- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to United Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

United Airlines' travel insurance aims to protect you if your trip is delayed, your baggage is lost or other travel mishaps occur. But the United Airlines flight insurance plan is far from comprehensive. Let’s look at what the policy covers, how to buy it and whether it's a good fit for you.

About United Airlines travel insurance

United’s flight insurance isn’t underwritten by United Airlines. While you can purchase a policy via United’s website, it’s actually issued by AIG and is called the Travel Guard plan.

United Travel Guard insurance is focused on benefits during your air travel, though it does have limited coverage beyond your flight time.

» Learn more: How much is travel insurance?

United trip insurance

Two policies are available via the United website: The Domestic Air Ticket plan and the International Air Ticket plan.

To get a sample quote, we put in two different flights. The first was a one-way economy class flight from San Diego to Newark, New Jersey. The total for the flight came out to $755.70, and the insurance premium offered totaled $60.46.

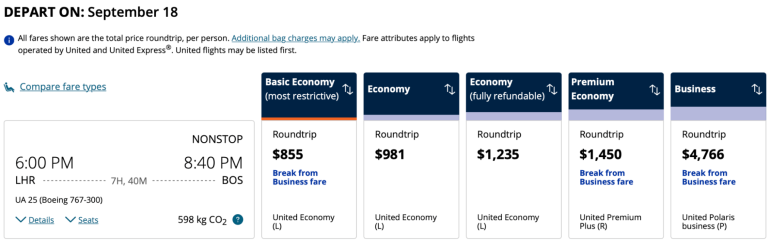

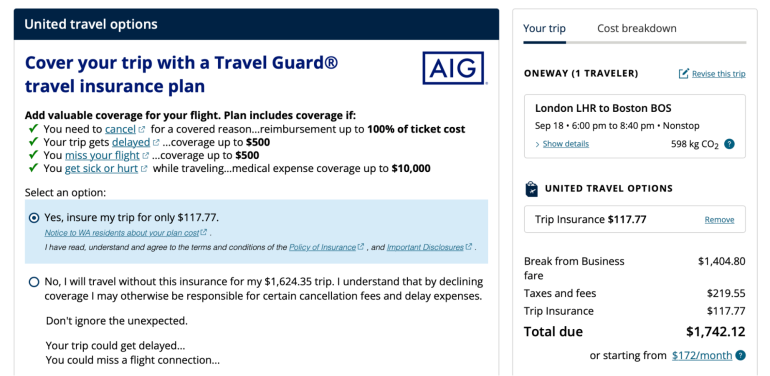

In our second quote, we checked out an economy class flight from London-Heathrow to Boston. A one-way ticket came out to $1,624.35, and the insurance policy quote was returned at $117.77

Here’s how the plans compare to one another.

The coverage for the policies is fairly similar whether you’re traveling domestically or internationally. However, international travel includes emergency medical and higher limits for issues with luggage. It’s also correspondingly more expensive.

» Learn more: How does travel insurance work?

What isn’t covered by United Airlines insurance

United’s travel insurance has generous policy limits.

They don’t ask you how much your trip cost and price the maximums accordingly; instead, there’s a flat rate benefit for trip interruption and trip delay, which can be great if you’re embarking on a more expensive vacation.

United’s travel insurance includes coverage for pre-existing conditions if you purchase a policy when booking your ticket.

However, this travel insurance isn’t comprehensive. While you’ll get superior benefits if you’re traveling abroad, other plans offer more customization.

Notably, these plans don't allow you to add any supplemental coverage, such as Cancel For Any Reason (CFAR) insurance, flight accidental death and dismemberment (AD&D) coverage and rental car insurance.

» Learn more: Trip cancellation insurance explained

Note that United’s website specifically calls out COVID-19 as a foreseen event, meaning that trip cancellation, trip interruption and trip delay as a result of quarantine will not be covered.

However, emergency medical benefits will still apply.

» Learn more: What to know about travel insurance for pre-existing conditions

How to buy United Airlines trip insurance online

When purchasing a ticket.

There are two ways to purchase United Airlines travel insurance online. The first is to do so when you’re booking your flight.

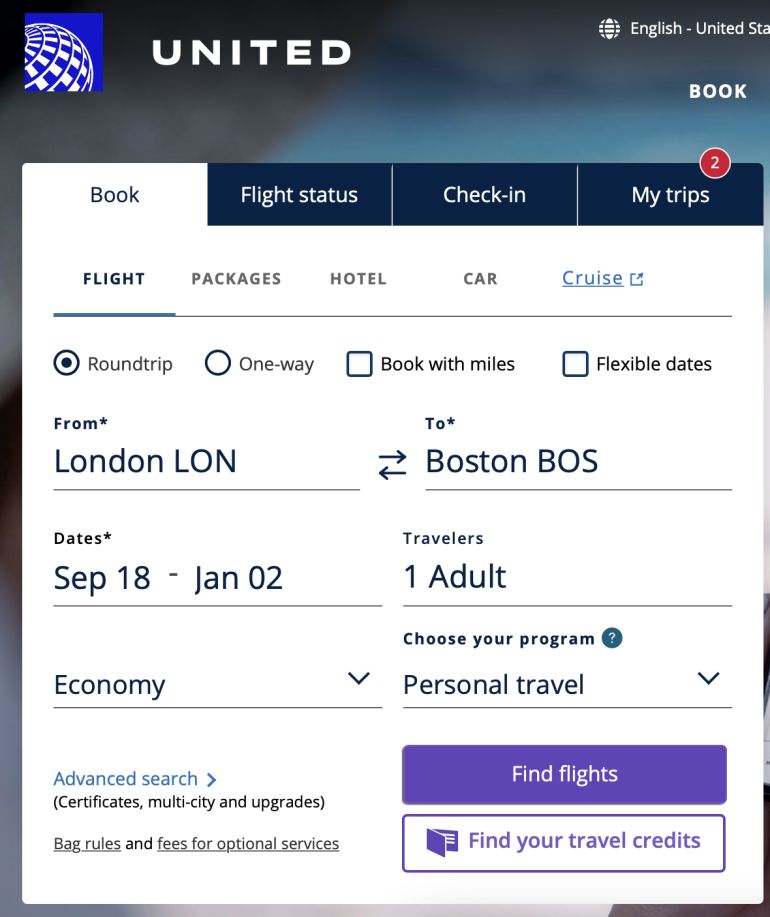

You’ll want to start at United’s home page, where you can input your travel information.

After you click Find Flights, you’ll be taken to a results page, where you can peruse available options.

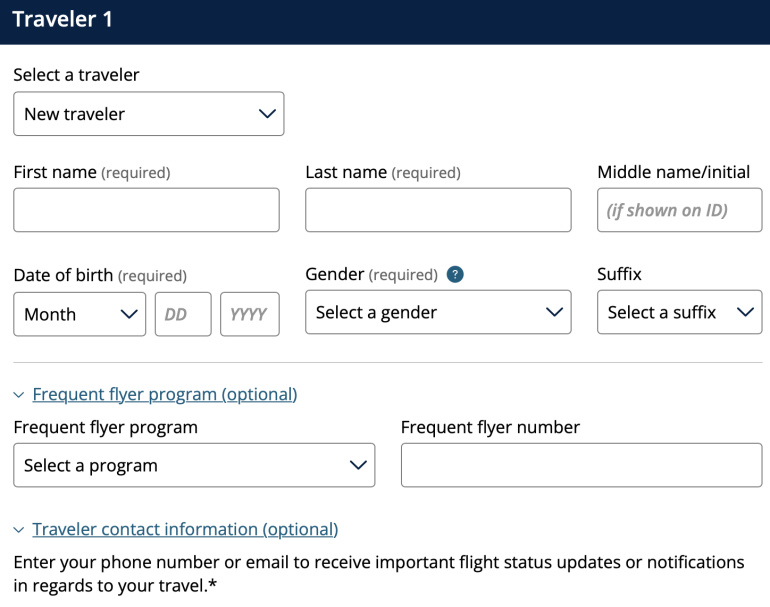

You’ll be able to select which flight suits your needs, after which you’ll begin the checkout process. Here you’ll need to put down all your personal information, including name, date of birth and frequent flyer number.

United will then take you through a couple pages of extras asking you if you’d like to purchase Wi-Fi or choose your seats. Once this is done, you’ll be presented with the United insurance page.

Here you can select whether or not you’d like to purchase the insurance. After this, you’ll be prompted to input your card information. Your payment will be processed (including the insurance) and then your ticket will be issued.

» Learn more: What to know before buying travel insurance

If you already have a ticket

Adding United’s insurance to a ticket you’ve already purchased is possible. To do so, you’ll either want to log into your account or search for your trip using your booking code and name.

If you’re logging in, you’ll want to click My Trips, then Manage Trip to get to the insurance page.

This will bring up of your trip details including flight numbers and upgrade options. Scrolling down to the Trip Extras section, you can purchase insurance.

» Learn more: Common travel insurance myths

Should you buy United travel insurance?

United Airlines makes it easy to purchase travel insurance by bundling it with your airfare purchase. However, you’ll always want to double-check the coverage and customizability to see if it fits your travel plans.

You’ll also want to gather multiple quotes before committing to a purchase. Sites such as Squaremouth gather providers from a variety of companies to generate a quote and get you the best deal.

Otherwise, many travel credit cards offer complimentary travel insurance as long as you pay for the trip with your card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

IMAGES