Top Travel Insurances for Albania You Should Know in 2024

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

A small Balkan country with historic cities, charming landscapes, exquisite beaches, and rich traditions such as traditional music and dance, Albania is an increasingly popular draw for visitors from overseas. Although travelling to Albania can be an accessible holiday destination for many people, and although healthcare costs in the country aren't outrageously expensive, it's still a very good idea to arrive there with travel insurance anway, as you'll want the highest-quality healthcare you can find.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to Albania and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

Albania Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for Albania:

Best Travel Insurances for Albania

- 01. Should I get travel insurance for Albania? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to Albania scroll down

Heading to Albania soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for Albania?

No, there's currently no legal requirement to take out travel insurance for travel to or through Albania.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to Albania or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for Albania:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to Albania. It lets you choose between various plans tailored to meet the specific needs of your trip to Albania, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for Albania:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to Albania? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to Albania

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for Albania. However, we strongly encourage you to do so anyway, because the cost of healthcare in Albania can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

The Best Travel Insurance for Albania [2024]

What’s the best travel insurance for Albania? 🤔🤔

Curious about ensuring a secure journey in Albania? Ever wondered how to choose the best travel insurance for Albania? 🌍 In this guide, we’re unraveling the secrets to finding the perfect coverage for your adventures.

Why is it crucial? Join us on a quest to discover the answers and gain insights that will redefine your travel experience. From understanding coverage essentials to selecting the right plan, we’ve got you covered.

Ready to embark on a stress-free journey? Let’s dive into the world of the best travel insurance in Albania, promising you worry-free travels and the security you deserve. Your adventure begins here! ✈️🗺️

Choosing the right insurance for your journey in Albania, consider these key factors :

- See the total cost of the insurance ,

- choose an amount you’re comfortable paying if you make a claim

- ensure the coverage suits your needs

- consider the medical benefits that matter to you

After you figure out your plan, check the World Health Organization website for the latest info on traveling to Albania. It’s like your go-to guide for staying updated! 🌍✈️

Best Albanian Travel Insurance Search Tool

Visitorscoverage – international travel insurance.

V isitorsCoverage – Its a user-friendly platform where you can compare travel insurance plans based on your trip details. It provides information on coverage options and prices.

Dive into the platform, where you can easily explore coverage options and prices for emergency services including hospitalization and surgery, prescription coverage , COVID-19 coverage, and lost luggage .

The secure booking process smoothly connects you with top insurance providers, ensuring a seamless experience. Throughout your journey, dedicated customer support is at your service, guaranteeing a hassle-free experience.

When getting quotes, consider the following aspects:

- Trip Duration: Longer trips may result in higher premiums.

- Coverage Levels: Comprehensive coverage with higher limits may cost more.

- Age: Older travelers may face higher premiums.

- Pre-Existing Conditions: Disclosing pre-existing medical conditions may impact the cost of coverage.

- Activities: If you plan to engage in high-risk activities, additional coverage may be necessary.

💡 Keep in mind that the cost of travel insurance is an investment in your peace of mind and financial security during your trip. It’s essential to carefully review the terms and conditions of the policy to understand the coverage limits, exclusions, and any additional benefits.

Do I need travel insurance for all incl. Resorts?🏝️

While travel insurance is not mandatory for visiting all-inclusive resorts in Albania, it is highly recommended to have travel insurance for several reasons. Let’s break it down: travel insurance gives you financial protection and covers unexpected events that might mess up or affect your trip.

Benefits of VisitorsCoverage International Travel Insurance :

Embarking on an adventure abroad? Ensure a worry-free journey with VisitorsCoverage’s comprehensive foreign travel insurance plans. Picture this: you’re exploring exotic destinations when suddenly, the unexpected strikes. That’s where V isitorsCoverage steps in, providing you with peace of mind and protection against unforeseen medical emergencies while you’re away from home.

What’s Covered with International Travel Insurance ?

- Medical Coverage: From unexpected illnesses to sudden injuries, we’ve got you covered for hospitalization and medical care abroad.

- Emergency Services: Need urgent medical attention, including surgery? V isitorsCoverage has your back.

- Medical Evacuation: In the rare event of a serious medical situation, VisitorsCoverage ensures you’re safely transported to the nearest medical facility.

- COVID-19 Coverage: Stay protected amidst the uncertainties of the pandemic.

- Prescription Medication: Don’t worry about running out of meds.

- Lost Luggage: Say goodbye to the stress of lost or stolen belongings.

Who’s Eligible for International Travel Insurance?

V isitorsCoverage international travel insurance plans cater to individuals, families, and groups, ensuring everyone can travel with confidence. With various coverage levels available, there’s an option to suit every budget and travel style.

Protect Your Health and Finances – Traveling abroad is an enriching experience, but unforeseen accidents and illnesses can put a damper on your plans. Don’t let unexpected medical emergencies become a burden on your journey. With international travel insurance from V isitorsCoverage , you can explore new cultures and visit loved ones with peace of mind, knowing you’re protected against the unexpected.

What isn’t covered by International Travel Insurance policies?

- Pre-Existing Medical Conditions: Disclose and secure coverage for pre-existing medical conditions

- High-Risk Activities: Standard insurance may exclude high-risk activities; consider additional coverage for extreme sports.

- Intentional Self-Harm: Coverage typically excludes incidents of intentional self-harm or suicide.

- Illegal or Reckless Behavior: Claims resulting from illegal or reckless actions may be excluded.

- War and Political Unrest: Review policy for exclusions related to war, terrorism, or political unrest.

- Pre-Existing Travel Advisories: Events tied to pre-departure travel advisories might not be covered.

- Unapproved Medical Treatment: Coverage may not extend to medical treatments not approved by professionals.

- Alcohol or Drug-Related Incidents: Incidents influenced by alcohol or drugs might not be covered.

- Failure to Take Precautions: Lack of precautions impacting claims’ coverage should be avoided.

- Losses Not Reported Timely: Timely reporting is crucial for the validity of claims; adhere to policy requirements.

EKTA Travel Insurance for High-Risk Activities :

EKTA Travel Insurance caters to various traveler groups. Ideal for visa applications, it covers Schengen visas and visas for any country. For those seeking relaxation , it ensures peace of mind during leisurely activities like running, swimming, or cave tours. Thrill-seekers can enjoy coverage for adrenaline-pumping adventures such as surfing, jeep safaris, and extreme sports like freeride or kiting.

Families with children and pregnant women benefit from tailored tariffs and coverage options, ensuring safety throughout their journey. With COVID-19 requirements in mind, EKTA Travel Insurance facilitates smooth entry into destinations while offering flexibility to customize coverage based on individual needs, ensuring a worry-free travel experience for all.

What’s Covered with EKTA Travel Insurance ?

- Fracture, sprain, bruise

- Food poisoning

- Calling a doctor or ambulance

- Lost luggage

- Flight cancellation

- Forced observation 14 days

Can I use my health insurance in Albania?

It’s essential to check with your health insurance provider to determine whether your coverage extends to Albania.

Do I need Albanian car insurance?

Certainly, if you’re planning to hit the road in Albania, having valid car insurance is a must. Here’s the deal: car insurance is mandatory for all vehicles cruising on Albanian roads, and driving without it breaks the law.

Breaking it down further, the minimum coverage you need is liability insurance. This type covers bodily injury and property damage to others if you’re at fault in an accident.

Stuck in the car rental dilemma? 🤔 Discover the ultimate guide to renting a car in Albania – your ticket to a smooth, carefree adventure. Click here for easy tips on renting a car . 🗺️🔓

Albanian Roadtrip Essential: Green Card Car Insurance

Ready to roll! 🚗💨 So, if you’re planning a road trip to Albania or cruising around in a foreign car, you better buckle up for the Green Card journey! 🌍✨

What’s the Green Card Adventure All About?

A Green Card is your golden ticket, an insurance document shouting, “Hey, my car’s got Albania covered!” 🤓🚗 Whether it’s your personal car or a snazzy rental, get the deets here:

- Check if your car insurance back home covers Albania. If yes, grab that Green Card and hit the road! 🏡

- Renting a car? Double-check with the rental company if they’re cool with an Albanian adventure. Oh, and ask about that Green Card price tag! 💳💼

- Hitting the Albanian border without a Green Card? No worries, you can snag one there for 49 euros. Green light to Albania, here you come! 🚧

Money Talk – How Much for the Green Pass? 💸💳

Hold onto your seatbelt! Green Card prices play hide and seek. 🕵️♀️ From 20 to 50 euros, every car rental company has its own game plan. Check, compare, and pick the sweetest deal for your Albanian escapade! 🔄

Home vs. Away – Where to Grab Your Green Shield? 🌍

Should you get it at home or at the border? It’s a chess game, my friend. If your home insurance offers it for a cool 10-20 euros, go for it! Otherwise, meet the Green Card dealer at the Albanian border. 🛒🏰💳

Insurance Inquiry at the Albanian Border – Yay or Nay? 🚧🤷♀️

Absolutely YAY! Albania’s got eyes on the road. Police checks? Oh, they’re real! Make the Green Card your driving armor. Get it, flaunt it, and avoid those traffic troubles! 🚓👮♀️💳

Caravan Chronicles – Don’t Forget Your Trailer’s Green Card! 🚗🚐

Bringing your caravan to the Albanian fiesta? Double up on the Green Cards – one for your car, one for the trailer. You don’t want your caravan feeling left out! 🚗🚐💚

Cross-Border Carousel – Can You Drive a Rental to Albania? 🚗🌍

Hold your horses! Not all rental cars are up for an Albanian adventure. Seek permission from your rental amigo. Prices vary, so be savvy and shop around! 🕵️♀️🏰🚗

License to Thrill – Driving & Licensing in Albania! 🚗🎉

EU, UK, or USA license in your pocket? Albania’s roads welcome you for a year-long joyride! No need for an international permit – just hit the road and embrace the adventure! 🚗🌟💼

Here are key points regarding car insurance in Albania 🚔

- Mandatory Third-Party Liability Insurance: All motor vehicles must have third-party liability insurance coverage. This insurance is mandatory and provides coverage for bodily injury and property damage caused to third parties in the event of an accident.

- Green Card Insurance: If you are a foreign visitor bringing your own vehicle into Albania, you may need to obtain a “ Green Card .” The Green Card is an international insurance certificate that provides proof of third-party liability coverage. Check with your insurance provider in your home country to ensure that your coverage extends to Albania.

- Local Insurance Providers: If you plan to rent a car in Albania , the rental agency will typically provide insurance coverage for the vehicle. Be sure to review the terms and conditions of the rental agreement to understand the extent of the coverage❗❗

- Additional Coverage: While third-party liability insurance is mandatory, you may also consider additional coverage options such as comprehensive insurance, which covers damage to your own vehicle in addition to liability coverage.

- Penalties for Non-Compliance: Driving without valid car insurance is considered a serious offense in Albania. If you are caught driving without insurance, you may face fines, vehicle impoundment, and other legal consequences.

Before driving in Albania, it’s crucial to confirm that you have the necessary insurance coverage. When renting a car , check the rental agreement for details on insurance coverage. If you’re bringing your own vehicle, ensure that your existing insurance policy includes coverage for Albania or obtain a Green Card .

Have questions about specific insurance requirements or coverage options? It’s recommended to consult with local authorities or insurance providers in Albania for accurate and up-to-date information.

Does my credit card offer Albanian car insurance?

While many credit cards offer rental car insurance, they usually cover damage to the rental vehicle, not liability insurance. Here’s the catch: in many countries, including Albania, liability insurance is a must. It covers damage or injury to others, and it’s legally required for vehicles.

So, even if your credit card covers rental car damage, it might not fulfill the legal requirement of liability insurance needed to drive in Albania.

It’s crucial to check the terms and conditions of your credit card’s insurance coverage to understand the extent of protection it offer s!

Buying Albanian car insurance at the border??

It’s generally not recommended to rely on purchasing car insurance at the border when entering Albania. It’s advisable to obtain the necessary insurance coverage before arriving at the border to ensure compliance with local laws and avoid potential complications.

Here are a few reasons why purchasing Albanian car insurance at the border may not be the most practical approach:

- Limited Options: When some countries may offer the option to purchase insurance at the border, the availability of insurance options at the border of Albania could be limited. It’s preferable to have access to a broader range of insurance providers and coverage options by arranging insurance in advance.

- Language Barrier: Communication at border crossings may not always be straightforward, and there could be language barriers. Purchasing insurance in advance allows you to clarify coverage details and understand the terms and conditions more effectively.

- Coverage Verification: Before crossing the border, you may be required to show proof of insurance coverage. Having insurance in advance ensures that you can provide the necessary documentation to authorities, facilitating a smoother border crossing process.

- Peace of Mind: Arranging insurance in advance provides peace of mind, knowing that you have the required coverage and are in compliance with local regulations. It also allows you to review policy details, coverage limits, and exclusions before starting your journey.

Final Thoughts: Best Travel Insurance for Albania

During your Albania vacation, it’s wise to be ready with travel insurance coverage for the worst-case scenario. Here’s the reality check: It’s the last thing anyone wants to think about, but it’s smarter to consider it before you actually need to. You might not think you need insurance… until you really do!

Given that we can’t predict every possible scenario, the best way to cover all bases is with an Albanian travel health insurance policy.

With a good plan from a reputable insurer, like VisitorsCoverage , you have the peace of mind to fully enjoy Albania — even if (or when) something unforeseen arises.

🗣 Albanian Language and Cultural Diversity Did you know that Albania takes pride in its linguistic and cultural diversity? While there isn’t a designated official language, Albanian holds a special place as the most widely spoken language. In addition to Albanian, the country embraces various regional dialects and languages, reflecting its rich cultural tapestry.

💶 Bring Cash – Don’t forget to bring cash, as it’s widely accepted for payments in Albania . Euros are commonly welcomed for transactions, including taxis, meals, and hotels.

💰 Albanian Currency – Lek The official currency of Albania is the Albanian Lek (ALL). When dealing with local transactions, it’s advisable to use the national currency. Although most places accept euros, sticking to the Lek ensures a more favorable exchange rate.

🏦 ATM – Credit cards are mainly accepted in larger hotels, big shops, and travel agencies in major cities. Using credit cards might incur higher fees, especially when withdrawing cash from ATMs.

☀️ Albanian Weather and Varied Landscapes Albania, located in the Balkan Peninsula, surprises visitors with its diverse landscapes. The weather varies across the country due to its geographical features. Coastal areas enjoy a Mediterranean climate, with hot and dry summers, while the inland regions, particularly in the mountains, experience cooler temperatures. The rainy season typically spans from October to March.

✈️ Albanian Travel Seasons • Busy Season (April – September): Summer marks the peak travel period, especially along the coastal areas. Warm weather and vibrant beach scenes attract tourists, but do keep in mind that June to November is considered the hurricane season.

• Slow Season (October – March): If you don’t mind a bit of rain, the slow season offers budget-friendly travel opportunities. Coastal areas might experience less tourist traffic during this period.

• Shoulder Season (Mid-October to November, January to Early-April): The shoulder season strikes a balance between favorable weather and reasonable prices, making it an ideal time for budget-conscious travelers.

- Sun Protection: The sun can be quite intense. Pack sunscreen, sunglasses, and a hat to shield yourself from those UV rays.

- Adapter and Charger: Ensure your devices stay charged. Albania uses the Europlug (Type C and F) electrical outlets, so bring the right adapter.

- Reusable Water Bottle: Stay hydrated while reducing single-use plastic. Albania has potable water, so you can easily refill your bottle.

- Light Jacket or Sweater: Evenings, especially in the mountains, can get cooler. A light jacket or sweater is handy for those chilly moments.

- Basic First Aid Kit: Include essentials like band-aids, pain relievers, and any personal medications you may need.

Remember, Albania offers a mix of landscapes, from coastal paradises to historic cities and mountain retreats. Tailor your packing list to your specific plans and enjoy your journey in this hidden gem of a country!✈️

If you’re wondering whether it’s safe to hit the road in Albania – the answer is a resounding YES! Embarking on a road trip in this picturesque Balkan nation is not only safe but also an excellent way to uncover its hidden gems. 🚗

Getting around Albania is easy. Roads are good, signs are in Albanian and English, and people drive in a friendly way. Just go with the flow and keep a map handy.

The one caveat to Albania driving safety is that you’ll be in a foreign country, unfamiliar with their laws and customs. Head here for a complete guide to Renting A Car in Albania: Everything You Need to Know , where you’ll also get 10 useful Albanian driving tips!

Renting a car? No big deal! Consider Rentalcars.com ; they make it super easy to find a car from local or international folks.

So, get behind the wheel and let every mile show you Albania’s cool stuff – history, nature, and all-around awesomeness. 🚗💨🌄

The official language of Albania is Albanian.😊 Therefore, knowing some basic Albanian phrases can be helpful during your visit. While English is increasingly spoken, especially in tourist areas and by the younger population, it’s not universally understood, particularly in more remote or rural areas.

Here are a few essential Albanian phrases that might come in handy:

- Hello – Tungjatjeta

- Goodbye – Mirupafshim

- Please – Ju lutem

- Thank you – Faleminderit

- Yes – Po

- No – Jo

- Excuse me – Më falni

- Do you speak English? – Flisni anglisht?

Learning a few local phrases can enhance your experience and show respect to the local culture. Albanians generally appreciate any effort made to speak their language. However, in more touristy areas, people working in the hospitality industry often have a good command of English.🌍✨

Albania allows visa-free entry for citizens of many countries for short stays. Citizens of the European Union (EU) member states, the United States, Canada, Australia, and many other countries typically do not need a visa for stays of up to 90 days within a 180-day period.

It’s recommended to visit the official website of the Ministry for Europe and Foreign Affairs of the Republic of Albania or contact the nearest Albanian embassy or consulate for the most up-to-date and accurate information regarding visa requirements and entry regulations.

Albania Safety Travel FAQ

Can you travel to albania right now.

Absolutely! Traveling to Albania is wide open. As you’ll discover below, there are virtually no travel restrictions currently in place for Albania. In light of this, many Europeans are choosing Albania as a refuge in these challenging times. For many, travel becomes a coping mechanism to combat Covid-19 fatigue.

DO I NEED A NEGATIVE COVID TEST TO TRAVEL TO ALBANIA?

Not at all! You don’t need to arrive in Albania with a negative Covid test. However, upon arrival, authorities at the airport may check your temperature. If it’s elevated, you might not be allowed to enter the country. Once you leave the airport, masks and temperature checks are generally not required for the majority of indoor spaces.

WILL I BE QUARANTINED IF I TRAVEL TO ALBANIA?

Great news – there’s no mandatory quarantine period upon arrival in Albania.

Is Albania Safe for Travel?

In short, yes. For the vast majority of travelers, Albania is safe. Safety, however, is a subjective feeling rather than an absolute fact, and no place on Earth is 100% safe. Given that tourism is a cornerstone of the country’s economy, the government takes significant measures to ensure areas frequented by tourists are secure.

Know Before You Go:

- ✈️ Airport: Tirana International Airport Nënë Tereza (code: TIA)

- ⏰ Time Zone: Central European Time (CET), GMT+1

- 💰 Currency: Albanian Lek (ALL)

- 🗣 Language: Albanian is the official language, with many also speaking Italian, Greek, English, and other languages due to the high number of Albanian diaspora and communities throughout the Balkans.

- 🎫 Albania Visa: Many travelers can enter Albania visa-free for up to 90 days, including citizens from the EU, US, and several other countries. It’s best to check the latest entry requirements before traveling.

- 🔌 Electricity Socket: Type C and F sockets are used in Albania, with a standard voltage of 230 V and frequency of 50 Hz. Travelers from countries with different standards may need a power plug adapter.

- 📲 SIM Card: Visitors can purchase a prepaid SIM card from local providers such as Vodafone or One Mobile. Free Wi-Fi is commonly available in hotels, restaurants, and cafes.

- 🚙 Car Rentals: Renting a car in Albania is an option for those wanting to explore independently. Companies like Kayak offer a range of vehicles and services. Be sure to understand the local driving laws and rental agreements.

Albania Travel: Frequently Asked Questions

Can you drink the water in albania.

Now, when it comes to tap water in Albania—definitely a no-go for sipping straight. Safety first, right? However, staying hydrated is key, especially with Albania’s sunny vibes.

Now, let’s talk about steering clear of dehydration, a common culprit for feeling under the weather in Albania. If you’ve snagged an Airbnb with a kitchen, a nifty trick is to give the tap water a good boil before sipping.

Now, the classic move is buying bottled water , but let’s be real, it can put a dent in your pocket and isn’t exactly a win for our lovely planet 🌍. My personal recommendation? The Filterable Water Bottle . It’s not just a reliable hydration buddy but also ensures the water you drink in Albania won’t throw you off, and it’s an eco-friendly choice! ♻️ Stay refreshed, stay safe!

🤔🤔 Curious about water safety in Albania? 🚱🚨 Check out by clicking the button below: Learn More About Drinking Water in Albania

Albania Map

Is albania worth visiting.

Absolutely, Albania is definitely worth a visit! Let me tell you why Albania is totally worth a visit! Imagine gorgeous Albanian beaches, untouched mountains, and a vibe that’s just real and authentic.

Wander through old towns like Berat city and Gjirokaster city – they’re like a trip back in time with their cool cobblestone streets and buildings that have stories to tell. And if you’re into history, check out Butrint ancient city ; it’s like a history book come to life.

Now, what sets Albania apart? The people. They’re not just friendly; they’re like your long-lost pals. Ever had traditional Turkish coffee with newfound friends? You might in Albania.

Money-wise, it won’t break the bank. You can feast on local treats , find cozy places to stay, and still have cash left for souvenirs.

Food alert! Albanian grub is a mix of Mediterranean and Balkan flavors. Traditional Albanian food like Byrek, qofte, and fresh seafood – your taste buds are in for a treat.

What’s the Albanian weather like?

Alright, let’s talk about the weather in Albania – it’s a bit of a mixed bag, but in a good way!

So, picture this: summers are like a warm hug with temperatures hovering around 25-30°C (77-86°F). It’s perfect beach weather, especially along the Albanian Riviera . You’ll want that sunscreen handy!

Now, winters are a bit cooler, ranging from 5-15°C (41-59°F). In the northern mountains , you might even spot some snow. Pack a jacket if you’re planning a winter visit.

Spring and fall ? Ah, they’re the sweet spots. Mild temperatures, blooming landscapes, and fewer crowds. Think 15-20°C (59-68°F) – pretty pleasant.

In a nutshell, pack your swimsuit for summer, a jacket for winter, and something comfy for the delightful in-between seasons. Albania’s weather is like a good friend – diverse and always ready for a good time! 🌞🌨️

What’s the best time to visit Albania?

It’s like this well-kept secret – timing matters for the best experience!

Summer Bliss (June-August): If you’re all about sunshine, sandy toes, and beach days, summer is your jam. The temperatures are a cozy 25-30°C (77-86°F) , making the Albanian Riviera a dreamy spot. Just be ready for some company – it’s peak tourist season.

Spring and Fall Magic (April-May, September-October): Now, if you’re into mild weather and fewer crowds, spring and fall are your golden windows. Picture this: 15-20°C (59-68°F) , blooming landscapes, and a chill vibe. It’s like having Albania all to yourself without the summer hustle.

Winter Wonder (November-March): Winter brings a cooler vibe, especially in the northern mountains where snow might join the party. Temperatures? Around 5-15°C (41-59°F) . It’s not the high season, but if you’re into tranquility and serene landscapes, winter has its own charm.

Choose your season based on your vibe – whether it’s the summer heat, the refreshing feels of spring and fall, or the peaceful winter vibes. Albania’s got the perfect mood for every season! 😎

Isit safe to drive in Albania?

I totally get your concern about driving in Albania. I’ve had the chance to explore this beautiful country, and from my experience, it’s generally safe to drive. Of course, like anywhere else, you need to be cautious.

The roads can be a bit tricky, especially in rural areas, with some narrow and winding paths. Keep an eye out for local drivers who might have their unique style. 😄 Traffic rules are there, but sometimes they seem more like suggestions.

In terms of safety, just drive defensively, watch your speed, and be prepared for unexpected situations. And oh, the views you’ll encounter are worth it! The landscapes are breathtaking, especially if you venture into the mountains.

ALBANIA CITIES

Albania’s captivating cities, like Tirana , Shkoder , Berat , Gjirokaster , and Vlora , are spread around the place.

The weather is kind of like a Mediterranean holiday – warm in summer and not too cold in winter. You can visit these cities anytime, really. But if you want the sun without the rain, April to October is a good bet . Still, each season brings its own vibe, so whenever you decide to check out Albania’s cities, they’ll be ready to say hi! 🌆🍃

ALBANIA BEACHES

Albania’s beach vibes go way beyond just cities! 🏖️ Picture this: pristine beaches that could easily outshine the big shots. Here are some seaside treasures to tickle your fancy, each with its own special magic:

Ksamil Beach: 🌊 South of Sarande, it’s like finding crystal-clear water in your own secret cove. Head there from June to August for the ultimate summer beach bliss.

Dhermi Beach: 🏞️ Tucked snugly between dramatic cliffs, Dhermi’s pebbly shores and blue waters make it a must-visit paradise. Hit it up from May to September for the full coastal experience.

Jale Beach: 🏝️ Need a break from the hustle? Jale Beach is your answer! Find peace and quiet there between May and September for the ultimate chill beach vibes.

Drymades Beach: 🎉 Ready for a beach party? Drymades is where it’s at! This lively spot with beach bars is the go-to for locals and visitors alike. Plan your visit from June to September for the ultimate summer bash.

Mirror Beach: 🌅 Near Dhermi, Mirror Beach’s calm and reflective waters make it a hidden gem. Enjoy its tranquility best during the summer season.

So, whether you’re into secluded coves or vibrant beach scenes, Albania’s coastline has something for everyone. Pack your sunscreen, and let the beach hopping begin! 🏖️☀️

Share this:

Albania Travel Insurance

Get ready to unravel the secrets of Albania’s captivating landscapes and vibrant culture, and let Soeasy Travel Insurance be your passport to worry-free exploration. From the azure beaches of the Albanian Riviera to the ancient history of Gjirokastër, our travel insurance is your reliable companion on this unforgettable journey.

Just as Albania’s beauty is boundless, so is our commitment to providing you with seamless protection. With Soeasy, your Albanian adventure is not just insured; it’s an invitation to embrace every moment with confidence. Explore Albania with ease, knowing that Seasy Travel Insurance has your back, ensuring your memories are cherished, not your worries.

Understanding The Importance Of Insurance For Albania

Albania, with its rich history and stunning vistas, is a dream destination for many. However, unforeseen circumstances can disrupt even the most well-planned trips. Secure your peace of mind by considering the following aspects:

Medical Coverage: Protecting Your Well-being

Insurance for Albania ensures you’re covered for unexpected medical expenses. From minor ailments to emergencies, a comprehensive plan guarantees access to quality healthcare without draining your finances.

Trip Cancellation Protection: Safeguarding Your Investment

Unexpected events can force you to cancel or delay your trip. With the right Albania travel insurance, you’re covered for non-refundable expenses, providing financial security when life throws unexpected curveballs.

Lost or Delayed Baggage: Ensuring a Smooth Journey

Imagine arriving in Albania without your luggage. Insurance for Albania offers compensation for lost or delayed baggage, ensuring you can replace essentials without hassle, so you can focus on enjoying your adventure.

Emergency Evacuation: A Safety Net in Unforeseen Situations

In rare but critical situations, emergency evacuation may be necessary. Travel insurance provides the necessary support, ensuring you receive prompt and efficient evacuation services.

How To Choose The Right Albania Travel Insurance?

Now that you understand the importance of Albania travel insurance, here’s how to select the right plan for your journey:

- Compare Plans: Finding the Best Value: Explore multiple insurance providers to find the best value for your money. Compare coverage, premiums, and customer reviews to make an informed decision.

best places to visit in albania

Albanian riviera.

The Albanian Riviera , also popularly known as Bregu, is a coastline along the Northeastern Ionian Sea in the Mediterranean Sea surrounding the districts of Sarandë and Vlorë in Southwestern Albania. Moreover, it was proclaimed as the 2012 Top Value Destination by Frommer’s.

The area is a major nightlife, ecotourist, and elite retreat destination in Albania. It features traditional Mediterranean villages, ancient castles, churches, monasteries, secluded turquoise beaches, bays, mountain passes, seaside canyons, rivers, underwater fauna, caves, and orange, lemon, and olive groves. Also, the Albanian Riviera has been host to several international music festivals such as Kala Festival, Soundwave Albania, and Turtle Fest while becoming known for its long-standing nightclubs.

Llogara National Park

The Llogara National Park is a national park centered on the Ceraunian Mountains along the Albanian Riviera in Southwestern Albania. Also the national park covers a surface of 10.1 km 2 . The park’s terrain includes large alpine meadows, vertical rock faces, and dense forests. Most of the land is covered by forests. Additionally, in 1966 researchers found that this area was home to several ecosystems and biodiversity of national importance.

At 1,027m, the Llogara Pass provides striking scenery, with tall mountains overlooking the Albanian Riviera and several islands in the sea. The region experiences a Mediterranean climate. Therefore, summers are hot and winters are generally dry-to-warm-to-cool.

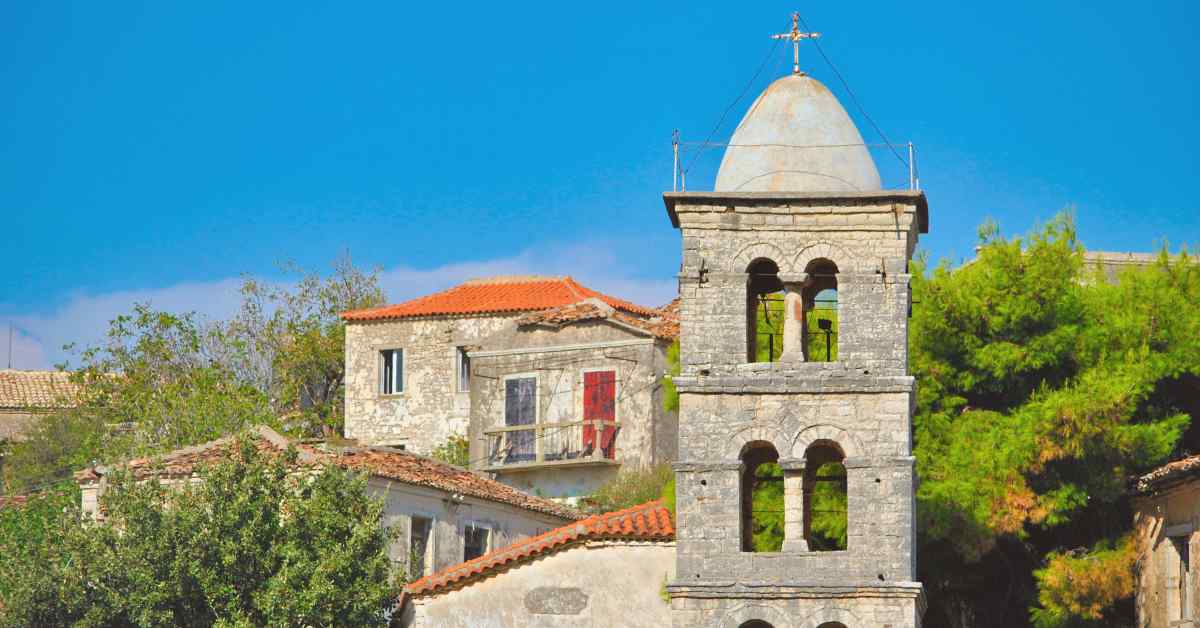

Gjirokastër

Gjirokastër is a city in Albania that appeared in the historical record in 1336 by its Greek name, Αργυρόκαστρο, Argyrókastro . It is located in a valley between the Gjerë mountains and the Drino, at 300 meters above sea level. Since 2005, the old town of Gjirokastër is a UNESCO World Heritage Site, described as “a rare example of a well-preserved Ottoman town, built by farmers of the large estate”.

The origin of the city was the castle of Gjirokastra. Intrestingly, the main characteristic of Gjirokastra is the intensive use of stone in building the houses, which look like small fortresses, and the streets of cobblestone, which all lead to Bazaar. Due to all these features, Gjirokastra is also known as the “The Stone City”.

Frequently Asked Questions – Travel Insurance Albania

Why do I need travel insurance for my trip to Albania?

Travel insurance for Albania is crucial to safeguard against unexpected events such as medical emergencies, trip cancellations, or lost baggage. It provides financial protection and ensures a worry-free experience.

What does medical coverage include in insurance for Albania?

Medical coverage in insurance for Albania includes expenses for unexpected illnesses, accidents, and emergencies. It ensures access to quality healthcare without the burden of hefty medical bills.

How does trip cancellation protection benefit me?

Trip cancellation protection reimburses non-refundable expenses in case unforeseen circumstances force you to cancel or delay your trip. It acts as a financial safety net for unexpected events.

What happens if my baggage is lost or delayed during my trip to Albania?

This travel Insurance provides compensation for lost or delayed baggage, allowing you to replace essentials without inconvenience. It ensures a smooth journey even if your luggage encounters issues.

Is emergency evacuation coverage necessary for my trip?

While rare, emergency evacuation coverage is essential for unforeseen situations where prompt evacuation is required. It ensures you receive timely and efficient evacuation services.

How can I choose the right travel insurance plan for my journey to Albania?

To choose the right travel insurance plan, consider your specific needs, read the policy details carefully, and compare plans from different providers. Tailor the coverage to match your unique travel requirements.

- Local Food Experiences

- Local Accommodation

- Travel Insurance

- Travel Books

- Travel Gear

Do You Need Travel Insurance For Albania? 8 Important Things To Keep In Mind

- Post category: Albania / Living Abroad / Travel Blog / Travel Gear

Do you need travel insurance for Albania? As someone who lives abroad in Albania, I wanted to shed some light on this topic.

Since 2019, I have been visiting the ‘land of Eagles’, finally moving here from Cork, Ireland in 2021.

I’ve traveled around the country a good deal and have lived in two cities, one in the north ( Shkoder ) and one in the south (Saranda).

With my personal experience and knowledge, I hope I can give some insight into whether you’ll need Albania travel insurance.

8 Tips For Albania Travel Insurance

Are you visiting Albania for a quick vacation trip or longer for some immersion into Albanian culture ?

Here are my top tips for you – a full guide on whether you need travel insurance for Albania.

Disclaimer: This site contains affiliate links that will cost you nothing extra but offer me a little commission for any purchases made. This helps me continue to offer helpful tips and information. Thank you so much for your support.

1. Do You Need Travel Insurance For Albania On A Short Trip?

The short answer is yes, you definitely need travel insurance for Albania.

Anywhere you travel, insurance is a no-brainer, definitely a must-have travel essential . Albania is a very safe destination in terms of crime – don’t buy into the stereotypes.

But for the health and emergency aspects, it is a real possibility that something could happen and you’d want to be covered.

Since Albania is not in the European Union, you won’t be able to use your EHIC (European Health Insurance Card).

I’ll explain more below about the health system and emergency response. If you’re in a hurry, I’d suggest checking out SafetyWing since they offer good coverage but are still very affordable.

I use SafetyWing myself and love how easy they make buying travel insurance. Arranging all my travel plans can give stress so I like that it’s fast and straightforward.

2. Do You Need Travel Insurance For Albania On A Longer Trip?

Recently, Albania has become a more well-known destination for digital nomads and retirees.

One reason for this is that Albania gives American passport holders a 1-year tourist visa upon arrival and they’ve also just made a digital nomad residency visa.

So it’s normal for people to stay from a month to years. If you are also interested in being in Albania for a long period, insurance plays an important role.

For the 1-year tourist visa, travel insurance for Albania is not required or mandatory, though that doesn’t mean you shouldn’t get it.

When applying for many types of Albanian visas/residency permits (even the digital nomad one), it is mandatory to have insurance.

3. Emergencies In Albania

Albania went through some really atrocious things under Communism.

Even since it ended, there have been other hindrances and tragedies, like the 2019 earthquake, lack of resources during COVID, ongoing corruption, etc.

Recovery from communism has been slow so the infrastructure of Albania still needs a lot of work.

It makes sense to say the emergency response won’t be top-tier if you compare it with western countries and even other Balkan countries.

Along with the infrastructure issues, Albanians have mass emigrated away to the US, UK, and EU countries.

This has left the population low, with many being elderly. Because of this, you’ll find a majority of land in Albania to be rural.

It is normal for some remote areas to not have roads, electricity, and running water.

The solitude you can find in Albania’s stunning nature is what draws many adventurists, but of course, can be dangerous if things go wrong.

Unfortunately, for these reasons, I’d definitely recommend getting travel insurance for Albania.

4. Public Hospitals In Albania

As I just mentioned, many Albanians emigrate away for education and employment opportunities.

This contributes to public hospitals lacking enough doctors and nurses which continues to hurt the Albanian health system.

Albania has a public health system that is technically ‘free’ for citizens of Albania but funded by a tax paid by employees and employers.

I emphasize the term citizens because as I mentioned before, if you are on a resident permit you might need to use your own insurance.

Of course, like most things in Albania, this is not always carried out how it is stated online.

As an example, I was horse riding with friends in the Albanian countryside, when one person’s saddle came loose as we were galloping.

I rode in the ambulance with him and he ended up having some broken bones and bruised ribs. He was asked to show his foreign ID, they treated him, and didn’t ask for payment.

The payment wasn’t avoided purposefully by any means, it was more of the case that all three of us were foreigners and didn’t know how things worked.

Now that I’ve been in Albania for a while I understand that tourists being treated at the public hospital isn’t straightforward.

Even for Albanians, it is normal to bribe doctors and nurses for shorter wait times and better care – which is exactly why I put free health care in quotes.

So the takeaway from this – as a foreigner visiting Albania, it’s hard to tell what to expect if you try to visit the public hospital.

5. Private Care In Albania

As a foreigner, communicating at the public hospital could be difficult since English could be limited there (knowing Italian could be beneficial, many doctors are older and know that better).

If you have an Albanian friend, you could bring them with you, things will go a lot smoother.

The other option is to seek private care, which will be closer to western standards in terms of care and facilities.

FREE MAP OF THINGS TO DO IN SHKODER ALBANIA

Join my exclusive email list & receive a map of things to do in Shkoder Albania. Use this convenient, digital guide so you know where to go & what to do in Shkoder on your visit!

By clicking to submit this form, you acknowledge that the information you provide will be processed in accordance with Maptrekking Privacy Policy.

We have successfully sent your walking tour map of Cork.

Can’t find it? Make sure to check your spam folder!

In the last decade, private health care in Albania has really expanded.

Private health care will be more likely to have English-speaking staff, so that will make it easier to communicate your issue or emergency.

I’m all for immersing yourself in the local language, but when it comes to medical emergencies, it’s obvious that clear communication becomes a top priority.

Of course, since the care is private it will cost you. I doubt any place will accept insurance.

Rather you will need to pay out of pocket and then be reimbursed by your provider later.

So the long answer to whether you need travel insurance for Albania is still yes, you need it.

6. Consider All Of Your Destinations

Usually, when travelers come to Albania, they are visiting multiple countries in the Balkan region.

Of course, I would argue that you could easily spend your whole trip slow traveling in Albania since there are a lot of hidden gems to find.

But if you are planning to cross some borders, you’ll want to make sure to have the right insurance for accurate coverage.

That’s why I’d suggest a company that covers multiple countries or whole regions without charging more. This is actually why I prefer to use SafetyWing .

Since it’s more of a subscription-based insurance, it follows you everywhere you go. This is ideal if you’re spontaneous – one less thing on your travel checklist.

7. Consider Your Health & Safety Needs

Everyone is different and ultimately you know yourself best.

If you know for a fact that you’re accident-prone or always finding yourself in unavoidable travel delays, then travel insurance might be a good call.

Naturally, some people have more medical costs than others and of course, age is a huge factor too.

If you know for a fact that you need expensive prescription medicine, tests, doctor visits, etc. then finding good travel health insurance for Albania is important.

If you live away from your home country (like me), these expenses are bound to creep up since you aren’t just on a short visit.

Unfortunately, most regular travel insurances don’t cover smaller medical problems, but rather large emergencies.

If you are wanting more comprehensive health insurance that follows you everywhere, I’d encourage you to check out SafetyWing’s global health insurance .

It’s designed by and for remote workers and digital nomads – plus with this insurance you’re still covered in your home country.

8. Travel Insurance Can Release Stress

For many, travel can create some anxiety, especially if you’re headed to unknown territory.

With unfamiliar circumstances, I think it’s normal to become overwhelmed, even as an experienced traveler. That is also the beauty of getting out of your comfort zone.

You get to grow through new challenges. When I first came to Albania, that’s exactly how I felt but it was honestly fun to experience the chaos.

Back then, I didn’t know how things worked here and also things weren’t as organized as they are now.

Personally, I find it easier to enjoy travel when I know I’m covered, it takes some pressure off.

Final Thoughts On Travel Insurance For Albania

I hope this guide on travel insurance for Albania guide has helped in some way. Albania is a beautiful country with deep history and great food, you should definitely visit.

If you have any further questions about Albania travel insurance, just shoot me a DM on Instagram.

Need some more inspiration for your trip? Check out one of the best road trips in Albania !

You Might Also Like

Hidden Gems In Europe: 4 Must Try Local Experiences

12 Tips To Find The Best Work Abroad Travel Insurance

Is Shkoder Worth Visiting? 8 Things You Should Know

- House Sitting

- Worldpackers

- Slow Travel

- Cultural Travel

- Living Abroad

- Travel Gifts

- Travel Stories

- WORK EXCHANGE

- Work With Me

- Privacy Policy

- Stuff I Love

- Start Blogging

Get a Free Insurance Quote

Help protect yourself and your family while on vacation.

Get A Free Travel Insurance Quote

Travel smarter with travel insurance from RoamRight. Get your free, no-obligation quote online today.

Major Tourist Attractions: Koutammakou, Lake Togo, Lome Grand Market, Togo National Museum, Fazao Mafakassa National Park

Albania Travel Insurance

Arch RoamRight offers travel insurance for U.S. residents traveling to Albania. Whether you need travel insurance to help protect the expenses you’ve paid into your vacation, or short-term travel medical insurance while you’re in Albania, we have several travel insurance plans for you to choose from. Get started by completing our quote form above.

About Albania

Albania has had a rough twentieth century. After nearly fifty years under the iron curtain of communism, they've only recently emerged back into the wider world. During those dark years, Albania under Enver Hoxha was unaligned with the Soviet Union or Yugoslavia; it instead existed as it's own culturally untouched cultural enclave. As a result, modern Albania is a country with a fascinating history and stunning natural beauty that is virtually untouched by mainstream travelers.

Although it hasn't become a popular tourism destination just yet, Albania has plenty to offer intrepid visitors. The Ionian and Adriatic coasts feature white sand beaches and translucent water, while the Albanian Alps are great for hiking. The hillsides are dotted with crumbling castles and magnificent mosques (Albania is one of just a handful of Muslim countries in Europe). Not a bad bang for your buck, which incidentally stretches much farther in Albania than in most of Europe.

It is not all smooth sailing for visitors yet. The travel infrastructure in Albania is still being developed and train services are limited. Bus is the primary mode of transportation, particularly to areas off the beaten path. That said, Albania is considered to be very safe, and it's people are particularly welcoming to tourists.

Some of the many unique activities found only in Albania include:

- Visit the town of a thousand windows, the historic Ottoman city of Berat.

- Sample locally made feta cheese.

- Travel overland to one of the world's newest countries: Kosovo.

- Photograph throwback communist architecture, like the Piramida in Tirana.

- Eat dinner at a 2000-year old castle, Petrela Castle.

- Knock back some raki, Albania's locally-distilled national drink.

- Visit ancient Roman and Greek ruins in Butrint and Durrës.

- Soak up the sun on the Albanian Riviera.

Embassy Contact

Related blog posts, what’s the difference between trip cancellation, trip interruption, and trip delay.

Will Your Health Insurance Cover You Abroad?

Real Travel Insurance Customer Stories

- Capital: Tirana

- Climate: Mild Temperate

- Currency: ALL - Albanian Lek

- Dialing Code: 355

- Drives on: Right

- Emergency (Ambulance) #: 17

- Emergency (Fire) #: 18

- Emergency (Police) #: 19

- Internet Top Level Domain: .al

- Land Mass (km2): 28748

- Official Language(s): Albanian

- Plug Configuration: F,C

- Population (est): 3,011,405

- Time Zone (of capital): CET (UTC/GMT +1 hour) NO DST

- Our Products

- Company Info

- Travel Destinations

- Travel Blog

- Video Testimonials

- Arch RoamRight Partners

- Partner Portal

- Brochures & Forms

- BBB A+ Accredited Business

Copyright© 2024 Arch Insurance Company. All rights reserved.

Site Map | Privacy and Data Protection Policy | Consumer Disclosures | Terms of Use | Accessibility Statement | Fraud Notices | Money-Back Guarantee

- Global travel destinations

Travel insurance for Albania, Albania travel insurance

Compare and buy travel insurance, what does visitor travel insurance cover, health care expenses, doctor visit, pharmacy drugs, pre-existing conditions, medical evacuation, repat of remains, albania healthcare for tourists, travel health insurance for albania.

Schengen visa insurance

US Expatriates Insurance

Albania Visitor Insurance

USA Visitors Insurance

Travel insurance for us citizens traveling to albania.

Albania is home to some of the best Mediterranean beaches. In 1967 Albania became the world’s first atheist state and it is the birthplace of Mother Teresa. Albania is a mountainous region with undisturbed nature, lakes, medieval-era castles, water springs and waterfalls. It’s capital Tirana is a charming city, and Albania has some of impressive archaeological towns like Butrint and Apollonia, fascinating hamlets like Berat, Gijrokaster that are UNESCO sites.

Albania is quite popular worldwide for its religious tolerance where Islam and Christianity are equally respected. Thousands of American citizens visit Albania. U.S. citizens are allowed to stay in Albania for up to 1 year without a residence permit with a valid passport for at least three months.

While traveling to Albania US travelers should consider buying travel insurance protection for their vacation. It is always best to include the best travel insurance cover especially given the Ukraine War, Covid19 pandemic and high inflation.US travelers can get coverage for any sudden travel and medical emergencies that may occur during the trip. The Trip Cancellation or Trip Delay covers can aid US travelers in insuring the trip expenses.

Europe travel insurance for Albania, Covid travel insurance for Albania

International travel to Albania has started again after the complete lockdown due to the Covid19 pandemic. However given the health risks and increased healthcare costs involved in light of the pandemic, it is very important to have good travel insurance which covers Covid19 illness.

Travelers can compare Albania Covid travel health insurance with coronavirus coverage by using our Europe travel insurance compare tool . Travelers should provide relevant information such as the travelers age, the duration of travel, the medical maximum coverage and the deductible

Albania Travel insurance with Covid coverage

Given the increased health risks involved in international travel during the Covid19 pandemic, it is particularly important to have good travel insurance which covers Covid19 illness.

The following US travel insurance work well for foreign visitors which provide Albania travel insurance with Covid coverage

- Safe Travels Outbound insurance by Trawick International is available for US citizens traveling to Albania with Albania Covid insurance coverage.

- Safe Travels International insurance by Trawick International works well for Non-US citizens visiting Albania and provides Covid19 insurance coverage.

- Travel Medical Plus Insurance offered by Seven Corners has covid health insurance for visitors to Albania. The Sevencorners coronavirus visitor insurance treatment benefit is available for COVID-19 (the disease); SARS-Cov-2 (the virus); and any mutation or variation of SARS-CoV-2.

- Diplomat Long term Insurance by Global Underwriters. The Diplomat Long Term travel insurance offers coverage for covid-19 as a new sickness and is available for both US and Non US citizens. It must be bought for a minimum of 3 months and insures up to 1 Million Dollars.

- Atlas International Insurance by World Trip offers good travel insurance for Albania and covers covid19 illness.

The Safe Travels insurance plans provide a visa letter stating that the Albania travel insurance covers Covid19 illness. This visa letter can be downloaded online after completing the travel insurance for Albania purchase.

Albania has made it mandatory for international travelers to have travel insurance for visiting Albania. Traveling outside one’s home country is risky, especially in light of the Covid19 pandemic healthcare costs have increased globally.

Albania require foreign travelers to have adequate medical coverage to covers medical expenses. Due to expensive health care cost it is advisable to buy best Albania travel insurance.

Best Covid19 international travel insurance Albania

- International travelers traveling outside their home country not to the USA.

- US Citizens and US residents traveling outside the United States

- Available for both US citizens and non US Citizens traveling to Europe up to 65 years.

- Available for both US and Non US citizens at moderate price with required benefits. It offers $50 per day for each day the travelers are quarantined abroad for a maximum of 10 days. Coverage must be bought for a minimum of 30 days. Show proof of quarantine mandated by a physician or governmental authority. Quarantine must be due to you testing positive for COVID-19/SARS-CoV2.

- Available for both US and Non US citizens at affordable price with premium benefits

- Available for both US and Non US citizens at affordable price with fewer benefits

- Coverage for travelers traveling outside their home country whose destination excludes the U.S. and its territories.

- Deductible options from $0 to $2,500

- Policy Maximum from $50,000 to $2,000,000

- Renewable upto 24 continuous months

- Covers COVID-19/SARS-CoV-2 as any other Illness or Injury.

- Patriot Platinum Insurance is best suited for travelers expecting first-class medical coverage; vacationing families; individuals up to $8 million.

- Deductible options from $0 to $25,000

- Policy Maximum from $1,000,000 to $8,000,000

- The minimum initial period of coverage that can be purchased is 3 months

- Traveling to the United States: Plan A: $500,000 Plan B: $1,000,000 Traveling Outside the United States: Plan A: $500,000, Plan B: $1,000,000

Albania travel insurance, travel insurance for visiting Albania

Long term europe visa insurance for albania.

Travelers who wish to live, work, study or do business in Albania for a long duration have to apply for resident visa or national visa of Albania. One of the necessary documents that they need while applying for long term Europe residence permit is adequate travel medical insurance with a minimum of 30,000 Euros travel insurance coverage, evacuation and repatriation coverage which must be valid though out the entire duration of stay in Albania. The long term Europe travel insurance plans are affordable and can be purchased easily once you choose the one that's right for you. Compare popular travel health insurance plans for long term Europe Visa and buy online.

Travel Insurance for Albania citizens traveling to the USA

The USA is a vibrant country with diverse culture, natural wonders, great career options and one among the most aspiring countries for Albania citizens. The first immigration of the Albanians was after World War II who were mostly political emigrants..

Over the years since then there were several Albanians who migrated to the US. There are approximately 203,600 Americans with Albanian descent in the US. Albania and the US have a strong and friendly relationship between each other. Thus several Albanian citizens travel to the US for vacation, work and to meet family. Summer would be an ideal time for tourists to visit the US.

Select the type of insurance for travelers to Albania...

travel insurance with quarantine coverage, travel insurance for quarantine coverage.

- Travel insurance for US Citizens and US Residents traveling outside USA

- Provides minimum coverage of $3,000 for potential or extended quarantine lodging expenses due to Covid19.

- Provides guaranteed travel insurance for Covid19 for medical expenses of at least USD $50,000.

- Covid-19 is covered as any other sickness

- Safe Travels Voyager plan's trip delay benefit can be upgraded.

- The base benefit is $3,000 (which is $250 per day). Traveler’s can choose $4000 ($300 per day) or $7000 ($500 per day).

- Travel insurance for American citizens and US Residents traveling outside USA

- Provides minimum coverage of $2,000 for potential or extended quarantine lodging expenses due to Covid19.

- Covid-19 is covered as any other sickness.

- Covid Quarantine Benefit: Coverage for accommodations due to a covered Trip Delay $2,000/$150 per person per day (6 hours or more) is included in the basic coverage.

- Optional Quarantine Benefit Upgrade at additional price Trip Delay Max Upgrade - including Accommodations (6 Hours or more) $4000 ($300/day) or $7000 ($500 per day)

- Travel insurance for Non US Citizens and Non US Residents traveling outside their home country

- Travel insurance for US Citizens and US Residents

- Provides minimum coverage of $1,000 for potential or extended quarantine lodging expenses due to Covid19.

- Covid19 medical expenses are covered and treated the same as any other sickness

- Offers coverage of $50,000 for emergency medical expenses

- Offers comprehensive trip cancellation coverage

- Travel medical insurance coverage outside USA

- Atlas insurance offers $50 per day for each day that travelers are quarantined abroad for a maximum of 10 days.

- Coverage must be bought for a minimum of 30 days. Proof of quarantine mandated by physician needed.

- Quarantine must be due to you testing positive for COVID-19/SARS-CoV2.

- Travel insurance for US Citizens and US Residents traveling outside US

- Trip cancellation up to $50,000

- Trip interruption up to 200% of trip cost

- $500,000 medical for sickness and injury/$1,000,000 medical transportation

- Include $2000 in travel delay benefits for quarantine/lodging.

Covid Quarantine insurance for US citizens

Despite the removal of the Covid-19 restrictions both in the US and around the globe, it is prudent for US citizens to purchase international travel insurance which will make the whole trip worry free and provide good protection for any medical or travel related expenses in case of unexpected situations.

US travelers can either buy US Covid quarantine coverage trip insurance (includes coverage for cost of the trip), or Covid quarantine travel health insurance (insures only the health of the traveler and is cheaper than trip insurance).

Travel medical insurance to emergency medical expenses

Best travel insurance, best international travel insurance for us citizens.

- Travel medical insurance for US Citizens and US Residents traveling outside USA

- Available up to 180 days

- Offers emergency sickness coverage up to $500,000

- Covid-19 covered as any other sickness

- USA travel medical insurance coverage outside USA for US citizens

- Available up to 365 days

- Offers maximum coverage up to $2,000,000

- Offers insurance coverage for Covid expenses

- US travel health insurance for US citizens outside USA

- Available from 5 days to 364 days

- Offers maximum coverage up to $5,000,000

- Travel Medical Choice insurance offers coverage for expenses related to COVID-19

- Short term fixed benefit cheap travel insurance USA for US citizens outside USA

- Plan maximum options available up to $130,000 for medical expenses

- Offers coverage outside the US

- Deductible options from $0 to $1,000

- Policy Maximum from $50,000 to $150,000

- Offers emergency medical evacuation coverage up to $500,000

- Offers coverage for travelling outside your home country

- It includes coverage for Covid-19 is covered as any other illness under the medical expense maximum.

- Testing for Covid-19 will only be covered if deemed medically necessary by a physician. The antibody test and prescreening test are not covered, as they are not medically necessary. Maximum age for plan eligibility is 64.

Expatriate heath insurance for living outside home country

Best expat insurance, best expatriate insurance, expat insurance plans.

- Ideal for US expatriates and for those global citizens living and working outside their home country.

- Xplorer Premier Insurance provides unlimited annual and lifetime medical maximum.

- It covers pre-existing conditions with creditable coverage

Trip cancellation insurance for trip investment expenses

Best trip cancellation insurance, best trip protection insurance, best trip cancellation insurance.

- Trip Cancellation: Up to 100% of insured trip cost

- US Residents on domestic and worldwide trips

- Travel SE Covid Quarantine Benefit : Travel SE plan offers Coverage for accommodations due to a covered Trip Delay $2,000/$125 per person per day is included in the basic coverage.

- Travel LX Covid Quarantine Benefit : Travel LX plan offers Coverage for accommodations due to a covered Trip Delay $2,500/$250 per person per day is included in the basic coverage.

- Inexpensive coverage for trip cancellation & interruption

- Travel Lite Covid Quarantine Benefit : Travel Lite plan offers Coverage for accommodations due to a covered Trip Delay $500/$125 per person per day is included in the basic coverage.

- Trip Cancellation: Up to 100% of Trip Cost Insured

- Up to 100% of Trip Cost Insured

- It covers Trip Cancellation coverage from $150 to $10,000.

- Trip Cancellation: Trip Cost: Up to a Maximum of $30,000.

- Maximum Trip Length 90 Days

- Offered by Trawick International and is highly rated.

- You can add a "Cancel for Any Reason" waiver onto the plan.

- It can cover trips up to 90 days long.

- Cancellation of policy must be purchased within 10 days of the initial trip deposit date.

- Trip Cancellation: Basic - $15,000 Max

- Trip Cancellation: Plus - $100,000 Max

- Trip Cancellation: Elite - $100,000 Max

- Trip Cancellation: 100% of trip cost up to $30,000

- Provides coverage for U.S. residents travelling outside their home country

- Trip Cancellation: 100% of trip cost up to $100,000

Trip cancellation insurance for Cancel for any reason

Cancel for any reason trip cancellation insurance, cancel for any reason plans.

- Cancel For Any Reason: 75% of non-refundable trip cost

- Trip Cancellation: Tour cost to a maximum of $100,000

- Cancel for Any Reason: Up to 75% of trip cost insured

- Trip Cancellation: Up to 100% of Trip Cost

- Cancel for Any Reason: 75% of non-refundable trip cost

- Trip Cancellation: Up to a Maximum of $50,000. ($30,000 for travellers above 80 years)

- Cancellation for Any Reason: 75% of the Insured Trip Cost within 21 days of trip deposit - some restrictions apply. Not available in NY or WA.

US seniors traveler insurance, Medicare supplement international travel insurance

Usa senior citizen travel insurance, us seniors travel insurance, travel insurance for older us travelers.

- The GlobeHopper Senior plan is available either as the GlobeHopper Single-Trip plan for single trips with coverage from 5 days to 365 days

- The GlobeHopper Multi-trip plan which covers a period of 12 months with a maximum of 30 days for each overseas trip

- It is an affordable international travel health insurance for US citizens.

- It offers coverage for medical and evacuation expenses for short trips.

- It is available up to 12 months

- It is an renewable long term international travel health insurance for US citizens.

- It offers coverage for medical and evacuation expenses.

- It is available up to 12 months.

Annual travel insurance, Yearly travel insurance

Best annual travel insurance, best yearly travel insurance, annual travel plans.

- Patriot Multi Trip is designed by IMG to cover travelers taking multiple trips in a year.

- Covers non US Citizens travelling multiple times annually outside their home country

- Trekker Essential Insurance offers maximum coverage of $50,000 for sickness and accidents.

- Available for both US and Non US citizens up to 75 years

- Maximum trip length is 30 or 45 days per trip

- Available for US residents only up to age 81 years

- Maximum trip length is 30 days per trip

- Voyager Annual (offered by USI Travel Insure) covers US citizens in and out of the US at least 100 miles away from home.

- It does not cover trip cancellation but can be used for 90 days at a time within a year and is great for frequent travelers.

- Take an unlimited number of Covered Trips during the 364 day Policy period