進階搜索 | 搜索提示

免Tu貸款 Online 極速查詢

我們著重客戶需要,亦顧及客戶的利益。

貸款年期:還款期由3個月至48個月

實際年利率:最高為59厘

貸款金額:最高可達月薪20倍

貸款利率:最低月平息0.8%

申請方法:親臨分行、電話申請、網上申請皆可

只須用whatsapp wechat提供文件,即可用作審批

1、還款期最短為3個月及最長為60個月。

2、實際年利率最高為59厘

3、簡述貸款有關費用如下以作參考:

- 12個月之分期貸款,每月還款額為HK$913 – HK$1103

- 利率:低至月平息0.8%-2.7%

- 實際年利率:19.12% – 57.4%

- 總還款額:HK$10956 – HK$13236

4、本公司會保留一切貸款之最終審批權利,

借定唔借?還得到先好借!

鑒於近日發現有不少冒充本公司職員的推廣或促銷電話,本公司長程財務有限公司(Long Journey Finance Limited )特此聲明,長程財務有限公司並沒有委託第三方或前職員使用客戶資料進行任何推廣ヽ促銷或代理信貸業務。一切非長程財務有限公司提供之產品ヽ服務ヽ推廣或促銷,一概與本公司無關。

為免被誤導及蒙受損失,客戶如收到任何自稱長程財務有限公司前職員的來電或對來電者身份有懷疑,請勿透露閣下任何個人資料,並立即致電9609 4733或電郵至[email protected]與長程財務有限公司客戶服務主任聯絡及核實。

如發現任何偽冒本公司名義之行為,長程財務有限公司必定採取法律行動,以保障客戶利益及公司形象。

Copyright 2024 長程財務有限公司. 網站地圖 | 網頁設計 由 EC Shop City 提供

Long Journey Finance Limited / 長程財務有限公司

- Address: 14 Floor Rich Towers 2 Blenheim Avenue Tsim Sha Tsui Kowloon Hong Kong, Hong Kong

- Site: http://www.longjourneyfinance.com

- Phone: 26608188

- Facebook: https://www.facebook.com/LJFLTD/

- Time zone: Asia/Hong_Kong

- Local Date:

- Local Time:

- Geo: 22.2968245287, 114.174513817

- Sunrise: 06:03 , Sunset: 18:43

- Moonrise: 11:20 Apr 15, 2024 , Moonset: 01:25 Apr 16, 2024

- Capital: Hong Kong

- Currency: Dollar (HKD)

- Dialing Code: +852

- ISO Code: HK / HKG

Where to find Long Journey Finance Limited / 長程財務有限公司? Long Journey Finance Limited / 長程財務有限公司 is located at 14 Floor Rich Towers 2 Blenheim Avenue Tsim Sha Tsui Kowloon Hong Kong, Hong Kong in the state Hong Kong, Hong Kong. What is the phone number of Long Journey Finance Limited / 長程財務有限公司? The place can be reached through its phone number, which is 26608188. The local time zone is Asia/Hong_Kong . The current local time and date is . You can go to their website for more information, The website is http://www.longjourneyfinance.com.

Today, If you want to go to Long Journey Finance Limited / 長程財務有限公司, the sun rises in Long Journey Finance Limited / 長程財務有限公司 at 06:03 and sets at 18:43. You can see the moon rise at 11:20 and set at 01:25 Apr 16, 2024.

- 大熊貓四川燒烤店:紅磡崇潔街27至29號

- Aerial Arts Academy Central

- Skyzone Deck & Lounge 30th Floor Rosedale Hotel Hongkong

- 【hiii】Prick Hedge@MTR YauMaTei·TempleStreet-HKG036

- JUMBO APEX 高爾夫球用品專門店

- 義手易物平台 EMind

- Forum Restaurant

- 365NC Studio

- 1 Flower Market 花墟1號

- China Exploration & Research Society

- SpeechTherapy

- 元朗mon皇 爆芒 手機維修 液晶玻璃 爆屏幕

- Cellistizzimo

- Tsang Tai Uk

- ceci.y handmade leather studio

- Hani Wedding 婚紗晚裝

- Yuet Wah Street Playground

- CodeMonkey HongKong

- Iff Premium Fine Foods & Beverages 4 Less

- Ginza Yoshie Clinic 銀座嘉惠診所 - 香港院

- Christerior Design Limited CDL

- Financial Service

- Log in/Sign up

LONG JOURNEY LIMITED

- 長征有限公司 (alternative legal name in ZH)

Latest Events

Corporate grouping user contributed, similarly named companies.

Found 13. Showing first 10

Problem/question about this data? Click here

For access please Log in / Sign up

- Long Journey Finance Limited / 長程財務有限公司

Phone Number : 26608188

Website : longjfinance.com.hk..

Categories : Financial service

Opening Hours :

Address : 14 Floor Rich Towers 2 Blenheim Avenue Tsim Sha Tsui Kowloon Hong Kong, Hong Kong

GPS Coordinates : 22.29695 , 114.17443

Facebook : facebook.com/1036863089724889

Instagram : Photos and Videos

Financial Services in Hong Kong

🚩 Report this page

Financial Services nearby

Companies and places nearby, what hotels, hostels and apartments are located near long journey finance limited / 長程財務有限公司.

There is a list of nearest hotels: Xi Hotel is a three stars hotel located at 7 Minden Avenue, in 20 meters west . Hop Inn on Mody is a one star hotel located at 5/F, Lyton Building, 36 Mody Road, in 43 meters northeast . Golden Bridge Hotel is a one star hotel located at Flat A, 4/F, Lyton Building, 32-48 Mody Road, in 44 meters northeast . Chelsea Hotel is a three stars hotel located at 8A Hanoi Road, in 50 meters north . Harbour Bay Hotel - formerly One Minden Hotel is a three stars hotel located at 1 Minden Avenue, Tsim Sha Tsui, Kowloon, in 56 meters west . Hotel Panorama By Rhombus is a four stars hotel located at 8A Hart Ave, in 86 meters north . Hyatt Regency Hong Kong Tsim Sha Tsui is a five stars hotel located at 18 Hanoi Road, in 100 meters northwest .

Your can find and book more hotels, hostels and apartments on our interactive hotels map .

Nearby cities, towns and villages

- 🇭🇰 Kellet Island

- 🇭🇰 Hong Kong

Reviews by country

- 🇲🇾 Malaysia 1204

- 🇦🇺 Australia 952

- 🇮🇳 India 893

- 🇿🇦 South Africa 877

- 🇬🇧 United Kingdom 659

- 🇨🇦 Canada 636

- 🇵🇭 Philippines 489

- 🇺🇦 Ukraine 308

- 🇬🇷 Greece 295

- 🇳🇬 Nigeria 268

- 🇵🇰 Pakistan 204

- 🇪🇸 Spain 198

Reviews about other places

Questions about other places.

- 🏠 WorldPlaces ›

- 🇭🇰 Hong Kong ›

Languages 1

- Company Credit (7)

- Expert Accountant (3)

- Accountant (1)

- Tsim Sha Tsui East (35)

- Tsim Sha Tsui (167)

- Jordan (34)

- Tseung Kwan O (1)

- Yau Ma Tei (34)

- Hung Hom (23)

- Causeway Bay (94)

- Hong Kong (55)

- Wan Chai District (277)

- North Point (69)

- Central (275)

- Mong Kok (180)

- Sheung Wan (159)

- Kowloon (1)

- Tai Kok Tsui (18)

- To Kwa Wan (5)

- Quarry Bay (16)

- Mid-level (1)

- Central & Western District (2)

- Sai Ying Pun (11)

Long Journey Finance - Tsim Sha Tsui

- Amend the information

- Add my company

- Search for a company anywhere in the world

Long Journey Finance

Other businesses in the same area.

Atradius Collections Hong Kong

Sr wealth securities, auto export, wing hang bank cheung sha wan branch, bank of east asia, yt piping technology, standard chartered bank - new mandarin plaza branch, standard chartered bank, increase the visibility and hits of your company right now , information available on the internet, categories related to company credit in tsim sha tsui.

- Other Companies & Services in Tsim Sha Tsui (267)

- Expert Accountant in Tsim Sha Tsui (184)

- Company Credit in Tsim Sha Tsui (21)

- Clothing Store in Tsim Sha Tsui (14)

- Bank in Tsim Sha Tsui (13)

- Company Credit - Broker in Tsim Sha Tsui (13)

- Legal And Financial in Tsim Sha Tsui (13)

- Estate Agency in Tsim Sha Tsui (12)

- Home & Garden - Housewares in Tsim Sha Tsui (5)

- Accountant in Tsim Sha Tsui (3)

- Government in Tsim Sha Tsui (2)

Locations related to Company Credit

- Company Credit in Wan Chai District (277)

- Company Credit in Central (275)

- Company Credit in Mong Kok (180)

- Company Credit in Tsim Sha Tsui (167)

- Company Credit in Sheung Wan (159)

- Company Credit in Causeway Bay (94)

- Company Credit in Kwun Tong District (87)

- Company Credit in North Point (69)

- Company Credit in Hong Kong (55)

- Company Credit in Cheung Sha Wan (44)

- Company Credit in Kowloon Bay (37)

- Company Credit in Tsim Sha Tsui East (35)

- Company Credit in Jordan (34)

- Company Credit in Yau Ma Tei (34)

- Company Credit in Tsuen Wan (32)

- Company Credit in Sheung Kwai Chung (24)

- Company Credit in Hung Hom (23)

- Company Credit in Lai Chi Kok (20)

- Company Credit in Sha Tin Heights (18)

- Company Credit in Tai Kok Tsui (18)

- Company Credit in Yuen Long (18)

Our Approach

Our legacy is determined by the customers we serve, the jobs we create, and the businesses we help to prosper.

SBFC provides financing opportunities to business owners who are underserved by traditional banks.

Our approach is to reimagine lending. We have developed a “PhyGital” model which uses technology and authentic in-person service to create loans which support the ambitions of our customers. We engage directly with small business owners and work through loan applications together, in person, at the customer’s pace.

SBFC’s business foundations include a commitment to responsible credit and trusting relationships with large banks.

Defining Features

We are building a financial institution, not just a business., financial strength.

We have the capital to grow with confidence and are backed by investors

We have a hand-picked team of people with diverse skills, relevant experience and a passion for customer service

Risk Management

We have effective methods for assessing credit-worthiness and we boast a strict compliance culture

SBFC's purpose is to serve small business mirco enterprises in unorganized sectors in non-top tier towns. These businesses are ubiquitous, spread throughout the country and hence tough to reach. These businesses are often extensions of individuals with cash flow ebbing and flowing to and fro from the individual and the business she runs. As a lender one is trying to understand the ability and willingness to pay and usually what one relies on to get there is past performance and present cash flow position of the business. This presents another challenge. The proposals here are often what we call Thin File. The amount of credible information that you can rely on is limited and we need to go above and beyond to really understand the business, the cash flow, the need, the sustainability and the Individual's intention.

We operate on a Phygital Model. We extensively use technology but we also believe that human touch is critical to understanding and underwriting credit to this customer segment. We have also taken the entire process from application to disbursal Digital through our www.sbfc.com using our in-House LOS/App called LeviOSa. (Meaning Light). We also understand that the small customer may not yet be comfortable with this technology and hence also operate on an Assisted Digital Model where our Loan Officers have the app through which they digitalise the application process at the office/residence of the customer. Leviosa is integrated at the back end with India Stack, Scorecards, Banking and Tax papers check enabling our officer to give an instant sanction. No files, no paperwork, no we will get back to you later.

We also believe that we do not sell a product. We are in the relationship business. Hence, we do not operate through third party agents to source business but our officers directly reach out to the customers and handle the relationship pre and post lending.

We are not in the business of distribution, we are in the business of risk management. We believe that if we can understand the customer, the need, the cash flows and the reputation of the customer we are evaluating, we will write superior credit. Yet, all this need not take time. Its a misnomer to believe that the more time you take to evaluate a proposal the better would be the understanding. We believe that if you know what you are looking for, you achieve quality with speed. A quick No is often better than a delayed Yes.

We understand that a loan is not over till the last EMI comes back. For us, Business, Credit, Operations and Collections are four distinctly different verticals. They report independently all the way up to ensure no conflict and adequate checks and balances in the system.

At SBFC we believe in controlled aggression. A strong Risk and Compliance culture is at the core of our business governance.

We optimise business processes and customer service using advanced data analysis

We use smart technology to enhance efficiency and make the customer journey easier

Why We Exist

The spirit of india’s entrepreneurship is found in small businesses..

7 crore MSMEs create 30% of India’s GDP and creates employment for about 11 crores people in the country.

However, less than 15% of these businesses have access to formal credit. Restricted access to finance is a major obstacle to launching a business in India. Traditional banks don’t suit the needs of entrepreneurs, particularly those with limited documentation or whose incomes are unpredictable.

SBFC sees an opportunity to support this under-served part of market. SBFC’s “PhyGital” business model and innovative methods for assessing credit-worthiness tap into a nationwide trend of accelerating digitalisation and make loans simple, flexible and convenient for some of the people who need it most.

Entrepreneurs and small business owners in India Source: CRISIL Research

MSMEs with access to formal business loans Source: CRISIL Research

117 lakh Cr

Estimated demand for credit from micro businesses in India Source: CRISIL Research

16 States & 2 UTs

Where SBFC branches are located

New Customers Enjoy up to $1,000 e-Gift Card

Enjoy Rewards of Up to $5,000 in Cash Coupons!

All card and loan balances paid off in one go

Zero Finance provides a wide range of loan options, empowering you to achieve your goals

X Cash Daily interest only $0.22/every $1,000

Zero Human Interference

Lightning Approval in Seconds

Zero Income Proof

24/7 Instant Funds

Zero Branch Visits

Flexible Loan Amount

Withdrawal & Pay At Anytime

Transparency

X Cash A.I. ( Small Loan Amount)

A.I. instant approval, only need HKID card to apply, and the daily interest is only $0.22 per $1,000.

X Loan ( Large Loan Amount)

Whether you’re seeking funds for emergencies, home improvements, medical expenses, or any other purpose, we can provide a swift solution.

X Debt Consolidation Loan

Zero Finance’s professional team provides you with a customized “Debt Consolidation Loan plan”.The application process is simple. All card and loan balances are paid off in one way, it gives you the flexibility to use your cash and helps you improve your TU Report Rating.

X Mortgage Loan

Provides low-interest property loans for owners, regardless of property type, such as private buildings, corporate shops, etc., including first mortgage and second mortgage. Apply online in just 3 simple steps!

X Property Owner’s Loan

Provide large loan amount for property owners, with loan amounts up to $1,500,000, allowing you to turnaround your cash flow in convenience way, application just in 3 simple steps.

X Funds (SME loan)

No matter which industry you work in, we will provide you with professional advice tailored to your business financial needs

What is the monthly instalment amount ?

Steps to financial freedom!

How to Apply:

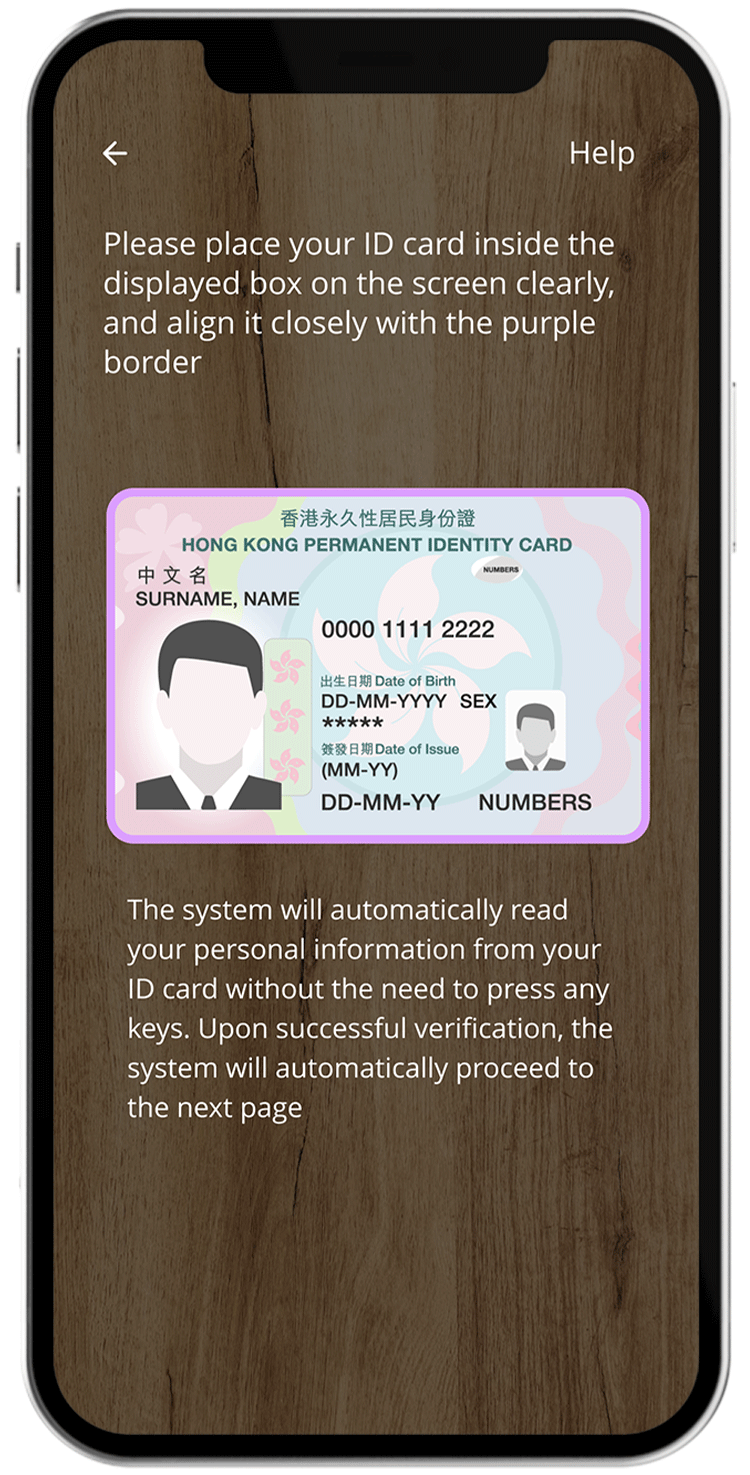

Verify identity.

Open X Wallet, take a photo of Hong Kong ID card to verify your identity, and enter general personal information.

A.I. Instant Approval

Using Machine Learning and data analysis to give you an approval result as fast as 5 seconds.

Confirmation and fund transfer

Confirm the loan contract and fill-in bank information in app, then the fund will be transferred through FPS instantly to your bank account.

Whats our Clients Say?

X Wallet Loan User | Self-employed

*The monthly repayment amount is calculated based on the actual annual interest rate of 8%.

X Wallet Loan User | Clerk

Recently, my family needs some money for medical expenses, but I have called two finance companies that I am already a client to apply for extra loan amount but were rejected. Fortunately, a friend introduced me a loan app – X Wallet of Zero Finance. The entire loan application process takes only few minutes, the loan can be automatically transferred even on Sundays, repay as much as you used. The repayment method is also very convenient, and I will recommend it to more friends in need in the future.

*The final approval of the application is subject to the financial condition of customer.

For Enquiry +852 2531 0333

Email Us [email protected]

For Mortgage +852 2531 0330

WhatsApp +852 2531 0331

Fax +852 2531 0300

Service hour Mon – Fri: 9:00-18:00 Sat, Sun and public holidays closed

- X Cash. A.I. (Small Loan Amount)

X Loan (Large Loan Amount)

- X Property owner’s Loan

Zero Finance

Company info.

- Money Lenders Ordinance

- Important Notice

- Personal Data (Privacy) Ordinance

- Terms and Conditions

- Note to Intending Borrowers

Warning: You have to repay your loans. Don’t pay any intermediaries.

Subscribe for our latest news!

Zero finance hong kong limited.

Money Lender’s License: 1100/2023

X8 Finance Limited

Money Lender’s License: 0807/2023

The above companies are wholly owned sebsidiaries of Termbray Industries International (Holdings) Limited (Stock Code: 0093)

Enquiry and Complaint Hotline : 2531 0333

© 2024 zero finance hong kong limited. all rights reserved..

Warning: You have to repay your loans. Don’t pay any intermediaries.

The above companies are wholly owned subsidiaries of Termbray Industries International (Holdings) Limited (Stock Code:0093)

Scan QR Code to Download APP

GET THE APP

X Cash. Ai (Small Loan Amount)

Get the results within 5 seconds

Monthly instalment

Pay off all debts at once

Low-interest Rate Property Loan

X Property Owner's Loan

Realise the Potential of your Home

X Funds (SME Loan)

Capitalize on Business Opportunities

Important Notice:Beware of fraudulent impersonating representatives/employees.

The minimum and maximum repayment period is 12 months and 72 months respectively.

The Minimum annual percentage rate is 12% and maximum annual percentage rate is 48%

A representative example of total cost for a loan below is for reference only: Loan mount:HK$10,000 Monthly instalment of HK$889 for 12 months Monthly interest rate: 0.55% Annual interest rate: 12% Total repayment amount: HK$10,688

According to user Lynn’s sharing, briefly describe her loan information:

The shortest repayment period starts from 61 days and the longest is 48 months.

Effective annual interest rate: 8% Interest rate: 0.67% monthly Loan amount: $15,000 A 48-month installment loan with a monthly repayment: $50

Total repayment: $17,400 The above loan-related fees are for reference only

Actual annual interest rate is from 8% to 48% as maximum.

About Key Finance

Committed to Excellence

Key Finance has been providing working capital support to some of the biggest companies across the globe for over 40 years. The long-term relationships we have with these blue chip businesses is testament to our reliability, our flexibility and our company ethos of getting the job done.

We’re incredibly proud of the reputation this family-run business has earned in that time and we welcome the opportunity to work with new clients of any size.

Our Chairman

Key Finance was established in 1987 by our Chairman John Mounsey who had the vision of establishing a new kind of financing, thanks to a long and successful career straddling both IT and leasing at blue chip corporations including IBM, ICL and ITEL.

He brought his vision for new leasing options to Key Finance, initially doing the same as he’d done previously – renting mainframes and PCs – but with ambitions to offer more, and to a wider spectrum of clients.

John wrote the first reference book on leasing in 1988, helped Hewlett Packard to develop its own lease strategy when PCs went mainstream in 1991 and – thanks to Key Finance’s fast-growing reputation in the world of finance – quickly attracted clients outside of the IT sector.

Since then Key Finance has helped some of the biggest international companies with finance options.

And whilst retaining those blue chip clients, Key Finance now works with companies of all sizes throughout the UK – and in many different sectors. But all have the same requirements: to grow their businesses, by securing bespoke and flexible finance.

Today, John Mounsey remains as Chairman of Key Finance, with his son Henry taking a front seat alongside the rest of the team. However the business practices, ideals and ethics remain the same as when Key Finance first started serving the IT community nearly 30 years ago.

Our Principles

Our principles are simple, but worth underlining nevertheless…

Number one, without doubt, is to keep our customers happy.

To maintain the highest standards of professionalism., to act timely., we do business with complete transparency., we don’t sell a finance package; we identify the needs of our customers and create a solution., we firmly believe in forging face-to-face, real relationships with all of our customers., why use key finance.

For over 40 years, Key Finance has provided transformational financial support to businesses across the entire spectrum of commerce and industry – from sole traders to leading multinational chains. We can help you build and execute a funding strategy for a wide variety of projects, growth opportunities and investments.

We are a proven successful team that knows how to execute.

We always deliver on our promises

Over 40 years in the market and no bad debt from any of our deals

We are a family office and treat our customers as such, enjoying the fundraising journey together

“Important Information on the Company name change to L&T Finance Limited (formerly known as L&T Finance Holdings Limited)" Click Here

- Quick Pay Login

“AAA”

About l&t finance limited (formerly known as l&t finance holdings limited).

Headquartered in Mumbai, L&T Finance Limited (formerly known as L&T Finance Holdings Limited) is one of the leading Non-Banking Financial Companies in India, with a strong presence across the lending business catering to the diverse financing needs of served and underserved customers. L&T Finance offers Personal loans, Two-Wheeler loans, Home loans, Rural Business loans, Farm loans, and SME loans. At L&T Finance, we are committed to providing customised financial solutions that meet the unique needs of our customers. With a focus on innovation and customer-centricity, we aim to be a trusted partner in our customers' financial journey.

Our Values

Built on four pillars, our culture endeavours to create an indomitable financial organisation

We aspire to achieve something more and doing better than we did yesterday.

Confidence in our abilities as a stable and sustainable organisation that always contributes to the customer and every stakeholder.

Creating a culture of results and not reasons, we place responsibility on doing what is right day after day.

Integrity beyond honesty, including focus, consistency.

Our Culture

Our Growth Journey

- L&T Finance Limited (formerly known as L&T Finance Holdings Limited) has completed the merger of its subsidiaries (L&T Finance Ltd., L&T Infra Credit Ltd., and L&T Mutual Fund Trustee Ltd.) with itself. The Merger is effective December 4, 2023 thereby creating a ‘Single Lending Entity’ housing all lending businesses under one operating Non-Banking Financial Company.

- Mr S N Subrahmanyan has been appointed as the Director and Chairperson of L&T Finance Limited (formerly known as L&T Finance Holdings Limited). This is in line with L&T’s overall commitment to strengthen its presence in the services area

- L&T Finance raised its first ₹ 200 Cr Sustainability Linked Rupee Loan from the Indian arm of the French multinational investment bank and financial services company - Société Générale

- L&T Finance Limited (formerly known as L&T Finance Holdings Limited) raised over ₹2,998.61 crore through rights issue. The issue was oversubscribed by 15 percent.

- L&T Finance Limited (formerly known as L&T Finance Holdings Limited) announced the merger of L&T Infrastructure Finance Company (LTIFC) and L&T Housing Finance with L&T Finance, all wholly owned subsidiaries of the company

- L&T Finance won ‘Technology leader of the year - Infra Finance’ in NBFCs at 3rd Quantics BFSI Excellence Awards for its impressive company profile and work

- L&T Finance Limited (formerly known as L&T Finance Holdings Limited) has been awarded the prestigious ‘Best Finance Transformation’ award in SAP ACE awards 2021 in the Disruptor in Best Finance Transformation category for large enterprises

- L&T Finance Limited (formerly known as L&T Finance Holdings Limited) to divest its Mutual Fund business which is in line with the strategic objective of the company of unlocking value from its subsidiaries to strengthen its balance sheet

- L&T Finance has been recognized as the most Socially Aware Corporate of the Year by the Business Standard Social Excellence Awards 2019, for the scale and gender-inclusive work of its digital-literacy initiative in rural India, Digital Sakhi

- L&T Infrastructure Finance will provide INR 518 crore term loan to Singapore-based gas major AG&P Group’s Indian arm for developing city gas networks in Rajasthan and Tamil Nadu

- L&T Infrastructure Finance received $50 million in the first tranche of the $100 million external commercial borrowing from the Beijing-headquartered Asian Infrastructure Investment Bank (AIIB)

- L&T Finance Limited (formerly known as L&T Finance Holdings Limited) gets a nod to raise up to INR 3,000 crore via rights issue to support growth of business verticals like retail and rural finance

- L&T Finance Limited (formerly known as L&T Finance Holdings Limited) and all its lending subsidiaries have AAA rating assigned/reaffirmed by CRISIL, India Ratings, ICRA and CARE, despite the environment of multiple downgrades across the sector.

- L&T Finance Limited announced the Public Issue of Secured Redeemable Non-Convertible Debentures (Secured NCDs) which was oversubscribed 4.45 times of the base issue size ( ₹ 500 crore)

- L&T Finance Limited announced Tranche 2 of Public Issue of Secured Redeemable Non-Convertible Debentures (NCDs) which was oversubscribed 6.48 times of the base issue size ( ₹ 500 crore)

- L&T Finance Launches ‘Sabse Khaas Loan' for Two-Wheeler Customers L&T Finance Launches „Digital Sakhi‟ in Tamil Nadu

- IFC leads $550 million ECB investment round in L&T Finance L&T Finance Limited announces Tranche I of Public Issue of Secured Redeemable Non Convertible Debentures (Secured NCDs) which was oversubscribed 3.01 times of the base issue size ( ₹ 500 crore)

- The CII National HR Circle Competition 2018 winner for "Management of Change & Excellence in HRM"

- Asian Centre Awards for "Best Audit Committee"

- LTF and its subsidiaries’ credit ratings upgraded to AAA by ICRA

- L&T Finance (LTF) opened its 1000th meeting center in Kolkata, West Bengal, for its Micro Loans business

- L&T Finance Limited (formerly known as L&T Finance Holdings Limited) featured in the Forbes India's Super 50 Companies 2018

- FINNOVITI 2018 Award for “SANGAM”, an Innovation in the Two-wheeler business

- Wholesale Finance and Infrastructure Debt Fund business won 3 awards at "The Asset Triple A Asia Infrastructure Awards 2018" for Infrastructure Fund Deal of the Year, Airport Deal of the Year and Private Equity M&A Deal of the Year

- LTF 2.0 re-defined. Stock Price reaching an all-time high of ₹ 200 and ROE of 13.63%

- Expanding our footprint by commencing our Micro loans business in Assam

- Awarded the "Best Finance Company in Renewable Energy" at the annual "Central Board of Irrigation & Power Awards"

- Re-orient strategy to focus on select products and deliver improvement on RoE

- Total Assets cross ₹ 50,000 Cr.

- Preferential issue of Equity Shares & Warrants to Bain Capital amounting to ₹ 708 Cr

- Maiden issue of preference shares

- Entry into Housing Finance – acquisition of IPHF

- Start of 2W Finance – acquisition of FamilyCredit

- Total Assets cross ₹ 20,000 Cr

- L&T Finance is listed on BSE and NSE

- LTIF notified as PFI

- Foray into Mutual Fund business – acquisition of DCAM

- LTIF secures IFC status, launches Infra Bonds

- Maiden public issue of NCDs by L&T Finance

- Total Assets cross ₹ 10,000 Cr

- Start of Microfinance & Loan Against Shares

- L&T Infra Finance established

- CV Financing commenced

- L&T Finance Incorporated

Our Leadership Team

Meet our team of stalwarts.

Board of Directors

Senior Management

Mr. S. N. Subrahmanyan

Non-Executive Director and Chairperson

Mr. Sudipta Roy

Managing Director & CEO

Mr. Dinanath Dubhashi

Whole-Time Director

Mr. R. Shankar Raman

Non-Executive Director

Mr. Thomas Mathew T

Independent Director

Dr. (Mrs.) Rajani R. Gupte

Dr. R. Seetharaman

.png?sfvrsn=8178b8b3_1)

Ms. Nishi Vasudeva

Mr. Pavninder Singh

Nominee Director

Mr. Sachinn Joshi

Chief Financial Officer

Mr. Raju Dodti

Chief Operating Officer

Mr. Santosh B. Parab

General Counsel

Mr. Sanjay Garyali

Chief Executive - Urban Finance

Mr. Abhishek Sharma

Chief Executive - SME Finance

Ms. Sonia Krishnankutty

Chief Executive - Rural Business Finance, Customer Service & Business Operations

Ms. Apurva Rathod

Company Secretary & Chief Sustainability Officer

Mr. Asheesh Goel

Chief Executive - Farmer Finance

Mr. S. N. Subrahmanyan is the Non-Executive Director and Chairperson of the company.

He is the Chairman & Managing Director (CMD) of Larsen & Toubro and serves on the board of directors of this multi-billion-dollar conglomerate. SNS, as he is popularly known, is also Vice Chairman on the boards of LTI, L&T Technology Services & Mindtree and Chairman of L&T Metro Rail (Hyderabad) Limited.

Prior to taking over the reins as CEO & MD in July 2017, SNS in his capacity as Deputy MD & President led L&T’s infrastructure business to its position as the country’s largest construction organisation and 14th in the world. He is now responsible for leading the breadth and width of L&T’s considerable business interests to new growth levels, riding on the enormous benefits of digitalisation, big data, and predictive analysis that he drives internally with exceptional zeal. He places a premium on innovation, project management and talent development, particularly in leadership roles.

Hailing from Chennai, India, SNS commenced his professional journey with L&T in 1984 as a project planning engineer armed with a degree in civil engineering and a post-graduation in business management. Mentored by stalwarts, he took on roles of increasing responsibility across business verticals. With an entrepreneurial mindset, drive, and foresight, he began to rewrite the rules of the game.

He led L&T’s foray into the realm of executing developmental projects starting with the extremely successful HITEC City project in Hyderabad and the Bangalore International Airport, forging deals in the process without precedent in the construction space. Successfully setting up the Ready Mix business in India for the first time, bagging mandates to design & build all major international airports in India, venturing into untapped geographies like the Middle East, Africa & ASEAN to establish L&T’s credentials and presence and building long-term relationships came easy to him.

Under his leadership, SNS has transformed L&T into a company that executes a wide range of projects at Speed & Scale and, in the process, builds the tallest, largest, longest, smartest, and most complex. L&T is among the three Indian companies to feature in the top 46 Most Honoured Companies according to the New York-based B2B publication, Institutional Investor, was recognised as the Company of the Year by business publication, Business Standard in 2020 and has featured on the Forbes list as one of the world’s best employers.

SNS was ranked 11th in the Construction Week Power 100 Ranking for 2021, that had previously recognised him as the Infrastructure Person of the Year for 2012. In 2020, SNS was ranked as the Top CEO (Sell Side) and the 3rd Best CEO (Overall) in the All-Asia Executive Team Survey conducted by Institutional Investor and recognised as the CEO of the Year by the leading Indian news channel, CNBC-Awaaz. He has been conferred the Emergent CEO Award at the CEO Awards in 2019 for his exemplary leadership and for delivering seamless growth for L&T. He has also been accorded the Leading Engineering Personality award by the Institution of Engineers (India) in 2014.

SNS holds positions of pre-eminence on various industry bodies, construction institutions and councils. In February 2021, he was appointed Chairman of the National Safety Council (NSC) for three years by the Union Ministry of Labour & Employment. In this role SNS will guide the NSC, which has a major part to play to ensure safety in workplaces under the new Occupational Safety, Health and Working Conditions Code, 2020 (OSH Code, 2020)

Mr. Roy is a consumer banking and payments professional with over 24 years of financial services experience. He joined the Company from ICICI Bank, where he served as Group Head and managed diverse businesses like Unsecured Assets, Cards, Payment Solutions, Student Ecosystem, E-commerce and Merchant Ecosystem, Millennial Banking and API Banking. Before his assignment with ICICI Bank since 2010, he has worked for Citibank and Deutsche Bank.

Mr. Roy has a deep understanding of consumer finance, cards and retail loans, lending and payments technology systems and associated risk management practices and has worked extensively in India, China and Canada in the consumer lending and payments business, having built green-field lending and cards businesses in all three countries.

He was voted as one of the Top 50 Digital Finance Influencers in the country in 2024 as well as the top 30 Fintech Influencers in India in the year 2021 and is a speaker at various forums on Retail Lending and Credit, History of Payments, Risk and Fraud Control and Future of Payments business.

Mr. Roy has also been a part of several Government and Reserve Bank of India committees in areas of transit payment systems, banking security and retail payments.

He is a chemical engineer from Indian Institute of Technology, Kharagpur and MBA from XLRI School of Management, Jamshedpur

Mr. Dinanath Dubhashi is the Whole-Time Director of L&T Finance Limited (formerly known as L&T Finance Holdings Limited).

With a rich experience of over three decades, Mr. Dubhashi has worked in multiple domains of Financial Services such as Retail & Infrastructure lending, Rural Finance, Corporate Banking, Cash Management, Credit Ratings, Insurance and Wealth Management.

Mr. Dubhashi has been associated with L&T Finance Limited(formerly known as L&T Finance Holdings Limited) since 2007 and has been instrumental in scaling up the retail businesses manifold, across customer segments and geographies. During his tenure as the Managing Director & CEO of L&T Finance Limited(formerly known as L&T Finance Holdings Limited) since 2016 to January 2024, LTF has achieved several market leading positions in flagship products like Rural Group Loans & Micro Finance, Farm Equipment Finance and Two-wheeler Finance.

Mr. Dubhashi has been instrumental in conceptualising the Company’s transformational strategic vision ‘Lakshya 2026’ aimed at transforming LTF into a top-class digitally-enabled, customer focused Fintech@Scale. By focusing on increasing the retail proportion of loan book and reducing the wholesale business, Mr. Dubhashi has led the organisation to deliver Retailisation of over 80%, Retail growth of over 25% CAGR, pristine Retail Asset Quality and optimum Retail RoA.

He has also built a strong digital and data analytics foundation for the company, leading to best-in-class customer value proposition and Turn-Around-Time (TAT) for loan approvals and disbursals. The increase in retail proportion of loan book under his leadership has been built on the foundations of distinctive digital and analytics-based offering and a robust risk management framework.

Prior to joining L&T Finance Limited(formerly known as L&T Finance Holdings Limited) in 2007, Mr. Dubhashi was associated with organisations such as BNP Paribas, CARE Ratings and SBI Capital Markets in various capacities.

In addition to his responsibilities at L&T Finance Limited(formerly known as L&T Finance Holdings Limited), Mr. Dubhashi has also been co-chairing the FICCI Committee on NBFCs since 2018 and is also on the board of Finance Industry Development Council (FIDC) – a representative body of NBFCs.

He is a Postgraduate from IIM Bangalore and holds a B.E. (Mechanical) degree.

Mr. R Shankar Raman is the Chief Financial Officer and Member of the Board at Larsen & Toubro Limited (L&T). He is a Non-Executive Director on the Board of our company. He is also on the board of several companies within the L&T Group. He joined the L&T Group in 1994 to set up L&T Finance Limited and has close to 35 years of experience in Finance and Management.

He is a Chartered and Cost Accountant by profession with a degree in Commerce from Madras University.

Thomas Mathew T. has over four decades of strategic leadership and operational experience in the Life Insurance & Reinsurance industry. He was the Managing Director and Interim Chairman of L.I.C. He was also India MD & CEO of 'Reinsurance Group of America'. He was nominated by SEBI as the Chairman of the Metropolitan Stock Exchange of India. He has served as Director on the Boards of Mahindra & Mahindra Limited, Tata Power Co. Limited, Voltas Limited, IFCI Limited and Corporation Bank. He was a member on the Governing Council of the MDI, Gurgaon, Actuarial Institute of India & Chairman of The National Insurance Academy, Pune. He was also a member of the ‘Take Over Panel’ of SEBI.

Mr. Thomas Mathew is also a Director on the Boards of LIC (International) B.S.C.(c), Bahrain.

Dr. Rajani R. Gupte had done Ph. D in Economics from Gokhale Institute of Politics and Economics, Pune University, on the topic "The impact of trade liberalisation on the level of protection of Indian Industry".

Currently, Dr. Gupte is the Vice Chancellor of Symbiosis International University, Pune. During the period 2004-2012, she had also served as a Director of Symbiosis Institute of International Business (SIIB). She was actively involved in establishing SIIB as one of the leading B-Schools in India.

In the past, she has also worked as Director-Finance, in a Private Limited Company, wherein she has handled Finance operations seamlessly.

She had earlier served as a Dean and Pro Vice Chancellor of Symbiosis International University. She had also served as member WTO committee, Government of Maharashtra, Department of Horticulture during the period 2002-06. She was invited to be a part of a committee of eminent economists formed by NITI Aayog to interact with the Honourable Prime Minister on "Economic Policy: The Road Ahead" in January 2018.

Dr. R. Seetharaman, Former Chief Executive Officer of Doha Bank (2007 – 2022), is a prominent personality in the banking industry throughout the Middle East, an economic expert who has achieved remarkable success for his contributions to Banking, Trade, Investment, Economics, Environment, Social responsibility, Philanthropy and Charity. Post his successful Finance/Banking career of over 40 years in he has adopted six sustainable development goals from United Nations and has registered a Non-profit organisation “Seetharaman School of Sustainable Development” with the vision of contributing to global sustainable development.

He is a Chartered Accountant and holds certificate in IT systems and Corporate Management, whilst being a gold medalist in his graduation Bachelor of Commerce.

He is recipient of multiple doctorates from leading universities of the world, including 3 PhD’s. • PhD in Global Governance by European University • PhD in Green Banking and Sustainability from Sri Sri University • PhD in “Economic Implications of Global citizenship” by Sri Sharda Institute of Indian Management. • Doctorate of Laws by Washington College for his unique and valuable contribution to society in the field of banking and knowledge management • Doctorate of Honoris Causa from European University for his contribution to global governance and social responsibility • Doctor of Philosophy (Honorary) by Arts, Science and Technology University, Lebanon (AUL) for his valuable contribution to Banking and Finance

In 2017, he was recognized and conferred by the Government of India with the prestigious Pravasi Bharatiya Samman Award, the highest honour conferred on overseas Indians by the Government of India.

Dr. R. Seetharaman was honoured with the “Green Economy Visionary Award” in 2016 by Union of Arab Banks for his contribution in promoting green economies. He was also honoured “Global Excellence Award in Renewable Energy 2017” by the Energy and Environment Foundation.

He was conferred with the “Lifetime Achievement Award” by The Banker Middle East to honour his contribution to the industry and his support for the environment and the business.

He was also conferred “Life time Achievement Award” from the Institute of Directors at the Global Summit.

He was recently conferred “Life time Achievement Award” by the Entrepreneur Middle East at the “Leaders in Fintech Awards 2023” in Dubai on 12th June 2023.

He is a prominent personality in the banking industry throughout the Middle East and being a high-profile economist, he was invited on a regular basis by international media such as BBC, CNN, FOX, CNBC, Sky News, ABC and Bloomberg to share his views.

Ms. Nishi Vasudeva is an internationally acclaimed leader and is the first woman to chair an oil and gas company in India. She represented Hindustan Petroleum Corporation Limited ("HPCL") as Chairperson/Director on the board of several joint venture companies. She was responsible for developing the vision and long-term objectives, improving growth and profitability, driving a high-performance culture geared towards operational excellence and consistent value creation for shareholders & all stakeholders.

Prior to assuming responsibility as Chairperson & Managing Director, she served on HPCL Board as Director- Marketing and was responsible for pan India sales (B2B & B2C segments), brand building, efficient supply chain management, Infrastructure development and leading HPCL foray into new business lines.

Her career at HPCL included leadership positions in Marketing, Corporate Strategy, Planning and Information systems and she has led key business transformation & organizational restructuring projects. She was also an Independent Director of L&T Finance Limited and Chairperson and Independent Director of L&T Infra Credit Limited which stand merged with L&T Finance Limited (formerly known as L&T Finance Holdings Limited). She is the first Indian to be awarded the Global CEO of the year at Platt's Global Energy Awards 2015. She received the SCOPE Award for excellence and outstanding contribution to Public Sector Management from the Hon'ble President of India and was also recognized with Outstanding Women Manager Award by SCOPE. She has been a member in several committees for development of policy in the Oil industry and Hydrocarbon sector in India. She is BA (Economic Honours) from Delhi University and an MBA from IIM Calcutta with over 38 years of experience in the petroleum industry.

Mr. Pavninder Singh is a Managing Director with Bain Capital in the Mumbai office. He joined the firm in 2001 and has worked in the New York and Mumbai offices. He is a founding member of Bain Capital's India office and he co-leads the firms India and South East Asia investments. Prior to joining Bain Capital, he was the Co-CEO of Medrishi.com, a healthcare services site. Prior to that, he was a consultant at Mercer Management Consulting (now Oliver Wyman) where he consulted in the e-commerce, retail, and energy industries.

He is actively involved in the investments in L&T Finance Limited (formerly known as L&T Finance Holdings Limited), Quest Engineering, Emcure Pharmaceuticals, Hero FinCorp and Himadri Chemicals & Industries Ltd.

He received an MBA from Harvard Business School where he was a Baker Scholar. He received a BA Magna cum Laude from Harvard College.

Mr. Sachinn Joshi leads Finance & Accounts, Financial Planning & Analysis, Treasury, and Investor Relations functions as the Chief Financial Officer.

He has over 27 years of experience with expertise in finance and operations. These include setting up business & treasury operations, risk & credit control, human resource management, public listing, strategic planning and crisis management.

Previously, Mr. Joshi worked with Aditya Birla Finance as the Chief Financial Officer heading Treasury, Finance, Secretarial & Statutory Compliance, and Admin verticals. He was the Executive Director & CFO at Angel Group, heading strategy and finance. At IL&FS, he worked across various capacities including that of CFO, COO and Executive Director - Finance & Operations. In this role, he played pivotal role in setting up of wholesale and retail businesses at one of its subsidiary IL&FS Investsmart.

Mr. Joshi is a qualified Chartered Accountant and a Cost Accountant. He has also done his post-graduation in Law and has completed Business Leadership Program from IIM Calcutta. He is an avid runner and regularly participates in full as well as half marathons, loves travelling and watching sports particularly cricket.

Mr. Raju Dodti is the Chief Operating Officer (COO) at L&T Finance. Prior to being elevated to the position of COO Mr. Dodti was the Chief Executive (CE) of Wholesale & SME Finance. As a CE of Wholesale & SME Finance Mr. Dodti was involved in active divestment, down-selling and resolution assets in Infrastructure and Real Estate finance. Additionally, he was responsible for driving the growth of SME business with the aim of establishing L&T Finance as a lender of first choice in the SME lending space. He also led the Special Situations Group which has been involved in the recovery and resolution of identified stressed assets, de-focused book and exit of private equity investments.

Mr. Dodti joined L&T Finance in 2015 and over the years he has held key positions in legal and compliance. As the Group General Counsel of the company, he was instrumental in building the in-house practice group that dealt with advisory, transactional and litigation portfolio for the lending and non-lending businesses as well as leading regulatory compliance including overseeing regulatory inspections. Mr. Dodti has also provided strategic direction & leadership to the Corporate Communications, Facilities & Channel Management functions of L&T Finance, in the past. Mr Dodti also led strategic initiatives of L&T Finance including divestment of the Mutual Fund and Private Wealth business.

Prior to joining L&T Finance, he was with IDFC, Rabo India Finance, ABN AMRO NV, Societe Generale and Global Trust Bank, in varied roles across the legal function. With more than two decades of diverse experience across national and multi-national banks & financial institutions in private equity, project finance, infrastructure finance and treasury borrowings, Mr. Dodti has contributed extensively by maneuvering at the crucial junctures of the organizations’ legal commitments.

Mr. Dodti holds a Bachelor's degree in law from Government Law College, Mumbai University, and a Bachelor's degree in commerce from Mumbai University. He loves music, travelling and is a fitness enthusiast.

Mr. Santosh B. Parab leads the Legal function at LTF in his capacity as the Group General Counsel. He has over 28 years of experience with expertise in varied legal and compliance domains – Retail, Wholesale and Banking Finance, Borrowings & Treasury, Mergers & Acquisitions of entities in the Financial Sector, Equity Raising, Private Equity, Litigation, Recovery and Resolution.

Prior to joining LTFS, Mr. Parab worked with IDBI, IDFC, IDFC Bank and Altico Capital in different roles across the legal and compliance functions. He has played a pivotal role in all major milestones achieved during his tenure with previous organisations including banking license, acquisitions and divestments of various financial entities, mergers of bank with NBFC, working on resolution plan among others.

Mr. Parab holds a Master's degree in law from Mumbai University, and a Bachelor's degree in commerce from Mumbai University.

Mr. Sanjay Garyali is the Chief Executive - Urban Finance at L&T Finance.

With over 26 years of experience across diverse sectors, Mr. Garyali in his role as the head of the Urban Finance business oversees the urban lending vertical of the company including Housing Finance and Personal loans businesses. He is also responsible for expanding the already established Two-Wheeler Finance business. Driving retailisation to help accelerate the growth momentum of the company is a core focus area for Mr Garyali and he will be driving a high-performance culture, concentrating on achieving operational excellence, strengthening processes and adding value to all the stakeholders.

Mr. Garyali specializes in strategy, scaling businesses and has built a solid track record in building customer-centric organisations as well as distribution networks. With a deep understanding of retail businesses, he is well experienced across retail collections, consumer durables and Two-Wheeler sales, branch banking, retail liabilities, NRI banking as well as investments and mortgages. Mr Garyali has worked with Kotak Mahindra Bank, HDFC Bank, GE Capital and Idea Cellular in the past.

An MBA from Panjab University, Chandigarh, Mr. Garyali also holds a B.E. (Electronic and Communications) degree from BV College of Engineering, Pune.

Mr. Abhishek Sharma is the Chief Executive - SME Finance at L&T Finance. Prior to being elevated to the role Mr. Sharma led the Group’s digital transformation initiative. He has over 15 years of experience in Corporate Strategy, Product Development and Sales Leadership, across the Group, Rural Finance & Housing Finance businesses.

Previously, he has served as a Captain in the Indian Army for five years.

Mr. Sharma has a Post Graduate Diploma in Business Management from XLRI, Jamshedpur and holds a Bachelor’s Degree in Business Economics from the Delhi University.

He loves reading and is an avid sports enthusiast.

Ms. Sonia Krishnankutty is the Chief Executive – Rural Business Finance, Customer Service & Operations. She is spearheading the Rural Business Finance, in charge of building best-in-class portfolio, systems & processes and setting up new products to cater to our rural customers. She is also heading the Customer Service & Operations Function for all the Retail Businesses of LTF.

Having completed her MBA from XLRI, Jamshedpur, Ms Sonia has more than 21 years of experience in Banking and Financial sector handling various roles in business, recoveries, credit and risk across Retail Asset Financing, Priority Sector Lending and Rural Finance.

She joined LTF in 2008, and was pivotal in setting up and managing the Asset management services for handling hard collection for all Retail businesses. Post this, she continued her journey towards setting up and managing the company’s Risk Control Unit for all Retail businesses. Having successfully built and established two key functions, she moved on to head the Farm Equipment Finance business where she transformed the entire business function, enhanced book quality and reduced NPAs while improving the market share multi-fold, setting up manufacturer relationships and completing the turn-around of Farm Equipment Finance. Post her success in the Farm Equipment Finance, she took charge as Business Head for Micro Loans where she helped build and strengthen the portfolio. Under her leadership the business has gone through several critical phases while emerging with book and profitability intact.

Prior to joining LTFS, Ms. Sonia had worked with Bank of Baroda in various functions covering Credit, Collections and Business in Retail Lending.

Ms. Apurva Rathod is the Company Secretary - L&T Finance Limited (formerly known as L&T Finance Holdings Limited) and the Group Head – Secretarial & CSR and Sustainability, L&T Finance.

With an experience of around 20 years, she has worked across Legal, Compliance, Risk Management and Corporate Secretarial functions. She moved to LTF from Fidelity in 2012 and has been at the helm of Corporate Secretarial function since 2016. In addition, she has also been leading the Group CSR & Sustainability initiatives of LTF since March 2020.

She has been spearheading the strategic initiative of corporate restructuring of various lending entities within LTF and has also played a pivotal role in strengthening the corporate governance framework through robust processes and controls.

As the Head of CSR initiatives, she has been instrumental in scaling up “Digital Sakhi” – the flagship program of LTF aimed at Digital Financial Inclusion of rural women and creating sustainable livelihoods. The program has won prestigious awards in the categories of women empowerment and digital literacy, across multiple forums.

She is also leading the strategy and implementation of LTF sustainability initiatives and has been a key part of its journey in addressing various environmental, social and governance risks across business platforms.

In her previous stints, she has been associated with the mutual fund arm of Fidelity International in India and Kotak Mahindra AMC Limited and has played a key role in corporate M&A.

Ms. Apurva is a member of the Institute of Company Secretaries of India and holds a Bachelor's degree in law and a Bachelor's degree in commerce from the University of Mumbai.

Mr. Asheesh Goel is the Chief Executive for Farmer Finance at L&T Financial Services and comes with a rich work experience of more than 28 years in the financial services industry. Mr. Goel has an excellent track record of developing and transforming systems and processes that has helped businesses scale new heights. This has been achieved by reengineering the existing business model, remodelling and building robust architecture and transformation of the deliverance platform for meeting the core objective of the Organization. In his long span in the lending business, Mr. Goel has launched new asset financing verticals, built robust infrastructure along with laying down customer- centric initiatives to build reach and scale.

A Chartered Accountant by qualification, before joining L&T Financial Services in 2019, Mr. Goel was with Citibank for close to 19 years heading varied asset verticals.

Our Achievements & Awards

'Best Digital Transformation Initiative of the Year'

Best Digital Transformation Initiative of the Year

L&T Finance Holdings Ltd. wins "Best Digital Transformation Initiative of the Year" Award from 4th Annual BFSI Excellence Award 2023

'Fame National Award'

Fame National Award

Received the prestigious 'Fame National Award' in the category of "Women Empowerment" for our Digital Sakhi Project in the NBFC industry.

'Prestigious Brand of India'

Prestigious Brand of India

Recognized as a 'Prestigious Brand of India' at the Goal Fest Conclave 2023.

'Best Company in Sustainable CSR'

Best Company in Sustainable CSR

L&T Finance Holdings Ltd. wins "Best Company in Sustainable CSR" Award from Krypton Business Media on August 25, 2023.

'Best CSR Initiative'

Best CSR Initiative

L&T Finance Holdings Ltd. wins "Best CSR Initiative" Award from Banking Frontiers on August 25, 2023.

'Most Effective App for Consumer'

Most Effective App for Consumer

PLANET App by L&T Finance honored with the prestigious Gold award in the 'Most Effective App for Consumer' category at the 14th edition of IDMA

'Best Digital Transformation in Tractor Finance'

Best Digital Transformation in Tractor Finance

Recognized with the prestigious "Best Digital Transformation in Tractor Finance" award at the ITOTY Awards 2023

'4th Elets BFSI Game Changer Awards'

4th Elets BFSI Game Changer Awards

Awarded for Digitizing Rural Financial Services at the 4th Elets BFSI Game Changer Awards.

'Best Enterprise Security at the BFSI Technology Conclave 2023'

Best Enterprise Security at the BFSI Technology Conclave 2023

The award is a recognition of L&T Finance's efforts toward maintaining high standards of security in its operations

'Best Mobile App Experience of the Year for the PLANET App'

Best Mobile App Experience of the Year for the PLANET App

L&T Finance won the Best Mobile App Experience of the Year for the PLANET App at the Digital Customer Experience Confex and Awards 2023.

'Best Website Redesign & Experience'

Best Website Redesign & Experience

L&T Finance won the Best Website Redesign & Experience at the Digital Customer Experience Confex and Awards 2023.

'Socio CSR Film Festival'

Socio CSR Film Festival

Socio CSR film festival is the most Prestigious International CSR Film Festival for Corporate Social Responsibility.

312e9616-102b-437c-b256-d44e3d064839.png?sfvrsn=7876f76a_1)

'IAMAI's 13th India Digital Award for Digital Sakhi Programme'

IAMAI's 13th India Digital Award for Digital Sakhi Programme

IAMAI's India Digital Awards is all about celebrating and recognizing successful business outcomes using digital as a medium.

'Dun & Bradstreet ESG Award for ‘Business Sustainability’'

Dun & Bradstreet ESG Award for ‘Business Sustainability’

LTFH won the Dun & Bradstreet ESG Award for Business Sustainability. The Dun & Bradstreet ESG Awards 2023 acknowledged and recognizes companies for their ESG performance towards achieving Sustainable Development Goals.

'Social and Business Enterprise Responsible Awards (SABERA) for Digital Sakhi project'

Social and Business Enterprise Responsible Awards (SABERA) for Digital Sakhi project

SABERA is a one-of-its-kind annual social impact award, and summit that highlights ESG practices and sustainable development initiatives by corporates, nonprofits, and individuals.

'ICAI Sustainability Reporting Awards 2021-22'

ICAI Sustainability Reporting Awards 2021-22

The objective of “ICAI Sustainability Reporting Awards 2020-21” is to recognise, reward and encourage excellence of businesses in Integrated Reporting and acknowledge initiatives of businesses with a transformative contribution to the 2030 agenda for sustainable Development.

'ICC Environment Excellence Awards 2022 (Certification of Appreciation)'

ICC Environment Excellence Awards 2022 (Certification of Appreciation)

The Environment Excellence Award is one of the most coveted recognition that is bestowed to an organisation for excellent environment management by the Indian Chamber of Commerce (ICC). It acknowledges their commitment towards the social well-being of the people and the planet.

'ESG India Leadership Award 2022 for Overall Leadership Skills'

ESG India Leadership Award 2022 for Overall Leadership Skills

The ESG India Leadership Awards aims at recognising sustainable Indian companies and celebrate their achievements in ESG space.

'Mahatma Award for Transparency and Reporting 2022'

Mahatma Award for Transparency and Reporting 2022

The Mahatma Awards honors the organization that leverages its resources, expertise, and talent to make a positive impact for the larger good.

'The Economic Times Infra Focus Awards 2022 - Emerging Infrastructure Debt Financer'

The Economic Times Infra Focus Awards 2022 - Emerging Infrastructure Debt Financer

The ET Infra Focus Awards recognize and reward India's best Infrastructure Finance Companies exhibiting world-class leadership, outstanding business excellence, best practices, and exemplary vision.

'Maharashtra CSR Awards 2022 - 'Digital Sakhi Project''

Maharashtra CSR Awards 2022 - 'Digital Sakhi Project'

The Maharashtra CSR Awards organised by India CSR Network, in its maiden edition, recognised and honoured companies which have significantly benefited the society through its CSR activities.

'Socio CSR Film Festival 2022'

Socio CSR Film Festival 2022

- 'Best Social Community Project Film'

'The Asset Triple A Asia Infrastructure Awards 2020'

The Asset Triple A Asia Infrastructure Awards 2020

for Renewable Energy Acquisition Financing Deal of the Year

for Utility Deal of the Year

.jpg?sfvrsn=9ef0e8a4_1)

'FICCI Corporate Social Responsibility Award'

FICCI Corporate Social Responsibility Award

for "Women Empowerment"

'10th India Digital Awards'

10th India Digital Awards

for our flagship CSR initiative - Digital Sakhi

'Business Standard Social Excellence Awards'

Business Standard Social Excellence Awards

2019 - Socially Aware Corporate of the year for the scale and gender-inclusive work of its digital-literacy initiative in rural India, Digital Sakhi.

'Golden Peacock Award'

Golden Peacock Award

for "Corporate Social Responsibility"

.jpg?sfvrsn=ca59a577_1)

for "Excellence in Corporate Governance"

'L&T Finance Holdings featured in the Forbes India's Super 50 Companies 2018'

L&T Finance Holdings featured in the Forbes India's Super 50 Companies 2018

.png?sfvrsn=d75a596e_1)

'FINNOVITI 2018 Award'

FINNOVITI 2018 Award

for "SANGAM", an Innovation in the Two-wheeler business

for "Risk Management"

'RE - Finance Awards'

RE - Finance Awards

for "Best Renewable Energy Financier of the Year 2017 for both the Solar and Wind Sector."

'Oracle Excellence Award'

Oracle Excellence Award

for "Oracle Cloud Platform Innovation in Connect and Extend Applications with Mobile and Bots."

'Central Board of Irrigation and Power Awards (Govt. of India Organization)'

Central Board of Irrigation and Power Awards (Govt. of India Organization)

for "Best Finance Company in Renewable Energy at the annual"

'Middleware Excellence award for "Effective usage of Mobile Cloud Service" at Oracle Open World, San Francisco.'

Middleware Excellence award for "Effective usage of Mobile Cloud Service" at Oracle Open World, San Francisco.

'Association of Renewable Energy Agencies of States (AREAS)- An MNRE Body Award'

Association of Renewable Energy Agencies of States (AREAS)- An MNRE Body Award

for "Promoting renewable energy and contributing towards energy equity, energy accessibility and sustainability in the country".

'Achieved 6th position in Asian Private Banker League Table'

Achieved 6th position in Asian Private Banker League Table

Achieved 6th position in Asian Private Banker League TableAchieved 6th position in Asian Private Banker League Table

Media Centre

Pause In The Time Of uncertainty- Authored Article by Dr. Rupa Rege Nitsure

By Dr. Rupa Rege Nitsure

Publication : moneycontrol.

.png?sfvrsn=9b93652f_1)

L&T Finance Limited (formerly known as L&T Finance Holdings Limited) completes the divestment of its mutual fund business

By L&T Finance Limited (formerly known as L&T Finance Holdings Limited)

Publication : mint.

2ac9d59f-dcfd-4292-98c7-89ccef4129ad.png?sfvrsn=d3c0781e_1)

Opinion: Monetary Policy | RBI moves in tandem with global central banks

Views: On Sustainability I Mr. Dinanath Dubhashi, MD & CEO (Financial Express)

By Mr. Dinanath Dubhashi

Publication : financial express.

Opinion: Monetary Policy | RBI continues its flexible approach

Get The PLANET App Today!

All your loan needs can be addressed under one roof with the L&T Finance Planet App. Download the Planet App now for maximum convenience.

Download the PLANET App Now!

Wish to be a part of our family?

Drop your updated resume with us today!

Our Investors

Understand more about the titans that have our back.

Sustainability & CSR

Curious about our environmental, social and corporate governance goals?

Download the PLANET App

Connect with us:

- Quick Links

Cyan Banister leaves Founders Fund for Long Journey Ventures

Cyan Banister is leaving Founders Fund to become a member of a new early-stage investment and operations-focused firm called Long Journey Ventures .

The move, first reported by Axios , brings Banister back to her early-stage roots as an investor after years at the multi-strategy and multi-stage investment fund founded by Peter Thiel. Banister’s departure comes weeks after Founders Fund announced the close of two new funds which will invest $3 billion in early and growth-stage companies.

In a blog post announcing her decision to join Long Journey Ventures, Banister wrote candidly about the tensions between the institutional investment firm and her own instincts as an earlier-stage backer of startup companies.

“Taking me on was an experiment. I’m notoriously early stage. I’m also fiercely independent. Over the years the team worked with me every step of the way to make things work for me. This included working around my unique family life, my unique way of investing, giving me space that I really needed when I had a stroke, welcoming me back with warm arms when I recovered,” wrote Banister. “They did everything to try to make me happy. Everything.”

However, as Banister notes, “I’m not cut out for later stage investing. I tried. I really tried. I gave it everything I had. FF was always supportive, however they are also stage agnostic and generalists and hoped I would be able to do all stages and I can not. I just can’t.”

So, for Banister, it’s on to Long Journey Ventures. The founding team includes Lee Jacobs, who most recently served as an advisor with AngelList; Brian Balfour, the founder and chief executive at Reforge; Jonathan Bruck, a product developer at Pocket, IndexTank, and Xoopit; and Meebo and Dandelion Chocolate co-founder Elaine Wherry.

BAJAJ BROKING

- Open Demat Account

- Upcoming IPO

- Stock Screener

- SENSEX Today

- Brokerage Calculator

- Jio Financial

- Bajaj Finance

- Knowledge Center

Bajaj Finance Ltd. – Key Insights

Listen to our podcast: grow your wealth and keep it secure., blog summary.

- 1 About Bajaj Finance Ltd.

- 2 Overview of Bajaj Finance Ltd.

- 3 Bajaj Finance Ltd. Historical Timeline

- 4 Major Subsidiaries of Bajaj Finance Ltd.

- 5 Major Acquisitions by Bajaj Finance Ltd.

- 6 Products of Bajaj Finance Ltd.

- 7 Bajaj Finance Ltd. Shares

- 8 Conclusion

For many Indians, the world of finance and investments has a significant name in the form of Bajaj Finance Ltd. This giant of the non-banking financial sector has not only set high standards but has also played a key role in shaping the financial ethos of the nation. In this article, you will learn about the journey of Bajaj Finance Ltd., its inception, meteoric rise, diversifications, and commitment to redefining India’s financial industry.

About Bajaj Finance Ltd.

Also Read: Larsen & Toubro Ltd.

Overview of Bajaj Finance Ltd.

Beginning its journey in 1987, Bajaj Finance Ltd. quickly climbed the ranks to emerge as a leading figure in India’s non-banking financial segment. Beyond just numbers and balance sheets, their consistent dedication to customer-focused innovation shines brightly. Their diverse range of financial products ranges from personal loans, asset management, to wealth advisory. Their strategies are rooted in a deep understanding of the Indian market trends, enabling them to introduce innovative financial solutions that appeal to both urban and rural customers.

Bajaj Finance Ltd. Historical Timeline

1987: Bajaj Finance Ltd. was founded.

1990s: Starting as a two-wheeler finance company in 1987, Bajaj Finance realised early that consumers value time and are willing to pay a premium for faster financing options. Capitalising on this insight and rising consumerism, the company diversified into Durable Finance in the late 1990s, becoming a key player in India’s booming electronics market.

2000s: Bajaj Finance expanded its services, embraced technology, and formed strategic partnerships. By 2006, its disbursements reached ₹1,000 crore, and by 2008, its Assets and Shareholders’ Funds surpassed ₹1,000 crore figure. Reflecting its broader scope, the company rebranded as Bajaj Finance Limited in 2010.

2011-2013: Bajaj Finance revolutionised the market with the EMI Card and Flexisaver, optimising approval times from 15 minutes to 5 seconds. By 2014, their assets neared ₹20,000 crore. Emphasising governance and safety, they achieved top ratings from CRISIL and ICRA.

2014-2015: The company marked a 45% growth in customer acquisition, acquiring 4.92 million customers. Rural business and digital product financing expanded remarkably, alongside introducing loans for doctors using advanced analytical tools. BFL introduced advanced wealth management channels in collaboration with Bajaj Allianz and HDFC Life.

2015-2016: Bajaj Finance reported a 36% growth in customer acquisition, introducing urban gold loans and strengthening its EMI card business, focusing on diversifying and de-risking business ventures.

2016-2017: An impressive quarter was recorded with 2.5 million loans. Innovations like life care finance were introduced, collaborating with over 2,500 healthcare establishments across top-tier cities.

2017-2018: A commendable year with Bajaj Finance’s AUM crossing ₹75,000 crore. Significant movements were the ₹4,500 crore raising via Qualified Institutional Placement and a strategic 11% stake acquisition in Mobikwik. Digital innovations led to the inception of Bajaj Finserv Direct Limited, enhancing the digital customer experience.

2018-2019: Bajaj Finance Limited earned a ‘BBB’ long-term and ‘A-3’ short-term credit rating from S&P Global Ratings, equivalent to India’s sovereign rating.

2019-2020: The year experienced noteworthy achievements despite ending with a pandemic outbreak. Assets Under Management (AUM) ascended by 27% YOY, reaching Rs. 1,47,153 crore by 31st March 2020. The company’s reach expanded to 2,392 locations in India, with a customer base surpassing 40 million. Bajaj Broking was also initiated, aiming to expand the Loan Against Securities (LAS) business.

2021-2022: Crossed the significant milestone of 40,000 employees, asserting its stature as one of India’s largest Non-Banking Financial Companies in terms of its workforce.

Also Read: Bharti Airtel

Major Subsidiaries of Bajaj Finance Ltd.

- Bajaj Financial Services Ltd: A powerhouse in its own right, Bajaj Financial Services Ltd. is known for its diversified financial services. In addition to traditional services, the entity has made significant advancements in fields such as wealth management and insurance brokerage, providing comprehensive financial solutions.

- Bajaj Housing Finance Ltd: Recognised as a driving force in India’s housing sector, it holds prominence with its extensive range of home loans and refinancing solutions. Prioritising transparency and client contentment, it serves an array of clients.

- Bajaj Allianz Life Insurance: In a strategic partnership with the global powerhouse, Allianz SE, it presents a suite of life insurance solutions, specifically designed to cater to the needs of Indian customers.

- Bajaj Allianz General Insurance: Furthering the alliance with Allianz SE, this subsidiary offers a wide range of non-life insurance products, ranging from health to vehicle insurance.

Major Acquisitions by Bajaj Finance Ltd.

- Snapwork Technologies (2022): Situated in Mumbai, Snapwork Technologies is a renowned technology firm that specialises in offering digital lending solutions to a wide customer base. Bajaj Finance Ltd. recognised the potential and strategic fit of Snapwork’s expertise and acquired up to 40 per cent stake. This significant acquisition was executed at a valuation of ₹93 crore (equivalent to US$12 million).

- Mobikwik (2018): Mobikwik is a prominent mobile wallet service in India boasting an impressive user base exceeding 100 million. Seeing the exponential growth in digital wallet services and the vast reach of Mobikwik, Bajaj Finance Ltd. took a strategic step by purchasing a 10.83% stake in the company. The deal was struck for ₹225 crore, which translates to about US$30 million.

Products of Bajaj Finance Ltd.

- Flexi Loans: Reflecting the essence of financial adaptability, Bajaj’s Flexi Loans are designed keeping in mind the diverse and dynamic borrowing needs of Indians. By offering borrowers the freedom to draw funds as per their necessity and paying interest only on the utilised amount, it has revolutionised the loan landscape.

- Digital EMI Network Card: A perfect blend of technology and finance, this product offers smooth conversions of purchases into easily manageable instalments. With partnerships spanning over a million outlets across India, its widespread presence is undeniable.

- Fixed Deposits: At a time when financial security is of utmost importance, Bajaj’s Fixed Deposits emerge as a pillar of reliability. Their competitive interest rates coupled with unmatched trustworthiness make them a top choice for investors.

- Lifestyle Finance: Reflecting Bajaj’s understanding of India’s evolving aspirations, this product range addresses a variety of lifestyle needs. Be it a dream vacation, a grand wedding, or unexpected medical emergencies, Lifestyle Finance ensures that you remain financially secure.

Bajaj Finance Ltd. Shares

The stock of the company has undergone a split thrice between Nov 2006 and Sep 2016. Furthermore, the company has consistently paid dividends to its investors. This, combined with the robust financial performance, stable management, and positive investor opinion of the company, consistently keep Bajaj Finance shares high in demand. The company figures as one of the most-desired blue chip stocks in India. In 2023, the company had an earnings-per-share (EPC) payout ratio of 57% with a dividend yield of 0.42%.

Bajaj Finance Ltd.’s remarkable journey, marked by innovation and customer-centricity, showcases its commitment to driving financial inclusivity in India. Through its offerings, strategic expansions, and unwavering vision, it has continually shaped the finance sector. To think of Bajaj Finance Ltd. solely as a financial institution would be oversimplifying its significance. The outlook for the future shines promisingly, indicating continued growth and lasting impact.

Get Free Demat Account*

By continuing, I confirm that I have read & agree to the * Terms & Conditions and Privacy Policy

Verify It’s You!

Enter the 4-Digit OTP sent to +91 8080808080

OTP expires in 00:59

- Related Articles

- Top Articles

Analysis to Become a Pro Investor

28 Dec, 2023 | 4 Min. read

Women In Real Estate Investing (Investree)

28 Dec, 2023 | 5 Min. read

How To Check Prudent Corporate Advisory IPO Allotment Status

27 Dec, 2023 | 3 Min. read

How To Boost Credit Score? – Steps to Improve Creditworthiness

27 Dec, 2023 | 4 Min. read

Advantages and Disadvantages of Opening Multiple Demat Accounts

26 Dec, 2023 | 4 Min. read

7th CPC LTC: Leave Travel Concession Rules for Central Government Employees

7th Pay Commission: House Building Advance (HBA) Interest Rate FY 2023-24

26 Dec, 2023 | 5 Min. read

The Future of Trading: Exploring Bajaj Broking’s Demat Features

26 Dec, 2023 | 6 Min. read

7th Central Pay Commission Cpc Fitment Table

23 Dec, 2023 | 7 Min. read

All Categories

- Authorised Person

- Calculators

- Commodities

- Commodities Market Today

- Company Overview

- Demat Account

- Derivatives

- Global Market

- Global Market And News

- Gold Rate Today Updates

- Group Companies

- How To's

- IPO Allotment Status

- Intraday Trading

- Mutual Funds

- Personal Finance

- Refer and Earn

- Sectoral Blogs

- Share Market

- Share Market News

- Share Market Updates

- Technical Analysis

- Top Gainers And Losers

- Trading Account

- US Stock Market

- YouTube Blogs

Read More Blogs

6.5 Lac+ Users

4.1 app rating, 4 languages, ₹ 3500 cr mtf book.

Start Investing Today

OTP expires in: 00:59

- Margin Trading Facility

- US Investing

- Research and Advisory

- Margin Calculator

- MTF Calculator

- Earning Calculator

- Bajaj Broking Mobile App

- Trading Platform

- Knowledge Centre

Important Links

- Privacy Policy

- Terms & Conditions

- Investor Charter for Stockbrokers

- Investor Charter for Research Analyst

- Investor Charter for DP by NSDL

- Investor Charter for DP by CSDL

- CSDL E-Voting

- NSDL E-Voting

- Web Stories

- IPO Calendar

- Bajaj Finserv Ltd

- Bajaj Finance Ltd

- Bajaj Housing Finance Ltd

- Bajaj Finserv Direct Ltd

- Bajaj Allianz Life Insurance

- Bajaj Allianz General Insurance

Discover Bajaj Broking

- About Bajaj Broking

TOP POPULAR ON BAJAJ BROKING

Popular Stock

POPULAR STOCKS: Tata Steel Tata Motors Reliance Industries ITC State Bank of India Adani Enterprises Wipro HDFC Bank Tata Consultancy Services Infosys

Useful Links

Attention investors:.

“Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing."