Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

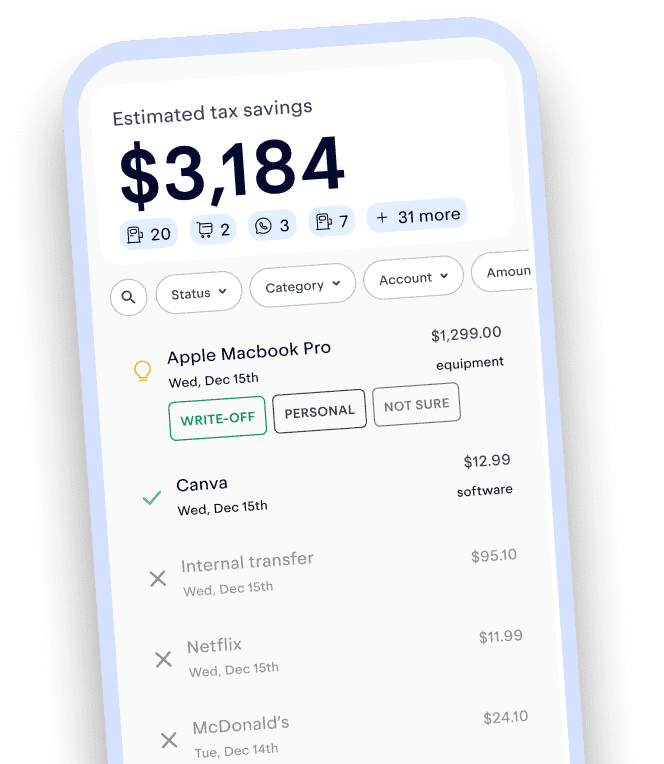

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

Home / Resources / Articles / IRS Publishes New Business Travel Per Diem Rates for 2021

IRS Publishes New Business Travel Per Diem Rates for 2021

October 6, 2020

Most business travel was temporarily suspended during the spring and summer months. Now some people have started traveling for business purposes again, albeit less than before the COVID-19 pandemic began. With travel cutbacks, now may be a good time to review — and possibly simplify — how your company reimburses its workers for out-of-town lodging, meals and incidental expenses.

One simplified alternative is the “high-low method.” Instead of reimbursing employees for actual travel costs, this method provides fixed travel per diems. These amounts are based on IRS-approved rates that vary from locality to locality. Here are the details.

How It Works

Under the high-low method, the IRS establishes an annual flat rate for certain areas with higher costs of living. All locations within the continental United States that aren’t listed as “high-cost” automatically fall into the low-cost category. The high-low method may be used in lieu of specific per diem rates for business destinations. Examples of high-cost areas include San Francisco, Boston and Washington, D.C. (See the chart below for a complete list by state.)

Under some circumstances — for example, if an employer provides lodging or pays the hotel directly — employees may receive a per diem reimbursement only for their meals and incidental expenses. There’s also a $5 incidental-expenses-only rate for employees who don’t pay or incur meal expenses for a calendar day (or partial day) of travel.

The following aren’t considered incidental expenses:

- Transportation between places of lodging or business and places where meals are taken, and

- The mailing cost of filing travel vouchers and paying employer-sponsored charge card billings.

Consider reimbursing employees separately for these expenses and then deducting the amounts as ordinary business expenses.

Simplified Recordkeeping

If your company uses per diem rates, employees don’t have to meet the usual recordkeeping rules required by law. Collecting paper or electronic receipts for expenses generally isn’t required under the per diem method. Instead, the employer simply pays the specified allowance to employees.

But employees still must substantiate the time, place and business purpose of the travel. Per diem reimbursements generally aren’t subject to income or payroll tax withholding or reported on the employee’s Form W-2. Also, per diem rates can’t be paid to individuals who own 10% or more of the business.

Updated Rates

The IRS recently updated the per diem rates for business travel for fiscal year 2021, which started on October 1, 2020. Under the high-low method, the per diem rate for all high-cost areas within the continental United States is $292 for post-September 30, 2020 travel ($221 for lodging and $71 for meals and incidental expenses). For all other areas within the continental United States, the per diem rate is $198 for post-September 30, 2020 travel ($138 for lodging and $60 for meals and incidental expenses). Compared to the prior simplified per diems, the high-cost area per diem has decreased $5 and the low-cost area per diem has decreased $2.

The IRS also modified the list of high-cost areas for post-September 30 travel. The following have been added to the high-cost list:

- Los Angeles, Calif.,

- San Diego, Calif.,

- Gulf Breeze, Fla.,

- Kennebunk/Kittery/Sanford, Maine, and

- Virginia Beach, Va.

On the other hand, these areas have been removed from the previous list of high-cost localities:

- Midland/Odessa, Texas, and

- Pecos, Texas.

Important note: Certain tourist-attraction areas only count as high-cost areas on a seasonal basis. Starting on October 1, the following tourist-attraction areas have changed the portion of the year in which they are high-cost localities:

- Sedona, Ariz.,

- Monterey, Calif.,

- Santa Barbara, Calif.,

- Washington, D.C.,

- Naples, Fla.,

- Jekyll Island/Brunswick, Ga.,

- Boston/Cambridge, Mass.,

- Philadelphia, Pa.,

- Jamestown/Middletown/Newport, R.I.,

- Charleston, S.C.

Important: This method is subject to various rules and restrictions. For example, companies that use the high-low method for an employee must continue to use it for all reimbursement of business travel expenses within the continental United States during the calendar year. The company may use any permissible method to reimburse that employee for any travel outside the continental United States, however.

For travel during the last three months of a calendar year, employers must continue to use the same method (per diem or high-low method) for an employee as they used during the first nine months of the calendar year. Also, employers may use either:

- The rates and high-cost localities in effect for the first nine months of the calendar year, or

- The updated rates and high-cost localities in effect for the last three months of the calendar year, as long as they use the same rates and localities consistently for all employees reimbursed under the high-low method.

Claiming Business Travels Deductions

In terms of deducting amounts reimbursed to employees on a company’s tax return, employers must treat meals and incidental expenses as a food and beverage expense that’s subject to the 50% deduction limit on meal expenses. For certain types of employees — such as air transport workers, interstate truckers and bus drivers — the percentage is 80% for food and beverage expenses related to a period of duty subject to the U.S. Department of Transportation’s hours-of-service limits.

Example: A company reimburses its sales manager for attending a business meeting in San Diego based on the $292 high-cost per diem. It may deduct $256.50 ($221 for lodging plus $35.50 for half of the meals and incidental expense allowance).

Changing Times

Most companies expect to cut back on business travel in the post-COVID-19 era. While you’re updating your company’s overall travel guidelines, consider switching to the high-low method. Though the list of high-cost localities varies slightly from year to year, this method can reduce the time and frustration associated with submitting traditional travel reimbursement forms. Contact your tax advisor for more information.

High-Cost Area List for 2021

Source: IRS* If no effective date is listed, the location is a high-cost area all year long.

Forecasting Cash Flow in the COVID-19 Era

Home Office Deductions in the COVID-19 Era

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

Webcast and events

Browse all our upcoming and on-demand webcasts and virtual events hosted by leading tax, audit, and accounting experts.

Related posts

When Do COVID-19-Related Extended HIPAA Special Enrollment Periods End?

ACA Preventive Health Services Mandate to Remain in Effect During Braidwood Appeal

CMS Issues Guidance on Elimination of MHPAEA Opt-Out Elections by Self-Insured Non-Federal Governmental Health Plans

More answers.

Use AI to stay abreast of changing tax regulations and legislation

Elevating your firm’s client services through automation

Head of Product at HRMS Company says AI is the copilot and not the replacement in the payroll industry

IR-2021-251, Standard Mileage Rates for 2022

News essentials.

News Releases

IRS - The Basics

IRS Guidance

Media Contacts

Facts & Figures

Around The Nation

e-News Subscriptions

The Newsroom Topics

Multimedia Center

Noticias en Español

The Tax Gap

Fact Sheets

IRS Tax Tips

Armed Forces

Latest News Home

IRS Resources

Compliance & Enforcement

Contact My Local Office

Filing Options

Forms & Instructions

Frequently Asked Questions

Taxpayer Advocate

Where to File

IRS Social Media

Issue Number: IR-2021-251

Inside this issue.

IRS issues standard mileage rates for 2022

IR-2021-251, Dec. 17, 2021

WASHINGTON — The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on Jan. 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021,

- 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2021.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. For more details see Moving Expenses for Members of the Armed Forces .

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Taxpayers can use the standard mileage rate but must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

Notice 22-03 , contains the optional 2022 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan. In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2022 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule.

Back to Top

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe .

This message was distributed automatically from the mailing list IRS Newswire. Please Do Not Reply To This Message.

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

IRS raises per diem standard rates for business travel

- Individual Income Taxation

- Personal Financial Planning

- Employee & Business Owner Planning

The special per diem rates by which taxpayers may substantiate ordinary and necessary business expenses of travel away from home will be slightly higher starting Oct. 1, the IRS provided Monday in Notice 2022-44 .

Generally, in lieu of actual lodging, meal, and incidental expenses incurred, a payer may consider substantiated for federal tax purposes an employee's expenses incurred for employment-related travel in an amount up to or equaling the federal per diem rate for the locality of travel. The high-low substantiation method applies a higher rate to designated high-cost localities and a lower rate to all other localities.

The annual update includes the per diem rate under the high-low substantiation method for travel within the continental United States (CONUS), which for non-high-cost localities will be $204. The rate for travel to high-cost localities within CONUS, which are listed in the notice, is $297. Those current rates for the period Oct. 1, 2021, to Sept. 30, 2022 are, respectively, $202 and $296. The portion of the rates treated as paid for meals for purposes of Sec. 274(n) is $74 for high-cost CONUS localities and $64 for all other CONUS localities, both the same as currently.

The notice also revises the list of high-cost localities for the upcoming new annual period (Oct. 1, 2022, to Sept. 30, 2023) for which the new rates are in effect. High-cost localities have a federal per-diem rate of $250 or more.

Notice 2022-44 also provides the special rates for taxpayers in the transportation industry. The meals and incidental expenses rates are $69 for any locality of travel within CONUS and $74 for localities of travel outside CONUS, both the same as currently.

The incidental-expenses only rate remains $5 per day as currently, for travel both in and outside CONUS.

— To comment on this article or to suggest an idea for another article, contact Paul Bonner at [email protected] .

Where to find April’s flipbook issue

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

Manage the talent, hand off the HR headaches

Recruiting. Onboarding. Payroll administration. Compliance. Benefits management. These are just a few of the HR functions accounting firms must provide to stay competitive in the talent game.

FEATURED ARTICLE

2023 tax software survey

CPAs assess how their return preparation products performed.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

FY 2024 Per Diem Rates Now Available

Please note! The FY 2024 rates are NOT the default rates until October 1, 2023.

You must follow these instructions to view the FY 2024 rates. Select FY 2024 from the drop-down box above the “Search By City, State, or ZIP Code” or “Search by State" map. Otherwise, the search box only returns current FY 2023 rates.

Rates are set by fiscal year, effective Oct. 1 each year. Find current rates in the continental United States, or CONUS rates, by searching below with city and state or ZIP code, or by clicking on the map, or use the new per diem tool to calculate trip allowances .

Search by city, state, or ZIP code

Required fields are marked with an asterisk ( * ).

Search by state

Have travel policy questions? Use our ' Have a Question? ' site

Have a question about per diem and your taxes? Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. GSA cannot answer tax-related questions or provide tax advice.

Need a state tax exemption form?

Per OMB Circular A-123, federal travelers "...must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." GSA's SmartPay team maintains the most current state tax information , including any applicable forms.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

Grow Your Skills

- Construction & Housing

- Human Resource

- Microsoft Office

- Payroll & Accounting

- Employee Retention

- Exempt vs Non-Exempt Employees

- Internal Investigation

- Social Media At Workplace

- Succession Planning

- April 20, 2024

- Compliance Prime Team

What are IRS mileage reimbursement rules?

When we talk about travel pay and how to handle it correctly , we often find IRS mileage reimbursement rules a bit challenging to understand. However, it’s essential to know about IRS mileage, and top 10 IRS forms , and the 5 most common mistakes that you should avoid to get the most out of your deductions and avoid tax issues.

In this blog post, we will discuss the basics, including standard mileage rates, tax implications, recordkeeping needs, and other deduction options, in easy-to-understand terms.

Standard Mileage Rates

First of all, you need to be clear about the difference between travel time pay and mileage reimbursement . Each year, the IRS establishes standard mileage rates to streamline the process of deducting expenses related to business, medical, and charitable travel. These rates are meticulously calculated to encompass various costs associated with vehicle usage, including fuel, depreciation, insurance, and other common expenses. Here’s a detailed breakdown of the standard mileage rates:

- Business miles: The standard rate for business-related travel is set at 67 cents per mile. This rate is widely utilized by employers for reimbursing employees who use their personal vehicles for work-related purposes.

- Medical and moving miles: For active duty military members relocating due to military orders, the standard mileage rate is 21 cents per mile. It’s important to note that this deduction was eliminated for most taxpayers in 2018, leaving it applicable only to active duty military personnel.

- Charitable miles: Individuals traveling for charitable purposes can deduct mileage at a rate of 14 cents per mile. This applies to travel conducted with personal vehicles for qualified charitable organizations.

Tax Deduction vs. Reimbursement

It’s crucial to grasp the distinction between tax deductions and reimbursements, especially for both employees and self-employed individuals. Understanding these differences can significantly impact how you manage your finances and navigate tax obligations.

- Employees: If you use your car for work and your employer reimburses you at the IRS mileage rate or higher, the reimbursement is not considered income and is not taxable.

- Self-employed individuals: You have two options: deduct your actual expenses incurred for using your vehicle for business purposes (gas receipts, repairs, maintenance, etc.), or choose the standard mileage rate for business miles driven.

Recordkeeping Essentials

Accurate and detailed record-keeping is paramount when it comes to claiming mileage deductions, regardless of whether you’re an employee seeking reimbursement or a self-employed individual claiming deductions on your tax return. To ensure you can maximize your deductions and comply with IRS regulations, here’s a breakdown of what you need to track:

- Date of each trip: Note down the date whenever you take a business trip.

- Purpose of each trip: Write down the reason or purpose behind every business trip you make.

- Odometer readings: Record the odometer readings both at the beginning and end of each business trip to determine the total distance traveled.

- Total miles driven for business purposes: Maintain a cumulative count of all the miles driven for business-related reasons throughout the year.

Alternatives to Standard Mileage Rates

While the standard mileage rate offers a simplified approach, deducting your actual expenses might be more beneficial if your car expenses exceed the standard rate for your mileage. However, this method requires meticulous record keeping of gas receipts, maintenance costs, insurance payments, and any other relevant car-related expenses.

Additional Resources

The IRS website offers valuable resources and publications to help you navigate mileage deductions. Here’s a link to their Online PDF on this topic: https://www.irs.gov/pub/irs-drop/n-23-03.pdf

Understanding IRS mileage reimbursement rules can empower you to maximize your tax deductions and ensure accurate reporting. By familiarizing yourself with standard rates, tax implications, and recordkeeping requirements, you can navigate the process with ease. Remember, the IRS website is a valuable resource for further clarification on mileage deductions and specific situations.

Be the first one to get latest industry news

Disclaimer: We do not make any warranties about the completeness, reliability and accuracy of the information provided on this website. Any action you take upon the information on this website is strictly at your own risk, and Compliance Prime will not be liable for any losses and damages in connection with the use of our website.

- 304 S. Jones Blvd #1666, Las Vegas NV 89107 United States

- (888) 527-3477

- [email protected]

- Privacy Policy

- Terms & Conditions

- Refund Policy

NEWSLETTER SUBSCRIPTION

10 productivity hacks, get free e-book.

Thanks, your free e-Books is on its way

Check your email to download the ebook. if you don't see the email, check in your spam folder as well..

High Contrast

- Asia Pacific

- Latin America

- North America

- Afghanistan

- Bosnia and Herzegovina

- Cayman Islands

- Channel Islands

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Hong Kong SAR, China

- Ireland (Republic of)

- Ivory Coast

- Macedonia (Republic of North)

- Netherlands

- New Zealand

- Philippines

- Puerto Rico

- Sao Tome & Principe

- Saudi Arabia

- South Africa

- Switzerland

- United Kingdom

- News releases

- RSM in the news

- AI, analytics and cloud services

- Audit and assurance

- Business operations and strategy

- Business tax

- Consulting services

- Family office services

- Financial management

- Global business services

- Managed services

- Mergers and acquisitions

- Private client

- Risk, fraud and cybersecurity

- See all services and capabilities

Strategic technology alliances

- Sage Intacct

- CorporateSight

- FamilySight

- PartnerSight

Featured topics

- 2024 economy and business opportunity

- Generative AI

- Middle market economics

- Environmental, social and governance

- Supply chain

Real Economy publications

- The Real Economy

- The Real Economy Industry Outlooks

- RSM US Middle Market Business Index

- The Real Economy Blog

- Construction

- Consumer goods

- Financial services

- Food and beverage

- Health care

- Life sciences

- Manufacturing

- Nonprofit and education

- Private equity

- Professional services

- Real estate

- Technology companies

- See all industry insights

- Business strategy and operations

- Family office

- Private client services

- Financial reporting resources

- Tax regulatory resources

Platform user insights and resources

- RSM Technology Blog

- Diversity and inclusion

- Middle market focus

- Our global approach

- Our strategy

- RSM alumni connection

- RSM Impact report

- RSM Classic experience

- RSM US Alliance

Experience RSM

- Your career at RSM

- Student opportunities

- Experienced professionals

- Executive careers

- Life at RSM

- Rewards and benefits

Spotlight on culture

Work with us.

- Careers in assurance

- Careers in consulting

- Careers in operations

- Careers in tax

- Our team in India

- Our team in El Salvador

- Apply for open roles

Popular Searches

Asset Management

Health Care

Partnersite

Your Recently Viewed Pages

Lorem ipsum

Dolor sit amet

Consectetur adipising

Tax issues arise when employers pay employee business travel expenses

Employers must determine proper tax treatment for employees.

Most employers pay or reimburse their employees’ expenses when traveling for business. Generally, expenses for transportation, meals, lodging and incidental expenses can be paid or reimbursed by the employer tax-free if the employee is on a short-term trip. However, the tax rules become more complex when the travel is of a longer duration. Sometimes the travel expenses paid or reimbursed by the employer must be treated as taxable compensation to the employee subject to Form W-2 reporting and payroll taxes.

The purpose of this article is to address some of the more common travel arrangements which can result in taxable income to employees for federal tax purposes. Although business travel can also raise state tax issues, those issues are beyond the scope of this article. This article is intended to be only a general overview as the tax consequences to an employee for a given travel arrangement depend on the facts and circumstances of that arrangement.

In the discussion below, it is assumed that all travel expenses are ordinary and necessary and incurred by an employee (or a partner in a partnership) while traveling away from home overnight for the employer’s business. In addition, it is assumed that the expenses are properly substantiated so that the employer knows (1) who incurred the expense; (2) where, when, why and for whom the expense was incurred, and (3) the dollar amount. Employers need to collect this information within a reasonable period of time after an expense is incurred, typically within 60 days.

Certain meal and lodging expenses can fall within a simplified substantiation process called the “per diem” rules (although even these expenses must still meet some of the substantiation requirements). The per diem rules are outside the scope of this article.

One of the key building blocks for the treatment of employee travel expenses is the location of the employee’s “tax home.” Under IRS and court holdings, an employee’s tax home is the employee’s regular place of work, not the employee’s personal residence or family home. Usually the tax home includes the entire city or area in which the regular workplace is located. Generally, only expenses paid or reimbursed by an employer for an employee’s travel away from an employee’s tax home are eligible for favorable tax treatment as business travel expenses.

Travel to a regular workplace

Usually expenses incurred for travel between the employee’s residence and the employee’s regular workplace (tax home) are personal commuting expenses, not business travel. If these expenses are paid or reimbursed by the employer, they are taxable compensation to the employee. This is the case even when an employee is traveling a long distance between the employee’s residence and workplace, such as when an employee takes a new job in a different city. According to the IRS, if it is the employee’s choice to live away from his or her regular workplace (tax home), then the travel expenses between the two locations which are paid or reimbursed by the employer are taxable income to the employee.

Example: Bob’s personal residence is in Chicago, but his regular workplace is in Atlanta. Bob’s employer reimburses him for an apartment in Atlanta plus his transportation expenses between the two cities. Since Atlanta is Bob’s tax home, these travel expenses are personal commuting expenses and the employer’s reimbursement of the expenses is taxable compensation to Bob.

Travel to two regular workplaces

Sometimes an employer requires an employee to consistently work in two business locations because of the needs of the employer’s business. Factors such as where the employee spends the most time, has the most business activity, and earns the highest income determine which is the primary location with the other being the secondary location. The employee’s residence may be in either the primary or the secondary location. In general, the IRS holds that transportation costs between the two locations can be paid or reimbursed by the employer tax-free. In addition, lodging and meals at the location which is away from the employee’s residence can generally be paid or reimbursed tax-free.

Example: Caroline lives in Location A and works at her company headquarters there. Her employer opens a new store in Location B and asks her to handle the day-to-day operations for two years while the store is getting up to speed. But Caroline is also needed at the headquarters so her employer asks her to spend two days a week at the headquarters in Location A and three days a week at the store in Location B. Because the work at each location is driven by a business need of Caroline’s employer, she is treated as having primary and secondary work locations and is not treated as commuting between the two locations. Caroline’s travel between the two locations and her meals and lodging at Location B can be reimbursed tax-free by her employer.

As a practical matter, the employer must carefully consider and be able to support the business need for the employee to routinely go back and forth between two business locations. In cases involving two business locations, the courts have looked at time spent, business conducted and income generated in each location. Merely having an employee “sign in” or “touch down” at a business location near his or her residence is unlikely to satisfy the requirements for having two regular workplaces. Instead, the IRS would likely consider the employee as having only one regular workplace with employer-paid travel between the employee’s residence and the regular workplace being taxable commuting expenses.

Travel when a residence is a regular workplace

In some cases an employer hires an employee to work generally, or only, from the employee’s home, as he or she is not physically needed at an employer location. If the employer requires the employee to work just from his or her residence on a regular basis, does not require or expect the employee to travel to another office on a regular basis, and does not provide office space for the employee elsewhere, then the residence can be the tax home since it is the regular workplace for the employee. When the employee does need to travel away from his or her residence (tax home), the temporary travel expenses can be paid or reimbursed by the employer on a tax-free basis.

Example: Jason is a computer programmer and works out of his home in Indianapolis for an employer in Seattle. He periodically travels to Seattle for meetings with his team. Since Jason has no assigned office space in Seattle and is expected by his employer to work from his home, Jason’s travel expenses to Seattle can be reimbursed by his employer on a tax-free basis.

Travel to a temporary workplace

Sometimes an employer temporarily assigns an employee to work in a location that is far from the employee’s regular workplace, with the expectation that the employee will return to his or her regular workplace at the end of the assignment. In this event, the key question is whether the employee’s tax home moves to the temporary workplace. If the tax home moves to the temporary workplace, the travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee because they are personal commuting expenses rather than business travel expenses. Whether or not the employee’s tax home moves to the temporary workplace depends on the duration of the assignment and the expecations of the parties.

- One year or less . If the assignment is expected to last (and actually does last) one year or less, the employee’s tax home generally does not move to the temporary workplace. Therefore, travel expenses between the employee’s residence and temporary workplace that are paid or reimbursed by the employer are typically tax-free to the employee as business travel.

Example: Janet lives and works in Denver but is assigned by her employer to work in San Francisco for 10 months. She returns to Denver after the 10-month assignment. Janet’s travel expenses associated with her assignment in San Francisco that are reimbursed by her employer are not taxable income to her as they are considered temporary business travel and not personal commuting expenses.

- More than one year or indefinite . If the assignment is expected to last more than one year or is for an indefinite period of time, the employee’s tax home generally moves to the temporary workplace. This is the case even if the assignment ends early and actually lasts one year or less. Consequently, travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee as personal commuting expenses.

Example: Chris lives and works in Dallas but is assigned by his employer to work in Oklahoma City for 15 months before returning to Dallas. Chris’s travel expenses associated with his assignment to Oklahoma City that are reimbursed by his employer are taxable income to him as personal commuting expenses.

- One year or less then extended to more than one year . Sometimes an assignment is intended to be for one year or less, but then is extended to more than one year. According to the IRS, the tax home moves from the regular workplace to the temporary workplace at the time of the extension. Therefore, travel expenses incurred between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are non-taxable business travel expenses until the time of the extension, but are taxable compensation as personal commuting expenses after the extension.

Example: Beth’s employer assigns her to a temporary workplace in January with a realistic expectation that she will return to her regular workplace in September. However, in August, it is clear that the project will take more time so Beth’s assignment is extended to the following March. Once Beth’s employer knows, or has a realistic expectation, that Beth’s work at the temporary location will be for more than one year, changes are needed to the tax treatment of Beth’s travel expenses. Only the travel expenses incurred prior to the extension in August can be reimbursed tax-free; travel expenses incurred and reimbursed after the extension are taxable compensation.

When an employee’s residence and regular workplace are in the same geographic location and the employee is away on a temporary assignment, the employee will often return to the residence for weekends, holidays, etc. Expenses associated with travel while enroute to and from the residence can be paid or reimbursed by an employer tax-free, but only up to the amount that the employee would have incurred if the employee had remained at the temporary workplace instead of traveling home.

Travel to a temporary workplace – Special situations

In order for an employer to treat its payment or reimbursement of travel expenses as tax-free rather than as taxable compensation, the employee’s ties to the regular workplace must be maintained. The employee must expect to return to the regular workplace after the assignment, and actually work in the regular workplace long enough or regularly enough that it remains the employee’s tax home. Special situations arise when an employee’s assignment includes recurring travel to a temporary workplace, continuous temporary workplaces, and breaks in assignments to temporary workplaces.

- Recurring travel to a temporary workplace . Although the IRS has not published formal guidance which can be relied on, it has addressed situations where an employee has a regular workplace and a temporary workplace to which the employee expects to travel over more than one year, but only on a sporadic and infrequent basis. Under the IRS guidance, if an employee’s travel to a temporary workplace is (1) sporadic and infrequent, and (2) does not exceed 35 business days for the year, the travel is temporary even though it occurs in more than one year. Consequently, the expenses can be paid or reimbursed by an employer on a tax-free basis as temporary business travel.

Example: Stephanie works in Location A but will travel on an as-needed basis to Location B over the next three years. If Stephanie’s travel to Location B is infrequent and sporadic and does not exceed 35 business days a year, her travel to Location B each year can be reimbursed by her employer on a tax-free basis as temporary business travel.

- Continuous temporary workplaces . Sometimes an employee does not have a regular workplace but instead has a series of temporary workplaces. If the employee’s residence cannot qualify as his or her tax home under a three-factor test developed by the IRS, the employee is considered to have no tax home and is “itinerant” for travel reimbursement purposes. In this case, travel expenses paid by the employer generally would be taxable income to the employee.

Example: Patrick originally worked in Location A, but his employer sends him to Location B for eleven months, then assigns Patrick to Location C for another eight months. Patrick will be sent to Location D after Location C with no expectation of returning to Location A. Patrick does not maintain a residence in Location A. Travel expenses paid to Patrick by his employer will likely be taxable income to him.

- Breaks between temporary workplaces . In an internal memorandum, the IRS addresses the outcome when an employee has a break in assignments to temporary workplaces. When applying the one-year rule, the IRS notes that a break of three weeks or less is not enough to prevent aggregation of the assignments, but a break of at least seven months would be. Some companies choose to not aggregate assignments when the breaks are shorter than seven months but are considerably longer than three weeks, given the lack of substantive guidance from the IRS on this issue.

Example: Don’s regular workplace is in Location A. Don’s employer sends him to Location B for ten months, back to Location A for eight months, and then to Location B again for four months. Although Don’s time in Location B totals 14 months, since the assignments there are separated by a break of at least seven months, they are not aggregated for purposes of applying the one-year rule. Consequently, the travel expenses associated with each separate assignment to Location B can be reimbursed by the employer on a tax-free basis as temporary business travel since each assignment lasted less than a year.

Conclusion

The tax rules regarding business travel are complex and the tax treatment can vary based on the facts of a situation. Employers must carefully analyze business travel arrangements to determine whether travel expenses that they pay or reimburse are taxable or nontaxable to employees.

RSM contributors

Subscribe to RSM tax newsletters

Tax news and insights that are important to you—delivered weekly to your inbox

THE POWER OF BEING UNDERSTOOD

ASSURANCE | TAX | CONSULTING

- Technologies

- RSM US client portals

- Cybersecurity

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

© 2024 RSM US LLP. All rights reserved.

- Terms of Use

- Do Not Sell or Share My Personal Information (California)

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

Are Reimbursements Taxable? Guidance on Employee Expense Reimbursement Plans

Sometimes, an employee might pay for a business expense out of their own pocket. When that happens, you can reimburse the employee.

An employee expense reimbursement does come with some complications. Are reimbursements taxable? Do you need to report the reimbursement? Find out below.

What are expense reimbursements?

Reimbursements are a way for you to pay employees back when they spend their own money on business expenses.

Let’s say an employee is driving the company vehicle between client meetings. They stop to refill the gas tank. The employee pays for the gas themselves and asks you for a reimbursement when they return to the business.

Expense reimbursements are common when employees travel for work . They might need to pay for meals, lodging, gas, and entertaining clients.

Are reimbursements taxable?

When you give money to an employee, you typically have to withhold and contribute taxes on the payment. So, are reimbursed expenses taxable? Well, it depends. The IRS expense reimbursement guidelines have two types of plans: accountable and nonaccountable. Whether or not you must withhold taxes depends on the plan used by your business.

You can learn more about expense reimbursements in Publication 15 .

Accountable plan

If your business uses an accountable plan, reimbursements are not taxable. You do not have to withhold or contribute income, FICA , or unemployment taxes.

To have an accountable plan, your employees must meet all three of the following rules:

- The employee must have incurred deductible expenses while performing services as your employee. The reimbursement must be a payment for the expense. The reimbursement must not be an amount that would have otherwise been paid to the employee as wages.

- The employee must substantiate the amount, time, place, and purpose for the expenses to you within a reasonable period of time.

- The employee must return any amount in excess of the substantiated expense. The employee should return the excess within a reasonable amount of time.

What are reasonable amounts of time for the accountable plan? According to the IRS, it is reasonable for you to reimburse employees within 30 days of when they incur the expense. It is reasonable for employees to account for their expenses within 60 days after they incur the expense. Employees should return excess amounts within 120 days of when the expense was incurred.

If your business uses an accountable plan but an employee fails to follow the plan, the expense reimbursement is taxable. For example, if an employee does not return excess amounts within a reasonable amount of time, the excess amounts are taxable.

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee’s wages on Form W-2 . Instead, report it in Form W-2 box 12 with code L.

- Unlimited payroll

- All pay frequencies

- Time and attendance integration

- Free, USA-based support

Nonaccountable plan

If your business uses a nonaccountable plan, you must pay tax on reimbursement of expenses. They are subject to all income, FICA, and unemployment taxes.

You have a nonaccountable plan if:

- The employee doesn’t have to substantiate expenses in a timely manner.

- The employee isn’t required to return excess amounts within a certain amount of time.

- You pay an amount regardless of whether you expect the employee to have a business expense.

- You pay an amount you would otherwise pay as wages.

Reimbursements under a nonaccountable plan are wages and are subject to taxes. You must report these wages and deposit taxes on them. Include the reimbursements and taxes on the employee’s Form W-2.

You might reimburse an employee with a per diem rate. Per diem pay is used to reimburse mileage, meals, lodging, and some other fixed allowances.

With per diem payments, the IRS says your employee accounted to you if the reimbursement does not exceed the established per diem rates.

You should include per diem payments in box 12 of Form W-2 using code L.

If your per diem payment exceeds the preset rates, the excess amount is considered wages. You must withhold and contribute taxes on the excess amount. Include the excess per diem amount and taxes on Form W-2.

Do you give taxable reimbursements to employees? Make recordkeeping and tax withholding easier with payroll software . When you sign up with Patriot Software, we’ll give you a free trial, free setup, and free support.

This article has been updated from its original publication date of November 22, 2017.

Stay up to date on the latest payroll tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

IRS increases mileage rate for remainder of 2022

More in news.

- Topics in the News

- News Releases for Frequently Asked Questions

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IR-2022-124, June 9, 2022

WASHINGTON — The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

For the final 6 months of 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the rate effective at the start of the year. The new rate for deductible medical or moving expenses (available for active-duty members of the military) will be 22 cents for the remainder of 2022, up 4 cents from the rate effective at the start of 2022. These new rates become effective July 1, 2022. The IRS provided legal guidance on the new rates in Announcement 2022-13 PDF , issued today.

In recognition of recent gasoline price increases, the IRS made this special adjustment for the final months of 2022. The IRS normally updates the mileage rates once a year in the fall for the next calendar year. For travel from January 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03 PDF .

"The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices," said IRS Commissioner Chuck Rettig. "We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.”

While fuel costs are a significant factor in the mileage figure, other items enter into the calculation of mileage rates, such as depreciation and insurance and other fixed and variable costs.

The optional business standard mileage rate is used to compute the deductible costs of operating an automobile for business use in lieu of tracking actual costs. This rate is also used as a benchmark by the federal government and many businesses to reimburse their employees for mileage.

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

The 14 cents per mile rate for charitable organizations remains unchanged as it is set by statute.

Midyear increases in the optional mileage rates are rare, the last time the IRS made such an increase was in 2011.

- Utility Menu

Get Reimbursed for Travel Expenses

Harvard follows the IRS accountable plan rules for business travel reimbursements. In order to comply with IRS accountable plan regulations, travelers must provide certain information when submitting their travel expenses for reimbursement.

Any expense that fails to meet IRS accountable plan rules must be treated as income to the reimbursee. Special rules apply to non-resident aliens and fellowship recipients; contact University Financial Services for more information.

- Read the University's official Travel policy that establishes how Harvard University will reimburse individuals for travel expenses incurred conducting. Please note, some units may have stricter local policies to address their particular needs; check with your local unit before traveling.

- Determine if your reimbursement should be processed through HCOM or Harvard's Web Reimbursement Application .

- Use these work instructions to create a Web Reimbursement request.

- Use these work instructions to process a request through HCOM .

Questions? Visit the Harvard Travel Services Website : or call (617) 495-8500, option 2.

If you need technical assistance on the Web Reimbursement application/system, please call HU Information Technology (HUIT) Support Services at (617) 495-7777.

- Accounts Payable

- Accounts Receivable

- Central Payroll

- Financial Accounting and Reporting

- Reimbursement and Card Services

- Student Financial Services

- NRA Tax Services

- University Tax Compliance

Corporate Card Employment Tax Issues GLACIER Peoplesoft PCard Travel Reimbursement University Tax Issues

What is mileage reimbursement?

Depending on how much you drive for business, mileage deduction or reimbursement can add up to significant savings Learn how self-employed people can deduct business-related miles driven from their taxable income.

Ready to start your business? Plans start at $0 + filing fees.

by Page Grossman

Page is a writer and strategist. In her spare time, she writes romantasy and fosters adorable, old cats. You can find...

Read more...

Updated on: April 16, 2024 · 17 min read

IRS mileage reimbursement policy

How to calculate your irs mileage deduction, requirements for irs mileage rate reimbursement, use reimbursement to your advantage, mileage reimbursement faqs.

For self-employed professionals, every mile traveled can represent both an expense and an opportunity. You can claim mileage reimbursement or a deduction from the Internal Revenue Service (IRS) for all business miles driven.

Whether you're a freelance consultant meeting clients across town, a real estate agent scouting properties, or a gig economy worker shuttling passengers, the miles you rack up on your vehicle are more than just a journey—they're potential deductions and reimbursements that can significantly impact your business’ bottom line.

Navigating the complexities of mileage reimbursement as a self-employed individual can be daunting. Unlike traditional employees who often have mileage reimbursement policies set by their employers, self-employed professionals must establish their own reimbursement policy and understand how to leverage IRS tax laws to maximize their deductions and reimbursements.

From understanding which miles are deductible, what forms you need to file, and how to leverage technology for seamless tracking, we'll equip you with the knowledge and tools necessary to navigate this crucial aspect of self-employment with confidence.

Mileage reimbursement, also known as mileage deduction, allows self-employed individuals to deduct the cost of business-related driving from their taxable income. Each mile you drive for business can be deducted from your taxes at the end of the year.

Typically, a reimbursement or deduction for mileage is calculated based on the number of miles driven for business purposes, using a predetermined rate per mile set by the IRS.

Mileage reimbursement serves as a means to fairly compensate individuals for the expenses incurred while using their personal vehicles for work-related activities, thereby helping to offset the financial burden of business-related travel. For self-employed people, these miles driven are considered one of many business expenses.

Eligible miles:

- Client visits : Driving to meet clients or potential customers

- Business errands : Picking up supplies, going to the post office, or any other errand for your business

- Travel to a temporary workspace : Driving between one workplace and another or from home to a temporary workplace

- Business events : Travel to conferences, workshops, or any other business-related events

Non-eligible miles:

Commute : Drive from home to your regular workplace and from your workplace back home

Personal : Any miles incurred for non-business activities are not deductible

Key takeaways

This guide dives deep into the requirements and technical details of receiving reimbursement for business miles. You can expect an understanding of:

- What mileage reimbursement is

- How self-employed people can deduct business-related miles driven from their taxable income

- How you can choose between the standard and actual mileage deduction

- Depending on how much you drive for business, mileage deduction or reimbursement can add up to significant savings

- The 2024 IRS mileage deduction is 67 cents per mile driven

Who is this guide for?

This guide focuses on mileage reimbursement policy for self-employed people.

Self-employed people who are eligible for mileage deduction are:

- Small business owners who report their income on Schedule C

- Freelancers

- Independent contractors

- Delivery and ride-share drivers (independent contractors)

- Real estate agents

- Truck drivers

In brief, we will cover mileage reimbursement for traditional employees, active duty military, and miles incurred for charitable organizations.

Who is mileage reimbursement for, and why is it important?

Mileage reimbursement is for anyone who uses a vehicle for business purposes. It can be for employed and self-employed people.

This guide primarily focuses on self-employed individuals and the requirements they must follow to receive mileage reimbursement or deduction from the IRS.

In addition to business mileage reimbursement payments, you can receive mileage reimbursement for some personal miles. Those include:

- Mileage related to medical appointments

- Miles driven while volunteering for a non-profit

The IRS mileage reimbursement policy is that self-employed people can deduct business-related miles driven from their taxable income. The IRS lays out two different methods for calculating how much you can deduct based on eligible miles driven.

Federal mileage reimbursement guidelines

The IRS offers two different ways to calculate the amount of deduction you’re eligible for. You can choose between the standard and actual mileage rate deductions.

How you use your car will determine which reimbursement method you’ll want to use. If you’re eligible for either method, you may want to calculate which will allow you to deduct more and choose that method.

The IRS updates the mileage rate each year . In 2024, the deduction rate for self-employed and business miles is 67 cents per mile driven.

This rate is intended to take into account depreciation or wear and tear on the vehicle, the cost of gas, and the expense of regular maintenance.

Who’s eligible for mileage reimbursement?

If you are self-employed and sometimes use your vehicle for business purposes, you’re eligible for federal mileage reimbursement.

There are a few stipulations on who is eligible:

- You must own or lease your vehicle

- You must be self-employed. This includes small business owners, delivery and ride-share drivers, independent contractors, sales representatives, real estate agents, and truck drivers

- Only business-related miles are eligible for mileage deduction. Personal travel and travel from home to work (your commute) are not eligible for deduction.

Those who are not eligible for business mileage reimbursement include:

- People who are not self-employed

- People who use more than four cars at the same time can’t use the standard deduction (If you have five employees, all of whom will be driving at 9 a.m. on Monday, then you’ll need to use the actual deduction method.)

An employer can offer mileage reimbursement to employees who drive as part of their job duties. If an employees uses their personal vehicles for business purposes, you can reimburse employees 67 cents per mile on the employee’s paycheck.

To pay employees, it’s as simple as asking employees to track their mileage and then provide mileage reimbursement.

Charity, medical, and armed forces

In addition to the above mileage reimbursements, some people are eligible for reimbursement for medical or moving purposes.

Members of the armed forces are eligible for reimbursement for expenses incurred while moving. This deduction is only for qualified active duty members.

The mileage reimbursement rate for medical and moving purposes is 22 cents per mile driven.

Mileage reimbursement requirements: What’s covered and what’s not

In short, most miles driven for business use are eligible for reimbursement or deduction under federal law. There are a few exceptions to this rule.

In addition to receiving a reimbursement for business mileage, you can also deduct other vehicle-related expenses. This applies to people who choose the actual reimbursement rate. If you choose the standard rate deduction, that has built in the assumed cost of maintenance, gas, and vehicle depreciation to the deduction rate.

For example, if you use your car for a mix of business and personal and your business use is approximately 40 percent of all use, you can deduct 40 percent of your other vehicle-related expenses. This includes gas, car loan interest, and maintenance. You should maintain receipts for all vehicle expenses in case of an IRS audit.

Eligible miles :

- Business errands : Picking up supplies, going to the post office, or any other errand for business purposes

- Travel to temporary workspace : Driving between one workplace and another or from home to a temporary workplace

Non-eligible miles :

Mileage deduction if you work from home

Many self-employed people choose to work from home. If you work from home, the deduction rules change slightly. Generally, mileage from your commute when driving from home to work is not deductible. This changes when your home is also your primary place of business.

If your home is the primary place where you work, you can deduct mileage when driving to and from home for business-related purposes. This is no longer considered a commute.

How much can you deduct from your taxes for mileage reimbursement?