How to use CIBC Aventura points to reduce travel costs

by Anne Betts | Apr 1, 2024 | Travel Hacking , Destinations | 0 comments

Updated April 1, 2024

What are the various ways to use CIBC Aventura points to reduce travel costs ? Is the Aventura program worth it? How does it work? What’s an Aventura point worth?

Here is my review as it relates to funding travel.

Table of Contents

What is the CIBC Aventura program?

How are aventura points earned, can aventura points be converted to another program, how can aventura points be used, what’s an aventura point worth, 1. flexible travel reward, 2. flight rewards, (i) book and pay with your aventura-earning credit card, (ii) log into cibc online banking and your credit card account , (iii) redeem with points while the transaction is pending, what’s to like about the cibc aventura program, shortcomings of the cibc aventura program.

CIBC Rewards is the in-house propriety program of the Canadian Imperial Bank of Commerce (CIBC). The reward currency is commonly referred to as Aventura points.

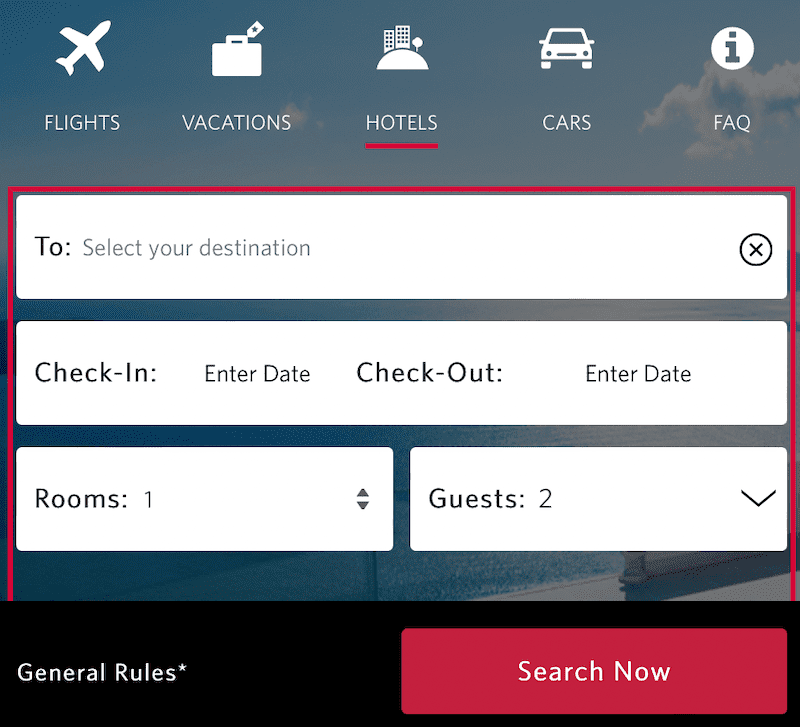

The CIBC Travel Rewards Centre is CIBC’s in-house travel portal. It’s operated by Merit Travel Group, an independent travel agency.

Aventura points are earned through credit card sign-up bonuses and everyday spending. Depending on the credit card, bonus points can be earned on promotions, bookings at the CIBC Travel Rewards Centre, and spending in accelerated earning categories such as groceries, gas, and dining. CIBC has ten Aventura-branded credit cards:

- CIBC Aventura Visa Card

- CIBC Aventura Gold Visa Card

- CIBC Aventura Visa Infinite Card

- CIBC Aventura Visa Infinite Privilege Card

- CIBC Aventura Visa Card for Students

- CIBC U.S. Dollar Aventura Gold Visa Card

- CIBC Aventura Visa Card for Business

- CIBC Aventura Visa Card for Business Plus

- *CIBC Aventura World Elite MasterCard

- *CIBC Aventura World MasterCard

*CIBC MasterCards are no longer available to new applicants.

Aventura points don’t expire if an Aventura-earning credit card account is in good standing. The primary cardholder can pool points by moving them from one Aventura-earning credit card account to another.

Contrary to what you might read on the internet or be told by a seller at an airport kiosk, Aventura points cannot be converted to Aeroplan (except in special circumstances). They were before CIBC co-branded Aeroplan cards were transferred to TD in 2014, when the ability to convert Aventura points to Aeroplan was discontinued. However, grandparenting protection remains in place for cardholders of three select cards held since before October 1, 2013:

- CIBC Aventura World Elite MasterCard

Aventura points earned since then can be converted, if they have been moved to the card held before 2014. Conversion is at the rate of 1:1 and points can only be converted in increments of 10,000.

Aventura points can be redeemed for travel, gift cards, donations, merchandise, experiences, credit card statement credits, or contributions to various CIBC financial products.

As with most reward programs, travel purchases usually return the best value. On most travel redemptions, Aventura points are capable of a value anywhere between 1 and 2.2 CPP (cents per point). Most travel booked through CIBC’s in-house travel portal returns a value of 1 CPP. When booking ‘Flight Rewards’ using CIBC’s Aventura Flight Rewards Chart, some redemptions offer a return of up to 2.2 CPP in value.

Credit Card Genius has calculated the value of Aventura points when redeemed for purposes other than travel. For example, charitable donations are valued at 1 CPP, CIBC financial products and statement credits at 0.83 CPP, gift cards at 0.71 CPP, and merchandise at an average of 0.71 CPP.

Occasional promotions on gift cards can return a redemption value of 1 CPP.

There are three ways to redeem Aventura points for travel.

A ‘Flexible Travel Reward’ applies to online bookings for flights via the ‘Flex Travel’ option on the Aventura Flight Rewards Chart or through online or telephone bookings at the CIBC Travel Rewards Centre.

Unless there is a promotion in effect, this option returns a value of one cent per point, considered the baseline value for most proprietary reward programs’ travel purchases.

Redeeming a Flexible Travel Reward involves booking through the CIBC Travel Rewards Centre and applying points to the purchase. It doesn’t apply to bookings through other suppliers.

Check for promotions in effect at the CIBC Rewards site. In the past, there have been auctions, accelerated earning rates on travel bookings, and flights for fewer points.

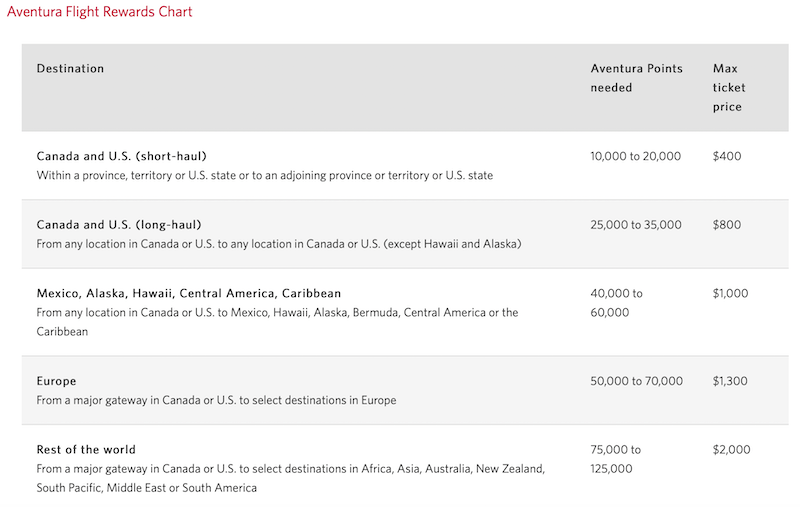

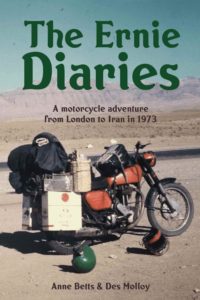

Flight Rewards are based on the Aventura Flight Rewards Chart for round-trip flights in various cabin classes, from basic economy to first class. Each group of regionally based destinations displays a sliding scale of points required for flights with a maximum base ticket price. The base ticket price is exclusive of taxes and other charges.

A greater value (than one cent per point) is possible with these redemptions the closer the cost of a flight is to the maximum ticket price listed on the chart. For example, the Canada and US (Long-Haul) travel region category shows a maximum ticket price of $800. Paying 35,000 points for a ticket with a base fare of $800 returns a value of 2.2 cents per point.

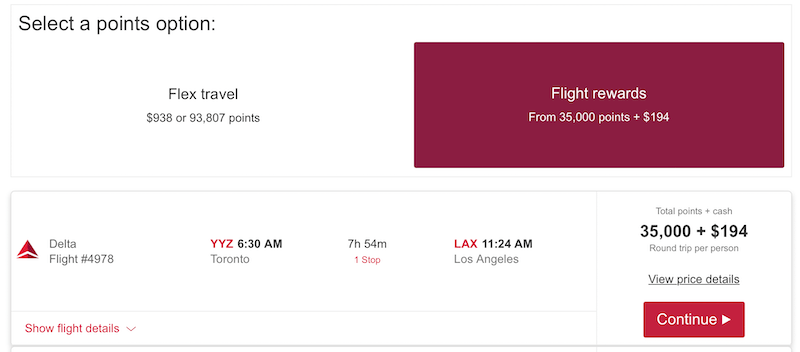

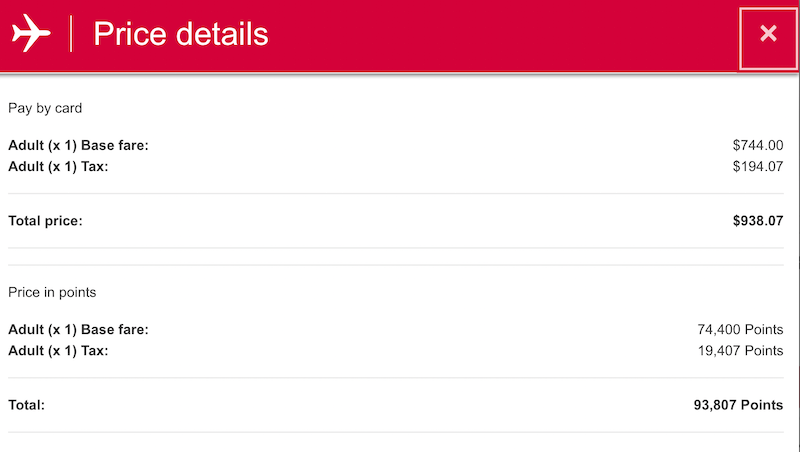

In the following example, a return flight in premium economy from Toronto to Los Angeles costs 35,000 Aventura points plus $194.07 in taxes and fees using the Flight Rewards option. Taxes and fees can be paid in any combination of points (at a value of one cent per point) and cash (charged to a credit card). If the traveller pays in points, the total would be 54,407.

In the same example, the Flex Travel option (at a value of one cent per point) shows a base fare of $744 for a total cost of $938, including taxes and other charges or 93,807 Aventura points.

By choosing the Flight Rewards option in this example, the traveller has achieved a value of 2.1 cents per point on the base fare and saved 39,400 Aventura points compared to the Flex Travel option.

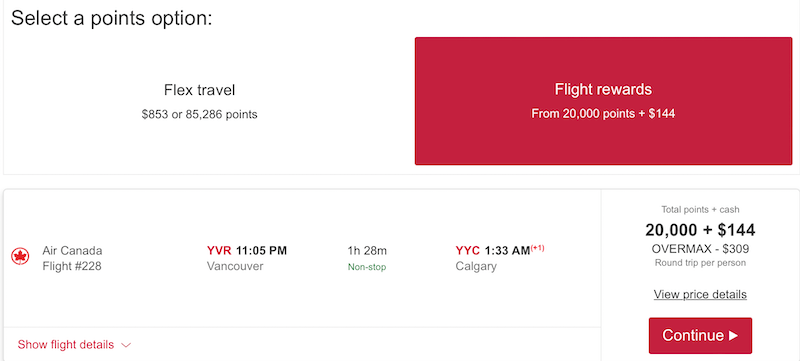

Any excess cost over the maximum ticket price can be paid for in cash or points (at a fixed value of one cent per point). As shown in the following example of a round-trip business class flight from Vancouver to Calgary, the excess appears as ‘OVERMAX’ in the search results.

The Aventura cardholder must have at least 80% of the points required to obtain the desired flight, and tickets are non-refundable unless advised otherwise. As the CIBC Travel Rewards Centre is the booking agent, any irregularities related to flight cancellations or ticketing errors will require their intervention, as opposed to the airline. Such is the dilemma of travellers who use third-party booking agencies.

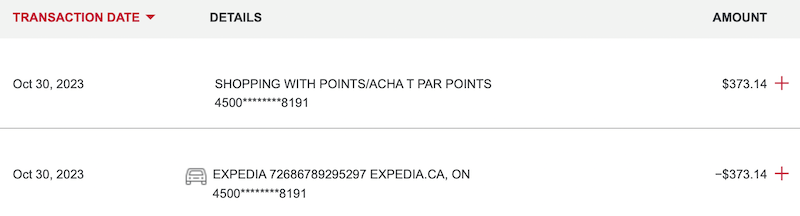

3. Shopping with Points

‘Shopping with Points’ involves booking through vendors other than the CIBC Travel Rewards Centre. Until a 2022 promotion, the rate of 8,000 points on each $50 purchase worked out to an abysmal value of 0.625 cents per point. The promotion doubled the value of 8,000 points to $100, or 1.25 cents per point. After several extensions with expiry dates, the promotional redemption rate has been extended indefinitely.

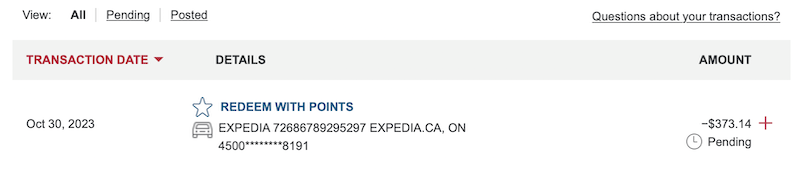

Redeeming points for travel purchases using the Shopping with Points option involves the following steps:

Make a travel purchase such as a flight, vacation package, cruise, hotel stay, or car rental at a vendor of your choice using a credit card earning Aventura points. The charge must be in Canadian dollars. I made the mistake of making a direct booking at Palmers Lodge , a London hostel, that never appeared on my account as eligible for redemption. When I booked Edinburgh and York accommodation at Expedia dot ca, both appeared almost immediately as redeemable with points.

Log into CIBC Online Banking (or mobile banking) and search for the transaction under ‘Pending’ in your transaction history. Chances are the charge will appear as soon as the booking has been confirmed. However, it could take a few days to post, so keep checking back.

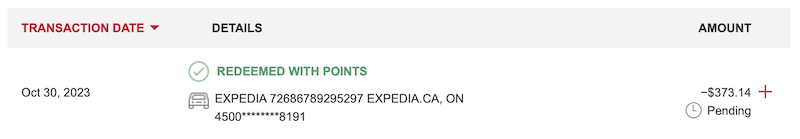

Click on ‘Redeem with Points’ (the link to redeem with points needs to be active on the transaction). If it’s an eligible travel purchase, the required points will automatically be reduced by 50% under the extended promotion. If the redemption is successful, confirmation will immediately appear within the credit card account.

The credit will be posted to the respective credit card account within two business days.

This redemption option is only available while the purchase is still pending. The Shopping with Points Terms and Conditions state that it’s non-refundable, non-exchangeable, and non-transferable. Therefore, making a refundable booking with the vendor is always preferable. Many miles-and-points enthusiasts turn Aventura points into cash with refundable bookings. Others use them to reduce travel costs.

- Depending on the credit card, CIBC offers travel perks such as lounge access through the Visa Airport Companion Program membership and passes, NEXUS fee rebates, and an attractive Mobile Device Insurance benefit.

For more information on the NEXUS program, see Is a NEXUS card worth it? and How to apply for a NEXUS card .

- There are regular first-year-free promotions where the annual fee is waived for the first year. Many come with improved sign-up bonuses. In addition, it pays to check rebate and affiliate sites such as Great Canadian Rebates for elevated sign-up bonuses when applying through their portal.

- It’s possible to hold more than one credit card of the same type (e.g., more than one Aventura Visa Infinite) at the same time. CIBC can be quite generous with approvals.

- CIBC is more likely than other banks to waive the annual fee on request. It may also be possible to obtain a prorated annual fee refund when cancelling or product switching a credit card.

- The redemption value of a ‘penny a point’ is easy to understand. The system calculates the exact amount with no sliding scale or topping upwards. My one-way flight from Cairns to Brisbane on Virgin Australia cost $129.08, translating into a precise redemption of 12,908 Aventura points.

- There’s a no-fee card in the Aventura family (CIBC Aventura Visa Card). Applying for, or product switching to the no-fee card, can help preserve a relationship with CIBC. It can also serve a useful purpose by protecting existing Aventura points in an account between applications for other cards. However, partial redemptions (part points, part cash) offer the means to use all Aventura points with no ‘orphan points remaining in an account.

- Aventura points can be transferred from one account to another in the Aventura family. This applies to accounts held by the same cardholder. The process is efficient and instantaneous. For holders of the CIBC Visa Infinite Privilege card, it can be done online. For cardholders of other cards, contact the CIBC Rewards Centre to execute the transfer. Unlike TD Rewards, where a minimum of 10,000 points can be transferred, any number of points can be moved from one account to another. The transfer is instantaneous.

For more information on the TD Rewards program, see How to use TD Rewards points to reduce travel costs.

- Online bookings are limited. For example, online flight searches are limited to those originating in Canada or the USA. Calling the Travel Rewards Centre is inconvenient and can be costly when trying to make a booking from another country.

- The Aventura Flight Rewards Chart applies to return flights. One-way flights can only be redeemed as a ‘Flexible Travel Reward’ at a value of one cent per point.

- Rewards are non-refundable, non-exchangeable, and non-transferable. With the exception of refundable bookings with vendors where the pending charge is redeemed with points, there are no refunds on any travel purchased with Aventura points.

- Hotel prices at the CIBC Travel Rewards Centre can be seriously inflated. For a booking via Expedia and redeemed using ‘Shopping with points,’ I paid $373 for a two-night stay at a Halifax hotel. The same hotel with the same dates at the CIBC Travel Rewards Centre, researched within minutes of each other, revealed a cost of $515.

- Other than redeeming points while a charge is pending, there’s no post-purchase option to redeem points against existing reservations or previous travel purchases.

The inability to convert Aventura points to other programs makes them less valuable than reward currencies such as AMEX Membership Rewards and RBC Avion Rewards, which can be converted to reward programs where it’s possible to extract much greater value.

Aventura points can be a beneficial reward currency in a diversified miles-and-points portfolio. When viewed as a secondary program along with, for example, TD Rewards and Scene+, they can reduce travel costs by funding miscellaneous travel expenses. These include train and ferry tickets, boutique hotel stays, flights with regional airlines, tours, and various travel experiences.

CIBC is to be congratulated for extending the promotion with an elevated redemption value through Shopping with Points. It significantly increases the value of the program.

Might you be interested in my other miles-and-points posts?

- How to use Scene+ points to reduce travel costs

- How to use TD Rewards points to reduce travel costs

- Is a no-FOREX-fee credit card always the best choice for international travel?

- Finding Aeroplan flights: a step-by-step guide

- Meeting Minimum Spend Requirements to travel the world on miles and points

- Lounge and flight review of United Airlines’ Polaris experience

- Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet?

- Why the Best Western loyalty program is good for travellers

- What is the best credit card for trip cancellation, trip interruption and flight delay insurance for trips on points?

Care to pin for later?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

By Sandra MacGregor

Fact Checked: Amy Tokic

Updated: January 25, 2024

Play article

( mins)

( )

CIBC Aventura rewards guide: Earn, redeem and fly sooner

Money.ca / Money.ca

What is the CIBC Aventura Rewards program?

CIBC Aventura Rewards (also known as the CIBC Rewards program) is a travel rewards loyalty program offered by the Canadian Imperial Bank of Commerce (CIBC), that gives cardholders the chance to earn and redeem points for various perks, including travel-related benefits.

You earn Aventura Points, the program's currency, by using Aventura-branded credit cards for everyday purchases. Points can be redeemed for numerous travel rewards, including flights, hotels, car rentals and vacation packages. The program offers flexibility, allowing cardholders to book flights on any airline without blackout dates. Additionally, unlike some other loyalty travel rewards programs, you can use your Aventura Points to cover the entire cost of the airfare, including taxes and fees. Furthermore, Aventura points are not just for travelers, they can also be used for statement credits, donations to charity, financial products, gift cards and merchandise.

CIBC provides a range of personal and business Aventura credit cards, each with unique benefits and earning structures to cater to different spending habits. Picking the credit card that aligns with your spending is the best way to ensure you get the most from your Aventura points.

How to earn Aventura points fast

There are a couple of smart strategies to accumulate Aventura Points faster. One of the most effective methods is to leverage the welcome bonuses offered by CIBC Aventura credit cards (note that not all of CIBC’s cards are Aventura cards so be sure to select a card linked to the rewards program). These bonuses often provide a substantial number of points when cardholders meet specified spending requirements within the first few months of card ownership. This influx of points can be a significant boost to your Aventura balance, meaning you’ll earn flights and rewards faster. The specific bonus you’ll earn and what you’ll need to spend to earn it will depend on the specific card you apply for. Also note that a good general rule of thumb is that the more premium the card, the bigger the bonus.

Keep in mind that while welcome bonuses are exciting and certainly accelerate earnings, they are a one-off way to earn a big point payoff. A better long-term strategy is to take advantage of higher earn rates with your credit card. Different Aventura credit cards offer varying points-per-dollar ratios for different spending categories. Choosing a card that aligns with your regular expenses, such as groceries, gas or travel, can result in more points earned for every purchase. By strategically using cards with elevated earn rates, you can optimize your point accumulation and thus get closer to your desired travel reward redemption.

How to redeem CIBC Aventura rewards

To redeem points, log in to your CIBC Aventura account on the CIBC Rewards Centre website or app, select the "Travel" tab and enter your travel details. The search results will display flights eligible for points redemption. You’ll have the choice of going with either the Flex Travel option or the Flight Rewards (aka chart) option. It’s always wise to compare which of the two options gives you the most value for your points. While the chart will usually offer the best deal, it’s smart to spend a few minutes to compare.

When you’ve found the flight you like, just click “Continue” to be taken to the passenger information and payment site. This is where you'll be required to provide details for each passenger and complete the necessary payment information. Carefully review the flight details and the summary of costs, including taxes and fees.

Why you want to use the CIBC Rewards Travel chart

While there are a variety of ways to redeem your Adventura points aside from travel — merchandise, gift cards and more — you’ll always get the best value when you redeem your points for travel. When redeemed for travel your points have a value of anywhere between 1 to 2.29. Whereas, outside of a promotion, you’ll only get an approximate value of .83 when you redeem points for statement credits or financial products or as low as .71 for gift cards and merchandise.

That being said, it’s important to note that, when redeeming for travel, your best bet is to go with the chart (the Flight Rewards option when you search) rather than just using your points to pay for a flight (called Flex Travel). Booking using the chart offers the best value and, depending on your flight, could get you a point value as high as 2.29 cents (and as low as 1.6) each whereas booking any flight at CIBC Rewards only gives you a max value of 1 cent per point.

Other ways to use your Aventura rewards

In addition to using your Aventura points for travel, there are several other ways you can redeem them for various benefits and financial products:

CIBC financial products : Aventura points can be used toward a variety of CIBC financial products, including mortgage payments, Registered Retirement Savings Plans, Tax-Free Savings Accounts, Investor's Edge accounts, personal loans, lines of credit and even as statement credits on your CIBC credit card.

Gift cards : You have the option to redeem your Aventura points for gift cards from a selection of retailers, like Amazon and Best Buy.

Products : Aventura points can also be redeemed for a variety of products available through the rewards program. This might include electronics, merchandise or other items depending on the current offerings within the program.

CIBC Aventura travel insurance

There is no standard set of travel insurance that comes with a CIBC Aventura card. The type of CIBC Aventura travel insurance coverage you’ll receive will depend entirely on the card you go with. In general, the more premium the card, the more coverage you’ll get. For example, the CIBC Aventura Visa Infinite Card features hotel burglary insurance, whereas the CIBC Aventura Visa Card for Business does not. So it’s always important to read the fine print to see exactly what insurance your card comes with. With that in mind, the CIBC Aventura travel insurance that may come with your card includes: emergency travel medical insurance, flight delay and baggage insurance, trip cancellation and trip interruption insurance, auto rental insurance, $500,000 common carrier accident insurance, mobile device and hotel burglary insurance.

Aventura vs. TD Rewards

Aventura vs. aeroplan, aventura vs. scene+, aventura vs. avion, aventura vs. air miles, how much is 10,000 aventura points worth.

The value of 10,000 Aventura points depends on what you redeem them for. If you use the chart for travel, you could get a value of as much as $229 (based on a max value of 2.29 per point). However, if you redeem the 10,000 points for merchandise or a gift certificate, you’ll only get a value of $71.

How many Aventura points do you need to travel?

How many points you’ll need to travel depends entirely on what method of redemption you use. Using the rewards chart you would need:

10,000-20,000 for short haul flights in Canada and US

25,000-35,000 for long haul flights in Canada and US (not including Alaska and Hawaii)

40,000-60,000 for Mexico, Alaska, Hawaii, Caribbean and Central America

50,000-70,000 for Europe

75,000-125,000 for destinations in Africa, Asia, Australia, New Zealand, South Pacific, Middle East or South America

How do I book a flight with CIBC Aventura points?

To book a flight with CIBC Aventura points, log in to your account on the CIBC Rewards Centre website or app. Navigate to the "Travel" tab, select flights, choose the Flex Travel or Flight Reward option (aka the chart) and enter your travel details.

Can you convert Aventura points to Aeroplan?

Unfortunately there is no way to transfer Aventura points to Aeroplan.

About our author

Sandra MacGregor has been writing about finance and travel for nearly a decade. Her work has appeared in a variety of publications like the New York Times, the UK Telegraph, the Washington Post, Forbes.com and the Toronto Star. She spends her free time travelling, and has lived around the globe, including in Paris, South Korea and Cape Town.

Latest Articles

CN Rail on track for growth this year, despite Red Sea shipping obstacles: CEO

An 'ambitious' global plastic treaty demands limits on production, Guilbeault says

Competition Bureau raises concerns over Bunge-Viterra deal

West Fraser Timber earns US$35 million in first quarter, up from loss last year

Most actively traded companies on the Toronto Stock Exchange

Freeland says $5 billion just a start for Indigenous loan guarantee program

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

CIBC Aventura

Earn CIBC Aventura Points

CIBC lets you earn Aventura Points primarily through its credit cards. There are four CIBC Aventura credit cards: three CIBC Aventura credit cards for consumers and one for SMEs. You will find the details below.

The earning rate is quite simple: $1 spent = 1 Aventura Point earned .

Spending at gas stations, grocery stores and drugstores earns 1.5 Aventura Points for every dollar spent.

CIBC Rewards travel purchases earn 2 Aventura Points for every dollar spent.

CIBC Aventura credit cards such as the CIBC Aventura ® Visa Infinite* Card or the CIBC Aventura ® Gold Visa* Card offer you CIBC Aventura points as a sign-up bonus. The financial institution regularly runs First-Year Free offers .

Redeeming CIBC Aventura Points

We will not mention the redemption of Points for various products purchased through the CIBC Rewards portal because, as in other programs, this is an inferior use of Points.

You can redeem your points to purchase a flight .

The number of points varies depending on the destination: for example, a short-haul flight can range from 10,000 to 20,000 Aventura Points with a maximum value of $400. If you can get that kind of return (10,000 points for $400), you get a 4% return which is excellent.

These tickets apply to Economy class flights only.

Taxes are extra and must be paid in cash or at the rate of 100 Aventura Points = $1.

If you don’t have the necessary amount of Aventura Points, you can purchase additional points up to 20% of the amount needed. But as with other programs, the price – 3 cents a point – is not very attractive again.

Finally, it is possible to make a mixed purchase, point and cash, but the redemption rate is fixed: 100 points = $1. The 1% cash back rate is therefore restored.

Finally, you can redeem your Aventura points to reduce your credit card balance, but the rate is not very interesting: 4000 points for $25, which is a 0.6% return.

CIBC Aventura Credit Cards

There are six CIBC Aventura credit cards for consumers:

CIBC Aventura ® Visa* Card

Cibc aventura ® visa* card for students, cibc aventura ® gold visa* card, cibc aventura ® visa infinite* card.

- CIBC Aventura ® Visa Infinite Privilege* card

- CIBC Aventura Gold Visa Card in US dollars

The two best-known CIBC Aventura credit cards are:

- ® Visa Infinite* Card" href="https://milesopedia.com/en/go/cibc-aventura-visa-infinite-card/" rel="noindex">CIBC Aventura ® Visa Infinite* Card

- ® Gold Visa* Card" href="https://milesopedia.com/en/go/cibc-aventura-gold-visa-card/" rel="noindex">CIBC Aventura ® Gold Visa* Card

The CIBC Aventura® Visa Infinite* Card is one of the best Visa credit cards with travel rewards .

You can earn up to 45,000 Aventura points with this CIBC digital exclusive offer for Milesopedia readers .

- 15,000 Aventura Points when you make your first purchase †

- 30,000 Aventura Points when you spend $3,000 or more in the first 4 monthly statement periods †

Plus, you can get a first-year annual fee rebate for you (a $139 value) and up to three authorized users ( $50 each; $150 value).

With this CIBC Aventura Credit Card, you get:

- 2 points for every $1 spent on travel purchased through the CIBC Rewards Centre †

- 1.5 points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores †

- 1 point for every $1 spent on all other purchases †

The CIBC Aventura® Visa Infinite* Card also offers:

- Airport lounges access: Visa Airport Companion Program membership with 4 complimentary visits per year

- A NEXUS application fee rebate (a $50 value)

The minimum annual income required for this card is $60,000 (personal) or $100,000 (household).

If you don’t meet the income requirements for the CIBC Aventura® Visa Infinite* Card , you can apply for the CIBC Aventura® Gold Visa* Card . The minimum annual income required for this card is $15,000 (household).

The CIBC Aventura® Gold Visa* Card also offers:

The CIBC Aventura® Visa* Card is one of the best no-fee Visa credit cards with travel rewards in Canada.

Get up to 10,000 Aventura Points (up to $100 in travel value † )

- 2,500 Aventura Points when you complete all five activities within 60 days of your CIBC Aventura® Visa* account approval. †

- 7,500 Aventura Points after you make your first purchase within first 4 months. †

With this no annual fee CIBC Aventura Credit Card, you get:

- 1 point for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores †

- 1 point for every $1 spent on travel purchased through the CIBC Rewards Centre

- 1 point for every $2 spent on all other purchases

And this no-annual-fee CIBC Credit Card offers some insurance coverage:

- Auto Rental Collision and Loss Damage Insurance

- $100,000 Common Carrier Accident Insurance

- Purchase Security and Extended Protection Insurance

The CIBC Aventura® Visa* Card for Students is one of the best travel rewards Visa credit cards for students in Canada.

Get up to 10,000 Aventura Points (up to $100 in travel value † ):

With this CIBC Aventura Student Credit Card, you get:

- 1 point for every $1 spent on travel purchased through the CIBC Rewards Centre †

- 1 point for every $2 spent on all other purchases †

Plus, with this CIBC Student Credit Card, you get a free SPC membership for instant savings when you make over 450 transactions in-store and online. And this CIBC Student Credit Card offers some insurance coverage:

Frequently asked questions about the CIBC Aventura program

What is the cibc aventura program.

The CIBC Aventura program is a CIBC loyalty program that allows Aventura credit cardholders to earn points on their spending. These points can be redeemed for various rewards, including flights, hotel stays, etc.

How do I get a CIBC Aventura credit card?

To get a CIBC Aventura Credit Card, you can apply online via Milesopedia, redirecting you to CIBC’s secure website, or visit a CIBC branch to complete an application in person. The offers on the Milesopedia site are generally more attractive than those offered directly by CIBC.

What are the advantages of the CIBC Aventura<sup>®</sup> Visa Infinite Privilege Card?

The CIBC Aventura ® Visa Infinite Privilege* Card offers exclusive benefits such as higher point accumulation rates, enhanced airport experiences, and comprehensive travel insurance options.

How does travel insurance with CIBC Aventura work?

CIBC Aventura Credit Cards offer various travel insurance options, including travel medical and trip cancellation insurance. Details of the amount and duration of coverage vary by card.

How can I use my Aventura points?

You can use your Aventura Points to purchase airline tickets, hotel stays and other rewards through the CIBC Rewards Centre. The number of points required varies according to the reward.

Are CIBC Aventura Rewards points flexible?

CIBC Aventura Rewards Points offer great flexibility. You can redeem your points using the CIBC Aventura Airline Rewards chart for optimum value or other options such as gift cards, statement credits and financial products.

How many Aventura points can I earn?

The standard accumulation rate is 1 Aventura point for every dollar spent. However, spending in specific categories such as gas stations, grocery stores and drugstores earns 1.5 Aventura points per dollar spent.

Are there any first-year promotions on CIBC Aventura cards?

Yes, CIBC regularly offers promotions for new Aventura credit card memberships, including first-year annual fee refunds and sign-up bonus points.

What about statement credits with CIBC Aventura Points?

You can redeem your Aventura points for statement credits to your credit card balance. However, the reimbursement rate is generally not very advantageous, with a return rate of 0.6%.

Can I use my Aventura points for car rentals?

Although not explicitly stated, Aventura points are generally flexible and can often be used for car rentals, flights, and hotel stays.

Are there any date restrictions for using CIBC Aventura Rewards?

No, there are no date restrictions. You can redeem your CIBC Aventura Points for reservations at any time, subject to availability.

Is there a validity period for CIBC Aventura Reward Points?

CIBC Aventura Rewards Points are valid as long as your credit card account is in good standing. If you decide to close your credit card account, you will have a 60-day window to redeem any remaining Aventura Points.

Can CIBC Aventura Rewards Points be used to cover additional costs such as taxes and fees?

Yes, your CIBC Aventura Points can be applied to cover additional costs such as taxes and fees. However, if you book a flight using the Aventura flight award chart, your points can only be used for the base fare of the flight.

Can CIBC Aventura Reward Points be transferred to other loyalty programs?

No, you cannot transfer CIBC Aventura Points to another program such as Aeroplan.

Is there a way to earn CIBC Aventura Rewards points faster?

The only way to earn CIBC Rewards Points faster is to use a CIBC Aventura Credit Card. Pay attention to the bonus categories of your card like the CIBC Aventura ® Visa Infinite* Card and use it for as many purchases as possible to increase your CIBC Aventura Points accumulation speed.

What are the terms and conditions of the CIBC Aventura program?

The terms and conditions of the CIBC Aventura program vary depending on the card you hold. It is important to read the terms and conditions to understand the limitations, fees and redemption options.

CIBC Aventura

With CIBC being one of the big five financial institutions in Canada, it’s no surprise that many Canadians have an Aventura credit card in their wallet. Similar to TD Rewards , Aventura is CIBC’s in-house reward program which presents a plethora of redemption options. Some house significant value whereas others are not even worth considering.

Let’s take a look at how you can earn more Aventura points and get phenomenal value out of your points on all future redemptions.

Earning CIBC Aventura Points

CIBC Aventura points can be earned via two methods: credit card welcome bonuses and organic credit card spending.

Credit Card Bonuses

Similar to other bank loyalty programs, the quickest way to earn CIBC Aventura points is through credit card sign-up or welcome bonuses.

Below is a table containing all of the credit cards that earn CIBC Aventura points, their respective welcome bonus, and their total value:

There are various data points that speak to the ability to hold multiple CIBC Aventura credit cards at once. That being said, if there is a good welcome bonus like the 45,000 Aventura points offer we saw previously, it may be worth applying for multiple cards.

Credit Card Spending

CIBC Aventura points are also earned for all eligible organic spend on any CIBC Aventura credit cards. You can earn the most points possible by maximizing specific category spending on the correct CIBC Aventura earning credit card.

The best organic earning rates can be found on the CIBC Aventura Visa Infinite Privilege card:

- 3 Aventura Points per dollar spent on travel purchases made through the CIBC Rewards Centre.

- 2 Aventura Points per dollar spent on dining, entertainment, transportation, gas, and grocery purchase.

- 1.25 Aventura Points per dollar spent on all other purchases.

Redeeming CIBC Aventura Points

Cardholders can redeem points via six methods: Aventura Airline Rewards Chart flight redemptions, CIBC Rewards Travel Centre, Shopping with points, statement credit, financial products, and gift cards or merchandise.

The best redemption value you should aim to achieve within the CIBC Rewards program is 1 cent per point when redeeming for cash equivalent products (in the right situation) and 2.2 cents per point when redeeming towards travel .

Aventura Airline Rewards Chart – Flight Redemptions

The Aventura rewards program has its own flight redemption award chart, presenting a solid value proposition in redeeming your points. For comparison, this is a very similar setup to redeeming RBC Avion through the RBC Rewards Air Travel Redemption schedule .

Within the Aventura Airline Rewards chart, there are multiple bands of redemptions:

- Within a province, territory or U.S. state or to an adjoining province, territory or U.S. state.

- From any location in Canada or U.S. to any location in Canada or U.S (except Hawaii and Alaska).

- From any location in Canada or U.S. to Mexico, Hawaii, Alaska, Bermuda, Central America, or the Caribbean.

- From a major gateway in Canada or U.S. to select destinations in Europe.

- From a major gateway in Canada or U.S. to select destinations in Africa, Asia, Australia, New Zealand, South Pacific, the Middle East, or South America.

The maximum ticket price denoted above for each redemption band is before taxes and any other applicable charges. In order to book an Aventura Airline Rewards flight, log into the CIBC Rewards Center or call the Aventura Travel Assistant at 1-888-232-5656.

CIBC Rewards Travel Centre

When booking travel through the CIBC Rewards Travel Centre (CIBC’s in-house travel agency), Aventura points can be applied towards the booking at a rate of 1 cent per point (meaning 10,000 Aventura points would be worth $100 towards your booking).

In order to book travel within the CIBC Rewards Travel Centre, simply log into your CIBC Rewards account and visit this page. You can then search for the hotel, car rental, or vacation package of your choosing.

While this can present an opportunity for redemption if you are looking to book a hotel, rental car, or any other travel expense, you should never use this feature for flight redemptions. Instead, look to the Aventura Airline rewards chart in the section above as you will be able to get much better value out of your points.

Shopping with Points

CIBC’s “Shopping with Points” redemption option gives cardholders the opportunity to apply their Aventura points towards a purchase of their choice that was charged to their card.

In order to redeem Aventura using the “Shopping with Points” feature:

- Make a purchase using your Aventura credit card that has the points you want to redeem

- Sign in to your CIBC online banking account

- Find the pending transaction, click on it, and click on the “Redeem with Points” button

- The redemption statement credit will be posted on your account within the next few business days

When using the “Shopping with Points” feature, points are redeemed at a value of 8,000 Aventura points for $50, or 0.625 cents per point which is poor value.

However, the redemption of Aventura through this method has presented some significant value in the past. For example, CIBC has run promotions where you can use 50% less of your Aventura points when redeeming for travel purchases through this method, meaning you can receive 1.25 cents per point which is a crazy strong redemption value for cash equivalencies.

Not to mention, you can cash out Aventura using the refundable hotel trick with this method.

Statement Credit

Similar to many other financial institution loyalty programs, you can apply CIBC Aventura points towards your credit card statement balance through the “Payment with Points” feature.

When redeeming Aventura points through this method, redemptions start at a minimum of 4,000 Aventura points required for a statement credit of $25 (a value of 0.625 cents per point). This is far below the typical value of 1 cent per point you can expect to receive from your Aventura when redeeming for cash equivalents, so it is recommended that you avoid using your points in this manner.

Financial Products

CIBC Aventura points can also be redeemed towards CIBC financial products including mortgages, lines of credit, and investment accounts (such as an RRSP or TFSA).

Redeeming Aventura as a credit towards any of the above-mentioned financial products works out to a value of 0.83 cents per point which is below our 1 cent per point target for cash equivalent redemptions. Cardholders must have a minimum of 12,000 Aventura points to make a redemption with this method.

Gift Cards & Merchandise

CIBC Aventura points can be redeemed for both merchandise and gift cards, similar to many other bank loyalty programs.

Redeeming for merchandise is never a good option and should be avoided. On the other hand, while we typically are against redeeming for gift cards, there are a few pockets of brilliance within the CIBC Aventura program. For example, there have been promotions in the past where you could redeem points for Chevron gift cards at a rate greater than one cent per point.

One of the other strong options is to redeem Aventura for Save on Foods gift cards at one cent per point . These gift cards can be used at Save on Foods to purchase other gift cards of your choosing. With this in mind, it might be worth considering if it makes sense for you to cash out your Aventura for gift cards.

Frequently Asked Questions

CIBC Aventura points have a rough value of 1 cent per point when redeeming for cash equivalent products (in the right situation) and a rough value of 2.2 cents per point when redeeming towards travel.

It depends on two things: the itinerary of your flight redemption and if you are redeeming Aventura through the Aventura Airline Rewards chart versus the CIBC Rewards Travel Centre.

They are very different programs and cannot easily be directly compared. While Aventura may be more straightforward to redeem for flights, you can extract much more value out of Aeroplan especially if you prefer to fly in premium cabins.

No, Aventura points cannot be transferred to your Aeroplan account.

If you hold an active CIBC Aventura credit card, your points will not expire. If you close a CIBC Aventura card, your points will be available to be redeemed for 60 days. After 60 days, they will expire.

Yes, through a few methods including redeeming for “Shopping with Points”, for statement credit, financial products, and gift cards. It is important to note that some of these methods do not present the best redemption value for your points so do your research before redeeming.

Posts About CIBC Aventura

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Subscribe to our newsletter .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

12 comments on “ CIBC Aventura ”

Hello need info on how it works my adventures points for a trip, is it good for all inclusive trip. Thank you

You can turn your Aventura points into a statement credit using the refundable hotel trick . From there, you can either withdraw the cash at a CIBC ATM (for no fees) or just make normal purchases on the card to draw down the balance. And hey, you could absolutely use the extra cash to book an All Inclusive!

I have not found a way of redeeming my mounting Aventura points. Please help.

The best way to currently redeem CIBC Aventura points is through the “Shopping with Points” feature, taking advantage of the refundable hotel trick . You can book a refundable hotel on Hotels.ca/Expedia.ca using your Aventura credit card, apply the Aventura points towards the hotel booking in your CIBC account, and then cancel the booking which will leave you with the redeemed cash value of the points.

Hi Josh, Do you know can we use the points to partially cover a hotel expense? One time I got my all points partially covered my travel package. But another time the CIBC agent said it cannot be redeemed for partial hotel expense. In addition, there is no option to use 50% less point when shopping with points. I have to call every time. Lorus

I’m actually not sure. I always cash out my full Aventura balance against a hotel booking, but have never tried a partial redemption using only some of the Aventura balance (unless if your total points balance only covered a portion of the hotel).

I would probably err on the side of what the rep told you since I haven’t experienced this myself. Personally, I would recommend cashing out all your Aventura points on a hotel booking via shopping with points, as that is the best value available at the moment.

Hi Josh, I meant that the rep said my points is not enough to cover the full hotel expense and thus I cannot redeem it. I am not sure what you did. Should the hotel fee less than the points value or more than it? Thank you!

Got it. For example, I just redeemed 41,000 Aventura this week (worth around $512) for a hotel booking that cost $900 total (which means that the Aventura did not cover the full balance). As long as you have Aventura points, once you make a valid hotel booking, you should be able to go into your CIBC credit card account and apply your Aventura points to the pending charge on your Aventura credit card (note the charge must be pending and cannot be finalized to use the “shopping with point feature”).

I’d like to browse the rewards catalogue to redeem for gift cards. How can I view the catalogue when I don’t do on line banking?

It is best to sign up for online banking. I am not sure you can browse without signing in, but you can redeem by calling the CIBC Rewards Center alternatively.

I don’t bank with CIBC. I would like to redeem my points for gift cards or cash…what are my options? Also I prefer to speak to someone re this. Thanks

Hi Wilma, I would direct you to these two articles for redeeming points for cash:

- Turning Credit Card Points and Frequent Flyer Miles into Cash

- How To Use The Refundable Hotel Trick

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. For complete and current information, please consult the entity's website.

- Book Travel

- Credit Cards

CIBC Aventura® Gold Visa* Card

Signup bonus:

Annual fee:, annual interest rates:, earning rate:, perks & benefits:.

The CIBC Aventura ® Gold Visa * Card is a near identical copy of the CIBC Aventura® Visa Infinite* Card , with a lower minimum income requirement and less travel insurance.

This card is right for you if you have a more modest income and want to earn Aventura Points to put towards travel.

Bonuses and Fees

The CIBC Aventura ® Gold Visa * Card is currently offering an elevated bonus of up to 45,000 Aventura Points, † structured as follows:

- 15,000 Aventura Points when you make your first purchase†

- 30,000 Aventura Points when you spend $3,000 (CAD) or more in the first 4 monthly statement periods†

The $139 annual fee is currently rebated in the first year † ; otherwise, if that offer weren’t available, it can be rebated if you have a CIBC Smart Plus Chequing Account . 2

Plus, you can enjoy a first-year annual fee rebate for up to three supplementary cardholders with the current offer. †

This is a digital exclusive offer.†

To be eligible for this offer, it must have been directly communicated from CIBC or from a partner/affiliate, and you must apply for the eligible card through the link provided by CIBC or the partner/affiliate.†

This offer is reserved for you. Please don’t send it to anyone else. CIBC may approve your application, but you are not eligible to receive this offer if you have opened, transferred, or cancelled another Aventura card within the last 12 months.†

Earning Rewards

This credit card earns CIBC Aventura Points on daily spending at the following rates:

- Earn 2 Aventura Points per dollar spent on eligible travel booked through the CIBC Rewards Centre †

- Earn 1.5 Aventura Points per dollar spent on eligible gas, groceries, electric vehicle charging, and drugstores †

- Earn 1 Aventura Point per dollar spent on all other eligible purchases †

Redeeming Rewards

CIBC Aventura Points can be redeemed in a variety of ways. However, the most valuable way to redeem Aventura Points is on travel purchases.

For example, you can redeem Aventura Points for eligible flights booked through the CIBC Rewards Centre at a rate of 1 cent per point.

However, you can also redeem CIBC Aventura Points for eligible travel booked in any way at an elevated rate of 1.25 cents per point (cpp) , which is twice the usual redemption value for flexible travel bookings. This is the best flexible travel redemption rate for fixed-value points in Canada.

Keep in mind that you must make the redemption while the transaction is still pending, and that CIBC may change or withdraw this promotional offer at any time.

You can also use CIBC Aventura Points towards an $800 (CAD) airline ticket in the “Canada and U.S. (Long-Haul)” category on the Aventura Flight Rewards Chart , which could increase the value of your points from 1 cent per point (cpp) to 2.28 cents per point.

Generally speaking, it’s recommended to redeem Aventura Points via the Aventura Flight Rewards Chart whenever possible, since it offers the maximum value for your points. It’s worth noting that this must be done through the CIBC Rewards Centre.

However, Aventura Points can also be useful for offsetting the cost of travel that’s otherwise difficult to book with points.

For example, Aventura Points can be used to cover the cost of eligible independent hotels, short-term rentals, car rentals, trains, or flights that can’t be booked with other airline- or hotel-specific loyalty programs.

Perks & Benefits

As the primary cardholder, you’ll enjoy four complimentary lounge visits per membership year for you and any guests, which can be used at 1,200+ lounges globally through the Visa Airport Companion Program . †

Four lounge visits per year can be useful if you don’t tend to travel very often and don’t otherwise have lounge access with another credit card.

Another unique feature is the NEXUS application fee rebate, which provides one rebate every four years towards the up to $100 (CAD) of the cost of your NEXUS application. †

NEXUS is a frequent traveller program designed to speed up your travels between Canada and the United States, and you’ll receive a full rebate simply by charging the application fee to your CIBC Aventura ® Gold Visa * Card.

It’s worth noting that the NEXUS application fee is $50 (USD). Since the NEXUS application fee rebate covers up to $100 (CAD), you won’t be on the hook for any extra fees, and you’ll be able to cover two NEXUS applications to boot.

Cardholders of the CIBC Aventura® Gold Visa* Card can save up to 10¢ per litre at participating Pioneer, Fas Gas, Ultramar, and Chevron gas stations.† To benefit from this discount, you’ll need to link your card with Journie Rewards, and then make qualifying purchases at eligible gas stations.†

Insurance Coverage

The CIBC Aventura ® Gold Visa * Card is effectively a version of the CIBC Aventura ® Visa Infinite * Card for those who don’t meet the higher income requirements. In fact, insurance is the only major aspect in which these two cards differ.

The CIBC Aventura ® Gold Visa * Card features out-of-province emergency medical insurance of up to $5,000,000,† plus coverage for flight and baggage delays,† hotel burglary,† and car rental loss or damage.†

It’s worth noting that the CIBC Aventura ® Gold Visa * Card doesn’t feature Trip Cancellation/Trip Interruption insurance, or emergency medical insurance for anyone over the age of 64, which are offered on the CIBC Aventura ® Visa Infinite * Card.†

There’s also Mobile Device Insurance available to cardholders.† By paying for your smartphone, tablet, or smartwatch using your CIBC Aventura ® Gold Visa * Card, you’ll get coverage of up to $1,000 in the event your mobile device is lost, stolen, or accidentally damaged, for up to 24 months!†

That can be beneficial for many people, and so the next time you’re in the market for a new mobile device, it’s worth considering using the CIBC Aventura ® Gold Visa * Card to fund your purchase.

Historical Offers

Legal disclaimers.

† Terms and conditions apply.

As a Visa product, this credit card has a minimum household income of $15,000. Follow the below link to the CIBC website to learn more about this card and submit an application.

There’s also a higher-tier card called the CIBC Aventura® Visa Infinite* Card with many of the same benefits described above. There's a higher income requirement of either $60,000 (personal) or $100,000 (household), but slightly stronger insurance coverage. Follow the below link to the CIBC website to learn more about this card and submit an application.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

IMAGES

VIDEO

COMMENTS

Get started. Apply online. Meet with us. Call us: 1-866-525-8622. Find a Banking Centre. Questions? Top credit card questions. Find out where your premium CIBC Aventura credit card will take you when you redeem your points for flights across the world.

We'll plan. You pack. With Aventura ®, get exclusive access to the Aventura Travel Assistant 4. Call 1 888 232-5656. More adventure, less planning, no booking fees. With the Aventura Travel Assistant 1, personalized expertise isn't a luxury—it's the standard. We remove the hassle by taking care of everything you need to travel.

The baseline use-case for CIBC Aventura points would be to redeem them at a value of 1 cent per point (cpp) against travel that's booked through the CIBC Rewards Travel Centre. For example, the current signup bonus of 35,000 Aventura points on the CIBC Aventura Visa Infinite would be redeemed against $350 worth of travel booked via CIBC.

Luckily, you can redeem your Aventura Points towards all travel at 1.25 cents per point through the "pay with points" feature. Otherwise, you can think of CIBC Aventura Points as a stop-gap for miscellaneous travel purchases on your travels around the world, between traipsing from hotel to hotel and flight to flight. ...

Redeem CIBC Aventura Points for 1.25 Cents Per Point. Meanwhile, with the Aventura Flight Rewards Chart, you can boost the value received up to 2.29 cents per point, depending on the flights booked. As a reminder, you can earn Aventura Points on CIBC's suite of Aventura credit cards, which often come with a nice welcome bonus.

Multiplying your Aventura Points is as easy as buying groceries, pumping gas or booking a trip. 1 point. for every $1 spent at eligible gas stations, electric vehicle charging stations, grocery stores and drug stores 3. Accelerate your savings with up to 10 cents off per litre on gas.

Redeeming Aventura Points. Normally, redeeming 16,000 Aventura Points with Shopping with Points reduces the credit card balance by $100. But thanks to the Shopping with Points promotion, you only need 8,000 points for $100! Automatically, the system shows the credit obtained and the points that will be deducted. Click on Use My Points to confirm.

On most travel redemptions, Aventura points are capable of a value anywhere between 1 and 2.2 CPP (cents per point). Most travel booked through CIBC's in-house travel portal returns a value of 1 CPP. When booking 'Flight Rewards' using CIBC's Aventura Flight Rewards Chart, some redemptions offer a return of up to 2.2 CPP in value. ...

Redeem Aventura points for flights & other travel. Sign on to CIBC Online Banking to access the Rewards Centre where you can book flights, hotels, cruises, car rentals and vacation packages. Browse travel rewards and view exclusive promotions through CIBC online portal. Book trips using the Aventura Travel Assistant, providing your personal ...

Redeem on travel—for 50% fewer points using Shopping with Points. Redeem travel purchases on your Aventura card for ½ the points using Shopping with Points! Simply go to your pending transactions, then redeem eligible purchases. *Conditions apply. Learn more. x. Register / Sign On.

10,000 Aventura Points, ‡ you could be taking off sooner than you think . 14. You can pay for your travel by redeeming your Aventura Points or using your CIBC Aventura Visa Infinite Card—or both! 15. Register for CIBC Rewards at cibcrewards.com. For a free travel quote or to book, call 1 888 232-5656. Round-trip Aventura flight destinations ...

Watch this video to learn how to redeem your Aventura Points. It's quick and easy! There endless reward redemption possibilities and flexibility - redeem tod...

For your convenience, you can access cibcrewards.com 24 hours a day to check your account balance and redeem for Travel and Rewards.. To contact us by phone: CIBC Aventura ® and CIBC Gold Visa * Customers . General Inquiries and Rewards Redemptions. Phone: 1-888-232-5656 (In Canada & U.S.) or 905-696-4907 (elsewhere)

Your best option is the CIBC Aventura Visa Infinite. You can redeem your CIBC points in 7 ways, including travel, charity, financial products, merch, gift cards, and statement credits. The best way to redeem your points is maximizing the CIBC Aventura Airline Redemption Chart, which can get you up to 2.29 cents per point.

With Aventura you can use a travel chart or just use your points toward any flight you choose. You can redeem for a range of travel expenses, like flights, hotels and car rentals. Value from 1 ...

Get up to 10,000 Aventura Points (up to $100 in travel value †) 2,500 Aventura Points when you complete all five activities within 60 days of your CIBC Aventura® Visa* account approval. 7,500 Aventura Points after you make your first purchase within first 4 months.

10,000 Aventura Points, ‡ you could be taking off sooner than you think. 11 . You can pay for your travel by redeeming your Aventura Points or using your CIBC Aventura Visa Card—or both! 12. Register for CIBC Rewards at cibcrewards.com. For a free travel quote or to book, call 1 888 232-5656. Round-trip Aventura flight destinations Aventura ...

Aventura points can be redeemed for travel, gift cards, financial products with CIBC, charity, and statement credits. Aventura Points Value. 2 cents per point on average. Aventura points range from 1.5 to 2.5 cents per point when redeemed towards airfare via the Aventura Airline Rewards Chart.

When possible, I recommend sticking to using Aventura points for flights as you'll lose out on a lot of value when redeeming points towards other forms of travel. 40,000 points redeemed using the Aventura Airline Rewards Chart will be worth $800 to $1,000 while redeeming 40,000 points for other forms of travel will be worth a flat $400.

Redeem on travel—for 50% fewer points using Shopping with Points. Redeem travel purchases on your Aventura card for ½ the points using Shopping with Points! Simply go to your pending transactions, then redeem eligible purchases. *Conditions apply. Learn more. x. Register / Sign On.

CIBC Rewards Travel Centre. When booking travel through the CIBC Rewards Travel Centre (CIBC's in-house travel agency), Aventura points can be applied towards the booking at a rate of 1 cent per point (meaning 10,000 Aventura points would be worth $100 towards your booking). In order to book travel within the CIBC Rewards Travel Centre ...

The CIBC Aventura ® Gold Visa * Card is currently offering an elevated bonus of up to 45,000 Aventura Points,† structured as follows: 15,000 Aventura Points when you make your first purchase†. 30,000 Aventura Points when you spend $3,000 (CAD) or more in the first 4 monthly statement periods†. The $139 annual fee is currently rebated in ...

Explore the CIBC Rewards program and earn points on your everyday purchases. Redeem them for travel, merchandise, gift cards and more.