sign up and keep track of your travel insurance events

Video: How to File a Travel Insurance Claim

If you bought travel insurance for your trip and something went wrong, filing a claim is quick and easy with Generali Global Assistance eClaims. Let’s take a look at how to get started.

There are five steps to begin your eClaim:

- First, you will want to find your policy number. You can find your policy number in the policy confirmation letter that you received when you purchased your plan. Once you have it, visit our Claims Portal and enter your policy number in the space provided. If you don’t know your policy number, or don’t have one, select “click here” for more information about how to proceed.

- After entering your policy number or selecting the “click here” link, you should reach the Generali Global Assistance eClaims website. Once you’re here, simply select Start a Claim and follow the prompts to create your eClaims account, login to the portal, and start your claim.

- After logging in and selecting Start Your Claim, enter your policy number or your reservation number to proceed. Notice that you can interact with the chat bot in the lower right side of the screen or visit the FAQ page through the link on the left if you have any questions.

- Now that you’re ready to get your claim started, we’ll need a little information about why you’re filing a claim. You will see a list of the different coverages that are included in your plan and a short description of each. Review the list and select all of the coverages that apply to your situation. Let’s say, for example, your trip was interrupted because your flight was canceled due to a storm. Select Trip Interruption and continue. As you move through the prompts, you will be asked questions for each coverage you selected, such as who was impacted and why, what happened, and the amounts that you are claiming. Continue through each section, acknowledging the fraud warnings and reviewing your information for accuracy.

- The last task to complete before submitting your claim is to provide supporting documents. You will see a list of both required and optional documents to include with your claim. Most of these documents, such as proof of payment for your trip and booking confirmation, are documents that you already have. Depending on the type of claim that you’re starting, you may also be asked to complete and provide other documents that can be accessed by clicking the Document templates link. Once you’ve uploaded all of your documents, submit your claim.

Good work, you’ve submitted your claim. We will assign your case to a dedicated claims team member who will review all of your documents and reach out if they have any questions. At any time, you may also login to the eClaims portal and select ‘Add information’ or ‘Track status of existing claim’ to provide additional documents and check the status of your claim.

More Videos

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

Click to see our Corporate Website

Information note and consent regarding cookies - This website uses its own technical cookies and third party cookies (technical and profiling) in order to improve your browsing experience and provide you a service in line with your preferences. If you click on this banner or close this window or access any element underlying this banner, you'll provide consent regarding cookies. If you want to learn more or prefer to withdraw consent for all or some of these cookies read our Cookie Policy

Travel Insurance

No matter where your travels take you, the last thing you want to do is think about something going wrong. Still, even the best-planned trips can be impacted by an unexpected illness, medical emergency, severe weather, delayed flights, or lost passports or baggage. These troubles can occur when least expected, forcing you to cancel or interrupt your trip, lose your non-refundable vacation costs, and incur unplanned expenses.

Standard, Preferred and Premium travel insurance plans from Generali Global Assistance are specially designed to help protect you and your traveling companions from specific covered events–and are competitively-priced based on factors like your age, destination, and length of trip. Be sure to get the right level of travel protection so you can relax and enjoy yourself.

To buy travel insurance for your trip, cruise or vacation visit Generali Global Assistance.

WITH GENERALI GLOBAL ASSISTANCE YOU GET:

- Coverage for Trip Cancellation, Trip Interruption, Medical and Dental, Baggage, Baggage Delay and more.

- Pre-existing medical conditions can be covered when the Premium Plan is purchased prior to or within 24 hours of final trip payment, if other requirements are met. See Plan Documents for full details.

- Award-winning customer service and responsive, in-house claims processing.

- 10 days to cancel your plan and receive a full refund of your plan cost provided you have not filed a claim or departed on your trip.

- 24/7/365 emergency assistance hotline from anywhere in the world, plus access to a global network of physicians.

- Concierge services with pet relocation assistance, Identity Theft Resolution service, and more

Formerly doing business as CSA Travel Protection, Generali Global Assistance provides the same outstanding customer service and travel insurance plans customers have come to expect over the past 25 years. Generali Global Assistance is with its clients every step of the way, whenever and wherever they are needed, helping them travel smarter.

Travel insurance plans are administered by Customized Services Administrators, Inc., CA Lic. No. 821931, located in San Diego, CA and doing business as CSA Travel Protection and Insurance Services. Plans are available to residents of the U.S. but may not be available in all jurisdictions. Benefits and services are described on a general basis; certain conditions and exclusions apply. Travel Retailers may not be licensed to sell insurance, in all states, and are not authorized to answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance. This plan provides insurance coverage for your trip that applies only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home and automobile policies. The purchase of this plan is not required in order to purchase any other travel product or service offered to you by your travel retailers. If you have any questions about your current coverage, call your insurer, insurance agent or broker. This notice provides general information on CSA’s products and services only. The information contained herein is not part of an insurance policy and may not be used to modify any insurance policy that might be issued. In the event the actual policy forms are inconsistent with any information provided herein, the language of the policy forms shall govern.

Travel insurance plans are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231. Generali US Branch operates under the following names: Generali Assicurazioni Generali S.P.A. (U.S. Branch) in California, Assicurazioni Generali – U.S. Branch in Colorado, Generali U.S. Branch DBA The General Insurance Company of Trieste & Venice in Oregon, and The General Insurance Company of Trieste and Venice – U.S. Branch in Virginia. Generali US Branch is admitted or licensed to do business in all states and the District of Columbia.

- Types of Travel Insurance

- Generali Global Assistance Cost

Compare Generali Travel Insurance

- Why You Should Trust Us

Generali Global Assistance Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Generali Travel Insurance is a reputable travel insurance provider offering generous tiers of travel insurance coverage at reasonable rates. In addition, Generali offers 24/7 global support for travelers who need assistance with planning, health emergencies, and other issues that may arise.

Generali's travel insurance branch is part of the Assicurazioni Generali Group, and its support team is part of the Europ Assistance Group. Both are well-established groups within the travel insurance industry. Ideally, this would translate to a travel insurance company with first-class service and coverage. The question for many consumers is simple: does Generali live up to customers' expectations?

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 3 plans with diverse coverage including sporting equipment and medical and dental

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Buyers can get up to $1 million in emergency assistance coverage with the premium plan

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable premiums

- con icon Two crossed lines that form an 'X'. CFAR coverage is expensive relative to standard policies

- con icon Two crossed lines that form an 'X'. CFAR only covers up to 60% of non-refundable costs

- con icon Two crossed lines that form an 'X'. Multiple reviews indicate claims team didn’t start processing claims until policyholders called more than 30 days after filing

Generali Global Assistance Travel Insurance Review: Types of Policies Offered

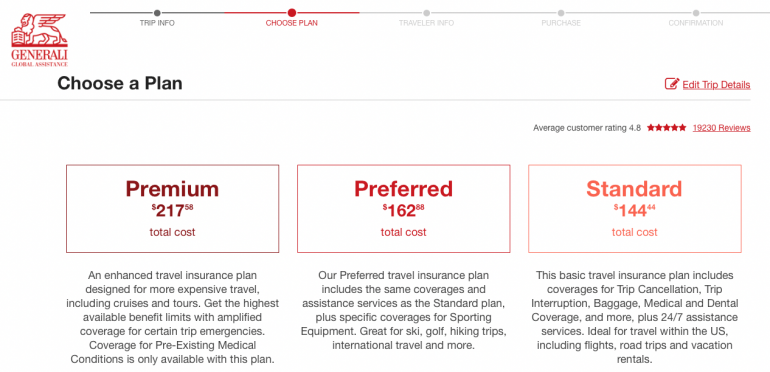

Generali offers three tiers of travel insurance coverage: Premium, Preferred, and Standard.

Its site has a simple plan comparison chart and quoting system to help potential buyers choose between the three options.

Generali travel insurance covers baggage delay and loss, travel delay, interruption, cancellation, and missed connection reimbursement benefits.

Here are some of the highlights for each plan to help you better understand what coverage you may need:

Generali's Premium plan offers generous coverage for various scenarios. For example, you'll enjoy up to 175% reimbursement of your trip cost if your travels are interrupted for reasons beyond your control. Generali's Premium plan also includes up to $1,000 per person in travel delay reimbursement and up to $1 million per covered individual for emergency assistance or transportation. Finally, it has up to $2,000 per person in replacement expenses (i.e., toiletries, clothing, and other necessities while you wait for your delayed bag) if your baggage is lost.

With the Preferred plan, you can expect 150% reimbursement for inevitable trip interruptions. It also offers travelers up to $1,000 per person for travel delay reimbursement. In addition, the emergency assistance or transportation coverage drops from $1 million to $500,000 per person, and travelers can enjoy up to $1,500 per person if baggage is lost.

The Standard Plan offers the lowest coverage with more budget-friendly premiums. It offers up to 125% reimbursement for trip interruption and up to $1,000 in travel delay reimbursement. Policyholders are limited to $250,000 per person for emergency assistance or transportation. If your baggage is lost, you'd have $1,000 to replace toiletries, clothing, and other belongings.

You can compare Generali's three plans below.

Additional Coverage Options

Generali Travel Insurance offers two add-on services alongside your base travel insurance plan:

Trip cancellation for any reason (CFAR)

Cancel for any reason (CFAR) coverage reimburses you for nonrefundable expenses associated with canceling travel you've already paid for. Generali's Premium plan is eligible for CFAR coverage which pays you back for 60% of the total nonrefundable cost of your travel.

You must purchase CFAR coverage on your Premium plan within 24 hours of your initial deposit. However, eligible customers can take advantage of its full benefits, as the name suggests, for any reason. Medical problems, family emergencies, work scheduling issues, or just changing your mind are a few of the reasons Generali might pay a CFAR claim.

Preferred and Standard plans are not eligible for CFAR upgrades. New York residents are also not eligible for CFAR coverage. Generali's website estimates buyers will pay an additional 50% in travel insurance premiums for this rider while the max reimbursement is only 60% of the "penalty amount" (i.e., nonrefundable costs).

Rental car damage protection

Travelers can also purchase rental car coverage alongside their travel insurance policy. Premium plan customers already have up to $25,000 in rental car protection in their policy benefits. Preferred and Standard plan holders can purchase the same coverage amount.

Texas residents are not eligible for rental car coverage. If you're unsure about this rider, we recommend checking the limits of your auto insurance. Generally, US-based auto insurance extends to rental cars. But you may want to supplement your coverage depending on what you already have.

Generali Global Assistance Travel Insurance Cost

We priced out a 9-day trip to two European countries for a healthy 34-year-old solo traveler from Texas staying in hotels and traveling by plane and train.

Here's what Generali's travel insurance estimate generator quoted for the trip:

Premium - $115

Preferred - $100

Standard - $86

CFAR coverage for this trip would cost an additional $57.50 if purchased alongside the Premium plan. But, again, the CFAR rider is only available with the premium plan.

How to File a Claim with Generali Travel Insurance

To file a claim with Generali's travel insurance division, start at the eClaims portal .

You can also call its claims department at 800-541-3522 for assistance. Generali promises all insurance claim calls will be returned within one business day, and most calls are returned on the same day they are received. Many people reported quick claims processing and reimbursement when we reviewed recent customer feedback.

However, several reviews described waiting over 30 days only to discover Generali had yet to review their claims submission. As such, if you are still waiting to receive a response indicating Generali is working on your claim within a few days, we recommend checking in with customer service.

You'll need to provide supporting documentation for your claim, such as proof of travel delay from the airline or relevant claim checks for lost baggage. Your eClaims portal should give you the necessary details and update you on the ongoing status of your claim. Email the claims team for questions at [email protected] or use the eClaims chatbot for automated assistance.

Learn more about how Generali Travel Insurance compares to popular travel insurance companies.

Generali Global Assistance Travel Insurance vs. Nationwide Travel Insurance

Nationwide Travel Insurance is part of an extensive network of insurance products. Unlike Generali, you'll recognize any Nationwide product as it's listed on the same website. In addition, Nationwide offers bundling discounts, depending on what you're buying. It also sells short-term and long-term insurance plans (like auto and home).

This established insurance company has been in business since 1925. Its travel insurance wing offers plans and coverage options to suit diverse travelers' needs. Customer review sites like TrustPilot had reviews complaining about long wait times and claims overlooked with Generali. Nationwide's reviews described long processing times, poor communication, and other claims-based issues.

If you're solely concerned about coverage and rates, Generali is upfront about the fact that its CFAR coverage is exceptionally costly. The company's website seems to imply the CFAR rider's cost is bloated compared to its value. But its basic plans have a few more perks compared to Nationwide's single-trip plans while Nationwide offers cruise plans and multi-trip options, Generali does not match at the time of this review.

Nationwide Travel Insurance Review

Generali Global Assistance Travel Insurance vs. Allianz Travel Insurance

Allianz Travel Insurance is another reputable insurance company that has been in business since 1890. Allianz is one of the biggest names in travel insurance, serving more than 55 million travelers across dozens of countries.

Both Generali and Allianz offer comprehensive single-trip coverage options for travelers. Generali's website makes reviewing and comparing its three travel insurance plans easy. However, Allianz offers annual (multi-trip) policies Generali doesn't. Both companies list rental car protections for some travelers.

Allianz customers leaving reviews online indicate the claims process may be confusing and drawn out. Most importantly, a few reviews cautioned future travelers to come in with complete documentation. In our experience, offering more paperwork rather than less with Allianz is better.

Allianz Travel Insurance Review

Generali Global Assistance Travel Insurance vs. InsureMyTrip

InsureMyTrip.com is an insurance broker using your travel details to collect insurance company bids on your behalf. You can enter your information and get multiple quotes back. As a result, Generali may be one of the insurance providers providing you with a quote through InsureMyTrip. Rates may not match what a provider would offer on its website. Broker websites like InsureMyTrip often charge a premium to account for third-party fees or offer discounts as a partner company knows it's competing for customers no matter what. Whatever the case, InsureMyTrip makes it easier to shop for travel insurance. However, it would not process any claims. So for some consumers, it may be more complicated to determine where to go to make a claim against their policies or get help if something goes wrong.

InsureMyTrip Travel Insurance Review

Why You Should Trust Us: How We Reviewed Generali Global Assistance Travel Insurance

When evaluating travel insurance companies, we consider various factors, including the number of plans available, the coverage, feedback from customer reviews, average premiums, customer support, ease of filing claims, and reimbursement times. No single factor can truly determine how travel insurance companies stack up.

These factors together allow us to develop ratings for each travel insurance company. Then we break down the pros and cons, pointing out potential issues. We also aim to bring to light solutions other buyers have already found should you choose to work with the travel insurance provider being reviewed. All of this is explained further in our insurance rating methodology .

Generali Global Assistance Travel Insurance FAQs

Generali Travel Insurance is part of an insurance network active since 1831. It offers three travel insurance plans with generous tiers of coverage at reasonable rates, and the company maintains an A financial rating with AM Best. This rating indicates Generali Global Assistance is likely to continue to meet its financial obligations.

You can file your travel insurance claim with Generali travel insurance through the company's eClaims portal. However, Generali offers phone, email, and other options for customers filing claims. Generali's responses to reviews on TrustPilot indicate it aims to process all claims within 30 days.

Generali is part of the Assicurazioni Generali Group. Across all its insurance products, it has 67 million customers across 50 countries.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

800-874-2442

"Generali wins out among the best travel insurance companies for its happy combination of below average fees for above average travel coverage."

“My husband and I were really surprised by how very smoothly and quickly we received our check.”

“We were thrilled when we found out everything was being covered.”

“I will absolutely use this company to insure my future trips.”

Take the Worry and Stress Out of Travel With Our Award-Winning Travel Insurance

Terms of Use | Privacy Policy | California Privacy Policy | Do Not Sell My Personal Information | © Forbes Advisor, 2021

Trusted by over 6 million travelers every year

Copyright© 1997 - 2024 CSA Travel Protection DBA Generali Global Assistance & Insurance Services, Company Code: 805-93, Approval Code: A 353 17 05

Travel insurance coverages are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures .

Compare Plans

Frequently Asked Questions

Can i be covered for a pre-existing medical condition.

If you purchase our Premium plan you can qualify for coverage for pre-existing medical conditions, as long as the travel protection plan is purchased prior to or within 24 hours of your final trip payment, you are medically able to travel at the time the plan is purchased, and all prepaid trip costs that are subject to cancellation penalties or restrictions have been insured.

At our Travel Insurance Definitions page , you can see how we define Pre-Existing Conditions or see Plan Documents for full details.

How does travel insurance work?

If something happen during your trip and you need to use your travel insurance, you’ll need to file a claim to be reimbursed. We have a page that explains how to start a claim , a great resource for learning more about the claims process.

Let’s say your baggage is delayed* and you need to buy clothes and toiletries, you would submit a claim to seek reimbursement. Travel insurance comes in handy in scenarios like this.

Oftentimes, travel insurance is offered when buying a cruise, airfare or booking a vacation rental. We encourage customers to pay attention to the fine print when considering insurance provided by travel suppliers. For example, a cruise line’s travel insurance may not pay cash to cover a cancelled or interrupted cruise, but instead offers credit towards a future cruise. If you prefer cash reimbursement, that’s reason to consider purchasing directly from a travel insurance provider instead.

We recommend bringing a print out of your plan documents with you when traveling so if you are affected by a storm and lose power or can’t connect to the internet, you’ll still know what number to call and what instructions to follow.

* Baggage Delay coverage can only be claimed if the delay lasts for the amount of time specified in the Schedule of Benefits

How Travel Insurance Can Help

Problems happen with travel plans more often than you might think. One in six U.S. adults reported having to cancel, interrupt or delay their trip.¹ Travel insurance can help protect your vacation investment from certain unforeseen events that could upset your travel plans and cost you.

Find the Plan That Fits Your Trip Best

There’s no better way to understand how travel insurance and assistance can help protect you and your trip than reading real life examples from fellow travelers.

When is the best time to get travel insurance?

We suggest you buy a travel insurance plan when you make your first trip payment, like airfare or a cruise. That way you have a long coverage period in case you need to cancel your trip. Later on, you can add coverage to the same plan for your hotel, tours and other pre-paid, non-refundable trip costs. It’s best to contact us to add coverage soon after you make new trip payments to be sure you have coverage for your full trip cost.

What are the benefits of travel insurance?

Generali Global Assistance offers a variety of plans and add-on coverages to help protect your trip. Our plans can help with a number of unexpected problems, including trip cancellations and interruptions ; travel delays ; lost, damaged and delayed baggage ; and unexpected sickness, injury and medical evacuation . Additionally, our 24-Hour Emergency Services , Concierge and ID Theft Resolution services are included with our plans. These services round out our travel protection plans to provide real-time assistance when you need it on your trip.

In addition to providing added peace of mind, travel insurance can also help international travelers satisfy passport insurance requirements. Depending upon your country of residence and where you’re traveling to, you may be required to possess passport insurance for emergency hospital treatment and emergency medical evacuation before you’re permitted to enter your destination country or receive your visa. For instance, if you’re traveling to a Schengen country, our Standard , Preferred or Premium plans fulfill the Schengen visa insurance requirements.

See more coverage details

Sources: 1. U.S. Travel Insurance Association survey 2. Centers for Disease Control

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Generali Global Assistance Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Generali Global Assistance plans and costs

Which generali travel insurance plan is best for me, coronavirus considerations, how to choose a generali plan online, what isn’t covered with generali, generali insurance, recapped.

- Three plan options.

- Includes wide ranging COVID coverage.

- The premium plan includes pre-exisiting medical condition coverage.

- Rental car coverage only on highest cost plan.

- CFAR only covers 60% of travel costs (75% is found elsewhere).

- Baggage delay benefits don't kick in until 24 hours on the Standard plan.

More travelers than ever are considering travel insurance, but navigating the vast seas of insurance companies and coverage options can leave you feeling less than enthused about your next trip. But if you want to protect your investment, Generali Global Assistance is a notable provider. Here’s what to expect and the plans the company offers.

Generali offers three different plans (Standard, Preferred or Premium), depending on what type of trip you’re planning. Each offers a different level of coverage and benefits.

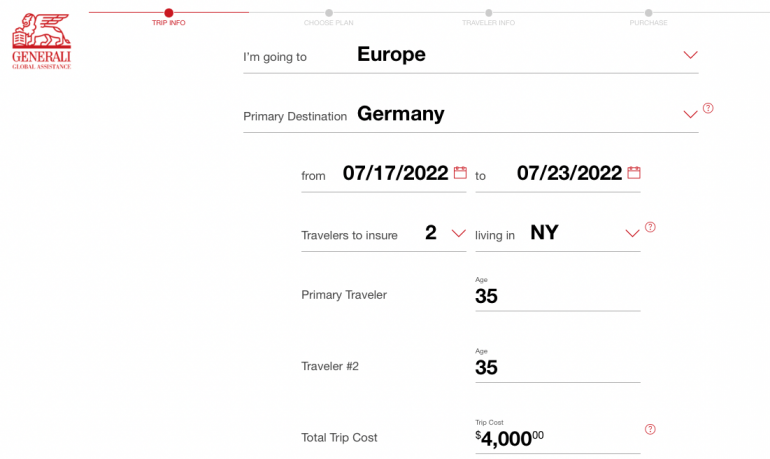

Generali plan cost

Here’s a closer look at what a standard coverage plan with Generali might cost. Let’s say you and your partner — two travelers in their thirties — are planning to take a roughly $4,000 trip from New York to Germany for one week.

For this itinerary, a Generali Standard plan would cost $144. Rental car coverage isn’t included, but you can add it to your plan for $63 for the week.

The Preferred level of coverage can be a good option for those traveling with expensive gear like golf clubs or skis. For the same sample itinerary, a Generali Preferred plan would cost $162, an $18 upgrade from Standard. Rental car coverage is also extra.

The Premium plan is designed for luxury travel or vacations with a high price tag. Notably, this plan includes rental car insurance for no extra fee. Also important to note that only the Premium plan offers coverage for pre-existing medical conditions . A Generali Premium plan for our sample itinerary would cost $217, a $55 upgrade from Standard.

» Learn more: How to cancel a flight with travel insurance

It’s important to choose the right coverage for you and your trip based on your needs and what each plan covers. So make sure to look at each carefully.

If you have pre-existing medical conditions, your best bet will be to stick with the Premium plan. It’s more expensive, but you’ll be covered no matter what medical issues arise on your trip.

The Standard plan is the only one with no coverage for accidental death and dismemberment during on-the-ground travel (air travel is covered, though).

If you’re traveling with sports equipment, you may want to opt for one of the top two tiers of coverage. Just make sure to accurately estimate how much your gear is worth to ensure you’re getting the coverage you need.

If your trip is worth more, you’re bringing more luggage, etc., consider more expensive coverage. That way, if something goes wrong, you, your possessions and plans are more fully protected.

Unlike some other travel insurance companies, Generali (formerly known as CSA Travel Protection or colloquially as CSA Travel Insurance) offers COVID-19 coverage with every plan. That means that if you, a family member or a travel companion test positive for COVID-19 before or during your trip, you’ll be covered for trip cancellation and interruption, travel delay, medical and dental, and emergency assistance and transportation.

You’ll also be covered if you have to extend your trip due to quarantining or isolation and can’t return home on schedule.

You do have to meet certain requirements to qualify — such as using an approved test and taking it while in front of an authorized supervisor.

When it comes time to get a quote and choose your travel insurance plan, you can do so on the Generali website. Type in trip details like destination, where you’re from, your age, the total cost of the trip and your travel dates. Quotes for all three tiers of plans will be presented.

Then, select add-ons like rental car insurance if you’re not opting for the Premium plan and start the checkout process.

Like many travel insurance policies, there are several incidents that aren’t covered by Generali travel insurance. Examples include injuries that result from mental disorders, pregnancy, injuries as a result of being under the influence of drugs or alcohol, or if you are flying an aircraft yourself.

Destination matters, too. As of publication, you can’t get coverage for travel to Belarus, the Crimea Peninsula, Cuba, Iran, North Korea, Russia, Syria or Ukraine. Also, you won’t be covered for anything that results from acts of war or civil disorder.

If you’re participating in extreme sports or activities like skydiving, mountain climbing or backcountry skiing, many benefits won’t be covered.

No matter what policy you choose, read the fine print before your buy, including everything that’s excluded from coverage. That will help ensure there are no surprises if your trip goes awry.

Generali provides three tiers of travel insurance for those who want to protect their nonrefundable trip expenses and/or who want to have a safety net in case their travels are disrupted or canceled.

Just like with any travel insurance policy, check to see if you’re already covered before you buy ( many travel credit cards offer travel insurance ), determine what kind of coverage you need and how much, and always read the details of what is and isn't included in coverage. That goes for policies available from Generali Travel Insurance as well as other providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Generali Global Assistance Travel Insurance Review — Is It Worth It?

Content Contributor

66 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Editor & Content Contributor

151 Published Articles 741 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Stella Shon

News Managing Editor

87 Published Articles 626 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Who Can Get Generali Global Assistance Travel Insurance?

Covid-19 coverage, optional add-ons, generali global assistance coverage types and benefits, coverage exclusions, generali global travel assistance standard plan, generali global travel assistance preferred plan, generali global travel assistance premium plan, how much does generali global assistance travel insurance cost, generali global assistance travel insurance vs. competitors, generali global assistance travel insurance vs. credit card insurance, tips for ensuring a smooth claim process, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

It’s not fun to think about, but part of trip planning includes considering the “what ifs.”

These include questions like: What if you have to go to the hospital during your trip? What if your flight home is canceled and you have unforeseen expenses as a result? What if you wreck the fancy convertible you rented to drive around the island or contract an illness that causes you to miss your flight home?

Generali Global Assistance is a U.S.-based travel insurance provider that offers 3 different plan levels (Standard, Preferred, and Premium) for trips of differing lengths and travel groups of various sizes. Its plans are available for both domestic and international travel and come as packages, rather than needing to purchase coverage elements independently.

Is Generali Global Assistance travel insurance right for you? Here’s what you should know.

Generali Global Assistance plans are available only to U.S. residents . And while plans are available for both domestic and international travel, not all destinations are covered .

Exclusions include Afghanistan, Belarus, Crimea and the Donetsk and Luhansk People’s regions, Cuba, Iran, Myanmar, North Korea, Russia, Syria, and Venezuela. Additionally, the Generali Global Assistance website says it has limited ability to help you if you’re visiting Ukraine.

What Does Generali Global Assistance Travel Insurance Include?

Before diving into the coverage terms and benefit types, let’s consider what’s included for all customers, regardless of which plan is chosen.

All customers get a “free look period” of up to 30 days, depending on their state of residence. This period allows you to get a full refund if you decide your Generali Global Assistance plan isn’t the right travel insurance plan for you. However, you can’t receive a refund if you’ve started your trip or if you’ve submitted a claim.

You’re also covered for financial insolvency of your common carrier as part of your trip cancellation and trip interruption benefits. Finally, you’ll have access to telemedicine consultations with any plan type, helping you access a doctor in non-emergency cases.

COVID-19 coverage applies under multiple policy benefits. If you meet the requirements , you can be reimbursed for 100% of your expenses and even have your policy extended until your quarantine period ends and you’re able to travel home.

This coverage applies to you, your traveling companions, and family members as long as you purchase your travel insurance plan before getting sick or visiting a doctor. Coverage applies also when you test positive, including at-home tests if they include video supervision.

There are 2 optional add-ons that merit discussion, as well. Cancel for Any Reason (CFAR) coverage isn’t included with any Generali Global Assistance travel insurance plans . However, you can add it to your Premium plan as long as you do so within 24 hours of making the first payment or deposit toward your trip.

Another add-on with Premium plans is coverage for pre-existing medical conditions . To get this coverage, you must add it to your plan before or within 24 hours of your final trip payment. Pre-existing conditions coverage applies if you’re medically able to travel at the time you buy the plan and if all prepaid trip costs with cancellation fees are insured.

Ensure you add Cancel for Any Reason or pre-existing conditions coverage to your plan within 24 hours. Otherwise, you’ll lose these options.

When considering a travel insurance plan, you’re probably assuming that you get more coverage when you pay more. That’s largely true. Benefit coverage amounts will be higher on premium plans from the same provider. But that’s not necessarily true when comparing providers to each other.

In order to know what you’re looking for in a travel insurance policy, you should first understand what the types of coverage are:

- Cancel for Any Reason (CFAR) Coverage: This add-on policy covers up to 60% of your losses if you cancel for reasons not covered in other sections of your policy.

- Pre-existing Medical Conditions: Available only with the Premium plan, your current medical conditions may be covered if you buy a plan before or within 24 hours of making your final trip payment and are medically able to travel at the time of purchase.

- Trip Cancellation Insurance: You’ll receive reimbursement for prepaid, non-refundable costs if you cancel a trip for one of the covered reasons listed in your policy.

- Trip Interruption: Once you start your trip, this coverage goes into effect and can reimburse non-refundable costs from lost portions of your travel plan. It also can cover costs to catch up with your trip if there are delays for covered reasons.

- Trip Delay: You can be reimbursed for meals, parking, transportation, and other expenses incurred because of delays. This coverage goes into effect after a delay of 10 hours with the Standard plan, 8 hours with the Preferred plan, or 6 hours with the Premium plan.

- Baggage Loss or Damage: This coverage is secondary to homeowner’s or renter’s insurance and covers lost, damaged, or stolen baggage — including the items inside, with some exceptions. This coverage may even reimburse the cost of replacing a passport during your trip.

- Baggage Delay: If your luggage is delayed, you can be reimbursed for reasonable costs incurred while waiting for it to arrive, such as clothes and toiletries. Reimbursement only applies after delays of 24 hours with the Standard plan, 18 hours with Preferred, or 12 hours with a Premium plan.

- Sporting Equipment Loss or Damage: Similar to baggage coverage, this section specifically applies to sporting equipment you take on your trip.

- Sporting Equipment Delay: You’ll be reimbursed for costs incurred while waiting for delayed sporting equipment, such as needing to rent skis until yours arrive. Required delays are 18 hours with Preferred plans and 12 hours with Premium plans.

- Missed Connection: This coverage applies only to cruises and tours and covers your extra costs to catch up with your travel plans and/or lodging and meals during your delays. Coverage applies to flights that are canceled or delayed for at least 3 hours because of inclement weather.

- Medical and Dental: This protection covers illnesses and injuries during your trip and the resulting expenses. It also can cover deductibles or unpaid expenses from your health insurance provider.

- Emergency Assistance and Transportation: If you encounter an emergency or medical situation where adequate healthcare isn’t available nearby, you can be evacuated to an appropriate facility. This policy also covers returning your remains to the U.S. or local burial costs in the event of death.

- Accidental Death and Dismemberment — Air Flight Accident: This coverage provides payments if you lose life, limb, or sight during a flight. In case of death, the payout goes to your designated beneficiary.

- Accidental Death and Dismemberment — Travel Accident: Similar to the coverage above, this covers loss of life, limb, or sight during other types of travel (not flights).

- Rental Car Damage: You’re covered for collision damage, theft, vandalism, natural disasters, or damages for reasons beyond your control. Some types of vehicles are excluded, but coverage applies to all drivers listed on your rental agreement. Coverage is up to the cash value of the car or the cost of repairs and related costs — whichever is less. This coverage isn’t available to residents of Texas.

It’s also important to note that each section has rules and restrictions about which costs are covered, when coverage applies, and other terms you must follow.

Sometimes, understanding what’s not included may be more important than comparing prices between Generali Global Assistance plans and other companies selling travel insurance.

Why is that? Well, exclusions are built into every insurance benefit , and it’s important to know if your particular trip, destination, or activity is excluded from coverage. Having robust travel insurance won’t help if it doesn’t cover your specific situation.

For example, you aren’t covered if you sustain injuries while intoxicated or for medical emergencies related to pregnancy . You also aren’t covered when you’re the one flying a plane or you’re participating in extreme sports .

Coverage excludes war zones and certain destinations , as well. These include Belarus, Cuba, Iran, North Korea, Russia, Syria, and disputed regions of Ukraine.

Comparison of Generali Global Assistance Plans

The Standard plan provides the most common coverage elements , reimbursing you for canceled, delayed, or interrupted trips if the reasons meet those outlined in your policy.

While you won’t be covered for sporting equipment problems or death/dismemberment anywhere outside a plane, you can be covered for medical problems and even missed connections. And if you use a credit card with rental car insurance , you may not be concerned about not having this coverage in your policy.

The Preferred plan includes everything in the Standard plan but with greater coverage amounts in nearly every category . Rental car coverage is still missing, but you’ll gain coverage for sporting equipment delays and damages/losses and coverage for death or dismemberment throughout your trip.

This is the only plan that includes car rental damage and is the only plan allowing for add-on coverage related to pre-existing medical conditions or canceling for any reason. It has the greatest coverage limits of any plan . It even includes $1,000,000 in emergency assistance and transportation coverage.

If you want coverage for pre-existing medical conditions or Cancel for Any Reason coverage, those are only available as add-ons to a Premium plan.

If you want coverage for pre-existing medical conditions, you must add this option before or within 24 hours of your final trip payment and must be well enough to travel at the time you purchase the policy. Cancel for Any Reason coverage is an optional add-on here, as well, and it must be added within 24 hours of your first payment toward the trip.

Let’s look at some sample plans to see how much a policy costs. This will give you a better idea of whether these plans fit your budget.

How Generali Global Assistance Travel Insurance Compares To Other Options

Before buying a travel insurance policy from Generali, it’s worth understanding how its plans compare to popular competitors like Seven Corners and WorldTrips . We priced a 5-day trip to Mexico in November 2023 for a family of 4 (ages 40, 39, 10, and 8) with a trip cost of $3,000 using Squaremouth. The first trip deposit was made in the past 24 hours in this estimate.

WorldTrips’ plan is significantly cheaper , despite all 3 offering similar trip cancellation, COVID-19, and terrorism-related coverage. Generali has the highest trip interruption amount — a full 25% higher than the other 2 options.

All 3 plans have the same coverage for medical-related cancellations, CFAR, and trip interruptions. Only WorldTrips has coverage for work-related cancellations .

While all 3 have the same coverage for medical evacuation , the emergency medical benefits are vastly different . Seven Corners offers $500,000, Generali has $250,000, and WorldTrips has just $150,000.

Generali Global Assistance charges more than some competitors without providing higher benefit thresholds across the board. The real differentiator is in trip interruption and emergency medical benefits. If you don’t need higher coverage in these areas, other companies may have better price-per-benefit options for you.

Before deciding to buy an insurance policy for an upcoming trip, understand that your credit card may provide some of the same coverage.

However, how you trigger that coverage can vary — such as whether you need to pay the full amount of the trip or just part of it with your card (or whether using points to pay qualifies). Here’s a look at how Generali’s Premium Travel Insurance Plan compares to coverage with The Platinum Card ® from American Express , Capital One Venture X Rewards Credit Card , Chase Sapphire Preferred ® Card , and the Chase Sapphire Reserve ® .

Always review and compare your options, whether that’s with another travel insurance company or travel insurance with a credit card .

You hope you never have to use your travel insurance. If you do, however, there are certain things you can do to improve the claims process.

First, save all receipts , especially if you buy new equipment or clothing for your trip. Insurance claims will use depreciation when evaluating how much lost/damaged items are worth. If your items are brand new, you’ll want to prove that they haven’t depreciated in value. You also want to save all receipts for your reimbursement claims. These include hospital visits, medications, meals during flight delays, etc.

Additionally, ensure you read the terms of your policy and that you understand them . This way, you’ll know what is and isn’t covered. This will help you avoid submitting claims for items that aren’t covered or purchasing items for which you won’t be reimbursed.

Finally, ensure you cover all costs associated with your trip . This is especially true for any parts of your trip with change or cancellation policies. When you must purchase your policy in relation to first payments and final payments changes depending on what coverage you want. Make sure you know this and get the right coverage at the right time to cover everything you need.

If you need to file a claim, you can do so in the online claims portal . You’ll start by putting in your policy number, which is included in your original confirmation email. From here, the site will guide you through the claims process. If you’ve lost the confirmation email and don’t know your policy number, you can call 800-541-3522 or email [email protected] .

Travel insurance is something you hope you never need. In an ideal world, your flights would all arrive on time and you’d never get hurt.

Unfortunately, however, things can and do go wrong. Generali Global Assistance offers 3 travel insurance plans with various coverage types and optional add-ons. Refer to this guide often to fully understand their similarities and differences to help you choose the right one for your next holiday.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For the baggage insurance plan benefit of the Amex Platinum card, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the car rental loss and damage insurance benefit of the Amex Platinum card, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the premium global assist hotline benefit of the Amex Platinum card, eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, card members may be responsible for the costs charged by third-party service providers.

For the trip delay insurance benefit of the Amex Platinum card, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of the Amex Platinum card, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is generali global assistance good insurance.

Generali offers multiple, robust insurance plans. After more than 26,000 customer reviews, Generali Global Assistance has a 4.8/5 rating on its own site, 4.36/5 average on Squaremouth, and 3.5/5 on Trustpilot.

How big is Generali Global Assistance?

It’s part of Assicurazioni Generali Group, one of the 50 biggest companies in the world, and Generali Global Assistance is one of the largest insurance providers in the world. It’s available in 60 countries on 5 continents, employing more than 75,000 people worldwide.

Who owns Generali travel insurance?

Generali Global Assistance is part of Assicurazioni Generali Group, headquartered in Italy. However, the U.S. division was founded in 1935. It maintains staff and support centers in San Diego and Pembroke Pines, Florida.

How do I contact Generali Global Assistance?

For 24-hour emergency assistance, call 877-243-4135 or 240-330-1529 from outside the U.S. For customer service, call 800-874-2442. You can file a claim online or email [email protected] .

How do I file a claim with Generali Global Assistance?

You can file a claim online or email [email protected] . You also can call 24-hour customer service for help with your claim. The U.S. phone number is 800-874-2442.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Generali Global Assistance Travel Insurance Review (2024)

Planning a trip? Read our review of Generali travel insurance to see if its policies offer the coverage you need.

in under 2 minutes

If you’re planning an international or domestic vacation, consider protecting your trip with travel insurance. The Generali Group is one of the most popular U.S. travel insurance providers. It’s our travel insurance pick for emergency assistance. It has extra policy inclusions, such as rental car collision coverage and sporting equipment benefits. Let’s see if this insurance provider is the best option for your upcoming trip — and if it is worth the price.

Learn more about the benefits of Generali travel insurance, what you might pay for coverage and how to get a quote.

- Average Cost: $201

- BBB Rating: A+

- AM Best Score: A+

- Medical Expense Max: $250,000

- Emergency Evacuation Max: $1,000,000

Our Take on Generali Global Assistance Travel Insurance

We gave Generali Global Assistance 4.5 out of 5.0 stars , with top marks for its emergency assistance features. Its trip interruption and travel delay coverages are generous, with up to 175% coverage for trip interruptions. Generali’s policies also offer to cover sporting equipment and baggage loss and delay , which is beneficial if you bring expensive equipment with you. All of Generali’s plans also include 24/7 multi-lingual support — a lifesaver if there’s an international emergency.

Generali’s travel insurance could be less valuable for you if you’re shopping for the most affordable coverage . In our review, we found that two people are likely to pay almost $300 on average for an international policy, which is less than budget options like Faye or Trawick. Generali’s CFAR reimbursement option also only covers 60% of trip costs, which is disappointing compared to other insurers.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Pros and Cons of Generali

Generali travel insurance plans.

Generali’s travel insurance policies are significantly more inclusive compared to the specific inclusions found on competitors’ policies. Coverages are generous. For example, while providers like Trawick have trip interruption coverage of 100% of plan expenses, Generali’s plans cover more — up to 175% of costs. These policies also have standardized items like sporting equipment and rental car coverage, which are usually add-ons with other providers.

Let’s look at Generali’s three plans: Standard, Preferred and Premium.

Standard Plan

Generali Travel Insurance’s basic trip coverage option is its Standard Plan. It includes a range of policy inclusions despite its low price point . You’ll find these protections on the Standard Plan:

- 100% of trip cancellation costs

- 125% of trip interruption costs

- $50,000 worth of coverage for emergency medical and dental expenses

- $1,000 ($150 per day) to cover accommodations and other expenses caused by trip delays

- $250,000 for medical evacuation and repatriation

- $1,000 in baggage coverage

- $200 per person for baggage delay

- $50,000 worth of accidental death and dismemberment (AD&D) coverage (flights only)

All Generali plans carry 24/7 travel concierge services, which help you access local medical care and emergency services. This inclusion is a major benefit if you visit a country where you cannot speak the primary language. It includes telemedicine, no out-of-pocket medical expenses and identity theft coverage, even the lowest-tier policy.

In addition to the Standard Plan, Generali offers two higher coverage tiers, which have extra and extended benefits.

Preferred Plan

The Preferred Plan is Generali’s middle-tier coverage and is useful for sports travelers because of its standard equipment coverage. The Preferred Plan includes all the benefits from the Standard Plan, plus these extra items or extensions:

- 150% of trip interruption costs

- $150,000 worth of coverage for emergency medical and dental expenses

- $1,000 ($200 per day) to cover accommodations and other expenses caused by trip delays

- $1,500 in baggage coverage

- $1,500 coverage for sporting equipment

- $300 for sporting equipment delays

- $300 per person for baggage delays

- $750 for missed connections

- $500,000 for medical evacuation and repatriation

- $75,000 worth of AD&D coverage (flights only)

- $25,000 worth of standard non-flight AD&D coverage

- Coverage for financial insolvency of your tourism and travel vendors

Premium Plan

The Premium Plan is Generali’s most comprehensive travel insurance plan, promoting coverage for extended medical and baggage incidents. It includes all of the coverage ranges found on the Preferred Plan, plus the following extra benefits and extensions:

- 175% of trip interruption costs

- $250,000 worth of coverage for emergency medical and dental expenses

- $1,000 ($300 per day) to cover accommodations and other expenses caused by trip delays

- $2,000 in baggage coverage

- $2,000 coverage for sporting equipment

- $500 for sporting equipment delays

- $500 per person for baggage delay

- $1,000 for missed connections

- $1 million for medical evacuation and repatriation

- $100,000 worth of AD&D coverage (flights only)

- $50,000 worth of standard AD&D coverage

- $25,000 worth of rental car collision coverage

The premium plan is the only one of Generali’s travel insurance plans that covers pre-existing conditions and that allows you to add CFAR coverage.

Generali Add-On Options

Add-ons, also known as insurance riders, are optional benefits you can add to a travel insurance policy to increase your coverage. Generali Global Assistance has fewer travel plan add-ons than some other companies. You can add the following two coverages to your policy:

- Rental car damage: This add-on covers costs associated with rental car damages while traveling. You can add it to the Standard or Preferred plans, and it’s automatically included in the Premium Plan.

- CFAR coverage: Extends your trip cancellation benefits to cover situations outside your standard policy. Generali only allows you to add this coverage to its Premium policies.

Cost of Generali Travel Insurance

The coverage tier you select plays a major role in your cost. Higher tiers of travel insurance include more expensive coverages and a wider selection of reimbursements, which increases the insurer’s financial risk. So, higher levels of coverage are more costly than lower tiers.

In our travel insurance review, we found the average traveler can expect to pay between $70 and $751 for coverage. The price is a bit more expensive than competitors like Faye, which specializes in budget policies.

The overall cost of your trip also affects travel insurance costs. Browse our table to get a better idea of how different types of trips may affect cost.

Use the chart below to compare Generali's average cost to competitors:

Generali Domestic Travel Insurance

Generali also offers travel insurance coverage on U.S. domestic trips. Our table summarizes what a 30-year-old couple could expect to pay for each of Generali’s plans on a $5,000 trip to New York.

Read More: Travel Insurance For Parents Visiting The USA

Generali Travel Insurance Reviews

Generali travel insurance holds 3.5 out of 5 stars from almost 250 customer reviews on Trustpilot. Many satisfied customers report that the process of getting an insurance policy is simple and the coverage is comprehensive. Unsatisfied customers mentioned how the claims process is complicated and can take months to resolve. However, in a number of cases, customers who initially left negative reviews about a lack of communication following claims noted swift resolution after leaving a review.

Below are some examples of positive and negative company reviews on Trustpilot.

“Very competitive plans at decent prices. Hard to say for sure how good it is until I make a claim, but the purchase experience was smooth. One problem with travel insurance is it is not always easy to determine what will be covered. Recently, I have come to believe that the most important feature of any travel insurance is coverage for an enormous loss, such as medical evacuation from a remote location (like a cruise ship). Even the basic Generali plan offers very good coverage in that area.” — Joe B. via Trustpilot “I've used Generali in the past. If I had a claim it was fulfilled in a timely manner. Once my trip was canceled and though there was some confusion about my policy, [Generali] stuck with it and I was refunded my entire amount. [Generali is] good to work with.” — Dennis S. via Trustpilot “I travel up to three times a year and always use Generali. I usually do not submit a claim but have for a skiing accident. I submitted the claim over a month ago and upon checking in with a live agent over chat, was told that in those 33 days, nobody has picked up the claim and there is nothing she can do about escalating it … But immediate action was taken after I left this review. The check is in the mail.” — Anteres N. via Trustpilot "In December we visited a sick relative who subsequently passed away. At the same time, both me and my partner got sick and could not travel. Almost two months later, we have not received the claim money from the trip. It seems our claim has not yet been assigned a rep. I realize there have been some airline meltdowns and [Generali is] busy but the communication is terrible. We are so frustrated … the whole time we've dealt with it has been horrible and extremely stressful — what you don't need when traveling!” — Carol S. vis Trustpilot

How To File a Claim with Generali Travel Insurance

Generali offers a three-step process for filing a travel insurance claim:

- Visit Generali’s website and log into your eClaims portal to access the claims form. If you’re in an area where you can’t file a claim online, call 800-541-3522.

- Upload supporting documentation to your account or email it to a representative according to Generali’s requests. Examples of documents you might need include hospital reports and flight cancellation confirmations.

- After submitting your claims package, Generali will assign your case a number and a representative. You’ll hear from your representative, who will help guide you through the next steps.

Keep your documentation — in either digital or physical form — as you travel in case you need to use emergency assistance services.

Compare Generali to Other Travel Insurance Companies

Now that you understand what Generali’s plans cover let’s take a look at how it stacks up against top travel insurance competitors.

The countries you visit also play a role in travel insurance pricing. Here are a few examples of how your destination might impact your travel insurance premium.

What’s Not Covered by Generali Travel Insurance?

While Generali’s policies include generous trip coverage and medical insurance , they don’t cover everything. The following are a few exclusions you’ll find on Generali’s coverages — and where you can find these inclusions if they’re important to you.

- Business equipment: While Generali’s policies have options to cover sporting equipment, coverage does not extend to business equipment and technology. If you plan to travel with more expensive business luggage, consider a provider like Travelex that offers protection for these items.

- Extreme sports: Medical insurance for travel policies doesn’t usually extend to injuries sustained while participating in extreme sports. If you’re planning on hiking, scuba diving, mountain biking or performing other serious physical activities abroad, consider a provider like IMG Travel Insurance or Travelex. While Generali doesn’t allow you to extend medical coverage to include these circumstances, other insurers offer an extreme-sports add-on.

- Non-medical emergency evacuations: Generali’s travel insurance plans include coverage for medical evacuations only. If you believe you might need emergency political or environmental evacuation resources, consider a provider like AXA , which has this option.

Is Generali a Good Choice for Travel Insurance?

The choice of travel insurance provider usually comes down to your individual needs. If you’re traveling to an area where you can’t speak the primary language, Generali’s around-the-clock concierge emergency service could provide peace of mind. But if you’re looking for political evacuation assistance and reimbursements or more expansive CFAR coverage, Generali might not be the best choice.

Frequently Asked Questions About Generali Travel Insurance

How do i file a claim with generali travel insurance.

You can file a claim with Generali Global Assistance travel insurance online using its eClaims portal. Alternatively, you can call the Claims Department at 1-800-541-3522. You will need to provide disclosures about the circumstances of your claim, along with supporting documentation to prove your losses, such as a credit card statement.

Once submitted, Generali will assign your claim to a representative to manage from start to finish. Your refunded amount will depend on your travel insurance plan and related coverage limits. You can monitor the status of your claim on the eClaims portal.

What is the difference between trip cancellation and trip interruption coverage?

Trip cancellation coverage includes non-refundable expenses you made before traveling, such as airline tickets and lodging. Coverage kicks in if your trip is canceled for a covered reason, leaving you unable to travel. Trip interruption coverage begins after you leave and covers expenses if you need to cut your trip short or return home early.

Both forms of insurance are designed to safeguard against unforeseen events, such as the policyholder or a close family member suffering an injury, serious illness or accidental death. Unforeseen events can also include terrorism and natural disasters.

How much do Generali travel insurance premiums cost?

The price of Generali travel insurance depends on factors such as the cost of your trip, how long you are traveling and who is going. Based on sample quotes we pulled for a $5,000 trip to Cancun, Mexico, it would cost $168 to insure two New York residents in their 30s under the Standard Plan. Prices were higher for the Preferred and Premium plans, ranging from $195 to $228.

We recommend you request a free quote on the Generali website to check rates and compare options before you buy travel insurance. The company also offers a 10-day “free look” period in which you can decide if the policy is right for you. If you are unsatisfied or find a better policy elsewhere, you can cancel for a full refund.

How does Generali pay claims?

Generali’s team recommends that you elect to receive claims payouts using its e-payment partner Zelle. When you choose to receive payments through Zelle, you can receive payment in as little as a day. Otherwise, Generali will mail you a check with your payment, which will usually take between seven and 10 business days.

Does Generali have 24/7 travel assistance?

Yes, all of Generali’s travel insurance policies include access to a 24/7 travel insurance hotline that is offered around the clock to support customers in all time zones. To get in touch with Generali’s 24/7 customer service team, call (877) 243-4135 if you’re in the U.S. +1 (240) 330-1529 if you’re abroad.

Does Generali cover COVID-19?

Yes, Generali’s travel insurance policies include COVID-19-related expenses as standard medical coverage. In other words, the company treats COVID-19 the same as any other illness under your travel insurance reimbursement limits and specifications.

Other Travel Insurance Providers to Consider

- TravelSafe Travel Insurance Review

- Nationwide Travel Insurance Review

- World Nomads Travel Insurance Review

- Faye Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travelers Travel Insurance Review

- Allianz Travel Insurance Review

- WorldTrips Travel Insurance Review

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.