Related Travel Research

Asia pacific travel market report 2021-2025.

Free for Open Access Subscribers

The Asia Pacific travel market, the world’s largest regional market pre-pandemic, continues to face significant pandemic-related challenges, though pent-up demand suggests a strong rebound in the near future. Market recovery and developments vary, due to differing government restrictions, traveler sentiment and public health policies.

For this report series, 12 markets comprise the Asia Pacific travel market: Australia New-Zealand, China, India, Japan, Northeast Asia (including Hong Kong, Macau, South Korea and Taiwan) and Southeast Asia (including Indonesia, Malaysia, Singapore and Thailand). Collectively, the series provides comprehensive market sizing and projections for the Asia Pacific travel industry from 2019-2025, including analysis of key segments, country-level share and trends, distribution dynamics and more.

Other reports in the Asia Pacific Travel Market Report 2021-2025 series include:

- Asia Pacific Travel Market Report 2021-2025 (regional overview)

- Australia-New Zealand Travel Market Report 2021-2025

- China Travel Market Report 2021-2025

- India Travel Market Report 2021-2025

- Japan Travel Market Report 2021-2025

- Northeast Asia Travel Market Report 2021-2025

- Southeast Asia Travel Market Report 2021-2025

What is Open Access

An Open Access subscription provides company-wide access to the whole library of Phocuswright’s travel research and data visualization.

Curious? Contact our team to learn more:

What is open access+.

With Open Access+, your company gets access to Phocuswright's full travel research library and data visualization PLUS Special Project deliverables.

Provide your information and we'll contact you:

Curious contact our team to learn more:.

UN Tourism | Bringing the world closer

Asia and pacific countries advance shared vision of tourism for development.

Asia and Pacific Unite in Support of the International Code for the Protection of Tourists

2nd UN Tourism Regional Conference on the Empowerment of Women in Tourism in Asia and the Pacific

First UN Tourism Regional Forum on Gastronomy Tourism for Asia and the Pacific

36th CAP-CSA and First UN Tourism Regional Forum on Gastronomy Tourism for Asia and the Pacific

International Accessible Tourism Forum - Asia & the Pacific

From our members.

Ramadhan in Brunei Darussalam: A Fascinating Cultural Experience

Refreshing Fujian: Starting Point of the Maritime Silkroad

Dining event presented by four top-notch chefs to introduce the charm of high-quality food of Niigata prefecture, JAPAN

International Tourism Investment Forum 2023

UNWTO Asia Pacific Newsletter 46 Issue

UNWTO Tourism Highlights, 2017 Edition 日本語版

UNWTO/GTERC Annual Report on Asia Tourism Trends – 2017 Edition

Managing Growth and Sustainable Tourism Governance in Asia and the Pacific

Latest news.

UNWTO Completes Gastronomy Tourism Project for Ub...

UNWTO Holds Executive Training Programme for Asia...

UNWTO and Pacific Asia Travel Association Focus o...

UNWTO Joins Global Tourism Economy Forum for Land...

2022 Asia Pacific Hotels and Hospitality A Roadmap to Recovery

September 22, 2022

Looking for a PDF of this content?

Confidence in Asia Pacific’s Hotels & Hospitality market continues to grow as borders reopen and operating performance recovers to pre-pandemic levels. The recovery continues to be largely driven by domestic demand, with international arrivals accelerating in markets within the Pacific and Southeast Asia, which have loosened entry and quarantine restrictions and are now open to all arrivals. CBRE forecasts tourism arrivals within the region to reach pre-pandemic levels by 2024, with hotels performance to reach 2019 levels in the same period. Furthermore, given the daily pricing structure and flexibility of rate changes in an evolving economic climate, hotels provide an inflationary hedge. CBRE is therefore forecasting increased investor appetite for operational real estate, such as hotels, as a strategy to enhance and/or maintain portfolio returns. Key highlights from this report include:

- International arrivals continue to grow in Asia Pacific as border restrictions ease.

- Domestic travel continues to drive tourism particularly in North Asia and the Pacific

- Asia Pacific hotel transaction volume rose to US$10.1 billion as of August 2022 y-t-d, an increase of 17% y-o-y.

- Cross-border capital flows into Asia Pacific for hotel assets have experienced minimal disruption, with net inflows of US$932 million since the beginning of 2021 driven predominantly by institutional investors.

- Average Daily Rate (ADR), Occupancy and Revenue per Available Room (RevPAR) is trending upwards in all Asia Pacific markets, with a regional recovery expected by 2024.

- With the supply pipeline remaining limited in most Asia Pacific markets, the risk of new competition saturating the market will be low, exerting weaker downward pressure on room rates and revenue.

Related Service

Hotels & hospitality.

We provide creative, hands-on hospitality expertise in all major markets, supported by a sophisticated service platform.

Business Contacts

Steve carroll.

Head of Hotels - APAC

- Phone +65 91791439

Ananth Ramchandran

Head of Advisory & Strategic Transactions, Hotels & Hospitality, Asia

Head of Asset Management, Hotels & Hospitality, Asia

Michael Simpson

Head of Hotels & Hospitality, Pacific

- Phone +61 2 9333 3240

- Mobile +61 431 649 724

Regional Director, Hotels & Hospitality, Valuation & Advisory Services, Pacific

- Mobile +61 439 398 769

Tomotsugu Ichikawa

Head of Hotels & Hospitality, Japan

- Phone +81 3 5288 9288

Helena Gomes

Sales & Solutions Lead, PJM AD

- Phone +65 62248181

Vasso Zographou

Director, Capital Markets, Australia

- Mobile +61 449 979 039

Jack Hernandez

Managing Director Capital Advisors – Gaming

Research Contacts

Henry chin, ph.d..

Global Head of Investor Thought Leadership & Head of Research, Asia Pacific

- Phone +852 2820 8160

Senior Director, Research, Asia Pacific

- Phone +852 2820 6557

Gus McConnell

Associate Director, Research, Asia Pacific

Ally McDade

Associate Director, Research, Australia

PATA confident that Asia will play pivotal role in tourism growth in the Asia Pacific region

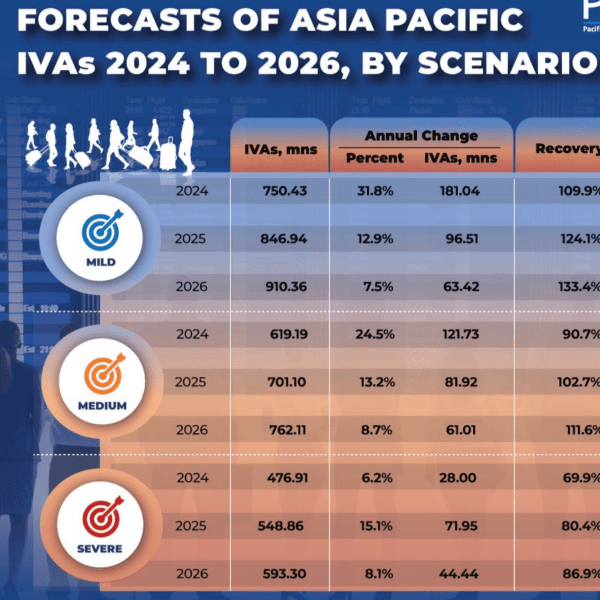

Following the release of the PATA Executive Summary Forecasts Report for the years 2024 to 2026 released earlier last month, the Pacific Asia Travel Association (PATA) today released a more comprehensive Asia Pacific Visitor Forecasts 2024-2026 report, taking a deeper dive into growth projections, focusing on the source market-destination pairs from 2024 to 2026 for each of the three Asia Pacific destination sub-regions. This report covers 39 destinations within Asia Pacific forecasting from 2024 up to 2026 in a series of three possible scenarios.

PATA CEO Noor Ahmad Hamid points out that, “While most destinations within the Asia Pacific region are rebounding strongly and moving closer to pre-pandemic levels, this forecast report highlights the significant changes as experienced by the individual destinations. Therefore, it is important to understand this trend which will impact the future growth for respective destinations as compared to the overall region.”

Under the medium scenario, international visitor arrivals (IVAs) to Asia Pacific are expected to increase from 619 million in 2024 to 762 million in 2026, with a recovery rate of 111.6% compared to the 2019 level. Asia will lead the recovery, with visitor arrivals reaching 564.0 million, followed by the Americas with 167.7 million and the Pacific with 30.4 million by 2026, highlighting the region’s resilience and growing potential as a travel destination.

In interpreting the Asia Pacific Visitor Forecasts 2024-2026 report, it is crucial to note that the data should not be viewed holistically, as destinations are undergoing recovery at varying paces. Each destination has its unique dynamics, contributing to diverse percentage changes in international visitor arrivals. For example, while numerous Pacific destinations are experiencing robust recovery, their numerical figures understandably differ in scale when compared to larger destinations globally. In analysing the forecasted growth, it becomes evident that understanding the nuanced recovery patterns of individual destinations is imperative for a comprehensive perspective on the evolving landscape of tourism in the Asia Pacific region. PATA emphasises the significance of observing the specific recovery rates and trends for each destination, as they shape the overall narrative of the region’s tourism resurgence.

Out of 39 destinations covered in the report, 34 are predicted to recover to pre-pandemic levels, with Japan and the Maldives topping the fastest-recovering destinations chart. Japan is forecast to welcome 49.3 million visitors by 2026, which is 155% more than the 2019 number. The Maldives is expected to host 2.5 million visitors, indicating a 148% recovery rate to pre-pandemic levels. With this in mind, the visitor arrivals recoveries in the region call for appropriate destination management strategies.

China, the US, the UK, and Australia are expected to maintain their leading positions as major source markets of IVAs to the Asia Pacific region, all of which are forecast to recover to pre-pandemic levels by 2024, fuelled by their economic growth potentials.

Noor added, “The ramifications for destination marketing organisations (DMOs) to be more agile, flexible and robust to quick changes in the marketplace, especially output from the source market will play a crucial role on which destination will perform better than the other in the coming years. Destination marketeers and policy makers must understand that what they do in 2023, might no longer work from this year onwards, as the travel market shifts expeditiously while consumer buying power depends very much upon user-generated content (UGC). In this regard, understanding the PATA forecast report, which takes into consideration various key factors such as economic indicators, travel capacity, etc., will be crucial.”

What you will learn from this report:

Forecast international visitor numbers for Asia Pacific between 2024 and 2026 by destination region, sub-region, and destination, highlighting changing opportunities in the post-COVID era;

Forecasts and growth patterns for 39 individual destinations facilitating the development of appropriate strategies over the next three years; and

Highlights of the key source markets within each Asia Pacific destination region over the forecast period of 2024 to 2026.

The PATA Asia Pacific Visitor Forecasts 2024-2026 is now available at www.pata.org/research-q1v63g6n2dw/p/asia-pacific-visitor-forecasts-2024-2026

PATA members have exclusive on-demand video access to the forecast related webinar, “ The Scientific Crystal Ball: Forecasting the Future Tourism Market ” and related PowerPoint presentations, which was held on Wednesday, February 7, 2024. The webinar includes expert panellists from The Hong Kong Polytechnic University (PolyU), Euromonitor International, Mastercard, and Amadeus. The speakers contributed invaluable insights on travel trends for the coming years, key factors driving tourism recovery, and various aspects of the Asia Pacific international visitor numbers forecast from 2024 to 2026.

Related Articles

PATA Face of the Future Award 2024: Submissions now open for Asia Pacific Tourism Industry ‘Rising Stars’

PATA predicts strong gains in Asia Pacific international visitor numbers for 2024

PATA and WTCF sign MOU to promote win-win cooperation in BRI Cultural Tourism Industry

PATA and Visa’s workshops for tourism SMEs successfully concluded in four destinations

Related courses.

You might also like:

The 3 types and the implementation of training and development

4 tips to attract and retain Gen Z employees

Hospitality workers and addiction – statistics, recovery and treatment options

Six winning strategies to increase direct bookings

Business travel is back, but corporate customers are more demanding than ever

Join over 60,000 industry leaders.

Receive daily leadership insights and stay ahead of the competition.

Leading solution providers:

Arch Amenities Group

Book Me Bob

Lighthouse (formerly OTA Insight)

- Technology & Innovation

- Financial services

- Strategy and Leadership

Sustainability

- All Sections +

Rebuilding tourism in Asia-Pacific: A more conscious traveller?

Social Share:

Pratima Singh is a senior manager with Economist Impact’s Policy and insights team in Singapore. She works with foundations, corporates, governments and non-profits seeking evidence-based analysis and policy recommendations. At Economist Impact, Pratima leads several of the organisation’s global and Asia-focused sustainability-themed research programmes.

Pratima has worked with a number of organisations across the public and private sector including the National University of Singapore—where her research focused on economic and social policy issues—the Centre for Civil Society, the Asian Development Bank, and Frontier Strategy Group, where she supported senior executives at several large multinational companies build their Asia Pacific business strategies. She holds a Master’s degree in Economics from University College London (UCL) and a BSc Economics degree from the Singapore Management University.

- Soity Banerjee, independent travel writer and project editor, Outlook Responsible Tourism Initiative

- Gaurav Bhatnagar, director, The Folk Tales

- Rachel Dodds, director, Sustaining Tourism and professor, Ryerson University

- Randy Durband, chief executive officer, Global Sustainable Tourism Council

- Philip Goh, regional vice-president, Asia-Pacific, International Air Transport Association

- Freya Higgins-Desbiolles, lecturer of tourism management, University of South Australia’s Business School

- Seul Ki Lee, director, LINC+ Project and associate professor, Sejong University

- Liz Ortiguera, chief executive officer, Pacific Asia Travel Association

Find out more about our findings in the infographic story from the same series.

More from this series

white paper

重新打造亞太地區旅遊業:更加自覺的旅客?

新冠肺炎 (Covid-19

アジア太平洋地域 の観光業を再構築:コンシャストラベ ラーとは?

新型コロナウイルス感染症(COVID-19

infographic

Infographic | Rebuilding tourism in Asia-Pacific: A more conscious traveller?

Related content.

Membina semula pelancongan di Asia Pasifik: Pelancong yang lebih berkesedar...

아시아태평양 지역의 관광 산업 회복: 지각 있는 여행자란?

การฟื้นฟูการท่องเที่ยวในเอเชียแปซิฟิก: มีนักท่องเที่ยวที่มีความใส่ใจรับผิดช...

โควิด-19 ได้เปลี่ยนแปลงการท่องเที่ยวในหลายทิศทาง ตั้งแต่การแพร่ระบาดของโรคที่ส่งผลเสียหายอย่างมากต่อชีวิตมนุษย์และสังคมได้เริ่มต้น นักท่องเที่ยวได้คิดใคร่ครวญถึงผลกระทบต่อวันหยุด พักผ่อนในชุมชน เศรษฐกิจในท้องถิ่น และสิ่งแวดล้อมกันมากขึ้น แม้ว่าจะมีการหยิบยกประเด็นนี้ มาพูดถึงเมื่อสองสามปีที่ผ่านมา แต่การแพร่ระบาดนี้ก็ส่งผลให้เกิดการตื่นตัวด้านการเดินทางท่องเที่ยวที่หลากหลายและเร่งรัดการผลักดันไปสู่ การเดินทางท่องเที่ยวที่ใส่ใจและรับผิดชอบมากยิ่งขึ้นในเอเชียแปซิฟิก

จากการสำรวจโดย Economist Impact ที่สอบถามนักท่องเที่ยวมากกว่า 4,500 คนในภูมิภาค ทั้งในออสเตรเลีย ญี่ปุ่น อินเดีย มาเลเซีย ฟิลิปปินส์ สิงคโปร์ เกาหลีใต้ ไต้หวัน และไทย แสดงให้เห็นว่ามากกว่า 7 ใน 10 (71.8%) ของผู้ตอบแบบสำรวจเห็นด้วยว่าโควิด-19 ได้เปลี่ยนแนวความคิดของพวกเขาที่มีต่อการท่องเที่ยวแบบยั่งยืนโดย ทำให้การท่องเที่ยวดังกล่าวมีความสำคัญต่อพวกเขามากขึ้น

ตัวเลขนี้เพิ่มสูงยิ่งขึ้นไปอีกในบางประเทศ โดยที่ผู้ตอบแบบสำรวจ 98.5% ในฟิลิปปินส์ 96.5% ใน อินเดีย และ 93.5% ในมาเลเซียกล่าวว่าการแพร่ระบาดได้เปลี่ยนแนวความคิดของพวกเขาที่มีต่อการท่องเที่ยวแบบยั่งยืน อีกทั้งมากกว่าสี่ในห้ายังกล่าวถึงความจำเป็นที่จะต้องมีหลักปฏิบัติเกี่ยวกับการท่องเที่ยวแบบยั่งยืนอีกด้วย

เป็นไปได้หรือไม่ว่าเรากำลังอยู่ในรุ่งอรุณของยุคแห่งการเดินทางท่องเที่ยวที่ใส่ใจรับผิดชอบมากขึ้น ผลการสำรวจของเราชี้ให้เห็นเช่นนั้น ผู้ตอบแบบสำรวจมากกว่าครึ่ง (57.1%) กล่าวว่าพวกเขามีมุมมองต่อการท่องเที่ยวแตกต่างออกไป รวมถึงวิธีที่จะทำให้การท่องเที่ยวมีความยั่งยืนอีกด้วย โดยเฉพาะอย่างยิ่ง เนื่องจากการท่องเที่ยวนี้ เกี่ยวโยงกับเศรษฐกิจในท้องถิ่น ชุมชน วัฒนธรรม และสิ่งแวดล้อม

รายงานจาก Economist Impact ที่ได้รับการสนับสนุนโดย Airbnb ฉบับนี้ สำรวจการฟื้นตัวของการท่องเที่ยวในภูมิภาคเอเชียแปซิฟิก โดยมุ่งศึกษาว่าการเดินทางท่องเที่ยวจะสามารถเปลี่ยนแปลงไปในทิศทางใดได้บ้างจากการเพิ่มขึ้นของนักท่องเที่ยวที่มีความใส่ใจรับผิดชอบ รายงานนี้อิงตามการศึกษาค้นคว้าที่ครอบคลุมในวงกว้างและการสำรวจนักท่องเที่ยวมากกว่า 4,500 คนจากทั่วทั้งภูมิภาค รายงานฉบับนี้ เขียนโดย Siddharth Poddar และ เรียบเรียงโดย Pratima Singh

เราขอขอบคุณผู้มีส่วนสนับสนุนต่อไปนี้ที่ให้ข้อมูลเชิงลึกเพิ่มเติม

• Soity Banerjee นักเขียนอิสระเรื่องการท่องเที่ยวและบรรณาธิการโครงการจาก Outlook Responsible Tourism Initiative

• Gaurav Bhatnagar ผู้อำนวยการจาก The Folk Tales

• Rachel Dodds ผู้อำนวยการจาก Sustaining Tourism และศาสตราจารย์ที่มหาวิทยาลัย Ryerson University

• Randy Durband ประธานเจ้าหน้าที่บริหารจาก Global Sustainable Tourism Council

• Philip Goh รองประธานประจำภูมิภาคเอเชียแปซิฟิกจาก International Air Transport Association

• Freya Higgins-Desbiolles อาจารย์ภาควิชาการจัดการการท่องเที่ยวของมหาวิทยาลัย University of South Australia’s Business School

• Seul Ki Lee ผู้อำนวยการจาก LINC+ Project และรองศาสตราจารย์ของมหาวิทยาลัย Sejong University

• Liz Ortiguera ประธานเจ้าหน้าที่บริหารจาก Pacific Asia Travel Association

Enjoy in-depth insights and expert analysis - subscribe to our Perspectives newsletter, delivered every week

- Privacy Policy

- Cookie Information

- Manage Cookies

Newsletter Signup

Salutation - Please Select - Ambassador --> Dr. Frau Lady Lord Madame Minister Monsieur --> Mr. Mrs. Ms. Mx. Sir Your Excellency -->

First Name *

Last Name *

Job Title *

Company / Institution *

Industry * -- Please Select -- Academia & Education Advertising Agriculture, Forestry & Fishing Associations & Charities Chemicals/Mining Communications Construction Financial Services Government, NGO & Local Authorities Healthcare, Pharmaceuticals Information Technology Manufacturing Media Oil & Gas Other Professional Services Recreational Services & Sport Retail Student / Unemployed Trade Unions Transport Travel, Tourism & Hospitality Utilities

Work Email *

Country * -- Please Select --

Please indicate your topic interests here. Economic Development Energy Financial Services Healthcare Infrastructure & Cities Marketing Strategy & Leadership Sustainability Talent & Education Technology & Innovation All

--> I wish to be contacted by email by the Economist Group * -- Please Select -- Yes No

The Economist Group is a global organisation and operates a strict privacy policy around the world. Please see our privacy policy here

Join our Opinion Leaders Panel

Salutation * -- Please Select -- Dr. Mr. Mrs. Ms. Mx.

Occasionally, we would like to keep you informed about our newly-released content, events, our best subscription offers, and other new product offerings from The Economist Group.

I wish to be contacted by email by the Economist Group * -- Please Select -- Yes No

Travel & Tourism - Asia

- It is estimated that the revenue in the Travel & Tourism market of Asia will reach US$326.20bn by 2024.

- Moreover, it is expected to grow annually at a rate of 5.36% between 2024 and 2028, resulting in a market volume projection of US$402.00bn by 2028.

- Among all the markets, Hotels is expected to be the largest with a market volume projection of US$165.40bn by 2024.

- Furthermore, the number of users in the Hotels market is expected to reach 624.30m users by 2028, while the user penetration is projected to increase from 20.3% in 2024 to 23.1% in 2028.

- The projected average revenue per user (ARPU) is expected to be US$352.90.

- It is estimated that 74% of the total revenue in the Travel & Tourism market will be generated through online sales by 2028.

- Finally, it is noteworthy that United States is projected to generate the highest revenue (US$199bn in 2024) in the Travel & Tourism market globally.

- In Japan, there has been a growing trend of "slow travel" where tourists are seeking authentic cultural experiences and staying longer in one destination.

Key regions: Malaysia , Europe , Singapore , Vietnam , United States

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information:

The main performance indicators of the Travel & Tourism market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues and users for the above-mentioned markets. Users represent the aggregated number of guests. Each user is only counted once per year. Additional definitions for each market can be found within the respective market pages.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

Prominent players in this sector include online travel agencies (OTAs) like Expedia and Opodo, as well as tour operators such as TUI. Specialized platforms like Hotels.com, Booking.com, and Airbnb facilitate the online booking of hotels and private accommodations, contributing significantly to the market's vibrancy.

For further information on the data displayed, refer to the info button right next to each box.

- Bookings directly via the website of the service provider, travel agencies, online travel agencies (OTAs) or telephone

out-of-scope

- Business trips

- Other forms of trips (e.g. excursions, etc.)

Travel & Tourism

- Vacation Rentals

- Package Holidays

- Analyst Opinion

The Travel & Tourism market in Asia continues to experience significant growth and development, driven by a variety of factors ranging from changing customer preferences to local special circumstances and underlying macroeconomic factors. Customer preferences: Travelers in Asia are increasingly seeking unique and authentic experiences, leading to a rise in demand for personalized and experiential travel options. From cultural tours to eco-friendly adventures, customers are looking for ways to immerse themselves in the local culture and environment. Trends in the market: In Japan, there has been a noticeable trend towards rural tourism, with more travelers exploring off-the-beaten-path destinations to escape the crowds and experience the tranquility of the countryside. This shift is driven by a desire for authenticity and a break from the fast-paced city life. Local special circumstances: South Korea has seen a surge in medical tourism, with visitors flocking to the country for high-quality healthcare services combined with the opportunity to explore the rich cultural heritage. The country's advanced medical facilities and skilled professionals have positioned it as a top destination for medical travelers in Asia. Underlying macroeconomic factors: In China, the growing middle class and increasing disposable income levels have fueled the demand for luxury travel experiences. This has led to a rise in high-end hotels, fine dining establishments, and exclusive tour packages tailored to affluent Chinese travelers looking for premium services and amenities.

- Methodology

Data coverage:

Modeling approach:

Additional notes:

- Sales Channels

- Global Comparison

- Key Market Indicators

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Unlimited access to our Market Insights

- Statistics and reports

- Usage and publication rights

Asia-Pacific travel and tourism statistics in 2023

By Kevin Tjoe — 20 Oct 2022

studies travel statistics

Updated February 2023 – With countries heavily impacted by harsh border restrictions, the Asia-Pacific region was no exception. Countries such as Australia, New Zealand, and Indonesia closed their borders to international travelers and limited domestic movement, causing the tourism industry within these regions to be heavily affected.

Fortunately, in 2023 the APAC region has started to see a positive trend.From digital trends in tourism to the rise in sustainable travel, in this article, we will identify the most prominent trends in travel and tourism in 2022 within the Asia-Pacific region. These statistics will provide tour and activity operators with valuable insight to adapt their business to the latest trends.

The tourism and travel statistics below were gathered from a survey conducted by Rezdy.

The behaviors of travelers in the Asia-Pacific

With the close proximity between Asian-Pacific countries, it’s no surprise that travelers within this region love to travel. And with traveling in 2023 becoming a whole lot easier, find out how Asia-pacific travelers are exploring the world in 2023.

- According to recent Australian tourism statistics , Australian travellers spend 16% more time on average booking a trip in 2022 than they did in 201 9. ( Tripadvisor )

- Australians devote 60% of their time to planning trips ( Tripadvisor )

- Travelers in Singapore spend 68% of their time researching local travel review sites ( Tripadvisor )

- 6 in 10 Singaporeans are planning to travel as most countries’ restrictions have eased, with 40% have booked a trip ( Traveldailynews )

- 50% of Singaporean travelers are planning to take one trip while 30% are planning to take two trips during the summer ( Traveldailynews )

- Almost 1 in 2 (46%) would like to have a trip that lasts at least 6 days

- Travelers aged between 18-25 are also most keen on taking trips that last 6-9 days (31%), or a trip of 4-5 days (29%) ( Traveldailynews )

- Travelers aged between 26-35 are also most keen on taking trips that last 4-5 days (37%), or a trip of 6–9-days (32%) ( Traveldailynews )

- 42% of travelers said international travel is a high-priority spending area for the coming year, far higher than domestic travel, fashion, and eating out ( Traveldailynews )

The road to recovery

There’s no doubt that the tourism industry within the Asia-pacific region faced many downfalls as a result of countries enforcing strict travel restrictions. This was especially prevalent in countries such as Australia and New Zealand and popular tourist destinations like Bali, Indonesia. Fortunately, tourism has started to pick up once again in 2023 and the APAC experiences industry is finally on its road to recovery.

- New Zealand was the largest source country, accounting for 24% of all visitor arrivals in Australia. ( ABS )

- There were 1,191,830 visitor arrivals in Australia, almost 8 times higher than the previous year. ( ABS )

- Revenue in the Travel & Tourism market is projected to reach US$10.84bn in 2022. ( Statista )

- In the Travel & Tourism market, 75% of total revenue will be generated through online sales by 2026. ( Statista )

- The APAC travel industry is projected to grow at a compound annual growth rate (CAGR) of 6.4% between 2021 and 2024 – when it’s expected to hit 500 million arrivals by 2024 ( Euromonitor )

- APAC travel sales forecast by 2024 ( Euromonitor )

- APAC attractions and experiences sales forecast by 2024 ( Euromonitor )

- In the first two months of 2022, Southeast Asia has welcomed more than 580,000 international visitors in total, a substantial +102% increase year-on-year ( Hospitalitynet )

- Pacific Asia Travel Association (PATA) projected that international visitor arrivals into Asia will grow by 100% between 2022 and 2023 ( Traveldailynews )

- The Asia-P acific region (APAC) has the highest growth potential in the online travel booking industry – with China and India leading the way. This growth can be attributed to the growth of the middle-class income group, increase in disposable income, and wider access to the internet ( GBTA )

Inbound & outbound travel in 2022

As travel begins to resume within the Asia-Pacific region, find out which countries and destinations have been the most popular.

Top 5 countries traveling to Australia

( Traveldailynews )

Top destinations for APAC travelers

- Jeju Island

- Kuala Lumpur

The rise in sustainable travel

With the rising awareness surrounding sustainability and the impacts tourism has on the environment, green tourism is a hot topic. Find out what travelers in Asia-Pacific think of sustainable travel.

- 93% of Indian travelers affirm that sustainable travel is important to them ( Traveldailynews )

- 77% of Singaporean travelers show a strong belief in the need to prioritize sustainable travel ( Traveldailynews )

For more support and tips on how to increase sales in your travel business, subscribe to the Rezdy newsletter .

Looking for a booking software & channel manager to support your business growth in 2023? You’ve come to the right place! Start a FREE 21-day trial with Rezdy or book a free demo today.

Start a free 21 day trial with Rezdy

Enjoy 21 days to take a look around and see if we are a good fit for your business.

No obligations, no catches, no limits, nada

Industry News

Australia & New Zealand travel and tourism statistics in 2023

Global travel & tourism statistics 2023

No spam. We promise.

Asia-Pacific Economic Impact Report

Discover the direct and total economic contribution that the Travel & Tourism sector brings to Asia-Pacific in this comprehensive report.

Create an account for free or login to download

Over the next few weeks we will be releasing the newest Economic Impact Research reports for a wide range of economies and regions. If the report you're interested in is not yet available, sign up to be notified via the form on this page .

Report details

This latest report reveals the importance of Travel & Tourism to Asia-Pacific in granular detail across many metrics. The report’s features include:

• Absolute and relative contributions of Travel & Tourism to GDP and employment, international and domestic spending

• Data on leisure and business spending, capital investment, government spending and outbound spending

• Charts comparing data across every year from 2014 to 2024

• Detailed data tables for the years 2018-2023 plus forecasts for 2024 and the decade to 2034

Purchase of this report also provides access to two supporting papers: Methodology and Data Sources and Estimation Techniques.

In collaboration with

Supported by.

Non-Members

Related products.

US Virgin Islands Economic Impact Report

Sweden Economic Impact Report

Taiwan, China Economic Impact Report

Conference Report

The 23rd asia pacific tourism association annual conference took place in busan, korea, from the 18th to the 21st of june, 2017. under the chairmanship of dr. yeong-hyeon hwang (dong-a university, korea), the apta 2017 annual conference was very successful. more than 250 valuable delegates attended, from 25 different countries or regions (korea, australia, azerbaijian, canada, china, germany, hong kong, india, indonesia, japan, macau, malaysia, mongolia, myanmar, netherlands, new zealand, philippines, singapore, switzerland, taiwan, thailand, turkey, uk, usa and zimbabwe). there were academics, researchers, industry practitioners, and city/government officials, and making the conference such a huge success by sharing their valuable ideas for sustaining the hospitality, leisure, and tourism industries..

After double-blind reviewing processes, a total of 156 research papers (about 20% of 196 submitted papers were rejected) were presented in poster/concurrent sessions during the three days of the conference. The issues of this year’s research presentations were categorized into eight domains: Tourism Marketing, Ecotourism, Special Interests Tourism, Mental Health, Education, Information & Technology, Human Resource Management, and Corporate Social Responsibility. During the conference, Mr. Bob Harayda was invited to give speeches about tourism issues in Composite Resorts – “Prospect and Issue of Integrated Resort Development: Experience of the Sands Group”. For the graduate panel session, Dr. Carol W. Shanklin, Dr. Jafar Jafari, Dr. David Weaver and Dr. SooCheong (Shawn) Jang served to lead the great panel discussion about “21st Century Knowledge Skills for Hospitality and Tourism: Preparing Graduate Students for Diverse Careers”.

The apta 2017 conference awards ceremony was held to celebrate those candidates who achieved outstanding results in their academic contributions. first, the founder’s (dr. hai-sik sohn) award was given to prof. emeritus. manat chaiswat at the prince of songkla university to recognize his dedication to developing and sustaining the hospitality, leisure, and tourism industries in asia pacific region. , second, the best paper award was presented to jinwon kim and sarah nicholls for their paper – “access for all beach access and equity in the detroit metropolitan area”. third, the thesis-in-progress session best paper award was presented to youngseok sim and seulki lee who drew up paper- “interaction between spatial price strategies on conditional proximity in lodging market”. lastly, the apjtr article of the year 2016 was given to markus schuckert, xianwei liu and rob law for their paper – “insights into suspicious online rating: direct evidence from trip advisor”..

Sponsorships were very important to the APTA2017 Busan conference. The assistance of our sponsors (The Hong Kong Polytechnic University, University of Houston, Institute for Tourism Studies, Busan Tourism Organization, Dong-A University, Korea Tourism Organization, Wakayama University, Xiamen University, University of Florida, Catcha Coens, and Busan Culture & Tourism Festival Organizing Committee) made this conference more ample and successful.

Overall, the APTA 2017 Busan Conference was evaluated to offer a significant academic platform for scholars and industry professionals to exchange their research outcomes and industry trends. Next year, the APTA 2018 Conference will take place in Boracay, Philippines.

APTA Founder’s (Dr. Hai-Sik Sohn) Award

Prof. Emeritus. Manat Chaiswat, Prince of Songkla University

APTA 2017 Best Papers

Jinwon Kim and Sarah Nicholls

“Access for All? Beach Access and Equity in the Detroit Metropolitan Area”

APTA 2017 Thesis-in-Progress Session Paper Award

Youngseok Sim and Seulki Lee

“Interaction between Spatial Price Strategies on Conditional Proximity in Lodging Market”

APJTR Article of the year 2016

Markus Schuckert, Xianwei Liu and Rob Law

“Insights into Suspicious Online Rating: Direct Evidence from Trip Advisor”

- The Star ePaper

- Subscriptions

- Manage Profile

- Change Password

- Manage Logins

- Manage Subscription

- Transaction History

- Manage Billing Info

- Manage For You

- Manage Bookmarks

- Package & Pricing

Lack of Chinese visitors hinders Philippines tourism growth

Tuesday, 16 Apr 2024

Related News

Trump has an edge over Biden on economy, Reuters/Ipsos poll finds

Chinese economy beats growth expectations in first quarter, cruise industry expected to further boost western cape's economy in south africa.

Pedestrians in Bonifacio Global City in Taguig City, Metro Manila, the Philippines, on Saturday, April 6, 2024. The Philippines trimmed its economic growth forecasts for this year and next amid stubborn inflation and elevated interest rates, while widening its fiscal deficit estimates to support higher spending. Photographer: Veejay Villafranca/Bloomberg

MANILA: The slow return of Chinese tourists has been holding back travel recovery in the Philippines, the Bank of America (BofA) says in a report that highlights the “uneven” recovery in Asia tourism.

As the region’s tourism sector enters the last leg of recovery from the pandemic’s onslaught, BofA said the Philippines, China, Hong Kong and Taiwan were the “laggards” in Asia as tourist arrivals in these destinations have yet to reach pre-pandemic levels.

In the Philippines, BofA noted that foreign visitor arrivals were still 76% of pre-pandemic levels as of February this year, albeit much better than Hong Kong’s 73.7% and Taiwan’s January 2024 figure of 69.6%.

Among the laggards, BofA said China was an “outlier” after it reopened its economy much later than other Asian destinations. Data compiled by the bank showed foreign tourist arrivals in China were 36.3% below pre-pandemic level as of December 2023.

In turn, the later reopening of China’s economy weighed on tourism recovery in countries that heavily depended on Chinese holidaymakers, such as the Philippines and Hong Kong.

Data compiled by BofA showed Chinese arrivals are only tracking at 20% to 30% of pre-pandemic levels in the Philippines, below trends elsewhere in the region. And the recovery is unlikely to speed up anytime soon, with BofA noting the “changing preferences” of Chinese consumers.

“The typical Chinese traveller these days is increasingly interested in exploring domestic cities that offer unique cultural experiences. This has also slowed their return to international destinations,” BofA said.

“The return of Chinese travellers might be a gradual process,” it added.

On the flip side, tourism is now back to pre-pandemic vigor in Japan and Vietnam as they benefitted from the weakness of their currencies.

BofA said Malaysia, Singapore and Thailand were among the “hopefuls” in Asia after seeing a sharp rebound in international arrivals in recent months.

Meanwhile, India, South Korea, Australia, New Zealand and Indonesia were in the “middle of the pack” whose visitor entries are tracking at 80% to 85% of pre-pandemic levels so far.

For this year, the Bangko Sentral ng Pilipinas (BSP) forecasts tourism receipts – a source of US dollars for the economy – to grow by 50%.

That would contribute to the projected US$700mil surplus in 2024 which, if realised, would be smaller than the US$3.7bil windfall recorded in 2023.

Moving forward, BofA said Asian economies with falling currencies would continue to attract more foreign visitors that are looking for cheap holiday destinations.

“Foreign exchange colleagues expect currencies in Asia to strengthen across the board against the US dollar over the next two years but remain weak by historical standards,” BSP said. — The Philippine Daily Inquirer/ANN

Found a mistake in this article?

Report it to us.

Thank you for your report!

REVIVING ‘THE GODDESS’ IN NADIAH BAMADHAJ’S WORK

Next in business news.

Trending in Business

Air pollutant index, highest api readings, select state and location to view the latest api reading.

- Select Location

Source: Department of Environment, Malaysia

Others Also Read

Best viewed on Chrome browsers.

We would love to keep you posted on the latest promotion. Kindly fill the form below

Thank you for downloading.

We hope you enjoy this feature!

- The Global Reporting Format (GRF)

- Smart Security

- Accessibility

- Accessibility Use Cases

- Mental Health at Airports

- Combatting Wildlife Trafficking

- Airport Slots

- Airport Business and Charges

- Cybersecurity

- Technology Innovation Awards

- Aviation Community Recommended Information Services (ACRIS)

- Our work at ICAO Assembly

- Voice of the Customer

- Voice of the Employee

- Airport Customer Experience Accreditation

- Advisory Services

- ASQ Awards and Recognition

- Global Airport Training Courses & Programs

- Airport Health Accreditation

- Public Health & Safety Readiness Accreditation

- Accessibility Enhancement Accreditation Program

- Intelligence Hub

- Host an APEX review

- Become an APEX Assessor

- Airport System Capacity Enhancement Program

- Small and Emerging Airports

- Airport Carbon Accreditation

- Counter Drones Knowledge Centre

- Session Calendar

- ACI Learning Hub

- In-house training

- Online Learning Centre

- Customer Experience

- Environment

- Leadership and Management

- Operations and Technical

- Airport Executive Leadership Program

- Airport Management Professional Accreditation Program (AMPAP)

- Airport Safety Professional (ASP) Designation Program

- Global Safety Network (GSN) Diploma Program

- Airport Security Diploma

- Airport Finance Diploma

- Airport Operations Diploma

- Airport Customer Experience Designation Program

- Aviation Fundamentals (AVIFUN)

- ACI Accredited Training Partner Program

- Become a Global Training Instructor

- ACI Regions

- ACI World Governing Board and Standing Committees

- Senior Staff

- Become an ACI Member

- ACI World Business Partners

- ACI World Newsroom

- Data Center

- Online Store

- ACI Insights Blog

- Asia-Pacific & Middle East

- Latin America-Caribbean

- North America

Top 10 busiest airports in the world shift with the rise of international air travel demand

Preliminary data reveals the strengthening of asia-pacific and middle east hubs alongside perennial us leaders.

Montreal, 15 April 2024 – Airports Council International (ACI) World has today unveiled the highly anticipated preliminary top 10 busiest airports worldwide for 2023, showcasing significant shifts driven by the resurgence of international air travel.

The global total passenger forecast for 2023 stands close to 8.5 billion, reflecting a remarkable recovery of 93.8% from pre-pandemic levels. Notably, international traffic recovery drew nearer to that of domestic traffic, emphasizing its essential role in propelling the industry’s resurgence and expansion.

The influx of passengers at international airports has been central in bolstering the recovery of hubs reliant on this segment, consequently influencing the composition of the top 10 busiest airports for total passengers.

ACI World Director General Luis Felipe de Oliveira said, “Global air travel in 2023 was chiefly fuelled by the international segment, propelled by several factors. Among these were the anticipated benefits from China’s reopening and a growing inclination towards travel despite macroeconomic conditions. While perennial leaders from the US continue to dominate the top 10 busiest airports for passengers, notably Hartsfield-Jackson Atlanta International Airport retaining its number one position, there are notable shifts. Dubai International Airport jumped to second rank for the first time, while Tokyo Haneda International Airport witnessed a remarkable ascent from 16 th position in 2022 to 5 th in 2023. Additionally, the unwavering strength of Istanbul and New Delhi airports keep them in top ranks, marking significant progress over 2019.

“Notably, cargo continues to play a key role in world commerce despite the year-over-year decrease. Hong Kong International Airport has maintained the top position, followed by Memphis International Airport and Shanghai Pudong International Airport. Doha International Airport rejoins the top 10, jumping to number 8 with a growth of 6.3% over 2019.

“The rankings highlight the crucial role these transportation hubs play in global connectivity, commerce, and economic development. Airports continue to demonstrate their resilience and adaptability amidst the challenges posed by the ever-evolving landscape of global travel. ACI World remains dedicated to advocating for airports worldwide throughout pivotal stages of policy formulation and to advancing the pursuit of airport excellence.”

Airport rankings are based on data gathered from over 2,600 airports across more than 180 countries and territories globally. This vast dataset places ACI World in a distinctive position as the foremost authority on airport travel demand, ensuring the utmost accuracy and reliability in its rankings.

Passenger traffic highlights

- Preliminary figures indicate that the 2023 global total passengers’ figure is close to 8.5 billion, representing an increase of 27.2% from 2022 or a recovery of 93.8% from pre-pandemic results (2019).

- While the domestic market grew by 20.2% (or a recovery of 96.8% of the 2019 level), the international market drove recovery with a 36.5% growth rate (or 90.4% of the 2019 level).

- The top 10 airports representing close to 10% of global traffic (806 million passengers), witnessed a gain of 19.8% from 2022 or a gain of 0.7% vis-à-vis their 2019 results (801 million pax in 2019).

- Hartsfield-Jackson Atlanta International Airport holds onto the top rank and is followed by Dubai International Airport for the first time, surpassing Dallas Forth Worth International Airport in third position.

- From the top 10 rankings for total passenger traffic, 5 airports are in the US.

- The biggest jump in the top 10 rankings is recorded for Tokyo Haneda, leaping from 16 th position in 2022 to the 5 th spot in 2023.

Hartsfield-Jackson Atlanta International Airport is set to host the 2024 ACI World Customer Experience Summit and Exhibition , from 23 to 26 September in Atlanta, USA.

Cargo traffic highlights

- Air cargo volumes are estimated to have decreased by 3.1% year-over-year (-4.6% versus 2019), to close to 113 million metric tonnes in 2023.

- Air cargo volumes in the top 10—representing around 26% (29.6 million metric tonnes) of the global volumes in 2023—lost 3.5% in 2023 year-over-year. The decline can be attributed to the ongoing geopolitical tensions and disruptions to global trade and supply chains.

- Hong Kong International Airport remained in top rank followed by Memphis International Airport and Shanghai Pudong International Airport. Anchorage Airport ranks 4 th and is followed by Incheon International Airport in 5 th .

Aircraft movements

- 2023 global aircraft movements are close to 95 million, representing a gain of 11.8% from 2022 results or a recovery of 92.7% from pre-pandemic levels.

- The top 10 airports representing over 6% of global traffic (6 million movements), witnessed a gain of 7.4% from their 2022 results or a recovery of 96.4% vis-à-vis their 2019 results (6.2 million in 2019).

- Hartsfield-Jackson Atlanta International Airport is at the top, followed by Chicago O’Hare Airport in second, and Dallas Fort Worth International Airport in third.

Airports Council International (ACI), the trade association of the world’s airports, is a federated organization comprising ACI World, ACI Africa, ACI Asia-Pacific and the Middle East, ACI EUROPE, ACI Latin America and the Caribbean and ACI North America. In representing the best interests of airports during key phases of policy development, ACI makes a significant contribution toward ensuring a global air transport system that is safe, secure, efficient, and environmentally sustainable. As of January 2024, ACI serves 757 members, operating 2109 airports in 191 countries.

Editor notes

- Learn more about ACI World .

- Join us at the 2024 ACI World Customer Experience Summit and Exhibition .

Media contacts

Sabrina Guerrieri Director, Communications ACI World Telephone: +1 514 373 1254 Email: [email protected]

More press releases

Up and away – EZZ partners with Asia Pacific Airlines Club

- EZZ partners with Asia Pacific Airlines Club with its branding to appear on 2 million boarding passes

- EZZ products and EAORON products will be available for purchase on APAC’s online shopping mall

- Advertising initiative aims to increase brand visibility and engage passengers during their travels

Special Report: Genomic life science company EZZ Life Science has struck an advertising partnership deal with the Asia Pacific Airlines Club (APAC), which will see EZZ and EAORON branding across 2 million boarding passes.

EZZ Life Science (ASX: EZZ) says under the partnership, set to go live by the end of March, EZZ and EAORON will be advertised across several key airlines operating in the Asia Pacific region including Air China, China Southern Airlines, China Eastern Airlines, Sichuan Airlines, Xiamen Airlines, and Hainan Airlines.

Under the deal exclusive EZZ and EAORON products will also be offered across the APAC online shopping mall.

EZZ is the exclusive wholesale distributor for the EAORON branded skin care range to pharmacies, supermarkets and specialist retailers in Australia and New Zealand.

The company also develops, produces, and distributes its own range of consumer health products under the EZZ brand.

EZZ is focused on genomic research and development to address four key human health challenges – genetic longevity, human papillomavirus (HPV), children’s health, and weight management.

Several phases to partnership

The first phase of the partnership will entail EZZ and EARON’s logos to be featured on the reverse side of two million boarding passes, which will be used by the mentioned airlines.

EZZ says the advertising initiative aims to increase brand visibility and engage passengers during their travel experience.

In another phase EZZ and EAORON products will be featured in the APAC online shopping mall, catering primarily to consumers in China.

The EZZ haircare range plus 12 EZZ products and 19 EAORON products, including best-sellers such as EAORON’s Hyaluronic Acid Glutathione Essence Face Mask and EZZ’s acclaimed Bone Growth Chews, will be sold on the APAC online shopping mall.

Additionally, select VIP Asia Pacific Airline Club customers will receive EAORON’s top-selling Hyaluronic Acid Glutathione Essence Face Mask as a complimentary gift.

The partnership will remain live until the two million boarding passes have been used, ensuring an extensive engagement with travellers.

“We’re excited to partner with Asia Pacific Airlines Club to further expand our offerings in the Asian market,” chairman Glenn Cross says.

“This partnership aligns perfectly with our commitment to providing travellers with innovative solutions that elevate their travel experience.”

Expanded product line

It’s been a busy start to 2024 for EZZ, which in February announced it was expanding its product line with three new offerings.

The company now offers 51 health supplements, food items, haircare, children’s health, and probiotics.

The new additions include:

EZZ Hair Protector

Designed to nourish and strengthen hair, this product contains biotin and pyridoxine hydrochloride to promote hair health and reduce breakage.

EZZ Sugar Metabolism

Crafted to support healthy sugar metabolism and balanced blood sugar levels, this blend of natural ingredients aids in glucose utilization.

EZZ Mount Peak III

Catering to the needs of fitness enthusiasts, this advanced formula supports endurance and recovery with ingredients like zinc oxide, enhancing stamina and reducing fatigue post-workout.

This article was developed in collaboration with EZZ Life Science, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Up and away – EZZ partners with Asia Pacific Airlines Club appeared first on Stockhead .

IMAGES

COMMENTS

Annual Report on Asia-Pacific Tourism (2021) This report is about the fourth priority area (sustainable tourism and economic growth), prepared by China, to collect and spread the development of APEC tourism within stakeholders. From 2011 to 2019, the inbound tourists of APEC before the COVID-19 saw a continuous increase.

Total contribution of travel and tourism to GDP in the Asia-Pacific region in 2022, with forecasts for 2023 and 2033, by country or territory (in billion U.S. dollars)

BANGKOK, May 31, 2023 -- Updated forecasts for 39 Asia Pacific destinations, released by the Pacific Asia Travel Association (PATA) today, show a very strong increase in aggregate international visitor arrivals (IVAs) under each of three scenarios in 2023, with robust annual growth continuing to the end of 2025. Sponsored by Visa and with data and insights from Euromonitor International, this ...

BANGKOK, February 7, 2024 -- The Pacific Asia Travel Association (PATA) today released the Executive Summary report for its latest forecasts for international visitor arrivals (IVAs) into and across Asia Pacific, which shows strong annual increases in numbers for 2024 with growth momentum continuing to 2026. It is expected that pre-COVID levels of IVAs shall be surpassed in 2024 under the ...

Download (Free: 1.54 MB ) Tourism in Asia and the Pacific has been transformed over the last 2 decades by the impacts of globalization, digitalization, rising disposable incomes, and shifting consumer preferences. The coronavirus disease (COVID-19) pandemic has accelerated some trends, such as digitalization, and is likely to have permanently ...

If key measures are followed the sector could restore more than 47 million jobs by 2022. London, UK: New research from the World Travel & Tourism Council reveals the recovery of the Asia Pacific Travel & Tourism sector has soared ahead of many regions in the world with a year on year growth of more than 36%.Before the pandemic struck, Asia Pacific's Travel & Tourism sector's contribution ...

The Asia Pacific travel market, the world's largest regional market pre-pandemic, continues to face significant challenges in the post-pandemic landscape. Market recovery and developments vary, due to differing government safety protocols and travel restrictions. This report provides comprehensive market sizing and projections for the Asia Pacific travel industry from 2019-2025, including ...

BANGKOK, February 24, 2022 -- In follow up to the most recent release of the PATA "Asia Pacific Overall Visitor Forecasts 2022-2024" last week, the Pacific Asia Travel Association (PATA) today announced the release of destination-specific reports for each of 39 destinations within the Asia Pacific region. Sponsored by Visa and with data and insights from Euromonitor International, this ...

Asia Pacific Journal of Tourism Research is the official journal of the Asia Pacific Tourism Association (Founded September 1995) and seeks to publish both empirically and theoretically based articles of high quality which advance and foster knowledge of tourism.. The Journal welcomes submissions of full length articles and critical reviews on major issues with relevance to tourism in the Asia ...

36th CAP-CSA and First UN Tourism Regional Forum on Gastronomy Tourism for Asia and the Pacific. Asia and the Pacific. International Accessible Tourism Forum - Asia & the Pacific. From Our Members. ... UNWTO/GTERC Annual Report on Asia Tourism Trends - 2017 Edition. Asia and the Pacific 2017. Managing Growth and Sustainable Tourism Governance ...

Key highlights from this report include: International arrivals continue to grow in Asia Pacific as border restrictions ease. Domestic travel continues to drive tourism particularly in North Asia and the Pacific; Asia Pacific hotel transaction volume rose to US$10.1 billion as of August 2022 y-t-d, an increase of 17% y-o-y.

The Asia Pacific region is poised to spearhead the resurgence of tourism, according to the latest findings by the Pacific Asia Travel Association (PATA). Released alongside the Executive Summary Forecasts Report, the Asia Pacific Visitor Forecasts 2024-2026 offers an in-depth analysis of growth projections across 39 destinations.

Asia Travel Re:Set - Asia Pacific Travel & Tourism Report (April 2021 Issue) April 2021. Jaeyeon Choe; In April, 2 travel bubbles took off, but 2 more were punctured. Other hot topics range from ...

Asia will lead the recovery, with visitor arrivals reaching 564.0 million, followed by the Americas with 167.7 million and the Pacific with 30.4 million by 2026, highlighting the region's resilience and growing potential as a travel destination. In interpreting the Asia Pacific Visitor Forecasts 2024-2026 report, it is crucial to note that ...

This report by Economist Impact, and supported by Airbnb, explores the recovery of tourism in the Asia-Pacific region. It looks at ways in which travel could change with the rise of the conscious traveller. The report is based on extensive desk research and a survey of more than 4,500 travellers from across the region.

The Travel & Tourism market in in Asia is projected to grow by 5.36% (2024-2028) resulting in a market volume of US$402.00bn in 2028.

Pacific Asia Travel Association (PATA) projected that international visitor arrivals into Asia will grow by 100% between 2022 and 2023 (Traveldailynews) The Asia-Pacific region (APAC) has the highest growth potential in the online travel booking industry - with China and India leading the way.

The Asia Pacific Tourism Association (APTA) is an internationally acclaimed association in the field of tourism and hospitality. A conference is held annually and a SSCI listed journal (Asia Pacific Journal of Tourism Research, APJTR) is published. Its quality research papers are distributed all over the world. The aims of APTA are to ...

This latest report reveals the importance of Travel & Tourism to Asia-Pacific in granular detail across many metrics. The report's features include: • Absolute and relative contributions of Travel & Tourism to GDP and employment, international and domestic spending. • Data on leisure and business spending, capital investment, government ...

Download the Asia Pacific Visitor Forecasts 2024-2026: Full Report now! The revelations don't stop there! The panel of experts continued to delve into a number of travel trends poised to shape the Asia Pacific tourism market in the years ahead. Let's explore some of these influential trends taking root: Generative Artificial Intelligence (GAI)

This updated Global Wellness Tourism Economy report revisits the framework and definition presented in the inaugural report and provides new data and insights on global, regional, and ... through 2022 will take place in Asia-Pacific, Latin America-Caribbean, Middle East-North Africa, and Sub-Saharan Africa, driven by a dramatic increase in both ...

Asia and Pacific Department Director, Krishna Srinivasan will give an overview of the economic outlook, discuss policy challenges, & answer reporters' questions. Full report will be released in Singapore on April 29, 10 PM ET. ... ** The full report, blog, and the video recording of the press conference will be available on this page on April ...

The 23rd Asia Pacific Tourism Association Annual Conference took place in Busan, Korea, from the 18th to the 21st of June, 2017. Under the chairmanship of Dr. Yeong-Hyeon Hwang (Dong-A University, Korea), the APTA 2017 annual conference was very successful. More than 250 valuable delegates attended, from 25 different countries or regions (Korea, Australia, Azerbaijian, Canada, China, Germany ...

In the Philippines, BofA noted that foreign visitor arrivals were still 76% of pre-pandemic levels as of February this year, albeit much better than Hong Kong's 73.7% and Taiwan's January 2024 ...

Montreal, 15 April 2024 - Airports Council International (ACI) World has today unveiled the highly anticipated preliminary top 10 busiest airports worldwide for 2023, showcasing significant shifts driven by the resurgence of international air travel.. The global total passenger forecast for 2023 stands close to 8.5 billion, reflecting a remarkable recovery of 93.8% from pre-pandemic levels.

Politics, Middle East, Asia - Pacific ... Report 1 year into Sudan conflict, hunger at risk of becoming catastrophic: UN ... Türkiye among top 10 health tourism countries in world. Related news.

Special Report:Genomic life science company EZZ Life Science has struck an advertising partnership deal with the Asia Pacific Airlines Club (APAC), which will see EZZ and EAORON branding across 2 ...

Rescuers in Taiwan scrambled to free dozens of people trapped in highway tunnels after the island was struck by its strongest earthquake in 25 years Wednesday, killing at least nine and injuring ...