- Register/Activate

- Mobile Banking

- Business Banking Online

- Internet Banking

- Directshares platform

- Margin Lending

- connections online

- PaymentsPlus

- Auto & Equipment Finance

International

Travel money card

It’s easy to activate and start using your Worldwide Wallet at home and overseas.

Need to activate your cards?

I received my cards in the mail

I picked up my cards in branch

Activate your cards and set up your PIN

Loading your account.

See our foreign exchange rates page or use our currency converter to view the latest foreign exchange rates.

1. Load AUD onto your travel money card

Logon to Internet or Mobile Banking and instantly transfer funds from your linked account to your Worldwide Wallet, or transfer funds from another financial institution using your account’s BSB and account number.

2. Convert AUD to another currency

Open your Worldwide Wallet account in Internet or Mobile Banking and select ‘Convert currency’ to convert your AUD to 10 foreign currencies.

- AUD - Australian Dollar

- USD - United States Dollar

- GBP - British Pound

- NZD - New Zealand Dollar

- CAD - Canadian Dollar

- JPY - Japanese Yen

- THB - Thai Baht

- ZAR - South African Rand

- SGD - Singapore Dollar

- HKD - Hong Kong Dollar

Using your travel money card overseas and at home

Contactless ways to pay.

Add your Worldwide Wallet to Google Pay™ or Samsung Pay™, or use your card to tap and go.

No ATM withdrawal fees

No ATM withdrawal fees at Global ATM Alliance ATMs around the world. 1

Shop online from home

Use your travel money card at home when shopping on overseas sites and pay no foreign transactions fees.

Extra perks

Complimentary airport lounge access for flight delays.

You and a companion could be eligible for complimentary access to over 1,000 airport lounges in more than 100 countries with Mastercard ® Flight Delay Pass. 2 In the event it’s delayed by 120 minutes or more, you could be enjoying drinks, nibbles and Wi-Fi. You could also benefit from special dining offers at selected cafes and restaurants. Make sure you register each flight before its scheduled departure time. T&Cs apply. To find out more information and pre-register your flight, visit flightdelaypass.mastercard.com/worldwidewallet.

Access unforgettable experiences and rewards

Your Mastercard gives you access to Priceless® Cities with unforgettable experiences in the cities where you live and travel. 3 You can also get cashback when you shop overseas with your Worldwide Wallet, thanks to Mastercard Travel Rewards . 4

You’ll be prompted to set up a PIN during the activation process.

You can update your PIN at any time using one of the below methods.

In the St.George App

- Sign in and tap on the services icon at the bottom right hand corner

- Tap Change Card PIN or Activate card (Set Card PIN - you will be prompted to set your card PIN once your card has been activated) under your cards

- Select card or activate your card and tap Continue

- Follow the authentication prompts and enter the SMS code

- Enter your new PIN twice and tap confirm

In Internet Banking

- Sign in and click on manage my accounts

- Select Change Card PIN or Activate card (Set card PIN - you will be prompted to set your card PIN once your card has been activated).

- Select or Activate your card

- Follow the authentication prompts and enter the SMS code

- Enter your new PIN twice and select confirm

If we don’t offer the currency you’re paying in, your Worldwide Wallet payments will be processed using other currencies in your account, as long as you have enough funds to cover the transaction.

The order in which your currencies are used is called the ‘drawdown sequence’ and the applicable exchange rate at the time will apply. That means you’ll still benefit from no foreign transaction fees. Read more in our Product Disclosure Statement (PDF 1MB) .

You can load AUD into your Worldwide Wallet account instantly by transferring from your transaction or savings account in Internet or Mobile Banking.

You can also transfer AUD from another financial institution by using your Worldwide Wallet’s BSB and account number. Please note, funds availability is dependent on the other financial institution’s cut off and processing times. We will make your funds available in your account within 1 Business Day from the time we receive instruction from the other financial institution. We are not responsible for processing interruptions or delays beyond our control.

If another St.George account holder transfers funds to your Worldwide Wallet, the funds will be available in your account within 1 Business Day from when the owner of the eligible St.George account receives confirmation that the transfer has been processed.

Mastercard Flight Delay Pass is a service that offers you and companion complimentary access to over 1,000 airport lounges2 in the event of a flight delay of two hours or more. You will need to register each flight before its scheduled departure time. If you are under 18 years old, you must be accompanied by an adult (18 years of age and older) to enter participating lounges. Please note to hold a Worldwide Wallet you must also be 14 years or over. Other terms and conditions apply. To learn more about Flight Delay Pass, pre-register your flight or read the T&Cs, please visit flightdelaypass.mastercard.com/worldwidewallet .

You can continue to access your funds if you have your spare card handy. When travelling, it's a good idea to keep your cards separate. For your security, the spare card should only be used by yourself, and not given to anyone else.

See all FAQs

Within Australia

1300 277 103

24/7 support

From overseas

+61 2 9155 7803

24/7 support

Visit a branch

The Australian Government has introduced strict requirements for social distancing and staying in our homes. But if you need to come into a branch, we can help.

Important information

Internet connection may be needed to make purchases using Google Pay or Samsung Pay and normal mobile data charges apply.

Google Pay is a trademark of Google Inc.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Westpac Global Currency Card

EUR and USD on sale until 23 April 2024.

The Westpac Global Currency Card is a prepaid multi-currency travel card that will allow you to spend like a local when you’re travelling overseas or shopping online internationally.

✔ Manage it online, anytime ✔ Lock in exchange rates with up to 9 different currencies ~ ✔ No purchase fee, no monthly fees and no bank transfer load fees #

See how it works Get a card now

1 NZD = {{formattedRate}} {{selectedCurrency}}

Enter amount

~ The exchange rate for each Load/Reload is locked in at the prevailing exchange rate at the time of the transaction. Mastercard will notify customers via the website of the rate that will apply at the time they request the Load/Reload. # Other fees and limits apply.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Westpac travel card review 2024

If you’ve planned a trip overseas, a dedicated travel money card can be a good way to make overseas spending easy and secure. Get the right card, and it could also mean you pay less overall, too.

Westpac offers its Global Currency Card which you can top up in NZD, and then convert to any of the 9 supported currencies for easy spending and withdrawals as you travel.

This guide covers the key benefits and fees of the Westpac card. Plus, we’ll also touch on a couple of popular alternatives for travellers from New Zealand, the ANZ debit card and the Wise travel money card, so you can compare them and see which works best for you.

Westpac travel card: key features

Westpac’s Global Currency Card is available to anyone aged over 18, resident in New Zealand, and with the right paperwork to get verified. There’s no fee to get a card – you just order online, top up to the minimum opening balance, and your card is sent to your home directly. The money you’ve put on your card is yours to spend – just add whatever you need for your trip, and you can then view and manage your balance via the Westpac app.

Before we look at how the Westpac travel money card works in detail, let’s get an overview of some of the Westpac travel card pros and cons:

Who is the Westpac travel card for?

The Westpac travel money card can be helpful in a broad range of situations:

- For anyone travelling to a country which uses one of the supported currencies

- For people who shop online in the supported currencies

- For travellers who want to load funds in advance and convert to the destination currency so they know their budget ahead of time

- For anyone looking to lock in exchange rates when they’re good – just add NZD and switch when you spot a good rate

What is the Westpac travel card?

The Westpac travel card is a multi-currency Mastercard which you can use to hold 9 different currencies, and for spending anywhere you see the Mastercard logo. You’ll be able to order your card online for home delivery, and can top up in NZD and convert in advance to the supported currency you need in your destination. It’s worth knowing that you’ll need to convert your funds in advance to avoid paying the 2.95% fee for spending a currency you don’t hold in your account.

There’s no fee to make an international ATM withdrawal with your card, and you can view and manage your card account online and in the Westpac app, making budgeting a breeze.

Is the Westpac Travel Money a multi-currency card?

Yes. The Westpac card supports the following currencies for holding and exchange:

- New Zealand dollars

- Australian dollars

- Pounds sterling

- Japanese yen

- Canadian dollars

- Hong Kong dollars

- Singapore dollars

You can also spend in other currencies, but you’ll pay a 2.95% fee when you do.

Alternatives to Westpac travel card

Westpac’s travel money card is a good option, but it doesn’t support all the currencies you might need if you’re headed off the beaten track. Plus, there are some fees to consider such as the 2.95% charge if you spend in a currency you don’t hold in your account already.

To check if the Westpac Global Currency Card is right for you it’s worth comparing it to a few other options available locally, such as Wise and ANZ.

Here’s a quick overview of how these providers line up on some key features:

Information taken from Westpac travel card desktop site and fee information , Wise pricing page , ANZ money transfers and ANZ New Zealand ; correct at time of writing, 27th July 2023

The Westpac travel money card can be convenient if you’re happy to convert over funds in advance of travel, and if you’re going to a country which uses one of the 9 supported currencies for holding and exchange. However, it’s worth comparing it to other cards to see if it’s the best for your particular needs, before you sign up.

The Wise card, for example, has a couple of advantages – you can hold a broader range of currencies, and there’s no need to convert your funds in advance. You can just leave your money in NZD and let the card automatically convert to the currency you need based on where you are, with the mid-market rate and low fees from 0.43%.

Alternatively if you bank with ANZ already you can just use your normal ANZ debit card when you’re spending foreign currencies with a relatively low 1.3% foreign transaction fee.

Wise digital multi-currency accounts can hold and exchange over 40 currencies, and the Wise card can be used for spending and withdrawals in 150+ countries. Open your account online or in the Wise app, and top up in NZD or any of the other 20 or so supported top up currencies. There’s no need to convert to your destination currency in advance if you don’t want to, as the card can do this for you with the lowest available fees every time. That said, if you want to set your budget in advance, or if you spot a really good exchange rate, you can also convert and hold in any of the 40+ supported currencies, making this a good card to pick even if you’re headed to a more unusual destination.

Wise travel card review

Get your Wise travel card

ANZ recommends customers just use their normal debit card when spending on foreign currencies. This has the advantage that there’s no extra hassle or fee to get a new card – but the drawback that you’ll be charged a foreign transaction fee every time you spend. Your spending will be converted using the network exchange rate, and the foreign transaction fee is set at 1.3% of the transaction value.

Read more about 4 best travel debit card for overseas travel

Westpac travel card fees & spending limits

As with all financial products, there are some important fees to know about when you’re thinking of ordering a Westpac travel card. Here are the key limits to bear in mind as a starting point:

*Information correct at time of writing – 27th July 2023

And here are the key Westpac fees you’ll want to consider when you’re deciding if this is the card for you.

Exchange rates

Westpac exchange rates may include a markup, margin or fee. Exactly how this works depending on the type of conversion you need to carry out.

If you’re topping up your account in a currency other than NZD, the rate used will be the Mastercard rate + a margin which you’ll be notified of at the time of top up. This is likely to apply if you need currency conversion within your account, or when you cash out too. You’ll see the full terms and conditions when you start the transaction, so you can double check the costs.

Once you have currencies in your account it’s free to spend them. However, if you’re spending in a currency other than one of the 9 supported currencies – or if you don’t have enough balance in your account in a specific currency to cover a purchase or withdrawal, a 2.95% conversion fee will apply on top of the Mastercard rate.

How to get Westpac travel card

You can apply for your Westpac travel card online. Here’s how to get a Westpac travel card, step by step:

- Open the Westpac Global Currency Card website and click Apply Now

- Follow the prompts to enter your personal and contact information

- Complete the verification step with your New Zealand passport or driving licence

- Top up at least the minimum opening balance amount

- Your card will be dispatched in 5 to 10 days, and will arrive by mail

What documents you’ll need

There’s a verification step needed when you order a Westpac travel money card. This is to keep accounts safe and comply with local and international law. Generally getting verified is very easy. In the first instance you’ll be prompted to enter information from either:

- Your New Zealand passport

- Your driving licence

Mastercard will then look to match your information with ID records. If this can’t be done – because you’ve changed your name or recently moved home for example – you can use your AA membership. If you’re still struggling with the verification process, you can email a copy of your relevant ID to Mastercard for manual verification. This should take just a couple of days.

What happens when the card expires?

Your Westpac card has 5 years validity. Once your card expires you’ll need to order a new one online, and can apply to have any residual balance moved from the old card to the new one for spending. If you don’t want to get a new card, you can also cash out the amount, minus any applicable fees.

How to use the Westpac travel card?

You can use your Westpac card anywhere you see the Mastercard logo. You’ll be able to tap to pay wherever contactless payments are supported, or use your physical card and PIN. Your card will check if you have a balance in the required currency. If you do not, your account will be debited according to a preset order of currencies, and the conversion fees will apply.

How to withdraw cash with the Westpac travel card?

Make cash withdrawals at ATMs globally that support Mastercard. You’ll need to enter your PIN to get cash, for security reasons. It’s also good to know that while there’s no Westpac fee for international ATM withdrawals, an ATM operator might charge a fee which Westpac doesn’t control. Local NZD withdrawals cost 4 NZD each.

Is the card safe?

Yes. The Westpac card is issued through Westpac and Mastercard – both large, well reputed and trustworthy providers. In fact, using a travel card can be a safe way to manage our travel money because it’s not linked to your everyday account, and you won’t need to carry lots of cash when you’re overseas, either.

How to use the Westpac travel card overseas?

Use your Westpac travel card overseas in the same way as you would any other payment card. Contactless is supported where the technology is available, or you’ll have a Westpac PIN to make POS payments and withdrawals as needed.

It’s important to remember that a fairly high fee of 2.95% applies to spend currencies you don’t hold – or if your balance in a particular currency isn’t enough to cover a transaction. Top up enough in advance and switch to your destination currency to avoid this fee.

Conclusion: Is the Westpac travel card worth it?

The Westpac Global Currency Card is a convenient option if you want a travel money card that’s distinct from your normal everyday account, and which lets you hold foreign currencies. You’ll need to order your card online, and top up in NZD before converting to the currency you need for your trip, to avoid the 2.95% conversion fee.

Compare the Westpac travel money card against alternative options like the Wise travel card and the ANZ debit card, to decide which is best for you. Wise has a broader range of currencies and offers automatic conversion at the point of payment, with low fees and the mid-market rate, while ANZ customers can spend globally with a fairly low 1.3% foreign transaction fee.

Westpac travel card review FAQ

How does the Westpac travel card work?

You can order your Westpac card online and add money in NZD before converting to the currency you need from the 9 supported currency options. You’ll then be able to spend and withdraw wherever you are. It’s free to spend in currencies you hold in your account, with a 2.95% fee to spend a currency you don’t have.

Is the Westpac travel card an international card?

Yes. The Westpac travel card can hold 9 currencies and can be used globally wherever Mastercard is accepted.

Are there any alternatives to a Westpac travel card?

Check out a few different options before you decide which travel money card suits you. The Wise card can be a good bet for frequent travellers, with 40+ supported currencies and low fees from 0.43% when you convert from one currency to another.

- Agribusiness

- Institutional

Using your credit or debit card overseas.

You can use your Westpac credit or debit card anywhere around the world that Mastercard® is accepted, at ATMs and directly with retailers, either online or in person.

Before you travel.

Tips for using your card overseas..

- No PIN? Make sure you get one loaded on your card before you go for added security.

- Use Global Alliance ATMs to avoid the usual transaction fee. More about Global Alliance ATMs .

- Paying in the local currency where possible can minimise foreign exchange costs. That way the currency conversion is handled by the credit card network, which can often give you a better exchange rate than if you chose to pay in New Zealand dollars 1 at the time.

- International cards will not be accepted at unattended card payment terminals in the US, for example some petrol stations. If you want to pay using your card, you’ll need to go to a petrol station where a cashier can take a card payment.

- If your card is declined, ask the merchant to call the local Mastercard office, or call Westpac on +64 9 914 8026 to advise us of the incident and provide merchant location details.

Helpful tools.

Monitor your card spend in real time with our money management app.

24/7 protection from fraudulent activity 2 . So you can use your card anywhere, anytime and leave your worries behind.

Help avoid fees, feel more secure and keep a track of your balance by enabling a range of email or TXT alerts within your credit card account.

Stolen or lost card while overseas.

Has your credit card got overseas travel insurance.

The credit cards below include complimentary overseas travel insurance cover 3 . You can find more information about the Overseas Travel Insurance policy wording, benefits, exclusions and conditions under the following policies:

Where cards are not accepted.

Here’s a list of the countries where Westpac cards won't be accepted 4 :

- North Korea

- Darfur region of Sudan

- Crimea region of Ukraine

- Donetsk region of Ukraine

- Luhansk region of Ukraine.

Things you should know.

1 A foreign currency fee is charged when you make a purchase or cash withdrawal in a foreign currency, and also applies to any fees and charges charged by the overseas bank or vendor in relation to the transaction. This fee is also charged when you make online purchases in a foreign currency. For personal credit or debit cards, the fee is 1.95% of the transaction amount. For business credit cards, the fee is 2.50% of the transaction amount. Transaction fees are subject to change. Refer to the Transaction and Service fees brochure for details 2 Provided you notify us as soon as possible, have not acted fraudulently or negligently, and have complied with the card’s Conditions of Use .

3 Terms, conditions, exclusions and eligibility criteria apply (see applicable policy document ), including a minimum spend for certain travel regions. Travel, Extended Warranty and Purchase Protection Insurances arranged by Westpac and underwritten by AIG Insurance New Zealand Limited. Westpac does not guarantee the obligations of, or any products issued by, AIG. 4 This list was last updated on the 22 March 2022 and is subject to change. This list of prohibited countries can change at any time. For more information, refer to the Conditions of Use .

Eligibility criteria, lending criteria, terms and conditions apply. Conditions of Use for the applicable card apply. Rates, transaction and services fees apply .

Mastercard is a registered trade mark and the circles design is a trade mark of Mastercard International Incorporated.

- Credit cards

- Personal Finance

What is a travel money card?

How does a travel money card work?

Why use a travel money card, how to compare travel money cards, how to get a travel money card, are travel money cards worth it.

A travel money card, also called a prepaid travel card, is a type of card that can hold foreign currencies. It’s intended for overseas travel, and you can use one to withdraw foreign cash from ATMs and to make purchases in a local currency.

Think of a travel money card as a debit card that uses local currency. Before you use a travel money card, you’ll preload a set amount of a specific international currency onto the card at the day’s exchange rate. For example, if you’re travelling to Italy and France for two weeks, you’d load Euros (€) onto the card and use it instead of your regular debit or credit card during your trip.

You can continue reloading money onto the card via an app or website as you spend your funds. So, if you blow through your Euros in Rome, you can top off your card’s balance before arriving in Paris.

Available currencies

The available currencies will depend on the card, but you’ll generally find the following options:

- United States Dollars (USD)

- Europe Euros (EUR)

- Great British Pounds (GBP)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED)

Know that the number of currencies available will also vary. For example:

- The CommBank Travel Money Card offers 13 currencies.

- The Westpac Travel Money Card has 11 currencies.

- The Qantas Travel Money Card has ten currencies.

The value of your exchange

The value you exchange currency for will depend on when you load your funds. Rates change from day to day, but you’ll lock in the rate used at the time you exchange currency. So, you’ll know the exact worth of the foreign currency in Australian dollars every time you use your preloaded card.

On the one hand, a locked-in rate protects you from volatile currencies with fluctuating values. However, if the rate drops, you could be stuck with devalued foreign funds. So, while you can’t predict the future, try to coordinate the load when the exchange rate is most valuable — even if that means waiting a few days.

- Provides access to multiple currencies. Most options allow you to convert Australian dollars into several different currencies simultaneously. That means you can have secure access to a handful of foreign funds during your next multi-country adventure.

- Saves on ATM fees. Credit card holders won’t usually be charged the standard 3% foreign transaction fee or pay extra for in-network ATM withdrawals, loading, and topping up their cards. However, these are just generalisations — each credit card company or bank will have its own fee structure.

- Exchange rates are locked. You’ll pay for the local currency using the exchange rate available when you load funds, which locks in the rate. Having dependable value for your funds goes a long way for peace of mind, especially when travelling.

- Fewer risks when lost. Losing a prepaid card while travelling is undoubtedly a hassle. However, a lost or stolen credit card can mean more risks, like thieves potentially accessing your personal banking details and account funds. Since a lost travel money card is unlikely to result in a stolen identity and fraud , some travellers find it a safer choice while abroad.

- Helps with budgeting. Trying to keep to preloaded funds may help you stick to a budget while on vacation. Plus, you see the value of money in the local currency, which can help you manage your finances while travelling.

- May come with rewards and perks. Some travel money cards earn frequent flyer points or come with other special travel perks, like overseas customer service. For example, the Qantas Travel Money Card earns Qantas points, and the Westpac Travel Money Card offers airport lounge access to the cardholder and one companion access when a flight is delayed.

Disadvantages

- There are delays when reloading. If you need to top up your balance, you may need to wait up to a few days before funds are available to use.

- Other fees. Some travel money cards may levy typical credit card fees for reloading funds, emergency card replacement, account maintenance, closures, inactivity and more. For example, Travelex and the Australia Post Travel Platinum Mastercard charge a $10 account closing fee.

- Limited acceptance. Travel money cards are less common than other payment options, so you may need help using one for all purchases. So, it’s always a good idea to carry emergency cash.

- May lack the rewards or perks you’re used to. Travel money cards may come with some, but these extras are usually less robust than the offerings on rewards credit cards .

Before you choose a travel card, consider a few key features.

One of these is the number of currencies available and the ability to load multiple currencies onto one card. That benefit can help you save and make it easier to manage your money while travelling overseas .

Another thing to look for is reduced or waived fees for loading or reloading funds, account keeping, account closing, and emergency card replacements. Be sure to check for any potential fees when accessing leftover foreign funds you didn’t use on your trip, as there may be an unloading fee.

Travel perks, such as airport lounge access or the ability to earn rewards, are also great features to look for. Digital wallet compatibility, allowing you to use a virtual version of your card, can also be helpful.

Of course, security features are also important. Look for a card with a PIN to use at ATMs and the ability to lock the card instantly if lost or stolen.

Finally, options to quickly load or reload funds and notifications when your balance is low can be beneficial. And, since you’re travelling overseas, 24/7 customer support is essential to ensure you have access to help when you need it.

To get a travel money card , you can go through your bank, an airline, a foreign exchange retailer or a payment merchant. For example, Westpac, CommBank, ANZ, NAB, Qantas, Travelex, Mastercard or Australia Post all offer travel money cards.

How to apply

Prepaid travel card eligibility is comparable to the requirements for a debit card. For example, CommBank requests that cardholders have a minimum age of 14, be registered with NetBank, and provide a valid email and residential address.

You can apply directly on the provider’s website once you choose your favourite prepaid travel money card. Make sure to submit your application at least a few weeks before your trip in case of delays.

» MORE: How old do you have to get a credit card?

How to activate

After you receive the card:

- download the provider’s app and familiarise yourself with how it works

- register your account

- activate the card

- convert your money to the chosen currency. You might want to start with a smaller amount for the first part of your trip and reload while overseas or make one big transfer.

While overseas, you’ll likely alternate between paying in local cash and pulling out your travel card. Your goal is to find the best travel card that allows you to pay for items with minimal fees and maximum protections flexibly.

The right travel money card supports a stress-free trip, but you don’t have to use one when travelling overseas — your bank card or credit card could also be a suitable option.

If you’re deciding between a travel money card and a travel credit card , it’s important to understand the differences in how they work.

- Travel money cards are preloaded with foreign currencies, while travel credit cards spend borrowed money. Travel money cards are generally easier to obtain as they don’t require good credit or income thresholds. With a travel money card, you can withdraw funds from an ATM without incurring interest or cash advance fees .

- Travel credit cards don’t usually hold foreign currency but offer perks such as international buyer protections, free insurance , airport lounge access and frequent flyer travel points .

Be sure to consider other important features — such as security, reduced fees and travel perks — to decide if a travel money card is worth it for you.

Frequently asked questions about travel money cards

Most Australian banks — including Westpac, CommBank, ANZ and NAB — have some travel products, whether a travel money card or a travel credit card.

About the Author

Amanda Smith is a freelance reporter, journalist, and cultural commentator. She covers culture + society, travel, LGBTQ+, human interest, and business. Amanda has written stories about planning for retirement for…

DIVE EVEN DEEPER

How Do I Pay With My Phone?

Instead of carrying your wallet around and pulling it out at check-out, you can just tap your phone, which is always on you, to pay for most things now.

What Is a Travel Credit Card?

Using a travel rewards credit card can help you get your next flight on a discount, hotel upgrades, or even cover the full cost of a trip.

What Is a Frequent Flyer Program Credit Card?

Frequent flyer credit cards earn points or miles that can upgrade your travel and help you score free flights.

How To Lock, Block Or Freeze Your Credit Card

A card lock is essentially an on-off switch that allows you to temporarily freeze or block your credit card and most debit cards.

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

Join the conversation

To share your thoughts or ask a question, visit the CHOICE Community forum.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Best Travel Cards for Australians Heading Overseas in 2024

We compare the best travel money cards including prepaid cards, debit cards and credit cards. Whether you want ease of access to money at any cost or no-frills or fees cash, find the best money solution when you travel overseas.

Wise - our pick for travel card

- No annual fee, hidden transaction fees, no exchange rate markups

- No minimum balance requirements

- Allows you to make payments and withdrawals wherever you are in the world in over 40 currencies

- Local bank account details in Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR), Canada (CAD) and New Zealand (NZD)

- Available in the US, UK, Europe, Australia, Singapore, Japan and New Zealand

Find out more about the Wise card .

With this card:

- It's very easy to set up and order

- You can receive foreign currency into a multi-currency account linked to the card

- Pay with your Wise card in most places overseas where debit cards are accepted

- Get the mid-market rate for currency conversion

Go to Wise or read our review .

It's not all good news though

- There is a 2% ATM withdrawal fee when you withdraw over $350 during a month

- It takes 7-14 days for delivery

How do I pick the best travel card for me?

Fed up with ATM charges when you travel overseas? Or running out of money when you need it the most? You probably brought the wrong card with you.

It can be tricky to choose the best travel card to use when you travel overseas. The best one for you will really depend on what you need from the card you're using.

You will generally use travel cards to make purchases online, in-stores and to withdraw money at ATMs. All travel cards have these basic capabilities. This means what you should really compare between travel cards are the following:

Exchange Rates and Fees

Compare exchange rates and fees

Conditions and limits

Spending conditions and max/min limits

Make sure your money is secure

Best Travel Cards for Australians Travelling Overseas

Wise is our pick for travel debit card.

- You can transfer money to a bank account overseas

- Currency conversion using the mid-market exchange rate

Click here to see the full list of cards and how Wise compares

Read the full review

- No annual fee, hidden transaction fees, exchange rate markups

- Local bank account details in Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR) and New Zealand (NZD)

- It takes 7-14 business days to receive the card

- Can't always access local technical support depending on where you are

- Free cash withdrawals limited to under $350 every 30 days

- Only currently available in the US, UK, Europe, Australia and New Zealand

Revolut - multi-currency travel card

- No purchase fee, load fee, reload fee, exchange rate margin or minimum balance requirements

- Unlike other Travel Cards, its free and easy to use the balance of your currency or convert it back to AUD

- Mid-market exchange rate, they add a mark-up for currency conversion during weekends

- For the free Standard account, there is a 2% ATM withdrawal fee when you withdraw over $350 during a month

- The premium account costs $10.99 a month, which can really add up if you are not using it often

Click here to see the full list of cards and how Revolut compares

- Very easy to use app

- Free to set up

- No hidden fees or exchange rate mark-ups (except on weekends)

- You can use it to transfer money to a bank account overseas

- Additional fees for using the card on a weekend

- 2% ATM fee once you withdraw more than $350 in any 30 day period

- 3-4 business days before you receive your card

- Ongoing subscription fee for Premium and Metal cards

Citibank Saver Plus - bank travel card

The Citibank Plus Everyday Account - bank debit card. With this card you can:

- withdraw money for free at over 3000 ATMs Australia-wide and overseas

- take advantage of no foreign transaction fees, monthly fees, or minimum opening balance

- transfer money to friends and family anywhere in the world for free

We think this is the ideal debit card whether you're staying local in Oz or travelling to destinations in Asia or Europe.

- No international ATM or transaction fees

- Fee-free international money transfers to any account worldwide

- SMS notifications through Citi Alert

- Cash deposits available within 24-48 hours

- Can't have two cards active at the same time

- $5 account closure

28 Degrees Platinum Mastercard - travel credit card

28 Degrees Platinum Mastercard - travel credit card. With this card:

- There are no annual fees

- No overseas purchase fee or currency conversion fee

- You get 55 days interest free on purchases

- Access to free 24/7 concierge service

- Emergency card replacement worldwide

The 28 Degrees Platinum Mastercard has additional benefits including shoppers and repayments benefits cover. For more information read our review .

- Can have 9 additional cardholders

- No overseas purchase fee, or currency conversion fee

- No foreign transaction fee

- Free Replacement Card

- High interest rates after the initial 55 days

- Minimum credit limit is $6000

- No introductory offers or rewards

Learn more about the 28 Degrees Platinum Mastercard

Travelex money card - prepaid travel card.

Travelex Money Card - prepaid travel card. With this card:

- There are no ATM fees so you can withdraw cash at no extra cost

- You can access Travelex's online rates

- You can lock in your initial loading cross currency rate

- Ideal for the organised traveller.

- Can load up to 10 currencies including AUD, USD, EUR, GBP, NZD, CAD, THB, SGB, HKD and JPY.

- Smartphone App & Free Wifi Cross

- $0 overseas ATM fees (Australia excluded)

- 24/7 Global Support

- Limited Currencies

- 5.95% currency conversion rate

- $100 minimum initial load

- 2.95% Australian ATM withdrawal fee

Learn more about the Travelex Money Card

What are the other travel card options.

Check our travel card comparison table for a comprehensive list of fees and features for different travel debit and credit cards available for Australians travelling overseas.

*ATM operators will often charge their own fees.

** Up to 5 ATM fees and unlimited currency conversion costs may be rebated if you deposit $1,000 and make 5 purchases per month.

***Account fee waived if you meet eligibility criteria, including depositing $2,000 per month

What are the different types of travel card in Australia?

There are 3 popular travel cards you can take with you on your trip:

Prepaid Travel Card

Travel Debit Cards

Travel Credit Card

1. Prepaid Travel Card

For prepaid travel cards, you're able to load the card with a set amount of money in the currencies you need. Ideally you do this before your trip, but often you can reload them as well.

Most prepaid travel cards allow for multiple currencies to be loaded onto the card. So it's important to know what currency you'll be using on your travels. Airlines also offer prepaid cards so the money you spend can earn you reward points.

With prepaid travel cards you need to be careful, as they can have numerous fees and charges which can make it more expensive than other options. But if you're organised and travelling to multiple cities a prepaid travel card is a good option. Read more of how to find the best travel card with no foreign transaction fees .

If you need more flexibility or you don't want to pay the multiple fees associated with prepaid travel cards, the HSBC and Citibank global accounts are better options.

- Exchange rate margins when you load your card

- Exchange rate margins when you close the card

- Flat or percentage-based fees to load the card

- ATM withdrawal fees

- Exchange rate conversion fee when you use the card

- Reloading fees

- Closing fees

Prepaid travel cards are best if:

- You want to lock in a rate

- You want to stick to a budget

- You lose it/it's stolen

Prepaid travel cards are not great if:

- You want the absolute best rates

- You need to hire a car, make payments on a cruise ship, or pay for a hotel

2. Travel Debit Card

An international card or your bank card offers the convenience of a credit card, but work differently. They draw money directly from your bank's everyday transaction account when you make a purchase. It's designed for everyday money transactions and means that you're not accumulating debt.

A debit card could make you stick to your travel budget, because you can't overdraw money from your account. And for daily purchases, we think a debit card can help you stick to your travel budget, because you can't overdraw money from your account.

We recommend bringing both a debit card and credit card for safety, flexibility and convenience on your trip.

- Currency conversion fee for overseas debit transactions

- Flat fee or percentage-based ATM withdrawal fees

- Foreign ATM owner fees

- Flat fee or percentage fee for debit card purchases via EFTPOS

Debit cards are best for:

- When you have time and you're happy to open a bank account to get one

- Fee-free cash withdrawals from ATMs

Debit cards are not great if:

- You switched from a better account to get one

- Or if you want to switch, but pick a costly travel debit card instead

3. Travel Credit Card

Credit cards have obviously been around for a long time. But now there are specialised travel credit cards. Generally, these cards give you longer to pay back what you've spent but the interest rates after this time can be quite high.

The main advantage with credit cards are the reward points you get in return for your customer loyalty when you spend. But it only works if you pay off the balance in full each month.

Credit cards are great to use for car hire, restaurants and accommodation - larger expenses that are easier for you to pay back over time. Some services only take credit cards to hold purchases so they can definitely be handy while you're travelling.

- Annual and reward scheme fees

- Cash advance fees

- Interest charges

Travel credit cards are best for:

- Getting the best spending rates

- If you have decent credit score and are legible for the credit card

- Frequent flyer points to help you get discounted or free flights

- Low or zero international transaction fees

- Complimentary travel and/or medical insurance offered with a lot of cards

Travel credit cards are not great if:

- Your credit score is poor

- You won't repay in full every month

- Can't afford high minimum credit and annual fees

- Want additional card holders (usually an extra cost)

- Your monthly salary minimum isn't high enough

- For some travel credit cards you have to be a permanent Australian resident

Best travel money card tips

Before you decide which travel money card will best suit your needs, it’s worth comparing a few, bearing in mind these handy travel money card tips:

- Exchange rate - check what rate is used to convert your dollars to the currency needed for spending in your destination. A card which uses the mid-market rate or as close as possible to it is usually the best value

- Coverage - make sure your card covers the currency you’ll need in your destination, as fees may apply if it doesn’t. Picking a card which covers a large number of currencies can also mean you’re able to use your travel money card on future trips.

- Safety - check the card’s safety features. Most cards are linked to an app which allows you to view transactions, check your balance and freeze or unfreeze your card if you need to

- Fees - read through all the possible fees associated with your card before you sign up. Costs may include a foreign transaction fee when spending an unsupported currency, ATM fees, a cash out charge or inactivity fees if you don’t use your card often for example

- Rewards - some travel money cards also offer some nice extras, like ways to earn rewards or discounts, or free wifi when you travel. Travel credit cards in particular have lots of rewards on offer, although you may have to pay an annual fee to get them

Travel card fees

The fees you pay for your travel money card will vary depending on the type of card you select, and the specific provider.

Travel prepaid cards fees can include:

- Fees when you get your card in the first place

- Load or top up fees

- An exchange rate margin when topping up foreign currencies

- Foreign transaction fees if you spend a currency you don’t have in your account

- ATM charges at home and abroad

- Cash out, close or inactivity charges

Read more about prepaid cards here

Travel debit card can include:

- Card delivery fee

- International ATM fees

- Currency conversion charges

Read more about travel debit cards here

International credit card fees can include:

- Annual fees to hold the card

- Cash advance fees if you use an ATM

- Foreign transaction fees

- Interest if you don’t repay your bill in full

- Penalties if you don’t pay your bill on time

Read more about credit cards here

Conclusion - What is the best card to use while travelling?

There’s no single best travel money card - which works best for you will depend on your personal preferences and where you’re heading.

Using a multi-currency debit card which supports a large range of currencies can keep your costs low and allow you to skip foreign transaction fees . Plus you’ll be able to use your card for online shopping in foreign currencies, or for your next trip abroad, with no ongoing fees to worry about.

Prepaid travel money cards are safe and easy to use , and you can often pick one up instantly if you’re in a hurry. You’ll be able to add travel money before you leave or top up as you travel, although it’s worth converting to the currency you need in advance, and looking for a card with mid-market exchange rates to avoid extra costs.

Generally using a credit card will come with the highest overall fees - but you’ll be able to spread out the costs of your travel over a few months if you need to, and you may also be able to earn rewards or cash back as you spend. Use this guide to compare different card types and options, and pick the perfect one for your needs.

Frequently Asked Questions - Best travel cards to use overseas

Which is the best travel card for use in australia.

The Citibank Plus Everyday Account is the best travel debit card for use in Australia. It works as a normal debit account, with no ATM fees at 3000 ATMs across Australia and has no account minimums.

Which travel card is best for Europe?

The best travel card for Europe is Wise . Not only do you get a great rate when spending in Euros, You get a set of bank account details with which you can recieve EUR transfers, as if you were a local.

Which high-street bank has the best travel card?

The best travel card from an Australian high-street bank is either the Citibank Plus Everyday Account or the CommBank travel money card . While Citibank's card offers more as a travel card (fee-free ATM withdrawals and excellent exchange rates), CommBank has far more in-person branches in Australia if you're someone who prefers doing your banking in person.

What is the best card to use while travelling?

There’s no single best travel money card - which is best for you will depend on your personal preferences. Usually having a few different ways to pay is a smart move, so packing a travel debit card or prepaid card, your credit card and some cash can mean you’re prepared for all eventualities.

Westpac Complimentary Credit Card Insurance and COVID-19 (Coronavirus) FAQ

Information for westpac eligible cardholders regarding covid-19.

Information on this page is correct as of 30 June 2022 .

Stay up to date on Travel Information for COVID-19 from the Department of Foreign Affairs and Trade (DFAT) Smartraveller website and World Health Organisation (WHO) and Department of Home Affairs .

Always consult the smartraveller.gov.au website prior to any travel. In addition to visas, COVID-19 testing, and proof of vaccination requirements, many countries now have compulsory insurance and medical cover proof conditions. Check with the nearest embassy, consulate or immigration department of the destination you are entering. If you require additional documentation regarding the complimentary international travel insurance policy due to international entry requirements, please contact us on 1800 091 710.

From 30 June 2022, if during the period of your cover, you (and your spouse/dependents, if they’re eligible for cover) are positively diagnosed as suffering a sickness recognised as an epidemic or pandemic (such as COVID-19), cover may be available under the following sections:

- 1.1 Overseas Emergency Assistance

- 1.2 Overseas Emergency Medical

- 1.4 Medical Evacuation & Repatriation

- 2.1 Cancellation

- 3.1 Additional Expenses

If your travel companion is positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, such as COVID-19, which impacts your journey, cover may be available to you under the following sections:

Note, you won’t be covered while travelling against advice or warnings issued by the Australian government and you did not take reasonable care to avoid contracting the sickness, for example by delaying travel to the country listed in a warning.

The above is a summary only, please refer to Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet for eligibility criteria, full terms, conditions, limits and exclusions.

A General Exclusion for epidemic/pandemic applies for all claims relating to any epidemic/pandemic outside of the select benefits in the applicable policy information booklet Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet . Please note, terms, conditions, limits and exclusions apply.

To receive a formal outcome, Eligible Westpac Cardholders must submit a claim.

Eligible Westpac travellers who meet the eligibility criteria should be aware that other General Exclusions have the potential to apply.

What is a General Exclusion?

A General Exclusion is an exclusion which will be applied across all sections of an insurance policy, and applies regardless of when eligibility for cover was gained. Should a General Exclusion apply, this means that your complimentary credit card travel insurance excludes cover for the event, activities or circumstances (specified in the exclusion) that causes your claim.

To understand what is excluded from the Westpac Complimentary Insurance covers, please refer to Part D – Excesses & General Exclusions section and the section specific exclusions of the relevant Westpac Policy Information Booklet for which your eligible Westpac card is applicable under: Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet .

Other exclusions may apply depending upon the circumstances of an individual claim. General Exclusions include but are not limited to:

- by the Australian government (when a ‘Reconsider your need to travel’ or ‘Do not travel’ alert is in place), which can be found on www.smartraveller.gov.au ; or

- which was published in a reliable mass media source.

- any interference with your travel plans by any government, government regulation or prohibition or intervention or official authority. For example, if Smartraveller has a warning, ‘Do not travel’ or ‘Reconsider your need to travel’ due to the risk of COVID-19 infection for a destination, and a cardholder chooses to ignore the warning and is infected with COVID-19, cover may be excluded. Or if a government closes its borders to inbound travellers due to COVID-19 and you are unable to enter and follow your planned travel across the closed border, cover may be excluded.

What if a Westpac Eligible Cardholder has booked travel and needs to cancel due to contracting COVID-19?

If you are unable to travel as a result of contracting COVID-19, Cancellation cover may be provided to eligible travellers, if you or your travel companion are positively diagnosed as suffering a sickness recognised as an epidemic or pandemic such as COVID-19, and cover is expressly included under the Cancellation section of the relevant Westpac Policy Information Booklet for which your eligible Westpac card is applicable under: Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet . If you are unable to travel as a result of an Epidemic or Pandemic related event which does not include you or your travel companion being positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, for example a border closure, there may be no provision to claim as a general exclusion for epidemic and pandemic applies. A General Exclusion for epidemic/pandemic applies for all claims relating to any epidemic/pandemic outside of the cancellation benefits in the applicable policy information booklet. Please note, terms, conditions, limits and exclusions apply.

You therefore need to consider your own personal circumstances. We are not able to provide you with a cover decision before submitting a claim. To receive a formal outcome, Westpac Eligible Cardholders must submit a claim.

You should also contact your travel agent or travel service provider (airline, cruise line or Tour Company, etc) as they may be able to support you in obtaining refunds, credits or travel re-scheduling.

Can Westpac Eligible Cardholders make a claim for consideration?

Every Westpac Eligible Cardholder can submit a claim and have their individual circumstances considered in accordance with the eligibility criteria which includes the terms, conditions, limits and exclusions that apply as set out in the Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet .

If you would like to claim, we encourage you to claim online via insurance.agaassistance.com.au/westpac

Call the Allianz Global Assistance Claims team

- Lost or stolen cards

- Online Banking – Personal

- Online Banking – Business

- Corporate Online

- Westpac Share Trading

- View all online services

- Westpac Wire

- Making News

Consumer pessimism shows inflation fight is not yet won

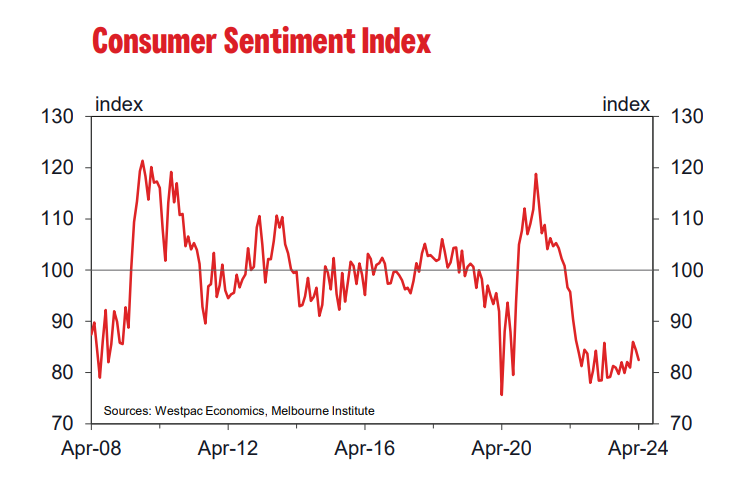

The gloom hanging over the Australian consumer shows little sign of lifting. The Westpac Melbourne Institute consumer sentiment index declined 2.4 per cent in April to 82.4, from 84.4 in March. That’s in line with the average seen over the last two years in what is proving to be one of the bleakest periods for sentiment since the survey began in the mid-1970s. April’s findings were particularly discouraging after previous months had shown hints of the start of a recovery. The latest setback is a reminder that inflationary pressures continue to bear down on households, with consumer price rises having outstripped wage growth by 6 percentage points over the last three years.

There were some minor positives to take out of the latest report. Views on family finances over the next year were slightly more upbeat, perhaps in anticipation of Stage 3 tax cuts which will kick in from July. Responses around the labour market were also positive, with people feeling comfortable about job security and their future prospects. But it’s clear that cost of living pressures, higher interest rates and an increased tax burden are still taking a toll. The sub-index which asks respondents whether now is a good time to buy a household item dropped by nearly 7 per cent, while views on broader economic conditions also showed a deterioration. Many people are yet to be convinced that interest rates have peaked, with over 40 per cent of respondents still expecting mortgage rates to move higher over the next 12 months. For Australia, the inflation fight has been a bit longer and harder than other countries. If we look at comparable measures in the U.S., the UK and Europe on a like-for-like basis they are consistent with sentiment rates in the 90 to 95 range, compared to Australia's in the low 80s. The inflation story is somewhat more advanced in those countries, with the Federal Reserve in particular having opened the door to potential interest rate cuts. We haven't had the same sort of messaging in Australia yet, although we may see a shift around that over the next few months. Westpac economists expect that that March quarter inflation report, due on April 24, will bring a more decisive move in headline inflation down to around 3.5 per cent. If that plays out, it should give the RBA more confidence around achieving its 2 to 3 per cent target in 2025. We may then get a clearer signal that further rate hikes are not likely, they may even open the door for rate cuts, although we expect them to tread cautiously around that. We also have the Federal Budget coming up in May, which could offer more cost-of-living support measures. Add the July tax cuts into the mix and there still looks to be a reasonable prospect of a recovery in sentiment in the next few months. But right here, right now, we're stuck at the bottom of the cycle and confidence remains downbeat. To read Matt’s full report, visit WestpacIQ .

Matthew is a senior economist with Westpac. His specific areas of expertise are housing markets and the Australian consumer sector. Matthew’s research has been instrumental in shaping Westpac’s views on the Australian economy, including recent calls on official interest rates. His research has provided important insights into housing market developments and the behaviours of the Australian consumer. He is the author of Westpac’s monthly Red Book report, regards as essential reading on the consumer sector. Before joining the Westpac team in 2007, Matthew held senior positions with leading economic consultancies in Australia and New Zealand.

- login to twitter account

Don't miss

More Aussies are planning moves in the property market

--> By James Thornhill Editor, Westpac Wire

SCAM SPOT: Beware a surprise pay-day

--> By Ben Young Head of Fraud and Financial Crime Insights

David Walker’s tech trends to watch in 2024

Stay connected with westpac wire.

Subscribe to our newsletter and follow us on LinkedIn , Facebook , Twitter and Instagram .

Related articles

Consumer sentiment gets reality check in march index.

15 days ago --> By Matthew Hassan Senior Economist, Westpac

Five opportunities and challenges facing Australian manufacturers

17 days ago --> By James Thornhill Editor, Westpac Wire

Swiftonomics: Assessing Taylor’s impact on spending

1 month ago --> By Matthew Hassan Senior Economist, Westpac

Browse topics

Best no-annual-fee travel credit cards of April 2024

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Travel rewards cards are a lot like gyms. The best ones may come with tons of added benefits (saunas, yoga class, etc.) but they also cost a lot, usually with a big financial commitment upfront.

As a result, whether you’re considering a Chase Sapphire Preferred ® Card (with its $95 annual fee) or a CrossFit membership, you probably have the same question on your mind: will I really use it enough to justify paying for it?

While there aren’t any free gyms we know of, there thankfully are plenty of no-annual-fee travel rewards cards that require essentially zero commitment. And just like an ab roller or a Richard Simmons DVD, you can simply use them a few times, forget about them, and put them in a drawer until beach season. Or, you can stick with it and make them part of your daily routine—whatever works for you.

You’re also far more likely to see “instant results” with these cards, too. From 100,000-point welcome bonuses to rewards for paying rent, free travel insurance to 3X on gas, these cards offer way more than you’d expect for a fee of $0 per year.

The best no-annual-fee travel cards for April 2024

Best overall: bilt mastercard, best for hotel rewards: ihg one rewards traveler credit card, best for airline rewards: united gateway℠ card, best for travel earnings: wells fargo autograph℠ card, best for flat-rate earnings: capital one ventureone rewards credit card.

The Bilt Mastercard allows you to earn points from paying rent and transfer them 1:1 to well over a dozen different travel partners including United MileagePlus and Marriott Bonvoy. Toss in some surprisingly robust travel insurance and you have our unconventional—yet logical—choice for the best overall no-annual-fee travel card of 2024.

Bilt Mastercard®

See Rates and Fees

Special feature

Rewards rates.

- 1x Earn 1X points on rent up to 100K/year

- 1x Earn 3X points on dining

- 2x Earn 2X points on travel

- 1x Earn 1X points on other purchases

- Use the card 5 times each statement period to earn points

- Uniquely earns points on rent

- Rent Day bonus every first of the month offers double points (excluding rent)

- Robust travel transfer partners

- Cash redemption rate is poor

- No traditional welcome bonus

- Travel perks: Trip Cancellation and Interruption Protection, Trip Delay Reimbursement, Auto Rental Collision Damage Waiver

- See this page for details

- Foreign Transaction Fee: None

Why we like this card: As mentioned, the Bilt Mastercard’s most compelling feature is that it allows you to pay rent with a credit card—even if your landlord doesn’t take plastic—and avoid the transaction fee paying rent by credit card would typically incur. Then, as long as you complete five transactions each month, you’ll trigger 1X rewards on your rent payments.

Note that rewards on rent are capped at 100,000 points per year.

In terms of earning potential, if you pay the median ~$2,000 rent in the U.S., you could earn approximately 24,000 points per year which can be used to book travel in Bilt’s portal at a value of 1.25 cents per point or transferred to any of Bilt’s airline or hotel partners at a 1:1 ratio. In other words, you could likely earn a domestic flight with United or a weekend stay at Hyatt, all for simply paying rent on time.

The Bilt card also provides trip cancellation and interruption protection, trip delay reimbursement, and primary rental car insurance (terms apply)—perks you wouldn’t typically find on a no-annual-fee credit card.

If you’re looking for a hotel rewards card that offers the most free nights for no annual fee, wait until you read about the IHG One Rewards Traveler Credit Card. With a six-figure welcome bonus, up to 17X on stays and other compelling rewards, it’s currently the gold standard for no-fee hotel rewards.

IHG One Rewards Traveler Credit Card

Intro bonus.

- 17x Earn up to 17X points when you stay at IHG Hotels & Resorts

- 3x Earn 3X points on dining, utilities, internet, cable, and phone services, select streaming services, and at gas stations

- 2x Earn 2X points on all other purchases

- Generous welcome bonus not typically seen in a $0 annual fee card

- Travel protections that are unusual for a no-annual-fee card

- Fourth night free on award bookings

- Limited redemption options outside of IHG

- IHG points are worth less than some other rewards currencies

- Silver status granted with the card has limited benefit

- Additional perks: Trip cancelation/interruption insurance, auto rental collision damage waiver, purchase protection, ability to spend to Gold status

- Foreign transaction fee:None

Why we like this card: We like calling the IHG One Rewards Traveler card the “Liam Hemsworth” of travel rewards cards because it lives in the shadow of its big brother—the IHG One Rewards Premier Credit Card —but still delivers plenty of quality and substance in its own right (with no annual fee, to boot).

For starters, you can get a welcome bonus of 80,000 bonus points after spending $2,000 on purchases within the first 3 months of account opening, potentially worth around $500 to $700 in IHG redemption.

Plus, enjoy up to 17X points when you stay at IHG Hotels & Resorts, instant Silver Elite status and a handy bonus where you redeem points for three consecutive nights and get the fourth night in your stay free. So, if you book a three-night stay using your welcome bonus, you’ll essentially be getting a complimentary four-night stay at a nice IHG property for no annual fee. The IHG One Rewards program could be very rewarding for the right traveler.

Check out our full review of the IHG One Rewards Traveler .

As a no-annual-fee airline card, the United Gateway℠ Card currently edges out its rival the Delta SkyMiles® Blue American Express Card by offering a more generous welcome bonus and travel insurance that the Delta card does not provide. If you fly occasionally and would like to earn miles, but aren’t willing to make the commitment of $95 or more for a mid-tier airline card with more perks, the Gateway is a strong choice.

Why we like this card: The United Gateway card offers 2 miles per $1 spent on United® purchases, at gas stations and on local transit and commuting plus 1 mile per $1 spent on all other purchases. Considering a United Mile is worth roughly around 1.2 cents these days, effectively earning 2.4 cents back on everyday purchases is a solid value proposition.

You’ll also get a welcome bonus of 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open. And, you can save with a discount of 25% back on United in-flight and Club Premium drink purchases.

New cardholders will enjoy a 0% Intro APR on Purchases for 12 months, after 21.99%–28.99% variable applies.

If the United Gateway card has a small lead on the Delta Skymiles Blue Amex at this point, it soars ahead (pun intended) when you look at the included travel and shopping protections. Both cards offer secondary rental car insurance, but only the Gateway includes trip cancellation and interruption insurance, purchase protection and extended warranty protection.

So, if you’re seeking a no-annual-fee card you can use to rack up miles—and you either tend to fly United most of the time or you’re at minimum not devoted to a competing airline—the United Gateway is the card to beat.

Check out our full review of the United Gateway Card for more info.

To view rates and fees of the Delta SkyMiles® Blue American Express Card, see this page

With a generous welcome bonus in exchange for an attainable spend amount, 3X on travel, and a fancy name, you’d think the Wells Fargo Autograph℠ Card would command an annual fee of at least $95. But it doesn’t, making it a superb candidate for general travel use.

Wells Fargo Autograph℠ Card

Intro bonus.

- 3X 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans

- 1X 1X points on other purchases

- No annual fee

- 20,000 bonus points when you spend $1,000 in purchases in the first 3 months (that's a $200 cash redemption value)

- Points transfer to partners

- Car rental insurance is secondary

- No travel insurance

- Transfer partners are limited

- Additional perks: Cell Phone Protection: Provides up to $600 in cell phone protection when you pay your monthly cell bill with your Wells Fargo Autograph card. Coverage is subject to a $25 deductible and limited to two claims every 12-month period.

- Foreign transaction fee: N/A

Why we like this card: The Wells Fargo Autograph offers unlimited 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans and even your landline bill too if you have one, plus 1X points on other purchases—all without charging an annual fee. And, to make traveling a little cheaper/less stressful, you’ll also get $600 worth of cell phone protection (minus a $25 deductible) as long as you pay your phone bill with this card and secondary rental car insurance.

Cardholders can transfer points at a 1:1 ratio to Wells Fargo’s first wave of transfer partners including Air France‑KLM Flying Blue, Avianca Lifemiles, British Airways Executive Club, AerClub, and Iberia Plus and 1:2 to Choice Privileges.

But even if you aren’t a member of those loyalty programs, earning 3X on dining, travel, gas, and more is hard to pass up. You can redeem points at a value of 1 cent each to offset past purchases on your account, meaning you can wield the Autograph either as a no-annual-fee travel card or as a cash-back card effectively earning unlimited 3% back in a wide swath of useful categories.

Check out our full review of the Wells Fargo Autograph .

Sometimes, you just want a card that offers a little more than 1X on every purchase—without having to worry about what this quarter’s rotating rewards are, or whether a specific merchant qualifies as “groceries” for the purposes of your card’s rewards. If you value simplicity and the lack of an annual fee in your travel card, you’ll probably be a fan of the Capital One VentureOne Rewards Credit Card and its straightforward rewards program.

Capital One VentureOne Rewards Credit Card

Reward rates.

- 5x Earn 5x miles on hotels and rental cars booked through Capital One Travel

- 1.25x Earn 1.25x miles on every other purchase

- Flexible travel rewards

- No foreign transaction fee

- Maximizing Capital One Miles requires a learning curve

- Cash redemption value is limited

- The VentureOne offers travel accident insurance, rental car coverage, extended warranty protection, exclusive access to events through Capital One Dining and Capital One Entertainment