The smarter way to travel

Multi-currency Cash Passport™. One Card, Ten Currencies.

Get your card Get the app

Multi-currency Cash Passport

10 currencies, locked in rates.

Lock in exchange rates each time you load and top up. Load up to 10 different currencies on one card. Pound Sterling, Euros, US Dollars, Australian Dollars, Canadian Dollars, New Zealand Dollars, South African Rand, Turkish Lira, Swiss Francs and Emirati Dirhams.

Stay in control

Manage and track your Cash Passport on the go via your mobile, tablet, laptop or PC. Login to My Account and stay in control of your money.

Accepted at millions of locations

Preload your Cash Passport and use like you would a credit or debit card in-store, online or to withdraw local currency at ATMs.

Global assistance

Help is only a call away. If your card is lost, stolen or damaged, we can replace it quickly or provide you with emergency cash up to the available balance on your card (subject to availability).

Today's exchange rates*

Running low on travel money.

Multi-currency Cash Passport is reloadable, allowing you to top up any of your currencies, anywhere, anytime.

You can top up in 5 ways:

- Bank transfer (via phone or internet banking)

- Via the mobile app

- Over the phone

- In participating branches

Learn more about your top up options.

Keep track of your travel money

You can use your mobile, tablet, laptop or PC to login to My Account and stay in control of your travel money.

Register for My Account , so you can:

- Track your spending

- Top up your card

- Transfer between currencies

- Retrieve your PIN number

- Suspend your card temporarily

You can also download the Cash Passport mobile app, available for iOS and Android devices.

Travel with confidence

Safe and secure access to your money

Cash Passport uses Chip and PIN technology which means you can rest assured you have additional security making your card safer than carrying cash. Accepted at millions of locations and cash machines worldwide.

Looking for a back-up card for safe keeping? Simply purchase an additional card when ordering online or in-store.

We're here to help

We're only a call or email away at all times. Our global assistance team will help you if your card is lost, stolen or damaged.

We can replace your card quickly or provide you with access to emergency cash up to the available balance on your card (subject to availability), so you can keep enjoying your holiday.

Need further help?

View our frequently asked questions or feel free to contact us .

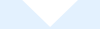

Cash Passport™ app

The new Cash Passport app has an improved design that makes managing your travel money faster and easier.

Start travelling smarter in just a couple of taps. Activate your Cash Passport card from your mobile, download the app from the iOS or Android store, log-in, and load up with your preferred currency. Simple!

Now you can securely store your payment card details in the Cash Passport app, so whenever and wherever you are, you can top up with up to 10 currencies, including Euros, US, Australian and Canadian Dollars and British Pounds at the touch of a button.

Stay in control the smart way. The new message centre feature lets you stay on top of tailored notifications, including low balance and transaction alerts. Keeping you up to date with your own personal need to know information.

Move money between your currencies with just a couple of taps – it’s that simple! Quickly move money between 10 currencies and spend more time enjoying your holiday.

Priceless Cities

Priceless Cities is a program available exclusively to Cash Passport cardholders and provides access to unforgettable experiences in the cities where you live and travel.

There’s a world of possibilities waiting for you to explore, so why not break free from your routine for a moment, a night, or even a weekend? Fuel your passions. Make memories to last a lifetime. Start Something Priceless.

Find out more

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

*Foreign exchange rates can fluctuate and the rate that applies one day will not necessarily be the same on any other day. The exchange rates set out on this website apply to top-ups that are made via this website only and that are applied to your card account within four hours. We will provide you with the applicable exchange rate at the time you top up.

Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

Today’s exchange rates*

- Tour Account ›

- Travel Forum ›

- Travel Forum

- General Europe

- Is a Travelex mon...

Is a Travelex money card worth it?

Hello, I was looking into some of my options for accessing my money abroad, and I came across the Travelex money card while ordering some euros from travelex.com. I was wondering if the Travelex money card would be worth getting for a 2 month trip. Mainly, I want to avoid incurring large fees for converting USD to Euros via my debit card, so I was originally thinking just carrying cash, but that’s a good way to get robbed and be broke in a foreign country for a couple months. So, a card that I can load with euros as well as other currencies for my 2 month trip seems like a better option, but I’m not sure if it’s the best option. Thanks.

Go to your nearest credit union (or find one online). Get an ATM card from them. They don't charge exorbitant fees because they're not-for-profit (I pay 1% of each transaction with my ATM card, no other fees). Get cash as you need it, use a no foreign exchange credit card whenever you can. No need to reinvent the wheel here. Travelex is not a good option for anything (haven't you discovered this when ordering money from them? what was the markup?). I don't believe this money card will be readily accepted anywhere, which is an even worse problem.

Give this a read: https://www.ricksteves.com/travel-tips/money

I didn’t notice a major markup using Travelex to order cash, but I did notice that when the hostel I booked for my arrival charged my chase account, I was charged a $5 transaction fee as well as a 5% markup. As for a credit union, I just checked and the nearest one to me requires you to be retired (I live near a wealthy retirement community), and the next one is over 70 miles away, so a credit union isn’t really an option.

Hate to tell you, but I think virtually everything you've written above is a mistake.

Two things which are highly contradictory...

I want to avoid incurring large fees

ordering some euros from travelex.com

Anything involving Travelex = you are paying VERY high fees, you are getting gouged.

There is no reason to "order euros", from anyone (least of all, from Travelex). There's also no reason to pay large fees for pulling your own money out of an account via debit card. As stated above, just use any reasonable bank or credit union, use their ATM in Europe to pull out Euros (or other local currency). The fees should be pocket change (unless your bank is a terrible one - in that case, join a local credit union).

You do not need to get Euros before you leave home, and you do not want to "exchange" money. You land at any airport in Europe, there will be ATM machines there, you use your ATM/debit card to pull out cash, any fees charged will be less than the cost of a beer.

It's easy, reliable, a non-issue.

As for a credit union, I just checked and the nearest one to me requires you to be retired (I live near a wealthy retirement community), and the next one is over 70 miles away, so a credit union isn’t really an option.

This is hard to believe. Credit unions are everywhere and they're prolific. I could be wrong, but I'd guess that your search for creit unions may not have been very effective. Where do you live? Would that be the Wyoming town in your username?

Wherever you are, try this link - a decent search engine for finding credit unions near anyplace: Credit Unions Near Me

Note: is says there are 50 credit unions near Cody, WY (although their definition of "near" may be a little loose)...

Travelex is synonymous with high cost foreign currency exchange. Germans don't like credit cards because the merchant usually has to pay about 3% fee and the money is slow, 7 to 10 days, to make it into their bank account, and rubs Germans the wrong way. So a 5% adder is common, especially for smaller establishments when using a credit card.

Besides credit unions, there are internet banks, like CapitalOne that don't charge foreign currency transaction fees.

Or open an online account with Charles Schwab and fund the checking account with the amount you want to have for your trip. No fees. When you need cash, you get the local currency from an ATM. Use a credit card that doesn't charge a foreign transaction fee.

perhaps this will help you search for a CU

http://www.asmarterchoice.org/

Thanks for the help. So, the overall message I’m getting is that Travelex is horrible, normal banks are a necessary evil, or credit unions are the best options in my case? Would incurring the transaction fees from chase be better than atm fees, or is cash the way to go in Europe? From my experience, cards have always been better, but I’ve read a lot that Europe is different in where cards are useful. I want to avoid issues with using USD on an ATM where I wouldn’t be able to, or are there no issues so long as I use an ATM that has the currency I need? For example, can I use my debit card with USD on an ATM in France to get Euros, and an ATM Switzerland to get Francs? Do they have to be special ATM’s?

I dumped my big bank for a credit union long ago. The fees are lower and the customer service is better. I still don't know what the advantage of a big bank is for checking and savings.

(You get the local currency from the ATMs in Europe - in France you get Euros, in Switzerland, Francs, etc. No USD comes from an ATM in Europe. The currency is converted for you - plus any other fees charged.)

There are plenty of credit unions you can join. You don't even have to visit physically. If you want one just for traveling, the Andrews Federal Credit Union in Maryland for example offers an ATM card (not even a debit card if you don't want a checking account) with no fee per-use and 0% currency conversion fee. I've used one for years. Andrews also offers a visa credit card with no foreign transaction fee and no annual fee (but no rewards program to speak of). It's also a chip and PIN card that works in train station ticket machines and unattended gas pumps, where many US chip credit cards won't work.

The only stipulation is that, to be eligible, you might need to join the American Consumer Council (ACC) - a one-time $5 fee.

If it bothers you to join a credit union that isn't local, no doubt you can join a local one even if it doesn't have quite the same rates as Andrews.

Credit unions offer reciprocal use of ATMs through something called the Co-Op network. You can use your local credit union's ATM without belonging to it, for no fee, if you use your ATM card from another credit union. And sometimes they offer something called "shared-branch banking" so you can do transactions in person with your remote credit union (like Andrews) without being a member there.

As for your Chase visa: they certainly offer some visa credit cards with no foreign transaction fees and no per-charge fees. All of their cards have different terms.

My take on Travelex prior to arriving in Europe....forget it period. Even the most generous exchange rate offered is just plain bad! There is a Travelex at SFO in the international departure area.

A couple of years ago I got 1,000 Euro from BofA, the minimum at which no service or any sort of fee would be charged. I went to a major branch office in SF, was told the cash would be available in a few days. They certainly did not have it on stock, so to speak.

It was, either I could have it mailed to me or come back to pick it up. The bank said I would receive a phone call so that I could come by to pick the cash. I chose that option instead of receiving in the mail

Part 2....credit cards are not necessarily better. It does depend upon where you are and who is being paid with your US credit card.

In Austria and Germany the small hotels/Pensionen and restaurants which don't primarily cater to tourists would much prefer cash. On the last 2 trips, 2016 and 2017, I've found myself paying more often with cash in Germany, so I didn't have to bother with a credit card, or I would not even check if the Visa/MC logo was on the restaurant door or window before stepping in.

You can use the credit card more freely in France and London.

Emma, my plan is to start in Paris, go to Lauterbrunnen, all over Italy, Athens, Budapest, Germany, Vienna, Prague, Amsterdam, Brussels, London, Edinburgh, and Dublin.

Travelex is fine for getting a starter pack of the local currency, whether it's Euros, Forints, Korunas, or English pounds. While you'll be paying a premium on the exchange you can minimize the damage by withdrawing the minimum, ie just enough to get you started, then rely on ATM's upon arrival...using a no fee debit card as others have suggested. Capitol One credit cards are a good choice for foreign travel.

I do not mean to be rude, condescending, obnoxious, etc to the OP, but - I am shocked at how many times this question has been answered in these pages with the same information over the several years I have been here, and how many times this same question gets asked, with the same anti-consumer products being looked at, and the same information always being given in response.

If you open a bank account online with CapitalOne or Schwab, since you say a credit union is not working for you, you will get an ATM card that working in the system will have a cost to use of between point-three and point-seven of one percent over the interbank exchange rate at the time. You cannot do better. Neither of these, as well as the various credit unions, charge a fee for ATM use (and Schwab refunds the fee if an external ATM charges you). European banks by law do not charge ATM fees. While the CapOne card is an ATM card only, the Schwab card is a chip-and-pin debit card and thus also may be used for ticket machines, automated gas, point-of-sale, overseas purchases online, and so on. If this is a joint account you can get a card for each of you with different numbers with the daily limit applied separately to each card. We have used these cards in 18 countries without any problem - ever. That there may be no physical bank within 500 miles of you will not matter, as you can transfer money to these accounts online from your regular daily bank.

I hope this article will help you choosing a good credit card for overseas travel (only for credit card purchases, not cash withdrawals)...give it a read (there is a link to cards with zero foreign transaction fees, which is helpful): "What to ask before taking credit cards overseas" https://www.bankrate.com/finance/credit-cards/taking-credit-cards-overseas-1.aspx

By the way, my credit union is in CA and I live in VA. Everything is done online, I don't visit the "bank" at all.

I use Schwab. I put 50% more than what I think will be needed into the Schwab account. I can access those funds on any terminal on the Plus system, which is common. No direct fees. As Larry notes, the conversion rate is how the system makes money. We have the Chase Sapphire card which does not charge fees for foreign transactions. As Larry says, these are well-known options.

European banks by law do not charge ATM fees.

That statement might be a little strong, since the Unicredit (big Italian bank) ATM's in Italy charged ATM fees last year when I was there. Walked down the street to an ATM operated by an Italian equivalent of a credit union/savings bank and they did not have ATM fees.

Caixa, a major Spanish bank, charged me its own fee as well as the ATM fee imposed by my own bank. Fortunately that is an exception. The OP should understand that a user fee for foreign exchange is charged by the issuer of the card back in the US. The exchange rate is a separate issue. Any way to get foreign currency -- over the counter, by bank card or credit card -- is actually buying the currency. The customer will pay more than the published exchange rate, and if selling it back at the end of the trip, will receive less than the published rate. The difference is profit margin for the bank. While fees for plastic vary, there's little to no difference on exchange rates. If I land at a European airport with no euros in my wallet, I will seek out a bank machine, even Travelex if no bank as available, and withdraw enough euros to keep my going until I get to an ATM in a bank near my hotel. There is no need to buy the euros back home, which is often more expensive. As a precaution, I maintain chequing accounts with ATM cards at two different financial institutions, so I have back-up. Travelling solo, I also never carry all my plastic in the same wallet. And I do withdraw substantial cash; it's no less secure than at ATM that gets lost/stolen/mangled.

Not all credit unions offer debit/ATM cards providing zero foreign transaction fees. The ones near me charge 3%. Search the Travel Forum for prior posts which include a full description of Travelex costs....high.

You've asked a good question. You are wise to be thinking in advance about such things.

Debit Cards: I have the Charles Schwab Investor Checking Account that I use exclusively for travel. I've used it for several years and have been very pleased. There are never any ATM fees period. There are no foreign transaction fees. This is better than anything you will get at a credit union. I have been pleased with their service. This is a great debit card for travel. I have found a secondary plus is that I put my travel savings into it each month and then it is separate and I always know how much money is available for travel. Note: In order to open this account, you also open a brokerage account. Don't be mislead by this. Although you open the brokerage account, you have no requirement to put any money into it. I never have. It is quite a simple process to do.

Credit Cards: There are several credit cards out there that do not charge foreign transaction fees. Next look for added features such as travel insurance, discounts, cash back, or frequent flyer miles. Andrews Federal Credit Union (anyone can join by first joining a consumer protection group) offers one of the few true chip and pin credit cards out there. Most of the time you will not need a true chip and pin unless you are dealing with automated services such as ticket machines or toll booths.

Travelex: They provide a service and do charge fees. If that service has enough value to you so that you don't mind the fees, there is not a problem with using them. They will cost more than other options.

Sam is correct, some Italian banks, along with Spanish banks, are in fact charging ATM fees. But note these are Italian banks. We used German bank ATMs in Italy and Spain the ,last two trips, they did nto charge fees as per their policy.

Regarding Travelex ATMs, we tested the Travelex ATM in Heathrow and were charged the identical conversion rate that we received later that morning at a NatWest Bank in London. With all ATMs and credit cards you must make certain that the transaction is being done in the local currency, and do not accept their offer to do this in your currency, which will be at a 3 to 5% mark-up.

For a really good version of the Chase Sapphire card, their Amazon card is no annual fee, no foreign transaction fee, 3% cashback on Amazon purchases, 25 cashback on gas, drugstores, restaurants and office supplies, and 1% on everything else. Foreign charges are exactly at the conversion rate as there is no friction to pay for ATM servicing. So using this at restaurants in Europe is the least expensive option, since you get cash back.

There are many many fees for everything you do on a Travelex money card. A fee to buy the card, a fee to add money to the card, an exchange fee to convert your USD to EUR to load to the card, a fee if you spend the money as a different currency than what you asked to be loaded to the card, a fee to get money from an ATM, a fee to use it to make a purchase, a fee to check the balance, a fee to close out the card after your trip if you want the remaining cash, and so on. Sounds like the exact opposite of what you wanted.

The default Capital One Debit card which has no fees is a Debit card with a MasterCard logo on it. It is not an "ATM only" card as reported in one comment. I have had one now for nearly 15 years and have never had it not work in Europe when getting cash from an ATM (which is the only thing I use it for). There is absolutely no cost for the Capital One 360 account, no minimum balance requirements (the account will never close as long as you have at least $1 in it), no fees to move money in and out. You can sign up for it online and never have to go to a physical location. Much better than the 5% + $5 the big US banks charge per transaction.

Unfortunately some European ATMs now do charge a fee. It is clearly indicated so you can avoid the fee by going to an ATM operated by a different bank. Also, never allow an ATM or a merchant to bill you in your home currency, always insist on being billed in the local currency (EUR, GBP, etc) or they will use an exchange rate that is very inflated in their favor costing you up to 5% over what you should pay. Your account will always get billed in your home currency anyway when the transactions settle.

Looking into both Shwab and Capital One, neither of them look like they’d work. Capital One says it’s used at their locations or ATMs to withdraw cash, so wouldn’t I still be hit with the same fees as Chase? And Shwab doesn’t have an ATM in Paris (just searched as an example), so wouldn’t it be the same scenario? Or would I just use a random ATM wherever I’m at?

Plus Shwab requires the brokerage account which says has a minimum $1,000 deposit.

I have no idea why people make this so complicated. I've had my Andrews FCU ATM card for years. $0 fee and 0% conversion fee sure is nice in Europe. Maybe someday I'll actually visit an Andrews branch if I ever get to Maryland - but I doubt it.

I don't think you have a very clear understanding of now ATMs work. Do you currently have and use a debit card at ATMs in your area? Second, the ATMs is a machine that processes your card regardless of who issues the card. It is the card issuer - generally the bank - who determines the fees charge for using the debit card. Therefore, Chase can charge different fees than Schab, or Bank One, or Capitol One, etc. There is no question that the cheapest and most convenient way to obtain local currency is via debit card at a bank owned ATM. It is best if your debit card charges low or no fees, but even if your debit card charges a standard 3% fee it is still cheaper than any other alternative -- including Travelex.

Ive always used a Wells Fargo card with Wells Fargo atms, and chase with chase atms. I was always told never to use other atms, so this scenario is completely new to me.

Will you withdraw $1000 while in Europe? If yes, then open a Schwab account and transfer money from the account as needed to the related checking account. What's so challenging?

I was always told never to use other atms

This makes sense as they probably charge you high fees to use other ATMs, and it keeps you loyal to Wells Fargo. The key is to find a less punishing bank because there is a spectrum of greedy to super greedy. A credit union works for me, I don't care to be shaken down when accessing my own money.

Every banking product (whether credit union or for-profit bank, or ATM debit card or credit card) spells out all the various fees on a one page-disclosure/summary. No one can answer what the fees are for the cards you are using, or plan to use overseas because each card has its own terms specific to that card (there are a variety of different combinations). You have to look up the exact card and the fees will be spelled out. It's not even small print, it's pretty large print so it's impossible to miss.

100% agree with Agnes. I never need to worry about hunting down an ATM in Europe from some specific bank - just use the closest most convenient one and never get charged any fees. Some people warn you away from ATMs not owned by banks, but I've never been charged a fee to use my credit union ATM cards anywhere in Europe over many trips. (In some countries e.g. Spain I hear some ATMs do charge fees but I've never been there.)

I'm one who will warn you to avoid ATM's not owned by banks. That's only because some machines that resemble ATM's have names on them like Travelex and are really exchanges that charge big fees. Stick with something that has bank, banc, banco, etc. in the name. I've really only seen the automated exchange machines in airports.

As for paying fees, if it's a bank ATM, the European bank won't charge you a fee (the comment about Italy is the first I've heard of in Western Europe). Your bank probably charges something. Shop for foreign transaction fees when you pick a bank or credit union. Some banks and brokerages have free options but they come with requirements. If the requirements work for you, great. The biggest banks often charge something like $5 per transaction plus three percent, which adds up quickly. It's fairly easy to find a one percent flat fee option from smaller banks and credit unions. Finally some banks advertise free transactions at participating ATM's in Europe. I'd avoid these. Unless you know exactly where a free ATM will be, and it's convenient, you're likely to spend too much effort trying to find a free machine and end up just paying big fees. I'm sure there are millions of ATM's in Europe. A couple thousand free one's may seem like a lot, until you start searching for them.

Schwab requires $1,000 in the brokerage account? Really? Do you have that in writing? Because I can tell you that my required Schwab brokerage account has ZERO dollars in it, and that has been the balance since it was opened several years ago. The checking account keeps about 2 grand in it, not because it is required, but because that is a comfortable amount for me to leave there and have ready. If there even is a minimum for the checking account, it can't be more than a hundred, but this simply is something I can ignore.

Perhaps you are confusing the $1,000 with the $1,000 that you are allowed to withdraw from it daily.

As for my CapOne account, the card is in fact an ATM only debit card, it has no chip, and CapOne says I will not be getting one with this account, which is their hi-interest money market account and I think is no longer an offered product. This is no problem, as with both cards, plus no foreign transaction fee credit cards from CapOne and the Chase's Amazon card we have all our cash needs covered.

And please, codyw - - it's been stated so many times here and in the past - CapOne and Schwab DO NOT CHARGE FEES AT THEIR END FOR ATM WITHDRAWALS - period.(sorry for theCaps)

The $1000 Schwab brokerage minimum is waived if you have a checking account.

"The Minimum Deposit Requirement is waived if you open a linked Schwab Bank High Yield Investor Checking® account or establish an incoming monthly transfer of at least $100 through direct deposit or Schwab MoneyLink.®"

https://www.schwab.com/public/schwab/nn/agreements/schwab_pricing_guide_for_individual_investors.html

There's currently a $100 bonus for new Schwab customers. It's not totally clear if the $1000 in brokerage account is necessary for the bonus. Opening the accounts will result in hard credit pulls. Google "schwab $100 bonus" for the bonus link plus details on various financial blogs.

I've used a Capital One bank ATM card pretty widely in Europe (it's the back-up to my credit union card). No problems and no fees. I did encounter an ATM in the eastern part of Germany that did not like my US ATM cards, and the bank confirmed that its machines were touchy that way. That was just one place in the eleven countries I've visited recently.

I think Brad hasn't spent much time in Spain in the last few years. As others have stated, there are most definitely some European banks charging ATM-usage fees. Several of them have machines in Barcelona, enough that it was sort of annoying. But there were also plenty of machines with no fees, so it was a matter of paying attention to which bank's machines you liked and which you wanted to avoid.

First of all, you do not have to fund a Charles Schwab brokerage account, only open it. Many, many people on this forum have done just that. You are not reading the information correctly.

A Debit card with a Visa logo (such as the Charles Schwab one) works at any ATM that takes VISA. This is pretty much any ATM anywhere in the world. They do not charge fees. If the local bank charges a fee, then Schwab credits your account back.

You are not required to use the same bank as issues your card.

I think we should drop the discussion about Schwab because it is just adding a lot of confusion -- yes they do. No they don't. We are mixing up the discussion about two complete different fees. ONE - a fee to use an ATM and TWO a fee for converting your money into the local currency -- currency conversion fee.

It is obvious that codyw does not have a good handle on how ATMs and Debit cards work. Too bad we cannot have a phone conversation for this one. It would be easier. See if I can keep it simple.

In the US and Europe all ATMs are owned by someone -- generally a bank. Generally any debit card with a VISA or Mastercard brand can be used at any ATM in the US and Europe. In the US the bank customers of the bank that owns the ATM can use that ATM for free. All other users will be charge a fee if they use a different bank's debit card at that ATM. That fee is often $2 or $3.

Therefore this is why your statement ----- Ive always used a Wells Fargo card with Wells Fargo atms, and chase with chase atms. I was always told never to use other atms .... is not totally accurate. You can use other ATMs but you will be charged a fee. OK ?? Free to use you own ATMs but not someone else.

In Europe, it is NOT common for the bank owner of the ATM to charge a fee to non-customers of that bank. Therefore, it is generally free to use your debit card with any other bank owned ATM. OK ????

The other fees we are discussing is commonly called the currency conversion fee (3-5%). THAT fee is totally determined by the card issuer and can be anything that they want to charge but it must be disclosed to you. Cannot be hidden. Any question about fees being charged -- call your bank.

I didn’t notice a major markup using Travelex to order cash

Really? You need to pay more attention.

Right now, according to Oanda.com, the Interbank (official exchange) rate is 804,18€ for $1000 US.

I just checked with Travelex's website and their rate is 729,90€ for $1000 US. That's for cash or to load a card. That's a 9¼% exch rate discount.

Wells Fargo, today, will give you 706€ for $996.97 US, which is a 5.2% discount. (Actually, Wells sets their rate or the day at 5% sometime in the early morning. As the day goes on, and the Interbank rate changes, the WF rate might be more or less than 5%.)

I was charged a $5 transaction fee as well as a 5% markup.

I guess I wouldn't be surprised for Chase, because I consider them crooks, but Wells Fargo only charges 3% for "exchange conversion" and charges $5 only for foreign ATMs, not other transactions. I put exchange conversion in quotes because it's really a foreign transaction fee. The bank will charge you this whether they pay in local currency or USD. So, Dynamic Currency Conversion, where the bank or vendor changes the charge for you into USD at their rate doesn't save you anything. Your bank will still charge you 3% regardless.

Good job Frank .

I think on the subject of fees to use an ATM, it can also be expanded to the 2 separate fees. In the example of the OP having accounts at Chase and Wells Fargo. If the OP tried to use the Chase card at a Wells Fargo, he would incur 2 fees, one from Chase for using somebody else's ATM, and another from Wells Fargo for using a card from somebody else's bank. The first would just show up on his bank statement, the second would be disclosed on the ATM screen before the cash is dispensed and you would have to click on the "OK" button to accept the fee and get your money.

So now, for the purpose of minimizing fees, lets use CapitalOne Bank as an example. CapitalOne is an internet bank that has no ATM's, so they can't charge a fee for using somebody else's ATM. The ATM owner may charge a fee, but that will be disclosed at the time of the transaction. Most, but not all, banks in Europe do not charge a fee for using the ATM. Since CapitalOne does not charge foreign currency transaction fees, that will be at the interbank rate prevailing at the time of the transaction. Currencies trade just like stocks, the precise rate changes constantly as millions of $ worth of currencies are being exchanged continually through out the day, 24-7.

Ok, so I think I understand now. Basically, even though capital one doesn’t have any ATM’s in Paris for example, I can use any ATM without incurring a fee on capital ones end? The only fees I’d occur would be on the end of whoever owns the ATM, and I can avoid those by finding an ATM with no fees?

Just the reverse of what you said. It is your card issuer that determines the fees.

Yes Frank, but doesn’t the capital one card have no fees so that means any fees would bevfrom the atm’s end?

Okay, this thread has become confusing for just about everyone....

First of all. Make sure you are talking about a Debit or ATM card (not a credit card). Credit Cards should not be used at ATMS unless it is the only option available to you. With Credit cards you accrue interest on a cash advance.

Secondly, each bank or credit union that issues a debit card has its own policy regarding ATM fees and foreign transaction fees. You want a card that 1) Does not charge ATM fees anywhere 2) Credits your account back for any ATM fees charged by ATM provider 3) Does not charge foreign transaction fees.

Several cards that meet these requirements have already been suggested in this thread so I won't go through it again. If your Debit Card has the VISA logo on it, you should not have difficulties using it in almost any ATM around the world. If you sign up for an account with the features listed above, you should not have any fees associated with the transaction.

No, Frank. You might still get charged a fee to use the ATM by the ATM's owner, particularly if it is not a bank ATM. There have been posts here about that happening.

Credit Cards should not be used at ATMS.

Correspondingly, I would say that debit cards should not be used for POS transactions.

CapitalOne is an internet bank that has no ATM's, so they can't charge a fee for using somebody else's ATM

Capital One has bank branches, ATMs, and Allpoint ATMs associated with it. It's not an internet bank, it has brick and mortar locations throughout the US. There is no evidence (that I know of) that they can't or don't charge for using other ATMs.

Capital One doesn't charge for use of European ATMs. I haven't tried using my Capital One ATM card in another bank's US ATM so cannot say for sure what would happen.

Cody, I saw nothing wrong with your short summary.

Why not? That is exactly what they are designed for. I use my debit card a lot more than my credit card, both to extract money from an ATM and for shopping. I only use the credit card on the internet (sometimes, debit card is often cheaper), or when travelling and the shop doesn't accept debit cards.

On the US end, of course lots of people use debit cards for POS. The issue is that credit cards have more legal protections than debit cards. Maximum liability for fraudulent use is $50 I believe, and even that almost never happens. When the statement is viewed, you can dispute and be reimbursed for fraud. With a debit card, someone can drain your entire bank account and the fine print of your bank agreement says the bank is not liable for the lost funds. In practice, banks usually do reimburse their customers, but it can be a hassle in time spent being "pennyless" until it gets cleared up and all the proper hoops have been jumped through.

Lately, the fraudsters have been using skimmers and tiny hidden cameras on unattended gas pumps, so they get both the card number and PIN.

When I am in Germany, I use mostly cash, which I get from ATMs with my debit card, for almost everything. The small, independent hotels or guesthouses I use almost never take plastic, and they are always less expensive than those that do. If I do use a credit card, it is usually for a purchase from a major retailer, and I never lose sight of the card.

At home, I have a debit card that I use for internet sales. It is tied to a checking account in which I usually keep less than $100, with no overdraft protection. I did this on the advise of my bank after they called me one day to ask if I had charged $18,000 to Avon for cosmetics.

You have to be careful which Capital One account you get: It must be the 360 online account they offer to guarantee you have no fees for ATM transactions. Some of their other accounts do charge fees for ATM use.

I have had the 360 account for over 15 years. I have never been charged any ATM fees by Capital One (or its predecessors for this account) anywhere in the entire world. I have used that Debit card in ATMs all over Europe.

I agree with the statement made about being told to not use your Wells or Chase card at ATMs not belonging directly to them. This is good advise in the US where ATM owners love to charge large fees when you use their ATMs. Since most places in Europe do not charge fees at the ATM, not something to really worry much about as long as the ATM is run by a bank. You do have to worry about the fees your bank will charge you for international transactions. They charge just because they can. . And no, you will not find ATMs operated directly by US banks anywhere in Europe so don't waste time looking for one.

This topic has been automatically closed due to a period of inactivity.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Travelex Money Card Review Australia

The Travelex Travel Money Card replaces the pre-existing Multi-currency Cash Passport with enhanced features and benefits. Learn about the Travelex travel card in this review to help you decide whether this is the card for you.

What is the Travelex Travel Money Card?

The Travelex Travel Money Card is a prepaid Mastercard%C2%AE currency card, designed specially for your overseas adventures. It replaces the Multi-Currency Cash Passport, which is no longer available.

Travelex itself is owned by Finablr, a financial company that owns many well known brands like Remit2India and UAE Exchange.

The company listed on the London stock exchange in 2019 with an implied valuation of about 1.23 billion pounds, making it one of the largest foreign exchange businesses in the world.

Pros and cons of the Travelex Travel Money Card

- Smartphone app and Free Wifi

- $0 international ATM fees

- Lock in exchange rates

- Limited number of currencies

- Expensive - high cross-currency conversion, extra initial loading, inactivity and closing fees

- ATM fees in Australia

When to use (and avoid) the Travelex Money Card for your travels

We think the Travelex Money Card is ideal for an organised traveller going to popular holiday destinations like Europe or the US. It comes with free Wifi, which fantastic for you to keep in touch with family or friends. Travelex has better online rates than your bank so you can lock in a good initial loading rate and save. Plus they don't charge you ATM fees while you're overseas.

Unfortunately, all of these conveniences comes with a high price tag. If you're looking for cheaper travel money options , you can also try the Wise (formerly TransferWise) debit card or Revolut .

Best way to use the Travelex card

The best way to use this card is to take cash from ATMs, because your limit is $3,000 and there are no additional ATM fees. The limit for in-store purchases is only $350 per day, which isn't much.

We also think it's a good idea to get a spare card, kept securely and separately from your main card. This way if your card gets lost or stolen, you won't have the hassle of ordering and waiting for a new card.

Learn more about the Travelex Money Card

Benefits of the travelex money card.

- Chip and PIN

- 24/7 Global Travel Assistance

- Emergency card/cash available if stolen/lost

Convenience

- Easy way to manage, spend and save on multiple currencies

- No bank account required

- Contactless payments

- No international ATM fee

- Lock in exchange rate by loading funds to foreign currencies and avoid fluctuations

Manage Your Money

- Reload and manage your funds easily online

- Redeem your unused funds easily on your return

How does a Travelex card work?

There are three main steps to setting up the travel money card with Travelex Australia, outlined below. You can also watch our video tutorial for a complete guide.

Step 1: Purchase Card

Order your Travelex Money Card online , over the phone or in your local Travelex store. Make an initial load amount of A$100 minimum. Get your travel card.

Step 2: Activate

Register your travel card details through the Travelex website or via the Travelex Money app and activate your card. You can manage your account online or through your app.

Step 3: Top-Up

Top up or reload money onto your travel card online, over the phone or via the Travelex Money app.

How much does the Travelex Money Card cost?

Travel money cards have multiple fees associated with them, which can make it difficult to compare.

For the Travelex Money Card, the initial load fee for Australian Dollars are the greater of 1.1% of the initial amount or A$15.00, but for loads or top-ups into all other currencies it's free. There is also a A$4.00 monthly inactivity fee.

Travelex exchange rates

Travelex provides a currency calculator on their website . However Travelex quotes the market rate, which is not necessarily the rate you will get when you load currencies on your card.

Travelex sets the exchange rate at the time you move your funds from one currency to another. If you don't have enough currency in your account and have made a purchase, Travelex will use the Mastercard%C2%AE exchange rate ("FX Rate") plus a margin of 5.95% of the transaction value to cover the cost.

All prices are in AUD * Foreign currency conversion is charged when you spend in a currency that is not loaded in the card

All prices are in AUD

Does the Travelex Money Card have an App?

Yes. When you have an account with Travelex, you can top-up your card through their website, or through their iOS and Android apps. This means Travelex is available to both Apple and Android users.

Like their website, Travelex's Money Card app is very easy to use. Having the app makes loading currencies and taking out cash on the go when you're travelling much easier.

Travelex Customer Reviews

TrustPilot TrustScore: 8.9/10

On TrustPilot , Travelex have four stars and most customers think it's an "excellent company" to use. Generally customers speak favourably about their experiences with Travelex Australia as a whole.

However customers are more negative when it comes to reviewing Travelex's travel money card. A lot of customers complained about difficulty in using the app and issues with reloading money onto the travel card.

With too many negative user experience stories in online forums, we think a comparison with alternative travel cards for your situation is a good idea.

Is the Travelex Money Card safe to use?

Yes. Travelex is regulated in Australia. They have an Australian Financial Services Licence, and are regulated by the Australian Securities and Investment Commission (ASIC). They also have strict regulatory guidelines to follow.

How to contact Travelex if you have a problem

Website: https://www.travelex.com.au/travel-money-card/contact

Phone: https://www.multicurrencycashpassport.com/contact-us/card-service-numbers/

Frequently asked questions about Travelex Money Card

How do i get a travelex card.

You can buy a Travelex Money Card from any Travelex store or online and can collect it from any Travelex store in Australia. In-store fees for the card are more expensive than buying online.

Where can I get a Travelex Money Card?

Travelex have plenty of stores all over Australia . They have 1,400 Bureau de Change outlets principally located in airports and tourist locations in over 100 airports, across 26 countries. You can pick up your Travelex Money Card instantly from any Travelex store.

Can I use my Travelex Money Card in Australia?

Yes, you can use your Travelex Money Card in Australia. However if you are withdrawing money from an Australian ATM you will be charged 2.95% of the total amount you are withdrawing.

What currencies can you load on your card?

Your Travelex Money Card can be loaded with Australian dollars, which is your default currency.

You can load up your card with 9 additional currencies, including US dollars (USD), Euro (EUR), Great British pounds (GBP), New Zealand dollars (NZD), Hong Kong dollars (HKD), Canadian dollars (CAD), Singapore dollars (SGD), Thai baht (THB) and Japanese yen (JPY).

Can I still use my Travelex Multi-Currency Cash Passport?

If you're an existing Cash Passport customer with Travelex, you can still use your card until the expiration date on the front of the card. Positively, you can also order and use a Travelex Money Card should you wish to do so. You can even transfer the balance from your existing Cash Passport to your new Travelex Money Card, in the same currencies and at no extra cost.

What happens if I lost my Travelex card?

If you lose or misplace your card you can contact 24/7 Global Assistance. Travelex quickly and securely provides you with emergency cash and a free replacement card.

Your currency knowledge centre

5 Cheaper Ways to Transfer Money Overseas

Using a bank is one of the easiest ways of transferring money overseas, but can also be the most costly. There are alternatives that can make the whole process cheaper.

- Read more ⟶

International Money Transfer Comparison and Reviews

Find the best international money transfer exchange rates to send money overseas from Australia. Compare the rates and fees from leading banks and money transfer services.

5 Safe Alternatives to Wise

Wise (formerly known as TransferWise) is a transparent and easy-to-use money transfer option. But it can still be worth looking at Wise's competitors to see which is the best option for you.

Travelex: Travel Money Card

About this app

Data safety.

Ratings and reviews

- Flag inappropriate

App support

Buy Currency

Top up card.

Enter the currency you need, or if you don't know what currency you need for your trip, simply enter the country that you're travelling to

Rate last updated Thursday, 25 April 2024 22:02:15 BST

[fromExchangeAmount] [fromCurrencyCode] British Pound

[toExchangeAmount] [toCurrencyCode] [toCurrencyName]

You can choose to receive cash via home delivery or pick up from store.

Enter the card number of the prepaid card you would like to top up

Card validated

Select the currency you would like to load or top up to your card

Enter how much you'd like to load or top up, either in Pounds Sterling, or in the foreign currency amount for the currency you have selected

How do we compare? Every day we check the exchange rates of major banks and high street retailers and adjust our rates accordingly to ensure that we give you a highly competitive overall price on your foreign currency.

- [name] [amount]

You can now add your Travelex Money Card, powered by Mastercard ® to the Apple Wallet

Get started in a few easy steps

- Travel Money Card

Secure spending abroad made easy.

- Safe and secure

- Choice of 22 currencies

- Seamless spending with Apple Pay and Google Pay

- Manage your travel money effortlessly via the Travelex Money App

- In case your card is lost, stolen, or damaged, our 24/7 global assistance team is here for you

Buy foreign currency

Order the currency you need online for our best rates. Pick up in store (including airports) or get it delivered to your home.

- Store Finder

Locate your nearest UK Travelex store. Order your currency online and collect in-store.

Join our Mailing List

Be the first to know about exclusive sales, competitions, product news and more.

Find your foreign currency now

Whether you're going to Australia or Thailand, we've got you covered. With a choice of over 40 currencies and our Travelex Money Card, we make it easy for you to get your travel money. Have it delivered straight to your door next day or pick it up from any of our UK stores at major airports, ports and retail locations.

How it Works

Choose from 40+ currencies

Select to have your currency delivered to your home or collect at one of our stores across the UK

Relax knowing that your travel money has been taken care of by the world's leading foreign exchange specialist

The Travel Hub: Tips & Guides

Discover top tips, indulgent guides and no end of travel inspiration at The Travel Hub! From the hottest destinations to last minute travel and family fun, here's to making your next trip the best one yet.

Quick Links

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

Join the conversation

To share your thoughts or ask a question, visit the CHOICE Community forum.

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.