insignificant company. To be honest, it wasn't that pleasant for me having to convince a lot of people what needed to be done.

If you feel very strongly about a strategy, you must figure out a way to convince people to support it. It's one of the things you don't realize until you've done it for a while. If you're any good as a CEO, part of your job is to be smarter and figure things out before everybody else. And if you can't, what the hell good are you? Why the hell should you be the CEO if you can't do that? This means that if I figure out a problem and a strategy for dealing with the problem, I've probably figured it out before other people have.

So you had to convince your EA board of directors that a layoff was necessary?

If you go to the board and tell them that you want a layoff, they'll be very supportive. Conventional wisdom says that management usually spends money and hires people. It implies that things must be serious if the CEO comes to the board saying that he's screwed up, should cut spending a no the board saying thall the board will say is, "You're not severing any major organs, are you? As long as it's only an arm or a leg or a hand." Pretty procedural things will happen at that point.

That brings up the question of why you were the best CEO for EA.

EA is an unusual combination because obviously, there's a big creative component to the business. I'm creative and I understand how to manage creative people and the creative process. I also got into the business because I really liked the product. Having a personal feel for the product helps a lot. Third, I'm a pretty good businessperson. Any business requires it, but when you look at the computer industry through the 1980's, you'll see that many companies were successes.

Many times the success was driven by market growth. For example, when I was at Apple, we all thought we were the cause of the success, but we weren't. We were just lucky to be at the right place at the right time. The whole industry just took off. That's the only time in my life I've had the opportunity to be in that kind of situation. It's only later on, when you realize that things don't always work that way, that you feel lucky. Many companies experience that kind of a growth and suddenly articles appear about what geniuses the managers are. Then the first thing goes wrong, the wheels come off, and they are suddenly losing money. Many times such market growth will hide real mediocrity in the management or in the strategy.

In games, it was really a tough business throughout the 1980's. There was no slack for anybody. The fatality rate was very high. In fact, out of the 135 companies at the start, only ten of them were still around five or six years later. There was incredible turnover of companies.

Tell us about the headaches you face as the manager of an established company. Is it difficult working with large corporate partners like AT&T?

Yes. AT&T has turned out to be our worst nightmare as a corporate partner. People usually think, "Big companies—solid, reliable." Well, they change direction more often and are completely ruthless about dropping things. In fact, EA and Matsushita were the real key investors in 3DO in the beginning. We assumed that by giving them equity, we would cement them as partners, but equity didn't really do it. The reason it didn't is that most companies are really driven by their operating P&L statement, so partners like EA really concentrate on quarterly revenues, profits, and license terms.

What about your VCs?

EA is a classically funded startup—we had three major venture firms who were involved and contributed well. My experience with venture capital money is that I only work with absolutely first-rate venture guys and only want first-rate thinkers if they are going to be on the board at all. Nonetheless, I didn't let them take over the company when they wanted to. We had a lot of problems in 1987. We had to deal with product transition issues and too much expansion. So we had a layoff, shut down some businesses, got refocused, and developed new growth strategies. The board and the venture guys, by Spring of 1988, were getting really, really nervous.

The funny thing was that EA was already half way through the solution at the time they were panicking. We had already done half of what we needed to fix things, but the results weren't going to show for six months. That was the only time when people on the board thought that they should cut my head off and try somebody else. Some people in that situation probably would have allowed it to happen but I didn't think that was the right thing for the company, so I hung in there tougher than others would have. At that time the VCs would liked to have changed the board in order be in a position where they could pull the trigger on me. I made sure they couldn't do that. Some of it was politics but some of it was ensuring I did the right thing and maintained the relationship the best way I could. The downside to venture guys is that they sometimes think they know more than they do about what's best for your company. They're accustomed to a certain level of performance in companies and in company management. Many times when they want to take over and make executive changes, it's probably the right thing to do. But they don't want to admit it when they make mistakes. If they fire the CEO and the guy they bring in screws things up, VCs say: The other guy was a disaster anyway. Well, maybe he wouldn't have been. Who knows? I'm not here to defend anybody else but I know that the VCs were definitely wrong to think that getting rid of me was the solution, and based on what happened since, they would certainly agree with that assessment now.

When I started 3DO, I just didn't want to go through that ordeal again. I wanted [venture capital firm] Kleiner Perkins in the deal for two reasons. First, [venture capitalist] Vinod Khosla is probably harder working, by a factor of ten, than any other venture capitalist.

There is so much more value having him involved because he's a talented operating thinker, a strategic thinker, a good negotiator, and he'll spend time helping you. Other guys just won't do that. A lot of venture guys are just bankers: show up for board meetings and that's it. Vinod had a good feeling for what we were trying to do; he had a strong personal interest in it. Second, I didn't want 3DO to be in a situation where everybody on the board had some vested corporate interest and therefore didn't necessarily care if the company made money. Venture capitalists, on the other hand, only make money if the company makes it. It's a nice influence to have. Although the corporate influences have never really been a problem with 3DO I think that's mainly because of the high level of class of the individuals involved.

What's the key to success in your business?

It's leverage. It's pure and simple.

What you must realize about capitalists is that capitalism is no longer like Economics 101. It's no longer about building a better product. It's no longer about being more efficient and offering a better product than your competition. Business is now a big Monopoly game. When you talk to venture capital guys about what they're trying to do, they're not trying to make a successful company or product anymore. They're trying to look for situations where they can have commanding market share and really drive it using, frankly, techniques that are supposed to be illegal, but the government doesn't seem to care about anymore. Everyone looks at it that way. In a business such as this one, companies are saying, "How do we achieve critical mass and control things that give me the leverage to squeeze more profit out of that critical mass?" Don't misunderstand me: I'm not willfully disobeying the law. That's not how I look at it. That's the way all these VCs look at it. They want Park Place and Boardwalk with a bunch of hotels on them.

If that is the case, what advice would you give to entrepreneurs who lack the access to huge sums of capital?

There are a couple of different ways to approach this issue. The first thing to note is that someone who's a real entrepreneur doesn't need anybody to tell them to start a company. They'll just do it. I once asked one of my venture capitalists, Don Valentine, if he was politically active in trying to get special tax treatment for capital gains and he said, "No, it wouldn't make any difference in my business." I said, "Gee, why is that?" He said, "First of all, my limited partners' money is municipal, tax-free, fun money. Second, the difference in capital gains profit wouldn't affect the behavior of entrepreneurs at all!" And he's absolutely right. Absolutely right.

So, a real entrepreneur is just going to do it. Nobody can talk them out of it. A real entrepreneur needs to get a good lawyer and become objective about having a good plan and a good team—ensuring the team has the skills to succeed. On the other hand, you can't tell most entrepreneurs anything. They're pretty opinionated about how to go about things. They must learn from their own mistakes, and the ones who do learn from their mistakes and adapt will be the successful ones.

There is a second approach for people who have a desire to start their own company, but don't have a specific product idea or vision. I think that's a lot more difficult. Perhaps it's possible for someone with the right training and the right business discipline. I remember a venture-funded company that was started around the same time as EA—Spinnaker. It was started by two Harvard Business School grads who had been working for Boston Consulting Group. Their approach was to look for a business to start by doing a study to determine which industry to start a company in. Right from the beginning I thought, forget it, they're history. They never figured out how to make any money. The company is still around in some form but they're long gone. The company just never really got anywhere. They were able to raise enough money from people who believed in that approach to starting a business.

On a personal note, what lessons have you learned about balancing your personal life with the demands of starting a company?

I've learned that it's very tough to manage a family life and a business. Many people try and don't succeed. I was married once before to a woman partially because she wanted to start her own company. The situation provided some intellectual attraction but it didn't necessarily make for a stable, long-term relationship. We never saw each other.

Today it's tough to balance, but when things are busy my wife and I make the time by scheduling dates in advance and sticking to them. My advice is to either find someone who's willing to support you and your career or to go it alone.

For more, order a copy of In the Company of Giants: Candid Conversations with the Visionaries of the Digital World .

Browse more of history's greatest speeches →

Find more from Steve Jobs and others related to this lecture:

- Who was Steve Jobs? Wisdom From The Man Who Built Apple and Pixar.

- Steve Job's "The Lost Interview from 1995"

- Jony Ive's "CCA Commencement Address and Advice for the Graduating Class"

- Steve Jobs “Stanford Commencement Address“ in 2005

- I, Steve: Steve Jobs In His Own Words

- Make Something Wonderful: Steve Jobs In His Own Words

- Insanely Simple: The Obsession That Drives Apple's Success

- Designed by Apple in California

Learn more about Steve Jobs: Who was Steve Jobs? Wisdom From The Man Who Built Apple and Pixar →

About the author

Daniel Scrivner is an award-winner designer and angel investor. He's led design work at Apple, Square, and now ClassDojo. He's an early investor in Notion, Public.com, and Anduril. He founded Ligature: The Design VC and Outlier Academy . Daniel has interviewed the world’s leading founders and investors including Scott Belsky, Luke Gromen, Kevin Kelly, Gokul Rajaram, and Brian Scudamore.

Thanks for reading. You can get more actionable ideas in my popular email newsletter. Each week, I share 5 ideas, quotes, questions, and more to ponder this weekend. Over 25,000 people subscribe . Enter your email now and join us.

Friday 5 Newsletter

Get weekly wisdom that you can read in 5 minutes. Add remarkable ideas and actionable insights to your inbox. Enter your email and try my free newsletter.

The Electronic Arts IPO (with Trip Hawkins)

Season 4. episode 7, acq2 episode.

The complete history and strategy of Electronic Arts

Acquired looks back at a monumental IPO from a *much* different era: Electronic Arts. We’re joined by EA’s founder Trip Hawkins to tell the incredible story of how he built the company that made video games mainstream. Starting from his high school years as both a geek and a jock, to then working for Steve Jobs as one of Apple Computer’s first employees and later completely changing the world of sports with John Madden Football, Trip always had a clear vision for what EA could become and what magic could happen at the intersection of technology and the liberal arts.

We finally did it. After five years and over 100 episodes, we decided to formalize the answer to Acquired’s most frequently asked question: “what are the best acquisitions of all time?” Here it is: The Acquired Top Ten . You can listen to the full episode (above, which includes honorable mentions), or read our quick blog post below.

Note: we ranked the list by our estimate of absolute dollar return to the acquirer. We could have used ROI multiple or annualized return, but we decided the ultimate yardstick of success should be the absolute dollar amount added to the parent company’s enterprise value. Afterall, you can’t eat IRR ! For more on our methodology, please see the notes at the end of this post. And for all our trademark Acquired editorial and discussion tune in to the full episode above!

Purchase Price: $4.2 billion, 2009

Estimated Current Contribution to Market Cap: $20.5 billion

Absolute Dollar Return: $16.3 billion

Back in 2009, Marvel Studios was recently formed, most of its movie rights were leased out, and the prevailing wisdom was that Marvel was just some old comic book IP company that only nerds cared about. Since then, Marvel Cinematic Universe films have grossed $22.5b in total box office receipts (including the single biggest movie of all-time ), for an average of $2.2b annually. Disney earns about two dollars in parks and merchandise revenue for every one dollar earned from films (discussed on our Disney, Plus episode ). Therefore we estimate Marvel generates about $6.75b in annual revenue for Disney, or nearly 10% of all the company’s revenue. Not bad for a set of nerdy comic book franchises…

9. Google Maps (Where2, Keyhole, ZipDash)

Total Purchase Price: $70 million (estimated), 2004

Estimated Current Contribution to Market Cap: $16.9 billion

Absolute Dollar Return: $16.8 billion

Morgan Stanley estimated that Google Maps generated $2.95b in revenue in 2019. Although that’s small compared to Google’s overall revenue of $160b+, it still accounts for over $16b in market cap by our calculations. Ironically the majority of Maps’ usage (and presumably revenue) comes from mobile, which grew out of by far the smallest of the 3 acquisitions, ZipDash. Tiny yet mighty!

Total Purchase Price: $188 million (by ABC), 1984

Estimated Current Contribution to Market Cap: $31.2 billion

Absolute Dollar Return: $31.0 billion

ABC’s 1984 acquisition of ESPN is heavyweight champion and still undisputed G.O.A.T. of media acquisitions.With an estimated $10.3B in 2018 revenue , ESPN’s value has compounded annually within ABC/Disney at >15% for an astounding THIRTY-FIVE YEARS . Single-handedly responsible for one of the greatest business model innovations in history with the advent of cable carriage fees, ESPN proves Albert Einstein’s famous statement that “Compound interest is the eighth wonder of the world.”

Total Purchase Price: $1.5 billion, 2002

Value Realized at Spinoff: $47.1 billion

Absolute Dollar Return: $45.6 billion

Who would have thought facilitating payments for Beanie Baby trades could be so lucrative? The only acquisition on our list whose value we can precisely measure, eBay spun off PayPal into a stand-alone public company in July 2015. Its value at the time? A cool 31x what eBay paid in 2002.

6. Booking.com

Total Purchase Price: $135 million, 2005

Estimated Current Contribution to Market Cap: $49.9 billion

Absolute Dollar Return: $49.8 billion

Remember the Priceline Negotiator? Boy did he get himself a screaming deal on this one. This purchase might have ranked even higher if Booking Holdings’ stock (Priceline even renamed the whole company after this acquisition!) weren’t down ~20% due to COVID-19 fears when we did the analysis. We also took a conservative approach, using only the (massive) $10.8b in annual revenue from the company’s “Agency Revenues” segment as Booking.com’s contribution — there is likely more revenue in other segments that’s also attributable to Booking.com, though we can’t be sure how much.

Total Purchase Price: $429 million, 1997

Estimated Current Contribution to Market Cap: $63.0 billion

Absolute Dollar Return: $62.6 billion

How do you put a value on Steve Jobs? Turns out we didn’t have to! NeXTSTEP, NeXT’s operating system, underpins all of Apple’s modern operating systems today: MacOS, iOS, WatchOS, and beyond. Literally every dollar of Apple’s $260b in annual revenue comes from NeXT roots, and from Steve wiping the product slate clean upon his return. With the acquisition being necessary but not sufficient to create Apple’s $1.4 trillion market cap today, we conservatively attributed 5% of Apple to this purchase.

Total Purchase Price: $50 million, 2005

Estimated Current Contribution to Market Cap: $72 billion

Absolute Dollar Return: $72 billion

Speaking of operating system acquisitions, NeXT was great, but on a pure value basis Android beats it. We took Google Play Store revenues (where Google’s 30% cut is worth about $7.7b ) and added the dollar amount we estimate Google saves in Traffic Acquisition Costs by owning default search on Android ($4.8b), to reach an estimated annual revenue contribution to Google of $12.5b from the diminutive robot OS. Android also takes the award for largest ROI multiple: >1400x. Yep, you can’t eat IRR, but that’s a figure VCs only dream of.

Total Purchase Price: $1.65 billion, 2006

Estimated Current Contribution to Market Cap: $86.2 billion

Absolute Dollar Return: $84.5 billion

We admit it, we screwed up on our first episode covering YouTube: there’s no way this deal was a “C”. With Google recently reporting YouTube revenues for the first time ($15b — almost 10% of Google’s revenue!), it’s clear this acquisition was a juggernaut. It’s past-time for an Acquired revisit.

That said, while YouTube as the world’s second-highest-traffic search engine (second-only to their parent company!) grosses $15b, much of that revenue ( over 50%? ) gets paid out to creators, and YouTube’s hosting and bandwidth costs are significant. But we’ll leave the debate over the division’s profitability to the podcast.

2. DoubleClick

Total Purchase Price: $3.1 billion, 2007

Estimated Current Contribution to Market Cap: $126.4 billion

Absolute Dollar Return: $123.3 billion

A dark horse rides into second place! The only acquisition on this list not-yet covered on Acquired (to be remedied very soon), this deal was far, far more important than most people realize. Effectively extending Google’s advertising reach from just its own properties to the entire internet, DoubleClick and its associated products generated over $20b in revenue within Google last year. Given what we now know about the nature of competition in internet advertising services, it’s unlikely governments and antitrust authorities would allow another deal like this again, much like #1 on our list...

1. Instagram

Purchase Price: $1 billion, 2012

Estimated Current Contribution to Market Cap: $153 billion

Absolute Dollar Return: $152 billion

When it comes to G.O.A.T. status, if ESPN is M&A’s Lebron, Insta is its MJ. No offense to ESPN/Lebron, but we’ll probably never see another acquisition that’s so unquestionably dominant across every dimension of the M&A game as Facebook’s 2012 purchase of Instagram. Reported by Bloomberg to be doing $20B of revenue annually now within Facebook (up from ~$0 just eight years ago), Instagram takes the Acquired crown by a mile. And unlike YouTube, Facebook keeps nearly all of that $20b for itself! At risk of stretching the MJ analogy too far, given the circumstances at the time of the deal — Facebook’s “missing” of mobile and existential questions surrounding its ill-fated IPO — buying Instagram was Facebook’s equivalent of Jordan’s Game 6. Whether this deal was ultimately good or bad for the world at-large is another question, but there’s no doubt Instagram goes down in history as the greatest acquisition of all-time.

Methodology and Notes:

- In order to count for our list, acquisitions must be at least a majority stake in the target company (otherwise it’s just an investment). Naspers’ investment in Tencent and Softbank/Yahoo’s investment in Alibaba are disqualified for this reason.

- We considered all historical acquisitions — not just technology companies — but may have overlooked some in areas that we know less well. If you have any examples you think we missed ping us on Slack or email at: [email protected]

- We used revenue multiples to estimate the current value of the acquired company, multiplying its current estimated revenue by the market cap-to-revenue multiple of the parent company’s stock. We recognize this analysis is flawed (cashflow/profit multiples are better, at least for mature companies), but given the opacity of most companies’ business unit reporting, this was the only way to apply a consistent and straightforward approach to each deal.

- All underlying assumptions are based on public financial disclosures unless stated otherwise. If we made an assumption not disclosed by the parent company, we linked to the source of the reported assumption.

- This ranking represents a point in time in history, March 2, 2020. It is obviously subject to change going forward from both future and past acquisition performance, as well as fluctuating stock prices.

- We have five honorable mentions that didn’t make our Top Ten list. Tune into the full episode to hear them!

- Thanks to Silicon Valley Bank for being our banner sponsor for Acquired Season 6. You can learn more about SVB here: https://www.svb.com/next

- Thank you as well to Wilson Sonsini - You can learn more about WSGR at: https://www.wsgr.com/

Get New Episodes:

Thank you! You're now subscribed to our email list, and will get new episodes when they drop.

Oops! Something went wrong while submitting the form

Related Episodes

Transcript: (disclaimer: may contain unintentionally confusing, inaccurate and/or amusing transcription errors)

Ben: Welcome to season four, episode seven of Acquired, the podcast about technology acquisitions and IPOs. I’m Ben Gilbert.

David: I’m David Rosenthal.

Ben: And we are your hosts. With all these A+ IPOs going on, we wanted to do a throwback episode to another era, 1989, when an IPO meant something very different. We come to you today from sunny Santa Barbara, birthplace of Logan Green's transportation dream, if you listened to the Lyft episode. Of course, the home of Sonos, if you listened to that episode.

Today, we sit here with Trip Hawkins, the founder of the most legendary gaming company in the world, Electronic Arts. Trip worked as an early employee at Apple computer as the director of strategy and marketing until 1982 before starting EA, taking it public, and later moving on to start other companies in the gaming space such as 3DO and Digital Chocolate. Trip is now a professor of practice in the Technology Management Program at the University of California, Santa Barbara. We are incredibly lucky to have him here with us today. Welcome, Trip.

Trip: Thank you. I’m delighted to be here.

Ben: Yeah, it's great to have you.

For anyone who's new to the show, here's how it works. We walk through the history and facts of a company from founding all the way through an acquisition or IPO. Then we analyze and grade the transaction where we issue judgment on if that was a good idea or not. The show is really one of storytelling followed by one of judgment.

If you are involved in startups and you want to dig in with us on company building topics rather than just the exit, we've got a second show for you. You can become an acquired-limited partner by clicking the link in the show notes or going to glow.fm/acquired and get access to these limited partner episodes featuring interviews with expert operators, investors, and of course, David and I diving deeper on topics like finding product market fit, term sheets, and how venture firms really work.

David: That's pretty cool. We started this as an experiment six months ago. It's like a real show now. We're just so pumped about how many guys are listening and getting value out of it.

Ben: It's been super fun. Lastly, before we dive in, I want to thank the sponsors of all the season four, Perkins Coie—counsel to great companies. We have with us today, Allison Handy, a partner in the corporate securities group and very conveniently, a fan of the show. Allison, we hear about a lot of investment bankers on the show as they prepare a company for IPO. What is counsel's role in getting IPO ready?

Allison: Thanks. I'm really excited that you've got me on here today. Outside counsel's role includes both getting the company ready to be a public reporting company and counseling in the IPO process. Council works first, with the company on preparing to satisfy securities loss and stock exchange listing requirements. Second, council will help the company in responding to investment bank legal due diligence requests, including doing their own diligence so that the council can provide legal opinions to the investment banks. Third, council works with the company and the banks to draft some parts of the S1 like the description of the business, the strategy, risk factors, MD&A. But council also takes the lead on some of the other less exciting disclosures like exec comp and governance matters.

Ben: Great. Thanks, Allison. If you want to learn more about Perkins Coie or reach out to Allison specifically, you can click the link on the show notes or in Slack. Alright, David. It is time.

David: It's time. I'm so excited to dive in with Trip here. Per usual, we like to start wayback at the beginning on this show. You grew up here in Southern California in the 1970s.

Trip: That's right.

David: What did your family do? What brought them to California?

Trip: I have a family who came here about 100 years ago.

David: Oh, wow.

Ben: You didn't start early enough, David.

Trip: They were back East, and a few of them were obviously entrepreneurs. I think that's how pretty much everybody in California got here is, they were willing to leave some other place and head to one of the most remote parts of the planet.

David: Growing up, you loved sports. You were jock, but you also loved games. Games meant something very different back then. There were no video games. Games were, pen and paper, they were dungeons and dragons, they were sports simulations. Those don't seem to me, sitting here, like jocks back then played dungeons and dragons. How did you meld both of those, and come to love them?

Trip: It was the golden age of television. I found that what I enjoyed the most on television was watching football and baseball. I could tell that something really interesting was going on from a strategy standpoint. I can't say that at the time, I realized that I was a strategic thinker. I'm just able to look back on and realize, "Yeah, that's why that spoke to me." I'm seeing these things on television because that's the medium that's available or in some cases, just even listening on the radio because everybody had a radio. Then, of course, I decided, "Hey, I'm going to play these things in real life." Becoming a jock in real life, and I'm watching on a TV, and I just had this craving for more interaction with it.

I found that back in the 1960s, some game designers had invented these cardboard dice games. A lot of people remember the one, it was called All-Star baseball, wherein [...] pieces of paper. You'd have one for Babe Ruth, and you'd have another one for Ty Cobb. If it's Babe Ruth, there was a big pie slice for him to hit a home run whereas Ty Cobb had a much bigger pie slice for hitting a single. You would put the thing on a spinner, and you'd hit the spinner with your finger.

David: I remember this. I had one of these growing up in the ‘80s too.

Trip: Yeah. A lot of people remember that one. They don't remember my favorite one, which is called Strat-O-Matic. Again, it was a game invented in the '60s. You roll dice, and there are all these player cards, and you would look up the result. Heck, I was about 10 when I basically, on my own, figured out Bayesian probability theory from studying the dice. I realized, "Why does this guy have this here, and the other guy has it there?" I realized, "Oh my god, there are more ways to roll the 7 than a 12. How many more ways are there? Why is that? Which guy do I want?" If I'm going to play my friend, and I want to win, I better figure out how this really works.

Again, I just kind of discovered that I found math and statistics fascinating if I can apply it to something strategic where I was competing—I'm a very competitive guy. Ideally, as a kid, you're tuning in to who you are. Part of you are gifts from your ancestors. Hopefully, you can discover what abilities you're already born with. You can figure out what's going on in your environment that really speaks to you and decide then, "What are you passionate about doing about it?" I had the good fortune to have those things happen.

David: On the environment front, was it your senior year in high school you were first exposed to computers?

Trip: Actually, earlier in high school, I think I was maybe a sophomore, I was trying to get my friends to play these games. A few of the nerdiest friends loved the games too. We all loved it, we all kind of saw what the value was, and a whole lot more friends, kids, they would drift back to watching televisions. It was too much work.

David: Too much work, too much overhead.

Trip: Yes. Things like DND are famously geeky in that way. It's just not everybody's cup of tea. I was just thinking about it, realizing, "Man, this is a really special experience to be this mentally engaged." But, not everybody can relate to it. It's just too much work to operate the thing. That's when, as soon as I heard about computers, and I could kind of see it with my own eyes, "This is how you do it. We're going to basically, put all the administrative operating stuff in a box. I'm going to put pretty pictures on the screen like a television." What I didn't realize, at that time is, I was seeing something that was going to be true 40 years later.

If you'd told me, "You know, Trip, that's going to take 40 years." I'll go, "Oh, nevermind." But you don't know that, so next thing you know, you spent 40 years working at it. By the way, I'd just have to say I didn't know I had this accurate forecast about something that would be...

David: You were in high school, right?

Trip: I didn't know it was going to turn out to be a $100 billion industry. I just thought it was a really cool thing that I cared about, and then I want to go help make happen. I have no idea what's going to happen 40 years from now. I don't know about you.

David: We're thinking about it.

Ben: We overly speculate, that's for sure.

David: This is all swirling around here in Southern California. You go to college at Harvard. You were there at the same time as Bill Gates, and Steve Ballmer, did you interact with them at all?

Trip: No. We ended up using some of the same computer labs, but I only knew that later. I think it's entirely possible that Bill and I would have been in the Aiken Computation Center at the same time without having ever actually met. Honestly, those of us who were really serious about it, we would go there at night because it uses timeshare systems. You didn't want to compete with all the students doing their homework during the day. You go at night. There were basically, nerds that you could smell from 10 feet away. There were guys sleeping under the tables. I mean, it was just chaos, but if you were really into it, you were just thrilled to be there on a machine at night when you had more speed.

Ben: You were also doing something that Bill Gates was not doing. That was playing for Harvard, playing football. Talk about how on earth you were balancing being a collegian athlete and being this person that's staying up all night by the computer lab? One of the only people at this time that were dedicated to the craft of learning and mastering the computer.

Trip: Yeah. That was a tough balancing act. I lettered in football as a freshman. Then, I realized, "Wow, this is so time-consuming that I can't do everything I'm doing." I would've loved to have done it all. In fact, in hindsight, if I can go back and do it differently, I probably would've loved to have played varsity football and done that longer. What I found was that they actually had a club football program. No practices, really. It was tackle football, and you will play with different dormitory groups. That was a hella lot of fun when you're doing that. We went undefeated and unscored on. We only played six games. It was really hard to have an elaborate offensive playbook because nobody is spending a lot of time practicing. I was the safety on that team. We never allowed anyone to score. I was the last line of defense. That was for me, probably the highlight of my football life.

David: That's amazing. Was it at this time or was it at Harvard where you realized you wanted to start a company and started laying in motion all the plans?

Trip: I’d actually already done it. I started working on it. I got some help from my best friend, who by the way, ended up becoming a football coach, so we're really into football. You can think of that in today's terminology that would be about prototyping and building a minimum viable product—I did that. Then I thought, "Hey, why don't I actually market this?" My dad was generous enough to loan me $5000. I went and sourced all of the different parts like silkscreen, gameboard, paper parts, and things that you have to have perforations on it so you could punch them out, dice. Had to figure out, "Who am I going to buy dice from?"

Ben: You're building a full tabletop game of your own?

Trip: Yeah, so that all got put together and the customers loved it. I got incredibly positive feedback from customers. I have no idea how to run a company. I didn't have enough money to do any marketing. Obviously, it didn't get very far, so I lost every penny.

Ben: This is during undergrad?

Trip: I'm in high school, basically.

Ben: High school.

Trip: I'm basically learning two things. One, "Wow. Ouch, man. It really hurts." When you have this baby, this thing you've created, it's your baby.

Ben: An extension of yourself.

Trip: And it has been rejected by the business world, and you can't keep going with it. That feeling of failure and disappointment that that dream has died creatively. It's a good experience to go through with that.

The second thing I learned was, "Man, this is so much fun, I've got to do this again, this is so amazing, so stimulating. Maybe I want to learn some more before I do it again, so I have a chance to have at a better outcome." This is again in the 1970s where I'm actively thinking about how computers can come into it, and it wasn't too long after that, it was in 1975, I'm in a summer job in Santa Monica.

David: You went to GSB, to Stanford Business School right after Harvard, right?

Trip: That comes a little bit later.

David: Oh, okay.

Trip: I'm still in college. This is when a colleague comes back and tells me, "Well, I was just in a retail store where you can rent computer terminals, and take them home. You can have them connect through a modem through your mainframe. They only charge you $10 an hour, and you can basically do computer-from-home." I said, "Wow, that's incredible. It's happening. It's finally happening." And then he said, "Oh shoot, Intel just announced the invention of the first microprocessor chip that can combine all these things on a single chip." I think, "Yeah, dang. That's going to get into homes," this is in the summer of 1975, it turns out that is the world's first computer retail store, it's called The Computer Store run by this guy Dick Heiser. He became an Apple dealer later on.

Literally, my colleague walks away. I immediately start sketching it out, saying, "Okay. How long is it going to take for the hardware cost to come down, for the number of stores to grow, and for the number of machines and homes to be big enough that you can make some money selling some games?" That's when I realize that I could probably do that by 1982, seven years later, and that is exactly what I did.

Ben: You bided your time a little bit until that listeners might expect, "Okay, you went and started Electronic Arts, but you did something else in the interim, and that was Apple computer. That was one of the very first employees at Apple computer. How did that happen?

David: Can you tell us the story of how you got the job and the phonecall you got from Steve Jobs?

Trip: Since you guys want to talk about the IPO of Electronic Arts, the company oddly enough, it didn't really even have all that much value until two years after the IPO. If you look at that time frame, creating that value was a 20-year process. Of course, a lot of entrepreneurs think, "Oh, yeah, look at this company. It's an overnight success." It turns out, well, often it's really not even remotely.

Pretty much, there was about a decade before Electronic Arts was founded where I'm planning the whole thing. Then took another decade of actually running the business before it really took off and had a lot of value.

Ben: Long game were in here.

Trip: It really is. It really is a long game. By the way, I thought about this recently when Google announced Stadia, which is their play on the idea of cloud-streaming games. My initial thought was, "They don't have the game catalog, and they're not going to get it because all the guys that have the game catalogs, two of which Sony and Microsoft, had now joined forces."

Ben: And they have no first party titles.

Trip: Right. How can they fix that problem? I realized, "Wait a minute. EA didn't have that in the beginning. Apple didn't have that in the beginning." If you’re in the long game, then you're saying, "Shoot! Nobody knows what games are going to be popular 10 years from now. Nobody even knows where the technology is going to be that the games are going to run. How do we hang around this long enough?”

Frankly, if Google thinks, "Yeah, we just want to be the leader 10 years from now," which young, super talented, data scientist, machine-learning, AI experts are young indie developers now that are going to grow in their careers to the point where five or ten years from now, they're going to make a hit that could be the next League of Legends, or the next Call of Duty, the next Fortnite?" If you're willing to plan ahead like that, most of us generally, are way too impatient for that. We want it to happen now. Of course, Google could maybe even acquire Electronic Arts, and then they could start to have the back catalog. That's going to be a very interesting space to watch.

But getting back to our story, you have this thing unfolding over a 20-year period, and I realized, "Man, I've got to know a lot more about how to run a business, and I also need to go help somebody sell computer systems into homes. How am I going to do that?" I'm not really an engineer, I don't even understand how electricity works, but I love software, so I've always been around software, software runs on hardware, and I was always good at talking to other engineers and understanding the system on how it worked. I thought, "I'm not going to have credibility in Silicon Valley by being an electrical engineer. I'm going to have to build my credibility some other way."

This is something that a lot of people can still do today. You don't have to be the expert on the tech. You have to be able to relate to those people. You have to be able to learn their dialect. You have to learn when they're bullshitting you, you have to go call them on their stuff, and then you have to command their respect and have credibility with that because you have the expertise about something they care about, in my case, the pathway in was being more knowledgeable up with the customer in the applications. I thought, "Okay, how do I get that going?"

Again, there's a lot of good fortune in a lot of these stories. When I first got to the Bay Area, I was finishing school at Stanford, and it turns out, I'm going right by the headquarters of Fairchild Semiconductor. They had actually just come out with one of the first consoles. It was one of the very first consoles, again, this is the mid-‘70s, that [...] the game card cartridges into.

Ben: I never knew they did that.

Trip: Yeah, it was called Channel F.

David: Where they're competing with Atari?

Trip: In effect, it was such a new industry that you were really just competing with yourself, honestly. But all the semiconductor companies in the ‘70s, they're trying to figure out how to drive demand for their chips so they can get more volume. More of them thought, "Let's have a consumer division. We'll make watches. We'll make calculators." Some of them thought, "Let's make arcade-type simple consoles like pawn games." A lot of them made pawn games. Only a few them just said, "Hey, how about a cartridge system where you can change the game?"

Anyway, Fairchild is one of them. It was pretty clueless. They abandoned it before too long. But while they're doing it, I dropped into their lobby, and I said, "I'd like to talk with somebody in marketing." And they go, "What about it?" "Well, I'm a Stanford student. I would like to offer you a free market research project." Free is a fabulous word, it's the most powerful word in the history of marketing, and it opens a lot of doors. This junior marketing guy comes out and says, "What do you want?" I said, "Well, here's the deal, if you just give me the addresses of a couple of hundred customers, I'll design a questionnaire and work with you and making sure your questions get answers. We'll basically try to understand more about who your customers are and what they want." Of course, secretly, I'm thinking, "Do they prefer football or baseball? Is there going to be a [...] because that's what I want to make." He says, "Okay, sure." I continue my drive to Stanford, and I said, "Now, I'm going to get course credit for this." I didn't get paid, but I was able to build it into my curriculum that way.

Then there I am in the library at Stanford not too long after that. I'm in the copier room. This guy just ahead of me on the copier, he pulls out this report, and I see video games on it. He puts it on the copier. He’s making a copy of a couple of pages from this thing. I said, "What is that?" He says, "This is a study I wrote last summer for this market research firm about this simple little pawn machines that the semiconductor companies have been making." He'd done a marketing analysis of it. I go, "Oh, okay." I basically followed the guy as he went and returned this report to the shelf in the library. As soon as he left, I took it off the shelf and read it cover to cover. I realized, "Dang, this is cool. I could do a report like this about personal computers." Nobody had done a report about personal computers. They were too new.

Ben: I've just been thinking about that statement.

David: I know. This would have been like, 1977? 1978?

Trip: This was 1976 probably. It was either fall of ‘76 or early ‘77. Okay. I need a summer job between the two years of business school, and I go talk to that same market research firm, they’re down in San Jose. They were in the habit of hiring MBAs and having them spend the summer writing a study. I said, "I'd like to write a study about personal computers." The head of that firm says to me, "What is a personal computer?"

David: This is in San Jose, the heart of Silicon Valley.

Trip: Yeah. It's a research firm. I explained it to him. He goes, "Yeah, we do business with all these big manufacturers and technology companies. They don't care about that. We have no demand for that."

David: Amazing.

Trip: I'm kind of doing an eyeroll, "Boy, are you out of it?" Then, he said, "But you know what? We do need to get a report done on computer printers?" There's the kind of printers that work with mainframe computers and so on. "I'll tell you what, why don't you do that for us this summer and then if that goes well, we'll talk about this other thing later." That went all really well. By the fall of 1977, he's beginning to hear about it because by then the first west coast computer fair had happened in Spring 1977. That's where the Apple 2 made its debut. I was there.

David: Did you meet Steve and Woz there?

Trip: They were probably there. I didn't meet them. I remember seeing the Apple 2 and thinking, "Wow."

Ben: Did that feel in the moment like, "Oh my god, I'm a part of the world changing right now." Could you feel that it was...?

Trip: You could totally feel that, but the other thing that really jumped out of me was recognizing, "It's that one." It's like, I know all these companies, I look at all their products, the Apple 2 looks like it's something from a sci-fi movie that's going to be happening in 20 years. Everything else in the entire convention hall looks like it's part of the past, like a bunch of buggy whips and carriages before the cars were invented. I just had that feeling.

David: It assume that you're going to get into this but the home computer market at this time, was dominated by Radio Shack.

Trip: Right, the TRS-80 also known as the Trash 80. It was a very convoluted system, among other things. It didn't even have color. In fact, it didn't have a bitmap graphics either. It was a really clunky thing. But it was cheap, RadioShack has thousands of stores, and so they were doing a lot of volumes.

Anyways, they allowed me to do the study. I got entrée to all these companies, that included Apple. I went down a visit with one of the first handfuls of office workers there. The most amusing part of this is, it's really a handful of people there at that time, this was probably late ‘77 or maybe early ‘78. I said, "Are you guys doing any software because I'm a software guy. What are you doing in software?" "Yeah, we're doing software." I said, "Cool. Can I see it?" He said, "Sure." We walk around the corner, and their entire software effort is one guy. Pretty sure this was Randy Wigginton, he was one of the very first engineers. He was working on a Star Wars ripoff where the company didn't have a Star Wars license, but the first Star Wars movie had come out in the summer of ‘77.

David: Wow. It's amazing how all these comes together.

Trip: They thought, “Hey, let's do something...” because we had bitmap graphics and, "We can do something where you're like Luke, and you’re trying to blow up the Death Star, and we're going to do that in really simple graphics."

Ben: Unbelievable that Steve Jobs would later buy Pixar from George Lucas and yet, Apple at this point, didn't have a Star Wars license.

Trip: In fact, I remember after I started Apple, we went to CES, and we're showing that game. This guy comes up and hands me a business card and says, "You're going to have to stop doing that." Unsure if he's from Fox. "You guys can't have a Star Wars game without us having us license it to you. You got to pay for that."

Ben: Like, “Oh, it's a different shaped trench.”

Trip: This is like the cowboy period where you’re not asking for permission, you’re just doing stuff until they stop you.

Ben: Right. Wow.

Trip: So anyway, I haven’t met the leaders of Apple yet. I go back. I’m finishing school, and the study gets finished. I’m doing a little bit of a tour to meet with clients, and talk about it. I produced a one-page flyer. I mailed it out to everybody that I knew and everybody that had been interviewed. Then I’m just at home one day, not too long after that when the phone rings. Then I pick it up, and there’s this guy yelling at me, and saying, “Why the hell are you calling Radio Shack out of the market share leader?”

David: This is incredible.

Trip: And it turns out it’s Steve Jobs. He’s seen this flyer that says, "Radio Shack is a market share leader." He’s really pissed off about it, and I knew why. Because they were running an ad campaign in the Hobby Magazine saying that Apple was the world’s best-selling personal computer, and it wasn’t the truth.

Ben: I know that.

David: Which, of course, was total trash.

Ben: Yeah, exactly.

Trip: Again, this is the cowboy period. The Apple 2 was frankly, a much more legitimate personal computer than the TRS-80 but it just wasn’t accurate for them to say that, and yeah, he thought, “Who is this dude that’s outing us and making us look bad? Making us look like liars.”

Ben: So, he called you up to berate you. But you turn the tables and then...

Trip: Here’s the other thing about how intimate Silicon Valley is that he had to know somebody that knew my home number. So, we knew somebody mutually.

Ben: Did you trace back how that ended up?

Trip: Oh, yeah, but at the time, I didn’t understand a word. He and I are having this conversation, of course, I’m having to hold the phone handset about a foot away from my ear because he’s yelling so loud.

I managed to tell him, “Yeah, the study is finished.” He wants to argue with me, naturally, that's what he does. I said, “I’d be happy to bring this study and show it to you.” This is a study that in today’s dollars would’ve cost about $2500. There's no way Apple can afford it. I know that being able to come in and show it to them, "Look at this. You're getting $2500 of free value."

David: Steve's probably very pleased with himself that his one phone call yielded this.

Trip: Oh, totally. Of course, he's arguing with what I'm saying about the company. I'm saying, “Well, I'll let you read what I said about the company. I think you’d find it very flattering. I think you guys are great.” “Okay.” Then I said, “Oh, by the way, I'm actually looking for a job in the industry." Alright. I go down there, and they offered me a job. It's all based on this idea that I know something about the market. I know something about customers. I'm just a kid.

David: Did Steve offer you a job on the spot when you came down there?

Trip: Not on the spot. Here's what's not really known that well about Apple is that everybody thinks about the two Steves.

Ben: Right.

David: But there was Mike.

Trip: There were really three equal Musketeer co-founders of the real corporation. It was kind of a hobby thing. Then Mike Markkula came in to be the adult supervision. He and the two Steves, each had about a third of the company, that kind of tells you who the real founders are.

Ben: Mike cashed out pre IPO?

Trip: Oh, no, no, no, no, no. Mike, actually hung in there longer than anybody. The thing about Mike is that Don Valentine had been told about the two Steves, and Don was already an elite leading venture guy in the 1970s.

Ben: And he'd come from Fairchild.

Trip: Yes, and Intel. He went met with the two Steves when they're in the garage, and he thought, “Yeah, this is way too early for us.” Then he told Markkula to talk to them.

Ben: No way.

Trip: He was kind of trying to turn Markkula into the angel that would help get it…

David: Legitimized enough…

Trip: A little more legitimized. Okay, so Mike goes and meets with them and they're pretty much unkempt, uncivilized people. Later Markkula would tell me that...

Ben: These are the days when Steve wasn't showering, right?

Trip: Literally my first week at Apple, I figured out what a hazardous person Steve was towards the end of that first week. I'm standing next to Mike and Steve's down at the other end of the hall going by, and I said to Mike, “Mike, we really need to do something about that.” I pointed at Steve, and I called him a "that" like he's a thing. Mike says, “Trip, look, come here.” He pulls me to his office, he closes the door and says, “Trip, you have no idea how much better he is now than a year ago. A year ago, he was like the wild man from Borneo. He was completely uncivilized. I had to teach him where you put the fork, and the knife, at a table setting. He's basically explaining almost as if he’s teaching…”

David: Like a feral child.

Trip: “...what a fork is and how you how you use a fork.” He was just asking me, “Trip, try to be patient.”

David: Look at the progress.

Trip: “This guy can do a lot for us.”

David: Yeah, well.

Trip: So those three guys got together...