Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

IRS Announces 2023 Standard Mileage Rates and Vehicle Value Limitations

EBIA

January 5, 2023 · 5 minute read

IRS Notice 2023-03 (Dec. 29, 2022); IRS News Release IR-2022-234 (Dec. 29, 2022)

News Release

The IRS has announced the optional 2023 standard mileage rates for business, medical, and other uses of an automobile, and the 2023 vehicle values that limit the application of certain rules for valuing an automobile’s use. For 2023, the business standard mileage rate is 65.5 cents per mile (a 3-cent increase from the 62.5-cent rate that applied during the second half of 2022—see our Checkpoint article ). The rate when an automobile is used to obtain medical care—which may be deductible under Code § 213 if it is primarily for, and essential to, the medical care—is 22 cents per mile for 2023. This is the same rate that was in effect during the second half of 2022 (see our Checkpoint article ). The same 22-cent rate will apply for deducting automobile expenses that are moving expenses under Code § 217. For taxable years beginning after 2018 and before 2026, however, the moving expense deduction is available only for certain moves by members of the Armed Forces on active duty (see our Checkpoint article ). The 2023 rate for charitable use of an automobile is 14 cents per mile (the same as in 2022).

Standard mileage rates can be used instead of calculating the actual expenses that are deductible. For example, the business standard mileage rate can be used instead of determining the amount of fixed expenses (e.g., depreciation, lease payments, and license and registration fees) and variable expenses (e.g., gas and oil) that are deductible as business expenses. Only variable expenses are deductible as medical or moving expenses, so the medical and moving rate is lower. Parking fees and tolls related to use of an automobile for medical or moving expense purposes may be deductible as separate items. Fixed costs (e.g., depreciation, lease payments, insurance, and license and registration fees) are not deductible for these purposes and are not reflected in the standard mileage rate for medical care and moving expenses. These and other details about using the standard mileage rate can be found in Revenue Procedure 2019-46 (see our Checkpoint article ).

The Notice also sets the maximum vehicle values that determine whether the cents-per-mile rule or the fleet-average valuation rule are available to value the personal use of an employer-provided vehicle. The cents-per-mile rule determines the value of personal use by multiplying the business standard mileage rate by the number of miles driven for personal purposes. The fleet-average rule allows employers operating a fleet of 20 or more qualifying automobiles to use an average annual lease value for every qualifying vehicle in the fleet when applying the automobile annual lease valuation rule. For vehicles (including vans and trucks) first made available to employees for personal use in calendar year 2023, the maximum vehicle value under both rules will increase to $60,800 (up from $56,100 in 2022) (see our Checkpoint article ). That amount will also be the maximum standard automobile cost for setting reimbursement allowances under a fixed and variable rate (FAVR) plan—an alternative to the business standard mileage rate that bases payments on data derived from the geographic area where an employee generally pays or incurs the costs of driving an automobile in performing services as an employee.

EBIA Comment: Transportation expenses that are deductible medical expenses under Code § 213 generally can be reimbursed on a tax-free basis by a health FSA, HRA, or HSA. (To simplify administration, some employers’ health FSAs or HRAs exclude medical transportation expenses from the list of reimbursable items.) The applicable reimbursement rate is the one in effect when the expense was incurred. For more information, see EBIA’s Cafeteria Plans manual at Sections XX.L.8.b (“Mileage Rate for Traveling to Obtain Medical Care”) and XX.M (“Table of Common Expenses, Showing Whether They Are for ‘Medical Care’”). See also EBIA’s Consumer-Driven Health Care manual at Sections XV.C (“What Is an HSA-Qualified Medical Expense?”) and XXIV.B (“HRAs May Reimburse Only Code § 213(d) Expenses”) and EBIA’s Fringe Benefits manual at Sections IV.F (“Employer Reimbursements for Business Use of an Employee’s Car”) and XVII.D.1.b (“Types of Expenses: Travel by Car”).

Contributing Editors: EBIA Staff.

- Cafeteria Plans

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

Webcast and events

Browse all our upcoming and on-demand webcasts and virtual events hosted by leading tax, audit, and accounting experts.

Related posts

When Do COVID-19-Related Extended HIPAA Special Enrollment Periods End?

ACA Preventive Health Services Mandate to Remain in Effect During Braidwood Appeal

CMS Issues Guidance on Elimination of MHPAEA Opt-Out Elections by Self-Insured Non-Federal Governmental Health Plans

More answers.

Capturing advisory opportunities: Where is your firm in its journey to advisory?

How to save money in your supply chain

E-invoicing basics for compliance professionals: Part 1

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Register for a NerdWallet account to access simple tax filing for a $50 flat fee, powered by

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

IRS Mileage Rates 2023-2024: What It Is, How It Works

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

IRS mileage rates for 2023

Irs issues mileage rates for 2024, irs standard mileage rate for business, calculating standard mileage vs. actual expenses for business, other irs mileage rate types, how to claim tax deductions using irs mileage rates, tracking your mileage.

Certain taxpayers can deduct mileage from vehicle use related to business, charity, medical or moving purposes

To take the deduction, taxpayers must meet use requirements and may have to itemize on their returns if claiming certain types of mileage.

For 2023, the IRS' standard mileage rates are $0.655 per mile for business, $0.22 per mile for medical or moving, and $0.14 per mile for charity.

If you drive for your business or plan to rack up some miles while volunteering this year, you might be eligible to deduct some of that mileage on your tax return.

To qualify for this deduction, the miles must have been driven for qualifying business, medical, moving or charity purposes, and you may have to itemize on your return to claim the tax break. Rates are valid for electric, PHEV, gas, and diesel-fueled cars.

For the 2023 tax years (taxes filed in 2024), the IRS standard mileage rates are:

65.5 cents per mile for business.

14 cents per mile for charity.

22 cents per mile for medical and moving purposes.

On Dec. 14, 2023, the agency announced the forthcoming tax year's optional mileage rates. Business rates will increase by 1.5 cents, charity miles will remain the same at 14 cents per mile, and medical and moving miles will decrease by 1 cent.

67 cents per mile for business.

21 cents per mile for medical/moving.

If you’re self-employed or work as a contractor, you might be able to deduct the cost of the use of your car for business purposes. Your tax deduction depends on how you use your vehicle. Commuting to work is generally not deductible mileage, but you may be able to deduct mileage for business-related trips, such as those made to clients, meetings or temporary workplaces [0] Internal Revenue Service . Publication 463: Travel, Gift, and Car Expenses . View all sources .

You can also choose whether to deduct standard mileage using the rates above versus actual expense (e.g., repairs, depreciation, gas, and so forth), but you can't deduct both. Expenses for tolls or parking fees related to business use, however, are separately deductible regardless of which method you use [0] Internal Revenue Service . Topic no. 510, Business Use of Car . Accessed Jan 17, 2024. View all sources .

There are two options for calculating the business deduction for the use of your vehicle.

1. Standard mileage deduction

This is the most straightforward way of calculating your driving expense: simply multiply the number of business miles by the IRS mileage rate. However, you’ll need to keep a record of your business-related mileage.

To use the standard IRS mileage deduction method, you must own or lease the car. But the rules for business mileage deductions can be complex, especially if you use lots of vehicles for business. The IRS website has more details [0] Internal Revenue Service . Topic No. 510, Business Use of Car . Accessed Jul 18, 2023. View all sources .

2. Actual expenses

If you don’t want to track your mileage, you could track and deduct the actual expenses you incur while using your vehicle for business purposes. These expenses may include:

Depreciation.

Lease payments.

Registration fees.

Gas and oil.

» MORE: See what other tax breaks you can take if you’re self-employed

IRS standard mileage rate for volunteering and charitable activities

If you used your car to help a charity or to go somewhere to volunteer, the mileage can be deductible. You can deduct parking fees and tolls as well.

If you don’t want to deduct your mileage, you can deduct your unreimbursed out-of-pocket expenses, such as gas and oil. However, the expenses have to relate directly to the use of your car in giving services to a charitable organization. Also, you can't deduct repair and maintenance costs, depreciation, registration fees, tires or insurance [0] Internal Revenue Service . About Publication 526, Charitable Contributions . View all sources .

» MORE: See what else counts as a charitable deduction

IRS standard mileage rate for moving

Only active-duty members of the military can deduct mileage related to moving. The move has to be related to a permanent change of station [0] Internal Revenue Service . Instructions for Form 3903 . View all sources .

IRS standard mileage rate for medical

If you used your car for medical reasons, you may be able to deduct the mileage. "Medical reasons" include:

Driving to the doctor, hospital or other medical facility.

Driving a child or other person who needs medical care to receive medical care.

Driving to see a mentally ill dependent if the visits are recommended as part of treatment.

You can deduct parking fees and tolls as well.

If you don’t want to deduct your mileage, you can deduct your unreimbursed out-of-pocket expenses, such as gas and oil. However, the expenses have to relate directly to the use of your car for medical purposes. Also, you can't deduct repair and maintenance costs, depreciation or insurance.

Mileage isn’t the only transportation cost you might be able to deduct as a medical expense. IRS Publication 502 has the details. Here’s a big caveat: In general, you can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income .

» MORE: See what else you might be able to deduct as a medical expense

If you're deducting mileage for moving, medical or charity purposes, you'll need to itemize on your tax return in order to claim the tax deduction. Itemizing means you’ll need to set aside extra time when preparing your returns to fill tax forms Form 1040 and Schedule A , as well as supporting schedules that feed into those forms.

If you're self-employed, you’ll claim your mileage deduction as a business expense on Schedule C . If you file your taxes online , the software will ask about your mileage during the interview process and calculate the deduction.

This is important because if you’re audited, you may need to substantiate your deduction by showing a log of the miles you drove.

There are lots of ways to keep track of your mileage. Something as simple as keeping a pen and paper in the glove compartment can suffice, but a quick trip to Google or your phone's app store will reveal a variety of tools that can streamline things.

On a similar note...

IR-2022-234: IRS issues standard mileage rates for 2023; business use increases 3 cents per mile

News essentials.

News Releases

IRS - The Basics

IRS Guidance

Media Contacts

Facts & Figures

Around The Nation

e-News Subscriptions

The Newsroom Topics

Multimedia Center

Noticias en Español

The Tax Gap

Fact Sheets

IRS Tax Tips

Armed Forces

Latest News Home

IRS Resources

Contact My Local Office

Filing Options

Forms & Instructions

Frequently Asked Questions

Taxpayer Advocate

Where to File

IRS Social Media

Issue Number: IR-2022-234

Inside this issue.

IRS issues standard mileage rates for 2023; business use increases 3 cents per mile

WASHINGTON — The Internal Revenue Service today issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on Jan. 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022.

- 22 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, consistent with the increased midyear rate set for the second half of 2022.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2022.

These rates apply to electric and hybrid-electric automobiles, as well as gasoline and diesel-powered vehicles.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. For more details see Moving Expenses for Members of the Armed Forces .

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Taxpayers can use the standard mileage rate but generally must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

Notice 2023-03 contains the optional 2023 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan. In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2023 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule.

Back to Top

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe .

This message was distributed automatically from the mailing list IRS Newswire. Please Do Not Reply To This Message.

2023 IRS Mileage Reimbursement Guide

Are you in search of guidance on mileage reimbursement and deductions within the United States? If so, this guide is for you! We have gathered everything you need to help you become an expert. From reimbursing your employees' business-related car expenses to deducting mileage as self-employed, our guide covers it all. Plus, we provide valuable insights on keeping accurate records and up-to-date IRS mileage rates.

Why does the IRS reimburse for mileage or car expenses?

The IRS mileage reimbursement is intended to provide taxpayers with a way to be reimbursed for business-related travel expenses. The IRS has established a set rate for miles driven for business purposes, which is designed to cover the cost of fuel and other related expenses. This reimbursement can be used to reduce a taxpayer's taxable income and make traveling for business purposes more affordable.

The two types of IRS mileage reimbursements are the standard mileage rate and the actual expense reimbursement.

- Standard Mileage Rate : The standard mileage rate is used to reimburse employees for taxes related to miles driven for business purposes. This rate is set by the IRS and calculated by multiplying the number of business miles driven by the published per-mile rate.

- Actual Expenses : The actual expense reimbursement is used to reimburse employees for any additional costs incurred when driving for business purposes. This includes expenses such as: fuel, vehicle maintenance, parking fees, tolls, and other related costs. Both reimbursement methods allow an employee to deduct business-related mileage from their taxable income.

How to Choose Between Using The Standard Mileage Rate or Actual Costs

Deciding whether to use the IRS Standard Mileage Rate or actual car expenses for a tax deduction can be a tricky business. Both approaches are acceptable, but ultimately taxpayers will have to choose one or the other and commit to it when filing their tax returns. The key is understanding what each approach involves.

If you opt for the standard mileage rate approach, then you must calculate your business miles traveled in a year and multiply that number by the current standard rate set by the IRS. On the other hand, those who choose actual car expenses must maintain documentation of all associated costs such as repairs, insurance, and maintenance.

There are different rules to follow depending on whether you own vs lease your vehicle, or if you are an employee vs a business owner, and much more.

Let's dig into the nuances.

If you own your vehicle

If you want to use the standard mileage rate for a car you own, you must choose to use it in the first year the car is available for use in your business. Then, in later years, you can choose to use either the standard mileage rate or actual expenses.

Can you change from the standard mileage rate to actual costs?

If you want to use the standard mileage rate for a car you own, you must choose to use it in the first year the car is available for use in your business. You can, however, choose to use either the standard mileage rate or actual expenses in later years, if you own the vehicle.

If you change to the actual expenses method in a later year, but before your car is fully depreciated, you have to estimate the remaining useful life of the car and use straight-line depreciation.

If You Lease your Vehicle

If you want to use the standard mileage rate for a car you lease, you must use it for the entire lease period. For leases that began on or before December 31, 1997, the standard mileage rate must be used for the entire portion of the lease period (including renewals) that is after 1997.

What changes if you are an employee vs being self-employed?

If you are an employee, you can’t:

- Deduct any interest paid on a car loan- this applies even if you use the car 100% for business as an employee.

- If your vehicle is provided by your employee to be used for business purposes, you can't use the standard mileage rate and can only deduct your actual unreimbursed car expenses.

Are there any other exceptions to using the standard mileage rate?

Can you imagine any tax codes that aren't riddled with exceptions or caveats? Neither can we.

According to the IRS, you can’t use the standard mileage rate if you:

Use five or more cars at the same time (such as in fleet operations)

In this case, you will need to deduct the actual expenses

Claimed a depreciation deduction for the car using any method other than straight-line depreciation

- This means that you depreciate the same amount year-over-year.

- Straight-line depreciation is calculated by taking the purchase price of the vehicle and subtracting the salvage value. That figure is then divided by the estimated useful life of the vehicle ( 5 years, according to the IRS )

Claimed a section 179 deduction on the car

Claimed the special depreciation allowance on the car

Claimed actual car expenses after 1997 for a car you leased.

What are the 2023 Federal Mileage Rates?

The 2023 Federal Mileage Rates are:

Why the federal mileage rate went up

The standard mileage rate for business use is based on an annual study of the fixed and variable costs related to operating a vehicle.

The IRS takes the following into consideration when setting mileage rates:

Fuel prices

Depreciation rates

Insurance rates

The cost to maintain a vehicle

What qualifies as miles driven for business purposes?

The IRS defines business mileage as mileage that is driven between two places of work, permanent or temporary.

Some common types of trips that are considered business-related include:

Traveling between two different places of work

Traveling to another location of your business.

Traveling to a temporary business location

Meeting clients and going on customer visits

Running business-related errands

Commuting to a second job only if you are going straight from your first job to work, regardless if the work location is permanent or temporary.

The following types of travel are excluded:

Driving to your main place of work - this is considered commuting and is not allowed

Commuting to a second job if you going straight from home to work.

What if you have no regular work location?

If you have no regular place of work but ordinarily work in the metropolitan area where you live, you can deduct daily transportation costs between home and a temporary work site outside of that metro-area.

Generally, a metro-area includes the area within the city limits and the suburbs that are considered part of that metropolitan area.

Example : Denver & Glendale, Colorado

You can’t deduct daily transportation costs between your home and temporary work sites within your metropolitan area as they are considered commuting expenses.

What qualifies as miles driven for medical purposes?

Visits to the doctor, as well as other healthcare or dentist appointments, are generally eligible for deductions according to the medical mileage rate. However, not all of your medical trips will be refundable - primarily those that aren't covered by an employer-sponsored health insurance plan. Despite being bound by one's adjusted gross income in terms of reimbursement limits, a medical deduction can still save you substantial amounts of money over time!

The sum of medical deductions you can claim is limited and depends on your adjusted taxable income and age. Medical expenses are eligible for deduction only if they exceed 7.5% of an individual's adjusted gross income (AGI). So, in the instance where someone earns $100,000 annually, their medical deductions would qualify when they surpass the threshold amount of $7,500. To learn more about this regulation and find out what qualifies as a medical expense head to the IRS' website here .

What qualifies as miles driven for Moving purposes?

For tax years 2018 through 2025, the deduction of certain moving expenses is no longer allowed for nonmilitary taxpayers. In order to deduct certain moving expenses, you must be an active member of the military and move due to a permanent change of duty station.

The IRS classifies a permanent change of duty station as:

A move from your home to your first post of active duty

A move from one permanent post of duty to another

A move from your last post of duty to your home or to a nearer point in the United States

The move must occur within 1 year of ending your active duty or within the period allowed under the Joint Travel Regulations .

Itching to learn more? The IRS covers all of the details regarding mileage reimbursements related to moving in Publication 521, which is available here.

What qualifies as miles driven for Charitable purposes?

Donating your time to philanthropic causes comes with its own rewards, but you could also receive a mileage tax deduction in return. This government incentive is meant to offset the costs associated with individual or group volunteering and makes doing good even better!

The IRS allows you to apply for a charity mileage deduction if your personal car is used while performing services for charitable organizations. However, keep in mind that the organization must not have already reimbursed you for such expenses. Additionally, if any other modes of transportation are utilized when providing these services away from home, be sure to abide by the following regulations:

Travel must be performed for an approved charitable organization

You can’t deduct mileage if a significant part of the trip involves recreation or vacation

More info about charitable contributions can be found here.

Check an organization's tax-exempt status here

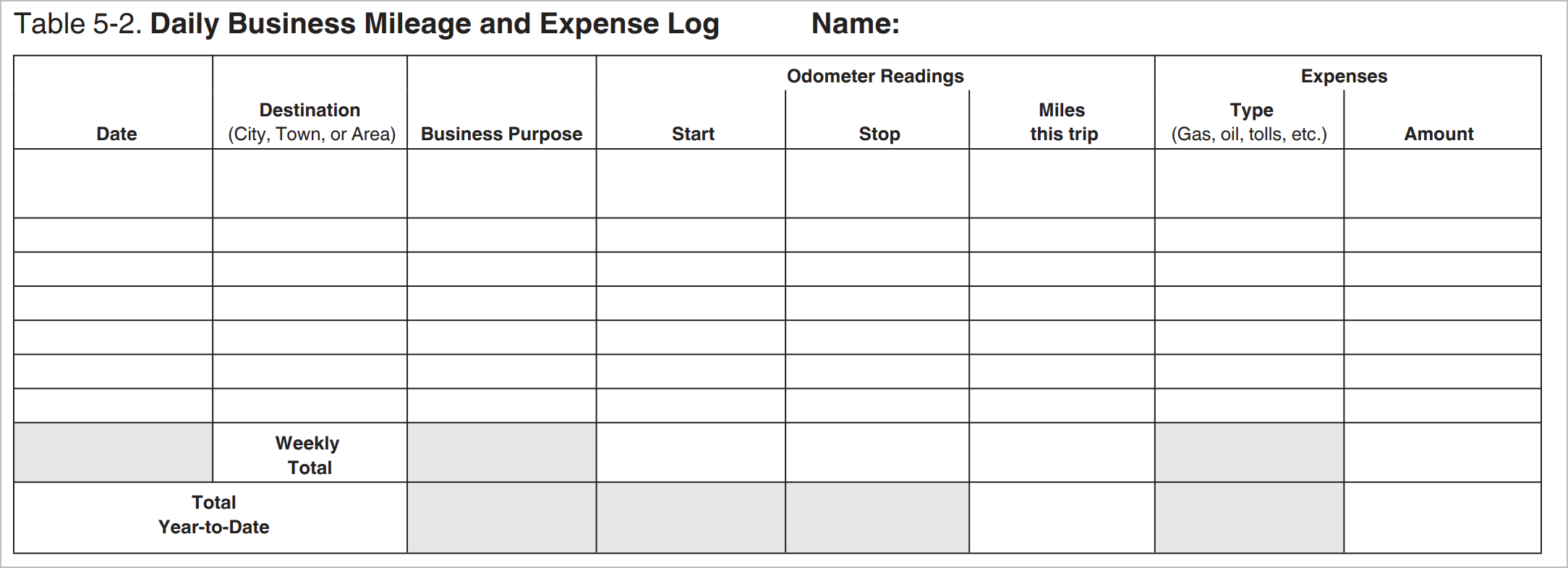

How should you keep track of your mileage or vehicle costs?

In order to successfully claim a mileage deduction, you must be able to provide proof that the miles were used for business purposes. This includes keeping meticulous records of your trips and any other related expenses, such as tolls or parking fees. The IRS also requires that you keep track of dates, destinations, mileage, and business purpose for each trip which they may review if your taxes are audited.

How to Split the costs for business and personal use

If you use your car for both business and personal purposes, you must divide your expenses between business and personal use. You can divide your expense based on the miles driven for each purpose.

For example, if you drive your car 50,000 miles in the year and 25,000 are driven for personal use, and 25,000 miles are driven for business use, you would claim 50% of the cost of operating your vehicle if you are using the actual costs method. If you had $5,000 in actual costs, you would only include $2,500 as a deduction on your tax return.

Which mileage-tracking app should you use?

Tracking your mileage can be a tedious manual process, but with the right software solution, it can be drastically simplified. Mileage-tracking apps offer a range of features designed to make logging and tracking miles easier.

When shopping for a mileage-tracking app, there are several things to consider.

- Look for an app that is compatible with your existing mobile device and operating system. Compatibility is key when it comes to ensuring that the app works seamlessly with your daily routine.

- It's important to find an app that is easy to use and has an intuitive user interface

- Be sure to look for an app that offers comprehensive analytics and reporting so you can get the most out of your data. Data portability is important, especially if you decide to switch apps midstream.

Here are a few tools that you might find handy when tracking your mileage:

And if you are old school and want to skip the apps, an old-fashioned handwritten mileage log works just fine. This is an example provided by the IRS:

Wrapping it Up

It is important to keep track of all miles driven and any other associated costs in order to successfully claim this deduction on your taxes. With the right mileage-tracking software or old-fashioned handwritten log, you can easily record and monitor your expenses so that you can maximize your tax deductions when filing. Whether it's through an app or manually keeping track, make sure that you have proof of how many miles were driven for business purposes versus personal use in order to take full advantage of this government incentive!

If you need some help tracking your actual vehicle costs and want to work with the best small business accounting team - look no further! We help our clients keep track of it all so that they are ready when it is time to file their taxes.

Ready to get started?

Why Hire a Fractional CLO? Strategic Benefits Revealed

In the pursuit of business excellence in a rapidly changing world, a new paradigm is reshaping the way organizations approach learning and...

The 1099 Survival Guide: Navigating Tax Season

Are you a business owner who dreads the thought of filing your taxes each year because it feels like understanding all the details and rules...

Simplify Sales Tax with Xero's Enhanced Avalara Integration

As a small business owner, managing sales tax can be a complex and time-consuming task. However, with the updated integration between Xero and...

December 2017 Tax Deadlines

As a small business owner, one of the most important things you’re responsible for is taking care of your taxes every month. If you don’t, Uncle...

April 2018 Tax Deadlines

Have you ever gotten a letter from the IRS in the mail demanding immediate payment? Not only do you owe your taxes, but now you've been slapped with...

An Accountants Guide to Closing the Books at Year End

Closing Out 2017 As 2017 comes to an end, accountants across the United States will work diligently to close out their clients' books, so that tax...

IRS Releases Standard Mileage Rates for 2023

By Emmanuel Elone

The Internal Revenue Service released the standard mileage rates for 2023 in a notice released Dec. 29.

The standard mileage rate in 2023 will be 65.5 cents per mile, up from 62.5 cents per mile, the IRS said in Notice 2023-03 .

The rate for medical or moving purposes in 2023 will remain 22 cents per mile, the IRS said. In June, IRS raised the rate to 22 cents from 18 cents. Under the Tax Cuts and Jobs Act ( Pub. L. 115-97 ), employer-paid moving expenses are taxable wages for most employees from Jan. 1, 2018, to Dec. 31, ...

Learn more about Bloomberg Tax or Log In to keep reading:

Learn about bloomberg tax.

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

IRS Boosts Standard Mileage Rate for 2023

The IRS is once again raising the standard mileage rate.

The agency on Dec. 29 announced that the 2023 business standard mileage rate is increasing to 65.5 cents, up 3 cents from the 2022 midyear adjustment of 62.5 cents. The agency made the rare midyear mileage rate adjustment in June —in addition to a regular annual adjustment announced last December that put the rate at 58.5 cents per mile for the first six months of 2022—as a way to combat the soaring inflation and high gas prices that have been taking a toll on employees.

The 2023 mileage rate took effect Jan. 1. In addition to the 65.5 cents per mile driven for business use, the IRS also announced the standard mileage rate for 2023 will be:

- 22 cents per mile driven for medical or moving purposes for qualified active-duty members of the armed forces, consistent with the increased midyear rate set for the second half of 2022.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2022.

These rates apply to electric and hybrid-electric automobiles, as well as gasoline- and diesel-powered vehicles, the IRS announced.

Driving costs increased overall in 2022 due to factors including high gas prices, surging vehicle acquisition costs due to ongoing supply chain constraints, and considerable increases in vehicle ownership and maintenance expenses, according to Motus, a Boston-based mobile workforce management software firm.

"We're currently facing extraordinary economic volatility, which has contributed to wide fluctuations across vehicle costs," said Todd Gebski, Motus' chief strategy and marketing officer. Motus noted that gas prices rose 49 percent for regular gasoline and 55 percent for diesel fuel over the first six months of 2022. Although gas prices dropped recently, with 26 states reporting gas prices below $3 a gallon, according to fuel savings platform GasBuddy , prices are expected to go back up next year. GasBuddy predicted average gas prices in June 2023, for example, will rise to between $3.79 and $4.19. The average cost per gallon could reach as high as $4.25 in August.

The standard mileage rate is used to compute the costs that are deductible by businesses and self-employed individuals for operating an automobile for business use, as an alternative to tracking actual costs. Employers often use the standard mileage rate to pay tax-free reimbursements to employees who use their own vehicles for business.

[SHRM members-only HR Q&A: Do we have to reimburse personal auto mileage for business-related trips? ]

Some experts say the IRS rate is optimal for low-mileage drivers who travel fewer than 5,000 business miles per year; however, it does not account for differences in vehicle ownership and operating costs, which can fluctuate throughout the year and are geographically specific.

Alternatively, employers can leverage maximum vehicle expenses when using a Fixed and Variable Rate (FAVR) allowance plan . Under FAVR, employees who drive their own vehicles can receive tax-free reimbursements from their employers for fixed vehicle costs (such as insurance, taxes and registration fees) and variable vehicle expenses (such as fuel, tires, and routine maintenance and repairs), instead of the standard mileage rate.

Under a FAVR plan, the cost of the vehicle may not exceed a maximum amount set by the IRS each year. For 2023, the standard automobile cost may not exceed $60,800 for automobiles, trucks and vans. That's up from a $56,100 threshold in 2022, the IRS reported in Notice 2023-03 .

Related Content

Rising Demand for Workforce AI Skills Leads to Calls for Upskilling

As artificial intelligence technology continues to develop, the demand for workers with the ability to work alongside and manage AI systems will increase. This means that workers who are not able to adapt and learn these new skills will be left behind in the job market.

Employers Want New Grads with AI Experience, Knowledge

A vast majority of U.S. professionals say students entering the workforce should have experience using AI and be prepared to use it in the workplace, and they expect higher education to play a critical role in that preparation.

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

New, trends and analysis, as well as breaking news alerts, to help HR professionals do their jobs better each business day.

Success title

Success caption

Profile Management

Global Locations

RECENT SEARCHES

RECOMMENDED

- SURVEY REPORT Energy Survey

- INSIGHTS Industry Intersections

IRS releases 2023 standard mileage rates

The IRS recently released guidance ( Notice 2023-3 ) providing the 2023 standard mileage rates for taxpayer use in deducting costs of operating automobiles for business, charitable, medical or moving expense purposes.

Notable rates are listed below:

- The 2023 standard mileage rate will be 65.5 cents per mile, up from 62.5 cents per mile last year.

- The 2023 medical or moving rate will remain at 22 cents per mile. In June 2022, the IRS raised the rate to 22 cents from 18 cents.

- The charitable rate will remain at 14 cents.

- The maximum standard automobile cost for computing the allowance under a fixed and variable rate plan will be $60,800 in 2023 (up from $56,100 in 2022).

Jeff Martin

Partner, Washington National Tax Office

Share with your network

Tax professional standards statement

This content supports Grant Thornton LLP’s marketing of professional services and is not written tax advice directed at the particular facts and circumstances of any person. If you are interested in the topics presented herein, we encourage you to contact us or an independent tax professional to discuss their potential application to your particular situation. Nothing herein shall be construed as imposing a limitation on any person from disclosing the tax treatment or tax structure of any matter addressed herein. To the extent this content may be considered to contain written tax advice, any written advice contained in, forwarded with or attached to this content is not intended by Grant Thornton LLP to be used, and cannot be used, by any person for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code. The information contained herein is general in nature and is based on authorities that are subject to change. It is not, and should not be construed as, accounting, legal or tax advice provided by Grant Thornton LLP to the reader. This material may not be applicable to, or suitable for, the reader’s specific circumstances or needs and may require consideration of tax and nontax factors not described herein. Contact Grant Thornton LLP or other tax professionals prior to taking any action based upon this information. Changes in tax laws or other factors could affect, on a prospective or retroactive basis, the information contained herein; Grant Thornton LLP assumes no obligation to inform the reader of any such changes. All references to “Section,” “Sec.,” or “§” refer to the Internal Revenue Code of 1986, as amended.

More tax hot topics

No Results Found. Please search again using different keywords and/or filters.

Hello. It looks like you’re using an ad blocker that may prevent our website from working properly. To receive the best experience possible, please make sure any blockers are switched off and refresh the page.

If you have any questions or need help you can email us

IRS Updates 2023-2024 Per Diem Rates for Business Travelers

Taxpayers can use the special per diem rates to substantiate the amount of expenses for lodging, meals, and incidental expenses.

Jason Bramwell

Sep. 26, 2023

The IRS has released the special per diem rates for 2023-24 that take effect on Oct. 1, which taxpayers can use to substantiate the amount of expenses for lodging, meals, and incidental expenses when traveling away from home.

Notice 2023-68 , which the IRS published on Monday, provides the special transportation industry rate, the rate for the incidental expenses-only deduction, and the rates and list of high-cost localities for purposes of the high-low substantiation method for the period of Oct. 1, 2023, to Sept. 30, 2024.

The use of a per diem substantiation method is not mandatory. Taxpayers can substantiate the actual allowable expenses if they maintain adequate records or other sufficient evidence for proper substantiation, according to the IRS.

The special meal and incidental expenses rates for taxpayers in the transportation industry are $69 for any location in the continental United States and $74 for any locality outside the continental U.S. The rate for any travel locale inside or outside the continental U.S. for the incidental expenses-only deduction is $5 per day.

For purposes of the high-low substantiation method, the per diem rates are $309 for travel to any high-cost locality and $214 for travel to any other locality within the continental U.S. The amount of the $309 high rate and $214 low rate that is treated as paid for meals is $74 for travel to any high-cost locale and $64 for travel to any other locality within the continental U.S.

Under the meal and incidental expenses-only substantiation method, per diem rates are $74 for travel to any high-cost locality and $64 for travel to any other locality within the continental U.S.

Notice 2023-68 also provides a list of high-cost localities that have a federal per diem rate of $261 or more.

Revenue Procedure 2019-48 provides the rules for using per diem rates, rather than actual expenses, to substantiate the amount of expenses for lodging, meals, and incidental expenses for travel away from home. Taxpayers who use per diem rates to substantiate the amount of travel expenses under Rev. Proc. 2019-48 may use the federal per diem rates published annually by the General Services Administration. Rev. Proc. 2019-48 allows certain taxpayers to use a special transportation industry rate or to use rates under a high-low substantiation method for certain high-cost localities. The IRS announces these rates and the rate for the incidental expenses-only deduction in an annual notice.

- Small Business

ABOUT CPA PRACTICE ADVISOR

- Cookie Policy

- Terms & Conditions

Magazines & Newsletters

- Magazine Archive

- Newsletters

Join for free!

CPA Practice Advisor is your technology and practice management resource for the accounting profession, giving you personalized access to the latest news, accounting-related events, and expert commentary across all of our channels, including website, whitepapers, newsletters, podcasts, social media, and our annual conference – Ensuring Success.

Join for free

CPA Practice Advisor is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors.

© 2024 Firmworks, LLC. All rights reserved

Individual and C corp tax returns:

Customer login

Tax Pro login

Personal taxes

2023 Internal Revenue Service (IRS) Standard Mileage Rates: Understanding the Changes and Benefits for the Mileage Rate

10 minute read

Copy Article URL

Antonio Del Cueto, CPA

September 8, 2023

IRS Standard Mileage Rates for 2023: 10 Ways to Help With Understanding the Changes and Benefits for the IRS Mileage Rate 2023

Kickstart your financial planning for 2023 by understanding the updated standard mileage rates issued by the Internal Revenue Service (IRS). In this article, we delve into the new 2023 mileage rates, compare them with those from the previous year, and discuss how to effectively utilize them for tax deductions related to business, medical, or moving purposes. This comprehensive guide aims to provide you with all the essential information, ensuring a smooth sail through your tax planning.

1. What's the New Mileage Rate for 2023?

Unveiling the irs mileage rate for 2023.

The Internal Revenue Service (IRS) has announced the standard mileage rates for 2023. The rates are as follows:

These rates are crucial as they aid in calculating the deductible costs of operating an automobile for different purposes as per the IRS guidelines .

How Does it Compare to 2022?

Compared to 2022, the standard mileage rate for business use has increased 3 cents, from 62.5 cents per mile to 65.5 cents per mile. This increment reflects the evolving economic factors impacting vehicle operational costs.

2. How Does the IRS Determine the Standard Mileage Rate?

Factors influencing the rate.

The IRS evaluates several elements to establish the standard mileage rates, which include:

- The cost of gasoline and oil

- Vehicle maintenance and repair expenses

- Vehicle depreciation

- Insurance costs

Comparison with actual expenses method

Taxpayers have two options for calculating the deductible costs of using a vehicle for business, medical, or moving purposes: the standard mileage rate or the actual expenses method. The actual expenses method entails keeping track of all costs incurred while operating the vehicle, such as fuel, maintenance, insurance, and depreciation. On the other hand, the standard mileage rate simplifies this process by providing a fixed rate per mile for various uses.

3. Who Can Benefit from the IRS Mileage Rate 2023?

Scenarios for business use.

Business owners, self-employed individuals, and employees can utilize the IRS mileage rate to calculate the deductible costs of operating a vehicle for business purposes. This method provides a straightforward way to account for vehicle expenses on their tax returns.

For medical or moving purposes

Similarly, individuals can use the standard mileage rate for calculating the deductible costs of using a vehicle for medical or moving purposes. Taxpayers need to maintain accurate records to substantiate their mileage claims.

4. Mileage Deduction: How Does It Work?

Calculating the deductible.

The deductible amount is computed by multiplying the standard mileage rate by the miles driven for business, medical, or moving purposes. For instance, if you drive 1,000 miles for business in 2023, your mileage deduction would be $655 (1,000 miles x 65.5 cents per mile).

Documentation required

Proper documentation is crucial for claiming mileage deductions. Taxpayers should maintain a log or use a mileage tracking app to record the date, purpose, and miles driven for each trip.

5. Mileage Rate for Business: A Closer Look

Rate per mile for business use.

The 65.5 cents per mile for business use is designed to cover the costs associated with operating a vehicle for business purposes. This rate reflects the average costs incurred by taxpayers and is updated annually to account for changing economic conditions.

Impact on self-employed individuals

Self-employed individuals can significantly benefit from using the standard mileage rate for calculating their vehicle expenses. This method simplifies tracking and documenting vehicle costs, making it easier to claim the mileage deduction on their tax returns.

The information on the IRS's method for determining the standard mileage rate, comparison with the actual expenses method, and documentation for mileage deductions is synthesized from general knowledge and IRS guidelines.

6. Mileage Rate for Medical and Moving: What's Changed?

Rate per mile for medical or moving purposes.

For 2023, the IRS set the mileage rate at 22 cents per mile for medical and moving purposes. This rate reflects the costs associated with operating an automobile for these specific purposes as determined by the IRS based on various economic factors.

Exceptions and special cases

It's crucial to note that the standard mileage rate for moving purposes only applies to active-duty members of the Armed Forces who are moving under a military order related to a permanent change of station.

7. Mileage Rate for Charitable Contributions: An Overview

Standard rate for charitable causes.

The standard mileage rate for charitable contributions remains at 14 cents per mile for 2023. This rate calculates the deductible costs of operating a vehicle for charitable purposes or while volunteering for a charitable organization.

How to claim the deduction

Taxpayers need to itemize their deductions on Schedule A of Form 1040 to claim a deduction for miles driven for charitable purposes. Accurate mileage records, including dates, purposes, and organizations benefited, are essential to substantiate the claim.

8. Gas Prices vs Mileage Rate: A Correlation?

Impact of gas prices on mileage rate.

Gas price fluctuations directly correlate with the standard mileage rate as they affect the overall cost of operating a vehicle. When gas prices rise, the IRS will likely adjust the mileage rate upward to reflect the increased costs.

Historical trends

Historically, there have been adjustments in the mileage rate in response to significant changes in gas prices. By tracking these historical trends, one can understand the reactive nature of the mileage rate to the broader economic factors, including fuel costs.

9. How to Report Mileage on Your Tax Return?

Using form 1040.

Mileage deductions are typically reported on Schedule A of Form 1040 if itemizing deductions or on Schedule C if self-employed. It's essential to have detailed records to substantiate the mileage claims.

Other IRS forms and documentation

Apart from Form 1040, other forms, such as Form 2106 (Employee Business Expenses) might be relevant, depending on individual circumstances. Maintaining a detailed log or using a mileage tracking app can provide the necessary documentation for claiming mileage deductions.

10. Preparing for the Future: Mileage Rate Projections

Predicting mileage rates.

While it's challenging to predict future mileage rates precisely, understanding the factors that influence these rates and monitoring economic trends can provide a rough estimate.

Preparing for changes

Awareness of the historical trends and the current economic environment can help individuals and businesses prepare for potential changes in mileage rates. Keeping abreast of IRS announcements and consulting with tax professionals can also provide insights into how to better plan for mileage deductions in the future.

The information regarding the mileage rate for medical, moving, and charitable purposes, as well as the impact of gas prices on mileage rates, reporting mileage on tax returns, and preparing for future mileage rate projections, is synthesized based on general knowledge and IRS guidelines.

In Conclusion: Navigating Mileage in 2023

- The IRS Mileage Rate for 2023 is set at 65.5 cents per mile driven for business purposes, a notable increase from previous years, reflecting changes in operating costs.

- The IRS provides Optional Standard Mileage Rates to calculate deductible costs associated with vehicle use for business, medical, or moving purposes.

- For medical and moving expenses , the rate is 22 cents per mile, catering specifically to medical reasons or a permanent change of station for armed forces members.

- Business Mileage can be deducted at the rate of 65.5 cents per mile. This includes all miles driven for business purposes, excluding commuting.

- Medical Mileage deduction is set at 22 cents per mile, applicable for miles driven for medical purposes or as part of a moving expense related to a job change.

- The 2023 IRS Standard Mileage Rates are essential for individuals and businesses to calculate travel expenses, including gas, maintenance, and other vehicle operational costs.

- Travel Expenses deductible under the IRS standard mileage rates include gas and oil, maintenance expenses, insurance, registration fees, and depreciation.

- Taxpayers cannot deduct mileage related to personal use but can deduct mileage for business-related travel, medical expenses, and moving expenses under specific conditions.

- The Fixed and Variable Rate (FAVR) method is an alternative to the standard mileage rate, allowing for the deduction of actual expenses, including fixed costs like depreciation and variable expenses like gas and maintenance.

- Form 1040 must be used for claiming these deductions, and the details of the miles driven for business, medical, or moving purposes should be accurately recorded.

- The Tax Cuts and Jobs Act has impacted the deductibility of certain mileage expenses, particularly about unreimbursed employee travel expenses.

- For reimbursing employees for business mileage, employers often use the IRS standard mileage rate to determine the reimbursement amount.

- The 2023 rate reflects adjustments in response to economic changes, such as rising gas prices and overall vehicle operating costs.

- The 2023 mileage rate of 65.5 cents per mile for business use, and 22 cents per mile for medical or moving purposes, is issued as part of the 2023 optional standard mileage rates .

- Cents per mile for business use have been carefully calculated to encompass all costs of operating an automobile for business, including gas and oil, and maintenance expenses.

- The IRS encourages taxpayers to use the IRS mileage rate to simplify calculating deductible mileage.

- Deductible mileage includes each mile driven for business, medical, or moving purposes, but does not include personal travel.

- For those operating a vehicle for business purposes , the new 2023 rate reflects the increased costs associated with vehicle operation, including higher gas prices.

- The IRS has increased the standard mileage rates in response to significant changes in the costs associated with operating an automobile for business .

- Fixed and variable costs like gas, insurance, and depreciation are considered when setting new rates.

- Mileage rates used to calculate the deductible costs are based on an annual study of an automobile's fixed and variable costs.

- Parking fees and tolls incurred while using a vehicle for business can be added to the standard mileage rate deduction.

- Individuals using their vehicle for business can deduct mileage at the standard rate or calculate actual expenses if more beneficial.

- Members of the armed forces moving due to a permanent change of station are entitled to use the 22 cents per mile rate for moving expenses.

- Mileage deduction cannot be claimed for travel expenses that have been reimbursed or are reimbursable.

- The standard automobile cost used by the IRS for these calculations reflects the average costs associated with vehicle use.

- Miles driven for medical reasons are also deductible at the 22 cents per mile.

- While volunteering this year, Miles are deductible, providing a financial incentive for charitable work, although the rate for such deduction is different.

- The mileage deduction applies only to properly documented miles that meet the IRS criteria for business, medical, or moving use.

With a clear understanding of the standard mileage rates and how they apply to different scenarios, you can effectively plan for your tax-related vehicle expenses and potentially save money. Staying updated on IRS announcements and maintaining accurate mileage logs will position you well for tax efficiency and financial success in 2023 and beyond.

How can Taxfyle help?

Finding an accountant to file your taxes is a big decision . Luckily, you don't have to handle the search on your own.

At Taxfyle , we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you.

Get started with Taxfyle today , and see how filing taxes can be simplified.

Legal Disclaimer

Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

Was this post helpful?

Did you know business owners can spend over 100 hours filing taxes, it’s time to focus on what matters..

With Taxfyle, the work is done for you. You can connect with a licensed CPA or EA who can file your business tax returns. Get $30 off off today.

Want to put your taxes in an expert’s hands?

Taxes are best done by an expert. Here’s a $30 coupon to access to a licensed CPA or EA who can do all the work for you.

Is this article answering your questions?

Thanks for letting us know.

Whatever your questions are, Taxfyle’s got you covered. If you have any further questions, why not talk to a Pro? Get $30 off today.

Our apologies.

Taxes are incredibly complex, so we may not have been able to answer your question in the article. Fortunately, the Pros do have answers. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

Do you do your own bookkeeping?

There’s an easier way to do bookkeeping..

Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. Get $30 off today.

Why not upgrade to a licensed, vetted Professional?

When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle. Get $30 off today.

Are you filing your own taxes?

Do you know if you’re missing out on ways to reduce your tax liability.

Knowing the right forms and documents to claim each credit and deduction is daunting. Luckily, you can get $30 off your tax job.

Get $30 off your tax filing job today and access an affordable, licensed Tax Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle.

How is your work-life balance?

Why not spend some of that free time with taxfyle.

When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility.

Why not try something new?

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs.

Is your firm falling behind during the busy season?

Need an extra hand.

With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients.

Perhaps it’s time to scale up.

We love to hear from firms that have made the busy season work for them–why not use this opportunity to scale up your business and take on more returns using Taxfyle’s network?

by this author

Share this article

Subscribe to taxfyle.

Sign up to hear Taxfye's latest tips.

By clicking subscribe, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

Get our FREE Tax Guide for Individuals

Looking for something else? Check out our other guides here .

By clicking download, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

File simpler.

File smarter., file with taxfyle..

2899 Grand Avenue, Coconut Grove, FL 33133

Copyright © 2024 Tickmark, Inc.

Original text

Mileage rates for travel are now set for 2023. The standard business mileage rate increases by 3 cents to 65.5 cents per mile. The medical and moving mileage rates stay at 22 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile.

2023 New Mileage Rates

Here are the 2022 mileage rates for your tax reference.

July 2022 through December 2022

January 2022 through June 2022

Remember to properly document your mileage to receive full credit for your miles driven.

Mark Devine ( devineaccounting.com ) is a mentor for SCORE RI. SCORE volunteers are available to assist you with your small business or entrepreneurial startup needs. Feel free to reach out to your local SCORE chapter at https://ri.score.org or call 401-226-0077.

For more than 50 years, SCORE has helped more than 11 million aspiring entrepreneurs and small business owners through mentoring and business workshops. More than 10,000 volunteers in more than 300 chapters serve their communities.

Like what you are reading? Subscribe to Rhode Island SCORE's twice monthly blog posts click here to Subscribe >>

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

FY 2024 per diem highlights

We establish the per diem rates for the continental United States (CONUS), which includes the 48 contiguous states and the District of Columbia. Federal agencies use the per diem rates to reimburse their employees for subsistence expenses incurred while on official travel.

Federal per diem rates consist of a maximum lodging allowance component and a meals and incidental expenses (M&IE) component. Most of CONUS (approximately 2,600 counties) is covered by the standard rate of $166 ($107 lodging, $59 M&IE). In fiscal year (FY) 2024, there are 302 non-standard areas (NSAs) that have per diem rates higher than the standard rate.

Since FY 2005, we have based the maximum lodging allowances on average daily rate (ADR) data. ADR is a widely accepted lodging industry measure derived from a property's room rental revenue divided by the number of rooms rented. This calculation provides us with the average rate in an area. For more information about how lodging per diem rates are determined, visit Factors Influencing Lodging Rates .

We remind agencies that the Federal Travel Regulation (FTR) allows for actual expense reimbursement when per diem rates are insufficient to meet necessary expenses. Please see FTR § § 301-11.300 through 11.306 for more information.

FY 2024 results

The standard CONUS lodging rate will increase from $98 to $107. All current NSAs will have lodging rates at or above FY 2023 rates. The M&IE per diem tiers for FY 2024 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59.

There are two new NSA locations this year:

- Huntsville, AL (Madison County)

- Charles Town, WV (Jefferson County)

The following locations that were NSAs (or part of an established NSA) in FY 2023 will move into the standard CONUS rate category:

- Hammond / Munster / Merrillville, IN (Lake County)

- Wichita, KS (Sedgwick County)

- Baton Rouge, LA (East Baton Rouge Parish)

- Baltimore County, MD

- Frederick, MD (Frederick County)

- East Lansing / Lansing, MI (Ingham and Eaton Counties)

- Kalamazoo / Battle Creek, MI (Kalamazoo and Calhoun Counties)

- Eagan/ Burnsville / Mendota Heights, MN (Dakota County)

- Akron, OH (Summit County)

- Wooster, OH (Wayne County)

- Erie, PA (Erie County)

- Corpus Christi, TX (Nueces County)

- Round Rock, TX (Williamson County)

- Appleton, WI (Outagamie County)

- Brookfield / Racine, WI (Waukesha and Racine Counties)

- Morgantown, WV (Monongalia County)

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

Mileage Reimbursement Rate 2024

Mileage Reimbursement Rate 2024 . A guide to travel and mileage reimbursement in india. Irs issues standard mileage rates for 2024;.

Effective from january 1, 2024, the irs has set the following standard mileage rates: Does mileage reimbursement include gas?

December 14, 2023 | Kathryn Mayer.

Irs mileage rate change in 2024:

The Irs Is Raising The Standard Mileage Rate By 1.5 Cents.

The irs sets a standard mileage rate each year to simplify mileage reimbursement.

Charitable Rate $ Per Mile.

Images references :, the 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year..

67 cents per mile for business purposes.

Effective From January 1, 2024, The Irs Has Set The Following Standard Mileage Rates:

You may have a few important questions., recent posts.

- Michaels Coupons In-Store 2024

- Nissan Kick 2024

- Jazmine Sullivan Concert 2024

- Holland Fireworks 2024

- Chinese Calendar Baby Gender 2024

- Who Won Turkish Elections 2024

- Pride Memes 2024

- Tabela Brasileirao 2024

- 2024 Corvettes

- Bruce Springsteen Tour 2024 Tickets

- Uscis Poverty Guidelines 2024

- Panthers Qb 2024

- Kevin Gates Concerts 2024

- Best River Cruises In Europe 2024

- Rihanna Net Worth 2024

Irs Expense Reimbursement Guidelines 2024

Irs Expense Reimbursement Guidelines 2024 . Whether or not you must withhold taxes depends on. Find current rates in the continental united states, or conus rates, by.

On december 14, 2023, the internal revenue service (irs) announced the 2024 standard mileage rate. As of 2024, the guidelines are as follows:

We Have Discontinued Publication 535, Business Expenses;

Normally, assistance provided above that level.

You Need Clear Rules And Guidelines To Implement Employee Expense Policies Effectively, Eliminate Grey Areas, And Avoid Fraud And Overspending.

Irs rules on travel expenses.

Best Strategies For Expense Reimbursement.

Images references :, the last revision was for 2022..

You need clear rules and guidelines to implement employee expense policies effectively, eliminate grey areas, and avoid fraud and overspending.

A Necessary Expense Is One That Is Helpful And Appropriate For.

Find current rates in the continental united states, or conus rates, by.

Irs Provides 2024 Hsa, Hra Inflation Adjustments.

Dolly Gabrila

Ca Mileage Reimbursement 2024

Ca Mileage Reimbursement 2024 . On december 14, 2023 the agency announced the following rates for 2024 business travel: Reminder regarding california expense reimbursement & irs increase of its mileage rate.

The maximum standard vehicle cost is the maximum standard automobile cost for 2024 is $62,000. See our full article and.

Daily Lodging Rates (Excluding Taxes) | October.

67 cents per mile driven for business use, up 1.5 cents from 2023.

This Is Up From $60,800 In 2023.

The maximum standard vehicle cost is the maximum standard automobile cost for 2024 is $62,000.

If You Need A Medical Mileage Expense Form For A Year Not Listed Here, Please Contact The Information And Assistance Unit At Your.

Images references :, the california state university mileage rate for calendar year 2024 will be 67 cents per mile, which is an increase from the 2023 rate of 65.5 cents per mile., irs issues standard mileage rates for 2024;..

Fy 2024 per diem rates for los angeles, california.

Adopt The Mileage Reimbursement Rate Suggested By The Irs Or By The California Department Of Human Resources (Which For 2024 Is $0.67 Per Mile), Or Agree.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

IRS reminder to U.S. taxpayers living, working abroad: File 2023 tax return by June 17; those impacted by terrorist attacks in Israel have until Oct. 7

More in news.

- Topics in the News

- News Releases for Frequently Asked Questions

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IR-2024-79, March 22, 2024

WASHINGTON — The Internal Revenue Service reminds taxpayers living and working outside the U.S. to file their 2023 federal income tax return by Monday, June 17, 2024. This deadline applies to both U.S. citizens and resident aliens abroad , including those with dual citizenship.

This deadline does not apply to taxpayers who live or have a business in Israel, Gaza or the West Bank, and certain other taxpayers affected by the terrorist attacks in the State of Israel . They are granted relief until Oct. 7, 2024, to both file and pay most taxes due. For more information, check out Notice 2023-71 PDF .

Taxpayers unable to file their tax returns by the June deadline can request a further extension to file, but not pay, until Oct. 15 .

Qualifying for the June 17 extension

If a taxpayer is a U.S. citizen or resident alien residing overseas or is in the military on duty outside the U.S., on the regular due date of their return, they are allowed an automatic 2-month extension to file their return without requesting an extension. If they use a calendar year, the regular due date of their return is April 15, and the automatic extended due date would be June 15. Because June 15 falls on a Saturday this year, the due date is delayed until the next business day, June 17.

A taxpayer qualifies for the June 17 extension to file and pay if they are a U.S. citizen or resident alien, and on the regular due date of their return: