- Discovery Platform

- Innovation Scouting

- Startup Scouting

- Technology Scouting

- Tech Supplier Scouting

- Startup Program

- Trend Intelligence

- Business Intelligence

- All Industries

- Industry 4.0

- Manufacturing

- Case Studies

- Research & Development

- Corporate Strategy

- Corporate Innovation

- Open Innovation

- New Business Development

- Product Development

- Agriculture

- Construction

- Sustainability

- All Startups

- Circularity

- All Innovation

- Business Trends

- Emerging Tech

- Innovation Intelligence

- New Companies

- Scouting Trends

- Startup Programs

- Supplier Scouting

- Tech Scouting

- Top AI Tools

- Trend Tracking

- All Reports [PDF]

- Circular Economy

- Engineering

- Oil & Gas

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

Top 9 Travel Trends & Innovations in 2024

How are the latest trends in the travel industry reshaping trip planning and enhancing tourist experiences in 2024? Explore our in-depth industry research on the top 9 travel trends based on our analysis of 3500+ companies worldwide. These trends include AI, immersive tourism, IoT, contactless travel & more!

Technological advancements in the travel industry meet the growing demand for personalized experiences, safety, and sustainability. Post the COVID-19 pandemic, emerging travel trends mark a shift towards contactless travel through digital payments, self-check-ins, and more. Additionally, artificial intelligence (AI), the Internet of Things (IoT), and blockchain are automating various hospitality and travel-related operations.

For instance, smart hotels make use of internet-connected devices to remotely control rooms. Further, businesses offer virtual tours by adopting extended reality (XR) technologies like virtual reality (VR) and augmented reality (AR). Travel companies also leverage data analytics to personalize marketing. At the same time, traveler assisting solutions like chatbots and voice technology aid them in booking accommodation and optimizing journeys. These travel trends improve the overall profitability of the tourism industry and enable it to make operations more sustainable and safe.

This article was published in July 2022 and updated in February 2024.

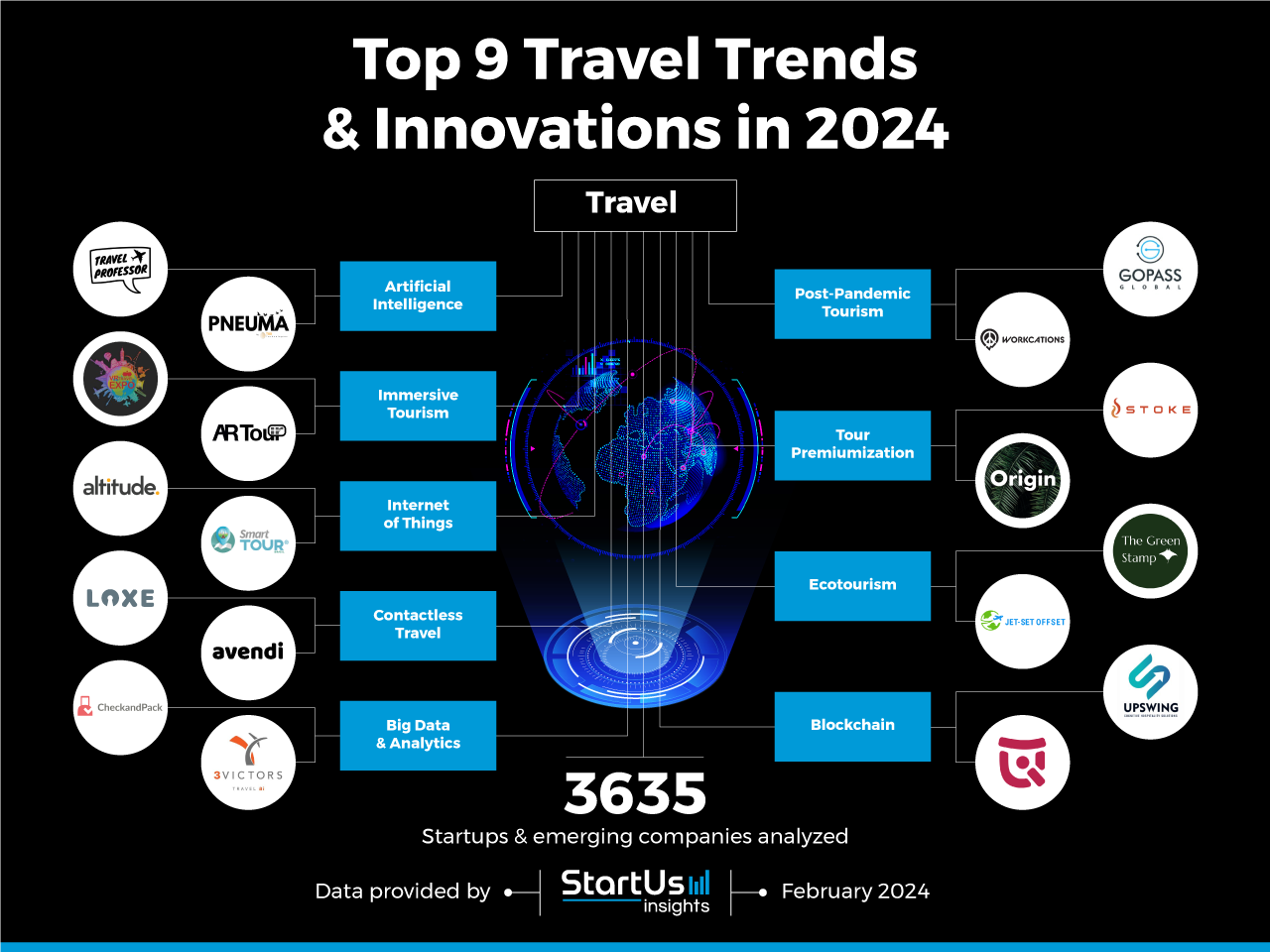

Innovation Map outlines the Top 9 Travel Trends & 18 Promising Startups

For this in-depth research on the Top 9 Trends & Startups, we analyzed a sample of 18 global startups and scaleups. The result of this research is data-driven innovation intelligence that improves strategic decision-making by giving you an overview of emerging technologies & startups in the travel industry. These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform , covering 2 500 000+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant startups, emerging technologies & future industry trends quickly & exhaustively.

In the Innovation Map below, you get an overview of the Top 9 Travel Trends & Innovations that impact travel & tourism companies worldwide. Moreover, the Travel Innovation Map reveals 3 500+ hand-picked startups, all working on emerging technologies that advance their field.

Top 9 Travel Trends

- Artificial Intelligence

- Immersive Tourism

- Internet of Things

- Contactless Travel

- Big Data & Analytics

- Post-Pandemic Tourism

- Tour Premiumization

Click to download

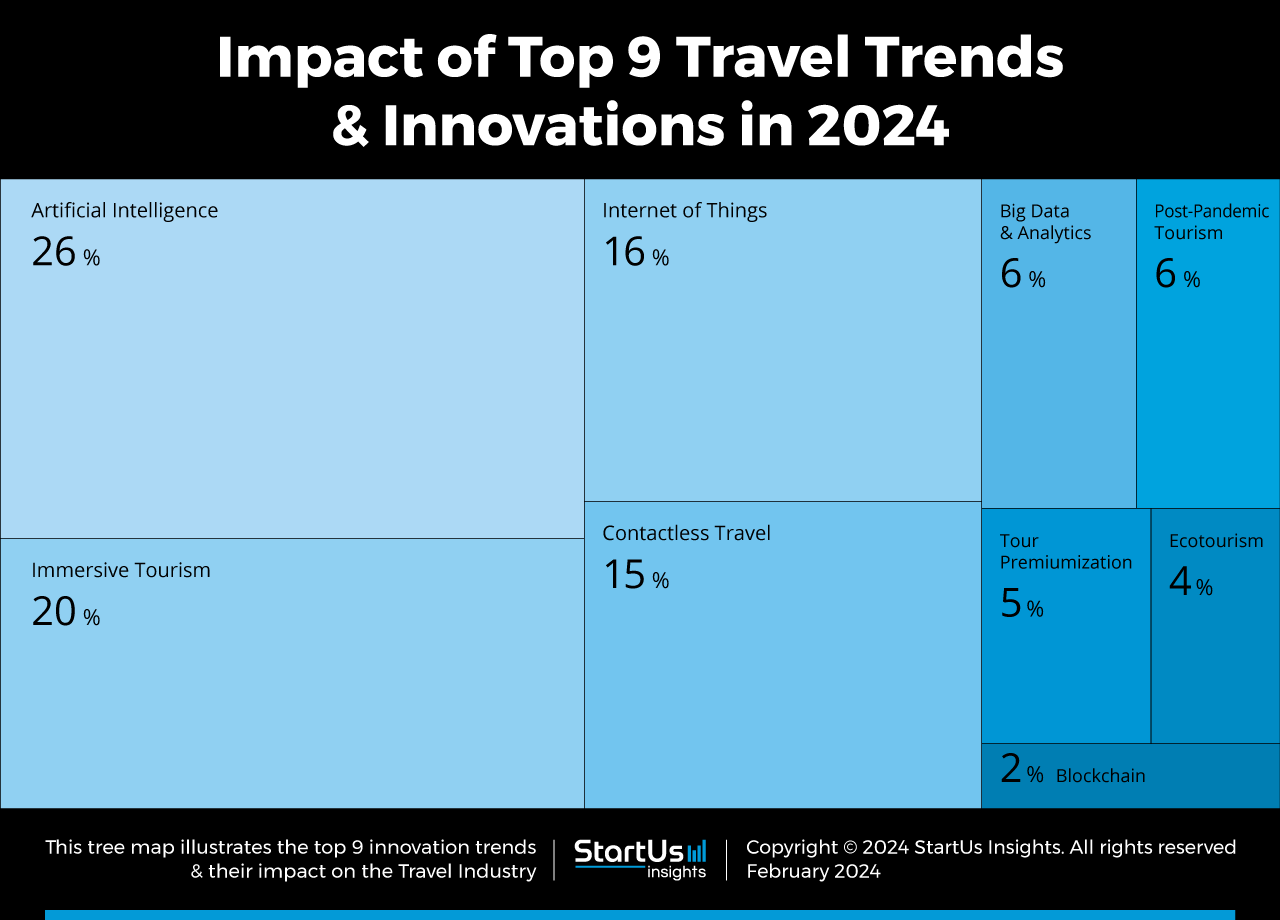

Tree Map reveals the Impact of the Top 9 Travel Trends

Based on the Travel Innovation Map, the Tree Map below illustrates the impact of the Top 9 Travel Industry Trends in 2024. Startups and scaleups are enabling contactless travel using technologies like biometrics, radio-frequency identification (RFID), and near-field communication (NFC). This is due to increasing health and hygiene concerns post the pandemic. The use of AI in tourism ensures hassle-free trip planning while AR and VR allow tourists to virtually visit various locations and excursions. IoT increases visibility into tourism industry operations and allows passengers to track their luggage more efficiently. Further, the demand for personalized and luxurious travel is rising. Several startups enable recreational space travel as well as offer sustainable travel options to passengers.

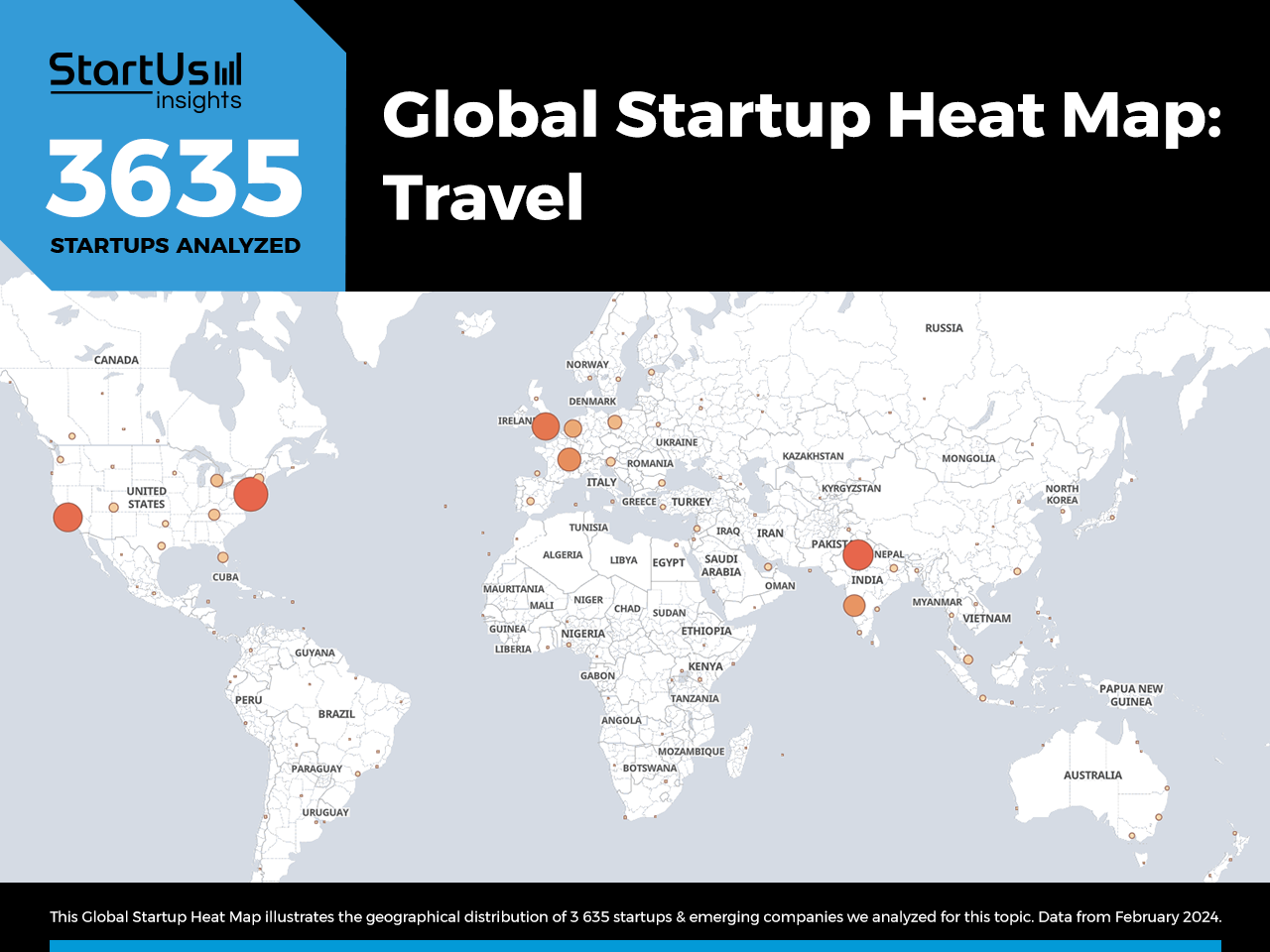

Global Startup Heat Map covers 3 635 Travel Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 3 635 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals that the US, Europe, and India see the most activity.

Below, you get to meet 18 out of these 3 635 promising startups & scaleups as well as the solutions they develop. These 18 startups are hand-picked based on criteria such as founding year, location, funding raised, and more. Depending on your specific needs, your top picks might look entirely different.

Interested in exploring all 3500+ travel startups & scaleups?

Top 9 Travel Trends in 2024

1. artificial intelligence.

Hotels employ intelligent chatbots, powered by AI, to provide quick and personalized responses to traveler inquiries. These chatbots simplify the booking process and gather customer reviews, aiding potential travelers in making informed decisions. Moreover, AI-based robots enhance the customer experience by automating hotel disinfection and delivering room service.

At airports, these robots guide travelers and assist with luggage handling. Facial recognition technology, driven by AI, expedites identity verification at airports, enhancing security and offering a swift alternative to traditional methods. Startups are developing AI-powered trip planning solutions, optimizing journeys, and personalizing travel experiences.

Travel Professor develops a Travel Chatbot

UK-based startup Travel Professor offers an AI-enabled chatbot for travelers. The startup’s chat widget software monitors multiple flight deals and notifies users when their preferences match. It also provides travel destination recommendations and flight price alerts. This allows travelers to book economical flights and have a budget-friendly tourism experience.

Pneuma Travel facilitates Travel Planning

US startup Pneuma Travel develops a voice-assisted digital agent, Sarah , to streamline the process of travel planning. This assistant, powered by AI, excels in arranging flight and accommodation bookings and assists travelers in discovering a variety of activities. Sarah , available round the clock, provides continuous support for all travel-related inquiries.

Moreover, Sarah customizes travel options according to individual preferences and budgetary constraints. The agent further enhances the travel experience by providing insights into local attractions in unfamiliar cities. Importantly, Sarah enables real-time modifications to travel plans, in compliance with specific airline policies, thereby minimizing waiting times for users.

2. Immersive Tourism

Immersive tourism caters to the growing demand for meaningful experiences among travelers, leveraging AR, VR, and mixed reality (MR). VR simulates original locations through a computer-generated environment, allowing tourists to virtually explore destinations. It provides travelers with a comprehensive 360-degree tour of points of interest.

AR enhances the travel experience with interactive elements such as navigation maps and ads. Travel companies employ AR and VR-based gamification to heighten tourist attractions. Moreover, these technologies enable hotels and resorts to present amenities and rooms in an engaging, interactive manner.

VR Travel Expo offers VR-based Travel Plans

US startup VR Travel Expo develops a VR travel application to transform the way people research and book travel. The application enables users to plan their vacations more efficiently. It provides an engaging platform for users to explore and expand their knowledge of the world. Moreover, it employs 3D geospatial technology that creates real-time digital twins of the world. This further enhances the travel planning experience.

AR Tour makes AR Glasses

Italian startup AR Tour offers AR-powered tours. The startup’s AR glasses superimpose reconstructed images of archaeological ruins to show how the site originally was. Its tour informs the tourists about the site’s history and significance via an audio-visual package. Moreover, the startup designs lightweight AR glasses to prevent motion sickness among tourists, improving convenience.

3. Internet of Things

IoT generates ample data that tourism companies leverage to personalize services in their subsequent visits. Hotels use IoT sensors to enable smart rooms that automate room lighting, temperature, and ambiance control, enhancing guest comfort. These sensors adjust appliances in vacant rooms, conserving energy and reducing the building’s carbon footprint.

Startups harness IoT to deliver location-specific information to customers, including real-time luggage tracking via IoT tags, minimizing lost items. Airlines also incorporate IoT-based solutions into seats, monitoring passenger temperature and heart rate for proactive health management.

Altitude enables Smart Hotels

New Zealand-based startup Altitude creates an IoT-based hotel software and hardware to develop smart hotels. The startup makes self-service kiosks to automate reservations, room up-gradation, payments, as well as check-in and check-out. Its hotel management platform further enables contactless engagement with guests. Additionally, Altitude’s mobile keys allow guests to open doors using mobile phones, providing convenience and saving time for travelers.

Smart Tour provides Smart Itineraries

Brazilian startup Smart Tour offers smart itineraries using IoT and quick response (QR) codes. The startup recommends travel routes and destinations based on the user’s preference in real-time. This facilitates a seamless experience for travelers. Besides, the user-generated data enables tourism managers to better understand consumer behavior and indulge in proximity marketing. The startup also offers a contact tracing solution to monitor COVID-19 infected travelers and ensure public safety.

4. Contactless Travel

Travelers benefit from contactless recognition technologies like retina scanning, which replace traditional travel documents, speeding up passenger identification and reducing airport queues. QR codes offered by travel companies allow tourists to access relevant information on their mobile devices, enhancing engagement.

Hotels have introduced contactless self-check-ins, enabling visitors to arrange services before arrival. Additionally, contactless payment modes are available in hotels and restaurants for swift and secure transactions. Moreover, wearable devices are transforming the travel experience by providing real-time notifications and touch-free access to services and information.

Loxe designs Smart Hotel Keys

US-based startup Loxe makes smart mobile keys for hotels. The startup’s smartphone app replaces key cards with contactless mobile keys that allow users to unlock doors using smartphones. It also reduces operational costs incurred in the manufacturing of conventional keys or plastic cards. Moreover, the startup designs a Bluetooth retrofit module that converts normal door locks into mobile-ready door locks. This allows hotel owners to easily convert their existing locks into smart ones without additional expenses while improving guest safety and convenience.

Avendi provides Contactless Payment

Singaporean startup Avendi offers contactless and cashless payments for travelers. The startup allows tourists to accumulate expenses throughout their trip and pay at the end of the journey. Avendi’s app utilizes QR codes to add all the billed expenses and shown through its dashboard. The user settles the tab amount in the preferred currency, preventing the inconvenience of cash withdrawal or credit card payments.

5. Big Data & Analytics

Big data empowers travel companies with customer trends for strategic marketing. Analyzing traveler behavior, they offer tailored recommendations for hotel bookings, cab hires, flight reservations, and ticket purchases.

Predicting future demand is another advantage of big data and analytics, helping hotels and airlines identify peak periods to optimize revenue. Advanced analysis of transactional data aids in detecting cyber fraud, and safeguarding sensitive customer information such as credit card details and biometric data.

CheckandPack creates a Travel Platform

Dutch startup CheckandPack offers a big data travel platform. It runs marketing campaigns to gather traveler data and understand tourism trends. Based on these insights, the platform enables businesses to approach travelers with a customized appeal. It also provides travelers with holiday planning.

3Victors provides Travel Data Analytics

US-based startup 3Victors offers travel data analytics. The startup’s product, PriceEye Suite , proactively monitors the prices of numerous airlines to provide insights into competitor prices. It creates a dashboard to display travelers’ location of interest, allowing travel airlines to better manage their revenue and pricing strategy.

6. Post-Pandemic Tourism

Post-pandemic tourism focuses on safe, sustainable, and flexible travel options, responding to evolving traveler preferences and health guidelines. Enhanced health and safety protocols, including regular sanitization and contactless services, become standard in airlines and hotels, ensuring traveler confidence.

Destinations and operators emphasize outdoor and less crowded experiences, catering to a heightened demand for nature-based and wellness travel. Flexible booking policies and trip insurance gain prominence, offering peace of mind amid uncertainties. Sustainable travel gains traction, with tourists and businesses prioritizing environmental impact and community well-being.

GOPASS Global enables Pre-travel Risk Management

Singaporean startup GOPASS Global provides a travel risk analytics platform against COVID-19. It analyzes the biosecurity risk elements involved in a trip, such as border restrictions, quarantine requirements, airport type, and airline transit points or seating in real-time. This allows travelers to assess risk factors and plan their trips accordingly.

Moreover, the startup creates world maps displaying information regarding COVID-prone areas, testing areas, and vaccine coverage. This provides travelers with a preview of the current situation, allowing them to ensure safety during business and leisure travel.

Workcations enables Work from Anywhere

Indian startup Workcations provides properties at tourist destinations for remote-working individuals. It offers amenities like internet connectivity, food, and a quiet ambiance, allowing tourists to work in a peaceful environment without hindrance. This increases employee productivity, motivation, and retention.

7. Tour Premiumization

Hyper-personalization in travel experiences is on the rise, with tourists eager to immerse themselves in diverse cultures. Luxury travelers enjoy tailored experiences and intuitive services through tour premiumization. Health and wellness packages offered by travel startups help tourists unwind.

These retreats enhance health and offer detoxifying food options. Space tourism is another exciting development, offering leisure or research trips to space. Lastly, travel startups are fostering customer loyalty and building strong relationships through membership or subscription models.

STOKE provides Space Tour

US-based startup STOKE facilitates space travel using everyday-operable rockets. The startup’s rockets are reusable and deliver satellites to any desired orbit. This enables on-demand access to space, paving way for space tours for exploration, recreation, and research. The startup also emphasizes the economical and rapid development of its hardware for feasible spacecraft launches, advancing space tourism.

Origin offers Travel Personalization

Dutch startup Origin provides premium travel personalization to tourists. The startup utilizes machine learning and travel curators to plan creative vacations. It also arranges flights and accommodation for travelers. Further, the startup measures the carbon output of itineraries and offers sustainable tourism options.

8. Ecotourism

Traveling responsibly minimizes tourism’s environmental impact and supports local communities’ well-being. Ecotourists strive to reduce their carbon footprint during their journeys. Startups contribute by developing sustainable transport, ecolodges, and solar-powered resorts.

Airline passengers have the option to offset carbon emissions during flight bookings. Local tourism stimulates small businesses economically and creates job opportunities. It also emphasizes minimum littering, which lowers pollution and the time spent on cleanups.

Jet-Set Offset simplifies Flight Carbon Offset

US-based startup Jet-Set Offset creates a carbon-offsetting platform for air travel. The startup partners with non-profit organizations working against climate change and connects them with travelers. Each time travelers book flight tickets via the startup’s platform, Jet-Set Offset contributes a certain amount per mile for their journey to environmental organizations. This way, the passenger’s journey promotes mileage-based donations to offset carbon emissions.

The Green Stamp facilitates Ethical Wildlife Tour

Dutch startup The Green Stamp provides a platform to book ethical wildlife tours. It curates tours based on the tourists’ inclinations toward certain locations or wildlife. Exploration of these projects allows travelers to indirectly contribute to their cause as these wildlife projects donate to the welfare of local communities and the environment.

9. Blockchain

Blockchain provides the travel industry with operational transparency and security. Traceable payments, particularly for international travel, are a key application, that fosters trust among parties involved in transactions.

Automation and enforcement of agreements in travel insurance and supplier contracts are achieved through smart contracts. This strengthens reliability and cuts administrative costs. Travel firms establish customer loyalty programs where points are exchanged for cryptocurrency. Lastly, blockchain increases data storage security, reducing the risk of information leaks.

Upswing facilitates Guest Profiling

Indian startup Upswing creates AURA , a blockchain-powered platform for guest profiling. It provides a holistic view of guests, their preferences, and purchase patterns. The platform associates a score with each guest and suggests improvements in their service. This facilitates hotels to provide a personalized experience to their guests and, in turn, increase sales.

UIQ Travel develops a Solo Traveling App

US-based startup UIQ Travel develops a blockchain-based app to connect solo travelers. It discovers people with shared interests and suggests tours or attractions. Such hyper-personalized recommendations assist in experience discovery and also increase traveler engagement.

Discover all Travel Trends, Technologies & Startups

Tourism, although severely impacted by the pandemic, now continues to rapidly grow across the globe. Post-pandemic trends indicate an increasing emphasis on hygiene and safety during travel. The industry is witnessing the widespread adoption of disruptive technologies like AI, XR, IoT, and blockchain. The travel industry utilizes big data to understand traveler trends for targeted marketing. The transition to ecotourism is accelerating as businesses integrate zero-emission transit and carbon offset programs to reduce their carbon footprint.

The Travel Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation and startup scouting process. Among others, personalization, decarbonization, and travel safety will transform the sector as we know it today. Identifying new opportunities and emerging technologies to implement into your business goes a long way in gaining a competitive advantage. Get in touch to easily and exhaustively scout startups, technologies & trends that matter to you!

Your Name Business Email Company

Get our free newsletter on technology and startups.

Protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Discover our Free Travel Report

Book a call today!

Mobility 22 pages report

Railway 22 pages report, cleantech 19 pages report.

Leverage our unparalleled data advantage to quickly and easily find hidden gems among 4.7M+ startups, scaleups. Access the world's most comprehensive innovation intelligence and stay ahead with AI-powered precision.

Get in touch

Your Name Business Email Company How can we support you? (optional)

Business Email

Protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

"People want to travel": 4 sector leaders say that tourism will change and grow

The global travel and tourism industry's post-pandemic recovery is gaining pace as the world’s pent-up desire for travel rekindles. Image: Unsplash/Anete Lūsiņa

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Anthony Capuano

Shinya katanozaka, gilda perez-alvarado, stephen kaufer.

Listen to the article

- In 2020 alone, the travel and tourism industry lost $4.5 trillion in GDP and 62 million jobs - the road to recovery remains long.

- The World Economic Forum’s latest Travel & Tourism Development Index gives expert insights on how the sector will recover and grow.

- We asked four business leaders in the sector to reflect on the state of its recovery, lessons learned from the pandemic, and the conditions that are critical for the future success of travel and tourism businesses and destinations.

The global travel and tourism sector’s post-pandemic recovery is gaining pace as the world’s pent-up desire for travel rekindles. The difference in international tourist arrivals in January 2021 and a similar period in January 2022 was as much as the growth in all of 2021. However, with $4.5 trillion in GDP and 62 million jobs lost in 2020 alone, the road to recovery remains long.

A few factors will greatly determine how the sector performs. These include travel restrictions, vaccination rates and health security, changing market dynamics and consumer preferences, and the ability of businesses and destinations to adapt. At the same time, the sector will need to prepare for future shocks.

The TTDI benchmarks and measures “the set of factors and policies that enable the sustainable and resilient development of the T&T sector, which in turn contributes to the development of a country”. The TTDI is a direct evolution of the long-running Travel and Tourism Competitiveness Index (TTCI), with the change reflecting the index’s increased coverage of T&T development concepts, including sustainability and resilience impact on T&T growth and is designed to highlight the sector’s role in broader economic and social development as well as the need for T&T stakeholder collaboration to mitigate the impact of the pandemic, bolster the recovery and deal with future challenges and risks. Some of the most notable framework and methodology differences between the TTCI and TTDI include the additions of new pillars, including Non-Leisure Resources, Socioeconomic Resilience and Conditions, and T&T Demand Pressure and Impact. Please see the Technical notes and methodology. section to learn more about the index and the differences between the TTCI and TTDI.

The World Economic Forum's latest Travel & Tourism Development Index highlights many of these aspects, including the opportunity and need to rebuild the travel and tourism sector for the better by making it more inclusive, sustainable, and resilient. This will unleash its potential to drive future economic and social progress.

Within this context, we asked four business leaders in the sector to reflect on the state of its recovery, lessons learned from the pandemic, and the conditions that are critical for the future success of travel and tourism businesses and destinations.

Have you read?

Are you a 'bleisure' traveller, what is a ‘vaccine passport’ and will you need one the next time you travel, a travel boom is looming. but is the industry ready, how to follow davos 2022, “the way we live and work has changed because of the pandemic and the way we travel has changed as well”.

Tony Capuano, CEO, Marriott International

Despite the challenges created by the COVID-19 pandemic, the future looks bright for travel and tourism. Across the globe, people are already getting back on the road. Demand for travel is incredibly resilient and as vaccination rates have risen and restrictions eased, travel has rebounded quickly, often led by leisure.

The way many of us live and work has changed because of the pandemic and the way we travel has changed as well. New categories of travel have emerged. The rise of “bleisure” travel is one example – combining elements of business and leisure travel into a single trip. Newly flexible work arrangements, including the opportunity for many knowledge workers to work remotely, have created opportunities for extended travel, not limited by a Monday to Friday “9 to 5” workweek in the office.

To capitalize on this renewed and growing demand for new travel experiences, industry must join governments and policymakers to ensure that the right conditions are in place to welcome travellers as they prepare to get back on the road again, particularly those who cross international borders. Thus far, much of the recovery has been led by domestic and leisure travel. The incremental recovery of business and international travel, however, will be significant for the broader industry and the millions who make their livelihoods through travel and tourism.

Looking ahead to future challenges to the sector, be they public health conditions, international crises, or climate impacts, global coordination will be the essential component in tackling difficult circumstances head-on. International agreement on common – or at least compatible – standards and decision-making frameworks around global travel is key. Leveraging existing organizations and processes to achieve consensus as challenges emerge will help reduce risk and improve collaboration while keeping borders open.

“The travel and tourism sector will not be able to survive unless it adapts to the virtual market and sustainability conscience travellers”

Shinya Katanozaka, Representative Director, Chairman, ANA Holdings Inc.

At a time when people’s movements are still being restricted by the pandemic, there is a strong, renewed sense that people want to travel and that they want to go places for business and leisure.

In that respect, the biggest change has been in the very concept of “travel.”

A prime example is the rapid expansion of the market for “virtual travel.” This trend has been accelerated not only by advances in digital technologies, but also by the protracted pandemic. The travel and tourism sector will not be able to survive unless it adapts to this new market.

However, this is not as simple as a shift from “real” to “virtual.” Virtual experiences will flow back into a rediscovery of the value of real experiences. And beyond that, to a hunger for real experiences with clearer and more diverse purposes. The hope is that this meeting of virtual and actual will bring balance and synergy the industry.

The pandemic has also seen the emergence of the “sustainability-conscious” traveller, which means that the aviation industry and others are now facing the challenge of adding decarbonization to their value proposition. This trend will force a re-examination of what travel itself should look like and how sustainable practices can be incorporated and communicated. Addressing this challenge will also require stronger collaboration across the entire industry. We believe that this will play an important role in the industry’s revitalization as it recovers from the pandemic.

How is the World Economic Forum promoting sustainable and inclusive mobility systems?

The World Economic Forum’s Platform for Shaping the Future of Mobility works across four industries: aerospace and drones; automotive and new mobility; aviation travel and tourism; and supply chain and transport. It aims to ensure that the future of mobility is safe, clean, and inclusive.

- Through the Clean Skies for Tomorrow Coalition , more than 100 companies are working together to power global aviation with 10% sustainable aviation fuel by 2030.

- In collaboration with UNICEF, the Forum developed a charter with leading shipping, airlines and logistics to support COVAX in delivering more than 1 billion COVID-19 vaccines to vulnerable communities worldwide.

- The Road Freight Zero Project and P4G-Getting to Zero Coalition have led to outcomes demonstrating the rationale, costs and opportunities for accelerating the transition to zero emission freight.

- The Medicine from the Sky initiative is using drones to deliver vaccines and medicine to remote areas in India, completing over 300 successful trials.

- The Forum’s Target True Zero initiative is working to accelerate the deployment and scaling of zero emission aviation, leveraging electric and hydrogen flight technologies.

- In collaboration with the City of Los Angeles, Federal Aviation Administration, and NASA, the Forum developed the Principles of the Urban Sky to help adopt Urban Air Mobility in cities worldwide.

- The Forum led the development of the Space Sustainability Rating to incentivize and promote a more safe and sustainable approach to space mission management and debris mitigation in orbit.

- The Circular Cars Initiative is informing the automotive circularity policy agenda, following the endorsement from European Commission and Zero Emission Vehicle Transition Council countries, and is now invited to support China’s policy roadmap.

- The Moving India network is working with policymakers to advance electric vehicle manufacturing policies, ignite adoption of zero emission road freight vehicles, and finance the transition.

- The Urban Mobility Scorecards initiative – led by the Forum’s Global New Mobility Coalition – is bringing together mobility operators and cities to benchmark the transition to sustainable urban mobility systems.

Contact us for more information on how to get involved.

“The tourism industry must advocate for better protection of small businesses”

Gilda Perez-Alvarado, Global CEO, JLL Hotels & Hospitality

In the next few years, I think sustainability practices will become more prevalent as travellers become both more aware and interested in what countries, destinations and regions are doing in the sustainability space. Both core environmental pieces, such as water and air, and a general approach to sustainability are going to be important.

Additionally, I think conservation becomes more important in terms of how destinations and countries explain what they are doing, as the importance of climate change and natural resources are going to be critical and become top of mind for travellers.

The second part to this is we may see more interest in outdoor events going forward because it creates that sort of natural social distancing, if you will, or that natural safety piece. Doing outdoor activities such as outdoor dining, hiking and festivals may be a more appealing alternative to overcrowded events and spaces.

A lot of lessons were learned over the last few years, but one of the biggest ones was the importance of small business. As an industry, we must protect small business better. We need to have programmes outlined that successfully help small businesses get through challenging times.

Unfortunately, during the pandemic, many small businesses shut down and may never return. Small businesses are important to the travel and tourism sector because they bring uniqueness to destinations. People don’t travel to visit the same places they could visit at home; they prefer unique experiences that are only offered by specific businesses. If you were to remove all the small businesses from a destination, it would be a very different experience.

“Data shows that the majority of travellers want to explore destinations in a more immersive and experiential way”

Steve Kaufer, Co-Founder & CEO, Tripadvisor

We’re on the verge of a travel renaissance. The pandemic might have interrupted the global travel experience, but people are slowly coming out of the bubble. Businesses need to acknowledge the continued desire to feel safe when travelling. A Tripadvisor survey revealed that three-quarters (76%) of travellers will still make destination choices based on low COVID-19 infection rates.

As such, efforts to showcase how businesses care for travellers - be it by deep cleaning their properties or making items like hand sanitizer readily available - need to be ingrained within tourism operations moving forward.

But travel will also evolve in other ways, and as an industry, we need to be prepared to think digitally, and reimagine our use of physical space.

Hotels will become dynamic meeting places for teams to bond in our new hybrid work style. Lodgings near major corporate headquarters will benefit from an influx of bookings from employees convening for longer periods. They will also make way for the “bleisure” traveller who mixes business trips with leisure. Hotels in unique locales will become feasible workspaces. Employers should prepare for their workers to tag on a few extra days to get some rest and relaxation after on-location company gatherings.

Beyond the pandemic, travellers will also want to explore the world differently, see new places and do new things. Our data reveals that the majority want to explore destinations in a more immersive and experiential way, and to feel more connected to the history and culture. While seeing the top of the Empire State building has been a typical excursion for tourists in New York city, visitors will become more drawn to intimate activities like taking a cooking class in Brooklyn with a family of pizza makers who go back generations. This will undoubtedly be a significant area of growth in the travel and tourism industry.

Governments would be smart to plan as well, and to consider an international playbook that helps prepare us for the next public health crisis, inclusive of universal vaccine passports and policies that get us through borders faster.

Understanding these key trends - the ongoing need to feel safe and the growing desire to travel differently - and planning for the next crisis will be essential for governments, destinations, and tourism businesses to succeed in the efforts to keep the world travelling.

Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Related topics

Recommended.

- Hotel industry worldwide

- Travel agency industry

- Sustainable tourism worldwide

- Travel and tourism in the U.S.

- Travel and tourism in Europe

Recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Estimated EV/Revenue ratio in the online travel market 2024, by segment

Estimated enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide as of April 2024, by segment

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2023

Share of travelers that believe sustainable travel is important worldwide in 2023

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

A travel boom is looming. But is the industry ready?

If things go well, we might be at the threshold of a new age of travel. Although COVID-19 variants may affect conditions, it seems only a matter of time before travelers in some parts of the world hit the road and take to the skies again, thanks to rising vaccination rates and manageable caseloads. Some countries have begun gingerly relaxing travel restrictions and reopening borders.

As the worst effects of the COVID-19 pandemic ebb, most indicators point to travel coming back—with a vengeance—as people look to reconnect, explore new destinations, or revisit reliable favorites. Many just want to get away from the confines of their homes. A McKinsey survey reveals traveling to be the second-most-desired activity among respondents (in first place: dining out). In the United States, air travel has hit two million daily passengers, closer to the prepandemic level of around 2.5 million than to the low of around 90,000, in April 2020. Hotel reservations and rental-car bookings are surging.

All these trends should taste sweet for the industry, but ill-prepared companies may find themselves facing the wrath of a cohort of leisure-focused vacationers who might already be struggling to keep up with new travel protocols. If the industry doesn’t work to increase capacity now, the ecosystem may buckle under the pressure, forcing travelers to endure long wait times and inflated prices.

This article projects two broad trajectories of how travel will likely bounce back, comparing countries that have near-zero caseloads with those that have more, but manageable, caseloads and higher vaccination rates. In both scenarios, travel companies that don’t prepare themselves for the forthcoming influx of travelers risk missing out on a valuable opportunity to recoup losses incurred during the height of the pandemic. On the flip side, we believe that by focusing on four key areas—building capacity, investing in digital innovation, revisiting commercial approaches, and learning from critical moments—travel companies can seize value as they exceed the needs and demands of their customers.

The tale of two travel recovery paths

Wherever in the world you look, you’ll see people itching to travel. Most high-income earners have not lost their jobs. In the United States, the savings rate among this demographic is 10 to 20 percent higher now than before the pandemic, and such people are eager to spend their money on travel. Leisure trips are expected to lead the rebound, with corporate travel trailing behind.

A recent survey of 4,700 respondents from 11 countries around the world, conducted by the International Air Transport Association (IATA), revealed that 57 percent of them expected to be traveling within two months of the pandemic’s containment, and 72 percent will do so as soon as they can meet friends and family. In our China travel survey, we see more and more respondents yearning for leisure trips further afield; 41 percent say they want their next trip to be outside China, the highest level we’ve seen, despite borders remaining sealed.

Yet it’s worth noting that despite the near-universal desire to travel, countries will likely manage their plans to reopen differently. Two main factors come into play here: current COVID-19 caseloads and vaccination rates. People living in countries with limited access to vaccines and uncontainable levels of cases—such as a number of countries in Africa and Southeast Asia—will continue to be bound by tight travel restrictions for some time to come.

Travel will take off in and between countries with manageable caseloads

We can expect a surge in travel in (and between) countries with manageable and moderate COVID-19 caseloads and vaccine access. These regions are willing to accept rising case levels as long as death and hospitalization rates stay low. In many European countries and the United States, a significant portion of the population has been inoculated. Such people feel safe enough to travel both domestically and internationally, especially with the introduction of safety measures such as the EU-issued digital health certificates given to people vaccinated against COVID-19. Despite fluctuating rates of new caseloads in these regions, the efficacy of the vaccine so far (to reduce the spread of the disease and avoid its worst effects) gives many people enough feeling of security to travel.

Countries in Europe that have gotten used to living with manageable caseloads of COVID-19 have begun to welcome visitors without asking them to quarantine: Iceland (March 2021), Cyprus (May 2021), and Malta (June 2021). In addition, Europe is open to vaccinated US travelers. After the US Centers for Disease Control and Prevention (CDC) started approving cruise vessels with conditional sailing certifications to enter the country, a Florida federal court ruled in June 2021 that CDC-issued regulations should serve only as nonbinding guidelines, further reducing restrictions on tourists.

If past instances serve as indicators, we’ll see travel demand soaring once travel restrictions are eased and freedom of mobility returns.

Domestic trips will lead the recovery of travel in near-zero countries

However, a slightly different picture is emerging for countries with near-zero caseloads. Countries in this group include Australia, China, New Zealand, and Singapore. Their governments face a difficult trade-off. They can open up national borders without quarantines—which will almost certainly lead to increased local transmissions of COVID-19 and an increase in new cases, especially in countries with low vaccination rates, such as Australia and New Zealand. Or, they can choose to continue imposing strict restrictions and quarantine measures until the pandemic has truly passed, which would deter all but the most determined of travelers. Unlike places that have adjusted to living with COVID-19, even a moderate increase of cases in countries with caseloads near zero would likely be unacceptable to the public.

That’s not to say there are no travel opportunities in these countries. First, we’ll likely see increased interest in domestic travel, especially for large countries with sizable home markets, such as Australia and China, which have traditionally been net exporters of tourists. With few international destinations open to visit, this group of travelers will likely seek out vacation experiences within their nations’ borders. China has seen hordes of tourists flood many scenic destinations and tourist sites, especially during peak travel seasons.

Second, even though travel bubbles have had only limited success so far, it may soon be possible for territories with very low COVID-19 caseloads and no local transmissions to open up access to each other. Mainland China, for instance, has been allowing citizens to travel to and from Macau without quarantine requirements. Hong Kong and Singapore have also restarted negotiations on a potential travel bubble between the two cities. The key is establishing common standards and trust in the public-health protocols and testing regimes of the participants in the travel bubble.

Four actions travel players must consider

Despite these promising signs, the tourism industry will likely struggle to capitalize on the imminent spike in travel demand, especially in Europe and the United States. From airlines and car rentals to hotels and airport restaurants, the entire travel supply chain is already showing signs of strain. Wait times at security checkpoints are stretching into hours at some airports, while popular vacation destinations, including Arizona, Florida, and Hawaii, are facing rental-car shortages.

Needless to say, bad news travels fast, and a negative experience can quickly become fodder for a viral video and bad publicity, leading customers to look for alternatives more in their control, including nearby drives and rental properties.

While the process is daunting, clear-sighted travel leaders know that preparing their organizations for a surge of travelers is also an opportunity to redefine their value propositions and make their offerings distinctive. This will not only reinstill confidence in travel but also increase customer loyalty. Leaders and executives would be wise to focus on the following four areas.

1. Bring back capacity

The most pressing imperative for all companies across the travel supply chain is bringing back capacity or, at the very least, ensuring that they’re able to do so. Many contract and temporary workers in the restaurant industry who were laid off during the pandemic have found other employment and are reluctant to go back to their former jobs, resulting in a labor crunch. In the United Kingdom, more than one in ten workers left the hospitality sector last year. In the United States, there was still a shortfall in April of around two million leisure and hospitality jobs—far greater than before the pandemic. Global aviation capacity levels are still well below prepandemic levels as many planes remain in long-term storage and staff remain furloughed. We believe that even though reactivating airline pilots and cabin crews, preparing grounded aircraft for service, and rehiring and training service staff can be pricey, the cost of standing by and doing nothing would be higher.

2. Invest innovatively to improve the entire customer journey

While cash might continue to be in short supply, an area still worth considering for overinvestment is digital operations. Remember that the customer experience is shaped across the entire end-to-end journey, from booking to travel to the return home. Even seasoned travelers will have to adapt to new protocols, such as digital health certificates and safety measures. Travelers now need more, not less, assistance. Furthermore, certain critical journeys and moments—such as a family vacation, an important business trip, or a last-minute emergency—carry a disproportionate weight in consumers’ minds when they plan their next trip. The anticipated volume of traffic during the summer and peak holiday periods will only compound these issues and bring about greater inconvenience in the overall system.

In our work in this sector, we have found that if even one pain point in the customer journey is not satisfactorily resolved, the entire perception of a travel company can be degraded. The industry needs to make sure that processes are smooth for reopening and that adequate assistance is available for travelers to help them adapt to new ways of traveling. It is likely that international trips will need additional documentation for some time. These requirements will vary by country and potentially by transit hub. They may include proof of COVID-19 vaccination (when, as well as which vaccine) and testing requirements (type of test and recency).

As the long wait times at airport checkpoints attest, manually navigating these complexities at the check-in desk is highly inefficient and prone to human error. Some airports are testing camera-powered and AI-based digital technologies to monitor crowd densities and reduce time spent standing in line—which makes the airport experience more bearable for travelers and ensures safe physical distancing. Autonomous robots are also being deployed to maintain hygiene standards; some are equipped with UV-light cleaners to disinfect areas, and others are outfitted with body-temperature sensors to help minimize the risk of virus outbreaks.

3. Reimagine commercial approaches

Travel companies may rethink their commercial approaches. The profiles of airline passengers and hotel guests will be different: more leisure guests, later booking windows, and higher demand for flexible tickets. Historical booking curves are no longer a good indicator of current behavior. Travel companies need to use every source of insight they can to anticipate demand and optimize pricing . Flexible pricing models can also ease customer discomfort with today’s heightened levels of unpredictability. For example, EasyJet now offers a Protection Promise program that gives fliers free changes up to two hours before the flight.

Hotels will need to find new purposes for meeting and conference spaces, which will be slower to fill. Airlines need to figure out how to fill intercontinental business class, likely with premium leisure promotions. For all travel companies, the boom may be higher in traveler numbers than in profits, as the most lucrative corporate business has been slow to return.

4. Learn from critical moments—and the wider ecosystem

Aside from streamlining processes and personalizing the customer experience, investing in digital analytics can allow companies to identify opportunities to differentiate their services. Companies would also be able to discern emerging trends and hiccups before they turn into nightmares. Industry players, such as online travel agents, may also be a trove of useful insights pertaining to how the external ecosystem is evolving; their experiences may be beneficial for hotels and airlines to explore potential partnerships with them.

The various parts of the travel industry have to work together as a whole to usher in a safe return of travel. Even as individual companies improve their internal operations, they should also keep a close eye on industry-wide developments, watching for collaboration opportunities. The industry and governments will have to reach consensus on safety standards and requirements. The IATA travel pass is a plug-in that could be used on airlines’ mobile apps, for example. Currently being tested by many airlines as a way to ensure passenger health, the app would allow travelers to manage verified certifications for COVID-19 vaccines and test results. Governments, in turn, could consider accepting and embedding the app into the flight check-in workflow.

It’s been a long time coming, but we see several factors aligning that could lead to a short-term travel boom, although not all countries and customer segments will boom at the same time. With continued perseverance, travel companies can ensure that travel is not just back but better.

Vik Krishnan is a partner in McKinsey’s San Francisco office; Darren Rivas is the director of capabilities, Global TLI, in the Atlanta office; and Steve Saxon is a partner in the Shenzhen office.

This article was edited by Jason Li, a senior editor in the Shanghai office.

Explore a career with us

Related articles.

The comeback of corporate travel: How should companies be planning?

The path to recovery for US hospitality

How air travel is evolving postpandemic

Related Expertise: Transportation and Logistics , Customer Demand

What Travel and Tourism Consumers Really Want—and Why

September 25, 2019 By Jean Lee , Lara Koslow , Greg McRoskey , Pranay Jhunjhunwala , and Jason Guggenheim

There has never been a better time to be a travel consumer, as new brands and innovative offerings continue to emerge all the time. But there has also never been a tougher time to be a travel executive—especially at incumbent companies. Those new offerings? They come from wave after wave of disruptive new entrants. In today’s environment, the traditional approach to understanding consumers—which focuses primarily on demographics and basic behaviors—no longer delivers the level of insight that companies need. Instead, companies need to understand what the underlying factors that influence a purchase decision are and how that decision can change, depending on a consumer’s context at the time of purchase and on the range of options available. Ultimately, companies will be in a better position to grow if they think less about what they’re trying to sell and more about what customers want to buy.

Over the past several years, companies in a number of other industries—most notably Identifying the Sources of Demand to Fuel Growth —have applied this approach, which we call demand-centric growth (DCG) . Increasingly, travel and tourism companies are using DCG to crack the code of a more dynamic market characterized by greatly expanded consumer choice. The concept has broad implications for new products and brands, loyalty programs, M&A, and other key areas of company strategy. For incumbent travel and tourism companies, it offers a clear way to address a tough market that is changing faster than they can.

Traditional Solutions No Longer Work

By most metrics, the travel industry is thriving overall and continues to grow, but the news is not all good. Supply has exploded, due to growth among incumbent companies and recent entrants that offer a wider set of options—some entirely new to the industry. In the cruise industry, supply will outpace demand within the next several years. In the lodging industry, Airbnb and other shared-economy entrants have changed the rules of the game by putting private apartments and homes on the market, thereby reducing the demand for hotel rooms.

Established companies in all travel and tourism segments—airlines, cruise lines, and hotels—are struggling to tap into new growth or wrest market share away from competitors. They have tried various strategies, with little success so far. Here are some common examples:

- Choosing Quantity over Quality. Some companies have put near-term growth ahead of all other objectives, to the point where they can’t deliver a consistent experience.

- Overrelying on Unsustainable Advantages. Other companies have attempted to aggressively control supply—as when some airlines hold gate slots at airports in order to limit competition—giving themselves a high share of booking customers not because the customers prefer them but because the customers have no choice. It’s only a matter of time before regulations evolve and supply again increases to meet growing demand.

- Stretching the Brand Too Far. Still other companies try to be all things to all consumers—and end up being nothing to anyone because they lack a clear and differentiated position in the market. Think of a resort that offers guests a party scene but also touts family-friendly vacations. It’s hard to satisfy the full range of consumer preferences, especially conflicting ones. Companies that have tried to do so end up not being able to maintain any clear emotional connections to consumers.

- Joining the Race to the Bottom. It’s tempting to gain share by offering price discounts, but that game is expensive and difficult, and it is rarely sustainable. Price wars usually result in lose-lose outcomes—confusing customers and dissolving any nascent brand loyalty when brands inevitably try to recover by raising prices.

The common flaw in these strategies is that they lack a deep understanding of what consumers want, how their needs may vary from one occasion to another, and where they may look to meet their needs. (See Exhibit 1.) Often, customers have more options than companies think. For example, the Delta Shuttle connecting New York, Boston, Washington, and Chicago competes not just with other airlines but also with Amtrak. Airlines in Asia and Europe compete with high-speed rail lines. Cruise lines compete with each other and also with land-based vacations. A hotel company can no longer afford to focus exclusively on other hotels as its competition; it must also consider owner-rented homes as potential rivals. Evidently, the traditional frames of reference in travel and tourism are broken.

Clear Advantages from a New Approach: DCG

To understand how consumers make choices on the basis of their real-world frame of reference, companies need to look at customer behavior in a fundamentally new way. Specifically, they need to understand how demand can fuel growth, either by taking market share from competitors or by unlocking new sources of revenue. DCG establishes this broader consideration set by examining choices through the lens of demand versus supply. It takes into account the set of underlying consumer needs that companies may or may not be meeting despite the choices consumers make in response to available supply. In a supply-constrained world, for example, travelers flying from a hub city typically turn to the dominant airline—not because they want to, but because the airline’s more convenient flight schedules and connections effectively force them to. Finally, DCG appreciates that consumers’ needs and interests are not static, and it analyzes the unique circumstances that may drive travelers to make different decisions when planning different trips.

The DCG approach has several qualities that incumbent travel and tourism companies will find advantageous:

- Lasting. Unlike demographic-based marketing, DCG helps companies understand how and why individual consumers make their choices about travel, leading to a far more accurate and enduring picture of the market. At times, it can illuminate factors that even consumers themselves can’t articulate. The result is a much more sustainable approach to growth—one that is built on a simple yet comprehensive view of demand.

- Holistic . DCG looks at demand holistically, considering both existing and prospective customers, and both traditional and disruptive competitors. This encourages companies to devise a forward-looking growth strategy grounded not just in what is, but in what could or should be, shedding light on missed opportunities and potential white spaces in the market. In addition, by replacing a traditional brand-based market perspective with an outside-in approach, DCG provides an objective, customer-centric view of where a company stands relative to its competitors.

- Quantifiable. DCG helps companies quantify the opportunities that potential initiatives present, by assessing latent demand and competitive intensity. Only through this lens can companies understand their potential share of a consumer’s wallet and begin to shape a winning, customer-centric strategy. (See the sidebar “IHG’s New Hotel Brand Addresses an Unmet Need Among Budget-Conscious Travelers.”) By describing the opportunity in terms of actual numbers, DCG brings science to the art.

IHG’s New Hotel Brand Addresses an Unmet Need Among Budget-Conscious Travelers

IHG, the parent company of such hotel brands as InterContinental Hotels & Resorts, Kimpton Hotels & Restaurants, Crowne Plaza Hotels & Resorts, and Holiday Inn Express, was looking for new growth in a portfolio that was already strong. Management was concerned about being fully saturated in the company’s largest markets. It used demand-centric growth to identify a clear unmet need among hotel customers: a mass offering that provided reliable quality in the form of a great night’s sleep in a clean, well-designed room at a fair price. (Current alternatives in the market were either at a price point higher than consumers desired for this type of travel or very unreliable in terms of quality and consistency.)

IHG repositioned its existing brands and offerings to minimize overlap, and then invested in the new hotel brand, which it called avid hotels. Key features include: rooms designed for sound sleep, featuring a “best in class” mattress and sleep experience; high-quality, complimentary grab-and-go breakfast with 24/7 bean-to-cup coffee; and public spaces with fresh, modern designs. This brand is designed for travelers who want a hotel stay that finally meets their expectations for the type of hospitality they value most—the basics done exceptionally well—at a per-night rate expected to be about $10 to $15 less than IHG’s industry-leading Holiday Inn Express brand.

IHG launched the new avid hotels brand in September 2017, less than a year after the start of brand development—an accelerated pace in the hotel industry. Today, there are over 170 executed licenses with franchisees to build and open hotels across the US, Canada, and Mexico, and IHG recently announced plans to expand to Germany. Credit Suisse described avid hotels as the “most significant addition to IHG’s brand stable in over 25 years” and upgraded the stock to “outperform” as a result.

- Foundational. Establishing a baseline understanding of demand gives companies a north star and a common language to use in aligning the entire organization. It is not just a consumer strategy but a company strategy. After assessing the demand landscape and analyzing sales volume and brand fit, management might decide to launch a new route or a new service offering, acquire a competitor that has a stronger position relative to that target, or shift investment to areas where a brand may be vulnerable to attack. (See Exhibit 2.) Every touch point in the customer journey should reinforce the brand’s positioning. And the company should align every one of its internal aspects and functions—from pricing to sales and marketing to capacity planning to organizational structure—to execute the strategy successfully.

- Transformational. Finally, DCG helps companies assemble portfolios of complementary brands. As a result, they can determine what the right M&A strategy is, whether to launch a new brand, or how to design their loyalty program. (See the sidebar “Alaska Airlines Integrates a Customer-Centric Merger.”)

Alaska Airlines Integrates a Customer-Centric Merger

After Alaska Airlines’ parent company bought Virgin America in 2016, it faced some key questions about the postmerger organization. Should it keep Virgin’s brand (licensed from Sir Richard Branson’s Virgin Group) or operate under the 85-year-old Alaska Airlines brand? Should it strive to become a nationally relevant brand or stay focused on the West Coast, where Alaska and Virgin America were both well known? And how should it position the brand vis-à-vis the competition? The stakes were high: the $2.6 billion Virgin America acquisition was costly in relation to Alaska Air Group’s market cap of about $10 billion. As a company that has always centered around the customer, Alaska knew that it couldn’t make these decisions in the boardroom alone. Management needed to understand its customers.

The Alaska management team used demand-centric growth to identify several key insights. First, a deep customer analysis showed that Alaska had industry-leading customer retention and loyalty once customers got to know the brand, whereas Virgin America was stronger in customer acquisition but somewhat less sustainable long-term. (Virgin America did appeal strongly to some customers, but they were a relatively narrow segment overall.) That led Alaska to announce that the Virgin America brand would be phased out over time; the distinctive red and white aircraft would eventually all display Alaska’s smiling Eskimo. In terms of the route network, Alaska had very strong brand affinity among West Coast travelers, and its customers cared deeply about route coverage in those markets. Armed with these insights, the company ran some economic simulations that pointed to a clear answer: focus on the West Coast.

Second, the company looked at the landscape of demand and implemented a new customer strategy centered on the concepts “feel good” and “refreshed”—a differentiating positioning that leverages the strength of both the Alaska Airlines and the Virgin America brands while balancing what existing customers already love with areas for potential innovation.

To activate this strategy, after conducting a robust conjoint analysis with target customers, the company rolled out a campaign with the slogan “Different Works” and reprioritized investments into experiential aspects that airline customers truly care about: feeling good and refreshed. Elements of the campaign included everything from new loyalty policies to bolder entertainment investments to music in airport ticketing and check-in areas. The company also empowered employees to ensure that customer interactions were positive, caring, and true to Alaska’s core.

In 2018 Alaska Airlines—the only legacy US carrier to have avoided bankruptcy throughout its 85-year history—ranked highest in the J.D. Power survey of customer satisfaction among traditional carriers for the 11th consecutive year.

It can also give companies critical guidance on the optimal way to enter a new market. The approach goes beyond assessing the performance of individual brands to show how a portfolio fits together. When brands within a portfolio lack differentiation from one another, parent companies risk confusing customers and cannibalizing sales. (See Exhibit 3.) At the same time, portfolio companies often miss out on clearly identifiable white-space opportunities. Brands compete internally for resources, too, and misaligned incentives often exacerbate disputes. A demand-centric growth approach sets up brands to compete together, rather than against each other.

The travel and tourism industry is ripe for customer-focused innovation—and so far, new entrants are getting there faster. As choices proliferate and consumer behavior becomes more complex, traditional demographic-based marketing will no longer suffice. Incumbent companies can continue to focus on price or supply, and suffer disruption from new entrants, or they can start taking steps to become more customer-centric, starting with developing a better understanding of what truly drives their customers’ decisions. Demand-centric growth provides a foundation for that understanding by clarifying what consumers want at the moment of purchase—and why.

Partner & Director, Customer Centricity

Managing Director & Senior Partner

Partner & Associate Director

Los Angeles

Managing Director & Senior Partner, Travel & Tourism Global Leader

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

Subscribe to receive the latest insights on Consumer Products Industry.

Understanding the Travel and Tourism Sector: A Business Perspective

The world of business is inextricably linked with the realm of travel and tourism. From corporate travel arrangements to the operation of hospitality giants, this sector plays a pivotal role in the global economy.