- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

WorldTrips Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Since 1998, WorldTrips has provided medical insurance and trip protection to travelers from the U.S. and around the world in addition to coverage for international students. The company also provides coverage for various tour groups, missionary work and student exchange programs. The insurance policies are underwritten by Tokio Marine HCC, a Houston-based insurance company.

Whether you’re a U.S. resident looking for comprehensive travel insurance plans or a student looking for a medical-only policy, WorldTrips insurance has coverage options.

What kind of plans does WorldTrips provide?

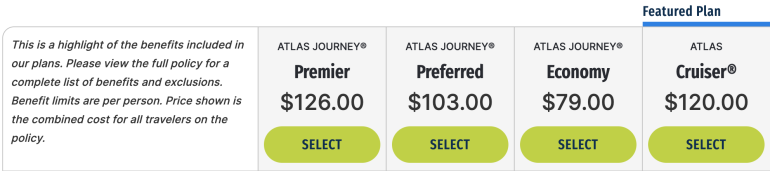

If you’re a U.S. resident, WorldTrips offers four single-trip comprehensive travel insurance plans: Atlas Cruiser, Atlas Journey Economy, Atlas Journey Preferred and Atlas Journey Premier. Here's a quick overview of the coverage offered by each plan.

Atlas Cruiser: This plan comes with 100% trip cancellation , 100% trip interruption , $25,000 medical expenses, $100,000 medical evacuation and $1,500 baggage loss coverage (up to $500 per item). This plan also offers optional Cancel For Any Reason coverage for up to 75% of the total trip cost (as long as you purchase it within 21 days of your initial trip payment and more than 48 hours before your trip begins).

Atlas Journey Economy: This budget plan covers 100% trip cancellation, 100% trip interruption, $10,000 medical expenses , $250,000 medical evacuation and $1,000 baggage loss (up to $250 per item).

Atlas Journey Preferred: This mid-range plan offers coverage for 100% trip cancellation, 150% trip interruption, $100,000 medical expenses, $1 million medical evacuation and $1,500 baggage loss (up to $500 per item). You can add Cancel For Any Reason coverage for 50% or 75% of the total trip cost.

Atlas Journey Premier: The priciest plan also provides the most coverage, including 100% trip cancellation, 150% trip interruption, $150,000 medical expenses (primary coverage), $1 million medical evacuation and $2,000 baggage loss (up to $500 per item). You have the option to add Cancel For Any Reason coverage for 50% or 75% of the total trip cost.

Non-U.S. residents and international students have access to medical-only policies. Annual plans aren’t available for U.S. residents.

» Learn more: The best travel insurance companies

WorldTrips travel insurance cost and coverage

WorldTrips offers several comprehensive single-trip plans that include basic trip protections and medical coverage. The cost varies based on coverage limits.

WorldTrips single-trip plan cost

Here's a comparison of the cost of WorldTrips insurance plans for a 10-day trip that costs $2,000 for a 35-year-old traveler from California. In our example, the destination isn’t specified, and the trip doesn’t include a cruise.

The Atlas Journey Premier plan comes in at $126, the most expensive option. The Atlas Cruiser plan has a similar cost of $120. The Preferred and Economy plans, which cost $103 and $79, respectively, are a bit cheaper, but come with lower coverage limits.

» Learn more: What to know before buying travel insurance

Which WorldTrips travel insurance plan is for me?

The kind of coverage you’re seeking for your upcoming travels is going to affect your plan selection. Here are a few situations which might influence your decision:

If you’ve made nonrefundable deposits for your trip: If you’re going on a safari to Kenya or on a cruise to Antarctica and you’ve prepaid nonrefundable expenses, you probably want to go with plans that offer more coverage, such as Atlas Journey Preferred or Atlas Journey Premier.

If you need to add on Cancel for Any Reason coverage: For single-trip insurance plans, go with either Atlas Cruiser, Atlas Journey Preferred or Atlas Journey Premier because they offer this optional upgrade.

If travel insurance is mandatory and you hold a premium travel rewards credit card : If a tour operator requires you purchase travel insurance but you hold a credit card that already provides some trip protections, you can probably get away with the least expensive Atlas Journey Economy policy.

» Learn more: What does travel insurance cover?

How to get a quote from WorldTrips

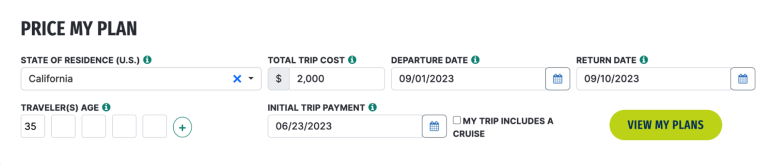

To get an online quote, go to the WorldTrips home page and select whether you’re a U.S. resident, a non-U.S. resident or an international student. If you’re a U.S. resident, click on that box, then fill out the form to price your plan.

Make sure to provide your state of residence, total trip cost, departure and return dates, traveler’s age and initial trip payment date. If you’re going on a cruise, be sure to check the box. Once the form is complete, select “View my plans” and compare the plan types.

What isn’t covered by WorldTrips insurance?

As with any travel insurance policy, there are some exclusions to coverage. Here’s a sampling of things WorldTrips doesn’t cover:

Intentional self-inflicted injuries, including suicide.

War, invasion or acts of foreign enemies.

Speed or endurance competitions as well as athletic stunts.

Piloting or learning how to pilot an aircraft.

Being engaged in illegal activities.

Medical tourism.

Traveling against a physician’s advice.

Operating a motor vehicle without a license.

» Learn more: How much is travel insurance in 2023?

Is WorldTrips travel insurance worth it?

WorldTrips insurance offers multiple plans for U.S. travelers looking for trip insurance and medical coverage abroad as well as non-U.S. travelers and students looking for medical coverage in case of an unexpected injury or illness.

If you travel once or twice per year, WorldTrips offers several comprehensive single-trip policy options that are worth checking out. However, if you need an annual plan, you'll want to look elsewhere.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

WorldTrips Travel Insurance Review — Is It Worth It?

Content Contributor

65 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

83 Published Articles 477 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Stella Shon

News Managing Editor

86 Published Articles 620 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Who Can Get WorldTrips Travel Insurance?

Worldtrips atlas journey travel insurance coverage types and benefits, pre-existing conditions, covid-19 coverage, worldtrips travel insurance economy plan, worldtrips travel insurance preferred plan, worldtrips travel insurance premier plan, atlas on-the-go insurance, atlas journey plans, atlas travel plans, worldtrips travel insurance vs. competitors, worldtrips travel insurance vs. credit card insurance, tips for ensuring a smooth claim process, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Planning trips is fun. Reading about travel insurance for them isn’t. But a little effort to plan for problems during your upcoming vacation can make a big difference.

WorldTrips provides multiple types of travel insurance, ranging from minimalist policies with just medical insurance to full-scale policies that cover anything that might go wrong during your next family vacation. The insurer also offers add-ons that most competitors lack, such as policies for students studying abroad, special provisions for hunting and fishing trips, veterinary emergencies, school activities that force you to delay your vacation, and even coverage for destination weddings when the bride or groom calls it off.

However, you may be surprised that rental car protections are only available as an add-on to WorldTrips plans, and you’ll need the most expensive plan if you want to add coverage for pre-existing medical conditions.

Here’s a look at the various travel insurance plans from WorldTrips and whether the costs are worth it.

Before understanding who can get a plan, it’s essential to understand the different types of travel insurance plans available from WorldTrips.

Atlas Travel plans are available for citizens and residents of numerous countries when traveling internationally. Conversely, Atlas Journey plans are available only to U.S. citizens and residents, covering domestic and international travel. Atlas Journey plans are geared primarily toward trip delay and cancellation benefits, while Atlas Travel plans are focused primarily on medical coverage. However, they share some crossover benefits.

WorldTrips also has travel insurance policies that aren’t focused on typical tourists. StudentSecure plans provide injury and illness coverage for those studying abroad. Atlas MultiTrip plans provide coverage for 364 days, covering trips up to 30 or 45 days each (depending on the plan you choose), and Atlas Group plans can provide up to a 10% discount if you’re traveling in a group of 5 or more people.

Additionally, WorldTrips Atlas Travel plans can provide medical coverage for those doing overseas volunteer or missionary work.

What Does WorldTrips Travel Insurance Include?

WorldTrips offers multiple types of travel insurance policies. Atlas Travel plans are available only for international trips (open to residents of many countries) and primarily focus on medical coverage. With these plans, you’ll choose your preferred deductible and maximum coverage limit, then provide your age and destination.

U.S.-based travelers have access to Atlas Journey plans. These cover domestic and international trips and are what you likely think of when considering travel insurance. We’ll analyze these in depth in the article and then cover the medical-focused Atlas Travel plans near the end.

To know what you’re looking for in a travel insurance policy, you should first understand what the types of coverage are:

- Trip Cancellation Insurance: Covers prepaid, non-refundable expenses when you cancel a trip for covered reasons like sickness, injury, or death of a family member.

- Trip Interruption: Reimburses prepaid, non-refundable expenses if you miss part of a trip or have to end a trip early due to covered reasons like weather, jury duty, or injury.

- Travel Delay: Applies to additional expenses incurred for delays of 5+ hours, covering accommodation, meals, and local transport costs.

- Travel Inconvenience: Applies when one of the following occurs: your return home is delayed and causes you to miss 2 or more days of work, your flight must land 50+ miles from the original destination, there’s a documented security breach causing delays at your departure terminal, you’re a victim of a verified physical assault, your credit/debit card is canceled for reasons beyond your control, or your travel documents are stolen and can’t be replaced locally.

- Emergency Accident and Sickness Medical Expense: Covers losses due to medical and dental emergencies. This is secondary coverage except on the Premier plan.

- Medical Evacuation and Repatriation of Remains: Covers medically necessary transportation and care en route when you’re ill or injured and don’t have access to appropriate care in the immediate area. You also can be covered for repatriation to your home or other U.S. city with appropriate care, requiring prior approval.

- Baggage Damage or Loss: Provides reimbursement for loss, damage, or theft of personal effects in excess of other insurance, such as homeowners’ or airline baggage policies.

- Baggage Delay: Provides reimbursement for covered expenses after 12+ hours of baggage delay at your destination. Covered expenses include necessary clothing, laundry, toiletries, and costs for retrieving your baggage. Coverage ends when your luggage is retrieved or you return home — whichever is first.

- Missed Connection: Can reimburse expenses related to missed cruises, tours, flights, or trip departures due to 3+ hours of delays. Covered delays include weather, carrier problems, strikes, quarantines, and more. Expenses cover costs to catch up with your trip or money lost from missing the trip.

- Airline Cancellation or Reissue Fees: Reimburses costs for changing or canceling tickets after interruptions or canceled flights. This coverage applies to costs after any refunds or vouchers you receive.

- Travel Assistance Services: Provides 24/7 assistance services like security advice, coordination of medical benefits, interpreters, legal referrals, and referrals for needs during emergencies. Note that you may have costs for services you use from these referrals.

It’s also important to note that each section has rules and restrictions about which costs are covered, when coverage applies, and other terms you must follow.

Optional Add-ons to Atlas Journey Plans

You’ll see options for additional coverage depending on the base plan you select:

- Cancel for Any Reason Coverage (CFAR): This add-on policy covers up to 75% of your losses if you cancel for reasons not covered in other sections of your policy, so long as you purchase within 21 days of your first deposit and cancel 48+ hours before the trip. This add-on isn’t available for Economy plans.

- Interruption for Any Reason: Provides reimbursement for 50% of non-refundable trip costs after a trip is interrupted for non-covered reasons. WorldTrips says, “No questions asked” on this coverage. This add-on is available for Premier plans only.

- Pre-existing Conditions: Requires purchasing a policy within 21 days of the initial deposit and covers pre-existing conditions that have a change in treatment or that make you unable to travel.

- Adventure Sports: Provides coverage for leisure, non-professional sports like bungee jumping, scuba diving, and mountain climbing up to 7,000 meters, as well as safari activities. This add-on is available for all plan levels.

- Rental Car Damage and Theft: Requires a $250 deductible; afterward, provides rental car coverage for collision, theft, and damage beyond your control. You must be authorized to drive at the destination and listed on the rental policy. This add-on is available for all plan levels.

- Pet Care: Provides reimbursement for a trip canceled due to the death or critical illness of your dog or cat within 7 days of trip departure. Provides up to $250 in coverage for boarding fees if your return home is delayed for a covered reason and up to $500 for emergency veterinary care for a pet traveling with you. This add-on is available with all plan types.

- Rental Accommodations Protection: Covers trip interruptions if you can’t access your vacation rental property for 12+ hours or if your property is unsuitable or not as described on arrival. It’s available on all plan levels.

- School Activities: Provides cancellation coverage for trips you must cancel due to school activities like exams or sporting events beyond standard season dates. This coverage also applies to study abroad, volunteer, or philanthropic programs. This add-on is available for all plan levels.

- Hunting and Fishing: Covers canceled and interrupted trips related to changes in government regulations or delays of 24+ hours in receiving your necessary equipment. This coverage also applies to theft, damage, and destruction of your essential equipment and trips where your guide or traveling companion becomes medically unfit to participate. This add-on is available for all plan levels.

- Destination Wedding: Provides reimbursement for lost funds when you plan to attend a wedding and then it’s canceled. Coverage also applies to canceled flights, flights forced to land 50+ miles from the intended airport, and flight delays of 12+ hours. This add-on isn’t available for Economy plans.

- Security/Terrorism: This covers cancellations due to terrorist events at your destination or trip interruption for riots/civil unrest lasting 12+ hours. It also can provide ransom payments or security assistance for kidnapping. However, it doesn’t cover countries like Mali, Afghanistan, Syria, or others excluded from the policy. It’s available on all plan levels.

- Primary Medical Coverage: This paid upgrade to Preferred plans makes the emergency medical and dental benefits primary coverage rather than secondary.

- Primary Baggage Coverage: This makes baggage coverage primary rather than secondary. This is available on all plan levels.

It’s also possible to upgrade your maximum coverage limits on certain benefits. These include baggage loss and upgrading benefits from secondary to primary coverage.

Few companies offer kidnapping ransom, destination wedding, or school activity coverage. If these are concerns for your upcoming trip, WorldTrips can make sense over competitors that lack these protections.

Take note that rental car protection isn’t included in any plans — not even the Premier plan. It’s available for an additional cost, but this reinforces the importance of using a good credit card that provides built-in rental car protections .

When purchasing an Atlas Journey plan, this coverage is included if you purchase your plan within 21 days of your initial trip payment.

Atlas and StudentSecure plans purchased on or after February 2, 2023, include coverage for medical expenses related to COVID-19.

Comparison of WorldTrips Atlas Journey Travel Insurance Plans

There are several coverages that are the same across all 3 plans :

- Coverage for Pre-existing Medical Conditions — Included if conditions are met and policy is purchased within 21 days of initial deposit

- 24/7 Travel Assistance Services — Included

- Adventure Sports Medical Coverage — Available add-on service; average cost $44

- Pet Care — Available add-on service; average cost $10

- Rental Car Damage and Theft — Available add-on service; average cost $50

- Rental Accommodation Protection — Available add-on service; average cost $21

- School Activities Protection — Available add-on service; average cost $16

- Hunting and Fishing Protection — Available add-on service; average cost of $20

This is the most inexpensive plan but still covers the essentials. You can be reimbursed for canceled, interrupted, and delayed trips and get reimbursed for sicknesses, injuries, and even delayed bags. Numerous add-ons can improve this plan, though the cost will increase.

This intermediate plan offers more coverage and higher cover limits than the Economy plan but costs more. This plan has additional add-on options, and it’s the lowest plan with an option for CFAR coverage.

The most expensive plan also offers the most robust coverage — in terms of types and values. It’s the only plan with an option to add coverage for pre-existing conditions, though many options remain add-ons and aren’t included in this plan (such as rental car coverage).

None of the Atlas Journey plans include rental car protections. Those are available as an add-on, however.

WorldTrips provides another travel insurance plan called On-The-Go . It’s only available to U.S. residents and covers non-refundable trip costs, lost or damaged personal items (including luggage), and medical expenses (including COVID-19).

You can be covered for trip interruption, travel delays, missed connections, and emergency medical expenses. However, you won’t be covered for trip cancellation and cannot add coverage for pre-existing conditions or CFAR.

How Much Does WorldTrips Travel Insurance Cost?

Let’s price some sample plans to see how they cost. This will give you a better idea of whether these plans fit your budget.

These plans are available to U.S. residents and citizens and cover domestic and international trips.

These plans are available to residents of numerous countries and only cover international trips.

Notice there is a high additional cost for elderly travelers . Also, your maximum coverage amount is lower for people aged 60 and above.

Since Atlas Travel plans primarily focus on medical coverage, you don’t need to provide your trip cost when getting a quote. These plans can make sense if you’re OK with minimal trip protections while ensuring you’re covered for possible injuries during a trip. You can choose from several options for a maximum coverage amount and deductible payment for your claims.

These plans are focused on medical coverage during international trips. If you aren’t worried about expenses for delays or cancellations, you could potentially save money by purchasing an Atlas Travel plan. These especially make sense for last-minute trips where your odds of cancellations are low.

As these plans have maximum coverage amounts and don’t cover trip cancellation, they’re cheaper. This can be a good option if your trip is unlikely to be canceled and you want protection for your stuff and your health during a vacation. As long as you’re a U.S. resident, plans are available for both international and domestic travel.

How WorldTrips Travel Insurance Compares To Other Options

Part of shopping for trip insurance is understanding what you get and how much it costs. The other part is understanding how this compares to competitors. What are companies like Generali Global Assistance and Nationwide charging for similar plans? Here’s a comparison of costs.

We priced a 1-week itinerary for 2 travelers (ages 40 and 39) going to Colombia in November 2023. The cost for the trip was estimated at $3,000, and the first trip deposit was made in the last 24 hours. Squaremouth provided these comparison costs.

The WorldTrips plan had the middle cost of the 3 .

All 3 plans included COVID-19 coverage; all 3 provided the same trip cancellation benefits and the same medical evacuation benefits . However, WorldTrips and Nationwide had lower maximums for emergency medical benefits than Generali, and WorldTrips also had the lowest maximum benefit for trip interruption .

WorldTrips has a competitive cost against similar plans from other providers. You’ll see similar coverage types and maximum payouts in some areas. However, you’ll see lower benefits for emergency medical and trip interruption than more expensive options. Consider these numbers and how important they are.

You may be surprised that your credit card could provide some of the same travel insurance . This could help you save money by not needing to buy a separate policy.

However, when the coverage goes into effect varies. Some credit cards require you to pay for the entire trip (including round-trip tickets, not one-way) with that card to trigger the protections. Others go into effect by paying just a portion of the trip with that card. It’s important to understand exactly what your card offers and when it’s available to determine if those protections are sufficient.

Here’s a look at how WorldTrips’ Atlas Journey Premier plan compares to coverage with The Platinum Card ® from American Express , Capital One Venture X Rewards Credit Card , Chase Sapphire Preferred ® Card , and Chase Sapphire Reserve ® .

WorldTrips’ Premier plan has lower trip delay, lower lost luggage, and lower accidental death and dismemberment benefit maximums than you may get with premium credit cards. However, WorldTrips’ top plan has better baggage delay protections and offers the best protections for emergency medical and emergency evacuation.

Even before your trip, you should think about “what if something goes wrong” and have a plan. That includes buying your plan within required deadlines (based on initial and final trip payments) and keeping receipts for every expense. Keep receipts for flights, hotels, rental cars, meals during trip delays, and even a toothbrush while waiting for delayed luggage. Keep it all.

You also should read the policy documents before and after buying a plan. These will help you know precisely what is and isn’t covered. For instance, destination wedding coverage can be handy if the wedding gets called off, but the policy’s fine print will tell you you’re not covered if you’re the bride or groom.

Keeping a paper trail and knowing what is (and isn’t) covered will ensure a smoother claim process because you’ll avoid submitting unnecessary claims and will avoid unnecessary delays during the evaluation process. It also helps you know what’s covered before you swipe your card for expenses during a delay.

If you need to submit a claim, WorldTrips has a “How the claims process works” page , and it includes instructions on what to do, what forms you need, and how the claims process varies based on whether your trip was inside or outside the U.S. It also provides information on how medical facilities can direct bill WorldTrips, which can save you the hassle of paying and then waiting for reimbursement.

No one likes to think about emergencies when planning an exciting holiday. However, planning for emergencies can reduce stress and costs should something go wrong. WorldTrips offers several types of travel insurance, covering all your bases or potential medical expenses. The sheer variety of options provides more potential coverage types than many competitors.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For the baggage insurance plan benefit of the Amex Platinum card, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the car rental loss and damage insurance benefit of the Amex Platinum card, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the premium global assist hotline benefit of the Amex Platinum card, eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, card members may be responsible for the costs charged by third-party service providers.

For the trip delay insurance benefit of the Amex Platinum card, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of the Amex Platinum card, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is worldtrips legit.

WorldTrips has been around since 1879 and operates in 180 countries. It’s headquartered in Houston, Texas, has excellent financial strength ratings from multiple credit rating organizations.

How do I contact WorldTrips insurance?

In the U.S., you can call 800-605-2282. From outside the U.S., call collect to 317-262-2132.

How do I submit a claim to Worldtrips?

Within the member portal (formerly the Client Zone), you can access the claimant form, fill it out, and then upload all of your documents electronically. It’s also possible to bill WorldTrips directly for medical expenses.

How do I cancel my Worldtrips policy?

Send an email to [email protected] to cancel your travel insurance policy. You must submit your request prior to the policy’s effective date to receive a refund.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Travel insurance plans

- WorldTrips cost

Compare WorldTrips Travel Insurance

- Why You Should Trust Us

WorldTrips Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

WorldTrips has been a reputable travel insurance provider for more than 20 years. Unsurprisingly, it boasts an A+ rating from the Better Business Bureau and positive reviews from thousands of customers.

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable base plans that can be customized with add-ons including rental car, pet care, hunting and fishing, and vacation rental coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Insurance plans available for international student travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage benefit that kicks in after just five hours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Pre-existing conditions waiver can be purchased within 21 days of initial trip payment

- con icon Two crossed lines that form an 'X'. Lower medical, evacuation and accidental death limits

- con icon Two crossed lines that form an 'X'. Limited, secondary baggage loss coverage although baggage protection can be upgraded at a low cost

- con icon Two crossed lines that form an 'X'. No special coverages for pets, sports equipment, etc.

- Travel medical insurance (Premium, Group, Annual, and International Student options)

- Trip cancellation insurance

- Trip protection insurance

WorldTrips Travel Insurance Review: Types of Policies Offered

WorldTrips offers several unique products for travelers, including a dedicated plan for students pursuing study abroad programs. This section will help you understand the different plans available through WorldTrips in either category.

Most plans include COVID-19 coverage by default. Many also allow you to customize the plan to include optional upgrades for additional protection.

Travel medical insurance plans

Atlas Travel

Flagship product Atlas Travel provides travel medical insurance for travelers of various nationalities - a valuable product for anyone seeking financial support while exploring the world. The maximum coverage available through an Atlas Travel plan goes up to $2 million.

It's worth noting Atlas Travel does not cover US citizens and residents. However, US citizens and residents can purchase travel insurance coverage for countries outside the United States under an Atlas International plan. In addition, non-US citizens outside of the United States are also eligible for coverage within the US under the Atlas America plan. The site automatically selects it for the traveler at the time of purchase.

Atlas Premium

Atlas Premium is an upgraded version of Atlas Travel offering more flexibility on deductibles, coverage duration, and coverage maximums. This plan is ideal for several types of travelers, including parents covering an entire family, travelers planning adventurous activities carrying some risk, and people planning luxury or expensive travel.

Atlas Group

Atlas Group offers Atlas Travel benefits at a 10% discount for people traveling in groups of five or more. This policy is ideal for traveler profiles such as youth groups, missionaries, students studying abroad, larger families, and organizations planning international travel.

Atlas MultiTrip

Digital nomads and frequent international travelers can benefit from an Atlas MultiTrip plan. It provides global health coverage for any number of pre-planned or last-minute trips within 364 days, as long as each trip lasts fewer than 30 or 45 days. The duration guidelines vary depending on the coverage selected.

StudentSecure

Students studying abroad can purchase StudentSecure, an international health insurance policy for full-time students and scholars pursuing academic studies outside their home country. StudentSecure comes in four levels of coverage to meet each student's specific needs and meets or exceeds most country or school insurance requirements.

Trip protection insurance plans

Atlas On-The-Go

Atlas On-The-Go covers you if you only need financial reassurance for your travel plans. This trip protection insurance is for US residents traveling worldwide. In addition, it provides medical coverage for unexpected sickness, injury, lost or stolen bags, or travel cancellations.

Atlas Journey

Atlas Journey offers trip protection coverage for US citizens and residents on domestic and international travel. You can choose from three tiers of coverage: Premier, Preferred, or Economy, with up to 150% of trip costs covered in the case of travel interruptions, as well as up to $1 million in medical evacuation expenses.

Additional Coverage Options (Riders)

Buyers can customize many WorldTrips policies to enhance the overall benefits of the insurance plan. Here are some of the available riders and purposes.

Cancel-for-any-reason (CFAR) coverage

Cancel-for-any-reason insurance coverage, often abbreviated as CFAR, is an optional upgrade. It allows you to claim a percentage of your nonrefundable travel costs if you cancel your trip for any reason.

CFAR is available as an add-on on specific WorldTrips policies and can cover either 50% or 75% of your total nonrefundable travel forfeited when you cancel. However, you'll have to purchase CFAR coverage within a specific time limit after your first payment for travel expenses. You must cancel your trip more than 48 hours before the scheduled departure to make an eligible CFAR claim.

Adventure activities coverage

WorldTrips offers additional coverage options for adventurous travelers pursuing risky or challenging activities. This add-on increases your medical and evacuation benefits in the event of an incident.

Pet care coverage

If you're traveling with a pet, this coverage will help cover some of the costs associated with pet travel, including medical expenses if needed.

Rental accommodations coverage

This add-on covers expenses you may incur if your accommodations are double-booked or untenantable.

Rental car coverage

If you rent a car during your travels, you can purchase this add-on to forego the coverage offered at the rental car desk. Note, if you hold a premium credit card with travel benefits, you may already have access to free rental car insurance meeting or exceeding any ceilings offered through WorldTrips, even with this upgrade.

School activities interruption/cancellation coverage

If a school schedule change impacts your travel plans, this add-on will reimburse you for nonrefundable travel expenses associated with the travel cancellation or interruption.

Hunting and fishing cancellation/interruption

This add-on will help defray your cost if changes to your local government restrictions or equipment delays impact your travel plans. Unfortunately, this policy does not cover big game hunting.

Destination wedding cancellation or interruption coverage

This policy add-on protects guests attending a destination wedding. If the couple cancels the wedding or the event is delayed or canceled due to other circumstances, this policy will help cover expenses incurred by the change in plans.

WorldTrip Travel Insurance Cost

Travel insurance coverage varies greatly, and the amount you pay reflects the range of protection . However, since travel insurance protects your financial investment, it's typically worth spending a few extra dollars for higher coverage maximums, especially for medical insurance and evacuation expenses.

Let's say you're planning a 10-day solo trip in Mexico over the winter holidays with a total cost of $6,000, including a cruise and some potential adventure excursions. Here's what a WorldTrips Atlas Journey insurance plan would cost and include. We have included three different tiers of coverage:

Many WorldTrips policies can be customized with optional add-ons enhancing the overall benefits of the insurance plan. We priced out a number of the available riders based on the hypothetical trip to Mexico and represented the cost of the add-on as a percentage of the estimated trip cost of $6,000.

How to File A Claim with WorldTrips

Unfortunately, the WorldTrips claim filing process leaves much to be desired. WorldTrips customers need to keep their travel insurance policy handy to know which claims process to follow.

You'll also need to have some other information on hand, such as whether or not a medical provider would bill WorldTrips directly on your behalf or if you have to pay out of pocket at the time of your service.

Atlas Travel, Atlas Premium, Atlas Group, Atlas MultiTrip, and StudentSecure travel medical insurance

If you hold a policy under one of the travel medical insurance products above, here's the step-by-step guide you'll reference when submitting a claim. You can submit your claim via email or regular mail using the following contact information:

Email: [email protected]

Mail: WorldTrips

Claims Department

Farmington Hills, MI 48333-2005

You can also submit your claim electronically through your customer portal: Client Zone for most policyholders and Student Zone for students.

Atlas Journey and Atlas On-The-Go trip protection insurance

If you have an Atlas Journey or Atlas On-The-Go plan, you'll reference the "submit a claim" section of this FAQ for the relevant forms you'll need to complete and the supporting documentation for your claim.

You can submit your claimant's statement and authorization form via your customer portal (Client Zone for most policyholders or Student Zone for students). Buyers can also use the WorldTrips Online service page and select "submitting a claim or an appeal" from the dropdown menu under the "contact us" header at the top of the page.

If you prefer to submit your claim through email or regular mail, the contact information is as follows:

If you can't access the required forms online, contact WorldTrips to have the documents faxed, emailed, or mailed.

If you're a student, you must submit additional documents for your claim proving you are a full-time student. Having the proper records can make your claim much less frustrating.

Deborah from California posted on Squaremouth, "When we returned home I called WORLD TRIPS and they said that I must file a claim with the airline first and then once that claim was adjudicated to file a claim with WORLD TRIP. I haven't gone back to read the policy terms but didn't think that this WORLD TRIP was secondary to other sources of recovery."

See how WorldTrips Travel Insurance stacks up against the competition.

WorldTrips Travel Insurance vs. Nationwide Travel Insurance

WorldTrips compares favorably to Nationwide . While Nationwide is also a reputable insurance provider with great reviews, the company offers just two standard plans customizable with unique add-ons. Nationwide does offer some of the most affordable travel insurance rates with a large and recognizable company name behind it. However, unique add-ons like sports equipment and pet coverage are not available.

Thus, travelers seeking more customized travel protection may prefer the unique plans offered through WorldTrips, especially those looking for specialized coverage for destination weddings, group travel, study abroad programs, and more. On the other hand, travelers without special coverage needs looking for cheap travel insurance may want to stick with Nationwide.

Karen S posted about her trip to Turks & Caicos on insuremytrip.com, saying, "It was easy to find a plan with the coverage that I needed. My travel companion is my 92-year-old mother so it was imperative that I have the best coverage at a reasonable cost."

Nationwide Travel Insurance Review

WorldTrips Travel Insurance vs. Berkshire Hathaway Travel Insurance

WorldTrips and Berkshire Hathaway are well-known insurance companies in the travel protection industry, offering various plans to meet the needs of any traveler. If you're planning a particular trip with multiple variables, WorldTrips has more customizable options with different types of add-ons and upgrades. However, Berkshire Hathaway offers a significantly easier claim filing process through its proprietary app, which can help you submit photos and other evidence for your claim in just a few seconds.

Both companies have customer reviews suggesting coverage provides peace of mind. But claims filing gets mixed reviews.

Berkshire Hathaway Travel Insurance Review

Why You Should Trust Us: What Went into Our WorldTrips Travel Insurance Review

We evaluated WorldTrips against the best travel insurance companies by comparing the options offered, customizations available, coverage ceilings, and ease of filing a claim. A licensed insurance agent reviews our articles. Our rating system is available to read in-depth here .

WorldTrips Travel Insurance FAQs

WorldTrips offers excellent travel insurance plans for any traveler but is particularly beneficial for students studying abroad, travelers planning a group trip, or digital nomads looking for continuous medical coverage while abroad.

WorldTrips offers different options to file claims, including mail, online, etc. However, it requires extra paperwork compared to many other travel insurance providers. As a result, the process may be more complicated compared to competitors.

WorldTrips offers a study abroad travel insurance policy called StudentSecure, which covers medical expenses and emergencies while students are abroad.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Tips to help stay healthier on your overseas trip

In June 2017, Kay Barcellos was enjoying a wonderful vacation in Sweden, celebrating her 80th birthday with her family. She didn’t anticipate her trip would be cut short by an accident.

While walking to her Stockholm hotel room, Kay tripped on a raised door sill and landed on her knee. She was taken by ambulance to a nearby hospital, where X-rays revealed she had fractured a bone above her tibia. In order to immobilize her knee, Kay had to wear a full leg brace and was dependent on a wheelchair.

Kay is not alone. According to the US Travel Insurance Association, nearly 20% of all travelers (17 million Americans) are expected to experience an illness or injury when traveling outside of the United States each year. Despite this fact, a recent UnitedHealthcare consumer survey 1 found that most Americans have never purchased travel insurance before an international trip. In fact, only 27% of people who traveled internationally in the past five years reported doing so.

Traveling internationally without the right coverage may put your health and financial well-being at risk. The International Federation of Health Plans found that without proper international health care coverage, an overnight hospital stay in Australia could cost an individual around $1,500 in out-of-pocket expenses. And the Centers for Disease Control and Prevention estimates a medical evacuation can cost $100,000 or more. In comparison, a UnitedHealthcare travel medical protection plan is available for a fraction of that amount. 2

Before you hit the road or take to the skies, consider these tips to help protect your health, safety and wallet while you're away.

- Resources: You can search a list of countries on the Centers for Disease Control and Prevention’s website to determine what vaccines you should consider.

- Resources: Learn more about travel medical protection on UnitedHealthcare’s SafeTrip website .

- Give yourself credit: Consider carrying an extra credit card with a large limit to use for unanticipated medical expenses. Foreign hospitals will typically want upfront payment, rather than billing the plan. Be sure to get clear, complete copies of all bills, medical records and discharge notes to submit for reimbursement from your plan.

- Resources: Learn more about Medicare and traveling abroad .

Follow these tips to help stay focused on fun, friends and family during your next overseas trip. For more information, visit uhcsafetrip.com .

More articles

Sign up to get the latest news from the unitedhealthcare newsroom.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Personal Loans for Fair Credit

- Home Equity

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

WorldTrips Travel Insurance Review (2024)

Protect your next trip.

Charlotte Armitage is a copywriter and content manager writing for brands primarily in the travel and recruitment industries. Writing is a major hobby as well as an occupation, but she also spends her time reading, dancing and bouldering.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

When you’ve been planning and looking forward to a vacation for months, the last thing you want is for your trip to be disrupted by an accident, emergency or cancellation. In these situations, travel insurance provides reimbursement and support that ensures that unexpected costs don’t ruin your travel experience.

Buying travel insurance before you leave for vacation is important, even if the chances of an unexpected incident are low. A range of travel insurance providers offer a variety of policies and coverage options, and WorldTrips is one of our top-rated recommendations .

In this article, we discuss the different policies and plans offered by WorldTrips to help you decide whether they’re the best provider to buy travel insurance from.

Our Take on WorldTrips Travel Insurance

WorldTrips is a travel insurance provider that offers a range of different coverage options, including specific travel medical plans. Founded in 1998, the company was one of the first to offer customers the ability to book travel insurance online. Services are now available to travelers 24/7.

WorldTrips earned 4.6 out of 5 stars according to our methodology because it has multiple plans with good coverage limits. It’s a particularly good company to insure a hunting trip, a specific type of vacation that many providers don’t include in their plans.

Pros and Cons

Compare worldtrips to the competition, why trust marketwatch guides.

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Does WorldTrips Cover?

WorldTrips has a basic policy called Atlas Journey , and it sells three levels of coverage: Atlas Journey Economy, Atlas Journey Preferred and Atlas Journey Premier.

The Atlas Journey Economy plan is the least expensive of the three and includes:

- Up to 100% of trip cost for trip cancellation or interruption, up to $10,000

- Up to $100 a day for trip or travel delays , with a $500 maximum

- Up to $500 for a missed connection

- Up to $200 for baggage delay

- Up to $250 per article for baggage loss or damage, up to $1,000

- Up to $10,000 for medical accidents and sickness

- Up to $500 for dental expenses

- Up to $250,000 for emergency medical evacuation

- Up to $10,000 for accidental death and dismemberment on a trip

If you’re looking for a basic travel insurance plan with more specific travel medical coverage , you can customize the Atlas Travel Insurance plan by picking from several medical insurance riders.

Optional Riders

Riders are add-ons that you can marry to your travel insurance policies, giving you extra coverage for specific activities or scenarios. Riders are useful if you or someone in your group has pre-existing medical conditions or if you’re going to a destination that has expensive healthcare.

Here are the optional riders available with Atlas Journey insurance products:

- Cancel For Any Reason (CFAR)

- Interruption for Any Reason

- Destination wedding cancellation coverage

- Adventure sports

- Rental car damage and theft

- Vacation rental accommodation issues

- Cancellation for academics, sporting events, volunteer and mission programs

- Hunting and fishing activities

- Primary coverage for emergency accidents and sickness

- Medical evacuation to hospital of choice

- Increased medical maximum benefit limit

- Primary coverage for baggage damage or loss

Policies Offered

WorldTrips has several policies designed for specific types of vacation. Each offers varying coverage limits and options, shown in the table below.

How Much Does WorldTrips Travel Insurance Cost?

According to our analysis, Worldtrips average policy cost is $191 . This is $30 lower than the average of all companies we shopped quotes for at $221.

Companies calculate travel insurance costs based on the level of coverage you need and the likelihood that you’ll end up making a claim. This takes into account where you are traveling, the age and health of the people on the trip and the length of time you need trip protection insurance for.

WorldTrips travel insurance is reasonably priced when compared to its competitors, with the Atlas Journey Economy plan providing the best value for money . The cost of insurance plans from the provider will vary depending on deductibles and add-ons, which can be used to customize your policy.

Quotes accurate as of June 14, 2023.

When you book the Premier package with WorldTrips, the optional add-ons are cheaper in comparison to when booked as part of the Economy plan.

Read More: Travel Insurance For United States Tourists

Does WorldTrips Offer 24/7 Travel Assistance?

Any customer that purchases Atlas Travel, Atlas Premium, Atlas Group, Atlas MultiTrip or StudentSecure insurance from WorldTrips gets 24/7 travel assistance. It provides medical assistance to people that buy Atlas Journey or Atlas On-The-Go insurance plans.

From within the United States, you can call the toll-free number 800-605-2282. Outside the U.S., the assistance phone number is +1-317-262-2132.

These travel assistance services include help with:

- Lost luggage

- Passports or travel documentation

- Language translation or interpretation

- Emergency travel arrangements

- Cash transfers

- Message services

- Prescription replacements

- Referrals for legal or medical services

This is a very beneficial service as it gives you access to expert advice and help in an emergency when you’re on vacation.

WorldTrips Customer Reviews

The customer reviews for WorldTrips insurance are mixed, with positive reviews mainly coming from customers that haven’t had to file a claim and were happy with the coverage they received and the information they were given by the company. However, some complaints from customers state that the claims process is incredibly long and that reimbursement is rarely given due to unexpected exclusions, along with reviews saying that customer service was unhelpful.

“Initially ran into a problem with setting up a claim, as I had used the incorrect policy number. I contacted Atlas, and they emailed me the paper version [of a claim form], which I manually filled out and mailed. I appreciate that they emailed me confirmation that it had been received. Two weeks later, I received a check in the mail with my refund. Excellent outcome.” — Rickie via Squaremouth “We filed a trip cancellation claim due to health reasons, and it was paid in full without any issues about six weeks later. It was a large claim, so I was expecting all sorts of questions and arguments… [It] was a great surprise that it went so smoothly. The only negative to the process was there was zero feedback from WorldTrips (or their 3rd party claims broker) about the status. Instead, I called WorldTrips every couple of weeks. They answered the phone quickly and updated me on the status.” — Jason via Squaremouth “Worst experience I've ever had with an insurance company. Any company, in fact. They wouldn't guarantee a payment before surgery, so I paid out of pocket because they assured me it would be a simple claims process afterward. The claims process was convoluted and tedious, and I suspected after reading numerous reviews that they'd find a reason to deny. As a shock to no one, they did. Total waste of time and money.” — Jerrica via Trustpilot “I bought their medical travel insurance. The claims process is convoluted, and they request you to submit your entire medical history, regardless of the type of claim. I had to follow up several times, and each time they would say that it takes 30-45 days for review of your email — then they still don't get back to you. Despite submitting all my dental and medical records, my small claim was denied, about a year later. It's pretty much the stereotypical worst nightmare of trying to deal with an insurance company.” — Amanda via Trustpilot

How to File a Claim with WorldTrips

There are two ways to submit a claim with WorldTrips. One is through an online form on its website under Trip Protection Insurance Plans. The other is via a form for Travel Medical Insurance Plans. Both processes require customers to fill in comprehensive forms and have copies of any necessary documentation that relates to their claim, such as records of medical expenses or credit card bills.

You can start the claims process with WorldTrips on its website .

The Bottom Line on WorldTrips

WorldTrips has an array of travel policies that include international student coverage , group travel plans , short-term coverage and both domestic and international plans for U.S. citizens. Some of its plans are highly customizable, perfect if you’re looking for a particular kind of coverage.

Some customer reviews for WorldTrips are positive, and in comparison to competitors, its coverage options provide good value for the money. But some customers report difficulties submitting claims and long wait times when contacting the company.

The selection of optional riders that you can customize plans with is excellent, and we particularly recommend this provider for hunting trips because of the specific coverage available for this activity.

Frequently Asked Questions About WorldTrips Travel Insurance

What are covered reasons for trip cancellation with worldtrips.

Covered reasons for trip cancellation with WorldTrips insurance plans include a doctor recommending you cancel your trip, the illness or death of a family member, companion, business partner, service animal or a travel companions’ family member. Other reasons are a natural disaster, severe weather in your destination, or a terrorist incident in a location on your itinerary.

How do you purchase a trip cancellation for any reason (CFAR) benefit?

You can buy CFAR coverage as an add-on when you purchase travel insurance from WorldTrips. Once you select your plan, you’ll get the option to include cancel for any reason coverage and choose whether you’d like this to cover 50% or 75% of your trip costs.

Can you buy trip protection insurance from WorldTrips after departing?

Unfortunately, you can’t buy trip protection insurance from WorldTrips after you start your trip. But WorldTrips permits customers to buy health insurance coverage when they’re in another country. That can provide emergency coverage for medical expenses.

How long will it take for WorldTrips to review a claim?

WorldTrips advises its customers that it can take up to 15 business days for a claim to be reviewed. You should hear back from the company within that time, and you may get asked to submit more information or documentation about your claim.

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

World Nomads Travel Insurance Review 2024

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're looking for travel insurance that allows you to confidently participate in a wide range of sports and adventure activities around the world, then World Nomads Travel Insurance might be right for you. The company's policies cover travel to almost anywhere on the globe and are available to residents of nearly every country.

World Nomads Travel Insurance Review

Among the best international travel insurance companies , World Nomads is particularly good at insuring athletes, covering well over 300 sports, including skydiving, bungee jumping, and golf. World Nomads is also a great last-minute purchase, allowing you to purchase coverage even after your trip has started. However, if you purchase a plan after departure, you will have to wait 72 hours before your plan kicks in.

That said, World Nomads lacks crucial coverage options, such as cancel for any reason coverage and coverage for pre-existing conditions. It also doesn't insure travelers older than 70.

Additionally the service has received middling reviews from customers, averaging 3.4 stars out of five across 2,510 reviews. Customers often complained about their lengthy claims processes and poor customer service.

Some also took issue with the "Nomads" branding, as some travelers with multiple destinations and long-term trips found their trip wasn't covered by Nomads' specific policies. It's worth noting that World Nomads was very responsive to positive and negative reviews on Trustpilot.

World Nomads Plans Available

World Nomads has two basic policies: Standard and Explorer. Each covers essentially the same things, but Explorer has higher amounts that World Nomads is willing to pay out for claims. The company's policies cover more than 150 specific activities. These range from bungee jumping and rock climbing to hang gliding and hot-air ballooning. You can see the full list on the company's website.

Additional Coverage Options (Riders)

One of the most common upgraded features of a travel insurance policy is cancel for any reason (CFAR) , where you really can cancel for reason beyond what's in a standard policy. This is not available on every policy, but it is often a feature that travelers are looking for while shopping for travel insurance before their trip. At this time, World Nomads doesn't offer CFAR coverage.

At the time of this review, World Nomads also offers sports equipment coverage. In February of 2022, it expanded coverage to include more than 150 sports and activities including Pickleball and FootGolf. It currently covers over 300 sports. So, as you can imagine, plans with sports coverage will cover virtually any sport you might play.

World Nomads Travel Insurance Cost

You can obtain a quote from World Nomads on its website by providing details about you and your trip. Be prepared to provide the following information:

- Your destination(s)

- Duration of trip

- Your country of residence

- State of residence (if you're from the US)

- Number of travelers

- Traveler(s) age

Notably, World Nomads does not ask you for the price of the trip, which many travel insurance companies factor into the trip of your policy. As such, World Nomads may be a good option if you're going on a particularly expensive trip.

We ran a few simulations to offer examples of how much a World Nomads policy might cost. You'll see that costs usually fall between 5% and 7% of the total trip cost, depending on the policy tier you choose.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following World Nomads travel insurance quotes:

- World Nomads Standard: $76.58

- World Nomads Explorer: $123.34

Premiums for World Nomads's plans are well below the average cost of travel insurance .

World Nomads provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- World Nomads Standard: $85.83

- World Nomads Explorer: $155.06

Once again, premiums for World Nomads plans are between 2.2% and 3.8%, below the average cost for travel insurance.

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following World Nomads quotes:

- World Nomads Standard: $152.96

- World Nomads Explorer: $276.34

Premiums for World Nomads plans are between 2.6% and 4.6%, once again below the average cost for travel insurance. This is especially impressive as travel insurance is often more expensive for older travelers.

How to File A Claim with World Nomad Travel Insurance

You can start an insurance claim by filing it on the company's website.

You can call toll-free in the US and Canada if you need to reach the company in an emergency at: (877) 289-0968.

Callers from outside the US and Canada can reach the company at: (954)-334-8143.

The email address is: [email protected]

You'll need to have the following ready to file a claim:

- Your policy number

- A contact number

- The nature of your problem

- Your location

- Prescribed medication (if any)

Make sure you keep any documents related to the claim you're filing. This includes any receipts, notices, and invoices.

Compare World Nomads Travel Insurance

World Nomads is particularly good at insuring traveling athletes, but let's see how it stacks up against the best travel insurance companies .

World Nomads Travel Insurance vs. Allianz Travel Insurance

Allianz Travel Insurance is a strong competitor against World Nomads, especially for travelers looking for a more business-oriented option. The company has been in business for more than 120 years and offers a wide range of insurance, not just travel-related, around the world.

A key difference between World Nomads and Allianz Travel Insurance is that Allianz Travel Insurance offers travel insurance that can cover multiple trips in the same year. You can take an unlimited number of trips within the same calendar year, but you do have to double-check that all of your destinations are covered by the policy you select.

Another difference is that Allianz Travel Insurance offers pre-existing condition waivers for qualifying customers. World Nomads doesn't have the same coverage, requiring that the pre-existing condition is fully stable in order for limited coverage with respect to trip cancellations or having to end a trip early.

Read our Allianz travel insurance review here.

World Nomads Travel Insurance vs. AIG Travel Guard

Travel Guard , a product backed by AIG Travel, is another potential alternative to World Nomads. AIG is a prominent player in the insurance industry, and the Travel Guard product represents true global coverage.

Unlike World Nomads, Travel Guard has coverage for pre-existing medical conditions, but there are conditions. Travelers must purchase their policy within 15 days of the initial trip payment to qualify for a pre-existing condition waiver.

Both travel insurance companies use a tiered approach, but Travel Guard has higher dollar amounts across the board. For example, trip cancellation for Travel Guard covers 100% of the trip cost, while with World Nomads the amount will depends on the tier of the coverage you purchase. Trip Interruption is also a fully covered event with Travel Guard's. Depending on the plan selected, it will either cover 100% or 150% of the trip cost.

If you're concerned about COVID-19 coverage with trip insurance, there's more coverage with World Nomads than Travel Guard. With Travel Guard, coverage for having to stay in a country past your original booking dates is an add-on, not a standard part of the policy.

Read our AIG Travel Insurance review here.

Compare World Nomad vs. Credit Card Travel Insurance

If you already have a major credit card in your wallet, you most likely have some travel insurance benefits that come with it. These benefits do vary from card to card. Be sure to check your card's specific policies.

Not all credit cards will feature travel insurance protection. The ones that do may have specific limitations. For example, many credit cards with travel protection require that your airfare is paid for with the card in question for protections to take effect.