Travel Insurance

Existing State customers get a 10% discount.*

Use Promo code: STATECUST

*Discount applies to existing State customers and to premiums for the standard policies net of Government levies and GST (if applicable). Discounts do not apply to premiums for cover additional to standard policies or to any minimum premium.

Important information: The Policy Wording includes specific information on how State Travel Insurance will respond to claims related to Covid-19.

A range of options for your domestic or overseas travel

Overseas cover & annual multi-trip cover

Your back up when going across the ditch or further afield.

Our cover includes medical and dental expenses* loss or theft of luggage, delayed travel and more. You can also select cover for travel related expenses if you need to change or cancel your trip.

Travel a lot? Take out our annual multi-trip option and you’re covered for as many trips as you like, for 12 months.**

See https://safetravel.govt.nz/ for the latest government advice regarding overseas travel.

Anywhere in NZ

Domestic cancellation.

Covers changes and cancellations outside of your control before you leave and extra expenses due to unforeseen circumstances while you're away. You choose the cover amount.

Domestic Plan

Comprehensive cover that also includes lost luggage, medical and dental expenses, and rental vehicle excess cover.

Inbound Cover Visiting NZ

If you are a non-resident visiting NZ our Inbound policy can cover medical and dental expenses, luggage and travel documents, rental vehicle insurance excess and personal liability.

Travel Cover During Covid-19

Travelling Overseas? Check out our handy scenario-based FAQs explaining how we could cover you if Covid-19 plays havoc with your trip: State Travel Cover and Covid-19 FAQs

Know before you go – our Covid-19 Benefits Destination Guide explains how State Travel cover applies when travelling to different international destinations: Covid-19 Benefits Destination Guide

*Medical cover will not exceed 12 months from onset. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to the Inbound Plan.

**For 12 months, over 100km from home, including domestic travel, up to maximum number of days per journey as selected by you.

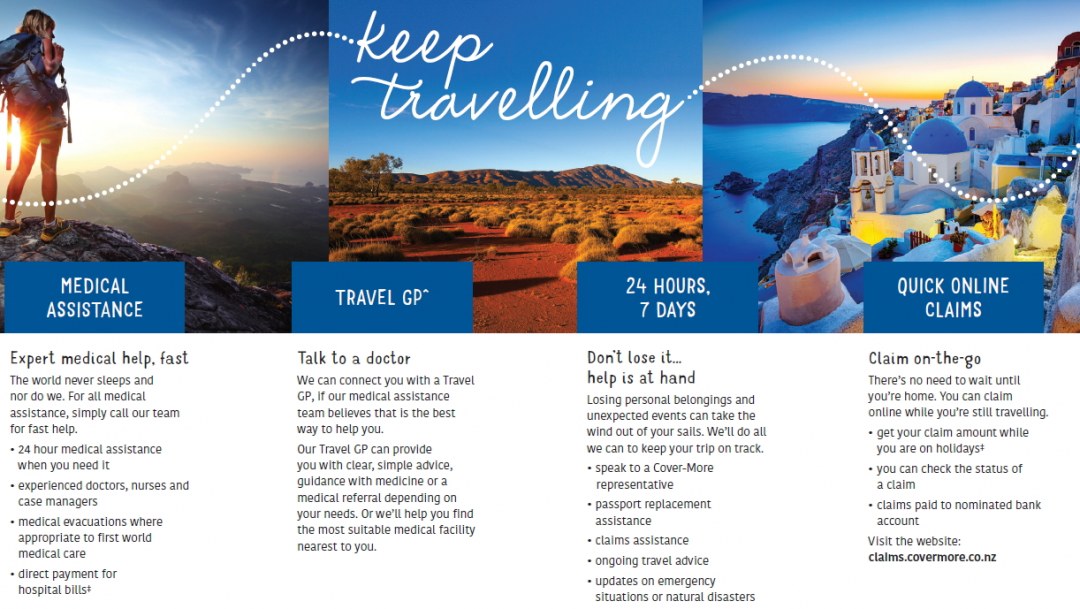

Get more from your travel insurance

24-hour assistance.

24/7 access to a team of experts with a global network of doctors, nurses, and logistical staff. Cover for emergency accommodation and transport expenses if a disaster like a volcano, tsunami, earthquake, or flood disrupts your journey.

Overseas medical cover

Includes hospital, medical, surgical, emergency dental and ambulance costs. Plus help to arrange treatment and medical evacuation.

Get 10% off when you buy online

*Discount applies to existing State customers and to premiums for standard policies net of Government levies (if applicable) and GST. Discounts do not apply to premiums for cover additional to standard policies or to any minimum premium.

Quick online claims

You can claim online while you are travelling. Find out more

Earn Flybuys™ on every policy you have with State. Don’t forget to register your Flybuys number with us, as we’ll also give you chances to get bonus Flybuys throughout the year too. Sweet.

The policy type you choose changes what you are covered for.

Select cover option:

International

Single Trip or Annual Multi-Trip

Limit per adult unless stated otherwise

Up to $1,500 for emergency dental expenses

Up to $1,000 per month

This is only a summary of the benefits provided. Please refer to the Policy Wordings for details of the cover provided.

Limit per adult

Up to $2,500 for personal vehicle insurance excess

Up to $250 per month

Single Trip

Limit per person

(choose the amount of cover that suits, on a per person basis)#

Not included

If you or your travelling companion are diagnosed with Covid-19 by a qualified medical practitioner and are unable to travel, you can claim cancellation or amendment costs for your prepaid trip up to a benefit limit of $10,000 per policy on an International Plan or $5,000 per policy on a Domestic Plan or if applicable, up to the level of cover purchased for cancellation (whichever is lower). There is also no cover if symptoms or diagnosis occurred prior to buying your policy. See the Policy Wording .

*Medical and dental expenses cover will not exceed 12 months from onset of the medical condition. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to the Inbound plan.

^ Cover chosen applies per policy. See the Policy Wording .

• Item limits applies for anyone item, set or pair of items including attached or unattached accessories. You may increase these item limits if you wish. See the Policy Wording .

No cover for trip cancellation costs for trips commencing within 21 days of policy purchase date if you test positive to COVID-19 and cannot travel. If your COVID-19 related cancellation claim is approved, then the maximum we will pay per policy is $5,000 for international trips and $2,500 for Domestic trips. See the Policy Wording .

# You can choose $200, $400, $800, or $1,500.

~ The maximum liability collectively for Sections 14, 15, and 16 is $15,000 International Plan, and $10,000 Domestic Plan.

This is only a summary of the benefit provided. Please refer to the Policy Wording . For details of the cover provided. Please read the entire document carefully to understand what the relevant policy covers. Importantly, please note that conditions, exclusions, limits and sub-limits apply, and this summary of benefits table may change at any time.

Our State Travel Insurance contains benefits relating to the Covid-19 pandemic. While your Policy Wording may respond, your claim remains subject to the terms and conditions, limitations and exclusions set out in the Policy Wording . Please ensure you familiarise yourself with these in the Policy Wording before taking out travel cover. For Covid-19 cover to apply, you must not travel to a destination on the "Do not travel" list issued by SafeTravel.govt.nz .

Domestic Policy FAQ's

Why buy state domestic cover.

Our Domestic and Domestic Cancellation plans are for New Zealand residents travelling within New Zealand.

More than one third of domestic travellers experience an unexpected circumstance that can leave them out of pocket.

It doesn’t matter if you are travelling to Auckland or Amsterdam, if your child becomes unwell and you need to cancel your trip, it’s good to know you’re covered.

Specific terms, conditions and exclusions apply to Covid-19. See our State Travel Policy Wording for full details.

Here are some examples of real-life stories

- An airline lost a customer’s suitcase and the items were not recoverable Luggage Value: $2,500

- A customer’s rental vehicle was written off after a third-party collision Rental Vehicle Insurance Excess: $4,000.

Here are some examples of types of claims

Medical claims*

- Sprained limbs or broken arm, leg, wrist due to outdoor activities

- Asthma, seizure, stroke, heart attack

- Swimmer's ear/ear infection.

*Pre-existing medical conditions must be declared, and extra cover purchased under Domestic Plan prior to departure

Your cancellation costs prior to travel

- Prepaid deposits on motorhome rentals, scenic train, or ferry tickets

- Prepaid fares for rail trips, adventure holidays and cruises

- Costs for cancellation due to redundancy, illness, injury, and medical operations.

Cancellation prior to departure will result in the loss of deposits paid and in other instances full cancellation fees often apply.

Delayed travel

- Travel delays due to weather e.g. snowstorms and fog delaying connecting flights.

Luggage claims

- Broken cameras, smartphones and electronic items

- Lost spectacles, hearing aids and damaged dentures.

What Domestic options are available?

We offer 3 Domestic plan options to choose from and these can be purchased quickly and easily on our website.

Domestic plan (Single Trip Policy or Annual Multi-Trip Policy)

Our Domestic plan (Single Trip Policy and Annual Multi-Trip Policy) is our most comprehensive domestic plan.

The Domestic plan Annual Multi-Trip Policy is sometimes a more suitable option for those travellers who are planning to travel more than twice this year and for no longer than 30 days at a time within New Zealand.

Domestic Cancellation plan Single Trip Policy

Our Domestic Cancellation plan covers domestic travellers for cancellation cover only and you choose the cancellation cover limit to best meet your needs when you purchase your policy.

What activities are covered?

There are plenty of fun activities to do around New Zealand year-round, and we have a comprehensive list of activities which are covered under our Domestic plans (excludes Domestic Cancellation Plan).

Our plans automatically include:

- Bungy Jumping

- Horse Riding

- Jet Boating

- Paragliding

- Parasailing

- Snorkelling

- White Water Rafting

Other activities may be covered as an add-on to your Domestic plan (excludes Domestic Cancellation plan). See our State Travel Policy for full details.

What cover is available for Skiing and Snowboarding?

Because being on the snow and participating in winter sports activities often increases the risk of injuries or incidents, you'll need to ensure you amend your Domestic plan (excludes Domestic Cancellation plan) to include snow activities like skiing and snowboarding by purchasing a winter cover (snow sports) upgrade. This can help protect you against unforeseen costs should you have a mishap on the slopes and need medical assistance. Sporting and ski equipment are not covered whilst in use and if you are a New Zealand citizen, ACC may cover some costs due to injury caused by an accident.

You will only be covered if you have purchased the Domestic Plan with the winter cover (snow sports) upgrade and:

- You are skiing, snowboarding or snowmobiling on-piste, or cross-country skiing;

- You are not participating in a Professional capacity; and

- You are not racing.

Note: sporting and ski equipment are not covered whilst in use.

What if I travel frequently in NZ, do you have a multi-trip option?

Multi-trip travel insurance may save you time and money. If you are planning to travel more than twice this year and for no longer than 30 days at a time within New Zealand, consider our Domestic Plan Annual Multi-Trip Policy.

Can you explain the rental vehicle insurance excess?

This benefit applies to our Domestic Plan (excludes Domestic Cancellation Plan) and covers the rental vehicle excess if your rental vehicle is stolen, or damaged while you are driving. You will still need to take out rental vehicle insurance.

A $4,000 rental vehicle excess cover can save you money if you need to make a claim.

Note: that your rental agreement may still require you to take out rental vehicle insurance.

If you are driving your personal vehicle on your domestic holiday there is bonus cover of $2,500 for your comprehensive vehicle insurance excess.

What does the medical cover provide for?

Our Domestic Plan D *(excludes Domestic Cancellation Plan) can provide you with cover for unexpected medical and dental expenses up to $1,500. This is for treatment provided in New Zealand.

It only applies up to 12 months from when you suffered a disabling injury, sickness, or disease. Travel insurance protects you from unforeseen events. Routine medical or dental treatments, prenatal visits and continuation of treatments are not covered.

What existing medical conditions are covered?

We automatically cover a range of existing medical conditions (EMC) under the Domestic plan (excludes Domestic Cancellation Plan). Automatically covered conditions include - asthma, epilepsy, gastric reflux and more! Read the State Travel Policy Wording for a full list of the conditions we automatically cover. If your existing medical conditions are not all automatically covered, you may complete an online medical assessment to determine if cover is available. Other travel insurance benefits unrelated to your EMC still apply, even if cover cannot be provided for your specific condition/s.

*Medical cover will not exceed 12 months from onset. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to International or Inbound Plans.

Before you travel

Travel safety.

Find out more information about events that may affect you when you travel.

Travel tips

Our team of intrepid Kiwi travellers have come up with a list of handy travel tips to help make your holiday even better.

Limits, sub-limits, conditions, and exclusions apply. Standard excess may apply. State Travel insurance is administered by Cover-More NZ Ltd, underwritten and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand. For further information see Zurich New Zealand’s financial strength rating . Any advice is general advice only. Consider the State Travel Policy Brochure and wording therein before deciding to buy this product. IAG receives a commission for the issue of State branded travel policies arranged through Cover-More (NZ) Limited ("Cover-More"). IAG New Zealand Limited ("IAG"), of which State is a business division, is not the insurer. IAG does not guarantee Zurich New Zealand or Cover-More.

You are using an outdated browser. Please upgrade your browser to improve your experience.

- Travel Insurance

Already with AMI? Take 10% off your travel insurance.*

*Use promo code AMICUST Discount applies to existing AMI customers and to premiums for the standard policies net of Government levies and GST (if applicable). Discounts do not apply to premiums for cover additional to standard policies or to any minimum premium.

Great options to suit your travel within New Zealand or overseas

Overseas cover & annual multi-trip cover

Our overseas travel covers medical, dental and hospital treatment*, lost luggage, and personal liability, and can get you and your family home in certain emergencies.

Travel a lot? Take out our annual multi-trip option and you’re covered for as many trips as you like, for 12 months.**

Find out more

Domestic Cover

If your plans while travelling in New Zealand change unexpectedly, we can cover the cost of cancelling or amending your flight, accommodation or rental car bookings and other expenses, up to $10,000.

Inbound Cover - Visiting NZ

Are you a non-resident visiting friends and family in NZ, or on a working holiday? Our Inbound plan can cover medical and dental expenses, luggage and travel documents, rental vehicle insurance excess, personal liability and more!

Travel Cover During Covid-19

Planning an adventure? Check out our scenario-based FAQs explaining how we could cover you if Covid-19 plays havoc with your trip: AMI Travel Cover and Covid-19 FAQs

Find out before you go – our Covid-19 Benefits Destination Guide explains how AMI Travel cover applies when travelling to different international destinations: Covid-19 Benefits Destination Guide

Still unsure? Ask us a question

Compare our Travel Cover Plans

Every driver’s different, so our car policies come with different features.

Policy benefits

Medical and dental expenses

Additional expenses

Amendment or cancellation costs

Luggage and travel documents

Delayed luggage allowance

Rental vehicle insurance excess

Travel delay

Resumption of journey

Missed connections

Special events

Hospital incidentals

Loss of income

Accidental death

Legal expenses

Personal liability

Get a travel quote now

This is only a summary of benefits provided. Please refer to AMI Travel Policy Wording for full details of the cover provided. Please read the entire document carefully to understand what this policy covers. Importantly, please note that conditions, exclusions, limits and sub-limits apply.

Specific terms, conditions and exclusions apply to Covid-19. See the policy wording for the most up to date information.

* Cover will not exceed 12 months from the onset of the illness or injury. Medical and dental expenses cover is limited to $1,500 for treatment provided in New Zealand. This $1,500 sub-limit does not apply to our Inbound Plan. ^ Cover chosen applies per policy. See the policy wording . • Item limits apply for any one item, set or pair of items including attached or unattached accessories. You may increase these item limits if you wish. See the policy wording . # If you or your travelling companion are diagnosed with Covid-19 by a qualified medical practitioner and are unable to travel, you can claim cancellation or amendment costs for your prepaid trip up to a benefit limit of $10,000 per policy on an international Plan or $5,000 per policy on a Domestic Plan or if applicable, up to the level of cover purchased for cancellation (whichever is lower). There is also no cover if symptoms or diagnosis occurred prior to buying your policy. ~ The maximum liability collectively 14, 15, and 16 is $15,000 International Plan, and $10,000 on a Domestic Plan

This is only a summary of the benefit provided. Please refer to the policy wording . For details of the cover provided. Please read the entire document carefully to understand what the relevant policy covers. Importantly, please note that conditions, exclusions, limits and sub-limits apply, and this summary of benefits table may change at any time.

Before you travel

Travel safety

Find out more information about events that may affect you when you travel.

Travel tips

Our team of intrepid Kiwi travellers has come up with a list of handy travel tips to help make your holiday even better.

AMI Travel insurance is underwritten by Zurich Australian Insurance Limited ("ZAIL") incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand. IAG New Zealand Limited (“IAG”), of which AMI is a business division, is not the insurer. IAG receives a commission for the issue of AMI-branded travel policies arranged through Cover-More (NZ) Limited (“Cover-More”). Cover-More administers the policy and acts on behalf of Zurich New Zealand. IAG does not guarantee Zurich New Zealand or Cover-More.

AMI Travel Website Disclaimer 12072022

Limits, sub-limits, conditions, and exclusions apply. Standard excess may apply.

AMI Travel insurance is administered by Cover-More NZ Ltd, underwritten and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640 , trading as Zurich New Zealand. For further information see Zurich New Zealand's financial strength rating .

Any advice is general advice only. Consider the AMI Travel Policy Brochure and wording therein before deciding to buy this product. IAG receives a commission for the issue of AMI branded travel policies arranged through Cover-More (NZ) Limited ("Cover-More").

IAG New Zealand Limited ("IAG"), of which AMI is a business division, is not the insurer. IAG does not guarantee Zurich New Zealand or Cover-More.

Quick and easy claims We're here for you if something disrupts your trip. Save time and submit your claim online.

Where are you going.

Worldwide including the Americas, the Caribbean and Antarctica: Antarctica (Cruising), Antigua and Barbuda, Argentina, Bahamas, Barbados, Belize, Bermuda, Bolivia, Brazil, Canada, Cayman Islands, Chile, Colombia, Costa Rica, Cuba, Dominica, Dominican Rep, Ecuador, El Salvador, Falkland Islands, French Guiana, Greenland, Grenada, Guadeloupe, Guatemala, Guyana, Haiti, Honduras, Jamaica, Martinique, Mexico, Netherlands Antilles, Nicaragua, Panama, Paraguay, Peru, Puerto Rico, St. Kitts and Nevis, St. Lucia, St. Vincent and Grenadines, Suriname, Trinidad and Tobago, United States of America, Uruguay, Venezuela, Virgin Islands.

Africa, Middle East, Indian Sub-Continent and Asia (other): Afghanistan, Algeria, Angola, Azores, Azerbaijan, Bahrain, Bangladesh, Benin, Bhutan, Botswana, Burkina Faso, Burundi, Cameroon, Canary Islands, Cape Verde, Chad, China, Central African Republic, Comoros, Congo (Dem. Rep), Djibouti, Egypt, Eritrea, Ethiopia, Equatorial Guinea, Gabon, Gambia, Ghana, Guinea, Guinea Bissau, India, Israel, Iran, Iraq, Ivory Coast, Jordan, Kazakhstan, Kenya, Korea (north), Korea (south), Kuwait, Kyrgyzstan, Lebanon, Lesotho, Liberia, Libya, Macau, Madagascar, Mauritius, Mauritania, Mozambique, Maldives, Malawi, Mali, Mongolia, Morocco, Namibia, Nepal, Nigeria, Niger, Oman, Pakistan, Qatar, Reunion, Rwanda, São Tomé and Príncipe, Saudi Arabia, Senegal, Seychelles, Sierra Leone, Somalia, South Africa, South Korea, South Sudan, Sri Lanka, Sudan, Swaziland, Syria, Taiwan, Tajikistan, Tanzania, Togo, Tunisia, Turkey, Turkmenistan, Uganda, United Arab Emirates, Uzbekistan, Yemen, Zambia, Zimbabwe.

Europe: Albania, Andorra, Armenia, Austria, Belarus, Belgium, Bosnia, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Georgia, Germany, Gibraltar, Greece, Herzegovina, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Maderia, Malta, Moldova, Monaco, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, Russia, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Ukraine, Vatican City.

UK: Channel Islands, England, Northern Ireland, Scotland, United Kingdom, Wales.

South East Asia, Hong Kong, Japan: Brunei, Cambodia, East Timor, Federated States of Micronesia, Guam, Marshall Islands, Micronesia, Hong Kong, Indonesia, Japan, Kiribati, Laos, Malaysia, Myanmar (Burma), Nauru, Northern Marianas, Palau, Papua New Guinea, Philippines, Singapore, Thailand, Vietnam

South Pacific and Norfolk Island: Cook Islands, Fiji, French Polynesia, New Caledonia, Niue, Norfolk Island, Samoa, Solomon Islands, Tokelau, Tonga, Tuvalu, Vanuatu, Western Samoa.

New Zealand Only: New Zealand domestic travel

New Zealand Inbound Travellers : New Zealand

Dates of Travel

Departure date (travel start date).

Single Trip - The date you depart New Zealand

Cover under the Amendment or Cancellation Costs benefit begins from the time you buy your policy. Cover under all other sections begins from the Travel Start Date you select.

Annual Multi-Trip - The date your policy will commence

Cover under the Amendment or Cancellation Costs benefit begins from the time you buy your policy. For further information, we recommend you read the definition of "Relevant Time" in the Policy Wording.

Return date - (Travel end date)

Single Trip - The date you return to your home

Annual Multi-Trip

Regardless of what you enter as the Return date, you will be quoted for a 12 month Annual Multi-Trip policy.

For further information we recommend that you read the definition of "Relevant Time" in the Policy Wording.

Traveller Details

Age of each traveller at issue date

Simply enter the age of each traveller including children.

Only use as many boxes as you have travellers.

Do all travellers live in New Zealand?

New Zealand resident travellers are able to purchase Travel Insurance policies from us to any area of travel and any country/destination.

Non-New Zealand resident travellers are only able to purchase a Travel Insurance policy if travelling inbound to New Zealand.

For Non-New Zealand resident travellers wanting to purchase Travel Insurance to travel to any other part of the world other than travel to New Zealand, please contact us as we may still be able to offer cover to you.

Travel Insurance You Can Trust

What country are you going to?

Select the Area of travel in which you will spend most time. NOTE: If you are spending more than 20% of your trip time in the Americas Area, it is compulsory to select a destination in the Americas Area for your policy.

If you are quoting a multi-trip policy please select “see region list” and select a destination in the appropriate region. For example United States for Worldwide cover or Spain for European cover.

When are you going?

Please select the departure and return dates for your trip.

For multi-trip policies the departure date will mark the start of your cover and it will automatically run for a year from that date.

Who is travelling?

Simply enter the age of each traveller including Adults and Accompanied Children*. Enter the age they are now.

Only use as many boxes as you have travellers.

*As per the Policy Wording: "Accompanied Children" means Your children or grandchildren plus one non-related child per adult policyholder who are identified on the Certificate of Insurance and travelling with You on the Journey, provided they are not in full-time employment and they are under the age of 21 years at the Relevant Time. If an Accompanied Child is in full time employment then they will need to purchase their own policy.

If you require a policy for more than 6 travellers, please contact Cover-More on (0800) 500 225 as we may still be able to offer cover to you.

Compare Our Travel Insurance Plans

At Cover-More, we make it easy for you to find the travel insurance policy that's best for your trip. We offer a variety of plans and options to vary your cover. You can compare our plans below and – if you find a suitable plan for you and your budget – you can buy a policy online today or give us a call at 0800 500 225 to speak to our friendly team.

Options Plan

Featured Benefits

Essentials Plan

Cover that suits you best

Compare our Cover-More’s Travel Insurance plans to find the policy that’s best for your trip and your budget.

No matter what Cover-More travel insurance plan you choose, every policyholder has access to our 24/7 emergency assistance team and cooling-off period ~ so you can relax and enjoy your holiday.

We look forward to providing you with great cover and superior service.

Find the right cover for you.

Travel Cover: How to Compare Travel Insurance

How to compare travel insurance policies

Choosing the right travel insurance is important, but comparing policies online can sometimes be confusing. To get through the lengthy policies, difficult wordings and long lists of what is and isn’t covered, we have a few tips to help make the process easier. Be sure to check the items below as you compare travel insurance plans.

Policy Excess

The word ‘excess’ is commonly thrown around when discussing travel insurance. Excess is the first amount of a claim that is not covered. The levels of excess can vary by insurer and by their policies offered, so make sure you compare the different levels.

To understand how excess works, imagine you lost your new iPad while travelling. Your travel insurance policy has a level of excess on personal electronics of $250, but the iPad is worth $450. Therefore, with this plan, you would only receive partial compensation for your lost iPad—the iPad’s current value of $450 less the excess of $250.

At Cover-More, we have a variety of international travel insurance plans that allow you to choose an excess level that works for your budget. Remember, the higher the excess chosen, the less you pay for your policy premium. Get a quote for our Cover-More Travel Insurance with your chosen level of excess now.

What is not covered in your travel insurance policy is just as important as what is covered by your plan, so be sure to compare exclusions.

Our Cover-More Travel Insurance policies provide cover for many incidents and unexpected events that other insurers may not cover. So, it is important to compare policies to understand the extent of what is covered. Start your Cover-More Travel Insurance quote now.

Emergency Assistance

Emergency medical assistance is an essential service for any holiday.

At Cover-More, we put our policyholders' health and safety first. We are committed to providing you with superior, round-the-clock service through World Travel Protection, our own medical and travel assistance division with over 30 years of experience.

All of our policyholders receive round-the-clock emergency medical assistance, no matter what plan you choose. Get a quote today .

Travel Cancellation Policies

Unfortunately, sometimes a holiday must be cancelled for unforeseen reasons such as personal or family illness, in which case lost deposits, costs of prepaid flights and cancellation fees only add to the feeling of misfortune.

When comparing travel insurance plans, be sure to check the policy’s cancellation cover so you are not left with exorbitant expenses in case you must cancel your trip. Get a quote for our Cover-More travel insurance with cancellation coverage today.

Travel Insurance Company Ratings

Be sure to research and compare travel insurer ratings. A company’s ratings are often indicative of their financial strength, meaning their ability to pay insurance claims quickly and efficiently. Our financial strength is thanks to Zurich Australian Insurance Limited trading as Zurich New Zealand (Zurich New Zealand), incorporated in Australia. Part of the Zurich Insurance Group, Zurich New Zealand holds a financial strength rating of AA- (strong) by Standard and Poor’s (Australia) Pty Ltd. (This is correct at the time of writing: April 2022.)

Protect your trip with travel insurance that will service its obligations to you. Get your quote now.

Travel Insurance Benefits

Most importantly, compare travel insurance plans to get a better idea of the benefits offered in each plan. Many travel insurance companies do not provide the variety of levels of cover like we at Cover-More do. We have several different plans and options so you can find a policy that matches your needs and your budget. Get a quote for your trip and compare the benefits available on our plans:

- Options Plan: our premium comprehensive plan

- Essentials Plan: our budget-friendly option

All our travel insurance plans can be adjusted with excess cover, cancellation cover, ski and winter sports cover , and existing medical conditions cover . Get a quote today to see if one of our Cover-More plans is suitable for your trip.

Please wait, generating your policy.

Top Travel Insurances for New Zealand You Should Know in 2024

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

New Zealand is known for its breathtaking landscapes, including glaciers, fjords, and the Southern Alps, as well as its unique Maori history. Visitors also come to experience the adventure activities, such as hiking, skiing, and rafting, and to see the unique wildlife like the Kiwi bird. Although travelling to New Zealand can be an accessible holiday destination for many people, out-the-pocket healthcare costs in the country tend to be expensive, so it's a very good idea to arrive there with travel insurance under your belt.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to New Zealand and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

New Zealand Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for New Zealand:

Best Travel Insurances for New Zealand

- 01. Should I get travel insurance for New Zealand? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to New Zealand scroll down

Heading to New Zealand soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for New Zealand?

No, there's currently no legal requirement to take out travel insurance for travel to or through New Zealand.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to New Zealand or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for New Zealand:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to New Zealand. It lets you choose between various plans tailored to meet the specific needs of your trip to New Zealand, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for New Zealand:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to New Zealand? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to New Zealand

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for New Zealand. However, we strongly encourage you to do so anyway, because the cost of healthcare in New Zealand can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Compare Travel Insurance

Compare Outstanding Value Travel Insurance

Compare Travel Insurance By Destination

Outstanding Value Travel Insurance Awards

Click profile to compare 5-Star Outstanding Value Travel Insurance:

International travel, trans-tasman travel, south pacific cruise, seniors travel, 5-star international travel insurance, 5-star trans-tasman travel insurance, 5-star south pacific cruise travel insurance, 5-star seniors travel insurance.

2023 Outstanding Value Travel Insurance Awards

Compare Travel Insurance by Destination

Canstar’s full travel insurance Star Ratings break down the best insurance providers and products for the following global holiday destinations, plus all destinations for senior travellers:

- Africa & Middle East

- Domestic Cruise

- Pacific Cruise

- Seniors – all destinations

Important information

- The Star Ratings in this table were awarded November 2023. The current features, rates and fees may be different to what was rated. The Star Rating shown is only one factor to take into account when considering a product. See our Ratings Methodology .

- The initial table display is sorted by Star Rating and then alphabetically by company.

- Any advice on this page is general and has not taken into account your objectives, financial situation or needs. Consider whether this general financial advice is right for your personal circumstances. You may need financial advice from a qualified adviser. Canstar is not providing a recommendation for your individual circumstances. See our Detailed Disclosure .

- Data in the table is updated from time to time to reflect product changes notified to us by product issuers. Check current product details and investment options with the product issuer. Consider the Product Disclosure Statement before making a purchase decision.

- The table above may not include all providers in the market and may not compare all features relevant to you. Canstar is not providing a recommendation for your individual circumstances.

- Canstar may earn a fee for referrals from its website tables, and from sponsorship (advertising) of certain products. Payment of sponsorship fees does not influence the star rating that Canstar awards to a sponsored product. Fees payable by product providers for referrals and sponsorship may vary between providers, website position, and revenue model. Sponsorship fees may be higher than referral fees. Sponsored products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored products may be displayed in a fixed position in a table, regardless of the product’s rating, price or other attributes. The table position of a sponsored product does not indicate any ranking, rating or endorsement by Canstar. See How We Get Paid for further information.

Compare Travel Money Cards

Headed off overseas and looking for the best in money cards? Here’s a rundown of some of the most popular cards in New Zealand:

The display order does not reflect any ranking or rating by Canstar.

This information is not an endorsement by Canstar of travel money cards or any specific provider. Information correct as of 20/09/23. For full pricing details see individual providers’ websites.

Latest in Travel Insurance

Banking & Insurance - March 6th

How to Move Funds to New Zealand

Thanks to international money transfers, it's relatively simple to transfer funds to New Zealand. Canstar looks at the steps you'll need to take. How do I transfer funds back to New Zealand? When you come back…

Travel Insurance - January 9th

How to Clear Customs Faster

What does it mean to 'clear customs'? Clearing customs involves going through the process of being inspected and approved by customs authorities when travelling overseas. This process ensures compliance with specific rules and regulations, the safety…

Banking & Insurance - December 22nd

Can NZ Citizens Get a Student Loan in Australia?

Can New Zealanders get a student loan in Australia? Most New Zealand citizens aren't typically eligible for a student loan, or HELP loan, in Australia. However, they can access Commonwealth Supported Places (CSP) instead. New Zealand…

Travel Insurance - December 14th

Travel Insurance & Rental Vehicle Excess: Don't Pay Twice

If you're headed off overseas, it's crazy not to consider taking out travel insurance. It's not something you ever want to use. But should the unexpected happen, it can prevent a ruined holiday turning into a…

Travel Insurance - November 21st

Canstar's Best Value Travel Insurance NZ

Holidays promise carefree relaxation away from work pressures and domestic chores. However, plenty of unforeseen events can ruin the best-laid vacation plans, from illness and accidents to the loss or theft of possessions. If the worst…

What is travel insurance and why do you need it when you travel?

What is travel insurance?

Travel insurance is financial cover for emergencies, accidents or loss that might occur to you or your belongings while you are travelling either domestically or internationally.

Why do you need travel insurance?

The New Zealand government website SafeTravel recommends travel insurance for anyone taking a trip away from home, especially overseas.

If you don’t have travel insurance and you lose your luggage, have an accident, medical emergency, or legal incident, you could face huge bills.

Cancelled flights and hotel accommodation can leave you out of pocket by thousands of dollars, but medical expenses can be even worse. A health emergency overseas can end up costing hundreds of thousands of dollars.

However, if you have travel insurance, you can travel confidently knowing you can get financial help in an emergency.

What else should you do before you travel?

In addition to organising travel insurance, before you leave:

- If you are going overseas, visit the SafeTravel website’s Travel Advisories page to ascertain the current risks of travelling to your chosen destination. If a country is flagged with a “Do Not Travel” advisory, be aware that you may not be able to obtain insurance for the trip.

- Regardless of where you are going, register your plans with SafeTravel. Your details will be stored securely and only used to reach you in an emergency.

- Ensure you have all the relevant travel documentation to take with you on your trip, and that a trusted friend or relation in NZ has a copy, too.

- Record the contact details of the New Zealand Embassy in your country of destination – just in case you need it.

Types of travel insurance and what they cover

There are two types of travel insurance cover policies.

1. Domestic travel insurance

Domestic travel insurance policies usually cover you for events such as:

- Lost or stolen luggage or other items

- Cancelling your trip unexpectedly due to illness, accident, holiday leave being revoked, or a natural disaster at home or at your intended destination

- Rental vehicle excess you have to pay if you have an accident driving a hire car

- Legal liability: the vast majority of policies researched include coverage for legal liability. Don’t take this as an excuse to break the law, though – you may end up invalidating your policy!

Domestic travel insurance usually doesn’t cover you for:

- Medical cover. However, this is not a big problem because, as long as you’re in New Zealand, you can still access publicly funded health services or your private health insurance , if you have it

- Certain “hazardous pursuits”. If you’re doing dangerous activities on your holiday, such as skiing, scuba diving, bungee jumping or rock climbing, you need to disclose it on your application. However, even if you disclose it, you still might not be covered for an accident that happens because of that activity, as it may be excluded from the policy. Ensure you read your policy terms and conditions carefully

2. International travel insurance

International travel insurance policies usually cover you for events such as:

- Medical or dental emergency. Typical emergency medical cover will include hospital admission, emergency care and medical evacuation to another country’s hospital. If your medical situation is not an emergency, it is recommend you contact your insurer before you receive treatment, to check if it’s covered by your policy

- Repatriation if you fall sick overseas and need to be evacuated back to NZ for treatment. Or if tragedy strikes, repatriation covers the cost of flying your body and belongings back home to NZ. Some travel insurance policies also include a separate sum for funeral expenses

- Lost or stolen luggage, passport or other items. Replacing luggage and travel documents is the most common claim for travel insurance

- Legal liability if you break a local law and need a lawyer and/or interpreter. Ignorance of local law is no excuse in most countries, so make sure you check SafeTravel before you depart. For example, in some Muslim countries it is an offence to wear a bikini on a public beach. If you break a law on purpose, your travel insurance policy may not cover your legal fees

International travel insurance usually doesn’t cover you for:

- High-risk countries. Check the government’s SafeTravel website for the travel advisory status of your destination. Countries flagged with a “Do Not Travel” advisory may not be covered under your policy

- Risky behavior. Any injury or loss caused by you behaving recklessly while you were under the influence of alcohol or drugs can be excluded from cover. This doesn’t apply to medication prescribed to you by a doctor and taken as prescribed

- Pre-existing medical conditions. If you have experienced symptoms of a condition before travelling, even if the condition wasn’t diagnosed, medical expenses for it will generally not be covered. Read your policy’s terms and conditions carefully

- High-value items. Many policies have a dollar limit that you can claim for each item, which may not be as much as it costs to replace the item

- Notification period. Your policy may specify that you need to notify your insurer of an accident or event within a specified timeframe, such as 24 hours. It’s important to be aware of that notification period and to call your insurer as soon as you can, in the event of a potential claim

- Loss of items left unattended. Keep an eye on your belongings at all times. You might not be covered if you leave your wallet and keys wrapped in a towel on the beach, or hidden in a shared room, or even in your checked-in luggage

- Hazardous pursuits. Dangerous activities such as scuba diving, bungee jumping, rock climbing, off-piste skiing and hang-gliding are usually excluded, but they can often be added to your policy for an extra fee. Also be aware that riding a moped or motorcycle overseas might also not be covered, even if you are legally entitled to ride one in NZ

NB: No travel insurance policy will cover you for every single thing that might go wrong while you’re away, so it’s important to read your policy’s terms and conditions carefully to discover the full extent of your cover.

Travel insurance glossary of terms

- Accident : An unexpected, unforeseeable, or unusual event that was unintended and caused loss or harm while you are on a trip covered by your policy.

- Accommodation : Any type of dwelling or lodging that you pay a fee to stay in overnight.

- Additional expenses : Additional expenses for accommodation and transportation that occur because of events such as illness, natural disasters, loss of travel documents, and transport union strikes.

- Beneficiary : The person who would receive compensation from your insurance policy if you were to pass away during your travels.

- Benefits: What your insurance provider gives you according to the terms of your policy. Benefits can apply if you make a claim or they can apply if a certain event happens, e.g. during an emergency.

- Cancellation or amendment costs : The cost of cancelling, changing, or rearranging your journey because of unforeseen circumstances outside your control such as illness, accidents and extreme weather events.

- Claim: A request for your insurance provider to pay certain expenses back to you in accordance with your policy.

- Cover or coverage : The extent of protection given to you by your policy. If you are covered for an event, it means that you can claim back from your insurance provider a specified amount of expenses you incurred during that event.

- Current market value : The amount of money you could get for an item if you sold it in the current local market. This amount is based on the original cost, the current condition and age of the item, and what it could be sold for in its present state.

- Damage: Harm or injury to a person or property, resulting in the property losing value or not being able to be used properly.

- Disability : A physical or mental condition that restricts a person’s movements, senses or activities. A disadvantage or handicap, especially one imposed or recognised by the law.

- Emergency medical care : Medical care that is needed in an unexpected emergency. This does not include any type of regular medical care or foreseeable medical needs.

- Endorsement: Any special condition listed on your insurance policy as an extra reason for you to buy the policy.

- Excess: The excess is an amount that you pay instead of the insurer, e.g. “the first” $250 or $500 of a claim. Insurers usually have either a policy with different excess options that you choose between, or separate policies that each have a different excess amount. You can pay a lower premium if you have a higher excess, but you need to be sure that you could afford to pay the excess unexpectedly if you had to make a claim.

- Exclusions : Anything that is not covered by your policy. Common exclusions include travel to high-risk countries, dangerous activities such as bungee jumping, risky behaviour, such as taking alcohol or drugs, pre-existing medical conditions, and loss of items left unattended.

- Home: Your usual place of residence in New Zealand.

- Incidental: Costs associated with an unexpected covered event, which are not directly related to the event.

- Inclusions: Any event, item or expense that is covered by your policy.

- Injury: Anything that physically harms you and occurs by accidental or violent means, which is covered by your policy.

- Journey: One of the terms insurers use to talk about the period you’re covered for, from the time you leave home until the time you return to your home. Also known as your trip, voyage, or travels.

- Limit/benefit limit: Policies have a limit on the amount of benefits you can claim per year or per journey.

- Luggage and personal effects: Personal items that you own or carry with you on a trip that is covered. This includes but is not limited to: suitcase or backpack, clothing, jewellery, computer or laptop, your phone and other portable electrical devices or equipment.

- Medically necessary: Medical treatment that is needed to preserve your health, is suitable to treat your symptoms, and can be safely provided in your current location. This does not include treatment or procedures that are performed in your current location because it is merely convenient.

- Natural disaster: An event caused by nature and not by any human activity, including earthquakes, storms, bushfires and floods.

- Overseas medical expenses: Expenses incurred overseas for ambulance transport, hospital admission, surgical nursing, and emergency dental treatment.

- Period of cover: The time your travel is covered by your policy.

- Personal liability cover: Cover for costs incurred for which you are legally liable. You are legally liable if your negligence causes loss or damage to someone else’s property. Personal liability also covers you for injury to a person who is not a member of your family or travelling party. Personal liability cover does not cover damage you caused deliberately or that breaks the law; damage caused by your business or your employee; your ownership or use of a vehicle, aircraft or watercraft; or you passing on an illness to someone else.

- Policy: The travel insurance contract you have taken out with an insurance provider.

- Pre-existing condition: A medical condition that existed in any form before you signed up for the insurance policy, whether or not you had your symptoms examined by a health practitioner. Your policy may usually list a time limit for the condition to be pre-existing, e.g. you have seen a medical practitioner in the past 90 days before you started your journey, or you have been prescribed a medication within the past 60 days.

- Premium: The amount you pay your insurance provider for your travel insurance cover. Your premium must be paid on time for your travel to be covered.

- Reasonable: When associated with an expense or cost, “reasonable” refers to what is usual, needed, and matches the standards of your previously scheduled travel.

- Refund: Cash or company credit that can be given to you as reimbursement for your expenses, according to the terms of your policy.

- Rental car insurance excess : The excess charged if your hire car is damaged or stolen.

- Resumption of journey benefit : The benefit you receive if you claim the expense of resuming your travels. You can make a claim if you had to return to New Zealand suddenly due to a serious injury, illness, or the death of one of your relatives or business partners in New Zealand.

- Sudden illness or serious injury : Illness or injury that occurs during your period of cover and requires immediate treatment by a health practitioner.

- Travel delay : Scheduled transport that is delayed by over six hours. Scheduled transport can include plane flights, trains, trams, buses, ferries or cruises.

- Unforeseen: Any circumstance that is out of your control. This can include illness, accident, cancelled flights, or natural disasters.

Which travel insurance providers are assessed by Canstar's ratings?

Products from the following travel insurance providers were rated in Canstar’s 2023 Travel Insurance Star Ratings and Awards:

- 1Cover Direct Insurance

- AA Insurance

- Air New Zealand

- American Express

- Chubb Insurance

- Cover-More Travel Insurance

- House of Travel

- Southern Cross Travel Insurance

- World Nomads

Recent Award Winners

View Canstar's Outstanding Value Travel Insurance Awards

Quick Links

Travel Insurance

Travel Insurance to keep you travelling.

Travel insurance to keep you travelling, no matter what the world throws at you

We've chosen a partner to help Kiwis fly. With quality Travel Cover comes peace of mind and the freedom to venture virtually anywhere in the world with confidence, knowing you'll have support and assistance whenever you need it. Cover-More have more than thirty years of experience and cover more than 3.8 million journeys every year. If something goes wrong, we know you'll want expert help and fast, the best possible medical care and to stay connected with friends and family. Whether it's for business or pleasure, before you explore the world, explore the cover options by Cover-More. Click on the link below to indulge your spirit of adventure and get an instant quote.

Why has ClickCover partnered with Cover-More?

We've researched the travel market, so that you don't have to. We believe that Cover-More is the most trusted travel insurance provider available. Cover-More have been operating in New Zealand for more than 30 years. They offer high quality cover and have an outstanding claims record (meaning their likely to pay out should you need it!). We’re happy to stand behind Cover-More, knowing they’ll protect our clients on their journeys – wherever that may be.

Why do I need Travel Cover?

What if you were travelling through the intrepid back blocks of South America and contracted a serious illness? Would you be able to afford your medical bills? Or what if you urgently needed to come home from a trip to Australia due to a serious family illness or death? Would you want to pay the last minute flight fees and forgo all your prepaid holiday expenses you couldn’t enjoy, such as accommodation, rent-a-car bookings or that pre-paid Movie World pass? Travel Insurance will cover you if any of the above happen, and more. Making sure you can enjoy your holidays without worrying about the unexpected.

When should I get Travel Cover?

Any time you travel overseas, be it short or long term, near or far, you should get Travel Insurance. Your usual insurance policies will only apply to New Zealand, so if you get into trouble overseas, your existing insurance policies may not apply. If you are travelling within New Zealand you don’t need to get Travel Insurance, but you may like to get flight insurance, which will protect you if your flight is delayed, cancelled or changed for whatever reason (wind in Wellington maybe?!). The easiest way to get flight insurance is to get it direct when you purchase your flights.

What does Travel Cover protect me for?

There are a few different types of policies – so there are some differences. But generally, most travel insurance policies will cover you for: - Any medical costs you incur - Emergency evacuation costs - Theft, or loss of any person items (including your passport and money) - Loss, delay or theft of your luggage/belongings - Flight delays or cancellations - Disablement or death - Personal liability, such as an injury or loss you may have caused.

What doesn’t Travel Cover protect me for?

The devil is in the detail, and we recommend you thoroughly read and understand your Travel Insurance document. Ask us if there is anything that you don’t understand, so you can understand what is and, sometimes more importantly, what isn't covered. As a general rule, most Travel Insurance providers will not cover you for any pre-existing medical conditions that you have. Most policies will also not cover you if your accident or injury occurred; while you were drunk, under the influence of drugs or doing something criminal. In addition to the above, you may not be covered if you travel to a destination that is considered an extreme risk by the New Zealand Government. You can find the countries currently on the extreme risk list at www.safetravel.govt.nz/travel-advisory-risk-levels. Most “extreme” sports and activities such as skiing, snowboarding, bungee jumping and even scuba diving are also not covered under a standard policy – so it’s important that if you’re going to partake in these activities while you’re away, that you choose a policy that specifically covers these activities.

What information do I need to tell Cover-More when taking out cover?

It's important you tell your insurer about any pre-existing medical conditions, as non-disclosure can mean that your claim is declined. Even if your medical condition is under control, you still need to tell your Travel Insurance provider. If your condition has been managed successfully for a period of time, you may not face a higher premium, but it’s important you tell the insurer this information and let them make that decision.

What is the difference between Individual and Group Cover?

There are two main types of Travel Insurance in New Zealand; Individual Cover and Group Cover. Individual Cover policies will only cover the policy holder (generally you). Group Cover policies will cover a group or family that is travelling together. Group Cover will usually work out cheaper than individual cover, as the cost and risk is spread out over a number of people. Some Travel Insurance providers offer special cover for different types of travel/travelers, such as students and adventurers, or for those partaking in overseas business or a cruise.

Do I need to have my Travel Insurance Policy with me at all times while travelling?

Most Travel Insurance providers will give you a toll free number you can call from anywhere in the world if you need to access your policy. It is important you keep this number with you at all times, as well as your travel policy number. We also recommend you keep a copy of your Travel Insurance Documents with all your other travel documents, as you may need to show this to certain authorities in the course of your travels.

How do I lodge a Travel Insurance claim?

Save time and lodge a claim online using Cover-More's Claims Centre at claims.covermore.co.nz. You can lodge a claim here from anywhere in the world. You will be asked to describe the incident, include medical expenses and upload supporting documentation. You can save and return to complete a claim for up to 28 days. Alternatively, you may download and complete a Claim Form from Cover-More's Claim page and send it in. When filling out the form, take care to provide as much detail as possible regarding the event you are claiming for. If you are in need of assistance when completing your claim, contact Cover-More Claims Customer Service on 0800 600 115 or email [email protected] For more information, see Cover-More's step-by-step guide to making a claim on their website.

Why does Travel Cover have an excess if you make a claim?

Most Travel Insurance policies will require you to pay some money when you make a claim (commonly referred to as an 'excess'). By asking you to bare some of the cost in the event of a claim, Travel Insurance companies can keep their premiums low and cost effective. The amount of excess varies between Travel Insurance providers and between the types of claim you are making. Excess amounts are set out in your policy.

- Chubb Assistance

- Products and Options

- Product Features

- Baggage and Travel Documents

- Overseas Medical, Cancellation/Additional Expenses

- Emergency Medical Assistance Overseas

- Personal Liability

- Accidental Loss of Life

We’ve got you covered for COVID-19

* This policy provides cover for costs incurred from having to cancel, curtail or change your trip because you contract COVID-19 and it is first diagnosed after the policy is issued. The Policy also provides cover for overseas medical emergency expenses incurred on your overseas trip, and transportation of remains or burial if you die during your trip, as a result of you having contracted COVID-19 which was first confirmed or diagnosed while on Your Trip (unless you were COVID-19 positive when your trip began, or you travel against a government issued “Do Not Travel” warning or border closure).

We do not cover trip cancellation, curtailment or change due to border closures caused by COVID-19. Limits apply and vary with each plan. See the Policy Wording for full terms, conditions and exclusions.

- Cover at a Glance

Cover for COVID-19

Cover for overseas medical expenses, emergency medical evacuation, and trip cancellation, curtailment or change, due to your COVID-19 diagnosis. See details above.

Medical Expenses

Provides cover for repatriation/evacuation, cost of overseas emergency medical treatment, emergency dental treatment and extra accommodation costs, in the event of a medical emergency while on your overseas trip. Excludes claims arising from pre-existing medical conditions.

Trip Cancellation and other Travel Inconveniences

The Policy provides cover if you need to cancel, curtail or change your trip due to certain unforeseen circumstances including injury or illness (excluding pre-existing medical conditions). The Policy also covers trip delay by providing additional hotel accommodation (room only) if your flight is cancelled or extensively delayed (waiting periods apply), as well as cover for lost or damaged personal baggage and travel documents (theft report required, limits and sub-limits apply, excludes items stolen if left unattended in a public place).

Cover for accidental death, hijack and kidnap cover, and cover for personal liability incurred, while on your overseas trip (excluding liability for use of vehicles or watercraft). Cover also provided for loss of income due to an overseas injury causing temporary total disablement.

Optional add-ons

Options include snow sports cover, cruise cover and rental vehicle excess cover (additional premiums apply).

Travelling against Government advice? We will not cover losses, pay or reimburse any costs, under any section of this Policy, arising from circumstances where: (a) prior to the Issue Date specified on Your Certificate of Insurance in the case of a claim for Cancellation; or (b) prior to You starting a Trip for all other claims under the Policy; the New Zealand Government or a New Zealand government agency(such as MFAT) issued a travel advisory warning advising you to ‘Do Not Travel’ or that borders are closed, for the destination You planned to travel to. Please refer to who.int or https://www.mfat.govt.nz/ or other government sites for further information.

This frequently asked questions (FAQ) document has been prepared to address some frequent coverage queries relating to the Chubb Travel Insurance Policy Wording . The FAQs are a summary only, they are not an exhaustive list of the coverage, terms, conditions or exclusions in the Policy.

Limits apply and vary with each plan. Please refer to the Policy Wording for further information on the terms, conditions and exclusions of the policy.

If I am diagnosed with COVID-19 during my overseas trip, will my overseas medical expenses be covered?

Yes, if you are first diagnosed with COVID-19 while on your overseas trip and require immediate medical treatment, cover is provided for the cost of medical treatment incurred overseas. Except where you were COVID-19 positive when your trip began, or you travel against a government issued “Do Not Travel” warning or border closure.

If I’m positive with COVID-19 when my trip begins, will I be covered for COVID-19 related medical expenses during my trip?

No, you’re not covered for medical expenses incurred during your trip if you were diagnosed with COVID-19 before your departure.

If I become ill with COVID-19 before or during my Trip, will I be able to claim for costs I incur for the Cancellation or Curtailment of my Trip?

Yes, cover is provided for costs arising from a necessary and unavoidable trip cancellation or curtailment as a result of an unforeseen illness (including COVID-19) where:

- you first contract and are diagnosed with COVID-19 after the policy is issued;

- a doctor confirms the illness in writing; and

- the illness is not a pre-existing medical condition.

I no longer want to travel because I am worried about the spread of COVID-19. Are my trip cancellation, curtailment or change costs covered?

No, cover is not available in this scenario. Simply no longer wishing to travel is not covered under the Policy.

If I need to cancel, curtail or change my trip due to a COVID-19 border closure as announced by any departure or destination government, am I covered?

No, cancellation due to COVID-19 government related travel advisories and/or border closures is not covered.

If I am diagnosed with COVID-19 after commencing my trip and subsequently issued with a quarantine order, will I be covered for the quarantine costs?

Yes, additional travel or accommodation expenses incurred are covered (within the benefit limitations) as a result of a mandatory quarantine order by a local government or public health authority. Except where you travel against a government issued “Do Not Travel” warning or border closure.

I have been classified by a public health authority as a close contact with a person diagnosed with COVID-19 and have been required to isolate as a result of this contact. Is there any benefit that I can claim?

No, cover is not available in this scenario.

Do I need to be vaccinated against COVID-19 to be eligible for the COVID-19 cover under this policy?

No, you do not need to have the COVID-19 vaccination to be eligible for cover under this policy. However, you will not be covered for any claim for cancellation, curtailment or trip change where you do not meet the vaccination protocols required by your transport provider or by any government authority (in New Zealand or at the destination) prior to departure

Is there an option to purchase COVID-19 Cover on a stand-alone basis?

No, COVID-19 cover is not available on a stand-alone basis.

Is cover provided for trip cancellation, curtailment or change due to a natural disaster at my intended travel destination?

Yes, provided there had been no official publication (prior to the purchase of the policy) warning that the natural disaster had occurred or was likely to occur. Please note that natural disasters do not include epidemics or pandemics (which are excluded under the policy).

I am unable to obtain my passport, entry visa or other required documentation in time and need to cancel my trip. Is this covered?

No, failure to hold or obtain all required documentation for your trip is not covered.

If I need to cancel my trip due to an illness or injury before my departure, am I covered?

Yes, cover is provided for trip cancellation which is necessary and unavoidable as a result of an unforeseen illness or injury as confirmed by a doctor in writing. The illness or injury must first be contracted or occur after the policy is issued. It’s important to check Policy Wording for details on pre-existing medical conditions which are not covered.

If I need medical treatment during my overseas trip, will my overseas medical expenses be covered?

Yes, if you suffer an unforeseen illness or injury on an overseas trip which requires immediate medical treatment, cover is provided for your medical expenses incurred overseas. It’s important to always check the Policy Wording , which excludes claims arising from pre-existing medical conditions and participation in certain sports.

Are Pre-Existing Medical Conditions covered?

This policy does not cover any pre-existing medical conditions. If you have a pre-existing medical condition, this cover may not be right for you. Before you purchase a policy, you should consider whether a medical condition is considered pre-existing based on the definition of ‘Pre-Existing Medical Condition’ which is found on page 20 of the Policy Wording .

What is a "Pre-Existing Medical Condition"?

A Pre-Existing Medical Condition generally means any medical or dental condition, illness, injury or disease that you previously required or continue to require treatment for, or that is under investigation at the time the policy is issued. It’s important to check the full definition of “Pre-Existing Medical Condition” on page 20 of the Policy Wording before making your purchase, as variable limits and time restrictions apply to specified conditions.

Is a video camera (or any other item) on loan or hire for the trip covered?

No, any items loaned, hired or entrusted to you are not covered

What happens if my luggage is delayed by the airline when I’m on my trip?

We will reimburse essential emergency clothing and toiletry expenses incurred (as required for a 24-hour period, up to the benefit amount under ‘Delay of Personal Baggage’ applicable to your chosen plan) if your luggage is delayed for 12 hours or more. If your luggage is delayed for more than 36 hours, the limit is increased up to the benefit amount under ‘Extended Delay of Personal Baggage’ applicable to your chosen plan.

Who is eligible for cover under the policy?