The best cards for earning American Express Membership Rewards

American express membership rewards transfer partners, how to transfer amex membership rewards points, the best amex membership rewards transfer partners, other options, what to know about transferring amex points to partners, amex transfer partners: full list of airlines and hotels for 2024.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: American Express® Green Card, Amex EveryDay® Credit Card, Amex EveryDay® Preferred Credit Card, Hilton Honors American Express Aspire Card, Marriott Bonvoy Boundless® Credit Card. The details for these products have not been reviewed or provided by the issuer.

- American Express Membership Rewards points are among the most valuable card rewards you can earn.

- You'll usually get the most value from Amex points by transferring them to airline and hotel partners.

- Airline partners like Air Canada and Virgin Atlantic can help you get the best value on first-class award flights.

- Read Insider's guide to the best travel rewards credit cards .

When it comes to transferable credit card rewards points , you might automatically think of Chase Ultimate Rewards ® or Capital One miles . But the American Express Membership Rewards program was one of the first points currencies to allow folks with associated credit cards to convert their hard-earned rewards into miles and points with various airline and hotel partners.

In fact, the Amex Membership Rewards program debuted way back in 1991 with just seven US airline partners. Today, Membership Rewards works with 17 frequent flyer programs and three hotel loyalty programs. Those numbers are impressive in and of themselves – consider, Chase has just 14 partners total, and Citi ThankYou Rewards has 16.

What sets Amex apart even more, however, is the excellent quality of its partners, and the myriad redemption opportunities they represent.

Here is a comprehensive guide to American Express transfer partners and how to get the most value from your points when taking advantage of them.

We're focused here on the rewards and perks that come with each card. These cards won't be worth it if you're paying interest or late fees. When using a credit card, it's important to pay your balance in full each month, make payments on time, and only spend what you can afford to pay.

Limited time offer: Earn 10X Membership Rewards® Points at restaurants worldwide for three months, on up to $25,000 in purchases when eligible card member refers a friend and the friend applies by May 22, 2024 and gets the card (terms apply). Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel (on up to $500,000 per calendar year) and on prepaid hotels booked with American Express Travel. Earn 1X Points on other purchases.

See Pay Over Time APR

Earn 80,000 Membership Rewards® points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Long list of travel benefits, including airport lounge access and complimentary elite status with Hilton and Marriott (enrollment required)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual statement credits with Saks and Uber

- con icon Two crossed lines that form an 'X'. Bonus categories leave something to be desired

- con icon Two crossed lines that form an 'X'. One of the highest annual fees among premium travel cards

If you want as many premium travel perks as possible, The Platinum Card® from American Express could be the right card for you. The annual fee is high, but you get a long list of benefits such as airport lounge access, travel statement credits, complimentary hotel elite status, and more.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Before you can redeem Amex points, you've actually got to earn them. Only a handful of Amex cards – both business and personal – rack up Membership Rewards points. Other Amex rewards cards earn either cash back, hotel points with programs including Hilton Honors and Marriott Bonvoy , or airline miles with programs such as Delta SkyMiles .

The following personal American Express cards earn Membership Rewards points:

And the following business cards earn Amex Membership Rewards points:

Now for a quick rundown of the current lineup of Amex Membership Rewards transfer partners.

You can transfer your Amex points to all of the following airline and hotel partners. Points transfer to many of these instantaneously, though some transactions might take a few business days to process.

Most transfer ratios are 1 Membership Rewards point to 1 airline mile or hotel point, but those that vary have been noted.

Once you start looking into booking awards using partner miles or points, your next step will be to actually transfer your Amex points to a partner program.

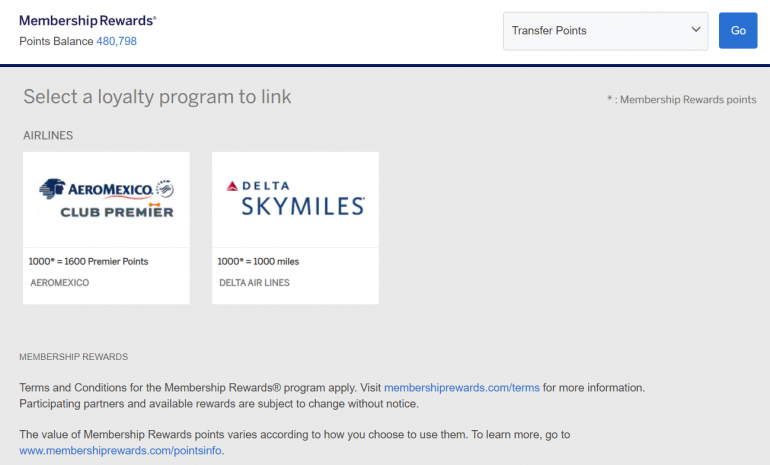

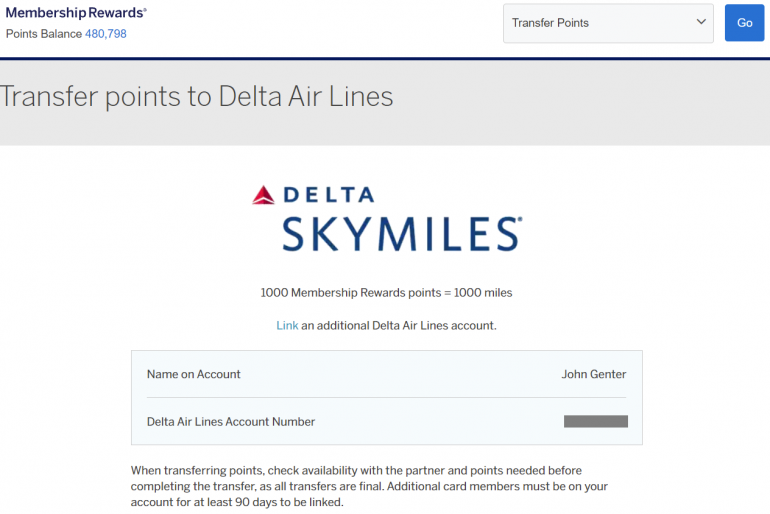

In order to do so, log in to your Amex account online. Click on the "Rewards" tab, and you should see your points balance and various options including one with an arrow that says, "Transfer Points." You will be redirected to a page that lists the various partner programs and the current conversion ratios.

Before you can initiate a transfer, you must link your Membership Rewards account to your various frequent flyer and hotel accounts. Doing so is as simple as clicking on the partner you want to use, then entering your credit card's security code and four-digit ID as well as your account number with the partner. Once you link accounts, you should be able to transfer whenever you like.

One thing to keep in mind: American Express also periodically offers transfer bonuses that tend to range from 20% to 40% to various partners. It's worth checking on available transfer bonuses from time to time, or taking advantage of ones you come across in order to get even more value from your points.

Before you get too overwhelmed with the number of transfer partners and all the points possibilities, here are the nine that deserve the most attention, with some examples of what makes them such fantastic options.

Just a quick note on some of the numbers, airlines, flight cabins, and routes cited here: These are accurate as of the time of publication, but are subject to any fleet and network changes individual airlines make, as well as government-imposed travel restrictions.

Air Canada Aeroplan

Air Canada Aeroplan has had a few ups and downs in recent years, including being spun off then reacquired by Air Canada. In late 2020, the airline introduced several major changes, but its award charts have not changed much, so its points have largely retained their value. Thus, Aeroplan remains one of the best frequent flyer programs for those who want to redeem their Amex points for flights on Star Alliance carriers such as United, Lufthansa, SWISS, and EVA Air.

Aeroplan's new award formula includes 10 distance-based charts for travel within and between four regions: North America, Atlantic, Pacific, South America.

Yes, it's a bit convoluted. In general, though, economy flight redemptions are a solid bet, and you should keep your eye out for specific premium award opportunities – especially in light of the fact that Aeroplan has eliminated fuel surcharges that used to range into the thousands of dollars.

Here are three possibilities based on both the distances of specific routes and the partner airlines you can fly:

- You only need 55,000 points each way for business class on ANA from either Vancouver or Seattle to Tokyo Haneda. For comparison, United would charge you 88,000 MileagePlus miles.

- Likewise, business class on Lufthansa or SWISS between Europe and several airports in the eastern US should cost just 60,000 Aeroplan points but would require 77,000 United miles.

- Finally, thanks to that same distance-based formula, you can book coach tickets between the West Coast of the US and Canada and Hawaii starting at 12,500 points each way versus 22,500 United miles – that's nearly twice as many miles!

Air France-KLM Flying Blue

Flying Blue is the mileage program of numerous airlines including not only Air France and KLM, but also carriers like Kenya Airways and TAROM. Members can also redeem their miles for flights on SkyTeam partners like Delta, Aeromexico, and Korean Air, among other partners.

Though Flying Blue levies hundreds of dollars in fuel surcharges for flights to and from Europe, there are still a couple of reasons to recommend the program.

First, it offers monthly rotating "Promo Rewards" with discounts of 20% to 50% off award pricing between certain cities and regions. In real terms, that means rewards for under 11,000 miles each way between North America and Europe in economy, or 28,750 miles in business class — if you can find them. Those numbers are hard to beat.

But even on a regular basis, Flying Blue members seem to have a lot more access to premium awards on both Air France and KLM than they would with other programs, such as Delta SkyMiles.

ANA Mileage Club

Getting back to Star Alliance for a moment, you can find some phenomenal possibilities by transferring your miles to All Nippon Airways' underrated frequent flyer program.

Without getting too bogged down in the details, Mileage Club does have a few important restrictions. Awards must be booked round-trip, though there's some flexibility thanks to open-jaw and stopover allowances. But the real beauty of the program is just how few miles you need even for the most premium experiences in the skies.

For example, you would need just 88,000 miles round-trip to fly business class on airlines like SAS and TAP Portugal between North America and Europe. Want to bump it up to first class on an airline like Lufthansa? That'll cost you 165,000 miles round-trip. Sure, that's still a lot of miles, but it's a far cry from the 242,000 miles United would charge you.

You could fly from North America to most of Asia for 85,000 to 95,000 miles round-trip in business class on Star Alliance carriers like Asiana or EVA, or 150,000 to 180,000 in first class. Yes, that's a lot of miles, but is still around half what other airlines' frequent flyer programs would charge.

Interested in taking either United's new services between Newark and either Cape Town or Johannesburg? You would need just 104,000 miles round-trip in business class with ANA, versus 176,000 United miles, or 170,000 Aeroplan miles.

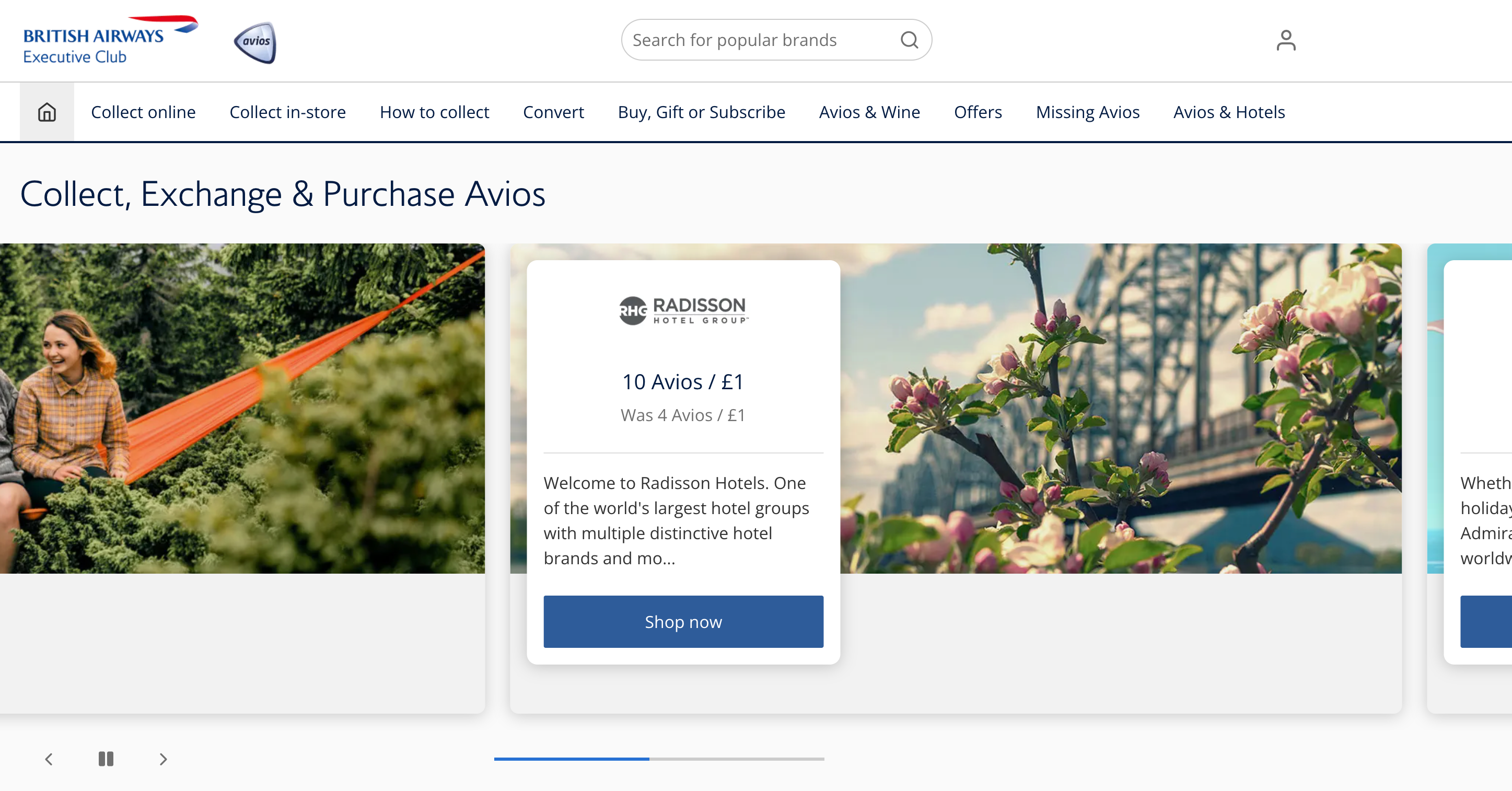

British Airways Executive Club

Thanks to a distance-based award formula that can result in exorbitant pricing for long-haul flights in premium cabins, some folks might shy away from transferring Amex points to British Airways . However, Executive Club has offered some of the most frequent transfer bonuses of any Amex partner, and is still an excellent choice for certain short-haul awards (flights that are about three hours or less).

Flying from the West Coast of the US to Hawaii will only cost you 13,000 Avios each way in economy on either American Airlines or Alaska Airlines, versus 15,000 to 22,500 using either of those carriers' miles. Likewise, using Avios to book shorter flights within Asia on Cathay Pacific, within Australia on Qantas, or from Miami or Dallas to the Caribbean on American Airlines can be a good way to save money on routes that can be expensive to book using cash.

You can also get from Los Angeles or San Francisco to Tokyo for just 27,750 miles each way in economy on JAL, or from Boston to Dublin on Aer Lingus for just 13,000 miles each way at off-peak times. Keep in mind that you can transfer Avios between British Airways Executive Club, Aer Lingus AerClub, and Iberia Plus for even more options, including some with lower surcharges on flights to and from Europe.

Cathay Pacific Asia Miles

While this Hong Kong-based airline's award chart won't be for everyone, if you're positively raking in the Amex points thanks to bonuses and spending, you might want to splurge with a few redemptions.

Like American Airlines AAdvantage , Asia Miles will charge you 70,000 miles each way in business class or 110,000 miles in first between the West Coast of the US (and Canada) and Hong Kong. The reason you might want to use Asia Miles instead of AAdvantage (or Alaska Mileage Plan miles, for that matter), is that it's easier to come by award space using the airline's own frequent flyer program rather than a partner, and unlike American and Alaska, you can transfer points from Amex as well as other card programs.

Another great premium possibility is to use 75,000 Asia Miles each way for Qatar Airways' outstanding business class between its hub at Doha and certain destinations within the US, including Boston, Chicago, New York-JFK, and Philadelphia.

Delta SkyMiles

Although Delta has made drastic changes to its award program over the past decade, it's still one of Amex's standout transfer partners for a number of reasons. First, it's the largest US carrier on the list, it's part of SkyTeam, and it also boasts non-alliance partners like Virgin Atlantic, so you can use Delta SkyMiles in a variety of ways.

That said, Delta has done its best lately to peg the value of SkyMiles to about 1 cent each, especially for awards on Delta itself. So use your Amex points for cheaper economy tickets that can cost as little as 5,000 miles each, or simply to top up your account with a few thousand miles here and there for specific tickets you are certain you will need to book in the near future (especially if that bumps you up from economy to business class).

Etihad Guest

Due to a clunky online interface and the fact that you have to call customer service to book awards on partner airlines, you might want to avoid Etihad Guest in general, unless you can pinpoint a few specific awards.

However, the carrier has a lot of interesting airline partners, including American Airlines, Air New Zealand, ANA, Korean Air, and Royal Air Maroc, among others. The airline also offers occasional award sales, bringing the price of some tickets down even further.

In general, though, here are two great awards you could consider transferring Amex points for:

- First, you can snag a one-way, one-segment business-class ticket on Royal Air Maroc, including between the US and Morocco, for just 44,000 miles.

- Second, Etihad makes first-class award space much more easily available to its own mileage program members than those of partners, including American Airlines AAdvantage. So if you want a shot at one of Etihad's fabulous first-class suites between Abu Dhabi and either the US or Europe, you'll probably want to start hoarding Amex points for a transfer to Etihad Guest.

Singapore Airlines KrisFlyer

Singapore Airlines partners with several of the other major transferable points programs, including Chase Ultimate Rewards, Citi ThankYou Rewards , and Capital One , so before you transfer Amex points, consider what other options you have. That said, there are a few redemption sweet spots to be aware of.

Economy awards between North America and Hawaii on either United or Air Canada are priced at a reasonable 19,500 miles each way, while flying business class within North America on either of those carriers is 26,000 miles each way.

But the real reason you might want to transfer Amex points to KrisFlyer is to redeem them for business- or first-class flights on Singapore Airlines itself, since the airline is very stingy with releasing award space to partners.

Sure, flights cost a lot of miles – flying business class on the world's current longest flight from Newark to Singapore will set you back 111,500 miles each way, or first class from New York-JFK to Frankfurt will require 97,000 miles — but spending some time in the lap of luxury could well be worth it.

Virgin Atlantic Flying Club

Virgin Atlantic Flying Club points are useful for partner award flights, some of which you can book for fewer points compared to other programs. The program will soon become more useful, as Virgin Atlantic will join the SkyTeam alliance in 2023 .

Among the best examples are using just 50,000 miles to fly Delta One Suites between the US and Europe (except the UK), or 60,000 miles between the US and Asia – a bargain considering you'd need at least 85,000 Delta SkyMiles for either option. You might also want to use 90,000 to 95,000 of them to fly ANA's gorgeous new business-class suites round-trip between the US or Europe and Japan, or 110,000 to 120,000 miles to fly first class.

Now that we've gotten the best partners out of the way, here are the details on the rest and why might or might not want to transfer your hard-earned Amex points to them.

Aer Lingus AerClub: In reality, Aer Lingus AerClub is linked to British Airways Executive Club, so it's relatively easy to transfer your Avios between accounts, but why add another layer of complexity to your rewards strategy? Aeromexico Club Premier: Although the transfer ratio to Aeromexico might seem favorable, and there are sometimes transfer bonuses, the Club Premier award chart lacks any truly great redemption opportunities. Avianca LifeMiles: While this program offers some fabulous award opportunities on Avianca's Star Alliance partners, its booking engine is not the most reliable, and its customer service reps can be hard to reach. Emirates Skywards: Emirates reduced the sky-high fuel surcharges it once tacked onto its award tickets, but mileage prices are still astronomical, especially for sought-after seats in first and business class. Hawaiian Airlines HawaiianMiles: While this program can come in handy specifically for tickets within Hawaii and between the islands and the US mainland, you might be better off simply getting one of Hawaiian Airlines' co-branded credit cards to enjoy extra earnings and perks. Iberia Plus: Another partner linked to British Airways Avios, Iberia's mileage program is a great way to save on fuel surcharges, and does have some excellent award options between the US and Europe, including certain business-class tickets that cost as few as 34,000 Avios. However, its search engine can be hard to use, and customer service is almost non-existent, so do your homework before transferring Amex points here. JetBlue TrueBlue: Folks can get a lot of value from TrueBlue points for flights on JetBlue, but the conversion ratio of 5 Amex points to 4 TrueBlue points takes it out of the running as a truly great transfer partner. Qantas Frequent Flyer: You might find some good deals redeeming Qantas miles for expensive flights on the airline's own metal within Australia and the South Pacific, but award prices for flights beyond that are jaw-droppingly high for the most part.

Choice Privileges: Booking some budget stays in the near future? Choice points could come in handy, but are unlikely to be a frequent transfer option for more aspirational travelers. Hilton Honors: Amex points convert to Hilton Honors points at a 1:2 ratio, which is great on the surface. But if you're interested in Hilton stays and perks, you should probably apply for a co-branded Hilton card instead . For instance, the Hilton Honors American Express Aspire Card is currently offering 150,000 Hilton Honors bonus points after you spend $6,000 in purchases on the card within your first six months of card membership, and it confers automatic top-tier Hilton Honors Diamond elite status , statement credits at Hilton Resorts and on certain eligible stays at Waldorf Astoria and Conrad properties, plus a free night reward each account year. Marriott Bonvoy: Considering the paltry 1:1 conversion ratio and Marriott's excellent stable of co-branded credit cards , you might want to avoid Amex transfers and instead apply for a product like the Marriott Bonvoy Boundless® Credit Card . It's currently offering new cardholders 5 Free Night Awards (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first three months from your account opening, plus benefits like automatic Gold elite status, 6 points per dollar on eligible Marriott purchases, 3 points per dollar on dining, gas, and groceries (on up to $6,000 in combined purchases each year), and 2 points per dollar on other eligible purchases.

American Express Membership Rewards points are among the most valuable and versatile travel rewards out there. That's thanks not only to the sheer number of airline and hotel loyalty programs cardholders can transfer their points to, but also to the variety of excellent redemption opportunities available.

The key to optimizing Membership Rewards points is to pick a credit card that will earn the most of them on the things you tend to purchase most frequently. And then, on the other side of the travel rewards equation, you will want to focus on just a few of the transfer partners with the best redemption opportunities for your needs and goals.

Once you pinpoint the right card and the right partners, you should be able to make strategic transfers and enjoy excellent award flights and hotel stays.

For rates and fees of The Platinum Card® from American Express, please click here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

Watch: Why flying is so terrible even though airlines spend billions

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Transfer AmEx Membership Rewards Points to Airlines and Hotels

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

1. Link your airline or hotel account

2. transfer membership rewards points to airlines and hotels.

You've diligently used your American Express card and saved up the Membership Rewards points needed for that trip you want to book. The next step is transferring points to airline and hotel loyalty programs so you can book the trip.

Whether it's your first time transferring points or you're experienced with points and miles, how to transfer Membership Rewards points to airlines and hotels may not be a straightforward process. Unlike when transferring other bank points, AmEx requires that you verify card details. You'll also need to link your loyalty accounts in a separate process before initiating the transfer.

But, no need to worry. We've got a comprehensive step-by-step guide to walk you through the process of how to transfer AmEx Membership Rewards points to airlines and hotels.

AmEx Membership Rewards points transfer partners and rates

American Express Membership Rewards currently transfer to 20 airline and hotel loyalty programs . Membership Rewards points transfer to 17 of these airline and hotel partners at a 1:1 transfer rate.

Aer Lingus (1:1 ratio).

AeroMexico (1:1.6 ratio).

Air Canada. (1:1 ratio).

Air France/KLM (1:1 ratio).

ANA (1:1 ratio).

Avianca (1:1 ratio).

British Airways (1:1 ratio).

Cathay Pacific (1:1 ratio)

Delta Air Lines (1:1 ratio).

Emirates (1:1 ratio).

Etihad Airways (1:1 ratio).

Hawaiian Airlines (1:1 ratio).

Iberia Plus (1:1 ratio).

JetBlue Airways (2.5:2 ratio).

Qantas (1:1 ratio).

Qatar Airways (1:1 ratio).

Singapore Airlines (1:1 ratio).

Virgin Atlantic Airways (1:1 ratio).

Choice Hotels (1:1 ratio).

Hilton Hotels & Resorts (1:2 ratio).

Marriott Hotels & Resorts (1:1 ratio).

For details on transfer ratios, see AmEx's website .

Based on user reports and various travel sites, point transfers are often immediate for most of these partners. AmEx itself shares that transfer times can typically take 48 hours, with actual posting to the new account delayed at times. The partners that most often have a one to two (or more) day wait for transfers are AeroMexico, ANA, Asia Miles, Iberia or Singapore.

» Learn more: The best airline and hotel rewards loyalty programs this year

Tips before transferring Membership Rewards points

Before we show you how to transfer Membership Rewards points to airlines and hotels, here's a few tips to consider before transferring points.

Check award availability first

American Express point transfers are one-way and irreversible. And airline and hotel loyalty programs can devalue loyalty programs without notice. So, it's best practice to wait until you're ready to book an award flight or reward stay before transferring points.

Check ahead of the transfer that the flight or hotel stay you want is currently bookable with points. For programs with dynamic pricing, checking award rates will also let you figure out how many points you'll need to transfer.

Since most Membership Rewards point transfers are instant, your points or miles should be ready to go soon after you check availability. If you’re looking to book on a program known for longer transfer times, just make sure to account for that time in your planning.

Figure out which transfer partner is best

If you're planning to book a Delta award flight, you might assume that transferring Membership Rewards points to Delta SkyMiles is your best option. And it might be. However, it's worth checking other options.

You can use Flying Blue miles , Virgin Atlantic points , or even AeroMexico Club Premier points to book Delta award flights. All three of these loyalty programs are also Membership Rewards transfer partners. And you might be able to save points by booking through alternative programs .

For example, for a business class award flight from Minneapolis/St. Paul to Paris, Delta can charge 310,000 SkyMiles per person. However, you can pay just 50,000 Virgin Atlantic points for the same flight.

» Learn more: When to use credit card points and when to transfer them to airlines

How to transfer Membership Rewards points to airlines and hotels

Now that we've gone over some dos and don'ts, let's go through the step-by-step process of how to transfer Membership Rewards points to airlines and hotels.

First, you'll need to log into your American Express account. As a shortcut, use this link to log into your account and auto-direct to the transfer points page. Or you can log into your AmEx account and then use this link to open the transfer points page.

Next, you'll need to link your Membership Rewards account with your airline or hotel loyalty program account. Once connected, accounts will remain linked unless you manually unlink them. For ease in future transfers, you may want to link all of your loyalty programs at the same time.

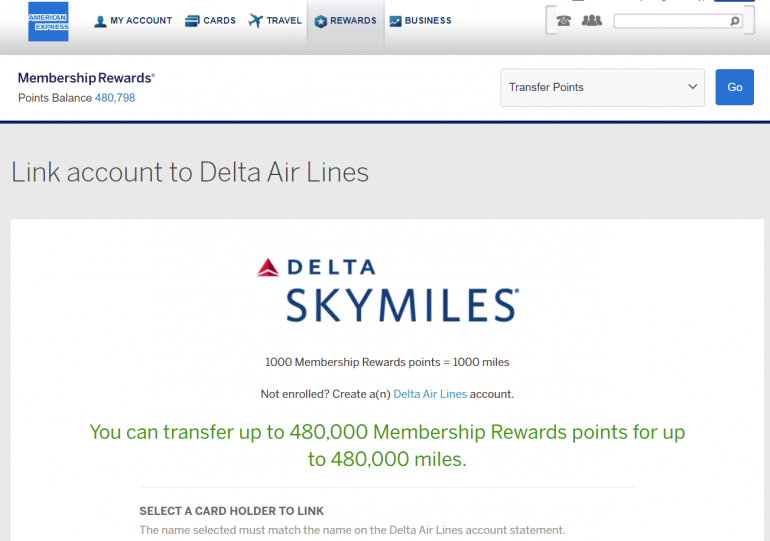

Click on the program you want to link to start the linking process. Once selected, you'll find the transfer rate and how many points or miles you can transfer to the hotel or airline partner.

Scroll down and select which card holder's loyalty program you want to link. In addition to linking your own loyalty program accounts, you can also link loyalty program accounts held by an additional card member. However, you'll need to wait at least 90 days after adding the additional card member before you can link their loyalty program accounts — likely to reduce fraudulent transfers.

Note that the cardmember's name must match the name on the airline or hotel account. So, if you've changed your name, double-check that your name matches in both accounts before submitting the link request.

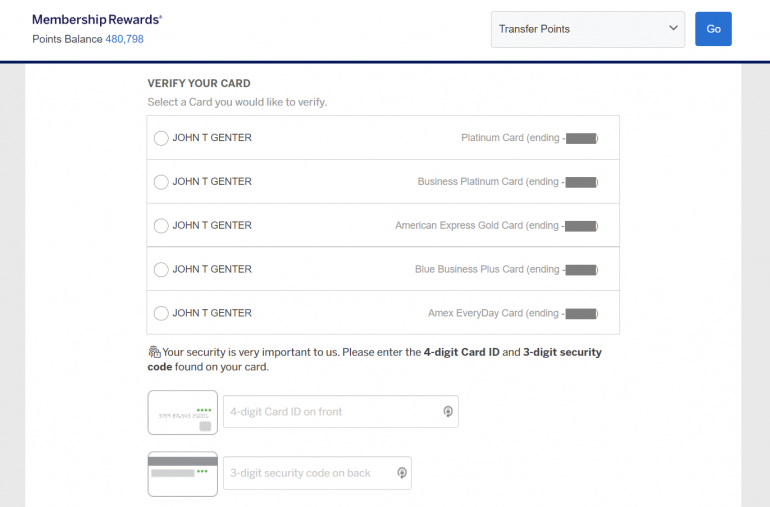

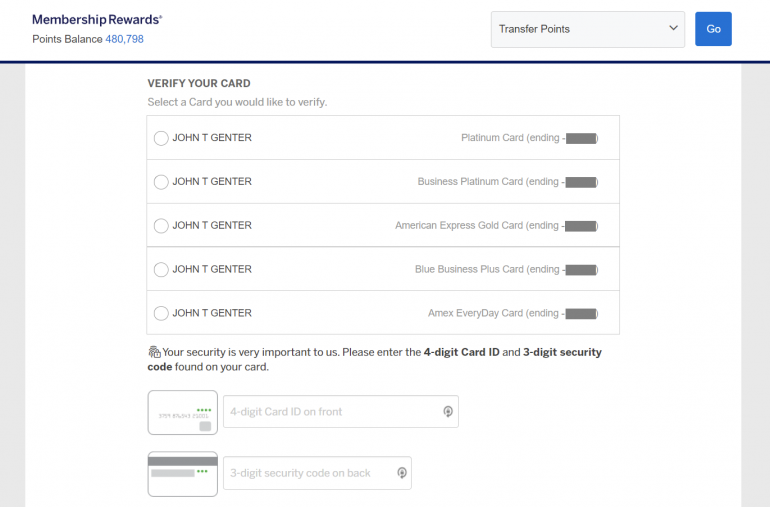

Next, you'll need to verify your AmEx card. You have the option to use any AmEx card that's linked to your account to verify your account. Choose that card from the list and enter both the four-digit code and the three-digit code on the card.

Last but certainly not least, enter your loyalty program account number. Then click "Link account."

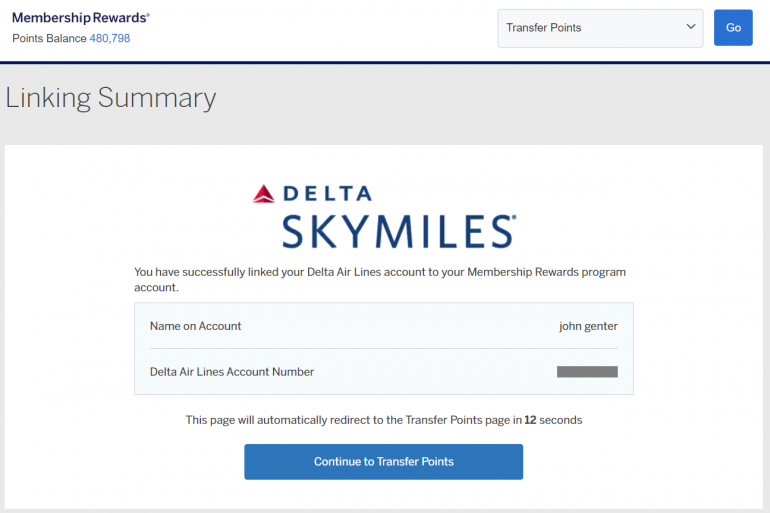

If successful, AmEx will display a confirmation page — but only for 15 seconds before it redirects to the transfer points page.

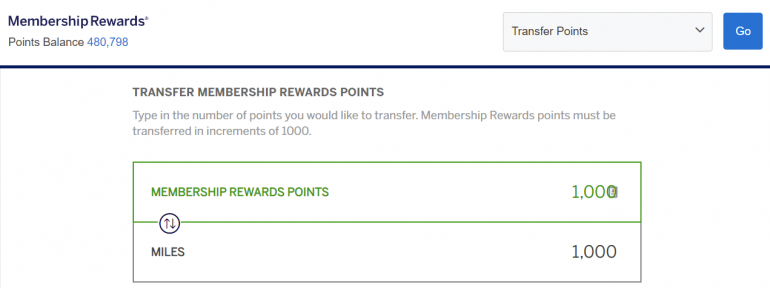

Now that you have linked your accounts, it's time to transfer points. From the Transfer Points page, click "Transfer points" for the specific airline or hotel to which you want to transfer points.

On the next screen, confirm that you're transferring points to the correct card member. It also can't hurt to double-check that the loyalty program account number is accurate.

Next, enter the number of points you want to transfer or the number of miles you wish to receive. Just note that transfers must be in increments of 1,000 points.

Then, you'll need to verify your AmEx card. Again, you can use any card that's linked to this AmEx account login. Select the card you want to verify from the list, enter the four-digit code on the front and the three-digit code on the back of the card.

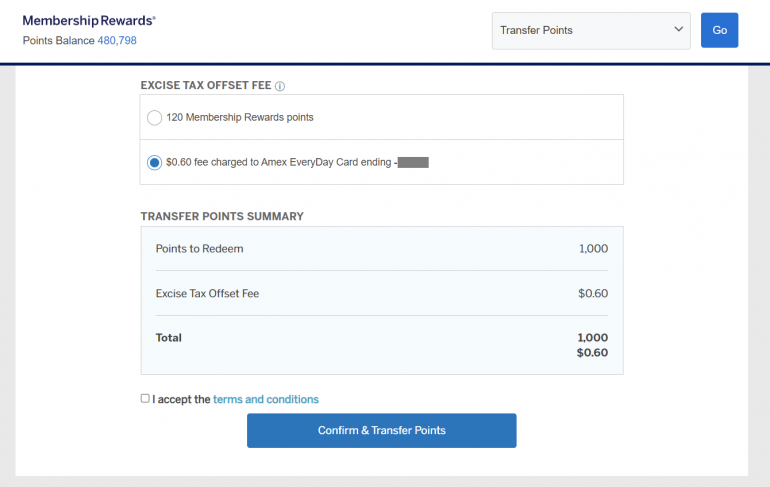

For transfers to U.S. airline programs , you'll need to pay an "excise tax offset fee" before you can transfer points. AmEx charges a fee of $0.0006 per point up to a maximum fee of $99. You can use Membership Rewards points to cover this fee. However, you'll only get half a cent per point in value, and there are much more valuable uses of Membership Rewards points.

Finally, read and accept the terms and conditions. Then, click the "confirm & transfer points" button to initiate the transfer.

» Learn more: How much are your airline miles and hotel points worth this year?

If you're transferring Membership Rewards points

To transfer Membership Rewards points to airlines and hotels, you will need an American Express card, your loyalty program account number and some patience. The process to link your accounts and then transfer points can take some time, so you may want to set aside some time to link several accounts at once to save the hassle later.

Before you transfer points, ensure that there's award availability for the flight or hotel you want. And a little work checking alternative transfer programs may yield a much cheaper award redemption.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best Ways To Fly to Europe With Points & Miles [Step-by-Step]

Senior Content Contributor

486 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Senior Editor & Content Contributor

91 Published Articles 671 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![amex travel partners points The Best Ways To Fly to Europe With Points & Miles [Step-by-Step]](https://upgradedpoints.com/wp-content/uploads/2019/01/Rothenberg-Germany-in-Europe.jpeg?auto=webp&disable=upscale&width=1200)

United MileagePlus

Ana mileage club, air canada aeroplan, avianca lifemiles, asiana club, air france-klm flying blue, delta skymiles, korean air skypass, american aadvantage, taxes and fees, lots of city options, finding more seats, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Paris in the spring.

Spain’s Costa del Sol in the summer.

Christmas markets in Germany.

No matter what time of year it is, there is always a great reason to travel to Europe!

If you book award tickets to Europe with miles and points, you can use all that vacation money you saved to enjoy the destination.

Let’s take a look at some of the best ways to book award flights to Europe.

Best Programs To Use To Book Flights

When you search for paid flights to Europe from the U.S., you will find a huge variety of options. From low-cost carriers to some of the world’s best first class products , there really is something for everyone. Just make sure you’re up to date regarding ETIAS and visiting Schengen countries in Europe before you book your ticket.

If you live on the East Coast, maybe you can handle the flight in economy class and save some of your points for another day.

But if you live on the West Coast, perhaps a lie-flat bed is a little more important so you can hit the ground running when you arrive at your destination.

We realize that many factors go into determining the best flight for a specific route, or even for a specific passenger: do you prefer lie-flat seats, great food, a friendly crew, or all of the above?

Choosing the best airline for you comes down to evaluating your personal preferences.

Below, we show you some of the best options for using your points for economy class, business class, and first class flights. No matter how you like to fly, we have you covered!

Hot Tip: We mainly discuss round-trip award prices, but keep in mind that many airline loyalty programs will let you book one-way award tickets for half the number of miles.

United Airlines’ MileagePlus program is one of the most popular ways to book award flights to Europe thanks to its extensive reach via the Star Alliance network.

MileagePlus is a fairly straightforward program that is easy to understand and use . Many of its partners are available to search for award space and book on the United site.

If you select Flexible Dates when doing your search, you can see a month-long calendar of award availability all at once. This makes finding award space much easier.

Although its mileage rates for award tickets to Europe are not the absolute best you can find, United has several things going for it. Specifically, the following are true:

- United miles are super easy to redeem

- No (or very low) fuel surcharges

- Great starter program for miles and points

Hot Tip: If you’re interested in learning more, don’t miss our in-depth United Airlines review !

You’ll notice that United charges more miles for partner flights than for its own flights , so you’ll want to make that consideration when thinking about which airline to fly on.

United doesn’t offer a first class product outside of North America, so if you have your mind set on flying first class, your main choice is Lufthansa .

Be prepared, though, as first class awards with Lufthansa are almost always not bookable until ~15 days before the departure date.

SWISS Air doesn’t make its first class available to partners . In fact, you’ll need top-tier elite status with SWISS Air to make these award bookings at all.

Also, nearly all European-focused Star Alliance partners such as Brussels Airlines, LOT Polish, and Turkish Airlines do not have first class.

The tradeoff when booking first class with a partner is that while it will cost a big chunk of miles, United will not hit you with carrier-imposed surcharges. This can save you over $500 in fees when you book Lufthansa first class , as other airline loyalty programs will pass those charges onto you.

If you want to fly in coach, however, choosing to fly with United or its partners doesn’t matter; it will cost the same amount of miles either way.

The following Star Alliance members and United partners operate flights between the U.S. and Europe — and are therefore bookable with your United miles :

- Aegean Airlines

- Austrian Airlines

- Brussels Airlines

- Croatia Airlines

- LOT Polish Airlines

- Scandinavian Airlines (SAS)

- Singapore Airlines

- TAP Air Portugal

- Turkish Airlines

- United Airlines

Here is the United MileagePlus award chart for round-trip flights (one-way tickets will cost half the miles):

Here are some fantastic routes you can book with United miles:

- Boston (BOS) – Dublin (DUB) round-trip in Aer Lingus business class for 154,000 United miles + ~$5.60 in taxes and fees

- Chicago (ORD) – Vienna (VIE) round-trip in Austrian Airlines business class for 154,000 United miles + ~$5.60 in taxes and fees

- Miami (MIA) – Zurich (ZRH) one-way in SWISS Air business class for 77,000 United miles + ~$5.60 in taxes and fees

- New York (JFK) – Frankfurt (FRA) one-way in Lufthansa first class for 121,000 United miles + ~$5.60 in taxes and fees

Follow these instructions to book your award flight using United miles:

- Visit United’s homepage .

- Check off the box that says Book with miles , fill out the search box’s fields, and click Find flights .

- Locate a flight that works for your plans, redeem your United miles, and pay for taxes and fees using a credit card.

Earning United Airlines MileagePlus Miles

In addition to earning miles when flying with United Airlines and its partners , you can transfer miles into the program from Bilt Rewards , Chase Ultimate Rewards , and Marriott Bonvoy .

Bilt and Chase transfer instantly at a 1:1 ratio.

Marriott Bonvoy transfers in around 3 business days, and it also has an improved transfer ratio of 3:1.1 instead of the standard 3:1 ratio.

If you transfer 60,000 Marriott Bonvoy points, you will receive 22,000 United miles plus a 25% bonus, increasing your total to 27,000 miles for 60,000 Marriott Bonvoy points!

Hot Tip: Check out our guide to the best Chase United credit cards where we compare the benefits and perks of United’s co-branded cards.

ANA Mileage Club offers some seriously unbeatable round-trip redemption rates for business class flights ! For the most part, it blows the competition out of the water in terms of value for your miles.

It doesn’t charge fuel surcharges on some airlines, so you can choose to fly ANA to minimize your out-of-pocket cost.

Here’s how flights to/from North America and Europe price out (round-trip):

In general, the best airlines to book with low fuel surcharges are Turkish Airlines, LOT Polish, SAS, and United Airlines .

Here are a few amazing routes you can book:

- Atlanta (ATL) – Istanbul (IST) round-trip in Turkish business class for 88,000 ANA miles + ~$532 in taxes and fees

- Chicago (ORD) – Paris (CDG) round-trip in United Polaris class for 88,000 ANA miles + ~$11 in taxes and fees

- Los Angeles (LAX) – Warsaw (WAW) round-trip in LOT Polish business class for 88,000 ANA miles + ~$601 in taxes and fees

- Newark (EWR) – Copenhagen (CPH) round-trip in SAS business class for 88,000 ANA miles + ~$20 in taxes and fees

- Washington, D.C. (IAD) – London (LHR) round-trip in United Polaris class for 88,000 ANA miles + ~$11 in taxes and fees

ANA is a pretty easy program to redeem miles with. You can make bookings completely online using its award search engine. However, we recommend doing your initial search on United’s website:

- Go to United’s homepage and perform your award search.

- Write down the flight details and schedule.

- Go to ANA’s U.S. website .

- Click Award Booking in the search box.

- Log into your ANA account. On the redirected page, enter your search details. Click Search.

- Choose the flight that matches your desired booking. Redeem your ANA miles and use a credit card for taxes and fees.

Earning ANA Mileage Club Miles

There are 2 transfer partners for ANA miles: American Express Membership Rewards and Marriott Bonvoy.

Amex transfers at a 1:1 ratio, while Marriott Bonvoy transfers at a 3:1 ratio with 5,000 ANA bonus miles after each 60,000 Marriott Bonvoy point transfer !

Amex takes 2 to 3 business days to transfer, while Marriott Bonvoy takes closer to 7 business days.

Recommended American Express Cards (Personal)

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

American Express ® Gold Card

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at Amex Travel

- Up to $120 annual dining credit: up to $10 monthly statement credit when you pay with the Amex Gold card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com , Milk Bar and select Shake Shack locations

- Up to $120 in annual Uber Cash : get $10 monthly in Uber Cash for Uber Eats orders or Uber rides in the U.S. when you add your Gold Card to your Uber account

- No foreign transaction fees (see rates and fees )

- Access to Amex’s The Hotel Collection

- Access to American Express transfer partners

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Find the Amex Gold 75k or 90k Welcome Bonus Offer

- Benefits of the Amex Gold

- Upgrade Amex Gold to Amex Platinum

- Amex Gold Benefits for Military

- Amex Gold vs Blue Cash Preferred

- Amex Platinum vs Amex Gold

- Amex Gold vs Delta Gold

Business Owner? Check out our article on the best Amex business cards that earn Membership Rewards.

Hot Tip: For more ways to earn ANA miles, check out our in-depth guide on how to earn a lot of ANA miles .

Air Canada’s Aeroplan program is one of our favorite ways to fly to Europe.

On a high level, Air Canada Aeroplan is an easy program to use. It has access to the Star Alliance network, and the number of Aeroplan points required for a flight is quite reasonable.

Unlike many airline loyalty programs, Air Canada uses a distance-based award chart for flights from North America to the Atlantic region , which includes all of Europe:

Hot Tip: Aeroplan allows stopovers , even on one-way flights, for an additional 5,000 points. Better yet, these stopovers are bookable 100% online! If you’re not able to see the availability you want, give Aeroplan a call at 800-361-5373 .

Of its Star Alliance partners that fly to Europe from the U.S., Air Canada does not add fuel surcharges to award flights .

As a result, you can fly on airlines such as SWISS Air, Lufthansa, and Austrian Airlines without having to worry about paying hundreds of dollars out of pocket!

Here are some great example routes you can book:

- Chicago (ORD) – Zurich (ZRH) one-way in SWISS Air business class for 70,000 Aeroplan points + ~$41 in taxes and fees

- Los Angeles (LAX) – Frankfurt (FRA) one-way in Lufthansa first class for 100,000 Aeroplan points + ~$41 in taxes and fees

- Miami (MIA) – Copenhagen (CPH) one-way in SAS business class for 70,000 Aeroplan points + ~$41 in taxes and fees

- New York (JFK) – Brussels (BRU) one-way in Brussels Airlines business class for 60,000 Aeroplan points + ~$41 in taxes and fees

- San Francisco (SFO) – Lisbon (LIS) one-way in TAP Air Portugal business class for 70,000 Aeroplan points + ~$41 in taxes and fees

Follow these steps to book your flight using Aeroplan points:

- Visit the Aeroplan website .

- In the top-right corner, click Sign in and log into your account.

- On the homepage, you’ll see a search box. Toggle the slider that says Book with points Aeroplan.

- Fill in the search box, perform the search, and find your desired flight option.

- If you wish to add a stopover to your trip, you can book your stopover online or call Aeroplan at 800-361-5373 to book your ticket.

Earning Air Canada Aeroplan Points

In addition to earning Aeroplan points by flying Air Canada and its partners, you can transfer points into the program from American Express Membership Rewards, Bilt Rewards, Capital One Miles , Chase Ultimate Rewards, and Marriott Bonvoy.

Amex, Bilt, Capital One, and Chase transfer almost instantly at a 1:1 ratio, while Marriott Bonvoy transfers in 5 business days at a 3:1 ratio.

For every 60,000 Marriott Bonvoy points you transfer to Aeroplan in a single transaction, you’ll get 5,000 extra Aeroplan points.

Recommended Capital One Cards

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- 2x miles per $1 on all other purchases

- Global Entry or TSA PreCheck application fee credit

- No foreign transaction fees ( rates & fees )

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- APR: 19.99% - 29.99% (Variable)

Capital One Miles

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture vs Venture X

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Capital One Credit Cards

- Best Travel Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Best High Limit Credit Cards

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards with Priority Access

- Best Credit Cards for Airport Lounge Access

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Choice Privileges Loyalty Program Review

Recommended Aeroplan ® Credit Card

Aeroplan ® Credit Card

The Aeroplan card is a great option for Air Canada flyers looking to earn more points and receive automatic elite status.

Flyers based in the U.S. may think they wouldn’t have a need for a card like the Aeroplan ® Credit Card , it might be much better suited for you than you think.

Not only does Air Canada offer fantastic award redemptions, but adding the card to your wallet makes the program even more rewarding by offering elite status, more points, travel coverage, and more. Let’s take a closer look and see why the Aeroplan card might make a lot of sense for you.

- 3x points per $1 on Air Canada purchases, at grocery stores, and dining at restaurants (including takeout and eligible delivery services)

- 500 bonus points for every $2,000 you spend in a calendar month (up to a maximum of 1,500 bonus points)

- Receive Aeroplan 25K status for the remainder of the calendar year, plus the following calendar year, and continue to extend it beyond that by spending $15,000 on the card per calendar year

- Free first checked bag for you and up to 8 traveling companions

- Global Entry, TSA PreCheck, or NEXUS fee credit

- Preferred pricing on award tickets

- No foreign transaction fees

- $95 annual fee

- Does not earn transferable rewards

- Earn 60,000 bonus points

- Earn 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open.

- $95 Annual Fee

- Redeem points for both international and domestic flights with the Aeroplan ® Credit Card.

- Fly to another continent and travel the world with the Aeroplan ® Credit Card.

- Earn 3X points for each dollar spent at grocery stores, on dining at restaurants, and Air Canada directly. Earn 1X point for each dollar spent on all other purchases.

- 500 bonus points for every $2,000 you spend in a calendar month - up to 1,500 points per month.

- Member FDIC

- APR: 21.74% - 28.74% Variable

- Airline Credit Cards

- Air Canada Aeroplan Loyalty Program Review

- Chase Launches Brand-New Air Canada Aeroplan Credit Card

- Best Ways To Earn Air Canada Aeroplan Points

- Best Ways To Redeem Air Canada Aeroplan Points

Bottom Line: Several airlines fly routes between the U.S. and Europe. Aeroplan has enhanced redemption value because it does not pass on any fuel surcharges on partner flights, which lends a huge helping hand for most Star Alliance airlines.

LifeMiles is the loyalty program of Avianca. There are tons of great ways to redeem LifeMiles, and one of the best ways is either in business or first class to Europe.

LifeMiles has a Star Alliance award chart, and it prices awards based on regions. It does not allow stopovers, but it never levies fuel surcharges. This is an easy way to save hundreds, if not thousands, of dollars on fuel surcharges !

Additionally, it periodically offers Promo Awards that can discount your flights up to 48%!

Economy class tickets are 30,000 miles, business costs 63,000 miles, and first class is 87,000 miles. Keep in mind that these prices are one-way prices .

Taxes and fees will be around $30 to $50 each way — what a steal!

And since Avianca is a Star Alliance partner, you can book Star Alliance flights to Europe.

You pretty much have to book with its online search engine. It can be clunky at times, especially with connecting flights or flights with 2 or more stops. If you’re booking nonstop flights, you shouldn’t have any issues.

Here are some of our favorite LifeMiles redemptions you can make to Europe:

- Houston (IAH) – Frankfurt (FRA) one-way in Lufthansa first class for 87,000 LifeMiles + ~$52 in taxes and fees

- Los Angeles (LAX) – London (LHR) one-way in United Polaris class for 63,000 LifeMiles + ~$52 in taxes and fees

- New York (JFK) – Vienna (VIE) one-way in Austrian Airlines business class for 63,000 LifeMiles + ~$52 in taxes and fees

- San Francisco (SFO) – Zurich (ZRH) one-way in SWISS Air business class for 63,000 LifeMiles + ~$52 in taxes and fees

- Toronto (YYZ) – Munich (MUC) one-way in Lufthansa business class for 63,000 LifeMiles + ~$52 in taxes and fees

Once you’re ready to make your booking, follow these instructions:

- Go to the LifeMiles website .

- Adjust the language to English by clicking the flag icon in the top-right corner.

- Click Log In .

- Click Travel on the top banner of the homepage.

- Fill in your flight details and click Find Flights .

- Choose the desired travel date(s).

- Select an option that you like, redeem your LifeMiles, enter your travelers’ information, and use a credit card for taxes and fees.

Avianca’s phone staff can be difficult to work with, so you’re pretty much out of luck if you can’t find the flight you want using its online award search.

Earning Avianca LifeMiles

Avianca LifeMiles is a transfer partner with American Express Membership Rewards, Brex Rewards , Capital One Miles, Citi ThankYou Rewards , and Marriott Bonvoy.

Amex, Brex, Capital One, and Citi transfer at a 1:1 ratio almost instantly (Brex may take up to 1 business day).

Marriott Bonvoy transfers at a 3:1 ratio, so for every 60,000 Marriott Bonvoy points transferred in a single transaction, you would get 20,000 LifeMiles.

Lastly, you can buy LifeMiles . There are frequent sales of pretty ridiculous bonus amounts — up to 200% bonus miles on top of your purchase.

These sales make purchasing miles very tempting, seeing as how you can fly first class for around $1,000!

Recommended Citi Cards

Citi Premier ® Card

Frequent flyers will enjoy 3x ThankYou Points at restaurants, gas stations, supermarkets, air travel, and hotels.

The Citi Premier ® Card is an excellent option for anyone looking for an all-around travel rewards credit card. The card helps you earn points fast with great 3x bonus categories such as restaurants, supermarkets, gas stations, airfare, and hotels. Plus, it offers access to airline and hotel transfer partners, doesn’t charge foreign transaction fees, and has a reasonable annual fee!

- 3x points at restaurants, supermarkets, gas stations, airfare, and hotel purchases

- Access to Citi transfer partners

- Annual hotel credit

- Earn 60,000 bonus ThankYou ® Points after you spend $4,000 in purchases within the first 3 months of account opening. Plus, for a limited time, earn a total of 10 ThankYou ® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

- Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou ® Points are redeemable for $600 in gift cards redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

- APR: 21.24% - 29.24% Variable

Citi ThankYou Rewards

- Benefits of the Citi Premier

- Authorized User Benefits of the Citi Premier

- Chase Sapphire Preferred Card vs. Citi Premier Card [Detailed Comparison]

- Best Citi Credit Cards

- Best Virtual Credit Cards

Asiana Airlines’ Asiana Club is what we’d consider an intermediate-to-advanced method for using points. Some of its redemption rates will blow your mind, but booking your award involves several additional steps.

Specifically, flying first class one-way from North America to Europe only costs 50,000 Asiana miles, and business is 40,000 miles!

We believe the best deal is first class for only 10,000 miles more. Yes, you will be paying fuel surcharges, but it may be worth it considering the points you would be saving.

Asiana Airlines is also a Star Alliance partner, so you can book all of the Star Alliance partners listed in the above sections.

Since there are very few Star Alliance partners that operate a first class cabin to Europe, we think the best use of Asiana miles is Lufthansa first class.

You’ll need to pay for surcharges on all partners, so prepare for that. Check out some of our favorite ways to redeem Asiana miles for flights to Europe:

- Chicago (ORD) – Frankfurt (FRA) one-way in Lufthansa first class for 50,000 Asiana miles + ~$800 in taxes and fees

- Miami (MIA) – Warsaw (WAW) one-way in LOT Polish business class for 40,000 Asiana miles + ~$250 in taxes and fees

- New York (JFK) – Frankfurt (FRA) one-way in Lufthansa first class for 50,000 Asiana miles + ~$800 in taxes and fees

- Newark (EWR) – Tel Aviv (TLV) one-way in United Polaris class for 40,000 Asiana miles + ~$10 in taxes and fees

- San Francisco (SFO) – Frankfurt (FRA) one-way in Lufthansa first class for 50,000 Asiana miles + ~$800 in taxes and fees

- Washington, D.C. (IAD) – Istanbul (IST) one-way in Turkish Airlines business class for 40,000 Asiana miles + ~$300 in taxes and fees

The process for redeeming Asiana miles is a bit more complex:

- Find award availability using United’s website .

- Write down all of the relevant flight details.

- Call Asiana Club at 800-227-4262 and feed your flight details to the live agent after explaining that you’d like to book a Star Alliance award flight using Asiana miles.

- Confirm the ticket over the phone, redeem your Asiana miles, and use a credit card for taxes and fees.

Earning Asiana Miles

Unfortunately, this is where the main drawback of Asiana Airlines comes in.

Asiana Club is transfer partners with just 1 points currency: Marriott Bonvoy.

Marriott Bonvoy transfers at a 3:1 ratio to Asiana Club with a bonus of 5,000 Asiana miles when you transfer 60,000 Marriott Bonvoy points to Asiana all at once. This makes it more difficult to earn Asiana miles .

Recommended Marriott Bonvoy Cards

We explore the large number of Marriott credit cards available in our detailed guide.

Air France-KLM’s Flying Blue loyalty program can be a great way to book award flights to Europe, especially when it runs Promo Rewards.

With connecting flights routing through either Amsterdam (AMS) or Paris (CDG) and being bookable on either airline, Flying Blue has some of the best award availability on its own flights between the U.S. and Europe.

Air France has variable award pricing, and the best thing you can do is use Flying Blue’s award calculator and search for the lowest-level award availability.

You cannot book first class awards with Air France or KLM — you must earn elite status with Flying Blue. Since not many of us earn the required status, that means most of us can’t book first class awards, so we are leaving it out of the discussion here.

Perhaps the best part of the Flying Blue program is that it has Promo Rewards . These awards are available for a special selection of destinations and are offered for a reduced number of miles — between 25% and 50% off what would normally be required for an award flight! Promo Rewards change every month and are limited in terms of availability, when you can book, and what airlines you can fly. If your schedule is flexible or you can book a trip closer to when it takes place, these Promo Rewards can be great options.

Air France and KLM are members of the SkyTeam alliance and also partner with additional airlines. You can use Flying Blue miles to book flights on any of the following airlines between the U.S. and Europe:

- Czech Airlines

- Delta Air Lines

- ITA Airways

Flying Blue adds carrier-imposed surcharges on its award redemptions, but depending on the routing, it often isn’t that bad.

Of course, as with any program, these surcharges are significantly higher for premium cabins. When booking an award, you will need to look at the charges and decide if it is still a good enough value.

For those partners that aren’t bookable on the Flying Blue site, you can check where to search them and then book awards by phone with either Air France or KLM.

Here are some of our favorite redemptions you can make:

- Atlanta (ATL) – Frankfurt (FRA) one-way in Delta One for 53,000 Flying Blue miles + ~$730 in taxes and fees

- Chicago (ORD) – Paris (CDG) one-way in Air France business class for 58,000 Flying Blue miles + ~$298 in taxes and fees

- Houston (IAH) – Amsterdam (AMS) one-way in KLM business class for 72,000 Flying Blue miles + ~$310 in taxes and fees

- Los Angeles (LAX) – Rome (FCO) one-way in ITA business class for 53,000 Flying Blue miles + ~$325 in taxes and fees

To book your flights, follow these steps:

- Visit Air France’s U.S. website .

- Log into your Flying Blue account.

- Click Book with Miles .

- Fill in the search box, and click Search flights .

- Choose the desired flight, enter the travelers’ personal information, use your Flying Blue miles, and supply a credit card to pay for any taxes and fees.

Earning Flying Blue Miles

In addition to earning miles when flying with Air France, KLM, and their partners, you can transfer points into the program from American Express Membership Rewards, Bilt Rewards, Brex Rewards, Capital One Miles, Chase Ultimate Rewards, Citi ThankYou Rewards, and Marriott Bonvoy.

Amex, Bilt, Brex, Capital One, Chase, and Citi all transfer at a 1:1 ratio almost instantly.

Marriott Bonvoy transfers at a 3:1 ratio in 3 business days. Also, when you transfer 60,000 points in a single transaction, you’ll get a bonus of 5,000 Flying Blue miles.

Having all of these transfer partners really makes it easy to earn enough miles for your trip!

For more recommendations, read our post on how to earn lots of Flying Blue miles .

Recommended Chase Cards

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024