- Skip to navigation

- Skip to main content

Paying your employees travel allowance

You can cover your staff's travel expenses. This is not mandatory, unless stated in the collective labour agreement (CAO) for your industry. Or if it is stated in your own employment contracts or company regulations. Read what you should take into account when paying travel allowances.

On this page

How does travel allowance work, tax-free travel allowance 2024, carpooling and travel allowance, travel allowance when working from home, travel allowance in case of illness, reimbursing more using the work-related costs scheme.

With a travel allowance ( reiskostenvergoeding ), you help pay for your employee's travel expenses. It does not matter if your employees travel on foot, by bicycle, private car, or public transport. The distance does not matter either. Nor whether it is a commute or business trip, such as a visit to a customer.

Kilometre allowance for self-employed workers

Do you use your private car for your business ? Then you may deduct a business allowance of €0.23 per kilometre from your profit. This is allowed if you are an entrepreneur for income tax purposes. You can submit the kilometre allowance with your annual income tax return.

In 2024, you may reimburse your employees €0.23 per kilometre tax-free. This amount is not regarded as salary by the Netherlands Tax Administration ( Belastingdienst ). So, you do not withhold payroll taxes over it. You can also reimburse a higher amount per kilometre. But the Tax Administration regards anything above €0.23 as salary, so it must be taxed.

Minimum travel allowance

You decide how many kilometres you want to reimburse. You can state the minimum number of kilometres in the employment agreement or collective labour agreement (CAO).

Reclaim travel expenses up to 5 years later

Employees may reclaim their travel expenses up to 5 years after the travel date. This means that your employees may still reclaim travel expenses from you for the past 5 years. Your employees must then be able to prove their travel expenses and/or kilometres travelled. For example, by keeping track of the kilometres travelled in a travel registration system. The travel expenses can only be claimed back if you have made agreements about the travel costs.

Own or public transport

If your employee travels by private transport, you may reimburse a maximum of €0.23 per kilometre tax-free. This is also possible if an employee has to detour. For example, to take children to school. In that case, you may not reimburse the kilometres for the detour tax-free, because these are private travel expenses.

Does your employee travel by public transport? Then you can also reimburse €0.23 per kilometre travelled. Or you can reimburse the actual travel costs tax-free. For example, the cost of the (return) train ticket. This is usually done via a declaration form. Your employee then submits the train ticket or an overview of the trips made with a public transport card. This lists the costs incurred.

Other transport

Does your employee travel in a different way than by public or private transport? For example, by boat, airplane, or taxi? Then you reimburse the costs incurred. A receipt proving the costs is required for this. Such as a plane ticket or receipt for the taxi ride.

Do your employees come to work together by car (carpooling)? Then there are 2 options for the travel allowance:

- You organise the carpool You make an appointment with one employee to drive and pick up other colleagues. You reimburse this employee €0.23 per kilometre, including the kilometres that they have to detour to pick up the others. The passengers do not receive any compensation, because you make this transport possible for them.

- Your employees organise the carpool themselves They will then all receive €0.23 per kilometre. You do not have to reimburse the kilometres for making a detour to pick up others. These are seen as private travel expenses.

Employees who partly work from home can also receive a travel allowance.

You can choose from 2 options:

- You calculate the actual travel costs based on the kilometres travelled on days that your employee travelled for work.

- You agree to a fixed fee with your employee. The law provides for the 128/214-day scheme (in Dutch) for this. This scheme means that an employee who travels to a fixed workplace for at least 128 days in a calendar year may receive an allowance as if they travelled on 214 days. For example, does your employee travel to a fixed workplace for 130 days? Then you may give an additional travel allowance for commuting for 84 days (214 -130 = 84).

Does your employee not work full-time?

Then you adjust the 128/214-day scheme to the number of days the employee works (pro rata).

Example 1: For an employee who works 3 days, this involves 77 travel days (3/5 of 128 days) and you reimburse 128.4 days (3/5 of 214 days).

Example 2: For an employee who works 4 days, this involves 102 travel days (4/5 of 128 days) and you reimburse 171.2 days (4/5 of 214 days).

If an employee reports sick and is expected to be absent for less than 6 weeks, you may continue to pay the travel allowance.

In case of long-term absence, you may only continue to pay the travel costs for the first 2 months. After that, this is allowed again in the first month after return.

The reimbursement of €0.23 per kilometre is the limit for the Tax Administration. If you reimburse more, your employee pays tax on that extra amount. If you use the discretionary scope ( vrije ruimte ) of your work-related costs scheme for this higher reimbursement, this amount will remain untaxed.

Read more about calculating the discretionary scope in chapter 10 of the Payroll Taxes Handbook (PDF, in Dutch).

Related articles

- Companies with 100 or more employees must report on business travel

- Work-related costs scheme: staff allowances

- Overview of personnel costs

Questions relating to this article?

Please contact the Netherlands Chamber of Commerce, KVK

Make an appointment ➝

Decades of experience within payroll and international business

We assist in hiring professionals from and all around the world.

TOSS in Portugal

Toss in belgium.

Payroll Services

Hiring an expat the easiest way with TOSS as legal employer.

IND Sponsorship

We are a recognized sponsor of the IND.

Salary Administration

Administrative obligations towards your employee and the authorities.

Employer of Record

Expand into the Dutch market without setting up a new entity.

Recruitment

Find the right employer and next adventure in the Netherlands.

Immigration Services

We arrange the right documents for your stay in the Netherlands.

A tax break specific for highly skilled expat employees in the Netherlands.

Tax Services

A wide range of tax services to assist with the often complicated tax implications.

Additional Services

Services and information to get you settled in the Netherlands.

Discover Amsterdam’s Fitness Revolution with Jimme

A new beginning: support for accompanying partners in the netherlands, ind salary criteria 2024, näpp: elevating childcare for international families in the netherlands, why you should hire abroad: 6 proven benefits of hiring expats, business case: the orientation year, how sick leave is arranged in the netherlands, working from home in the netherlands: 7 things employer and employee should know, renting out your house in the netherlands, how and why, 14 fun things to do during spring in the netherlands.

Everything You Need to Know About Travel allowance in the Netherlands: A Guide for Employers and Employees

Travel expense reimbursement is an important topic for both employers and employees. Whether you commute to the office daily, travel to clients regularly, or visit different locations for work, it’s essential to be aware of the options and rules regarding travel expense reimbursement. In this blog, you will find everything you need to know about it.

Is travel allowance mandatory in the Netherlands?

In the Netherlands, reimbursement of travel allowance by employers is not required by law unless it is in the collective bargaining agreement. Many employers reimburse travel expenses even though it is not in their collective bargaining agreement (cao). Reimbursing travel allowance is fair and should be discussed during the job interview.

Does travel expense reimbursement apply to every mode of transportation?

Yes, travel allowance applies to every mode of transportation. Whether the employee commutes to the office by bike, public transport, or car, they are entitled to travel allowance. Even carpooling qualifies for reimbursement. Employers have the choice to reimburse either based on the number of kilometers or the actual incurred costs.

Fixed travel allowance

The exempted travel expense reimbursement for personal transportation has been increased to EUR 0,21 per kilometer in 2023, and it will be further raised to EUR 0,22 in 2024. This can be done based on the actual number of kilometers traveled or through a fixed reimbursement. Opting for a fixed reimbursement reduces administrative burdens, and there is no need for adjustments when an employee occasionally works from home, is sick, or on leave.

Formula for calculating fixed travel allowance

If you want to calculate the amount of travel expenses, there is a formula, which may be more complex than you initially think. First, calculate the distance between home and work. The tax authorities consider the most commonly used route as the standard. Taking the shortest route as a starting point is not applicable. Often, the route via the highway is chosen, which may be longer in terms of distance but faster.

The following formula can be used to calculate monthly travel expense reimbursement:

Monthly travel expense reimbursement EUR 0,21 x distance from home to work x 2 x 214 / 12.

Thus, the employee receives the same amount of travel expenses every month, based on the monthly average, taking into account the number of working and non-working days in that month.

This calculation assumes 214 working days per year.

Variable travel allowance

Variable travel expense reimbursement can be provided to an employee in situations where the employee’s travel patterns and needs vary. Here are some examples of when a variable travel expense reimbursement may be appropriate. For instance, if an employee works at different locations, has flexible working days, uses different modes of transportation, or has varying distances to travel, such as visiting clients.

Public transportation costs

The complete costs for traveling by public transportation can be reimbursed. The employee needs to submit original transport tickets as proof. If an employee uses an OV-chipkaart (public transport card), they can download a declaration overview from www.ov-chipkaart.nl.

If an employee uses their own car, scooter, bicycle, motorcycle, etc., the employer can offer a tax-free reimbursement of EUR 0,21 per kilometer. To qualify for this, the employee must provide a complete declaration overview. The overview should include at least the date, postal code, house number, and city of both the starting and ending points of the journey. If any of this information is missing, unfortunately, no reimbursement can be provided.

If the employee uses a company car, it is not possible to receive a variable travel expense reimbursement since the employee already benefits from using the company car.

Are homeworkers eligible for travel expense allowance?

Employees who work from home often incur additional expenses such as heating, toilet paper, coffee and tea, water, and electricity. A home office allowance can be provided to compensate for these extra expenses. It is not mandatory, but there may be rules regarding it in the collective labor agreement (cao). If there are no provisions in the cao, agreements regarding the home office allowance can be made between the employer and the employee.

How high can the home office allowance be in 2023?

Starting from 2022, the option to provide a tax-free home office allowance was introduced. In 2022, this allowance was EUR 2,00 per day. Now, it has increased to EUR 2,15 per day.

The employer and the employee can make agreements regarding a fixed home office allowance based on the expected number of work-from-home days per week, eliminating the need to track whether the employee worked from home or in the office.

More information about this subject?

Recent blogs.

All , Settling

The solution that not only keeps you fit but also connects you with the local community: Jimme.

All , Moving , Settling , Working

the TOSS coach not only helps and guides the expatriate but also the accompanying partner.

All , Hiring , Working

The important changes in laws and regulations.

Read all blogs

- Call +31 20 820 15 60

- Search

- For employers

- For employees

- Contracting solutions

- StiPP Pension fund

- Service translations

- Work permits

- Highly Skilled Migrants

- Orientation year highly educated persons

- Citizen Service Number

- Health insurance

- Public Register Recognized Sponsors

- Income requirement

Working in the Netherlands: Travel allowance in the Netherlands

On March 13, 2019 by Dutch Umbrella Company

In the Netherlands, the reimbursement of travel expenses by your employer is not required by law. However, most Dutch companies do offer reimbursement for business travel in their employment contracts. The agreements regarding the reimbursement of travel expenses are stated in the collective labour agreement, company regulations or your labour contract. In this blog, we will provide you with everything you need to know regarding travel expenses and travel allowance in the Netherlands.

Travel allowance per km with private transport

When you travel by private transportation (car, motorcycle, bicycle or by foot) it is common to receive travel allowance per km. This tax-free travel allowance may not exceed the maximum of € 0,19 per kilometer. It does not matter if this is commuting or business related travel (e.g. transportation to a client or a business meeting). The tax-free reimbursement of € 0,19 per kilometer doesn’t apply for:

- Additional kilometers made out of employees private travel (e.g. bringing children to school before driving to work);

- Reimbursement for (parts of) travel your employer arranges for the employees (fixed fee).

Travel allowance calculation

For commuting your employer can reimburse a fixed allowance based on the regulations given by the tax authorities. The most used calculation method is as follows:

- (number of kilometers one way * 2) * € 0,19 * 214 working days / 12 months * part-time percentage = untaxed fixed travel allowance per month.

To calculate the fixed travel allowance the calculation uses 214 working days. Vacation, national holidays and sickness are already considered. In case of long-term absence of the employee, for example, due to sickness, the travel allowance can be paid for another six weeks. After this period of absence, the reimbursement needs to be stopped. If your employer wants to reimburse more than € 0,19 per kilometer, everything above € 0,19 per kilometer is wage and thus taxed accordingly.

Reimbursements for travel expenses your employer pays in addition to the € 0,19 per kilometer, will be labelled and taxed as salary. Which includes fees for parking, tolls, fees for (additional) depreciation of the car and extra fuel consumption by a trailer or vehicle damage.

Parking expenses and final levy

Parking expenses with a company car are considered intermediary costs and therefore it is possible to reimburse them tax-free. This is only the case when it concerns parking expenses with a company car. This is different when you make parking expenses with a private car. When your employer reimburses € 0,19 per kilometer, parking expenses are deemed to be included in this reimbursement. When you (as an employee) declare parking expenses, the parking expenses are taxable. So, your employer needs to include them in the payroll with a final levy. The parking expenses (including parking permits) you make in order to park near your place of residence are also taxed in the payroll.

Use of foreign driving license

Please note that if you have a foreign driving licence, there are some rules regarding the validity of your driving license and changing it to a Dutch driving license. In our blog ‘Using your foreign driving license in the Netherlands’, you can read all you need to know about your foreign driving licence.

Travel by electric vehicle

As of January 1, 2019, there are three categories regarding tax liability in the Netherlands:

- 4% in case of private use of a new fully electric hydrogen vehicle.

- 22% for hydrogen- and all other corporate cars in case the ‘date of first admission’ (DET in Dutch) is before January 1, 2017.

- 25% in case the date of admission (DET in Dutch) is before January 1, 2017.

When you are about to choose a new lease vehicle, it is important that you are aware of these tax categories.

Travel allowance per km; electric vehicles

If you, as an employee, are the owner of an electric car, your employer may give you travel allowance with a maximum of € 0,19 per kilometer. Reimbursements of electricity costs are not possible. The € 0,19 per kilometer should cover all the expenses.

But typically, electric cars are not owned by the employee but leased or owned by a company. Recharging the car at the work location will probably not cost the employee anything. However, depending on the situation, this may not be the case when the car is charging at home.

Travel by public transport in the Netherlands

By public transport, we mean transport by bus, ferry, train or subway. So, public transport is not any transportation by taxi, boat or aircraft. These examples of transport are part of a separate arrangement, which we will discuss later in this blog.

Reimbursement public transport expenses

If you are travelling by public transport in the Netherlands, you may receive a travel allowance with a maximum of € 0,19 per kilometer. And expenses made by the employee for business travel or commuting with public transport may be reimbursed tax-free. Your employer may also choose to pay the actual expenses. If your employer wants to do so, he/she must demonstrate your business travels by public transport in the Netherlands. For this reason, you will need to save copies of the tickets. It is possible to create a digital list of trips and costs incurred with the public transport card (OV-chipkaart). A copy of your monthly subscription will also do.

Travelling by company car in the Netherlands

When the employer allows, it is possible to use your company car for private occasions, like holiday trips, groceries or family visits. When you drive over 500 private kilometers on an annual basis, the private use of company car will be considered as ‘salary of kind’.

Please note that if you have a foreign driving licence, there are some rules regarding the validity of your driving license and changing it to a Dutch driving license. Read in our blog ‘Using your foreign driving license in the Netherlands’ all you need to know about your foreign driving licence.

Travelling by taxi, boat or airplane in the Netherlands

If you are travelling by taxi, boat or airplane, your employer may reimburse the actual expenses. For these types of transport, the maximum tax-free allowance is € 0,19 per kilometer. Any additional compensation will be labelled and taxed as salary.

Any questions about travel allowance in the Netherlands?

Would you like to know more about travelling or travel allowance in the Netherlands? Or not sure about your travel allowance as an employee? Don’t hesitate to contact us, send us an email at [email protected] and we will answer any questions you might have.

Dutch Umbrella Company 2024 ©

© 2024 - Dutch Umbrella Company

Donauweg 10, 1043 AJ Amsterdam

+31 (0)20 820 15 60

- Website by dotBlue

Privacy Overview

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

A comprehensive guide to corporate travel allowances in the Netherlands

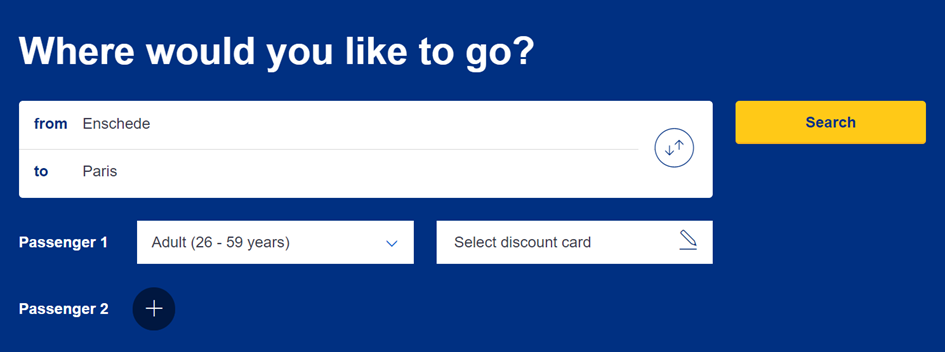

What are the mileage allowance rates in the netherlands for 2023, how does mileage allowance work, employees driving their personal car, employees driving a company van or car, electric vehicles, taxi, boat, or airplane, traveling by public transport.

- Employees must travel more than 10 kilometers each way to reach their place of work from home.

- Staff must commute to the same workplace at least 1 day a week and for at least 40 days each year. Each journey must be completed within 24 hours to count towards their total.

What additional tax implications are there?

Additional reimbursements, employees driving their own vehicles.

- (number of kilometers traveled one way 2) €0.21 * 214 working travel days / 12 months = your tax-free travel allowance per month.

Company vehicles

Parking expenses, public transport users.

- The distance traveled between the employee's home and their work location.

- The number of days the employee travels into the office.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

?)

10 Biggest challenges when choosing a corporate travel company

?)

The 5 best car rental companies in Czech Republic

?)

The 5 best car rental companies in Malta

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

Extraterritorial costs that you may reimburse or provide tax-free

The extraterritorial costs include costs such as the following:

- the additional costs incurred for maintenance resulting from the higher cost of living in the Netherlands as compared to the country of origin (cost of living allowance)

- the costs incurred in travelling to the Netherlands to become acquainted with the country, where relevant by the employee and the employee's family, for example to search for a home or school

- the costs incurred in applying for or converting official personal documents, such as residence permits, visas and driving licences

- the costs incurred in arranging for the medical examinations and vaccinations required for the stay in the Netherlands

- the costs incurred for double accommodation, for example when the employee continues to live in the land of origin, such as hotel costs

- the (1st) accommodation costs Only the (1st) housing costs that exceed 18% of the wage from present employment are deemed extraterritorial costs.

- the costs for storage of the part of the household effects that will not be moved to the country of employment (long-term storage)

- travel expenses incurred travelling to the country of origin, for example for a family visit or family reunion

- the additional costs incurred in arranging for the completion of the income tax return when these costs are in excess of the costs incurred in arranging for the return to be completed by a comparable tax consultant in the country of origin For 2021 this is still limited to a maximum of € 1,000 for each employee. This maximum will cease to apply as from 1 January 2022. You can read more about this under ' Additional costs for the income tax return '.

- the costs the employee and members of the employee's family accompanying the employee to the Netherlands incur in following courses to learn Dutch

- the additional (non-business) costs incurred in making telephone calls to the country of origin

- the costs of applying for social security exemption, such as a so-called E 101 certificate or an A1 form/certificate of coverage (CoC)

- the costs of applying for the 30%-facility

School fees are also considered to be extraterritorial costs, but you can provide a separate allowance to your employee if it concerns school fees for an international school or an international department of a regular school. This is the case if:

- the education programme of the school concerned or the department thereof is based on a foreign school system

- the school or the department is intended especially for children of employees posted abroad

The school fees allowance is therefore unrelated to the 30%-facility.

Costs that are not extraterritorial

The following costs are not extraterritorial costs and, consequently, you may not issue tax free reimbursements or provisions for these costs:

- secondment allowances, bonuses and comparable reimbursements (foreign service premium, expat allowance and overseas allowance)

- capital losses in the state of residence

- purchase and sales costs of a home (reimbursement expenses purchase of the house, brokers fee)

- compensation for higher tax rates in the Netherlands (tax equalisation)

Reimbursement of the actual costs

You may issue tax free reimbursements for the actual costs incurred only when you can make plausible that the total extraterritorial costs are higher than 30% of the wages inclusive of the reimbursement. These are not then governed by standards or limitations.

Additional costs for the income tax return

Does your employee come from another country? And do you pay the costs for the filing of your employee's income tax return? If so, this is considered taxable wages (wages in kind). In the event of extraterritorial costs, a specific exemption applies. As regards the value of this taxable benefit, you could still assume a maximum amount of € 1,000 for the year 2021, if you had no invoice or an insufficiently itemized invoice. From 1 January 2022, you must assume the invoice value. If your invoice is not sufficiently itemized, you must reconstruct the value of the wage in kind. You must do so on the basis of a requested specification or otherwise.

What are the costs for filing a tax return?

The costs for filing a tax return include:

- the costs for filing

- the costs of applying for a provisional assessment

- the costs of assessing the issued assessment or assessments

- any costs to ensure the tax return is filed with the correct form

The costs for filing a tax return does not include:

- the costs of objection and appeal

- the costs for the income tax return of the employee’s partner

- the costs for filing any foreign tax return

- the costs of consultancy in relation to housing

- other consultancy costs

Please note!

The wage further includes costs that were not incurred for the income tax return, such as tax advice for the employee.

How do you determine what the extraterritorial costs are?

For the income tax return, you determine which part is taxable income and which part is extraterritorial costs as follows:

- Does your employee only have to file a tax return in the Netherlands? And are the costs for this higher than the costs for filing the return in the country of origin by a tax consultant? In that case, the extra costs are extraterritorial costs and specifically exempt. The remainder is taxed wages.

- Does your employee only have to file a tax return in the country of origin? In that case, the costs for this are deemed taxed wages. Are the costs for filing that return higher because the employee works in the Netherlands? In that case, the extra costs are extraterritorial costs and specifically exempt. The remainder is taxed wages.

- Does your employee have to file a tax return in the Netherlands and in the country of origin? In that case, the costs for the Dutch tax return are extraterritorial costs and specifically exempt. The costs for filing a tax return in the country of origin are taxed wages. Are the costs for filing the return in the country of origin higher because the employee works in the Netherlands? In that case, the extra costs are extraterritorial costs and specifically exempt. The remainder is taxed wages.

- Are you seconding a Dutch employee abroad and does he have to file a tax return in that country? In that case, the costs for the foreign tax return are extraterritorial costs and specifically exempt.

An employee comes from France to work in the Netherlands. You reimburse the costs for his Dutch income tax return, € 1,500 (including VAT). The employee does not have to file an income tax return in France. A French tax consultancy would charge € 1,200 (including VAT) for that return. Of the € 1,500 that you reimburse for the Dutch tax return, € 1,200 is taxed wages and € 300 is specifically exempted as extraterritorial costs.

Do you apply the 30% facility? In that case, the extra costs for having the income tax return completed are not specifically exempted and therefore taxed.

Javascript is disabled in this web browser. You must activate Javascript in order to view this website.

Travel costs

In the Netherlands, it is normal to receive travel expenses when you have to travel to work. The amount differs and is determined by your contract or the CAO. There are two types of reimbursement. One is a mileage allowance. The other is a public transport allowance. Sometimes you can choose between the two and sometimes the employer decides which reimbursement you get.

Mileage allowance

If you receive a mileage allowance, it does not matter how you travel to work. One car uses more gas than the other. You do not have to hand in your receipts for petrol. You can even go to work by bicycle, and then you will make a profit on your mileage allowance. Or you can carpool and travel for free. For commuting and business trips, your employer can give you a tax-free allowance of EUR 0,19 per kilometre, regardless of the means of transport. This EUR 0,19 is only a limit for the tax authorities. Your employer can give you as much more as he or she wants. If you do get more, the tax authorities consider everything you get above EUR 0,19 per kilometre as income on which you have to pay tax.

Every contract or CAO states a maximum travel distance allowance in kilometres. Often this is around 40 kilometres for a single journey. If you travel 60 kilometres to work, for example, you will pay 20 kilometres out of your own pocket.

There is also a minimum distance you have to travel in order to receive an allowance. This differs per contract or CAO. Often it is about 5 kilometres. So if you travel 3 kilometres to work, for example, you will often not be reimbursed.

Public transport

If you travel by public transport, you can also opt for reimbursement of the actual costs incurred. In that case, the entire amount is tax-free. For this you must keep your tickets or download your travel statements at ov-chipkaart.nl. In most cases your costs for bus, train, tram or metro are fully reimbursed by your employer. No tax is calculated and you will receive a net payment on top of your salary.

Other travel cost reimbursements

When you travel for your work, you will often receive an allowance for parking costs. You have to keep the parking tickets and declare them to your employer.

Some employers even give you a free bicycle. In that case, you get a budget of, for example, EUR 2000 to buy a bicycle. This is often laid down in a CAO.

Best saving accounts

Study online: Bachelor / Master / MBA

Healthcare allowance

House rental allowance

Special attractions

Theme Parks

Top 10 zoos

Amsterdam City Card

How can I get a mortgage?

Investment account

Taking sick leave at work

How to find a job

Take out liability insurance

Lijst van diensten.

Can you not find your answer on our website? Send us your question.

Do you need help to find the right company for your needs? We offer you help!

Find here an easy overview of all the articles and more.

Sign up for newsletter

Thank you, we keep in touch!

About Expat-Netherlands.nl

Terms of service

Privacy statement

All Rights Reserved |

Expat-Netherlands.nl © 2022-2024

Travel allowance and work from home allowance

Travel allowance

Do your employees travel to work by car or public transport? Then you can often reimburse the costs incurred by these employees as commuting expenses. You can also pay an allowance for business travel. You can choose to reimburse travel expenses per trip or to pay a fixed travel allowance.

Is an employee entitled to a travel allowance?

Nowhere in the law is stated that an employee is entitled to a travel allowance. The employee is only entitled to it if there are agreements about this in the collective labour agreement, employment contract or company regulations. If that is the case, you must reimburse travel expenses as an employer.

What is the maximum travel allowance that I can pay as an employer?

It is important to know whether the employee uses his own transport, uses public transport or is carpooling with colleagues.

Tax-free reimbursement of own transport

If the employee travels to work by his own transportation, you can reimburse a maximum of € 0.19 per kilometer without having to withhold taxes. For this maximum kilometerage it does not matter which means of transport the employee uses.

If you pay a higher travel allowance, the portion in excess of € 0.19 per kilometer is considered wages. You must then deduct payroll taxes over the excess.

Tax-free reimbursement of public transport

If the employee makes use of public transport to travel to work you can choose between a tax-free reimbursement of

- the actual travel costs incurred;

- the number of kilometers traveled up to a maximum of € 0.19 per kilometer.

Mileage compensation for carpooling

If you organize carpooling, you may reimburse the driver € 0.19 per kilometer. This includes the kilometers that the driver makes a detour. If the employee organizes the carpooling himself with a colleague, then each colleague or employee can receive an allowance of € 0.19 per kilometer. The kilometers that the employee has to make a detour for this purpose can’t be reimbursed free of tax in that case.

Fixed travel allowance

In the past, it was possible for the employer to pay a fixed travel allowance if employees would have to travel 60% or more of the time to come to work. But since the corona crisis, a large proportion of people work from home. As a result, many companies found themselves in a bind with their fixed travel allowances. The government then stipulated that work-from-home days could also be considered travel days for determining commuting expenses. This regulation was abolished as of January 1, 2022.

Since January 1, 2022, employers are only allowed to reimburse actual travel expenses. Of course, as an employer you may still decide how much travel expenses you give an employee, but only the actual costs incurred can be reimbursed untaxed.

Employers must therefore determine whether their employees meet the conditions for a fixed travel allowance in 2022.

The statutory scheme says that an employee who travels to a fixed place of work on at least 128 days in a calendar year may receive reimbursement based on 214 days. This applies to five travel days. If an employee travels fewer days, the allowance must be calculated on a pro rata basis.

Example William travels to work four days per week in 2022. The one-way travel distance is 20 kilometers, or 40 kilometers back and forth. William must travel to work for at least 128 x 4/5 = 103 days. He meets this requirement. He travels four days x 52 weeks = 208 days to work. These 208 days do not include vacations and short-term sickness. But it is expected that William will certainly travel to work for at least 103 days in 2022. William can be paid a travel allowance for 214 x 4/5 = 172 days in 2022. This leads to an allowance of 172 x 40 km x € 0.19 / 12 months = € 108.93 per month.

Work from home allowance

As of January 1, 2022, the new targeted exemption for working from home is in effect. You can pay your employees an allowance of € 2 per day worked from home. From 1 January 2023 this amount will be increased to € 2.15. The allowance can be paid to compensate for the additional costs incurred by the employee due to working from home. These additional costs include:

- water and electricity consumption;

- coffee and tea;

- toilet paper.

Such an allowance does not take up any of your free space under the work-related costs scheme. Would you like to give your employees a higher allowance? Then the excess falls in the tax-free margin. Remember to designate the allowance as a final taxable component.

If you make agreements regarding the travel/work from home pattern of your employee you can give a fixed (monthly) allowance. With these agreements you make it plausible on how many days the employee works at home and/or travels. These written agreements are formless. This means that it is not necessary to keep records or make periodic declarations.

To determine the compensation, you can use the so-called 128/214-day rule (statutory regulation). This regulation means that if your employee travels at least 128 days per year to the fixed workplace, the travel allowance on an annual basis may be calculated as if your employee travels on 214 working days. This formula already takes into account occasional working from home, sickness and vacations.

It is permitted to occasionally deviate from agreements made without an adjustment. This follows from the 128-day rule. If there are structural changes, then the allowances must be reconsidered.

As of 2022, the work from home and travel allowance must both be calculated pro-rata based on the number of travel days and work from home days (instead of previously working days).

Example 1 In 2022, William works two days at home and travels to the office three days. The one-way travel distance is 20 kilometers, so 40 kilometers back and forth. The 128 days test means that William must work at least 128 x 2/5 = 52 days at home for a fixed allowance. And in addition, on at least 77 days must travel to the office. An allowance for working from home is possible for 214 x 2/5 = 86 days. This leads to an allowance of 86 x € 2 /12 months = € 14.33 per month. In addition, a travel allowance is possible for 214 x 3/5 = 129 x (40 km x € 0.19) / 12 months= € 81.70 per month.

Example 2 Bouchra works 4 days a week. She works 2 days at home and 2 days at the office (single journey distance 12 km.) Travel allowance: 214 x 2/5 = 86 days x (24 km x € 0.19) / 12 months = € 32.68 per month Work from home allowance: 214 x 2/5 = 86 days x € 2 / 12 months = € 14.33 per month

Combination of working from home and travelling to the office on the same day

The exemption for a work from home allowance of up to € 2 per day (2023: € 2.15) can also be applied if an employee only works from home for part of the day. However, you cannot give a work from home allowance for the days when you also pay a travel allowance for commuting. This means that if an employee works at home for part of the day and the other part at the regular workplace, you can only apply one of the exemptions:

- either you reimburse the commuting expenses;

- or you pay a work from home allowance.

You decide in consultation with your employees which allowance is paid. The turning point is around five kilometers one way.

It is, however, permitted to give both a travel allowance and a work from home allowance on a day on which part of the work is done from home and the employee travels to a place other than the fixed workplace. This practical interpretation makes it possible to give an employee a travel allowance on a claim basis for a business trip from home. Think for example of a customer visit. The fixed work from home allowance does not need to be adjusted for this.

Transport on behalf of the employer

If transportation is provided by the employer, then a work from home allowance is only possible if no use is made of that transportation on the work from home day. Transport on behalf of the employer includes a company car or bicycle and the reimbursement, provision or issue of a public transport season ticket.

Allowance for furnishing a home office

For the furnishing of a home office, an employer may already give a tax-free allowance. The costs of an office chair, a computer or telephone can be reimbursed by the employer via other targeted exemptions under the work-related costs scheme.

Use of private PC and internet

On top of the work from home allowance, as an employer you may also pay an allowance if the employee uses his own computer and internet subscription for work. The condition is that the use is necessary. Necessary in this case means that the employee can’t perform his work properly without this facility. This means that the employee needs and uses the internet subscription for work.

If the internet at your employee’s home meets the conditions, then the reimbursement of the subscription costs is specifically exempt. You can also apply the targeted exemption if the employee pays a personal contribution for private use. An allowance for internet use proportional to the number of homeworking days does not conflict with the necessity criterion.

Has your employee purchased a 3-in-1 package (internet, landline telephone and television) from a provider? If so, you determine the portion of the invoice that is for the internet connection. If necessary, you can check what the provider charges for a separate internet subscription. That part can be specifically exempted from reimbursement.

Changes for 2023

Increase of tax-free travel allowance.

There will probably be an increase in the current tax-free travel allowance. However, the exact increase is unknown at the time of writing. Based on the reserved amount, an increase in the tax-free travel allowance of 1 to 1.5 cents as of 2023 should be possible. The exact details are still being worked out.

Increase of tax-free work from home allowance

As of January 1, 2023, the tax-free work from home allowance will be indexed on the basis of the table correction factor. This table correction factor takes inflation into account. It is expected that the table correction factor will amount to 1.063, which means that the tax-free work from home allowance as of 2023 will amount to € 2.15 per work from home day.

So there are a number of options for untaxed reimbursement of your employers’ travel expenses. You can also pay an allowance for home working days. Make proper agreements on this with your employees so that it is clear what choices are being made. Also ensure that the calculation of the tax-free allowance is correct. This can be complicated, especially if travel days and homeworking days coincide.

It is expected that the tax-free amounts will be increased in 2023. However, this increase will not be able to keep up with inflation. But it is important to adjust the calculations with the changed amounts, if desired of course. Because paying a travel allowance or home-work allowance is not a legal obligation. And therefore also not the amount thereof. This is only different if agreements have been made about this in the collective labour agreement or the employment contract. But this does not always automatically include any increase in the untaxed amount.

Similar Posts

Reimbursement of expenses for domestic and foreign business trips 2022

The employer can reimburse expenses occurred during a domestic or foreign business trip tax free based on the rate lists for civil servants.

What does an employee cost? Calculate the employer costs

Employer costs are the costs that an employer pays (in addition to the salary) for his employees.

Your employee is pregnant: maternity leave and maternity benefit

What are the consequences for you as an employer and what needs to be arranged?

Is your employee entitled to maternity leave and a maternity allowance?

Transport and travel costs of your employees in the Netherlands: tax rules

Information about the tax rules around the reimbursements and benefits in kind for trips your employee makes for work. You will also find information about the provision of means of transport, public transport tickets and parking facilities.

Application of anonymous rate in the payroll administration

This guide tells you when to apply the anonymous rate and how to process this in the payroll tax return

The work-related costs scheme (WKR)

The work-related costs scheme is a tax regulation under which the allowances and benefits in kind that employers give to their employees can remain tax-free to a certain extent.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Announcements

- Research funding

Reimbursement of expenses for business trips in the Netherlands

Are you travelling on business in the Netherlands? Then your travel and subsistence expenses will be reimbursed. Before making a business trip, arrange permission from your manager.

Travel with public transport unless this is unfeasible, in which case you may use your own vehicle, a taxi or a rental car, but do discuss this beforehand with your manager.

If you receive a travel allowance from a party other than the University, this will be deducted from the sum for which you may claim.

The following travel expenses will be reimbursed:

- If you travel with public transport, your actual costs will be reimbursed. If you travel by train, you may travel first class and will be reimbursed for this.

- If you have permission to travel with your own car, you will be reimbursed € 0.23 per kilometre.

- If you have permission to travel by taxi or rental car, the full cost will be reimbursed. When travelling by rental car, do not forget to keep a logbook of your kilometres and submit this as proof for your claim.

- If you have a disabled badge, you will be reimbursed € 0.23 per kilometre and any parking fees.

- If your business trip lasts longer than four hours and takes you further than one kilometre from your workplace, you are entitled to an accommodation expenses allowance: for instance, for meals and small expenses. There are fixed reimbursement rates for these costs and you must meet a number of conditions.

Fixed reimbursement rates

The allowance will be paid out to you tax-free, irrespective of the amount of your actual expenses, provided you meet the following conditions:

- You must have actually incurred these expenses for lunch, evening meals, lodging and breakfast in an establishment intended for that purpose.

- To qualify for the lunch and dinner allowance, your business trip must include lunchtime (between 12:00 and 14:00 hrs) and dinnertime (between 18:00 and 21:00 hrs). You do not have to submit receipts for these expenses.

- You are entitled to the daytime component if your business trip lasts at least 4 hours per full 24 hrs period.

- You are entitled to the evening, lodging and breakfast components only if your business trip includes an overnight stay.

- If your business trip lasts longer than eight days, you will be reimbursed for the full evening component for the first eight days, following which your allowance will be halved

If you regularly take the same route on University business, use a route card (in Dutch: trajectkaart ) or the like to reduce costs.

Submit your expense claims

- You can submit your travel and accommodation expenses via Self Service.

- Log on to Remote Workplace .

- Choose SAP Self Service.

- Submit your claim as soon as possible but no more than three months after the end of the calendar year.

- Ensure that you have an electronic copy of your proof or purchase, for instance an original receipt, before you submit your claim.

- Before making a business trip, arrange permission from your manager. Your activity holder and budget holder must approve your claim.

Expense claims if you are not employed by the University >>

Human Resources

- Working hours

- Business travel

- CAO and regulations

- Individual Choices Model

- Terms of employment in short

- Registration and contract

- Practical issues

- International staff

- University doctor

- Working with a functional limitation

- Mental fitness

- Work pressure

- Leiden Healthy University

- Self Service

- Confidential counsellors and complaints committees

- PSSC Service Point

- Service Centre International Staff

- Immigration and formalities

- Social life and settling in

- Taxes and social security

- Getting around

- Frequently asked questions

- Career guidance and mobility

- Teacher development

- PhD candidates and postdocs

- Code of conduct

- Recruitment and selection

- Diversity and inclusiveness

- P&D interviews

- Continuing education rules and regulations

- Confidential counsellors

- Staff ombuds officer

- Complaints committees

- Collective insurances

- Unfit for work

- Unemployment

Finance & Procurement

- Expense claims

- Other allowances

- Invoice payments

- Sales invoices, credit notes and receiving payments

- Payments without an invoice (by bank transfer, VVV gift card or cash), taxable remuneration (IB47)

- Payments to research participants

- Conferences and seminars

- Framework contracts

- Procurement procedures

- Service portal

- Research equipment

- Real estate

- University finances

- Financial planning and control cycles

- Regulations and guidelines

- Working for third parties

- Financial project management

- Department Financial Economic Affairs

- FSSC Service point

- Controllers

- University Procurement

- Audit department

- Synchronising mail and calendar

- Printing and copying

- Software and online tools

- Forgotten your password

- Activating and managing your account

- Additional authentication

- Applying for a guest/external account

- Office 365 and OneDrive

- Microsoft Teams

- Remote workspace

- Secure online workspace from home

- Application forms

- Helpdesks and contact

- Maintenance and incidents

- Research data

- IT and education > go to Education

- General Data Protection Regulation (GDPR)

- Archive management

- Personal data

- Working securely online

Buildings & Facilities

- Workplace in the office

- Reserving workstations

- Requesting facilities for working from home

- Laboratories

- Environmental awareness at work

- Post and Transport

- Breastfeeding and quiet rooms

- Reserving rooms

- Service desks and receptions

- Management and maintenance

- Floor plans and house rules

- Construction projects

- Ordering catering

- Faculty Club

- Restaurants and bars

- Vending machines

- Event locations

- Reporting unsafe situations

- ERO coordinators

- Health and safety coordinators

- Servicedesk and receptions

- Blended learning

- AI in education

- Digital tools

- Tools for interactive learning

- Lecture halls and computer rooms

- Evaluation of education

- The Programme Committee

- Board of Examiners

- Site visits and accreditation

- Vision on education

- Integrity and fraud

- Student success

- Degree programmes

- Educational support units

- ICT and education

- Library and education

- Internationalisation in education

- Accessible Education

- Tests and theses

- Giving a presentation

- Remote teaching

- Reserving equipment

- Referral options

- Unacceptable behaviour

- Training and workshops for staff

- Training and workshops for students

- Online self-help for students

- Bringing students together

- Background information on student well-being

- CROHO and teacher's academy

- Comenius programme

- Teaching innovation

- Contact about internationalisation

- Arrange partnership and exchange

- Sign up student and staff

- Safety abroad and crisis management

- Preparing for a trip: visa and Europass

- Academic calendar

- Course and Examination Regulations

- Studying for a PhD

- PhD ceremony

- After your PhD

- Career Platform

- Confidential Counsellor and university doctor

- Becoming a postdoc

- Collaborating with renowned researchers

- Training programmes, coaching and career guidance

- Practical support for internationals

- Confidential advisers, health & safety

- Research programme data science

- Collaboration Leiden-Delft-Erasmus

- Research internationalisation

- Find and prepare

- Write your proposal

- Submit your proposal

- Grant awarded

- Help and support

- Data storage

- Datamanagement

- Research software

- Sharing and sending files

- Publication tools

- Research from home

- Roadmap and examples

- Research visitations

- Academic integrity

- Ethics committees

- Publishing your doctoral dissertation

- Scholarly Publications and LUCRIS

- Open Access

- ORCID iD and DOI

- Leiden University Press

Communications & marketing

- Communication tools

- Media relations

- Science communication

- Bachelor recruitement

- Master recruitment

- Recruitment international students

- Alumni relations

- Alumni database

- House style

- Writing and translating

- Use of images

- Making a presentation

- Website and web editorial team

- Social Media

- Conferences and Events

- Working securely: tips

- Privacy and security policy documents

- Learning platform

- Incidents and dangerous situations

- Safety in a lab

- Working with hazardous substances

- Emergency Response Officer

- Risk Inventory and Evaluation

Select a different organisation

- Dual careers

- Volunteering

- ACCESS Features

- ACCESS Magazine

- Counselling

- Childbirth Courses

- First Aid Courses

- Testimonials

- Disclaimer and privacy policy

- Thank you for registering for the Eindhoven Childbirth Course

- ACCESS Partners

- ACCESS Counsellors

- ACCESS Trainers

Helpdesk + 31(0)85 4000 338 helpdesk[at]access-nl.org

Visit us in:

The Hague - Amsterdam

Amstelveen - Utrecht

ACCESS NL > Dual careers in the Netherlands > Working in the Netherlands > Employment contracts > I want to know whether or not the employers in the Netherlands are obliged to pay a majority of the employee’s travel to work expenses, and if they’re not, is there a way I can claim it back in taxes?

Employment contracts

Does Dutch employment law apply to me?

Dutch employment law applies to you, even if you have moved to the Netherlands with an expatriate employment contract governed by the law of your home country or if you are working for an international organisation.

What is a CAO (collective labour agreement)?

Most companies and organisations participate in a collectieve arbeidsovereenkomst – CAO (collective labour agreement). This is a written agreement between one or more employers and one or more trade unions about the labour conditions for all employees, such as wages, payment for extra work, working hours, probation period, pension, education and childcare.

The provisions in a CAO are often more favourable than those prescribed by law, but they may not contradict the law.

How do I know that my contract is in accordance with Dutch law?

You can also use the free legal services of Het Juridisch Loket for questions about your employment contract.

Which information is usually included in an employment contract?

You can find information about what should be included in an employment contract here

It is important to carefully check all the conditions of your employment contract before signing.

It is not compulsory, but most companies in the Netherlands reimburse employee’s costs for commuting to work. In the collectieve arbeidsovereenkomst – CAO (collective labour agreement), company regulations or in your work contract, you can find the applicable rules.

If you take your own car or bicycle to work, your employer can reimburse a maximum amount per kilometre.These costs are not deductible from your income for tax purposes. You can find the actual amounts here (Dutch only)

Travel costs are tax deductible if you receive insufficient or no reimbursement from your employer under the following conditions:

- you use public transport to and from work with both addresses being in the Netherlands

- you travel more than 10 km. one way

- you have an openbaar vervoer verklaring – OV-verklaring (transportation provider declaration) or reisverklaring ( from your employer) as proof that you have used public transport. Bear in mind that you should keep any paper/digital tickets that you have used to travel to and from work

If you have a personal OV chipkaart , you can find an overview of all your trips and the costs at the website of the OV chipcard . If you are unsure of what situation applies to you, visit the Belastingdienst (tax office) website for more information on where to apply for the openbaar vervoer verklaring or reisverklaring . This will depend on the ticket you use (Dutch only)

Please note that you cannot claim a deduction if the employer bought the tickets for you. If your travel expenses have partially been covered by your employer, you can only claim the part that has not been covered.

What are my legal rights and obligations when I have an on-call contract?

An oproepkracht (on-call employee) only comes to work when called upon to do so. The rules that apply depend on the type of contract. For instance, there are rules with on payment when no work is available, minimum hours guarantee or minimum wages for hours worked.

More information about on-call contracts is available here .

What are the rules for dismissal?

A temporary employment contract ends on an agreed date or during a trial period. In both cases, there is no dismissal procedure.

If you have a permanent contract, an employer must have good reasons to dismiss you when you have a permanent contract. More information about the rules for dismissal is available here .

What are my legal rights and obligations when I have a temporary employment contract?

A temporary contract has a start date and an end date. The contract will end on the agreed date, though the employer is required to inform you in writing if the contract will be renewed at least one month before the end date. We strongly advise you to ensure that you get a contract in writing, although a verbal agreement is also valid in the Netherlands. The employer is obliged to inform you in writing of the main items covered in the contract within one month after the start of the contract. Within legal limits, both employers and employees are free to decide what will be covered by the contract.

You can find more information about temporary contracts here

What are my legal rights and obligations when I have a permanent employment contract?

The most important difference between a temporary and a permanent contract is that a permanent contract has no end date. This means there is no indication of any intention to limit the duration of the contract, such as “for the duration of the project”. Hence, and unlike temporary contracts, there is no mention of an end date in a permanent contract. Also the “term of notice” will be different for a permanent contract, since your legal position is different. The differences for terminating a permanent labour contract are explained below:

- A permanent employment contract can be ended by one of the parties. The legal terms of notice need to be respected.

- The rules are different for employers and employees. The employee has the legal right to end the contract without a procedure but he or she must respect the legal and agreed period, which is usually a minimum of one month’s notice.

- Both employer and employee have the right to go to court and ask to end the permanent labour contract.

What are my legal rights and obligations when I have an employment contract with an employment agency?

The contract with an uitzendbureau (employment agency) differs fundamentally from a contract with an employer. The employment agency is your legal employer while you work in a company that hires you from the employment agency. In particular, your protection against dismissal during a certain temporary period is not regulated. On the other hand, both you and the company you are working for can terminate your employment at any given time during the agreed employment period. Uitzendbureaus have their own CAO (Collective Labour Agreement).

There is a Wet allocatie arbeidskrachten door intermediairs (Allocation of Workers by Intermediaries Act) that regulates issues related to uitzendbureaus . For example:

- Uitzendbureaus are prohibited from deducting any amount from an employee’s salary for the service of providing temporary work.

- Uitzendbureaus must inform temporary workers in writing about the working conditions at the place of work in advance.

Please note that a werving- en selectiebureau (employment/recruitment agency) is not the same as an uitzendbureau. If a placement is via an uitzendbureau , then the person works via the agency for the duration of the assignment, whereas with recruitment, you work for the company straight away, and the agency receives a fee.

I have some legal issues with my employment contract. Where can I get a legal assistance?

If you cannot clarify any legal issues you may have regarding your contract with your employer, you can seek information and advice at het Juridisch Loket (the legal advice office) free of charge. If they conclude that you need professional legal assistance, they may be able to give you some suggestions. Their website lists 30 offices throughout the country as well as contact details. It is possible to send an email by filling in the online form (form is in Dutch only). Sometimes contact by email is not possible. In this case, it is suggested to make a phone call.

It is good to know that individual labour disputes in the private sector are generally dealt with by a single court judge. Individual labour disputes in the public sector are regulated by administrative law and dealt with by an administrative court. Labour law is an intricate and complex field subject to changes. It is advisable to consult legal professionals when issues or disputes arise.

What are the official public holidays in the Netherlands?

Whether you are free from work on public holidays depends on the agreements made between employers and employees in the CAO (collaborative labour agreement) or those in your employment contract.

The Netherlands has one national holiday:

- Koningsdag (King’s Birthday) on 27 April

In addition, there are a number of generally-observed public holidays:

- Nieuwjaarsdag (New Year’s Day)

- Tweede Paasdag (Easter Monday)

- Hemelvaartsdag (Ascension Day)

- Pinksteren (Whit Monday)

- Eerste Kerstdag (Christmas Day)

- Tweede Kerstdag (Boxing Day, also known as Second Christmas Day)

What vacations am I entitled to in the Netherlands?

Every employee in the Netherlands is entitled to vacation with full pay. The right to vacation days is built up during the course of a year. The minimum number of vacation days to which you are entitled after one year is four times the agreed number of days you work each week (usually 4 x 5 = 20 days). If you have not yet been employed for one year by an employer, your vacation days will be calculated proportionately.

You will receive full pay during your vacation. In addition, you are entitled to a minimum vacation allowance. The vacation allowance is payable by your employer and is paid at least once a year (usually in May). Your employer must specify the amount of your vacation allowance on payment in your contract.. The vacation allowance amounts to a minimum 8% of your income in money (basic wage, bonuses and allowances).

The CAO (collaborative labour agreement) might include other agreements about the number of vacation days, the payment, and the amount of the vacation allowance.

Legal vacation entitlements can be saved up to six months. Any extra vacation entitlements (e.g. if you are entitled to more than the minimum number of vacation days) can be saved up to five years. It is also possible for an employee to exchange vacation days for money from the employer, but neither the employer nor the employee can force the other into such an arrangement.

Which possibilities are available for special leave?

Employees in the Netherlands are not only entitled to fully-paid vacation days, but also to several kinds of special leave such as:

- Emergency leave

- Parental leave

- Adoption leave

- Paternity leave

- Pregnancy and maternity leave

- Extraordinary leave

- Short-term compassionate leave

- Long-term compassionate leave

More information about special leave is available here .

I have heard employees receive a holiday allowance. How much do I get and when?

In the Netherlands, all employees receive at least 8% holiday allowance over their gross income during 12 months. It is common to pay it every year in May, but another payment date is possible too. If you have worked extra hours and got paid for this, the holiday allowance is also calculated over this income.

What should I do when I am ill and unable to work?

When you are ill and unable to work, you need to inform your manager as soon as possible. Every organisation has its own rules regarding when you need to inform your employer. Sometimes you need to call the administration. You don’t have to give any medical information. The company doctor ( bedrijfsarts) will invite you to see him if your illness lasts longer than just a few days or a few weeks. He will also advise your employer if you can do your work or if there are any limitations to take into account (e.g. fewer hours, no physically heavy work). If you would like to discuss anything with the bedrijfsarts when you are not ill, you can make an appointment. Sometimes employers don’t like this, but you have the legal right to see a bedrijfsarts.

Your manager will probably ask you if there is any work that needs urgently looked after by a colleague and when you expect to be back at work. When your illness lasts longer than 6 weeks your employer must get in touch with you to make a reintegration plan. This plan has to be finished six weeks after you became ill.

Finding a job in the Netherlands

View the FAQ’s

Work permits in the Netherlands

Unemployment in the Netherlands

Dutch pension system

Dutch business culture

Related Partners

Women’s Business Initiative International

Volunteer The Hague (PEP)

AWC (American Woman’s Club)

Connecting Women

Toastmasters of The Hague

The tax deduction for travel expenses/commuting (reisaftrek)

.png)

Tax deduction table for travel expenses/ commuting

The only expenses which can be deducted in the annual income tax return in Box 1 relating to income from current employment, are qualifying expenses for commuting per public transport. For deduction itis required that the employee travels at least one day per week from the place of residence or regular place of stay to the place where the employment is exercised.

Traveling at least 40 days per year, qualifies as traveling once per week. The travel must be done by public transport and evidenced by a so-called public transport statement (in Dutch: 'openbaarvervoerverklaring').

The expenses must be reduced with travel cost reimbursements received from the employer.

If the employee travels at least 4 days per week, the deduction for travel expenses/commuting can be calculated as follows (2023):

If the employee travels 3, 2 or 1 day(s) per week, the deduction is respectively 75%, 50% or 25% of the above mentioned annual amounts if the commuting distance is less than 90 kilometers. If the commuting distance is more than 90 kilometers , the deduction equals 26 cents per kilometer multiplied with the travel kilometers and days on which the employee travels, but no more than € 2,354 per year in 2023 (€ 2,214 for 2022).

Frederieke den Hartog

Director/ senior consultant - payroll & expat practice, our services, payroll & hr services, global mobility services, related news.

Don’t miss out on our regular updates on international taxation.

- Bank details

- Corporate Banking

- For entrepreneurs

- Private individuals

- Immigration

- Consultations

- Order status

- machtiging activation

- How to order a service?

- Knowledge base

- Ask a question

- Glossary of terms

- Calculators

- Business offers

- Comments and suggestions

Who is entitled to a tax deduction for travel in public transport?

In the Netherlands, reimbursement by employers of travel expenses of employees is widely practiced. However, not always. And if you pay your own fare for ...

Widely practiced in the Netherlands reimbursement employers of travel expenses of employees. However, not always. And if you pay for your own travel to work on public transport? In this case, you can enter travel expenses on your income tax return and receive a tax deduction - reisaftrek.

Conditions for receiving a travel allowance

- the distance from home to work in one direction by public transport is more than 10 kilometers;

- you commute to work more than one day a week or commute to the same place of work for at least 40 days in a calendar year;

- You can confirm trips using the methods below.

How do I verify travel to work on public transport?

- If you have issued subscription for travel - for example, OV-jaarkaart - then the transport company itself transfers data about your trips to the tax office, your intervention is not needed . Check on the website of your transport company whether this data is transmitted.

- If data is not being transferred, you need to request a certificate from the transport company (openbaarvervoerverklaring or OV-verklaring). This can be done through your "My OV-chip" account on ov-chipkaart.nl .

- If you cannot get OV-verklaring because you are traveling on separate tickets, for example, then you need to get a travel certificate from your employer (reisverklaring). It should indicate:

- your name and address;

- the name and address of your employer;

- the number of days per week you commute to work by public transport.

How much travel expenses can be deducted?

The amount you can deduct depends on:

- one-way distance from home to work by public transport;

- the number of days per week you commute to work.

The size of the deduction for travel in public transport for 2023

* In this case, the calculation is used: 0,26 euros per kilometer one way, multiplied by the number of days on which trips were made to work in 2023. The deduction is a maximum of 2354 euros.

The size of the deduction for travel in public transport for 2022

*In this case, the calculation is used: 0,24 euros per kilometer one way, multiplied by the number of days on which trips were made to work in 2022. The deduction is a maximum of 2214 euros.

To ensure that you receive all your subsidies and tax deductions, file a declaration via Nalog.nl!

In order not to miss new and useful materials, subscribe to our social networks:

- What will change in education in 2023

- Residential property tax could rise by 9,1%

Latest news

- 10.05.2024 Life will be made easier for low-income residents of the Netherlands

- 09.05.2024 I'm a businessman. How important is it to meet the hour criterion?

- 08.05.2024 Congratulations on the Feast of the Ascension of the Lord!

- 08.05.2024 Fines for violating traffic rules have increased again!

- 07.05.2024 I'm a businessman! Do I need a separate business account?

Open a BV in the Netherlands

Turnkey company registration.

Turnkey immigration and adaptation

Consultation

Calculate the exact cost of services

What do you think of this site? *

The purpose of your appeal?

Do not enter any personal information such as name, social security number, or phone number. We do not respond to questions, comments and complaints that come through this form.

Are travel costs deductible?

Incurred travel costs they might be deductible, i travel to work by public transport..

If you travel to work by public transport, it could be the case that you are entitled to a deductible. If you fulfill the requirements, your travel costs are deductible.

Requirements

- You do not receive compensation (or a really low amount);

- Your journey with public travel is more than 10km;

- You travel once a week or at minimum 40 days a year;

- You travel back and forth within 24 hours;

- You have a public transport statement or a travel statement.

- You travel with your personal OV-chipcard.

- You can prove that you made the journeys yourself. For example, by providing a declaration overview, which you can get from your online OV-chipcard environment.

Be aware! Your travel history is only saved for 18 months.

Requesting a public transport statement or a travel statement

If you travel with a monthly or annual ticket, you can request such a statement at the public transport company. Do you travel by another ticket? In that case, you can request a travel statement from your employer.

What amount is deductible?

The deductible amount depends on how often you travel and on how long the journeys are. The table mentioned below shows which amount is deductible in your situation.

Does it mention a * ? In that case, the deductible amount is € 0.28 per kilometer of one way of the journey x the number of days you have traveled in 2024.

The maximum travel deduction is €2.185.

I travel to work using my own transport.

Do you travel to your work using your own car or motorcycle, for example? In that case, you are not allowed to deduct travel costs. However, your employer is allowed to give you tax-free compensation per kilometer. In 2024, this amounts up to €0.23 per kilometer.

We are happy to help!

The TaxSavers is happy to help you get the most out of the deductible items with your annual tax return or provisional assessment. A provisional assessment ensures that you receive a monthly refund from the tax authorities.

Do you have questions regarding deductible travel costs or other tax-related matters? F ill in our contact form or give us a call on +31 (0)20 – 2170120 .

Contact form:

Fill in our contact form and we will get in touch!

WhatsApp us:

+31 (0)20-2170120

The TaxSavers

Amsterdamseweg 71A 1182GP Amstelveen E. [email protected] T. +31 20 – 2170120

For employers

Frequently Asked Questions

Office hours

Monday to Friday (9am – 6pm)

BTW-registration NL859458301B01 (VAT) Kvk-registration: 73318752 (Chamber of Commerce)

General terms and conditions

Privacy statement

Official partners

- International Newcomers Amsterdam

- International Welcome Centre Utrecht Region

- The Hague International Centre

- International Centre Leiden Region

- International Welcome Center North

- Holland Expat Center South

- Food Valley Wageningen

Applying for reimbursement of travel expenses to attend appointments at the UWV

Have you been invited to attend an appointment at the Uitvoeringsinstituut Werknemersverzekeringen – UWV (Employee Insurance Agency) ? You may then be eligible for reimbursement of your travel expenses. Do you need a carer to accompany you to the appointment? Your carer may then also be eligible for a reimbursement.

Last updated on 27 December 2021

Lees deze informatie in het Nederlands

Eligibility for reimbursement of travel expenses by the UWV