- Skip to primary navigation

- Skip to content

- VAT Advisor

- VAT Auditor

- VAT Calculator

- EU VAT Number Checker

- Data Insight Tools

- VAT & GST rates

- Global VAT & GST changes

- Digital Services Tax Global Tracker

- Country VAT guides

- EU VAT reforms

- VAT in the Digital Age

- EU VAT registration & Intrastat thresholds

- E-invoicing global tracker

- SAF-T global tracker

- VAT on digital services global tracker

- US sales tax thresholds

UK 20% tourism & hospitality VAT rate returns 1st Apr 2022

Covid-19 hospitality vat rate cut introduced in july 2020 now withdrawn.

The UK temporary Value Added Tax rate cut on hospitaliy and tourism has now ended, with the sector now returning the standard VAT rate of 20%. The pandemic cut to support hotels, catering and hospitality operated over to phases:

- 5% between 15 July 2020 and 30 September 2021 (an extension from the planned 12 January 2021 withdrawal); and

- 12.5% 1 October 2021 and 31 March 2022. It has now returned to 20%

Sign-up for VAT Calc’s FREE global VAT and GST news e-mail updates.

What UK tourism and hospitality services benefited from the VAT cut?

Restaurants; cafes; pubs (ex alcohol); hospitality; hotels; B&B’s; home rental; caravan and tent sites; hot take away food; theatres; fairs; circuses; amusement parks; concerts; museums; zoos; cinemas; studio or factory tours; botanical gardens; exhibitions; and similar cultural events and facilities. The reduction only applied on entrance fees to the attractions listed; not other supplies provided during the visits such as souvenirs.

Note: served alcoholic drinks did not benefit from the cut. It excluded entry into sporting events.

Services subjected to tourism VAT reduction per HMRC:

- boarding houses and similar establishments;

- seasonal pitches for caravans, including supplies of facilities provided in relation to the occupation of the pitches; and

- pitches for tents and camping facilities;

- hot and cold food for consumption on the premises on which they are supplied;

- hot and cold non-alcoholic beverages for consumption on the premises on which they are supplied;

- hot takeaway food for consumption off the premises on which they are supplied; and

- hot takeaway non-alcoholic beverages for consumption off the premises on which they are supplied.

Countries such as the Germany , Lithuania and the Belgium are now in the process of withdrawing their tourism and hospitality VAT rate cuts introduced during COVID-19 crisis.

Future global VAT / GST changes

Richard Asquith

Richard is a frequent contributor to international VAT and GST debate and public policy consultations. Prior to VAT Calc, he helped establish and grow two tax tech businesses. He started his career with the 'Big-4', working with KPMG and EY in the UK, Hungary, Russia and France

You may also like

UK launches EU IOSS VAT portal

- United Kingdom

UK HMRC consults on private taxi operators VAT

UK raises VAT registration threshold to £90,000

Get our latest news right in your mailbox

Email address:

- International edition

- Australia edition

- Europe edition

British retailers welcome planned return of VAT-free shopping for tourists

Government to consult on long-called-for scheme which is likely to cost almost £1.3bn

- Mini-budget: Kwarteng scraps top 45% rate of income tax and cuts stamp duty

Retailers and the hospitality industry have welcomed the planned return of VAT-free shopping for international tourists, saying it would help to boost sales.

The government said it would consult on introducing a new tax-free shopping scheme for Great Britain and would modernise the one in place in Northern Ireland .

The scheme will enable tourists to get a refund on VAT on goods bought on the high street, at airports and other departure points and exported from the UK in their personal baggage.

The move, which will cost almost £1.3bn in 2024-25, when it is likely to be brought in – according to government documents published alongside Kwasi Kwarteng’s mini-budget on Friday – unwinds the scrapping of the long-term VAT-free scheme in January 2021 by the former chancellor Rishi Sunak after Brexit.

The government said a consultation would “gather views on the approach and design of the scheme” before it was delivered as soon as possible.

Retailers, especially in tourist hot spots such as central London, have long called for the return of the scheme, saying its loss had led to tourists opting to spend more elsewhere.

Helen Dickinson, the chief executive of the British Retail Consortium, which represents most major retailers, said: “We welcome the reintroduction of tax-free shopping for tourists, which will boost sales and bring the UK back in line with other European nations.”

But she added that the government had not taken any measures to tackle the burden of business rates, the property-based tax which retailers say hobbles them from competing with online specialists such as Amazon.

“Retailers are facing immense cost pressures, not just from energy bills, but also a weak pound, rising commodity prices, high transport costs, a tight labour market and the cumulative burden of government-imposed costs,” Dickinson said.

“Yet what was missing from today’s announcement was any mention of business rates, which are set to jump by 10% next April, inflicting another £800m in unaffordable tax rises on already squeezed retailers. It is inevitable that such additional taxes will ultimately be passed through to families in the form of higher prices.”

Kate Nicholls, the chief executive of UKHospitality, the trade body that represents restaurants, bars and hotels, added: “While tax-free shopping for overseas customers is a welcome step to attract overseas tourists, a far more immediately impactful step would be to reduce VAT for our domestic customers.

“Our VAT rate is the highest among modern economies, so if we want a globally competitive market, we need lower VAT and an equitable alternative to business rates.”

- Retail industry

- Tax and spending

- Mini-budget 2022

- Travel & leisure

- Hospitality industry

- Economic policy

- Shopping trips

Most viewed

+44 (0) 1273 022400

- VAT Customs duties, import taxes

- Sales tax Retail, ecommerce, manufacturing, software

- Import One-Stop Shop (IOSS) Simplify VAT registration requirements

- Selling Internationally Customs duties and import taxes

- Retail For online, ecommerce and bricks-and-mortar shops

- Software For apps, downloadable content, SaaS and streaming services

- Manufacturing For manufacturers with international supply chains

- Accounting professionals Partnerships, automated solutions, tax research, education, and more

- Business process outsourcers Better serve the needs of clients

- Marketplace sellers Online retailers and ecommerce sellers

- Shared service centres Insource VAT compliance for your SSC

- Enterprise An omnichannel, international sales solution for tax, finance, and operations teams

- Our platform

- Calculations Calculate rates with AvaTax

- Returns & Reporting Prepare, file and remit

- VAT Registrations Manage registrations, simply and securely

- Fiscal Fiscal representation

- Content, Data, and Insights Research, classify, update

- Exemption Certificate Management Collect, store and manage documents

- Avalara E-Invoicing and Live Reporting Compliant in over 60 countries

- Making Tax Digital (MTD) Comply with MTD Phase 2

- Webinars Free advice from indirect tax experts

- Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders

- Whitepapers Expert guidance and insights

- Brexit VAT and customs guidance

- Digitalisation of tax reporting Realtime VAT compliance (including MTD)

- Ecommerce VAT reforms 2021 EU and UK VAT reforms

- Selling into the USA Sales tax for non-US sellers

- EU Rates At-a-glance rates for EU member-states

- Global Rates At-a-glance rates across countries

- U.S. Sales Tax Risk Assessment Check U.S. nexus and tax responsibilities

- EU VAT Registration

- EU VAT Returns

- Distance Selling

- EU VAT digital service MOSS

- About Avalara

- Customer Stories

UK tourism VAT review

- Mar 12, 2018 | Richard Asquith

Today’s UK Spring Statement included an announcement of a consultation around Northern Ireland cutting its 20% tourism VAT rate to match Ireland’s 9%.

This was an election manifesto promise of the DUP, which is now in a power sharing arrangement with the Conservative government. As part of the DUP 'confidence and supply' deal, the Conservatives committed to review tourism VAT.

This demand has long been rejected by the UK government which controls UK-wide policy under EU VAT laws. However, following Brexit, Northern Ireland will be free to claim a reduced regional tourism rate. This could mean the break-up of the unified UK VAT regime – triggering potential tax competition between the north and south in Ireland, and between the UK countries. Scotland already controls the independent setting of income tax rates, which it recently raised on higher earners above the UK rate.

UK alone in higher tourism VAT rates

Currently, the UK is one of the few countries in the EU to charge full VAT on such hospitality services. Countries such as Ireland and Germany have long provided a tax subsidy to this key sector, with considerable boosts in job creation and international visitor numbers.

Potential for UK VAT regime break-up on Brexit

The UK’s likely 2019 departure from the EU would enable Northern Ireland and Scotland to claim control over its VAT rates and revenues. Northern Ireland could opt to use such VAT cuts to win tourism and other trade from the Republic and other home countries. This could trigger internal UK tax competition following Brexit.

Click for free British VAT info

Need help with your UK VAT compliance?

Researching UK VAT legislation is the first step to understanding your VAT compliance needs. Avalara has a range of solutions that can help your business depending on where and how you trade.

UK VAT news

Total results : 4, union vs non-union oss: what’s the difference, uk vat guide - avalara, north america country vat guide - avalara, us 2021 sales tax updates for foreign businesses.

Irish shoppers may win as UK plans return of VAT refunds for tourists

Plan to reintroduce vat refunds won’t apply to the north.

The British government plans to reinstate VAT refunds for tourists shopping in the UK. (Photo by CARLOS JASSO/AFP via Getty Images)

Irish visitors to Britain could save 20 per cent on their holiday shopping following a significant overhaul of the UK’s VAT regime announced by the British chancellor.

While the scheme, which will allow tourists and other travellers to Britain, to claim VAT back as long as the goods are exported from in their personal baggage, the savings are not likely to materialise until 2024 at the earliest.

If the proposals are implemented in the years ahead however, Irish consumers will be potentially be able to offset much of the cost of a short trip to Britain through VAT savings on high end electronics and other luxury goods.

The cost of a pair of Manolo Blahnik shoes, for example could fall from close to £1,200 (€1,346) to just under £1,000 once the VAT rebate is claimed, while a high end phone could cost as much as £400 less if the proposals are implemented.

PTSB most exposed Irish lender to competitive threat from Spanish move into market

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/V2ZND52EDBGPRFPEIRRQ2TIM6M.JPG)

Stella Li of Chinese car maker BYD: ‘We don’t want to engage in a price war’

:quality(70):focal(1950x1026:1960x1036)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/3MSMDOMTWRHPTFF5BFSREISNZA.jpeg)

Will consumers benefit from Aviva entering the Irish health insurance market?

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/DAW5FH6LKZGL5LNMHJOJFU3ARI.jpg)

The world’s richest countries must invest in effective, cheap technologies to tackle climate change

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/RML25XCBIJHRVP57KTN2M7VG3I.jpg)

However, the VAT cuts will not apply to people crossing the Border from the Republic to the North because of the Northern Ireland Protocol.

Retailers and the hospitality industry in Britain welcomed the planned return of VAT-free shopping for international tourists, saying it would help to boost sales.

The UK government said it would consult on introducing a new tax-free shopping scheme for Britain and would modernise the one in place in the North.

The scheme will enable tourists to get a refund on VAT on goods bought on the high street, at airports and other departure points and exported from the UK in their personal baggage.

The move, which will cost almost £1.3 billion (€1.46 billion) in 2024-25, when it is likely to be brought in — according to government documents published alongside Kwasi Kwarteng’s mini-budget on Friday — unwinds the scrapping of the long-term VAT-free scheme in January 2021 by the former chancellor Rishi Sunak after Brexit.

The UK government said a consultation would “gather views on the approach and design of the scheme” before it was delivered as soon as possible.

Retailers, especially in tourist hot spots such as central London, have long called for the return of the scheme, saying its loss had led to tourists opting to spend more elsewhere.

Helen Dickinson, the chief executive of the British Retail Consortium, which represents most major retailers, said: “We welcome the reintroduction of tax-free shopping for tourists, which will boost sales and bring the UK back in line with other European nations.”

But she added that the government had not taken any measures to tackle the burden of business rates, the property-based tax which retailers say hobbles them from competing with online specialists such as Amazon.

“Retailers are facing immense cost pressures, not just from energy bills, but also a weak pound, rising commodity prices, high transport costs, a tight labour market and the cumulative burden of government-imposed costs,” Ms Dickinson said.

“Yet what was missing from today’s announcement was any mention of business rates, which are set to jump by 10% next April, inflicting another £800m in unaffordable tax rises on already squeezed retailers. It is inevitable that such additional taxes will ultimately be passed through to families in the form of higher prices.”

Kate Nicholls, the chief executive of UKHospitality, the trade body that represents restaurants, bars and hotels, added: “While tax-free shopping for overseas customers is a welcome step to attract overseas tourists, a far more immediately impactful step would be to reduce VAT for our domestic customers.

“Our VAT rate is the highest among modern economies, so if we want a globally competitive market, we need lower VAT and an equitable alternative to business rates.” - Guardian

IN THIS SECTION

‘totally freezing’ trump rails against ‘very, very unfair’ gag order, david mcwilliams: a small town in co kerry and a formula for rejuvenating rural ireland, tesla shares rebound, but doubts remain, sinn féin meets uk investors in london, three solar farms set to power 10,000 irish homes a year, irish in london: ‘nobody was making me stay. i could have left at any time and gone home to sligo ... that was 24 years ago’, ‘i’m alone pretty much all the time. the older i become, the less hopeful i am this will change’, former taoiseach leo varadkar raises concerns about racism in late late show interview, ozempic changed the lives of obesity patients. and then we had to stop prescribing it, latest stories, munster secure another victory over the lions to wrap up stellar south africa tour, family of minister for justice evacuated following hoax bomb threat, aontú calls for ‘irish sea border in terms of people’ to ensure stricter immigration checks in northern ireland, frenetic finish sees antrim strike late to beat wexford, premier league wrap: late penalty sees burnley rescue a draw with manchester united.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/VR3765MFOBH2NMV2QNICYDF67M.png)

- Terms & Conditions

- Privacy Policy

- Cookie Information

- Cookie Settings

- Community Standards

- Skip to main content

- Accessibility help

Information

We use cookies to collect anonymous data to help us improve your site browsing experience.

Click 'Accept all cookies' to agree to all cookies that collect anonymous data. To only allow the cookies that make the site work, click 'Use essential cookies only.' Visit 'Set cookie preferences' to control specific cookies.

Your cookie preferences have been saved. You can change your cookie settings at any time.

Reduced VAT for Scottish tourism and hospitality: letter to UK Government

Letter from Small Business Minister to the UK Government calling for a reduction in VAT for Scotland's tourism and hospitality sector ahead of the autumn budget statement.

From: Richard Lochhead, Minister for Small Business, Innovation, Tourism and Trade To: Sir John Whittingdale, Minister of State for Media, Tourism and Creative Industries and Kevin Hollinrake: Parliamentary Under Secretary of State - Minister for Enterprise, Markets and Small Business

Dear Sir John and Kevin

Support for tourism and hospitality Sector - VAT

I am writing to you jointly, given the split in responsibilities across departments, on behalf of Scotland’s tourism and hospitality sector.

The sector is vitally important to Scotland’s economy, as is the case across all parts of the United Kingdom, accounting for some 8% of jobs, 9% of businesses and contributing £3.4 billion in gross value added to our economy. These operators serve the visitor economy and communities alike, offering a whole spectrum of choice to be enjoyed by all parts of society. They are however businesses first and foremost, and to be successful they must remain viable.

The sector has proved to be incredibly resilient in the wake of the pandemic, which hit it harder than most other sectors, and from which some are still recovering. Trading conditions remain very challenging, and this is compounded by ongoing economic issues impacting negatively on operating costs and disposable income in household budgets, as well as challenges in the recruitment and retention of staff across all skills disciplines. Recent surveys conducted by industry groups, including the Scottish Tourism Alliance, consistently report these pressures as being of greatest concern to businesses.

I am committed to do all that is possible to help the sector within the Scottish Government’s increasingly constrained resources, but I would like to raise with you the issue of VAT, which is of course reserved and upon which only the UK Government can take action on at this time.

During the pandemic the tourism and hospitality sector benefited from reduced levels of VAT, 5% then 12.5%, before returning to the standard 20% rate in April last year. The industry continues to make a strong case for the return of a reduced rate of VAT for the sector. Many countries, particularly across Europe but also elsewhere, maintain reduced rates of VAT for tourism and hospitality. I believe the UK Government could support tourism and hospitality by looking again at a reduced rate of VAT for the sector here, and I ask you to support this and make the case for it to your Ministerial colleagues, particularly ahead of the autumn budget statement on 22 November.

This could help boost business viability in a challenging trading climate. The cost to the Exchequer of a VAT cut could be partly mitigated by stimulating demand in the sector. My colleague, the Deputy First Minister and Cabinet Secretary for Finance, Shona Robison MSP, has included this ask for a reduced rate of VAT for tourism and hospitality in her recent pre-budget correspondence to the Chancellor.

I am sure you have received similar representations to myself from the respective trade bodies across tourism and hospitality and will understand their reasons for wishing to see further help from government in this way. I hope that this is an area we can agree on in support of all our great businesses across the sector and I would be happy to discuss this, and other pertinent issues impacting these businesses, with you both in due course.

I am copying this letter to my colleague Shona Robison MSP, Deputy First Minister and Cabinet Secretary for Finance, to the Rt. Hon. Alister Jack MP, Secretary for State for Scotland and John Lamont MP, Parliamentary Under Secretary of State.

There is a problem

Thanks for your feedback

Your feedback helps us to improve this website. Do not give any personal information because we cannot reply to you directly.

The toilet roll tax: UK's strange VAT rules

'Mysterious' and 'absurd' tax brought in £168 billion to HMRC last year

- Newsletter sign up Newsletter

Britain's VAT rules have long triggered confusion and debate – not least about biscuits and cake – yet the tax is one of the top three money-makers for HMRC.

First introduced in 1973, Value Added Tax (VAT) on goods and services brought in £168 billion to the Treasury last year. And while VAT rates have been described as "mysterious" and "absurd", said the BBC , the duty remains central to the government's tax-and-spend plans.

What is exempt?

There seems little rhyme or reason why some goods and services are charged at the standard rate of 20%, and others at 5% or zero, in the full list on Gov.uk .

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Biscuits are an especially "tricky tax terrain", said The Economist . A McVitie's chocolate digestive, for example, faces a 20% VAT levy, while a plain one has zero. Famously, a 1991 court ruling found Jaffa Cakes to be biscuits, despite their name, and therefore exempt from VAT altogether.

Potato crisps are regarded as confectionery and are so are taxed at 20%, while tortilla chips are not. Nuts are even more confusing, with those sold for human consumption zero-rated if in their shells, but taxed at 20% if de-shelled and roasted or salted.

Wigs or hairpieces are exempt from VAT if bought because of a medical condition, and women who have undergone surgery for breast cancer are exempt from paying VAT on their bras. Like the argument against the "tampon tax", radiographers have labelled this "discriminatory", said the London Evening Standard , and have called for everyone to be exempt since bras are a basic necessity.

Lottery, bingo and raffle tickets are exempt from VAT, as are most books, newspapers and magazines – but not diaries or stamp collections.

Why are some goods VAT-free and not others?

The argument for VAT exemptions is primarily based on fairness, as cutting the levy on "essential" goods helps the poorest in society.

But this does not always stack up. Toilet paper is deemed to be "luxury goods" and is charged at 20%, while caviar and helicopter rides are classed as "essentials" and are VAT exempt.

The £247 million that the toilet roll levy rakes in for the Treasury each year may be "pennies to the government," said the Daily Express , but it "has a much greater impact on UK households, and disproportionally affects the most vulnerable in our society".

In February, toilet roll manufacturer Who Gives a Crap started a campaign for the "roll tax" to end, backed by the Hygiene Bank, a charity that helps those on low incomes by providing essential toiletries.

But "one criticism of campaigns like this is that the money goes back to the businesses, not consumers", said The Guardian . Analysis of the impact of removing the "tampon tax" by advisory firm Tax Policy Associates found that prices were cut by just 1% with the majority of the savings, worth about £10m a year, retained by retailers.

Does the system work?

Britain has more VAT reliefs than almost any other Organisation for Economic Co-operation and Development (OECD) country, worth around £70 billion annually, according to HMRC.

"In the UK it is applied on only about half of overall consumption, which is really low by international standards," Professor Rita de la Feria, chair in tax law at Leeds University, told The Guardian .

"If you look at very progressive societies, they have high levels of VAT collection," she said, citing New Zealand, which has no zero rates but where VAT is used to support those on low income.

Despite the estimated £40 billion that would be raised by bringing the UK into line with the OECD average, political considerations have long stymied any serious reform of the VAT system.

George Osborne was the last chancellor to propose a major change, with plans in 2012 to extend the levy from cold takeaway food to hot takeaway food. But he was forced into an embarrassing climbdown after tabloids branded it a "pasty tax". Keir Starmer's Labour Party plans to charge VAT on private school fees, but even this has been labelled merely tinkering round the edges of a much bigger problem.

"Wholesale reform, not piece-by-piece tweaks", is needed, said The Economist, and "would focus the conversation on the overall tax system".

"Some grumbling would be inevitable: there would be headlines about 'coffin taxes' and 'zoo levies'. But if tax increases were wholly or partly offset by a cut to the standard 20% rate of VAT and by more generous benefits for the poorest, that would clean up Britain's tax system, encourage firms to grow and shut down the cottage industry of lobbyists clamouring for more exemptions."

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

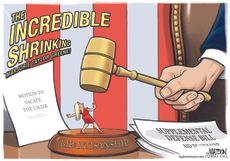

Talking Point House of Representatives finally 'met the moment' but some say it came too late

By The Week UK Published 27 April 24

Cartoons Artists take on Republican opposition, aid to Ukraine, and more

By The Week US Published 27 April 24

The Week Recommends The author's account of ordeal which cost him his eye is both 'scary and heartwarming'

By The Week Staff Published 27 April 24

The Explainer It may be tempting to splurge — but there are smarter places to put that money

By Becca Stanek, The Week US Published 8 April 24

The Explainer With time running out, a last-minute checklist could help you make the most of your allowances

By Marc Shoffman, The Week UK Published 26 March 24

The Explainer Here are some options to help you pay the IRS what is owed

By Becca Stanek, The Week US Published 22 March 24

the explainer Here is what you need to keep and how long to keep it

By Becca Stanek, The Week US Published 15 March 24

the explainer Here is what to know before hiring a pro

By Becca Stanek, The Week US Published 13 March 24

The Explainer There are steps you can take to reduce the odds you will be singled out

By Becca Stanek, The Week US Published 19 February 24

The Explainer The biggest shift in the expanded child tax credit would be for lower-income families

By Becca Stanek, The Week US Published 12 February 24

The Explainer Working from home can get you a tax deduction — in some cases

By Becca Stanek, The Week US Published 7 February 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise With Us

The Week is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

VAT Tertiary Legislation

Flat rate schemes.

Tertiary legislation about the VAT Flat Rate Scheme and the Agricultural Flat Rate Scheme (originally published in VAT Notice 733).

VAT Flat Rate Scheme for small businesses

The following text has force of law under VAT Regulations 1995, regulations 55A to 55V, 57A and 69A and was originally published in VAT Notice 733

1. Keeping records and filling in your VAT return — keeping special records

You must keep a record of your flat rate calculation showing:

- your flat rate turnover for the VAT accounting period

- the flat rate percentage you have used

- the tax calculated as due

- the amount you spend on relevant goods

This record must be kept with your VAT account.

2. The basic turnover method — special rule for certain invoices issued or payments received after 23 November 2016 and before 1 April 2017

If (a) you issue a VAT invoice in the period starting with 24 November 2016 and ending on 31 March 2017 and the invoice is in respect of services to be performed on or after 1 April 2017, or (b) if you receive any payment in respect of those services in that period, the supplies of those services shall, to the extent covered by the invoice or payment, be treated as taking place on 1 April 2017 for the purposes of ascertaining your relevant turnover. If the invoice or payment covers services to be performed in a period spanning 1 April 2017, an apportionment based on a fair and reasonable method should be made.

3. The cash based turnover method

3.1 using the cash-based turnover method.

You’ll need to follow the rules, for:

- cash (coins or notes) you receive payment on the date you receive the money

- cheques you receive payment on the date you receive the cheque, or the date on the cheque, whichever is the later ― if the cheque is not honoured you do not need to account for the VAT, however if you have already accounted for the VAT you can adjust your records accordingly

- giro, standing order or direct debit you receive payment on the date your bank account is credited with such a payment

- credit or debit card you receive payment on the date you make out a sales voucher for a credit/debit card payment (not when you actually get paid by the card provider)

3.2 If you received a payment ‘net of deductions’

If you receive a net payment, you must include the full value before such deductions (and including the relevant VAT) in your scheme turnover. This will usually be the value shown on your sales invoice.

3.3 If you receive payments in kind (for example, barter, part exchange)

If you’re paid fully or partly in kind, such as by barter or part exchange, you must include the value including VAT in your flat rate turnover each time you make or receive a ‘payment’. You receive ‘payment’ on the date you receive the goods or services agreed in lieu of money.

3.4 If you want to stop using the cash-based method

If at any time you stop using the cash based accounting method, you must account for VAT on all the supplies made by you while you were using the method for which payment has not been received.

3.5 Special rule for certain payments received after 23 November 2016 and before 1 April 2017

If you receive a payment in the period starting with 24 November 2016 and ending on 31 March 2017 and the payment is in respect of services to be performed on or after 1 April 2017 the supplies of those services shall, to the extent covered by the payment, be treated as taking place on 1 April 2017 for the purposes of ascertaining your relevant turnover. If the payment covers services to be performed in a period spanning 1 April 2017, an apportionment based on a fair and reasonable method should be made.

4. The retailer’s turnover method

4.1 what to include in your daily takings.

You must include and record the following in your daily takings as they are received from your customers:

- debit or credit card vouchers

- Switch, Delta or similar electronic transactions

- electronic cash

4.2 What non-cash sales to include in daily takings

In addition to cash payments you must add the following to, and record in, your daily takings, on the day you make the supply:

- the full value of credit sales

- the cash value of any payment in kind for retail sales

- the face value of gift, book and record vouchers redeemed

- any other payments for retail sales

4.3 Making adjustments to your daily takings

If you wish to adjust your daily takings, the following rules apply

- you must be able to provide evidence to support any adjustments to your daily takings figure

- if you make an adjustment but receive a payment later, the amount must be included in your daily takings

- you must not make any reductions from daily takings for till shortages that result from theft of cash, fraudulent refunds and voids or poor cash handling by staff

For further details about cash handling, read Point of Sale Retail Scheme VAT Notice 727/3 .

5. Leaving the scheme — making a stock adjustment

The following steps explain how you make the adjustment

Step 1 - Work out the VAT exclusive value of stock on hand on which you had recovered input tax before you joined the Flat Rate Scheme. If you were previously on cash accounting, this will be based on stock you had paid for. For the example use £10,000.

Step 2 - Work out the VAT exclusive value of stock on hand on which you will be unable to recover input tax after you stop using the Flat Rate Scheme. For example, use £20,000.

Step 3 - Subtract the figure at Step 1 from the figure at Step 2. If the figure at Step 1 is larger than the figure at Step 2, you will not be entitled to the adjustment. No further action is necessary. For example, £20,000 - £10,000 = £10,000.

Step 4 - Multiply the result of Step 3 by the standard rate of VAT. For example £10,000 × 20% = £2,000.

Step 5 Claim the VAT calculated at Step 4 in the VAT recoverable portion of your VAT account in the first return you make after leaving the Flat Rate Scheme. £2,000 recoverable from HMRC as a result of FRS stock adjustment.

VAT Agricultural Flat Rate Scheme

The first page of the VAT 98 form carries the force of law under Regulation 204(c) of the VAT Regulations 1995.

- Application for certification (VAT98)

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

IMAGES

VIDEO

COMMENTS

Guidance has been updated to reflect the extension of the VAT reduced rate for tourism and hospitality from 12 January to 31 March 2021. 21 July 2020 A new section about Retail Schemes has been ...

Previously the standard rate of VAT applied to most goods and services supplied by the tourism and hospitality sectors. However, groups 14, 15 and 16 were introduced into Schedule 7A VATA when the ...

COVID-19 hospitality VAT rate cut introduced in July 2020 now withdrawn. The UK temporary Value Added Tax rate cut on hospitaliy and tourism has now ended, with the sector now returning the standard VAT rate of 20%. The pandemic cut to support hotels, catering and hospitality operated over to phases: 5% between 15 July 2020 and 30 September ...

Zero rate. 0%. Zero-rated goods and services, eg most food and children's clothes. The standard rate of VAT increased to 20% on 4 January 2011 (from 17.5%). Some things are exempt from VAT, such ...

In July 2020 the then Chancellor, Rishi Sunak, announced a series of initiatives to boost job creation in the context of the Covid-19 pandemic, including a temporary 5% VAT rate on most tourist and hospitality-related activities. Initially it was anticipated that the 5% rate would apply to supplies made between 15 July 2020 and 12 January 2021.

The report provides an up-to-date analysis of the full fiscal and economic impact of a reduced rate of VAT for the UK hospitality and tourism sector at 12.5% rather than 20%, assuming normal trading conditions and that this is a permanent measure. The long-term benefits of reduced VAT on hospitality and tourism services have long been

The standard rate of VAT increased from 17.5% to 20% on 4 January 2011. In 2008, following the financial crash, the government introduced a temporary cut in the rate of VAT to 15%.

Venues say the 5% VAT rate has been a pandemic "lifeline" but are concerned as it rises again. BBC Homepage. ... and ensure the UK remains competitive in a global tourism market, along with ...

Survey Results December 2020/January 2021. The impact of the 5% VAT rate in helping UK tourism & hospitality businesses get through the Covid-19 crisis. Results of a survey of businesses by the Cut Tourism VAT Campaign in association with UK Hospitality, the Tourism Alliance and the Association of Leading Visitor Attractions undertaken in late ...

An influential group of MPs recommended that VAT for hospitality and tourism be set at 12.5%. Prior to the rate of VAT returning to 20%, reverting back to pre-pandemic levels, the All-Party Parliamentary Group (APPG) for Hospitality and Tourism backed our calls and said that a lower rate of VAT would bring benefits including jobs international competitiveness and social wellbeing.

3 March 2021 - the UK's Chancellor of the Exchequer, Rishi Sunak, has extending again the VAT rate cut on hospitality and tourism from 20% to 5% until 30 Sep 2021; then 12.5% until 30 April 2022. 24 Sep update - the UK has extended the cut in VAT on hospitality and tourism from 13 Jan 2021 until 31 March 2021.

The VAT rate for hospitality and tourism businesses was reduced during the pandemic but that scheme came to an end in April 2022. ... UK-owned ship hit by Houthis sinks off Yemen coast. BBC News ...

Government to consult on long-called-for scheme which is likely to cost almost £1.3bn. Mini-budget: Kwarteng scraps top 45% rate of income tax and cuts stamp duty

For accounting purposes, the reduced rate had applied as follows: 5% from 15 July 2020 to 30 September 2021. 12.5% from 1 October 2021 to 31 March 2022. A new temporary reduced rate of VAT of 5% ...

Today's UK Spring Statement included an announcement of a consultation around Northern Ireland cutting its 20% tourism VAT rate to match Ireland's 9%. This was an election manifesto promise of the DUP, which is now in a power sharing arrangement with the Conservative government. As part of the DUP 'confidence an

The levy is 1.6% of a property's rateable value, rising to 4.5% in 2024/25 and 2025/26. It is expected to raise £939,000 per year in the latter two years. The levy is administered by Liverpool BID Company, which already operates a 'retail and leisure' BID and a 'culture and commerce' BID.

Fri Sep 23 2022 - 17:56. Irish visitors to Britain could save 20 per cent on their holiday shopping following a significant overhaul of the UK's VAT regime announced by the British chancellor ...

During the pandemic the tourism and hospitality sector benefited from reduced levels of VAT, 5% then 12.5%, before returning to the standard 20% rate in April last year. The industry continues to make a strong case for the return of a reduced rate of VAT for the sector. Many countries, particularly across Europe but also elsewhere, maintain ...

The UK just reversed its elimination of VAT refunds for overseas shoppers. British Chancellor of the Exchequer Kwasi Kwarteng announced that as part of the government's fiscal package, VAT refunds would be reintroduced as soon as possible for overseas tourists. As quoted in the Financial Times, he promised:

From 15 July 2020 to 31 March 2021, certain supplies of catering and hot takeaway food that would normally be taxable at the standard rate of VAT, will be liable to the reduced rate of 5%.

But if tax increases were wholly or partly offset by a cut to the standard 20% rate of VAT and by more generous benefits for the poorest, that would clean up Britain's tax system, encourage firms ...

National insurance was cut this month, for the second time this year, from 10% to 8% on employee earnings between £12,570 and £50,270. The change, announced by the chancellor in his March budget ...

The VAT Road fuel scale charges will be updated from 1 May 2024. You'll need to use the new scales from the start of the next prescribed accounting period, beginning on or after 1 May 2024. You ...

The following has force of law under Paragraph 11, Schedule 6 and paragraph 12 Schedule 9ZA of the Vat Act 1994 and was originally published in VAT Notice 700

Step 2 - Work out the VAT exclusive value of stock on hand on which you will be unable to recover input tax after you stop using the Flat Rate Scheme. For example, use £20,000.