- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

GeoBlue Travel Insurance Review: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does GeoBlue travel insurance offer?

Geoblue travel insurance cost and coverage, what isn’t covered, how to choose a geoblue plan online, is geoblue travel insurance worth it.

- Flexible deductible options.

- Wide ranging medical coverage.

- Low prices for medical only needs.

- Lacks in traditional travel insurance coverage options such as trip Interruption, bag delays, etc.

- Better when paired with travel credit card insurance coverage.

If you’re going on a trip soon, you may be wondering whether to invest in travel insurance. This type of insurance can offer protection in the event that you fall ill, your plans change unexpectedly or you experience unavoidable delays.

GeoBlue is one insurance provider offering plans to travelers, with a number of plans available based on your needs. Here's a review of GeoBlue travel insurance, including the options offered and how to choose your plan.

GeoBlue insurance offers two different plans for travelers, though it focuses mainly on medical coverage . These plans are called Voyager Essential and Voyager Choice. The former offers lower coverage options than the latter and is generally cheaper (though as you'll see, not always by a large amount).

The company also provides multitrip, long-term and group options for those who need them.

» Learn more: How much is travel insurance?

How much does GeoBlue cost? GeoBlue’s travel insurance is mostly medical-based and includes a comprehensive list of inclusions, though it also has coverage for some travel mishaps.

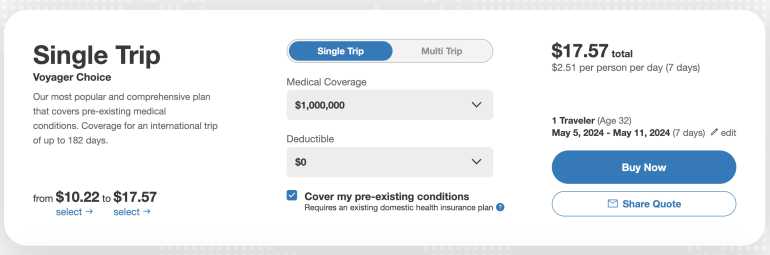

To get an idea of costs, we used a sample trip for a 33-year-old traveler from California with existing insurance heading out in August on a two-week trip.

Note that for this GeoBlue insurance review, we selected the highest coverage amount with no deductible. There are choices that allow you to include a higher deductible and a lower coverage limit, which may lower your plan cost.

Here’s what the two GeoBlue plans cover:

As you can see, there’s not a big difference when it comes to how much GeoBlue’s plans cost, with just about $7 between the two different offerings.

In terms of benefits, most are the same as well — the biggest difference between the Voyager Essential and Voyager Choice plans comes down to prescription medication coverage and coverage related to accidental death and dismemberment .

The less-expensive Essential plan pays 50% of your prescription costs, while the Choice plan covers the full 100%. As well, the Choice plan doubles accidental death coverage from Essential's $25,000 to $50,000.

Other than that, differences are minimal. You’ll get less coverage for emergency dental care and quarantine expenses , but otherwise, everything else is the same.

» Learn more: How does travel insurance work?

Is GeoBlue travel insurance good? Unlike many other travel insurance policies, GeoBlue’s products include coverage for hazardous activities and medical quarantine.

However, while GeoBlue shines when it comes to medical coverage, it falls short in other travel insurance aspects. Many travel insurance plans provide better options in the event that your bags are delayed , your flight is canceled or you miss nonrefundable bookings.

In GeoBlue’s case, the low levels of reimbursement for these types of issues may be problematic. However, bear in mind that many travel credit cards provide complimentary travel insurance that would pair well with a GeoBlue plan.

» Learn more: What to know before buying travel insurance

To purchase a GeoBlue plan online, go to the company’s website .

You’ll see the option to generate a quote and you’ll type in your trip dates, traveler's age and ZIP code.

Once you hit "Get A Quote" the results page pops up, which will give you the option to choose your deductible amount and maximum level of coverage. You can also toggle between single trip and multi trip.

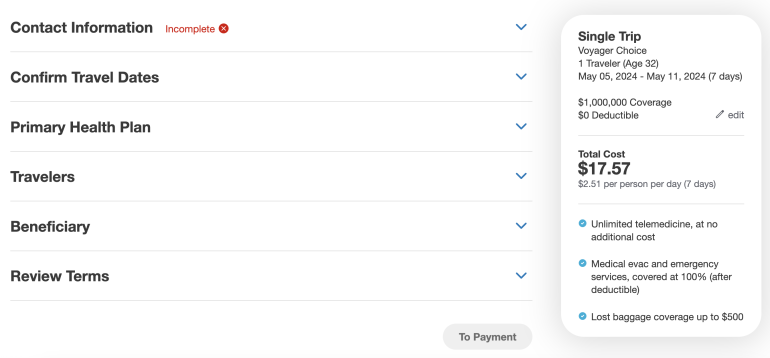

Once you’ve decided on a plan, you’ll need to fill out all pertinent information including your contact information, your health plan details and beneficiary. Once you review the terms of the plan, select to payment and input your credit or debit card information.

After that, your policy will be issued.

» Learn more: 6 common travel insurance myths

While it offers excellent medical care for low prices, GeoBlue’s policies fall short when it comes to other travel coverage. However, if you also have a travel credit card , you may be able to pair the two together for relatively strong travel insurance coverage at a low cost.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

GeoBlue Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Director of Operations & Compliance

1 Published Article 1172 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Why choose geoblue, travel medical insurance and the covid-19 virus, short-term single-trip plan options — geoblue voyager, multi-trip plan options — geoblue trekker, long-term plan options, additional plans available, how to obtain a quote, the value of travel insurance comparison sites, geoblue vs. other travel insurance companies, geoblue vs. credit card travel insurance, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss travel insurance and look closely at companies that offer the coverage , but today we’re narrowing our focus from comprehensive travel insurance to a specific type of travel coverage — travel medical insurance.

Chances are you’ve heard of BlueCross BlueShield (BCBS), one of the leading healthcare insurance providers in the U.S. The company was established in 1929 and currently insures over 107 million members. GeoBlue, an independent licensee of BCBS, picks up where BCBS leaves off, offering travel medical coverage worldwide .

You do not have to be a member of BCBS to purchase travel medical insurance from GeoBlue as the company makes its products widely available to U.S. citizens and permanent residents.

In an effort to determine the benefits of GeoBlue as a viable option for purchasing travel medical insurance, join us as we explore the following in today’s review:

- Why you should consider travel insurance and specifically GeoBlue

- An overview of the types of plans the company offers

- Comparing plans and obtaining a quote

- How the company measures up versus other companies and to credit card travel insurance

Insurance products, in general, serve the purpose of indemnifying you and making you whole (or nearly whole) should a covered event cause you to incur a financial loss. Travel insurance , and in this case travel medical insurance, is designed to accomplish the same objective.

Since our topic for this article is narrowed to travel medical insurance , let’s look at several reasons you’d want to consider this coverage.

- Your current health insurance policy does not provide coverage outside of the U.S. and/or its territories

- Your current health insurance policy covers you outside of the country but has a high deductible

- You are on Medicare and do not have a supplement plan

- You want a primary travel medical policy that gives you access to a network of medical providers in the country you’re visiting

- You have insurance from your credit card for trip cancellation, trip interruption , and other travel disruptions, but not travel medical coverage

- You are traveling to a remote area and want to have emergency evacuation insurance

This is just a sampling of some of the situations where you’d want to consider purchasing a travel medical insurance policy. Fortunately, the coverage is affordable and widely available.

Bottom Line: If your current health insurance policy does not cover you while traveling abroad or has a high deductible if it does provide coverage, you’ll want to consider purchasing travel medical insurance . Additionally, you should consider travel medical insurance if you’re concerned about emergency medical evacuation, or want to have 1 primary policy that covers you during your travels.

If you have the need to purchase travel medical insurance, there are certainly a lot of companies from which to select. GeoBlue stands tall among those competitors for several reasons.

First, the company has been providing global health insurance options since 1997, is a licensee of BCBS with a rating of excellent by financial insurance rating company, AM Best, and has an A+ rating by the Better Business Bureau.

Additionally, you can expect the following benefits when insuring with GeoBlue:

- GeoBlue has a vetted group of elite doctors in a network that spans 190 countries. Physicians must be certified by the American or Royal Board of Medical Specialties.

- Visits to network doctors/facilities are handled cashless, eliminating the need to file a claim for reimbursement.

- In addition to in-person care, GeoBlue utilizes alternative telemedicine options available 24/7 and provides access to a global network of physicians and facilities.

- Access is available to 24/7 assistance including translation services, physician referrals, prescription services, destination assistance, and more.

Bottom Line: GeoBlue is an established, highly-rated company that specializes in providing travel medical insurance with associated care via its global physician network, telemedicine services, and 24/7 medical assistance services.

Travel insurance, in general, does not cover voluntary trip cancellations due to the fear of getting ill for any reason, including the fear of contracting the COVID-19 virus. In addition, some travel insurance companies specifically exclude COVID-19 for most coverages. Other travel insurance companies provide limited coverage for COVID-19-related illnesses under trip interruption and medical care coverages only.

You’ll want to review any policy you’re considering to make sure your greatest concerns are covered.

In order to have any coverage that provides reimbursement for a voluntary trip cancellation, for example, you’ll need to consider Cancel for Any Reason (CFAR) insurance .

Travel medical insurance does not normally include extensive coverage for trip cancellations or disruptions but focuses more on providing medical care and reimbursement for the associated expenses that occur as a result of becoming ill or having an accident during your travels.

Fortunately, many of the medical insurance policies offered by GeoBlue do cover COVID-19-related illness . Let’s look closer at the available options.

Bottom Line: In order to have coverage for trip cancellation due to the fear of getting ill, you would need to purchase Cancel for Any Reason insurance. Some policies provide limited coverage for COVID-19 under trip cancellation and trip disruption coverages should you contract the virus prior to or during your travels. Many of the travel medical policies offered by GeoBlue cover COVID-19-related illness care .

GeoBlue Policy Comparisons

GeoBlue offers single trip, multi-trip, and long-term plans. The company also issues specialty travel medical plans for students, workers on assignment, missionaries, volunteers, and maritime workers while abroad.

First, let’s look at the policy options for individuals and group travelers.

GeoBlue Voyager plans are designed for individual single-trip travel or group single-trip events. Groups are defined as 5 or more persons traveling together and a 10% discount off of individual pricing is provided.

Voyager plans include coverage for COVID-19-related illness care.

Here’s how the 2 Voyager policy options compare.

If you’re a frequent traveler, it could make sense to purchase 1 annual policy that covers multiple trips. GeoBlue Trekker multi-trip plans cover all trips made within a 12-month period (up to 70 days in length) and offer 2 levels of coverage options.

Here is a comparison of the 2 GeoBlue Trekker plans.

Both plans cover pre-existing conditions and emergency and non-emergency medical care. Both plans require that you have a primary health plan in place to qualify for purchasing these plans.

If you’re a U.S. citizen or permanent resident living abroad and need medical insurance, GeoBlue offers 2 plans that may provide the coverage you need for you and your family.

These plans are different from short-term plans in that medical underwriting is needed in order to qualify. Here’s a brief summary of GeoBlue plans for U.S. expats.

All GeoBlue plans offer 24/7 global medical assistance, translation services, doctor searches, and destination health/security information.

GeoBlue Navigator, Xplorer, and Voyager plans include coverage for COVID-19-related illness .

GeoBlue provides additional medical plans for specific types of travelers working abroad, on assignment, or participating in study programs.

- Incoming international students studying in the U.S.

- Students studying abroad

- Employees of multi-national companies working abroad

- Expatriate Crew International Health Plan — for those working on ships

- Expatriate Missionary and Volunteer International Health Plan — covers missionaries, aid workers, and volunteers worldwide

Bottom Line: GeoBlue offers several comprehensive individual travel medical plan options, comprehensive student plans including coverage for international visiting students, and plans for U.S. students, faculty, and family when studying abroad. GeoBlue also offers employer plans that provide coverage to employees working abroad and their families. Missionaries, those who volunteer internationally, and maritime workers will also find policies designed specifically for those situations.

Obtaining a quote for any type of travel insurance can be quick, easy, and can even result in securing immediate coverage. The process is similar for travel medical insurance.

To obtain a quote from GeoBlue for a single trip plan, you’ll need to input your travel destination, your state of residence, the length of your trip, age, cost of the trip, and the date you made the first trip deposit.

For a multi-trip annual plan quote, the process is similar. You’ll need to input your zip code, age, and the desired effective date of the policy.

Obtaining a quote with GeoBlue for a single or multi-trip policy can be done in just a few minutes. To obtain a long-term policy quote, you’ll need to submit some of the same basic information and a quote will be emailed to you.

Bottom Line: Obtaining a quote for a single or multi-trip policy is a quick and simple process completed on the GeoBlue website. A long-term quote for qualifying applicants must be requested via email.

While purchasing a travel medical policy from GeoBlue ensures you’re dealing with a highly-rated established company, it’s always good to do some comparison shopping when looking for any type of insurance.

Viewing a selection of policies side-by-side makes it easy to compare coverages and costs. This task is easily accomplished by utilizing a travel insurance comparison website such as the ones listed here.

Additionally, comparison sites allow you to narrow the number of policies to those that contain the coverages most important to you. Here are a few we recommend:

- InsureMyTrip — great for stand-alone medical travel insurance policy comparisons but also offers comprehensive travel insurance policies from over 20 providers

- Squaremouth — easy to navigate site that allows you to compare dozens of travel insurance companies and filter by desired coverage, including travel medical insurance

- TravelInsurance.com — you’ll want to use this site for comparing travel insurance plans, including those with medical coverage, however, no stand-alone medical plan quotes are available

Bottom Line: Utilize a travel insurance comparison site to help you easily compare several plans, filter by desired coverage, and select those that best match your coverage priorities.

How GeoBlue Compares — Summary

We know that GeoBlue is a reputable choice for travel medical insurance but let’s look at how the company’s offerings compare to other travel medical providers and to the coverage that comes with your credit cards.

When we searched for a quote using the criteria of a traveler, age 40, for a trip to Mexico for 1 week that costs $3,000, the top 4 results above were shown. You’ll notice by the results that single-trip travel medical insurance can be an affordable option.

The next key element in selecting a policy will be to compare coverages. We know that GeoBlue Voyager policies include coverage for COVID-19 with the Voyager plans, for example, so this may be a key factor in our selection.

Digging deeper into our comparison we find that 1 policy does not include coverage for COVID-19. If we narrow our search to plans that only include this coverage, the next step will be to look at other coverages and limits that are important to us.

In this case, coverages for these policies are similar and costs do not vary widely. GeoBlue, however, remains competitive in both coverages offered and premiums charged.

Bottom Line: While GeoBlue holds its own and is competitive in both coverages and cost when compared to other travel medical insurance companies for single-trip plans, we know that coverage for multi-trip plans does not include coverage for COVID-19-related illness.

We frequently remind travelers that even the best credit cards for travel insurance are not a replacement for a comprehensive travel insurance policy. This is especially true for travel medical insurance coverage as you won’t find comprehensive medical coverage on any credit card .

There are very few cards that do offer emergency evacuation insurance and other ancillary medical/dental coverage. Here are 2 of the best options for travel-related coverages and benefits.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

To learn more about all the travel insurance coverages that come with the Amex Platinum card, you’ll want to review our in-depth article on the topic. Note that terms apply and enrollment may be required for some benefits, so make sure you enroll through your American Express account.

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- Member FDIC

- APR: 22.49%-29.49% Variable

Chase Ultimate Rewards

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Chase Sapphire Preferred vs Reserve

For more information on Chase Sapphire Reserve card travel insurance coverages , you’ll want to access our expanded overview.

Bottom Line: While credit cards may offer travel accident, trip delay , and other ancillary travel insurance coverages, these cards do not offer travel medical insurance.

Here’s some additional information we need to pass along applicable to the GeoBlue policies mentioned in our article:

- Eligibility includes U.S. citizens and permanent residents only

- Single and multi-trip medical insurance policies must be purchased in your home country before you travel

- Long-term policies, such as those for expats, may be purchased while abroad

- Travelers under 96 are generally eligible for coverage; other age limits may apply to specific policies

- Coverage is valid in all countries other than where the plan would violate U.S. economic trade sanctions

- Some GeoBlue policy options are secondary and require you to have an underlying medical insurance policy

- All policies issued by GeoBlue have a 10-day money-back guarantee

GeoBlue’s expertise at providing travel medical insurance makes it a good choice for purchasing coverage for a single or group trip, or if you’re an expat needing longer-term medical coverage while abroad. Students, faculty, and employers will also find comprehensive medical plans that fit their international medical insurance needs.

Finally, keep in mind that our article today is simply an overview and abbreviated summary of GeoBlue’s policy offerings — plenty of terms and conditions apply. The company’s website provides everything you need to select the appropriate policy, review coverages, obtain a quote, and purchase a plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

How does geoblue travel insurance work.

GeoBlue specializes in travel medical insurance. Care is provided internationally primarily via a comprehensive, vetted, and certified worldwide network of physicians and hospitals in 190 countries, but out-of-network international care is also covered. Additionally, the company provides worldwide care via telemedicine appointments.

The company offers international single trip, multi-trip, and group travel medical insurance plans.

It’s specialty travel medical insurance plans include policies for visiting international students, U.S. students studying abroad, and faculty members.

Additional plans include plans for those who work abroad for multi-national companies, maritime works, missionaries, and volunteers.

Is GeoBlue a good travel insurance company?

Yes. GeoBlue, a licensee of Blue Cross Blue Shield, is an established travel medical insurance company that has been offering international health insurance since 1997.

The company received a high financial rating from insurance rating company A.M. Best and an A+ rating from the Better Business Bureau.

Does GeoBlue meet Schengen visa insurance requirements?

Yes. GeoBlue travel medical insurance plans meet Schengen visa insurance requirements.

Does GeoBlue cover dental?

GeoBlue Voyager and Trekker plans offer ancillary dental coverage with limits between $100 and $500, depending on the plan, which includes emergency dental care for injury or relief of pain.

Voyager plans have additional dental and vision care riders which are optional add-ons.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![geoblue travel insurance reviews reddit Citi Simplicity® Card — Review [2023]](https://upgradedpoints.com/wp-content/uploads/2019/11/Citi-Simplicity-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

EDITOR'S PICK

Best Price Guarantee By Comparing Top Providers In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Policies from trusted providers including: Travel Insured International, AEGIS, Global Trip Protection, Arch RoamRight and others

- Travel Insurance

- GeoBlue Review

GeoBlue Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is GeoBlue rated?

Overall rating: 3.7 / 5 (very good), geoblue plans & coverage, coverage - 4 / 5, emergency medical coverage details, baggage coverage details, geoblue financial strength, financial strength - 3.5 / 5, geoblue price & reputation, price & reputation - 3.5 / 5, geoblue customer assistance services, extra benefits - 3.8 / 5, travel assistance services.

- Return Travel Arrangements

- Lost Baggage Search

- ATM Locator

- Lost Passport/Document Assistance

- Emergency Cash

- Translation Services

- Legal Assistance Referral

Emergency Medical Assistance Services

- Physician Referral

- Emergency Medical Case Management

- Emergency Prescription Replacement

- Eyeglass Replacement Assistance

Concierge Assistance Services

- Restaurant/Event Referral and Reservation

- Weather Advisories

Our Comments Policy | How to Write an Effective Comment

11 Customer Comments & Reviews

- ← Previous

- Next →

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

- Provider Review

Reviews, Sales, and Service Ratings for GeoBlue

0.0% (4) negative reviews to sales Average on Squaremouth is 0.2%

- 1 star 2

- Customer Service Before Trip

- Customer Service During Trip

- Customer Service During Claim

Customer Reviews for GeoBlue

Sort by Most Helpful, Most Recent, Star Ratings, or select “Filed Claim” to only show reviews from customers who filed a claim.

- Next ›

- Last »

- Sort and Filter Sort/Filter All ratings 1 star 2 stars 3 stars 4 stars 5 stars Newest First Rating, best to worst Rating, worst to best Most helpful first Filed claim

I would purchase travel insurance again through SquareMouth.

I liked the updates Geo- Blue gave about things going on in the country I visited. They were informative.

Great support from Squaremouth when trying to choose a policy.

I have used GeoBlue for 3-4 trips. Comprehensive coverage but never used for medical claims. Easy to contact . Will use again.

The gentleman i talked to was incredibly helpful and patient.

See my positive previous review regarding my experience with GeoBlue sustomer service

I did not need to contact GeoBlue during my recent travel/vacation to Canada, or submit a claim, so I'm unable to comment on that matter. Otherwise, I am satisfied with my medical travel insurance purchasing experience with GeoBlue. Thank you.

submitted our claim on May 26th, was told originally that it would take 2-3 weeks. After 2-3 weeks passed, was told that it's 2-3 business weeks. After 2-3 business weeks passed, was told it's 1 business month. Still waiting for the claim result...

Really pleasant person at GeoBlue assisted me pre-departure when I had some difficulties accessing membership cards via the internet. She was very patient and very helpful. We had no health incidents while traveling, but we expect to purchase similar coverage next time we travel out of the U.S.

I filed the claim and nobody get back to me as of now... Terrible...

Insurance Providers

- Arch RoamRight

- AXA Assistance USA

- Azimuth Risk Solutions, LLC

- Berkshire Hathaway Travel Protection

- CSA Travel Protection

- Detour Insurance

- Generali Global Assistance

- Global Alert

- Global Guardian Air Ambulance

- Global Underwriters

- HTH Travel Insurance

- INF Visitor Care

- John Hancock Insurance Agency, Inc.

- MedjetAssist

- Nationwide Mutual Insurance Company

- Seven Corners

- Travel Insured International

- Travelex Insurance Services

- Trawick International

- USA-Assist Worldwide Protection

- USI Affinity Travel Insurance Services

Additional Information

- AM Best Ratings

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

GeoBlue Travel Insurance Review (2024)

Get a free quote to protect your next vacation below.

from Geoblue via Squaremouth.com

Josh Lew is a travel journalist and writer based in the midwestern U.S. He has been active for the past decade, covering airlines, international destinations and ecotourism for sites like TravelPulse and TreeHugger. He currently contributes to content writing agency World Words.

Sabrina Lopez is an editor with over six years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she is not working on articles to help consumers make informed decisions, Sabrina enjoys creative writing and spending time with her family and their two parrots.

GeoBlue is a bit different from other top travel insurance providers . In a world of comprehensive trip insurance, this independent licensee of Blue Cross Blue Shield keeps it simple by offering straightforward single-trip and multi-trip health plans.

This insurance brand caters to all types of travelers, from vacationing families to adventure-seekers living or studying abroad for extended periods. With features like a network of doctors who bill GeoBlue directly and coverage for pre-existing conditions, GeoBlue is for people who only need medical coverage when traveling.

At the same time, those seeking trip cancellation insurance won’t find what they are looking for with GeoBlue, which only offers modest interruption and lost baggage coverage.

GeoBlue Travel Insurance Overview

GeoBlue has plans designed for different types of travelers. Its single-trip and short-term coverage is branded as “GeoBlue Voyager.” These options have travel medical coverage limits ranging from $50,000 to $1 million and include accidental death and dismemberment, emergency evacuation , repatriation and prescription drug reimbursement.

In addition to different coverage limits, this insurer has deductible options ranging from $0 to $500. Also, patients can use telemedicine services for non-emergency care.

Trekker-branded insurance coverage is for frequent international travelers needing medical coverage across multiple trips. Meanwhile, Navigator and Xplorer plans to provide emergency and non-emergency healthcare benefits to expats, students, maritime crew members and missionaries.

Pros and Cons of GeoBlue

Compare geoblue to the competition.

Use the table below to compare GeoBlue to other travel insurance providers. However, keep in mind that other providers will cover more costs for your trip, such as cancellation and interruption, whereas GeoBlue just provides travel medical insurance.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Does GeoBlue Cover?

GeoBlue’s Voyager Essential and Voyager Choice are budget-friendly travel insurance options focusing on medical services. Essential does not require a U.S.-based primary health plan, but Choice does.

Here is what you get with the GeoBlue Voyager Essential plan.

- $50,000 to $1 million emergency and non-emergency medical coverage

- $500,000 for medical evacuation

- $25,000 for death, dismemberment, or repatriation costs

- 50% prescription drug coverage up to $5,000

- $500 baggage coverage per trip or $100 per bag

- $1,000 trip interruption insurance

If you plan to take multiple trips or live abroad for more than six months, the Xplorer or Trekker plans can provide long-term protection.

Optional Riders

A rider is an addition to a standard insurance agreement. It amends the details or adds other coverage to the policy. For instance, a rider could raise coverage limits or make exceptions for a pre-existing condition.

Because of the varying coverage limits and deductible choices on the Voyager Essential plan, riders are usually not necessary. However, Voyager Choice offers several upgrades that may be worthwhile to some travelers.

- $50,000 death and dismemberment coverage

- 100% coverage for prescription drugs up to $5,000

- No 180-day exclusion for pre-existing conditions

- $50 per day for trip interruptions involving quarantine

Though both these plans are open to all U.S. citizens, Voyager Choice requires that you have an active health insurance policy in the U.S.

Policies Offered

GeoBlue travel insurance plans focus on medical care, including emergencies and regular outpatient office visits. However, other coverages are also a part of some plans.

All policies offer $25,000 for specified hazardous activities, such as alpine skiing and scuba diving (diving certification required for coverage).

How Much Does GeoBlue Travel Insurance Cost?

Travel insurance policy prices depend on different factors, including the cost of your trip, your age, pre-existing medical conditions, your destinations, coverage limits, the length of your stay, and other factors. The insurer will ask about these different variables during the signup process.

Cost of International Travel Insurance

Quotes represent the cost for a month-long trip from Sept. 1 to Sept. 30, 2023 for a 40-year-old traveler from Texas. The plan has a $0 deductible and $1,000,000 in medical coverage.

Voyager plans have $1,000 in trip interruption and $500 in lost baggage coverage.

Read More: Travel Health Insurance For Visitors To USA

Does GeoBlue Offer 24/7 Travel Assistance?

GeoBlue says it offers 24/7/365 assistance for all medical insurance plans through its mobile app, site and a toll-free international call center.

The app includes self-service features like virtual insurance ID cards, in-network doctor listings, medication dose conversions and access to telemedicine services on compatible devices. Telemedicine services are via Teledoc Health and include same-day appointments and additional communications, such as appointment notes, via the policyholder’s phone.

Insured customers can also contact GeoBlue via phone on toll-free and collect-call hotlines. Operators are able to coordinate services listed on the policy, check coverage eligibility and find doctors in the country.

GeoBlue Customer Reviews

GeoBlue has over 80 reviews on Squaremouth and a rating of 4.63 out of 5 as of June 2023. Many of the customers mentioned that they needed international health insurance without cancellation or other travel coverage and found that GeoBlue was the best fit for their needs. Some reviewers struggled to find information about healthcare providers in GeoBlue’s network in their destination country.

Here are four reviews from verified customers on Squaremouth.

“Really pleasant person at GeoBlue assisted me pre-departure when I had some difficulties accessing membership cards via the internet. She was very patient and very helpful. We had no health incidents while traveling, but we expect to purchase similar coverage next time we travel out of the U.S.” —Catherine from GA “My trip to Israel was canceled by the tour company one week before we were to leave. I sent an e-mail to GeoBlue to inform them that the trip had been canceled. Within minutes I received an e-mail from GeoBlue that my insurance had been canceled and that I would receive a refund to my credit card ASAP. I hope to re-schedule this trip as soon as possible and I will only use GeoBlue for securing travel insurance. I could not have been more satisfied with the service and would highly recommend them to anyone considering travel insurance in the future.” —Pamela S. Johnson from OH “I had my suitcase stolen while on my trip in Sweden. When I returned, I filed a claim ($500 total, $100 per item for lost/stolen Item) and have been turned down twice, the latest because I have no receipts for the items lost (we are talking suitcase, [clothes], shoes, electric toothbrush, toiletries, etc. [Things] that people do not keep receipts on). The first denial was noted as not providing medical records and receipts, as if they hadn’t even bothered to read the claim. I did provide them with the police report that I was provided, the report that the Gate 1 tour company provided, and a break-down of what was in the suitcase, including prices.” —Kenneth from AL “I have been constantly asked by the medical doctor in Greece over a 6 month period to help them as I made 2 visits to the doctor and they claim they were not paid. Since I [contracted] Covid I also had bloodwork, chest X-rays, etc., 2 visits in all. I paid direct to the hospital [on my] first visit and met my deductible . ($250 or 240.50 euros). The doctor claims they were never paid by GeoBlue! I called from Greece, which is very expensive, to GeoBlue twice and asked that they [please] straighten this out. I sent 2 emails stating the same. But to this day the doctor’s secretary is writing to me to secure payment for them. I was sick in May — it is now November! I told the doctor that you are in GeoBlue’s network and you should be contacting GeoBlue to get paid. Most annoying and frustrating.” —Martha from FL

Note: GeoBlue responded to the above review with the following : Thank you for your review! A response to your claim inquiry email was sent on 11/16/2022, please check your email and spam folder for our resolution to your claim issue.

How To File a Claim with GeoBlue

GeoBlue offers several options for filing a claim. Customers with travel medical plans will have access to the Member Hub and mobile app. Both allow for electronic claims submission. The process includes filling out a claims form and submitting scans or images of medical bills and supporting documents. You can also file a claim by fax, email or traditional mail.

GeoBlue has country-specific phone numbers for some destinations.

Is GeoBlue Worth It?

GeoBlue focuses on providing health insurance for people traveling outside of their home country. You can use deductible and coverage limit options to change the cost and level of protection of your policy.

GeoBlue stands out for travel health insurance because it offers telemedicine, a worldwide network of doctors, direct payment for in-network services and both short and long-term insurance options. We recommend requesting a quote from GeoBlue, along with at least two other travel insurance providers, to make sure you get the best value for your trip.

Frequently Asked Questions About GeoBlue

Does geoblue cover pre-existing conditions.

Some GeoBlue programs cover pre-existing conditions. For single-trip coverage, the Voyager Choice plan covers all pre-existing conditions. The basic Voyager Essential also does, but it has a six-month exclusion period from the coverage start date.

Does GeoBlue have policies for group travel?

GeoBlue offers group options for both of the Voyager plans. If you travel with a group of five or more people, you qualify for a 10% discount. Group members must be 95 years old or younger.

Does GeoBlue have a plan for expatriates?

The GeoBlue Xplorer plan is for expats and their family members who plan to be outside the country for at least three months during the year. Explorer Essential has no U.S. coverage, while Xplorer Premier offers comprehensive coverage at home and abroad.

Does GeoBlue offer trip cancellation insurance?

GeoBlue does not have traditional trip cancellation insurance. Voyager plans include $1,000 in trip interruption coverage and $25 to $50 per day for quarantine-related delays.

Other Insurance Resources From MarketWatch Guides

Gain insight into our ratings for the best home, renters, pet, travel or life insurance providers and find affordable recommendations for necessary insurance products.

- Prominent Pet Insurance Companies

- Premier Travel Insurance Companies

- Outstanding Homeowners Insurance Providers

- Top Renters Insurance Firms

- Budget-friendly Renters Insurance Providers

- National Term Life Insurance Providers

- Cost-effective Homeowners Insurance Companies

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

If you have questions about this page, please reach out to our editors at [email protected] .

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.