Time Charter vs. Voyage Charter: Everything You Need to Know to Make the Right Choice

Navigating maritime logistics demands a robust understanding of chartering options—each type has unique implications for operational strategy and financial outcomes.

Choosing between a time charter and a voyage charter isn’t merely a logistical decision; it’s a strategic one that impacts cost, control, risk management, and operational flexibility.

In this article, we delve deep into the two main types of charters – a time charter and a voyage charter – exploring their advantages and disadvantages, and offering a comparison between the two.

The goal of this article is to:

- equip you with the essential knowledge to navigate these choices

- ensure that your chartering decisions align seamlessly with your business objectives and market conditions

- enhance your company’s competitive edge in the global marketplace.

But before going any further, it’s important to understand the terms used by the industry. Here are the most common:

Time Charter

A time charter grants the charterer the use of a vessel and its crew for a specified period from a shipowner. The ship owner and the charterer will agree on the exact period the lease will run for.

However, the two parties will not need to agree on ports of call and destinations, as the charterer has complete discretion over this. The charterer can direct the vessel’s movements and cargo operations within agreed and imposed contractual limits.

The shipowner retains responsibility for the vessel’s operational aspects, including maintenance (ensuring the vessel meets all necessary maritime safety standards), and crewing, but the charterer must pay for fuel and supply costs, as well as the cost of cargo operations and port charges.

This arrangement is akin to leasing a car, where the lessee drives but doesn’t worry about long-term maintenance. For example, a charterer might lease the ship for six months, during which time they have the flexibility to choose their routes and destinations.

Ship owners generally prefer their vessels to be leased on a time charter. This is because time charters guarantee income for a long period, giving the ship owner increased security.

Voyage Charter

A voyage charter focuses on the transportation of a specific cargo on a single voyage between designated ports.

The most common way to pay for this type of charter is on a per-ton basis. As the name implies, this sees the charterer paying a set price for every ton of cargo they transport and is preferred when the amount of cargo they’re transporting is significantly less than the vessel’s gross maximum cargo tonnage.

The second most common payment method is a lump sum – one payment that allows the charterer to transport as much cargo as they wish. It is the ship owner’s responsibility to ensure the cargo weight does not exceed the gross maximum tonnage of the vessel. This type of payment is preferred by charterers when they’re carrying a higher weight of cargo.

Under this contract, the ship owner is tasked with delivering the cargo and handling all nuances of the voyage itself. Nearly all costs are covered by the ship owner and include costs relating to staffing, berthing, loading, unloading, and fuel. They cover these costs by charging the charterer a fee for leasing the vessel.

Before the charter contract is signed, the parties will agree on the end destination, any ports of call, laytime, and whether there will be any restrictions on cargo. The ship owner pays for all costs at the port of call. If the charterer exceeds the agreed time, they must pay demurrage to the ship owner.

This type of vessel chartering is generally preferred by charterers. This is because it often has more competitive prices, plus they are not tied down to any long-term commitments

Voyage and Time Charters

There are other definitions which are useful to understand.

Charter party

Central to these contracts is the charter party —the formal agreement that stipulates the specific terms, conditions, and obligations agreed upon by the ship owner and the charterer.

This document is crucial as it governs what each party is responsible for, including costs, risks, and how disputes are resolved.

Freight Rates

Freight rates, a critical element of the contract, determine the cost associated with transporting cargo and are influenced by various market conditions and ship specifications.

These rates not only affect the profitability of a voyage but also influence global trade patterns.

Cost Analyses

Cost analysis in this context involves evaluating the expenses related to different chartering options to determine the most cost-effective approach.

This analysis is essential for chartering managers and financial analysts who aim to optimize operational costs against market conditions.

The Statement of Facts (SoF) is an important maritime document that logs vessel activities while in port. It includes times of arrival and departure, cargo handling details, and records of any delays or incidents, providing a factual foundation for operational and legal evaluations.

Freight and Charges

Lastly, understanding freight & charges—the costs incurred during the shipment of cargo—is vital. These charges can vary widely depending on the route, type of cargo, and specific terms of the charter party.

Once again, the use of historical data from SoFs can assist in providing clarity and transparency on these fees.

Advantages and Disadvantages of a Time Charter

Time chartering presents a unique set of advantages and disadvantages that vessel chartering managers, operations VPs, and demurrage cost analysts must weigh carefully when strategizing for optimal operational flexibility and cost efficiency.

Advantages:

- Flexibility in Operations : Time charters offer charterers significant control over the vessel’s employment, including the types and routes of cargoes, as well as one of the most important: access to a vessel. This flexibility is invaluable for adapting to changing market conditions or specific logistical requirements. Using no-code workflows to streamline processes and voyage turnaround simulators can support maritime operations and greatly improve flexibility.

- Cost Predictability : With a fixed daily hire rate, companies can better forecast and manage their shipping expenditures. This predictability aids in budgeting and financial planning, reducing the unpredictability associated with fluctuating freight rates in spot market dealings.

- Reduced Exposure to Market Volatility : During periods of market volatility, time charter arrangements protect the charterer from soaring freight rates, as the hire rate remains constant regardless of market conditions.

Disadvantages:

- Long-term Commitment : One of the primary drawbacks of time charters is the requirement for a longer-term commitment to a vessel. This can be a double-edged sword, especially if market rates fall below the agreed hire rate, potentially leading to higher-than-market operational costs.

- Operational Costs and Risks: While the shipowner handles maintenance and crewing, the charterer is responsible for costs related to the voyage, including fuel, port charges, and other variable expenses.

Charterers should employ proactive cost tracking, negotiate favorable fuel clauses, utilize cost-efficient routing software, and maintain transparent communication with shipowners about anticipated expenses and operational strategies.

For example, a well-prepared and accurate Statement of Facts (SoF ) can provide detailed information about the events that occurred during the time a vessel spent at port.

However, when the opportunity to properly analyze the SoF has not been made available, disputes over ambiguous statements may arise.

On one side, charterers will try to leverage the delays that happened to decrease demurrage. Shipowners, on the other hand, may challenge a charterer’s laytime statement based on the events that are available in the SoF.

Time charters often include terms for demurrage (charges when the charterer uses the vessel beyond the agreed period) and dispatch (rewards for completing operations early). The SoF provides the necessary data to calculate these charges or rewards accurately, documenting the exact time spent during loading and unloading.

- Lesser Control Over Maintenance : Charterers have limited control over the maintenance and condition of the vessel, relying on the shipowner to maintain standards. Poor maintenance can affect cargo schedules and overall shipping efficiency.

Maintenance of the vessel can also have a direct effect on the charterer due to new emissions regulations.

Keeping track of current changes in maritime emissions regulations is a challenging task. With so many initiatives and new norms being implemented, trying to provide frameworks to capture and report on emissions, makes the topic extremely complex for operators, shipowners, and commodity manufacturers.

Advantages and Disadvantages of Voyage Charter

Voyage charters represent a different approach compared to time charters, focusing on specific trips rather than extended periods. This method suits operations that require precise cargo deliveries without long-term ship commitment, but it also carries its own set of pros and cons.

- Direct Cost Association : The major appeal of voyage charters lies in their direct cost association with individual voyages. The charterer is not liable for any costs, except the initial charter fee, and is not responsible for finding a crew. Charterers pay per trip, making it easier to allocate costs directly to specific cargoes or projects.

- No Long-Term Commitment or Contract: Unlike time charters, voyage charters do not require a long-term commitment to a vessel, providing flexibility to switch between ships and routes as dictated by cargo needs or market conditions.

- High Control Over Cargo Operations : Charterers maintain extensive control over the loading and unloading processes, ensuring that handling aligns with their standards and schedules. This is particularly beneficial for sensitive or high-value cargoes.

- Vulnerability to Market Fluctuations : While time charters protect against market volatility, voyage charters expose charterers to fluctuating freight rates. During peak times, costs can escalate significantly, affecting overall profitability and a lack of flexibility for the charterer.

- Inconsistent Costs (and higher initial costs): The costs in voyage charters can vary widely from one trip to another, influenced by factors like fuel prices, port fees, and canal dues. This inconsistency makes budgeting and financial planning more complex.

For example:

a. Exceeding laytime – the time allowed for loading and unloading cargo at ports – can lead to demurrage charges. Having a well-prepared SoF ensures that the arrival, cargo operations, and departure times are documented, which are key data points for laytime calculations.

b. New emissions regulations leading to the use of specific fuels or ship adjustments may soon be passed on to charterers via higher freight costs. For many ships, technical modifications may be the only realistic way to attain the required certifications and to be under the emissions limit, impacting the commercial operation of the vessel.

- Dependency on Ship Availability : Charterers are at the mercy of market availability. During periods of high demand, finding suitable vessels can be challenging and more expensive, potentially leading to delays and increased operational risks.

How to Choose Between Time Charter and Voyage Charter: Factors to Consider

Choosing between a time charter and a voyage charter is a strategic decision that hinges on several criteria to be weighed carefully to align with organizational objectives and the dynamic nature of the maritime industry.

Here we present six criteria that every chartering manager or analyst should consider.

- Duration and Frequency of Cargo Needs

Consider the length and frequency of your shipping needs.

Time charters are more suitable for longer and more regular shipping requirements, providing stability and predictability. These agreements are signed only for a limited period, without providing any specified route to the other party. Throughout this charter period, the Charterer can use the vessel for trading on the recognized trade routes without restrictions. This offers

On the other hand, voyage charters are ideal for single, occasional, or irregular shipments. These contracts are signed for carrying a particular quantity of goods on the preset by the two parties. They also are obliged to carry the stated commodity onboard between pre-decided ports only. After the said trip is completed, the contract is automatically terminated.

- Market Conditions and Freight Rate Volatility

The current and anticipated market conditions play a crucial role. In a volatile market with rising freight rates, a time charter might lock in a more favorable rate for a longer period.

Conversely, in a stable or declining market, voyage charters might offer more cost-effective and flexible options.

- Operational Control

Evaluate the level of control you need over the vessel’s operation.

Time charters offer more control over the vessel’s itinerary and operations, beneficial for complex logistics operations.

Voyage charters provide control over the cargo but less so over the vessel’s operations.

- Financial Planning, Profitability, and Budget Constraints

Assess your financial flexibility

Time charters require a substantial and consistent financial commitment, which is predictable but potentially higher in the long term.

Time charters provide more predictable cash flow due to fixed daily hire rates, which can be advantageous in a volatile market as they protect against rate increases.

However, they may result in negative cash flow if the market rates decrease significantly below the charter rate agreed upon, as the charterer still must pay the fixed rate.

Voyage charters , while potentially more variable in cost, do not require long-term financial commitments and can be adjusted according to budgetary needs. The absence of a long-term commitment allows companies to avoid the financial drain of a non-performing asset, which is possible in a time charter if market conditions worsen.

Typically, payments in voyage charters are tied to specific milestones, such as loading or unloading completion, which can help in planning cash flow.

- Cargo Specificity and Handling Requirements

Consider the nature of the cargo. Special handling requirements, sensitivity, and value of the cargo might dictate the need for more direct control over handling processes, favoring voyage charters.

- Risk Tolerance

Finally, analyze your company’s risk tolerance.

Time charters minimize exposure to market fluctuations but involve commitment risks . They provide more predictable cash flow due to fixed daily hire rates, which can be advantageous in a volatile market as they protect against rate increases. However, they may result in negative cash flow if the market rates decrease significantly below the charter rate agreed upon, as the charterer still must pay the fixed rate.

Voyage charters offer flexibility but expose the charterer to market rate risks and operational uncertainties. Profitability and effectiveness in managing cash flow depend on the charterer’s ability to manage and mitigate risks associated with market volatility and operational uncertainties.

By automating manual workflows with available low-code technology , companies can save and reduce risk while maintaining data integrity and real-time visibility of their voyages’ most essential KPIs.

To reduce risk, dedicated software to automatically assign tasks and notify stakeholders prevents constant back and forth through emails or updating of spreadsheets can be implemented. Stakeholders can be given dedicated access to track their inbound shipments, schedule changes, and collect documents.

If you want the lowest possible ongoing costs, the clear winner is the voyage charter.

Why? Because they don’t require a long-term contract. They do have a higher initial cost, but this is offset by the fact that no other significant fees need to be paid, in general.

But, when it comes to the initial cost of chartering a ship, it’s nearly always going to be cheaper to go with a time charter.

A ship owner is more open to a lower price, as they know you’ll be hiring the vessel for longer. What’s more, you, and not the ship owner, will be expected to cover other costs, pushing the initial price down further. As the vessels are leased for long periods, the vessel can be used to travel anywhere, without restriction.

In making your final decision, engage with stakeholders, including operations managers, financial analysts, and logistics coordinators, to understand the full implications of each option.

Besides, using a holistic approach to evaluate these factors will guide you toward the most strategic chartering decision for your specific circumstances.

- April 30, 2024

Share this post

Voyage Charter : Definition & Full Guide

- By MascotMaritime

- April 22, 2022

- 3 mins read

Table of Contents

What is a voyage charter.

Voyage charter definition : The voyage charter is a contract (voyage charter party) between the shipowner and the charterer wherein the shipowner agrees to transport a given quantity of a shipment, using a pre-nominated vessel for a single voyage from a nominated port (say X) to a nominated port (say Y), within a given time period.

Who is a voyage charterer? What is the freight & voyage charter party?

The person who charters the vessel is called the voyage charterer , the payment is called freight & the contract is called the voyage charter party. The freight rate is calculated as $/tonne of shipment.

What is the most significant part of a voyage charter party?

The most significant parts are the description of the voyage, size & capacity of the vessel, cargo, the allocation of duties and costs in connection with loading and discharging, the specification of the freight, and the payment of the freight, the laytime rules, the allocation of the liability for the cargo and the allocation of other costs and risks.

Depending on the circumstances, other questions and clauses can be very important in the negotiations between the owners and the charterers.

In this type of charter, the vessel must be in the position that the owner specified when the charter was concluded & the vessel must, without undue delay, be directed to the port of loading.

At the port of loading, the charterer must deliver the agreed cargo.

The cargo must not be dangerous cargo unless otherwise agreed. The cargo must be brought alongside the ship at the loading port & must be collected from the ship side at the port of discharge.

Mainly with the bulk cargoes, the charterer often undertakes to pay to load and discharge & often clauses of f.i.o or f.o.b are met. Very often parties agree on f.i.o.s or f.i.o.s.t terms.

In voyage charter, the discharge port need not be nominated in the charter party & in such cases, the charterer must have the right later to direct the vessel within a certain range to a specific port of discharge.

In a voyage charter where the charterer carries out loading &(or) discharging, it is generally agreed that the charterer will have a certain period of time at his disposal for loading & discharging of the vessel & it is called laytime .

If the charterer fails to load and(or) discharge the cargo from the vessel within the laytime, then he has to pay compensation for the extra time used called demurrage . Once in demurrage always in demurrage.

In other cases, if the charterer loads &(or) discharges the cargo from the vessel more quickly than the agreed laytime time, then he is entitled to claim compensation (only if agreed earlier) called despatch money.

In voyage charter, unless lumpsum freight is paid, the owner may claim freight compensation if less cargo is delivered, or cargo is delivered in such a way that ship’s capacity cannot be utilized due to broken stowage . This freight compensation is called deadfreight .

Voyage charter party agreement example:

Click here to see the example of a voyage charter party (NORGRAIN 73).

What are the factors which influence the freight rate in a voyage charter market?

In the voyage charter market, rates are influenced by cargo the charterer must deliver the agreed cargo size, commodity, port dues, and canal transit fees, as well as delivery and redelivery regions.

In general, a larger cargo size is quoted at a lower rate per tonne than a smaller cargo size. Routes with costly ports or canals generally command higher rates than routes with low port dues and no canals to transit.

Voyages with a load port within a region that includes ports where vessels usually discharge cargo or a discharge port within a region with ports where vessels load cargo also are generally quoted at lower rates because such voyages generally increase vessel utilization by reducing the unloaded portion (or ballast leg) that is included in the calculation of the return charter to a loading area.

What are the costs paid by the shipowner & charterer in a voyage charter?

In a voyage charter, the shipowner retains the operational control of the vessel and pays all the operating costs (crew, fuel, freshwater, lubes, port charges, extra insurances, taxes, etc.), with the possible exclusion of the loading/unloading expenses.

The charterer’s costs are usually costs & charges relating to the cargo.

What are the types of voyage charter?

It can be of the following types:

- Immediate – which is carried out within weeks of the contract agreement and the agreed freight rate is called the spot rate.

- Forward – which is scheduled & fulfilled at the agreed time in the future, for example in say three months.

- Consecutive – which refers to several same consecutive voyages.

Related Popular Articles

Women in shipping – pros and cons.

Women currently make up only 1.2% of the maritime workforce. This presents an incredible opportunity for growth, diversity, and empowerment within the maritime industry

Passive income streams for mariners

Passive income streams for mariners can vary depending on individual circumstances, skills, and interests. Most mariners focus on honing their skills in navigation, safety, operating

Seafarers happiness on board – Key factors

Seafarers lead a challenging life, navigating the seas for extended periods, enduring isolation, facing unpredictable weather, and maintaining vessels. Their resilience and commitment ensure global

6 Responses

- Pingback: INCOTERMS 2020 : A MUST READ FOR SHIPPING, CUSTOM & LOGISTIC PROFESSIONALS! - MascotMaritime

Thanks a bunch for sharing this with all folks you actually know what you’re talking approximately! Bookmarked. Kindly also talk over with my site =).

We may have a link alternate arrangement between us

I cοuldn’t refrain from commenting. Exceptionally well written!

I’m gone to inform my little brother, that he should also visit this web site on regular basis to get updated from newest news update.

Hi there every one, here every person is sharing these kinds of familiarity, therefore it’s pleasant to read this website, and I used to pay a quick visit this web site daily.

First off I want to say excellent blog! I had a quick question that I’d like to ask if you don’t mind. I was curious to know how you center yourself and clear your head prior to writing. I have had trouble clearing my thoughts in getting my ideas out.

I do enjoy writing however it just seems like the first 10 to 15 minutes are usually lost just trying to figure out how to begin. Any recommendations or tips? Kudos!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Terms & Conditions | Privacy Policy | Disclaimer

World Clock ×

- Market recognition

- Social responsibility

- Dispute resolution

Charter Parties: The Complete Guide – Types & Agreements

August 21, 2023

Looking for a comprehensive guide to charter parties? Our page covers all types and agreements, distinguishing us from the competition.

Charter Parties The Complete Guide

Charter parties , the legal contracts for chartering vessels, are the backbone of international shipping. They define the rights and obligations of shipowners and charterers, ensuring smooth operations on voyages. Whether it’s a time charter or a voyage charter, these agreements play a crucial role in facilitating global trade for carriers.

A charter party is not just any document; it serves a specific purpose in the context of chartering. Its clauses, articles, and provisions outline the terms that govern the relationship between parties involved in maritime commerce, typically in a contract. Shipowners carefully craft these agreements, known as charterparties, to protect their interests while meeting the needs of charterers who engage their services as carriers.

Understanding charter parties is essential for anyone venturing into international shipping. From specifying the duration of the charter period to determining responsibilities during loading and unloading, every detail matters in chartering. So let’s dive into this intricate world of maritime contracts and explore how they shape our interconnected global economy, specifically in relation to carrier and specific cargo.

Types of Charter Parties

Time charters.

A ship chartering, or time charter, involves leasing a vessel from a ship owner for a specific period. This type of charter party allows the charterer, or carrier, to have exclusive use and control over the vessel during the agreed-upon timeframe. It provides flexibility as the charterer can determine the ports of call and cargo carried.

Voyage charters

Voyage charters in ship chartering involve hiring a vessel for a single journey. Unlike time charters, which focus on an extended period, voyage charters are specific to one trip. The charterer pays the ship owner for transporting goods from one port to another without long-term possession or control over the carrier.

Bareboat charters

Bareboat charters involve ship chartering by leasing a vessel without crew or provisions. In this type of arrangement, the charterer assumes complete responsibility for operating and maintaining the ship during the agreed charter party duration. The shipowner transfers possession and control to the charterer, who becomes the carrier responsible for all aspects of navigation, crewing, and provisioning.

These main types of charter parties, including time charters, voyage charters, and bareboat charters, offer different options depending on the specific needs and requirements of the charterparty, carrier, ship owner, or shipowner. Time charters provide flexibility and extended use, voyage charters focus on individual trips, while bareboat charters grant full control to the lessee. By understanding these various types, individuals and businesses can choose which option best suits their particular circumstances.

Charter Party Agreements

Charter party agreements, also known as charterparty agreements, are legally binding documents that are negotiated between shipowners and charterers. These agreements specify important terms such as freight rates, laytime, demurrage, and more. Here’s a brief overview of charterparty agreements and how they form an essential part of container shipping.

- Charter party agreements, also known as charterparty agreements, are contracts that outline the terms and conditions of the chartering arrangement for container ships. They are typically negotiated between the shipowner, who owns the vessel, and the charterer, who will be using the container ship for a specific period or voyage.

- Charter party agreements include various provisions that define important aspects for ship owners. This includes details about freight rates (the cost of hiring the vessel), laytime (the allowed time for loading and unloading cargo), demurrage (additional fees if there is a delay in cargo operations), and other relevant terms.

- Legally binding documents: Once both ship owners agree to the terms outlined in a charter party agreement, it becomes a legally binding document. This means that both ship owners are obligated to fulfill their respective responsibilities as stated in the agreement.

Charter party agreements play a crucial role in the shipping industry by providing clarity and protection for all parties involved. They ensure that both shipowners and charterers understand their rights and obligations throughout the duration of the charter. Whether it’s a slot charter (a partial space booking) or a demise charter (complete transfer of vessel control), these agreements establish clear guidelines for smooth operations.

The Importance of Charter Parties in International Trade

Charter parties play a vital role in facilitating global trade, ensuring the efficient transportation of goods by sea. These agreements establish clear responsibilities and liabilities for both shipowners and charterers, promoting smooth operations and minimizing disputes. Let’s explore why charter parties are crucial in international trade.

- Facilitate global trade by providing vessel availability : Charter parties enable shipowners to make their vessels available for hire, allowing them to meet the demand for transporting goods across borders. This availability ensures that businesses can access reliable shipping services to move their products worldwide.

- Ensure efficient transportation of goods by sea: By defining the terms and conditions of carriage, charter parties help streamline the logistics process for ship owners. They specify loading and unloading procedures, delivery timelines, and any additional requirements for cargo handling. This clarity promotes efficiency and helps avoid delays or misunderstandings during transit, benefiting both shipowners and the overall shipping industry.

- Establish clear responsibilities and liabilities: Charter parties outline the obligations of both shipowners and charterers, ensuring accountability throughout the voyage. They determine who is responsible for vessel maintenance, crew expenses, insurance coverage, and compliance with maritime regulations. Clearly defined responsibilities minimize uncertainties and protect all parties involved.

Charter Parties and Bills of Lading

A bill of lading issued under charter party terms serves as a crucial document for shipowners in the shipping industry. It provides evidence of cargo receipt and condition, making it essential for transferability and financing.

- Under voyage charters or bareboat charters, a bill of lading is often issued to acknowledge the receipt of specific cargo by the shipowner or charterer.

- This document is essential for shipowners and charterers in the shipping industry as it serves as proof that the cargo has been loaded onto the ship and is in good condition. It is particularly important for both bareboat charter and voyage charter party agreements during the specified charter period.

- Charter parties facilitate the agreement between the shipowner (or bareboat charterer) and the charterer, outlining their respective rights and responsibilities.

- The bill of lading acts as a contract between the carrier (shipowner) and the shipper (charterer), ensuring that both parties fulfill their obligations.

- For freight forwarders, having a bill of lading issued under charter party terms allows them to confidently arrange transportation for their clients’ cargo with the ship owner’s assurance.

- The bill of lading also enables financing options for shippers who may need to use it as collateral or provide proof of ownership for obtaining loans during a bareboat charter, slot charter, or voyage charter party within the charter period.

- In addition to its importance in commercial transactions, bills of lading issued under charter parties serve as critical documents for ship owners’ insurance claims related to damaged or lost cargo.

Charter parties and bills of lading are integral components within the shipping industry. They ensure smooth operations, protect stakeholders’ interests, and provide necessary documentation for various purposes.

Ship Speed and Fuel Consumption in Time Charter

Ship speed plays a crucial role in determining fuel consumption within time charter agreements. The rate at which a vessel travels directly impacts the amount of fuel it consumes during its journey. Here are some key points to consider:

- Slow steaming: Slowing down the ship’s speed can significantly reduce fuel costs. By adopting this practice, charter parties can achieve substantial savings. However, it is important to note that slow steaming also extends the duration of the voyage.

- Cost versus time: When deciding on ship speed, charter parties must strike a balance between cost reduction and voyage duration. While slower speeds may result in lower fuel consumption, they can lead to longer transit times, affecting overall efficiency and profitability.

- Fuel efficiency considerations: In time charter agreements, fuel efficiency is a critical factor that influences financial outcomes. Parties involved must carefully evaluate the impact of ship speed on fuel consumption to ensure optimal profitability.

By considering these factors, charter parties can make informed decisions regarding ship speed and its effect on fuel consumption within time charter agreements. Achieving the right balance between cost reduction and voyage duration is essential for maximizing profitability while maintaining operational efficiency.

Understanding Laytime and Total Laytime

Laytime, a crucial aspect of charter parties for ship owners, refers to the time allowed for loading/unloading cargo. It determines the financial implications for both ship owners and other parties involved. Exceeding the laytime incurs demurrage charges, resulting in additional costs for ship owners.

Key points to understand about laytime and total laytime:

- Laytime : Laytime is the agreed-upon period during which the charterer has the right to load or unload cargo. It is typically expressed in days, hours, or even minutes. The clock starts ticking once the vessel arrives at the designated port or berth.

- Demurrage : When laytime is exceeded due to delays caused by either party, demurrage charges come into play. Demurrage refers to the money the charterer paid to compensate for the extra time taken beyond the agreed-upon laytime. This ensures that shipowners are compensated for any lost time and potential revenue.

- Financial Implications : Understanding laytime is essential because it directly impacts both parties’ financial interests. For shipowners, shorter laytimes result in quicker turnaround times and increased efficiency. On the other hand, charterers aim to maximize their use of laytime while avoiding demurrage costs.

By comprehending these concepts related to laytime and total laytime, ship owners and other parties involved in charter parties can effectively manage their operations while minimizing potential financial risks.

Remember: Promptly completing loading or unloading operations within the agreed-upon timeframe helps avoid unnecessary expenses and contributes to smoother logistics processes for all stakeholders involved in the ship charter, slot charter, voyage charter party, and charter party chain.

Safe Port Requirements in Voyage and Time Charters

Voyage charters require the charterer to transport cargo from one port to another by ship. In these agreements, it is crucial for the charterer to ensure that the chosen ports for cargo operations meet certain safety requirements. Similarly, time charters impose an obligation on the charterer to nominate safe ports throughout the duration of the agreement.

The selection of a safe port is crucial for ships due to the potential risks involved. Safety concerns encompass navigational hazards, ship security measures, and infrastructure conditions. By considering these factors, charter parties can mitigate dangers and ensure smooth ship operations.

Here are some key points regarding safe port requirements for ships in both voyage and time charters.

- Charterers must carefully evaluate the safety aspects of each port before initiating cargo operations on their ship.

- When entering a voyage charter party, it is essential to consider navigational hazards such as shallow waters, narrow channels, or unpredictable weather conditions that may be encountered during the ship’s journey.

- Security measures at ports are crucial in safeguarding cargo, whether on a ship or on land, from theft or any other criminal activities.

- The responsibility to nominate safe ship ports lies with the charterer throughout the duration of the contract.

- It is essential for charterers to stay updated on any changes in safety conditions at nominated ports to ensure their ships’ safety.

- Regular communication between all parties involved in the ship ensures that any safety concerns related to the ship are promptly addressed.

Key Takeaways on Charter Parties

Charter parties are critical legal instruments in the maritime industry. They establish rights, obligations, and liabilities between parties involved in international shipping. Here are some key aspects to consider:

- Lesson: Charter parties serve as a vital framework that ensures smooth operations within the maritime sector.

- Aspects: These agreements cover various aspects, including vessel specifications, cargo details, and the duration of the charter.

- News: Staying informed about recent developments and changes in charter party regulations is crucial for all parties involved.

- Details: The terms and conditions outlined in charter parties provide specific details regarding payment terms, insurance requirements, and dispute resolution mechanisms.

- Act: Charter parties act as binding contracts that protect the interests of both shipowners and charterers.

- Fortior: By clearly defining responsibilities and obligations, these agreements fortify relationships between shipowners, charterers, and other stakeholders.

Charter parties play an instrumental role in facilitating international trade by ensuring the efficient transportation of goods across borders. As these agreements govern vital aspects of maritime operations, it is essential for all parties to familiarize themselves with their provisions. Understanding the intricacies of charter parties can help mitigate potential disputes while fostering mutually beneficial relationships within the global shipping community.

Real-world Challenges with Charter Party Disputes

Legal professionals play a crucial role in resolving charter party disputes, which can be complex and challenging. These disputes often arise from breaches of the terms outlined in the charter party agreement. Arbitration is frequently employed as an alternative to court proceedings to settle such disagreements.

The involvement of legal professionals is essential due to the intricate nature of charter party disputes . Breaches of contract terms can lead to various issues, including financial costs, risks, and responsibilities for both parties involved. Here are some examples that highlight the complexities faced in this industry:

- Maintenance Responsibility: Disagreements may arise.

- Demise Charter Issues: A demise charter involves transferring full control and possession of a vessel to another party. However, conflicts may occur regarding the condition or performance of the vessel during this arrangement.

- Country-Specific Practices: Different countries have their own regulations and practices concerning charter parties, leading to potential clashes between international parties.

Arbitration is commonly utilized to settle these disputes outside of traditional court processes. This alternative dispute resolution practice offers several advantages:

- Confidentiality: Arbitration provides a more private setting compared to court hearings.

- Expertise: Parties involved can select arbitrators with specialized maritime law knowledge or specific aspects of their cases.

- Flexibility: The arbitration process allows for tailor-made procedures that suit the unique circumstances of each dispute.

At ANHISA, we have established ourselves as trusted lawyers and counsels for shipowners and charterers involved in charter party disputes. Our extensive experience in practical cases has allowed us to successfully advise and resolve complex situations, such as indemnification requests by shipowners due to early termination breaches.

We understand the importance of finding amicable solutions that benefit all parties involved. However, when negotiations fail, our team at ANHISA is well-equipped to guide shipowners through the arbitration process, ensuring their claims are properly represented.

Our expertise goes beyond shipping knowledge; we possess the technical know-how and strategic insights required to meet our clients’ expectations. With a strong foundation in shipping practice and a track record of working with international and local clients, we are committed to providing efficient, reliable, and personalized service for all your charter party disputes.

If you require assistance in resolving any charter party dispute, do not hesitate to reach out to us for a consultation. We are here to help.

Contact us via:

- Mr. Dang Viet Anh

- Email: [email protected]

- T: +84 28 5416 5873

- M: +84 983 467070

Q1: How can ANHISA assist with charter party disputes?

At ANHISA, we offer comprehensive legal counsel and guidance throughout the process of resolving charter party disputes. From negotiation strategies to arbitration representation, we ensure that our clients’ interests are protected.

Q2: What sets ANHISA apart from other law firms?

ANHISA’s unique advantage lies in our deep-rooted expertise in shipping practice combined with years of experience working with international and local clients. Our team possesses the technical knowledge and insights necessary to navigate complex charter party disputes effectively.

Q3: Can ANHISA help with both voyage and time charter disputes?

Yes, our expertise covers both voyage and time charter disputes. Regardless of the type of charter party involved, we have the knowledge and experience to provide tailored solutions for our clients.

Q4: How long does resolving a charter party dispute typically take?

The duration of resolving a charter party dispute can vary depending on the case’s complexity and the parties’ willingness to reach a settlement. At ANHISA, we strive to expedite the process while ensuring thorough representation for our clients.

Related posts

Mr. Đặng Việt Anh is one of the key speakers at Advanced Mediation Skills Training Course organized by the Vietnam Mediation Center (VMC)

April 10, 2024

Ship Arrest in Vietnam? ANHISA – Your Trusted Legal Services

April 02, 2024

Bills of Lading: Importance for International Shipping

March 19, 2024

Mediators’ Role in Alternative Dispute Resolution (ADR)

March 13, 2024

What is Alternative Dispute Resolution (ADR) – ANHISA International Law Firm

March 03, 2024

- [email protected]

- [email protected]

- Hanoi Office: +84 24 320 47609

- Saigon Office: +84 28 5416 5873

- +84 (0) 939 117 398

- +84 (0) 983 488 380

© 2022 Anhisa LLC

Charter Party Agreements

Img is one of the only law firms in the pacific northwest that focuses on both the transactional side and the litigation side of charter party agreements..

Different charter parties impose different obligations, exclusions, and limitations between each entity. For this reason, both shipowners and charterers should consider seeking sound and practical legal advice before drafting, amending or complementing any time charter, voyage charter, or bareboat charter party. During a contentious charter party dispute, shipowners and charterers should be especially aware of their legal exposures and contractual liabilities.

With experience in bareboat, time and voyage charters, contracts of affreightment and slot charters, dry bulk and containerized cargoes, oil, gas and products, IMG regularly acts on behalf of the region’s largest shipowners and charterers. Indeed, our expertise in transactional and contentious charter party matters gives us an invaluable perspective – we can foresee the problems that might arise and take steps to avoid them. Need help understanding your legal rights in a charter party contract? IMG can help.

or call (206) 707-8338 to speak to a legal expert.

Bareboat Charters – What you need to know

Strapped for capital but want to expand your fishing fleet? Bareboat charters can be a great financial alternative, provided you understand your liability.

Frequent Charters We Advise Upon

Time Charters

Time chartering is a complex business. The shipowners give the time charterers substantial control over the commercial operation of the vessel in exchange for the regular payment of hire. While this arrangement suggests that the shipowners have transferred much of the potential operational risk to the charterers and that the charterers can do more or less what they like with the ship, such an initial impression on behalf of the time charterer is both deceptive and dangerous.

If you would like clarification of your rights and liabilities as either a time charterer or a shipowner, IMG can help.

Voyage Charters

Voyage charters are the most commonly used charter party agreement. Under a voyage charter, a ship owner and a charterer enter into a contract whereby the vessel will carry cargo between two points. The voyage can be a single trip or multiple trips, provided that the charterer has absolutely no operational control over the vessel while it is being operated. Any delays during the loading and unloading of the cargo, as well as any delays during the seagoing part of a voyage, generally fall onto the vessel owner. Many charterers prefer this allocation of risk.

Bareboat Charters

A bareboat charter is the simplest type of charter party agreement. Under a bareboat charter (a.k.a. “demise charter”), the charterer effectively becomes the owner of the vessel for all operational and trading purposes, and thus, is responsible for the navigation, operation, repair, maintenance, insurance, and crew of the vessel.

Despite an appearance of simplicity, bareboat charters are complex agreements, and numerous problems can arise during their use. Owners and charterers should seek sound legal advice before drafting or amending a bareboat charter.

What to Expect From Your Legal Team

- We provide practical, commercial and results-driven advice on a discreet and confidential basis.

- All assignments will have a nominated lead partner who will be your dedicated point of contact.

- We will work to your agenda, timescales and budgets to achieve the best outcome.

- We would expect to be your trusted adviser during the process and our industry knowledge and reputation will facilitate a direct and open dialogue between all stakeholders.

Ship Chartering Process – The Ultimate guide

When a ship is taken on rent, it is known as ship chartering. Just as people take an apartment or a car for rent, some people may rent a ship based on their requirements. It could be to transport passengers or cargo.

Renting a ship is known as ship chartering and it begins with the shipowner and a second party entering into an agreement. In shipping parlance, this agreement is known as a charter party.

The party that rents out the ship is the shipowner and the second party who is taking the ship on rent is known as the charterer.

Who brings these two parties together?

Shipbrokers play an important role in bringing the right shipowner and charterer together and in finalizing the terms of the agreement between them.

Typically, someone who wants to take a ship on a lease would approach a shipbroker to find the right vessel that suits their purpose.

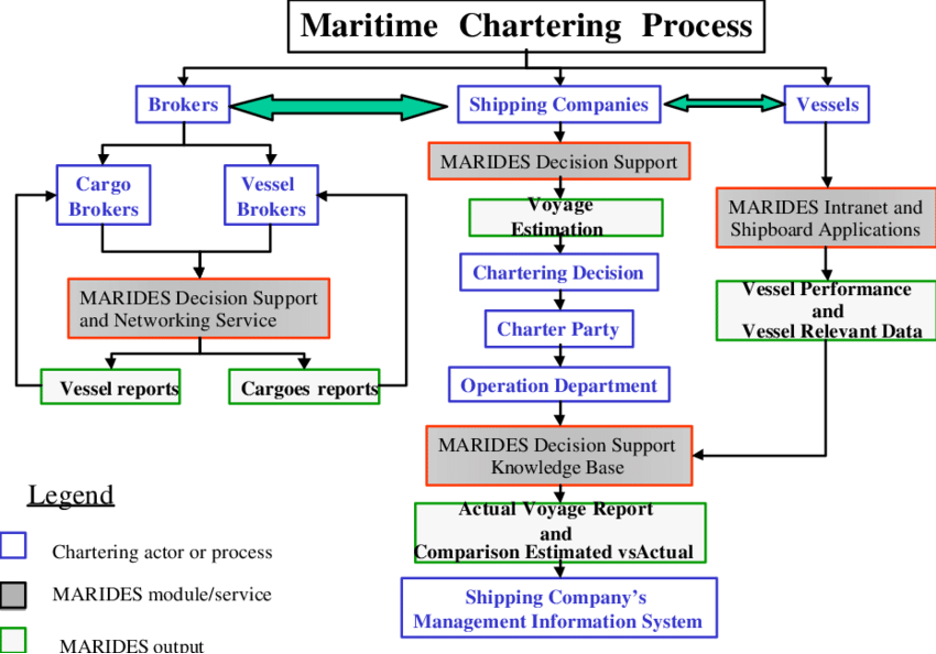

As we can see here, there are three parties in the process of ship chartering:

– the shipowner who owns the vessel being rented,

– the charterer who requires the ship on rent, and

– the shipbroker who has helped to bring them together.

Let us take a quick look at the roles of each of these parties.

Table of Contents

A shipowner may be an individual or an organization who owns merchant ships that are registered under their name with a ship registry. Merchant ships carry cargo or passengers for a charge.

Shipowners are usually members of the regional chamber of shipping or the International Chamber of Shipping (ICS). This global body is responsible for all regulatory and operational issues to do with shipping. Legal issues that crop up in the shipping business are also handled by the ICS.

Someone who wants to rent a ship, either to transport cargo or passengers, is called a charterer. The cargo may or may not belong to the charterer. The charterer may be transporting it on behalf of a different party.

Sometimes a charterer may take a vessel on lease and re-rent it to another party for the transport of cargo or passengers, for a profit.

The charterer plans the ship’s voyage and the arrangements for the handling of cargo during loading and unloading. As such, he is responsible for the safety of the ship, its crew, and the cargo.

The charter party is signed between the shipowner and the charterer.

Like all other brokers, shipbrokers also help to identify the right customer for a shipowner who wants to rent his ship or vice versa. For their services, they charge a fee or a commission to the shipowner. The commission may be a percentage of the total freight paid to the shipowner by the charterer.

Sometimes, a shipowner might appoint a full-time shipbroker for getting business. In the ship chartering business, it is common to find brokers who specialize in the chartering of certain types of vessels. It could be for the transportation of goods such as dry bulk, liquid bulk, etc.

A shipbroker is not liable for the ship, its operations, or the cargo that it carries. He is just the intermediary between the shipowner and the charterer.

The Institute of Chartered Shipbrokers

The Institute of Chartered Shipbrokers (ICS) founded in 1911 is a professional body that is recognized worldwide among the shipping fraternity. It was brought under the British Royal Charter in 1920.

Based in London, the Institute of Chartered Shipbrokers is considered the representative body of the many shipbrokers and ship managers on a global level. Through its various courses, it certifies qualified and experienced individuals to become professional shipbrokers.

Ship Registry

The authority or body that registers a merchant ship is known as a ship registry. It may be a government ship registry or a registry owned by private organizations such as the Lloyds Registry, Bureau Veritas, Indian Register of Shipping (IRS), etc.

Every ship has to be registered whereby it gets its nationality and confirmation of ownership. Each registered ship comes under the jurisdiction of the law of the country where it is registered, known as the flag state. Some countries or organizations may register only the ships of that particular country. Such organizations are known as National Registries.

Organizations that are open to register both national, as well as ships of other countries, are called Open Registries.

The 3 Main Types of Ship Charters

Voyage charter.

This is the most common type of ship charter. A voyage charter normally involves renting the vessel as well as its crew for a particular voyage between two or more ports. The rent will be based on the quantity or weight of the cargo that is carried on the voyage or it could be a fixed amount that is agreed upon between the parties.

Time Charter

When a ship is hired for a certain period, it is known as a time charter. As in the other types of charters, the vessel is rented along with the crew but for a stipulated period. The charter party will clearly state the terms and conditions of the voyage, the agreed period of hiring, the type of cargo to be carried, etc.

In a time charter, the charterer may pay a daily or a monthly rate based on the deadweight ton.

Bareboat Charter

In the bareboat charter, the vessel is operated and managed by the charterer’s crew and vessel management staff. The shipowner will only be looking after the ship’s technical management and matters relating to port operations.

Responsibility for the safety of the ship and all the financial settlements with outside parties will be with the charterer for the duration of the charter party. A bareboat charter is also known as a demise charter.

Charterparty

The charter party is a contract between the shipowner and the charterer. It states the responsibilities of both these parties with regard to the ship charter.

The charter party must be detailed and cover all aspects of the charter, especially points like re-renting of the vessel by the charterer, the type of cargo to be loaded on the ship, and ports of call .

In ship chartering, all the parties involved should be aware of the various details that go into the making of a successful charter party or fixture.

The shipowner, as well as the charterer, must be aware of the background of the other, their financial standing, and business reputation.

Just as the shipowner must know the type of cargo that is to be carried on the ship and its date of sailing etc. the charterer should be aware of the cargo-handling capacity of the vessel and its flag.

It would do the shipbroker good if he knew all these details before approaching a prospective client.

You might also like to read:

- Who is a Shipping Agent?

- Who is a Container Surveyor?

- Who is a Marine Surveyor – Responsibilities, Qualifications, and Skills

- Who is a Harbour Master (Port Master)?

- NOTIFY PARTY in Shipping – Everything You Wanted To Know

Do you have info to share with us ? Suggest a correction

About Author

Hari Menon is a Freelance writer with close to 20 years of professional experience in Logistics, Warehousing, Supply chain, and Contracts administration. An avid fitness freak, and bibliophile, he loves travelling too.

Latest Maritime law Articles You Would Like :

Why Dry Ice Is Used For Packaging

What is the Purpose of DG Shipping?

What are Logistics Risks?

How Port and Terminal Operators Can Control Emissions?

Minimum Quantity Commitment (MQC) and Liquidated Damages in Container Shipping: Concept and Relevance

MARPOL (The International Convention for Prevention of Marine Pollution For Ships): The Ultimate Guide

Latest News

Subscribe To Our Newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.

Leave a Reply

Your email address will not be published. Required fields are marked *

Subscribe to Marine Insight Daily Newsletter

" * " indicates required fields

Marine Engineering

Marine Engine Air Compressor Marine Boiler Oily Water Separator Marine Electrical Ship Generator Ship Stabilizer

Nautical Science

Mooring Bridge Watchkeeping Ship Manoeuvring Nautical Charts Anchoring Nautical Equipment Shipboard Guidelines

Explore

Free Maritime eBooks Premium Maritime eBooks Marine Safety Financial Planning Marine Careers Maritime Law Ship Dry Dock

Shipping News Maritime Reports Videos Maritime Piracy Offshore Safety Of Life At Sea (SOLAS) MARPOL

WAIT! Did You Download 13 FREE Maritime eBooks?

Sign-up and download instantly!

We respect your privacy and take protecting it very seriously. No spam!

WAIT! Did You Download 12 FREE Maritime eBooks?

Voyage Charter vs Time Charter – Everything You Need to Know

Voyage Charter vs Time Charter – Everything you need to know.

One of the biggest questions facing a charterer is whether to opt for a voyage charter or a time charter. Evaluating voyage charter vs time charter can be a complex process, but we’ve broken everything down on this page, making it easier for charterers to decide which type of vessel chartering is best for them.

1. What is a Charter? 2. What is a Voyage Charter? 3. Voyage Charter Features/Terms 4. Voyage Charter Pros & Cons 5. What is a Time Charter? 6. Time Charter Features/Terms 7. Time Charter Pros & Cons 8. How to Choose a Charter Type 9. Charter Cost 10. Ongoing Cost 11. Flexibility 12. Contract Length 13. Convenience 14. FAQs About Voyage Charter and Time Charter 15. Conclusion

What is a Charter?

A voyage charter and a time charter are two options commonly found in the chartering business. A voyage charter is when the charterer leases a vessel for a specific voyage, such as Dubai to Singapore, while a time charter is a type of lease that allows the charterer use of the vessel for a specific period of time.

As you might imagine, there are many differences between these two types of charters, and both vessel chartering options have their own pros and cons. Keep on reading this page about voyage charter vs time charter to find out which of the two options will be most suitable for your ship chartering requirements.

Voyage Charter

What is a voyage charter.

A voyage charter is a type of ship chartering that sees the charterer agree to lease the vessel for one specific voyage. So, for example, the agreement might be for the charterer to gain use of the charter ship for a journey from Dubai to Dover.

Features/Terms

As just mentioned, a voyage charter is when a charterer leases a vessel for one voyage. Before the charter contract is signed, the parties will agree on the end destination, any ports of call, and whether there will be any restrictions on cargo. Once signed, the charterer must not deviate from any of these agreements.

The terms and conditions of the charter agreement will also stipulate the laytime permitted. The laytime refers to the amount of time it takes for the vessel to be loaded and unloaded. As the ship owner pays for all costs at the port, they need this process to be as quick as possible. If the charterer exceeds the agreed time, they must pay demurrage to the ship owner. Conversely, the ship owner will usually refund some money if the loading and unloading is quicker than stipulated.

But who is responsible for what costs? Well, with a voyage charter, nearly all costs are covered by the ship owner. These include costs relating to staffing, berthing, loading, unloading, and fuel. They cover these costs by charging the charterer a fee for leasing the vessel.

The amount of money paid by the charterer can be determined in two ways. The most common way to pay is on a per-ton basis. As the name implies, this sees the charterer paying a set price for every ton of cargo they transport. This is preferred by charterers when the amount of cargo they’re transporting is significantly less than the vessel’s gross maximum cargo tonnage.

The other payment type is a lump sum – one payment that allows the charterer to transport as much cargo as they want to. It is the ship owner’s responsibility to ensure the cargo weight does not exceed the gross maximum tonnage of the vessel. This type of payment is preferred by charterers when they’re carrying a higher weight of cargo.

This type of vessel chartering is generally preferred by charterers. This is because it often has more competitive prices, plus they are not tied down to any long-term commitments.

Pros & Cons

Pro: Charterer not liable for any costs, except initial charter fee Pro: Incentives to complete port operations quickly Pro: No need to find a crew Pro: No long-term contract

Con: Lack of flexibility for charterer Con: Higher initial charter fee

Time Charter

What is a time charter.

A time charter is a type of vessel chartering that sees the charterer lease the ship for a set period of time. So, they might lease the ship for two months, during which time they have the flexibility to choose their own routes and destinations.

Before anything is signed, the ship owner and the charterer will agree the exact period of time the lease will run for. Unlike with voyage charters, the two parties will not need to agree on ports of call and destinations, as the charterer has complete discretion over this.

With a time charter, the ship owner does not cover all costs. Instead, the charterer must pay for fuel and supply costs, as well as the cost of cargo operations. However, the charterer won’t have to pay such a large charter fee, which balances things out somewhat. The owner is still required to pay for the crew and ongoing maintenance, and also must ensure the vessel meets all necessary maritime safety standards.

It is generally the case that the charterer will pay for hire in advance, on a per-day basis. Payment is not usually made in one lump sum, with the charterer instead paying the lease charge in set instalments, which are usually quarterly. It’s important to note that, should the ship be held up in unforeseen circumstances, such as inclement weather, the lost time – referred to as off-hire hours – will not usually be charged for, although if too many off-hire hours are accrued, the charterer might end up being liable.

Ship owners generally prefer their vessels to be leased on a time charter. This is because time charters guarantee income for a long period of time, giving the ship owner increased security.

Pro: Guarantees charterer access to a vessel Pro: Initial lease cost is lower Pro: More flexibility for the charterer

Con: Several ongoing costs to pay Con: Tied down to long-term contract

How to Choose a Charter Type

We’ve discussed voyage charter vs time charter above, looking at the various pros and cons of each. But which should you choose when looking to charter a ship?

Well, this really depends on your requirements. We’ve broken things down into five sections – charter cost, ongoing costs, flexibility, contract length, and convenience – and will let you know which of the ship chartering options is better for each one.

Charter Cost

When it comes to the initial cost of chartering a ship, it’s nearly always going to be cheaper to go with a time charter. This is because the ship owner will be more amenable to a lower price, as they know you’ll be hiring the vessel for longer. What’s more, you, and not the ship owner, will be expected to cover other costs, pushing the initial price down further.

So, if you’re looking for the lowest possible upfront cost, the best option is a time charter. However, remember that other costs will also need to be paid.

Ongoing cost

If you choose to take out a time charter, you will have to pay several costs, including fuel and supply costs. With voyage charters, the only significant cost payable is the initial charter – all other major expenses are covered by the ship owner.

Therefore, if you want the lowest possible ongoing costs, the clear winner is the voyage charter. However, the upfront cost will be more expensive than a time charter.

Flexibility

Those who sign up for a voyage charter are limited in their movements, as they will have already agreed a set route with the ship owners. Those who have taken a time charter have far more freedom, as they can choose where to go throughout their charter.

This clearly means that those looking for more flexibility should opt for a time charter, as there are no limitations on route, ports of call, and destinations.

Contract Length

With a time charter, you’re tied into a long contract, committing you to ongoing payments. Voyage charters, on the other hand, only last for the duration of the voyage, meaning voyage charters are generally much shorter than time charters.

This all means that those looking for the shortest contract should opt for a voyage charter. However, if you know you’ll constantly need an available vessel, the long contract of a time charter could be more suitable.

Convenience

There will be no need to hire and pay a crew when opting for either the time charter or the voyage charter. It’s only bareboat charters that require the charterer to hire and pay their own crew. However, the ongoing costs associated with time charters can be inconvenient.

Overall, voyage charters are the more convenient of the two options, as there’s no need to organise payment for such things as port costs and fuel. However, both options are generally far more convenient than a bareboat charter.

FAQs About Voyage Charter and Time Charter

What are BIMCO Sanctions Clause for Voyage Charter Parties 2020?

These are intended to help in two scenarios. Firstly, if one of the signatories of the agreement gets sanctioned, the other signatories will be able to end the contract and claim damages. Secondly, when the trade or activity is subject to or becomes subject to sanctions, the ship owners can refuse to perform their contracted duties.

What is the difference between bill of lading and charter party vs time and voyage charter?

A charter party is an agreement between charterer and ship owner to lease a ship. A bill of lading is an agreement that legally obligates the charterer to carry cargo that has been loaded aboard the ship.

A time charter is a type of vessel chartering whereby the ship owner leases the ship for a set length of time. A voyage charter is a type of vessel chartering whereby the ship owner leases the ship for the duration of a specific voyage.

What are the duties and responsibilities of the ship owner and charterer under a time charter and voyage charter party?

Under a voyage charter, the ship owner assumes almost all responsibility, including hiring and paying crew, and paying for all significant costs associated with the journey. The charterer simply has to pay the ship owner a fee to secure their vessel.

With time charters, ship owners must still hire and pay staff. However, most other significant costs associated with a voyage, such as fuel and port fees, must be paid by the charterer.

Why do ship owners prefer voyage charter over time charter?

Quite simply, they don’t. Ship owners usually prefer time charters, as they ensure that their ship is guaranteed to be chartered for a longer period, generating income throughout.

Voyage charters are short, meaning the ship owner must continually find new charterers to lease the vessel to – something that isn’t always possible. When a new charterer can’t be found, the ship owner loses money.

Please note that charterers are required to take out insurance for both types of charter, to cover them against damage, injury, marine salvage , and more.

Those looking for short-term charters are best served by opting for a voyage charter, as these don’t require a long contract to be signed. They do have a higher initial cost, but this is offset by the fact that no other significant fees need to be paid.

However, those who know they’ll regularly require the use of a vessel might be better off with a time charter, as these see vessels leased for a long period of time. During this time, the vessel can be used to travel anywhere, without restriction. Time charters cost less upfront, but require the charterer to pay various other costs, such as the cost of fuel and port fees.

Have you found this page to be helpful? If so, please share it on social media! Also, feel free to leave a comment below!

DEXTER OFFSHORE LTD

Mazaya Business Avenue – BB2- 1403 – First Al Khail St – Dubai, United Arab Emirates Tel: +971 04 430 8455

MORE INFORMATION

Contact Us About Us Meet Our Team QHSE Policy

CONNECT WITH US

LinkedIn Facebook Instagram YouTube

The ins and outs of ship chartering

Ship chartering is the hiring out the use of a ship by a vessel owner to another company, the charterer, for the transportation of goods. It may sound straightforward enough, but in practicality, it’s anything but simple. There are many different types of charter contracts, various cost components, and of course many different players involved. In this article, we’ll breakdown the ins and outs of chartering, covering how it works, who’s involved and how costs are divided.

- The main players

The two main players in ship chartering are the ship owner and the charterer. There are others as well, the most important being the ship broker. There is also the shipping agent who takes care of the essential in-port details and the ship manager, who takes care of operating and crewing the vessel on behalf of the owner for a fee.

It should be noted that the term charter party refers to the contract itself, and not to the parties entering into the contract. The charter party defines the rate, duration, and terms agreed between the ship owner and the charterer.

The ship owner provides the means for transporting cargo from one port to another. The Charterer enters into a contract with the owner to hire the ship, or space in the ship, for transporting his cargo. In some cases a charterer may own the cargo and employ a ship broker to find a suitable vessel to deliver the cargo for a certain price, called the freight rate.

The charterer may also not have his own cargo, but instead charters a vessel for a certain period of time and trades the ship to carry cargoes at a profit. He can also sub-hire the ship to other charterers in positive market conditions.

The ship broker is essentially a middleman who connects the principals in order to earn a brokerage fee. He can represent either the owner or the charterer in negotiations, and usually specialises in specific areas of cargo carrying. For example, a dry cargo broker focuses on the chartering of bulk carrier vessels. He can represent either an owner looking for a charterer, or a charterer seeking a suitable vessel for shipping his cargo.

Similarly, and as the name suggests, a tanker broker specialises in chartering tanker vessels and has a good understanding of the specific needs for transporting crude oil, gas, oil products, or chemicals.

Shipping Agents are designated to take responsibility for handling shipments and cargoes at the ports on behalf of the owners, fleet managers, and charterers. They handle the essential routine tasks, such as crew transfers, customs documentation, waste declarations and so on, working closely with port authorities. They can also provide detailed information on activities at the destination port, so that the shippers can be aware of situations while the goods are in transit.

- Types of charters

The three most common types of charter contracts are the voyage charter, the time charter, and the demise (or bareboat) charter.

Voyage Charter

The basic hiring of a vessel and its crew for a voyage between the port of loading and the port of discharge is known as a voyage charter. In this type of contract, the ship owner is paid by the charterer either on a per-ton basis, or as a lump sum. Port costs, with the exception of stevedoring, fuel costs, and the crew costs are paid by the owner, and payment for the use of the vessel is known as freight.

Under the terms of a voyage charter, a specific time is agreed for the loading and unloading of the cargo. This is known as laytime, which, if exceeded, obliges the charterer to pay demurrage. Conversely, if laytime is saved, the owner may have to pay despatch to the charterer.

There is also a consecutive voyages clause. This is used when one voyage follows another immediately for an agreed number of voyages within a specific timeframe. The ship is thus going back and forth with an agreed cargo between agreed ports.

Time Charter

A time charter refers to the hiring of a vessel for a specific period of time. Here, the owner still manages the ship, but the charterer selects the ports, decides the routing, and has full operational control of the vessel for the duration of the contract. He pays the fuel costs, port charges, cargo handling costs, commissions, and a daily hire fee.

There is also a trip time charter covering a specific voyage route only for the transportation of a specific cargo. It can be said to be a combination of a voyage charter and a time charter. The responsibilities are similar to those with a time charter (the fixed costs being paid by the owner and the variable costs by the charterer), but as with a voyage charter, the period of the contract depends upon when the voyage is completed.

The Demise Charter

Under the terms of a demise charter, also known as a bareboat charter, the charterer has full control of the vessel. Apart from the capital cost of building the vessel, which is the owner’s responsibility, all other costs including fuel, crew, port charges and insurance, are paid by the charterer. The legal and financial responsibility for the vessel rests with the charterer.

Under the demise clause, the contract can be for long period charters lasting for many years. This is fairly common for tankers and bulk carriers. It can be a form of hire-purchase whereby the charterer eventually acquires ownership of the vessel.

In the leisure industry, the term used is Bareboat Yacht Charter and the Demise Charter term is not used. It is normally a short-term charter for a matter of weeks only. Here, the owner supplies the yacht fully fuelled and in seaworthy readiness. The charterer is expected to pay for the fuel consumed.

Contract of Affreightment

Finally, there is what is known as a contract of affreightment. This is not strictly a charter contract, but is somewhat similar to a voyage charter. Under this type of contract, the owner agrees to transport the goods for the charterer on a specified route and for a specific period of time. More than one ship can be used and, in contrast to a true charter, there is no laytime period and no demurrage is payable.

- Who pays what?

There are various cost components applicable to all charter contracts. These can be summarized as follows:

In all cases, the owner is responsible for the capital cost of building and equipping the ship. The operating costs (OPEX), i.e. operating and maintaining the ship and complying with all applicable rules and requirements, are also paid by the owner in voyage and time charters. In demise charters, however, the operating costs are paid by the charterer.

Periodic costs are those that are incurred at certain intervals of time. These include, for example, periodic technical inspections and surveys for class classification purposes. Here again, the owner is responsible with time and voyage charters, but not for demise charters. In demise charters, it is the charterer who pays such periodic costs.

Voyage costs cover the fuel, any right of passage dues, such as canal dues, towage and piloting costs, as well as port agency costs. With time and demise charters, the voyage costs are paid by the charterer. Only in voyage charters are these costs paid by the owner.

The same is true of cargo handling costs – the cost of loading and discharging the cargo. With time and demise charters this is the responsibility of the charterer, while the owner pays these costs only with voyage charters.

Sign up for our newsletter for latest news, insights and innovations

Vessel Chartering: A Comprehensive Guide to the Benefits and How to Charter a Vessel

Vessel chartering is the process of hiring a vessel for the transportation of goods. It is a vital part of the global shipping industry, as it allows for the efficient and cost-effective movement of commodities around the world.

Types of vessel charters

There are three main types of vessel charters:

- Voyage charter: A voyage charter is a contract for the carriage of a specific cargo from one port to another. The charterer pays the shipowner a freight rate per ton of cargo or a lump-sum amount for the entire voyage.

- Time charter: A time charter is a contract for the hire of a vessel for a specific period of time. The charterer pays the shipowner a daily hire rate and is responsible for the operating expenses of the vessel, such as fuel, crew wages, and maintenance.

- Demise charter: A demise charter is a contract that is similar to a time charter, but with the key difference that the charterer takes on full operational control of the vessel. This includes responsibility for the vessel’s crew, maintenance, and insurance.

Vessel chartering is a complex process that involves a number of different factors, such as the type of cargo being shipped, the size and type of vessel, the distance traveled, and the current market conditions.

Key benefits

Here are some of the key benefits of vessel chartering:

- Flexibility: Vessel chartering offers a high degree of flexibility for both shipowners and charterers. Shipowners can lock in freight rates for a specific period of time, while charterers can secure capacity for their shipments without having to invest in their own vessels.

- Cost-effectiveness: Vessel chartering can be a cost-effective way to transport goods, especially for large shipments. Charterers can often negotiate favorable rates with shipowners, and they can avoid the fixed costs associated with owning and operating their own vessels.