- Money Transfer

- Rate Alerts

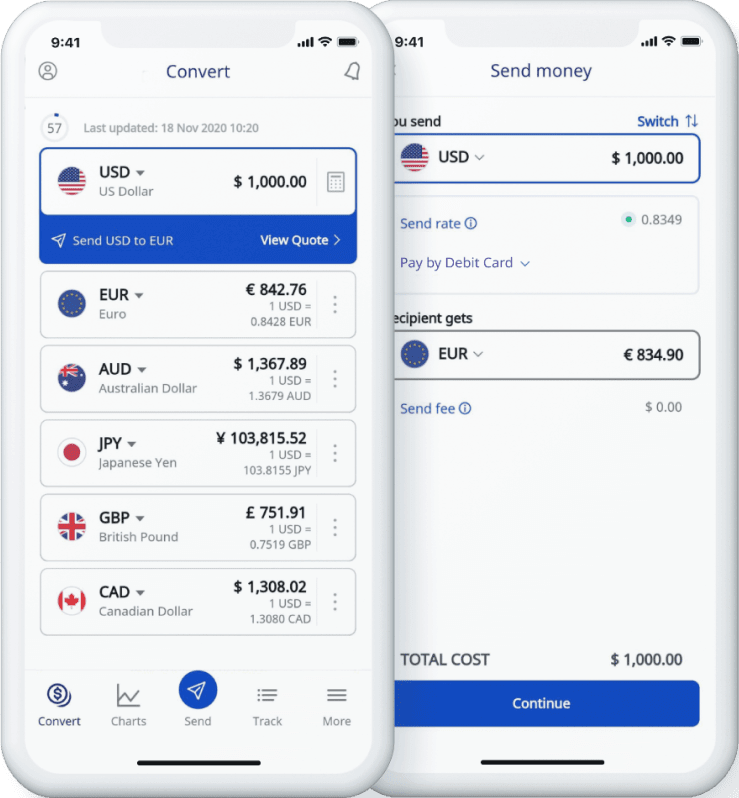

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

Maximise your holiday money

Compare exchange rates, find local currency bureaux and get the best deal on your foreign exchange

Travel Money

Currency buyback, currency cards, money transfers.

Whether you're looking to buy currency for an upcoming holiday, exchange leftover currency back to pounds, or send money to an account overseas; our currency comparisons can save you money by showing you the best deals available right now from the UK's biggest foreign exchange providers

Get the best exchange rate

From Argentine pesos to Vietnamese dong; get the best travel money deal by comparing the exchange rates, fees and commission from the UK's top currency brands.

Popular currency suppliers

The Currency Club exchange rates

ABTA Travel Money exchange rates

HSBC exchange rates

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

- M&S Travel Money

Buy Travel Money

Currency calculator.

Our currency calculator is a quick and easy way to check our latest foreign currency exchange rates.

What do I need to bring to collect my foreign currency?

The benefits of exchanging your holiday money with M&S Bank

Wide range of foreign currencies.

We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. See footnote * *

As well as the euro and US dollar , our range includes currencies such as the UAE dirham, Bulgarian lev , Turkish lira , Thai baht and Mexican peso .

Travel money sale now on!

Click & Collect sale on euro and US dollar available until 11 April 2023.

£150 minimum order. Exchange rates will still fluctuate daily during the sale period, but you’ll receive the best rate applicable on the date your order is placed. Rates shown when placing your order are sale rates. Offer subject to availability, buy back not included. Cancellation fee and full T&Cs apply.

SameDay Click & Collect

- Order between £150 and £2,500

- Euro and US dollars available to order and collect in over 450 stores *

- Order and collect euro , US dollars , Turkish lira , New Zealand dollar , Australian dollar , Thai baht , Canadian dollar , South African rand and UAE dirham, from our Bureau the same day

Find my nearest Click and Collect store

Click & Collect † See footnote †

- A wide range of currencies available to collect from our in store Bureaux See footnote * *

- Order and collect from the next day

Our best rates on euro and US dollar when you Click & Collect

To get an even better exchange rate on euro and US dollar , use our Click & Collect service. Pay now and lock in today's rate, then collect from a store at a time convenient for you.

CHANGE4CHANGE

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureaux, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a Bureau

Travel money buy-back service

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the Bureau de Change. That's all unused notes in any denomination we sell.

Find out more about M&S Travel Money Buy Back service

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureau stores, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a bureau

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the bureau de change. That's all unused notes in any denomination we sell. Proof of purchase may be required so please retain your receipt, just in case.

Up to 55 days' interest-free credit when purchasing with an M&S Credit Card See footnote ** **

Representative example: based on an assumed credit limit of £1,200, our 24.9% rate per annum (variable) for purchases gives a representative rate of 24.9% APR (variable). Credit is subject to status.

No cash advance fee when M&S Travel Money is purchased using an M&S Credit Card.

What you'll need to bring

To collect foreign currency you've purchased online, you will need:

- A valid UK photographic driving licence, passport or EU national identity card (Romanian & Greek National ID Cards are not accepted)

- Your card you used to place your order - both ID and payment card must have the same name

- Your order number (this can be found on your confirmation email)

To purchase foreign currency in one of our Bureaux, you will need:

- A valid UK photographic driving licence, passport or EU national identity card - both ID and payment card must have the same name

Find my nearest M&S Bureau de Change

Use the M&S Bank Bureau Finder to find your nearest M&S Bureau de Change and opening hours.

Find a Bureau de Change

Manage your existing travel insurance policy

Want to renew, change or cancel your policy or need to make a claim?

Find out more - about managing your travel insurance policy

Need some winter sun?

Planning a winter sunshine break? Use our handy guide to help with your planning.

Ready to hit the slopes?

Thinking about a skiing holiday in Europe, North America or Asia? Use our guide to help you with your trip.

Planning to travel with cash?

Our guide explains how much money you can take abroad.

Learn more about the euro

How many countries use the euro? When was the euro first introduced? Find out more.

Using your credit card abroad

Going on holiday? Get to grips with how you can use a credit card outside of the UK.

What is RFID blocking technology?

If you are concerned about having your passport or credit card skimmed whilst abroad learn more about RFID technology.

What influences exchange rates?

Discover what factors contribute to the exchange rates that you see today.

How to budget for long term travel

Going on a long-term trip? Read our guide on how to budget successfully to ensure you have the most memorable time possible.

Visiting a Christmas market?

Learn more about the many Christmas markets across Europe.

Frequently asked questions

Can i use a credit card to purchase travel money.

Yes, you can use a credit card to purchase travel money. However, please check with your card provider as they may apply fees or charges e.g. cash advance fees or other fees.

Our Bureaux accept the majority of UK issued major credit cards.

How much cash can I travel with?

You can learn more about taking cash in and out of Great Britain and declaring cash by visiting gov.uk .

Should I get foreign currency before I travel?

Buying your travel money before you travel can be an important part of pre-holiday preparation. You can use our Currency Converter to get the latest exchange rates across worldwide holiday destinations.

Where can I collect M&S Travel Money from?

You can collect M&S Travel Money from over 100 bureaux de change or from over 350 stores nationwide. You can find your nearest M&S Bureau de Change using our Bureau Finder .

Where can I get the best exchange rate?

Exchange rates change on a regular basis and vary depending on the currency you order. At M&S Bank, we offer our best rates for euro and US dollar via the Click & Collect service, where you can order your currency and collect from the next day in an M&S location local to you. If you order online before 4pm, you can collect the same day. For all other currencies, check our website for more information.

How much travel money can I order?

For orders placed via Click & Collect, there is a minimum £150 order and maximum of £2,500. For Bureau de Change walk-ups, there is no minimum order.

How do I confirm my Travel Money purchase using my M&S Credit Card?

There are three ways to verify your payments - you can use our M&S Banking App, a one-time passcode via text message or by using a card reader to verify your payment. Use our how-to videos or step-by-step guides to find out more.

Have a question about travel money or other travel products?

Ask our Virtual Assistant

Useful information

View exchange rates

Find out more about euro rates

Find out more about US dollar rates

Find out more about Australian dollar rates

Find out more about Canadian dollar rates

Find out more about New Zealand dollar rates

Find out about M&S Travel Insurance

Important documents

M&S Travel Money Terms and Conditions

M&S Travel Money Click & Collect Sale Terms and Conditions

You may require Adobe PDF reader to view these documents. Download Adobe Reader

* Subject to availability

** With the M&S Credit Card, you'll receive up to 55 days' interest-free credit when you pay your balance in full and on time each month.

† Next Day collection is subject to availability. Please confirm your collection date and location at the checkout.

Travel Money

- Clubcard Prices Clubcard Prices

Clubcard Prices are available for all currencies, just enter your Clubcard number on the next page. Full T&Cs below.

- Click & Collect Click & Collect

Collect for free from more than 350 Tesco stores with a Bureau de change.

- Home Delivery Home Delivery

Free delivery on orders worth £500 or more.

Exchange rates may vary during the day and will vary whether buying in store, online or via phone.

Select currency

Error: Please select if you have a Clubcard to continue

Do you have a Tesco Clubcard?

How much would you like?

Error: Please enter an amount between £75 and £2,500

Find a Store to get your Travel Money

With Click & Collect you can order your travel money online and pick it up from selected Tesco stores near you, or you can buy instantly from an in-store travel money bureau.

Enter a postcode or location

Search results

3 easy ways to purchase Travel Money

Click & collect.

- Order online and choose to collect from over 500 Tesco store locations Order online and choose to collect from over 500 Tesco store locations

- Pick a collection day that works for you Pick a collection day that works for you

- Order euro or US Dollars Order Euros or US Dollars before 2pm and you can pick-up from most stores the next day

About Click & Collect

Home delivery

- Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK

- Free delivery for orders of £500 or more Free delivery for orders of £500 or more

- Secure delivery via Royal Mail Special Delivery Secure delivery via Royal Mail Special Delivery

About Home Delivery

Buy in-store

- Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK

- Turn unspent travel money back into Pounds with our Buy Back service Turn unspent travel money back into Pounds with our Buy Back service

About Buy Back

Best Travel Money Provider 2023/24

Now in it’s 26th year and voted for by the public, the Personal Finance Awards celebrate the best business and products in the UK personal finance market. We’re delighted that you voted us as Best Travel Money Provider 2023/24.

Additional Information

Ordering and collection.

You can pick a collection date when you're ordering your money. Order before 2pm and you can pick up Euros and US Dollars from most Tesco Travel Money bureaux the next day. Other currencies can take up to five days. Alternatively, you can order any currency for next weekday delivery to most of the selected customer service desks.

Please make sure you collect your money within four days of your chosen date. If you don't, your order will be returned and your purchase will be refunded, minus a £10 administration charge.

Will I be charged if I cancel my order?

Collection fees

Click and collect from stores with a Bureaux de change:

- Free for all orders

For non-bureaux stores with a click and collect function:

- £2.50 for orders of £100.00 - £499.99

- Free for orders of £500 or more

What to bring

For security, travel money will need to be picked up by the person who placed the order.

- a valid photo ID – either a passport, EU ID card, or full UK driving license (we do not accept provisional driving licenses)

- your order reference number

- the card you used to place the order (you’ll also need to know the card’s PIN)

Home Delivery

We can send your travel money directly to you via secure Royal Mail Special Delivery. You can even pick the delivery date that suits you best.

We also offer next-day home delivery on all currencies to most parts of the UK if ordered before 2pm Monday-Thursday.

Check the Royal Mail site to find out if your postcode is eligible for next day delivery

Delivery costs

£4.99 for orders of £100 - £499.99 Free for orders of £500 or more

- You’ll need to make sure there’s someone at home to sign for your delivery.

- Bank holidays and public holidays will affect delivery times.

- We are unable to cancel or amend home delivery orders after they have been placed.

Clubcard Prices

Clubcard Prices are available on the sell rate only for currencies in stock online, on your date of purchase. The Clubcard Price will be better than the standard rate advertised online on the date of purchase. When purchasing online you must enter a valid Clubcard number to obtain the Clubcard Price rate. Exchange rates may vary whether buying in store, online or by phone.

Clubcard Prices apply to foreign currency notes in stock on your date of online purchase. Due to constant market and currency fluctuations, rates on the date of purchase cannot be compared to another day’s rates. The actual rate you receive may vary depending on market fluctuations. Clubcard data is captured by Travelex on behalf of Tesco Bank.

Check out the Tesco Bank privacy policy to find out more.

Buying foreign currency using a credit or debit card

No matter how you purchase your travel money, whether it be in store, online or over the phone, you will not be charged any card handling fee by us. However, regardless of your card type, your card provider may apply fees, e.g. cash advance fees or other fees, so please check with them before you purchase your travel money.

Click & Collect cancellations

You can cancel a Click & Collect order any time prior to collection. We'll refund you with the full Sterling amount that you paid for your order, unless you cancel less than 24 hours before your collection date, in which case we'll charge a £10 late cancellation fee.

We are unable to refund any fees charged by your card issuer, so please contact them if you have any further queries.

When you get home, we'll buy your travel money back

Let us turn your unspent holiday money into Pounds. It couldn't be simpler.

Just pop into one of our in-store Travel Money Bureaux when you get home. We buy back all the currencies we sell in most banknote values and also the Multi-currency Cash Passport™. Buy back rates may vary during the day.

It doesn't matter where you bought your travel money, even if it wasn't from a Tesco Travel Money Bureau, we'll still buy it back.

More about currency buy back

How our Price Match works

If you find a better exchange rate advertised by another provider within three miles of your chosen Tesco Travel Money Bureau, on the same day, we'll match it.

Price Match only applies in store on a like-for-like basis on sell transactions and does not apply to any exchange rate advertised online or by phone. This is not available in conjunction with any other offer. We reserve the right to verify the rate you have found and the three mile distance (using an appropriate route planning tool).

See full terms and conditions below.

Tesco Travel Money is provided by Travelex

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

How much travel money will I need?

Whether it’s a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We’ll help you manage your travel budget like a pro.

The text on this page has been made available under the Creative Commons Attribution-ShareAlike License and Creative Commons Licenses

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans . You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important , as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions , so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance, travel money, exchange rate calculator.

Nectar members get better rates on travel money*

Our travel money rate sale is now on

Ends 09:30am Thursday 2 May 2024. Only available on foreign currency bought online or by phone. Not available instore, on sterling, or on travel money card home delivery orders and reloads. Sale rates are calculated by reducing our margin on the rates you would otherwise get. Currency fluctuations may cause exchange rates to vary during the sale period.

- Europe - Euro (EUR)

- USA - U.S. Dollar (USD)

- United Arab Emirates - UAE Dirham (AED)

- Australia - Australian Dollar (AUD)

- Canada - Canadian Dollar (CAD)

- New Zealand - New Zealand Dollar (NZD)

- Switzerland - Swiss Franc (CHF)

- Thailand - Thai Baht (THB)

- Aland Islands - Euro (EUR)

- American Samoa - U.S. Dollar (USD)

- Andorra - Euro (EUR)

- Anguilla - East Caribbean Dollar (XCD)

- Antigua and Barbuda - East Caribbean Dollar (XCD)

- Austria - Euro (EUR)

- Bahrain - Bahraini Dinar (BHD)

- Barbados - Barbadian Dollar (BBD)

- Belgium - Euro (EUR)

- Bulgaria - Bulgarian Lev (BGN)

- Chile - Chilean Peso (CLP)

- China - Chinese Renminbi (CNY)

- Cook Islands - New Zealand Dollar (NZD)

- Costa Rica - Costa Rican Colon (CRC)

- Croatia - Euro (EUR)

- Cyprus - Euro (EUR)

- Czech Republic - Czech Koruna (CZK)

- Denmark - Danish Krone (DKK)

- Dominica - East Caribbean Dollar (XCD)

- Dominican Republic - Dominican Peso (DOP)

- Ecuador - U.S. Dollar (USD)

- El Salvador - U.S. Dollar (USD)

- Estonia - Euro (EUR)

- Faroe Islands - Danish Krone (DKK)

- Fiji - Fijian Dollar (FJD)

- Finland - Euro (EUR)

- France - Euro (EUR)

- French Guiana - Euro (EUR)

- French Southern Territories - Euro (EUR)

- Greece - Euro (EUR)

- Greenland - Danish Krone (DKK)

- Grenada - East Caribbean Dollar (XCD)

- Guadeloupe - Euro (EUR)

- Guam - U.S. Dollar (USD)

- Haiti - U.S. Dollar (USD)

- Holy See (Vatican City State) - Euro (EUR)

- Hong Kong - Hong Kong Dollar (HKD)

- Hungary - Hungarian Forint (HUF)

- Iceland - Icelandic Króna (ISK)

- Indonesia - Indonesian Rupiah (IDR)

- Ireland - Euro (EUR)

- Israel - Israeli New Sheqel (ILS)

- Italy - Euro (EUR)

- Jamaica - Jamaican Dollar (JMD)

- Japan - Japanese Yen (JPY)

- Jordan - Jordanian Dinar (JOD)

- Kenya - Kenyan Shilling (KES)

- Kiribati - Australian Dollar (AUD)

- Korea, Republic of - South Korean Won (KRW)

- Kuwait - Kuwaiti Dinar (KWD)

- Liechtenstein - Swiss Franc (CHF)

- Lithuania - Euro (EUR)

- Luxembourg - Euro (EUR)

- Malaysia - Malaysian Ringgit (MYR)

- Malta - Euro (EUR)

- Marshall Islands - U.S. Dollar (USD)

- Martinique - Euro (EUR)

- Mauritius - Mauritian Rupee (MUR)

- Mayotte - Euro (EUR)

- Mexico - Mexican Peso (MXN)

- Micronesia, Federated States of - U.S. Dollar (USD)

- Monaco - Euro (EUR)

- Montenegro - Euro (EUR)

- Montserrat - East Caribbean Dollar (XCD)

- Nauru - Australian Dollar (AUD)

- Netherlands - Euro (EUR)

- Niue - New Zealand Dollar (NZD)

- Norfolk Island - Australian Dollar (AUD)

- Northern Mariana Islands - U.S. Dollar (USD)

- Norway - Norwegian Krone (NOK)

- Oman - Omani Rial (OMR)

- Palau - U.S. Dollar (USD)

- Panama - U.S. Dollar (USD)

- Philippines - Philippine Peso (PHP)

- Pitcairn - New Zealand Dollar (NZD)

- Poland - Polish Zloty (PLN)

- Portugal - Euro (EUR)

- Puerto Rico - U.S. Dollar (USD)

- Qatar - Qatari Riyal (QAR)

- Saint Barthélemy - Euro (EUR)

- Saint Kitts and Nevis - East Caribbean Dollar (XCD)

- Saint Lucia - East Caribbean Dollar (XCD)

- Saint Martin (French part) - Euro (EUR)

- Saint Vincent and the Grenadines - East Caribbean Dollar (XCD)

- San Marino - Euro (EUR)

- Saudi Arabia - Saudi Riyal (SAR)

- Singapore - Singapore Dollar (SGD)

- Slovakia - Euro (EUR)

- Slovenia - Euro (EUR)

- South Africa - South African Rand (ZAR)

- Spain - Euro (EUR)

- Sweden - Swedish Krona (SEK)

- Taiwan - New Taiwan Dollar (TWD)

- Timor-Leste - U.S. Dollar (USD)

- Tokelau - New Zealand Dollar (NZD)

- Türkiye - Turkish New Lira (TRY)

- Turks and Caicos Islands - U.S. Dollar (USD)

- Tuvalu - Australian Dollar (AUD)

- Vietnam - Vietnamese Dong (VND)

- Virgin Islands, British - U.S. Dollar (USD)

- Virgin Islands, U.S. - U.S. Dollar (USD)

- No matches found

Exchange rates may vary depending on whether you buy instore, online or by phone.

^ Travel money cards are available on selected currencies only.

Buy travel money

Buy, exchange money and order foreign currency online, by phone, or at our bureaux.

How to get travel money with Sainsbury’s Bank

Need holiday money? Order currency online, by phone or visit a Sainsbury’s store with a bureau today. Or get a Sainsbury’s Bank Travel Money Card for easy and secure spending overseas.

There are various ways to buy travel money with Sainsbury’s Bank. Choose the method that’s easiest for you.

1. Buy currency online for home delivery. 2. Order currency online and collect instore. 4-hour click and collect available. T&Cs apply. 3. Buy currency via telephone. 4. Visit one of our bureaux to buy currency in a Sainsbury’s store.

Buy a prepaid travel money card

Our travel money card makes it safe and easy to manage and spend your holiday money. 1. Order for collection – Collect your travel money card from your nearest Sainsbury’s Bank bureau. 2. Order for delivery – We’ll send your travel money card straight to you. 3. Download the app or log in online – Check your balance, exchange between currencies, top up and manage your account.

Where can you get foreign currency with Sainsbury’s?

Get travel money delivered to you.

Order online or by phone and we’ll mail your holiday money to you securely via special delivery. Order more than £400 of foreign currency and get free delivery.

Collect travel money instore

Visit a store with an instore travel bureau to collect your travel money on your next weekly shop.

In a hurry? You can now order and collect Euros, US Dollars, and Travel Money Card pre-paid orders in as little as 4 hours with our click and collect travel money service^.

Click and collect currency the same day at a Sainsbury’s Bank travel money bureau when you:

- Order Euros, US Dollars, or a Travel Money Card

- Place your order on a Monday to Friday (excluding Bank Holidays), and

- Order at least 4hr before the bureau’s scheduled closure time

For orders made outside of this period, or for any other currency, you will be able to select your preferred collection date when placing your online order.

Get your travel money card delivered to you

We’ll send your travel money card straight to you, with your PIN arriving separately for security.

Visit one of our bureaux

We have stores with instore travel bureaux across the UK where you can pick up holiday money on the day.

Why use Sainsbury’s Bank for foreign currency

- Wide range of currencies, including USD and EUR We offer over 50 different foreign currencies, so it’s easy to get the holiday money you need.

- Nectar Prices Nectar members get better exchange rates both online, on the phone and at our bureaux. See our Nectar member benefits .*

- Currency buy-back Got holiday money left over when you get home? We’ll buy back most foreign currency, so you’re not out of pocket.

- Pick up your travel money in one of our stores Within travel bureaux across the UK, it’s convenient to pick up holiday money as you shop with Sainsbury’s Bank.

- Multiple ways to order and receive travel money Order online or by telephone, collect instore or receive holiday money by post – the choice is yours.

- 24/7 telephone assistance and online portal Our team are on hand to help with your travel money card any time of the day or night, no matter where you are in the world.

- Access to Western Union You can send an international money transfer instore with Western Union Money Transfer® services .

Choose your foreign currency

From Euro and US Dollar to Swedish Krona and Japanese Yen, we have more than 50 foreign currencies from all over the world.

Take a look at our most popular currencies.

Add to your travel money card to withdraw and spend on holiday.

US Dollar (USD)

Order by telephone and receive your travel money in the post.

Dirham (AED)

Order online for bureau collection or buy directly instore.

Turkish Lira (TRK)

Buy travel money at one of our bureaux de change.

Thai Baht (THB)

Order currency online and get free delivery over £400.

Canadian Dollar (CAD)

Get a travel money card instore to use on holiday in Canada.

Frequently asked questions

Are there any administration fees.

No, we don't charge any administration fees when you order currency from us.

Will I be charged for using my credit/debit card?

No, we don’t charge any extra when you buy foreign currency by card.

Some card providers may charge a cash advance fee and interest for buying currencies. Cash advance fees will not show on your travel money order, but you’ll be able to see them on your card statement. If you’re not sure, you should check with your card issuer.

There is no cash advance fee when you use a Sainsbury’s Bank Credit Card. No interest will be charged, as long as the full outstanding balance on the credit card is cleared during the current billing cycle. If a balance remains on the account at the end of the billing cycle, interest will be charged and may apply to the currency purchased.

Do I get any benefits for being a Nectar member?

Yes, you do. If you tell us your Nectar card number when you place your order, we’ll give you a better exchange rate*. Not a Nectar member? Sign up today .

When will I receive my home delivery order?

You can select a specific working day delivery date up to seven days in advance. Please note Saturday deliveries are not guaranteed. Also, if you’ve chosen a Monday delivery, Royal Mail may try to deliver on Saturday.

The earliest day you’ll be able to select for delivery is:

What are the home delivery fees?

How much money can i order online.

Orders for collection at any Sainsbury's Bank Travel Money Bureau or for home delivery are subject to a maximum value of £4,500 per person per day.

All home delivery orders are subject to a minimum value of £100** and a maximum of £2,500. There is no minimum order value for orders for collection at a Sainsbury's Bank Travel Money Bureau.

How long will my travel money card take to arrive?

We’ll send out your travel money card as soon as you order it, so it should be with you in three to five working days. You can also get a travel money card immediately at our bureaux if you need yours at short notice.

Can I exchange unused travel money?

Yes, we can buy back your foreign currency. Just bring your unused currency back to a Sainsbury’s Bank travel money bureau and we’ll exchange it back to sterling. Please note that we can buy back notes but not coins.

Terms and conditions

*Nectar members receive better exchange rates on single purchase transactions of all available foreign currencies. Excludes travel money card home delivery orders and online reloads. Exchange rates may vary depending on whether you buy instore, online or by phone.© You need to tell us your Nectar card number at the time of your transaction. No cash alternative is available. We reserve the right to change or cancel this offer without notice.

**You can order currency for a secure home delivery by 1pm on the day of your choice by Royal Mail (Mon- Sat). For next day delivery your order needs to be confirmed before 2pm (Mon- Fri). Please note that whilst Royal Mail make every effort to delivery on schedule, we cannot guarantee this as it is beyond our control. Highlands and Islands (including Channel Islands) are not guaranteed next day delivery. Delivery is free on all cash orders £400 or more (£4.99 for orders between £100 and £399.99). The minimum order for home delivery is £100. The delivery day quoted is dependent on the order day being a working day; if one of those days is a public holiday then additional day(s) will be added accordingly. All home delivery orders are sent via Royal Mail Special Delivery, unless we advise you otherwise, to your billing address, and a signature will be required upon delivery. A valid telephone number is required for home delivery. ^ For Euro, US Dollar and Travel Money Card only:

If you selected same-day collection your order will be available 4 hours from the initial order confirmation email received or if your order was placed before 6 am then the earliest your order will be available to collect is from 10 am. Please allow at least 4 hours for your order to be processed. Remember to check the bureau opening hours before collecting your order.

If you selected tomorrow or a future date your order will be ready from 10 am on your chosen collection date. For all other currencies

Your order will be available from 2.00 pm on your chosen collection date.

Your order should be collected within 72 hours or will be subject to cancellation. Sainsbury's Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Find more Terms & Conditions here

Nectar prices for Nectar members*

- Moscow Tourism

- Moscow Hotels

- Moscow Guest House

- Moscow Holiday Homes

- Moscow Flights

- Moscow Restaurants

- Moscow Attractions

- Moscow Travel Forum

- Moscow Photos

- All Moscow Hotels

- Moscow Hotel Deals

- Things to Do

- Restaurants

- Holiday homes

- Travel Stories

- Add a Place

- Travel Forum

- Travellers' Choice

- Help Centre

Exchange rate at Domodedovo airport? - Moscow Forum

- Europe

- Russia

- Central Russia

- Moscow

Exchange rate at Domodedovo airport?

- India Forums

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Holiday Rentals

- Central Russia forums

- Moscow forum

Hi can anyone tell me what the current exchange rate is from sterling to rubles at Domodedovo airport please? I know it won;t be as good as in the city, but I'm trying to compare to what I can get in the UK before I set off, for immediate purchases.

Thank you :)

Why not just draw rubles from an ATM using your bank card like most people do?

Per Marassa's hint, please refer to the MONEY "article" top right of this page for a wide variety of points around money in Russia...ATMs offer the most competitive "legal" exchange rates I have seen based on my years of extensive usage...(OK, every summer for 2 weeks!)...

Thanks for replies :)

[Why not just draw rubles from an ATM using your bank card like most people do?]

- because the bank charges 5% and I'm struggling to see how that can be the best deal!

> the bank charges 5%

I didn't know there's only one bank left in the UK, there seemed to be plenty when I last was there! :)

Best rates are 48-49 rubles per pound, but I'm not sure you will be able to find such rates in the airport. But 44.8 is a rip off, it can't be worse than that!

http://cash.rbc.ru/?pagerLimiter=70&order=DESC&sortf=BID&city=1¤cy=321&sum=1&time=60&positionData=2

I have priced out buying foreign currency (rubles) in US, and it is a WAY worse deal...for sure, it will be at a currency kiosk, and if one is able to buy at one's bank, unless you buy a HUGE amount of currency, very likely you will get a very bad rate...

Again, I have done down to the penny tests of the various rates for RUBLES, ATM, credit card, and even, yes, getting currency "abroad", and hands down ATM wins. Maybe if one is talking a major currency (no slam against the ruble intended), like pounds or euros, story would be different, but I even doubt that...

Sorry, missed the point about the 5%...are you using a "debit" card or credit card for this? Even credit cards only typically charge 3%...could be a country thing, or, could be "time to change banks"...based on a number of posts here, and PERHAPS, yes, "US bank biased", but I believe very few people have ended up getting whacked with any fees - or, if they do, it is one of those $3/use- not %- (again, US)...admittedly, if you take out $50 worth at a time, not a good deal!

I have found that the Russian ATM-BANK charges about a $2-$3 fee. And my host (USA-BANK) also charges about the same. So a 1 time use can cost up to $6? You can use your charge card for hotels & such to save some fee's, but you will need some cash to carry around. ATM's & such are down much more than in USA or Europe. So when I land at SVO, I exchange enough $ into Rubles that I may need for walking around money. And exchange it back at SVO before I fly out. You need enough cash to at least get you to your hotel, and pay for food and such. Russia is not the USA or Europe, as in not every corner store takes a C-C & or debit card! I hope this helps? Good Luck. AIM.

We must have been to different Moscows or different SVOs (or maybe have very different ideas of what "about the same" means). Whenever I am at SVO (at least three times a year), the exchange rates at the exchange booths are shocking:

http://lh3.googleusercontent.com/-4FfSYIELSX4/Ttj7gRDl4iI/AAAAAAAACj4/LO7a6A17mKw/s800/IMAG0012.jpg

If you absolutely have to exchhange currency at SVO, rather look for MasterBank exchange machines (look like ATM), they display much better rates, but I have never actually tried them so can't be sure they don't add some commission on top:

http://lh6.googleusercontent.com/-NFNCOJ_nF7E/Ttj7gR4cUcI/AAAAAAAACj0/jJr882TlQo0/s800/IMAG0015.jpg

- Train Booking Moscow to St. Peter 24 April 2024

- Planning trip to Russia 09 April 2024

- SIM card. Russian SIM cards, do they still work in the UK? 09 April 2024

- Union Pay debit card 27 March 2024

- Russian trying to book a hotel in Jerusalem 14 March 2024

- Dual Citizen Arrested in Russia 12 March 2024

- about clothes 27 February 2024

- NOTE - border crossing from Finland into Russia closed 09 February 2024

- Snow boots in Red Square 04 February 2024

- Travelling to Moscow & Murmansk with toddle in winter 02 February 2024

- Anyone traveling from London to Moscow this week ? 27 January 2024

- Booking accommodation 11 January 2024

- Traveling friends (Designers preferred) :) 05 January 2024

- Are shops and things closed during Christmas and New Week ? 15 December 2023

- Lenin's Mausoleum - entrance? Opening hours? 5 replies

- MS Volga Dream between St Petersburg and Moscow 37 replies

- Transit visa requirement 46 replies

- Best thing to buy in Moscow 6 replies

- Getting Copy of Russian Birth Certificate for my Stepson 19 replies

- Any express shuttle-bus between Domodedovo & Sheremetyevo? 2 replies

- Kremlin-Hours and cost for guided tour? 2 replies

- Sheremetyevo Airport - transfer from terminal F to D 103 replies

- best nightclubs? 7 replies

- Visa from India 13 replies

- Where can I get initial answers to ANY question?

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Today’s top money market account rate roundup: Earn up to 5.12% — April 26, 2024

Taylor Tepper

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Published 8:39 a.m. UTC April 26, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

Money market accounts (MMAs) offer a middle ground for savers searching for higher interest rates than those typically found offered by traditional savings accounts, while also desiring more account flexibility. MMA rates nudged slightly upward over the last week, according to Curinos data, and are considerably higher than this time last year, thanks to the Fed’s year-long effort to moderate inflation.

Money market account rates

Money market accounts with a $10,000 minimum balance currently offer an average APY of 0.59%, per Curinos data, slightly higher than last week.

The highest rate in the Curinos dataset sits at 5.12%, so you may be able to find higher rates in your own research.

If you were to invest $10,000 into an MMA with a 5.12% interest rate that compounds daily, you would earn more than $520 in interest over a year, assuming no withdrawals or additional contributions are made.

Money market accounts vs. savings accounts

Money market account rates usually offer higher yields than what you’ll find on savings accounts, especially those offered at brick-and-mortar banks . MMAs often require a higher minimum deposit or balance, but banks and financial institutions typically reward clients for maintaining larger balances with higher rates.

Currently, the average rate on an MMA with a $10,000 minimum balance in Curinos’ dataset stands at 0.59% APY, while the average rate you’ll find on a savings account with a $10,000 balance is a mere 0.24% APY.

Keep in mind that savings accounts are better suited to achieve a particular goal, such as maintaining an emergency fund or amassing a down payment on a home. By placing your funds in a high-yield savings account , you’ll earn interest and you’ll hopefully also be less inclined to spend the money.

What is a money market account?

Think of a money market account as a mixture between a savings and checking account , often offering competitive interest rates and typically requiring a higher minimum balance. You can enjoy the perks of a high-yield savings account while having access to a debit card and check-writing, all with FDIC insurance up to $250,000. Though not designed for everyday spending, these accounts provide some flexibility with limited transactions.

Methodology

To establish average money market account rates, Curinos focused on accounts intended for personal use. Money market accounts that fall into specific categories are excluded, including promotional offers, relationship-based accounts, private, youth, senior and student/minor. The average money market account rates quoted above are based on a $10,000 minimum deposit amount.

Frequently asked questions (FAQs)

Depending on the bank, you might be able to open your account online. You’ll need to provide some basic information, such as your name, address, date of birth, Social Security number and phone number. Additionally, you’ll need to supply the account number and routing number of the bank you intend to use for your initial deposit if you’re funding a new money market savings account online.

Once your account is opened and funded, you can manage it just like any other bank account. This includes regularly reviewing your statements or account activity, setting up transaction alerts and linking it to your other bank accounts for seamless transfers.

In some cases, yes. Some banks or credit unions may charge monthly maintenance fees, which can sometimes be waived if you maintain a certain minimum balance.

Others may impose fees for excess transactions, as MMAs are subject to federal regulations limiting the number of certain types of transactions (such as transfers and withdrawals) to six per month. It’s essential to review the account terms and fee structures before opening a money market account to ensure you’re getting the best possible deal for your financial situation.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Taylor Tepper is the lead banking editor for USA TODAY Blueprint. Prior to that he was a senior writer at Forbes Advisor, Wirecutter, Bankrate and Money Magazine. He has also been published in the New York Times, NPR, Bloomberg and the Tampa Bay Times. His work has been recognized by his peers, winning a Loeb, Deadline Club and SABEW award. He has completed the education requirement from the University of Texas to qualify for a Certified Financial Planner certification, and earned a M.A. from the Craig Newmark Graduate School of Journalism at the City University of New York where he focused on business reporting and was awarded the Frederic Wiegold Prize for Business Journalism. He earned his undergraduate degree from New York University, and married his college sweetheart with whom he raises three kids in Dripping Springs, TX.

Jenn Jones is the deputy editor for banking at USA TODAY Blueprint. She brings years of writing and analytical skills to bear, as she was previously a senior writer at LendingTree, a finance manager at World Car dealerships and an editor at Standard & Poor’s Capital IQ. Her work has been featured on MSN, F&I Magazine and Automotive News. She holds a B.S. in commerce from the University of Virginia.

Best national banks of April 2024

Banking Dori Zinn

Capital One bonuses and promotions of April 2024

Banking Emily Batdorf

How to make a budget

Banking Jacqueline DeMarco

Best bank bonuses & promotions of April 2024

Best credit unions of April 2024

The 7 best budgeting apps of April 2024

Betterment cash management account review 2024

No-penalty CD vs. savings account: Which should you choose?

Banking Bob Haegele

Alliant Credit Union review of 2024

Banking Cassidy Horton

Wells Fargo vs. Bank Of America: Which is best for you?

KeyBank review of 2024

YNAB budgeting app review

Banking John Egan

PNC Bank promotions of April 2024

Best compound interest accounts

Banking Lauren Ward

Discover Bank promotions of April 2024

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Where Americans Are Traveling in 2024: By the Numbers

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Americans are traveling abroad in droves.

The number of U.S. citizens flying to international destinations reached nearly 6.5 million passengers in March, according to the International Trade Administration. That’s the highest March total in over five years and shows that the post-pandemic “revenge travel” trend is the new normal.

It wasn’t just March, which usually sees a spike in international departures for spring break. In every month of 2024 so far, more Americans left the country than last year and 2019. These trends point to a blockbuster summer for overseas travel.

Nearly half of Americans (45%) plan to travel by air and/or stay in a hotel this summer and expect to spend $3,594 on average, on these expenses, according to a survey of 2,000 U.S. adults, conducted online by The Harris Poll and commissioned by NerdWallet.

That's despite rising travel prices that have caused some hesitancy among would-be travelers. About 22% of those choosing not to travel this summer cite inflation making travel too expensive as a reason for staying home, according to the poll.

So where are traveling Americans going? And what does it mean for those looking to avoid crowds of tourists and higher travel prices?

New travel patterns

Nearly every region in the world saw an increase in U.S. visitors in March 2024 compared with March 2023, according to International Trade Administration data. Only the Middle East saw a decline of 9%. Yet not every region saw the same year-over-year bump. U.S. visitors to Asia saw a 33% jump, while Oceania and Central America each saw a 30% increase.

Comparing 2024 with 2023 only tells part of the story, however. The new patterns really emerge when comparing international travel trends to 2019. For example, Central America received 50% more U.S. visitors in March 2024 compared with March 2019. Nearly 1.5 million Americans visited Mexico, up 39% compared with before the pandemic. That’s almost as many visitors as the entire continent of Europe, which has seen a more modest 10% increase since 2019.

Only Canada and Oceania saw fewer visitors in March 2024 than in 2019, suggesting that interest in these locations has not rebounded. Indeed, the trends indicate a kind of tourism inertia from COVID-19 pandemic-era lockdowns: Those destinations that were more open to U.S. visitors during the pandemic, such as Mexico, have remained popular, while those that were closed, such as Australia, have fallen off travelers’ radars.

Price pressures

How these trends play out throughout the rest of the year will depend on a host of factors. Yet, none will likely prove more important than affordability. After months of steadiness, the cost of travel, including airfare, hotels and rental cars, has begun to sneak up again.

About 45% of U.S. travelers say cost is their main consideration when planning their summer vacation, according to a survey of 2,000 Americans by the travel booking platform Skyscanner.

That’s likely to weigh further on U.S. travelers’ appetite for visiting expensive destinations such as Europe, while encouraging travel to budget-friendly countries. It could also depress overall international travel as well, yet so far, Americans seem to be traveling more.

For those looking to avoid crowds while maintaining a budget, Skyscanner travel trends expert Laura Lindsay offered a recommendation many of us might need help finding on a map.

“Albania has been on the radar of travelers looking for something different,” Lindsay said. "Most people have yet to discover it, but flights and tourism infrastructure are in place, and there are fewer crowds in comparison to trending European destinations like Italy, Greece, or Portugal.”

On the flip side, American travelers looking to avoid crowds of compatriots would do well to avoid Japan, which has seen a staggering 50% increase in U.S. tourists between March 2019 and 2024.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Balance transfer cards

- Cash back cards

- Rewards cards

- Travel cards

- Online checking

- High-yield savings

- Money market