- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Seniors in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

As an older adult, you may look forward to traveling the world when you retire. Whether taking a single trip or traveling extensively, health concerns and sickness can derail even the best plans.

One way to address those risks is to purchase one of the best travel insurance policies for older adults . We cover multiple insurance carriers and provide policy premiums and benefits examples to help you find the best travel insurance to meet your needs.

This is the shortlist of the best travel insurance for older adults:

HTH Travel Insurance .

John Hancock .

TravelSafe .

Seven Corners .

World Nomads .

Factors we considered when picking a travel insurance policy

Choosing the right travel insurance policy is an important decision. Yet, the best travel insurance company depends on your needs and budget. Here are the factors we focused on when making this list.

Available policy types . The best travel insurance companies offer multiple policy types to meet the needs of various travelers.

Policy coverage limits . How much will the policy cover if you need to make a claim?

Exclusions . Do you have pre-existing conditions that may affect your ability to travel, increase the potential for medical treatments during your trip or cut your trip short? What would cause the insurance company to deny a claim?

Cost . How much does the insurance company charge for a basic policy? Is this price affected by your age, length of the trip or overall health condition?

Website usability . We value insurance companies that make it simple for travelers to compare options, get a quote and purchase a policy online.

Customization . Are the insurance company's policies customizable to meet a traveler's needs or must they choose from a rigid set of options?

What matters most to you also impacts which travel insurance is best for you. Whether it's medical evacuation, pre-existing conditions or the repatriation of remains, each policy's coverages and limits differ.

Additionally, policy premiums can vary widely based on the length of coverage and your age. If you frequently travel, buying an annual policy instead of policies for each trip may make more sense. Additionally, your premiums may be much different as a new retiree at 65 compared with someone in their 70s or 80s.

You may be able to save money on your travel insurance policy by taking advantage of credit card benefits. For example, many travel cards include trip cancellation, delay and interruption benefits, luggage protection and rental car coverage at no additional charge when using the card to book flights and rent cars.

» Learn more: How to find the best travel insurance

An overview of the best travel insurance for older adults

We requested quotes from multiple travel insurance companies for a 10-day trip to Madrid in July 2023. Our hypothetical traveler is a 65-year-old man from California who is spending $8,000 for the trip. His trip cost includes airfare plus prepaid hotels and excursions.

On average, the price of a policy offered by the listed companies was about $514, with a median price of $609.

* Cost refers to the basic coverage cost if multiple options are available.

There are various coverage options and price points when comparing travel insurance policies for older adults. While the lowest-priced options in the chart are the most affordable, their policies offer different coverage. For example, policies from HTH Travel Insurance only provide medical coverage but not trip interruption, delay or cancellation protection.

Comparing coverage limits and exclusions when selecting a policy is important so you are satisfied when making a claim.

» Learn more: Is Cancel For Any Reason travel insurance worth it?

Top travel insurance options for older adults

Let's look at our six travel insurance policy recommendations for older adults.

HTH Travel Insurance

What makes HTH Travel Insurance great:

Medical benefits of up to $1 million with deductibles as low as $0.

Access to English-speaking doctors in more than 180 countries.

Insurance covers hospital care, surgery and prescription drugs.

Here's a snippet from our HTH Travel Insurance review:

"HTH has a few travel insurance policies. These include medical plans and trip protection plans, so you'll want to decide what type of coverage you require."

Since Medicare doesn't cover healthcare needs when traveling outside the United States, some travelers purchase healthcare-only policies such as this one from HTH Travel Insurance. For our test trip, their healthcare-only coverage cost is just $90. However, keep in mind that this plan only provides medical coverage — if you want insurance for things like trip cancellation , trip interruption or baggage delay, you'll need to purchase a different plan.

John Hancock

What makes John Hancock great:

Emergency medical evacuation coverage starts at $250,000 per person.

Trip interruption coverage of 125% of trip cost.

Trip delay benefits start at six hours.

Here's a snippet from our John Hancock review:

"John Hancock offers three different plans for travelers depending on their needs: Gold, Silver and Bronze. As you'd expect, the Gold level comes with the most coverage and the highest price, while the Bronze level costs the least."

John Hancock's basic coverage cost for our test trip is $616, which is slightly above average. This policy is ideal for travelers worried about health problems requiring an emergency medical evacuation during their trip.

What makes TravelSafe great:

Coverage for pre-existing conditions is available if the policy is purchased within 21 days of booking travel.

Includes a $500 benefit for missed connections or trip delays.

Trip cancellation protection of up to $10,000.

Here's a snippet from our TravelSafe review:

"TravelSafe insurance offers two different plan types: Basic and Classic. Both of them only cover single trips; the company doesn't sell multi-trip or year-long plans. The TravelSafe Basic plan offers a lower level of protection than the company's more expensive option, TravelSafe Classic."

TravelSafe's basic coverage cost for our test trip is $855. While this policy has a higher price, it offers coverage for pre-existing conditions if you buy it within 21 days of booking your trip.

Seven Corners

What makes Seven Corners great:

Lost baggage benefits of $500 per person (per item limit of $250).

Delayed bags are reimbursed up to $100 per day ($500 max).

Trip delay of up to $200 per day per person after six hours ($600 maximum).

Here's a snippet from our Seven Corners review:

"The RoundTrip Basic plan is a good comprehensive travel insurance option and offers 100% trip cancellation (for trips up to $30,000), 100% trip interruption, $100,000 for emergency medical expenses (secondary coverage), $250,000 for medical evacuation/repatriation, lost luggage, baggage delay and other benefits."

Seven Corners' basic coverage cost for our test trip is $602, which is slightly above average. It offers superior protection against lost or delayed luggage, which can really put a damper on your travel plans.

What makes Tin Leg great:

Trip cancellation and interruption for COVID included at no extra charge.

Coverage extended up to seven days for medical quarantine .

Sports equipment is covered under baggage loss coverage.

Here's a snippet from our Tin Leg review:

"Tin Leg offers nine different travel insurance coverage policies. Prices vary for each depending on your itinerary and trip costs. The Basic plan is exactly what it sounds like: a policy for low-risk trips. It includes coverage for trip cancellation, delay and interruption, plus missed connections, emergency medical and evacuation, and lost and delayed luggage coverage."

Tin Leg's basic coverage cost for our test trip is $844. COVID's impact on retirees can be severe, so having a policy with generous benefits regarding coronavirus is critical. One of the best features includes up to one week of additional coverage at no charge if you're medically quarantined.

World Nomads

What makes World Nomads great:

Covers more than 200 adventure activities.

Ability to extend coverage while traveling.

Emergency medical coverage of $100,000 for all policies.

Here's a snippet from our World Nomads review:

"World Nomads offers the Standard and Explorer travel insurance plans and excels in sports/activity-related travel insurance coverage while offering solid trip delay, baggage delay and lost luggage protections. The provider offers insurance plans for travel to nearly any country and is available to residents of most countries."

World Nomads' basic coverage cost for our test trip is $74. However, take note of the coverage limits on its policies, which can be much lower than the cost of your trip. Its Basic policy coverage caps trip cancellation or interruption at $2,500, which could leave a large gap in comparison to our traveler's $8,000 trip cost.

Best travel insurance for older adults recapped

The types of insurance plans for older adults — and how much they cost — vary significantly. There are options for those who only want to cover medical costs and plans for those who want coverage for any travel mishap that might befall them.

Other things to consider are pre-existing medical conditions, what types of activities you're doing and how long you'll be traveling.

Your chosen policy will depend on your travel needs and your comfort with risk. The upfront cost may be well worth it if you need to make a claim on an expensive injury, a canceled flight or a medical evacuation.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

AARP's Brain Health Resource Center offers tips, tools and explainers on brain health.

Popular Searches

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

Suggested Links

AARP MEMBERSHIP — $12 FOR YOUR FIRST YEAR WHEN YOU SIGN UP FOR AUTOMATIC RENEWAL

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

- AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

AARP Hearing Center

Ways To Improve Your Hearing

Brain Health Resources

Tools and Explainers on Brain Health

How to Save Your Own Life

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

Budget & Savings

Make Your Appliances Last Longer

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Beach vacation ideas

Vacations for Sun and Fun

Plan Ahead for Tourist Taxes

AARP City Guide

Discover Seattle

How to Pick the Right Cruise for You

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

TV for Grownups

Best Reality TV Shows for Grownups

Robert De Niro Reflects on His Life

Free Online Novel

Read 'Chase'

Sex & Dating

Spice Up Your Love Life

Navigate All Kinds of Connections

How to Create a Home Gym

Store Medical Records on Your Phone?

Maximize the Life of Your Phone Battery

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

AARP Smart Guide

Spring Clean All of Your Spaces

Driver Safety

Maintenance & Safety

Trends & Technology

How to Keep Your Car Running

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

AARP Travel Discounts

Aarp membership comes with hundreds of valuable member benefits, resources and services that can follow you anywhere—including aarp travel discounts to help members save on planning the trip of a lifetime..

1. Does AARP make travel discounts available to members?

Yes. Members have access to a world of tips, ideas and AARP travel discounts to help you set off on your next adventure.

2. Does AARP make available car rental discounts for members?

AARP members can enjoy car rental discounts at top companies everywhere. The AARP Travel Center Powered by Expedia is also a resource for discounts.

Members can get 30% off car rentals, along with an upgrade on compact through full-size car bookings (when available), an additional driver at no cost and more.

Members can get up to 30% off base rates at Budget—plus, add an extra driver and get an upgrade on compact through full-size car rentals for free.

Budget Truck Rental

AARP members can save 10%–20% on local or one-way truck rentals.

Payless® Car Rental

Members can receive 5% off leisure daily, weekly, weekend and monthly base rates, and a free upgrade on compact through full-size car rentals (if available).

Zipcar Car Sharing

Members get $20 off an annual Zipcar membership—plus, members can earn a $40 driving credit once they join.

Learn more about AARP discounts on car rentals at www.aarp.org/membership/benefits/car-rental-discounts/ .

3. Does AARP make available hotel discounts?

Yes. Book your next home away from home with help from AARP’s hotel discounts —whether you’re looking for an everyday hotel stay or other vacation rentals.

Best Western Hotels & Resorts

Save 5% or more off your room at over 4,000 Best Western properties. You can also earn 10% more bonus points per stay by joining Best Western Rewards® for AARP Members.

Wyndham Hotels & Resort

Enjoy a 10% discount on your next stay at Wyndham Hotels & Resorts.

Choice Hotels

Members get 10% off at participating Choice Hotels around the world, including Ascend Hotel Collection, Cambria Hotels, Clarion, Comfort Inn, Comfort Suites, Econo Lodge, MainStay Suites, Quality, Rodeway Inn, Sleep Inn and Suburban Extended Stay Hotel.

Hilton Hotels & Resort

AARP members save up to 10% on Hilton Hotel & Resorts brands worldwide. Plus, you can enjoy late checkout until 2 p.m. when available.

Red Roof Inn®

With your AARP membership, you can save 10% on the best available rates at Red Roof Inn®, Red Roof PLUS+®, Hometowne Studios by Red Roof and The Red Collection®. Also, members get a free bottle of water per room at check-in.

Discover more AARP hotel discounts and learn how to book your reservation at www.aarp.org/membership/benefits/hotel-discounts/ .

4. Does AARP have flight discounts?

Members can enjoy savings on flights around the world. Here are a few ways to use your AARP flight discounts :

British Airways

Get $65–$200 off your ticket with British Airways. Your discount works on round-trip transatlantic tickets to over 130 destinations globally.

AARP Travel Center Powered by Expedia

Get a $50 gift card of your choice when booking any flight package, exclusively through the AARP Travel Center Powered by Expedia. Terms and conditions apply.

AARP is here to support your every day—and your once-in-a-lifetime—with countless resources, programs and services just for you.

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

Discover AARP Members Only Access

Already a Member? Login

EASY WAYS TO FIND AARP MEMBER BENEFITS

See All Member Benefits

Discover all the benefits available with your membership in one place.

Get the AARP Now App

Download our app for easy access to your digital membership card, daily news, events, and nearby benefits.

Download the Benefits Guide

View, save or print the guide to see the details of every member benefit.

Or Call: 1-800-675-4318

Enter a valid from location

Enter a valid to location

Enter a valid departing date

Enter a valid returning date

Age of children:

Child under 2 must either sit in laps or in seats:

+ Add Another Flight

Enter a valid destination location

Enter a valid checking in date

Enter a valid checking out date

Occupants of Room

Occupants of Room 1:

Occupants of Room 2:

Occupants of Room 3:

Occupants of Room 4:

Occupants of Room 5:

Occupants of Room 6:

Occupants of Room 7:

Occupants of Room 8:

Enter a valid date

You didn't specify child's age

There are children in room 1 without an adult

You didn't specify child's age for room 1

There are children in room 2 without an adult

You didn't specify child's age in room 2

There are children in room 3 without an adult

You didn't specify child's age in room 3

There are children in room 4 without an adult

You didn't specify child's age in room 4

There are children in room 5 without an adult

You didn't specify child's age in room 5

You have more than 6 people total

Please select a trip duration less than 28 days

There must be at least 1 traveler (age 12+) for each infant in a lap

Enter a valid From location

Enter a valid start date

Enter a valid drop location

Enter a valid drop off date

Select a valid to location

Select a month

Enter a valid going to location

Enter a valid from date

Enter a valid to date

AARP VALUE &

MEMBER BENEFITS

Denny's

15% off dine-in and pickup orders

AARP Travel Center Powered by Expedia: Vacation Packages

$50 gift card of your choice when booking any flight package

$20 off a Walmart+ annual membership

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

- Vacation packages

- Things to do

- AARP Member Savings

- Create an Account

- List of Favorites

- Not ? Log in to your account

Create your free account

Sign in to your account, travel protection plans, expedia cancellation plan.

When plans change, there's help. Expedia Cancellation Plan from Berkely can cover your expenses if you need to cancel or change your flight. Don't leave home without it!

- Includes trip cancellation coverage

- Interruption coverage can provide reimbursement for airfare home

- Coverage for travel in the continental U.S. only

Booking a hotel along with your flight? Get broader coverage with the Expedia Package Protection Plan

Please see Terms and Conditions for full terms, including limitations and exclusions.

- Plan Coverage

- What's Not Covered

- Claim Instructions

- Terms Of Coverage

- Definitions

Stonebridge Casualty Insurance Company Policy Number MZ0911076H0000A

DESCRIPTION OF COVERAGE

- Schedule: Expedia, Inc Maximum Benefit Amount

PART A. TRAVEL ARRANGEMENT PROTECTION

- Trip Cancellation Up to Total Flight Cost

- Trip Interruption Up to Total Flight Cost

Trip Cancellation and Trip Interruption Benefits Pre-Departure Trip Cancellation

We will pay a Pre-Departure Trip Cancellation Benefit, up to the amount in the Schedule if you are prevented from taking your Covered Trip due to your, an Immediate Family Member's, Traveling Companion's, or Business Partner's Sickness, Injury or death or Other Covered Events as defined, that occur(s) before departure on your Covered Trip. The Sickness or Injury must: a) commence while your coverage is in effect under the plan; b) require the examination and treatment by a Physician at the time the Covered Trip is cancelled; and c) in the written opinion of the treating Physician, be so disabling as to prevent you from taking your Covered Trip.

Pre-Departure Trip Cancellation Benefits

Post-departure trip interruption, post-departure trip interruption benefits.

- 1. the additional transportation expenses by the most direct route from the point you interrupted your Covered Trip: a) to the next scheduled destination where you can catch up to your Covered Trip; or (b) to the final destination of your Covered Trip;

- 2. the additional transportation expenses incurred by you by the most direct route to reach your original Covered Trip destination if you are delayed and leave after the Scheduled Departure Date. However, the benefit payable under (1) and (2) above will not exceed the cost of a one-way economy air fare by the most direct route less any refunds paid or payable for your unused original tickets.

- being directly involved in a documented traffic accident while en route to departure;

- being hijacked, Quarantined, required to serve on a jury, or required by a court order to appear as a witness in a legal action, provided you, an Immediate Family Member traveling with you or a Traveling Companion is not: 1) a party to the legal action, or 2) appearing as a law enforcement officer;

- having your Home made uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster;

- Your involuntary termination of employment or layoff which occurs after your effective date of coverage and was not under your control. You must have been continuously employed with the same employer for 1 year prior to the termination or layoff. This provision is not applicable to temporary employment, independent contractors or self-employed persons.

Contact Information

This program was designed and is administered by Aon Affinity Berkely Travel. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc.; (AR 244489); in CA, MN & OK , AIS Affinity Insurance Agency, Inc. (CA 0795465); in CA, Aon Affinity Insurance Services, Inc., (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY and NH, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code. As an MGA we are acting on behalf of our carrier partner.

Please see Terms and Conditions for full details include plan terms, conditions and exclusions.

WE WILL NOT PAY FOR ANY LOSS CAUSED BY OR INCURRED RESULTING FROM:

- mental, nervous, or psychological disorders, except if hospitalized;

- being under the influence of drugs or intoxicants, unless prescribed by a Physician;

- normal pregnancy, except if hospitalized; or elective abortion;

- declared or undeclared war, or any act of war;

- service in the armed forces of any country;

- operating or learning to operate any aircraft, as pilot or crew;

- any unlawful acts, committed by you or a Traveling Companion (whether insured or not);

- any amount paid or payable under any Worker's Compensation, Disability Benefit or similar law;

- Elective Treatment and Procedures;

- medical treatment during or arising from a Covered Trip undertaken for the purpose or intent of securing medical treatment;

- business, contractual or educational obligations of you, an Immediate Family Member or Traveling Companion;

- failure of any tour operator, Common Carrier, or other travel supplier, person or agency to provide the bargained-for travel arrangements;

- a loss that results from an illness, disease, or other condition, event or circumstance which occurs at a time when the plan is not in effect for you.

Policy Number MZ0911076H0000A

- TRIP CANCELLATION CLAIMS: Contact Expedia, Inc. and Berkely IMMEDIATELY to notify them of your cancellation and to avoid any non-covered expenses due to late reporting. Berkely will then forward the appropriate claim form which must be completed by you AND THE ATTENDING PHYSICIAN, if applicable. If you are cancelling due to a death, a death certificate will be required.

- ALL OTHER CLAIMS: Report your claim as soon as possible to Berkely. Provide the policy number, your travel dates, and details describing the nature of your loss. Upon receipt of this information, Berkely will promptly forward you the appropriate claim form to complete. If you are interrupting due to a death, a death certificate will be required.

Online: www.travelclaim.com Phone: 1-877-718-4651 or 1-(516) 342-2720 Mail: Berkely 300 Jericho Quadrangle, P.O. Box 9022, Jericho, NY 11753 Office Hours: 8:00 am - 10:00 pm ET, Monday - Friday; 9:00 am - 5:00 pm ET, Saturday IMPORTANT: In order to facilitate prompt claims settlement upon your return, be sure to obtain as applicable: detailed medical statements from Physicians in attendance where the Accident or Sickness occurred. These statements should give complete diagnosis, stating that the Sickness or Injury prevented traveling on dates contracted. Provide all unused transportation tickets, official receipts, etc.

Claims Provisions

Payment of Claims Claims for benefits provided by the plan will be paid as soon as written proof is received. Benefits are paid directly to you, unless otherwise directed. Any accrued benefits unpaid at your death will be paid to your estate, or if no estate, to your beneficiary. If you have assigned your benefits, we will honor the assignment if a signed copy has been filed with us. We are not responsible for the validity of any assignment. Travel Insurance is underwritten by Stonebridge Casualty Insurance Company, a Transamerica company, Columbus, Ohio; NAIC # 10952 (all states except as otherwise noted) under Policy/Certificate Form series TAHC5000. In CA, HI, NE, NH, PA, TN and TX Policy/Certificate Form series TAHC5100 and TAHC5200. In IL, IN, KS, LA, OR, OH, VT, WA and WY Policy Form #’s TAHC5100IPS and TAHC5200IPS. Certain coverages are under series TAHC6000 and TAHC7000. This is a brief Description of Coverage which outlines benefits and amounts of coverage that may be available to you. If you are a resident of one of the following states (IL, IN, KS, LA, OH, OR, VT, WA, or WY), your Policy is provided on an individual form. You can request a copy of your Individual Policy or Group Policy for all other states by calling 1-800-453-4090. Your Individual Policy or Group Policy will govern the final interpretation of any provision or claim. Notice to California residents: This plan provides cancellation coverage for your trip and other insurance coverages that apply only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home and automobile policies. If you have any questions about your current coverage, call your insurer, insurance agent or broker. The purchase of this plan is not required in order to purchase any other travel product or service offered to you by your travel retailers. Unless individually licensed as an insurance agent, your travel agent is not qualified or authorized to answer your technical questions about the benefits, exclusions or conditions of this plan or to evaluate the adequacy of any existing insurance coverage you may have. Questions should be directed to the plan administrator at the toll-free number provided.

For questions or claims, please contact Berkely. Call: 1-800-453-4079 Email: [email protected] Office Hours: 8:00 AM to 10:00 PM EST Mon-Fri, 9:00 AM to 5:00 PM EST Sat.

- the date the Covered Trip is completed;

- the Scheduled Return Date;

- your arrival at the return destination on a round-trip, or the destination on a one-way trip;

- cancellation of the Covered Trip covered by the plan.

In the certificate, "you", "your" and "yours" refer to the Insured. "We", "us" and "our" refer to the company providing the coverage. In addition certain words and phrases are defined as follows: Accident means a sudden, unexpected, unintended and external event, which causes Injury. Business Partner means an individual who is involved, as a partner, with you in a legal general partnership and shares in the management of the business. Covered Trip means a period of travel away from Home to a destination outside your city of residence; the purpose of the Trip is business or pleasure and is not to obtain health care or treatment of any kind; the Trip has defined departure and return dates specified when the Insured enrolls; and the Trip does not exceed 31 consecutive days in length. Common Carrier means any land, water or air conveyance operated under a license for the transportation of passengers for hire. Domestic Partner means a person who is at least eighteen years of age and you can show: 1) evidence of financial interdependence, such as joint bank accounts or credit cards, jointly owned property, and mutual life insurance or pension beneficiary designations; 2) evidence of cohabitation for at least the previous 6 months; and 3) an affidavit of domestic partnership if recognized by the jurisdiction within which they reside. Flight means a scheduled trip for which coverage has been elected and the plan payment paid and all travel arrangements are arranged by Expedia, Inc. prior to the Scheduled Departure Date of the trip. Home means your primary or secondary residence. Hospital means an institution, which meets all of the following requirements

- it must be operated according to law;

- it must give 24 hour medical care, diagnosis and treatment to the sick or injured on an inpatient basis;

- it must provide diagnostic and surgical facilities supervised by Physicians;

- registered nurses must be on 24 hour call or duty; and

- the care must be given either on the hospital's premises or in facilities available to the hospital on a pre-arranged basis.

Why should I purchase Expedia Cancellation Plan? You've saved, you've waited, and now you're all set to go on the trip of your life. Preparing for your trip should include covering yourself against unfortunate occurrences that may interfere with even your best-laid plans. By purchasing Expedia Cancellation Plan, you may be reimbursed for covered cancellation or interruption penalties. Unexpected situations can happen to anyone, even immediate family members that are not traveling with you, and provide you with a reason you might need to cancel or interrupt your trip. Did you know that Expedia Cancellation Plan can reimburse covered expenses if:

- You become ill and can't travel.

- Someone in your immediate family has an illness or injury and you must cancel or interrupt your trip, even if he or she is not scheduled to travel with you.

- Involuntary job loss

- Your house becomes uninhabitable due to a hurricane.

- An immediate family member back home passes away and you must return from your trip early.

- You are injured and must visit a doctor while traveling.

- Many other unforeseeable events as listed in the Description of Coverage.

What does Expedia Cancellation Plan cover? Expedia Cancellation Plan includes coverage for Trip Cancellations and Trip Interruptions. If you must cancel or interrupt your trip for a covered reason, the plan provides coverage for covered penalties and expenses up to the cost of your originally booked flight. In the event of an interruption, covered benefits include the new airfare paid, less the value of an unused return travel ticket, to return home or rejoin your trip (up to a maximum of the cost of the originally booked flight). Covered reasons include illness, injury or death to you, a traveling companion or an immediate family member. Additional covered reasons for cancellation include jury duty, the issuance of a subpoena for court or administrative hearing, involuntary job loss, having a home made uninhabitable by a natural disaster, hijacking, quarantine, and being involved in a documented traffic accident en route to departure. Please refer to the Description of Coverage for full details. There is no Pre-existing Condition Exclusion in Expedia Cancellation Plan. Will my current home, renters, or credit card policies cover me during my trip? Most people don't have any insurance coverage at all for penalties incurred when they need to cancel their flight. It is not a typical coverage found in homeowners and renters policies. Likewise, most credit cards do not offer trip cancellation coverage; however, check your documentation carefully to see if yours might. Who can I contact for more information? You may call Berkely, the plan administrator, with any questions regarding Expedia Cancellation Plan. Their CustomerCare representatives will be happy to assist you. Hide Via email: [email protected] Via phone: 1-877-718-4651 or 516-342-2720 Via mail: Berkely P.O. Box 9022 300 Jericho Quadrangle Jericho, NY 11753 Office Hours:8AM-10PM (EST), Monday-Friday 9AM-5PM (EST), Saturday This program was designed and is administered by Aon Affinity Berkely Travel. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc.; (AR 244489); in CA, MN & OK, AIS Affinity Insurance Agency, Inc. (CA 0795465); in CA, Aon Affinity Insurance Services, Inc., (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY and NH, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code. As an MGA we are acting on behalf of our carrier partner. ` When is payment for the plan due? The plan must be purchased when your flight is purchased. How do I enroll in Expedia Cancellation Plan? The option to enroll is presented to you while booking your ticket. If you would like to purchase Expedia Cancellation Plan, simply select it and the cost of the plan is automatically included in the total amount due for your trip. Simply pay the amount indicated to purchase the plan. When does coverage go into effect and will it cover me for the entire length of my trip? The Trip Cancellation coverage takes effect upon receipt of the required plan cost by Expedia. The Trip Interruption Coverage takes effect at 12:01 AM on your scheduled departure date and location. The plan will cover you for the entire length of your Expedia-booked ticket. I am not a resident of the U.S. or Canada. Can I purchase the plan? Expedia Cancellation Plan is available only to U.S. residents and non-U.S. residents traveling to the U.S. who book their travel arrangements with Expedia. What happens if I need to cancel my trip? Please contact Expedia and Berkely as soon as possible in the event of a claim, as the insurer will not reimburse you for any additional charges incurred due to a delay in notifying Expedia of your cancellation. Berkely will then forward you the appropriate claim form in order to file a claim. How do I file a claim? You may request a claim form online via www.travelclaim.com or alternatively, call Berkely, the plan administrator, at 1-877-718-4651 from 8:00 am to 10:00 pm EST Mon-Fri or 9:00 am to 5:00 pm EST Sat. Please note that you may want to have a copy of your Expedia invoice handy as there are some details that will be needed in order to initiate your claim. This information includes your travel dates, date of cancellation, booking number, and some brief information regarding your reason for cancellation or interruption. Important: Be sure to also contact Expedia to notify them of cancellations, as well as to avoid additional expenses due to late reporting. Who is considered an "Immediate Family" member under the plan? Our definition of "Immediate Family" is quite broad. It's not just the family members who reside with you. "Immediate Family" includes: parents, spouses, domestic partners, grandparents, siblings, siblings-in-law, children, grandchildren, aunts, uncles, nieces, nephews, and business partners. See the Definitions section of the Description of Coverage for a full listing. Are there exclusions? Certain restrictions do apply. For example, the coverage in the plan does not provide duplicate payments if there are other sources of reimbursement available. Please see the Terms and Conditions for a full list of exclusions. Is there a Pre-Existing Condition exclusion? Expedia Cancellation Plan does not have a pre-existing condition exclusion.

How to use your AARP discount on travel

When AARP — the 38-million-strong organization for people over 50 — starts contacting you about becoming a member, you may freak out. My first reaction was, "I am not that old."

But after I got over my initial consternation, I realized that becoming an AARP member might open up a treasure trove of travel savings for me, including some that are always available and others that come and go periodically.

And it's a small investment: Either pay $12 a year for a multiyear membership with automatic renewal or $16 if you rejoin annually.

"One of the strengths of the AARP program is it's always on and always available," said Matthew Phillips, director of travel for the membership organization. "Another strength is there's the AARP discount and AARP member rate, and you also get those awards points with the programs you are enrolled in."

Members have access to discounts and member-specific deals at more than 10 hotel chains and their brands. There are also exclusive AARP deals for Avis Budget Group car rentals and through a cobranded AARP Travel Center powered by the Expedia portal.

Here are all the ways that you can use AARP discounts on travel, including a few you might not know about.

AARP travel deals

Hotel stays.

Hotel savings for AARP members are between 5% and 10% off the best available rate. Some hotels offer additional perks, too, such as a late checkout at 2 p.m., when available. The ongoing travel discounts are clearly spelled out on the AARP travel benefits website .

Members can click through to the AARP Expedia booking portal or link directly to the booking sites of select providers.

With an AARP membership, you can score discounts for brands in the portfolios of companies such as Hilton and Wyndham Hotels & Resorts . Wyndham, for example, offers up to 10% off, plus a late checkout when available. When you click on the AARP rate during the booking process, you should be able to see the terms, conditions and benefits.

The savings are 5% or more off stays at Best Western Hotels & Resorts and up to 10% off Choice Hotels , whether booked through the AARP Expedia portal or directly with the brands. AARP members also save 10% on stays with budget brands Motel 6 and Red Roof Inn.

At some point during the booking process, you may be asked for your AARP membership number. In some cases, you will need to show your membership card at check-in at the hotel.

Airline tickets

This may come as a surprise, but AARP has a long-standing relationship with British Airways .

The deal is for $65 off World Traveller (standard economy) and World Traveller Plus (premium economy) fares, as well as $200 off Club World (business class) fares. The discount does not apply to basic economy fares.

The savings offer applies to round-trip transatlantic tickets purchased online. Connections to more than 130 destinations in Europe, Asia, the Middle East and Africa are available.

With the offer, you can collect British Airways Executive Club Avios based on the fare booked.

Car rentals

AARP's car rental partnership with Avis and Budget gives members discounts of up to 30% on base-rate rentals when you pay in advance. Other perks from the Avis and Budget brands include an upgrade on a booking for a compact through full-size car, based on availability, and you can add an additional driver at no cost. There's also a 5%-off deal on Payless rentals.

As with hotels, you may need to show your membership card at the car rental counter.

Other AARP deals

Through the Expedia portal, AARP members booking cruises have access to whatever sale fares are being offered, plus an onboard spending credit of up to $100 you can use for drinks, massages or other purchases on the ship, according to Phillips. Featured cruise companies include Princess Cruises and Holland America Line .

AARP members booking vacation packages with flights and hotels or rental cars on the Expedia portal receive the bonus of a $50 prepaid Visa card.

Three escorted and guided tour companies — Collette, Grand European Travel and Vacations By Rail — also offer discounts to AARP members.

Additionally, there's a discount on airport parking — 12% with ParkRideFly — available at nearly 40 airports throughout the U.S. Popular locations include New York's John F. Kennedy International Airport (JFK) and Chicago's O'Hare International Airport (ORD) and Midway International Airport (MDW).

Exclusive AARP offers

In addition to the anytime deals, there are other targeted sales of travel products. For example, if a car rental company is having a sale open to the general public on SUVs, there may be an added offer exclusive to AARP members.

Plus, AARP members receive the organization's magazine and printed bulletin, both of which include some travel content, and can sign up for various newsletters like "Hot Deals," which has limited-time offers in a number of areas, such as dining and insurance products — and sometimes travel.

How to become an AARP member

While AARP is focused on people over 50, there is no minimum age to join. Anyone of any age can take advantage of the travel offers and the discounts on a lot of other products.

AARP provides access to 200-plus benefits, according to the company. While most are available to any member, products that are age-restricted by vendors, such as certain insurance products, are only available to members who are at least 50 years old.

A catch for anyone younger than 50 is that everything AARP does is geared and heavily marketed toward those age 50 and up. As such, you'll get pitches that may be irrelevant to your age group.

If you decide to enroll, it's fast and easy to sign up on the AARP website .

Bottom line

Is an AARP membership worth It?

The low cost of joining AARP makes it a good bet for all ages, even if you only take advantage of the travel discounts. You'll get an immediate return on your $16 membership investment with just one car rental or hotel stay.

In addition to multiple travel benefits, including hotel, car rental and airline discounts, you can take advantage of dining discounts at over a half-dozen brands — why not save 10% off your oysters, steak and truffle fries at McCormick & Schmick's?

Ultimately, for a small annual investment, your wallet will thank you.

Ready to take the plunge? Join AARP for free .

Related reading:

- 11 common rental car mistakes — and how to avoid them

- How to save on cruises with AARP Travel

- Got an AARP card? You now can get a lucrative perk when booking a Holland America cruise

- Barclays revamps and launches new AARP cards for all applicants

- Valuable travel discounts and deals for college students and young adults

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

9 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

For the Frequent Traveler: The 11 Best Annual Travel Insurance Policies

Content Contributor

60 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

80 Published Articles 456 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3068 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

GeoBlue Trekker Choice

Geoblue trekker essential, trawick international safe travels annual basic, trawick international safe travels annual deluxe, allianz travel alltrips basic plan, allianz travel alltrips prime plan, allianz travel alltrips executive plan, allianz travel alltrips premier plan, aig travel guard annual travel insurance plan, usi affinity voyager annual travel insurance, seven corners travel medical annual multi-trip, a plan that didn’t make our list, how annual travel insurance works, when to buy an annual travel insurance policy, what annual travel insurance policies do and don’t cover, understanding trip length rules, is annual travel insurance worth it, how much do annual travel insurance policies cost, does credit card travel insurance apply annually, choosing an annual travel insurance policy, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you take multiple trips every year, insuring each one can be a hassle. There are forms to fill out, comparison shopping over and over again, and then remembering the policy documents for each specific trip. And then there’s the risk you might forget to take out travel insurance for one of your trips.

Plus, those costs add up. There must be a better way.

Enter annual travel insurance. Also known as multi-trip travel insurance, taking out an annual policy covers you for a whole year of travel. Not only is it simpler, it may be cheaper than taking out multiple single-trip policies. But is it right for you?

Annual travel insurance policies aren’t exactly the same as the trip insurance you’d buy for a weeklong holiday with your family. Here are the best annual travel insurance policies, what they do and don’t cover, and how to decide whether taking out a yearly policy might be right for you.

The 11 Best Annual Travel Insurance Policies

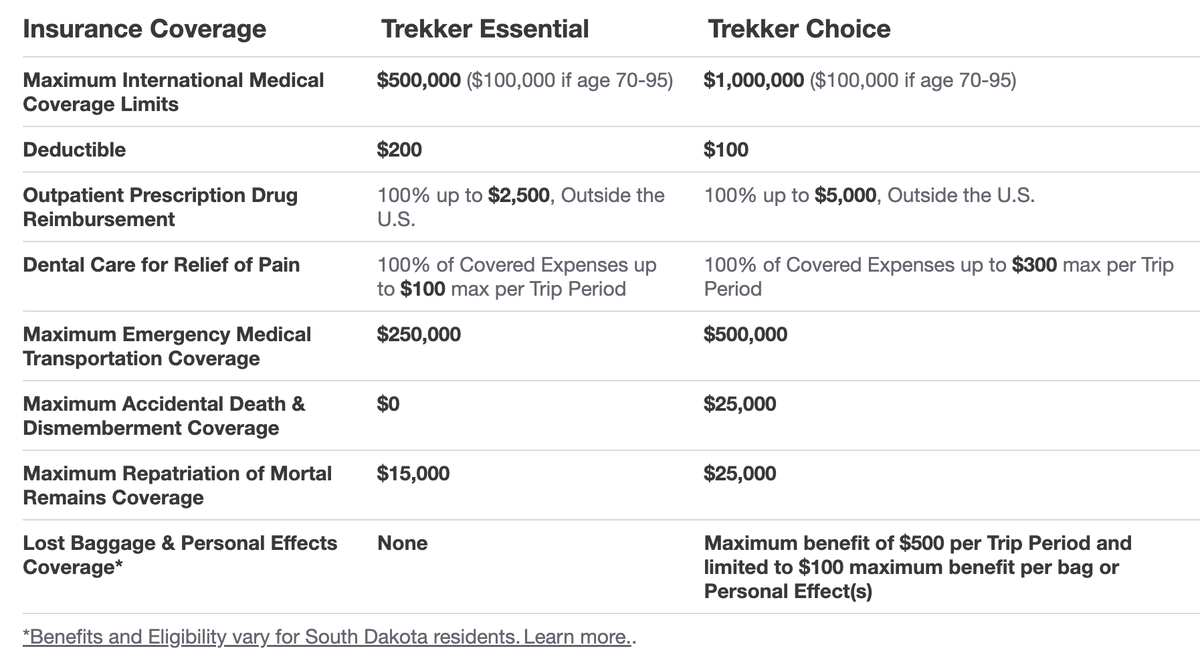

GeoBlue offers 2 Trekker plans for annual coverage, which are unique in several ways. These plans cover preexisting conditions, COVID-19, and all travel outside the U.S.

However, they don’t cover any trips inside the U.S. or provide any coverage for canceled, delayed, or interrupted trips. Instead, these are travel medical insurance plans . With the GeoBlue Trekker Choice plan , you’ll get higher maximum payouts in all categories and pay a lower deductible ($100). However, note that this is still secondary coverage .

You’ll get unlimited access to telemedicine and coverage for trips up to 70 days in length . Additionally, coverage is available up to age 95, which isn’t offered on most other policies.

The GeoBlue Trekker Essential plan offers the same pros and cons as the Choice plan. The main differences are the lower maximum payout values and the higher deductible ($200 instead of $100). You also won’t get the Choice plan’s lost baggage and personal effects coverage, which can provide up to $500 per trip. Again, this secondary medical insurance policy is only valid on trips outside the U.S.

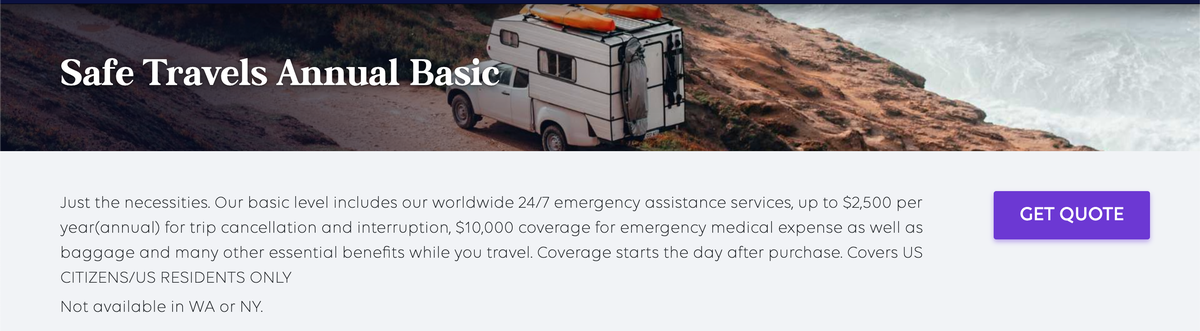

Trawick International offers 2 annual plans, and the Safe Travels Annual Basic plan is more economical. You’ll have coverage for everything you expect in a trip insurance policy , such as 100% coverage for trip cancellation or interruption (up to a $2,500 annual maximum) and coverage for delays, lost luggage, delayed luggage, and even medical expenses. To make up for the lower cost of the plan, coverage limits are lower than what you’ll find elsewhere . However, if you want peace of mind while traveling, you can get it for a year and cover trips up to 30 days in length.

While Trawick International’s Safe Travels Annual Deluxe plan offers higher maximum coverage limits than the Basic plan, its maximum payouts for medical and evacuation benefits are lower than what you’ll find with competitors . Where this plan shines is in the coverage for change fees, lost deposits on tours, and coverage for lost items if an airline misplaces your luggage.

You’ll be covered for up to $300 per trip for prepaid excursions, up to 100% of your trip cost (with an annual maximum of $5,000) for trip cancellations or interruptions, and up to $150 per item and $750 per trip for personal effects. After signing up for a plan, you’ll also get a 10-day free look period.

If you want an annual plan with a low price tag , this could be what you’re looking for. The Allianz Travel AllTrips Basic plan covers you for unlimited trips up to 45 days each over the course of a year. Coverage includes emergency medical, emergency medical evacuation, baggage loss and delays, travel delays, rental car theft and damage, and travel accident coverage.

However, there’s a fair list of exclusions from this plan . That includes trip cancellation, trip interruption, missed connections, and change fees. As the name implies, you’ll get basic coverage at a basic price.

The Allianz Travel AllTrips Prime option covers 365 days of trips, though the maximum trip length is just 45 days. While you’ll get coverage for all the standard travel insurance benefits, including trip cancellation, trip interruption, emergency medical, delays, and baggage mishaps, there are limits you should know about with this plan.

The travel accident coverage, which applies to death or the loss of a limb, maxes out at $25,000 per trip, baggage delay maxes out at $200, and baggage loss or damage maxes out at $1,000. The maximum coverage for emergency medical is $20,000, and costs can exceed that quickly in a true emergency.

However, this is a decent option if you want a fair amount of coverage across numerous categories without a high price tag.

For those worried about expensive business equipment or losing points and miles, this plan has you covered. On top of higher maximum payouts in categories such as trip cancellation, emergency medical transportation, or travel delays, you’ll also get rental car damage and theft coverage, change fee coverage, and reimbursement for renting business equipment if yours is lost, stolen, damaged, or delayed during a trip.

Moreover, you can be reimbursed up to $500 to cover fees for reinstating your points and miles if a covered trip is canceled or interrupted. The Allianz Travel AllTrips Executive plan also provides coverage for preexisting medical conditions if you meet certain criteria and buy at least 14 days before the first trip.

Allianz also has a customizable AllTrips Premier plan , allowing you to choose between several payout tiers for trip cancellation and interruption. You’ll pay more when choosing higher maximums, but this allows you to choose exactly what you want in coverage and not pay for more than you need. Another positive is coverage for preexisting medical conditions if you meet certain criteria and buy your policy at least 14 days before your first trip.

You’ll also get rental car damage and theft coverage , $500,000 of emergency medical transportation coverage, $50,000 of emergency medical, and coverage for travel delay expenses after a delay of 6 hours or more. The baggage delay coverage is up to $2,000, but it requires a delay of 12 or more hours. The maximum trip length allowed is 90 days.

The AIG Travel Guard Annual Travel Insurance plan isn’t available to Washington state residents. Still, it provides coverage for trip interruption, trip delay, lost baggage, delayed baggage, and missed connections, as well as both medical and security evacuation, accidental death and dismemberment, and travel medical expenses. However, the coverage limit for dental is just $500, and the maximum coverage for travel medical expenses is just $50,000. Those are lower limits than other plans. Additionally, trip cancellation isn’t included.

However, Travel Guard has some strengths. Trip delay coverage applies for up to 10 days and requires a delay of just 5 hours, and the missed connection benefit applies after just 3 hours. You get a “free look” period of up to 15 days to cancel for a refund, so long as you haven’t started your trip or filed a claim. Maximum coverage for any particular trip is 90 days.

USI Affinity’s Voyager plan has a Silver and Gold option , and pricing is easy to determine from the chart. Simply find your age bracket and the associated cost. The key differences between the plans are in the higher maximum payouts for nearly every coverage type with the Gold plan, other than emergency dental and accidental death and dismemberment. However, the Gold plan also includes coverage types the Silver plan doesn’t: political and natural disaster evacuation, airline ticket change fees, and trip interruption. However, trip cancellation isn’t included with either plan .

The maximum trip length is 90 days, and coverage for Silver and Gold plans lasts for 364 days. An unlimited number of international and domestic trips are covered, and you’re covered for trips as little as 100 miles from home. That’s a lower requirement than most other plans (which tend to require 150 miles).

This plan is ideal for those who don’t live in the U.S., as other plans on this list are only available to U.S. residents and citizens. While the plan technically lasts for 364 days, Seven Corners’ Travel Medical Annual Multi-Trip plan is customizable. It lets you choose a maximum trip length of 30, 45, or 60 days and include or exclude coverage for the U.S. Note U.S. citizens and residents cannot add coverage for inside the U.S.

Seven Corners also provides coverage for travelers aged 14 to 75 years, though maximum payouts decrease in some categories for those aged 65 and older. If you receive medical care in the U.S., Seven Corners will pay 90% of the first $5,000 of covered expenses and 100% of the cost afterward. You’re covered 100% outside the U.S. Note that coverage doesn’t apply to your home country (which includes the U.S. if you’re a citizen, even if you live in another country) and isn’t available in Antarctica, Cuba, Iran, Israel, North Korea, Russia, Syria, or Ukraine.

We considered another plan. Here’s why this annual travel insurance policy didn’t make our “best of” list.

IMG Patriot Multi-Trip International : For trips inside the U.S., you may be on the hook for 20% of your medical expenses if you visit a provider outside IMG’s PPO network. Additionally, the maximum trip length is 30 days, and coverage limits are quite low in multiple categories. These include $50,000 for emergency medical evacuation and $10,000 for political evacuation, a maximum of $50 per item and $250 overall for lost luggage, a $100 maximum for dental treatment, and $25,000 for accidental death and dismemberment 24/7 coverage.

Annual travel policy plans vary considerably. Most provide secondary medical insurance, so you may need to submit to your other coverage (home healthcare plan, credit card insurance provider, etc.) first and then submit to your travel insurance provider for any remaining expenses or deductibles. If you won’t have other coverage, you may want to look for a plan that provides primary health coverage instead. Also, understand that most plans provide reimbursement, so you would pay out of pocket for overseas hospital visits and then submit to your insurance provider for reimbursement after the fact.

What Is Annual Travel Insurance?

Annual travel insurance covers you for many trips over the course of a year (or sometimes 364 days). Rather than needing to buy a travel insurance policy for each trip separately — which can add up — you can buy a single policy that covers all your trips for the next year. It’s important to understand the terms of these policies, though. Some may require buying coverage in advance, such as 14 days before your first trip, while that requirement normally doesn’t exist on single-trip travel insurance.

It’s also important to note which types of trips and destinations are covered by your policy — and which aren’t. Look for how far from home you must travel to be covered and whether domestic trips are included. Moreover, consider what benefits you’re looking for. These can vary from medical-only to all the bells and whistles, such as baggage delay and medical evacuation. Once you know the type of coverage you want, you can find a policy or policies that align with your needs, helping you narrow down your options to conduct a more effective comparison.

Annual travel insurance works as an umbrella policy, covering all your trips during the policy period. You don’t need to inform the policy provider about each trip’s start and stop dates or destinations. You simply buy a policy, and then you’re protected for every trip that meets the conditions while your policy is in effect. Some regions may be excluded from coverage, and you may be subject to a maximum trip length.

Trip length is an important element to pay attention to. Annual travel insurance doesn’t cover you for a year-long trip. It covers you for a year for many small trips within that time, typically up to 30 or 45 days per trip. If you’re looking for a plan to cover you during a year-long trip to another country, you should look for specialized plans for study abroad, mission work, or other situations that apply to you. Traveling full-time? You may need a policy geared toward digital nomads and backpackers.

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and determine that the cost of insuring each alone would be higher than that of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want.

Considering that single-trip plans can sometimes be found for $10, yet an annual trip is likely to cost $150 or more per adult, you’d need 15 trips to justify the annual policy. However, that’s not really an apples-to-apples comparison, as a $10 basic travel insurance policy won’t provide as much coverage as you’re likely to find on even the most basic of annual policies.

It’s also not just about the number of trips you take but the types of trips, the complexity of the trips, and money at risk in nonrefundable costs. The more of these you foresee in your next year of travels, the more likely an annual plan would be good for you.

We already highlighted that annual policies don’t cover traveling nonstop for a year due to their restrictions on the maximum trip length. Annual travel insurance policies also restrict how far you must travel for coverage to kick in. Driving to the next town over may be a trip in your kids’ eyes, but it’s probably not far enough for your travel insurance to kick in.

While coverage varies by policy, you’ll typically have coverage for sickness, accidental death and dismemberment, lost or delayed luggage, trip cancellation, and possibly injuries during skiing or snowboarding. However, it’s important to read the terms of each policy because coverage maximums and inclusions vary widely. Some policies only provide medical coverage, while others offer robust coverage across the board.

Each policy specifies a maximum trip length. How trips longer than that are treated can vary. Most policies won’t cover any expenses related to a trip longer than the maximum trip length. Suppose you take a trip of 41 days on a policy with a maximum of 40 days. In that case, claims for delayed luggage or medical expenses may be rejected when the claim evaluator asks for your trip confirmation details.

However, GeoBlue covers the first 70 days of any particular trip. If something goes wrong during that time, you’re covered. You’re on your own for anything that happens on days 71 or beyond. Still, you’re covered on those first 70 days, despite taking a longer trip.

If you foresee long trips in the future, make sure you understand these rules.

For some travelers, yes, annual travel insurance is worth it. For others, it’s not.

Annual travel insurance is worth it when it costs less than what you’d pay to insure each trip individually. It’s also worth it if you think you might forget to purchase some of those individual policies throughout the year and would prefer to be done with them for another 365 days.

However, annual travel insurance isn’t worth it if you only take a few trips a year, they’re mostly domestic, and you don’t have major nonrefundable expenses. If you’re traveling within the U.S. with your standard health insurance policy in effect and you have credit cards that provide trip insurance for delays or cancellations, that coverage may be sufficient.

Costs will vary by your home state, age, and number of people included in the policy. Here are the “starting at” costs for our best annual travel insurance policies, sorted from lowest to highest:

Yes and no. Using a credit card to pay for your trip can provide some built-in protections. However, you should be mindful of annual maximums on any policy. You may run into limitations such as a maximum of 2 claims per 12-month period or similar exclusions. If you take many trips, that could be an issue.

To better understand what is and isn’t covered, check out our complete guide to credit card insurance .

To choose the right policy, look beyond the cost alone. Rather than immediately choosing the cheapest policy, find the policy or policies that provide the coverage types you want with payout maximums that cover your travel plans for the next year — both confirmed bookings and likely plans.

Consider your coverage needs. Will you be carrying expensive items such as scuba equipment for a trip to the Galapagos or top-notch camera lenses for a bird-watching tour in Papua New Guinea? How many extreme sports will you participate in?

Conversely, how many “never heard of this airline before” flights will you take to get off the beaten path? These are flights where you may be worried about cancelations that lead to extra costs or a misplaced suitcase.

Consider the types of trips you’ll take and the up-front money at risk if something goes wrong or you get delayed, then look at which plans align with your travels. From there, choose the best plan that aligns best with your needs, which may or may not be the cheapest one.

As an annual travel policy holder myself, I promise you that having the right plan is important when you wind up in a remote hospital in Tanzania with malaria.

Annual travel insurance isn’t right for everyone. However, it makes sense for those who travel often and could save money by taking out a single policy instead of many separate policies. It also makes sense if you’d prefer to avoid filling out paperwork numerous times throughout the year for each trip.

Annual travel insurance policies aren’t great for those who tend to travel closer to home, don’t have major nonrefundable travel expenses, or need to customize coverage for each trip because their travels tend to vary. For example, you might need different coverage for a backcountry ski trip with friends versus a 2-hour drive with your family.

Look at what annual policies do and don’t cover and see if these align with your travel goals and needs. Then, consider the prices for the plans that align well with your situation. After taking an informed look, you should have a good idea of whether an annual policy is right for your situation.

Frequently Asked Questions

Is yearly travel insurance worth it.

For some, yes. For others, no. Annual travel insurance is worth it when the cost is less than what you’d pay to insure each trip separately or you would prefer to just sign up once then be done for a year. However, annual travel insurance isn’t worth it if you only take a few, mostly domestic, trips a year where your healthcare coverage works, and you don’t have major nonrefundable expenses.

How much does annual trip insurance cost?