UponArriving

Citi Prestige Travel Insurance Benefits Review [2019]

There’s nothing worse than feeling like you have everything figured out when it comes to your travel plans only to be blindsided by some situation that you would have never expected to deal with. Not only is it stressful trying to adapt to a situation on-the-fly but many times it can be extremely costly, especially when you are dealing with nonrefundable travel expenses.

Luckily, there are cards like the Citi Prestige that offer substantial travel insurance benefits that can help you get coverage and mitigate your expenses. In this article, I will go over all of the Citi Prestige travel insurance benefits, such as trip cancellation, trip delay protection, baggage delay protection, and many more.

Table of Contents

What is Citi Prestige travel insurance?

The Citi Prestige offers an entire suite of travel insurance benefits, which come in the following forms:

Trip cancellation and interruption

Trip delay protection, baggage delay protection, lost baggage protection, roadside assistance.

- Travel in emergency assistance

- World wide travel accident insurance

Medical evacuation

Below, I will go into detail about each of these protections and tell you the key terms that you need to know about when it comes to things like coverage limits and what sort of expenses are eligible.

Eligibility

Before jumping into each of these benefits, it is good to know that for the most part the coverages going to apply to yourself into your family members.

Here is how family members are defined for these protections:

Family Members means Your children, spouse, fiancée, Domestic Partner and their children, including adopted children or step-children; legal guardians or wards; siblings or siblings-in-law; sons-in-law or daughters-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews. Domestic Partner means a committed relationship between two unmarried adults, in which the partners, (1) are each other’s sole Domestic Partner, (2) maintain a common residence, (3) share financial obligations if both are employed, (4) are not married or joined in a civil union to anyone else or are not the Domestic Partner of anyone else, and (5) are not blood related.

NOTE: You are still eligible for coverage on many trips for Your Family Member(s) even if you are not traveling.

Documentation

If you have never dealt with filing a claim for any type of travel insurance related benefits/expense, you need to know that you will be required to have documentation for just about everything.

Thus, it is very important to maintain and record every single thing that you can related to your claim.

If your bags are delayed, you should take and store every single little item/form that you are given to sign or review because chances are that is going to come in handy. If you are ever given a reference number, case number, or anything like that be sure to jot that down. Also, try to note the names of any reps that you every speak with and get their numbers and extensions if you can.

And make sure that you maintain all of your receipts and try to keep a record of all of the dates and times that everything happened. Taking time-stamped photos with your phone of everything is a great way to do this.

Having all of these records will make your life much easier when it comes time to file your claim. Trust me.

Also, pay attention to the filing deadlines. Typically, you will have about 60 days to file your claim so be sure to do that. Sometimes if you wait longer than that they will still allow you to file your claim, but I would not count on an exception.

This is a benefit that comes in handy whenever you have to cancel a trip or cut a trip short/extend a trip due to some unforeseen circumstances that qualify as a “Covered Reason.” These usually involve things like illnesses, personal situations, and travel and/or weather issues.

Here are some examples of some covered situations:

- You become sick and are advised by a doctor not to travel

- You are advised not to travel by a doctor due to the outbreak of some type of disease

- A family member has an injury or illness that is very serious

- You lose your job

- You’re summoned to jury duty

- Severe weather or natural disaster halts all travel to or from your destination for 24 hours

- You miss more than half of your trip due to two missed connections or delays

The key with this protection is that if you are not feeling well, you need to get a doctors note that you are not able to travel. Simply not feeling well but still being able to travel it will not allow the coverage to kick in.

How much is covered?

With this protection, you can get reimbursed for up to $5,000 per trip. Getting $5,000 worth of protection isn’t bad but note that you can get up to $10,000 worth of protection with the Sapphire Reserve.

In order to get coverage you will need to use your Citi Prestige card and pay for at least a portion of the trip with that card. Note that if you only pay a portion of your trip, you will only be reimbursed up to that amount.

You will be covered for a lot of different type of expenses which could include:

- The value of unused transportation tickets

- Change fees

- Costs to get the traveler home as long as the arrangements are with in the same class of service as the original booking

- Costs to get the traveler to rejoin the trip that has been interrupted as long as the arrangements are within the same class of service as the original booking

- Reasonable expenses for similar accommodations and meals that are incurred because of an interruption or reasonable extension of the trip

You will need to file a claim within 60 days of cancellation or interruption.

Trip delayed protection kicks in whenever a common carrier is delayed.

Common Carrier means a vehicle that’s licensed to transport any public passenger who pays a fare or buys a ticket, and is available on a regular schedule. Examples include planes, trains, ferries and cruise ships, but does not include taxis, car service, rental car and rideshare service.

If a common carrier is delayed for at least six hours you can get reimbursed for up to $500 per traveler, per trip.

This benefit should cover the following expenses:

- Ground transportation excluding car rentals

- Personal or business necessities such as toiletries

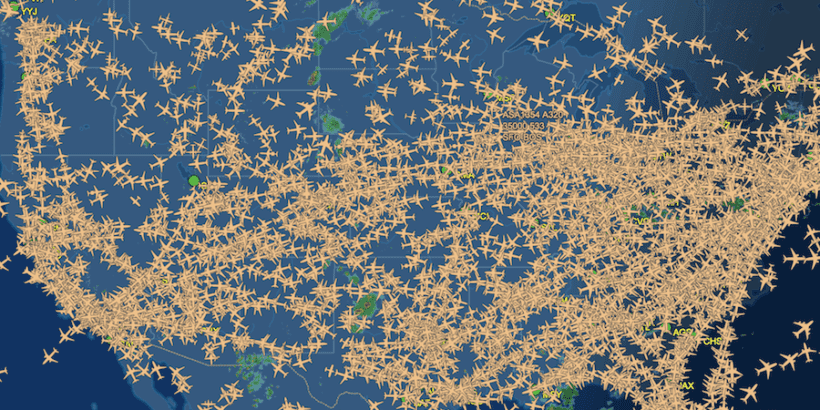

This is a great benefit because many airlines are not required to provide you with any type of compensation if their flights are delayed and the reason for the delay is not their fault. So for example if bad weather causes a flight to be delayed eight or 10 hours the airline is often not required to provide you with anything ( see infographic ). So with insurance like this you are covered in those scenarios.

Also even if the delay is the airline’s fault and they offer to provide you with some type of benefits, you may only get a stay covered at a nearby contract hotel so getting $500 worth of coverage per traveler can be a much better and more comfortable scenario.

You will need to file a claim with in 60 days of the delay.

If your checked baggage with a common carrier is delayed six hours or more you can be covered for up to $500 per per trip. This protection used to kick in after only three hours of delay, which was industry-leading. So it is a little bit of a bummer to see it back at six hours but six hours is still very good for this type of protection.

What is covered?

This benefit covers personal and business items that the traveler may need when their baggage is delayed. This includes things like toiletries and a change of clothes.

The terms exclude any item that is not contained in the checked baggage. This means that you want to be careful when shopping for new clothes because if you go out and purchase something that you did not already happen your checked baggage that is technically not covered.

Something else that is interesting about this benefit is that it gives you $500 per trip and is not based on a set amount per day. Other cards might limit you to something like $100 per per day so this is actually one of the more liberal policies.

You will need to file a claim within 60 days of the baggage being delayed.

If your baggage is lost, stolen or damaged by the common carrier while on a trip you might be refunded for the purchase price of the missing items or the cost to repair or replace the damaged items whichever is less.

You are covered for up to $3,000 per traveler, per trip. Or you might be covered up to $10,000 in total for all travelers.

There are certain items that are not included in this coverage and these include the following:

- Antique items

- Collector items

- Rare precious metals

- Stamps and coins

Note that coverage does not apply whenever the item is seized by customs or by a government agency.

You will need to file your claim within 60 days of the bags being lost, stolen, or damaged.

Roadside assistance is available 24/7 whenever you have trouble and are on the road in any of the 50 United States or in certain territories.

You can get the following types of services:

- Towing and winching (You will be responsible for expenses associated with the towing beyond 10 miles)

- Jump starts

- Flat tire changes

- Lockout service

- Delivery of up to 2 gallons of fuel

This is very similar to the roadside protections offered by other cards such as American Express cards .

In order to use this benefit you will need to make sure that you are with the vehicle and that you are in a regularly travelled area. Basically, if you are off road somewhere that is not easily accessible you probably won’t get coverage.

The phone number for this is: 1-866-506-5222.

Travel and emergency assistance

If you need assistance before or during a trip you can find services and referrals worldwide in case of emergencies or help with travel requirements with complications. This is the exact type of benefit that you want whenever you are in a country and you don’t speak their language but you need immediate assistance to resolve something.

Here are the type of services provided:

- Around-the-clock access to emergency travel arrangements

- Emergency transfer of cash from a family member friend or business account

- Information on travel requirements such as visas

- Help locating the loss travel items such as lost luggage

- Monitoring of threats

- Referrals to local doctors dentists or other services (You can also have these dispatch to your location)

- Assistance with prescriptions

- Coordination with doctors or nurses in the US you can consult with the local medical professionals to help monitor you

Just note that the cost of utilizing these professionals is not covered and will be your responsibility. This benefit basically just helps you get in connection with those who can help you.

I wish I had utilized a benefit like this a few years ago when I got very sick in Iceland. We struggled to find any medications that we could understand and I probably could have used a service like this to find something to take and to find a doctor to see. So trust me having a service like this can be a life-saver.

Worldwide travel accident insurance

Hopefully you or anyone that you love will never need this but this is the type of coverage that applies if you or a loved one dies in a tragic accident or gets seriously injured. You can get coverage for up to $1 million per person depending on the type of injury you had .

You need to file a claim with in 60 days of the accident.

If you experience a serious medical emergency and need help getting home or to the right medical facility you can get coverage up to $100,000.

This benefit will ply in the following situations:

- A traveler becomes seriously sick, injured or even dies while traveling wanted trip

- A doctor certifies that the traveler has an illness or injury that is severe enough to require emergency medical evacuation

- In the process of the medical evacuation, the traveler is transported to the most direct and cost-effective route

- The trip is less than 60 consecutive days long

And here are the type of expenses that you can get covered:

- Transportation from the place where the traveler became sick or injured to the nearest medical facility where they can receive treatment

- Transportation to the travelers home or to an appropriate medical facility near their home. This is if they need further treatment after being treated at a local medical facility.

- Related medical services and supplies needed while transporting the traveler

- In the case of death transportation to return the travelers remains to their home

The Citi Prestige has some quality travel insurance benefits offered for any premium card. The biggest limitations to note is that these apply to yourself and to family members so if you have non-family members traveling with you don’t get coverage for them. However, if you’re traveling with family then you can take advantage of some solid protections. Just remember to maintain all of the documents needed to support your claims.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Overview

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- • Credit card strategy

- • Credit card comparisons

Bankrate expert Garrett Yarbrough strives to make navigating credit cards and credit building smooth sailing for his readers. After regularly featuring his credit card, credit monitoring and identity theft analysis on NextAdvisor.com, he joined the CreditCards.com and Bankrate teams as a staff writer to develop product reviews and comprehensive credit card guides focused on cash back, credit scores and card offers.

- • Rewards credit cards

- • Travel credit cards

Nouri Zarrugh is a writer and editor for CreditCards.com and Bankrate, focusing on product news, guides and reviews. His areas of expertise include credit card strategy, rewards programs, point valuation and credit scores, and his stories on building credit have been cited by Mic.com, LifeHacker, People.com and more. Through his thorough card reviews and product comparisons, Nouri strives to demystify personal finance topics and credit card terms and conditions to help readers save money and protect their credit score.

Antonio Ruiz-Camacho is the former senior director of content for CreditCards.com and Bankrate Credit Cards . He has more than 20 years of international experience leading content teams, focused on consumer advice, technology and immigration.

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Citi Prestige® Credit Card

*The information about the Citi Prestige® Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Intro offer

Earn 50,000 bonus points after spending $4,000 in purchases within the first 3 months of account opening

Offer valuation

Offer valuation is not available for this credit card.

Rewards rate

Earn 5 points per $1 on Air travel Earn 5 points per $1 on Restaurants Earn 3 points per $1 on Hotels Earn 3 points per $1 on Cruise Lines Earn 1 point per $1 on all other purchases

Regular APR

On This Page

- Pros and cons

- Current offer details

- Value of rewards

- Key cardholder perks

- Understanding the fees

- Expert experience

- Citi Prestige® Card vs. other premium travel cards

- Is this card worth getting?

Citi is an advertising partner.

Citi Prestige® Card Overview

The Citi Prestige® Card is a premium travel credit card offering select luxury travel perks for frequent flyers. While its $495 annual fee is not for the fainthearted, regular travelers can make their money back easily by taking advantage of Citi Prestige benefits like a complimentary fourth-night hotel stay and an annual $250 travel credit. The card has a generous rewards rate too, so you can accelerate your ThankYou points balance and get more for your spending.

What are the pros and cons?

5X points on air travel and restaurant purchases; 3x points on hotels and cruise line purchases; 1X point on all other purchases

Get the fourth night free when booking four consecutive nights or more at any hotel through Citi ThankYou.

$250 annual travel credit, which also includes supermarket and restaurant purchases through December 2021

up $100 application fee credit for Global Entry to TSA PreCheck every five years

Priority Pass Select VIP airport lounge access

Pairs well with other no annual fee Citi rewards cards

$495 annual fee

ThankYou points are only worth up to 1 cent each unless transferred to travel partner

Fewer travel benefits and protections compared to other similarly-priced travel cards

No intro purchase or balance transfer APR

A deeper look into the current card offer

Quick highlights.

- Rewards rate : 5X points on air travel and restaurant purchases; 3x points on hotels and cruise line purchases; 1X point on all other purchases

- Welcome offer : 50,000 bonus ThankYou points after spending $4,000 within three months of account opening

- Annual fee : $495

- Purchase intro APR : None

- Balance transfer intro APR : None

- Regular APR : 16.99 percent–23.99 percent variable

Current welcome offer

The Citi Prestige comes with a respectable 50,000 ThankYou points if you spend at least $4,000 in the first three months. This sign-up bonus is redeemable for $500 in travel if you book through the ThankYou Travel center—effectively offsetting your entire annual fee in the first year.

While this is a solid bonus, Chase Sapphire Reserve® has a great welcome offer for qualifying cardholders. But 60,000 Chase points (after you spend $4,000 on purchases in the first three months from account opening) is worth $900 in travel—if redeemed for travel through Chase Travel℠.

The Citi Prestige earns Citi ThankYou points , which provide a solid 1:1 value toward travel through Citi. Luckily, there is a good variety of redemption options, but it’s hard to squeeze extra value out of your points without utilizing Citi travel transfer partners. Waiting till the right moment is no problem, though, since your points won’t expire as long as your account stays open. However, points that are shared with another account expire in 90 days and purchased points must be used within a year.

Earning rewards

Unless you bank with Citi , the only way to earn substantial rewards is through spending with your credit card. Your biggest bonus category earns 5X points on air travel and at restaurants (including cafes, bars, lounges and fast-food restaurants—which isn’t always the case), but you’ll also rake in 3X points at hotels and on cruise lines. Naturally, you’ll also earn 1X points on all other purchases.

If you plan to maximize your rewards for travel, this 5X rewards rate makes the Citi Prestige one of the best cards for restaurants and airlines .

Redeeming rewards

Rewards redemption is where Citi Prestige comes into its own. You can use points to cover recent travel purchases (such as flights, hotels and car rentals) or eligible online bills, redeem them for a gift card, pay for purchases at participating retailers, receive them as cash back, donate them to charity or even share them with another person who has a ThankYou account. You may also be able to use points for payments up to $1,000 toward qualifying Citi credit lines, like a mortgage or student loan.

What’s particularly special about the Citi Prestige is that points earned on this card (and the Citi Premier® Card ) can be transferred to a partner airline loyalty program at a transfer ratio of 1:1. Points transfer at this ratio is not available with other no annual fee Citi credit cards .

How much are points worth?

Unlike other reward programs like Chase Ultimate Rewards, you can’t redeem your ThankYou points for a higher value toward travel. The best value you can get from your points through Citi is 1 cent apiece toward booking travel, redeeming for gift cards or contributing to your Citi home mortgage or student loan balance.

Other redemption options typically bring less than a 1:1 value, but your best opportunity to wring more value from your points is to transfer them to a partner Citi travel loyalty program. According to our latest points and mile valuations , ThankYou points can be worth up around 1.9 cents with the right transfer partner.

Outside the pack-in World Elite Mastercard benefits , the Citi Prestige carries the best additional features of any Citi card. If you travel regularly, these perks will elevate your travel experience and more than justify the hefty annual fee.

Complimentary hotel night

The Citi Prestige’s complimentary fourth-night hotel stay offer is by far the most popular benefit. Simply book a hotel of your choice through Citi’s online portal for four consecutive nights and you’ll only have to pay for three (excluding taxes and fees). What’s more, you can claim this benefit up to two times per calendar year.

Up to $250 annual travel credit

Every year, you’ll automatically receive up to $250 in statement credits toward eligible purchases that fall within the “travel purchases” category. Citi automatically identifies each of these purchases on your card and posts a credit one to two billing cycles later. Qualifying personal travel expenses include purchases from:

- Travel agencies, travel aggregators and tour operators

- Commuter transportation, including commuter railways, subways and bus lines

- Taxis, car services and limousines

- Bridge and road tolls

- Paid parking lots and garages

- Cruise lines

No worries if you’re hesitant to travel at the moment, your travel credit will also cover supermarket and restaurant purchases through December 2021.

Other travel perks

- Priority Pass Select airport lounge access. You and up to two guests can access hundreds of Priority Pass Select VIP lounges worldwide.

- Global Entry or TSA PreCheck credit. Get up to $100 back in fee credit for Global Entry or TSA PreCheck applications every five years.

- Concierge service. Cardholders are entitled to Citi’s Concierge service , which gives you access to a personal assistant who can help with travel planning, shopping, restaurant reservations and more.

Annual Citigold banking relationship bonus credits

This valuable perk is a bit under-the-radar but can make a difference in offsetting your annual fee each year. By being a Citi Prestige cardmember with a qualifying Citigold wealth management account, you can earn a $145 statement credit within three billing cycles of your assessed $495 annual fee being charged to your card. If you happen to have one or more authorized users, you’ll also receive a $25 statement credit for each $75 authorized user fee on your account.

Rates and Fees

The Citi Prestige has an annual fee of $495 and a further $75 for an additional authorized user, but there are no foreign transaction fees. Late payment triggers a fee of up to $40, and a penalty APR of 29.99 percent variable may apply.

In line with other travel rewards credit cards, there are no introductory APR periods with the Citi Prestige. However, if you need to transfer your balance with Citi , the balance transfer fee is either $5 or 3 percent of the transfer amount (whichever is greater). Both your purchases and balance transfers will be subject to the ongoing 16.99 percent to 23.99 percent variable APR, which is on par with other elite travel cards .

We tried it: Here’s what our experts say

Even through the benefits Citi Prestige Card have significantly decreased since she opened her account, Katie Genter , a travel rewards specialist at The Points Guy , is still keeping her card:

My Citi Prestige is perhaps my most frequently used card due to its five points per dollar earning rate at restaurants worldwide. Plus, it often has good Citi Merchant Offers. I’ll also occasionally find an independant hotel I want to book through the Citi Travel portal and use one of my two annual fourth night free benefits. I’m not getting nearly the value I used to get from my card, but I’m not ready to close it yet – especially since it’s no longer available. — Katie Genter, Senior Writer, The Points Guy

How the Citi Prestige Credit compares to other premium travel credit cards

The Citi Prestige’s main rivals are the Chase Sapphire Reserve and The Platinum Card® from American Express . Both of these cards are loaded with more travel benefits, especially travel and purchase protections but have a higher annual fees. Chase Sapphire Reserve offers a seemingly lower 3X rate on travel and dining (after earning your $300 travel credit), but you’ll get a stronger $300 annual travel credit and 50 percent more value when redeeming points for travel through Chase Travel℠.

The Platinum Card, on the other hand, offers 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel, plus a rich portfolio of extra benefits. The Platinum Card stands alongside the Sapphire Reserve as one of the best credit cards for travel insurance and delivers perks like complimentary Marriott Bonvoy and Hilton Honors elite gold status, annual credits for merchants like Uber (terms apply) and Saks Fifth Avenue and top-tier airport lounge access worldwide.

Citi’s Prestige Card may have a lower annual fee and wider category coverage, but it could be hard to stack up to these rivals’ perks and higher potential point value (Bankrate’s latest point valuation rates both Chase Ultimate Rewards points and Amex Membership Rewards points at around 2 cents apiece). However, the Citi Prestige may be the best choice hands down if you already bank with Citi or are considering other Citi rewards cards. The regular ThankYou points from eligible Citi banking activity and the partial annual fee credits from Citigold can pad out your rewards balance. Citi’s no annual fee rewards cards also compliment the Prestige card incredibly well, perhaps making the most cost-effective issuer card combinations to maximize rewards .

Recommended Credit Score

Chase Sapphire Reserve®

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Earn 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠. Earn 5x total points on flights through Chase Travel℠. Earn 3x points on other travel and dining. Earn 1 point per $1 spent on all other purchases.

The Platinum Card® from American Express

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership.

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year. Earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

Best cards to pair with Citi Prestige

To fast track your ThankYou points, you could pair this card with the no annual fee Citi Double Cash® Card . While you’ll earn up to 2 percent unlimited cash back on purchases — 1 percent when you buy and 1 percent when you pay — you can convert cash back rewards into ThankYou points at a 1:1 ratio and pool them with your Citi Prestige. The Double Cash is already one of the best flat-rate cash back cards on the market, but it can seriously buff up your rewards income by doubling the points on purchases that fall outside your Prestige card’s bonus categories.

Citi’s rewards card is also amazing for earning extra ThankYou points on everyday purchases outside these categories. The Citi Custom Cash® Card has a novel approach to cash back: earn 5 percent cash back on your top spending category per billing cycle (up to $500, then 1 percent back). This bonus rate can apply to one of 10 categories that the Citi Prestige doesn’t cover, including common travel expenses like gas stations, select transit, live entertainment, grocery stores and more. The best part is that you actually earn ThankYou Points that can then be converted to cash back if you’d like. You can squeeze even more value from your purchases by pooling these points with your Citi Prestige and transferring them to a travel partner, or — if you’re not traveling soon — funnel your Prestige card’s points through the Custom Cash for a higher cash back redemption rate.

Bankrate’s Take — Is Citi Prestige worth it?

If your life or work involves regular travel, then you can no doubt get a lot of value from the Citi Prestige Card. Once you take benefits into account, like the $250 yearly travel credit and the biannual complimentary fourth night free for eligible hotel stays, the Citi Prestige’s annual fee is pretty easy to recoup—especially if you already have a Citigold bank account or plan on getting another Citi card.

While the Citi Prestige has fewer benefits compared to other issuers’ flagship travel cards, its issuer-centric focus elevates the Prestige card’s comparative ongoing value if you’re a loyal Citi customer.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

The information about the Citi Prestige® Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Capital One SavorOne Cash Rewards Credit Card Review

Chase Freedom Unlimited® Review

Citi Custom Cash® Card Review

Discover it® Cash Back Review

Bank of America® Customized Cash Rewards credit card Review

Upgrade Cash Rewards Elite Visa® Review

Prime Visa Review

Discover it® Chrome Review

Bank of America® Unlimited Cash Rewards credit card Review

Capital One Quicksilver Cash Rewards Credit Card Review

Find your odds with no impact to your credit score

Apply for a credit card with confidence.

Apply for a credit card with confidence. When you find your odds, you get:

A personalized list of cards ranked by likelihood of approval

Special card offers from top issuers in our network

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score

Tell us your name to get started

This lets us verify your credit profile

Your personal information and data are protected with 256-bit encryption.

Your personal information is secure

We use your info to run a soft credit pull which won’t impact your credit score

Here’s how we protect your safety and privacy. That means:

We only use your info to run a soft credit pull, which won’t impact your credit score

We’ll never send mail to your home

All of your personal information is protected with 256-bit encryption

What’s your mailing address?

This helps us verify your credit profile.

Why we're asking

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

What’s your employment status?

What's your estimated annual income?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Increase non-taxbile income or benefits included by 25%.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio (DTI) which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? Your DTI gives us a clearer picture of your credit profile, which allows us to evaluate which cards you’re likely to get approved for more accurately.

Monthly rent or mortgage payment

Put $0 if you currently don’t have a rent or mortgage payment.

Almost done!

We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by 256-bit encryption.

A soft credit pull will not affect your credit score.

Enter the last 4 digits of your Social Security number

Last step! Once you enter your email and agree to terms:

Your approval odds will be calculated

A personalized list of cards ranked by order of approval will appear

Your odds will display on each card tile

Enter your email address

Enter your email address to activate your approval odds and get updates about future card offers.

By clicking “Agree and See Results” you acknowledge receipt of our Privacy Notice , Privacy Policy and agree to our Terms of Use . By agreeing, you are giving your written instruction to Bankrate and our lending partners (together, “Us”) to obtain a soft pull of your credit report to determine whether you may be eligible ...show more for certain targeted offers, including pre-qualified and pre-approved offers (your "CardMatch offers"), as well as display what we estimate your approval odds to be for participating offers (“Approval Odds”). You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less

We’re sending you to the issuer’s site to complete your application.

Just a second... We’re matching you with personalized offers

Hold tight, we’re loading your personalized results page, sorry, we couldn't access your approval odds..

This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Check your approval odds before you apply

Answer a few questions and see if you’re likely to be approved in less than a minute—with no impact to your credit score.

Check your approval odds on similar cards before you apply

Before you apply...

See which cards you’re likely to be approved for

In less than 60 seconds, answer some questions and we’ll estimate your odds of approval on eligible cards. You get:

A personalized list of cards ranked by likelihood of approval.

Access to special card offers from top issuers in our network.

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score.

But don’t worry! You can check out other cards that are a better fit.

Who is covered by your credit card travel insurance?

Update: Some offers mentioned below are no longer available. View the current offers here .

Reader Questions are answered twice a week by TPG Senior Points & Miles Contributor Ethan Steinberg .

No matter how carefully you plan your vacation, things like bad weather or mechanical delays can throw your trip off track without any warning. That's why it's important to consider getting travel insurance to protect your trip, and thankfully many of the top travel rewards cards on the market include various travel protections automatically when you use your card to pay for your trip. TPG reader Natalie wants to know who is covered by her travel insurance policy ...

[pullquote source="TPG READER NATALIE"]Everything I've read about my Chase Sapphire credit card travel protections mentions cardholder and immediate family — does that include my parents?[/pullquote]

Natalie is smart to be planning ahead and trying to understand her card benefits before she travels. I'll admit that on more than one occasion I've made costly mistakes because I didn't understand who and what was covered by my credit card insurance policy. Now it's important to note that the specific terms will vary from policy to policy and between card issuers.

In this post I'll take a look at the travel protections that come with some popular rewards cards, but if you have a card that isn't on this list or if you bought your insurance through a third-party provider you should check with them directly to avoid any confusion.

Chase offers trip delay, cancellation and interruption insurance on a number of its credit cards, including the Chase Sapphire Preferred Card and Chase Sapphire Reserve. The exact terms of the policy, including when they kick and how much coverage they carry, vary by card, but the list of eligible parties does not. Depending on which travel protection you're using, here's who your Chase cards cover:

- Trip delay reimbursement: Cardholder, cardholder's spouse or domestic partner, dependent children under age 22.

- Trip cancellation/interruption insurance: Cardholder, immediate family members (even if the cardholder is not traveling).

Chase defines immediate family as "your Spouse or Domestic Partner and their children, including adopted children or step-children; legal guardians or wards; siblings or siblings-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews."

In answer to Natalie's question, if she paid for even part of her eligible trip with her Chase Sapphire Preferred, her parents would be covered as immediate family members for trip cancellation/interruption insurance, but not for trip delay reimbursement.

Amex recently announced that it would be adding trip delay and cancellation coverage to certain premium cards, effective Jan. 1, 2020:

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- American Express Corporate Platinum Card

- The Hilton Honors American Express Aspire Card

- Delta Reserve® Credit Card from American Express

- Delta Reserve for Business Credit Card

- Marriott Bonvoy Brilliant™ American Express® Card

The information for the Hilton Aspire Amex card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Because this new feature isn't live yet there isn't any information on the Amex website about it. I spoke to an agent on the phone who said that she also couldn't find any information on her end, and we'll have to wait until closer to the end of the year to see who exactly Amex will extend coverage to.

Citi took a lot of heat this year when it announced that it was dropping nearly all travel benefits from its cards , including the flagship Citi Prestige® Card. While that card still continues to earn 5x points on airfare purchases, travelers should strongly consider paying with a card that offers them better coverage instead.

Bottom line

Chase is generous extending its trip cancellation and interruption insurance to the cardholder's immediate family, so Natalie's parents would be covered assuming their delay was for an eligible reason. Meanwhile they wouldn't receive any trip delay coverage, as that is limited to the cardholder, their spouse or domestic partner and dependent children under age 22. In terms of other issuers, we'll have to wait and see how Amex chooses to define its trip delay and cancellation coverage when it adds those benefits to some of its cards on Jan. 1, 2020.

Thanks for the question, Natalie, and if you're a TPG reader who'd like us to answer a question of your own, tweet us at @thepointsguy , message us on Facebook or email us at [email protected] .

The Citi Prestige has made its $250 annual travel credit more flexible for another year

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Citi Prestige® Card, Citi Premier® Card. The details for these products have not been reviewed or provided by the issuer.

- The Citi Prestige® Card is a premium travel credit card that is no longer available to new applicants.

- The card comes with up to $250 in annual travel credit.

- Through 2022, Citi has again expanded this credit to include supermarkets and restaurants.

- Read Insider's guide to the best travel rewards credit cards .

The Citi Prestige® Card (not available to new applicants) was once the most enticing, benefits-packed premium credit card on the market. It had strong travel perks, unmatched travel insurance , and unique features like free golf and American Airlines Admirals Club lounge access.

The card has since eliminated the majority of these benefits. But one feature that remains unchanged — and has in fact improved — is its annual $250 travel credit .

Read more: Citi Prestige Card review

In the wake of coronavirus, Citi has attempted to keep its Citi Prestige cardholders from canceling by tweaking its benefits. It's a travel credit card, after all, and its price tag of $495 for the primary cardmember is difficult to justify if you're not traveling.

For the third consecutive year, Citi is expanding the yearly travel credit worth up to $250 to include supermarket and restaurant spending. Here's what you need to know.

Citi Prestige $250 travel credit expanded to cover more than just travel

Normally, the Citi Prestige travel credit would automatically reimburse you for expenses such as airfare, hotels, rental cars, cruises, etc. But it will also trigger for restaurant (including takeout) and supermarket purchases between January 1 and December 31, 2022.

If you spend $250 per year on dining or groceries, this credit effectively lowers your annual fee to $245 per year.

Read more: The best credit cards for buying groceries in 2022

Here are the excluded purchases listed by Citi.

Supermarket purchases that won't count are those made with:

- General merchandise/discount superstores

- Freezer/meat locker provisioners

- Dairy product stores

- Miscellaneous food/convenience stores

- Warehouse/wholesale clubs

- Specialty vendors

- Candy/nut/confectionery stores

- Meal kit delivery services

Online supermarkets that don't code as "supermarket" on your statement will also not count.

Restaurant purchases that do not qualify are:

- Restaurants located inside other establishments (such as department stores, warehouse clubs, etc.)

That looks like an intimidating list, but in practice, your credit should work where you think it will. I've still got the Citi Prestige and my credit has always activated on the purchases with which I intended to use it.

Read more: The best Citi credit cards in 2022

Remember, this credit is awarded per calendar year , not anniversary year — so your credit has been replenished as of January 1. Here's to a week or two of free groceries and restaurants!

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

Watch: Why the Chase Cards CEO is not worried about the hundreds of millions lost last quarter due to credit card rewards

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Benefits I Wish Came With My Citi Prestige Card

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Citi Prestige® Card may not be as frequently covered as other premium rewards credit cards, but it definitely has its merits. This card is loaded with generous welcome and category bonuses, a $250 annual travel statement credit and Priority Pass Select membership, to name a few great perks.

The card offers creative travel benefits and an awesome rewards program, but there are a few perks that would really round it out. Here are five benefits I wish came with my Citi Prestige® Card :

» Learn more: Citi Prestige: Premium perks at a plump price

Travel and purchase protection

Citi removed most travel and purchase protections in September, which makes charging purchases to the Citi Prestige® Card difficult to justify sometimes. This is especially true since other credit cards like the Chase Sapphire Reserve® still offer trip cancellation and interruption insurance (in addition to bonus points on travel). It’s unlikely Citi will undo this decision in the very near future, but here's hoping it will restore some of these benefits.

» Learn more: Chase Sapphire Reserve review: A first-class premium travel card

Lower annual fee

At $495 , the annual fee on the Citi Prestige® Card is quite high. For a card that competes with the likes of the Chase Sapphire Reserve® , the annual fee feels a little too high — especially since the card lacks valuable travel and purchase protections. Citi seems unlikely to drop the annual fee after it already increased it, but hopefully in the future there will be more protections in place to make this fee easier to justify for some cardholders.

Added perks for hotel bookings

The Citi Prestige® Card ’s fourth-night-free benefit on hotel bookings is an awesome perk. Basically, it amounts to 25% off the base rate on four-night room rates, which (even though you can only use it twice a year) is pretty substantial. You do have to book through CitiThankYou.com to get this benefit, which isn’t bad — but we wish Citi would throw in some perks like AmEx Travel does through its Fine Hotels & Resorts and Hotel Collection programs.

Perks offered through these programs include complimentary breakfast, hotel credits, room upgrades and more. Since Citi already has a booking site, it would be nice if they negotiated similar benefits with hotels to sweeten the deal.

Auto collision damage waiver

Auto collision damage waiver is offered by few cards, and it can be very useful when you’re renting a car. Many rewards credit cards offer rental car coverage that is secondary, meaning it only kicks in if your own insurance company denies coverage. The Chase Sapphire Reserve® is one of the few cards that offers primary rental car coverage. As a competitor, it would be nice if the Citi Prestige® Card offered it, too — especially considering it did away with so many of the other travel protections.

The bottom line

The Citi Prestige® Card is a solid card overall, but there is always room for improvement. If Citi hopes to remain competitive with Chase and American Express, it’s going to have to improve its premium card benefits. Here’s hoping to positive changes coming in 2020.

In the meantime, the card does offer a pretty big welcome bonus if you’re looking to stock up on Citi ThankYou points: Earn 50,000 bonus points after spending $4,000 in purchases within the first 3 months of account opening*

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

Planning a trip? Check out these articles for more inspiration and advice: Find the best travel credit card for you Citi ThankYou points: How to earn and use them Best Citi ThankYou point redemptions

On a similar note...

Citi Prestige Travel Credit Card 2024 Review

Update: This card is no longer available to new customers.

If you spend a lot of time traveling, a travel rewards credit card can be your best friend .

Depending on the card, you could earn miles or points towards free travel, plus cash in on things like priority boarding or free checked bags.

The Citi Prestige Card is one to consider if you’re looking for a card that’s packed with premium travel features .

In addition to earning rewards on travel, dining, and everyday purchases, you can take advantage of things like an annual air travel credit, concierge service, and complimentary nights at the hotel of your choice.

This card has no foreign transaction fee, but it does come with a $495 annual fee .

Our review of the Citi Prestige Card is a must-read if you need a little help deciding whether you should cough up the cash for this card.

Citi Prestige Travel Card Pros & Cons

- Good for people who want a card packed with premium travel features

- Annual $250 airline travel credit every year

- Get a free 4th night in a participating hotel

- Complimentary airport lounge access

- Points can be redeemed for travel, shopping, concert tickets, and more

- $450 annual fee

- If you don't travel frequently, card may not be worth annual fee

- Need excellent credit to get approved

Exceptional Travel Perks Come with a Price Tag

The Citi Prestige Card is a premium travel rewards card. We’ll get to how you can earn points in a moment.

First, we wanted to highlight all of the various travel benefits that make this card a true standout.

Annual Travel Credit

Right off the bat, you get a $250 travel credit per year . This credit will cover the cost of travel-related purchases, including airfare, baggage fees, seating class upgrades, in-flight purchases, hotels, car rentals, parking, ground transportation and more.

You use the card to pay for it as you normally would and the credit will be applied automatically to eligible travel purchases.

You will still earn rewards on this travel spending.

Tip: If you have trouble taking full advantage of this credit, you can buy gift cards through the airline . Save it and use it for later as you wish.

Complimentary 4th Night Stay

If hotel stays are a regular part of your travel routine, the Citi Prestige Card can make hotel bill less expensive.

When you book a stay of four nights or more through the Citi Prestige Concierge, your fourth night is instantly free.

The complimentary night is available at your choice of hotels so you can go low-key with a budget room or live it up in a luxury suite.

How it works is you'll receive a statement credit for the 4th night .

There is an annual limit on this perk. You can redeem this perk only twice per calendar year.

Global Entry Application Fee Credit

Global Entry membership can save you time at the airport if you’re traveling back to the U.S. from an international destination.

To apply, you’ll need to pay a $100 application fee but you can recoup that with your Citi Prestige Card.

If you use your card to pay the fee, Citi will issue you a $100 statement credit against the cost.

At airports, members just have to show their passports, scan their fingerprints, and turn in their customs declaration.

Complimentary Airport Lounge Access

When you’re stuck in the airport waiting to catch a flight, being able to relax in the lounge can make passing the time easier.

Priority Pass Select membership is included with your card , which means you can visit more than 900 VIP lounges around the world.

Lounge access is free for you and up to two guests. For each additional guest, there’s a $27 fee that’s charged on every lounge visit.

Citi Concierge Service

The Citi Prestige Concierge service can make your life a little easier if you need help making travel arrangements or you just need to find a great restaurant for dinner .

Concierge specialists are standing by 24/7 to answer your questions and guide you to where you want to go.

Discounts on Travel

When you’d rather cruise than fly or you’re looking to book an all-inclusive vacation, you don’t have to pay full price.

The Citi Prestige Card offers exclusive discounts on luxury tours, vacation packages, ocean cruises, and river cruises.

Earn Rewards On Every Purchase

As if the travel extras weren’t enough, the Citi Prestige Card comes with a generous rewards program.

You’ll earn:

- 5 ThankYou points per dollar on air travel and restaurants

- 3 ThankYou points per dollar on hotels and cruise lines

- 2 ThankYou points per dollar on entertainment (to be removed 8/31/19)

- 1 ThankYou point per dollar on all other purchases

Your points aren’t capped and they don’t expire as long as your account is open and in good standing.

To top if off, this card has a sizable points bonus that’s available to new card members who meet the minimum spending requirement.

Redeeming ThankYou points

When you’re ready to use all those ThankYou points you’ve earned, you’ve got plenty of choices, including:

- Gift cards to partner brands

- Electronics, jewelry, apparel, and other merchandise

- Statement credits

- Online bill pay

- Charitable donations

The number of points you’ll need and the value of those points will depend on what you’re redeeming them for. For instance, a $25 Barnes and Noble gift card requires 2,500 points. In that case, one point is worth $0.01.

A 50-inch TCL Roku TV retailing for $399.99, on the other hand, would take 49,990 points.

If you do the math, your points would then be worth one-eighth of a cent. It’s important to understand how the value compares so you can be sure you’re getting your money’s worth.

Shop or Pay with Points

If you’d rather buy merchandise directly from the merchant, you can shop or pay with points at selected Citi partners. Shop With Points is available at Amazon.com, Expedia, and Live Nation.

You can use Pay With Points at BestBuy.com or through the Wonder app. Again, the redemption value may vary.

Use Points for Travel

Frequent travelers will appreciate the ability to use their points towards flights, hotel stays, and other travel expenses. You’ve got several great ways to redeem points for travel .

First, you can use them to book your trip through the Citi ThankYou Travel Center. There are no blackout dates or restrictions and you can book flights, vacation packages, car rentals, or hotel rooms.

Best of all, when you book through the travel center, your points are worth 33% more. That means 40,000 points would be worth $532 in credit towards a flight.

If you prefer a particular airline or hotel brand, you also have the option of transferring your points directly to their loyalty program.

Citi partners with the Asia Miles, Flying Blue, Qantas, and Virgin Atlantic, just to name a few.

Your ThankYou points typically transfer on a 1:1 basis, with some exceptions.

There’s no fee to transfer points but there’s one big difference compared to booking with points through the Travel Center.

You may be subject to blackout dates or other restrictions set by the loyalty program you’re transferring your points to. That’s something you’d want to factor in when making your travel plans.

Is the Annual Fee Worth It?

As far as annual fees go, the Citi Prestige Card is on the pricey side. But it's important to consider how the fee measures up against the value of what you’re getting .

Between the free 4th nights, $100 credit for Global Entry, the $250 annual Air Travel Credit, free Priority Pass membership, and the money you can save when you redeem points for travel, you could easily earn back the fee and then some.

If you were to charge just $5,000 a year on travel purchases and get the $250 travel credit, that alone could make up for the fee.

If you’re still on the fence, take a look at your travel habits. If you only take trips once or twice a year, paying nearly $500 for benefits you may not use doesn’t make sense.

On the other hand, if you’re traveling several times a year, that may be money well spent to travel in comfort.

Shop and Travel Safely With Citi’s Security Protections

Your Citi Prestige Card protects you in more ways than one, whether you’re jetting around the globe or just hitting the mall.

The card’s security measures include an EMV chip, Citi Identity Theft Solutions, and the Early Fraud Warning System, which monitors your account for suspicious activity.

When you’re shopping online or in-store, you’re also covered by:

- Damage and theft purchase protection

- Extended warranty protection

- $0 liability guarantee

These perks can add to your peace of mind every time you use your card.

Should You Choose a Different Citi Card?

The Citi Prestige Card might be looking pretty appealing by now but we’re not through yet. Here are other Citi cards you may want to consider instead.

Citi Rewards+

The is a rewards credit card that offers many ways to earn and maximize rewards points.

Cardmembers earn 2x points at supermarkets and gas stations for the first $6,000 per year and 1x points thereafter.

Most interestingly, every purchase earns points rounded up to the nearest 10 points.

Read Citi Rewards+ Card Editor's Review

Citi Double Cash Card

The is aimed at spenders who’d rather earn cash back in lieu of travel rewards.

This card makes it easy to rack up the cash by paying 1% cash back when you make purchases and 1% back when you make a payment . No muss, no fuss, and no annual fee.

Read Citi Double Cash Card Editor's Review

Citi Premier Card

With the Citi Premier Card, you can earn 3 points per dollar on travel including gas, along with double points on dining out and entertainment. All other purchases will earn you one point per dollar.

This card does have an annual fee of $95 , which applies after the first year.

Final Verdict: Should You Get This Card?

The Citi Prestige Card is a real head-turner if you travel often and you like to do so in style.

The $495 annual fee makes it a less attractive choice for someone who’s more frugal about their travel budget or just doesn’t travel that often.

All in all, it’s best for someone who travels often enough to use all the perks available through the card.

You might also like

Advertiser Disclosure:

We believe by providing tools and education we can help people optimize their finances to regain control of their future. While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased. The content that we create is free and independently-sourced, devoid of any paid-for promotion.

This content is not provided or commissioned by the bank advertiser. Opinions expressed here are author’s alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

MyBankTracker generates revenue through our relationships with our partners and affiliates. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. View our list of partners.

MyBankTracker has partnered with CardRatings for our coverage of credit card products. MyBankTracker and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

- United States

- United Kingdom

Citi credit card complimentary travel insurance

A citi credit card with complimentary travel insurance offers you cover for overseas and interstate trips – here’s what you need to know..

In this guide

Which Citi cards have complimentary travel insurance?

What do i need to do to use citi credit card complimentary travel insurance.

- What’s covered by Citi complimentary international travel insurance?

- What’s not covered?

Pre-existing medical conditions

How to make a claim through your citi credit card complimentary international travel insurance policy, other types of citi complimentary credit card travel insurance, citi credit card complimentary insurance for shopping, what you need to know:.

- Citi Rewards, Prestige, Premier and World Mastercard credit cards offers comprehensive international travel insurance for trips of up to 6 months.

- You'll get cover when you meet the requirements before travelling (e.g. by paying for your trip with the card).

- Your spouse and dependants travelling with you can also get cover, but there are some requirements and exclusions .

- Do you have a question or need to make a claim right now? Call Allianz (the insurance provider) on 1800 072 791 or +61 7 3305 7499.

You can get complimentary travel insurance with a Citi Rewards, Prestige, Premier or World Mastercard, including cards that earn Qantas Points. These are the personal cards you can currently apply for that offer insurance:

Some Citi cards that aren’t currently available for new applications also offer complimentary insurance, so if you have a card that’s not listed here you can check the Citi website to see if it’s eligible for cover.

If you're planning a trip and want cover through your Citi credit card, you'll need to meet the following requirements:

- Australian resident. You need to be permanently living in Australia at the time you book your trip and also need to depart from Australia.

- Pay for the overseas travel ticket with your eligible Citi credit card.

- Book through the Citi Travel Program.

- Use frequent flyer points to book your overseas travel ticket, as long as you’ve transferred a minimum of 15,000 points from your Citi card to the frequent flyer account in the past 12 months.

- Length of travel. This cover is available if your trip is for 6 consecutive months or less.

- Account status. You need to have an active, eligible Citi credit card in your name at the time of your booking.

The cover is automatically available to you and eligible family members (your spouse and dependants) when you meet these requirements.

But unlike some travel insurnace policies, the Citi policy document does not include details of a maximum age for cover. So if you need further details or want confirmation of cover, call Allianz on 1800 072 791.

What’s covered by Citi complimentary international travel insurance?

Here, we’ve broken down the key options for different types of benefits for eligible Citi credit cards currently on the market. But remember: you should always read the insurance policy booklet for complete details of the cover.

Medical, dental and emergencies cover

Cancellation, delays and transport, luggage and personal items cover, death, funerals and personal liability, what’s not covered.

Some of the key situations that aren't covered by Citi's complimentary credit card insurance include:

- If the purpose of your trip includes getting medical treatment

- Dangerous activities, including rock climbing, white water rafting, bungy jumping, skydiving, water skiing, off-piste snow skiing and professional sports

- Government interference with your travel plans

- Acts of war

⚠️ Remember: Check the Citi card insurance policy booklet or call Allianz on 1800 072 791 for more details about exclusions.

If you need cover for a skiing trip, bungy jumping or other overseas adventures, check out adventure sport travel insurance costs and conditions.

Does Citi credit card international travel insurance cover COVID-19?

Yes. In June 2023, Citi updated its complimentary international travel insurance with details of when you can make claims related to COVID-19 and other known pandemics and epidemics. This includes:

- Overseas emergency assistance

- Overseas emergency medical

- Cancellation

- Additional expenses

To make a claim, you need to be positively diagnosed with COVID-19 (or another pandemic/epidemic disease) and meet all the other requirements for a claim. This also extends to an eligible spouse or dependants travelling with you – but won’t apply if you’re travelling against government advice. As there are lots of conditions to meet for this type of cover, make sure you read the policy booklet or call Allianz on 1800 072 791 before you travel.

Does Citi credit card travel insurance cover family members?

Yes, your spouse and dependants (i.e. your children) can also get cover when you meet the eligibility requirements for international travel insurance. For them, the key requirements to get cover are:

- They need to meet the same travel length and travel booking requirements as you.

- They need to travel with you for at least 50% of the trip that you’ve got cover for.

They also need to meet the other conditions of the insurance policy. Keep in mind that some claims have different limits for a spouse or dependants compared to what you (as the primary cardholder) get.

With Citi’s complimentary international travel insurance, a limited number of pre-existing medical conditions are covered when you meet the requirements, including:

⚠️ Keep in mind: Every travel insurance policy has its own definition and details about pre-existing conditions. You'll find full details in the Citi credit card complimentary travel insurance policy document.

What if I don't meet the requirements or have a different pre-existing condition?

Call Allianz on 1800 072 791 to check if you can use this insurance. You may be able to get written confirmation from Allianz that a pre-existing medical condition is covered, although be aware that additional fees may apply.

Otherwise, you won't get cover for any pre-existing conditions that cause issues. This includes conditions that you've had professional treatment for and untreated conditions you're aware of before you travel.

Got a pre-existing health condition? Compare other travel insurance policies that offer cover for conditions including anxiety, high blood pressure and knee replacement.

- Go to the Allianz online claim portal at https://claimmanager.com.au/aga/agreement

- Confirm you agree with the terms and conditions, then click "Create new claim"

- Select the "Credit card insurance" option and provide details of your card

- Fill in the details on the claim form and upload your supporting documentation

You will hear back about your claim within 10 business days, according to the online claims website.

What to include in your claim

With insurance claims, include as many details as you can. This makes it easier for the insurer to look at the claim and your eligibility for a payout. Some examples include:

- A referral or letter from a doctor or other professional you see in relation to a claim

- Photo evidence

- Police reports

Tip: Use a travel wallet or create an online folder to keep all your important documents together. This could include your passport, itinerary, printed tickets, a copy of the Citi card insurance policy booklet and anything that could become supporting documentation for claims.

Transit accident insurance

- What is it? Cover for accidents that happen when you're boarding, leaving or travelling overseas on a plane, train, cruise ship, bus or other eligible vehicle.

- When can I use it? If you have paid for the entire trip with your eligible Citi credit card before you leave.

- Is there an excess cost? No.

Interstate flight inconvenience insurance

- What is it? Cover for specific issues that come up when you're travelling to a different state or territory in Australia. For example, cancelled return flights, flight delays of 4 hours or more and delayed or lost luggage.

- When can I use it? If you have paid for your return interstate flights with an eligible Citi credit card and are travelling for no more than 14 days in a row.

- Is there an excess cost? There is a $200 excess for cancellation and luggage claims.

Rental vehicle excess in Australia insurance

- What is it? Cover for damage or theft of a car or other vehicle you have hired in Australia, up to a maximum of $2,250. This cover is included as part of the interstate flight inconvenience insurance benefits in the Suncorp credit card complimentary insurance policy document.

- When can I use it? If you meet the requirements for interstate flight inconvenience insurance and the vehicle hire agreement includes an excess cost.

How to make a claim under one of these policies

Call Allianz on 1800 072 791 or submit your claim through the Allianz online claim portal at https://claims.agaassistance.com.au/ .

Citi credit cards also give you access to other types of insurance for items you buy. Here's a basic explainer of each one, with full details in the Citi credit card insurance policy booklet: