How to Use American Express Travel

Julie Tremaine

October 4, 2023

Going has partnered with CardRatings for our coverage of credit card products. Going and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses, and recommendations are the author's alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of all of the card offers that appear on this page are from advertisers; compensation may affect how and where the cards appear on the site; and Going does not include all card companies are all available card offers.

Since American Express introduced the traveler’s cheque in 1891, the company has been an invaluable resource to travelers domestically and abroad. One of the best of those resources: AmexTravel.com, a travel booking site for hotels, airline tickets and rental cars. Though the company offers points perks and member pricing to American Express cardholders, anyone can book on the site, not just members.

Many AmEx cards have travel perks, with different levels of points awarded for cards like the entry-level American Express Green and mid-tier Gold. The American Express Platinum, a premium card with a high annual fee of $695, offers the highest level of rewards. For all levels of card, the company offers baggage insurance, rental car insurance, trip delay insurance and a 24-hour global traveler’s assistance line (terms and conditions apply). (In addition to standard AmEx cards, the company also offers partnership cards with Delta, Hilton and Marriott.)

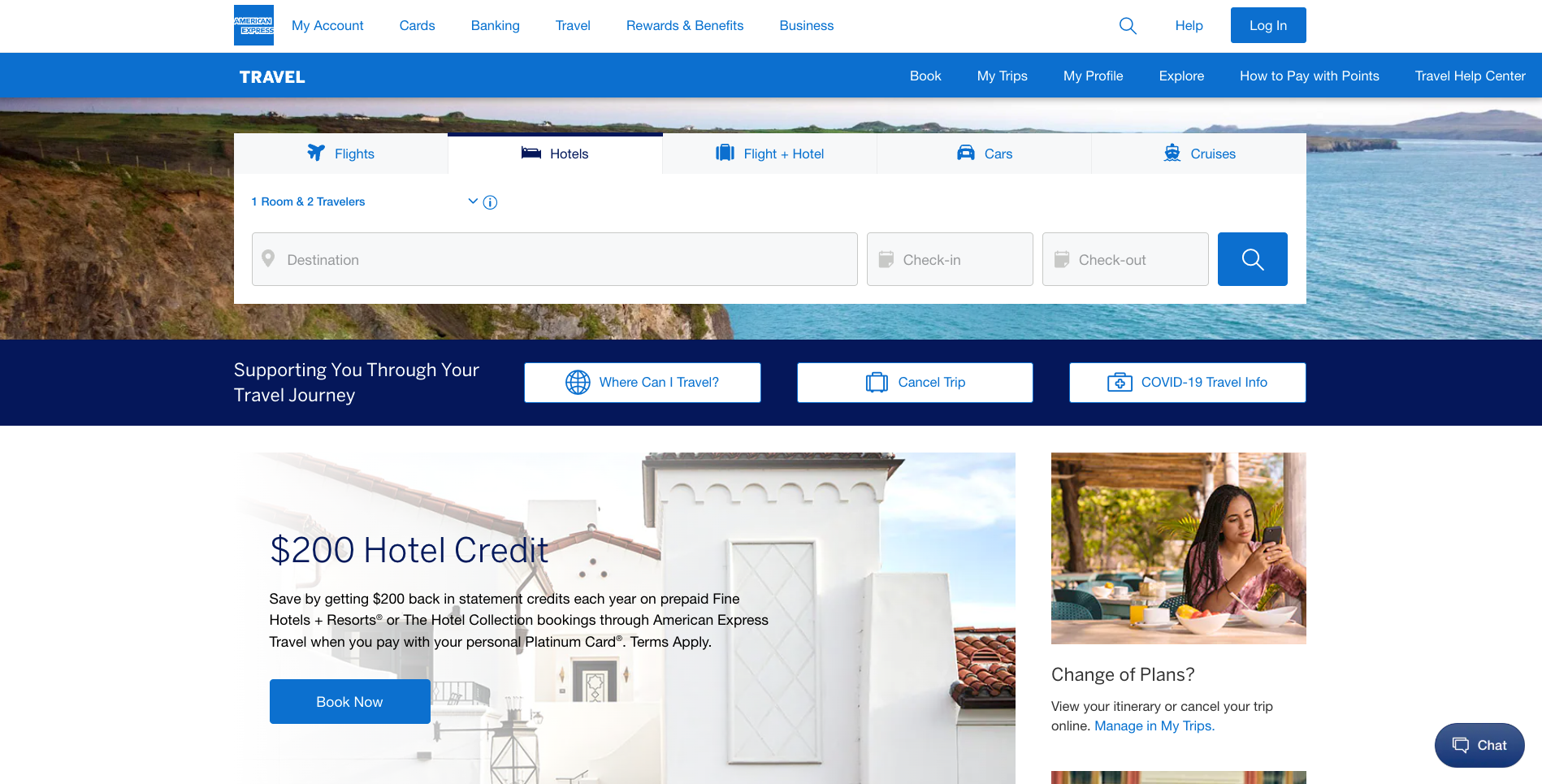

It’s simple to use: navigate to AmexTravel.com and enter search terms like you would on any other airline site or travel aggregator like Orbitz or Expedia. Once there, you’ll find special member pricing, incentives to use points, and easily accessible, customer-first customer service.

Earning Amex Travel points

American Express cardholders earn points through purchases, which can be redeemed for anything from gift cards to premium retailers like Saks Fifth Avenue and Nordstrom to cash off your current balance due. (I don’t recommend that—you’ll get much better value for your points redeeming for travel.)

Each level of AmEx earns points on purchases, and the higher tier cards offer progressively more points, especially on travel. In addition, there are rotating deals you can add to your card periodically at specific retailers, managed through the website.

Among other ways to earn points, Green cardholders earn 3x points on transactions involving restaurants, travel and transit. In addition to the traveler insurance offered to all cardholders, Green cardholders receive a $100 credit towards CLEAR Plus, and a $100 credit towards LoungeBuddy purchases. This card is $150 annually. Terms and conditions apply.

Travel-specific points earning for American Express Gold cardholders includes 4x points on restaurants and 3x points on flights booked through AmEx Travel.

In addition, card_name holders of the get access to member pricing of the Hotel Collection, a select group of hotels on the travel site. This card is $250 annually. Terms and conditions apply.

card_name earn 5x points on flights up to $500,000 per calendar year and prepaid hotels through AmEx Travel, among other points earning.

Amex Platinum cardholders have a significant increase in travel perks, including a $200 annual airline fee credit, a $200 annual hotel credit, and a dedicated Platinum customer service line.

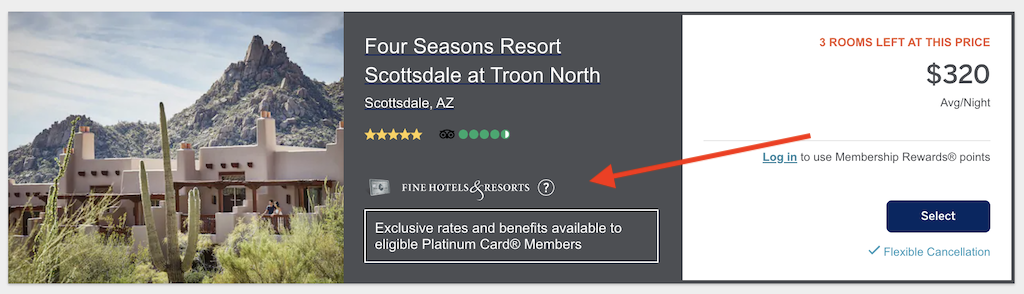

When Platinum cardholders book select hotels from the Fine Hotels Collection, guests have access to room upgrades, early 12pm check in and 4pm late check out when available, in addition to on-site perks like free breakfast for two and a $100 property credit. Terms and conditions apply.

All travel purchases can be made with cash or points on AmEx Travel. Some prices are offered as daily deals to members for even lower cost when purchased with points.

The American Express Travel portal

The user-friendly travel portal works like any other airline or travel aggregator website: choose the thing you want to search for (hotel, airline tickets, flight + hotel packages, rental cars and cruises) then select from options.

There are some downsides, though. When booking airline tickets through AmEx Travel, seat assignments are considered “requests” and not always honored. I’ve recently had American Airlines not honor that request and leave me with an unassigned seat at 24-hour check in, meaning I had to pay $35 to guarantee an assigned seat.

Another downside is the hotel search function. There are usually plenty of options in a given hotel search—but sometimes, when there is a limited selection of participating hotels in a given area, the site will offer hotels 50+ miles away and not make it immediately clear that the options are far away from the desired area. American Express only gets a designated number of rooms, too, so sometimes a hotel site will have options that AmEx doesn’t have.

And of course the biggest downside is that, should something go wrong, you may end up not being able to work with the hotel or airline directly since your flight or hotel was booked with a third party.

Benefits of using Amex Travel to book your trip

Often, prices for plane tickets and for basic hotel accommodations are within a few dollars of each other through AmEx Travel or on the direct booking site—but if you pay with an American Express card and book on Amex Travel, you’ll earn a significantly higher point reward.

One of the major upsides to the Platinum card is that cardholders get status with Marriott Bonvoy and Hilton Honors, which means they can book lower-tier rooms and generally be upgraded at least one room level at check in. (This is not guaranteed, but in more than 50 hotel bookings over the past few years, I’ve never not been offered an upgrade.) (Terms and conditions apply.)

Additionally, you can stack points programs: pay in full with your card to get 3x or 5x points, and earn points through Bonvoy and Hilton Honors. The same goes with rental cars. With Hertz, Platinum cardholders are given status that guarantees an upgraded level of car, allowing you to book a less expensive option and receive a better rental. You can also skip the line at the counter and go directly to your car. (Terms and conditions apply.)

All cardholders get significant traveler perks. Airline baggage insurance will reimburse up to $500 for lost checked luggage and $1250 for lost carry-ons. Rental cars paid in full with American Express cards are entitled to damage and loss insurance—but not liability insurance—that allows you to waive the add-on damage insurance through the car rental service. (Terms and conditions apply.)

The Amex Travel International Airline Program

Platinum and Platinum Business cardholders have access to the International Airline Program. This benefit includes access to lower prices on premium airline tickets such as business and first class seats. According to American Express, cardholders save an average of $600 per first class ticket, $300 per business class ticket and $150 on premium economy fares. While the prices aren't quite as low as what we frequently see on Going (our alerts save members an average of $2,000 per roundtrip in business class , they can be a great deal when deals are scarce).

Twenty-five partner airlines include Delta, KLM, Lufthansa, British Airways, Air France, Emirates and Virgin Atlantic. Platinum cardholders earn 5x points on these purchases. When Platinum Business cardholders purchase airfare with points, they can earn a 35% points rebate.

If you see a great deal from Going, it’s worth checking the price on Amex to see if there’s an additional discount.

Booking hotels and resorts on Amex Travel

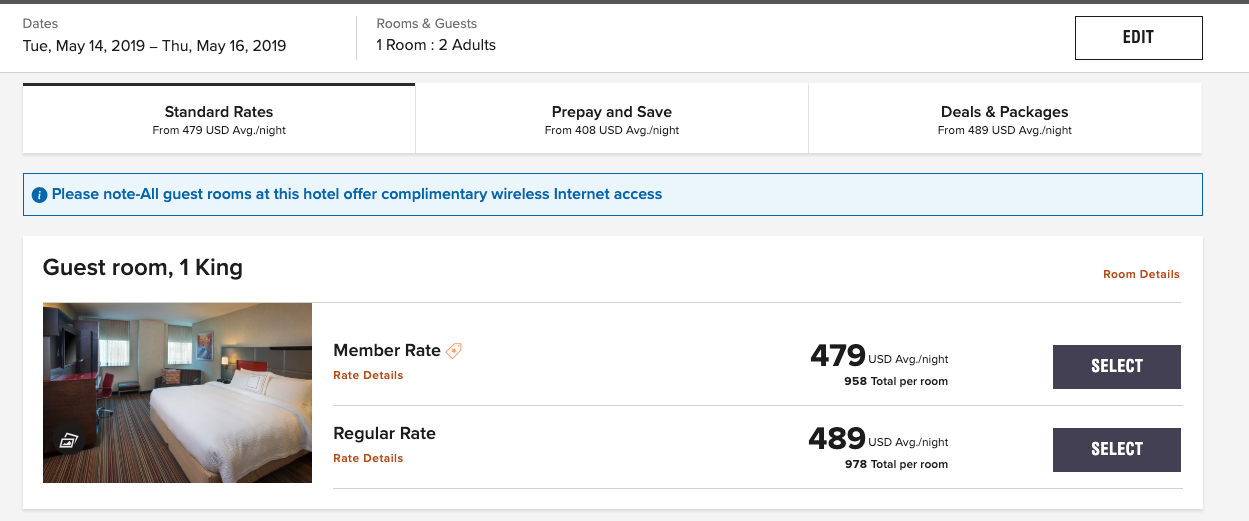

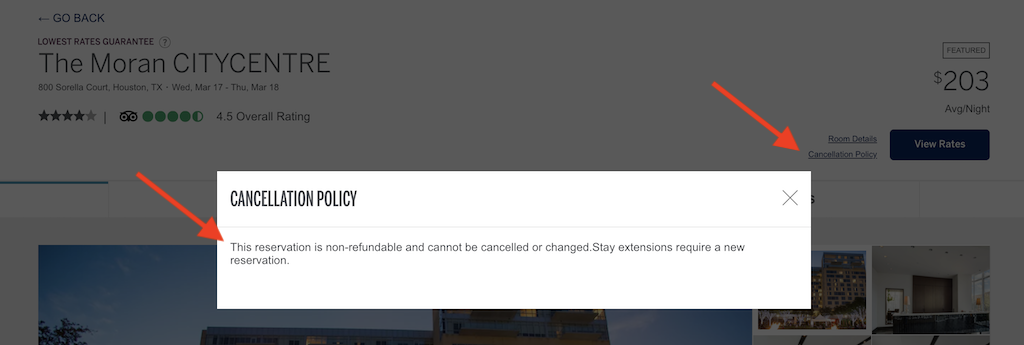

American Express Travel offers a lowest rate guarantee: if you book on AmEx Travel and see a lower price elsewhere, you can file a claim for a refund of the difference.

Though the Fine Hotels Collection offers higher room rates at nicer hotels, those rooms can sometimes be a better deal than lower-tier hotels, given the extra time at the resort, room upgrade, free breakfast and property credit. This is especially true for last-minute deals.

I recently snagged a Fine Hotels room at the NoMad Las Vegas, normally around $500 per night, for $160. At check-in I was given a suite on one of the highest floors instead of the standard room I booked, and there was a bottle of wine waiting for me in the room. I also got early check in and late check out, free breakfast for two every morning and a $100 property credit good at the entire complex (NoMad is part of Park MGM). When all was said and done, the perks were more valuable than the room, which paid for itself in added value.

Trip cancellation and insurance

Some levels of American Express card come with trip delay insurance and trip cancellation and interruption insurance, which vary by card, including the Centurion Card, Platinum, and Delta, Hilton, and Marriott cards. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Frequently asked questions about American Express Travel

Going has partnered with CardRatings for our coverage of credit card products. Going and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses, and recommendations are the author's alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of all of the card offers that appear on this page are from advertisers; compensation may affect how and where the cards appear on the site; and Going does not include all card companies are all available card offers.

Freelance Writer

Published October 4, 2023

Last updated January 22, 2024

Articles you might like

Amex Transfer Partners: Guide to American Express Membership Rewards

Mar 11, 2024

Best Travel Credit Cards of 2024

Mar 19, 2024

Credit Card Transfer Bonuses in April 2024

Apr 4, 2024

Treat your travel to cheap flights

Most deals are 40-90% off normal prices with great itineraries from the best airlines. If it's not an amazing deal, we won't send it. Sign up for free to start getting flight alerts.

Thomas Barwick/Getty Images

Advertiser Disclosure

Guide to the American Express Travel portal

Booking directly with the issuer comes with plenty of perks for Amex cardholders

Published: June 16, 2022

Author: Emily Sherman

Editor: Kaitlyn Tang

Reviewer: Barri Segal

How we Choose

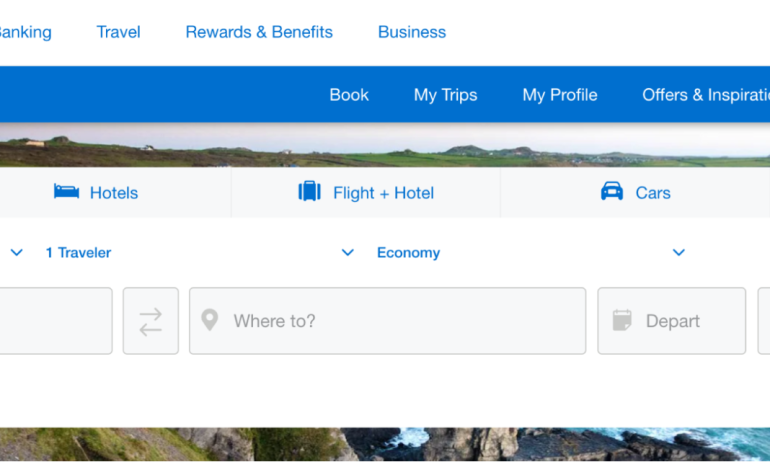

You can book your next vacation with American Express, and it’s as easy as using any third-party booking site.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

If you’re an American Express cardholder looking to book your next vacation, you’ll definitely want to consider booking through American Express Travel . On top of the ability to pay with Membership Rewards points, you’ll unlock exclusive deals on flights, hotel stays, cruises and car rentals.

The American Express travel portal is available to everyone, but it’s particularly valuable for American Express Membership Rewards cardholders . This is especially true for The Platinum Card® from American Express users, who are awarded additional perks such as dining credits, room upgrades and discounted vacation packages on hundreds of travel purchases.

American Express Membership Rewards is one of the top rewards programs on the market, and it’s as powerful and vast as its namesake. Read on to learn everything you need to know about Amex Travel, booking through the portal and more.

- What is American Express Travel?

American Express Travel is a booking site for flights, hotels, cars, cruises and vacation packages provided by American Express. In addition to offering great deals on travel purchases, the site includes extra rewards for Amex cardholders and special deals on Delta Air Lines flights.

Benefits of booking with American Express Travel

The main benefit of booking through American Express Travel is that you can use your Membership Rewards points ( valued at 1.19 cents per point by CreditCards.com) to either fully or partially cover your trip.

You can find all your vacation needs — flights, hotels, flight and hotel bundles, car rentals and cruises — on the American Express Travel portal. You can also go there to find travel guidelines concerning COVID-19, whether you need a packing list, information about flying during the pandemic or assurance on which countries’ borders are open right now for you to visit.

One huge benefit that comes with booking hotels through Amex Travel is the lowest rate guarantee. If you can find the same room for a lower nightly rate before your stay, American Express will refund you the difference (excluding special offers and discounts like AAA). This takes the pressure off hunting for the best deal and makes it easier to book your next hotel stay.

Most of all, certain Amex credit cards , like the Amex Platinum Card or American Express® Gold Card , allow you to earn extra points when you book with Amex Travel. The Platinum Card, for instance, awards 5X points if you purchase directly from the airline or amextravel.com, whereas the Gold Card earns 3X points for doing the same. If anything happens and you need to cancel your vacation, your Membership Rewards points will return to you in the form of a statement credit .

With most purchases on the American Express Travel portal, you have the option to pay entirely with Membership Rewards points, partially with points and with card, or fully with card. That flexible feature alone makes it worthwhile to book through American Express Travel.

How to book with American Express Travel

When you land on the homepage for American Express Travel, it will look like most third-party travel booking sites. You can easily toggle between types of travel purchases and filter results based on travel dates and destinations.

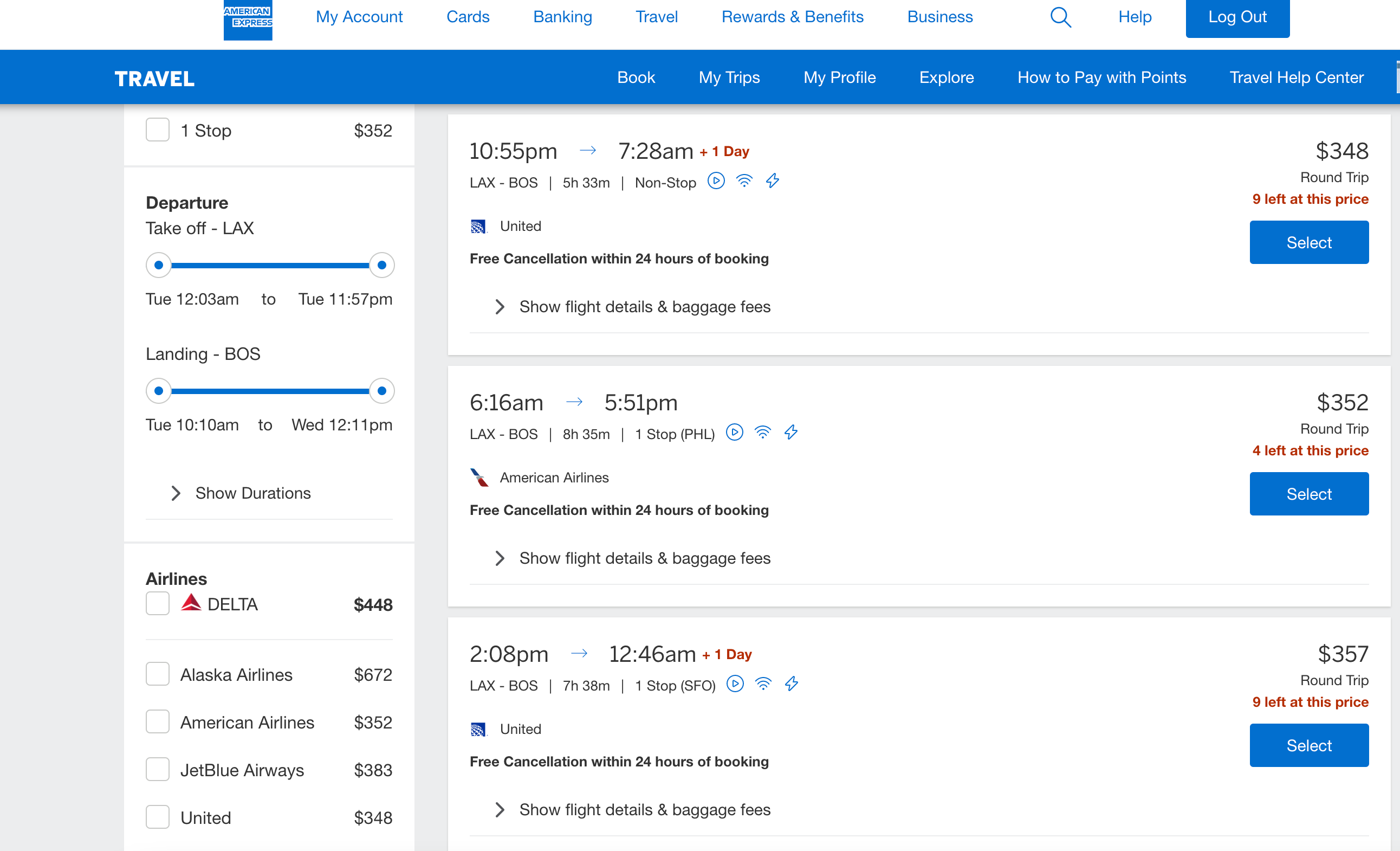

Booking flights

Booking a flight on American Express Travel works like on most other third-party booking sites. You simply select your departure and arrival destination, travel dates and number of travelers to filter available flights. After searching for your trip, the first result is usually a special deal from Delta Air Lines, with other options sorted by price underneath.

When you search for a flight on American Express Travel, the price of the trip will be displayed in dollars. However, you can log into your Membership Rewards account and select “Use only points” or “Use points + card” at checkout to redeem rewards for the cost. Of course, there’s an option to “Use only your card.” You’ll be charged for the trip on your credit card, then get a statement credit offsetting the cost of your rewards redemption within 48 hours.

You can also use the “Plan It” feature to pay for your airfare purchase in installments with a fixed fee. The option is available during the checkout, and you can be offered up to three duration options depending on the purchase amount and other factors, such as your account history, creditworthiness and more. Note that you can’t pay with points when using “Plan It” on amextravel.com. However, you can go with the “Use points + card” option and use “Plan It” on the credit card charge in your Amex app.

Booking hotels

As previously mentioned, Amex Travel has a lowest rate guarantee policy. If you can find the same room for a lower rate elsewhere, American Express promises to refund you the difference. Of course, some exceptions apply, but the policy is good insurance while you shop around for hotels.

The American Express Travel search page works similarly to booking flights when booking hotels, though results are sorted by recommended properties by default.

For non-cardholders and most American Express cardholders, booking a hotel is as simple as following the prompts and entering your personal information. However, Gold Card, Platinum Card and The Business Platinum Card® from American Express cardholders have a few other options.

American Express Travel also offers access to two elite hotel collections — Fine Hotels & Resorts and The Hotel Collection . With Fine Hotels & Resorts, American Express Platinum, Business Platinum and Centurion cardholders who pay for their stay in full with their card enjoy additional benefits, including room upgrades, daily complimentary breakfast for two, free Wi-Fi and more.

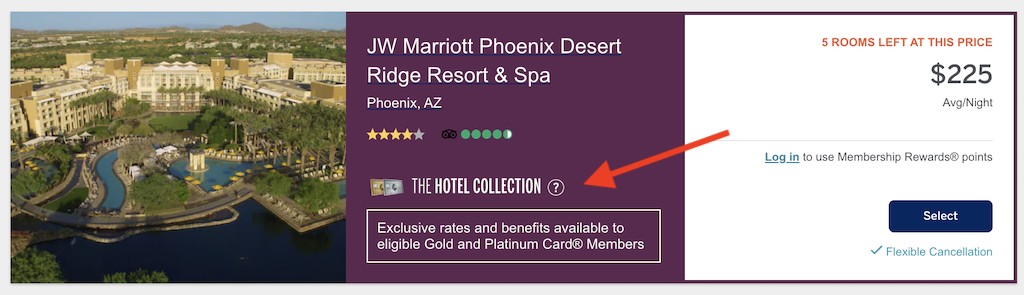

The Hotel Collection offers similar perks and is available to a few more cardholders. American Express Gold, American Express® Business Gold Card , Platinum and Centurion cardholders who book a stay of two nights or more on their card unlock benefits such as room upgrades (upon availability) and a $100 credit for dining, spa and resort services ($200 for Amex Platinum).

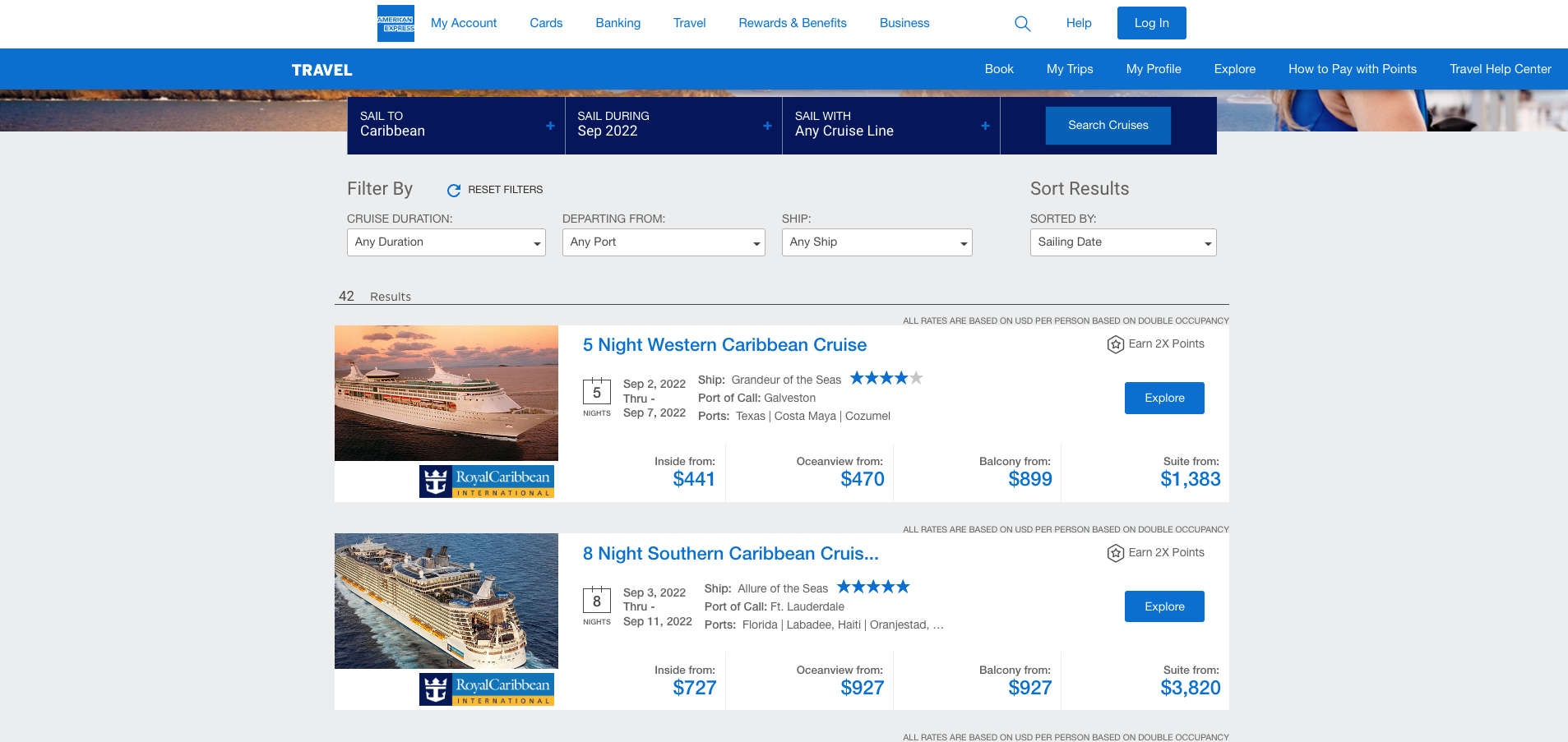

Booking cruises

To book a cruise on American Express Travel, simply filter search results by destination, cruise line, month and length of trip. You can then toggle between special offers and all available trips.

If you are a Platinum, Business Platinum or Centurion cardholder, you also have access to the Cruises Privileges Program . When you book a cruise of five nights or more and at least double occupancy (versus single), you’ll earn a stateroom credit of up to $300 as well as an exclusive amenity based on the cruise line. You just have to pay in full for an eligible trip with your qualified Amex card.

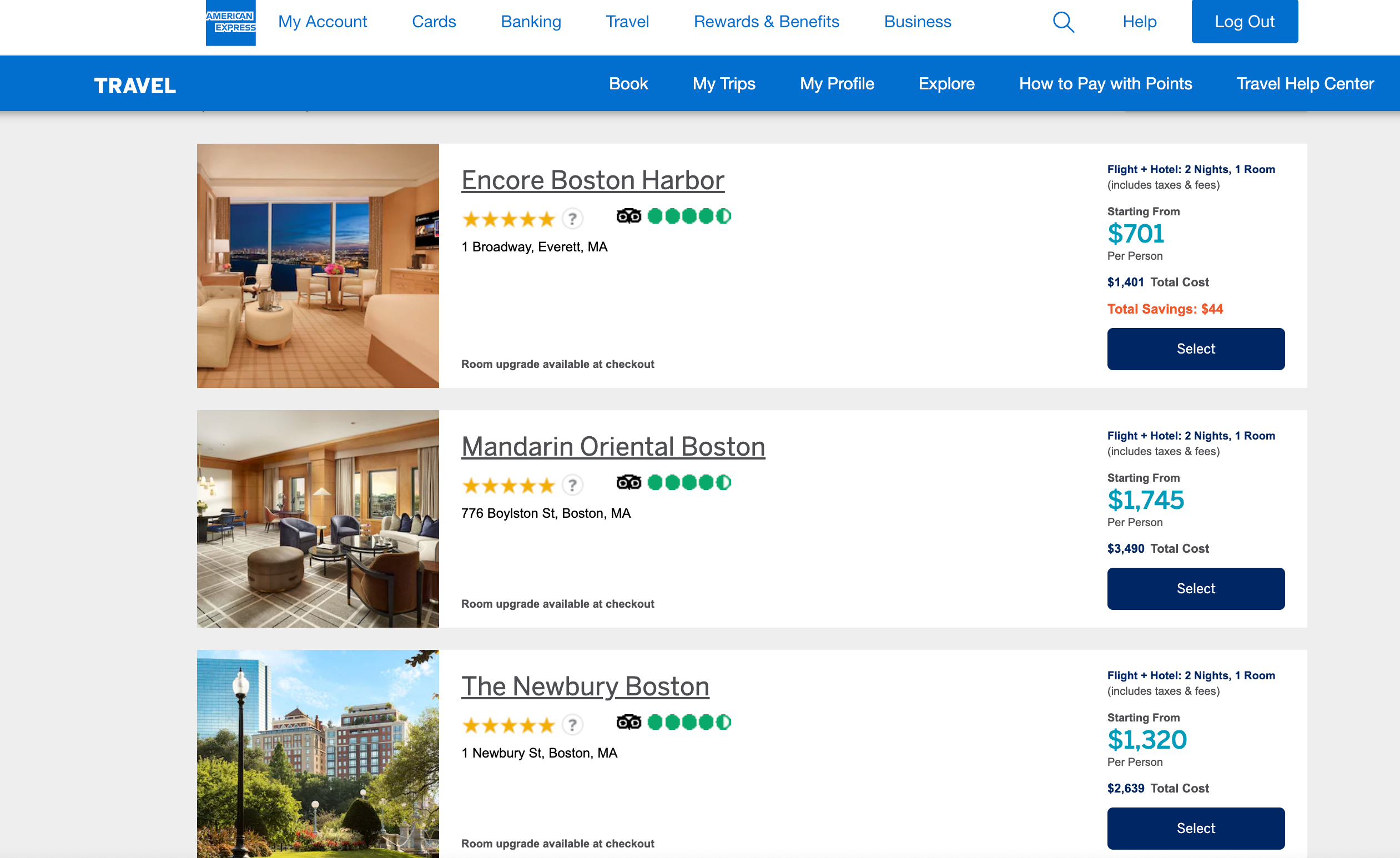

Booking travel packages

American Express Travel also lets users book package deals on flights and hotels. You search like any other travel purchase but can unlock special deals and savings. Typically flight and hotel packages are cheaper than booking them separately.

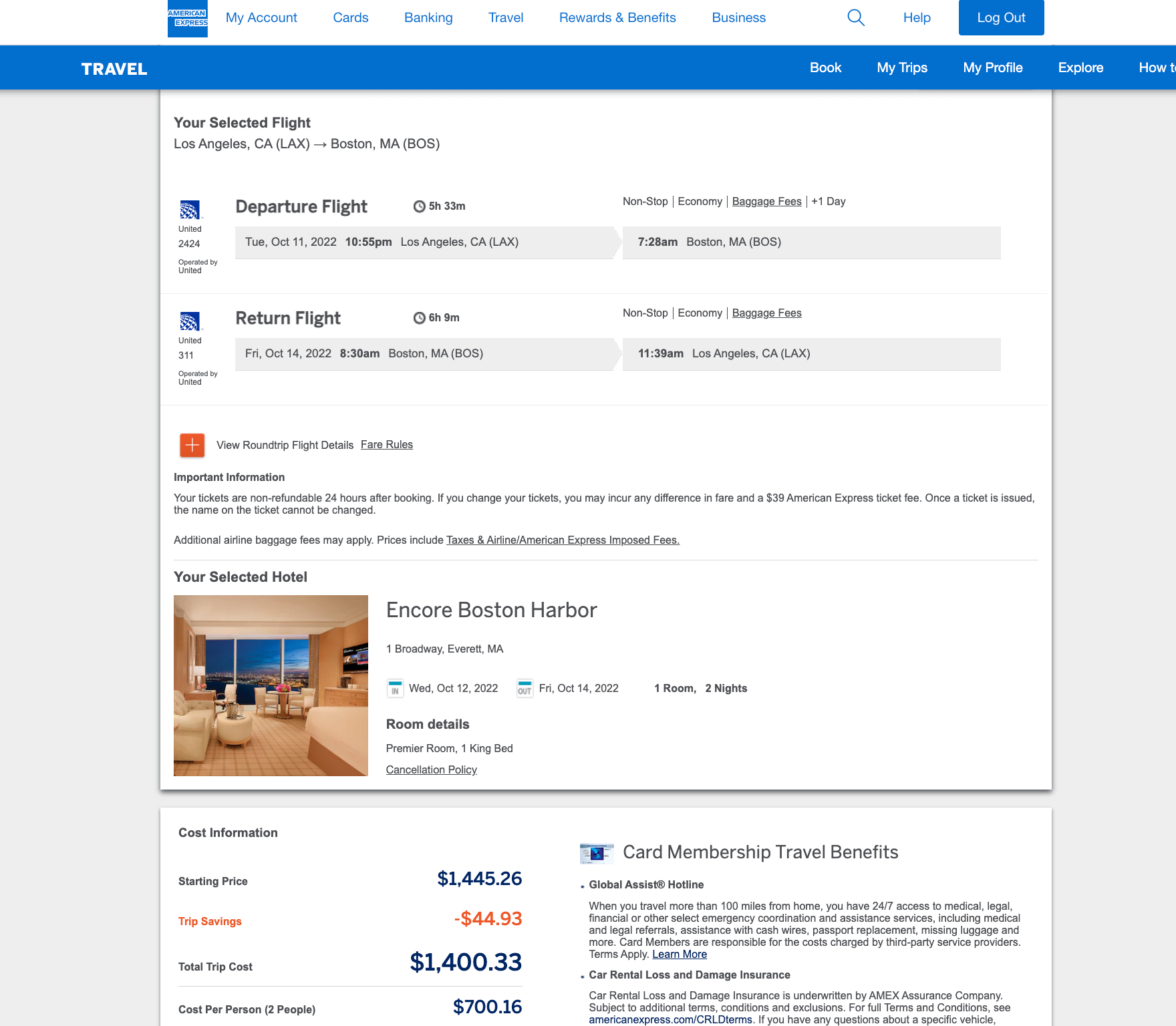

Take, for example, this package for a trip to Boston. It includes one round-trip ticket from Los Angeles, and a two-night stay at Encore Boston Harbor. The entire package totals to around $1,400.33.

When you book the flight alone, a round-trip ticket comes out to close to $348. And the same room, a premier room with a king bed, is listed at around $335 per night when booked on its own.

Booking the flight and hotel for the same trip separately nets a total cost of $1,018. That means booking a travel package would cost you an extra $382. Though some people may prefer travel packages so that all their bookings are in one place, some thriftier travelers may find it worth it to do the math beforehand. Sometimes, booking the flight and hotel separately, like in our example, is cheaper.

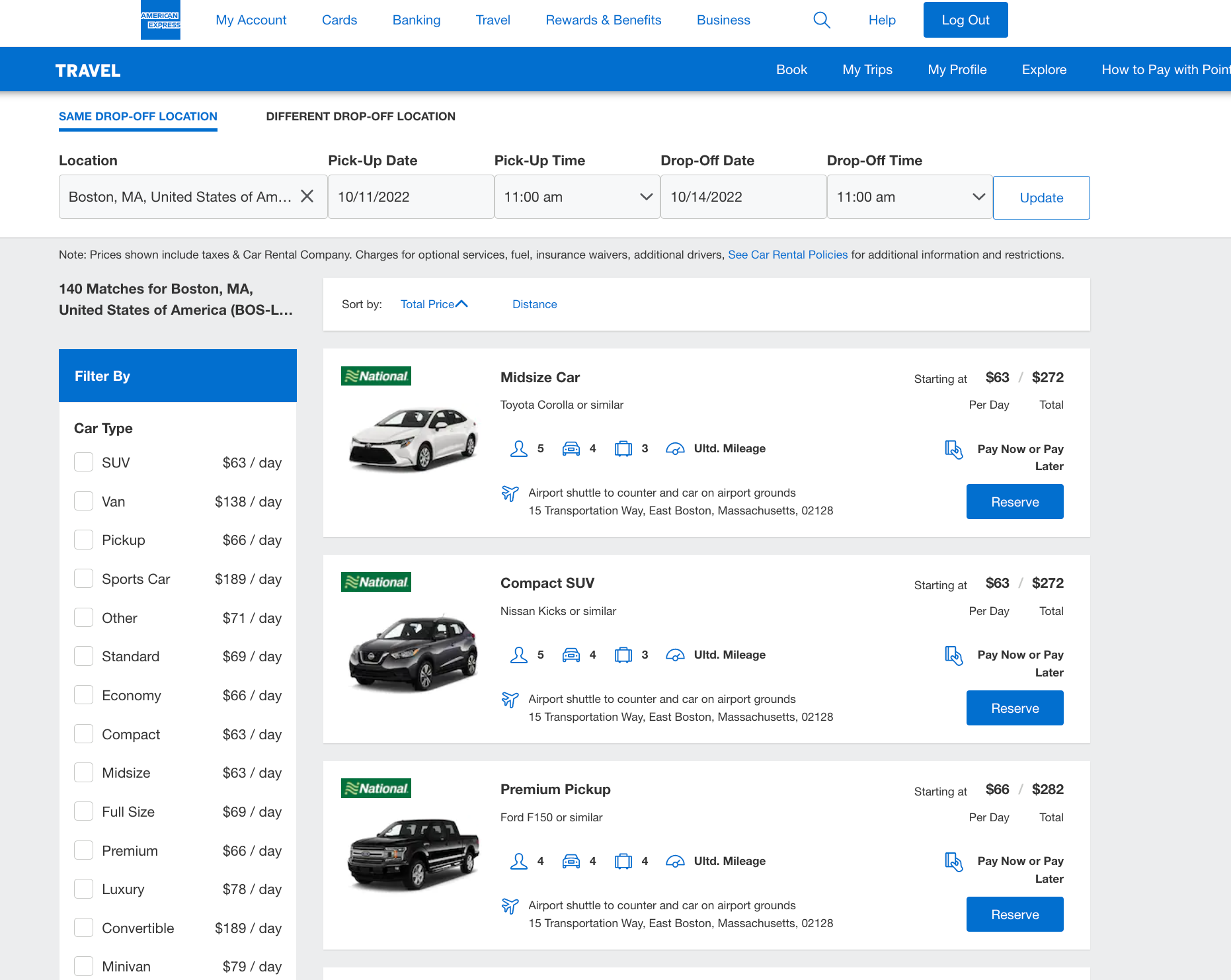

Booking rental cars

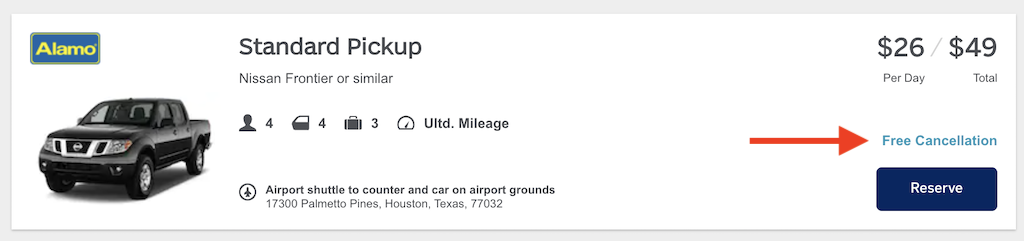

To help you book your whole trip on one site, Amex Travel also includes a rental car booking service. You can search available cars near the airport at your destination or any address. American Express then provides a quick breakdown of available rates along with your search results.

No matter what kind of travel purchase you’re booking, the American Express travel portal is a user-friendly option that makes it easy to find a great deal on your next vacation.

Which Amex card should you book with?

When you make a travel purchase through American Express Travel, American Express cardholders who earn Membership Rewards get at least 1 extra point per dollar. However, some cards earn an even better rate.

Plus, for American Express Platinum and Business Platinum cardholders, additional benefits such as dining credits, late checkout and free Wi-Fi can add significant value to qualifying stays.

Drawbacks to booking with American Express Travel

Despite a simple booking process and extra perks for American Express cardholders, there are a few downsides to booking with American Express Travel.

Additional fees

On top of any airline fees, flights booked through American Express Travel incur a $6.99 fee on domestic flights and a $10.99 fee on international flights.

No hotel elite benefits

If you are part of a hotel loyalty program, you won’t be able to enjoy elite benefits such as complimentary breakfast or late checkout when booking through American Express Travel since it is a third-party booking site. One exception to this is a hotel stay booked through the Fine Hotel & Resorts Collection (these stays still earn benefits), but this option is only available to American Express Platinum, Business Platinum and Centurion cardholders.

Is booking with American Express Travel worth it?

There are several factors to consider when deciding if booking through the American Express travel portal is right for you, including the value of the points you can earn and the price of different purchases compared to other booking sites.

Insider Fares

American Express Travel offers special deals on flights called Insider Fares, which are available to American Express cardholders with enough Membership Rewards points to cover the entire cost of the flight. These offers, primarily on Delta flights, tend to be the lowest available price and allow you to cover the flight for fewer points than normal. You must, however, be logged into your Rewards account to view any Insider Fare offers.

Special deals with Delta Air Lines

Delta Air Lines is a partner of American Express and therefore offers all sorts of special promotions on American Express Travel. In addition to Insider Fares, Delta offers great rates on flights for any user. Plus, Delta SkyMiles members will still earn miles on flights booked through the platform.

Rates compared to other booking sites

Overall, American Express Travel seems to advertise competitive rates to other travel booking sites on both hotel and flight purchases.

For example, a round-trip flight from LAX to BOS on American Airlines resulted in the following prices when booked through American Express Travel, directly on the American Airlines website and through Priceline .

A two-night stay at the Lake Nona Wave Hotel in Orlando also turned up positive results for American Express when compared to popular budget booking sites Hotels.com and Expedia . The nightly rates for different room types were the same across the booking sites.

Even budget-conscious travelers can find great deals, as a two-night stay at the moderately priced Best Western Plus Kissimmee-Lake Buena Vista South Inn & Suites in Orlando includes the similar rates on all three sites.

Use points to pay for trips

As mentioned, you can book through American Express Travel using your Membership Rewards points. Plus, travel purchases through the Amex travel portal will get you the the most value out of each point.

It is clear that booking through American Express Travel comes with great benefits, but you’ll have to consider the cost of additional fees and the value of your hotel elite status benefits before deciding if it’s right for you.

Tips for maximizing American Express Travel

- Pay with your American Express rewards card to earn more points on travel purchases.

- Save up enough Membership Rewards points to cover your whole trip to unlock Insider Fares.

- Compare rates on other travel sites to ensure you are getting the best deal.

- Monitor the rate of your hotel stay up until your trip to take advantage of Amex’s lowest fare guarantee.

- Compare prices among travel packages and booking flight and hotel separately to make sure you’re getting the best deal.

Bottom line

Booking through American Express Travel is a great option — not only if you want to pay with Membership Rewards points, but also if you want to score great deals on your next trip.

*All information about the American Express Green Card has been collected independently by CreditCards.com and has not been reviewed by the issuer. This offer is no longer available on our site.

Frequently Asked Questions

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Emily Sherman is a senior editor at CreditCards.com, focusing on product news and recommendations. She is also one of the founders of To Her Credit, a biweekly series of financial advice by women, for women. When she's not writing about credit cards, she's putting her own points and miles to use planning her next big vacation.

On this page

- Benefits of booking with Amex Travel

- How to book with Amex Travel

- Choosing an Amex card to book with

- Amex Travel booking drawbacks

- Is it worth booking with Amex Travel?

- Tips for maximizing Amex Travel

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

7 ways to earn American Express points

Here’s how you can use your everyday spending to rack up American Express points faster.

What you need to know about American Express credit card benefits

American Express credit cards offer cardholders stand-out benefits in travel protection and retail protections. Plus, the issuer grants cardholders access to pre-sale tickets, unique experiences and valuable offers with partner merchants and services.

Best ways to spend American Express points

Earn up to 120,000 bonus points with the Platinum cards from American Express

Is the Blue Business Plus card from American Express worth it?

How to add an authorized user to an American Express card

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

The State of the Hotel Best Rate Guarantee

Where do you book your hotels rooms? Directly on a hotel website, through an online travel agency (OTA) like Priceline.com, through a members-only outfit like Club1 or with a traditional travel agent? Hotel chains are trying their hardest to get you to answer that question with "directly on the hotel website."

Between offering free internet, free breakfast , promising lower rates than booking through OTAs and even running expensive ad campaigns, hotel chains are investing significant amounts of money to get you to book directly. The reason behind this is simple -- when you don't book directly through the hotel, it has to pay your preferred booking channel a commission that can get as high as 10–15% of the room rate. Booking directly saves the hotel chains money, which they can then use to pass along savings. It also benefits you, the points-traveler, by allowing you to earn and use elite status perks, as well as hotel points.

Best Rate Guarantee Programs

To further incentivize direct bookings, all the major hotel chains offer best rate guarantees just in case you find a better deal somewhere else. Here's a look at their offerings.

IHG will match the lower competitor's rate and then give you five times the IHG Rewards Club points, up to 40,000 maximum, worth $200 according to TPG's latest valuations .

Hilton's price-match guarantee program is one of the most generous. If you find a lower rate, Hilton will match that rate and then offer 25% off the matched room rate. Hilton's claim form is also the most robust, since it pre-populates your reservation information for you.

Hyatt's best rate guarantee gives you a choice. Should you successfully submit a best rate guarantee claim , Hyatt will match the lower rate and then give you a choice: an additional 20% off the matched rate or 5,000 World of Hyatt points , worth $85 according to our latest valuations .

Like Hyatt, Marriott's best rate guarantee also gives a choice. After filing a valid claim, you can choose either an additional 25% off the matched rate or 5,000 Marriott Bonvoy points (worth $40).

Related: The Best Credit Cards for Family Vacations

Terms and Conditions

Like many good things in life, the various hotel best rate guarantee comes with lots of conditions. Each chain has different language around the best rate guarantee but some of the key terms and conditions are shared across the chains.

- You must have already booked the room directly through the hotel chain (except for Hilton).

- The lower rate must be found on a valid competitor website.

- This excludes sites that don't tell you the hotel brand until the reservation is completed, sites that offer membership prices, sites that don't offer immediate confirmations and some others.

- The lower rate must have the exact same conditions as the rate booked directly through the hotel chain:

- same booking dates

- same room type

- same cancellation policies

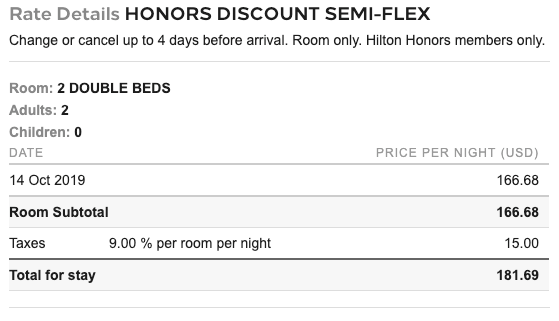

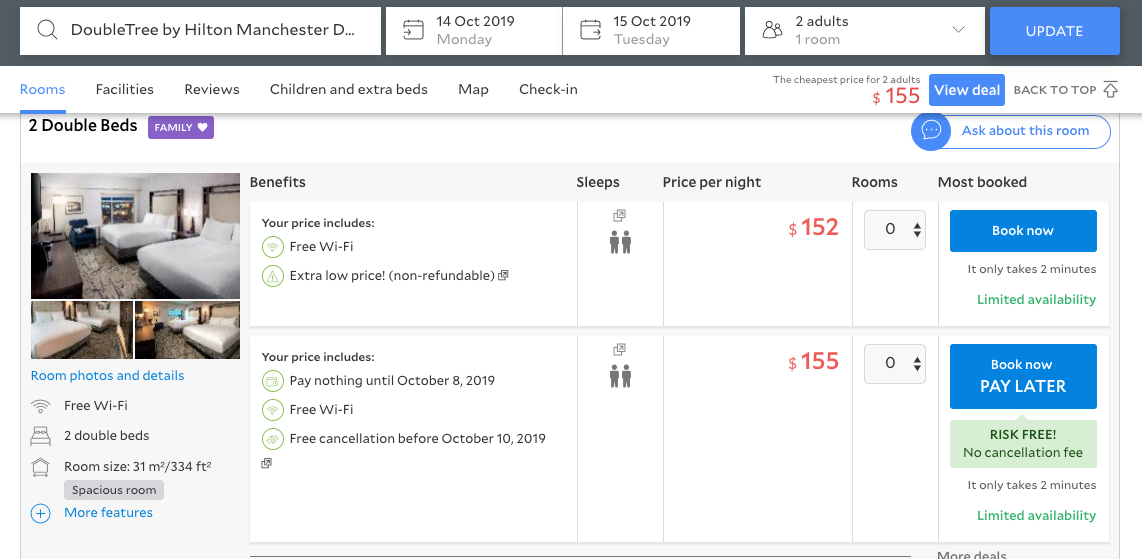

I recently made 14 hotel bookings to test whether the hotel chains stuck to their words. Of my 14 best rate guarantee claims, only six were approved. What can you learn from my ~50% success rate?

1. Be Careful With Cancellation Policies

In my research, many of the lower rates I found had slightly different cancellation policies than the policy offered directly with the hotel. When I went to submit a best rate guarantee claim for the DoubleTree by Hilton Manchester Downtown , my claim was denied because the cancellation policies were different. But you tell me, how different are these cancellation policies?

- Doubletree's cancellation policy: Change or cancel up to four days before arrival (up to 10/10/2019)

- Agoda.com cancellation policy: Free cancellation before Oct. 10, 2019

Clearly, the ambiguous language of "before Oct. 10" and "up to four days before arrival" was enough to invalidate my best rate guarantee claim.

2. Don't Forget to HUCA

Even though most best rate guarantee claims need to be submitted online (Hilton and Hyatt can be done over the phone), that doesn't mean you can't apply the principles of one of the best tricks in the book: Hang up, call again (HUCA).

In the previous example, I received an email from Hilton denying my claim. Nowhere in the denial email did it say I could contest the decision, but I simply replied to the email stating that the two cancellation policies are, in fact, the same. A few hours later, I received an update that my claim had been approved. It never hurts to ask!

3. Book the Absolute Lowest Rate

Another three of my claims were denied because I didn't book the "lowest available rate" directly through the hotel chains. In those three cases, I had booked the lowest publicly available rate, which was a bit higher than the rates the hotel chain offers to its loyalty members. Upon further inquiry, I needed to book the "Member" rate in order to satisfy the condition of booking the lowest available rate.

Beware: Although the hotel chains don't let you price match to an OTA's member rates, they hold you to a double standard by requiring you to book their absolute lowest rate, even if that rate requires you to be a member of the hotel's loyalty program.

4. Good Luck With the Math

Only two of my six successful best rate guarantee claims matched the exact competitor rates that I originally sent in. The other four approvals ranged from being 10% lower to 10% higher than the competitor rate that I sent in.

My assumption is that the rate discrepancies can be attributed to how the hotel chains calculates taxes and fees in the competitor's rate. While it was hard to pinpoint exactly how the chains figured the matched rate, one thing was clear: Don't expect to understand what's going on in the calculation.

5. Upload a Screen Shot

To streamline the claims process, take advantage of Hyatt's optional "Upload a Screen Shot" field. Take a screen shot of your web browser showing the OTA's lower rate and upload it to the Hyatt's claim form.

For the other chains, make sure to fill out the optional comments section, describing exactly how one could replicate your search for a lower hotel rate. Two of my OTA rates couldn't initially be verified during the claims process, so I had to explain by email exactly how I found the rate I submitted.

6. Patience Is a Virtue

After you've submitted your best rate guarantee claim, take a deep breath and wait. And then wait some more.

All the hotel chains promise an answer within 24 hours, but in my experience, Marriott and Hyatt take up much of their 24-hour allowance. In fact, I've still yet to hear back from Hyatt for one of my claims. Hilton took the award for quickest response, with an average response time of an hour or less.

Bottom Line

Hotels are trying their hardest to get you to book direct. By taking them up on their best rate guarantees, you can beat hotels at their own game when you find a cheaper rate on a competitor website. Book direct, find a better rate elsewhere and then get the hotel to match the rate and give you a further 20–25% off the matched rate. Just know what to expect when you submit that best rate guarantee claim and you'll be set for success.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to the AmEx Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the American Express Travel portal?

Benefits of booking travel on amex travel, how to book travel in the portal, is travel insurance included when booking through amex travel, downsides of booking via amex travel, final thoughts on the amex travel portal.

The American Express Travel portal is similar to many other online booking sites in that it allows you to purchase flights, hotels and other travel reservations. The main difference is that only those who hold an American Express card can use it.

Certain cards come with additional perks for booking in the portal. For instance, some AmEx cards allow travelers to earn extra points for bookings, receive a 35% points rebate, pay for a portion of the reservation with points, get room upgrades and more. Terms apply.

Here's a look at what the AmEx Travel portal offers and how to use it to maximize your benefits.

American Express Travel flights, hotels and other reservations are available for American Express cardholders. Depending on which American Express card you have, you may earn additional points on your reservation or unlock additional features. Terms apply.

For example, The Platinum Card® from American Express cardholders earn 5x points on flights booked directly with an airline or through AmEx Travel and 5x points on prepaid hotels booked through AmEx Travel. They also have access to the Fine Hotels & Resorts collection through the travel portal. Additionally, American Express® Gold Card and The Platinum Card® from American Express cardholders can book room reservations with The Hotel Collection . Terms apply.

Here are eight reasons why booking with AmEx travel could be a good idea.

1. Earn up to 5x points

When you book flight through the AmEx Travel portal, your credit card may earn additional points for the purchase. In addition, prepaid hotel reservations through the AmEx travel portal also earn extra points. These are a few of the cards that offer a bonus when making reservations through AmEx travel:

on American Express' website

• 5 points per $1 on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

• 1 point per $1 on other eligible purchases.

Terms apply.

• 4 points per $1 at restaurant plus takeout and delivery in the U.S.

• 4 points per $1 at U.S. supermarkets (on up to $25,000 in purchases per year).

• 3 points per $1 on flights booked directly with airlines or with American Express Travel.

• 3 points per $1 on eligible travel purchases.

• 3 points per $1 on restaurants worldwide.

• 1 point per $1 on other purchases.

• 2 points per $1 on the first $50,000 in purchases each calendar year.

• 1 point per $1 on purchases above $50,000 in a calendar year.

» Learn more: AmEx Membership Rewards: How to earn and use them

2. Pay for reservations using Pay with Points

With American Express Travel, flights, hotels and more can be paid for with points instead of cash. Members can even choose to pay a portion of the trip with points and the rest with cash. Once your reservations have been booked, the full amount of your trip will be charged to your American Express credit card, and then a credit will be posted for the points redeemed within 48 hours.

You must redeem at least 5,000 points in order to use Pay with Points. Points are redeemed at a value of 1 cent per point when booking flights or making Fine Hotels & Resorts reservations. Other eligible travel receives only 0.7 cents per point. NerdWallet values Membership Rewards points at 2.8 cents per point if you take advantage of transferring to and booking through travel partners, so the redemption rates in the travel portal are significantly below our ideal value.

If you need to cancel your reservation, you'll receive a statement credit on your card for the cash equivalent. Members who would rather have the unused Membership Rewards points returned to their accounts must contact American Express customer service at 800-297-3276. Terms apply.

3. Upgrade flights with points

Eligible flights booked with cash can be upgraded using your American Express Membership Rewards points. You'll receive 1 cent per point credit towards the cost when upgrading a flight with points (which is again below our AmEx point valuation ).

To upgrade your flight with points, select your airline and provide your reservation details in the AmEx travel portal. You will be notified if your flight is eligible or not. If your flight is eligible, you can submit an offer to the airline for the upgrade. The airline will accept or reject your bid between one and five days of your flight's departure and you'll receive a decision via email.

If your upgrade offer is accepted, the points will be deducted from your account. Your statement will show a charge and a credit for the corresponding points.

» Learn more: You can now use AmEx points to bid on flight upgrades

4. Discounted international flights through AmEx IAP

Platinum cardholders have access to discounted flights through International Airline Program (IAP) , which allows members to book first, business and premium economy at a discount on select airlines and routes. Plus, you'll receive 5x Membership Rewards points on the booking when using your The Platinum Card® from American Express or The Business Platinum Card® from American Express to pay for the flight. Terms apply.

There are 25 airlines that participate in this program. You can book refundable and nonrefundable tickets for up to eight passengers through the IAP. Tickets can be paid with your card, points or a combination of the two. You will have to pay a $39 nonrefundable ticketing fee, however the discount received on these tickets should outweigh the fee.

5. Cancel For Any Reason insurance

CFAR is shorthand for an insurance policy that allows you to cancel your trip for any reason whatsoever and receive a refund. In May 2022, AmEx launched its own version of CFAR coverage for airfare booked through the travel portal using an AmEx card.

This feature, called Trip Cancel Guard, will get you up to a 75% reimbursement on nonrefundable airfare costs, provided you cancel at least two calendar days out from your departure. You'll need to purchase Trip Cancel Guard coverage at the point of booking and if you cancel, whether through the airline directly or through AmEx Travel, you can request reimbursement online or over the phone.

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

6. 35% points rebate with The Business Platinum Card® from American Express

When The Business Platinum Card® from American Express cardholder book flights using points through the AmEx travel portal, they can receive up to 35% of their points back . The benefit is available on first or business class flights on any airline and all economy flights with their chosen airline. This benefit provides up to 500,000 points back per calendar year.

However, as with all AmEx credits , it's not as straightforward as you may hope. You will have to designate the airline for the 35% rebate and the airline must be the same as the one chosen for the $200 airline incidental credit .

» Learn more: The best travel credit cards right now

7. Fine Hotels & Resorts

The Loews Portofino Bay Hotel at Universal Orlando. (Photo by Sally French)

Fine Hotels & Resorts (FHR) is a collection of resorts and benefits available only to Platinum Card members. There are over 2,000 properties worldwide that participate in this program. When making reservations with Fine Hotels & Resorts for one night or more, you'll receive the following benefits:

$200 statement credit provided once per year.

Noon check-in (when available).

Room upgrade upon arrival (when available).

Daily breakfast for two.

Guaranteed 4 pm late checkout.

Complimentary in-room WiFi.

Unique property benefit valued at least $100.

These benefits rival those that many travelers receive when booking directly with hotels to obtain elite status perks. Some locations also offer a last-night free benefit, depending upon when you make your reservation. And some of the best hotels to book using FHR credits offer especially-unique amenities.

For example, many theme park fans consider Loews Portofino Bay Hotel as the best FHR hotel in Orlando . That's because — on top of all the above benefits — guests receive complimentary Universal Express Unlimited ride access, which allows you to skip the lines inside the Universal theme parks .

8. The Hotel Collection

The Loews Sapphire Falls at Universal Orlando falls under The Hotel Collection. (Photo by Sally French)

AmEx Gold and Platinum cardholders receive elite status-level perks at more than 600 hotels worldwide. When you stay for two nights or more, you'll receive a $100 resort credit and an upgrade upon arrival (when available). In addition, you can use your AmEx Membership Rewards credit card to book and pay for your reservation entirely or partially with your points.

While you can book travel over the phone with an agent, it is often quicker and more convenient to make your reservations through the AmEx Travel portal.

Here's how to book travel in the American Express travel portal:

Go to americanexpress.com/en-us/travel/ .

Log in with your username and password.

Select flights, hotels, flight + hotel, cars, or cruises.

Enter your travel dates, cities and other relevant information.

Choose options based on your trip.

Pay with your American Express credit card, points, or a combination.

Since you need an American Express card to make reservations through AmEx travel, you may already hold a card that offers complimentary travel insurance . If you don’t get travel insurance perks through your AmEx card, you can purchase Trip Cancel Guard through when making your booking.

Trip Cancel Guard works similarly to CFAR in that it allows you to cancel your trip for any reason whatsoever and get up to a 75% reimbursement of your travel costs as long as the cancellation is made two full days before your trip.

What is the AmEx Travel cancellation policy?

When you book travel through the American Express travel portal, you may be eligible to cancel your reservation within 24 hours and get a full refund. However, the cancellation policy is determined by the airline.

As such, AmEx instructs travelers to refer to the cancellation policy on the itinerary or reach out to customer service with any questions. Terms apply.

There are many appealing reasons why travelers want to book reservations with the AmEx travel portal. However, there are some downsides as well. These are some of the most common reasons why you shouldn't:

Low value for your points. Redeeming points through the AmEx travel portal yields a value of 1 cent per point or less. That's at least a 50% reduction compared to our value of Membership Rewards points.

Complicated customer service. Resolving flight or hotel reservation issues becomes more complicated when you book through a third party such as AmEx travel. The airline or hotel blames the booking agency and may not immediately resolve the problem in some instances. However, providers have no scapegoat when you book direct.

No hotel elite status benefits or loyalty credits. Most hotels require you to book directly to receive elite status benefits, stay credits or earn points. For travelers looking to take advantage of their elite status or earn status for the next year, booking AmEx travel hotel reservations is not a good idea.

Despite the above policy, hotels booked through Fine Hotels & Resorts allow you to earn elite night credit and earn loyalty perks associated with your elite status level on any hotel reservations — regardless if you book in the portal or not.

The AmEx travel portal offers numerous benefits for all American Express cardholders. If you have a Membership Rewards credit card, you can pay for all or part of eligible travel reservations using your points.

And any portion that you pay with your Membership Rewards card can earn up to 5x points. AmEx Travel also offers two hotel collections that provide additional perks similar to elite status benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

UponArriving

Amex Travel: Everything You Need to Know [2021]

Offers contained within this article maybe expired.

American Express has a very robust travel portal. Not only can you book different types of travel, but you can also take advantage of a lot of additional perks and benefits depending on the type of cards you have.

But you need to know the ins and outs of how everything works in order to squeeze out all the value you can.

In this article, I’ll break down everything you need to know about Amex Travel.

I’ll start by explaining the bonus points you can earn and how to use your points to book travel. I’ll then cover some of the special perks you can get through the program like 5X earnings.

And I’ll show you the results from my research I did to see if Amex Travel is cheaper or more expensive than booking directly (the results are a little surprising).

Finally, I’ll show you how to efficiently use Amex Travel to book your travels.

Table of Contents

What is Amex Travel?

Amex Travel is an online travel portal that allows you to book various forms of travel including:

Rental cars

- Vacation Packages

Amex Travel overview

Bonus earnings.

Membership Rewards-earning cards will earn one extra Membership Rewards point for every dollar spent on certain purchases like:

- Pre-paid hotels

- Vacation packages (flight + hotel packages)

- Cruise reservations

Eligible travel purchases do NOT include car reservations, non-prepaid hotels, ticketing service or other fees

These Membership Rewards-earning cards that earn an extra point include favorites like the:

- Amex Gold Card

- Amex EveryDay

- Amex EveryDay Preferred

- The Centurion Card

- Blue Business Plus Credit Card

- Business Gold Card

- Business Green Rewards Card

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Platinum Cards

Platinum and Business Platinum Cardmembers are only eligible for 1 additional point on cruise reservations. However, they earn 5X on prepaid hotels and airfare.

If you value Membership Rewards at 1.75 cents per point then it’s like earning 8.75% back on airline purchases !

The Platinum Card earns some pretty impressive rates across the board when it comes to Amex Travel.

Take a look at all of the 5X categories:

Tip: The Platinum Card also comes with some pretty stout benefits including the best airport lounge access offered by any credit card.

Amex Green Card

The Amex Green Card earns a very respectable 3X on a wide range of travel purchases which include amextravel.com. Therefore, you can earn 3X on airfare, hotel bookings, cruises, etc.

Lowest price guarantee

When it comes to booking hotels, you can get the lowest price guarantee with Amex Travel.

Like other similar guarantees, the terms are very strict about when this can be honored.

You will need to find the exact same room in the same hotel for the exact same dates and number of children and adults.

The price will need to be found online before taxes and fees and you must submit your claim prior to your stay before the date of check-in. This perk is only valid for American Express cardmembers.

Certain types of rates not available to the public will be excluded including:

- Rates or discounts that are not available to the general public (e.g., corporate, AAA, government, etc.)

- Hotel rooms booked with loyalty points, coupon promotions, etc.

- Rooms booked on websites that do not allow you to see the name of the hotel until your reservation is complete

- Promotional packages, deals, all-inclusive packages

- Bundles that include additional amenities such as parking, meals, etc.

- Rates booked through the Fine Hotels & Resorts and The Hotel Collection programs.

Elite benefits

If you book through Amex Travel, you will likely lose out on the ability to earn elite credits and also you might even lose out on receiving elite benefits.

For example, if you are a Hilton Honors Gold member, typically you would earn 18 points per dollar spent at a Hilton property.

In addition, you would be eligible for benefits like a free breakfast, upgrades, and late check out.

But if you use Amex Travel to book a stay at a Hilton property, you would not earn 18 points per dollar and you may not receive things like a free breakfast.

You won’t always miss out on receiving your elite perks as I recently received an upgrade as a Hyatt Discoverist on a stay I booked through Amex Travel.

However, it will be on you to contact the property and add your loyalty number to your accounts. In addition, you likely will need to be proactive about requesting benefits like upgrades.

Tip: You can still get elite benefits with the Fine Hotels & Resorts and The Hotel Collection programs.

Access to Amex Travel

Initially I thought that only American Express cardmembers could use Amex Travel to book travel. But I inquired with an American Express agent and they informed me that anybody can use the travel portal.

Is Amex Travel cheaper?

The most important question you are probably wondering is whether or not it is cheaper to book your travel through Amex Travel or directly through the airlines, hotels, etc.

To answer this question, I did a handful of sample bookings for flights, hotels, rental cars, and cruises.

Below are the results.

For flights, all five sample bookings were a little bit cheaper when I chose to book directly. In many cases the price was about $7 cheaper which isn’t a huge gap but is still cheaper nonetheless.

Here are the prices that I compared:

It’s worth noting that American Express imposes small fees for certain airline bookings.

For example, they will charge a non-refundable fee of $6.99 per domestic ticket and $10.99 per international ticket for each ticket for an airline that pays them a standard fee or commission.

So the price differences above likely were affected by these fees.

Tip: Logged in Platinum cardmembers and Centurion members will not be charged this fee.

For hotels, the opposite was true.

Amex Travel was cheaper on more occasions although in some cases the price was virtually identical.

Also, you can earn 5X Membership Rewards on pre-paid hotel stays with your Platinum Card. That’s a lot of points and in some cases it could make up for the lost value of elite benefits.

The rental car prices were almost completely identical.

The cruises were generally cheaper with direct booking. This was partially the result of flash sales that were happening with some of the cruise lines. These flash sales were not showing up on Amex Travel.

Overall, my data points showed that booking flights is slightly more expensive through Amex Travel (likely due to Amex fees) but that booking hotels and rental cars can be virtually identical.

Cruises may also be identical in pricing but you may not have access to flash deals which can cause significant discrepancies in price.

Tip: The Platinum Card receives special perks on some cruise packages such as credits.

Using Membership Rewards to book Amex Travel

One of the cool things about Amex Travel is that you can use your Membership Rewards points to book travel.

Your redemptions must involve a minimum of 5,000 Membership Rewards.

Something important to know is that the value of your points will differ based on the type of travel that you book.

Here is a breakdown of the value your points get for different types of travel.

Tip: You can also use the points calculator to check out the value of your Membership Rewards.

As you can see, flights and hotels through the FHR get the most value for your points. Other types of redemptions like hotels are not great.

When you consider that a card like the Chase Sapphire Preferred can get you 1.25 cents per point in the Chase Travel Portal on all different types of travel, all of a sudden redeeming Membership Rewards for .7 cents per point seems very poor.

If you have a small business card like the Business Platinum Card or the Business Gold Card , you can actually get more value for your points.

The Business Gold Card has a 25% bonus which comes out to 1.33 cents per point . Meanwhile, the Business Platinum Card has a 35% bonus which comes out to 1.54 cents per point.

You can only get the bonus/rebate for either a First or Business class flight on any airline or for flights with your selected qualifying airline.

Here some of the airlines you might be able to choose:

- Alaska Airlines

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

Note: There is a limitation on your rebate as you will only be able to receive up to 250,000 bonus points per calendar year for the Business Gold Card and up to 500,000 points per calendar year for the Business Platinum Card.

Alternative to using points for Amex Travel

Instead of using your points on travel, you could redeem them in other forms such as cash back, gift cards, or on Amazon.

The values for cashback and Amazon are not very good as you can see below but sometimes gift cards can be a decent option when you can cash out at one cent per point.

Should you use your Membership Rewards?

Even though your Membership Rewards can be transferred out to valuable travel partners for optimal value, sometimes it could make sense to use a travel portal.

One of the biggest reasons is that using something like Amex Travel is simpler.

You don’t have to deal with black out dates, award inventory, or figuring out how to do transfers and booking with partners.

However, if you do decide to transfer your points to American Express travel partners, here is a breakdown of the partners you can transfer to:

Related travel programs

There are three programs that are related to Amex Travel but are also different and stand out in different ways.

These include the:

The Hotel Collection

Fine hotels and resorts, international airline program.

These programs are mostly focused on premium and luxury travel so if you are in those markets, you will get the most value out of these related programs.

The Hotel Collection is a special hotel portal that allows you to receive up to $100 in property credits and upgrades when you book hotels of two nights or longer.

The Hotel Collection is only available to the following U.S. American Express Card Members:

- Consumer and Business Gold Card Members

- Business Gold Rewards Card Members

- Consumer and Business Platinum Card Members

- Consumer and Business Centurion Members

The hotel credit will equal the amount spent on the hotel at checkout up to $100 and it will be credited at check out based on qualifying charges made excluding charges for taxes, gratuities, fees and cost of room.

You must make your payment in full with an American Express Card in the Eligible Card Member’s name.

Also, the cardholder must travel on the itinerary booked. There is a limit of one credit per room per stay and a three room limit per card member per stay.

Room upgrade is based on availability and eligibility at check-in.

For bookings made on amextravel.com , you will earn 2X Membership Rewards on each The Hotel Collection booking and you can also use Pay with Points.

Amex Fine Hotels and Resorts , also known as “FHR,” is a luxury hotel program that offers special elite-like perks at over 975 world-class properties all around the world.

There are also special hotels within this program known as Preferred Hotels & Resorts which “represents one of the world’s finest and most diverse portfolios of independent hotels.”

These hotel networks are only available to cardmembers of Platinum Cards and Centurion Cards.

Amex Fine Hotels and Resorts offers an entire suite of benefits which include:

- Noon check-in, when available

- Guaranteed 4pm late check-out

- Room upgrade upon arrival, when available

- Daily breakfast for two people

- Complimentary Wi-Fi

- Special amenity unique to each property

As mentioned above, you can earn 5X with the Platinum Card on prepaid bookings through FHR . Something else that stands out is that you can still receive your elite benefits and elite credits when going through this portal.

The Amex International Airline Program (IAP) is a special program available to Platinum cardholders and Centurion cardholders that allows you to receive special discounts on up to eight first class, business class, and premium economy fares when booking through Amex.

The discounts can range from saving a couple of hundred bucks to saving a few thousand bucks so the International Airline Program can be arguably the most valuable benefit offered by any American Express card.

Not every airline participates in the program. Currently, here is the list of airlines that participate:

- Air New Zealand

- Asiana Airlines

- British Airways

- Brussels Airlines

- Cathay Pacific

- China Airlines

- Etihad Airways

- Japan Airlines

- South African Airways

- Virgin Atlantic

You’ll notice that notably absent are domestic carriers United and American.

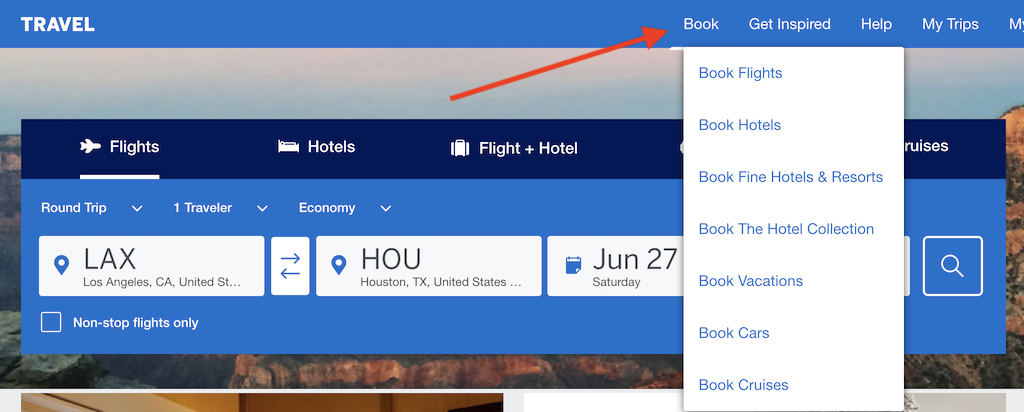

How to use Amex Travel

- Head to the Amex Travel website

- Choose the type of travel you want to book and input your destinations, travel dates, etc.

- Utilize filters to find the type of booking best suited for you

- Complete your booking!

The main menu

If you hover over “Book” you will then be able to select the type of travel you want to book.

(The default menu already displays flights, hotels, and vacations so you can easily start the booking process for those.)

For flights, simply enter in your departure and arrival locations along with your dates and other details such as cabin preference.

You’ll then see results populated and you can use filters to narrow down the results. You can sort by things like price, duration, and departure time. You can also filter the results down by airline.

The search results allow you to quickly view details like baggage fees and in some cases you’ll also be able to view the seat map which is very convenient.

The hotel search results also provide you with robust filters and sort features to make your searching efficient.

I like to use the map feature and to filter by stars to narrow down my potential properties.

You can also filter by price and if you are interested in the luxury hotel collection or find hotels and resorts you can filter by those programs.

If you do come across a hotel that is part of the Fine Hotels and Resorts, you will see that clearly indicated on the search result.

The same applies for The Hotel Collection.

Make sure that you pay attention to the cancellation policy for that specific hotel.

As you view the search results, you can see if there is flexible cancellation which would allow you to cancel up to a certain window prior to booking.

If there is a flexible cancellation policy, you will be able to view the exact terms to see the deadline to get a refund. When you click on “cancellation policy” you will see a message like this:

There is no charge for cancellations made before 18:00 (property local time) on March 16, 2021. Cancellations or changes made after 18:00 (property local time) on March 16, 2021 or no-shows are subject to a property fee equal to 100% of the total amount paid for the reservation.

Other hotels will be completely nonrefundable.

Again, you can always click on a hotel and then click on view cancellation policy to get the specific terms for that booking.

For rental cars, you have a lot of filters that you could use for things like the size of the rental car, the rental car company, price, etc. You will be able to easily view if the booking has free cancellation or not.

If you have an account, you should take a short amount of time to fill in your profile.

You will be able to input your personal details like your name and birthdate to make a booking quicker in the future. You can also input your known traveler number and your redress number if you have one.

In addition to your personal information, you can also easily add loyalty numbers to your frequent flyer program and hotel loyalty programs.

Next you can select things like your travel preferences. So for example, for flights you can select if you want a window or aisle seat. Or perhaps you have a meal preference such as gluten free meals.

And then if there are any additional preferences like unaccompanied minor status , vision impairments , etc., you can select those.

Finally, you can also add companions.

Amex Travel also has a section where you can view all of your booked trips.

This is really convenient when you need to change or cancel the booking since you have a quick way to find them.

You can also view past trips.

Amex Travel FAQ

Based on my 20 data points, Amex Travel is slightly more expensive for airfare (likely due to Amex fees) but prices are virtually identical for other types of travel such as hotels and car rentals. In some cases, Amex Travel had cheaper prices.

The Platinum Card is the best Amex card to use because you can take advantage of special 5X earnings on flights and hotels and also receive solid travel protections.

You may not receive your elite status benefits when booking hotels through Amex Travel because it is considered an OTA. However, you can still contact the hotel ahead of time and ask them to add your loyalty number to your reservation. After they do that, you may be able to receive some elite benefits depending on the brand and property. You can still get elite benefits with the Fine Hotels & Resorts and The Hotel Collection programs.

Yes, you can book travel with points on Amex Travel. However, you will have to use a minimum of 5,000 Membership Rewards.

Yes, Membership Rewards earning cards will earn one additional point when booking on Amex Travel for certain types of purchases. However, some cards like the Platinum Card and the Green Card will earn additional points.

Yes, but you may be subject to a non-refundable telephone air transaction service fee of $39 per ticket for airline tickets or air + hotel packages. Also, reservations within 6 hours of departure cannot be made by telephone.

Yes, you can change your airline booking but you may be subject to fees from the airline. In addition, American Express may charge you a $39 change fee per ticket reissue .

For bookings made online you can call Amextravel.com at: 1-800-297-2977. If you made your booking by phone with a Platinum Travel Counselor, you can call 1-800-443-7672.

No, you will need to use a card that has travel insurance like the Platinum Card or purchase a travel insurance package to get insurance for your bookings.

Flights Hotels Rental cars Cruises Vacation Packages

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Overview

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Why the Amex Platinum Is the Only Card I’ll Use To Book Flights

Carissa Rawson

Senior Content Contributor

250 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Stella Shon

News Managing Editor

84 Published Articles 608 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

The Amex Platinum Card Earns Me the Most Points

The amex platinum card has excellent travel insurance, amex’s global lounge collection is industry-leading, amex points are my favorite flexible currency, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Although I’m not technically a digital nomad, I fly enough to qualify as one.

With trips taking me on roughly 100 flights per year, I’ve done a lot of research when it comes to booking airfare.

Though I have plenty of credit cards to spare, The Platinum Card ® from American Express always finds its way to the front when it comes time to pay — here’s why.

There are plenty of credit cards that earn bonus points on travel , and especially airfare. However, the Amex Platinum card personally beats out others, despite its $695 annual fee ( rates & fees ).

This is because it earns 5x American Express Membership Rewards points per $1 spent (up to $500,000 per year) on flights booked directly with the airline or via AmexTravel.com .

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve