Best Cruise Travel Insurance of April 2024

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

A cruise vacation can take much of the stress out of planning a vacation. With a pre-set itinerary on the high seas, you don't have to worry about how you're getting to your destination and what you're going to do there. However, an unexpected emergency can take the wind out of your sails and money out of your travel budget. So you'll want to ensure you have the best cruise insurance plan that won't leave you high and dry in an emergency.

Our top picks for the best cruise insurance

- Best Overall: Nationwide Travel Insurance

- Best for affordability: AXA Assistance USA

- Best for seniors: Seven Corners Travel Insurance

- Best for expensive trips: HTH Worldwide Travel Insurance

- Best for exotic locations: World Nomads Travel Insurance

How we rate cruise insurance companies »

Best overall: Nationwide

Nationwide Travel Insurance is a long-standing and reputable brand within the insurance marketplace that offers cruise insurance plans with solid coverage and reasonable rates.

It has three cruise insurance options: Universal, Choice, and Luxury. The Nationwide Choice plan, for example, offers $100,000 in emergency medical coverage and $500,000 in emergency medical evacuation coverage.

The right plan for you depends on your budget and coverage needs. But each plan offers cruise-specific coverages like ship-based mechanical breakdowns, coverage for missed prepaid excursions if your cruise itinerary changes, and covered service disruptions aboard the cruise ship.

Read our Nationwide Travel Insurance review here.

Best for affordability: AXA

AXA Assistance USA offers three comprehensive coverage plans: Gold, Silver, and Platinum. Each of these plans offers coverage for issues like missed flights, medical emergencies, lost luggage, and more.

The highest-tier Platinum plan provides $250,000 in medical emergency coverage and $1 million in medical evacuation coverage. The baggage loss coverage is $3,000 per person, and their missed connection coverage is $1,500 per person for cruises and tours.

In addition, travelers can take advantage of AXA's concierge service, which provides an extensive network of international service providers. They'll be able to assist you with things like restaurant reservations and referrals, golf course information, and more. This service could come in handy if you're stopping at a variety of unfamiliar destinations during your cruise.

The coverage limits on AXA's policies are on the higher end compared to other providers. And you can buy coverage for a little as 4% of your trip cost depending on your age, travel destination, and state of residence.

Read our AXA Travel Insurance review here.

Best for seniors: Seven Corners

Seven Corners Travel Insurance lets cruisers enjoy traveling in their golden years with the knowledge they're covered in the event of an accident or emergency. While other providers do offer coverage to those 80+ years old, Seven Corners is known for its affordable premiums while offering above-average medical expenses and medical evacuation coverage limits — two areas of travel insurance coverage that are even more important as we get older.

Seven Corners also offers the option of a preexisting conditions waiver and CFAR insurance at an additional cost, plus "Trip Interruption for Any Reason" coverage, which you won't find on many policies.

You can choose between the Trip Protection Basic or Trip Protection Choice plans, with the higher-tier Choice plan costing more but providing more coverage.

Read our Seven Corners Travel Insurance review here.

Best for expensive trips: HTH Worldwide

HTH Worldwide Travel Insurance offers three levels of trip protection: TripProtector Economy, Classic, and Preferred. The higher the tier, the more coverage you'll get for things like baggage delays, trip delays & cancellations, and medical expenses. But their premiums remain reasonable even at the highest tier of coverage.

Not only does the HTH Worldwide Trip Protector Preferred plan offer higher-than-average medical emergency and evacuation coverage limits ($500,000 and $1 million, respectively), but you'll also get a baggage loss coverage limit of $2,000 per person and coverage for trip interruption of up to 200% of the trip cost. You also have the option to add CFAR coverage for an additional cost.

Read our HTH Worldwide Travel Insurance review here.

Best for exotic locations: World Nomads

World Nomads Travel Insurance has been a top choice for comprehensive travel insurance for many years now. And it's a great option when it comes to cruise coverage, too.

Even the most basic Standard Plan comes with $100,000 in medical emergency coverage and $300,000 in emergency evacuation coverage. And you'll get higher coverage limits with their Premium Plan. Plus, unlike many other providers, World Nomads trip cancellation and emergency medical coverage include COVID-19-related issues.

What sets World Nomads apart from many other insurance companies is that its policies cover 200+ adventure sports. This can be important for adventurous cruisers who plan to take part in activities like jet skiing, scuba diving, or parasailing during their cruise.

Read our World Nomads Travel Insurance review here.

Introduction to Cruise Insurance

Cruise insurance may offer unique coverage like missed port of call and medical evacuation coverage. You might not need the flight protections of a regular travel insurance plan if you're catching a cruise at a port near you, but medical and cancel for any reason coverage could be critical. The best travel insurance plans will provide flexibility to add coverage options to fit your travels needs.

Understanding the Basics of Cruise Insurance

At its core, cruise insurance is your financial lifeboat, designed to protect you from unforeseen events that could disrupt your sea voyage. Whether it's a sudden illness, adverse weather, or other unexpected occurrences, having the right insurance can make a world of difference.

Why Cruise Insurance is Important

Picture this: You're all set for your dream cruise, but a sudden family emergency means you can't set sail. Or worse, you fall ill in the middle of the ocean. Without cruise insurance, you're not just missing out on an adventure, but also facing potentially huge financial losses. That's why securing cruise insurance isn't just recommended; it's a crucial part of your cruise planning.

Types of Cruise Insurance Coverage

Cruise insurance isn't a one-size-fits-all life jacket. There are various types of coverage, each tailored to protect different aspects of your cruise experience.

Trip Cancellation and Interruption Coverage

This coverage is like your safety net, catching you financially if you need to cancel your trip last minute or cut it short due to emergencies, be it due to personal, health-related, or even certain work conflicts.

Medical Coverage

Being on a cruise shouldn't mean being adrift from medical care. Medical coverage ensures that if you fall ill or get injured, your medical expenses won't sink your finances.

Emergency Evacuation Coverage

In the rare case that you need to be evacuated from the ship due to a medical emergency or severe weather, this coverage ensures you're not left adrift in a sea of expenses.

Baggage and Personal Effects Coverage

Imagine reaching your dream destination only to find your luggage lost at sea. This coverage ensures that lost, stolen, or damaged baggage doesn't dampen your cruise experience.

Buying Cruise Insurance

Securing the best cruise insurance isn't just about finding the best price; it's about ensuring it covers all your potential needs.

When to Purchase Cruise Insurance

Timing is everything. Purchasing your insurance soon after booking your cruise can often provide additional benefits and ensure you're covered for any early surprises. As you get closer to your trip your coverage options may get more expensive, and certain providers may not be able to offer you coverage.

How to Find the Best Deals on Cruise Insurance

Keep a lookout for deals, but remember, the cheapest option isn't always the best. Balance cost with coverage, and ensure you're getting the protection you need at a price that doesn't rock your financial boat. A travel insurance comparison site like SquareMouth is a good place to compare multiple quotes from all of the major carriers at once.

How we reviewed cruise insurance plans

When comparing cruise travel insurance providers, we evaluated them based on the following criteria to come up with our list of top picks:

Customer Satisfaction

We look at ratings from JD Power and other industry giants to see where a company ranks in customer satisfaction. We also look at customer review sites like Trustpilot and SquareMouth.

Policy Types

We look at policy types and offerings, from standard travel protections to adventure sports coverage. We look at the amount of insurance offered

Average Premiums

We compare average premiums per trip. Some companies also offer annual plans, and we compare policies accordingly.

Claims Paid

How frequently do companies pay claims easily and quickly? We check customer reviews and other resources to see which companies honor policies most effectively.

We look at the company's overall behavior. Is it operating ethically? Companies can earn additional points for such behaviors.

You can read more about how Business Insider rates insurance here.

How much does insurance cost for a cruise?

As a rule of thumb, you can expect to pay between 5% and 10% of your prepaid, nonrefundable trip expenses for cruise insurance coverage. The price will vary depending on factors like your age, your travel destination, and whether you require additional coverage.

When is the best time to buy cruise insurance?

If you're booking a cruise, we recommend purchasing travel insurance when you make your first trip payment. That could be for the cruise itself or an expense like airfare to get you to your cruising destination. This way, if you have to cancel your trip, you'll have the most extended coverage period possible.

Can I buy my own cruise insurance?

You can buy your own cruise insurance that isn't offered directly through the cruise line operator. In fact, this could be a better option if you want coverage for your travel to the cruise's departure point, not just for the cruise itself.

What is the difference between travel insurance and cruise insurance?

The difference between traditional travel insurance and cruise insurance is that cruise insurance offers more specialized coverage, for situations such as missing a departure port and more coverage for medical evacuations, since it's more expensive to evacuate someone at sea than on land.

Can I claim for missed ports on a cruise?

Most cruise insurance includes coverage for missing a departure port, so you should be able to claim for a missed port. Just make sure you check the details of your policy before you file a claim, and before you travel so you know what compensation you're entitled to.

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

Best Cruise Travel Insurance Plans of February 2024

(Updated Feb 2024) Here are the best plans to cover your cruise, plus everything else you need to know about cruise travel insurance

Looking for the best cruise travel insurance for your upcoming trip?

Your search ends here. Our complete guide features the best cruise travel insurance plans. But we’re not just going to give you a travel insurance for cruise recommendation. We’re going to walk you through everything else you need to know about insuring your cruise. You’ll learn about the various types of coverage – including trip interruption coverage, medical emergency coverage, and much, much more.

Cruises are one of the most insured types of trips because this style of travel comes with unique risks. In fact, over 75% of cruisers buy travel insurance for their trip, versus about 40% of travelers in general.

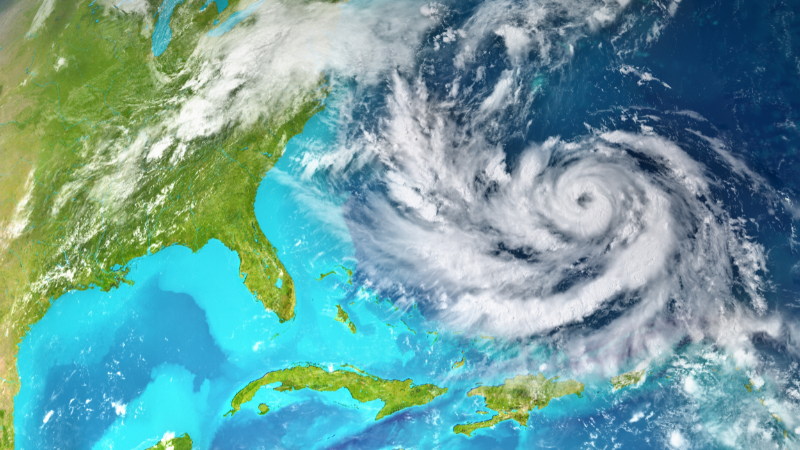

What are these cruise-specific risks? You might have connecting flights to catch the departing ship. Your cruise could be during hurricane season. When you’re on the cruise you will be far from hospitals. Cruise companies also have strict cancellation rules. These policies put your trip expenses at risk if you need to cancel. This is the beauty of purchasing cruise travel insurance – you gain peace of mind knowing that in a worst case scenario, you aren’t out the thousands of dollars you spent on the adventure.

Before we unveil the best cruise insurance companies and plans of the year, we want to talk about the type of coverage we recommend you get.

Criteria for cruise travel insurance coverage

I recommend the following standards for choosing a plan, and will expand on each at the end of the guide. These criteria are mandatory for my picks:

- Trip cancellation includes Covid coverage

- Emergency medical includes Covid coverage

- Emergency medical coverage is $100,000 min.

- Medical evacuation coverage is $250,000 min.

- ‘Cancel for any reason’ available

I recommend the above criteria, and my picks meet these standards. The following criteria are good to have if possible. I factor these into my choices:

- Hurricane & weather cancellation coverage includes NOAA hurricane warnings

- Hurricane & weather coverage triggers at 12 hours or less

- Itinerary Change coverage included

- Missed Connection coverage included

Now, we’ll talk you through the importance of various types of travel insurance coverage for cruises later on. Right now, we’re excited to unveil the best cruise insurance plans of the year for travelers just like you. We’ll start off with a recommendation for most travelers:

Best cruise travel insurance for most travelers

This is my top cruise plan based on the criteria above, individual plan features, and cost. Below I have also selected a best plan for families and seniors. All recommended plans are from A.M.Best Rated reputable companies that specialize in travel insurance.

What makes this the best overall plan? This plan covers hurricane warnings, while many plans don’t. It has missed connection coverage to help you “catch up” to your ship. It has itinerary change coverage if unexpected changes happen. It has the option for Cancel For Any Reason coverage, which has become very popular since Covid. Finally, it is fairly priced so you get good value for the money.

- Covid covered for sickness cancellation and emergency medical

- $100,000 Emergency Medical (Primary)

- $1,000,000 Medical Evacuation

- Cancel For Any Reason upgrade is available if purchased within 21 days of first trip payment

- Weather coverage includes NOAA hurricane warnings

- Travel Delay after 12 hour common carrier delay

- Includes itinerary change coverage

- Very good Missed Connection coverage $2,500/person after 3 hour delay

- Great for: Best overall plan. This plan has cruise-specific coverage like Missed Connection, Itinerary Change, and hurricane warning coverage that makes it stand out.

Example quote $232 (includes all travelers): For the above plan, the example trip includes 2 travelers (45, 45) on a 7-day cruise with airfare, with a total trip cost of $3,500).

Best cruise insurance for families

This is the best cruise insurance for parents traveling with children. Families will have extra concerns to consider, and this plan covers families better at a good price. Again, all recommendations are from reputable companies that specialize in travel insurance.

What makes this the best plan for families? This plan covers hurricane warnings, while many plans don’t. It covers school year extension for cancellations, for something like extra school to make up for snow days. It has missed connection coverage to help you “catch up” to your ship. It has the option for Cancel For Any Reason coverage, which has become very popular since Covid. Finally, the pricing is very good when traveling with children under 18.

Worldwide Trip Protector

- Travel Delay after 6 hour common carrier delay

- Missed Connection coverage $500/person after 3 hour delay

- Unique family-friendly coverage for cancellation if your school year is extended unexpectedly.

- Very good value, the sample quote below is under 4% of the trip cost– well below average

- Great for: Families concerned about delays, Travel Insured has a generous delay trigger and high coverage.

Example quote $224 (includes all travelers): For the above plan, the example trip includes 4 travelers (45, 45, 12, 10) on a 7-day cruise with airfare, with a total trip cost of $6,500).

Best cruise plan for seniors

- Pre-existing conditions covered

- Great for: The best overall pick is also great for senior travelers. The pricing is competitive in this higher premium bracket, plus it covers pre-existing conditions

Example quote $938 (includes all travelers): For the above plan, the example trip includes 2 travelers (70, 70) on a 14-day cruise with airfare, with a total trip cost of $9,000).

How much does cruise travel insurance cost?

In general, travel insurance costs between 4-10% of your insured trip cost. I chose the policies above because they met the criteria listed. The plans also had unique individual coverages and were well priced.

Here is a summary of the cost of travel insurance from the examples above:

- Best Overall Plan – TravelSafe Classic 6.6% of the trip cost

- Best Family Plan – Travel Insured WTP 3.4% of the trip cost

- Best Senior Plan – TravelSafe Classic 10.4% of the trip cost

Why is the “family” plan such a low percentage of the trip cost? Because there are more travelers the cost of the trip is spread between all travelers, and therefore the risk per traveler is reduced. This reduces the insurance company’s risk exposure.

How much travel insurance do I need for a cruise?

As we covered at the top of the page, I recommend minimum levels of emergency medical and evacuation coverage. Due to the nature of cruise trips, these higher levels provide adequate protection:

- Emergency medical coverage $100,000 min.

- Medical evacuation coverage $250,000 min.

Requirements by cruise line

With cruise lines operating again, many require unvaccinated travelers to buy medical coverage to board the ship. These are the requirements of the cruise lines and I believe they are too low. But, the cruise lines are requiring this to protect themselves.

Royal Caribbean: Travelers must have $25,000 in Emergency Medical coverage and $50,000 in Medical Evacuation coverage.

Carnival Cruise Line: Travelers must have $10,000 in Emergency Medical coverage and $20,000 in Medical Evacuation coverage.

Disney Cruise Line: Travelers departing from Florida must have $10,000 in Emergency Medical coverage and $30,000 in Medical Evacuation coverage.

What expenses can I insure?

Travel insurance covers your pre-paid, non-refundable trip expenses . This includes airfare to your port of departure, hotel at the port of departure, the cruise fare, shore excursions, organized tours, or event tickets. It is important to spend a few minutes to gather all of your trip costs to make sure you don’t miss anything. If the expense is not included in your insured trip cost, you will not be covered.

What does cruise insurance cover?

Finding the best cruise travel insurance means finding the right coverage. Every trip is different, and cruises come with their own list of risks.

Protection before you leave

Trip Cancellation Insurance This protects your trip cost if you need to cancel or interrupt your trip for a covered reason. The most common reason people cancel is someone getting sick right before the trip. It also covers death in the family, hurricane & weather, house fire, quarantine, jury duty, terrorism, and more. The medical issues also apply to family members, so a parent getting sick and needing your care would be covered.

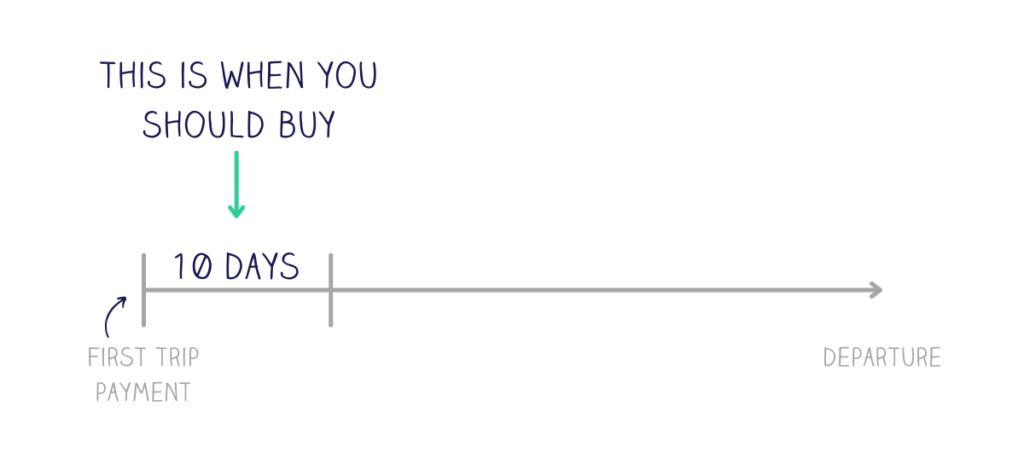

Cancel For Any Reason (CFAR) Coverage Upgrade The list of covered reasons for cancellation includes most common situations. But, that list cannot include everything. Cancel For Any Reason insurance extends your cancellation coverage to “everything”. You need to cancel at least 48 hours before departure and insure your full trip cost. You also buy in time (usually within 10 days of your first trip payment). All the above best cruise travel insurance plans have CFAR as an optional upgrade.

Protection while at sea

Emergency Medical Coverage This covers expenses for emergency medical treatment while on your trip. Your insurance from home may not cover you when you leave your home country.

Emergency Evacuation Coverage This coverage pays for medical transportation . It includes an ambulances to the hospital, an airlift from a remote location, or a medical flight back home.

Primary medical coverage Having Primary coverage for medical emergencies is better than Secondary coverage. It means the plan will pay first, without needing to use any other insurance you may have. With a Secondary coverage plan you would need to use any other coverage you might have first. Then you would use the travel insurance coverage. You’re covered either way, but having Primary coverage makes it easier to file a claim.

Protection throughout your trip

Travel Delays This covers extra expenses caused by travel delays . For example, a few extra nights in a hotel, meals, or personal items.

Baggage Loss, Theft, or Damage This covers your baggage not only on your flight, but on your entire trip. It will reimburse you for personal items and luggage if your bags are lost, stolen, or damaged during your trip.

Baggage Delay If your baggage is delayed in reaching your destination, you might need extra cloths or personal items. This coverage reimburses you for these expenses.

Covid-19 Cruise Insurance: How is coronavirus covered?

The pandemic remains a concern for all travers, especially those traveling with children or elderly parents. The plans above cover cancellations if you get Covid-19. A doctor will need to verify that you cannot take your trip. In this case, Covid is treated like any other sickness for trip cancellation coverage .

The best cruise travel insurance plans also cover Covid for emergency medical treatment. This is important when you travel abroad where your insurance from home may not cover you.

There are many other covered reasons for trip cancellation . These include severe weather, terrorism, house fire, or a death in the family. Getting sick before your trip is the most common.

What makes cruises different than other trips?

Cruises are a different type of travel. To find the best cruise travel insurance, you need to consider some extra risks that are unique to cruises. These include hurricanes and other weather-related concerns, the harsh cancellation policies associated with cruise lines, high pre-paid expenses, and the distance to emergency medical help. We’ll break these issues down more in-depth to help you understand why travel insurance for cruises is so important.

Cruising and hurricane season

Bad weather and hurricanes affect thousands of trips every year. Many cruises go to hurricane-prone destinations, putting them more at risk. Your flight can be canceled or delayed, causing you to miss your boat.

What makes good hurricane & weather coverage ?

Low time trigger for delays – Trip cancellation coverage covers common carrier (airlines) delays of a certain length of time. Some companies set this amount at 6, 12, 24, or even 48 hours. That would mean your flight would need to be delayed for 48 hours before your cancellation coverage would apply. So, the shorter this time, the better for you. I selected 12 hours or less for the criteria.

Hurricane warnings covered – This is not a common feature in most plans, which is why 2/3 of the best plans include it. This extends your coverage because you don’t actually need to be affected by the hurricane, but you can cancel your trip with full reimbursement if the NOAA issues a hurricane warning. Note: you must purchase travel insurance before the storm is named.

Missed connection coverage – This helps you catch up to your itinerary if you miss your departure for a covered reason, such as bad weather or a flight breakdown on the way to the port.

Itinerary Change coverage – This will reimburse travelers for missed events if their travel supplier changes their itinerary.

Cruise lines have harsh cancellation penalties

Cruise companies usually have the most harsh cancellation penalties of all travel suppliers. Hotels would let you cancel up until the day before, and airlines would charge a fee to change your tickets. Cruise lines would have a penalty schedule that put you on the hook for the full expense weeks before departure.

One bright side of the Covid pandemic has been the relaxing of some of these hard policies. To get travelers spending money again, travel suppliers have reduced or eliminated many of these penalties.

Even with these new policies the best you can hope for in the event of a cancellation is a voucher with the cruise line. The downside is they expire. This puts you under pressure to book another trip with the same cruise line in that time frame.

You have high pre-paid expenses

Cruises are sold as package travel experiences. This means costs like lodging, transport, and even meals are combined into a single cost. These expenses are pre-paid and non-refundable. That means you could lose your expenses if you needed to cancel.

You are far from hospitals if there’s an emergency

Cruise ships have medical care on board, but it is not a fully equipped and staffed hospital. If you have a serious issue onboard you want the proper medical care. Serious conditions include a stroke, heart attack, or appendicitis. Off the ship, you are likely in foreign locations where you would want proper medical care.

When should I buy my plan?

My rule: Buy travel insurance within 10 days of your first trip payment.

Some travel insurance coverage is time-sensitive. This means you need to purchase your plan soon after your initial trip deposit . This period of time is different for each company. The lowest is 10 days, and some companies are as high as 30 days.

This is why 10 days is the safest goal for you. No matter which company, 10 days will put you within that time-sensitive window.

What coverage is time-sensitive?

Cancel For Any Reason coverage (also known as CFAR) is an optional coverage with some plans. Every company that sells CFAR requires you to purchase within their time frame. If you try to purchase after this time period, you will not be able to.

Pre-existing condition coverage is time-sensitive. This does not cost extra, but many companies will cover this if you purchase at the right time.

Are these insurance companies trustworthy?

Yes. All companies featured in our review of the top travel insurance for cruises are reputable. You don’t have to take our word for it either – they are regulated by the Division of Insurance.

Zero Complaint Guarantee

Every policy purchased through CoverTrip comes with a unique Zero Complaint Guarantee .

If you are unhappy with how your travel insurance claim is handled, Squaremouth’s team of licensed claims adjusters will investigate your case and mediate with the provider on your behalf. If the complaint is not resolved to Squaremouth’s satisfaction, they will remove the provider from the website and stop selling their policies.

Cruise travel insurance FAQs

Before we wrap up our yearly review of the best cruise insurance companies and plans, we want to answer some frequently asked questions we get on this subject. If you still have questions after reading through these FAQs, don’t hesitate to reach out – we’re passionate about helping you get coverage that fits your needs and budget!

Why do I need travel insurance for a cruise trip?

A few reasons. Your pre-paid expenses for your cruise are non-refundable, and you could lose it if you needed to cancel. Cruises often take place during hurricane season, which means more opportunity for a cancellation. Cruises take you far from hospital care in the event of a medical emergency.

Is cruise travel insurance refundable?

Yes. Every travel insurance plan we sell comes with a Free Look period. This means you have a certain number of days to examine your coverage, and still have the ability to cancel for a full refund. This period is different for each company, but 10 days is a safe standard to keep in mind.

What is the cheapest cruise travel insurance company?

Most travel insurance companies have 2-3 plans at different premium levels, following the “good, better, best” pricing strategy. I tend to recommend plans in the middle level because they have great value– the right mix of coverage and pricing. Cheaper travel insurance plans will have lower coverage limits for medical, evacuation, baggage, and delays. They might also be missing some less popular coverages. We have a complete guide on the cheapest travel insurance available if you’re interested.

What is not covered by travel insurance?

Travel insurance covers sudden and unforeseen events such getting sick, a death in the family, a hurricane, theft, a house fire, and more. Therefore, if you already know you will need to file a claim you cannot purchase travel insurance to cover it. The list of exclusions also includes losses as a result of war, professional sports, some hazardous activities, drug/alcohol abuse, etc. Learn more in our in-depth discussion on what travel insurance covers .

Are cruises covered under travel insurance?

Yes, travel insurance covers cruises. Some companies market “cruise” plans, which is a collection of coverages that are important to cruise travelers.

Is travel insurance necessary for a cruise?

Yes, sort of. In the past insuring cruises insurance was popular but not necessary. For example, up to 70% of cruisers buy insurance, vs just 40% of regular travelers. But Covid has made travel insurance a requirement in many ports-of-call so it is necessary.

Can you get cruise insurance after booking?

Yes. I recommend you purchase within 10 days of your first trip payment. If you do this, you have the most options and access to coverages like Cancel For Any Reason and Pre-existing Conditions. You can purchase travel insurance right up until departure, but if something happens that causes a cancellation, you need to already have coverage purchased.

Final Thoughts On The Best Cruise Insurance Coverage

That concludes our list of the best cruise insurance plans of the year. You now know which companies and specific plans best suit your needs. More importantly, you recognize the importance of insuring your cruise. Travel insurance in general is important – but even more so when your trip involves a cruise. There are unique risks to this type of vacation that travel insurance covers. So, what are you waiting for? Enjoy peace of mind and protection by investing in quality cruise insurance coverage today! And if you want to learn more about comparing travel insurance , read our complete guide. It will help you gain confidence in making your decision.

DamianTysdal

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.

Cheapest Travel Insurance Plans March 2023

- 14 October 2022

The Best Travel Insurance Plan in January 2024

- 25 March 2022

Best Group Travel Insurance Plans of April 2023

- 3 March 2022

Travel with peace-of-mind... Compare quotes for free

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Protect your cruise with the insurance 70 million+ Americans trust

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

Type the country where you will be spending the most amount of time.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Travel Insurance for Cruises

When experienced cruisers are about to set sail, they choose Allianz Travel Insurance to protect their cruise. Why? Because when you’re at sea, small mishaps quickly become major problems. Travel insurance can help make things right.

If the ship sails without you because your flight to Miami was delayed, travel delay benefits can help you catch up. If you break your leg and have to cancel your trip, the cruise line won't reimburse you—but travel insurance can. And if you suffer a medical crisis on board, travel insurance can cover your evacuation and emergency medical care.

Here’s the best part: Allianz Travel Insurance is much more than cruise travel insurance. Our plans can protect your flights, hotel stays, cruise excursions, and just about any other kind of travel. Learn about the options and insure your next cruise, so you can leave your worries at the dock.

Share this Page

- {{errorMsgSendSocialEmail}}

Featured Article

Cruise Line Insurance Plan Comparison

Every cruise line offers some kind of protection plan to it passengers. Should you buy it?...

{{articlePreview.snippet}} Read More

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Nomadic Matt's Travel Site

Travel Better, Cheaper, Longer

The Best Cruise Travel Insurance

Travel insurance is one of the most important things you can get for your trip.

As I’ve come to learn — and as any traveler will tell you — things don’t always go as planned when you travel.

You just never know what will happen .

Sure, nine times out of ten you’ll be completely fine. But every now and then you’ll stumble into an unfortunate situation.

Maybe it’s just a missed flight or a delayed connection. Maybe your wallet disappears while riding a crowded bus. Maybe, like me, you burst an eardrum while scuba diving in Thailand .

Bad things, unfortunately, do happen when you travel. And they can get really expensive if you’re injured or fall sick abroad and are not insured.

But what about if you’re taking a cruise — how does travel insurance work then?

Well, of course, you still need travel insurance if you’re on a cruise, but there are some extra things you’ll want to be aware of.

These include delays and cancellations (such as a flight delay that causes you to miss the ship), getting sick while onboard (we all saw how quickly illness spreads on cruise ships during the height of the COVID-19 pandemic), and getting injured (on an excursion or on the ship itself). Whichever travel insurance policy you choose, make sure you double-check that it’s valid for any of these emergencies and problems that might arise on a cruise.

Also, purchase insurance as soon as you make the initial deposit for your cruise. Some insurance policies must be purchased within a certain time frame (such as within 14 days of paying your deposit), plus, you can only be covered for incidents that happen after your coverage begins. If a hurricane ruins your trip, your travel insurance would only cover you if you bought it before the hurricane formed. Don’t wait to get insurance. I’ve seen it happen too often!

All that being said, here’s everything you need to know about buying travel insurance for cruises!

7 Things to Look for in a Cruise Travel Insurance Policy

1. Both international and domestic coverage – Even if you’re cruising close to home, you may still run into unforeseen issues. For example, in the United States, medical insurance stops covering you when your ship is more than six hours away from a US port; in Australia, it stops as soon as your ship leaves port. For that reason, you’ll want to get a policy that covers you even if you’re in/around your home country.

2. Medical coverage – Be aware that the treatment for less serious medical conditions — the kinds that don’t require you to leave the trip — are more expensive on a cruise ship than on land. Make sure your policy has a sufficient amount of medical coverage (at least $100,000 USD).

3. Emergency evacuation – Remember, if you fall seriously ill when you’re at sea and you need to be evacuated to a hospital, it’s more expensive than if you’re already on land. Evacuation by helicopter to the nearest treatment facility can be in the tens of thousands of dollars. Make sure your policy has sufficient evacuation coverage (at least $250,000 USD).

If you don’t want to get stuck in that “nearest” hospital, consider getting Medjet . They are the premier membership program that then gets you all the way to a hospital at home (read more in my Medjet review ).

4. Cancellation, delay, or trip interruption coverage – If you have a flight delay that means you’ll miss the start of the cruise, it’s a lot more difficult to deal with than just arriving late for a land-based trip. Hurricanes or other severe weather events also affect cruises significantly, and you’ll want your insurance policy to take that into account.

5. Activity coverage – Take a look at the shore activities you might participate in during the cruise and check if any need to be mentioned to your insurer, like certain adventure activities or water sports.

6. Theft or loss of personal property – Unlike other kinds of travel, you might be more likely to take valuable jewelry and expensive clothing for some of the fancy dinners and events cruise ships hold. Often a regular travel insurance policy will only cover these items up to a certain value, so check that your belongings are covered against possible loss or theft.

7. Option for Cancel for Any Reason (CFAR) coverage – This add-on is not something that everyone will want to pay for (it increases the cost of policies quite a bit). But if you want the ultimate peace of mind knowing that you’ll be able to get reimbursed no matter the reason for cancelling your trip, you might want to upgrade to CFAR coverage.

What is the Best Cruise Travel Insurance?

With so much to consider, it can be hard to decide which cruise travel insurance to choose.

Be aware that while many cruise companies offer their own insurance, the conditions are often stricter, they don’t cover any part of your trip that’s not on the cruise (such as airfare and/or hotels while you’re traveling to the departure port), and you might find it hard to make a claim.

They also rarely pay out in cash (and instead simply provide vouchers for future cruises), tend to have a short list of acceptable cancellation reasons, and rarely cover pre-existing medical conditions. You’re always better off using a third-party insurer.

Whichever policy you decide on, it’s vital that you read the policy details carefully so you know exactly what you are covered for.

The insurers below are some I recommend that have specific cruise insurance policies and offer a decent amount of coverage for a lot of potential mishaps:

Travel Guard Travel Guard has specific cruise insurance policies, which makes it simpler than trying to find an add-on. If you’re getting a quote online, they’ll ask you to specify if you’re taking a plane, a cruise, or both. They cover any emergency travel assistance, trip interruption, delay, and cancellation.

Medical expenses and emergency evacuation are covered, but the maximum amount varies between the essential, preferred, and deluxe plans: the essential plan includes a $150,000 limit on emergency evacuation, which might not be quite enough from some parts of the world, but you can get up to $1,000,000 of coverage on the deluxe plan.

Insure My Trip Insure My Trip is an unbiased aggregator site that you can use to look at many different insurance policies to find the one that best fits your needs. It’s also the best place to find travel insurance for travelers over 65 .

VisitorsCoverage VisitorsCoverage is another insurance marketplace with a specific cruise section that compares different plans, including the popular SafeCruise plan by IMG. This plan is designed for cruise travelers and includes everything you might need, including the add-on for cancel for any reason coverage. Additionally, as long as you purchase insurance by the time you make your final trip payment, there’s a waiver for most pre-existing conditions, too.

Don’t go on a cruise without proper travel insurance. That means being aware and paying a bit more attention than usual to the conditions of your policy. Make sure that any policy you choose covers you sufficiently for medical evacuation, medical treatment onboard, and other mishaps like missed connections, stolen luggage, delays, and cancellations.

And be sure to purchase cruise insurance as soon as you book your cruise so that you can take advantage of cancellation benefits should the need arise.

If you can’t afford to add cruise travel insurance to the costs of your trip, you probably can’t afford to travel. It’s just not worth the risk of coming home with a bill in the tens of thousands of dollars or more if something unexpected goes wrong.

In my experience, it’s always better to be safe than sorry. The peace of mind is worth the extra cost.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight Find a cheap flight by using Skyscanner . It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation You can book your hostel with Hostelworld . If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free? Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip? Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip? Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase. I recommend only products and companies I use and the income goes to keeping the site community supported and ad free.

Related Posts

Get my best stuff sent straight to you!

Pin it on pinterest.

All Your Questions About Cruise Travel Insurance, Answered

By Elissa Garay

Rarely does real life make its way into our fantasies of a dream vacation : palm trees swaying in the breeze, expertly plated meals served at whim, toes pointed toward the horizon on a sun-soaked day at sea. That vision doesn't factor in missed flights, lost bags, or medical mishaps. But life has a way of getting in the way, even when you’re trying to get away from it all. Add in an unexpected curveball like the coronavirus pandemic (and the disease it causes: COVID-19)—which has effectively wiped out cruising, for the near future, at least—and things get even more complicated.

In most instances, you can buy peace of mind in the form of a well-tailored cruise travel insurance policy, which industry experts say is nearly always a smart bet. Not only does coverage insure your financial investment in the case of a hiccup, but it can also help with access to quality medical care on the road, as well as reimbursement for any unforeseen expenses that may pop up in the face of such scenarios. In this primer on travel insurance for cruises, we break down everything you need to know so you can pick up a policy with ease—and then get back to planning your eventual lounge on the lido deck.

What does cruise travel insurance cover?

“A cruise vacation has so many moving parts, including the sheer number of destinations you visit, flights, and hotels bookings. Things can go wrong after you’ve made that final deposit, and without travel insurance, you’d likely lose that payment,” says Colleen McDaniel, editor-in-chief of cruise review and community site Cruise Critic .

While specific policies vary in their coverage—you’ll need to review the fine print carefully before you buy—most offer recourse for commonly encountered issues like the need to cancel a trip (for approved reasons like your traveling companion falling ill, or the involuntary loss of your job) or trip delays and interruptions. “If you miss your initial embarkation of a cruise due to a flight delay or a weather event, such as a hurricane or winter storm , travel insurance could help cover the costs of you getting to the next port of call, so you can join your cruise,” says James Page, senior vice president and chief administrative officer of AIG Travel, whose subsidiaries sell policies designed to cover cruisers.

Other potential problems might include the airline losing your checked bags , getting pickpocketed in port, the cruise line canceling your sailing due to weather or mechanical issues—or, as we’ve seen of late, due to not being able to run itineraries in areas affected by the coronavirus. While the cruise line would almost certainly pay out a refund in cases of cancellation or major itinerary changes, other prepaid expenses not purchased through the line directly, such as flights or hotel nights, would be on your dime without a qualifying policy in place. “The biggest tip is to make yourself aware of exactly what your plan will cover prior to purchasing,” McDaniel says.

Weather is not covered unless it results in the cancellation of or significant interruption to the cruise. McDaniel says that you won’t get a refund if the scheduled ports visited on a cruise itinerary are changed due to bad weather. “Skipped ports would not be covered by travel insurance,” she says, in cases of inclement weather.

How is the coronavirus affecting travel insurance?

When it comes to coronavirus , it’s important to know that circumstances like epidemics and pandemics are not typically listed as covered events under most standard cancellation policies. Also worth noting: Preemptively canceling a trip out of fear for your health and safety is never part of a standard policy. Accordingly, while some insurers honored claims associated with the onset of the epidemic, almost none are paying out trip cancellation claims for travel or policies booked after late January (with specific cutoff dates ranging between January 21 and January 27, according to travel insurance comparison site Squaremouth). This is owed to the rationale that once the outbreak became a known event, risk is assumed by the would-be travelers who book.

“However, there are now some providers who do not consider contracting the virus as foreseen, even during a global pandemic like the coronavirus outbreak,” says Kasara Barto, public relations manager for Squaremouth. “In this case, trip cancellation benefits can still apply if a traveler contracts the virus or is physically quarantined and unable to travel as planned."

Economic-woe scenarios, like having to cancel if you are laid off from your job, or if a travel supplier should declare bankruptcy, are typically covered under standard plans. Squaremouth notes, however, that coronavirus-prompted impacts like travel bans and border closures are not usually covered by standard policies, nor are cases of cruise lines canceling a scheduled sailing (in which case, the cruise companies themselves would be expected to pick up the tab for reimbursement, or to offer a voucher for future travel).

Because of these exclusions, industry experts advise that a “cancel for any reason” policy upgrade will offer some level of protection even if your reason for canceling is based on fear of travel alone. With this more expensive insurance, you must meet criteria like purchasing your policy within a set time frame (typically within 14 to 21 days of your initial trip deposit) and you must also cancel your trip at least two days in advance of departure.

Keep in mind, too, that down the road, in the post-coronavirus world, industry insiders forecast that new virus-related policy inclusions will become part of standard policies. “Similar to how the September 11 attacks led to terrorism coverage to be offered standard on most travel insurance policies, we anticipate that the COVID-19 pandemic will lead the travel insurance industry to offer more policies that include coverage for pandemics, which may cover things like CDC alerts, travel advisories, and stay-at-home orders,” Barto says.

Insurance and medical incidents

Beyond trip cancellation, medical incidents while traveling present another major need for coverage, since it’s unlikely that your regular health insurance covers such expenses abroad. Most ships have onboard doctors, but visiting them isn’t cheap nor is emergency medical evacuation in the case of more serious illnesses or injuries. “Without [insurance], your out-of-pocket costs could be astronomical,” McDaniel says.

Shannon McMahon

CNT Editors

Hannah Towey

Page of AIG Travel agrees. “Even a short weekend cruise could turn costly if a traveler has an accident or becomes ill, and requires emergency medical treatment or a medical evacuation from sea,” he says, pointing out that travelers are more prone to injury since they often take risks on vacations—like jet-skiing or hiking on unfamiliar terrain —that they might not take back home. “It’s important to ensure the policy you purchase covers the things you may need, such as pre-existing medical conditions or adventure activities,” Page says.

Specific to the coronavirus, should you contract the virus while cruising, “medical coverage availability will vary per travel insurance provider,” Barto says, noting that a half-dozen insurers were offering such medical coverage as of press time. “While some providers are still providing medical benefits for newly purchased policies, others are only covering medical expenses related to the coronavirus to insureds who bought a policy prior to the outbreak.” Coverage in regards to scenarios like being denied boarding (for registering a fever at port or having recently traveled to a high-risk destination for COVID-19, for instance) or being placed in mandatory quarantines likewise can vary by insurer.

Orlando —based travel agent Kelley Lord is an avid cruiser, with nearly 40 cruises under her belt, and she has taken out a policy for every one of them. It’s proven to be a smart strategy: In 2017 alone, her family had to cancel three separate cruises at the last minute, due to medical issues. “We had a 17-night, port-intensive cruise and Europe trip planned for early June that included expensive flights, prepaid excursions, hotels, and the cruise fare,” she says of one incident. “My husband tore up both of his knees in late May playing kickball at the company picnic and had to have double knee surgery. There was no way we could make the trip.” Thankfully, in that and the other two instances that followed that year, “we filed with our travel insurance and were able to recoup most of the cost of the trip,” she says.

Where to buy cruise travel insurance

While cruise lines usually offer their own insurance policies, experts advise looking instead to an independent, third-party insurer. “Travel insurance policies from independent insurers tend to be more comprehensive than those you might purchase through a cruise line,” McDaniel says. “Cruise line insurance is usually secondary coverage, meaning you’ll first need to file through any private insurance policies [like homeowner’s or renter's] that you have before your travel insurance will kick in. This could mean needing to pay out-of-pocket to start.”

Adds Page: “The advantage of purchasing a comprehensive travel insurance policy through an insurance provider like Travel Guard is that the comprehensive plans may offer additional benefits, such as emergency medical evacuation, which may not be available under protection plans offered through cruise lines.”

In addition, cruise line insurance can be more limited than you might expect. “Travelers who purchase the cruise line’s policy can only insure expenses purchased directly through that cruise line," says Jenna Hummer, former director of public relations for Squaremouth. "Any outside airfare or expenses would be forfeited in the event of a cancellation.”

You can pick up a policy from your travel agent directly through a reputed individual insurance provider (like AIG Travel Guard or Allianz), or via an insurance comparison site that lets you compare plans from various insurers (like Squaremouth or InsureMyTrip).

How much does cruise travel insurance cost?

The cost of a standard policy is calculated as a percentage of your overall vacation expenses—generally anywhere from 5 to 10 percent of your total prepaid, nonrefundable trip cost, according to data provided by Squaremouth. “The premium varies by policy and provider, depending on three primary factors: total trip cost, age of travelers, and length of travel,” Hummer says. “Older travelers taking long, expensive cruises will most likely be paying more for the same policy as a younger traveler taking a cheaper trip.”

According to Squaremouth, “cancel for any reason” benefits will typically increase a policy’s premium by roughly 40 percent over the cost of a standard policy, and will only cover a portion (up to 75 percent) of the total trip cost’s reimbursement.

When to buy cruise travel insurance

Experts say to buy your travel insurance as soon as you’ve booked your cruise —that will give you the biggest window of protection should anything arise before you set sail. Hummer says that coverage for preexisting medical conditions is sometimes available at no additional cost from independent insurers—but only if you purchase that policy within 14 to 30 days of your first trip payment.

Remember that you can’t purchase a policy after an event transpires that leads to a claim (say, after you get into an accident and break your leg), but you can purchase standard insurance plans as late as 24 hours in advance of your scheduled departure. As noted before, "cancel for any reason" policies typically must be purchased within 14 to 21 days of your initial trip deposit.

Though you may never use the insurance you purchase, should an issue pop up, the investment can prove to be of great benefit, both economically and psychologically. Lord says, from experience, “You never know when you will need it, but if you do, you will be so grateful that you have it.”

This story was last published in March 2020. It has been updated with new information.

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » The Best Cruise Travel Insurance – Sail on Safely In 2024

The Best Cruise Travel Insurance – Sail on Safely In 2024

Ahoy me maties! While ordinarily us Broke Backpackers are land-lubbers, from time to time we do like to dip our toes into the waters and take a trip upon the high seas.

And moreover, while us Broke Backpackers are usually, erm, broke, sometimes some of us do manage to cobble together the bucks for a high end luxurious experience; and there are few experiences more luxurious and magical than taking a cruise!

If you’re daydreaming about feeling the ocean breeze in your hair while sipping on a (free) pina colada as you sail from one paradise island to the next, then a cruise may be just what you need.

But wait—before you dive into that pool deck or try your luck at onboard casinos, let’s talk about something less sexy but incredibly vital: Cruise Travel Insurance . Trust me, when you’re out at sea or gallivanting through multiple ports, the last thing you want is to be caught without adequate coverage.

In this post we will examine why regular travel insurance may not be quite suitable for cruises and we will instead show you some excellent cruise travel insurance providers.

5 Best Cruise Travel Insurers

- > User friendly app based interface

- > Good level of cover on trip interruption and medical evacuation

World Nomads

- > Wide range of activities covered

- > Can buy after a trip has started

- > Flexible cover – no end date and no itinerary needed.

- > Decent medical cover for emergency and non-emergencies

- > Fast reimbursement

- > Good medical and trip interruption coverage

Visitors Coverage

- > Bespoke cruise cover

- > Excellent medical and evacuation cover

What Makes Cruise Travel Different?

Is regular travel insurance suitable for cruises, top 5 best cruise travel insurance companies, faqs about cruise cover, final thoughts on finding the best cruise travel insurance.

All aboard! Now, you probably know that Cruises really aren’t quite like your typical two-week beach holiday or weekend city escape. In some ways, there are more akin to backpacking trips in that travellers are hopping from country to country but really, that’s where the similarity ends.

Remember that on a cruise, you spend a lot of time in international waters where law and regulation can be as blurry as your vision after that third margarita and are often visiting a new country every single morning.

Cruises are also, of course, notoriously expensive. Seriously now, it’s not particularly unusual to pay upwards of $10k for a two-week Caribbean cruise and while that generally does include all food and drink on board, it usually doesn’t cover excursions and organised trips to shore which can sometimes sting passengers for another few G’s.

For these reasons and many more besides, you need to make sure that you are properly prepared and fully covered and insured when you go a-cruising.

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Because of the unique nature of cruise travel, regular backpacker insurance may often not be appropriate cover.

Perhaps you already have some form of travel insurance policy in place, or maybe you are thinking of using the travel insurance company you used for your last vacation. While regular or more conventional travel insurance might be suitable for your cruise, it might not be.

In order to help you work out whether “normal” travel insurance is suitable for a cruise, let’s look at some of the major considerations;

- Visiting Different Countries: Most regular policies focus on one country whereas on a cruise, you will be visiting many different ones and spending a lot of time in international waters. If your normal insurer does not cover just one of the countries you visit during the cruise, then you are not sufficiently covered.

- Missing the Boat: A standard “trip interruption” policy may not help if you miss the boat and need transport to meet it again. A cruise-specific plan covers you if you get stuck in one of the ports because you lost track of time or got lost.

- Medical Emergency Support: Having to get airlifted off a cruise liner from the middle of the ocean will prove massively, seriously, weepingly expensive. Normal travel insurance policies may therefore simply not cover it.

- Trip Interruption: With cruises sailing away from a different port in a country every night, the risk of missing the boat increases exponentially and normal travel insurance policies may not cover this.

- Cancellation Policies: If you get sick or have a family emergency a week before your cruise and can’t go, you probably want that $10k back. As such, you need a cruise travel insurance policy that offers the best possible cancellation cover.

- Onboard Treatment: Sprained ankle from onboard salsa dancing? You’ll want that covered too.

Basically, while your regular, go-to travel insurance may be OK, relying on your standard policy could prove to be riskier than a late-night bet at the cruise casino. As such, we think it is worth looking for specialist cruise travel insurers, or at least travel insurance providers who offer a cruise cover package.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

Things To Look For in Cruise Travel Insurance

Let’s recap just what an ocean-bound traveller needs to look for when selecting travel insurance for a cruise;

- All Destinations Covered: Firstly you need to make sure that all countries you will visit on the cruise are covered. You need to be careful and pay close attention here. This is especially critical if you’re stopping at a U.S. territory as many policies do not cover the US or require an additional premium.

- International Waters Covered: You also need to ensure that the policy covers international waters and maritime law.

- Medical Coverage: To be fair, you can get ill on sea or on land. Therefore only consideration here is that you may end up being sent to a hospital in any number of different countries and need to ensure that they are all covered.

- Emergency Evacuation: Evacuations at sea don’t come cheap. There are other aspects of safety involved in travel out on the ocean that are covered by special insurance.

- Trip Cancellation and Interruption: If you need to miss the cruise, then it’s a LOT of money down the pan. As such, check that your policy offers robust trip cancellation coverage and covers the full value of your trip.

- Trip Interruption: The big risk here is that you miss the boat at a particular port and need to fly to the next one to catch up with it. Regular insurance policies may not cover this so find one that specifically confirms that it does.

- Onboard Incidentals: Some policies offer quirky but essential features like a “missed port” trip interruption coverage coverage.

- Lost or Stolen Items: Phones and wallets can fall into the ocean, by being stolen from your cabin or pick-pocketed from your person at port (and note that thieves ad gangs specifically target cruise passengers in every single port on earth) As such, make sure that the lost and stolen items cover is adequate.

- Duration of Coverage: Are you a one-cruise wonder or a serial cruiser? Choose accordingly and make sure that the policy covers your whole trip, including flights to and from home.

Even though travel insurance for cruises is a niche and ‘non-standard’ financial product, there are nevertheless rather a lot of different policies on offer from a wide range of providers.

In fact, there are different travel insurance options out there that choosing between them can prove to be nothing short of overwhelming. However the good news is that we have looked at a LOT of these policies and can wholeheartedly recommend that you start your enquiries by checking out the ones below.

These are our top personal picks for the cruise travel insurance;

Faye is a US based, fin-tech-travel-insurer whose industry leading innovative platform was created to be efficient and user friendly placing an emphasis on resolving claims fast. Users can buy and manage their Faye policy without the need for any paperwork whatsoever by downloading the Faye app.

The app allows them to interact with Faye in real time, and successful claims are paid out almost instantly to travellers’ e-wallets.

While Faye do not offer a specific cruise travel insurance package, their policy does offer the following;

- Medical emergency evacuation and repatriation up to $500k

- Emergency medical expenses up to $250k (Int’l)

- Up to 100% of non-refundable trip costs for trip cancellation

- Up to 150% of non-refundable trip costs for trip interruption

- Up to $300/day (subject to a max of $4,500 per trip) for trip delays

User friendly app based interface

Good level of cover on trip interruption and medical evacuation

Only available to citizens

Specialised “cruise cover” not available

We’ll go ahead and save you some precious time and energy: World Nomads travel insurance has been designed by travelers for travelers, with coverage for more than 150 activities as well as emergency medical, lost luggage, trip cancellation and more.

World Nomads travel insurance is provided in over 100 countries. And if you leave home without travel insurance or your policy runs out, you can easily buy or extend while on the road – that’s a big bonus!

World Nomads keeps it pretty simple. There are two plans to choose from: the Standard Plan and the Explorer Plan. Depending on your country of residence, age, and travel destination(s), the prices will vary accordingly.

Check out the full list of what is covered under each insurance plan.

Wide range of activities covered

Can buy after a trip has started

Not the cheapest

Currently not available in the EU

SafetyWing’s Nomad Insurance offers a flexible and comprehensive insurance option that may be suitable for cruisers. This plan covers a range of on-board activities, including athletic events, and does not require travellers to follow a fixed travel itinerary.

Additionally, it is applicable to a multitude of cruise destinations worldwide (with some country exclusions) and allows individuals to easily sign up even if they are already embarked on a cruise.

While the medical cover and flexibility SafetyWing offers are great, the downsides are that they do not offer the best trip interruption and cancellation insurance . If you end up missing the boat or have to cancel the whole trip, then you could end up out of pocket. Oh, and SafetyWing does not cover anybody over the age of 74.

Flexible cover – no end date and no itinerary needed.

Decent medical cover for emergency and non-emergencies

Very limited trip interruption and cancellation cover.

HeyMondo provides whole-trip travel coverage and care that brings out the best in each journey with industry-leading technology that enables smarter and smoother assistance with faster claims resolutions.

Their app-based travel insurance covers your health, your trip and your gear all via an app that provides real-time proactive solutions, quick reimbursements and 24/7 customer support.

HeyMundo are a great option for cruise guests as they offer medical evacuation of up to $500k as well as excellent trip delay and trip interruption coverage that we will set out below;

- American Citizens :

Trip Cancellation or Interruption: Up to $10,000.

Trip Delay: Up to $3000

Missed- Connection: Up to $750

- The rest of travellers :

Trip Cancellation or Interruption: Up to €7000.

Trip Delay: Up to 1500€

Miss Connection: Up to 1000€

Fast reimbursement

Good medical and trip interruption coverage

Not a cruise cover specialist

Not suitable for seniors

VisitorsCoverage is an insurtech company primarily known for providing travel insurance solutions for international travelers. Founded in 2006 and headquartered in Santa Clara, California, the company offers a broad range of travel insurance policies catering to various needs, from trip cancellation to medical emergencies.

What makes Visitors Coverage a cracking great choice is that they offer a Safe Cruise policy which is custom-made for cruise travellers.

All of the major benefits like trip interruption, medical evac and missed connection are there as well as a pretty good Covid-19 coverage.

However, note that this cover is only available to citizens of the US.

Bespoke cruise cover

Excellent medical and evacuation cover

Missed connection limited to $2k

Only available for US citizens

Let’s keep the ball rolling. Here are some frequently asked questions about getting your cruise covered.

Do I really need travel insurance for a cruise?

While travel insurance for a cruise is not mandatory, it is highly recommended. Cruises are a significant investment and have unique risks, such as medical emergencies at sea or in foreign ports, and itinerary changes due to weather conditions.

Can I get a refund if I decide to cancel my cruise?

Whether or not you can get a refund for your cruise depends on both the cruise line’s cancellation policy and the type of travel insurance you have. Some travel insurance plans also offer “Cancel For Any Reason” coverage although it’s usually more expensive and may only reimburse a portion of your costs.

Will my travel insurance cover excursions?

Coverage for excursions depends on the specifics of your travel insurance policy. Some plans will cover injuries or illnesses that might occur during shore excursions. High-risk activities like scuba diving, zip-lining, or jet skiing may require an additional “adventure activities” or “hazardous sports” rider.

Our GREATEST Travel Secrets…

Pop your email here & get the original Broke Backpacker Bible for FREE.

Alright, sailor, by now you should be all aboard with why cruise insurance is non-negotiable. So go ahead, book that dreamy Mediterranean or Caribbean adventure, but do it with the peace of mind that only the right kind of insurance can provide.

And remember, the cruise travel insurers we showed you here are just a few of the providers out there. While they are our personal favourites others are out there and if you feel we missed anybody, please let us know in the comments below.

Bon Voyage , or as they say on the high seas, fair winds and following seas!

And for transparency’s sake, please know that some of the links in our content are affiliate links . That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!

Aiden Freeborn

Share or save this post

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance