- Welcome Bonus

- Kredit Tanpa Agunan

- Kredit Multiguna

- Kredit Mobil Baru

- Kredit Mobil Bekas

- Kredit Motor

- Kredit Pemilikan Rumah

- Asuransi Mobil

- Asuransi Jiwa & Kesehatan

- Asuransi Perjalanan

- Asuransi Kesehatan Karyawan Baru

- Asuransi Umum Baru

- Bantuan Darurat Jalan Baru

- Listrik PLN

- Voucher Game

- Data Roaming Internasional

- Internet & TV Kabel

- Angsuran Kredit

- E-Samsat Baru

- Voucher Streaming Baru

- Emas Digital

- Tabungan Berjangka

- Tabungan Syariah

- Deposito Syariah

- Daftar Pusat Service

- Daftar Bengkel Asuransi

- Lembaga Keuangan

- Daftar Istilah

- Ruang Edukasi

- Siaran Pers

- Masuk | Daftar

- Masuk Daftar

Asuransi Perjalanan Covid-19 untuk Liburan Aman

Berlibur di masa pandemi Covid-19 memerlukan perlindungan ekstra supaya tetap terjaga. Agar perjalanan tetap nyaman dan bebas dari rasa khawatir, Cermati.com berkomitmen untuk memberikan perlindungan menyeluruh untuk kamu dan keluarga tercinta.

Cermati.com kini menghadirkan Asuransi Covid-19 untuk melindungi perjalanan dan liburan kamu bersama keluarga setiap saat. Nikmati perlindungan menyeluruh terhadap Covid-19 untuk perjalanan domestik dan internasional dengan biaya pertanggungan hingga Rp1.500.000.000. Dapatkan Asuransi Perjalanan Covid-19 Terbaik di Cermati.com sekarang

Beli Asuransi Perjalanan Covid-19 Sekarang

Jaminan perlindungan terhadap risiko Covid-19 selama perjalanan hingga Rp1.500.000.000,- dan memenuhi kriteria pengajuan visa

Jaminan perlindungan lengkap mulai dari biaya kecelakaan, perawatan medis, kerusakan atau kehilangan bagasi, hingga jaminan tambahan lainnya

Layanan Call Center 24 jam yang siap menangani segala keluhaan dan menjawab pertanyaan setiap saat

Tentang Asuransi Covid-19 untuk Perjalanan di Cermati.com

Asuransi Perjalanan Covid-19 adalah sebuah jenis asuransi yang diperuntukkan untuk menanggung segala biaya perawatan atau pengobatan terhadap risiko Covid-19 selama perjalanan atau liburan berlangsung

Berikut ini adalah daftar negara tujuan yang membutuhkan asuransi perjalanan Covid-19 sebagai syarat tambahan untuk masuk.

Sebagian besar negara di seluruh dunia memiliki kebijakan yang mewajibkan para pengunjung yang berasal dari luar negaranya masing-masing untuk memiliki asuransi Covid-19 Meskipun memiliki kebijakan yang berbeda-beda, kepemilikan asuransi Covid-19 secara umum dibutuhkan untuk memenuhi kriteria pengajuan Visa sekalipun sudah melakukan vaksinasi.

Apabila seorang pengunjung dari luar negara tujuan terdeteksi terjangkit Covid-19 di negara tersebut, tentunya bisa dirawat di fasilitas kesehatan terdekat dengan biaya perawatan atau pengobatan yang bisa langsung ditanggung selama perjalanan Selain itu, perlu diketahui juga setiap negara juga memiliki kebijakan tersendiri akan minimum besaran uang pertanggungan untuk asuransi Covid-19 yang harus dimiliki sebagai syarat perjalanan.

Jadi, pastikan sebelum bepergian atau berlibur untuk mengajukan dan memiliki asuransi perjalanan dengan cakupan perlindungan Covid-19 Perhatikan juga kebijakan jumlah minimum uang pertanggungan untuk asuransi Covid-19 di negara tujuan supaya bisa mendapatkan asuransi perjalanan dengan jumlah yang tepat.

Untuk memastikan perjalanan kamu dan keluarga tetap aman, Cermati.com menawarkan Asuransi Perjalanan Covid-19 dengan berbagai manfaat terbaik sebagai berikut:

- Perlindungan Hingga Rp1,5 Miliar: Jaminan perlindungan terhadap risiko Covid-19 senilai hingga Rp1.500.000.000,- Asuransi ini juga telah memenuhi kriteria pengajuan Visa untuk perjalanan ke luar negeri

- Cakupan Perlindungan di Seluruh Dunia: Dapatkan cakupan perlindungan untuk perjalanan domestik dan internasional di seluruh dunia

- Jaminan Perlindungan Komprehensif: Jaminan perlindungan yang lengkap mulai dari pertanggungan biaya kecelakaan perjalanan, perawatan medis, ketidaknyamanan perjalanan, kehilangan atau kerusakan bagasi, serta jaminan tambahan lainnya

- Biaya Premi Fleksibel: Biaya premi dihitung berdasarkan hari perjalanan sehingga bisa disesuaikan dengan kebutuhan dan rencana perjalanan

- Layanan Medis Cashless: Kemudahan memperoleh layanan medis tanpa dana tunai (cashless) di daerah atau negara tujuan perjalanan

- Call Center 24 Jam: Tersedia layanan call center 24 jam yang siap menangani segala keluhan dan menjawab pertanyaan setiap saat

Cermati tabel manfaat yang akan kamu dapatkan di bawah Ini:

Berikut langkah-langkah pengajuan asuransi Covid-19 untuk perjalanan di Cermati.com:

- Kunjungi situs Cermati.com atau unduh aplikasi Cermati.com di smartphone kamu.

- Pergi ke halaman asuransi perjalanan, lengkapi data, dan pilih cari sekarang.

- Pilih produk asuransi perjalanan dengan manfaat Covid-19 lalu klik beli.

- Lakukan verifikasi dan pembayaran.

- Transaksi selesai dan kini perjalanan kamu dan keluarga sudah terlindungi.

Jl. Tomang Raya No. 38, Jatipulo Palmerah, Jakarta Barat 11430

PT Dwi Cermat Indonesia - [email protected]

Direktorat Jenderal Perlindungan Konsumen dan Tertib Niaga Kementerian Perdagangan RI

(Directorate General of Consumer Protection and Trade Compliance)

Disclaimer: Kami akan menjaga informasi yang akurat dan terkini, namun Kami tidak dapat menjamin keakuratan informasi. Silakan verifikasi informasi kartu kredit, dan tingkat suku bunga selama proses aplikasi.

© 2024 Cermati.com. All Rights Reserved.

Instant travel insurance with Travel Cover

Get travel insurance now

Download Grab app

Why Travel Cover

Quick and easy.

Get an instant quote and purchase our affordable travel insurance directly in the Grab App. Simply indicate your trip duration, destination and who the coverage is for. Your travellers' information will automatically be saved for future purchases.

Travel insurance benefits

Whether you’re on a trip overseas or exploring Indonesia, we’ll cover you for overseas medical expenses, travel delays, lost baggage and more! The additional COVID-19 benefits reimburses you for trip curtailment, overseas hospital confinement and other quarantine benefits.

Great value

With premiums starting as low as Rp3,8rb a day for domestic travel and Rp17,1rb for International travels, why wait? Buy travel insurance with the Grab App right away.

Premi harian / Daily Premium

Cakupan perjalanan / travel coverage view full policy wording, got questions we’ve got answers..

For more questions, please visit our Help Centre .

No, you’ll need make your purchase before departing Malaysia.

- I’ve extended my trip. Can my travel insurance policy be extended too? Yes, simply purchase a new policy to cover the extended dates. This purchase must be done before or during your trip. Do remember to provide all policy numbers when making a claim.

- You’ll be glad to hear that cover starts from the time you leave your home in Indonesia to go directly to your departure point, or 3 hours before the scheduled departure time of the carrier in which you have arranged to travel, whichever is later.

- Coverage stops when you return to your place of residence in Indonesia, or 3 hours after the scheduled arrival time of the carrier in which you travel, or the date on which the policy is terminated, whichever is the earliest.

- You are covered for activities that are accessible to the general public without restriction (other than height or general health or fitness warnings) and which are provided by a recognised local tour operator are covered. You should be acting under the guidance and supervision of qualified guides and/or instructors of the tour operators when carrying out such tourist activities

- The policy does not cover any sports or sporting activities that present a high level of inherent danger (i.e. involves a high level of expertise, exceptional physical exertion, highly specialised gear or stunts) including but not limited to big wave surfing, canoeing down rapids, cliff jumping, horse jumping, ultra-marathons, biathlons, triathlons and stunt riding

I’m overseas and need emergency assistance. What should I do?

Must-have travel insurance at a great value

Get Travel Cover

May we suggest

Discover and book amazing hotel stays.

Upsize your protection for your Grab rides

Travel Cover (“Insurance Product”) is undertaken by PT Grab Teknologi Indonesia as master policyholders of the Insurance Product. The Insurance Product is underwritten by PT Chubb General Insurance Indonesia. Please note that PT Chubb General Insurance Indonesia and PT Grab Teknologi Indonesia may agree to make changes to the Insurance Product from time to time without prior notice to you. PT Chubb General Insurance Indonesia is registered and supervised by Otoritas Jasa Keuangan.

- Inside Grab

- Investor Relations

- Trust & Safety

- GrabForGood Fund

- GrabExpress

- GrabRewards

- Subscriptions

- GrabMart Kilat

- Clean & Fix

- Driver Centre

- Code of Ethics

- Grab for Business

- Business Delivery Service

- Help Centre

- GrabMart Consumer Service

- Developer Portal

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best COVID-19 Travel Insurance Options

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

Generali Global Assistance »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best COVID Travel Insurance Options.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

Even though COVID-19 is no longer considered a global emergency, concerns around illness-related costs remain for many travelers. If you're looking for travel insurance that covers COVID – as well as other potential disruptions like flight delays and lost luggage – these are your best options.

- Travelex Insurance Services: Best Optional Coverage Add-ons

- Allianz Travel Insurance: Best for Multitrip and Annual Plans

- World Nomads Travel Insurance: Best for Active Travelers

- Generali Global Assistance: Best for Comprehensive Travel Insurance

- IMG Travel Insurance: Best for Travel Medical Insurance

Best COVID Travel Insurance Options in Detail

Plans include coverage for COVID-19

Optional CFAR coverage is available with Travel Select plan

Some coverages require an upgrade, including rental car collision, accidental death and dismemberment, and more

Not all add-ons are available with every plan

Allianz offers some travel insurance plans that come with an epidemic coverage endorsement

Single-trip, multitrip and annual plans available

COVID-19 benefits don't apply to every plan

Low coverage limits with some plans (e.g., only $10,000 in emergency medical coverage with OneTrip Basic plan)

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Low trip cancellation benefits ($2,500 maximum) with Standard plan

No CFAR option is offered

Free 10-day trial period

Some coverage limits may be insufficient

Rental car damage coverage only included in top-tier Premium plan

Offers travel medical insurance, international travel health insurance and general travel insurance plans

Some plans include robust coverage for testing and quarantine due to COVID-19

Not all plans from IMG offer coverage for COVID-19

Cancel for any reason coverage not available with every plan

Frequently Asked Questions

When comparing COVID-19 travel insurance options, you'll want to make sure you fully understand the coverages included in each plan. For example, you should know the policy inclusions and limits for COVID-related claims, including coverage for testing, treatments, trip cancellation or COVID-related interruptions that can occur. Meanwhile, you should understand how your coverage will work if you contract some other illness while away from home.

Also ensure your travel insurance coverage will kick in for other mishaps that occur, and that limits are sufficient for your needs. If you're planning a trip to a remote area in a country like Costa Rica or Peru , you'll want to have emergency evacuation and transportation coverage with generous limits that can pay for emergency transportation to a hospital if you need treatment.

You can also invest in a travel insurance policy that offers cancel for any reason coverage. This type of travel insurance plan lets you cancel and get a percentage of your prepaid travel expenses back for any reason, even if you just decide you're better off staying home.

It depends on your private health insurance provider and/or travel insurance policy. As of May 11, 2023, private health insurers are no longer required to cover the cost of COVID-19 testing. Out-of-pocket costs for COVID-19 test kits at local drugstores and on Amazon are relatively affordable, however.

As you search for plans that will provide sufficient coverage for your next trip, you'll find travel insurance that covers COVID-19 quarantine both inside and outside the United States. However, you'll typically need to have your condition certified by a physician in order for this coverage to apply. Also make sure your travel insurance plan includes coverage for travel claims related to COVID-19 in the first place.

Many travel insurance plans do cover trip cancellation as a result of COVID-19, although the terms vary widely. You typically need to be certified by a physician in order to prove your condition. Disinclination to travel because of COVID-19 – such as fear of exposure to illness – will generally not be covered. This means you will actually have to test positive for coronavirus for benefits to apply; simply not wanting to travel is not a sufficient reason to make a claim.

If you want more flexibility in your COVID-19 travel insurance, ensuring you have a cancel for any reason policy may be your best bet, but be sure to check with your chosen travel insurance provider to assess your options.

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering travel insurance and travel for more than a decade. She has researched the best travel insurance options for her own trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Over the years, Johnson has successfully filed several travel insurance claims for trip delays and trip cancellations. Johnson also works alongside her travel agent partner, Greg, who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

5 Best Travel Insurance Plans for Seniors (Medical & More)

Holly Johnson

Discover coverage options for peace of mind while traveling.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Bus & Travel

- Airport Transfer

Things to Do

Covid-19 insurance is now available on traveloka.

Add an extra layer of protection for your next trip with a range of coverage from COVID-19 Insurance.

Now available on Traveloka App

Traveling in this pandemic requires you to be cautious. As your trusted traveling partner, we are committed to help you provide an additional layer of protection to you and your loved ones.

Together with Asuransi Takaful Umum and powered by Qoala Insurtech, Traveloka provides protection during your trip with COVID-19 Insurance plan: COVID-19 Health Insurance.

With our coverage and hassle-free insurance experience, now you can travel with ease in this new normal.

Coverage and Eligibility

Who are eligible for this plan.

You are eligible to be insured with COVID-19 Health Insurance if you are an Indonesian citizen aged between 6 months – 65 years old.

How to get protected

Book your ticket

Go to Traveloka website or open your Traveloka app and proceed with your ticket booking.

Add COVID-19 Insurance to your booking

Fill in the contact information needed and tick the COVID-19 Insurance checkbox.

Submit Payment

Complete your payment using the selected method.

Your trip is now protected

Once payment is confirmed, your insurance certificate will be sent to your registered email.

How to claim

Qoala Insurtech

GoWork Menara Standard Chartered

Jl. Prof. DR. Satrio No. 164, RT.3/RW.4

Karet Semanggi, Kecamatan Setiabudi

Jakarta Selatan 12930

Call Center: +62 21 5064 5035

Email: [email protected]

WhatsApp: +62 811 1171 708

PT Asuransi Takaful Umum

Graha Kospin Jasa Lantai 3, Jl. Jend. Gatot Subroto Kav. 1

Jakarta Selatan 12870, Indonesia

Call Center: +62 21 285 43111

Email: [email protected]

Whatsapp: +62 812-9321-9318

Payment Partners

About Traveloka

- How to Book

- Help Center

- Installment

Follow us on

- International Data Plans

- Gift Voucher

- Traveloka for Corporates

- Traveloka Affiliate

- Privacy Notice

- Terms & Conditions

- Register Your Accommodation

- Register Your Experience Business

- Traveloka Press Room

- Traveloka Ads

Download Traveloka App

How COVID-19 Travel Insurance Works

From weekend getaways to extended vacations, specialized covid-19 travel insurance can provide security if the virus affects your travel plans..

)

3+ years writing about auto, home, and life insurance

7+ years in personal finance and technology

Amy specializes in insurance and technology writing and has a talent for transforming complex topics into easy-to-understand stories.

Read Editorial Guidelines

Featured in

)

Licensed auto and home insurance agent

4+ years in content creation and marketing

As Insurify’s home and pet insurance editor, Danny also specializes in auto insurance. His goal is to help consumers navigate the complex world of insurance buying.

Updated September 18, 2023

Reading time: 4 minutes

)

Table of contents

- Pandemic insurance

- What’s covered

- Is it worth it?

- Secure a policy

Travel lets you see new places, meet new people, and experience different cultures. But the lurking shadow of COVID-19 can make traveling uncertain. Almost half of canceled trips in 2020 were due to the virus, according to the U.S. Travel Insurance Association (UStiA). [1]

Travel insurance can help if something goes wrong before or during your trip, but not all policies cover COVID-19 issues. Let’s explore how COVID-19 travel insurance works and how it might — or might not — shield you on your next journey.

How pandemic travel insurance works

Most travel insurance policies include protections for trip cancellations, delays, or other trip interruption coverage. However, many policies don’t cover disruptions due to pandemics. [2] That’s where COVID travel insurance comes into play.

COVID travel insurance is a specialized policy that can refund your money if the virus throws a wrench into your plans. It typically has three coverage levels: coverage for a trip delay, canceling for any reason, and medical care if you get sick.

Travel delay coverage

Illness, injury, jury duty, and other circumstances beyond your control can delay your travel plans. Travel delay insurance covers flight issues, bad weather, sudden breakdowns, and unexpected illnesses or injuries that happen before reaching your destination. It can pay you back for non-refundable expenses and cover extra costs, too — like food, hotel rooms, or cab rides.

Cancel for any reason

Travel insurance policies typically have strict rules, but a cancel-for-any-reason (CFAR) option offers more leeway, allowing you to cancel for reasons not covered in the original policy.

But with CFAR benefits, you might only get a partial refund amount. Reimbursements usually range from 50% to 75% of the total price. [2]

Medical coverage for COVID-19

If your health insurance is only valid in a specific area and doesn’t cover international travel, travel insurance with medical expenses coverage can fill the gap.

If medical insurance is included in your trip policy, it can help pay for medical attention and treatment costs if you, a family member, or another traveling companion becomes ill from COVID-19 before or during your trip.

Will travel insurance cover you if you need to quarantine?

Some travel protection plans cover quarantine or self-isolation due to COVID-19 concerns. It can reimburse you for lost prepaid expenses and cover additional lodging and meal costs. However, it depends on your policy and the conditions leading to the cancellation, delay, or disruption.

Protection often hinges on two factors:

Not all travel insurance plans include a pandemic as a covered reason. If COVID-19 was a significant public concern when you purchased the policy, insurers may not provide coverage because it’s a “foreseeable” threat. But some plans let you add COVID-19 coverage as an endorsement.

Even if you set out to buy COVID-19 travel insurance, it may not be available for your plan or location. Review your benefits and endorsement options to look for “pandemic” or “epidemic-related” language to see if COVID-19 is a covered event.

Is travel insurance worth it?

The Centers for Disease Control and Prevention (CDC) declared the COVID-19 public health emergency over in May 2023, but there’s still a risk of infection, according to the World Health Organization (WHO). [3] [4]

Your credit card’s travel protections are worth considering, but you may not want to rely on that alone. Credit cards often limit travel coverage, and most companies don’t include trip cancellation coverage. [5]

Travel delay benefits can fill the gap — especially benefits with COVID-19 coverage. Compare the policy cost against the potential loss if you have to cancel or delay your trip to determine if it’s worth it. The up-front payment for travel insurance is typically a fraction of what you might spend out of pocket if plans go south.

The CDC reports that medical bills in the first six months of a COVID-19 diagnosis average nearly $8,400. [6] Factor in non-refundable trip costs, accommodation charges, and other miscellaneous expenses, and the expenses can skyrocket.

How to find the best travel insurance

If you’re concerned about the pandemic and the potential effects on your travels, here are some tips to help you secure a policy with the best travel insurance plan:

Research coverage and services

Compare multiple companies and policies and read reviews to see others’ experiences.

Check for pandemic coverage

Not all policies cover travel disruptions from COVID-19. Review your coverage to make sure it specifically addresses pandemic reasons.

Buy medical coverage

Travel policies don’t automatically include medical emergencies. Consider adding medical travel insurance, and ask about emergency assistance coverage and medical evacuation in case of a natural disaster.

Consider a cancel-for-any-reason insurance policy

CFAR policies can be beneficial, especially with unpredictable pandemic-related concerns and travel restrictions.

Understand refund policies

Read the fine print and policy information to verify how the insurer handles refunds. Some policies might offer partial refunds.

COVID travel insurance FAQs

The COVID-19 virus has made travel plans tricky. Whether you’re planning a weekend getaway or a month-long vacation, here’s what you need to know about COVID-19 travel insurance.

Will travel insurance cover COVID cancellations?

It depends. Standard travel insurance policies don’t cover COVID-19 or other pandemic-related reasons, but some travel insurance companies offer specialty COVID-19 coverage against the virus’ potential interference. If you cancel your trip due to the virus, a COVID travel insurance policy may provide refunds or reimbursements for your expenses.

Do you get your travel insurance premium refunded if you cancel your trip?

Travel insurance offers varying refund policies depending on the travel insurance company, but it doesn’t refund your premium. Instead, coverage can reimburse you for prepaid trip costs, meals, hotel rooms, or cab rides because of the interruption.

Will travel insurance cover quarantine outside the U.S.?

It’s possible. Travel insurance policies may cover quarantine or self-isolation expenses outside the United States due to COVID-19 concerns. However, coverage depends on your specific policy and the circumstances leading to the quarantine. It’s crucial to review the specific details and look for “pandemic” or “epidemic-related” language to ensure coverage.

How does COVID travel insurance differ from regular travel insurance?

Regular travel insurance often covers typical trip cancellations, interruptions, or delays. However, many don’t address pandemic-related disruptions. COVID travel insurance provides specialized coverage for travel hiccups related to the virus, ensuring you’re shielded financially if COVID-19 affects your journey.

Related articles

- Tesla Battery Replacement Cost

- What to Know About Illinois Emissions Testing

- How Much Will Insurance Pay for My Totaled Car? (Full Guide)

- What Is the Difference Between a Real ID and a Driver’s License?

- Can You Legally Drive with an Expired License?

- How Many Cars Can You Have in Your Name?

- Study: Average Miles Driven Per Year in the U.S. (2024)

Popular articles

- Car Insurance for Leased Vehicles: What to Know

- Can You Get Car Insurance With no Credit Check?

- 6 Best Pay-as-You-Go Car Insurance Companies

- Can You Add Someone Who Doesn’t Live with You to Your Car Insurance?

- The Best Car Insurance for Bad Drivers

- Hugo Car Insurance Review: Ratings and Quotes

- Best Cheap Full-Coverage Car Insurance

- US Travel Insurance Association . " Consumers Spend $1.72B on Travel Protection in 2020, According to New UStiA Study ."

- National Association of Insurance Commissioners . " Travel Insurance ."

- Centers for Disease Control and Prevention . " End of the Federal COVID-19 Public Health Emergency (PHE) Declaration ."

- World Health Organization . " Coronavirus disease (COVID-19) pandemic ."

- US Travel Insurance Association . " Will Your Credit Card Protect Your Travels? ."

- Centers for Disease Control and Prevention . " Direct Medical Costs Associated With Post–COVID-19 Conditions Among Privately Insured Children and Adults ."

)

Amy is a personal finance and technology writer. With a background in the legal field and a bachelor's degree from Ferris State University, she has a talent for transforming complex topics into content that’s easy to understand. Connect with Amy on LinkedIn .

Latest Articles

)

How to Get a Texas Driver’s License: A Step-by-Step Guide

To become a licensed driver in Texas, you must pass a three-part test. You might also need to take driver’s ed courses depending on your age.

)

How to Get Cheap Car Insurance

Don’t assume you already have the best car insurance deal for you. Strategies beyond bundling can result in cheap rates. Learn more.

)

17 Factors That Affect Car Insurance Rates

Curious what factors affect your car insurance rates? Learn more about how insurers determine your premiums here.

)

Tickets vs. Citations: What’s the Difference?

A citation is the same thing as a ticket. Using the word “ticket” instead of “citation” is much like saying “pink slip” instead of “termination notice.”

)

What Is a Car Insurance Premium?

A car insurance premium is the amount you pay to keep your coverage. Learn more about what factors influence your premium in our guide.

)

What Are the Best Cars for Senior Drivers?

Toyota Camry, Acura Integra, and Honda CR-V are among the best cars for senior drivers. Learn more about safe and affordable vehicle options.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

The best Covid-19 travel insurance companies to protect yourself against the uptick in cases

Travel insurance can help if you have to cancel or cut a trip short due to covid..

Though the height of the pandemic may have passed, Covid-19 continues to be a consideration in everyday life. And that's especially true for those who are traveling or booking a trip.

Getting sick on the road or having to cancel your vacation because of illness is a common concern. However, travel insurance can help you ensure you're covered. Many travel insurance policies consider Covid like they would any other illness, but not all. So, you'll still want to carefully read any travel insurance policy you're considering to make sure Covid isn't excluded. For the most comprehensive coverage, you'll want to opt for a plan with cancel for any reason (CFAR) coverage.

To find the travel insurance policies best suited to handle Covid-related issues, CNBC Select looked at Covid coverage and limits for medical coverage and evacuation, among other factors. We found four standouts for the best Covid travel insurance policies. (See our methodology to learn more about how we created this list.)

Best Covid-19 travel insurance

- Best overall : AXA Travel Insurance

- Runner up : Nationwide Travel Insurance

- Best for luxury travel : Berkshire Hathaway Travel Protection

- Best for cancel for any reason coverage : Allianz Travel Insurance

Best overall

Axa assistance usa travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

24/7 assistance available

- Three tiers of plans available

- Highly rated for financial strength

- Cancel for any reason only available on highest-tier coverage

Who's this for? AXA Travel Insurance is ideal for those seeking high coverage limits for emergency accident and sickness medical expenses, as well as emergency evacuations.

Standout benefits: AXA's silver plan offers up to $25,000 of medical emergency accident and illness coverage and $100,000 of emergency evacuation coverage, higher than many of the base travel plans we compared. The company's gold and platinum plans offer higher limits, up to $250,000 of medical emergency coverage and $1 million of evacuation coverage. When comparing AXA policies, make sure you have the "Epidemic Coverage Endorsement" included.

[ Jump to more details ]

Runner up

Nationwide travel insurance.

Nationwide's wide coverage for travel insurance allows many different types of travelers to find coverage that fits their needs. Three levels of cruise insurance coverage gives extra options to cruise passengers.

- 10-day review period on cruise insurance policies to make sure the plan meets your needs (not available in NY or WA)

- Most basic cruise plan doesn't offer CFAR coverage

Who's this for? Nationwide's travel insurance offers higher limits than many other base plans we reviewed, with limits of $75,000 for medical coverage and $250,000 of emergency evacuation coverage in its essential plan.

Standout benefits: Nationwide offers several plans tailored to different needs, including a cruise-specific travel insurance plan and an annual plan for frequent travelers.

Best for luxury travel

Berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

- Wide variety of policies available

- Strong financial strength rating by AM Best

- Cancel for any reason only provides reimbursement for up to 50% of non-refundable trip payments

Who's this for? Those considering expensive travel can find sufficient coverage with Berkshire Hathaway Travel Protection that meets a variety of needs, including coverage for Covid if needed.

Standout benefits: Berkshire Hathaway's top-tier LuxuryCare Travel Insurance includes coverage for up to 150% of the trip cost for trip interruption coverage and $100,000 of medical expense coverage.

Best for cancel for any reason coverage

Allianz travel insurance.

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Who's this for? For those wanting the option to cancel for any reason (CFAR), Allianz Travel Insurance plans offer lots of different options, including CFAR add-ons.

Standout benefits: Allianz's Cancel Anytime upgrade can reimburse up to 80% of non-refundable trip costs for almost any unforeseeable reason not already covered by the policy. That's higher than most other CFAR coverage, which generally covers 70% to 75% of non-refundable trip costs. It's only available on the brand's OneTrip Prime and OneTrip Premier policies.

More on our top Covid travel insurance companies

Axa travel insurance .

AXA offers three travel insurance plans starting at $16. Its silver plan, the lowest tier of coverage, offers high limits for emergency medical expenses at $25,000 and up to 100% of trip costs for trip interruption coverage. Many policies now include epidemic-related covered reasons.

CFAR coverage available?

Yes, up to 75% of prepaid, nonrefundable trip costs

24/7 assistance?

[ Return to summary ]

Nationwide Travel Insurance

Nationwide offers travel insurance plans for single trips, multi-trips and cruise-specific plans. The company has an A+ rating for financial strength from rating agency AM Best, and its most basic single trip and cruise plans offer a high limit of $75,000 of medical coverage.

Berkshire Hathaway Travel Protection

Berkshire Hathaway's travel coverage can be tailored towards the specific needs of cruise and luxury travelers, with options for higher coverage limits for medical coverage and trip interruption benefits.

Yes, up to 50% of prepaid, nonrefundable trip costs

Allianz Travel Insurance

Allianz Travel Insurance stands out for those who want cancel for any reason coverage, as the percentage reimbursed is higher than other travel insurance providers we reviewed. For traveling families, the company's OneTrip Prime plan also offers free coverage for children ages 17 and younger with a parent's coverage.

Yes, up to 80% of prepaid, nonrefundable trip costs through the optional Cancel Anytime upgrade

Does travel insurance cover Covid?

Travel insurance generally covers Covid-19 as it would any other illness. While fear of catching an illness isn't a cause for cancellation under most policies without a cancel for any reason (CFAR) add-on, being diagnosed with Covid-19 right before or during your trip could qualify you for cancellation, interruption or travel delay coverage.

As with any insurance coverage you're considering, read your travel insurance policy carefully to understand what it does and doesn't cover.

What does travel insurance cover?

Travel insurance can cover your trip expenses if you're unable to go due to an unforeseen, covered reason or face an illness or injury during your trip. It can also help in the event that you lose your bags or face delays in your itinerary.

Bottom line

If you find yourself coming down with Covid before or during a trip, travel insurance could help you recoup funds from a lost trip or cover medical bills while you're abroad. Look for a travel insurance plan with strong medical coverage and flexible cancellation options.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every travel insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products . To research the best travel insurance companies, we compiled over 100 data points on more than a dozen travel insurance companies. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best travel insurance.

Our methodology

To determine the best Covid-19 travel insurance companies, CNBC Select analyzed dozens of travel insurance companies and compared them based on their Covid policies, and medical and evacuation coverage limits.

While narrowing down the best travel insurance companies, we focused on Covid-19 coverage, availability of cancel for any reason coverage, and the limits of emergency medical coverage and emergency medical evacuation coverage. We also considered factors like whether 24-hour assistance was available, Better Business Bureau ratings, and financial strength ratings from AM Best .

Note that the premiums and policy structures advertised for travel insurance companies are subject to fluctuate in accordance with the company's policies.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- 5 things to avoid if you’re applying for a mortgage Kelsey Neubauer

- Best sole proprietorship business credit cards Jason Stauffer

- This is the best budgeting app to help investors track their money Jasmin Suknanan

How do you choose travel insurance that covers COVID-19?

Oct 26, 2021 • 5 min read

COVID-19 has made it more important to check the health coverage on your travel insurance © Maskot/Getty Images

After 18 months of pandemic-related travel restrictions, you may be itching to act on your pent-up wanderlust—but the situation and the rules are still continuously evolving. So before you go anywhere, it’s best to have a travel insurance plan that protects the investment you’ve made in a long-awaited trip.

A robust travel insurance plan will reimburse pre-paid trip costs and non-refundable deposits if you have to cancel or interrupt your trip, encounter trip delays, experience baggage loss or require medical expense and medical evacuation. Your policy will also reimburse “covered reasons” in your plan, such as death, illness or injury, serious family emergencies, unplanned jury duty, military deployment, acts of terrorism, or your travel supplier going out of business.

But COVID-19 has added an additional checklist to your usual insurance needs—it’s now important to check to ensure your travel insurance plan includes coverage for COVID-19 medical expenses, and losses related to illness. Your policy should also cover quarantine costs if you need to self-isolate after testing positive for the virus.

What do I look for in COVID-19 insurance coverage?

When you’re shopping for a travel insurance plan that covers COVID-19, you need to do your research and read the fine print of your plan.

Look for a travel insurance product that will protect your non-refundable, prepaid expenses if you have to cancel your trip due to illness caused by COVID-19. Your policy should also cover emergency medical treatment and emergency medical transportation. With regard to COVID-19 coverage, be sure your policy covers medical care, medicine, hospitalization and quarantine expenses.

“The type of coverage you should look for depends on you, your needs, travel dates, and the type of trip you’re taking,” says Sasha Gainullin, CEO of battleface , a travel insurance carrier. He says some travel insurance companies have now excluded COVID-19 coverage because it has been labeled a “known/foreseeable event”, while others may exclude pandemics altogether.

“It’s important to search for plans that include medical and quarantine expenses as well—this will be critical in the event you become ill and need to receive treatment while traveling,” continues Gainullin.

One additional tip is to confirm there are no exclusions based on the destinations you’re traveling to—this can happen with countries under government-issued travel warnings, Gainullin says.

“If a traveler feels uncertain, I recommend speaking with the travel insurance company directly. They can review the policy details with you, answer all of your questions, and confirm all of your required coverage options are included,” he adds.

Is getting coverage dependent on vaccination?

While it’s a good idea to be fully vaccinated before traveling, vaccination is not required to purchase a travel insurance policy, says Daniel Durazo, spokesperson with Allianz Partners USA.

What are the medical costs that are covered by travel insurance?

Travel insurance can cover the cost of both medical treatment and emergency medical transportation. A US health insurance plan, as well as Medicare, generally will not cover overseas medical expenses, so it’s best to check with your personal health insurance provider if any global coverage is available.

“While losing the cost of a trip due to an unexpected cancellation would be painful, paying for expensive emergency medical treatment or emergency medical transportation can be financially devastating,” Durazo says.

Under a travel insurance plan, medical costs could range doctor visits, pharmacy expenses, imaging costs and covering a hospital stay if required. Other expenses that can be covered are transportation to medical care and medicine.

Read more: Will my health insurance cover getting COVID-19 while traveling in the US—or abroad?

What about covering an unexpected quarantine due to COVID-19?

Many international destinations are now requiring that visitors purchase travel insurance coverage for an unexpected quarantine. Allianz Travel Insurance has added coverage to many of its products that includes reimbursement for quarantine-related accommodations if you or a traveling companion is individually-ordered to quarantine while on their trip, says Durazo.

This coverage typically covers the cost of additional food, lodging and transportation while quarantined. In addition, trip interruption and travel delay benefits on certain Allianz plans also provide coverage if you or your travel companion is denied boarding by your travel carrier due to suspicion of illness.

The benefits for quarantine coverage vary from carrier to carrier. For example, on select Trawick International plans, they offer $2,000 in quarantine benefits and for an additional charge, and you can increase it up to $7,000.

What about pre-flight COVID-19 testing?

Your plan may provide coverage for flights if you are turned away at a border for not passing a health inspection. Foster says Trawick’s travel insurance plans that cover COVID-19 would cover the expenses if you could not pass your pre-health inspection. Also, the plan would cover the costs of the failure of your PCR test to return to the United States, such as having to quarantine abroad.

It’s important to note that the actual cost of the PCR test is not covered by your policy, just the loss associated with the negative test.

Read more: PCR tests for travel: everything you need to know

Some destinations require COVID-specific insurance coverage—how do I comply with those restrictions?

Before any international travel, you should check the country where you are headed to make sure you comply with insurance coverage requirements. Countries like Spain, Turks and Caicos and Thailand are among the nations that mandate COVID-19 insurance coverage.

“You first must check the countries’ specific COVID regulations for entry into the country. Some countries require travelers to provide proof of travel insurance that covers COVID-19 related expenses purchased from a third party,” explains Foster. Providing proof coverage is key; so travelers need to ensure they receive documentation from their insurance provider that their policy covers COVID-19 related expenses to show customs officials, she says.

Should you arrive in a country that requires proof of insurance to cover COVID-19 medical expenses and quarantine costs, and you don’t hold a policy, you will not be granted entry.

For more information on COVID-19 and travel, check out Lonely Planet's Health Hub .

You may also like: What happens if I'm denied entry to a country on arrival? What is a vaccine passport and do I need one to travel? What is the IATA Travel Pass and do I need it to travel?

Explore related stories

Destination Practicalities

Mar 28, 2023 • 3 min read

Here’s all you need to know about getting a traveler visa to visit China now that “zero COVID” has come and gone.

Sep 12, 2022 • 4 min read

Apr 19, 2024 • 7 min read

Apr 19, 2024 • 6 min read

Apr 19, 2024 • 10 min read

Apr 19, 2024 • 9 min read

Apr 19, 2024 • 11 min read

Apr 19, 2024 • 4 min read

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Is There Travel Insurance That Covers COVID Quarantine?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

We get it — traveling these days can be an uncomfortable experience. In the ever-changing world of COVID-19 variants, border restrictions and PCR tests, learning how to stay protected is important.

Travel insurance can insure you against a variety of complications during travel, including trip delay, trip cancellation and medical issues. But not all policies are the same, and coverage can vary not only across providers, but across policies themselves.

Let’s take a look at travel insurance that covers COVID-19 quarantine, plus the best COVID-19 travel insurance.

What does travel insurance usually cover?

Travel insurance can provide peace of mind on vacation, especially when things go awry. There are varying types and levels of coverage for travel insurance, though these are common inclusions for travel insurance policies:

Trip cancellation insurance.

Trip interruption insurance.

Trip delay insurance.

24-hour hotline assistance.

Emergency medical insurance.

Primary/secondary medical insurance.

Lost or delayed baggage insurance.

Rental car insurance.

There's a lot of variety when it comes to travel insurance and the types of incidents it’ll cover. The cost of your premium will vary according to the plan you select.

Cancel for Any Reason insurance allows you to cancel your trip and recoup your costs, no matter why you’ve chosen to cancel.

Before buying travel insurance, check to see if any of your credit cards offer trip insurance . Some travel credit cards offer this insurance free of charge when you use your card to pay.

The Chase Sapphire Preferred® Card , for example, provides primary rental car insurance when you charge the car to your card.

The Platinum Card® from American Express , meanwhile, will cover trip cancellation, trip delay and lost luggage insurance. Terms apply.

There are no credit cards whose benefits include medical insurance. You’ll want to read the terms carefully to be sure that any travel insurance you purchase covers instances of COVID-19.

» Learn more: Will my travel insurance cover coronavirus?

Finding insurance that covers COVID quarantine

In the beginning of the pandemic, many insurance policies covered losses related to COVID-19, including trip cancellation and medical issues.

Since then, some providers have chosen to exclude coverage for coronavirus-related issues. So you’ll need to search specifically for an insurance policy that covers COVID-19.

Fortunately, there are still insurance providers that’ll provide coverage in the event you’re affected by COVID-19, including:

Trip cancellation.

Trip delay.

Medical care/hospitalization.

Quarantine.

Several countries — like Thailand — actually require that you purchase this insurance before traveling.

If you already have an insurance provider in mind, take a look at their coverage options — and any available add-ons — to see if COVID-19 quarantines are covered.

» Learn more: The best travel insurance companies

If you aren’t already committed to an insurance company, sites such as SquareMouth, a NerdWallet partner, will allow you to search for and compare policy coverage from multiple companies at once.

You’ll be asked to provide a variety of information, such as your destination, dates of travel, age, and whether you’d like to be reimbursed for cancellations.

SquareMouth’s search also includes the ability to filter search results so you’ll only see policies with COVID-19 protections.

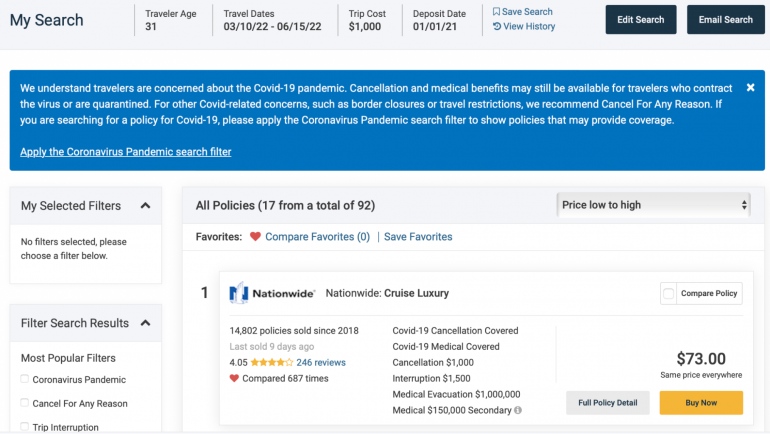

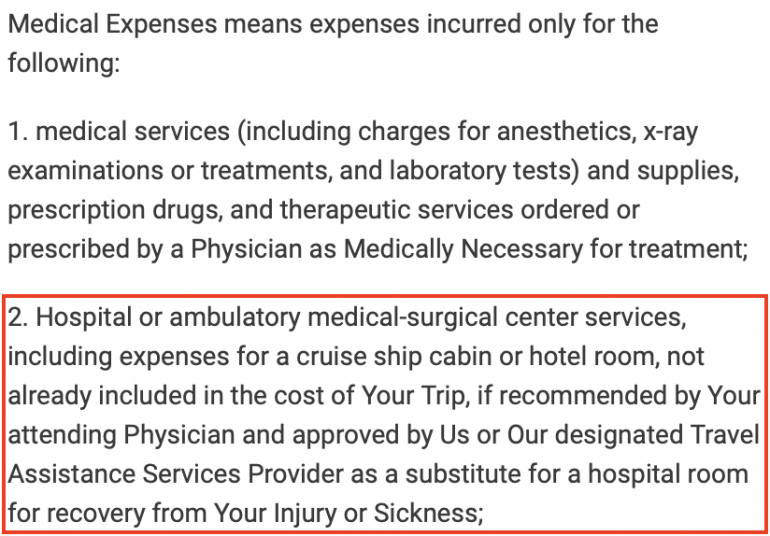

Once you’ve found a provider whose policy includes COVID-19 coverage, you’ll want to make certain that quarantine will also be reimbursed. Reading the policy in full will tell you; it can look something like this:

» Learn more: What to know before buying travel insurance

How much will COVID quarantine travel insurance cost?

The price of travel insurance is going to depend on many factors, including the length of your trip, your age, your destination and your coverage limits.

As you’d expect, the more comprehensive your coverage and the higher your limits, the more expensive your policy will be. The same is true if you’re heading out of the country for an extended period of time.

When comparing insurance policies, you’ll want to think about coverage limits as well as whether the insurance will provide primary or secondary coverage. Compare these factors against other policies to see which policy is the right fit for you.

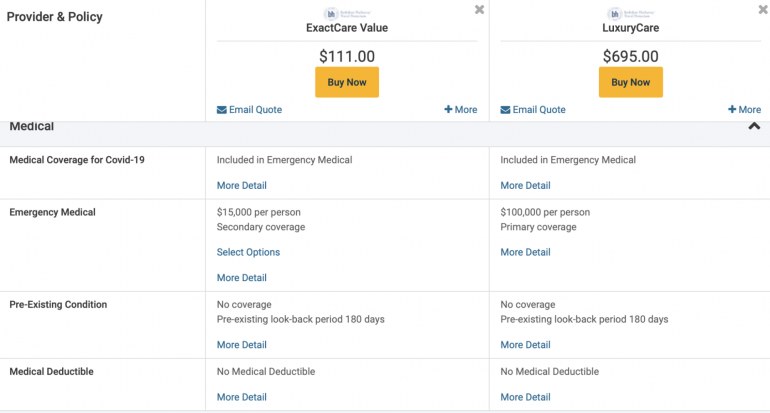

Here’s a comparison between two different policies. Although neither of these requires a deductible, one of these is secondary (it pays out after other insurance) and caps out at $15,000 per person in emergency medical expenses.

The other is primary (it pays out before other insurance policies) and covers up to $100,000 per person in emergency medical expenses:

While $15,000 may seem like a lot of money, remember that this total includes all doctor visits, tests and medications — in addition to the cost of your quarantine stay.

If you’re staying somewhere expensive, those costs can quickly add up.

Although some communities, such as New York City, may provide cost-free isolation accommodation, others will leave you to fend for yourself.

Even if staying in a moderately priced hotel, five to 10 days (or more) of isolation can quickly run into the thousands of dollars. You’ll want to be sure your insurance policy can cover this.

» Learn more: Does travel insurance cover COVID-19?

Final thoughts on travel insurance that covers COVID quarantine

Although the world is still trying to grapple with the COVID-19 pandemic, you may be looking to get out and travel again. Being protected in the event something happens can give you peace of mind when away from home.

This is especially true when it comes to mandatory COVID-19 quarantine, when costs can easily pile up. Acquiring travel insurance with COVID-19 quarantine protection can save you — and your wallet — in case of an emergency.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertisement

Supported by

What You Need to Know Now About Travel Insurance

A spate of new travel insurance policies have begun covering Covid-19, just as many international destinations begin to require it. Here’s what to look for.

- Share full article

By Elaine Glusac

When the pandemic struck, many travel insurance policies failed to cover Covid-19-related trip interruptions and cancellations, often because they excluded pandemics. But in the intervening months, the travel insurance industry has introduced a spate of new policies covering the disease just as many foreign destinations begin to require them.

“We’ve seen progress in that many plans will now treat Covid like any other unexpected sickness or illness,” said Stan Sandberg, a co-founder of the comparison website Travelinsurance.com . “If you have a trip and travel insurance and came down with Covid-19, which made it impossible to travel, that would fall under cancellation coverage as an unexpected illness that prevents you from traveling.”

Likewise, policies now including Covid-19 would cover holders in the event that a doctor diagnosed them with the virus while traveling under the trip interruption benefit.

Not all travel insurance excluded pandemics when the coronavirus began to spread early this year; Berkshire Hathaway Travel Protection was one exception. But the broader change partially arises from consumer demand, a better understanding of the virus — including mortality rates and hospital costs — and the industry’s eagerness for travel to resume.

“People who are traveling are more conscious of their risks and thinking about protecting themselves and their investment,” said Jeremy Murchland, the president of the travel insurer Seven Corners. The company launched policies that included Covid-19 coverage in June; they now account for more than 80 percent of sales.

But, like all insurance, the devil is in the details when it comes to understanding travel insurance, including what’s covered, destinations where it’s required, and the inevitable caveats, as follows.

How travel insurance covers Covid-19

The new Covid-inclusive insurance generally covers travelers from the day after purchase until their return home. During that period, if you become sick and a doctor determines you cannot travel (because of the virus or another illness), trip cancellation and trip interruption benefits would kick in.

These benefits vary by policy, but a search to insure a $2,000 weeklong trip to Costa Rica in December on Travelinsurance.com turned up a $69.75 Generali Global Assistance Standard policy with Covid-19 benefits that would be triggered if you, your host at your destination, a travel companion or a family member tested positive for the virus.

If this happened before your departure, the policy would cover your prepaid travel expenses. If you or your travel companion contracted Covid-19 during the trip and were diagnosed by a physician, it would reimburse prepaid arrangements, such as lodgings, and cover additional airfare to return home — once a doctor deems it safe to travel — up to $2,500. Should you be required to quarantine and can’t travel, travel delay coverage for lodging, meals and local transportation would pay up to $1,000. The policy also covers medical expenses for up to one year, even after you return home, up to $50,000 — though the policy also states that a holder would have to exhaust their own health insurance benefits before seeking coverage under the travel insurance plan.

Travelers should read these policies carefully to understand the benefits (for example, some rules vary by your state of residence), but brokers like TravelInsurance.com, InsureMyTrip and Squaremouth are making them easier to find through filters, F.A.Q.s and flags.

The new more comprehensive policies don’t necessarily cost more. On a Squaremouth search for insurance for two 40-year-olds on a two-week trip costing $5,000, the site turned up a variety of policies with or without coronavirus exclusions from $130 to $300, with no apparent premium for Covid-19 coverage.

Not every Covid-19-related expense is covered by many of these policies, including tests for the virus that many destinations require before arrival (those may be covered by private insurance).

Many policies include medical evacuation to a nearby facility, but won’t necessarily transport you home. For those concerned about treatment abroad, Medjet , a medical evacuation specialist, now offers Covid-19-related evacuations in the 48 contiguous United States, Canada, Mexico and the Caribbean that will transport you to the hospital of your choice in your home country (trip coverage starts at $99; annual memberships start at $189).

“Covid-19 requires special transport pods to protect the crew and others, which adds logistical issues,” said John Gobbels, the vice president and chief operating officer for Medjet.

In addition to the Medjet plan, travelers would need separate travel insurance with medical benefits to cover treatment costs and trip interruption.

Destination insurance requirements

Travelers aren’t the only ones worried about health. A growing list of countries are mandating medical coverage for Covid-19 as a prerequisite for visiting, often along with other measures like pre-trip virus testing and health screenings for symptoms on arrival.

Many Caribbean islands are among those requiring travel medical insurance, including Turks and Caicos and the Bahamas . St. Maarten requires health insurance coverage and strongly recommends additional travel insurance covering Covid-19.

Farther-flung countries also require policies that cover Covid-19, including French Polynesia and the Maldives .

Some destinations specify the required plan as a way to ensure travelers have the correct coverage and to expedite treatment. Aruba requires visitors to buy its Aruba Visitors Insurance, regardless of any other plans you may have.

“Insurance through a destination typically only covers Covid and infection while you’re there,” said Kasara Barto, a spokeswoman for Squaremouth.com. “If you catch Covid before, they don’t offer cancellation coverage. If you break a leg, the policy may only cover Covid medication. It varies by country.”

Costa Rica also requires insurance that includes an unusual benefit stipulating a policy cover up to $2,000 in expenses for a potential Covid-19 quarantine while in the country.

In response to the new requirement, which Costa Rica announced in October, insurers, including Trawick International , have begun introducing policies that meet the standard.

“It was a pretty quick and nimble reaction,” Mr. Sandberg of TravelInsurance.com said.

Normally, travel insurance varies by factors including the age of the traveler, destination, trip length and cost (most range from 4 to 10 percent of the trip cost). But some destinations are providing it at a flat fee, with most policies spelling out coverage limits and terms for emergency medical services, evacuation and costs associated with quarantines.

Jamaica, which will require insurance, but has not said when the new rule will go into effect, plans to charge $40 for each traveler. The Bahamas will include the insurance in the cost of its Travel Health Visa, an application that requires negative Covid-19 test results, which runs $40 to $60 depending on length of stay (free for children 10 and younger). The Turks and Caicos is offering a policy for $9.80 a day, and Costa Rica ’s policies, if purchased locally, cost roughly $10 a day.

Expect this list of destinations to grow. In January, the Spanish region of Andalusia plans to require travel medical insurance and is working on finding a provider to make it easy for travelers to buy it.

Gaps in travel insurance

Policies that cover Covid-19 as a medical event that may cause trip cancellation or disruption, or those that provide coverage for medical treatment and evacuation still don’t necessarily cover travelers who have a change of heart when they learn they will have to quarantine upon arrival, even if they don’t have the virus. Nor are policies necessarily tied to conditions on the ground, like a spike in infections, State Department travel warnings, a government travel ban or the cessation of flights to and from a destination.

For those events, there’s Cancel For Any Reason, or CFAR, an upgrade to plans that generally only returns 50 to 75 percent of your nonrefundable trip costs.

“Prior to the pandemic, we wouldn’t necessarily recommend CFAR because most of travelers’ concerns were covered by standard plans,” Ms. Barto of Squaremouth.com said. “It’s about 40 percent more expensive and we didn’t want travelers to pay for additional coverage.” Now, she added, there’s been a surge in interest in the upgrade, including in 22 percent of policies sold at the site since mid-March.

Industry experts predict some of these outstanding issues may work their way into policies of the future as they adapt to enduring realities, much as they did after 9/11 in covering travelers in case of terrorist events, which was not the norm before.

The pandemic “was unprecedented, but once it happened, the industry has been pretty quick to react and create coverage, and that’s in the spirit of how this industry is trying to define itself, to be one of those subtle but valuable assets,” Mr. Sandberg said. “Once the world opens back up, we expect travel insurance to be much more top of mind with travelers.”

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best COVID travel insurance of 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 4:00 a.m. UTC April 1, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

The best COVID travel insurance is Seven Corners’ Trip Protection Basic, according to our analysis of travel insurance plan rates and coverage options.

Editor’s note: This article contains updated information from a previously published story .

Seven Corners

Travel insured, usi affinity.

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 851 coverage details evaluated.

- 161 rates reviewed.

- 5 levels of fact-checking.

Top-rated travel insurance for COVID-19

Top-scoring plan

Medical limit per person, emergency evacuation limit per person, what you should know.

Seven Corners’ Trip Protection Basic plan is the most affordable of all COVID travel insurance plans we analyzed. This 5-star plan comes with basic coverage levels for emergency medical and medical evacuation.

If you’d like higher coverage limits, consider Seven Corners’ Trip Protection Choice plan which gets 4 stars in our rating. It’s more expensive but comes with $500,000 per person in primary medical coverage and $1 million per person in medical evacuation coverage.

Pros and cons

- A low cost option for COVID travel insurance.

- “Cancel for any reason” and “interruption for any reason” upgrades available.

- Average cost of a CFAR upgrade is lower than many competitors.

- Basic plan has secondary emergency medical coverage, not primary.

- No coverage for non-medical evacuation with Basic plan ($20,000 with Choice plan).

Top-scoring plans

Medical evacuation limit per person.

WorldTrips has two COVID travel insurance plans that tie with 4.5 stars: Atlas Journey Preferred and Atlas Journey Premier.

The Preferred plan is more affordable and provides $100,000 per person in emergency medical benefits as secondary coverage, with an optional upgrade to primary coverage. Atlas Journey Preferred is also the best travel insurance for cruises .

The more expensive Premier plan comes with $150,000 in travel medical insurance that’s primary coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan includes travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

- “Interruption for any reason” upgrade is only available with the Premier plan and only offers up to 50% reimbursement if you want to end your trip early.

Travel Insured’s Worldwide Trip Protector plan provides strong benefits overall for the price. It falls short of our emergency medical coverage benchmark but offers superior evacuation benefits at a competitive price.

- Emergency medical evacuation coverage is a superior $1 million.

- Excellent 75% “cancel for any reason” upgrade available.

- Very good 75% “interruption for any reason” upgrade available.

- Lost baggage and personal items coverage of $1,000 per person could be better.

- Relatively low emergency medical coverage of $100,000.