- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Aaa visa credit cards review: generous bonus cash-back categories with no annual fee, there are two aaa cash-back credit cards with different bonus spending categories..

The American Automobile Association (AAA) offers two cash-back credit cards that are surprisingly rewarding for certain purchases: The AAA Daily Advantage Visa Signature® Credit Card and AAA Travel Advantage Visa Signature® Credit Card . These cards shine for earning cash back on groceries, gas and EV charging. However, both cards have caps on some the most rewarding spending categories, so they aren't the best fit for everyone.

CNBC Select has the details for the rewards, welcome bonus and rates and fees of these no-annual-fee cash-back credit cards .

AAA Travel Advantage Visa Signature® Credit Card

*You can earn a maximum of $350 in combined cash back each calendar year at gas stations and electric vehicle charging stations, after that purchases earn 1% for the rest of the year.

Welcome bonus

Earn a $100 statement credit when you spend $1,000 within the first 90 days of account opening.

Regular APR

19.24% to 33.24%, based on your creditworthiness

Foreign transaction fee

Balance transfer fee.

Either $10 or 5% of the amount of each transfer, whichever is greater.

AAA Daily Advantage Visa Signature® Credit Card

*You can earn a maximum of $500 in combined cash back each calendar year at grocery stores, gas stations and wholesale clubs, after that purchases earn 1% for the rest of the year

AAA Visa Signature cards review

Benefits and perks, how to earn and use cash back, rates and fees, alternatives to the aaa credit cards, are the aaa credit cards right for you, bottom line.

Both AAA Visa Signature cards have the same welcome bonus, which allows you to earn a $100 statement credit after spending $1,000 within the first 90 days from account opening.

Both of these cards come with a handful of Visa Signature credit card perks , including:

- Three free months of Shipt membership (free delivery on $35+ orders)

- Three free months of Skillshare membership

- Travel and emergency assistance services

- Visa concierge services

- Exclusive access to Sofar events and eligibility for a free ticket per show

The AAA Daily Advantage Visa Signature® Credit Card and AAA Travel Advantage Visa Signature® Credit Card are both cash-back rewards credit cards, but they earn bonus cash back on different purchases.

The AAA Daily Advantage Visa Signature® Credit Card earns:

- 5% cash back on grocery store purchases

- 3% cash back on gas and electric vehicle charging stations, wholesale clubs, streaming services , pharmacy and AAA purchases

- 1% cash back on all other purchases

Cardholders can earn a maximum of $500 combined from the 5% and 3% bonus categories each calendar year at grocery stores, gas stations and wholesale clubs , after that purchases earn 1% for the rest of the year. So if you use this card exclusively for grocery store purchases, you would earn 5% back on $10,000 in spending.

The AAA Travel Advantage Visa Signature® Credit Card earns:

- 5% cash back on gas and electric vehicle charging station purchases

- 3% cash back on grocery stores, restaurants , travel and AAA purchases

The AAA Travel Advantage Visa Signature® Credit Card lets you earn a maximum of $350 in combined cash back each calendar year in the 5% bonus category, after that purchases earn 1% back for the rest of the year. That's the equivalent of spending $7,000 a year at gas stations and electric vehicle charging stations.

You can redeem cash back for a direct deposit or statement credit once you have earned at least $5 in rewards. You can also cash out your rewards for gift cards or merchandise and travel through participating AAA clubs.

Both AAA credit cards have the same rates and fees. There are no annual fees and no foreign transaction fees . Balance transfers and cash advances are charged a 5% fee of the amount of the transaction with a $10 minimum. The standard APR is a variable 19.24% to 33.24% and there is no introductory APR offer . There is a fee of up to $41 for late payments and returned payments.

AAA Daily Advantage Visa Signature® Credit Card vs. Blue Cash Preferred® Card from American Express

The Blue Cash Preferred® Card from American Express is CNBC Select's best credit card for groceries . It has a higher rate of return for groceries than the AAA Daily Advantage Visa Signature® Credit Card on grocery purchases (6% back on the first $6,000 in purchases per year at U.S. supermarkets) and U.S. streaming services (6% back).

It also has a more generous welcome offer and a $0 intro annual fee for the first year, then $95 (see rates and fees ). The Amex Blue Cash Preferred card has better benefits, including return protection, up to $84 a year in Disney Bundle credits ($7 a month with an eligible $9.99 a month Disney Bundle subscription) and up to $120 in annual Equinox credit ($10 a month). These credits can offset the card's annual fee (see rates and fees ), so the decision may come down to how much cash back you'll earn with each card. The AAA Daily Advantage Visa Signature® Credit Card limits select bonus cash-back categories to $500 in rewards each year before the return drops to 1%. So if you expect to earn more cash back than that, the Blue Cash Preferred could be more lucrative.

Blue Cash Preferred® Card from American Express

6% cash back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%), 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations, 3% cash back on transit (including taxis/rideshare, parking, tolls, trains, buses and more) and 1% cash back on other purchases. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout.

Earn a $250 statement credit after you spend $3,000 in purchases on your new card within the first 6 months.

$0 intro annual fee for the first year, then $95.

0% for 12 months on purchases from the date of account opening

19.24% - 29.99% variable. Variable APRs will not exceed 29.99%.

Either $5 or 3% of the amount of each transfer, whichever is greater.

Credit needed

Excellent/Good

See rates and fees , terms apply.

AAA Travel Advantage Visa Signature® Credit Card vs. Chase Freedom Flex℠

The Chase Freedom Flex earns 5% cash back on the first $1,500 in combined purchases in a variety of rotating quarterly categories . That's a potential $75 in bonus cash per quarter or $300 per year. While this is $50 lower than the $350 annual cash-back cap for the AAA Travel Advantage Visa Signature® Credit Card's 5% bonus category (then 1% back), it applies to a wider range of purchases and the Chase Ultimate Rewards points you earn with the Freedom Flex can be much more valuable.

When you pair the Freedom Flex card with a Chase credit card that allows point transfers such as the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® , you can also transfer the points you've earned with your Freedom Flex card. For example, $300 cash back is 30,000 Chase points, which you can transfer to Hyatt to book a standard night award at a Category 7 hotel, like the Grand Hyatt Kauai Resort & Spa or Park Hyatt Tokyo. A night at these hotels can cost $700+, so having the ability to transfer Chase points dramatically increases the Freedom Flex's value.

Chase Freedom Flex℠

5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate (then 1%), 5% cash back on travel booked through the Chase Ultimate Rewards®, 3% on drugstore purchases and on dining (including takeout and eligible delivery services), 1% cash back on all other purchases

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

0% for the first 15 months from account opening on purchases and balance transfers

20.49% - 29.24% variable

Intro fee of either $5 or 3% of the amount of each transfer, whichever is greater, on transfers made within 60 days of account opening. After that, either $5 or 5% of the amount of each transfer, whichever is greater.

Member FDIC. Terms apply. Information about the Chase Freedom Flex℠ has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Read our Chase Freedom Flex℠ review.

The AAA Daily Advantage Visa Signature® Credit Card and AAA Travel Advantage Visa Signature® Credit Cards both have value. They have no annual fees and earn cash back, which is always useful and never complicated. If you want to add a card to your wallet to use exclusively for groceries or gas stations, then these cards are hard to beat. However, some of the most rewarding bonus cash-back categories for both cards have an annual limit, then the return drops to 1%. So heavy spenders may be better off with a card with unlimited bonus categories .

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

The American Automobile Association offers two co-branded credit cards , the AAA Daily Advantage Visa Signature® Credit Card and AAA Travel Advantage Visa Signature® Credit Card . These are no-annual-fee cash-back cards with generous bonus spending categories. However, the amount of bonus cash-back you can earn each year is capped for select categories (then it drops to 1%), which limits the value for anyone whose spending will exceed these limits.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

For rates and fees of the Blue Cash Preferred® Card from American Express, please click here .

Clarification: This story has been updated to clarify that certain AAA credit card bonus categories have capped cash-back rates and earn a lower return once that limit is reached.

- How Quicken Simplifi can help you get a grip on your spending Elizabeth Gravier

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

Your go-to credit card

Aaa travel advantage visa signature ® credit card.

Meet your go-to credit card for everywhere you go. Using your AAA Travel Advantage Visa Signature ® Credit Card , you can take advantage of cash back on a wide range of purchases and experiences.

With purchases, earn $100 statement credit when you spend $1,000 within the first 90 days of opening. 3

Use the AAA Travel Advantage card to start earning:

- 5% cash back on gas purchases and electric vehicle-charging stations 1

- 3% cash back on travel, restaurants, grocery store, and purchases at AAA 1

- 1% cash back on all other purchases 2

- No annual fee and no foreign transaction fees 4

With the AAA Travel Advantage Visa Signature ® Credit Card you can earn 5% cash back on the first $7,000 spent on gas & electric vehicle-charging purchases in a calendar year, then 1% thereafter.

Credit card offers are subject to credit approval.

AAA Travel Advantage Visa Signature ® Credit Card Accounts are issued by Comenity Capital Bank pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association and used under license.

1 Offer is exclusive to AAA Travel Advantage Visa Signature ® Credit Card holders enrolled in the AAA Travel Advantage program. For offers associated with a specific category, earnings will only be awarded if the merchant code for the purchase matches a category eligible for the offer. Each merchant is assigned a code by a third party that indicates the merchant’s area of business. Comenity Capital Bank does not have the ability to control assignment of merchant codes. Maximum of $350 USD in cash back in a calendar year on the 5% category, and earn 1% cash back on all net eligible purchases thereafter. Excludes third-party insurance and offers, automobile extended warranties, and trip insurance. Cash back can be redeemed as statement credits, direct deposit, rewards and qualifying purchases at participating AAA locations. This rewards program is provided by Comenity Capital Bank and its terms may change at any time. For full Rewards Terms and Conditions, please see AAA.com/AdvantageTravelTerms.

2 Offer is exclusive to AAA Travel Advantage Visa Signature ® Credit Card holders enrolled in the AAA Travel Advantage program. Cash Back can be redeemed as Statement Credits, Direct Deposit, Rewards and qualifying purchases at participating AAA locations.

3 Valid one time only. Offer is exclusive to AAA Travel Advantage Visa Signature ® Credit Card holders enrolled in the AAA Travel Advantage program. Maximum of $100 statement credit per account.

4 For new accounts, as of January 2024: Variable Purchase APR of 19.24% to 33.24% based on your credit worthiness at the time of account opening and the Prime Rate. Balance Transfer APR of 26.99%. Variable Cash Advance APR of 34.24%, based on Prime Rate. Minimum Interest Charge is $2. Balance Transfer Fee of the greater of $10 or 5% of the transfer. Cash Advance Fee of the greater of $10 or 5% of the advance.

AAA Travel Advantage Visa Signature® Credit Card

Advertiser Disclosure : The offers that appear on this site are from companies from which Allcards.com receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Allcards.com does not include all companies or all offers available in the marketplace. AllCards has partnered with CardRatings for our coverage of credit card products. AllCards and CardRatings may receive a commission from card issuers. Learn More Here Credit Score Disclosure : Allcards.com credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.

Editorial Note: We earn a commission from partner links on Allcards. Commissions do not affect our authors’ or editors’ opinions or evaluations. From our partners: See our advertiser disclosure here .

The AAA Travel Advantage Visa Signature® Credit Card is a cash back rewards card designed for anyone who didn’t apply for the AAA Daily Advantage Visa Signature® Credit Card, because you have to choose one or the other–you can’t have both. You don’t have to be a AAA member, however. This card has a small welcome offer and great ongoing rewards, although you are limited to a maximum of $350 cash back earned on the 5% category in a calendar year, then 1%. The 3% cash back categories are uncapped. Some benefits may depend on your location. We dive into the details and your approval odds in this AAA Travel Advantage review.

Welcome Offer

0% on Purchases

Reward Rate

1% to 5% cash back

0% on Balance Transfers

Earn a $100 statement credit when you spend $1,000 within the first 90 days of account opening.

Features & Benefits

Interest rates & fees, what credit score is required to get the aaa travel advantage visa signature® credit card.

The following credit score data are based on publicly available information we have collected from various forums. We have no way to confirm the accuracy of this data. In addition, keep in mind that credit card issuers use numerous factors in their underwriting process, and these factors can change at any time.

Lowest Approved Credit Score : 784

Average Approved Credit Score : 784

Pros & Cons

- Welcome offer

- No annual fee

- No foreign transaction fee

- Up to 5% cash back

- Requires good credit

What Are the Best Alternatives?

PenFed Platinum Rewards Visa Signature® Card

Rewards Range

1x to 5x points

No Annual Fee

Citi Premier® Card

Wells Fargo Active Cash® Card

Related articles.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- • Rewards credit cards

- • Travel credit cards

Brendan Dyer holds a Master of Fine Arts in Journalism from Western Connecticut State University and worked previously as a content editor for Regional News Network, a hyper-local TV news station contracted by Verizon FiOS1 News. As a national service volunteer, Brendan exercised a passion for helping underserved communities and demographics through direct, community service. He constantly seeks to apply his expertise as a journalist to the field of personal finance with the goal of helping people navigate the complexities of the credit card industry.

- • Credit scores

- • Building credit

Courtney Mihocik is an editor at Bankrate Credit Cards and CreditCards.com specializing in credit card news and personal finance advice. Previously, she led insurance content at Reviews.com and worked as the loans editor at The Simple Dollar.

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bottom line

AAA Member Rewards Visa® Credit Card

*The information about the AAA Member Rewards Visa® Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Balance transfer intro APR

Regular APR

Rewards rate

3X points on eligible travel and AAA purchases 2X points on gas, grocery store and drugstore purchases 1 point per $1 on purchases everywhere else

On This Page

- Current offer details

Alternatives to the AAA Member Rewards card

Aaa member rewards card pros and cons.

- Best cards to pair with the AAA Member Rewards Visa

- Is the AAA Member Rewards card worth keeping?

- Card rating methodology

Bankrate Insight

The AAA Member Rewards card is discontinued. Interested applicants can apply for AAA’s current cards , the AAA Daily Advantage Visa Signature® Credit Card or the AAA Travel Advantage Visa Signature® Credit Card, if they’re particularly interested in AAA. Both of these cards have tiered cash back rates and are issued by Comenity Capital Bank.

AAA Member Rewards Visa® Credit Card card overview

If you’re on the road often, then you may still get a lot out of the AAA Member Rewards Visa Credit Card. While it doesn’t offer premium travel perks, we love that it’s an all-rounder — you’ll get bonus rewards for travel, AAA, grocery store, drugstore, gas station and wholesale club purchases for no annual fee .

- 3X points on qualifying travel and AAA purchases

- 2X points on gas, grocery, drugstore and wholesale club purchases

- 1X point on all other purchases

Expert Appraisal: Typical

Welcome offer

- $200 statement credit if you spend at least $1,000 in the first 90 days

Expert Appraisal: Good

Rates and fees

- Annual fee: None

- Balance transfer fee: Either $10 or 3 percent of the amount of each transfer, whichever is greater.

- Foreign transaction fee: None

- Ongoing APR: 15.24 percent to 25.24 percent variable

This card is no longer available, but if its rewards rates, welcome offer and APR appeal to you, here are alternative cash back and rewards cards worth considering.

Intro offer

Receive a $150 statement credit after you make at least $500 in purchases within the first 90 days of account opening

Recommended Credit Score

American Airlines AAdvantage® MileUp®

Earn 10,000 American Airlines AAdvantage® bonus miles and receive a $50 statement credit after making $500 in purchases within the first 3 months of account opening

Earn 2 AAdvantage® miles for each $1 spent at grocery stores, including grocery delivery services Earn 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases Earn 1 AAdvantage® mile for every $1 spent on other purchases

Discover it® Miles

Unlimited Bonus: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

Automatically earn unlimited 1.5x Miles on every dollar of every purchase.

AAA Member Rewards card vs. Capital One Quicksilver Cash Rewards Credit Card

The Capital One Quicksilver Cash Rewards Credit Card offers a solid mix of flat-rate and boosted cash back. Since the AAA Member Rewards Visa is discontinued, the Quicksilver Cash Rewards is a solid back up for its boosted rewards for Capital One Travel purchases . It also rewards generously on everyday spending with 1.5 percent cash back on all purchases, including wholesale clubs, drug stores, gas and groceries. Although this is half a percentage point lower than the AAA Member Rewards card’s 2X rate in these categories, the Quicksilver’s rate is for all purchases that earn only 1X point with the AAA Member Rewards card.

If you still have the AAA Member Rewards card, it may be worth keeping because it increases the average age of your accounts. You’ll find very few direct comparisons to the AAA Member Rewards card, but flat-rate cards with a boosted travel category like the Capital One Quicksilver come close to matching the rewards potential of the AAA Member Rewards card.

AAA Member Rewards Visa vs. Wells Fargo Autograph℠ Card

The Wells Fargo Autograph Card blends travel, everyday, eligible streaming and phone service subscription purchases to give cardholders a nuanced rewards card that nearly does it all.

If the AAA Member Rewards card’s 3X travel category brings a ton of value to your wallet, then Wells Fargo’s travel category certainly will, too. It will also reward you more generously for everyday purchases like restaurants, gas stations and electric vehicle charging stations, while the AAA Member Rewards card would only award 2X points for gas. The AAA Member Rewards card has a higher rate for groceries and wholesale purchases, but that’s its only selling point over the Autograph card.

Low ongoing APR and intro APR rival some of the best low-interest cards’ rates.

Earns boosted points at wholesale clubs.

Doesn’t charge foreign transaction fees or an annual fee.

Need at least 5,000 points for cash or AAA voucher redemption, which could be a hassle.

AAA points don’t have as much value as other rewards programs.

Best cards to pair with the AAA Member Rewards card

Holding onto the AAA Member Rewards card may increase the average age of your credit card accounts, bolstering your score. But if you want to maximize other cash back and rewards cards, you can stack the AAA card with other options like the ones below

Capital One Quicksilver Cash Rewards Credit Card

If you want to redeem cash rewards for any amount at any time, pairing your AAA Member Rewards credit card with the Capital One Quicksilver Cash Rewards Credit Card could be the answer. You’ll earn an unlimited 1.5 percent cash bank on all purchases for no annual fee ( See Rates & Fees ) , plus there’s a cash bonus of $200 if you spend $500 in the first three months.

Citi Double Cash® Card

Another pairing option for flexible cash back is the Citi Double Cash Card , which offers an unlimited 1 percent cash back as you buy, plus another 1 percent back when you pay for your purchases. It comes with an 18-month 0 percent introductory APR on balance transfers (19.24 percent to 29.24 percent variable APR thereafter).

Bankrate’s Take — Is the AAA Member Rewards card worth keeping?

The AAA Member Rewards card is worth holding onto if you’re a regular traveler but want the flexibility to earn and redeem rewards for more than travel. It’s also worth keeping because it increases the average age of your accounts, which looks great on your credit report. However, it isn’t the best option for a strong credit card rewards strategy. Pairing the AAA Member Rewards card with other cash back and rewards credit cards can be a great way to maximize your rewards strategy while keeping a decent credit history.

Closing the card account could decrease your score, so it may be worth considering a product change instead. Switching credit cards with your issuer will keep your card account open but will transition you to a new credit card with all of the ongoing benefits and rates that it offers. However, you won’t get to take advantage of a welcome offer or any other intro offer. Since Bank of America issues the AAA Member Rewards card, you might consider the Bank of America® Customized Cash Rewards Card because it has a rewards program with overlapping categories available on the AAA Member Rewards card.

How we rated this card

We rate credit cards using a proprietary card scoring system that ranks each card’s estimated average rewards rate, estimated annual earnings, welcome bonus value, APR, fees, perks and more against those of other cards in its primary category.

Each card feature is assigned a weighting based on how important it is to people looking for a card in a given category. These features are then scored based on how they rank relative to the features on other cards in the category. Based on these calculations, each card receives an overall rating of 1-5 stars (with 5 being the highest possible score and 1 being the lowest).

We analyzed over 150 of the most popular rewards and cash back cards to determine where each stacked up based on their value, cost, benefits and more. Here are some of the key factors that influenced this card’s overall score and how the score influenced our review:

Rewards value

The primary criteria for a rewards or cash back card’s rating is its rewards value. This includes the card’s average rewards rate, estimated annual rewards earnings, sign-up bonus value and reward redemption value.

To estimate a card’s average annual rewards earnings, we first calculate its average rewards rate based on how much it earns in different bonus categories and how closely its categories align with the average person’s spending habits, according to data from the Bureau of Labor Statistics .

Based on this data, we determine a “chargeable” spend (which purchases are likely to be put on a credit card and earn rewards). This includes the following spending by category:

- Groceries: $5,200

- Dining out: $3,000

- Entertainment: $2,500

- Gas: $2,100

- Apparel and services: $1,700

Using this data, we assign a weighting to each of a card’s bonus categories. For example, a card’s grocery rewards rate receives a 23 percent weighting based on how much of the average person’s budget is spent on groceries. We also estimate the redemption value of points or miles from various issuer, airline and hotel rewards programs.

This weighting and rewards valuation allows us to estimate a card’s average annual rewards earnings — how many points or miles you’d earn with a given card if your spending was about average and you used the card for all of your purchases, as well as what those points are worth. We also use point valuations to determine a card’s sign-up bonus value

With these calculations complete, we assign each card a score based on how its average rewards earnings, sign-up bonus value, rewards rate and redemption value stack up against other rewards cards.

We also rate cards based on how much it costs to keep them in your wallet or carry a balance.

To start, each rewards or cash back card is scored based on whether it offers an intro APR and how its ongoing APR compares to the rates available on other rewards or cash back cards.

We also score each card based on how its annual fee influences its overall value.

We consider a card’s annual fee in two ways — how it ranks relative to the fees you’ll find on other cards in the category and how it impacts a card’s overall rewards value. Cards with an annual fee will always be at a slight disadvantage in our scoring system since annual fees inherently cut into your rewards value, but if a card offers terrific value via its ongoing rewards and perks, it can earn a high score even if it carries a high annual fee.

With this in mind, we rate a card based primarily on how its ongoing rewards value and ongoing perk value (such as annual credits or bonuses) stack up against other cards in the category when you subtract its annual fee.

Flexibility

We rate each card’s flexibility based on the restrictions it imposes on earning and redeeming rewards and factor this rating into a card’s overall score.

Flexibility factors include whether a card only allows you to earn a high rewards rate on a small amount of spending or requires you to meet a certain earning threshold before you can redeem rewards. We also examine whether your points are worth less when you redeem for some options versus others and whether a card gives you the flexibility to transfer rewards to airline and hotel partners.

We also score each card’s set of features – its perks and benefits — against five tiers of features to provide a rating.

We break down these tiers as follows:

- Tier 1 has less than standard card features (an ultra-streamlined card that offers basic utility and next to nothing in the way of ancillary benefits.

- Tier 2 includes the benefits you’d expect on standard Visa or Mastercard credit cards, such as free access to your credit score, car rental insurance and $0 liability for fraudulent charges.

- Tier 3 includes “prime card” or better-than-average card features like cellphone insurance, lost luggage insurance, concierge services and purchase protection.

- Tier 4 includes luxury features such as airport lounge access, elite status with an airline or hotel and credits for expedited security screening membership programs.

- Tier 5 includes the sort of exemplary benefits you’ll find on top-tier luxury cards, such as high-value travel credits, cardholder memberships and other unique and valuable perks.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Hilton Honors American Express Surpass® Card Review

Marriott Bonvoy Brilliant® American Express® Card Review

Hilton Honors American Express Card Review

Choice Privileges® Mastercard® Review

Find your odds with no impact to your credit score

Apply for a credit card with confidence.

Apply for a credit card with confidence. When you find your odds, you get:

A personalized list of cards ranked by likelihood of approval

Special card offers from top issuers in our network

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score

Tell us your name to get started

This lets us verify your credit profile

Your personal information and data are protected with 256-bit encryption.

Your personal information is secure

We use your info to run a soft credit pull which won’t impact your credit score

Here’s how we protect your safety and privacy. That means:

We only use your info to run a soft credit pull, which won’t impact your credit score

We’ll never send mail to your home

All of your personal information is protected with 256-bit encryption

What’s your mailing address?

This helps us verify your credit profile.

Why we're asking

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

What’s your employment status?

What's your estimated annual income?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Increase non-taxbile income or benefits included by 25%.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio (DTI) which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? Your DTI gives us a clearer picture of your credit profile, which allows us to evaluate which cards you’re likely to get approved for more accurately.

Monthly rent or mortgage payment

Put $0 if you currently don’t have a rent or mortgage payment.

Almost done!

We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by 256-bit encryption.

A soft credit pull will not affect your credit score.

Enter the last 4 digits of your Social Security number

Last step! Once you enter your email and agree to terms:

Your approval odds will be calculated

A personalized list of cards ranked by order of approval will appear

Your odds will display on each card tile

Enter your email address

Enter your email address to activate your approval odds and get updates about future card offers.

By clicking “Agree and See Results” you acknowledge receipt of our Privacy Notice , Privacy Policy and agree to our Terms of Use . By agreeing, you are giving your written instruction to Bankrate and our lending partners (together, “Us”) to obtain a soft pull of your credit report to determine whether you may be eligible ...show more for certain targeted offers, including pre-qualified and pre-approved offers (your "CardMatch offers"), as well as display what we estimate your approval odds to be for participating offers (“Approval Odds”). You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less

We’re sending you to the issuer’s site to complete your application.

Just a second... We’re matching you with personalized offers

Hold tight, we’re loading your personalized results page, sorry, we couldn't access your approval odds..

This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Check your approval odds before you apply

Answer a few questions and see if you’re likely to be approved in less than a minute—with no impact to your credit score.

Check your approval odds on similar cards before you apply

Before you apply...

See which cards you’re likely to be approved for

In less than 60 seconds, answer some questions and we’ll estimate your odds of approval on eligible cards. You get:

A personalized list of cards ranked by likelihood of approval.

Access to special card offers from top issuers in our network.

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score.

But don’t worry! You can check out other cards that are a better fit.

- Credit Cards

- Rewards Credit Cards

- AAA Travel Advantage Visa Credit Card

AAA Travel Advantage Visa Credit Card review

Advertisement disclosure.

You should know that in some cases, we may receive compensation when you click on links or purchase through links on this site. This is at no extra cost to you. It lets us operate the business and keep the service free for everyone. Here's How We Make Money .

This site does not include all companies and offers available. We are an independent comparison service. While we aim to provide you with the most accurate information and keep things up to date, prices and terms of products and services can change. We encourage you to always do your own research and double check the terms. Using the information on this site is at your own risk and without warranty.

Am I eligible?

To get this card, you must also:.

Note: This information is only intended as a guide. The final decision is up to the bank and your application could still be rejected even if you can answer 'Yes' to all the minimum criteria above. Always consider your options and your financial situation before you apply for a credit card.

Disclaimer: All products, logos, images and trademarks are the property of their respective owners. Content is not provided or commissioned by any company mentioned. Any views, analyses, or recommendations expressed here are those of the author's alone, and may not have been reviewed, approved or otherwise endorsed by any company mentioned.

Information in this article is believed to be accurate at the time it was written, but terms and conditions may change at any time. All information is presented without warranty or guarantee. Please verify all terms and conditions of any credit card prior to applying.

The Informr is an independent, advertising supported website and may receive compensation for sponsorships or when you click on certain affiliated links.

Use this card?

Help inform others by sharing your experience with AAA Travel Advantage Visa Credit Card

Is AAA membership worth it?

I've been a AAA member for more than 15 years, and I can confidently say that the perks and benefits have come in handy — especially the well-known roadside assistance benefit.

Over the years, AAA has opened up its network to provide vast options and money-saving discounts for travelers beyond roadside assistance.

I'm also partial to the regional magazine AAA produces six times a year; Arizona's is called Via and California's is called Westways. Each issue is full of travel inspiration and valuable tips. AAA even has a travel service you can use to book vacations.

How I've used AAA benefits

Living in Arizona, you can expect that your car battery will not survive more than two years due to the heat. In my case, the two-year timing always seemed to happen in August — the hottest month of the year. I have called AAA on more than one occasion to take advantage of its mobile battery service , and workers have come to my location with a new car battery.

Usually, they will test your current battery power and sell you a new one on the spot if needed. Members receive a $25 discount on batteries purchased during the on-the-spot installation. They even offer a battery warranty, so there's a chance if you purchased your last battery from AAA, your replacement might be free.

It has been a fantastic time saver and more convenient than getting jumper cables and making it to the nearest auto shop. Additionally, AAA membership covers the individual, not just the vehicle. So, you can use your membership for a service call even if you're a passenger in a stalled car.

To request 24/7 roadside assistance , use the AAA online assistance tool, call 800-AAA-HELP (800-222-4357) or you can text HELP to that same phone number and follow the prompts from there.

According to the AAA website, response time varies depending on several factors including time of day, breakdown location, and severity of the issue, and that AAA strives to provide the fastest and most efficient service possible. If you make your request online, you can track the progress of your request and the location of your technician.

What does AAA membership cost?

Membership rates are determined by the local club and may vary, a AAA spokesperson confirmed. The pricing below is provided as an example and is based on Arizona's current club pricing.

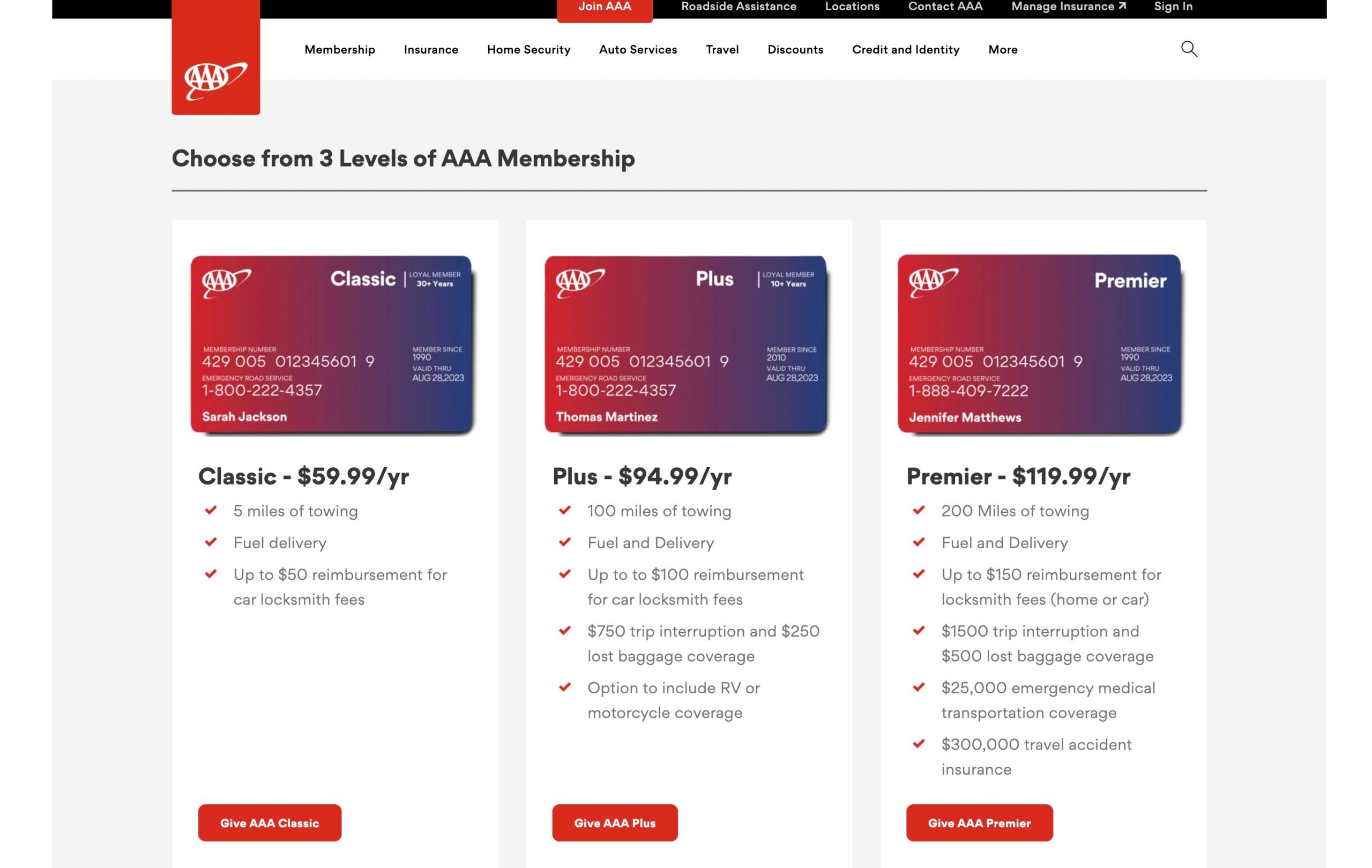

There are three AAA membership levels based on the types of services included.

The entry-level "Classic" membership starts at just $59.99 per year. This basic option allows for 5 miles of towing, fuel delivery and up to a $50 reimbursement for locksmith fees.

The next membership level is called "Plus" and is $94.99 annually. This level will more than pay for itself if you had to use just the locksmith option which is up to $100 reimbursement. This option also includes 100 miles of towing, fuel and delivery, $750 trip interruption, $250 lost baggage coverage and an option to include RV or motorcycle coverage.

The third option, called "Premier" costs $119.99 annually and has upgraded levels of everything in the Plus membership, but also adds $25,000 of emergency medical transportation coverage and $300,000 of travel accident insurance.

Does AAA offer discounts and perks?

AAA can help you save on everything from theme park tickets to car insurance and car repair. AAA membership offers a vast network of discounts and perks when you show your card or make online reservations with certain companies that provide AAA member discounts.

Guide: 6+ unexpected travel discounts to save you money.

A quick look at the AAA merchant list for attractions, zoos, museums and tours reveals discounts for CityPass for some major U.S. cities, Legoland Discovery Centers, Busch Gardens, Six Flags Theme Parks, AMC Theatres and Regal Cinemas, to name a few. You can search by city on the website to narrow down your results.

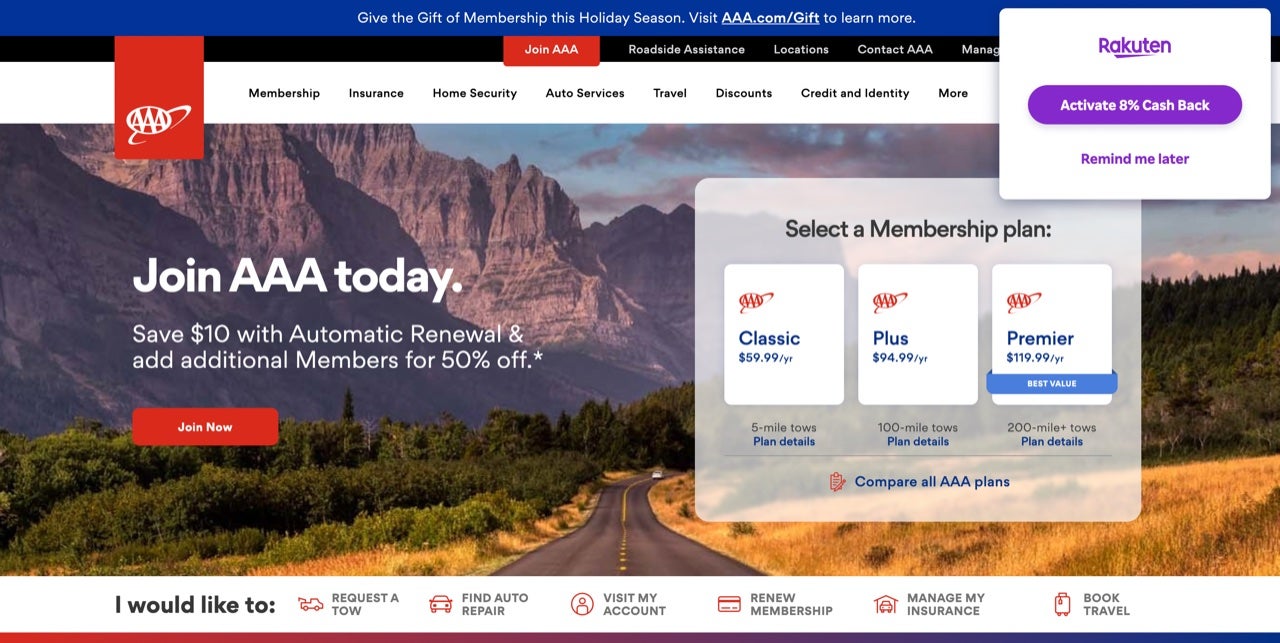

As I navigated to the AAA website, my Rakuten browser extension popped up and offered me 8% back, so there are ways to stack offers while using your AAA membership.

AAA is a trusted name in the auto industry and not just for its roadside assistance. Auto repair shops can be AAA trust-certified which means as a consumer which means you can access this network and receive discounts on regular automotive service or repairs; the work carries a warranty for 24 months/24,000 miles. You will also get access to priority service and a minimum of 10% off labor costs.

Through AAA Smart Home you can save money on items for your home such as a home security system, smart door locks, energy-efficient thermostats and even home automation.

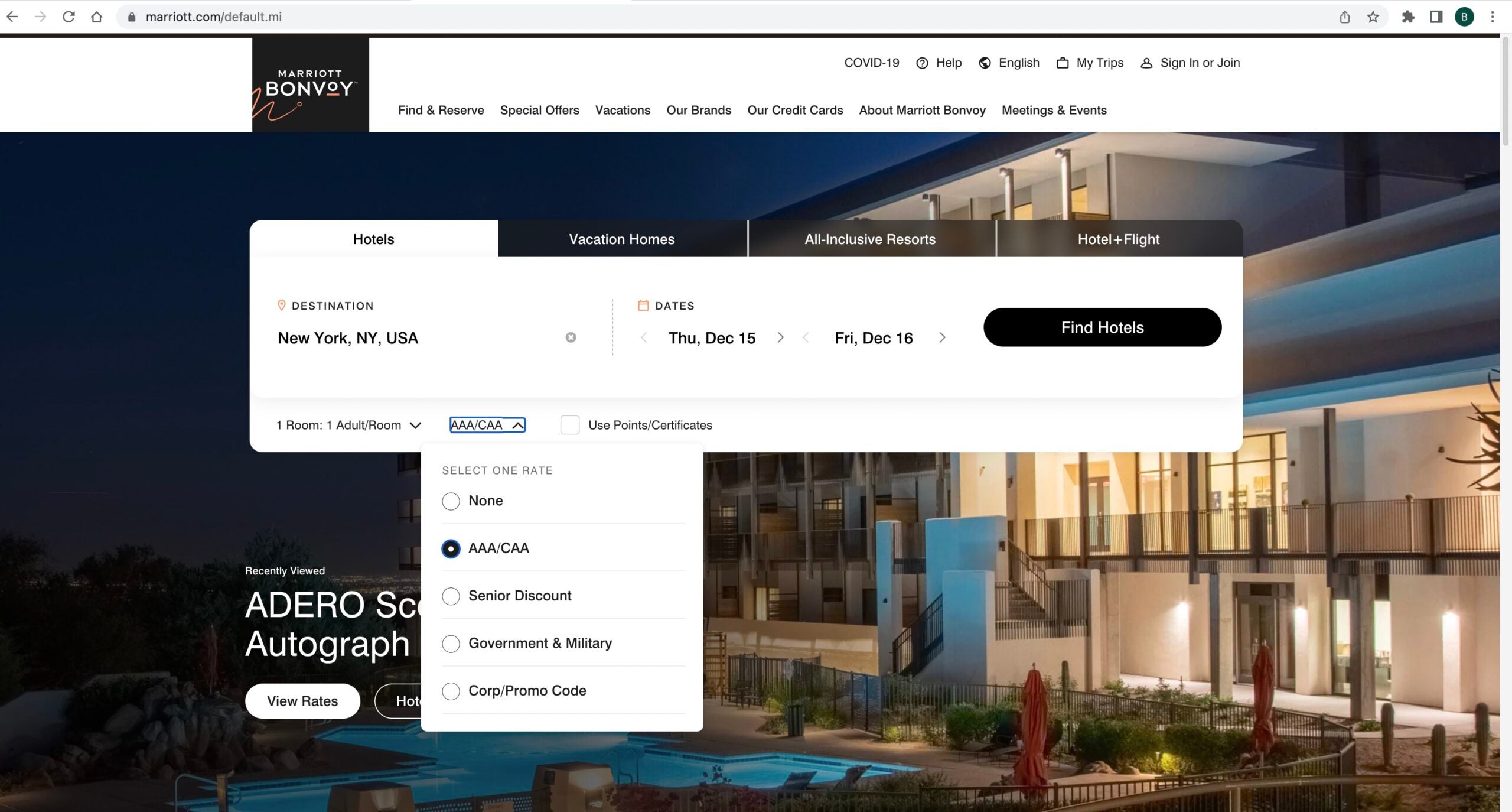

Many hotel companies offer AAA discounted rates which usually hover around 10% off the best available rate. If you click for rate options, you'll see a AAA rate option on many hotel booking websites.

Another way to utilize AAA perks is for car rentals — many rental companies offer AAA corporate rates which you can find using the AAA travel portal. If you are a renter under 25 , you can rent through Hertz, which specifically honors the AAA discount for younger drivers.

Can I gift AAA membership to a friend or family member?

According to the AAA website, gift memberships are available for purchase in some regions of the country: Northern California, Nevada, Utah, Arizona, Montana, Wyoming and Alaska. If the person you want to gift membership to lives in another region, you can search by zip code to find the local AAA club where they live.

Is AAA worth it?

If you enjoy saving money and getting additional home and travel perks, I recommend checking out AAA to see if it is a program you can benefit from. If you are a T-Mobile customer, see if your plan includes the Coverage Beyond program — this includes AAA membership free for customers (a $60 value).

Related: AAA tests program to allow California users to get Real ID

AAA Travel Advantage Visa Signature® Credit Card

Use your card to enjoy the benefits below.

- 5% cash back on gas purchases and electric vehicle charging 2

- 3% cash back on grocery stores, restaurants, travel and AAA purchases 2

- 1% cash back on all other purchases 3

- No annual fee or foreign transaction fees 4

Premium travel benefits with everyday rewards when you use your card

- Gas pump 5% cash back 2 on gas purchases and electric vehicle charging

- Shopping cart 3% cash back 2 on grocery store, restaurants, travel, and AAA purchases

- Globe 1% cash back 3 on all other purchases

- No fees No annual fee or foreign transaction fees 4

Earn a $100 statement credit

We'll Be Right Back!

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Alignment Health Plan Medicare Advantage 2024 Review

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Alignment Health Plan

CMS Star Rating Average Medicare star rating, weighted by enrollment. Star ratings are determined by the Centers for Medicare & Medicaid Services (CMS).

Alignment Health Plan sells Medicare Advantage plans in six states, and star ratings from CMS are about average.

M-F 9am-9pm ET, Sa 10am-9pm ET

Speak to a licensed insurance agent on askchapter.org

from askchapter.org

States available

Members in high-rated plans Percentage of members who are in rated contracts with a Medicare star rating of 4 or higher.

High (90% or more)

Member experience The average of CMS' star ratings for quality measures in the domain "Member Experience with the Health Plan," weighted by contract enrollment.

2.36 (Below average)

- Low-cost plans, and a lower average out-of-pocket max than most.

- All plans include prescription drug coverage.

- Some plans in 2024 will include Part B rebates.

- Available in only 6 states.

- Member experience ratings are below the average for major providers.

Alignment Health Plan Medicare Advantage plans are available in six states, and the provider’s star ratings from the Centers for Medicare & Medicaid Services (CMS) are average. Member experience ratings, however, fall below those of major providers. In 2024, members may have access to new benefit offerings, such as Medicare Part B premium rebates.

Here’s what you should know about Alignment Health Plan Medicare Advantage.

Alignment Health Plan Medicare Advantage pros and cons

Alignment Health Plan’s offerings have advantages and disadvantages.

Low-cost plans: Most Alignment Health Plan Medicare Advantage plans offer a $0 premium, and the average maximum out-of-pocket cost is lower than major providers.

Part B help: Alignment’s smartHMO plans offer Medicare Part B rebates.

Drug coverage: All Alignment Health Plan Medicare Advantage plans include prescription drug coverage.

Help for chronically ill: Alignment offers a $500+ quarterly allowance to members of some Dual-Eligible Special Needs Plans (D-SNPs) that they can use for things like groceries and home safety items.

Limited availability: Alignment Health Plan offers Medicare Advantage plans in just six states: Arizona, California, Florida, Nevada, North Carolina and Texas.

Member experience marks: Average member experience ratings, including customer service and care coordination, for all Alignment Medicare Advantage plans fall below the average for major providers.

» MORE: Best Medicare Advantage plans

Alignment Health Plan Medicare star ratings

Average star rating, weighted by enrollment: 3.95

The Centers for Medicare & Medicaid Services maintains star ratings for Medicare Advantage plans on a 5-point scale, ranking plans from best (5 stars) to worst (1 star). The agency bases these ratings on plans’ quality of care and measurements of customer satisfaction, and ratings may change from year to year.

Based on the most recent year of data and weighted by enrollment, Alignment Health Plan’s 2024 Medicare Advantage plans get an average rating of 3.95 stars [0] Centers for Medicare & Medicaid Services . 2024 Star Ratings Data Tables (Oct 13 2023) (ZIP) . Accessed Apr 18, 2024. View all sources .

For comparison, the average star rating for plans from all providers is 4.04 [0] Centers for Medicare & Medicaid Services . 10.13.23 Fact Sheet - 2024 Medicare Advantage and Part D Ratings (PDF) . Accessed Apr 18, 2024. View all sources .

You can find a plan’s rating with the Medicare plan finding tool .

What does Alignment Health Plan Medicare Advantage cost?

Costs for Medicare Advantage plans depend on your plan, your geographic location and your health needs.

One of the costs to consider is the plan’s premium. In 2024, nine out of 10 Alignment Health Plan Medicare Advantage plans that aren’t special needs plans (SNPs) have a $0 premium [0] Centers for Medicare & Medicaid Services . CY2024_Landscape_Files_Final_20240314 (ZIP) . Accessed Apr 18, 2024. View all sources .

Even as a Medicare Advantage user, you’ll still be responsible for paying your Medicare Part B premium, which is $174.70 per month in 2024 [0] Centers for Medicare & Medicaid Services . Costs . Accessed Apr 18, 2024. View all sources , although some plans cover part or all of this cost. (Most people pay this standard amount, but if your income is above a certain threshold, you'll pay more .)

Copays, coinsurance and deductibles

Requirements for copays, coinsurance and deductibles vary depending on your plan, location and the services you use. Other out-of-pocket costs to consider include:

Whether the plan covers any part of your monthly Medicare Part B premium.

The plan’s yearly deductibles and any other deductibles, such as a drug deductible.

Copayments and/or coinsurance for each visit or service. For instance, there may be a $10 copay for seeing your primary doctor and a $45 copay for seeing a specialist.

The plan’s in-network and out-of-network out-of-pocket maximums.

Whether your medical providers are in-network or out-of-network, or how often you may go out of network for care.

Whether you require extra benefits, and if the plan charges for them.

To get a sense of costs, use Medicare’s plan-finding tool to compare information among available plans in your area. You can select by insurance carrier to see only Alignment Health Plan plans or compare across carriers.

Available Medicare Advantage plans

There are a few kinds of Alignment Health Plan Medicare Advantage plans, and they vary in terms of structure, costs and benefits. Alignment Health Plan offers Medicare Advantage prescription drug plans (MAPDs).

Plan offerings include the following types:

A health maintenance organization (HMO) generally requires that you use a specific network of doctors and hospitals. You may need a referral from your primary doctor in order to see a specialist, and out-of-network benefits are usually very limited.

HMO point of service (POS) plans are HMO plans that allow members to get some out-of-network services, but they’ll pay more for those services.

Preferred provider organization (PPO) plans provide the most freedom, allowing you to see any provider that accepts the insurance. You may not need to choose a primary doctor, and you don’t need referrals to see specialists. You can seek out-of-network care, although it may cost more than seeing an in-network doctor.

Special needs plans (SNPs) restrict membership to people with certain diseases or characteristics. Hence, the benefits, network and drug formularies are tailored to the needs of those members. Alignment Health Plan offers two types of SNPs:

Chronic Condition SNP: Designed to meet the needs of members living with certain chronic conditions, such as diabetes, congestive heart failure and cardiovascular disease.

Dual-Eligible SNP: For people who are entitled to Medicare and who also qualify for assistance from a state Medicaid program.

Alignment Health Plan Medicare Advantage service area

Alignment Health Plan offers Medicare Advantage plans in six states: Arizona, California, Florida, Nevada, North Carolina and Texas.

Alignment Health Plan covers 144,000 Medicare Advantage beneficiaries [0] The Chartis Group . Mounting Headwinds in Medicare Advantage Market Haven't Stopped Growth . Accessed Apr 18, 2024. View all sources .

Compare Medicare Advantage providers

Get more information below about some of the major Medicare Advantage providers. These insurers offer plans in most states. The plans you can choose from will depend on your ZIP code and county.

AARP Medicare Advantage plans .

Aetna Medicare Advantage plans .

Anthem Medicare Advantage plans.

Blue Cross Blue Shield Medicare Advantage plans .

Cigna Medicare Advantage plans.

Humana Medicare Advantage plans .

Kaiser Permanente Medicare Advantage plans.

UnitedHealthcare Medicare Advantage plans .

Wellcare Medicare Advantage plans .

Find the right Medicare Advantage plan

It’s important to do your research before selecting a Medicare Advantage plan for yourself . Here are some questions to consider asking:

What are the plan’s costs? Do you understand what the plan’s premium, deductibles, copays and/or coinsurance will be? Can you afford them?

Is your doctor in-network? If you have a preferred medical provider or providers, make sure they participate in the plan’s network.

Are your prescriptions covered? If you’re on medication, it’s crucial to understand how the plan covers it. What tier are your prescription drugs on, and are there any coverage rules that apply to them?

Is there dental coverage? Does the plan offer routine coverage for vision, dental and hearing needs?

Are there extras? Does the plan offer any extra benefits, such as fitness memberships, transportation benefits or meal delivery?

More on NerdWallet.com

Best Medicare Advantage Plans

Medicare Open Enrollment: What You Need to Know

What Is Medicare, and What Does It Cover?

IMAGES

VIDEO

COMMENTS

The AAA Daily Advantage and Travel Advantage cards both have no annual fee, no foreign transaction fees, $100 signup bonus, and 5%/3% categories for Grocery and Gas. ... Comenity AAA Daily Advantage & Travel Advantage Credit Cards Review ($100 Signup Bonus, 5% Gas/Grocery) November 17, 2022.

AAA Daily Advantage Visa Is issued by Comenity, it's 5% groceries and 3% warehouse clubs and 3% gas with a $10k total spend cap. There is also the AAA Travel Advantage Visa which is 5% on gas and EV charging and 3,% dining with a $7k total spend cap. I use the AAA Daily Advantage. The Good. You don't have to be a AAA member!!!

The AAA Travel Advantage Visa Signature® Credit Card earns: The AAA Travel Advantage Visa Signature® Credit Card lets you earn a maximum of $350 in combined cash back each calendar year in the 5 ...

A credit card for those on the go. Meet your go-to credit card for everywhere you go. Using your AAA Travel Advantage Visa Signature® Credit Card, you can take advantage of cash back on a wide range of purchases and experiences. With purchases, earn $100 statement credit when you spend $1,000 within the first 90 days of opening.3.

The AAA Travel Advantage Visa Signature® Credit Card is a cash back credit card that focuses on travel-oriented purchases. It has no annual fee and no foreign transaction fee which makes it a great well-rounded credit card for travel near and far. AAA Daily Advantage Visa Signature® Credit Card. AAA Travel Advantage Visa Signature® Credit Card.

This card has a small welcome offer and great ongoing rewards, although you are limited to a maximum of $350 cash back earned on the 5% category in a calendar year, then 1%. The 3% cash back categories are uncapped. Some benefits may depend on your location. We dive into the details and your approval odds in this AAA Travel Advantage review.

With purchases on the AAA Travel Advantage card, you earn: 5% Cash Back on Gas & Electric Vehicle-charging stations.1. 3% Cash Back on Grocery Stores, Restaurants, Travel, and AAA purchases.1. 1% Cash Back on all other purchases.2. $100 Statement credit when you spend $1,000 within the first 90 days of account opening.*.

20,000 to 49,999 points: 25% more value. 50,000 or more points: 40% more value. For example: 50,000 points redeemed for cash back will get you $500. In comparison, 50,000 points redeemed for AAA ...

Rewards. 3X points on qualifying travel and AAA purchases. 2X points on gas, grocery, drugstore and wholesale club purchases. 1X point on all other purchases. Expert Appraisal: Typical. Rewards ...

The initial purchase price is determined by whether you're an AAA member or not. It's $5.95 for AAA members and $9.95 for non-members. And deactivate the card once you're done with the card, or you'll be charged $1.25 each month you don't use it. Product name. AAA Visa TravelMoney card.

Recommended Credit Score. 720850 excellent. Get the AAA Member Rewards Visa Signature® Credit Card card today. 3X points = 3% cash back on qualifying AAA and travel purchases.

Purchases on your AAA Travel Advantage Card will enjoy the following card benefits: $100 Statement Credit when you spend $1,000 within the first 90 days of account opening on your AAA Travel Advantage card 1. 5% Cash Back on Gas and Electric-Vehicle charging purchases 3. 3% Cash Back on Grocery Stores, Restaurants, Travel and AAA purchases 3.

The AAA Travel Advantage Visa Credit Card currently has an Informr score of 5.5 out of 10. This score is based on our evaluation of 2 sources including reviews from users and the web's most trusted critics.

Terms page for the AAA Daily Advantage Card. AAA Travel Advantage. 5% Cash Back on Gas & Electric Vehicle-charging stations ($7000 annual spending cap) 3% Cash Back on Grocery Store, Restaurants, Travel, and AAA purchases. 1% Cash Back on all other purchases. $100 statement credit when you spend $1,000 within the first 90 days of account opening.

There are three AAA membership levels based on the types of services included. AAA.COM. The entry-level "Classic" membership starts at just $59.99 per year. This basic option allows for 5 miles of towing, fuel delivery and up to a $50 reimbursement for locksmith fees. The next membership level is called "Plus" and is $94.99 annually.

Variable Cash Advance APR of 34.24%, based on Prime Rate. Minimum Interest Charge is $2. Balance Transfer Fee of the greater of $10 or 5% of the transfer. Cash Advance Fee of the greater of $10 or 5% of the advance. Credit card offers are subject to credit approval. AAA Travel Visa Signature® Credit Card Accounts are issued by Comenity Capital ...

Member stats. 28.3%. Average credit utilization (or what percent of the card's credit limit is being used) of members who matched with this card or similar cards. 47 years. Average age of members who matched this card or similar cards. $100,178. Average annual income of members who matched this card or similar cards.

Based on the most recent year of data and weighted by enrollment, Alignment Health Plan's 2024 Medicare Advantage plans get an average rating of 3.95 stars. Centers for Medicare & Medicaid ...