- + 1-888-961-4454 (TOLL-FREE)

- +1 (917) 444-1262 (US)

- [email protected]

COVID-19 has impacted all businesses across the globe.

our reports from the

CONSUMER GOODS CATEGORY

The novel coronavirus has affected all businesses across the globe

to access all our reports from the CONSUMER GOODS Category, featuring the impact of the pandemic

featuring the impact of the pandemic

Avail the Christmas season discount on the Travel Retail Market Report 20% OFF

(offer valid only till season lasts)

A Guide on Travel Retail: Definition, Growth Factors, and Future Prospects

Travel retail industry is one of the major subsidiary yet standalone industries of the travel and tourism sector. Since the last few years, barring the pandemic period, this industry has seen a substantial rise in terms of its growth number. Though one of the obvious reasons behind the growth in travel retail industry is the growth in number of travelers, there are certain growth factors which are characteristic to the travel retail industry itself.

In the 1700s, there was a shift from primary economic activities like agriculture, mining, etc. to secondary sector constituting manufacturing, construction, etc. This shift was primarily facilitated by the Industrial Revolution which was kickstarted in the Great Britain. Consequently, on similar lines, the ICT revolution enabled a shift from secondary to tertiary sector which predominantly constituted of service-oriented economic activities. One of the biggest industries that emerged out of the tertiary sector was the travel and tourism industry.

What is Travel Retail and Why is it on the Rise Since the Last Few Years?

In the last few decades, especially after the opening of majority of the global economies post-1991, travel and tourism industry has grown like anything else. Some economists even consider it to be a separate economic sector altogether. On account of this growth, several subsidiary and standalone industries have propped up and thrived under the travel and tourism sector. One such standalone industry is the global travel retail industry. Travel retail pertains to creating, planning, and providing travel services, while at the same time, engaging in sales activities to cater to the shoppers’ demands while they are in transit.

The growth in the travel retail market is mainly attributed to four main factors which are discussed below:

- Boom in the Travel Industry on the Whole

Except the aberration witnessed in the last two years due to the Covid-19 pandemic, there has been a steady growth in the number of people travelling across the globe. Though the reasons for travel might be different for each individual, the travel retail industry has been able to fulfill their varied demands efficiently. Hence, a growth in the travel industry has been mirrored by the travel retail industry. Also, since people have been exploring countries and places that were previously not so often visited, the travel retail industry has found new ways and avenues to offer their services.

- Travelers Tend to Shop More

Studies by various behavioral economists have shown that travelers, especially the ones going out for vacations, tend to shop more. This shift from a thrift behavior, according to these experts, is due to the leisurely atmosphere and stress-free state of mind. Also, since travelers have a lot of free time at their disposal, they can shop for longer periods of time. Another interesting theory as to why people spend more at transit channels, such as airports , is that the infrastructure inside airports is built on the concept of open-plan setups. As a result, luxury shopping and casual shopping spaces are intertwined in each other, thus blurring the lines between the two.

- Accurate Data Insights

The retailers engaging in travel retail and sales activities have an added advantage of accurate information about their customers. Their travel and departure times, the type of aircrafts they are travelling, their destination, etc. helps the retailer in getting a brief idea as to what the traveler might be looking for. This helps these retailers to plan their sale strategy accordingly, which helps in maximizing their profits. Also, providing customer service to the passengers or people in transit becomes much easier due to these vital data points.

- Better Showcasing of Products

Since travelers tend to shop more products and spend more on luxury items during their travel, they tend to appreciate certain products more than in normal circumstances. This provides the companies and travel retailers to showcase their products and test whether the products are sellable. Hence, various international brands of different sectors tend to launch and market their unique products through the travel retail industry.

Future of Travel Retail Industry

Though the Covid-19 pandemic and the subsequent lockdowns put a strain on the travel and the travel retail industries, market analysts are confident that both these industries will register huge growth rates in the post-pandemic world. Also, digitization of financial services has improved the quality of shopping experience at the transit channels and has helped in reducing the complexities associated with foreign currency exchange. Moreover, the introduction of smart technologies has further improved data collection, which has helped travel retailers to improve their business strategies in a much better way. All these factors point toward a great future of the global retail travel industry.

About the Author(s)

Princy A. J

Princy holds a bachelor’s degree in Civil Engineering from the prestigious Tamil Nadu Dr. M.G.R. University at Chennai, India. After a successful academic record, she pursued her passion for writing. A thorough professional and enthusiastic writer, she enjoys writing on various categories and advancements in the global industries. She plays an instrumental role in writing about current updates, news, blogs, and trends.

Related Post

Why camping and caravanning are becoming more popular than ever, which top 3 companies are in the process of designing world-class urban air mobility, how popularly do capsule hotels takeover the position of conventional hotels in developed countries, a concise study of duty-free retailing industry’s three major players in 2022.

How is Cybersecurity Becoming a Vital Measure to Combat Emerging Threats in the Banking Sector Globally?

Wood Pellet Biomass Boilers: An Eco-Friendly Heating Solution

5 Ways Vanilla Oil Can Transform Your Life

Discovering the Magic of Toasted Flour: Why & How to Use It

Request Sample Form

Subscribe to our newsletter and get our newest updates right on your inbox.

Blog Name Here

Obtain comprehensive insights on the Travel Retail Industry

Preview an Exclusive Sample of the Report of Travel Retail Market

The Company

- Why Research Dive?

- Research Methodology

- Syndicate Reports

- Customize Reports

- Consulting Services

- Design your research

- GDPR Policy

- Privacy Policy

- Return Policy

- Delivery Method

- Terms and Condition

30 Wall St. 8th Floor, New York, NY 10005 (P).

- + 1-800-910-6452 (USA/Canada) - Toll Free

- + 1-888-961-4454 (USA/Canada) - Toll - Free

- +1 (917) 444-1262 (US) - U.S

- [email protected]

Get Notification About Our New Studies

- © 2024 Research Dive. All Rights Reserved

What Is Travel Retail? A Comprehensive Guide

What Is Travel Retail?

Have you ever wondered why duty-free shops are so common in airports and other travel hubs? Or why some products seem to be so much cheaper when you buy them at the airport? If so, you’re not alone. Travel retail is a multi-billion dollar industry, and it’s growing rapidly. But what exactly is travel retail, and how does it work?

In this article, we’ll take a closer look at travel retail. We’ll discuss what it is, how it works, and why it’s so important to the global economy. We’ll also explore some of the challenges facing the travel retail industry today.

So, what is travel retail? Simply put, travel retail is the sale of goods to travelers. This can happen in a variety of settings, including airports, train stations, cruise ships, and border crossings. Travel retail is a global industry, and it’s estimated to be worth over \$50 billion per year.

Travel retail is important for a number of reasons. First, it helps to generate revenue for airports and other travel hubs. Second, it provides travelers with a convenient way to buy goods that they might not be able to find at home. Third, it helps to promote tourism.

However, the travel retail industry is facing a number of challenges today. These include rising costs, increased competition, and changing consumer preferences. Despite these challenges, the travel retail industry is still growing, and it’s expected to continue to grow in the years to come.

“`html

What is Travel Retail?

Travel retail is the sale of goods to travelers in airports, seaports, train stations, and other points of departure and arrival. It is a global industry that generates billions of dollars in revenue each year.

Travel retail offers a unique shopping experience for travelers, who can find a wide variety of products that they may not be able to find at home. It also provides a convenient way for travelers to buy gifts for friends and family back home.

The travel retail industry is constantly evolving, as new technologies and trends emerge. In recent years, there has been a growing focus on sustainability and ethical sourcing. Travel retailers are also looking for new ways to engage with travelers and create memorable experiences.

History of Travel Retail

The history of travel retail can be traced back to the early days of commercial air travel. In the 1920s, airlines began selling duty-free goods to passengers on long-haul flights. This was done to offset the high cost of fuel and to make air travel more appealing to passengers.

Duty-free shopping quickly became a popular amenity for air travelers, and it soon spread to other modes of transportation, such as cruise ships and trains. In the 1960s, the first duty-free shops opened at airports. These shops offered a wider variety of products than the duty-free shops on airplanes, and they quickly became a popular destination for travelers.

In the 1970s, the travel retail industry began to grow rapidly. This was due to a number of factors, including the increase in air travel, the growth of the global economy, and the rise of tourism. By the end of the 1970s, the travel retail industry was a multi-billion dollar business.

The travel retail industry continued to grow in the 1980s and 1990s. This was due to the continued growth of air travel, the expansion of duty-free shopping into new markets, and the development of new technologies. By the end of the 1990s, the travel retail industry was a global phenomenon.

The travel retail industry has continued to grow in the 21st century. This is due to the continued growth of air travel, the expansion of duty-free shopping into new markets, and the development of new technologies. The travel retail industry is now a major part of the global economy.

Types of Travel Retail

There are a number of different types of travel retail outlets. These include:

- Airport duty-free shops: These shops are located in airports and sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

- Border shops: These shops are located near international borders and sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

- Train station shops: These shops are located in train stations and sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

- Cruise ship shops: These shops are located on cruise ships and sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

- Other travel retail outlets: These shops are located in other places where travelers gather, such as hotels, casinos, and tourist attractions. They sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

The different types of travel retail outlets offer a variety of shopping experiences for travelers. Airport duty-free shops are typically large and offer a wide variety of products. Border shops are typically smaller and offer a more limited selection of products. Train station shops are typically located in high-traffic areas and offer a variety of convenience items. Cruise ship shops are typically located near the ship’s casino and offer a wide variety of luxury items. Other travel retail outlets offer a variety of shopping experiences, depending on the location and the type of products that are sold.

Travel retail is a global industry that offers a unique shopping experience for travelers. It is a major part of the global economy and is constantly evolving to meet the needs of travelers.

Benefits of Travel Retail

Travel retail offers a number of benefits to both retailers and consumers. For retailers, travel retail provides an opportunity to reach a wider customer base and generate additional sales. In addition, travel retail can be a more profitable channel than traditional retail, as retailers are able to charge higher prices for products due to the lack of competition.

For consumers, travel retail offers a number of benefits as well. First, travel retail provides access to a wider range of products than is typically available in traditional retail stores. This is because travel retailers are able to source products from a variety of countries and regions, which can give consumers the opportunity to find products that they would not be able to find otherwise. Second, travel retail can offer lower prices than traditional retail stores, as retailers are able to pass on some of the savings they earn from duty-free shopping to their customers. Finally, travel retail can offer a more convenient shopping experience than traditional retail stores, as consumers can often find travel retail stores located in airports and other transportation hubs.

In addition to the benefits listed above, travel retail can also provide a number of other benefits to both retailers and consumers. For retailers, travel retail can help to increase brand awareness and loyalty, as well as generate positive word-of-mouth advertising. For consumers, travel retail can provide a more enjoyable shopping experience, as well as the opportunity to find unique and hard-to-find products.

Challenges of Travel Retail

While travel retail offers a number of benefits, there are also a number of challenges associated with this channel. One of the biggest challenges is the high cost of doing business in travel retail. This is due to the fact that travel retailers typically have to pay rent and other fees that are much higher than those charged by traditional retail stores. In addition, travel retailers often have to deal with high levels of theft and fraud, which can further increase their costs.

Another challenge of travel retail is the fact that it is a seasonal business. This is because travel retail sales are typically highest during peak travel times, such as the summer and winter holidays. During off-peak times, travel retailers can experience significant drops in sales. This can make it difficult for travel retailers to maintain a consistent level of profitability.

Finally, travel retail can be a challenging channel to manage due to the fact that it is often subject to a variety of regulations and restrictions. These regulations can vary from country to country, and can make it difficult for travel retailers to operate in a consistent and efficient manner.

Despite the challenges, travel retail can be a profitable and successful channel for retailers and consumers. By understanding the benefits and challenges of travel retail, retailers can make informed decisions about whether or not this channel is right for them.

Travel retail is a growing industry that offers a number of benefits to both retailers and consumers. By understanding the benefits and challenges of travel retail, retailers can make informed decisions about whether or not this channel is right for them.

What is travel retail?

Travel retail is the sale of duty-free and other goods to travelers in airports, seaports, train stations, and other points of departure and arrival. It is a global industry that generates billions of dollars in revenue each year.

Why is travel retail so popular?

There are a few reasons why travel retail is so popular. First, travelers often have extra money to spend when they are on vacation. Second, travel retail stores offer a wide variety of products that travelers may not be able to find at home. Third, travel retail stores often offer duty-free prices, which can save travelers a lot of money.

What are some of the challenges facing the travel retail industry?

The travel retail industry faces a number of challenges, including:

- The growth of e-commerce

- The rising cost of travel

- The increasing security measures at airports and other points of departure and arrival

What is the future of travel retail?

The future of travel retail is uncertain. However, there are a number of factors that suggest that the industry will continue to grow in the coming years. These factors include:

- The continued growth of international travel

- The increasing demand for luxury goods

- The development of new technologies that will make it easier for travelers to shop

How can I get involved in the travel retail industry?

There are a number of ways to get involved in the travel retail industry. You can:

- Work for a travel retail company

- Start your own travel retail business

- Become a travel retail consultant

- Attend travel retail trade shows

Additional resources

- [The International Duty Free Association](https://www.idfa.aero/)

- [The Travel Retail Business](https://www.travelretailbusiness.com/)

For consumers, travel retail offers a convenient and affordable way to purchase a wide range of products, from luxury goods to everyday essentials. In addition, travel retail can often be a more tax-efficient way to shop than at home. For businesses, travel retail provides a valuable opportunity to reach new customers and grow their sales. By understanding the needs of the traveling consumer, businesses can develop strategies to reach this lucrative market.

As the travel industry continues to grow, so too will the travel retail industry. By understanding the unique challenges and opportunities of this industry, businesses can position themselves to succeed in the years to come.

Author Profile

Latest entries

- January 19, 2024 Hiking How to Lace Hiking Boots for a Perfect Fit

- January 19, 2024 Camping How to Dispose of Camping Propane Tanks the Right Way

- January 19, 2024 Traveling Information Is Buffalo Still Under Travel Ban? (Updated for 2023)

- January 19, 2024 Cruise/Cruising Which Carnival Cruise Is Best for Families?

Retail & Trade

Duty free and travel retail industry - statistics & facts

How has the travel retail and duty free industry held up after the pandemic, the duty free market and retail sales of airports, key insights.

Detailed statistics

Leading global travel retailers in 2022, based on turnover

Airports with the most international air passenger traffic worldwide 2022

Avolta: revenue worldwide 2013-2023

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Travel retail: global forecast market size 2030

Shopping Behavior

Duty free shop customer conversion rate worldwide 2017-2022

UK: retail revenue of the Heathrow Airport Ltd. in 2022, by category

Related topics

Recommended.

- Tourism worldwide

- Online travel market

- Tourism industry in China

- Travel and tourism in the U.S.

- Travel and tourism in Europe

Recommended statistics

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Global air traffic - scheduled passengers 2004-2022

- Premium Statistic World: duty free and travel retail sales 2010-2022

- Premium Statistic Global travel retail sales 2022, by region

- Premium Statistic Duty free shop customer conversion rate worldwide 2017-2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Global air traffic - scheduled passengers 2004-2022

Number of scheduled passengers boarded by the global airline industry from 2004 to 2022 (in millions)

World: duty free and travel retail sales 2010-2022

Duty free and travel retail sales worldwide in 2010 to 2022 (in billion U.S. dollars)

Global travel retail sales 2022, by region

Duty free and travel retail sales worldwide in 2022, by region (in billion U.S. dollars)

Customer conversion rate of duty free shops worldwide from 2017 to 2022

Leading travel retailers

- Premium Statistic Leading global travel retailers in 2022, based on turnover

- Basic Statistic Avolta: revenue worldwide 2013-2023

- Premium Statistic Lotte Duty Free: global revenue 2013-2022

- Premium Statistic Turnover of The Shilla Duty Free worldwide 2013-2022

- Premium Statistic China Duty Free Group's global turnover from 2013 to 2022

- Premium Statistic Lagardère Travel Retail: sales worldwide 2014-2022

- Premium Statistic Turnover of DFS worldwide 2013-2022

Leading travel retailers worldwide in 2022, based on turnover (in million euros)

Revenue of Avolta (Dufry) worldwide from 2013 to 2023 (in million Swiss francs)

Lotte Duty Free: global revenue 2013-2022

Turnover of Lotte Duty Free worldwide from 2013 to 2022 (in million euros)

Turnover of The Shilla Duty Free worldwide 2013-2022

Turnover of The Shilla Duty Free worldwide from 2013 to 2022 (in million euros)

China Duty Free Group's global turnover from 2013 to 2022

Turnover of China Duty Free Group worldwide from 2013 to 2022 (in million euros)

Lagardère Travel Retail: sales worldwide 2014-2022

Sales of Lagardère Travel Retail worldwide from 2014 to 2022 (in million euros)

Turnover of DFS worldwide 2013-2022

Turnover of DFS Group worldwide from 2013 to 2022 (in million euros)

Retail revenues of leading airports

- Premium Statistic Changi Airport: concession sales 2017/18 to 2022/23

- Premium Statistic Los Angeles World Airports: duty free operating revenue 2016-2022

- Premium Statistic Revenue of HK International Airport 2023, by segment

- Premium Statistic Offshore duty-free sales value in Hainan, China 2012-2022

- Premium Statistic Sydney Airport revenue 2022, by type

- Premium Statistic UK: retail revenue of the Heathrow Airport Ltd. in 2022, by category

- Premium Statistic Revenue of Schiphol Group in the Netherlands by business area 2022

Changi Airport: concession sales 2017/18 to 2022/23

Value of concession sales of Changi Airport from financial year 2017/18 to financial year 2022/23 (in million Singapore dollars)

Los Angeles World Airports: duty free operating revenue 2016-2022

Duty free revenue of Los Angeles World Airports from FY 2016 to FY 2022 (in million U.S. dollars)

Revenue of HK International Airport 2023, by segment

Revenue of Hong Kong International Airport in FY2023, by segment (in billion Hong Kong dollars)

Offshore duty-free sales value in Hainan, China 2012-2022

Annual offshore duty-free sales value in China's Hainan island from 2012 to 2022 (in billion yuan)

Sydney Airport revenue 2022, by type

Revenue of Sydney airport in Australia in 2022, by type (in million Australian dollars)

Retail revenue of the Heathrow Airport Limited in the United Kingdom (UK) from 2019 to 2022 (in million GBP), by category

Revenue of Schiphol Group in the Netherlands by business area 2022

Distribution of revenue of Schiphol Group in the Netherlands in 2022, by business area

Consumer behavior

- Premium Statistic Duty-free shoppers average spend by category worldwide 2022

- Premium Statistic Duty-free shoppers conversion rate by category worldwide 2022

- Premium Statistic Duty-free shoppers average spend worldwide by age 2022-Q1 2023

- Premium Statistic Share of wallet duty free purchases worldwide Q2 2023

- Premium Statistic Leading categories duty free shoppers traveling with children visit 2023

Duty-free shoppers average spend by category worldwide 2022

Average spend of duty free shoppers in different categories 2022, by region (in U.S. dollars)

Duty-free shoppers conversion rate by category worldwide 2022

Share of duty free shoppers browsing and making a purchase in different categories 2022, by region

Duty-free shoppers average spend worldwide by age 2022-Q1 2023

Average spend of duty free shoppers worldwide in 2022 and 1st quarter 2023, by generation (in U.S. dollars)

Share of wallet duty free purchases worldwide Q2 2023

Duty free purchases of shoppers worldwide as of the 2nd quarter 2023, as a share of total spend

Leading categories duty free shoppers traveling with children visit 2023

Leading duty free categories shoppers traveling with children visited at international airports as of 2023

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Retail Dogma

RETAILDOGMA

RETAIL EDUCATION & TRAINING SOLUTIONS

Travel Retail

What is travel retail.

Travel retail is a term that describes retail outlets that sell products to end consumers in a travel environment.

Some of these shops are duty free, where customers are exempted from certain local taxes and duties, and in this case shops usually require proof of travel, such as a boarding pass, to complete the transaction.

Travel retail is a major source of revenue for airports, and provides a great sales channel and branding opportunity for consumer brands, as there are billions of international travelers that pass through airports each year. That’s why it is one of the main distribution channels in the beauty industry.

In some countries, certain types of products are not sold freely inside the country but are available at duty-free shops, such as alcoholic beverages, which drives the sales of these products upon arrival at these airports.

The market size of this segment has been steadily growing over the last few years, and is expected to reach $156.3 billion dollars by 2030, with a CAGR of 10.7% between 2023 to 2030.

Types of Travel Retail

- Airport shops

- Border shops

- Cruise & ferry shops

- Some shops at international railway stations

- Shopping onboard an aircraft

- Certain downtown stores that require proof of travel

Product Categories

The most common product categories include:

- Perfume & Cosmetics

- Confectionery

- Food & Beverage

- Electronics

- Accessories (Bags, watches, eyewear,..etc)

THE PROFESSIONAL RETAIL ACADEMY (PRA) ™

- In-depth retail management courses

- Learn the best practices of the industry

- Download ready-to-use professional templates

- Get certificates of completion for each course

- One membership = Access to all courses

More Resources

- Brick & Mortar Store

- Department Store

CONNECT THE DOTS

Learn how to manage a retail business end-to-end.

We’ve put together a curriculum, specifically designed for retail owners or retail professionals who want to advance into senior management roles.

Learn how to connect the dots of the business and take the basic knowledge to the next level of application .

4 reasons why travel retail is booming

Why this expansion?

1. more people travel, 2. travelers are more prone to shop while en route.

- The open-plan setup: Airports are a democratic shopping spaces – much more so than malls and high streets. In airports the differentiation between luxury and casual brands becomes blurred. Travelers just need to enter the open-plan stores (as airport shops have no doors) to access brands and items they may not have visited in a more traditional setting.

- Free time to browse and buy: Long waits and demands to show up in advance provide passengers with a lot of time to spare in airports. As airports are constructed as shopping spaces, which encourage passengers to leisurely walk around and shop during their wait.

- Holiday atmosphere: After having passed check-ins and security controls, passengers traveling for leisure are left in the right condition to buy items – whether to indulge themselves, to start off or cap off their trip.

3. Retailers can use data insights to better cater for customers

4. products get even more visibility.

Retailers have realized that travel retail provides them with tremendous opportunities to create visibility for their products, increase customer loyalty and recruit new customers in different countries. Airports have become an area where brands test their possible success in new markets, basing on customers’ nationalities and flight destinations. Many brands also offer “travel retail exclusive”, special products which are only available to travelers to entice shoppers to buy appealing to their desire for exclusive items. Travel retail is, in many ways, different from traditional retail spaces. Brands have managed to capitalize on the differences to tap into a very lucrative market. As travel retail is expected to grow steadily in the next few years, brands count on some of their success in airports to trickle down to their traditional stores, and possibly help open new, profitable markets.

Don’t buy retail management software until you read this

Ready for departure: How the travel retail sector can succeed in the post-Covid environment

By Gabriel Schillaci

Recommendations and case studies for airports and retailers

Like all aviation-related industries, the travel retail sector has been turned on its head by the Covid-19 pandemic. A change in the passenger mix at airports, as well as longer idle times due to Covid-related delays, are driving new trends and behaviors. Digital channels are becoming increasingly important, for example, and shoppers are buying more because shops are quieter. Travel retailers need to adapt to these changes, or risk being left behind. In this article we assess the transformation taking place in the sector and present a series of recommendations for airports and retailers on how they can not only adapt to the new challenges, but also thrive. We also offer two case studies outlining successful Roland Berger travel retail projects.

"Airports, retailers and the entire ecosystem must embrace the new market dynamics."

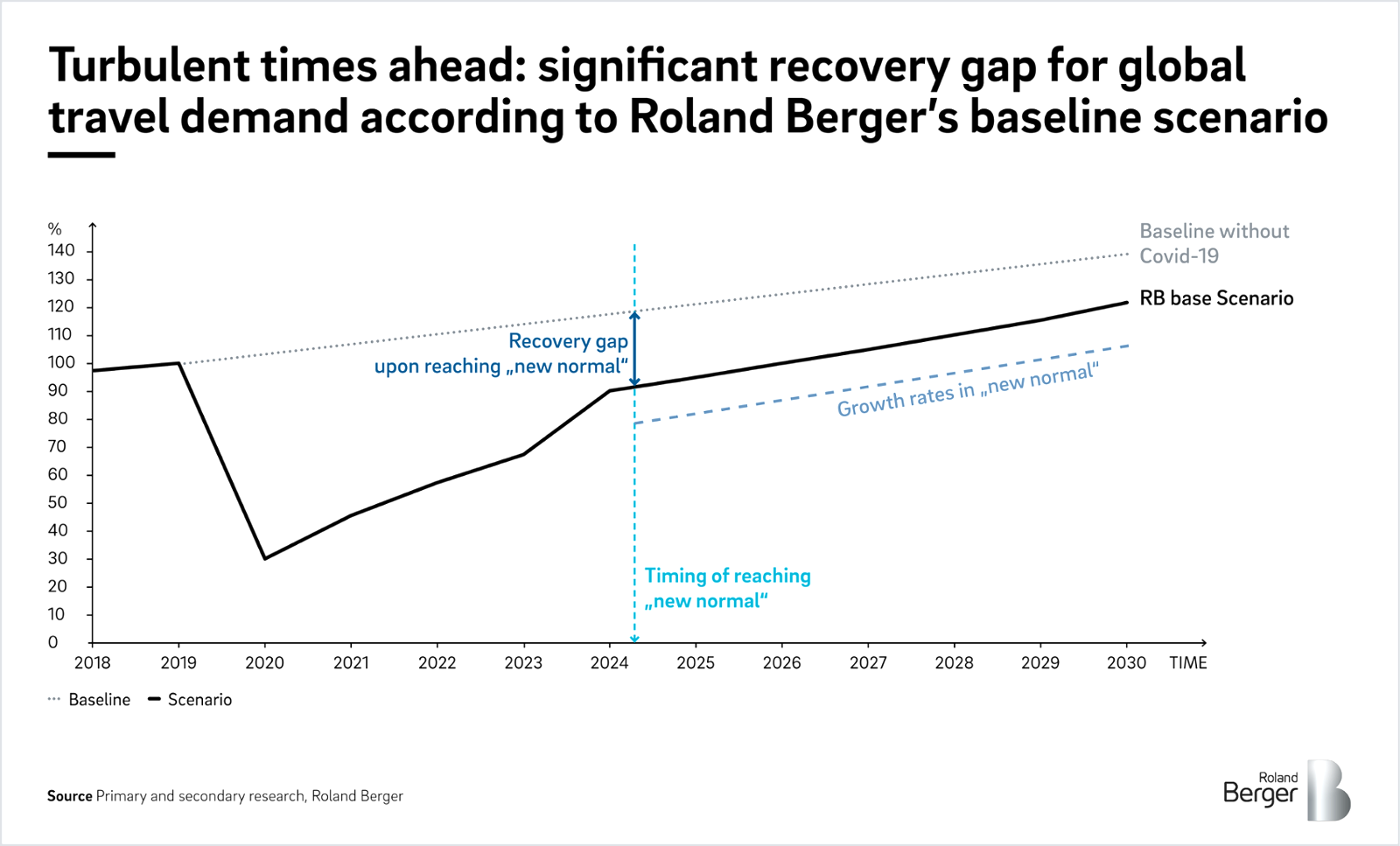

The Covid-19 pandemic has likely changed the air travel market for some time to come. Business travel has been decimated as workers switch to virtual mobility tools, one in five private travelers are choosing to fly domestically rather than internationally and passenger demand is set to remain well below pre-Covid forecasts for years to come, according to a recent Roland Berger study.

While airlines and airports have borne the brunt of the crisis, this reshuffled passenger mix has also had a profound impact on the travel retail sector. For example, fewer big-spending intercontinental passengers from Asia or Brazil mean fewer high-end sales, with retailers now having to adapt their offer to better suit the growing proportion of continental / domestic passengers, and especially low-cost passengers. On the other hand, less traffic and strong concerns over Covid-related delays at airports mean passengers are spending longer periods in airports, pushing up idle times available for shopping.

"Airports need to refocus their offer on their core passengers. They must adapt their product assortment and merchandizing to target the growing share of low-cost passengers."

New trends = new behaviors

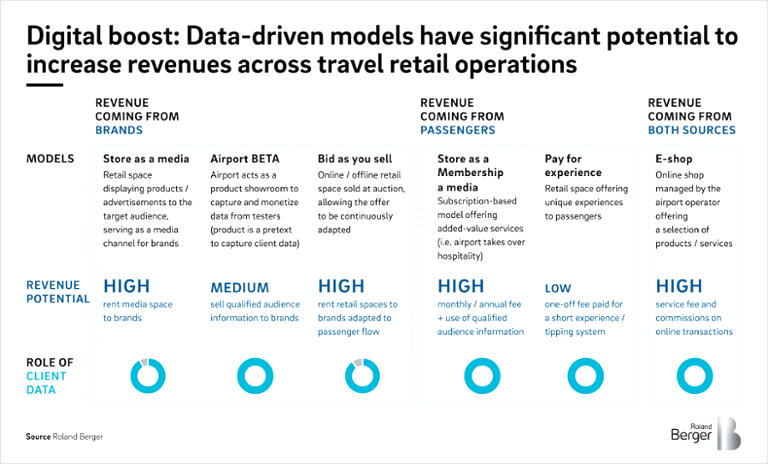

This shift has accelerated several trends in travel retail, some that existed pre-Covid and some a result of the pandemic. First, the digital effect has become more pronounced. Retailers’ and brands’ omnichannel strategies are increasingly influencing clients, and e-commerce is driving up pricing transparency. Second, new forms of competition, such as social media use and music and video streaming are vying for passengers’ idle time. Third, the range of offers at some airports, which for years have been focused on either luxury or high-volume items, are becoming less attractive. Fourth, passengers now expect more than just traditional airport “shopping”, with demand growing for experience-based events, especially virtual ones. Finally, opportunities are growing to capture and exploit passenger data.

These trends and the reshuffled passenger mix are driving changes in buyer behavior. With less traffic in airports, passengers are buying more because the quieter environment makes it more appealing to spend time in airport shops. Increased idle times also mean they stay longer. In addition, better price transparency means that passengers can more easily compare duty free offers against online or Main Street prices, and dismiss offers that are not the bargain they purport to be.

Recommendations: How can travel retailers adapt?

The upshot is that travel retail players need to adapt to survive. In short, airports, retailers and the entire ecosystem must embrace the new market dynamics. To do this, we believe they need to focus on two key areas: revamping their traditional offer and reinventing their business models. Below we give our recommendations.

"Collaboration between airlines, airports and travel retailers is essential to realize the potential of new business models."

Revamp the offer

Refocus on core passengers: Travel retailers know that some passengers spend more than others. Their traditional offer has always included a premium element (designer stores, upmarket boutiques and restaurants, etc.) to cater to them. But this low volume/high value market has been badly hit by travel restrictions placed on some of its biggest spenders, such as Asian or Brazilian passengers. As a result, airports need to refocus their offer on their core passengers. They must adapt their product assortment and merchandizing to target the growing share of low-cost passengers, who while traveling low cost, do not necessarily have lower purchasing power at the airport.

Renew formats: To stay fresh, travel retailers need to frequently reinvent their formats. These might include pop-up stores, shop-in-shops, live performances and games. Integrating modularity into the design of commercial spaces helps with this.

Modernize concepts: A purely transactional approach to travel retail is no longer enough. Players must develop concepts such as retail-as-a-media, where capturing data points on passengers is more valuable than making a sale. This involves showcasing, for example, electronics, with customers able to try out new products provided they register first.

Offer experiences: Memorable events can improve brand awareness, customer relations and sales. With their captive audiences, airports provide a perfect platform for surprising, entertaining events, such as concerts, virtual reality experiences and selfie-worthy backdrops.

Leverage data and AI: Good use of data can help turbocharge a retailer. For example, ultra-personalization can help to cement client relationships and performance can be improved by closely monitoring datapoints and adapting to changes accordingly.

"Our expert teams have considerable knowledge of travel retail, and have supported airports, travel retailers, brands and airlines through a host of strategic and operational challenges."

Reinvent business models

Leverage cooperation and value sharing: Collaboration between airlines, airports and travel retailers is essential to realize the potential of new business models. This could include developing loyalty cards for a retailer or airline, or a branded payment card for a retailer.

Case studies: Roland Berger success stories

Our expert teams have considerable knowledge of travel retail, and have supported airports, travel retailers, brands and airlines through a host of strategic and operational challenges. The following case studies highlight two recent success stories. Feel free to get in touch for more information.

Case study 1: Airport

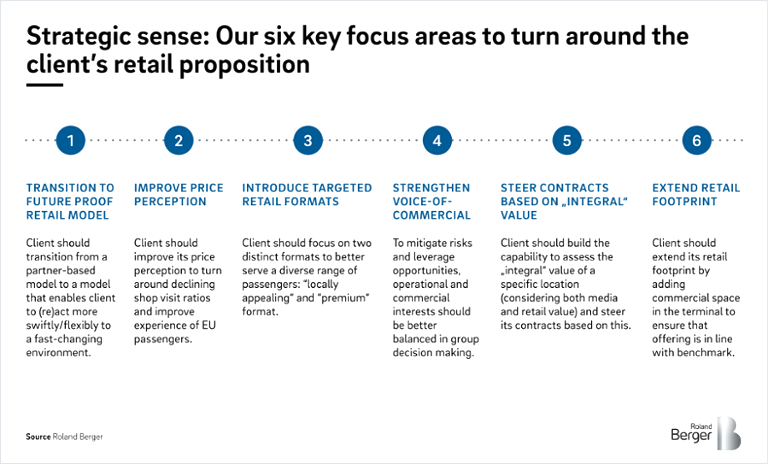

Project: A well-known European airport had a bottleneck in travel retail sales growth. Roland Berger was tasked with identifying the root cause and finding a transformation solution.

Approach: A comprehensive internal diagnosis identified declining sales per passenger as the root cause. Key factors behind this included passengers perceiving the retail offer to be expensive, an indifferent quality of assortment, insufficient consumer traction and a below-average commercial footprint.

Benchmarking against best practices at the airport’s leading competitors revealed it needed to step up to remain competitive. As such, we designed a commercial strategy with six key focus areas:

Case study 2: Duty-free retailer

Project: A leading Asian duty-free player wanted to win a concession in a major airport in Japan.

Approach: We conducted a thorough analysis of the retail RFP issued by the airport and compared it to the airport's specificities to determine the perfect requirements of its retail business. We identified three key needs, and proposed three corresponding KSFs:

Partial recovery: How three trends are changing long-distance travel

We calculated the impact of three trends on four key travel dimensions to determine the "recovery gap" between pre-crisis long-distance travel and the post-pandemic situation.

The future of long-distance mobility: How Covid jolted long-distance business travel

The outbreak of Covid-19 affected especially long-distance business traveling which is shown by a 66% globally decrease in air traffic last year.

The future of long-distance mobility: How Covid changed consumer appetites

The first part of our article series on long-haul mobility examines how private travel has forever changed, and why European demand might not return until 2025.

Transportation, Tourism & Logistics

Roland Berger supports the mobility and logistics industry in digitization along the entire value chain.

Smart Mobility

Smart Mobility contributes to a more sustainable and value-adding state of mobility. Find out more about new mobility scenarios for our society here.

- Publications

- Recommendations for successful travel retail

Related Expertise: Retail Industry , Transportation and Logistics , Sales Channel Strategy

Why Travel Retail Needs an Upgrade

September 04, 2018 By Filippo Bianchi , Gabriele Ferri , Stefano Minini , Ivan Bascle , Patricio Ramos , and Hean-Ho Loh

As the number of air travelers has surged in recent years, so has the amount of shopping that they do in airports. But while the so-called travel retail market has tripled in size since 2002, the rate at which passengers are spending has slowed over the past five years. To reverse this decline, airports, airlines, retailers, and brands will need to work together in innovative ways.

Some of those players are already launching ventures to boost performance, both in the airport and in the air. Among the most recent examples, Kuala Lumpur International Airport is building an integrated big data platform to support operations and provide real-time information to customers and airport operators; it will also facilitate passenger access to retail with features such as click and collect, where passengers buy products online that are subsequently delivered to their gate prior to boarding. In another venture, Singapore Airlines and duty-free operator DFASS have partnered with SATS, a gateway and food services provider, to convert onboard catalogs into an omnichannel e-commerce experience.

While such efforts are a step in the right direction, companies need to do more than launch standalone initiatives or even individual joint ventures. They must join forces to create a travel retail ecosystem through which they can share data about passengers’ schedules, purchasing behavior, and other related insights, and use that information to offer passengers a compelling shopping experience at every step of their journey.

More Passengers—and More Challenges

Over the past 15 years, the combined revenue of travel retail markets around the world has grown at a CAGR of 8.6%, at least twice as fast as any other offline retail channel. Today it stands at nearly $70 billion. (See Exhibit 1.)

Asia-Pacific travel retail in particular has exploded, with a CAGR of 14.4%. After surpassing Europe in 2011, the region currently accounts for almost half (45%) of global revenue.

Airline passenger growth has provided a major tailwind for the growth in revenue. During the same 15-year period, the number of global passengers increased by 5% year over year. (See Exhibit 2.) And travel retail is likely to expand even further: according to the International Air Transport Association (IATA), the number of passengers will double between 2016 and 2035.

Until recently, revenue growth was also driven by an overall improvement in product assortment and the customer experience. Spending per passenger rose throughout the first decade of the 2000s, peaking globally in 2013, but has declined ever since. (See Exhibit 3.)

Both the growth in the number of passengers and the slowdown in spending per passenger need to be viewed against the backdrop of a transforming aviation industry. The emergence of low-cost carriers (LCCs), shifting demographics, and the growing impact of new regions are changing the face of aviation—and presenting new challenges for travel retail.

Low-cost carriers are on the rise. With their competitive prices, LCCs are enabling new consumers to enter the aviation market; these carriers now claim up to 35% market share in key regions. By expanding into secondary airports, they have also opened up new markets for travel retail. Since the arrival of Ryanair in 2002, for example, the number of passengers at Milan’s Orio al Serio International Airport has grown from 1 million to 11 million a year, a growth rate six times faster than that of other airports in the region. And in keeping with their lean operating model, LCCs take a digital-first approach when it comes to things like booking and checking in for flights.

But while LCCs can help to stimulate further growth in travel retail, other carriers will need to tailor their offerings to the needs and priorities—and the spending patterns—of the new LCC customer base as well. This could involve, for instance, increasing food and beverage offerings rather than retail products or focusing more on mass-market chains instead of luxury retail. LCC-focused airports need to accommodate the airlines’ operational-efficiency requirements while maintaining the service quality expectations of their travel retailcustomers.

Market demographics are shifting. Aviation demographics are also undergoing substantial changes, with new age groups taking center stage. A BCG study on the evolution of travel habits found that, by 2020, millennials (those born between 1980 and 1994) will account for 46% of business trip spending in the US, an 11% rise from 2013. (See Traveling with Millennials , BCG Focus, March 2013.)

To stimulate the buying power of millennials, travel retail will need to leverage digitally driven, omnichannel, and loyalty-based platforms. Meanwhile, baby boomers (those born between 1946 and 1964) and members of Generation X (born between 1965 and 1979) will increasingly retire and spend more time traveling. Travel retail will need to provide those groups with convenient offers that appeal to their respective socioeconomic and demographic profiles in order to stimulate impulse purchases.

In addition to these generational changes, the number of affluent and free independent travelers (those who travel on their own, not in prearranged group tours) will also rise.

New regions are coming into play. More travelers are coming from the Middle East and Asia-Pacific, at a rate almost twice that of visitors from Europe and the Americas over the past ten years. When it comes to Chinese travelers, traffic is expected to increasingly come from outside the four tier 1 cities (Beijing, Shanghai, Guangzhou, and Shenzhen); consumers from tier 2 and 3 cities will drive consumption patterns that reflect the relative immaturity of those local retail markets.

In the meantime, the growth of global GDP has transformed large sections of major countries such as India from low- to middle-income status. And according to the IATA, once people have more disposable income, they tend to spend more on travel.

Travel Retail Remains Fragmented

Between February and April 2018, BCG in partnership with the Tax Free World Association (TFWA) conducted in-depth interviews with more than 20 senior managers at airports, airlines, retailers, and brands in three regions (North America, Europe, and Asia-Pacific). All managers agreed that, by operating in silos, key industry players limit the value they can deliver to customers. Rather than sharing information about passengers and coordinating to provide them with the most compelling offerings in the most appealing environment possible, travel retail players continue to go it alone in a fragmented market.

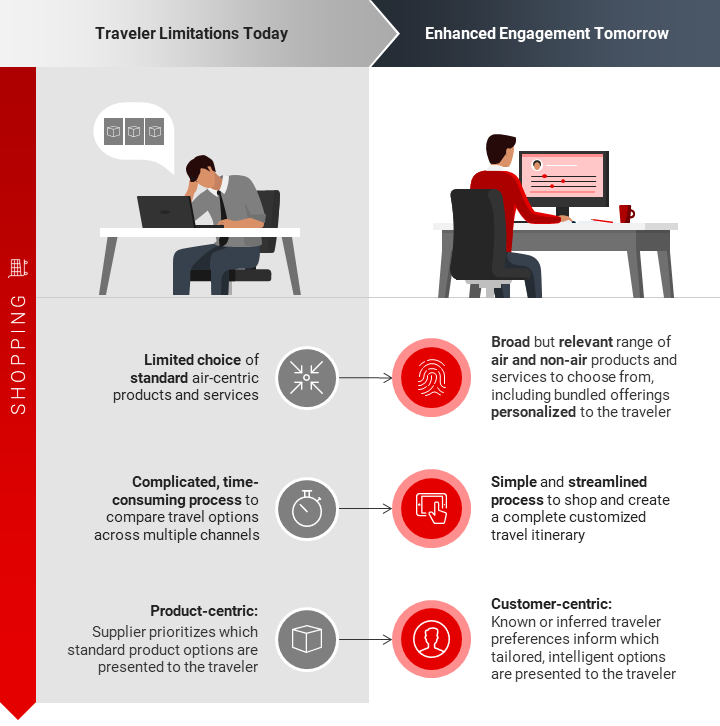

Integration is limited along the customer journey. Every point along the customer journey provides a buying opportunity. And airports and airlines have an unparalleled amount of real-time information about passengers as they make those journeys, from their age and nationality to their present and future locations. By not giving retailers and brands access to that data, they lose the ability to target customers with personalized offers.

Conversely, many retailers and brands don’t have the infrastructure to collect such data. Those that do gather information tend to focus on customer demographics, preferences, and buying patterns. But competition for concession contracts is fierce, and retailers and brands view their customer data as a source of competitive advantage. Rather than sharing the information, they keep it to themselves.

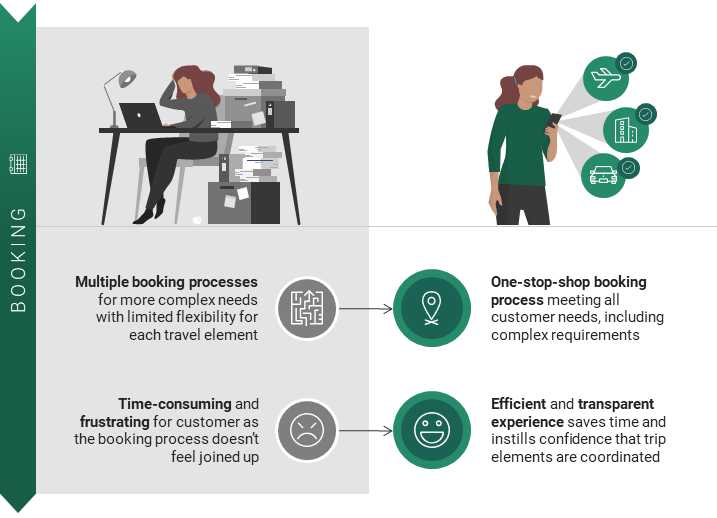

Players’ priorities conflict. On the basis of experience with an airport in Asia-Pacific, BCG has found that the amount of money passengers spend can increase by up to 2.5% for every extra minute they’re in the retail area. But security processes and airlines’ gate allocation, preboarding, and boarding requirements limit the amount of time passengers can spend browsing. (And free Wi-Fi means that many passengers stay away from the retail section altogether, choosing instead to sit in leisure areas and use their phones or laptops.) Another notable source of friction is related to the cabin allowance. A TFWA survey of nonshoppers indicated that 8% are uncertain about what they’re allowed to bring onboard (whether related to regulations or airline-imposed restrictions), which is one reason they don’t make a purchase in the retail area.

Quality is compromised, and assortments are limited. Contracts between airports and retailers tend to be short in duration, have razor-thin margins, and place the lion’s share of risk—such as fluctuating airport traffic levels and the inconsistent revenue stream that can result—onto the retailer. The result is that retailers must compromise on product quality and customer service. But TFWA found that the lack of value and selection were among the main reasons travelers didn’t make purchases.

Low margins and tight contract durations also force retailers to minimize their investments in new products and formats. Brands are subsequently unable to deliver their full array of assortments and pricing options to customers.

Standalone Improvements Generate Only Incremental Value

Airports, airlines, retailers, and brands are making notable changes to accommodate the shifts in passenger demographics and priorities. But individual improvements will take them only so far. They need to consider—and support—passengers’ entire travel experience.

Airports need to win market share by focusing on quality. Airports are increasingly looking for ways to generate revenue from nonaviation sources such as travel retail. Indeed, travel retail is a vital element when it comes to delivering a competitive experience, particularly for airports competing on premium routes. Improving terminal offerings helps attract new carriers and, with them, more passengers. But BCG research shows that more than 20% of passengers are still unhappy with the airport commercial area. Passenger complaints vary across airports, with the most common being poor Wi-Fi connections, dissatisfaction with the food and beverages available, and difficulty finding their way around.

Airlines need to offer more, and better, selection. In the face of strong pressure on profits from LCCs and other competitors, all carriers have been developing lean operating models—often to the detriment of travel retail, both onboard and in the airport. For example, in an effort to improve operational effectiveness, such as by reducing turnaround times and imposing one-bag carry-on limits and other constraints, airlines have also cut back on both the quality and the variety of products available to buy while in the air, causing growth in onboard retail to stagnate. Instead, they should be looking to partner with retailers to offer items that can be purchased during the flight and picked up upon landing.

Retailers need to focus on customer convenience and new formats . While leading travel retailers have consolidated to strengthen their financial performance, they could do more for the customer, such as making the shopping experience more convenient by offering click-and-collect systems or by enhancing loyalty schemes through vertical integration with airports and brands. Retailers could also improve their in-terminal formats, investing in innovative layouts and further distinguishing their product offerings from those of traditional retail channels.

Brands need to differentiate their offerings and formats. Brands are also refining their approach to travel retail—for example, by considering it as a separate channel and dedicating departments to it. Pricing strategies and customer service could be further improved, however, as could format innovation, even in a constrained environment such as the airport. One example is the new Louis Vuitton store in Singapore’s Changi Airport; opened in late 2017, it is the first LV airport store in Southeast Asia and features, among other things, a glass and copper-diamond mesh surface and a digital LED display at the entrance.

Building a Travel Retail Ecosystem

Travel retail’s ability to provide the customer with a compelling shopping experience while meeting the strategic challenges of new markets, changing demographics, and competition from online retail will hinge on how quickly and effectively airports, airlines, retailers, and brands can work together. By moving past their current silo mentality, they can create a travel retail ecosystem that makes personalization and integration core features of the passenger experience.

Industry players can take a number of steps toward creating such an ecosystem. These actions are grounded in two guiding principles: a renewed focus on the customer and the establishment of a value-based platform for cooperation and collaboration.

Use data to provide the customer an integrated experience. Convenience—in both price and delivery—as well as immediacy are two of the primary reasons online retail is so successful, and together, they give it a competitive advantage over today’s travel retail offerings. One way the travel retail industry can fight market erosion from online competition is to match the convenience and immediacy that online provides. Travel retail should enable purchasing at every stage of the customer journey, from booking and other pretravel activities, to time spent in the airport, to in-air travel—all the way through to after deplaning. A strong partnership among industry players, which a third-party technology provider could help to anchor, is critical. But the success of any technology platform will depend on its ability to integrate data from all players regarding products and services that can be offered along the traveler’s journey. (See the sidebar.)

Integrated Data Platforms in Travel Retail

Several travel retail players have already developed integrated data platforms. For example:

- AOE has developed an omni-channel and multimerchant marketplace for Frankfurt Airport, which hosts one of the largest shopping areas in Germany. Users can download the Frankfurt Airport app to browse products offered by selected retailers and receive related promotions, reserve products for purchase that they can collect at the gate once they’ve landed, and check their flight status in real time.

- Skybuys is a prototype app that integrates the offerings of more than 100 duty-free points of sale globally (in-airport, onboard, and downtown) for the frequent traveler. Users can browse offerings across multiple duty-free retailers, compare items by location, save items to wish lists, and reserve and collect purchases in the airport.

- Flio integrates more than 300 individual airport apps into one. For each airport, it provides a vast array of operational information, from airport maps to flight time- tables to lists of shops and services; a one-click connection to airport Wi-Fi; the ability to make in-app purchases for further travel; as well as lounge access and selected promotions from featured retailers.

Airlines (and their data) are a critical component of the ecosystem. They can play a role in increasing the value of the travel retail market in three ways, starting with passenger data. Unlike airports, retailers, or brands, airlines are the main point of contact with passengers. As such, they have an unparalleled amount of knowledge about their customers, which they’ve used to develop competitive pricing policies and precision-marketing strategies. And they could take this even further—for example, by offering customer information such as ticket fare class to retailers for use when marketing travel retail products. This data could be shared in exchange for transparent transaction fees.

Another way of increasing travel retail revenue is for airlines and retailers to form joint ventures to create digital platforms that complement onboard service. For example, Singapore Airlines and travel retail operator DFASS signed a joint venture agreement with gateway and food services provider SATS to move the catalogs they provide to passengers in the air onto an omnichannel e-commerce platform. With such agreements, retailers can expand their ability to reach customers, and airlines can shore up any limitations in their product offerings while still maintaining operational efficiency.

In addition, airlines could allow a wider variety of goods to be promoted during check-in and at the booking stage. And they could provide complementary onboard travel retail services. For example, the online brand REWE is trialing an onboard grocery-shopping offering with Lufthansa that allows passengers on selected long-haul flights to shop for products that can be delivered once they arrive home.

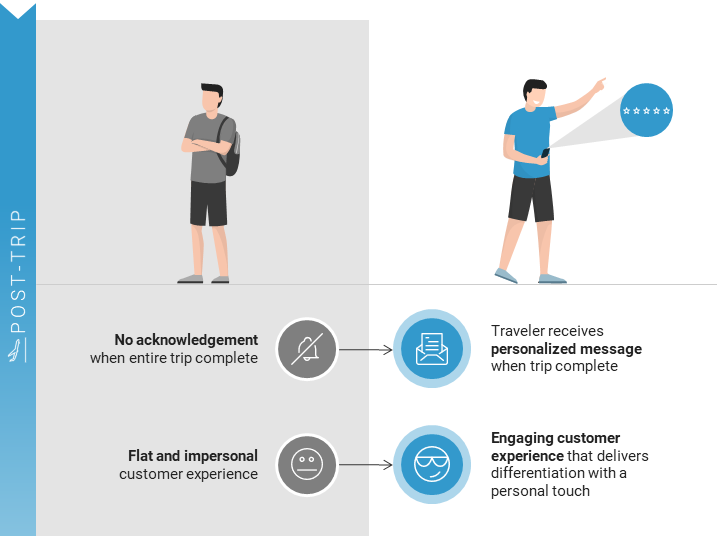

Enhance the customer experience, from terminal planning to in-store execution. The travel retail industry should focus on building differentiated offerings that deliver a surprise effect. For example, in early 2018, Tiffany used its iconic blue packaging to draw passengers to its pop-up store in John F. Kennedy International Airport’s Terminal 4.

Excellence in customer experience starts with retailers and airports sharing a common understanding of the core principles that govern terminal design and passenger acquisition strategies. For example, when planning a terminal expansion, operators of one European airport engaged heavily with their commercial partners to establish criteria for space allocation and passenger flows. Engagement with large retailers started four years before the terminal opened; with select luxury brands, engagement began two years before it opened.

When it comes to operations, travel retail needs to be flexible enough to respond to changes in the number of passengers in different locations and at various times of the day in order to maintain profitability. One example is the integrated big data platform that Kuala Lumpur International Airport is deploying for its KLIA2 terminal. The platform will pull in data about passengers’ real-time locations throughout the airport so that services and supports can be adjusted to seamlessly accommodate fluctuations in passenger flow. Airports can also use big data and analytics to better manage resourcing, parking congestion, and in-terminal retail assortments.

The first steps toward this transformation have already been taken. Brands and retailers are developing new formats by using technologies such as video and augmented reality. They’re also embarking on enhanced partnership agreements with airports to create new formats, such as pop-up shops, that can occupy unused terminal space while providing novelty to travelers.

Refocus on the customer with tailored products, pricing, and promotions. Retailers and brands must further integrate around products to deliver differentiated offerings, starting with a shared understanding of customer demographics and purchase patterns.

According to Swiss travel retail research firm m1nd-set, the top two reasons Chinese consumers say they buy duty-free items are that they offer good value for money and a clear price advantage. With that in mind, the travel retail industry should exploit the price advantage offered by tax exemptions on core categories. That will allow them to compete with prices found elsewhere, whether online, downtown, or at the passenger’s destination, especially given that those other prices can be discovered with a simple web search. One solution—already widespread among e-commerce retailers—could entail the introduction of dynamic-pricing policies to match those of the competition.

The industry can also take advantage of airports’ intrinsic data richness, pooling customer information with real-time data to further tailor promotions and marketing campaigns. An example is the data-driven advertisement initiative jointly developed by Dubai International Airport, Dubai Duty Free, and JCDecaux. Together, they created a marketing ecosystem that integrates all their data to optimize ad scheduling, boosting the efficiency of campaigns. Retailers can change their artwork every 15 seconds using different languages and promotions according to the time of day and the expected passenger flows in the airport.

Three Ways to Start Working Together

To help airports, airlines, retailers, and brands craft their next steps, we offer three business model archetypes for partnerships that could provide the foundation of a travel retail ecosystem.

A Data-Driven Marketing and E-Commerce Platform

The industry could partner with a third-party technology provider to create an integrated, data-driven global-insights platform that could increase the number of marketing opportunities by focusing on customer outreach before travel starts and on convenience both during and after the journey.

All industry players would share data about their customers—from their age and nationality to their brand loyalty status—in a way that complies with privacy regulations. The platform would systematize and orchestrate the exchange of that data in return for a fee. For increased impact, the ecosystem could be extended to include, for example, hotels, parking operators, and online travel agencies.

The platform would then feed into a second, commercial platform that enables comarketing activities among airlines, airports, brands, and retailers. Given their natural connection with the customer, airlines and brands would serve as the touchpoint channels, while retailers and airports would provide the right assortment, resources, and areas for the comarketing activities.

The platform could be used to push targeted airport retailer promotions when the customer is engaged with the airline, either at check-in online (such as discounts on family meals or parking promotions) or while onboard (for example, a click-and-collect system at the gate during a stopover). Brands could also leverage the platform to increase the span of services they offer customers, such as the ability to collect or return items purchased online during a forthcoming airport visit.

Similar platforms are already being developed in adjacent markets. One example is Journera, a back-end data platform that collects passenger information from participating travel partners to provide a single, real-time snapshot of passengers that participants can use to offer a customized experience. For example, a hotel operator could see that one of its guests landed ahead of schedule and offer an early check-in time.

A Passenger Control Tower

Today, passenger flows are static and operations-driven. Airports allocate gates on the basis of customs officer availability, aircraft turnaround times, and ground handling requirements, for example. To give passengers a better experience while maximizing the amount of money they spend, airports could work with airlines, retailers, and brands to develop a digital passenger control tower. (See Exhibit 4.)

This tool would take data from multiple sources (retailers, airlines, airports, and data streams produced through passengers’ digital devices via airport Wi-Fi) and pertaining to multiple fields—from passenger purchasing preferences to flight departure times. Using this data, the system would then provide real-time passenger information to retailers, such as point of origin or destination, and would optimize a series of airport-critical operations that would help to direct passenger flow. For example, the system would dynamically redesign gate allocation in order to maximize passenger exposure to the retail areas most appealing to them.

Airports would need to lead the development of this tool, setting criteria and providing the operating resources. Robust data platforms and innovative partnership agreements would be especially important because success would depend on airlines sharing their passenger information, brands and retailers defining their potential interest, and airports dynamically allocating suitable gates while ensuring that minimum levels of operational service are fulfilled.

Small-scale mockups undertaken for specific airports have already shown that such tools can deliver significant increases in spending per passenger.

A Personalized Pricing and Assortment Tool

Today’s customer wants personalization and special treatment on the basis of loyalty. Moreover, travel retail customers are rational in their purchase decisions and often compare prices online even while in airports. Retailers can take the lead in improving customer personalization by devising a real-time, personalized pricing and assortment tool.

The system would leverage the intraday difference in passenger mix as well as the inherently data-rich environment of the airport to optimize and dynamically offer pricing, promotions, and assortments. The ultimate objective of this type of system would be to reorient the product mix, increase spending per ticket, and generate more impulse purchases. Such a tool would be especially helpful during an economic downturn, when spending per passenger needs to compensate for any shortfall in the number of travelers.

For input, the system would require airport information, such as flight schedules and the position of passengers in the retail area using beacons and Wi-Fi, consumer brand preferences, and third-party information such as downtown benchmark prices or the weather in a destination city. For example, the system could optimize duty-free prices and special offers at an airport in Antalya, Turkey, prior to the departure of an evening flight to Russia in order to align with prices in downtown Moscow and the categories preferred by Russian consumers.

Online retailers already make plenty of daily adjustments to prices as well as to promotions, and similar experiments are also taking place in many brick-and-mortar retail stores. To achieve comparable results in the airport environment, retailers would need to coordinate their efforts and—most important—they would have to invest in adapting their systems to dynamic pricing, all of which would require that they revise the compensation terms of their concession contracts.

The travel retail industry has experienced exceptional growth over the past 15 years. But while an increase in the number of passengers has been a major tailwind, airports, airlines, retailers, and brands have contributed to the development of the sector as well. In the past five years, however, signs suggest that the market is reaching a turning point, with travel retail spending per passenger dropping in all regions around the globe.

To reverse that decline, airports, airlines, retailers, and brands need to abandon their current silo approach and instead create a travel retail ecosystem. Only by sharing information, aligning operational priorities, and integrating along the entire customer journey can the travel retail industry reverse the current falloff in passenger spending and stave off any further declines.

Managing Director & Senior Partner, EMESA Regional Lead, Fashion & Luxury Industry

Managing Director & Partner

Project Leader

Managing Director & Senior Partner

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

A travel boom is looming. But is the industry ready?

If things go well, we might be at the threshold of a new age of travel. Although COVID-19 variants may affect conditions, it seems only a matter of time before travelers in some parts of the world hit the road and take to the skies again, thanks to rising vaccination rates and manageable caseloads. Some countries have begun gingerly relaxing travel restrictions and reopening borders.

As the worst effects of the COVID-19 pandemic ebb, most indicators point to travel coming back—with a vengeance—as people look to reconnect, explore new destinations, or revisit reliable favorites. Many just want to get away from the confines of their homes. A McKinsey survey reveals traveling to be the second-most-desired activity among respondents (in first place: dining out). In the United States, air travel has hit two million daily passengers, closer to the prepandemic level of around 2.5 million than to the low of around 90,000, in April 2020. Hotel reservations and rental-car bookings are surging.

All these trends should taste sweet for the industry, but ill-prepared companies may find themselves facing the wrath of a cohort of leisure-focused vacationers who might already be struggling to keep up with new travel protocols. If the industry doesn’t work to increase capacity now, the ecosystem may buckle under the pressure, forcing travelers to endure long wait times and inflated prices.

This article projects two broad trajectories of how travel will likely bounce back, comparing countries that have near-zero caseloads with those that have more, but manageable, caseloads and higher vaccination rates. In both scenarios, travel companies that don’t prepare themselves for the forthcoming influx of travelers risk missing out on a valuable opportunity to recoup losses incurred during the height of the pandemic. On the flip side, we believe that by focusing on four key areas—building capacity, investing in digital innovation, revisiting commercial approaches, and learning from critical moments—travel companies can seize value as they exceed the needs and demands of their customers.

The tale of two travel recovery paths

Wherever in the world you look, you’ll see people itching to travel. Most high-income earners have not lost their jobs. In the United States, the savings rate among this demographic is 10 to 20 percent higher now than before the pandemic, and such people are eager to spend their money on travel. Leisure trips are expected to lead the rebound, with corporate travel trailing behind.

A recent survey of 4,700 respondents from 11 countries around the world, conducted by the International Air Transport Association (IATA), revealed that 57 percent of them expected to be traveling within two months of the pandemic’s containment, and 72 percent will do so as soon as they can meet friends and family. In our China travel survey, we see more and more respondents yearning for leisure trips further afield; 41 percent say they want their next trip to be outside China, the highest level we’ve seen, despite borders remaining sealed.

Yet it’s worth noting that despite the near-universal desire to travel, countries will likely manage their plans to reopen differently. Two main factors come into play here: current COVID-19 caseloads and vaccination rates. People living in countries with limited access to vaccines and uncontainable levels of cases—such as a number of countries in Africa and Southeast Asia—will continue to be bound by tight travel restrictions for some time to come.

Travel will take off in and between countries with manageable caseloads

We can expect a surge in travel in (and between) countries with manageable and moderate COVID-19 caseloads and vaccine access. These regions are willing to accept rising case levels as long as death and hospitalization rates stay low. In many European countries and the United States, a significant portion of the population has been inoculated. Such people feel safe enough to travel both domestically and internationally, especially with the introduction of safety measures such as the EU-issued digital health certificates given to people vaccinated against COVID-19. Despite fluctuating rates of new caseloads in these regions, the efficacy of the vaccine so far (to reduce the spread of the disease and avoid its worst effects) gives many people enough feeling of security to travel.

Countries in Europe that have gotten used to living with manageable caseloads of COVID-19 have begun to welcome visitors without asking them to quarantine: Iceland (March 2021), Cyprus (May 2021), and Malta (June 2021). In addition, Europe is open to vaccinated US travelers. After the US Centers for Disease Control and Prevention (CDC) started approving cruise vessels with conditional sailing certifications to enter the country, a Florida federal court ruled in June 2021 that CDC-issued regulations should serve only as nonbinding guidelines, further reducing restrictions on tourists.

If past instances serve as indicators, we’ll see travel demand soaring once travel restrictions are eased and freedom of mobility returns.

Domestic trips will lead the recovery of travel in near-zero countries

However, a slightly different picture is emerging for countries with near-zero caseloads. Countries in this group include Australia, China, New Zealand, and Singapore. Their governments face a difficult trade-off. They can open up national borders without quarantines—which will almost certainly lead to increased local transmissions of COVID-19 and an increase in new cases, especially in countries with low vaccination rates, such as Australia and New Zealand. Or, they can choose to continue imposing strict restrictions and quarantine measures until the pandemic has truly passed, which would deter all but the most determined of travelers. Unlike places that have adjusted to living with COVID-19, even a moderate increase of cases in countries with caseloads near zero would likely be unacceptable to the public.

That’s not to say there are no travel opportunities in these countries. First, we’ll likely see increased interest in domestic travel, especially for large countries with sizable home markets, such as Australia and China, which have traditionally been net exporters of tourists. With few international destinations open to visit, this group of travelers will likely seek out vacation experiences within their nations’ borders. China has seen hordes of tourists flood many scenic destinations and tourist sites, especially during peak travel seasons.

Second, even though travel bubbles have had only limited success so far, it may soon be possible for territories with very low COVID-19 caseloads and no local transmissions to open up access to each other. Mainland China, for instance, has been allowing citizens to travel to and from Macau without quarantine requirements. Hong Kong and Singapore have also restarted negotiations on a potential travel bubble between the two cities. The key is establishing common standards and trust in the public-health protocols and testing regimes of the participants in the travel bubble.

Four actions travel players must consider

Despite these promising signs, the tourism industry will likely struggle to capitalize on the imminent spike in travel demand, especially in Europe and the United States. From airlines and car rentals to hotels and airport restaurants, the entire travel supply chain is already showing signs of strain. Wait times at security checkpoints are stretching into hours at some airports, while popular vacation destinations, including Arizona, Florida, and Hawaii, are facing rental-car shortages.

Needless to say, bad news travels fast, and a negative experience can quickly become fodder for a viral video and bad publicity, leading customers to look for alternatives more in their control, including nearby drives and rental properties.

While the process is daunting, clear-sighted travel leaders know that preparing their organizations for a surge of travelers is also an opportunity to redefine their value propositions and make their offerings distinctive. This will not only reinstill confidence in travel but also increase customer loyalty. Leaders and executives would be wise to focus on the following four areas.

1. Bring back capacity

The most pressing imperative for all companies across the travel supply chain is bringing back capacity or, at the very least, ensuring that they’re able to do so. Many contract and temporary workers in the restaurant industry who were laid off during the pandemic have found other employment and are reluctant to go back to their former jobs, resulting in a labor crunch. In the United Kingdom, more than one in ten workers left the hospitality sector last year. In the United States, there was still a shortfall in April of around two million leisure and hospitality jobs—far greater than before the pandemic. Global aviation capacity levels are still well below prepandemic levels as many planes remain in long-term storage and staff remain furloughed. We believe that even though reactivating airline pilots and cabin crews, preparing grounded aircraft for service, and rehiring and training service staff can be pricey, the cost of standing by and doing nothing would be higher.

2. Invest innovatively to improve the entire customer journey

While cash might continue to be in short supply, an area still worth considering for overinvestment is digital operations. Remember that the customer experience is shaped across the entire end-to-end journey, from booking to travel to the return home. Even seasoned travelers will have to adapt to new protocols, such as digital health certificates and safety measures. Travelers now need more, not less, assistance. Furthermore, certain critical journeys and moments—such as a family vacation, an important business trip, or a last-minute emergency—carry a disproportionate weight in consumers’ minds when they plan their next trip. The anticipated volume of traffic during the summer and peak holiday periods will only compound these issues and bring about greater inconvenience in the overall system.