- Travel, Tourism & Hospitality ›

- Leisure Travel

Cruise industry worldwide - statistics & facts

What are the biggest global cruise markets, what are the leading cruise companies worldwide, key insights.

Detailed statistics

Revenue of the cruises industry worldwide 2019-2028

Revenue growth of cruises worldwide 2019-2028

Revenue of the cruise industry in leading countries 2025-2028

Editor’s Picks Current statistics on this topic

Number of global ocean cruise passengers 2009-2027

Worldwide cruise company market share 2022

Further recommended statistics

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Revenue of the cruises industry worldwide 2019-2028

- Premium Statistic Revenue growth of cruises worldwide 2019-2028

- Premium Statistic Revenue of the cruise industry in leading countries 2025-2028

- Premium Statistic Share of sales channels of the global cruise industry revenue 2018-2028

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Revenue of the cruises market worldwide from 2019 to 2028 (in billion U.S. dollars)

Revenue growth of the cruises market worldwide from 2019 to 2028

Leading countries in the cruise industry revenue worldwide from 2025 to 2028 (in million U.S. dollars)

Share of sales channels of the global cruise industry revenue 2018-2028

Revenue share of sales channels of the cruise industry worldwide from 2018 to 2028

Cruise ships

- Basic Statistic Largest cruise ships worldwide 2023, by gross tonnage

- Basic Statistic Longest cruise ships worldwide 2023, by length

- Premium Statistic Most expensive cruise ships worldwide by building cost 2022

- Premium Statistic Gross tonnage of new cruise ship orders worldwide 2015-2022

- Premium Statistic Gross tonnage of new cruise ship orders worldwide by region 2022

- Premium Statistic Gross tonnage of cruise ship deliveries worldwide by region 2022

- Premium Statistic Gross tonnage of cruise ships in the global order book by region 2022

- Premium Statistic Average passenger capacity of ocean-going cruise vessels worldwide 2018-2026

Largest cruise ships worldwide 2023, by gross tonnage

Largest cruise ships worldwide as of April 2023, by gross tonnage (in 1,000s)

Longest cruise ships worldwide 2023, by length

Largest cruise ships worldwide as of February 2023, by length (in meters)

Most expensive cruise ships worldwide by building cost 2022

Most expensive cruise ships worldwide in 2022, by building cost (in billion U.S. dollars)

Gross tonnage of new cruise ship orders worldwide 2015-2022

Annual gross tonnage of new cruise ship orders worldwide from 2015 to 2022

Gross tonnage of new cruise ship orders worldwide by region 2022

Gross tonnage of new cruise ship orders worldwide in 2022, by region (in millions)

Gross tonnage of cruise ship deliveries worldwide by region 2022

Gross tonnage of cruise ship deliveries worldwide in 2022, by region (in millions)

Gross tonnage of cruise ships in the global order book by region 2022

Gross tonnage of cruise ships in the global order book in 2022, by region (in millions)

Average passenger capacity of ocean-going cruise vessels worldwide 2018-2026

Average passenger capacity carried by ocean-going vessels in the cruise industry worldwide from 2018 to 2023, with a forecast until 2026

Cruise passengers

- Premium Statistic Number of global ocean cruise passengers 2009-2027

- Premium Statistic Number of global ocean cruise passengers 2019-2023, by source market

- Premium Statistic Main global cruise destinations 2019-2023, by number of passengers

- Premium Statistic Busiest cruise ports worldwide 2019-2022, by passenger movements

- Basic Statistic Number of Carnival Corporation & plc passengers worldwide 2007-2023

- Premium Statistic Number of passengers carried by Royal Caribbean Cruises worldwide 2007-2023

- Premium Statistic Number of passengers carried by Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic TUI cruise passengers worldwide 2013-2023, by brand

Number of ocean cruise passengers worldwide from 2009 to 2023, with a forecast until 2027 (in millions)

Number of global ocean cruise passengers 2019-2023, by source market

Number of ocean cruise passengers worldwide from 2019 to 2023, by source region (in 1,000s)

Main global cruise destinations 2019-2023, by number of passengers

Leading ocean cruise destinations worldwide from 2019 to 2023, by number of passengers (in 1,000s)

Busiest cruise ports worldwide 2019-2022, by passenger movements

Busiest cruise ports worldwide in 2019 and 2022, by number of passenger movements (in 1,000s)

Number of Carnival Corporation & plc passengers worldwide 2007-2023

Number of Carnival Corporation & plc passengers worldwide from 2007 to 2023 (in millions)

Number of passengers carried by Royal Caribbean Cruises worldwide 2007-2023

Number of passengers carried by Royal Caribbean Cruises Ltd. worldwide from 2007 to 2023 (in 1,000s)

Number of passengers carried by Norwegian Cruise Line worldwide 2011-2023

Number of passengers carried by Norwegian Cruise Line Holdings Ltd. worldwide from 2011 to 2023 (in 1,000s)

TUI cruise passengers worldwide 2013-2023, by brand

Number of passengers on TUI cruise brands worldwide from 2013 to 2023, by brand (in 1,000s)

Cruise companies

- Premium Statistic Worldwide cruise company market share 2022

- Premium Statistic Revenue of Carnival Corporation & plc worldwide 2008-2023, by segment

- Premium Statistic Net income of Carnival Corporation & plc 2008-2023

- Premium Statistic Revenue of Royal Caribbean Cruises worldwide 2009-2023, by segment

- Premium Statistic Net income of Royal Caribbean Cruises worldwide 2007-2023

- Premium Statistic Revenue of Norwegian Cruise Line worldwide 2013-2023, by segment

- Premium Statistic Net income of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic TUI cruise brand revenue worldwide 2015-2023, by brand

Worldwide market share of leading cruise companies in 2022

Revenue of Carnival Corporation & plc worldwide 2008-2023, by segment

Revenue of Carnival Corporation & plc worldwide from 2008 to 2023, by segment (in billion U.S. dollars)

Net income of Carnival Corporation & plc 2008-2023

Net income of Carnival Corporation & plc worldwide from 2008 to 2023 (in billion U.S. dollars)

Revenue of Royal Caribbean Cruises worldwide 2009-2023, by segment

Revenue of Royal Caribbean Cruises Ltd. worldwide from 2009 to 2023, by segment (in billion U.S. dollars)

Net income of Royal Caribbean Cruises worldwide 2007-2023

Net income of Royal Caribbean Cruises Ltd. worldwide from 2007 to 2023 (in million U.S. dollars)

Revenue of Norwegian Cruise Line worldwide 2013-2023, by segment

Revenue of Norwegian Cruise Line Holdings Ltd. worldwide from 2013 to 2023, by segment (in billion U.S. dollars)

Net income of Norwegian Cruise Line worldwide 2011-2023

Net Income of Norwegian Cruise Line Holdings Ltd. worldwide from 2011 to 2023 (in million U.S. dollars)

TUI cruise brand revenue worldwide 2015-2023, by brand

Revenue of TUI cruise brands worldwide from 2015 to 2023, by brand (in million euros)

Impact of COVID-19

- Premium Statistic Annual growth rate of the global cruise passenger volume 2017-2023

- Premium Statistic Global cruise passenger volume index 2019-2026, by scenario

- Premium Statistic COVID-19 impact on cruise passenger volume worldwide 2020-2023, by source region

- Premium Statistic Percentage change in revenue of leading cruise companies worldwide 2020-2023

Annual growth rate of the global cruise passenger volume 2017-2023

Annual growth rate of the cruise passenger volume worldwide from 2017 to 2023

Global cruise passenger volume index 2019-2026, by scenario

Cruise passenger volume index worldwide from 2019 to 2021, with a forecast until 2026, by scenario

COVID-19 impact on cruise passenger volume worldwide 2020-2023, by source region

Percentage change in cruise passengers due to the impact of the coronavirus (COVID-19) pandemic worldwide from 2020 to 2023, by source region (compared to 2019)

Percentage change in revenue of leading cruise companies worldwide 2020-2023

Percentage change in revenue of leading cruise companies worldwide from 2020 to 2023 (compared to 2019)

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Switch language:

Cruise in 2022: the state of the industry

Using the latest thematic insights from GlobalData, Peter Nilson looks at the state of the cruise industry.

- Share on Linkedin

- Share on Facebook

At the beginning of the year, many companies, governments, and travel authorities had predicted a stronger recovery for the cruise market in 2021. Unfortunately, that was not the case.

The pandemic has proven unpredictable, with many cruise destinations going into second and third lockdowns during 2021 after a global surge in Covid-19 cases .

Go deeper with GlobalData

Innovation in Ship: Anti-fouling Ship Hull Coatings

Environmental sustainability in ship: bio-fuel propulsion marine ve..., premium insights.

The gold standard of business intelligence.

Find out more

Related Company Profiles

The walt disney co, carnival corporation & plc, expedia group inc, norwegian cruise line holdings ltd.

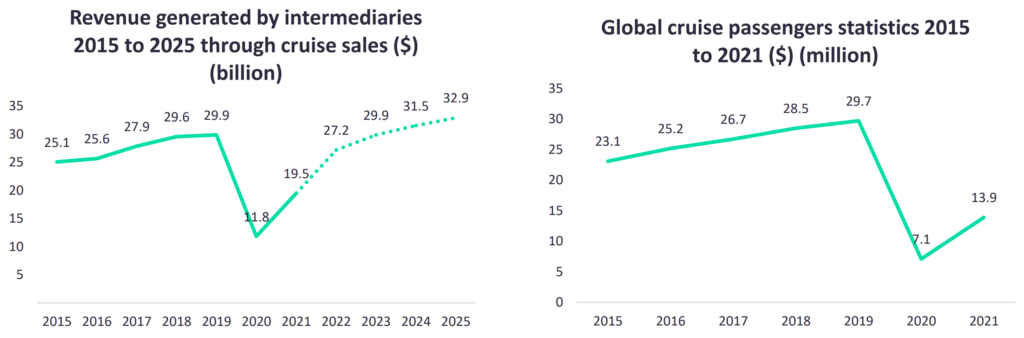

While the cruise industry has experienced a 96% Year-on-Year (YoY) increase of passengers, reaching 13.9 million, it still does not compare to the pre-pandemic levels of 2019, where there were 29.7 million passengers globally. It has been an even worse year for travel intermediaries specializing in cruise holidays.

These companies are the primary selling points for cruise trips and are often responsible for selling upgrades, premium drinks packages and excursions. Global spending across 60 major cruise markets increased by 65% YoY, resulting in total revenues of $19.4bn. Nevertheless, this was still far from pre-pandemic levels in 2019, which were approximately $29.8bn, 35% higher than 2021’s figure.

To reduce costs, many ships were retired between 2019 and 2021. Cruise ships are the most expensive assets, making this practice a necessity for many firms to stay afloat.

However, more optimistic times lie ahead for the sector. During the pandemic, the cruise industry has witnessed new innovative cruise ships and a brand-new competitor in the form of Virgin Voyages . Many cruise liners have come good with orders for new cruise ships built before the pandemic, resulting in an exciting time for loyal cruise holidaymakers to try new ships, services, and onboard experiences.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

Global cruise passengers and revenue

2021 provided a tough lesson for the cruise industry, with businesses aiming to make a swifter recovery from the latest round of lockdowns.

The cruise industry’s recovery rate was modest in 2021. Although a 96% YoY increase sounds positive, it is still nowhere near pre-pandemic levels. In 2021, only 13.9 million passengers went on a cruise, 53% lower than the pre-pandemic levels of 2019.

With the fluctuations of global passengers, revenues will generally follow a similar pattern unless there is a substantial shift in consumer behaviour. Usually, the most significant impacts on a travel company’s revenues, aside from passenger flows, are an economic recession, foreign exchange, or a change in booking trends.

During the pandemic, it has become clear that the latter affected cruise intermediary revenues. In 2021, revenue generated for cruises from intermediaries reached $19.5bn, a 65% YoY increase from $11.8bn. However, cruise passenger flows increased by 95% YoY, which is a significantly higher rate of improvement.

According to the CEO of the Royal Caribbean Group, Richard Fain, this was not unexpected. The world’s fourth-largest cruise company has seen intermediaries such as online travel agencies (OTAs) and high street agencies lose a proportion of their market share, with customers opting to book directly with the cruise operator rather than a third party.

The same sentiment was echoed by Norwegian Cruise Lines CEO Frank Del Rio, who said the company had witnessed a similar booking pattern. The result is not surprising. Many agencies have had to cut back on their workforce due to poor revenue performance in 2020, resulting in fewer sales agents to capture the rising demand in 2021. This has led to more customers booking directly with cruise companies.

Research from GlobalData also supports this, when comparing two consumer surveys from 2019 and 2021. In 2019, 44% of respondents said they typically book via an OTA. However, in a Q4 2021 survey, only 24% of respondents said they booked their last holiday via this booking method. In addition, respondents who said they booked directly increased from 32% to 36%.

New cruise ships and trends for 2022

There are many new cruise ships scheduled to set sail in 2022. Many of these boast a more contemporary feel to their décor and interior, moving away from the traditional looks of the past cruise ships and moving to a more fashionable boutique hotel design.

The motivation for this stems from the fact that cruise operators need to attract a younger market. This evolution is necessary for making cruise businesses more resilient in the future by drawing the next generation of cruise tourists.

According to a 2020 GlobalData survey, 37% of Gen Z and Millennials said that they ‘strongly’ or ‘slightly’ agreed with the notion that they would book an international trip this year. In comparison, only 22% of those older than 35 responded with the same sentiment, highlighting that the younger generation may be more likely to travel in today’s travel climate.

Furthermore, cruising has also become more popular with younger adults. In GlobalData’s Q3 2019 and 2021 global consumer surveys, the percentage of Gen Z and Millennial respondents who typically take a cruise holiday increased from 17% to 21%, indicating changes in consumer tastes.

The importance of Covid-19 safety protocols on cruise ships has never been more critical. According to GlobalData, there is a demand from consumers to receive information about Covid-19 initiatives. This data shows that consumers need substantial levels of communication from cruise providers, and that cruise companies will need to develop robust communication strategies, which need to be scaled over the next few years.

Many travellers are opting to book directly with the operator rather than via an intermediary such as an OTA. According to a Q3 2019 GlobalData survey, 44% of consumers said they typically book via an OTA.

However, this has fallen substantially over the last two years. In a Q4 2021 survey, only 24% of respondents said they booked their previous holiday via an OTA.

In addition, respondents who said they booked directly with a travel supplier increased from 32% to 36%, showing that booking directly with the supplier is becoming more trustworthy and popular.

Nevertheless, this booking behaviour could well be a temporary result, with some cruise operators expecting intermediary trade to pick up again in 2022.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

Orient Express adds Brunvoll propulsion to Silenseas sailing cruise ship

Leading robotics companies in the shipping industry, bunker fuels, lubricants and fluids for the shipping industry, ship corrosion prevention: cathodic protection, coatings and insulation for the shipping industry, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

Ship Technology In Brief

Ship Technology Global : Ship Technology Focus (monthly)

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

Growth of the Ocean Cruise Line Industry

Worldwide, the ocean cruise industry experienced an annual passenger compound annual growth rate of 5.9% from 1990 to 2024.

While the COVID-19 pandemic brought the ocean passenger cruise industry to a standstill for nearly two years, it also prompted the accelerated retirement of numerous older ships. Simultaneously, new additions to fleets adopted a more modern and environmentally friendly approach. In 2024, passenger numbers are expected to surpass the pre-COVID levels of 2019.

Between 2023 and 2024, a total of 10 new ships, with a combined passenger capacity of 25,450, are set to be added (refer to the tables below). This influx will bring the worldwide ocean cruise passenger capacity to 673,000, spread across 360 ships. These vessels are projected to carry a total of 30.0 million passengers by the end of 2024, representing a 4.2% increase over 2023 and a 9.2% increase over 2019.

Shipbuilding Summary

Sources: Royal Caribbean Cruises, Ltd., Carnival Corporation and plc, NCL Corporation Ltd., Thomson/First Call, Cruise Lines International Association (CLIA) , The Florida-Caribbean Cruise Association (FCCA) , DVB Bank and proprietary Cruise Market Watch Cruise Pulse data.

- Share full article

Advertisement

Supported by

The Cruise Industry Stages a Comeback

After watching thousands of passengers get ill and more than a year of devastating financial losses, the global cruise industry is coming back to life. And it says it knows how to deal with the coronavirus.

By Ceylan Yeginsu and Niraj Chokshi

Nothing quite demonstrated the horrors of the coronavirus contagion in the early stages of the pandemic like the major outbreaks onboard cruise ships , when vacation selfies and videos abruptly turned into grim journals of endless days spent confined to cabins as the virus raged through the behemoth vessels, eventually infecting thousands of people, and killing more than 100.

Passengers on the Diamond Princess and Grand Princess, two of the worst-hit ships, were forced to quarantine inside their small staterooms — some without windows — as infections on board spiraled out of control. Every day anxiety and fear mounted as the captains of the ships announced new cases, which continued to spread rapidly through ventilation systems and among crew members, who slept in shared quarters and worked tirelessly throughout the day to deliver food to guests.

At the time, it was difficult to imagine how the ships, which carry millions of passengers around the world each year, would be able to sail safely again. Even after the vaccination rollout gained momentum in the United States in April, allowing most travel sectors to restart operations, cruise ships remained docked in ports, costing the industry billions of dollars in losses each month.

Together, Carnival , the world’s largest cruise company, and the two other biggest cruise operators, Royal Caribbean and Norwegian Cruise Line , lost nearly $900 million each month during the pandemic, according to Moody’s, the credit rating agency. The industry carried 80 percent fewer passengers last year compared to 2019, according to the Cruise Lines International Association, a trade group. Third-quarter revenues for Carnival showed a year-to-year decline of 99.5 percent — to $31 million in 2020, down from $6.5 billion in 2019.

And yet in June, Richard D. Fain, chairman and chief executive of Royal Caribbean Cruises, was beaming with excitement as he sat sipping his morning coffee onboard Celebrity Edge, which became the first major cruise ship to restart U.S. operations, with a sailing out of Fort Lauderdale, Fla. “At the beginning we didn’t have testing capabilities, treatments, vaccines or a real understanding of how the virus spread, so we were forced to shut down because we didn’t know how to prevent it,” he said.

Several epidemiologists questioned whether cruise ships, with their high capacities, close quarters and forced physical proximity, could restart during the pandemic, or whether they would be able to win back the trust of travelers traumatized from the initial outbreaks.

Now, said Mr. Fain, the opposite has proved true. “The ship environment is no longer a disadvantage, it’s an advantage because unlike anywhere else, we are able to control our environment, which eliminates the risks of a big outbreak.”

Cruise companies restarted operations in Europe and Asia late last year, and, after months of preparations to meet stringent health and safety guidelines set by the Centers for Disease Control and Prevention, cruise lines have started to welcome back passengers for U.S. sailings, where demand is outweighing supply, with many itineraries fully booked throughout the summer.

Carnival said bookings for upcoming cruises soared by 45 percent during March, April and May as compared to the three previous months, while Royal Caribbean recently announced that all sailings from Florida in July and August are fully booked.

Several coronavirus cases have been identified on cruise ships since U.S. operations restarted in June, including six passengers who tested positive on Royal Caribbean’s Adventure of the Seas recently, testing the cruise lines’ new Covid-19 protocols, which include isolating, contact tracing and testing passengers to prevent the virus from spreading. Most ships were able to complete their itineraries without issues, but American Cruise Lines, a small ship company, cut short an Alaska sailing earlier this month after three people tested positive for the virus.

The industry’s turnaround is far from guaranteed. The highly contagious Delta variant, which is causing surges of the virus around the world, could stymie the industry’s recovery, especially if large outbreaks occur on board. But analysts are generally optimistic about its prospects and the potential for passenger numbers to recover to prepandemic levels, perhaps as soon as next year. That optimism is fueled by what may be the industry’s best asset: an unshakably loyal customer base.

Even during the pandemic, huge numbers of people who had booked opted against taking refunds , instead converting payments already made into credit for future travel, which the companies often offered at a higher value as an incentive. Last fall, Carnival reported that about 45 percent of customers with canceled trips had opted for credit instead of cash back. About half of customers in a similar position with Royal Caribbean Cruises did the same by the end of last year, the company said at the time.

“The demand is there,” said Jaime Katz, an analyst with Morningstar. “You know that there have been 15 months of people who have had cruises booked that have been canceled.”

No U.S. bailout for the cruise companies

By April 2020, the industry was in crisis. Cruises were halted around the world after the alarming outbreaks on ships, leading to sailing bans from the C.D.C. and other global authorities.

While they employ many Americans, the major cruise companies are all incorporated abroad and were ultimately left out of the $2 trillion federal stimulus known as the CARES Act, with lawmakers chafing at the prospect of bailing out foreign corporations largely exempt from income taxes. Environmentalists lobbied against the aid, citing the industry’s poor track record on climate issues. And criticism over how the companies handled early virus outbreaks on board ships sapped any remaining political will to help. Huge losses mounted as questions swirled about whether cruise lines could avoid bankruptcy.

“All our conversations here were, ‘At this cash burn rate for each of these companies, how long can they survive?’” said Pete Trombetta, an analyst focused on lodging and cruises at Moody’s.

Cruise lines were forced to send most cruise workers home, keeping small skeleton crews on board to maintain their ships. After months without work or an income, many of the workers, who are frequently drawn from countries like the Philippines, Bangladesh and India, fell into debt and struggled to provide for their families.

The timing couldn’t have been worse for Virgin Voyages , the new cruise company founded by the British billionaire Richard Branson, which had planned to launch its inaugural ship, Scarlet Lady, with a sailing from Miami in March 2020. The ship’s official U.S. debut has been delayed until October, but a series of short sailings will take place in August out of Portsmouth, England, for British residents.

“It’s been a very difficult 15 months and we had to make some very tough cuts along the way like the rest of the industry,” said Tom McAlpin, president and chief officer of Virgin Voyages.

In the end, most cruise companies made it through the pandemic intact, but only after receiving help. That came in the form of assistance from governments abroad or money raised from investors emboldened by efforts to backstop the economy from the Federal Reserve and others. The cash wasn’t cheap, though. When Carnival Corp. sold $4 billion in bonds in April 2020, it agreed to interest on those bonds of 11.5 percent — more than half of which it recently refinanced at a more reasonable rate of 4 percent.

Carnival, which operates under nine brands globally, has lost more than $13 billion since the pandemic began and said in a securities filing last month that it expects those losses to continue at least through August. The company amassed more than $9 billion in cash and short-term investments as of the end of May — enough, it said last month, to pay its obligations for at least another year. It says it expects to have at least 42 ships carrying passengers by the end of November, representing just over half of its global fleet.

The industry faces a long road back to normal. Moodys downgraded ratings for each of the big three cruise companies during the pandemic and says it will probably take until 2023 for the major cruise operators to start substantially reducing their debt, which had nearly doubled during the pandemic.

The companies have also been caught up in a series of legal battles in Florida, the biggest base of operations in the United States, that has them sometimes allied with the administration of Gov. Ron DeSantis, and sometimes opposing it.

In June, Florida sued the C.D.C., saying the agency’s guidelines for how cruising could restart were burdensome and harmed the multi-billion-dollar industry that provides about 159,000 jobs for the state. The C.D.C. guidelines require 98 percent of crew and 95 percent of passengers to be fully vaccinated before a cruise ship can set sail, otherwise the cruise company must carry out test voyages and wait for approval.

So far, the state has prevailed in the courts, with a ruling from a federal judge that prevented the C.D.C.’s vaccine requirements from going into effect after July 18. A federal appeals court upheld that ruling on July 23.

Despite the court’s decision, Cruise Lines International Association, the trade group, said cruise companies will continue to operate in accordance with the C.D.C. requirements. The cruise lines found the C.D.C.’s initial guidance too onerous, but once the agency made revisions to factor in the U.S. immunization program, the companies agreed to comply and said they preferred passengers to be vaccinated, because it simplifies the onboard experience.

As that suit was making its way through the courts, Norwegian filed suit on July 13 against the state of Florida, saying that a law banning business from requiring proof of immunization from people seeking to use their services prevented the company from “safely and soundly resuming passenger cruise operations.”

There has yet to be a ruling in the case.

Hurdles remain

Several other hurdles could also derail the rebound of the industry. While cruising has resumed, operators still have to contend with a patchwork of domestic and international rules, some of which impose strict conditions on passengers who go on shore excursions. A serious and widespread outbreak aboard a ship, or a broader communitywide surge in virus infections, could drive away potential customers and stall the momentum of the cruise comeback.

But despite the delays and potential for further disruptions, Virgin Voyages is hopeful for a successful launch of its new brand. Virgin’s Scarlet Lady adult-only ship, which was inspired by a superyacht design, aims to attract a hip and younger crowd, offering 20 different buffet-free dining options and a range of entertainment, including D.J. sets and immersive experiences.

“We have a fantastic set of investors behind us, and I think we are well positioned to make a big comeback because people are ready to travel and cruise again and we are launching a very attractive new onboard product right in the middle of it all,” Mr. McAlpin said.

Two new cruise ships, Carnival’s Mardi Gras and Royal Caribbean’s Odyssey of the Seas are set to launch in the U.S. this week.

And cruise workers, many of whom burned through savings and went into debt during their enforced layoff, are thrilled to be back. “I can’t believe the day has come when I have been called back to work,” said Alvin Villorente, a wine steward for Norwegian Cruise Line, who spent the last year at home in the Philippines, carrying out odd jobs to pay his bills.

“It felt too good to be true,” he continued. “I made my wife read the email to make sure I understood correctly and when I saw her smile everything suddenly went from black to bright colors. I could look after my family again.”

At a time when airports are busy and chaotic and hotels and holiday rentals are expensive and booked up, cruise companies hope to appeal to people who wouldn’t normally consider a cruise vacation.

“I’m still on the fence about booking any travel because of the constantly changing rules around the world, but an adult-only cruise with some friends could be fun, especially if it meant not having to fly anywhere,” said Crystal Marks, a 37-year-old personal trainer from Miami who went on a cruise once as a child and has been looking at Virgin sailings for early next year after a friend sent her a promotional video.

“Yoga classes at sunrise, fitness throughout the day, city-style restaurants, spa treatments, it sounds pretty perfect to me,” she added with a laugh. “If everyone on board is vaccinated and tested regularly it’s probably one of the safer options for international travel.”

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places list for 2021 .

Ceylan Yeginsu is a London-based reporter. She joined The Times in 2013, and was previously a correspondent in Turkey covering politics, the migrant crisis, the Kurdish conflict, and the rise of Islamic State extremism in Syria and the region. More about Ceylan Yeginsu

Niraj Chokshi covers the business of transportation, with a focus on autonomous vehicles, airlines and logistics. More about Niraj Chokshi

Come Sail Away

Love them or hate them, cruises can provide a unique perspective on travel..

Cruise Ship Surprises: Here are five unexpected features on ships , some of which you hopefully won’t discover on your own.

Icon of the Seas: Our reporter joined thousands of passengers on the inaugural sailing of Royal Caribbean’s Icon of the Seas . The most surprising thing she found? Some actual peace and quiet .

Th ree-Year Cruise, Unraveled: The Life at Sea cruise was supposed to be the ultimate bucket-list experience : 382 port calls over 1,095 days. Here’s why those who signed up are seeking fraud charges instead.

TikTok’s Favorite New ‘Reality Show’: People on social media have turned the unwitting passengers of a nine-month world cruise into “cast members” overnight.

Dipping Their Toes: Younger generations of travelers are venturing onto ships for the first time . Many are saving money.

Cult Cruisers: These devoted cruise fanatics, most of them retirees, have one main goal: to almost never touch dry land .

Carnival Corp. Reports Q1 2024: Record Revenue

- March 27, 2024

Carnival Corporation announced financial results for the first quarter 2024 and provided an outlook for the full year and second quarter 2024.

- Record first quarter revenues of $5.4 billion with record net yields (in constant currency) and record net per diems (in constant currency) both significantly exceeding 2023 levels.

- The company improved its first quarter bottom line by nearly $500 million compared to 2023 and adjusted net loss was better than December guidance, with continued strength in demand driving ticket prices higher (see “Non-GAAP Financial Measures” below).

- During the first quarter, booking volumes hit an all-time high with prices considerably higher year over year.

- Following a successful wave season (peak booking period), the company raised its full year 2024 net yield guidance (in constant currency) by over a point to approximately 9.5 percent compared to 2023 based on continued strength in demand and also improved its adjusted cruise costs excluding fuel guidance (in constant currency) by $35 million as compared to its December guidance.

- Total customer deposits reached a first quarter record of $7.0 billion, surpassing the previous first quarter record by $1.3 billion.

- The company redeemed its remaining second lien debt (9.875% second-priority secured notes), upsized its forward starting revolving facility by $400 million and extended its availability by two years.

- The company ordered its first newbuilds in five years, the tenth and eleventh in its highly successful excel-class, scheduled to be delivered to Carnival Cruise Line in 2027 and 2028.

“This has been a fantastic start to the year. We delivered another strong quarter that outperformed guidance on every measure, while concluding a monumental wave season that achieved all-time high booking volumes at considerably higher prices,” commented Carnival Corporation & plc’s Chief Executive Officer Josh Weinstein.

“These results are a continuation of the strong demand we have been generating across our brands and all core deployments, leading to an upward revision of full year expectations by more than a point of incremental yield improvement and setting us up nicely to deliver a nearly double-digit improvement in net yields,” Weinstein added.

“With much of this year on the books, we have even greater conviction in delivering record revenues and EBITDA, along with a step change improvement in operating performance, and have begun turning more of our attention to delivering an even stronger 2025,” Weinstein noted.

First Quarter 2024 Results

- Cash from operations was $1.8 billion and operating income was $276 million.

- Adjusted net loss was better than December guidance. U.S. GAAP net loss of $214 million, or $(0.17) diluted EPS, and adjusted net loss of $180 million, or $(0.14) adjusted EPS (see “Non-GAAP Financial Measures” below).

- Adjusted EBITDA of $871 million exceeded December guidance by over $70 million (see “Non-GAAP Financial Measures” below).

- Record first quarter revenues of $5.4 billion, with record net yields (in constant currency) and record net per diems (in constant currency) both significantly exceeding 2023 levels.

- Gross margin per diems increased 73 percent compared to 2023 levels and net per diems (in constant currency) were up nearly five percent, significantly exceeding strong prior year levels.

- Onboard revenue per diems were higher than 2023 for the company’s North America and Australia (“NAA”) segment as well as its Europe segment. On a consolidated basis, onboard revenue per diems reflected a mix impact due to the increased weighting of its Europe segment driven by its higher occupancy growth.

- Cruise costs per available lower berth day (“ALBD”) increased 7.9 percent compared to 2023. Adjusted cruise costs excluding fuel per ALBD (in constant currency) were better than December guidance due to the timing of expenses between the quarters and up 7.3 percent compared to 2023 (see “Non-GAAP Financial Measures” below).

- Total customer deposits reached a first quarter record of $7.0 billion, surpassing the previous first quarter record by $1.3 billion ($5.7 billion as of February 28, 2023).

The company experienced an early start to a robust wave season with record booking volumes for all future sailings that exceeded expectations, the company said in a statement.

The company achieved considerably higher prices (in constant currency) than last year on first quarter booking volumes, having entered 2024 with less inventory remaining for sale, in line with the company’s strategy to pull the booking curve forward. In fact, pricing (in constant currency) on bookings for the remainder of the year for the company’s NAA segment was considerably higher compared to the prior year, with its Europe segment up double digits.

“We are enjoying a phenomenal wave season with strength across all major deployments and brands. Even with less inventory available for the remainder of the year, booking volumes hit an all-time high, driven by demand for 2025 sailings and beyond. Our brands have demonstrated continued success creating demand that outstrips available capacity translating into higher prices (in constant currency) and a further elongation in the booking curve,” Weinstein noted.

The company’s booked position for the remainder of the year continues to be the best on record, with both pricing (in constant currency) and occupancy considerably higher than 2023.

2024 Outlook

Francis Scott Key Bridge in Baltimore:

- Given the timing of yesterday’s event in Baltimore and the temporary change in homeport, our guidance does not include the current estimated impact of up to $10 million on both adjusted EBITDA and adjusted net income for the full year 2024.

For the full year 2024, the company expects:

- Net yields (in constant currency) up approximately 9.5 percent compared to 2023, over a point better than December guidance, based on continued strength in demand and with occupancy at historical levels.

- Adjusted cruise costs excluding fuel (in constant currency) are $35 million better than December guidance, with adjusted cruise costs excluding fuel per ALBD (in constant currency) 0.5 percentage points higher than December guidance as a result of lower ALBD’s from the Red Sea rerouting as certain ships reposition without guests.

- Adjusted EBITDA of approximately $5.63 billion, over 30 percent growth compared to 2023, and better than December guidance, despite the impact of the Red Sea rerouting of approximately $130 million or $0.09 adjusted EPS through November 2024.

For the second quarter of 2024, the company expects:

- Net yields (in constant currency) up approximately 10.5 percent compared to 2023 levels, including the unfavorable impact from the Red Sea rerouting of 0.5 percentage points, with occupancy at historical levels.

- Adjusted cruise costs excluding fuel per ALBD (in constant currency) up approximately 3.0 percent compared to the second quarter of 2023, including the unfavorable impact of 1.3 percentage points as a result of lower ALBD’s from the Red Sea rerouting as certain ships reposition without guests.

- Adjusted EBITDA of approximately $1.05 billion, over 50 percent growth compared to the second quarter of 2023.

Financing and Capital Activity

“Continued execution coupled with strengthening demand for our brands is driving increased confidence in our ongoing performance. We are pleased this has been recognized by S&P and Moody’s with their recent upgrades, as well as the recent upsizing and two-year extension of our revolving credit facility,” noted Carnival Corporation & plc’s Chief Financial Officer David Bernstein.

“Looking forward over the next several years, we expect our robust revenue growth, responsible approach to capital investment, and ongoing efforts to refinance debt at favorable rates to deliver substantial free cash flow which will significantly reduce our leverage and build shareholder value,” Bernstein added.

The company continues its efforts to proactively manage its debt profile. During the first quarter, it redeemed and retired nearly $1 billion of debt with original maturities in 2027, including all of the remaining second lien debt outstanding.

The company successfully extended the maturity of its forward starting revolving credit facility (“New Revolving Facility”) to August 2027 and upsized its borrowing capacity by $400 million, bringing its total commitment to $2.5 billion.

The company ended the quarter with $5.2 billion of liquidity. On March 26, 2024, the company prepaid its $837 million euro term loan, saving interest expense and continuing to simplify its capital structure by removing secured debt.

The first quarter generated cash from operations of $1.8 billion and adjusted free cash flow of $1.4 billion. The company took delivery of two spectacular new ships and drew down on two export credit facilities, continuing its strategy to finance its newbuild program at preferential interest rates.

The company ordered its first newbuilds in five years. These newbuilds, the tenth and eleventh in the highly successful excel-class across four different brands, are scheduled to be delivered in 2027 and 2028, which is consistent with the company’s measured capacity growth strategy. These new ships will join the Carnival Cruise Line fleet, helping to meet the brand’s outsized demand and drive further revenue growth.

Cruise Industry News Email Alerts

- Breaking News

Get the latest breaking cruise news . Sign up.

54 Ships | 122,002 Berths | $36 Billion | View

Highlights:

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Pre-Order Offer

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

The economics of cruise ships

In the wake of coronavirus and tanking stocks, cruise companies have sought assistance from the us government. but for decades, the industry has done everything in its power to avoid paying into the ....

Published: June 30, 2020

Updated: February 09, 2024

Cruise ships are often called “monsters” of the sea.

If you’ve ever seen one in action, you’ll understand why: A vessel like Royal Caribbean’s Symphony of the Seas is longer than 12 blue whales. At 228k gross tons, it is 5x the size of the once-formidable Titanic . It can hold 6,680 passengers and 2,200 crewmembers, the population of a small American town .

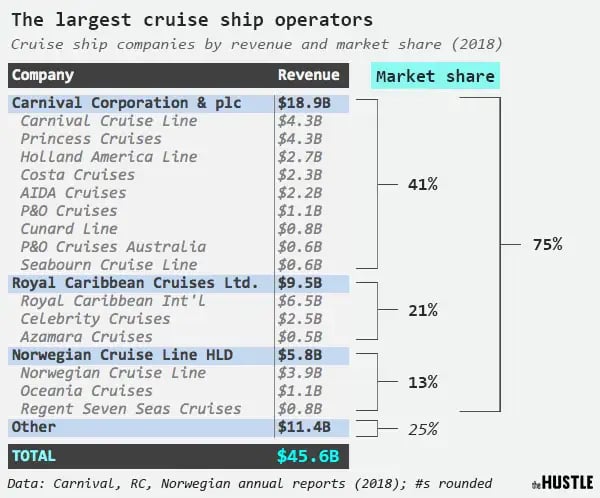

In 2018, 28.5m passengers — the bulk of them from America — spent more than $46B on cruises globally. The biggest players see annual profits in the billions.

But cruise companies have done more to earn the “monster” moniker than churning out huge ships and market gains.

For decades, these companies have utilized century-old loopholes to avoid paying corporate taxes. They’ve gone to great lengths to bypass US employment laws, hiring foreign workers for less than $2/hour. They’ve sheltered themselves as foreign entities while simultaneously benefitting from US taxpayer-funded agencies and resources.

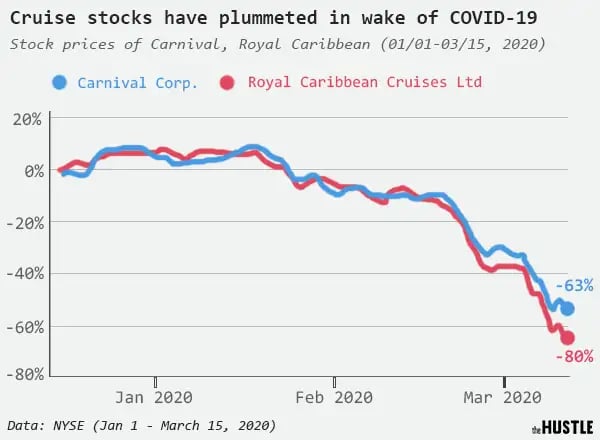

Now, in the wake of a coronavirus crisis that has sunk cruise stocks by double digits , these companies are lobbying for federal assistance.

To better understand the dynamics of this wild industry, we spoke with maritime lawyers, legislators, and cruise experts in 3 countries.

The cruise industry at large

Before we get into how cruise companies circumvent US taxes and regulations, let’s take a quick look at the major players, the money they make, and how they make it.

The global market comprises dozens of cruise lines and more than 250 ships. But 3 players — Carnival Corporation & PLC, Royal Caribbean Cruises LTD, and Norweigan Cruise Line HLD — control roughly 75% of the market.

Zachary Crockett / The Hustle

These companies, which preside over an empire of subsidiary cruise lines, collectively raked in $34.2B in revenue in 2018.

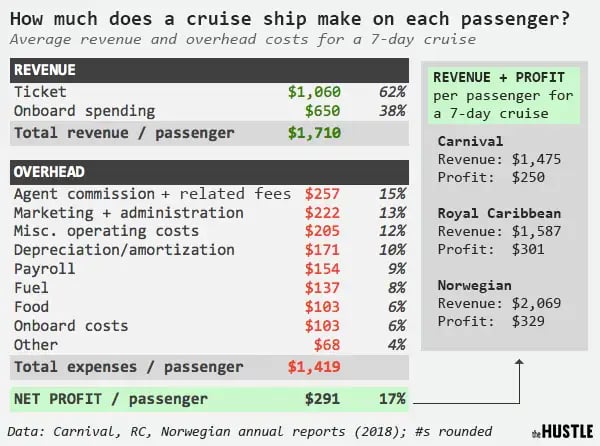

Cruise ships make this money through two channels: Ticket sales and onboard purchases (e.g., alcoholic drinks, casino gambling, spa treatments, art auctions, and shore excursions), which passengers pay for with pre-loaded cruise cards and chip-equipped wristbands.

On average, tickets account for 62% of total revenue and onboard purchases make up the remaining 38% .

Though tickets represent a majority of revenue, onboard purchases account for the lion’s share of the profit, according to several experts.

As a high fixed-cost business, a cruise ship relies on getting as many passengers as possible on the ship — even at fire-sale rates. The major cruise lines will often fill each ship to 105%-110% capacity, then upsell its captive consumers on additional services.

“They have mastered the ability to get their hands into people’s pockets and to take out every last dollar,” says Ross A. Klein, a professor at Memorial University of Newfoundland, who has closely studied the cruise ship industry. “They can almost give a cabin away for free and still make a profit.”

Despite sizeable overhead costs — which include travel agent commissions, fuel, marketing, and payroll — these large crowds yield handsome profits. Industry-wide, cruise lines enjoy net margins of 17%, nearly double the average of some comparably large hotel chains:

- Carnival: $3.2B net profit (17% margin)

- Royal Caribbean: $1.8B net profit (19% margin)

- Norwegian: $955m net profit (16% margin)

To make these figures a bit more relatable, here’s what this works out to on a per-passenger level for a 7-day cruise:

On average, a passenger will spend $1,060 ($151/day) on a ticket and $650 ($92/day) on onboard purchases. After subtracting overhead costs, a ship will make out with roughly $291 in net profit per passenger, per cruise.

That means that at full capacity, a single ship like Royal Caribbean’s Symphony of the Seas might make $9.8m in revenue ($1.7m of which is profit) during one 7-day excursion. That’s $239k in profit per day at sea.

As 50% of this money comes from American travelers, one might expect the cruise industry to be a substantial contributor to the US tax system.

But there’s a catch: These companies aren’t technically American. And they harbor what one legal expert calls a “dirty little secret.”

How cruise companies avoid paying US taxes

Carnival, Royal Caribbean, and Norwegian all have headquarters in Miami, Florida, a city that brands itself as the “ Cruise Capital of the World .”

With this homeland base, a large foundation of US customers, and red, white and blue logos, these cruise lines have manufactured an identity as authentically American corporations. President Trump has even called them a “great US business.”

Legal paperwork tells a different story.

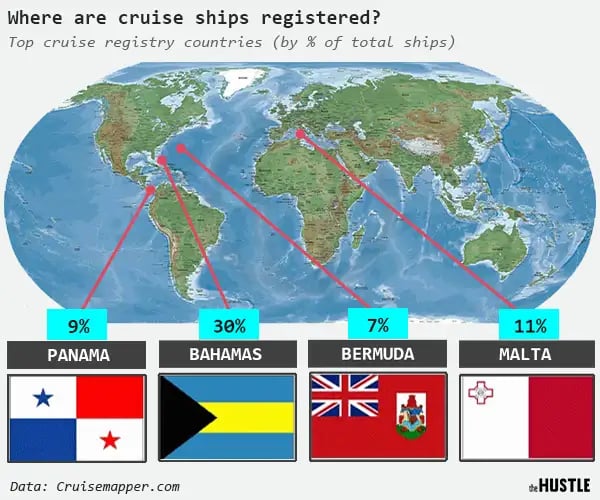

International law requires every ship to register with a country and fly its insignia in open waters. A ship is only subject to the laws of the country it is registered in.

Under an obscure, 99-year-old section of the US tax code, cruise companies are able to register their ships with countries that have more lenient laws than the US — an act called flying a “ flag of convenience ” — and avoid paying into the US tax system.

It’s a tax loophole big enough to drive a cruise ship through.

The cruise industry isn’t alone in avoiding Uncle Sam: US companies use offshore accounts to avoid paying an estimated $90B-per-year in taxes.

But it is especially adept at the practice: Carnival is incorporated in Panama and flies the flags of Panama and the Bahamas; Norwegian is incorporated in, and flies the flag of, the Bahamas; Royal Caribbean has been incorporated in Liberia since 1985, and flies the flags of the Bahamas and Malta.

These impoverished countries often compete with each other to offer cruise lines the cheapest services, much like many US cities groveled for Amazon’s HQ2 by offering large tax cuts.

“Cruise lines want to register somewhere where they pay no taxes, are exempt from labor and wage statues, and don’t have to follow health and safety codes,” says Jim Walker, a Miami-based maritime lawyer. “They’re looking for a place that will leave them alone, not oversee their operations.”

For the most part, that’s what cruise companies have gotten: According to annual report filings, the major cruise lines pay an average tax rate of 0.8% — for below the 21% US corporate tax rate.

The benefits of such arrangements are nominal for the countries that register the ships.

Cruise lines will generally pay a small head tax ($4-$15 per passenger) to call on a port. According to Klein, these countries often spend more on maintaining facilities for cruise ships than they make through the fees.

They might also promise a boost to the economies they frequent. But Klein says they work out deals with local vendors where they take up to 70% of the onshore revenue — and studies have shown that local populations in foreign ports don’t get much out of such partnerships.

A cruise ship employee cleans a slot machine onboard MSC cruises’ Magnifica in Saint-Nazaire (FRANCK PERRY/AFP via Getty Images)

Registering ships abroad also shelters cruise companies from US employment and safety laws.

Cruise ships hire crew members from Southeast Asia, Eastern Europe, and “anywhere else you can find people willing to work for nothing,” and demand grueling workloads in exchange for comparatively paltry wages.

The standard contract for a crew member like a cleaner or dishwasher requires a mandatory 308 hours per month — 11 hours a day, 7 days a week, for as long as 8-10 months, with no days off — for the equivalent of $400-700 per month, or $1.62 to $2.27 per hour .

Unprotected by labor laws and regulations, crew members who get injured on the job are swiftly replaced, like “ fungible goods .”

In its latest report , the Cruise Lines International Association, an influential trade group, argues that the cruise industry has a $52.7B “total economic impact” on the US economy and “supports” 421k American jobs. But Klein says it’s unclear what goes into calculating these figures.

The Hustle asked several major cruise lines to comment on the concerns raised in this article. None of the companies responded.

There is one thing the cruise industry has been expeditious about doing on US soil: Lobbying to keep its exemptions in place.

According to the nonprofit Open Secrets , the cruise industry spent $66.2m in lobbying fees between 1998 and 2019. It also made contributions of at least $1.1m to candidates in cruise ship states, including $29.5k to a US representative from Florida who chairs the Panama Caucus, and $23.5k to a senator who fought to blockade a cruise tax.

$813,807 for a single taxpayer-funded rescue effort

While cruise ships avoid paying US taxes, they simultaneously benefit from the services of taxpayer-funded federal agencies.

Professor Klein, who has testified before Congress on matters of cruise ship safety, says that in the past 25 years:

- 361 passengers have fallen overboard on cruise ships (14 per year)

- 353 gastrointestinal/norovirus outbreaks have broken out on cruise ships

- 500+ environmental violations have been charged to cruise ships

In many of these cases, US agencies have to intervene — and taxpayers, not cruise companies, usually eat the cost.

Rescue teams search for survivors on the Costa Concordia, which struck a rock off the Italian coast in 2012 (Target Presse Agentur Gmbh/Getty Images)

Klein has filed open-records requests and obtained documents on the companies, which he shared with The Hustle . They show that a single cruise ship passenger rescue effort can cost the US Coast Guard and the US Navy from $500k to $1m+ . One 2009 search for a woman who fell overboard off the coast of Florida set the Coast Guard back $813,807.

When ships go dead in the water — as was the case with Carnival’s Splendor fire in 2010 and its Triumph disaster in 2013 — these costs can balloon to $5m+.

Walker, the maritime lawyer, adds that, in certain cases, cruise ships also require the resources of taxpayer-funded agencies like the US Public Health Service, Centers for Disease Control and Prevention, United States Citizenship and Immigration Services, and US Customs and Border Protection.

What does this all mean in the context of coronavirus?

In the wake of a COVID-19 pandemic that has infected more than 157k and killed at least 5.8k people worldwide (as of March 14), the hospitality industry is reeling.

Cruise ships — often called “ floating petri dishes ,” for their adeptness at spreading illnesses — have been hit especially hard. After at least 21 passengers tested positive for COVID-19 aboard Carnival’s Grand Princess , the State Department urged the public to “not travel by cruise ship.”

Customers clamored to cancel trips and cruise stocks fell by 60% — the worst stock performance on record for the industry.

Initially, some cruise lines attempted to weather the storm by selling tickets at all costs . According to emails obtained by the Miami New Times, salespeople at Norwegian were instructed to respond to coronavirus-inquiring customers with scripted one-liners, like “The only thing you need to worry about for your cruise is do you have enough sunscreen?”

When we called the company’s booking hotline last week, a salesperson told us that coronavirus doesn’t exist in tropical climates .

Some major lines have since self-imposed suspensions on cruise trips to and from US ports for up to 60 days — a move that further imperils their revenue.

The Trump administration has hinted at a potential bailout , and the Cruise Lines International Association is urging its 43k travel agent partners to call the White House to express their support for the industry.

Critics like Klein aren’t having it. “They pay no taxes and now they want taxpayer support?” he says. “What happened to laissez-faire capitalism?”

But as federal aid begins to look unlikely, some cruise operators have shifted their pleas to a different set of ears.

In a video posted to Twitter, Jan Swartz, the President of Carnival’s Princess cruise line, called on the American public to help guide the company through dark waters.

“We ask you to book a future Princess cruise to your dream destination as a sign of encouragement for our team,” she wrote. “With your support we will emerge from this time of trial even stronger.”

Follow us on social media

Get the 5-minute news brief keeping 2.5M+ innovators in the loop. Always free. 100% fresh. No bullsh*t.

Thank you for submitting the form!

100% free crm.

Nurture and grow your business with customer relationship management software.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Earnings News

Norwegian Cruise Line Holdings GAAP EPS of $0.04, revenue of $2.2B

- Norwegian Cruise Line Holdings press release ( NYSE: NCLH ): Q1 GAAP EPS of $0.04.

- Revenue of $2.2B (+20% Y/Y)

2024 Outlook

- Record bookings during the first quarter, drove a record booked position for the next twelve months.

- 2024 full year Net Yield guidance on a Constant Currency basis increased 100 basis points from the prior guidance to approximately 6.4% from 5.4%.

- 2024 full year Adjusted EBITDA guidance increased $50 million from the prior guidance to approximately $2.25 billion from $2.20 billion.

- Full year Adjusted Net Income guidance increased $45 million from prior guidance to $680 million from $635 million, and Adjusted EPS guidance increased $0.09 from prior guidance to $1.32 from $1.23.

More on Norwegian Cruise Line Holdings

- Norwegian Cruise Line: 11X P/E And A Lever For Earnings Growth (Rating Upgrade)

- Norwegian Cruise Line: Upside Remains Huge And Dilution Risks Exaggerated

- Deleveraging Efforts And More Ships Make Norwegian Cruise A Buy

- Norwegian Cruise Line Holdings Q1 2024 Earnings Preview

- Norwegian Cruise Lines places its largest order for 8 new ships

Recommended For You

About nclh stock, related stocks, trending analysis, trending news.

Growing cruise industry latest in Hawaii’s tourism economy

H ONOLULU (KHON2) — Cruises are once again becoming a popular way to book trips for those wanting the most out of their vacation at the lowest cost.

Get Hawaii’s latest morning news delivered to your inbox, sign up for News 2 You

Since the beginning of 2024, over 49,000 visitors have come to Hawaii via 31 tours aboard out-of-state cruise ships, according to the Department of Business, Economic Development & Tourism. Over 30,000 people flew to the state to board the Hawaii home-ported ship, Pride of America.

March 2024 saw a 40 percent increase in visitorship with over 12,000 people compared to 8,000 people who came in March of 2023. The State’s Chief Economist, Dr. Eugene Tian said it’s all about the cost savings.

“The main reason is that the hotel room rate is a factor and another one is the inflation. Consumer inflation especially with restaurant foods, increased a lot,” stated Dr. Tian.

Cruise ship visitors like the Keenas agreed adding, “Hotels, especially in Hawaii, we found, were a little expensive where the cruise per night is not as bad.”

Others echoed similar thoughts saying they had saved a couple thousand dollars for the days they planned to travel.

“I think that people definitely save, especially those who like to drink alcohol with all the inclusive options on the ship,” said Yevgeniy Malyarchuck, another cruise ship visitor.

The state’s economy also feels a slight boost from just the pocket money spent by incoming cruise ship visitors. According to Dr. Tian, Hawaii accrued $20 million in the first quarter of 2024.

For others wanting to tour the islands, cruises are a way to vacation while being mindful.

Check out what’s going on around the nation on our National News page

“We love the island of Maui, but due to what’s happening, we decided to be respectful to the people of Hawaii and do it in a way that doesn’t take up rooms in Hawaii – being on a ship!” said Malyarchuck.

For the latest news, weather, sports, and streaming video, head to KHON2.

IMAGES

COMMENTS

In 2022, the cruise industry revenue worldwide amounted to nearly 19 billion U.S. dollars, rising significantly compared to the first two years of the coronavirus (COVID-19) pandemic but remaining ...

State of the Cruise Industry Report May 2024 Updated 8 May 2024. 2 3. About Cruise Lines . International Association. 4. Cruise by the Numbers. 15. Cruise Trends. 24. ... Source: CLIA analysis of cruise line member ocean -going ship fleet; 2028 projected fleet profile is as of December 2023 .

Cruise is a global industry, with cruise lines operating in every major world region; 10; Percentage of cruise passengers traveling by cruise to the ... allows ship engines to be switched off for significant emissions reductions. Today, 120 ships (46% of the fleet and 52% of

Cruise Lines International Association (CLIA) has released its 2024 State of the Cruise Industry report. This year's report includes the release of 2023 passenger volume, which reached 31.7 million— surpassing 2019 by 7%.The report also shows continued demand for cruise holidays, noting intent to cruise at 82%. The forecast for cruise ...

The global cruise market size was valued at USD 7.67 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) 11.5% from 2023 to 2030. This can be attributed to the rising popularity of the vacation on a cruise due to the cost difference and the amenities provided by the alternative vacations.

About the Annual Report: The 400-page report covers everything from new ships on order to supply-and-demand scenarios from the early 1990s through 2027+. Plus there is a future outlook through 2027, completely independent cruise industry statistics, growth projections for each cruise line, cruise industry market reports, and detailed ship ...

The cruise industry worldwide generated $13.6 billion dollars in revenue in 2022, with the U.S. being the largest contributor in terms of paying passengers.

The Cruise Industry News Annual Report is the only information resource of its kind — presenting the entire worldwide cruise industry in 400 pages with cruise industry analytics and statistics, in print and PDF formats.. The 2024 Annual Report is available for order in both print and PDF formats.. About the Annual Report: The 400-page report covers everything from new ships on order to ...

Global cruise passengers and revenue. 2021 provided a tough lesson for the cruise industry, with businesses aiming to make a swifter recovery from the latest round of lockdowns. The cruise industry's recovery rate was modest in 2021. Although a 96% YoY increase sounds positive, it is still nowhere near pre-pandemic levels.

Growth of the Ocean Cruise Line Industry. Worldwide, the ocean cruise industry experienced an annual passenger compound annual growth rate of 5.9% from 1990 to 2024. While the COVID-19 pandemic brought the ocean passenger cruise industry to a standstill for nearly two years, it also prompted the accelerated retirement of numerous older ships.

The mainstream media quickly depicted cruise lines as a petri dish, and the guest numbers went down to almost 0 for May and June. The cruise industry generated more than $40 billion in revenue ...

Third-quarter revenues for Carnival showed a year-to-year decline of 99.5 percent — to $31 million in 2020, down from $6.5 billion in 2019. ... Page 3 of the New York edition with the headline ...

In terms of total revenue, the cruise industry generated $46.6 bln. in 2018, exhibiting a spectacular rebound since revenue had declined abruptly below $25 bln., due to the recession spread after 2008 ... Lessons and challenges for the cruise ship industry, report, Sustainalytics, a Morningstar Company, posted on June 24. 2020. ...

The Cruise Line Industry - A High Level Overview ... 2018 data depicted below, these three companies accounted for nearly 85% of the industry's capacity and 75% of industry revenues. Source ...

THE STATE OF THE CRUISE INDUSTRY 2023 CRUISE LEADERSHIP IN RESPONSIBLE TOURISM Cruise lines are utilizing LNG now as a transitional fuel while cruise lines explore sustainable marine fuels and propulsion technologies • LNG is currently the cleanest fuel available at scale while cruise lines are exploring sustainable

March 27, 2024. Carnival Corporation announced financial results for the first quarter 2024 and provided an outlook for the full year and second quarter 2024. Record first quarter revenues of $5.4 billion with record net yields (in constant currency) and record net per diems (in constant currency) both significantly exceeding 2023 levels.

According to the nonprofit Open Secrets, the cruise industry spent $66.2m in lobbying fees between 1998 and 2019. It also made contributions of at least $1.1m to candidates in cruise ship states, including $29.5k to a US representative from Florida who chairs the Panama Caucus, and $23.5k to a senator who fought to blockade a cruise tax.

Disney sees "enormous" opportunities with Disney Cruise Line, CFO Hugh Johnston said Tuesday on the company's fiscal Q2 earnings call. Disney Cruise Line was a significant contributor to revenue ...

Viking Holdings Ltd. shares climbed 8.8% in the luxury cruise operator's first trading session after an expanded initial public offering that raised $1.54 billion, a sign that the US listing ...

The Walt Disney Company reported its second quarter and six-month earnings for fiscal year 2024 on Tuesday, revealing a revenue increase to $22.1 billion from $21.8 billion in the prior-year quarter. Disney noted that its experiences business was a growth driver in the second quarter, with revenue ...

Norwegian Cruise Line Holdings reports robust Q1 2024 financial results with a GAAP EPS of $0.04 and a revenue increase of 20% YoY. ... FTC's attack on high-profile exec rattles oil industry ...

Disney's newest cruise ship, Disney Treasure (144,000 GT), is scheduled to start sailing from the port at the end of 2024 and Celebrity Cruises will be homeporting for the first time at Port ...

The cruise industry has long been a popular choice for travelers seeking a unique and luxurious vacation experience. ... Norwegian Cruise Line Holdings ... the company reported Q1 revenue of $1.9 ...

The reality of 2020 sits in stark contrast to the year that immediately preceded it. In 2019, the global cruise industry welcomed nearly 30 million passengers, creating jobs for 1.8 million people around the world and contributing over $154 billion to the global economy. With this growth came increased recognition of cruising as one of the best ...

The state's economy also feels a slight boost from just the pocket money spent by incoming cruise ship visitors. According to Dr. Tian, Hawaii accrued $20 million in the first quarter of 2024.

Port Canaveral projected it would homeport 13 cruise ships in 2024 and welcome 913 ship calls (when a ship docks temporarily) and host more than 7.3 million passengers through the year. Related ...

Experiences revenue rose by 10% year-over-year in Q2 to $8.4 billion, led by stronger guest spending in the U.S. theme parks and resorts, growth at the Disney Cruise Line operations, and higher ...