- United States

- United Kingdom

Travel insurance for cancellations

Claim back costs from unused flights, prepaid accommodation and other non-refundable expenses with travel insurance that covers cancellations..

In this guide

Get travel insurance with cancellation cover

What is travel insurance for cancellations and flight delays, what is covered by travel cancellation insurance, what isn't covered by travel cancellation insurance, how to find the best travel cancellation insurance for you, frequently asked questions.

Destinations

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

If you have to cancel your trip for a reason outside of your control, travel cancellation insurance will make sure you don't lose out on any non-refundable expenses that you've already paid for. It can help cover the cost of prepaid accommodation, travel and any deposits that you've already put down.

Most comprehensive travel insurance policies cover cancellations. It's not typically included with basic travel insurance policies.

Travel delays is a separate benefit that's also included with most comprehensive travel insurance policies. It can pay for reasonable costs related to trip disruptions – for example, accommodation if you become stranded.

Here are some examples of prepaid travel expenses that you can claim back on cancellation cover:

- Cancellation fees charged by airlines, hotels, tour operators, rental car companies and more

- Non-refundable deposits for pre-booked flights, accommodation, tours and more

- Travel agent cancellation fees

- Lost frequent flyer points that cannot be recovered ( find a credit card offering frequent flyer points )

- Additional travel expenses if you need to return home early from your trip

- Tuition fees if you had paid for a course or training at your travel destination

As we touched on above, travel insurers only cover you when you need to cancel or cut your trip short due to situations that are unexpected and outside your control. That means no cover will be provided if:

- You change your mind. You can't cancel your trip "just because" and expect to get reimbursed.

- You need to cancel because your visa is denied or you have passport issues. It's up to you to make sure you have permission to enter the country you are visiting. Your insurer won't pay for your cancelled trip if you've made the assumption that your visa would be granted or that your passport would arrive on time.

- Your best friend dies. Most policies clearly state that you can only claim for cancellation if it is a relative who dies. They will make it clear in the fine print what they mean by relative.

- You get reimbursed by the provider. You can't double up if you're eligible for a refund through your trip provider like your hotel. Your insurance will only pay for prepaid expenses that you can't get back any other way.

- You travel against your doctor's advice. Travelling against medical advice is a key exclusion on all policies. However, if you cancel your trip because your doctor says you're unfit to travel, you'll be covered for cancellation fees and lost deposits.

- Your tour is under-booked. If you've pre-booked a tour on your holiday and then it's cancelled due to under-booking, your policy won't provide any cover. It will be up to the tour provider to either reschedule your trip or provide a refund.

- You purchase after something happens or there has been a warning. Your insurer won't cover you if you bought your insurance after there had been reports of an approaching hurricane, social unrest or whatever it is you are trying to claim for.

The best policy for a person might not be the best policy for another, so your ideal policy comes down to your specific requirements. Here are some tips on how to settle on the right policy:

- Determine your needs and budget. Weigh up how much you are spending on your trip with the likelihood of having to cancel and how much it would hurt to lose that money if you did cancel. This helps you decide how much cancellation cover to get.

- Look at what is covered. Check the fine print of a few policies to find out what exactly they accept for a cancellation claim. For example, some insurers will cover you if you cancel because your first cousin or aunt passes away. Others limit it to immediate family only.

- Look at what's not covered. It's important to know exactly what your policy won't cover you for. For example, some policies won't cover you if you have to cancel because you were injured skiing if you haven't purchased their optional ski cover as well.

Why you can trust Finder's travel insurance experts

We're experts

We're independent

We're here to help

Will travel insurance cover me if i cancel my trip.

Travel insurance can cover you if you need to cancel for reasons outside of your control. It can cover non-refundable expenses that you've already paid for.

Is there trip cancellation insurance for any reason?

No, this isn't typically offered by Australian travel insurers.

Does travel insurance cover you for cancelled flights?

Travel insurance will generally cover you for cancelled flights, providing it is not due to a mechanical issue with the plane. In this case, the responsibility will fall on the airline to make other arrangements for you.

What type of cancellation does travel insurance cover?

Travel insurance covers cancellations due to unexpected events. Many insures specify the unexpected events it covers. For example, most will cover you if you need to cancel due to the unexpected death of a family member, or you get injured or ill and can't travel anymore. This can include cancelling due to catching COVID-19.

Does travel insurance cover cancellation due to illness?

It can, but it also depends on your illness. To get your claim approved, you need to have a certificate from a medical practitioner saying that you're not fit to travel. This means that you won't be covered for mild headaches and stomach cramps.

If your illness is related to a pre-existing medical condition that you haven't disclosed, you won't be covered for any expenses.

James Martin

James Martin was the insurance editor at Finder. He has written on a range of insurance and finance topics for over 7 years. James often shares his insurance expertise as a media spokesperson and has appeared on Prime 7 News, WIN News, Insurance News, 7NEWS and The Guardian. He holds a Tier 1 General Insurance (General Advice) certification and a Tier 1 Generic Knowledge certification, both of which meet the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

The best travel insurance policies are different for each individual traveller.

We take a look to see if you are fully protected by insurance if your Airbnb trip goes wrong.

South Korea has become a tourist hotspot in recent years, and is usually a very safe choice if you travel smart.

Everything you need to know about taking your pet overseas including rules for flying with pets and how to prepare for your trip.

Find out how travel insurance for trip disruption actually works and policies from Australian brands.

Find out how travel insurance covers accidental death and what will be paid from in the event of a claim.

Beware when swimming at Byron, Ballina, Bondi and Bells.

Learn more about travel insurance brokers, how they are paid and the way they can help you find comprehensive travel cover.

Is travel insurance a worthy investment? Find out why travel insurance is an invaluable travel item.

Guide to high-risk travel insurance: What is and isn't covered.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

26 Responses

I have booked a flight for next April 2020 for an overseas holiday. Am l able to get insurance if l have to cancel the flight due to work not giving me holidays at this time?

Thanks for getting in touch with us at Finder.

Unfortunately, most insurers won’t consider this a reason outside of your control. Examples of this would be if there was a death in the family or an unexpected natural disaster.

You might be eligible for a cancel-for-any-reason cover , but this is only available through certain travel agencies and brokers.

I hope this helps, and good luck with getting your leave approved!

Kind regards, Jessica

I am holding travel insurance which only covers the cruise component of a subsequently extended trip that follows the cruise. I will commence the cruise in less than three weeks and I am outside the refund window. The included medical conditions are quite limited. Do insurers decline to insure on declared non included conditions and refund the premium? If I take out an alternate policy for the whole trip with another insurer will I have a problem when it comes to claiming? Do I have to deactivate the unused policy? I do not favour extending my existing policy.

Thank you for reaching out to Finder.

For your first question, (Do insurers decline to insure on declared non included conditions and refund the premium?) it really depends on the conditions as to why the insurer would decline the claim. You may need to contact your insurer directly to check if this is within the policy you signed up for or not. For your second question, (If I take out an alternate policy for the whole trip with another insurer will I have a problem when it comes to claiming? Do I have to deactivate the unused policy? I do not favor extending my existing policy.). Doubling up and having two insurance policies is actually more common than you might think. … However, many insurance policies renew automatically, and if you don’t cancel your original policy before taking out new cover then it’s possible you could pay twice for the same thing.

Hope this helps!

Cheers, Reggie

We would like to book our own non refundable flights from Sydney to Perth. Stay a few days at a motel that we book. Fly to Broome. Book a 4 day cruise around WA. Flight back to Perth/Sydney. Can we get cover for all these portions if we need to cancel for something unseen such as broken leg?

Thank you for getting in touch with finder.

Yes, non-refundable deposits for pre-booked flights and accommodation are examples of pre-paid travel expenses you can be reimbursed for under trip cancellation cover. Unexpected events which are outside of your control like serious injury, you probably be covered. Some insurers come right out and tell you what they’ll cover, while others only tell you what they won’t cover – these are called exclusions.

I hope this helps.

Please feel free to reach out to us if you have any other enquiries.

Thank you and have a wonderful day!

Cheers, Jeni

I am planning a 12 week trip for 2019 and have just been advised I may be called up for jury service until Oct 2019. Which policies cover jury service?

Thanks for your inquiry and for visiting finder.

When you’re called up for jury duty or to serve as a witness in court, this is recognized as qualifying for cover, as long as there’s no way you could have seen them coming (ie, unexpected).

Just make sure you check your insurer’s policy documents because not every insurer treats these situations exactly the same. You will need to provide evidence of this.

To know which insurance provider’s cover jury duty, you may use the table above. Simply enter the information needed on the fields and click GET QUOTE NOW. This will show the list of providers.

As a friendly reminder, carefully review the Product Disclosure Statement of the product before applying. You may also contact the insurance provider should you have any questions about their policy.

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

Regards, Nikki

My husband is in aged care suffering from dementia. He is physically well, apart from an inability to walk, which has him confined to a wheelchair. Would I be covered if say, he had a fall which caused severe injury or worse? He is a fall risk.

Thank you for getting in touch with Finder.

According to our review on travel insurance exclusions , the family emergency portion of your policy reimburses you for expenses incurred by you if a relative dies unexpectedly during your journey or becomes hospitalised due to illness or injury like if your husband had a fall and caused severe injury. Common exclusions include the following:

- No cover if you had prior knowledge that such an incident would occur.

- No cover if the illness, injury or death was the result of a pre-existing medical condition.

- No cover if you are able to seek compensation from any other source.

- No cover if the claim arises as a result of you or your travelling companion changing travel plans.

I suggest that you double check this situation with your chosen insurer.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Travel Insurance for Pre-Existing Conditions

What Does Travel Insurance Cover?

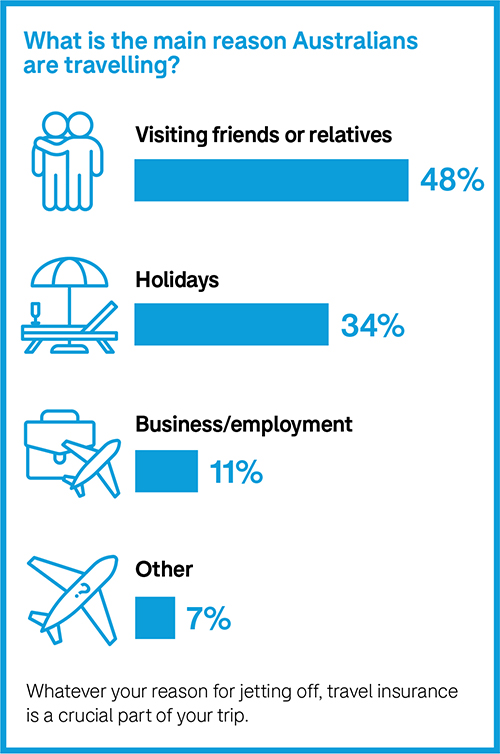

Why do i need travel insurance.

- Travel Insurance COVID-19

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Travel Insurance With Cancellation

Compare policies with Savvy to help you find the best cancellation cover on the market.

Fact checked

Compare Travel Insurance Quotes in 30 Seconds

- 100% free to use. No obligation.

Even the most well-planned holidays can face cancellations or delays, whether it be due to bad weather or an unexpected illness. If you need to postpone or call off your getaway plans for any reason, having the right travel insurance is essential, which is where Savvy can help you.

Comparing travel insurance policies with us can help you find the right coverage to protect you from any cancellation or delay costs on your trip, so start considering your options right here with Savvy today.

What is cancellation cover on travel insurance?

Cancellation cover on travel insurance is one of the key benefits you receive from taking out a comprehensive policy. This covers you for the cost of calling off or rescheduling a slew of non-refundable bookings, such as flights, hotels and tours, if they’re derailed by an insured event. For example, if you are injured before your holiday and cannot travel, you can claim back the money you would have lost without insurance.

This coverage allows you to get your money back on any deposits you’ve paid and spares you cancellation fees. This can be particularly handy if you’ve spent a lot of money on your holiday on car hire and various tours. In addition, some insurance providers on the market offer policies exclusively covering cancellations, which may be useful if you’re travelling light within Australia or New Zealand .

In most cases, basic travel insurance won’t offer cancellation cover at all. If you opt for mid-level coverage, insurers will generally put a claim limit on your policy, usually in the region of $25,000. However, if you choose top-level coverage, there's no limit on what you can claim. Before you file a claim, it’s a good idea to try and get a refund through your travel agent, tour company, airline or cruise company.

What can I claim under cancellation cover on my travel insurance?

Whether it’s due to bad weather or because you fall ill and can’t travel, cancellation cover has your back when you need to call time on your holiday, sometimes before it’s even underway.

Some of the covered reasons for cancellation can include:

- Severe illness: Falling seriously ill and being too unwell to fulfil your travel plans.

- Accidents: Suffering a bad fall or being involved in a serious accident which means you’re physically unable to travel.

- Family emergencies: A sudden and serious illness affecting a close relative or business partner.

- Natural disasters: An earthquake, avalanche, bushfire or related catastrophe forces the closure of your accommodation and cancellation of your flights.

- Pregnancy: Falling pregnant before you’re set to go on holiday and/or being advised not to travel.

- Cancellation of course: A seminar or course you were intending on travelling to is called off.

- Loss of job: You are made redundant or lose your job before your travel.

- Annual leave is cancelled: You’re a full-time essential worker, such as a police officer or firefighter, and your annual leave is scrapped to deal with a crisis.

Some of the costs you can claim back due to these and other extreme events include:

Non-refundable deposits

If you’ve part-paid your flights and accommodation, you can get your deposit back if you need to cancel your trip due to a covered event. It’s always handy to book with airlines and hotel chains which offer ‘flexible’ bookings, as you’ll be able to rework your bookings instead of calling the whole thing off. However, you won’t be covered if you turn up late and miss your flight.

Visas can cost you a pretty penny and some countries require them if you wish to travel there, even as a tourist. While this won’t be an issue if you’re travelling to the United Kingdom , America or most other countries, you’ll need to pay for one if you visit Indonesia or India, for example. If something happens and you need to cancel your trip, you can claim back the cost of your visa under cancellation cover.

Pre-paid activities

Have you pre-booked some tours for your next holiday? You can recover the cost of these holiday activities through your insurance company if you need to call off your travel plans.

Lost Frequent Flyer points

If you paid for your flights with Frequent Flyer points, some travel insurance companies would allow you to claim back the frequent flyer or similar reward points you used if you cannot fly due to a covered event. However, you may not be able to get back your points if your flight was purchased at a discount.

Travel agent commission

Booking your flights and accommodation through a travel agent can give you peace of mind. You have someone looking out for you while travelling home or abroad. If your agent charges a commission and you need to cancel your trip at the last minute, most insurers will allow you to claim back the commission you’ve paid and any cancellation fees they charge.

Most comprehensive policies cover you in the event your travel plans are impacted by the pandemic. Many will allow you to claim back about $2,500 if you need to cancel your holiday due to a positive COVID-19 diagnosis or are required to self-isolate.

However, there are circumstances where travel insurance companies won’t cover these costs, including:

- If you change your mind and decide not to travel

- You’ve already been compensated by your airline or hotel

- You missed your flights

- The flights are cancelled due to mechanical faults. It’s up to the airline to refund your booking

- If you’re travelling against government advice

How do I compare travel insurance policies with cancellation cover?

The right cancellation coverage can give you peace of mind that if you’re planning to travel around Australia or overseas and need to cancel for any reason, your insurer has your back. When you’re comparing with Savvy, take a look at these factors to help you hunt down the best plan:

When shopping around for the right travel insurance, you’re bound to have one eye on the cost of your premium. If you’re a backpacker on a tight budget but looking to cover yourself for cancellations, you can take out mid-level coverage to insure you for the bare necessities. Get a few travel insurance quotes and compare to sniff out the best policy.

Inclusions and exclusions

While cancellation coverage is stock standard among most comprehensive policies, it’s still important to compare providers to make sure you’re getting the coverage you need. For example, some providers may not cover if you have your pre-arranged leave cancelled and can’t travel, while others will.

Pre-existing conditions

Travel insurance companies cover a few pre-existing conditions if you suffer a medical issue overseas. These typically include common conditions such as asthma or certain types of diabetes. Look around and see which policy covers your illness, which is handy if it’s the reason you need to cancel your trip.

If you need to claim your travel insurance for any reason, your travel insurance will require you to pay an excess . Once you cover the excess, the insurers cover the remainder of the cost up to the pre-agreed limit. Excesses can vary, usually between $100 and $250, so it’s a good idea to compare so you don’t have to pay more than you should. There are even some insurers out there who won’t charge an excess at all in some situations, but the lower your excess, the more you’ll pay for your premium.

Before taking off on your long-awaited trip, ensure your destinations are covered under your chosen provider’s policies. It’s a good idea to choose a policy which offers protection for all destinations on your trip, including those you’re only spending a short stopover in.

Types of travel insurance

International.

International travel insurance can offer cover for a range of events, including medical expenses, lost luggage or items, cancellation fees and more when you're overseas and a long way from home.

If you're journeying within Australia, domestic policies are designed to offer many of the same protections as international travel insurance (with the exception of medical expenses).

Single trip

The most standard and common type of travel insurance, this policy can cover you for one trip starting and ending in Australia (and is available for both international and domestic travel).

Annual multi-trip

As the name suggests, this type of travel insurance covers multiple trips over a 12-month period. Depending on your insurer, you may be able to take an unlimited number of trips up to 90 days each.

You don't have to have a return ticket booked to take out cover while you're overseas. One-way travel insurance enables you to access cover without a set end date, such as if you're moving temporarily.

You may need to take out specialist coverage if you're setting sail on a cruise. Fortunately, cruise insurance can cover emergency evacuation, cabin confinement and more.

Just because you're older doesn't mean travel insurance isn't still important. If you qualify for cover, seniors' travel insurance can offer greater peace of mind for included events while you're travelling.

Adding winter sports or ski cover to your policy can add protection against damage to your equipment, piste closure due to bad weather and activities such as back-country skiing, heliskiing and more.

Adventure sports

Looking to enjoy some adventure sports on holiday? An adventure sports pack can grant you cover for a range of activities, such as hiking, scuba diving and motorcycle or scooter riding.

Jetsetting with the whole clan in tow? Some insurers offer family travel insurance, which enables you to include yourself, your partner and your dependent children under one policy to help you save.

If you're travelling interstate or overseas with your partner (or simply another friend or family member), you may be able to access a discount by taking out a joint or duo travel insurance policy.

Why compare travel insurance with Savvy?

Reputable insurance partners, fast and convenient online process.

You can complete the quote, comparison and purchase process online through Savvy quickly and easily.

Competitive quote costs

Regardless of the type of insurance you’re looking for, we can help you compare between competitive quotes.

Simple steps to making a cancellation claim on your travel insurance

Check you’re covered for what you’re claiming.

If you're claiming cancellation on your travel insurance, you should first consult your Product Disclosure Statement and make sure the type of cancellation you're claiming is covered under your policy. This will save you time and avoids you claiming for something not covered.

Submit your claim early

Once you've checked your Product Disclosure Statement, contact your insurer as soon as possible. Most travel insurance policies come with around-the-clock support, so you should be able to get help whenever you need it.

Gather your documents

Make sure you organise all of your paperwork, including receipts and medical certificates, which can support your submission. It's a good idea to manage these quickly, as it can be tricky to get a hold of them when you're back home.

Fill in the claim form

Your insurance company will then require you to share some details about your claim as much detail as possible. Try and complete your claim form as soon as the incident occurs. Otherwise, it can be tricky to remember precise details if you're already back home.

Wait for a response

It usually takes ten business days for your insurer to come back to you with a verdict on your claim. If your claim is approved, your insurer will request your bank details so they can deposit your payout directly to you.

Frequently asked travel insurance cancellation questions

Yes – you can cancel your travel insurance free of charge if you cancel inside the cooling-off period. Insurance policies come with cooling-off periods ranging from 14 to 25 days, and when you’re shopping around for travel insurance quotes to find the best deal, it’s a good idea to consider this when making your decision. You may not be able to get a refund if you cancel outside of the cooling-off period, but this also depends on what provider you choose.

Yes – your travel insurance covers the cost of repatriation of your body if you die on your holiday, as long as it’s related to a covered accident. If you die on holiday, your insurance will pay out a lump sum of money to your family, usually about $50,000.

If you’re made redundant from your job or have urgent work pop up, you can cancel your trip and claim your expenses back through your insurer.

While you won’t be covered if your pet is sick and you need to cancel your holiday, some providers offer cover if you need to board your furry family member or they require an urgent trip to the vet while in the care of a relative.

Travel insurance companies provide automatic trip protection for a range of pre-existing conditions, including:

- Gastric reflux

- Incontinence

- Osteoporosis

- Sleep apnoea

However, more severe illnesses not automatically covered by your policy include:

- Deep vein thrombosis

- Heart conditions

- Lung disease

- Multiple sclerosis

Yes – cancellation travel insurance covers ski holiday-related costs such as bad weather forcing your ski resort or the slopes to close and you being unable to carve up the snowfields. If you need to cancel your winter holiday, most comprehensive policies will cover you as long as your reason is among those covered by your policy.

Helpful travel insurance guides

Cheap Travel Insurance For Seniors

Compare travel insurance for seniors with Savvy to help you find the cheapest. Compare Travel Insurance Quotes in 30 Seconds...

How Late Can You Buy Travel Insurance?

Find out how close to your departure you can purchase your policy with Savvy. Compare Travel Insurance Quotes in 30...

Travel Insurance That Covers Alcohol-Related Accidents

Find out what you can be covered for under your travel insurance by comparing offers here. Compare Travel Insurance Quotes...

Asking yourself why you need travel insurance for your holiday? Compare with Savvy and understand the benefits. Compare Travel Insurance...

Need to know what your travel insurance covers? Compare and find out with Savvy today. Compare Travel Insurance Quotes in...

Best International Travel Insurance

Travelling abroad? Compare policies and find your international travel insurance here with Savvy. Compare Travel Insurance Quotes in 30 Seconds...

Best Multi-Trip Travel Insurance Australia

Compare your multi-trip travel insurance options with Savvy to help you find the best. Compare Travel Insurance Quotes in 30...

Travel Insurance That Covers Border Closures

Find out if travel insurance policies cover border closures by comparing with Savvy. Compare Travel Insurance Quotes in 30 Seconds...

Best Travel Insurance for Seniors

Make the most of your next holiday. Compare with Savvy and find the best seniors travel insurance today. Compare Travel...

Travel Insurance for Expats

Are you an Australian expatriate chasing travel insurance back home? Compare with Savvy and find the best policy. Compare Travel...

Explore your travel insurance options for your next destination

Travel Insurance for Germany

Travel Insurance for Taiwan

Travel Insurance for Cambodia

Travel Insurance for Dubai

Travel Insurance for Indonesia

Travel Insurance for Bangkok

Travel Insurance for South Africa

Travel Insurance for Bali

Travel Insurance for the Maldives

Travel Insurance for South Korea

Travel Insurance for Greece

Travel Insurance for Ghana

Travel Insurance for Antarctica

Travel Insurance for the Middle East

Travel Insurance for Malta

Travel Insurance for London

Travel Insurance for Canada

Travel Insurance for China

Travel Insurance for Vietnam

Travel Insurance for Lebanon

Travel Insurance for Las Vegas

Travel Insurance for New Zealand

Travel Insurance for Denmark

Travel Insurance for Phuket

Travel Insurance for Hungary

Travel Insurance for Bulgaria

Travel Insurance for America

Travel Insurance for the Czech Republic

Travel Insurance for Ireland

Travel Insurance for Iceland

Disclaimer: We do not compare all travel insurance brands currently operating in the market. Any advice presented above or on other pages is general in nature and does not consider your personal or business objectives, needs or finances. It’s always important to consider whether advice is suitable for you before purchasing an insurance policy.

Savvy earns a commission from our partners each time a customer buys a travel insurance policy via our website. We don’t arrange for products to be purchased from these brands directly, as all purchases are conducted via their websites.

Before purchasing your policy, we recommend you refer to the provider’s PDS for any further information on the terms, inclusions and exclusions.

- Giving Back

- Partner with us

- Privacy Policy

- Terms of Use

- Credit Guide

- How We Handle Complaints

- Scam and Fraud Warning

- Comparison Rate Warning

1300 974 066

Sign up to our newsletter.

Quantum Savvy Pty Ltd (ABN 78 660 493 194) trades as Savvy and operates as an Authorised Credit Representative 541339 of Australian Credit Licence 414426 (AFAS Group Pty Ltd, ABN 12 134 138 686). We are one of Australia’s leading financial comparison sites and have been helping Australians make savvy decisions when it comes to their money for over a decade.

We’re partnered with lenders, insurers and other financial institutions who compensate us for business initiated through our website. We earn a commission each time a customer chooses or buys a product advertised on our site, which you can find out more about here , as well as in our credit guide for asset finance. It’s also crucial to read the terms and conditions, Product Disclosure Statement (PDS) or credit guide of our partners before signing up for your chosen product. However, the compensation we receive doesn’t impact the content written and published on our website, as our writing team exercises full editorial independence.

For more information about us and how we conduct our business, you can read our privacy policy and terms of use .

© Copyright 2024 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved.

Thanks for your enquiry!

Our consultant will get in touch with you shortly to discuss your finance options.

We'd love to chat, how can we help?

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- All Insurance Guides

- Australia Travel Insurance

On This Page

- Key takeaways

Australia travel information & requirements

Do i need travel insurance to visit australia, what does travel insurance for australia cover, what isn’t covered by travel insurance for australia, how much does travel insurance for australia cost, tips for getting the best australia travel insurance, australia travel insurance faqs, related topics.

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

- To travel to Australia, you must have a valid U.S. passport , but you don’t need a visa.

- The Australian government doesn’t require American tourists to purchase travel insurance, but it’s wise to have at least medical and medical evacuation coverage since your U.S. health insurance won’t work in Australia .

- In addition to medical emergencies, travel insurance can also cover things like trip cancellations, trip interruptions and rental car damage .

- According to our research, our top picks for travel insurance for Australia come from Travel Insured, Travelex and Faye ( skip ahead to view these plans ).

- We recommend using an online comparison tool to find the best travel insurance policy to suit your needs.

Whether you want to explore the Outback or attend an opera in Sydney, there’s always a chance that something will go wrong during a trip to Australia. To protect yourself, we recommend purchasing travel insurance tailored to your unique needs.

We created this guide to help you understand:

- Why you might need travel insurance during your Australian vacation

- What travel insurance covers

- How much travel insurance costs for a trip to Australia

- How to select a comprehensive travel insurance policy

Our top picks for the best australia travel insurance

- Travel Insured International: Best for Robust Coverage

- Travelex Insurance Services: Best for Basic Medical Coverage

- Faye Travel Insurance: Best for Digital Claims Process & App

Our top picks for travel insurance for Australia

Travel insured international, travelex insurance services, faye travel insurance.

Are there COVID-19 restrictions for U.S. tourists?

No. Australia has no COVID-19-related restrictions for American travelers. However, the Australian government does recommend getting the COVID-19 vaccine, wearing masks and practicing good hygiene.

Do I need a visa or passport to travel to Australia?

Yes. You need a valid U.S. passport with at least one blank page for your entry stamp.

Is it safe to visit Australia?

The United States and Australia have a strong diplomatic relationship. Although there’s always some level of risk involved in traveling to a foreign country, Australia is generally safe for Americans. The U.S. Department of State has issued a Level 1 travel advisory , indicating that you don’t need to take any special safety precautions when visiting the “Land Down Under.”

Australia doesn’t require U.S. tourists to buy travel insurance, but we highly recommend purchasing a comprehensive policy before your trip commences.

Below are some risks you may encounter that would make purchasing travel insurance worthwhile .

Risks with adventure activities

Australia is one of the best places to visit if you love parasailing, paragliding, hot air ballooning, diving and other adventure activities. Unfortunately, these activities are risky, so there’s a chance that you’ll break a bone or sustain some other type of injury.

Travel insurance covers medical expenses and other costs associated with these injuries, ensuring you don’t end up with a huge hospital bill. This type of insurance is especially helpful if you plan to explore the Great Barrier Reef, take an excursion into the Outback or swim near the shoreline of one of Australia’s beautiful beaches.

Risks due to wildlife

Australia is full of dangerous critters, from venomous spiders and snakes to aggressive kangaroos. Depending on where you visit, you may end up encountering an unfriendly Tasmanian devil. U.S. medical insurance typically doesn’t work in Australia, so it’s important to have travel insurance for these unexpected situations. If you’re bitten by a Tasmanian devil or sustain some other wildlife-related injury, travel insurance takes the place of your regular medical insurance.

Risks due to bushfires

Bushfires have a high heat output and can cause a significant amount of damage in a short amount of time. If you find yourself in Australia during one of these fires, you may have to contend with damage to your rental car or your personal belongings. Comprehensive travel insurance may reimburse you for damaged or destroyed items, or it may reimburse your rental car agency for the cost of repairing or replacing a damaged vehicle.

Risks related to long-distance driving

Australia has many isolated regions that are hundreds of miles from the nearest populated area. You may have to drive several hundred miles to reach your destination, so it’s important to have travel insurance before you set off on an adventure.

Travel insurance covers a wide range of circumstances, including the ones below.

Trip cancellation insurance

It’s never fun to cancel a vacation you’ve been looking forward to for months, but it’s even worse when a cancellation results in significant financial losses. Trip cancellation insurance protects you if you have to cancel your trip to Australia for a covered reason. For example, if one of your travel companions is diagnosed with advanced cancer before your departure date, you can use your insurance to recoup pre-paid, nonrefundable expenses.

If you want to have coverage for any type of circustance, you can purchase cancel for any reason (CFAR) insurance . Typically sold as an add-on, this type of coverage will reimburse you for around 50% to 70% of your total prepaid costs .

Trip delay insurance

To get to Australia, you may have to rely on the services of multiple common carriers. For example, you may have to fly to Australia and then take a ferry to your final destination. Trip delay insurance reimburses you for any expenses you incur as the result of a common carrier delay. If your flight is canceled, for example, your insurer may reimburse you for meals, additional transportation costs and other related expenses.

Trip interruption insurance

Imagine that you arrive in Australia, enjoy a few days of fun and then come down with a severe illness. You’re so sick that you have to return to the United States sooner than expected. Trip interruption insurance reimburses your pre-paid, nonrefundable expenses in this type of scenario. It should also cover the cost of adjusting your travel plans or accessing emergency assistance services.

Travel medical insurance

As noted previously, you probably won’t be able to use your U.S. health insurance in Australia . Therefore, it’s important to have travel medical insurance to cover things like nursing care, hospitalization, blood tests, CT scans and other healthcare services. If you’re injured while snorkeling or suddenly develop appendicitis during your trip, you can rest easy knowing that your medical expenses are covered.

Medical evacuation insurance

If you’re injured in the Outback, you can’t exactly hop in a cab and get to a hospital within a few minutes. Medical evacuation insurance covers the cost of transporting you to a healthcare facility that’s capable of meeting your needs. For example, if you need emergency assistance, your policy may cover the cost of air medical services (like helicopter transportation).

Insurance for personal items

We recommend that you leave your valuables at home, but if you just have to take jewelry, designer clothing or expensive sports equipment on your trip, make sure your travel insurance includes coverage for lost, stolen and damaged items. This type of coverage reimburses you if a common carrier loses or damages your luggage or its contents.

Rental car coverage

Rental car coverage can protect you under the following circumstances:

- You’re involved in an auto accident caused by someone else.

- Someone vandalizes your rental vehicle.

- Someone steals your rental vehicle.

If your policy includes this type of coverage, your insurer will reimburse the rental agency any time you experience a covered loss. For example, if you get into a fender-bender in one of Sydney’s famous traffic jams, your insurance company should reimburse the rental agency for the cost of repairs.

Travel insurance for Australia doesn’t cover the following:

- Pre-existing conditions: If you’re diagnosed with a medical condition like asthma or diabetes before you buy your travel insurance, your insurer won’t pay for medical expenses associated with that diagnosis. In some cases, however, you can opt for a plan with a waiver. This can ensure coverage for pre-existing conditions during your trip.

- Illegal activities: Travel insurance doesn’t cover expenses arising from any illegal activities, such as injuries that occur while under the influence of illicit substances.

- Fear of travel: If you book a trip and then suddenly develop a fear of flying, your insurance company won’t reimburse you for your pre-paid expenses. The same applies to a fear of seeing a spider or encountering a Tasmanian devil during your trip.

- Expected events: Travel insurance doesn’t cover expenses associated with events that you knew about (or should have known about) before a trip. For example, if you book a trip and buy insurance after a named storm has started developing, your insurer won’t reimburse you if the storm forces you to cancel or interrupt your trip.

For a trip to Australia, we found that the cost of travel insurance ranges from less than $1 per day to around $11 per day depending on the type of coverage.

To give you a better idea, we requested multiple quotes from leading travel insurance providers.

These quotes are based on the following criteria:

- Age: 35 years old

- Destination: Australia

- Trip Length: 7 days

- Trip cost: $2,000

You can see our quotes for basic travel insurance in the following table. The cheapest travel insurance plan costs just under $1 per day .

Example Where Plan Doesn’t Reimburse the Full Trip Cost

The plans in this next table are more comprehensive. In addition to medical and medical evacuation coverage, they also include trip cancellation and trip interruption coverage. According to our quotes, these plans cost between $7 and $11 per day .

Example Where Plan Does Reimburse the Full Trip Cost

Your costs won’t be exactly the same, as insurance companies base their premiums on these factors:

- Trip cost: Insurance companies reimburse you for up to 100% of your prepaid, nonrefundable expenses. The more your trip costs, the more your insurance provider has to pay you if you experience a covered loss. Therefore, the cost of your insurance plan depends on the cost of your trip.

- Age: Older people are more likely to develop serious medical problems while traveling, so it costs more to insure a 60-year-old or 70-year-old traveler than it does to insure someone in their 20s.

- Insurance benefits: Some travel insurance plans come with more benefits than others. For example, a plan that offers $1 million in medical evacuation coverage will cost more than a plan that comes with only $100,000 in medical evacuation coverage.

- Destination: Some destinations are riskier than others, so insurance companies charge different rates based on your itinerary.

- Add-on coverage: You may need to purchase add-on coverage, such as insurance for adventure activities. If so, you’ll pay an additional premium for the extra benefits.

To find the best travel insurance for your needs, follow these tips:

Consider how you’re getting to and around Australia.

You’ll have to take an airplane from the United States to Australia, but depending on your plans, you may also need to ride a train or take a ferry at some point. The more carriers you use, the more likely you are to experience delays and other problems, increasing the amount of coverage needed.

Think carefully about what you plan to do.

If you want to visit the Sydney Opera House and check out the Australian Museum, you won’t need as much coverage as someone who plans to camp in the Outback or go parasailing over the Gold Coast. You may also want to limit your cancellation costs by purchasing cancel-for-any-reason coverage.

Time your purchase carefully.

Although you can buy Overseas Visitors Cover when you arrive, it’s typically cheaper to purchase travel insurance well in advance of your trip.

What travel insurance do I need to travel to Australia?

You’re not required to purchase travel insurance for Australia, but we highly recommend that you do. You never know when you’re going to have an emergency or encounter some kind of problem during a trip. To find the right policy to suit your needs, try using an online comparison tool .

Does American health insurance work in Australia?

In most cases, no. Medicare and Medicaid only work in the United States, and most private health insurance companies will only cover expenses if you use U.S. medical facilities.

Can foreigners buy travel insurance in Australia?

When you travel to Australia, you have the option of buying Overseas Visitors Cover. However, not many companies provide this type of coverage. There may also be waiting periods for medical coverage. Therefore, we recommend that you buy travel insurance before you leave the United States.

Leigh Morgan is a seasoned personal finance contributor with over 15 years of experience writing on a diverse range of professional legal and financial topics. She specializes in subjects like navigating the complexities of insurance, savings, zero-based budgeting and emergency fund development.

In the last 5 years, she’s authored over 300 articles for credit unions, digital banks, and financial professionals. Morgan is also the author of “77 Tips for Preventing Elder Financial Abuse,” a book focused on helping caregivers protect the elderly from financial scams.

In addition to her writing skills, she brings real-world financial acumen thanks to her previous experience managing rental properties as part of a $34 million real estate portfolio.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions April 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Tips & Quotes for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Tourist Information & Tips

Best UK Travel Insurance: Coverage Tips & Plans April 2024

Travel Insurance for Trips to the Bahamas: Tips & Safety Info

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review April 2024

Travel Insurance for Thailand: US Visitor Requirements & Tips

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review April 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Generali Travel Insurance Review April 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for April 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review April 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Visiting Australia? Consider Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Different types of travel insurance

Do you need travel insurance for australia, which credit cards offer australia travel insurance, other ways to get travel insurance, if you want to get travel insurance for australia.

Now open to tourists after two years of pandemic-related closures, Australia is back on many travelers’ wish lists, and for good reason. Whether you’re interested in surfing on the Gold Coast, taking a road trip through the Outback or diving along the Great Barrier Reef, there are a lot of options to consider. But with so many adventurous — and potentially dangerous — activities, you may also want to think about purchasing travel insurance.

Let’s take a look at the different types of travel insurance for Australia, which credit cards provide complimentary coverage and other ways you can acquire insurance for added peace of mind.

A must-have for many, travel insurance can help cover unexpected costs related to travel mishaps, medical incidents or evacuations. However, not all travel insurance is created equal. There are a variety of types available for every kind of situation, and you’ll need to do some research to understand what’s worth purchasing and what might not be necessary.

Here are some common types of travel insurance:

Trip cancellation insurance . Used to recoup costs when you cancel a trip due to something unanticipated, like a medical issue.

Trip interruption insurance . Reimburses you for travel costs when you need to cut a trip short and return home unexpectedly.

Baggage loss insurance . Provides reimbursement when your baggage is lost, damaged or stolen.

Emergency evacuation insurance . Covers costs related to evacuating you to a different location, either for medical or safety reasons.

Travel medical insurance . Used to cover medical costs while traveling, either as a primary or secondary insurer, depending on the type of coverage you purchase.

Cancel for Any Reason insurance . A supplemental insurance that provides partial reimbursement of nonrefundable travel costs when you cancel a trip for any reason.

Rental car insurance . Covers costs related to damage or repair of a rental vehicle. This can be especially useful when renting a car in another country.

Accidental death insurance. Similar to life insurance, this coverage provides payment to a person of your choosing in case of death while you’re traveling.

You may also want to consider finding insurance that covers COVID quarantine costs. Not all policies include this coverage, so you’ll want to be sure it’s included if it’s important to you.

» Learn more: The best travel insurance companies, according to Nerds

While it’s not required for entry, it may be a good idea. Travel insurance can come in useful just about anywhere, especially because it’s difficult to anticipate things like travel delays and accidents.

If you’re fairly confident about your travel plans, you may be comfortable with the insurance provided by your credit cards, though be aware that they may have lower limits than you’d like.

Otherwise, purchasing a travel insurance policy is always an option. Keep in mind that rates will vary according to your travel destination, dates of travel, ages and total trip cost.

» Learn more: What you need to know before shopping for travel insurance

Even if you’ve decided not to buy travel insurance, you may already have some coverage. Plenty of travel cards include some form of complimentary travel insurance, though the types — and limits — you receive will vary depending on which card you hold.

Many Chase credit cards offer primary rental car insurance, which will cover you in the event of an accident without needing to involve your personal auto insurance company. You’ll need to decline the rental car company’s coverage and pay with your eligible Chase card .

You can find trip delay insurance, emergency medical evacuation, lost baggage coverage and more among the different protections offered by these cards. Here are some of the more common travel cards that provide complimentary travel insurance.

Chase Sapphire Preferred® Card .

Chase Sapphire Reserve® .

The Platinum Card® from American Express . Terms apply.

Capital One Venture X Rewards Credit Card . (Benefits may change over time.)

United℠ Explorer Card .

You’ll want to read each card’s benefits guide very carefully before deciding which card to use. For example, both the The Platinum Card® from American Express and the Chase Sapphire Reserve® offer lost luggage insurance. Terms apply.

However, insurance from the The Platinum Card® from American Express only applies in the event that you’ve either paid for the full fare with your AmEx card or have redeemed your AmEx points for the flight. Using your card to pay the taxes and fees on an award flight you’ve booked elsewhere — such as redeeming Delta SkyMiles for your flight — does not mean that you’ll receive insurance coverage benefits. Terms apply.

This is in contrast to the Chase Sapphire Reserve® , whose lost luggage benefit is much more generous. In the event that your luggage is lost, you need only have paid the remainder of the charges for the flight after redeeming reward miles, points, coupons or other certificates. This means that charging just the taxes and fees on your card renders you eligible for benefits.

Aside from American Express and Chase cards, you may also want to consider the Capital One Venture X Rewards Credit Card .

Capital One’s offering includes a plethora of travel insurance benefits, including primary rental car insurance, travel accident insurance, trip cancellation and interruption insurance, lost luggage reimbursement, trip delay reimbursement, travel and emergency assistive services and more. Of course, in order to qualify for these benefits, you’ll need to have charged the trip to your card. Benefits may change over time.

» Learn more: The best credit cards with travel insurance

Even if your card provides complimentary travel insurance, you may also want to consider acquiring an additional policy — especially if you’re planning on some of the more adventurous activities you’ll find within Australia, such as camping in the Outback.

Health insurance benefits provided by credit cards such as the Chase Sapphire Reserve® max out at relatively low levels, which may mean you end up paying out of pocket in the event of an emergency.

If you’re looking for a supplemental policy, you’ll want to check quotes from a variety of providers. You can do this manually, but websites such as Squaremouth will compare multiple policies at once, making it much easier to peruse offerings. You can also filter your search according to the type of coverage you’d like.

» Learn more: Is travel insurance worth it?

Travel insurance can provide peace of mind to the wary traveler. Whether or not you’re interested in purchasing travel insurance, a variety of credit cards offer complimentary coverage for incidents such as trip delays, emergency medical care, rental car collisions and lost luggage.

Otherwise, you may want to consider buying an additional policy to ensure that you’re covered. If this is what you’re looking to do, make sure to acquire quotes from a variety of providers in order to find the best deal possible.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

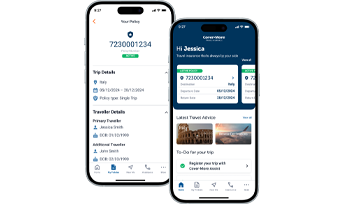

- Travel Insurance Compare Our Plans Popular Benefits COVID-19 Benefits International Plans Domestic Plans Comprehensive Insurance Annual Multi-Trip Inbound Plan Cruise Ski & Snowboard Motorcycle & Moped Adventure Activities Seniors Medical Conditions

- Emergency Assistance

- Travel Alerts COVID-19 International Travel Tool Cover-More App

- Manage Policy

Travel insurance that’s always by your side

- travel_explore Not sure? See region list.

Your policy in your pocket... and more

Register your trip in our app for access to your travel insurance policy details, as well as up-to-date travel advice, real-time safety alerts and 24/7 emergency assistance, all in the palm of your hand.

Travel's back on - and we've got your back

Feel in control by choosing the most suitable plan for you

Feel safe with 24/7 access to Emergency Assistance

Feel joy with 80+ adventure activities included

Feel confident with our 35+ years of travel expertise

Looking for the best travel insurance plan for your holiday?