Beyond Compliance, Grow Sustainably.

Tax Deductible Expenses For Company In Malaysia 2022

- September 21, 2022

In this article, we will share about the latest tax hot alerts. There are a total of 17 tax components that business should alert with. Kindly scroll down to find out further details!

Table of Contents

1. Road tax, motor vehicles insurance, repair and maintenance for non-company vehicles

If the Company incurred the expenses for those road tax, motor vehicles insurances, repair and maintenance for non-company vehicles such as car belong to salesman), these are not deductible for tax purpose unless the Company has declared the benefit-in-kind/perquisite in the relevant owner’s EA. Please document the owner’s name in the general ledger.

2. Wiring expense

This is not tax deductible for the wiring expenses such as installation of new machine. Wiring expenses under repair purpose is allowed for tax deduction. Please document the nature of the wiring expenses in the general ledger clearly.

3. Small value assets

4. repair and maintenance.

Generally, repairs and renewals expenses are claimed as deductions from a person’s gross income from a business or rental source. Paragraph 33(1)(c) of the ITA allows a deduction for the expenses wholly and exclusively incurred for:

- The repair of premises, plant, machinery or fixtures employed in the production of gross income; or

- The renewal, repair or alteration of any implement, utensil or article so employed in the production of gross income from that source other than implements, utensils or articles on which the expenditure would be qualifying plant expenditure for the purposes of Schedule 3 of the ITA.

However, the cost of reconstructing or rebuilding:

- a) Any premises, buildings, structures or works of a permanent nature;

- b) Any plant or machinery; or

- c) Any fixtures are not allowed as a deduction from the gross income in ascertaining the adjusted income from that source.

Generally, the expenditure on repairs and renewal of assets that are capital and revenue in nature are as follows.

Please document the nature of the respective repair and maintenance clearly in general ledger.

5. Benefit in kind (BIK)

BIKs are benefits not convertible into money, even though they have monetary value. The phrase not convertible into money means that when the benefit is provided to the employee, that benefit cannot be sold, assigned or exchanged for cash either because of the employment contract or due to the nature of the benefit itself.

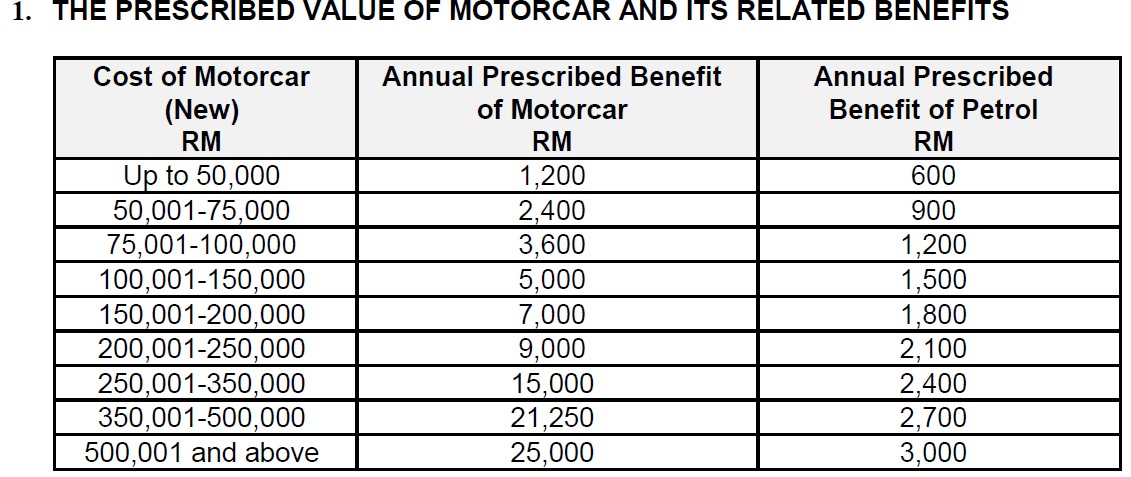

The Company need to account the relevant benefit in kind into the employee’s EA such as company’s motor vehicle used by the directors. The relevant BIK also need to be accounted for calculation of monthly tax deduction (PCB) which the BIK value shall be divided by 12 months period .

Following are some of the prescribed values:

6. Petrol, toll & parking

Those non company car petrol expenses, if it is claim by mileage with claim form or like outstation allowance paid per trip – is allowable and no perquisite to be required. Only full petrol bill paid is subject to tax under perquisite.

Hence, the tax planning tips are:

1. To claim travelling reimbursement based on mileage , by submitting claim form and state its incurred for which client & purpose.

Mileage rate must be standardize for all staff or set based on category/level of staff.

Tax impact: Fully exempted as it is incurred in performance of employment duties.

Following are sample of claim Form:

2. If claim by petrol bill, this will only exempted to RM 500 per month (RM 6,000 per year) per employee, any amount exceeding shall be declared as PERQUISITE in the EA Form or IRBM will resulted with adding back the remaining amount incurred.

Tax planning: To control each staff/director claiming petrol by bill to MAX RM 500 per month ONLY.

Ang Pow paid to staff, with pure intention to celebrate the festival must be proven by providing listing of staff and amount paid to each staff shall be in reasonable amount, otherwise, it may leading to be deemed as a replacement of bonus and hence, subject to be included under respective staff’s EA Form.

Ang Pow paid to non-staff such as customers or business associates are NOT deductible.

Wages paid to part-timers or contract workers must be supported with proper supporting to prove such as pays lip, payment voucher (recommended to use bank transfer), attendance slip and daily worksheet/log book (if any).

Besides that, the recent changes on Form E guideline has also stated all type of employment with the Company (include permanent, intern, part-timer and contract wages) has to be declared. The IRB’s recent employer’s file audit has also requested reconciliation between data submitted in Form E and payroll declared in the Income Statement.

9. Disable staff

Remuneration paid to disable staff will be entitled for double deduction. In this respect, please provide us below documents & information for the tax deduction claims:

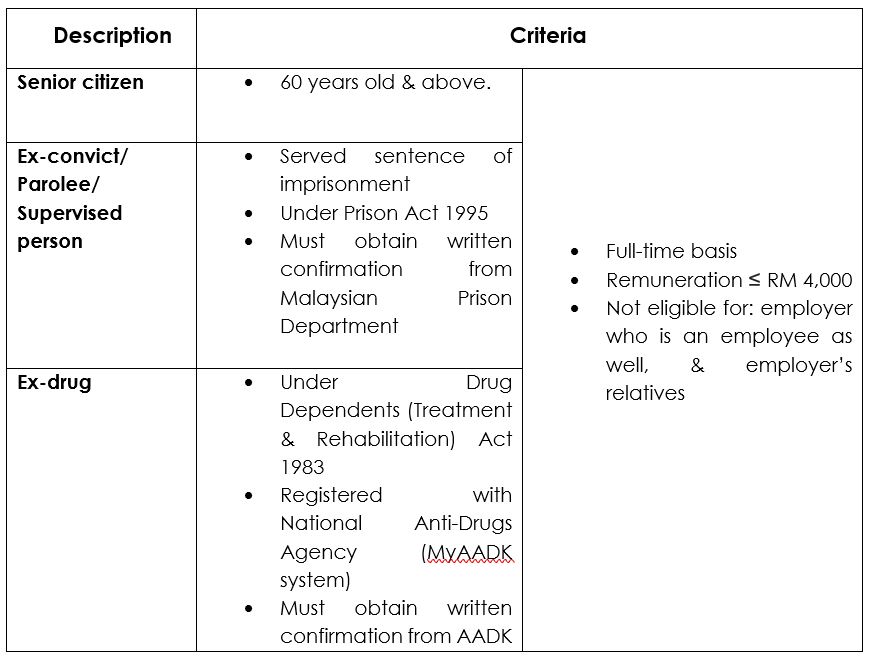

10. Senior citizen / Ex-convict / Ex-drug staff

Remuneration paid to senior citizen / ex-convict / ex-drug who is pure staff, will be entitled for double deduction. In this respect, please provide us below documents & information for the tax deduction claims:

11. Determination of SME status for preference tax rate

A Company is considered a small and medium enterprise (SME) for the year of assessment 2020 and can enjoy the preference tax rate if they have fulfilled the below requirements:

1. The gross income from all business sources for the year is less than RM 50 million, and

2. Paid up capital of the Company in respect of ordinary shares of less than RM2.5 million at the beginning of the basis period, and

3. None of the related companies has a paid up capital in respect of ordinary shares of more than RM2.5 million, and

4. Not an investment holding company and not a dormant company .

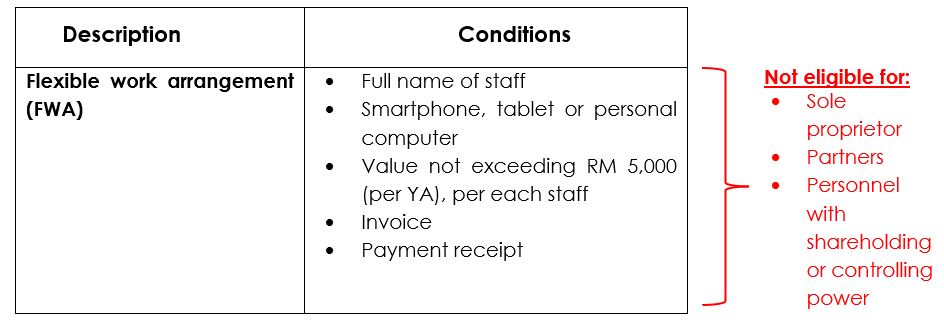

12. Staff welfare (Flexible work arrangement)

To support flexible work arrangement, the Government has allowed special deduction to employer who incurred expenditure on smartphone, tablet or personal computer given to the employee effective from year of assessment 2020.

In this respect, for easy monitoring, suggest to create special ledger of account, segregate for each staff or to rename each transaction for respective personnel.

Note: The above conditions only eligible resident person/entity in Malaysia. The expenses incurred are not considered as employer’s fixed assets since its GIVEN to employee.

13. Special deduction on rental reduction

Landlord who gives min 30% rental reduction to its SME’s tenant, will be eligible for special deduction on the rental discount.

14. Special deduction on renovation

The Government had introduced this incentive from 1 March to 31 December 2021 , under the Economic Stimulus Package to combat Covid-19 impact. The total cost of renovation eligible for special deduction incurred during these periods are RM 300,000 .

Non-compliance

These Rules is not applicable should a taxpayer made separate claim for deduction as allowable expenses, or as capital allowance, to avoid double claiming issue.

15. Deductible expenses incurred for staff & exempted in the hand of staff

There are a number of perquisites eligible for Company’s tax deduction and at the same time exempted at the hand of employee. However, this exemption is not applicable to director with controlling interest/power.

16. INCOME TAX (ACCELERATED CAPITAL ALLOWANCE) (MACHINERY AND EQUIPMENT INCLUDING INFORMATION AND COMMUNICATION TECHNOLOGY EQUIPMENT) RULES 2021

The normal annual capital allowance rate is 10% or 14% (depending on type of assets), however the Government has gazette new Rules deemed as “accelerated annual rate” which is 40%.

Pursuant to the Rules, persons who have incurred or will be incurring qualifying plant expenditure (“ QPE ”) on machinery and equipment (including information and communication technology equipment (“ ICT Equipment ”) for business purposes between 1 March 2020 and 31 December 2021 are eligible for Accelerated Capital Allowance (“ ACA ”) in the following manner:

- Initial allowance: 20% of the QPE incurred; and

- Annual allowance : 40% of the QPE incurred.

Under the Rules, QPE refers to a capital expenditure incurred under paragraph 2 of Schedule 3 to the Income Tax Act 1965 (“ ITA ”) in relation to provision of machinery and equipment including ICT Equipment except motor vehicle. According to the Rules, ICT Equipment includes the following equipment:

- Access control system;

- Banking systems;

- Barcode equipment;

- Bursters / Decollators;

- Cables and connectors;

- Computer Assisted Design (CAD);

- Computer Assisted Manufacturing (CAM);

- Computer Assisted Engineering (CAE);

- Card readers;

- Computers and components;

- Central Processing Units (CPU);

- Scanners / readers;

- Accessories; and

- Communications and networks.

A person who has previously been eligible for and claimed ACA in respect of the same QPE, be it a claim for deduction under the Income Tax (Accelerated Capital Allowance) (Automation Equipment) Rules 2017 or an exemption under the Income Tax (Exemption) (No. 8) Order 2017 will not be eligible to claim ACA under the Rules.

Further, the Rules include a deeming provision relating to hire purchase agreement . It provides that where a person incurs QPE under a hire purchase agreement for the purchase of machinery and equipment including ICT Equipment for business purposes, that person shall be treated as the owner of such machinery and equipment including ICT Equipment and the QPE incurred by that person shall be taken to be the capital portion of any instalment payment, or where there is more than one such payment, of the aggregate of those payments made by that person under the hire purchase agreement.

For further information, you may click on the link below:

https://lom.agc.gov.my/ilims/upload/portal/akta/outputp/1702679/PUA268_2021.pdf

17. PROTÉGÉ

On 11 May 2021, the Income Tax (Deduction for Training Costs under the Professional Training and Education for Growing Entrepreneurs (PROTÉGÉ-Ready to Work (RTW)) Programmed) Rules 2021 was gazette and work retrospectively from 11 September 2019, to replace the previous deduction given on Training Cost for Skim Latihan 1 Malaysia. The order provide deduction as below:

Content Contributor

Senior Tax Manager

Stay Current with Our Newsletter

Keep ahead of the competition with the important industry highlight, tax updates, insightful articles, and other exciting news..

Disclaimer clause:

The information provided by CHENG & CO (“we,” “us” or “our”) on www.chengco.com.my (the “Site”) [and our mobile application] is for general informational purposes only. All information on the Site [and our mobile application] is provided in good faith; however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information on the Site [or our mobile application].

Related Posts

Simplified Guide to the Transition of Sales and Service Tax Rate Changes

Transfer Pricing Disputes: Protecting Your Business with Proper Documentation

You should not miss considering to participate the Special Voluntary Disclosure Programme 2.0 (SVDP 2.0) of Malaysia

Trending now.

- Aug 19, 2023

Navigating the Rules: Traveling Expenses and Tax Deductions

Updated: Aug 22, 2023

Introduction

The deductibility of travel expenses has been a common issue disputed between taxpayers and tax authorities.

Several landmark UK tax cases have established important principles that guide the resolution of such disputes in Malaysia as well.

Revenue Law

Under Malaysian tax law, expenses are deductible under Section 33(1) if they are wholly and exclusively incurred in the production of gross income.

However, travel expenses incurred between an individual's residence and place of employment are treated as personal expenses and disallowed under Section 39(1)(d).

Inland Revenue's Position

The Inland Revenue assumes that daily travel between an individual's residence and a usual place of work is a personal expense related to allowing the person to live at home while working.

Therefore, such travel costs are not incurred in the production of income and not tax deductible.

Court's Position

The courts in cases like Mallal, Newsom and Taylor have affirmed the principle that expenses for travel between home and the regular place of employment are generally non-deductible private expenses rather than business expenses.

This is so even if some work is done from home.

However, the courts have distinguished this from travel between two places of work/employment, which may be deductible if necessarily incurred for work purposes rather than private purposes.

Mallal v Pitkeathly (1952) 2 All ER 401 , which was a key tax case in the UK regarding the deductibility of travel expenses.

The key points of Mallal's case:

Mallal was a barrister who lived in Cambridge but often had work in London. He claimed deductions for train fares incurred travelling between Cambridge and London.

The tax authorities disallowed the deductions, arguing the travel expenses were incurred travelling between home and work.

Mallal appealed the decision. The House of Lords allowed Mallal's appeal and held that the travel expenses were deductible.

The Lords found that as a barrister, Mallal's place of work was both Cambridge, where he lived and London, where he often worked. Therefore the travel between the two was for business purposes and deductible.

This case established the precedent that travel between two places of work is deductible if the travel is necessary for employment duties.

Newsom v Robertson [1952] 1 All ER 767 is another landmark UK tax case related to the deductibility of travel expenses. The key points are:

Newsom was a barrister practising in London. He claimed deductions for travelling from his home to courts/chambers.

The tax authorities disallowed the claims, arguing the travel was from home to work.

Newsom appealed. The House of Lords dismissed his appeal and upheld the tax authorities' decision.

The Lords distinguished this case from Mallal's case. They found Newsom essentially had one place of work - London. Travel from his home in London to courts/chambers in London was not travel between two places of work.

Therefore, Newsom's travel expenses were non-deductible as they were incurred in travelling between his home and his regular place of work.

The Lords emphasised that the test is whether the expense was necessarily incurred in performing the employment duties.

Taylor v Provan [1975] AC 194 is another relevant UK tax case concerning the deductibility of travel expenses:

Taylor was a professional musician who lived in London but had engagements at various venues.

He claimed deductions for transporting himself and his instruments between his home and performance venues.

The tax authorities disallowed the claims, arguing the travel was between home and work.

Taylor appealed. The House of Lords dismissed the appeal and upheld the tax authorities' decision.

The Lords held that the essential character of the whole journey was private travel, merely to enable Taylor to live at his home and work at the performance venues.

The fact that he had to transport instruments did not alter the nature of the journey from home to work.

Therefore, the travel expenses were not incurred in performing his duties and hence were not deductible.

Based on these precedents, travel between an employee's residence and regular place of work would not satisfy the wholly and exclusively test for deductibility under Malaysian tax law.

However, travel between two places of employment may be deductible if incurred for business purposes.

Takeaway for Malaysian Taxpayers

When claiming deductions for travel expenses, Malaysian taxpayers must be able to show the expenses were necessarily incurred for business purposes rather than private purposes.

Keeping detailed records is essential. Expenses related to commuting or travel to the usual place of work are generally not tax deductible.

Disclaimer:

The articles, templates, and other materials on our website are provided only for your reference.

While we strive to ensure the information presented is current and accurate, we cannot promise the website or its content, including any related graphics. Consequently, any reliance on this information is entirely at your own risk.

If you intend to use the content of our videos and publications as a reference, we recommend that you take the following steps:

Verify that the information provided is current, accurate, and complete.

Seek additional professional opinions, as the scope and extent of each issue may be unique.

我们网站上的文章、模板和其他材料只供参考。

虽然我们努力确保所提供的信息是最新和准确的,但我们不能保证网站或其内容,包括任何相关图形的完整性、可靠性、适用性或可用性。因此,您需要承担使用这些信息所带来的风险。

如果你打算使用我们的视频和出版物的内容作为参考,我们建议你采取以下步骤:

核实所提供的信息是最新的、准确的和完整的。

寻求额外的专业意见,因为每个问题的范围和程度,可能是独特的。

Keep in touch with us so that you can receive timely updates

请与我们保持联系,以获得即时更新。

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/

7. Threads ✍ https://www.threads.net/@ccs_your_auditor

8. 小红书 ID ✍ 2855859831

Recent Posts

New Releases: Stay Up-to-Date with LHDN's e-Invoice Guidelines and SDK

Use of the Billing Number as a Payment Reference for Labuan Business Activity Tax (CAPL) from 1 April 2024

PR No. 1/2024 – Investment Tax Allowance – Promoted Product Under The Manufacturing Sector dated 24 January 2024

Individual Income Tax in Malaysia: A Guide for 2023

Introduction:

The realm of individual income tax can often seem labyrinthine and overwhelming, especially for those grappling with the regulations for the first time. In Malaysia, every income earner, be it a resident or a non-resident, must understand the intricacies of the income tax system to ensure accurate compliance and optimal financial planning. This article aims to serve as a comprehensive guide for understanding individual income tax in Malaysia for the year 2023.

Tax Residency and its Implications:

In Malaysia, an individual is deemed a tax resident if they reside in the country for a cumulative period of 182 days or more in a calendar year. Understanding one’s tax residency status is crucial, as it directly impacts the amount and type of income subjected to tax. Tax residents are taxed on worldwide income, whereas non-residents are only taxed on income derived from Malaysia.

Understanding Taxable Income:

Taxable income is the income on which an individual has to pay tax. It encompasses various forms of income, including but not limited to:

- Employment Income: Salaries, bonuses, allowances, and any other income derived from employment.

- Business Income: Profits earned from conducting business activities.

- Dividend Income: Income earned from shares of stock.

- Rental Income: Income derived from renting out property.

- Interest Income: Income earned from savings or fixed deposits.

Each type of income may have specific exemptions or deductions applicable, and understanding these nuances is pivotal for accurate tax calculation.

Progressive Tax Rates:

Malaysia implements a progressive tax rate system for individual income tax. The tax rates for 2023 range between 0% to 30%, segmented by varying income brackets. Individuals with lower income fall into the lower tax brackets, and those with higher income are taxed at higher rates on the incremental income.

Leveraging Tax Reliefs:

Tax reliefs serve as a significant component in reducing the taxable income for individuals. The government provides various tax reliefs to encourage activities like savings, investment in education, and purchasing of books and sports equipment. Some notable tax reliefs include:

- EPF Contributions and Life Insurance Premiums: Contributions to the Employees Provident Fund and life insurance premiums are eligible for relief.

- Education Fees: Individuals pursuing higher education in specific fields can claim relief for education fees.

- Medical Expenses for Serious Diseases: Medical expenses incurred for treating serious diseases are eligible for relief.

- Purchase of Books, Computers, and Sports Equipment: Purchases of books, personal computers, and sports equipment for promoting physical health are granted relief.

Understanding and maximizing the utilization of available reliefs can substantially reduce the taxable income and, subsequently, the tax payable.

Tax Rebates and their Impact:

Tax rebates, such as those available for Zakat payments, are another vital aspect of the Malaysian tax system. These rebates are directly deducted from the tax payable, offering another avenue for individuals to manage their tax liabilities effectively.

Embracing Tax Deductions:

Beyond reliefs, individuals can also claim tax deductions for particular donations, gifts, and contributions made to approved charities and organizations. These deductions further reduce the taxable income, allowing taxpayers to contribute to societal welfare while achieving tax efficiency. Proper documentation is critical to substantiate the claims made under this category.

Compliance with Tax Filing & Payments:

The deadline for individual tax return submission and payment is the 30th of April of the subsequent year. Late filing and payment attract penalties, making timely compliance crucial for avoiding unnecessary financial burdens. Using online platforms like e-Filing can facilitate quicker and more efficient submission of tax returns.

Insights for Optimal Tax Planning:

- Knowledge of Tax Residency: Determine tax residency accurately to identify the appropriate tax regime applicable.

- Detailed Income Declaration: Declare all forms of income, including those from part-time or freelance engagements, to avoid discrepancies and penalties.

- Strategic Claiming of Reliefs and Deductions: Stay informed about the available reliefs and deductions and claim them strategically to minimize taxable income.

- Timely Compliance: Adhere to the tax return submission and payment deadlines to circumvent penalties and maintain financial prudence.

Navigating through the individual income tax landscape in Malaysia necessitates a thorough understanding of various elements, including tax residency, taxable income, tax rates, reliefs, deductions, and compliance requirements. By leveraging the insights provided in this guide, individuals can approach their tax obligations for the year 2023 with enhanced clarity and confidence.

The Malaysian tax system is structured to promote fairness, encourage participation in societal development, and facilitate optimal financial planning. By being diligent and informed, individuals can fulfil their tax obligations efficiently and contribute effectively to the nation’s development.

Disclaimer:

This guide is intended to provide a broad overview of the individual income tax system in Malaysia for 2023 and does not constitute legal, financial, or tax advice. For precise and detailed advice tailored to individual circumstances and for the latest tax updates and amendments, consult with a qualified tax advisor or refer to the official publications and guidelines issued by the Inland Revenue Board of Malaysia.

For more comprehensive human resource solutions and support related to individual income tax and other HR-related inquiries, reach out to CentralHR .

Author : Atikah

Latest posts.

- Maternity Leave Malaysia: An Employer’s Guide

- Public Holidays in Malaysia for 2023

- Public Holidays in Malaysia for 2024

- Guide: How to Calculate Overtime in Malaysia

- Why Is Payslip Important and How to Prepare It in Malaysia

Click one of our representatives below to chat on WhatsApp.

- Our Awards and Milestones

- Our Business Continuity Policy

- Our International Network

- Our Digital Master Plan

- Our Mobile App

- Corporate Social Responsibility

- Switch to 3E Accounting Malaysia

- Client Testimonial

- Robotics Accounting Firm

- Penang Corporate Services Provider

- Malaysia Company Incorporation Services

- Venture to Malaysia with 3E Accounting Singapore

- Why 3E Accounting’s Company Incorporation Package is the best in Malaysia

- Malaysia Company Registration Packages

- Nominee Director Services

- Appointing the Right Person as your Nominee Director in Malaysia

- Setting Up Foreign Owned Company in Malaysia

- Key Considerations Before a Foreigner Starts a Business in Malaysia

- Foreign Company Setup Options

- Liberalisation of the Services Sector in Malaysia

- Equity Policy in the Manufacturing Sector

- An Expatriate Guide to Starting a Business in Malaysia as Foreigner

- An Expat’s Guide: Commonly Faced Problems by Foreigner When Doing Business in Malaysia

- Standard Procedures for Incorporation in Malaysia

- Guide to Malaysia Company Registration

- Guide to Start Business in Malaysia

- Guide to Select Your Malaysia Company Names

- Free Malaysia Company Name Check

- Incorporation FAQ

- Determining Financial Year End

- Sole Proprietor vs LLP vs General Partnership vs Company

- Online Incorporation Form

- Limited Liability Partnership Setup

- Conversion into LLP

- Annual LLP Services

- Taxation for Limited Liability Partnership LLP

- Limited Liability Partnership LLP FAQ

- Guide to LLP Setup

- Limited Liability Partnership (LLP/PLT) Compliance Requirements

- Key Issues And Ambiguities

- Name Search for Limited Liability Partnership (LLP)

- Limited Liability Partnership LLP Setup Form

- Overview of SST in Malaysia

- Goods and Person Exempted from Sales Tax

- SST Return Submission and Payment

- SST Registration in Malaysia

- SST Penalties and Offences in Malaysia

- How to Check SST Registration Status for A Business in Malaysia

- Malaysia Sales Tax 2018

- Malaysia Service Tax 2018

- SST Treatment in Designated Area and Special Area

- SST Deregistration Process

- Guide to Imported Services for Service Tax

- Digital Service Tax in Malaysia

- Ways To Pay For Sales And Services Tax (SST) In Malaysia

- Sales Tax on Low Value Goods (LVG)

- Transitional Rules for SST Rate Change

- Start a Malaysia Company

- Corporate Secretarial

- Human Resource

- Business Setup

- Business Advisory

- Start a LLP

- Immigration

- Associate Business

- Other Jurisdictions Setup

- Virtual Office

- Stamp/Seal Makers

- Software Sale and Development

- Latest News in Malaysia

- Malaysia Public Holidays

- Guide to Setup Malaysia Business

- Malaysia Taxation

- Corporate Compliance Requirement

- Malaysia Budget

- Goods and Services Tax (GST)

- Industry Guide

- Expatriates

- Human Resources & Immigration

- Sales and Service Tax (SST) in Malaysia

- Miscellaneous Topics

- Finances and Grants

- E-Newsletter

- Feedback to 3E Accounting Malaysia

- Book an Appointment With 3E Accounting

Malaysia Corporate Income Tax Guide

- Company Income Tax in Malaysia

Territorial basis of taxation

Malaysia adopts a territorial system of income taxation.

A company or corporate, whether resident or not, is assessable on income accrued in or derived from Malaysia. Income derived from sources outside Malaysia and remitted by a resident company is exempted from tax, except in the case of the banking and insurance business, and sea and air transport undertakings. Effective from YA 2022, foreign-sourced income of Malaysian residents (companies and individuals) which is received in Malaysia may be subject to tax. Please refer to Malaysian Taxation of Foreign-Sourced Income for more information.

Tax residency

A company is tax resident in Malaysia for a basis year if the management and control is exercised in Malaysia at any time during that basis year.

Management and control is the key factor used to ascertain the residence status of a company in Malaysia. The management and control refers to the controlling authority which determines the policies to be followed by the company. The management and control is considered to be exercised where the directors meet to conduct the company’s business / affairs irrespective of where the company might be incorporated. The management and control of a business of a company would depend upon how the business is managed.

If, at any time during the basis year for a year of assessment at least one meeting of the board of directors is held in Malaysia concerning the management and control of the company, even though all other meetings are held outside Malaysia, then the company is resident in Malaysia for that basis year.

Branches of foreign corporations in Malaysia are generally treated as non-residents in Malaysia unless it can be established that the management and control of its affairs or of its businesses or of any one of its businesses is exercised in Malaysia.

Resident companies are taxed at the rate of 24%.

For small and medium enterprise (SME), the first RM150,000 Chargeable Income will be tax at 15% , RM150,001 to RM600,000 Chargeable Income will be tax at 17% and the Chargeable Income above RM600,000 will be tax at 24%.

The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM2.5 million. It must not owned by or owned a company having paid up capital of more than RM2.5million directly or indirectly. In addition, it must have a gross income from source or sources consisting of a business of not exceeding RM50 million.

Effective from YA 2024, to qualify for the reduced tax rate, an additional condition is imposed in which not more than 20% of the paid-up capital in respect of ordinary shares / total contribution of capital at the beginning of the basis period for a YA is directly or indirectly owned / contributed by a company or companies incorporated outside Malaysia or an individual or individuals who are not Malaysian citizen.

Single Tier System

Under the single tier system, income tax payable on the chargeable income of a company is a final tax in Malaysia. Any dividends distributed by the company will be exempt from tax in the hands of the shareholders.

Tax Deductions

Generally, tax deduction is allowed for all outgoings and expenses wholly and exclusively incurred in the production of income.

Here is a list of common allowable items. However, please note that business expenses vary among types of business and industries and IRB may assess based on common industry practices and examine the object of the expenses and their correlation with the income generating activity.

- Employment costs to employees such as salary, allowance, EPF, SOCSO

- Business insurance

- Rental of premises

- Advertisement to promote sales

- Lease rental on plant and machinery

- Electricity, water, telephone and internet charges

- Renewal of license

- Repair and maintenance

- Promotional gift of trading product

- Promotional samples

- Gift with company logo

- Printing and stationery

- Travelling allowance to employees

- Travelling for carrying on a business

- Petrol or mileage claims by employees

- Legal fees for recovery of trade debts

- Commission to secure sales

- Repainting of premises

- Entertainment to employees

- Specific trade debt written off (subject to meeting conditions)

- Staff training

Certain expenses have often been refused a tax deduction even though, for businessman, they are regarded as necessary business costs. Knowing what expenses are not tax deductible might help company to minimise such expenses.

The following are more common non-allowable expenses.

Expenses that are not incurred:

- Provision of expenses

- General provision of bad debt

- Depreciation and loss on disposal capital assets

- Unrealised foreign exchange loss

Capital expenditure:

- Pre-commencement expenses

- Costs including incidental costs, of acquiring, improving or altering capital assets

- Costs of protecting, preserving or defending the title of capital assets

- Renovation or construction cost of premises

- Acquisition repair

- First painting on premises

- Licensing and registration expense

- Income tax, tax penalties and cost of tax appeals

- Fines and penalty

- Legal fees for bank loan or premises acquisition

- Entrance fees to club

- Registration of trademark

- Fees for designinig company logo

Prohibited expenses

- Expenses not wholly and exclusively incurred in the production of income

- Domestic, private or capital expenditure (The Company can claim capital allowance for capital expenditure incurred)

- Lease rentals for passenger cars exceeding RM50,000 or RM100,000 per car, the latter amount being applicable to vehicles costing RM150,000 or less which have not been used prior to the rental

- Employer’s contributions to unapproved pension, provident or saving schemes

- Employer’s contributions to approved schemes in excess of 19% of employee’s remuneration

- Non-approved donations

- Employee’s leave passages

- Interest, royalty, contract payment, technical fee, rental of movable property, payment to a non-resident public entertainer or other payments made to non-residents which are subject to Malaysian withholding tax but where the withholding tax was not paid

- Input tax incurred by the person if the person is liable to be registered under GST but is not registered

- Input tax incurred by the person and the input tax is claimable by that person

- Output tax which is borne / absorbed by a person who is GST registered or liable to be GST registered

- Entertainment to potential customers

- Entertainment to existing customers (50% allowable)

- Entertainment to suppliers (50% allowable)

Tax Incentives

Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors, which include the traditional manufacturing and agricultural sectors, as well as other sectors such as those involved in Islamic financial services, ICT, education, tourism, healthcare as well as research and development. Through tax incentives, the Government aims to attract foreign direct investments (FDIs) as investors from abroad need to be incentivised to relocate or set up their operations in Malaysia.

These tax incentives appear in various forms, such as exemption on income, extra allowances on capital expenditure incurred, double deduction of expenses, special deduction of expenses, preferential tax treatments for promoted sectors, exemption of import duty and excise duty, etc.

Although Malaysia is neither a tax haven nor a low tax jurisdiction, for companies which are eligible for the tax incentives, the effective tax rates may be significantly below the normal corporate tax rate of 24%. For instance, a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7.2% as only 30% of its profits are subject to tax. Some of the major tax incentives available in Malaysia are the Pioneer Status (PS), Investment Tax Allowance (ITA) and Reinvestment Allowance (RA).

Search site

- From Zafigo

Malaysian Domestic Travel Tax Relief: How to Maximise Your 2022 Claims

Did you travel within Malaysia in 2022? As a way to stimulate tourism, the government has given Malaysians tax breaks worth up to RM1,000! Find out if your holiday qualifies for the tourism tax exemption. (Image by Chan Chai Kee .)

Now that the 2023 tax year has begun, it’s time to check over your individual deductions and reliefs from last year — 2022 — to see if there’s anything you can do to bring down your taxable income. Proper tax planning can save you a surprising lot.

One piece of good news is the domestic trip income tax relief, which entitles you to receive tax reductions for travel expenses of up to RM1,000. So, if you’d booked a hotel or visited a tourist attraction in Malaysia in 2022, you could be eligible for an income tax relief of up to RM1,000 on the expenses.

Introduced in YA 2020, this relief is intended to help the domestic tourism and travel industry in Malaysia recover from the losses incurred during the COVID-19 pandemic.

What can you claim under this relief?

- Hotel accommodation

- Entrance fees to tourist attractions

- Tour packages purchased through local travel agencies registered with the Ministry of Tourism, Arts, and Culture

The Ministry of Tourism, Arts, and Culture Malaysia website includes a searchable list of registered tourist accommodation premises.

Remember to save all proof of spending — such as statements, invoices, and receipts — before claiming the aforementioned tax breaks. This is done in anticipation of potential future tax authority audits. You must retain the documents evidencing to your tax returns for a minimum of seven years.

The full list of tax exemptions can be found on the Inland Revenue Board of Malaysia website here .

A journalist by profession, self-proclaimed horror movie expert by passion. Danisha needs to spend more time watching sunsets than Netflix. Ultimately, she's just another girl figuring out her place in the world in between the multitudinous demands of adult life.

9 Instagrammable Hotels In Penang With Stunning Old World Charm

An Insider’s Guide To Langkawi’s Hidden Hotspots

Ninja Private Kitchen: When Sekinchan Is The Day Trip Of Dreams To Take With Your Best Girls

Tax Reliefs

Year of Assessment 2023 (Last updated on 6th November 2023)

Year of Assessment 2022

Year of Assessment 2021

Year of Assessment 2020

Year of Assessment 2019

Year of Assessment 2018

Year of Assessment 2017

Year of Assessment 2016

Year of Assessment 2014 & 2015

Employee Benefits That are Tax Deductible (Employers) & Tax Exempted (Employees)

What are the employee benefits that are tax deductible for employers and tax exempted for employees? Let’s check it out!

Employee Benefits That are Tax Deductible (Employers) & Tax Exempted (Employees)

Employee Benefits That are Tax Deductible (Employers) & Tax Exempted (Employees):

- Parking Fee / Allowance (Limit to reasonable amount)

- Official Travelling Allowance

- Meal Allowance (Limit to reasonable amount)

- Dental Benefit

- Medical Treatment

- Childcare Allowance

- Subsidies on Interest (Limit to loan amount less than RM300k)

- Professional Subscriptions

- Obligatory Insurance Premium

- Innovation Award

- Productivity Award

- Long Services Award (For services more than 10 years)

- Monthly Bills for Telephone (Limit to 1 phone line)

- Gift of a Handphone (Limit to 1 unit)

- Leave Passage in Malaysia

- Gift of Own Products (For products less than RM1,000)

Take this for example:

These are the benefit that company provide for Staff A within a year:

- Travelling allowance RM6,000

- Meal allowance RM3,600

- Dental benefits RM800

- Childcare allowance RM2,400

- Professional subscription RM1,000

- Long services award RM2,000

- Free gift of handphone RM6,000

- Domestic travel RM1,000

- Gift or own product RM1,000

These benefit worth RM23,800 in a year. All the benefit Staff A enjoyed is tax deductible for the company and tax exempted for him!

In this case, he can enjoy a total tax exemption up to RM6,700.

While the company can enjoy tax deduction on this benefit!

*Kindly take note that this rule is not applicable for those employees who have controlling power of the company. (Having controlling power: Holding more than 50% of the company shares)

⇒Did your accountant or tax agent advise you on this rule? Without it, your company expenses may get higher! Hence, having a tax agent that always give you advise is mandatory for your company!

If you are looking for accountant, contact us now!

- Introduction

- Liew Chang Chee

- Teng Kong Yang

- Chin Xin Yee

- Accounting and Book-keeping Services

- Accounting Software

- Accounting Standard

- Audit Introduction

- Private Limited Company (Sdn. Bhd.)

- Sole Proprietorship

- Partnership

- Limited Liability Partnership

- Liquidation

- Malaysia Tax System

- Tax Planning

- Income Tax Audit

- Income Tax Incentive

- Transfer Pricing

- Withholding Tax

- Integrated Reporting Services

- TESTIMONIAL

- Advice For Employer

- National Economic Recovery Plan (PENJANA)

- Economic Stimulus Package 2020

- Wage Subsidy Programme (WSP)

- Employment Retention Program (ERP)

- Template Listing

- Benefit In Engaging Our Outsourced Accounting Services

- Tips To Reduce Audit Fee

- What Determine Your Audit Fee?

- Audit Exemption

- Five Things to Look For When Choosing an Audit Firm

- The Significance of Implementing Audit System in Every Company

- Personal Tax Relief

- Tax Saving In Buying Company Vehicle

- MTD (Monthly Tax Deduction)

- How To Pay Income Tax

- Tips For Income Tax Saving

- Rental Income

- Five Factors to Consider When Hiring a Tax Advisor

- Why Do We Need Tax Consultants?

- Choose An Ideal Business Vehicle

- Business License

- Halal Certificate

- Employees Provident Fund (EPF)

- Social Security Organization (SOCSO)

- Employment Insurance Scheme (EIS)

- Monthly Tax Deduction (MTD)

- Human Resources Development Fund (HRDF)

- How to Start Up a Business in Malaysia?

- Open Position

- Internship Placement

- Career Opportunities

- Limited Company (Sdn. Bhd.)

- Business Income

- Employee Income Tax

- Register Private Limited Company (Sdn. Bhd.) Registration

赶快订阅我们以获得最新资讯!

地区 * Johor Bahru Kuala Lumpur Penang Others

生意性质 * Services Trading Construction Manufacturing F&B Others

语言 * 中文 英文 中文/英文

Subscribe Us Now to Get Latest Information!

Email Address *

Full Name *

Contact Number *

Location * Johor Bahru Kuala Lumpur Penang Others

Company Address *

Company Name *

Business Nature * Services Trading Construction Manufacturing F&B Others

Language * Chinese English Any one from above

We would greatly welcome for any inquiries or favorable feedback from you. You may submit in your inquiries via our web form below, or alternatively, you may either email us at [email protected].

IMAGES

VIDEO

COMMENTS

A company is tax resident in Malaysia for a basis year if ... •Travelling for carrying on a business ... •Licensing and registration expense •Income tax, tax penalties and cost of tax appeals •Fines and penalty •Donation •Legal fees for bank loan or premises acquisition

Travel Costs: Amount: RM40,000; Tax Treatment: Fully deductible as leave passage benefits. This deduction is supported by proviso (viii) to paragraph 39(1)(l) of the Income Tax Act (ITA), which allows deductions for costs associated with leave passage when facilitating a yearly event within Malaysia that includes employees and their immediate ...

e-Filing Status Form Amount of Tax paid for previous year Travel Restriction Check UPDATED AS AT 11/05/2022. ... A company is tax resident in Malaysia for a basis year if ... •Licensing and registration expense •Income tax, tax penalties and cost of tax appeals •Fines and penalty

All expenses deductible. Company's passenger vehicle & not declared BIK. Amount of BIK will be added back in Co's tax computation. Non-company's vehicle. All related expenses non-deductible. Vehicle bring into Co's using trust deed. All related expenses not deductible unless, the whole amount declared as BIK. 2.

Revenue Law. Under Malaysian tax law, expenses are deductible under Section 33 (1) if they are wholly and exclusively incurred in the production of gross income. However, travel expenses incurred between an individual's residence and place of employment are treated as personal expenses and disallowed under Section 39 (1) (d).

Malaysia implements a progressive tax rate system for individual income tax. The tax rates for 2023 range between 0% to 30%, segmented by varying income brackets. Individuals with lower income fall into the lower tax brackets, and those with higher income are taxed at higher rates on the incremental income. 1. Resident individuals.

Tax rate. Resident companies are taxed at the rate of 24%. For small and medium enterprise (SME), the first RM150,000 Chargeable Income will be tax at 15% , RM150,001 to RM600,000 Chargeable Income will be tax at 17% and the Chargeable Income above RM600,000 will be tax at 24%. The SME company means company incorporated in Malaysia with a paid ...

29th October 2021 - 1 min read. Finance Minister Tengku Zafrul Aziz has announced that under Budget 2022, the government will extend the special individual income tax relief for domestic travel of up to RM 1,000 until the end of 2022. The domestic travel income tax relief, which was first introduced under the Economic Stimulus Package 2020 ...

5.1 Foreign income received in Malaysia by a resident. 5.1.1 Effective from 1 January 2022, generally, all types of foreign income received in Malaysia by a resident is subject to tax. 5.1.2 The list of foreign income which is subject to this tax treatment according to Section 4 of the ITA 1967 are as follows:

F20 Domestic tourism expenses 24 - Tax schedule for year of assessment 2021 26 EXPLANATORY NOTES be 2021 RESIDENT ... and travelling expenditure incurred in the production of gross employment income and discharge of official duties ... Value of living accommodation provided in Malaysia by the employer. Working Sheet HK-2.5 and Appendix B4,

the Director General of Immigration. This Safe Travel Portal is linked to the existing MyEntry portal. What is new now is the differentiation between short term business travellers (up to 14 days stay in Malaysia) or long term business travellers (more than 14 days stay in Malaysia). Interesting to note from our further clarification with MIDA:- 1.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. This booklet also incorporates in coloured italics the 2024 Malaysian Budget proposals based on the Budget 2024 announcement on 13 October 2023 and the Finance (No. 2) Bill 2023.These proposals will not become law until their enactment and may be amended in the ...

500. Purchase of breastfeeding equipment once every two years (for women taxpayers only). 1,000. Fees paid to childcare centre and kindergarten (for child / children below six years old). Additional deduction of MYR 1,000 for year of assessment 2020 to year of assessment 2024 (increased maximum to MYR 3,000). 2,000.

One piece of good news is the domestic trip income tax relief, which entitles you to receive tax reductions for travel expenses of up to RM1,000. So, if you'd booked a hotel or visited a tourist attraction in Malaysia in 2022, you could be eligible for an income tax relief of up to RM1,000 on the expenses. Introduced in YA 2020, this relief ...

same group of companies as his employer are not exempted from tax. The exemption is restricted to RM1,000. (ii) Leave passage for travel (confined only to the cost of fares for the employee and members of his immediate family). (a) within Malaysia (including meals and accomodation) for travel not exceeding 3 times in any calendar year; or

Medical expenses for serious diseases for self, spouse or child. 6,000 (Restricted) 7. Medical expenses for fertility treatment for self or spouse. 8. Complete medical examination for self, spouse, child (Restricted to 500) 9. Lifestyle - Expenses for the use / benefit of self, spouse or child in respect of:

Currently, personal tax relief of up to MYR 1,000 is given to resident individuals for the following domestic travel expenses incurred from 1 March 2020 to 31 August 2020: (i) accommodation expenses at premises registered with the Ministry of Tourism, Arts and Culture Malaysia; and. (ii) entrance fees to tourist attractions (these are yet to ...

An individual carrying on a business in Malaysia is assessed tax based on the calendar year to be in line with the assessment year. ... One leave passage for travel in a calendar year from Malaysia to any place outside Malaysia, up to a maximum of MYR3,000. ... Lifestyle expenses (internet, newspapers, books, smartphones, tablets/computers ...

Special personal income tax relief for domestic travelling expenses It was announced in the Economic Stimulus Package that a special personal income tax relief of up to RM1,000 be given to resident individuals for domestic traveling expenses incurred between 1 March 2020 to to 31 August 2020. This has now been extended to 31 December 2021.

2. Expenses which qualify for the double deduction are: Food, travelling, accommodation allowance and expenses incurred for provision of the qualifying programme (total deduction restricted to RM5,000 per apprentice per YA) Monthly training allowance of not less than RM300 paid to the apprentice Insurance provided to the apprentice 3.

Official Travelling Allowance; Meal Allowance (Limit to reasonable amount) Dental Benefit; ... Leave Passage in Malaysia; Gift of Own Products (For products less than RM1,000) ... your company expenses may get higher! Hence, having a tax agent that always give you advise is mandatory for your company! If you are looking for accountant, contact ...

3.8 "Local leave passage" means travelling within Malaysia. 3.9 "Overseas leave passage" means travelling between Malaysia and any place outside Malaysia. 4. Generally, any benefit or amenity provided for the employee by or on behalf of his employer would be subject to tax as gains or profits from an employment. 5.

Effective 1 January 2027, all the FSI would be taxable in Malaysia upon remittance by tax resident individuals. 1. The income of a resident individual is subject to income tax at progressive rates after personal relief while the income of a Non-resident individual is subject to income tax at the top marginal rate without personal relief.2.