Welcome to Beauty Packaging

Login join welcome to -->, subscribe free magazine enewsletter magazine enewsletter --> checkout.

The Estée Lauder Companies Announces New Travel Retail Leadership

Elevates Israel Assa and Javier Simon to greater roles following the retirement of Olivier Bottrie.

- Israel Assa , currently President, Commercial, Travel Retail Worldwide, will succeed Bottrie and will be named Global President, Travel Retail Worldwide. He will be based in New York and will report directly to Peter Jueptner, President, International. He will join the company’s Executive Leadership Team (ELT).

- Javier Simon , currently President, Travel Retail Asia Pacific, will succeed Assa, and will be named President, Commercial, Travel Retail Worldwide. He will report directly to Assa and will be based in Switzerland. He will join the company’s Executive Leadership Team (ELT).

- Andrea Dorigo , Senior Vice President, General Manager, Global Retail and Head of Commercial, North America, will continue to report directly to Mark Loomis, President, North America, for his Commercial, North America responsibilities, and will report directly to Jueptner for his Global Retail responsibilities.

Israel Assa Appointed Global President, Travel Retail Worldwide

Javier simon appointed president, commercial, travel retail worldwide, andrea dorigo to report directly to mark loomis and peter jueptner.

- L Catterton Acquires Majority Stake of Kiko Milano

- Estée Lauder Companies Creates a Beauty AI Innovation Lab

- Former L’Oréal Exec Becomes Kering Beauté’s President and CEO, Americas

- Sephora Launches Drunk Elephant in Mainland China

- Independent Beauty Association Celebrates 50 Years

April/May 2024

- What’s New in Sustainable Packaging?

Cookies help us to provide you with an excellent service. By using our website, you declare yourself in agreement with our use of cookies. You can obtain detailed information about the use of cookies on our website by clicking on "More information”. Got It

- Privacy Policy

- Terms And Conditions

Latest Breaking News From Nutraceuticals World

Latest Breaking News From Coatings World

Latest Breaking News From Medical Product Outsourcing

Latest Breaking News From Contract Pharma

Latest Breaking News From Beauty Packaging

Latest Breaking News From Happi

Latest Breaking News From Ink World

Latest Breaking News From Label & Narrow Web

Latest Breaking News From Nonwovens Industry

Latest Breaking News From Orthopedic Design & Technology

Latest Breaking News From Printed Electronics Now

Copyright © 2024 Rodman Media. All rights reserved. Use of this constitutes acceptance of our privacy policy The material on this site may not be reproduced, distributed, transmitted, or otherwise used, except with the prior written permission of Rodman Media.

AD BLOCKER DETECTED Our website is made possible by displaying online advertisements to our visitors. Please consider supporting us by disabling your ad blocker.

- Modern Retailing

- NDC for Airlines

- NDC for Corporations

- NDC for Travel Retailers

- Sabre Travel AI

- Tech Transformation

- Sabre Labs & Research

- News & Views

Agencies & OTAs

- Corporate Travel

- Developers & Startups

- Data & Analytics

- Traveler Experience

- Industry & Public Affairs

- Press Releases

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

The Future of Travel Retailing: Elevating the Passenger Experience

- Around the Industry

- General Blog

Retailing & Merchandising

- Sabre Direct Pay

- Sustainability

- Travel Providers

- Travel Trends

Sabre is forging ahead in its ambition to modernize travel industry standards and accelerate retailing transformation, standing shoulder-to-shoulder with IATA in a shared vision for the future.

Over the coming weeks, we will lead you step-by-step on that journey towards change. This blog series will break down some of the key themes presented in IATA’s most recent white paper to support a common understanding of the challenges and benefits of moving to an Offer and Order model.

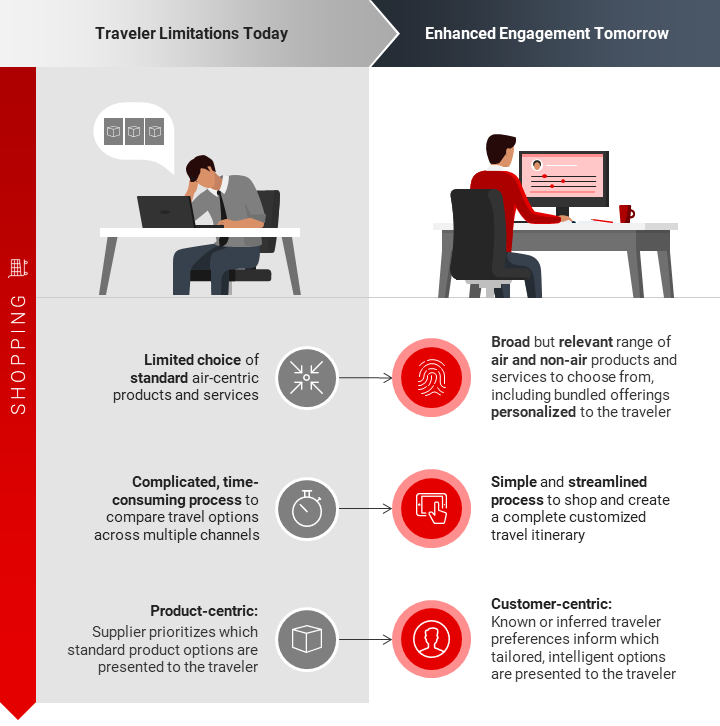

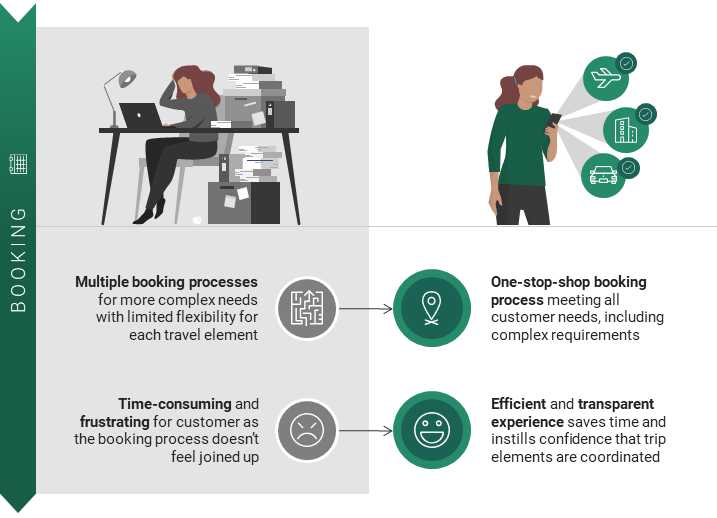

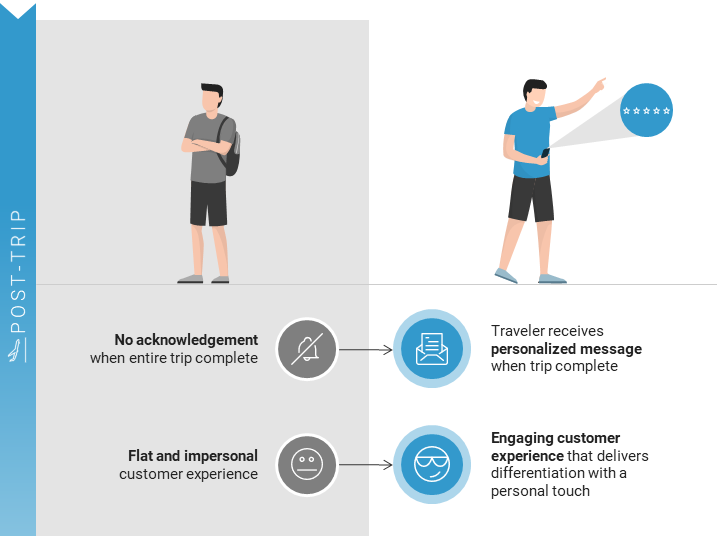

In this first blog we’ve chosen to view the industry through the eyes of the traveler, tackling their most common frustrations at key stages of the travel journey; from shopping , booking and payment through to pre, during and post-travel touchpoints. Many of the challenges arise from inherent limitations within existing business processes and technologies. We highlight where and how the traveler experience could be improved once the transition to a retailing model has been completed – and how this would ultimately drive increased revenue across the travel ecosystem.

In future blogs we’ll peel back the layers of Offer and Order as we take a closer look at the challenges and opportunities from the perspective of an airline, explore the core building blocks of a robust retailing solution, and break down some of the complex legacy processes that will, over time, yield to upgraded solutions that are better able to meet and exceed customer expectations.

A broader selection of more targeted products and services will enhance the customer experience, improve conversion rates and ultimately drive increased revenue for travel providers.

A simple and customer-friendly booking process increases the likelihood of customers booking ancillaries and added value extras .

Consumers want greater choice in how and when they pay for products and services, including travel.

Clear and transparent communication, combined with rapid resolution of issues, increases traveler satisfaction and drives long-term customer value for an airline.

Capitalizing on untapped opportunities to instill consumer loyalty is a proven path to repeat business and enhanced revenue growth .

*Statistics referenced within this article originate from a survey commissioned by Sabre in Q4 2021 comprising over 10,000 global respondents

Responsiveness to change is critical to long-term success.

As we’ve shown in the illustrations above, there are multiple opportunities for the travel industry to progress beyond the principles and processes that brought it to this point in its evolution. The established ways of working may still be fit for purpose, but the travel industry is poised to enter a dynamic new phase in its development – one which offers exciting opportunities for growth and progression beyond those on offer today.

Technological advancements in the last 15 years have catalyzed more innovative and progressive thinking within the travel sector. At the same time, consumer expectations have evolved across all facets of modern life, including travel. People have become accustomed to technology-driven, self-serve, personalized shopping experiences.

To date, in the eyes of consumers, the travel industry – and airlines in particular – have struggled to deliver. The limits of many existing systems and processes have been reached or exceeded, and consumer demands are outpacing the industry’s ability to evolve. Sabre firmly believes that travel providers must pivot towards simplified, scalable, end-to-end solutions that deliver highly personalized travel experiences.

Interested in learning more? From educational resources to industry insights, we’ve got you covered at Sabre.com/open .

Related Post

April 2, 2024

Beyond NDC supports multi-passenger offers

The reason for booking a trip usually informs how many people will be involved. Corporate travel often includes one adult, while leisure trips typically involve multiple adults, or families with young children in tow. Sabre’s NDC...

April 1, 2024

Booking NDC content is easy in the Sabre GDS. Here’s why.

Looking for more detail? Check out our resources for getting started with NDC: Don’t miss out on NDC updates from Sabre! Subscribe to stay up to date on news and fresh resources.

February 26, 2024

Performing while transforming: Three ways to unlock revenue along the path to modern airline retailing

In recent months, there has been a noticeable shift in the industry conversation around airlines’ transition to offer- and order-enabled retailing, with questions like ‘if’, ‘why’ and ‘when’ being replaced by ‘how’. Many have already started...

January 26, 2024

9 questions on modern retailing for travel agencies to ask themselves

Are you discussing modern, offer- and order-based travel retailing with other leaders at your agency? Airlines, tech providers, and many travel retailers are figuring out what the future means for them, and now is a great...

September 25, 2023

Can your agency tech stack meet the demands of modern retailing?

Agency tech stacks will need to be updated to consume new data standards and process more data in new ways. Sabre supports leisure agencies, travel management companies, and online travel agencies to achieve modern retailing success...

August 31, 2023

Rethink your agency operations to achieve modern retailing success

Modern travel retailing, enabled by offers and orders and enhanced with AI/ML solutions, presents new ways for agencies to interact with customers. It also means new processes, increasingly fragmented content, shopping-led instead of schedule-led workflows, and...

July 27, 2023

What Top Gun can teach us about the future of airline retailing

Few movies have stood the test of time as well as Top Gun, and while I’ve let go of my childhood dreams of becoming a fighter pilot, I’m now focused on technological advancements in air travel...

July 25, 2023

Building a strategy for modern agency retailing success

Modern travel retailing, enabled by offers and orders and enhanced with AI/ML solutions, presents new ways for agencies to interact with customers. To capitalize on new opportunities and stay competitive, agency leaders should consider implications to...

Unsupported browser detected, for a better experience please upate to a newer version of Internet Explorer.

site categories

Parent item expand the sub menu, travel retail resets to a ‘new normal’.

Shifting purchasing behavior and uneven geographic and product category recoveries are helping to transform the business.

European Beauty Editor

- Share this article on Facebook

- Share this article on X

- Share this article on Flipboard

- Share this article on Pin It

- Share this article on Tumblr

- Share this article on Reddit

- Share this article on LinkedIn

- Share this article on WhatsApp

- Share this article on Email

- Print this article

- Share this article on Talk

CANNES, France — A new normal.

That is what travel retail beauty executives are grappling with and focused on during the recent TFWA World Exhibition and Conference.

The Cannes, France-based event, held from Oct. 1 to 5, was fittingly dubbed “Open World” by trade show organizers. Everything is now open to discussion and analysis, as travel retail resembles nothing like it did in 2019, pre-coronavirus pandemic.

Related Articles

This acquisition aims to build a one-stop sustainability shop for fashion and beauty, all the beauty and wellness retail expansions of 2024.

“The world has shifted dramatically since 2019,” said Alexandre Callens, president global travel retail at Groupe Clarins.

“Everything has changed,” agreed Giovanni Sgariboldi, Euroitalia president.

Beauty is a bellwether for travel retail. With about a 40 percent share, perfume and cosmetics was by far the number-one category sales-wise in the channel’s almost $65 billion business in 2022, with more than 60 percent year-over-year growth, according to Generation Research. Behind beauty comes wine and spirits, and fashion and accessories, with about 15 percent each.

Among beauty categories overall, skin care generated more than half of total sales, followed by fragrance and makeup.

Beauty executives at TFWA percolated with excitement, ideas and optimism, with many saying their business had already surpassed 2019 levels, despite the fact that Chinese consumers — traditionally top luxury cosmetics spenders, especially for skin care — are still not traveling beyond their country’s borders.

“There is plenty of positivity around duty-free and travel retail at the moment,” said Erik Juul-Mortensen, president of TFWA, during the opening conference. “People are hungry to travel again…but we are not quite back to where we were in 2019.”

Overall passenger numbers by the end of 2023 are expected to reach 90 percent of 2019 levels, according to travel analytics company ForwardKeys, a travel analytics company. It estimates the Americas and Middle East and Africa regions should be up 101 and 105 percent, respectively, while Europe and the Asia-Pacific regions to be at 94 and 70 percent, respectively, of the 2019 levels.

ForwardKeys forecasts the global 2019 level of international Chinese passengers will be reached in 2026, but that some regions such as the Middle East and the Americas should recover earlier, in 2025.

“The surge in air traffic, although welcome, has created some staffing problems, since 43 percent of airport workers worldwide left the sector during the pandemic,” said Mortensen, citing Air Transport Action Group statistics. “It remains true travelers are returning, but buying habits have evolved.”

“The channel must adapt to the evolution of the worldwide population and the traffic,” said Antonin Carreau, global director for beauty at Dufry Group, which will soon be called Avolta.

“Our world is largely dominated by the younger generation valuing experience, digitalization and social responsibility,” said Carreau, who noted a greater demand for luxury experiences, such as personalization, cocreations and exclusive events.

Some challenges have a bright side.

“From a macro level, the challenge — and the opportunity — is traffic recovery,” said Israel Assa, global president, travel retail at the Estée Lauder Cos. “As traffic grows, the industry has the opportunity to grow with it.”

Yet it’s not always a perfect equation.

“Even though traffic is recovering strongly, average spend per passenger is below pre-pandemic levels,” said Mortensen.

To help ramp up in-store penetration, L’Oréal is accelerating digital activations for preflight marketing, according to Vincent Boinay, the group’s outgoing general manager for travel retail worldwide, who early next year will become president of the the company’s North Asia zone and chief executive officer of L’Oréal China.

Gebr. Heinemann is taking a similar approach.

“That’s where we see big opportunities for us to make sure that more customers buy in our stores,” said Britta Hoffmann, director of purchasing for perfumes and cosmetics at the German operator.

A TFWA-commissioned study suggests the travel retail industry must transition from a one-size-fits-all approach to a segmented value proposition tailored to each customer category.

“This is where we have collectively, as a trinity, a challenge,” said Boinay, referring to the triumvirate of suppliers, retailers and airports.

Other factors are shaping travel retail’s new normal, too. Yaël Blassin, regional director at Interparfums SA, highlighted a rise in special offers in European travel retail doors.

“For the retailers, it now represents 15 percent to 20 percent of their fragrance business,” she said.

“One of the challenges is the massive discounts we see in the beauty category everywhere,” said Hoffmann.

This has a large knock-on effect.

Another concern voiced by executives is the vast number of products in store.

“The biggest challenge is the reduction in space [for existing brands], because retailers are listing more and more,” said Blassin.

Experiential Retail

A key phrase of this 38th edition of TFWA — which clocked 7,385 attendees, up 23 percent versus 2022 and down just 2 percent against 2019 levels — was “experiential retail.”

“We have to provide experiences, retail-tainment,” said Bommier. “It’s not a transactional relationship anymore. In our shops, we need to adapt our concept, our journey, which must be seamless.”

In Cannes, DFS revealed it will open a “seven star” luxury retail and entertainment destination in Hainan, China, by 2026. That is to spread more than 1.38 million square feet and carry more than 1,000 luxury brands. Called DFS Yalong Bay, it is the largest project ever conceived by the LVMH Moët Hennessy Louis Vuitton-owned travel retail operator, and will also boast immersive concepts.

Category-specific, DFS reopened a renovated and expanded store, called Beauty Store of the Future, in Galaxy Macau in late October 2022.

“This is the type of experiential retail, catering to one category only, which is beauty, that encapsulates what we’re aspiring to do,” said Benjamin Vuchot, CEO of DFS Group.

The location offers a wide selection of products and services. There are Valmont luxury treatment rooms with a full-service menu, for instance, and artisanal fragrances from the likes of Maison Francis Kurkdjian, Le Labo and Diptyque.

“[They are] very beautiful brands that require a little bit more space to narrate what they’re all about,” said Vuchot.

Digital touch points are important, as well.

“We wanted to make sure that those touch points that people see online are replicated in the store,” he said.

The Beauty Store of the Future has a studio for livestreaming.

DFS sets out to create “destinations within destinations,” said Vuchot.

Heinemann is working to further expand and diversify its assortments, while focusing on innovation, new concepts and experiences. In the Düsseldorf, airport, for instance, the operator opened its Test and Learn concept.

“We have dedicated spaces for the beauty category specifically, for online brands that are targeting Gen Z — assortments that maybe we don’t typically have in duty-free,” said Hoffmann. “The first learnings is that it works super well.”

Every three to six months, the concept and brands here will change, and Test and Learn is expected to roll out to other airports.

Perfume Mania

In travel retail, as in the domestic market, fragrance — especially high-end perfume — is driving the beauty category’s growth. In 2022, fragrance was the second-largest category overall, after skin care, which makes more than half of beauty’s overall sales, according to Generation.

“Fragrance was traditionally a very large segment of the European and Latin American businesses, but the fantastic thing is that we’re seeing very strong growth for artisanal and luxury fragrance from the Asia-Pacific region,” said Assa. “So, it’s truly a global phenomenon.”

“It’s a lever of growth in the months and years to come,” said Bommier. “We will build this category with the brands.”

Other travel retail operators were quick to jump on the trend, too.

Dufry has developed an Haute Parfumerie concept, involving fragrance brands such as Penhaligon’s, Maison Francis Kurkdjian, Acqua di Parma, Parfums de Marly and Amouage. The first location was launched in Zurich airport in March. The 1,940-square-foot, freestanding store has lots of digital assets, including fragrance finders.

“We’re looking into expanding the concept worldwide and evolving it from a store design and consumer standpoint,” said Carreau.

Puig has a rich portfolio of niche brands in very tight distribution. L’Artisan Parfumeur, for instance, is found in just 300 doors globally.

The company sets out to have a unique, dynamic offer in the channel. Beginning in July, it prelaunched Rabanne’s new image in Heathrow Airport T2.

“What we’ve seen is the amazing engagement of passengers with that new image and look, and that elevation of brand equity,” said Noens.

L’Artisan Parfumeur staged a pop-up in Charles de Gaulle airport in Paris, which has become a road map for further rollouts.

“Partnering with retailers to bring unique and different experiences is the only way we’re going to walk away from a price war that is a short-term element,” said Noens. “It’s not going to add value to the brand, the retailer or the landlord.”

Caroline Andreotti, CEO of Coty Prestige, said a fragrance brand like Chloé Atelier des Fleurs has hopped on a rising trend of perfume layering.

“We explain to the customers how they can layer different flowers together to get to a certain outcome,” she said, adding consumers are also layering ancillaries with scent to reinforce a perfumes’ long-lastingness.

Coty and others in the industry have noted the increasing importance of travel retail exclusives today.

“You have discovery sets,” said Markus Stauss, vice president of global marketing travel retail at Coty, citing as an example a coffret with five bestselling perfumes in 10-ml. spray bottles.

Molton Brown keeps rolling out its “fragrance first” strategy in travel retail.

“There’s such a demand from our consumer for services, individualization and personalization. Traditionally, those have been saved for our high-street locations,” said Mark Johnson, president of Molton Brown global, who earlier this year was also appointed president of cosmetics business AEMEA at parent company Kao Corp. “But now what we see is within the travel retail industry, the consumer no longer has that divide.”

Inspired by its global flagship on London’s Regent Street, Molton Brown reworked its T5 location in Heathrow Airport to become a space focused on perfume, with a gift bar and engraving. That reopened in November 2022.

“We’ve really worked on Atkinson to rebuild the image, fragrances, exposure and distribution,” said Sgariboldi. “We are ready to raise the visibility and presence of Atkinson in duty free.”

Retail-tainment and exclusives are also names of the game for perfume. The Estée Lauder Cos., among other groups, has been launching some products in travel retail before the domestic market. Tom Ford introduced a two-month exclusive preview of its Grey Vetiver fragrance in the Europe, Middle East and Africa region starting in April.

“It was an incredible success,” said Assa.

For the exclusive launch of Coty’s Boss Bottled Summer Edition 2023, there was a cross-category animation with Heinemann, including eyewear, watches and fashion, as well as immersive experiences in Frankfurt Airport, also in April. That included a surfboard with virtual-reality simulation and a photo booth with a surfboard and ocean backdrop.

“It was really to bring them into the universe of Boss as a brand,” said Stauss.

“More and more consumers are looking at travel retail to discover innovation that they don’t see in the domestic market,” said Andreotti.

In July, Coty introduced Burberry Goddess in travel retail worldwide for a one-month exclusive. The group said the launch is setting new market records.

Events — with glitter and a giant logo — for Jimmy Choo’s I Want Choo were staged in the channel in the U.K. a few times this year.

“For travel retail, [the concept] has to be understood immediately, because people are stressed, they do not have much time,” said Blassin.

Skin Care and Makeup

While perfume is booming, skin care and makeup sales are taking longer to recover in travel retail.

In part, that’s due to the fact fewer Chinese are traveling abroad, which has allowed beauty brands and retailers outside China to become less reliant on skin care.

“It’s more diversified, the growth footprint,” said Peter Jueptner, group president, international at the Estée Lauder Cos.

Still, the category’s business is picking up.

In China Duty Free’s International Duty Free Mall Xin Hai Gang, in Haikou, China, the Estée Lauder Cos. opened some treatment rooms for some of its brands, marking a first for the group in travel retail.

Assa said that has been well received from an experiential perspective.

“The consumer now has the ability not just to shop, but also be pampered while they shop, and that definitely resonates with the luxury, higher-end consumer,” he said.

Carreau expects by mid-2024 skin care sales in travel retail will reach 2019 levels, even without the full recovery of Chinese footfall.

At DFS, people have been seeking out clean beauty.

“I’m particularly interested also now in bringing products that are good for hair and sun care,” said Vuchot.

DFS launched in Galaxy and The Londoner, in Macau, an area called Beauty Collective, which gives an opportunity to bring in more indie brands. Its 2.0 version is due to be revealed late this year, and the rollout will include Hysan in Hong Kong in December.

Dufry has been developing and launching a well-being concept dubbed Mind. Body. Soul., which works cross-category.

“It proves to be successful in recruiting consumers,” said Carreau.

Noelle Goris, vice president global travel retail and distributor markets at La Prairie Group, has also noted momentum ramping up again for skin care.

“We are ready,” she said. “We are gearing up our BA capacity and capability.”

Over the past year, while La Prairie has closed about 15 doors in the channel, the brand’s footprint in square meters has grown 10 percent.

“We gained in terms of quantity of space, but also a lot in terms of quality of space,” said Goris, adding the brand is gaining market share most everywhere.

La Prairie is implementing more services and a channel-related offer. In February, with Heinemann, it opened an Art of Beauty suite with two facial cabins in Sydney International Airport. This month, it launched its first travel retail discovery set.

“You have a full ritual,” said Goris.

Meanwhile, Groupe Clarins’ travel retail sales are today substantially above 2019 levels, according Callens. The company in September began launching its Precious prestige skin care range in travel retail in almost 90 doors, of which almost half are in Asia.

In the channel overall, the group is homing in on a seamless omnichannel approach, with the goal of having the Clarins consumers’ data shared between the travel retail and the domestic markets, to give clients a seamless experience.

“How do we fully integrate and recognize the loyalty of our consumer across the world, across the distribution channel, across all sorts of retailer barriers?” mused Callens.

It’s been a bit easier for Clarins to achieve that in Asia, especially China, due to the WeChat mini programs and the Tencent ecosystem allowing the company to engage and collect data through the equivalent of WhatsApp.

L’Oréal, with its portfolio of brands spanning dermocosmetics to hair care, and luxury to mass market products, sets out to sell beauty for all travelers, according to Boinay.

L’Oréal Paris, in an extension of a study begun last year, asked travelers on the Chinese island of Hainan why they enter travel retail stores. Thirteen percent said it was due to the accessible-luxury brand L’Oréal Paris. Of those that purchased L’Oréal Paris in the channel, 68 percent bought another brand, as well.

“So L’Oréal Paris is really a traffic driver and has tremendous recruitment power,” said Karina Behar-Lecuiller, general manager of the Consumer Products Division Travel Retail Worldwide at L’Oréal, while standing near a merchandising unit showcasing the new mascara Panorama.

Color cosmetics is the beauty category taking the most recovery time.

“Makeup will come back more strongly,” said Jueptner. “If you look at makeup today, it’s still behind significantly. We think it’s a matter of time. There’s a big opportunity to reinvent and upgrade the experience you have with makeup.”

Sustainability Minded

A sustainability focus has amped up in the channel of travel retail and at TFWA, where L’Oréal and Heinemann revealed a new partnership.

“We will be embarking on a collaborative green road map,” said Kim Rowney, travel retail sustainability director at L’Oréal.

Guido Tappesser, chief commercial officer of L’Oréal travel retail, explained that since the health crisis began, consumers have been demanding more sustainable products and brands with a purpose.

The first step of the tie-in will concern product assortment within Heinemann’s Future Friendly concept, slated to have a global rollout starting in 2024. The partnership will be wide-reaching, including CO2 emission reduction, cooperating on social projects and customer engagement.

“We are super convinced that our business can be green and profitable,” said Hoffmann.

Executives strongly believe in the health of travel retail mid- to long-term.

“All the fundamental drivers are intact,” said Jueptner. “You will have more people traveling, more middle class in the emerging markets, more people getting a passport.

“We’ve been through this COVID disruption and have seen amazing recovery in EMEA and the Americas,” he continued. “We’re basically back to where we were before — and then some. The recovery in China, particularly, is taking more time than everybody expected, but it will come eventually.”

This is a period of transition, but also a great opportunity for industry reinvention, according to Jueptner.

“It opens up the space to do more from a segmentation perspective, with different traveling corridors and travel nationalities,” said Assa.

“It’s a very interesting period of time, because it’s time to reset,” said Callens. “Forget about 2019 — have the same ambition or bigger ambition for performance. But the methodology behind 2019, which was for everybody the record year, doesn’t work. We need to change ingredients and make a different recipe.

“Forget about what we know,” he said.

Sign up for beauty news straight to your inbox every day

WWD and Women's Wear Daily are part of Penske Media Corporation. © 2024 Fairchild Publishing, LLC. All Rights Reserved.

Fashion Expand fashion menu

- Fashion Trends

- Fashion Features

- Fashion Scoops

- Designer & Luxury

- Ready-To-Wear

- Accessories

Business Expand business menu

- Government & Trade

- Mergers & Acquisitions

- Marketing & Promotion

- Human Resources

- Business Features

- Real Estate

Beauty Expand beauty menu

- Beauty Features

Men's Expand mens menu

- Mens Accessories

- Mens Clothing Furnishings

- Mens Designer Luxury

- Mens Lifestyle

- Mens Retail Business

- Mens Sportswear

- Mens Fashion

Runway Expand runway menu

- Men’s Fall 2024

- Pre-Fall 2024

- Spring Ready-to-Wear 2024

- Fall Couture 2023

- Resort 2024

Denim Expand denim menu

Sustainability expand sustainability menu.

- Environment

- Social Impact

Home/Design Expand home-design menu

- Interior Design

- Architecture

WWD Weekend Expand wwd-weekend menu

Events expand events menu, eye expand eye menu.

- Celebrity Real Estate

Shop Expand shop menu

More expand more menu.

- Fairchild Live

- RetailRx Community

Verify it's you

Please log in.

United States

Open and close mobile menu

https://www.elcompanies.jp/ja-jp

- Our Values and Beliefs

- Executive Leadership

- Board of Directors

- The Lauder Family

- The Estée Story

- A Family in Business

- Key Moments

- AERIN Beauty

- Bobbi Brown Cosmetics

- Bumble and bumble

- Darphin Paris

- Editions de Parfums Frédéric Malle

- Estée Lauder

- Jo Malone London

- KILIAN PARIS

- The Ordinary

- Tom Ford Beauty

- Women’s Advancement

- Social Investments

- Employee Engagement

- Writing Change

- Breast Cancer Campaign

- Inclusion, Diversity & Equity

- Sustainability

- Climate and Environment

- Responsible Sourcing

- Product Responsibility

- Working With Our Suppliers

- Social Impact & Sustainability Report

- Supply Chain

- Research & Development

- Kuala Lumpur

- Why Work Here

- Our #ELC Family

- Learning & Development

- Internships

- Full-Time Programs

- News & Media

- Media Resources

- Resources & Reports

- Email Alerts

- Earnings & Financials

- Quarterly Earnings

- Annual Reports

- SEC Filings

- Proxy Statements

- Events & Presentations

- Corporate Governance

- Governance Principles

- Executive Officers

- Press Releases & News

- Stock Information

- Stock Chart

- Fundamentals

- Dividend History

- Analyst Coverage

- Ownership Profile

- Investor Resources

- Investor Contacts

- Investor Toolkit

- Stockholder Services

- Financial Tear Sheet

Home News & Media Newsroom

ELC Announces Key Leadership Appointments for its Travel Retail Business

Press Release , Mar 11, 2022

NEW YORK --(BUSINESS WIRE)-- Today, The Estée Lauder Companies Inc. (NYSE:EL)("ELC") announced key leadership appointments for its Travel Retail business, which follow the announcement that Olivier Bottrie, currently Global President, Travel Retail and Retail Development , will retire in June 2022 after an exceptional career.

The following appointments will be effective May 1, 2022:

- Israel Assa , currently President, Commercial, Travel Retail Worldwide , will succeed Olivier and will be named Global President, Travel Retail Worldwide . He will be based in New York and will report directly to Peter Jueptner, President, International. He will join the company’s Executive Leadership Team (ELT).

- Javier Simon , currently President, Travel Retail Asia Pacific , will succeed Israel , and will be named President, Commercial, Travel Retail Worldwide . He will report directly to Israel and will be based in Switzerland . He will join the company’s Executive Leadership Team (ELT).

- Andrea Dorigo, Senior Vice President, General Manager, Global Retail and Head of Commercial, North America , will continue to report directly to Mark Loomis, President, North America , for his Commercial, North America responsibilities, and will report directly to Peter for his Global Retail responsibilities.

“We are proud of the exceptional depth and quality of talent across the organization, and as Olivier steps into his well-deserved retirement, we are pleased to elevate Israel and Javier, two dynamic, internally-trained and highly experienced leaders into these roles of greater responsibility,” said Peter Jueptner. “ELC remains committed to investing in and growing our local and international talent around the world, particularly leaders like Israel and Javier, who have extensive first-hand experience in Travel Retail and deep global expertise across all aspects of prestige beauty.”

Please find further information about Israel’s and Javier’s respective appointments and Andrea’s updated matrix reporting line below.

Israel Assa Appointed Global President, Travel Retail Worldwide

With over 21 years of experience within The Estée Lauder Companies and Travel Retail, Israel Assa is renowned industry-wide as a passionate brand steward and brand builder who has continually championed innovation within the Travel Retail channel, making him uniquely qualified to lead ELC’s winning Travel Retail business.

In this role, Israel will lead The Estée Lauder Companies’ global Travel Retail business, which has grown from approximately 6% of ELC’s net sales in fiscal year 2004 to approximately 28% in fiscal year 2021.

Over the course of his career, Israel has held diverse roles across ELC’s Travel Retail business, touching all aspects of the channel as a Regional lead, a Brand lead and a Commercial lead. He has an intimate knowledge of how to bring together brands and retailers to develop locally-relevant consumer experiences, as well as scaling distribution to meet consumer demand.

In his most recent role as President, Commercial, Travel Retail Worldwide, Israel oversaw Travel Retail’s Regional businesses in APAC, EMEA, and Americas as well as created a centralized Center of Excellence in Switzerland to enhance the organization’s service to global and regional retailers. Since taking on this position in 2019, Israel has overseen tremendous growth within The Estée Lauder Companies’ Travel Retail business and has acted as a steadying force throughout the volatility of the global pandemic.

A change champion, under Israel’s leadership Travel Retail’s Regional organizations have focused on building new capabilities, simplifying processes, and investing in learning and technology to set up Travel Retail for sustainable, long-term success. This approach has paid off with ELC not only maintaining the top market share position during the pandemic 1 , but the company is also well positioned to capture consumer spend when global international travel returns.

Israel joined The Estée Lauder Companies in New York in 2001 as Executive Director, Travel Retail Marketing, and moved to Miami as Vice President and General Manager, Travel Retail Americas, in July 2006. In 2014 Israel was appointed Senior Vice President and General Manager, Estée Lauder, Travel Retail Worldwide until taking on the role of Senior Vice President, Business Operations, Travel Retail Worldwide, in 2016.

A champion of the company’s values of Inclusion, Diversity, and Equity, Israel has played an active role in the creation of Travel Retail’s learning and development program with Florida A&M University, a top public Historically Black College/University (HBCU) in the United States , 2 to build the next generation of Black beauty talent in Travel Retail. He is also a member of the advisory board for The Estée Lauder Companies’ Hispanic Connections employee resource group, that aims to strengthen the company's position within the Hispanic and Latino marketplace and community as well as focus on the professional growth of group members.

A Cuban American and a native New Yorker, Israel holds his Master of Business Administration from NYU and a Bachelor of Arts in International Studies from The University of Michigan , Ann Arbor . He also is a graduate of the Advanced Management Program of the Wharton School, University of Pennsylvania .

“Israel’s deep understanding of our Travel Retail business, his longstanding relationships with retailers and airport landlords, and his passion for our consumer make him perfectly positioned to take ELC’s Travel Retail business into its next generation of growth,” said Peter Jueptner. “I look forward to working closely with Israel to drive this business forward in his new position as Global President, Travel Retail Worldwide.”

Javier Simon Appointed President, Commercial, Travel Retail Worldwide

A well-respected, driven, and innovative leader with a track record of building high-performing teams, Javier’s deep understanding of the Travel Retail channel, strong retailer relationships and global experience make him extremely well-suited to step into the role of President, Commercial, Travel Retail Worldwide.

In this role, Javier will oversee Travel Retail’s Regional businesses in APAC, EMEA, and Americas as well as the global retailer Center of Excellence in Switzerland focused on commercial and channel partnerships.

Most recently appointed President, Travel Retail Asia Pacific, in 2019, Javier has been a transformational leader, overseeing a period of tremendous growth. Under his stewardship, powered by the traveling Chinese consumer, the rise in online pre-order and a commitment to delivering the highest quality brand-building experiences, Travel Retail Asia Pacific has continued to excel, even in the face of the global pandemic. Javier’s ability to steer his team through the uncertainties of the global pandemic, pivoting their focus to Hainan and Chinese domestic travel have been critical to maintaining success for the channel and the company.

Javier’s passion for innovating the retail experience and meeting the consumer wherever they are in the journey, has enabled The Estée Lauder Companies to lead the way in transforming the Travel Retail channel. In taking key strategic bets such as embracing the potential of online pre-order and diversifying the company’s consumer messaging to highlight experience as well as value, Javier and his team have proven Travel Retail’s ability to deliver an omnichannel, brand equity-building experience.

Javier has continually pushed the boundaries to grow ELC’s business and win within Travel Retail. His cultivation of the company’s brand portfolio, from launching new brands in the channel to scaling and developing brands to new heights, has been critical in sustaining Travel Retail’s top market share position. Taking his experience in Asia Pacific , his strong retailer relationships, and ability to build diverse teams of change agents, Javier is well positioned to scale the growth created in APAC across all three Travel Retail regions to capture the traveling consumer as international travel returns.

A native of Venezuela , Javier joined The Estée Lauder Companies in 2000 as Regional Director for the Estée Lauder brand in Travel Retail Americas, and then went on to become Vice President and General Manager for Travel Retail Americas in 2001. In 2006, Javier was appointed General Manager for the Swiss Affiliate before returning to Travel Retail as Vice President and General Manager, Travel Retail APAC, in 2009.

Javier holds his Bachelor of Science in International Studies from the Universidad Central de Venezuela and an MBA from the Ecole Supérieure de Commerce de Paris . He also is a graduate of the Advanced Management Program of the Wharton School, University of Pennsylvania .

“Javier is highly respected by his teams and peers within the industry as an innovative leader who creates a culture of excellence,” said Peter Jueptner. “His track record of growth, deep Travel Retail knowledge, and respect for the global consumer will be critical to continually capture and scale the future potential of Travel Retail. I look forward to his success in this role.”

Andrea Dorigo to Continue to Report Directly to Mark Loomis for Commercial, North America Responsibilities, and Directly to Peter Jueptner for Global Retail Responsibilities

Andrea’s new reporting line to directly to Peter for his Global Retail responsibilities reflects the elevation of the company’s Global Retail business to International to support its continued actions to lead retail transformation at the global level.

“I look forward to partnering closely with Andrea to drive retail growth in the brands and across the enterprise through innovative thinking and disruptive growth models,” said Peter Jueptner. “Together, we will further strengthen the vision and strategy for the future of retail at our company.”

About The Estée Lauder Companies Inc.

The Estée Lauder Companies Inc. is one of the world’s leading manufacturers and marketers of quality skin care, makeup, fragrance, and hair care products. The company’s products are sold in approximately 150 countries and territories under brand names including: Estée Lauder, Aramis, Clinique, Lab Series, Origins, Tommy Hilfiger, M·A·C, La Mer, Bobbi Brown, Donna Karan New York, DKNY, Aveda, Jo Malone London, Bumble and bumble, Michael Kors, Darphin Paris, TOM FORD BEAUTY, Smashbox, Ermenegildo Zegna, AERIN, Le Labo, Editions de Parfums Frédéric Malle, GLAMGLOW, KILIAN PARIS , Too Faced and Dr. Jart+, and the DECIEM family of brands, including The Ordinary and NIOD.

ELC-C ELC-L

__________________________ 1 Generation Research 2019; Generation Research 2020 2 US News and World Report 2022 Best Colleges

View source version on businesswire.com: https://www.businesswire.com/news/home/20220311005081/en/

Investors: Rainey Mancini [email protected]

Media: Jill Marvin [email protected]

Source: The Estée Lauder Companies Inc.

We use cookies to ensure our website works properly, and to collect statistics to provide you with the best experience. By continuing to use this site, you are agreeing to this. Find out more about how we use cookies and how to manage your settings .

Accept Do not accept

Enter the valid email address

- Regional News

The Estée Lauder Companies doubles travel retail output with new facility

By Charlotte Turner | Tuesday, 7 June 2022 14:00

TRBusiness spoke with Assa on-location at the opening of a new ‘state-of-the-art’ distribution centre in Galgenen, Switzerland, which ELC says will double its total output capacity, ‘enabling the flexibility necessary to adapt to the channel’s high growth potential’, it said.

ELC is home to market-leading beauty brands, such as Estée Lauder, Clinique, Mac, La Mer, Bobbi Brown, Aveda, Jo Malone London, Tom Ford Beauty, Le Labo and Dr. Jart+ among many others, and its travel retail division represented 28% of the group’s sales in fiscal year 2021.

FIVE YEARS IN THE MAKING

Plans for the new facility were formalised pre-pandemic in 2017 and the centre finally began operating in November of last year. Understandably the official opening was postponed until now.

Video below: ELC’s new, state-of-the-art distribution centre in Switzerland will support the dynamic growth of the Company’s TR business

L to R: Umair Ansari, VP/GM, Travel Retail EMA, Fabrizio Freda, President and Chief Executive Officer, Jane Lauder, EVP, Enterprise Marketing and Chief Data Officer, and Roberto Canevari, EVP, Global Supply Chain cut the ribbon at the new Galgenen distribution centre.

Addressing the timing of the opening and the challenges facing all travel retail stakeholders currently, Assa insisted that volatility in the market was short-term.

“I think there’s definitive short-term volatility that’s being cause by the pandemic; there’s short-term volatility that’s being caused by other geo-political factors, but the truth is this facility and our stance overall is that we believe in the travel retail channel and we’re 100% committed to the success and resilience of the channel.”

ELC says it will double its total travel retail output capacity.

ELC celebrated the milestone opening today (7 June) in the presence of VIP guests among which were representatives from its travel retail partners, Dufry, DFS, Dubai Duty Free, Gebr. Heinemann, Lagardère Travel Retail and Aer Rianta.

The following ELC representatives were in attendance: Fabrizio Freda, President and Chief Executive Officer; Roberto Canevari, Executive Vice President, Global Supply Chain; Nadine Graf, Senior Vice President, General Manager, Europe, Middle East, and Africa (EMEA); Maike Kiessling, General Manager, Switzerland; Jamal Chamariq, Senior Vice President, Global Supply Chain, EMEA and Travel Retail Worldwide and Sascha Trabelsi, Vice President, Supply Chain, Travel Retail Worldwide.

Fabrizio Freda, CEO and President of Estée Lauder Companies addressed VIP guests at the opening of the new Galgenen distribution centre today.

LONG HISTORY IN SWITZERLAND

ELC is well-established in Switzerland, opening its affiliate office more than 55 years ago and its first manufacturing plant more than 45 years ago. It is the fifth largest employer in the canton of Schwyz.

The company currently has four distribution centres in Switzerland. “Switzerland is also home to ELC’s EMEA and TR Supply Chain Management Hub in Wollerau, which drives agility, speed, and collaboration across our EMEA and Travel Retail supply chain teams,” added the company.

Plans for the new facility were formalised pre-pandemic in 2017 and the centre finally began operating in November of last year.

Whilst expanding its already sizeable distribution footprint in the region, the new facility will enable ELC to ‘remain at the forefront of delivering its prestige beauty products and high-touch services to travelling consumers around the world’, it says. The centre is also equipped to further drive the company’s sustainability efforts.

“Travel retail continues to demonstrate its resilience, driving tremendous growth over the last decade for The Estée Lauder Companies. We remain extremely confident in the channel for the long-term, especially as travel restrictions ease globally and people start travelling again,” said Fabrizio Freda.

“The opening of our new Galgenen distribution centre will enable us to adapt even better to ever-changing retail needs and growth opportunities for the channel, and expand upon our existing distribution presence in Switzerland,” added Freda.

ELC MARKS 30 YEARS IN TRAVEL RETAIL

Assa added his remarks: “As we mark the 30th anniversary of The Estée Lauder Companies’ travel retail business, we are incredibly proud of our track record of exciting and delighting travellers all over the world with our exclusive products and high-touch experiences for the travel retail industry and having made the channel an integral engine of growth for ELC.

According to ELC, the distribution centre’s roof solar panels generate 1600 kilowatts at peak performance (kWp).

“As we look to the future, this investment here at Galgenen is a testament to our belief in the long-term growth potential of this channel and that by investing in these capabilities and with our retailers, we can capture the next generation of growth in this dynamic, prestige marketplace.”

“Galgenen will serve as a cornerstone of The Estée Lauder Companies’ agile, global fulfillment network,” said Roberto Canevari. “This distribution centre will not only significantly enhance our capacity but enable operational efficiencies, speed-to-market and resiliency through innovative, highly automated equipment and technologies. Additionally, we are proud that Galgenen is also a shining example of ELC’s commitment to safety, quality, and sustainability.”

SUSTAINABLE SOLUTIONS

According to ELC, the building’s design is based on the newest standards to reduce energy and water consumption. It features total LED lighting, an energy-efficient HVAC system and the roof’s solar panels generate 1600 kilowatts at peak performance (kWp).

Estée Lauder Companies is the fifth largest employer in the canton of Schwyz.

Furthering sustainability efforts, a comprehensive waste management system has been implemented to separate out numerous recyclables, with electric trucks ready for waste removal. As part of the recycling undertaking, wooden waste pallets will generate renewable heating energy.

“Worldwide, ELC is driving strategic initiatives to reduce its environmental footprint, integrate environmentally responsible practices and invest in innovative technology as part of efforts to not only provide consumers with transformative products and experiences, but also to contribute to the well-being of the planet,” it stated.

Like what you’re reading? Follow TRBusiness on Linkedin:

Most popular

- Most Shared

Alcohol insights: Conversion up, spend down in Q4

Conversion of visitors in the alcohol category in duty free has risen to 54% in Q4 2023,...

Men buy and spend more in travel retail says new research by m1nd-set

Men have a higher conversion rate and spend more when shopping in travel retail, says new...

Saudia Arabia's KKIA unfurls T3 duty free expansion

King Khalid International Airport (KKIA) has unveiled the first stage of its much-vaunted duty...

In the Magazine

TRBusiness Magazine is free to access. Read the latest issue now.

E-mail this link to a friend

In case you missed it....

- women in travel

For the brave

The Future of Travel Retail Webinar

Where others see uncertainty, we see a world of possibility.

Times have changed. Radically so. Yet while other industries have pushed the boundaries of retailing innovation, travel stayed the same. Now, we want what they’ve got – and that demands huge transformation.

Watch our webinar about the future of travel retail and the monumental change that’s to come.

Listen to Jen Catto, CMO at Travelport, delving into the minds of travelers, to uncover why travel retailing is broken — and how it can be fixed —exclusively revealing the results of our retailing research.

Then find out from Travelport’s CPTO, Tom Kershaw, how we’re reinventing travel retailing and what we’re doing in Travelport to deliver on our vision for the future.

Finally hear from Sam Hilgendorf, CIO at Fox World Travel, about how they’re navigating the complex world of retailing and how Travelport is helping them on their journey.

The Future of Travel Retail

Webinar recordings are also available in other languages: German , Italian , Japanese , Spanish

Want to learn more about modern retailing? Visit our ‘The Future of Travel Retail’ hub and learn from experts across all industries.

Find anything you save across the site in your account

Make better business decisions

Sign up to our newsletter for a truly global perspective on the fashion industry

Enter your email to receive editorial updates, special offers and breaking news alerts from Vogue Business . You can unsubscribe at any time. Please see our privacy policy for more information.

Estée Lauder Companies sales fall 10% as travel retail craters

By Ezreen Benissan

To receive the Vogue Business newsletter, sign up here .

Estée Lauder Companies (ELC) said Wednesday that first-quarter sales fell 10 per cent to $3.52 billion, due to slower-than-expected recovery of prestige beauty in mainland China as well as a poor performance from the company’s Asia travel retail business. The results prompted the American beauty conglomerate giant to lower its fiscal 2024 outlook, and shares fell more than 15 per cent on Wednesday morning in response.

By region, EMEA saw the biggest decline. Net sales fell 27 per cent, with global travel retail sales down double digits, due to ELC resetting retailer inventory levels. It plans to reduce excess and obsolete inventory through its regionalised supply chain network, particularly across Asia. Sales in Asia decreased 3 per cent, thanks to a slowdown in overall prestige beauty in mainland China. ELC says the decline was partially offset by increases in other countries within the region including Hong Kong, Japan and Australia. The American market rose 6 per cent, with gains in North America and Latin America. CEO Fabrizio Freda also told investors that the Israel-Hamas war has impacted operations. “We are reflecting the risks of business disruptions in Israel and other parts of the Middle East,” he said on Wednesday.

“While the Asia travel retail business, a slowing Chinese economy, and sluggish US demand (in the wholesale channel in particular) remain headwinds entering full year 2024, we believe these factors are reflected in current valuation levels, and we continue to see secular growth in the global beauty category over the longer-term with underlying demand among Chinese consumers as a driver,” Dana Telsey, CEO of Telsey Advisory Group, said in an analyst note.

Estée Lauder’s sales have continued to decline quarter-on-quarter. In August, fiscal year 2023 sales fell 10 per cent thanks to a stagnant recovery of travel retail sales in Asia. Similarly, third-quarter sales also saw double-digit decline thanks to a slow rebound in China. Travel retail in China continues to be a pain-point for beauty giants. Last month, L’Oréal reported a sales dip in Asia and said travel retail in Asia was sluggish, thanks to a change in policy regarding daigous, or traders who take advantage of cross-border price differences to resell luxury goods on the grey market.

By José Criales-Unzueta , Vogue Business

By Maliha Shoaib , Vogue Business

By Madeleine Schulz , Vogue Business

By category for Estée Lauder, skincare was hit the hardest. Sales decreased 21 per cent due to travel retail challenges as well as changes to retailer inventory levels in Europe and the Middle East. Prestige labels Estée Lauder and La Mer sales were down, while affordable skincare line The Ordinary saw sales increase double-digits in every geographic region.

Fragrance saw the most growth, increasing 5 per cent, compared to the previous year, on gains at Le Labo and Tom Ford, which Estée Lauder completed the acquisition of earlier this year. ELC’s makeup division, meanwhile, increased 1 per cent, with an increase in net sales from Mac Cosmetics, Too Faced, Tom Ford and Clinique, which offset the decrease from Estée Lauder.

The decline is set to continue through the next quarter. Net sales for the second quarter are forecasted to decrease between 9 and 11 per cent, compared to the previous year. Full-year 2024 sales are expected to decrease between 1 and 2 per cent and accounts for a 1 per cent headwind due to the “potential risks of further business disruptions in Israel and other parts of the Middle East”, according to the company’s statement.

The road to recovery begins, said CFO Tracey Travis, with a profit plan that will rebuild margins in fiscal 2025 and 2026.

Comments, questions or feedback? Email us at [email protected] .

More from this author:

Inside Lagos Fashion Week’s focus on growing Pan-African design at home

Lukhanyo Mdingi wins the 2023 Amiri Prize

Unesco’s first African fashion report unpacks both potential and problems

By Maliha Shoaib

By Laure Guilbault

By George Arnett

Moodie Davitt Report

Connect with us

L’OCCITANE Travel Retail kicks off nature-positive pop-up campaign at Paris airports

INTERNATIONAL. L’OCCITANE Travel Retail is launching a nature-positive pop-up takeover in European travel retail this summer. The campaign kicked off at Paris Charles de Gaulle and Orly airports, where it ran throughout April. The pop-up campaign will continue during the summer months in other key European aviation hubs and will be rolled out in Americas and Asia Pacific travel retail at the beginning of July.

The Paris pop-ups were launched in partnership with Lagardère Travel Retail (through the Société de Distribution Aéroportuaire joint venture with Groupe ADP). They were launched to coincide with Earth Day on 22 April.

L’OCCITANE’s ‘green roadshow’ will extend globally in partnership with Dufry. The animation is already taking place in Madrid, with a scheduled launch in São Paulo in July. This will be followed by a London takeover in August.

The Paris animations immersed shoppers in relaxing natural environments. They featured real flowers, bird and locust sounds to mimic the sounds of nature. A recyclable cardboard tree was the central element of the pop-ups. Constructed with sustainable materials, the tree invited customers to pick a leaf to redeem a complimentary hand massage or skin diagnosis. Each leaf contained a pack of flower seeds to encourage customers to plant new trees in their own gardens.

L’OCCITANE en Provence’s sustainable product ranges were the stars of the nature-positive pop-up campaign. Customers can discover the lines through a QR-code enabled interactive eco-game. A special travel retail-exclusive edition of the L’OCCITANE en Provence Shea Butter Hand Cream was also available at the pop-ups.

The nourishing hand cream is made from sustainably-sourced Shea Butter from Burkina Faso. The cream contains 96% natural-origin ingredients and is packaged in a 95% recycled aluminium tube. The Shea Butter Hand Cream is L’OCCITANE Travel Retail’s best-selling hand cream globally.

Underlining its support for reforestation and biodiversity, 1% of L’OCCITANE Travel Retail’s sales in April will be donated to support the Office National des Forêts’ (ONF) tree-planting project in France. This initiative, launched under the L’OCCITANE Foundation, will see the regeneration of 40 hectares of forestland in France.

L’OCCITANE is committed to inspiring customers to reduce waste and adopt more conscious practices. Commenting on its nature-positive project, L’OCCITANE Group Travel Retail General Manager EMEA & Americas Ekaterina Ievleva said: “As a trailblazing brand in sustainability, L’OCCITANE firmly believes in inspiring and engaging with customers to reduce waste and to think in a more eco-conscious way. In doing so, we can all significantly contribute to protecting the biodiversity of the planet.

“We are hugely grateful to our partners, Lagardère, BuyParisDutyFree and Dufry Group, for their invaluable support in helping us to disseminate this crucial message through our ‘nature positive’ pop-up stores.”

Commenting on the Paris pop-ups, a spokesperson from BuyParisDutyFree/SDA added: “We, at BuyParisDutyFree, were delighted to have partnered with L’OCCITANE Travel Retail on this Earth Day ‘nature positive’ pop-up concept at our duty-free airport stores in Paris. By offering this exclusive eco-friendly retail experience to our travellers, we hope to reinforce our commitment on sustainability trying to provide alternatives to mass market beauty products.”

L’OCCITANE Group is committed to promoting sustainable business practices through open-source sharing and its nature-first approach to packaging, reducing waste, minimising its carbon footprint and regenerating biodiversity. An eco-pioneer since its inception in 1976, L’OCCITANE Group has always been committed to eco-friendly manufacturing, design and sustainable packaging in line with its ‘Reduce, Recycle, React’ ethos.

Note: The Moodie Davitt Report has launched an e-newsletter, Sustainability Curated, in association with L’Occitane. It offers a curated selection of key sustainability stories in travel retail and beyond.

To subscribe free of charge please email [email protected] headed ‘Curated Sustainability’. All stories are permanently archived on this website. If you would like to be added to its mailing list (or to those for any other Moodie Davitt titles), please click here .

Follow us :

The Moodie Davitt Report Newsletter

Subscribe to our newsletter for critical marketing information delivered to your inbox

Related Articles

Episode one of Series 4 features Paul Duckworth, a renowned expert in the field of negotiation, an expertise constantly required (though often lacking) in travel retail but seldom talked about publically.

27 April is World Gummi Bear Day and leading gummi bear company Haribo is celebrating its signature Goldbear line with a takeover of The Moodie Davitt Report.

In a huge boost to the event, Zayed International Airport Managing Director & CEO Elena Sorlini is the latest big-name addition to a power-packed speaker line-up at the forthcoming Airport Food & Beverage (FAB) + Hospitality Conference & Awards.

- Login/Register

Asia travel retail hampers Estée Lauder fiscal 2023 performance

By Kapila Ireland in Brand News , Cosmetics , Financial News , Fragrance , Latest News , Lead Stories August 18, 2023 Comments Off on Asia travel retail hampers Estée Lauder fiscal 2023 performance

Overall, global travel retail net sales decreased double digits due to challenges in Hainan and Korea. However, travel retail net sales grew strong double digits in EMEA and The Americas

The Estée Lauder Companies (ELC) has reported net sales of $15.91bn for its fiscal year ended 30 June 2023, a 10% fall from $17.74bn reported last year.

The company said organic net sales fell 6% primarily due to pressures in Asia travel retail, in Hainan and Korea, and continued softness in North America. However, this was partially offset by growth in almost every market in both Asia Pacific and Europe, Middle East & Africa (EMEA).

Travel retail focus

For the full fiscal year, ELC’s business continued to be disrupted by the impact of the Covid-19 pandemic. Most notably, the pace of recovery in Asia travel retail and mainland China was slower than anticipated. In Hainan, prolonged store closures initially presented a headwind and, thereafter, low levels of conversion occurred when travel resumed. This was compounded by inventory tightening by certain retailers.

Meanwhile, in Korea, the travel retail business slowed during the transition to post-Covid regulations. In addition, the slower-than-anticipated resumption of international flights, granting of visas, and organized group tours further challenged the Asia travel retail recovery. As a result, the Company’s Asia travel retail business was challenged throughout the fiscal year by the slower than anticipated recovery.

Overall, global travel retail net sales decreased double digits, reflecting the aforementioned challenges that led to lower product shipments primarily to retailers in Hainan and Korea. However, travel retail net sales grew strong double digits in EMEA and The Americas, benefiting from the increase in domestic and international travel compared to the prior year as well as increased activations, in-store staffing, and advertising.

Product category performance

By Product Category, total organic net sales rose 14% in Fragrance across every region and led by TOM FORD, Estée Lauder and Le Labo. Makeup were virtually flat compared to the prior year and performance increased sequentially each quarter, to growth of 13% in the fiscal 2023 fourth quarter, while Skin Care suffered due to the challenges in Asia travel retail, dropping 14%. Hair Care net sales rose 6%, primarily reflecting growth from both The Ordinary, due to the recent launch of the brand’s hair care products, and Aveda.

Fabrizio Freda, President and Chief Executive Officer said, “We returned to organic sales growth in the fourth quarter, delivering our outlook. Momentum continued in the markets of EMEA and Latin America, and accelerated strongly in Asia Pacific led by mainland China and Hong Kong SAR.

“For full-year fiscal 2023, we delivered organic sales growth and prestige beauty share gains in many developed and emerging markets, but Asia travel retail pressured results, particularly in Skin Care, and we continued to experience softness in North America. Fragrance excelled, up double digits in every region, and Makeup improved sequentially to double-digit growth in the fourth quarter as more markets emerged into the post-pandemic era.”

Outlook for Fiscal 2024 First Quarter and Full Year

In the next year, ELC will continue to focus on “accelerating balanced and profitable growth across regions, brands, product categories and channels”. The rebalancing of inventory in Asia travel retail is expected to partially offset the anticipated growth in many other markets globally, as the industry focuses on the gradual transition of selling to individual travelers, aligned with the environment and regulations.

The company aims to return to net sales growth in fiscal year 2024 and over the next few years progressively rebuild its margins. It also plans to continue to strategically invest in areas to support recovery, share gains and long-term profitable growth. These investments include innovation, advertising, accelerating retail growth in its Asia travel retail business, growth of its emerging markets and the completion of its first manufacturing facility in Asia, located in Japan, to support the development of the Asia/Pacific region.

The Company is mindful of the headwinds that have emerged in China’s economy. Lastly, the Company is also conscious of the potential impacts to its business from volatility associated with high inflation, the strengthening U.S. dollar, and recession concerns in many markets globally.

Tagged with: Estée Lauder Companies

Related articles

Opportunities for e-commerce success in Europe: Retail media networks

Key takeaways.

- In the United States, retail media was worth more than $30 billion in 2021.

- Retail media networks (RMNs) are growing by more than 10 percent year-over-year in the United Kingdom.

- Distinctive challenges and opportunities within European, Middle Eastern, and African (EMEA) markets create potential opportunities for retail media networks (RMNs) as well as different considerations in execution.

For all the headlines about e-commerce over the past decade, the reality is that online sales were, until two years ago, just a small fraction of total retail revenue. 1 “ How e-commerce share of retail soared across the globe: A look at eight countries ,” McKinsey, March 5, 2021. COVID-19 created significant challenges for retailers. Consumers shifted to e-commerce channels by nearly 30 percent , accelerating the sector’s growth and creating challenges for traditional retailers, many of whom made significant investments to compete with pure-play online sellers. So what should traditional retailers do now?

They could lean on their longstanding, inherent strengths. Traditional retailers have customer relationships that often span generations. They know who their customers are, what they buy, and how their tastes have changed over time, and they’ve earned their trust and loyalty. Although competing with pure-play e-commerce platforms is expensive for brick-and-mortar retailers, retail media networks (RMNs) provide a potential opportunity for them to drive profitable growth by scaling their e-commerce operations.

RMNs hold potential value for consumers, in targeted advertising that addresses their needs and wants; for brands, in direct access to the targeted market; and for retailers, in the chance to build a high-margin business to drive e-commerce innovation. In the United States, retail media was worth more than $30 billion in 2021, and retailers across EMEA are starting to recognize RMNs as a hidden and fast-growing profit stream (RMNs are growing by more than 10 percent year-over-year in the United Kingdom, for example). 2 Sara Lebow, “US retail media ad spend will pass $30 billion for the first time this year,” Emarketer, November 17, 2021.

Here, we explain the opportunity RMNs hold for retailers across EMEA, a market significantly different from the United States. Some of the differences could provide greater opportunity for retailers if they consider approaches that include developing a distinct go-to-market strategy that reaches the right customers, fostering collaboration between the RMN and the organization, and taking advantage of loyalty programs to maximize the addressable audience.

Would you like to learn more about our Growth, Marketing & Sales Practice ?

How rmns could complement a fast-changing industry.

RMNs leverage retailers’ knowledge of consumer buying behavior to offer advertising opportunities for brands (Exhibit 1) to target relevant consumers through a retailer’s digital channels, physical store locations, and syndication on third-party platforms like Facebook, Google, or Roku.

Many major retailers in the United States have already built and scaled RMNs, led by Amazon, Target, and Walmart Connect. In EMEA, one potentially compelling reason to pursue RMNs is that they may enable bricks-and-mortar retailers to follow the shift of consumer spending online— and benefit from retail media’s significantly higher margins compared with those of core retail e-commerce.

That’s important: retailers, especially in low-margin businesses such as grocery, have a strategic need to drive higher profitability given the costs involved in creating and scaling e-commerce operations. RMNs can offset some of those higher costs: the additional investment to build an RMN is relatively low, and activating ads on a retailer’s site can deliver margins ranging from 60 to 85 percent. 3 Experts interview, Capital IQ.

RMNs also offer an opportunity to provide brands with direct access to customers. Research shows 91 percent of customers are more likely to spend on brands that provide relevant offers and recommendations, yet brands have traditionally had limited access to first-party customer data, limiting their ability to target audience segments. 4 “ Perspectives on Personalization @ Scale—Volume 2: The Next Frontier ,” McKinsey, February 2020. Additionally, the likely decrease of availability of third-party data due to tighter privacy approaches by companies such as Apple and Google may accelerate in the next two years, making access to first-party data even more important for brands that want to undertake targeted marketing.

Retailers already hold rich first-party consumer data through their websites and loyalty programs, which some 20 percent of brands cite shopper insights as a primary reason for working with RMNs. 5 Rachel Dalton et al, “The State of Ecommerce 2021,” Kantar Retail IQ, March 2021. Audience segmentation may not only enable brands to reach the right customers and increase the effectiveness of their advertising spend; when it’s combined with audience intelligence, which allows brands to measure the impact of their advertising across channels, outcomes could be optimized. We’ve found using first-party retailer data to target customers can deliver margins ranging from 30 to 50 percent.

Finally, RMNs offer an opportunity to deliver a seamless, digitally enabled experience. Retailers globally have opportunities to innovate in both physical stores and online as competition from pure-play e-commerce platforms grows. Tailored ads, built with first-party audience data, ensure that customers who consent receive relevant offers and recommendations, and digitally enabled ads in physical stores hold the promise of a personalized omnichannel experience by engaging with consumers as they shop.

The tech transformation imperative in retail

The emea retail media opportunity—and challenges.

Many RMNs were established in the United States prior to COVID-19. In EMEA, the consumer shift to e-commerce during the pandemic encouraged retailers to re-examine RMNs as a means to quickly invest in and scale online sales channels (Exhibit 2). There are also differences between EMEA and US markets which present distinct opportunities—and challenges—for RMNs in EMEA.

First, while e-commerce penetration is slightly lower in some EMEA markets than in the United States (online represented 14.4 percent of total sales in Western Europe in 2021 versus 15.3 percent in the United States). In others, it is significantly higher. Online sales comprise 28.3 percent of retailer revenue in the United Kingdom and 18.1 percent in Germany, meaning there’s a significant retail media opportunity in those markets as available inventory is proportionately higher. 6 Rhys Lewis, “Internet sales as a percentage of total retail sales (ratio) (%),” Office for National Statistics, UK, May 20, 2022; “Online Trends: UK, Europe & N. America 2021.........the pandemic curse,” Center for Retail Research, February 2022.

Second, the in-store digital experience is more advanced in Western Europe for example than in the Unites States. Many EMEA retailers have been more aggressive in seeking to monetize the in-store opportunity in response to the region’s stricter data-privacy laws. They have an existing advantage when it comes to developing RMNs (Exhibit 3). For example, retailers could use in-store digitization to deliver personalized ads that increase their share of wallet among bricks-and-mortar customers, while attributing the customer-data source to loyalty programs. In-store advertisements may also help retailers further differentiate their solutions from other media providers and significantly increase the reach (and revenue opportunity) of RMNs.

Third, additional regulatory requirements in EMEA, notably through the European Union’s General Data Protection Regulation, could also create opportunities for retailers with strong loyalty programs. GDPR requires informed consent from users before they can be included in digital-marketing campaigns, reducing the opportunities to use third-party data for advertising (a challenge compounded by moves to tighten privacy protections by companies). Yet RMNs are built on first-party data, notably through loyalty programs. That makes RMNs one of the few ecosystems where brands can access valuable audience data and gain end-to-end attribution, which is incredibly valuable to brands.

Finally, there are challenges. There are few genuinely multicountry grocers in EMEA, which limits the number of addressable impressions or loyalty card members an individual country’s RMN can leverage. While the country-level retail media opportunity is still significant— the UK RMN market alone is forecast to exceed $6 billion by 2025—this broad fragmentation makes it challenging for companies to reach the same scale as the US market. 7 Sara Lebow, “US retail media ad spend will pass $30 billion for the first time this year,” Emarketer, November 17, 2021. Second, the trade-promotion ecosystem is much more developed and profitable in EMEA compared with the United States, comprising around 55 percent of commercial spending among consumer-packaged-goods companies. 8 Expert surveys; CEB NA benchmarks. That heightens the potential risk of RMNs impacting trade-promotion budgets, which must be taken into consideration in the design of RMN strategy.

Three opportunities in retail media

For European retailers, RMNs are quickly moving from something nice to have to something essential. Consumers value the deeper engagement RMNs offer both in-store and online, and brands are starting to demand them from their partners. Finally, the opportunity to drive profitable online growth by investing in innovative e-commerce offerings is critical, given the shifts in consumer behavior.

Building and expanding RMNs could be considered around three steps:

- provide training for the sales team on metrics valued by marketers, such as cost per mille (CPM), click-through rate (CTR), page views, and reach

- foster an understanding of agency dynamics and the priorities for key agency stakeholders

- institute a compensation system that rewards sales teams not just for productivity but in expanding brand relationships

- digital commerce, to create the advertising experiences with consumers

- IT, to support the data and technical infrastructure to power the network

- marketing, to negotiate and govern the allocation of inventory reserves for third-party brand ad placement across physical and digital experiences

- merchandising, to coordinate interactions with supply-chain partners across both trade promotions and media