Suggested companies

Insurefor.com, admiral insurance, leisureguardinsurance.

Bigbluecover Reviews

In the Money & Insurance category

Visit this website

Company activity See all

Write a review

Reviews 1.5.

Most relevant

Should be closed down

Should be closed down. Incompetent, does not provide literate response to simple questions. It seems it is just an operation to entice customers to another bad egg, which is called Reactive claims. Avoid both at all cost.

Date of experience : 08 November 2023

Won’t be using this company again

Called up and woman was very confused by what I was asking ….didn’t seem like she knew what she was talking about. Very disappointed! Won’t be using this company again

Date of experience : 09 October 2023

absolute crooks

absolute crooks , took my money. When holiday was cancelled , they wouldn't respond to calls or emails 2 months later eventually got to speak to someone online ,said I wasn't covered due to corona virus , we took out insurance three months before outbreak . still not going to honour their contract .have given up any chance of getting our money back. AVOID THIS COMPANY . (UNSCRUPULOUS SHOWER)

Date of experience : 11 June 2020

Dubious insurer

Insured for trip to Australia which was cancelled due to covid 19 upon the direction of the prime minister. And Australia's prime banning all persons not Australian nationals. On my first contact with said company they said that Corona virus was known about prior to my dates. They tried to ignore their responsibilities. However I do not give up easily. Continual emails and phone calls led them to offer me 50% refund. Not enough I replied. Referred to Insurance ombudsman.

Date of experience : 10 February 2021

Big Blue travel insurance offers BAGGAGE cover that it has no intention of paying out on. If your baggage is lost or delayed they have limits of cover on their policies, however they have no intention of honouring baggage claims. They push you away to the airline and quote you protocols, such as the Montreal protocol. Therefore i don't understand why they pretend to cover baggage if you MUST claim from the airline.....and have you actually tried claiming baggage from an airline???????!!

Date of experience : 26 January 2023

Great to deal with!!

Had to cancel our holiday a few weeks before depature, due to my wife having an accident. Spoke to a lovely lady on the phone who explained the procedure clearly and sent me the appropriate claim form. Within two days of sending the form and documents back, I was advised that my claim would be paid in full. Within a further two days, the money was in my account!!

Date of experience : 07 February 2020

Missed A Trick Here.

Like alot of comments below i also changed my holiday to next year, I was also told we can't change policy date to later than April 14th, best they offered me was a 'Goodwill gesture' of £8.93 return of my £27 i paid them, If they let us change dates instead of being greedy wanting money for nothing they would still have our custom, now none of these 1 stars would use or recommend them again, they've lost our custom and gained themselves a bad reputation. They'll no doubt change company name and carry on scamming.

Date of experience : 04 September 2020

Shocking company on all counts

Shocking company on all counts. Mislead you into buying policy with medical conditions disclosed and when paid for policy then inform you cover for these conditions is declined. Then can’t get refund as admin email address bounces back and telephone calls continually engaged. Even the compliance email address dies nit respond. I will be reporting to FCA. Avoid at all costs

Date of experience : 14 March 2020

asked if our travel cover could changed…

asked if our travel cover could changed to different dates due to havein to cancel because of corona virus. took them weeks to respond told me could not transfer cover to holidays after april 2021 . and only offered half our money back plus want a £5 admin fee.should be able to refund all our money . totally disgusting avoid this company

Date of experience : 03 July 2020

DO NOT buy the Big Blue Cover holiday…

DO NOT buy the Big Blue Cover holiday insurance. They fail to tell you that the excess is £199 per person per claim not £199 per claim when taking out the insurance. Absolutely useless and even though they knew I was claiming for 3 separate people, requested further information even though they knew it would be below their per person excess so that’s £468 lost! I will be taking out a new policy with a different company.

Date of experience : 13 March 2023

Won't pay for car after flight divert.

Because we had an internal flight in New Zealand diverted and no replacement flights were available until after our return flight to the UK would have left. We had to hire a car to drive from Auckland to Wellington we hired a car to drive the 400 miles and Big blue (non) cover have told us that they will not pay out for the car because it only covers missed departures to the UK. Even though we saved them money by doing this they refuse to reimburse us. Avoid look at the other reviews

Date of experience : 23 January 2020

Purchased travel insurance…

Purchased travel insurance forourholidaysin June 2020 . Our holiday was cancelled due to covid19 pandemic. We contacted Bigblue cover to request cancellation of our insurance cover. After several attempts to contact them via email and phone we never got a reply. They got £25 for absolutely nothing. They are quick enough to take your money but don't reply when asking for a refund. Definitely won't use them again and have told family and friends not to either

Date of experience : 17 June 2020

Worst insurance co I have ever dealt…

Worst insurance co I have ever dealt with. They take forever to answer emails , Ended up I got another insurance company as I had no reply from BIG BLUE as to what was happening , my holiday had been changed by a month on .I have lost money over them due to very poor communications blamed on the current situation according to them. I need to contact the OMBUSMAN.

Date of experience : 16 July 2020

If you are travelling abroad

I have started a Facebook group for those unsatisfied with BigBlue Cover. Look out for it. If you are travelling abroad, don't whatever you do get covered by Big Blue Travel Insurance. They are absolute rubbish. Having taking your payment, they refuse to answer their phones when you ring. Ruth just waited a completed half hour - which will be on our phone bill - and no answer. And we have just got a message that they will not pay for any insurance that is cancelled because of coronavirus.

Date of experience : 26 June 2020

Racketeers. Avoid, avoid, avoid.

Basically a scammy/fraudulent company that opt you in to renewals without permission and then refuse to answer contacts. Renewals can only be removed through a link buried in their FAQs. Should be prosecuted Link is here: rockinsurance dot com forward slash autorenew Although I have no confirmation of any kind that the policy has even been removed.

Date of experience : 11 January 2021

Pity anyone who has to make a claim…

Pity anyone who has to make a claim through this company, do they actually exist? I went through Money Supermarket, trusting them, then after read so many reviews on Trustpilot that I decided to cancel. Four e mails later, numerous phone calls and a letter later, I still cant get a reply. They tell you to use live chat and there is none. Good luck.

Date of experience : 19 March 2020

WARNING - If you chose to go on your holiday to a destination where there is a FCO warning in place you will not be covered.... HOWEVER this is NOT a valid reason to be able claim cancellation costs even if your holiday was booked weeks before this happening?!!!!! So basically we have been told you can not go on your holiday and we also will not help pay towards the cancellation costs. (Note- we also had premium cover the highest that they provide) STAY CLEAR FROM BIG BLUE COVER! Thank you for completely destroying our once in a life time honeymoon.

Date of experience : 30 August 2018

Wished I'd checked this site before paying…

Wished Id check this site before paying for cover. Seemed too cheap to be true???? No communications once policy issued, no response to emails, no confidence they would provide service if needed but can't cancel. Today 19.7.2022 website not reachable??? and no FB page either. DONT RISK IT!!!

Date of experience : 19 July 2022

Sick in Vietnam

In March 2018 I got very sick with the flu, bronchitis and sinus while on holiday in Vietnam. The service I received from Bigbluecover was nothing short of amazing. They arranged for me to be moved into a room without stairs, arranged and paid for my return flight back to the UK, paid for my hotel room and I had telephone support from a nurse checking up on my recovery throughout my illness. I didn't have to worry about anything and I felt very supported at a time when I needed it the most.

Date of experience : 19 March 2019

Completely agree with the hopeless…

Completely agree with the hopeless customer service. They never answer the phone. I am being told after an hour of holding at 11am in the morning that the 'lines are due to close soon' and to call back tomorrow. Given this is the second whoel day I have been on the call this seems somewhat unbelievable. GEt some new staff or enabel changes on line I won't be renewing here

Date of experience : 12 August 2022

This site uses cookies to deliver its services and analyze traffic.

More Details OK

- Pet Insurance

- Compare Pet Insurance

- Compare Time Limited Pet Insurance

- Compare Maximum Benefit Pet Insurance

- Compare Lifetime Pet Insurance

- Compare Accident Only Pet Insurance

- Compare Dog Insurance

- Compare Cat Insurance

- Compare Multi-Pet Insurance

- Pet Insurance News

- Travel Insurance

- Compare Travel Insurance

- Travel Insurance News

- Home Insurance

- Compare Home Insurance

- Compare Contents Insurance

- Compare Buildings Insurance

- Home Insurance News

- Health Insurance

- Compare Health Insurance

- Health Insurance News

- Life Insurance

- Compare Life Insurance

- Compare Level Term Life Insurance

- Compare Decreasing Term Life Insurance

- Life Insurance News

- Bicycle Insurance

- Compare Bicycle Insurance

- Compare Electric Bicycle Insurance

- Compare Folding Bicycle Insurance

- Compare Mountain Bicycle Insurance

- Compare Road Bicycle Insurance

- Bicycle Insurance News

- App-Based Bank

- Compare App-Based Bank

- App-Based Bank News

- Current Accounts

- Compare Current Accounts

- Current Accounts News

- Dog Insurance

- Cat Insurance

- Accident Only

- Multi-Pet Insurance

- Maximum Benefit

- Insurance Providers

- Pet Protect

- English Springer Spaniel

- Labradoodle

- Provider v Provider

- Compare Pet Insurance Plans

- Start a Quote

Big Blue Cover Reviews

During these unprecedented times, BigBlueCover.com is creating policies to ensure they’re flexible for their customers needs

- Service (0)

- Renewals (0)

- 87 reviews found on websites such as TrustPilot

- £10m limit for medical cover

- £5k cancellation cover limit

- Claims (0),

- Service (0),

- Renewal (0)

No Reviews Found

Quotes our team received.

Trip Details

7 nights in Spain

Single Trip Quote

Medical cover limit, cancellation cover limit.

Worldwide cover including USA

Annual Trip Quote

Travel insurance guides.

Check out our insurance guides for more information

Suggested companies

Insurefor.com, admiral insurance, leisureguardinsurance.

Bigbluecover Reviews

In the Money & Insurance category

Visit this website

Company activity See all

Write a review

Reviews 1.5.

Most relevant

Awful!!! Zero help from customer service. The information provided in my policy document was out of date and the number I was told to call for emergencies ended up not working after I was stranded without a flight in my layover destination. Apparently they don't cover journeys that include a connecting flight - something that they don't tell you when you buy the insurance!!

Date of experience : 05 February 2023

I can confirm I got all my money back

I can confirm I got all my money back 419£ ! Car rental company had charged me for small scratches and luckily I had reactive claims (big blue insurance company), it took about 15 days to get confirmation email that I'm getting my money back and then after another 4 days I got it. It took longer for them to proceed as they had asked me further documents and photo of the scratches after 7 days. I guess most people either not providing proper documents or mostly people leave negatives reviews having bad experience, when you have good experience, usually we don't leave good reviews.

Date of experience : 06 August 2019

AVOID THIS COMPANY AT ALL COSTS THEY DO NOT PAY OUT

Am insulted that I have to leave 1 star for a imbomidable insurance company whose policies aren’t worth the paper it’s written on. They refused to pay out for three flights cancelled by the airlines and nearly £3k out of pocket but the will pay out if it is delayed plus use COVID as an excuse not to pay out. Biggest load of tosh avoid, avoid, avoid.

Date of experience : 06 November 2020

We bought our travel insurance on 2nd…

We bought our travel insurance on 2nd January for our 2 week holiday in Greece on 10th to 24th June.Due to the coronavirus, Jet 2 cancelled our holiday and immediately refunded the full amount of our holiday. ABSOLUTELY BRILLIANT AND WE WILL BE USING JET 2 NEXT YEAR. However, I have spent the past 3 weeks trying to contact Big Blue Cover in an attempt to get a refund (£82.75) on my Insurance. I've tried phoning only to be told by a robot to go on the website for an online chat (does not exist), multiple emails non of which have been answered. They appear to be a typical insurance company whereby all they want is your money for no returned service.

Date of experience : 01 June 2020

Wanted to upgrade my policy to…

Wanted to upgrade my policy to Worldwide cover for an up and coming holiday - tried several time to contact them with no success. You can't get through, left hanging on the phone for ages and on several occasions the call just dropped, one of which due to the 7pm watershed for the call centre closing! So we can only assume if I had to make a claim it would hell. AVOID THIS INSURANCE MIDDLE MAN.

Date of experience : 23 January 2019

I would never use this company again…

I would never use this company again because the service is unbelievably bad. I’ve been trying to change my travel dates but they don’t answer the phone because their dialling system to speak to the right department has been disconnected. I’ve emailed them several times but no one gets back to you. It’s a big con and they should be held to task. I will be contacting the ombudsman to complain. DO NOT USE THIS COMPANY!!!!

Date of experience : 04 December 2020

Fast claim settlement

After having to cancel trip to Australia due to family illness,Big Blue insurance have made up the penalty cost imposed. Claim took 10 days, really impressed and will use again

DIABOLICAL COMPANY AND HAVE COMPLAINED TO OMBUDSMEN

This company is the most diabolical I have ever had the misfortune to deal with. Not a cent back after having 3 flights cancelled plus other losses in the US at the beginning of COVIID. Other company policies were Compensating for cancelled flights but not this one. Thank god we didnt get ill whilst away. Absolutely appalled and I would avoid this company like the plague. Never felt so disgusted.

Date of experience : 05 August 2020

oh dear - shambles of a company using a provider for GLOBAL RESPONSE , DO NOY USE THESE PEOPLE - I am unsure how they have managed get such a star rating .... 10 weeks to settle a claim and then take above and beyond the excess in the final payout. The ethics and morals of a pay day lender !!!!!!!

Date of experience : 25 February 2018

Literally the most uncontactable…

Literally the most uncontactable company ever ! I purchased a policy months ago and have been trying to contact them to make an amendment morning, noon and night with no reply from any numbers. I put in an official complaint and was told to expect a response in 4 weeks, then exactly 4 weeks later I get another e mail saying it will be another 4 weeks. Are these guys for real ! My holiday will be over by then. God help us if we need to contact them in an emergency. I’m literally flabbergasted as to how they can get away with this. I’m now contemplating taking out another policy as this company is so unreliable. Don’t purchase a policy from them, you may regret it. I wish I’d read the reviews first, seems this is a common theme

Date of experience : 03 August 2022

Avoid this company

Avoid this company - Short Term travel insurance was purchased and holiday was cancelled by Jet 2 - rearranged holiday for next year and thought all i had to do was contact Big Blue Cover to change the dates. Advised policy had to be cancelled and would only return 50% of the premium i had paid. I asked why to be advised that in the event of cancellation the policy was in force from date of purchase even though my holiday was not until month later. I raised a complaint 6 weeks ago and not had a response - what chance have i got if they are not even following the correct complaints process that they have set in place. Avoid

Date of experience : 27 July 2020

They do not even do their own car insurance

They do not even do their own car insurance cover. It is another company called Reactive claims. Be prepared to be hung up on by staff there and every time they request an extra document off you it takes 5 to 10 working days for them to even look at it. Painful and rude staff. Go with anyone else!

Date of experience : 30 August 2019

Auto renew but cannot contact to stop it

Been told my policy will auto renew, so tried to contact on email address given which is for ROCK INSURANCE and website will not load, tried phoning BIG BLUE COVER and kept on hold for excessively long time. Beginning to think this is just one big scam. How am I supposed to put in a claim if it occurs if there is no contact. Won’t be using them again. SCAMMERS

Date of experience : 21 March 2020

Avoid at all costs

This company auto-renewed my annual car hire excess policy with no prior warning. I have been trying to get in touch with them for weeks to cancel the renewed policy but there is no way to contact them. All of the phone numbers take you to a menu but then you can't get any further as it doesn't register when you select a menu option. It feels like a total scam.

Date of experience : 06 October 2020

Took out holiday insurance back in Jan

Took out holiday insurance back in Jan. this year for a holiday in October. Attempted to contact Bigblue to clarify my cover, very long wait on the telephone on my 1st attempt, sent 2 e-mails - no response, tried on line chat-not working, 2nd attempt on the telephone managed to speak to someone who then told me basically i am not covered for cancellation. This company is a complete waste of money and would never use them again as judging by other reviews not many will,

Date of experience : 21 September 2020

Lack of customer service

Lack of customer service I have Tried to contact big blue on several occasions (by phone and email) and have been unable to get anyone to answer my emails (first one sent over a month ago) or telephone calls (the longest I waited was over two hours) not sure what to do next

Date of experience : 05 June 2020

Buyers beware!!!!!!!!…

Worst company ever auto renew bordering on fraudulent phone them and expect to be on hold over an hour try to cancel online and they don't recognize your policy number or details this is a well rehearsed con Be very careful about dealing with this company

Date of experience : 08 September 2021

don't cover hurricanes/storms under curtailment

I took out holiday insurance for a trip to America. Two days into my holiday it was cut short because of a hurricane. It was a terrible time, fleeing to another part for saftey. no electicity or hot water anywhere. Managed to get an earlier flight home (a week early). I put in a claim for the days our holiday was cut short by and was told under their curtailment reason , hurricane wasn't covered. When I questioned it , it said "storm in your home", I assumed that was the my home for a fortnight. In their glossary of word "home" meant your current home in the uk. They couldn't make it more complicated if they tried. The FOM sided with them but the most annoying part is the other 4 people that travelled with me were compensated by their insurance companies. It's just not fair. Beware to read the small print folks. I won't be going with these again.

Date of experience : 16 March 2023

Just glad I didn't need their services…

Just glad I didn't need their services on a holiday! I took out annual insurance on March 1st, have tried to contact them about a claim for the deposit I lost. As everyone else has said they don't answer the phone , they don't reply to e mail and the online chat is joke. I hope this all causes them to cease trading as they are just thieves!

Date of experience : 14 June 2020

Spam emails

I have started receiving unsolicited marketing emails from this company. I have asked them to stop, I have also asked how they obtained my details as I have never been in contact with them; so far both requests have been ignored. I can't comment on their product as I've never used it but based on this experience I never will and they rightly deserve 1 star.

Date of experience : 28 February 2020

Big Blue Travel Insurance Review

Everything you need to know before you buy travel insurance from Big Blue!

The experts say:

As an experienced traveller, I'm always looking for the best protection when I'm away. Big Blue's Premier Cover travel insurance looks pretty good - it scored a solid 61% with Which?, giving it a ranking of 59 out of 71 providers. It includes superior Covid cover, and covers medical expenses up to £1,000,000 - but unfortunately there's no cover for airline failure. The baggage cover stands at £2,500 and the cancellation cover is £5,000. Excess payable on medical claims is £99. Finally, Fairer Finance rated it 2 stars - not bad, but could be better! All in all, Big Blue's Premier Cover looks like a decent option for your next trip.

What Big Blue customers are saying right now:

- 🤩 Great cover limits on baggage

- 😊 Push customers to airlines for protocols

- 😃 Low prices for cover

- 🙂 Website and Facebook page available

- 🤗 Link to cancel renewals in FAQs

- 😡 Big Blue has no intention of paying out on BAGGAGE cover

- 😡 Appalling customer service - long wait times on the phone and no response to emails

- 😡 Fraudulent company - opt you in to renewals without permission and then refuse to answer contacts

Big Blue customer reviews summary

Big Blue travel insurance is an absolute disaster. From its dishonest baggage cover to its appalling communication, this company should be avoided at all costs. With customers unable to access their website and other customers reporting that they are scammed into unwanted renewals and are unable to get in touch with customer service, Big Blue travel insurance has earned itself a score of 0/10.

AllClear Travel Insurance Review

Everything you need to know before you buy travel insurance from AllClear!

Co-op Insurance Services Travel Insurance Review

Everything you need to know before you buy travel insurance from Co-op Insurance Services!

Covered2Go Travel Insurance Review

Everything you need to know before you buy travel insurance from Covered2Go!

Reviewed: 100+ UK travel insurance providers

- Privacy Policy

- Car Insurance Reviews

- Pet Insurance Reviews

- Home Insurance Reviews

Copyright © 2023 TravelInsuranceReview.co.uk

You are using an outdated browser. Please upgrade your browser to improve your experience.

No results found

Try adjusting your search to see more results.

A company can partner with Smart Money People and invite their verified customers to leave a review. When they do this it’s labelled as "Verified source" on the Smart Money People website.

There are a number of automated invitation techniques available to businesses. All of which are trusted and ensure that only verified customers can leave reviews through them.

Big Blue Cover: Travel Insurance reviews

No new 5 star reviews, no new 1 star reviews, latest highest rating:.

Latest lowest rating:

About the Travel Insurance

Our Big Blue Cover Travel Insurance reviews can help you to find out what life as a Big Blue Cover customer is really like. And if you have experience of using this product, why not write your review on Smart Money People today?

Review Big Blue Cover: Travel Insurance now

Big blue cover travel insurance reviews ( 4 ), don't answer the phone, charged twice for excess refused to pay expenses due to accident, cant claim personal accident as i'm not dead or lost a limb.

Poor provider

blue cover is the most travel insurace companys

Showing 4 of 4

Join Smart Money People

Keep up to date on ratings of your favourite businesses. Find out about our awards and write new reviews with ease

News, guides and insight from our team

The impact of not collecting customer reviews

First time buyer guide to mortgages: what you should know before buying a property

.png)

The hidden costs of home ownership

How customer reviews can help with SEO

Bigbluecover Reviews

In the Money & Insurance category

Visit this website

Company activity See all

Write a review

Reviews 1.5.

Most relevant

Should be closed down

Should be closed down. Incompetent, does not provide literate response to simple questions. It seems it is just an operation to entice customers to another bad egg, which is called Reactive claims. Avoid both at all cost.

Date of experience : 08 November 2023

Won’t be using this company again

Called up and woman was very confused by what I was asking ….didn’t seem like she knew what she was talking about. Very disappointed! Won’t be using this company again

Date of experience : 09 October 2023

absolute crooks

absolute crooks , took my money. When holiday was cancelled , they wouldn't respond to calls or emails 2 months later eventually got to speak to someone online ,said I wasn't covered due to corona virus , we took out insurance three months before outbreak . still not going to honour their contract .have given up any chance of getting our money back. AVOID THIS COMPANY . (UNSCRUPULOUS SHOWER)

Date of experience : 11 June 2020

Dubious insurer

Insured for trip to Australia which was cancelled due to covid 19 upon the direction of the prime minister. And Australia's prime banning all persons not Australian nationals. On my first contact with said company they said that Corona virus was known about prior to my dates. They tried to ignore their responsibilities. However I do not give up easily. Continual emails and phone calls led them to offer me 50% refund. Not enough I replied. Referred to Insurance ombudsman.

Date of experience : 10 February 2021

Big Blue travel insurance offers BAGGAGE cover that it has no intention of paying out on. If your baggage is lost or delayed they have limits of cover on their policies, however they have no intention of honouring baggage claims. They push you away to the airline and quote you protocols, such as the Montreal protocol. Therefore i don't understand why they pretend to cover baggage if you MUST claim from the airline.....and have you actually tried claiming baggage from an airline???????!!

Date of experience : 26 January 2023

Great to deal with!!

Had to cancel our holiday a few weeks before depature, due to my wife having an accident. Spoke to a lovely lady on the phone who explained the procedure clearly and sent me the appropriate claim form. Within two days of sending the form and documents back, I was advised that my claim would be paid in full. Within a further two days, the money was in my account!!

Date of experience : 07 February 2020

Missed A Trick Here.

Like alot of comments below i also changed my holiday to next year, I was also told we can't change policy date to later than April 14th, best they offered me was a 'Goodwill gesture' of £8.93 return of my £27 i paid them, If they let us change dates instead of being greedy wanting money for nothing they would still have our custom, now none of these 1 stars would use or recommend them again, they've lost our custom and gained themselves a bad reputation. They'll no doubt change company name and carry on scamming.

Date of experience : 04 September 2020

Shocking company on all counts

Shocking company on all counts. Mislead you into buying policy with medical conditions disclosed and when paid for policy then inform you cover for these conditions is declined. Then can’t get refund as admin email address bounces back and telephone calls continually engaged. Even the compliance email address dies nit respond. I will be reporting to FCA. Avoid at all costs

Date of experience : 14 March 2020

asked if our travel cover could changed…

asked if our travel cover could changed to different dates due to havein to cancel because of corona virus. took them weeks to respond told me could not transfer cover to holidays after april 2021 . and only offered half our money back plus want a £5 admin fee.should be able to refund all our money . totally disgusting avoid this company

Date of experience : 03 July 2020

DO NOT buy the Big Blue Cover holiday…

DO NOT buy the Big Blue Cover holiday insurance. They fail to tell you that the excess is £199 per person per claim not £199 per claim when taking out the insurance. Absolutely useless and even though they knew I was claiming for 3 separate people, requested further information even though they knew it would be below their per person excess so that’s £468 lost! I will be taking out a new policy with a different company.

Date of experience : 13 March 2023

Won't pay for car after flight divert.

Because we had an internal flight in New Zealand diverted and no replacement flights were available until after our return flight to the UK would have left. We had to hire a car to drive from Auckland to Wellington we hired a car to drive the 400 miles and Big blue (non) cover have told us that they will not pay out for the car because it only covers missed departures to the UK. Even though we saved them money by doing this they refuse to reimburse us. Avoid look at the other reviews

Date of experience : 23 January 2020

Purchased travel insurance…

Purchased travel insurance forourholidaysin June 2020 . Our holiday was cancelled due to covid19 pandemic. We contacted Bigblue cover to request cancellation of our insurance cover. After several attempts to contact them via email and phone we never got a reply. They got £25 for absolutely nothing. They are quick enough to take your money but don't reply when asking for a refund. Definitely won't use them again and have told family and friends not to either

Date of experience : 17 June 2020

Worst insurance co I have ever dealt…

Worst insurance co I have ever dealt with. They take forever to answer emails , Ended up I got another insurance company as I had no reply from BIG BLUE as to what was happening , my holiday had been changed by a month on .I have lost money over them due to very poor communications blamed on the current situation according to them. I need to contact the OMBUSMAN.

Date of experience : 16 July 2020

If you are travelling abroad

I have started a Facebook group for those unsatisfied with BigBlue Cover. Look out for it. If you are travelling abroad, don't whatever you do get covered by Big Blue Travel Insurance. They are absolute rubbish. Having taking your payment, they refuse to answer their phones when you ring. Ruth just waited a completed half hour - which will be on our phone bill - and no answer. And we have just got a message that they will not pay for any insurance that is cancelled because of coronavirus.

Date of experience : 26 June 2020

Racketeers. Avoid, avoid, avoid.

Basically a scammy/fraudulent company that opt you in to renewals without permission and then refuse to answer contacts. Renewals can only be removed through a link buried in their FAQs. Should be prosecuted Link is here: rockinsurance dot com forward slash autorenew Although I have no confirmation of any kind that the policy has even been removed.

Date of experience : 11 January 2021

Pity anyone who has to make a claim…

Pity anyone who has to make a claim through this company, do they actually exist? I went through Money Supermarket, trusting them, then after read so many reviews on Trustpilot that I decided to cancel. Four e mails later, numerous phone calls and a letter later, I still cant get a reply. They tell you to use live chat and there is none. Good luck.

Date of experience : 19 March 2020

WARNING - If you chose to go on your holiday to a destination where there is a FCO warning in place you will not be covered.... HOWEVER this is NOT a valid reason to be able claim cancellation costs even if your holiday was booked weeks before this happening?!!!!! So basically we have been told you can not go on your holiday and we also will not help pay towards the cancellation costs. (Note- we also had premium cover the highest that they provide) STAY CLEAR FROM BIG BLUE COVER! Thank you for completely destroying our once in a life time honeymoon.

Date of experience : 30 August 2018

Wished I'd checked this site before paying…

Wished Id check this site before paying for cover. Seemed too cheap to be true???? No communications once policy issued, no response to emails, no confidence they would provide service if needed but can't cancel. Today 19.7.2022 website not reachable??? and no FB page either. DONT RISK IT!!!

Date of experience : 19 July 2022

Sick in Vietnam

In March 2018 I got very sick with the flu, bronchitis and sinus while on holiday in Vietnam. The service I received from Bigbluecover was nothing short of amazing. They arranged for me to be moved into a room without stairs, arranged and paid for my return flight back to the UK, paid for my hotel room and I had telephone support from a nurse checking up on my recovery throughout my illness. I didn't have to worry about anything and I felt very supported at a time when I needed it the most.

Date of experience : 19 March 2019

Completely agree with the hopeless…

Completely agree with the hopeless customer service. They never answer the phone. I am being told after an hour of holding at 11am in the morning that the 'lines are due to close soon' and to call back tomorrow. Given this is the second whoel day I have been on the call this seems somewhat unbelievable. GEt some new staff or enabel changes on line I won't be renewing here

Date of experience : 12 August 2022

HelloSafe » Travel Insurance » Reviews by Travel Insurance Companies » Big Blue Cover Travel Insurance

Big Blue Cover Travel Insurance Review and Quotes

verified information

Information verified by Adeline Harmant

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

Table of Contents

It might be the least exciting thing about your journey. But travel insurance is a must-have when it comes to getting assistance from the other side of the world.

Are you aware of this and are here to know whether Big Blue Cover is the right company to go on holidays with?

In this definitive Big Blue Cover review, we will tell you everything you need to know about their travel insurance policies: coverage options, prices, contact details, cancellation or claim process and much more. Let’s dive in!

Is Big Blue Cover the best travel insurance for you?

Always just going for the cheapest travel insurance might not be the best option when it comes to getting assistance or a refund abroad.

At Safe, we strive to help any people travelling from the UK to get the best travel insurance to leave home with complete peace of mind. This is why we’ve dug into Big Blue Cover travel insurance policy booklet and attributed our own neutral rating based on five weighted criteria as shown below.

4 Safe overall rating for Big Blue Cover

Big Blue Cover travel insurance reviews by expert and consumers

To check if Big Blue Cover is the right travel insurance for you, you can use our free travel insurance comparison tool and get quotes from main travel insurance companies in a few seconds only. 100% anonymous and free.

Find the best travel insurance in just a few seconds!

What does Big Blue Cover travel insurance cover?

Big Blue Cover travel insurance offers different travel insurance covers to suit any traveller needs, whether you’re leaving for three days alone in Scotland or six months in Antarctica with your partner or whole family.

The insurance cover that Big Blue Cover Travel provides is available to individuals, couples, family, single parent family and a group of people. For the Couple's travel option, discounts are provided for couples who have lived together for up to six months. The discounts provided are not specified. For the family option, family discounts are offered to suit the budgets and children under the age of 18 are provided cover for free.

Big Blue Cover single-trip and annual multi-trip travel insurances

You will find below the limits breakdown per level of cover for single and annual multi-trip insurance policies at Big Blue Cover:

Big Blue Cover winter sports travel insurancet

The winter sports travel insurance is usually an option that you can take on top of your single or annual multi-trip policy.

The Winter cover option provided by Big Blue Cover Travel Insurance includes the following:

- Up to £1,000 cover in the case that the Ski equipment is damaged, lost or stolen (if it is owned by the traveller)

- Up to £500 cover in the case that the Ski equipment is damaged, lost or stolen (if it is not owned by the traveller)

- Cover in the case that the Ski pass is lost or stolen

- Up to £500 cover in the event that there is an avalanche and as a result of this, the resort is closed.

What are the other travel insurance options available at Big Blue Cover?

Due to Brexit, some outbound flights from international airports might be delayed or cancelled. We would advise you to call Big Blue Cover before travelling and make sure you get the right compensation amount for your flight or journey if it is cancelled or delayed as well as for Schedule Airline Failure Cover.

How much is Big Blue Cover travel insurance?

You'll find below indicative quotes per level of cover at Big Blue Cover:

It is, however, quite difficult to give precise price ranges as Big Blue Cover travel insurance policy quotes will depend on a range of factors such as:

- Your age at the time of travelling

- The length of your stay

- Your trip destination (Europe, North America, Worldwide)

- The period you wish to be covered for (single trip, annual multi-trip, extension)

- If you need specific insurance (cruise, ski, backpackers, gadget cover)

- Your medical condition before travelling

- Who is travelling with you (on your own, as a couple, as a family).

Can I get travel insurance discounts or promo codes at Big Blue Cover?

Yes. A 10% discount is offered with the promo code: BLUE10 on the website.

Use our travel insurance comparison tool to be aware of latest promo codes and vouchers available at Big Blue Cover.

What else should I know about Big Blue Cover travel insurance?

What are the general exclusions at big blue cover travel insurance.

To be eligible for a Big Blue Cover Travel insurance policy, you need to meet various criteria. Among general exclusions that will not lead to financial compensation for the policyholder, some of the exclusions are:

- Any claim made for medical expense where you have not declared a diagnosis at the time of purchasing the policy or that you are travelling against the advice of a medical practitioner

- Pregnancy and childbirth complications while travelling

- Any claim made as a result of war or natural disaster, whether it concerns baggage and belongings or trip cancellation, delays, accommodation etc.

- Accidents caused as a result of being under the influence of alcohol or drugs

- Any claim made as a result of illegal or hazardous activity

- Any claim made as a result of extreme sports unless the appropriate upgrade has been paid

- Any claim made as a result of you not getting a particular vaccination especially as a pregnant woman

How do I get travel insurance quote from Big Blue Cover?

Nothing easier. Use our 100% online travel insurance comparison tool to compare all policies in just a few seconds, without giving any personal details. If Big Blue Cover is the right one for you, then just click on get quote and you'll be automatically directed through the company's sale channel.

Good to know

Shopping around while shopping for personal insurance and not auto-renewing is always the best way to get the best deal and benefit from new customers discounts.

How do I log in to Big Blue Cover website?

There is no login option on the Big Blue Cover Travel Insurance Website.

How to claim at Big Blue Cover travel insurance?

At Big Blue Cover Travel Insurance, a claim can be made by calling the listed number, sending an email or online by downloading the claims form.

How do I contact Big Blue Cover travel insurance?

Big blue cover contact phone numbers, big blue cover other contact details, how to cancel your annual big blue cover travel insurance policy.

You will find below main information to cancel your travel insurance policy at Big Blue Cover:

Our opinion on Big Blue Cover travel insurance

Big Blue Cover Insurance is under the ROCK Insurance Group, which has been providing customers with travel insurance for over 15 years. They are located in the South East of England, and since its inception, they have insured more than 1 million customers. Their insurance policies are underwritten by Bulstrad Life Vienna Insurance Group JSC.

Big Blue Cover Insurance offers a variety of travel insurance services including cover for Cruises, Winter Sports and Gadgets. Their insurance policy is divided into the single trip policy and the annual trip policy. For both policy options, three levels of cover are provided: Economy, Standard and Premier. On both the Single and Multi trip policies, a sum of £5,000 is provided for cancellation, £2,500 for luggage protection and medical cover of up to £10 million and they are all offered as a standard on both policies.

The company however has a poor rating of 1.8 on TrustPilot and most of the reviews recorded centered around how long it took for them to pay out claims and their overall nonchalance when relating to customers.

Their online service is commendable and the rates offered are affordable but based on the comments recorded on review websites, their customer service seems to be poor.

Alexandre Desoutter has been working as editor-in-chief and head of press relations at HelloSafe since June 2020. A graduate of Sciences Po Grenoble, he worked as a journalist for several years in French media, and continues to collaborate as a as a contributor to several publications. In this sense, his role leads him to carry out steering and support work with all HelloSafe editors and contributors so that the editorial line defined by the company is fully respected. and declined through the texts published daily on our platforms. As such, Alexandre is responsible for implementing and maintaining the strictest journalistic standards within the HelloSafe editorial staff, in order to guarantee the most accurate, up-to-date information on our platforms. and expert as possible. Alexandre has in particular undertaken for two years now the implementation of a system of systematic double-checking of all the articles published within the HelloSafe ecosystem, able to guarantee the highest quality of information.

Suggested companies

Insurefor.com, admiral insurance, leisureguardinsurance.

Bigbluecover Reviews

In the Money & Insurance category

Visit this website

Company activity See all

Write a review

Reviews 1.5.

Most relevant

Should be closed down

Should be closed down. Incompetent, does not provide literate response to simple questions. It seems it is just an operation to entice customers to another bad egg, which is called Reactive claims. Avoid both at all cost.

Date of experience : November 08, 2023

Won’t be using this company again

Called up and woman was very confused by what I was asking ….didn’t seem like she knew what she was talking about. Very disappointed! Won’t be using this company again

Date of experience : October 09, 2023

absolute crooks

absolute crooks , took my money. When holiday was cancelled , they wouldn't respond to calls or emails 2 months later eventually got to speak to someone online ,said I wasn't covered due to corona virus , we took out insurance three months before outbreak . still not going to honour their contract .have given up any chance of getting our money back. AVOID THIS COMPANY . (UNSCRUPULOUS SHOWER)

Date of experience : June 11, 2020

Dubious insurer

Insured for trip to Australia which was cancelled due to covid 19 upon the direction of the prime minister. And Australia's prime banning all persons not Australian nationals. On my first contact with said company they said that Corona virus was known about prior to my dates. They tried to ignore their responsibilities. However I do not give up easily. Continual emails and phone calls led them to offer me 50% refund. Not enough I replied. Referred to Insurance ombudsman.

Date of experience : February 10, 2021

Big Blue travel insurance offers BAGGAGE cover that it has no intention of paying out on. If your baggage is lost or delayed they have limits of cover on their policies, however they have no intention of honouring baggage claims. They push you away to the airline and quote you protocols, such as the Montreal protocol. Therefore i don't understand why they pretend to cover baggage if you MUST claim from the airline.....and have you actually tried claiming baggage from an airline???????!!

Date of experience : January 26, 2023

Great to deal with!!

Had to cancel our holiday a few weeks before depature, due to my wife having an accident. Spoke to a lovely lady on the phone who explained the procedure clearly and sent me the appropriate claim form. Within two days of sending the form and documents back, I was advised that my claim would be paid in full. Within a further two days, the money was in my account!!

Date of experience : February 07, 2020

Missed A Trick Here.

Like alot of comments below i also changed my holiday to next year, I was also told we can't change policy date to later than April 14th, best they offered me was a 'Goodwill gesture' of £8.93 return of my £27 i paid them, If they let us change dates instead of being greedy wanting money for nothing they would still have our custom, now none of these 1 stars would use or recommend them again, they've lost our custom and gained themselves a bad reputation. They'll no doubt change company name and carry on scamming.

Date of experience : September 04, 2020

Shocking company on all counts

Shocking company on all counts. Mislead you into buying policy with medical conditions disclosed and when paid for policy then inform you cover for these conditions is declined. Then can’t get refund as admin email address bounces back and telephone calls continually engaged. Even the compliance email address dies nit respond. I will be reporting to FCA. Avoid at all costs

Date of experience : March 14, 2020

asked if our travel cover could changed…

asked if our travel cover could changed to different dates due to havein to cancel because of corona virus. took them weeks to respond told me could not transfer cover to holidays after april 2021 . and only offered half our money back plus want a £5 admin fee.should be able to refund all our money . totally disgusting avoid this company

Date of experience : July 03, 2020

DO NOT buy the Big Blue Cover holiday…

DO NOT buy the Big Blue Cover holiday insurance. They fail to tell you that the excess is £199 per person per claim not £199 per claim when taking out the insurance. Absolutely useless and even though they knew I was claiming for 3 separate people, requested further information even though they knew it would be below their per person excess so that’s £468 lost! I will be taking out a new policy with a different company.

Date of experience : March 13, 2023

Won't pay for car after flight divert.

Because we had an internal flight in New Zealand diverted and no replacement flights were available until after our return flight to the UK would have left. We had to hire a car to drive from Auckland to Wellington we hired a car to drive the 400 miles and Big blue (non) cover have told us that they will not pay out for the car because it only covers missed departures to the UK. Even though we saved them money by doing this they refuse to reimburse us. Avoid look at the other reviews

Date of experience : January 23, 2020

Purchased travel insurance…

Purchased travel insurance forourholidaysin June 2020 . Our holiday was cancelled due to covid19 pandemic. We contacted Bigblue cover to request cancellation of our insurance cover. After several attempts to contact them via email and phone we never got a reply. They got £25 for absolutely nothing. They are quick enough to take your money but don't reply when asking for a refund. Definitely won't use them again and have told family and friends not to either

Date of experience : June 17, 2020

Worst insurance co I have ever dealt…

Worst insurance co I have ever dealt with. They take forever to answer emails , Ended up I got another insurance company as I had no reply from BIG BLUE as to what was happening , my holiday had been changed by a month on .I have lost money over them due to very poor communications blamed on the current situation according to them. I need to contact the OMBUSMAN.

Date of experience : July 16, 2020

If you are travelling abroad

I have started a Facebook group for those unsatisfied with BigBlue Cover. Look out for it. If you are travelling abroad, don't whatever you do get covered by Big Blue Travel Insurance. They are absolute rubbish. Having taking your payment, they refuse to answer their phones when you ring. Ruth just waited a completed half hour - which will be on our phone bill - and no answer. And we have just got a message that they will not pay for any insurance that is cancelled because of coronavirus.

Date of experience : June 26, 2020

Racketeers. Avoid, avoid, avoid.

Basically a scammy/fraudulent company that opt you in to renewals without permission and then refuse to answer contacts. Renewals can only be removed through a link buried in their FAQs. Should be prosecuted Link is here: rockinsurance dot com forward slash autorenew Although I have no confirmation of any kind that the policy has even been removed.

Date of experience : January 11, 2021

Pity anyone who has to make a claim…

Pity anyone who has to make a claim through this company, do they actually exist? I went through Money Supermarket, trusting them, then after read so many reviews on Trustpilot that I decided to cancel. Four e mails later, numerous phone calls and a letter later, I still cant get a reply. They tell you to use live chat and there is none. Good luck.

Date of experience : March 19, 2020

WARNING - If you chose to go on your holiday to a destination where there is a FCO warning in place you will not be covered.... HOWEVER this is NOT a valid reason to be able claim cancellation costs even if your holiday was booked weeks before this happening?!!!!! So basically we have been told you can not go on your holiday and we also will not help pay towards the cancellation costs. (Note- we also had premium cover the highest that they provide) STAY CLEAR FROM BIG BLUE COVER! Thank you for completely destroying our once in a life time honeymoon.

Date of experience : August 30, 2018

Wished I'd checked this site before paying…

Wished Id check this site before paying for cover. Seemed too cheap to be true???? No communications once policy issued, no response to emails, no confidence they would provide service if needed but can't cancel. Today 19.7.2022 website not reachable??? and no FB page either. DONT RISK IT!!!

Date of experience : July 19, 2022

Sick in Vietnam

In March 2018 I got very sick with the flu, bronchitis and sinus while on holiday in Vietnam. The service I received from Bigbluecover was nothing short of amazing. They arranged for me to be moved into a room without stairs, arranged and paid for my return flight back to the UK, paid for my hotel room and I had telephone support from a nurse checking up on my recovery throughout my illness. I didn't have to worry about anything and I felt very supported at a time when I needed it the most.

Date of experience : March 19, 2019

Completely agree with the hopeless…

Completely agree with the hopeless customer service. They never answer the phone. I am being told after an hour of holding at 11am in the morning that the 'lines are due to close soon' and to call back tomorrow. Given this is the second whoel day I have been on the call this seems somewhat unbelievable. GEt some new staff or enabel changes on line I won't be renewing here

Date of experience : August 12, 2022

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

GeoBlue Travel Insurance Review: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does GeoBlue travel insurance offer?

Geoblue travel insurance cost and coverage, what isn’t covered, how to choose a geoblue plan online, is geoblue travel insurance worth it.

- Flexible deductible options.

- Wide ranging medical coverage.

- Low prices for medical only needs.

- Lacks in traditional travel insurance coverage options such as trip Interruption, bag delays, etc.

- Better when paired with travel credit card insurance coverage.

If you’re going on a trip soon, you may be wondering whether to invest in travel insurance. This type of insurance can offer protection in the event that you fall ill, your plans change unexpectedly or you experience unavoidable delays.

GeoBlue is one insurance provider offering plans to travelers, with a number of plans available based on your needs. Here's a review of GeoBlue travel insurance, including the options offered and how to choose your plan.

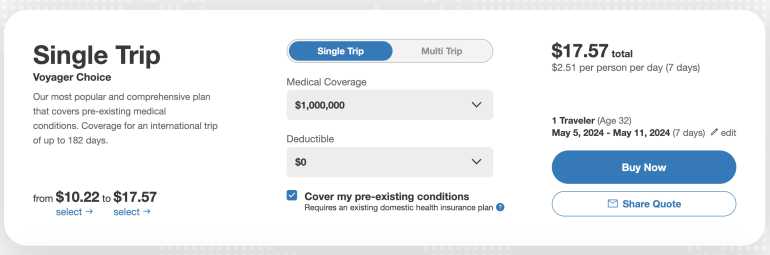

GeoBlue insurance offers two different plans for travelers, though it focuses mainly on medical coverage . These plans are called Voyager Essential and Voyager Choice. The former offers lower coverage options than the latter and is generally cheaper (though as you'll see, not always by a large amount).

The company also provides multitrip, long-term and group options for those who need them.

» Learn more: How much is travel insurance?

How much does GeoBlue cost? GeoBlue’s travel insurance is mostly medical-based and includes a comprehensive list of inclusions, though it also has coverage for some travel mishaps.

To get an idea of costs, we used a sample trip for a 33-year-old traveler from California with existing insurance heading out in August on a two-week trip.

Note that for this GeoBlue insurance review, we selected the highest coverage amount with no deductible. There are choices that allow you to include a higher deductible and a lower coverage limit, which may lower your plan cost.

Here’s what the two GeoBlue plans cover:

As you can see, there’s not a big difference when it comes to how much GeoBlue’s plans cost, with just about $7 between the two different offerings.

In terms of benefits, most are the same as well — the biggest difference between the Voyager Essential and Voyager Choice plans comes down to prescription medication coverage and coverage related to accidental death and dismemberment .

The less-expensive Essential plan pays 50% of your prescription costs, while the Choice plan covers the full 100%. As well, the Choice plan doubles accidental death coverage from Essential's $25,000 to $50,000.

Other than that, differences are minimal. You’ll get less coverage for emergency dental care and quarantine expenses , but otherwise, everything else is the same.

» Learn more: How does travel insurance work?

Is GeoBlue travel insurance good? Unlike many other travel insurance policies, GeoBlue’s products include coverage for hazardous activities and medical quarantine.

However, while GeoBlue shines when it comes to medical coverage, it falls short in other travel insurance aspects. Many travel insurance plans provide better options in the event that your bags are delayed , your flight is canceled or you miss nonrefundable bookings.

In GeoBlue’s case, the low levels of reimbursement for these types of issues may be problematic. However, bear in mind that many travel credit cards provide complimentary travel insurance that would pair well with a GeoBlue plan.

» Learn more: What to know before buying travel insurance

To purchase a GeoBlue plan online, go to the company’s website .

You’ll see the option to generate a quote and you’ll type in your trip dates, traveler's age and ZIP code.

Once you hit "Get A Quote" the results page pops up, which will give you the option to choose your deductible amount and maximum level of coverage. You can also toggle between single trip and multi trip.

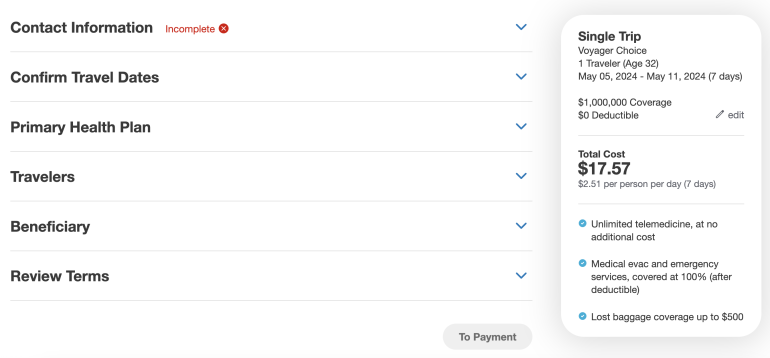

Once you’ve decided on a plan, you’ll need to fill out all pertinent information including your contact information, your health plan details and beneficiary. Once you review the terms of the plan, select to payment and input your credit or debit card information.

After that, your policy will be issued.

» Learn more: 6 common travel insurance myths

While it offers excellent medical care for low prices, GeoBlue’s policies fall short when it comes to other travel coverage. However, if you also have a travel credit card , you may be able to pair the two together for relatively strong travel insurance coverage at a low cost.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Skip to main content

- Skip to primary sidebar

- Frequently Asked Questions

IMPORTANT INFORMATION ABOUT CORONAVIRUS (COVID-19 including mutations)

For policies purchased from 14 April 2020: Please note that there is no cover under Cancellation & Curtailment for any claims arising from any epidemic or pandemic, including but not limited to Coronavirus disease (COVID-19); severe acute respiratory syndrome coronavirus (SARS-COVID-2) or any mutation of these.

For policies purchased between 17 March 2020 and 13 April 2020: Because the World Health Organisation declared the ongoing Coronavirus (COVID-19) outbreak a pandemic on 11th March 2020 this is now a known event. This affects the cover provided by our Travel Insurance policies. Any policies purchased between 17/03/2020 and 13/04/2020 will not include cover under any section whatsoever for claims directly or indirectly caused by the Coronavirus. This includes any preventative containment or delay measures.

For any policies issued before 17/03/2020 cover remains as per the policy terms and conditions.

- About Your Policy

- Eligibility

- Emergencies and Claims

- Geographical Limits

- Medical and Health

- Policy Purchase and Details

- Sports & Activities – including Golf

- Winter Sports

FAQ’s related to policies issued before 16 March 2020. Travel Insurance Advice for Customers Affected by Coronavirus

Am I covered if I catch Coronavirus in the UK and need to cancel my holiday?

Yes, you are covered under the cancellation and curtailment section for cancellation of your trip if, after you have purchased your policy, you test positive for Coronavirus and you advised not to travel by your GP or Doctor.

Your policy will pay you up to the amount shown in the summary of cover for the unused portion of your travel and accommodation costs that you have paid or contracted to pay and you suffer a financial loss because you cannot get a full refund if you cancel before the start of your trip or cut your trip short and return home early during the period of insurance because of the following:

- the death, bodily injury, illness or being subject to quarantine of you, a close relative or any person you have arranged to travel or stay with during your trip;’

Am I insured if I travel against the advice of the Foreign and Commonwealth Office (FCO)?

None of the policies underwritten by Ageas will provide any cover if you decide to travel against the advice of the FCO. This would be for ‘All Travel’ and ‘All but Essential Travel’.

If the area is classified as ‘All but Essential Travel’ and customers are still planning to go, they must contact us in advance with their reasons for travel and cover must be agreed by the Underwriters.

Will my policy cover medical treatment for the Coronavirus? And will repatriation be covered?

Yes, you are covered as follows; if you travel to a country that the FCO has not advised against travel to and catch Coronavirus or require medical treatment, then yes cover will be in place for emergency and necessary treatment. Customers should be aware that our policies are travel insurance policies and not private medical insurance meaning that there is no cover for any medical expenses incurred in private medical facilities if we have confirmed that medically capable public facilities are available.

Please contact our Assistance Team if you require medical treatment.

Our policies will provide cover for repatriation (bringing you home) that is medically necessary. Our Assistance Team will liaise with your treating doctor(s) about your treatment plan and if required obtain a ‘fit to fly’ certificate. We also liaise with you and advise on, and put in place, suitable repatriation plans to get you home as soon as it is medically safe to do so in order to achieve your optimal recovery. Our team are unable to make arrangements to repatriate you where it is against local advice, where travel is restricted or where you would pose a risk to other passengers.

Am I covered for cancellation due to the Coronavirus?

Under all Ageas underwritten policies there is ‘specified cause’ cancellation cover, which does not extend to cancellation due to the Foreign & Commonwealth Office advising against travel to a country (or parts of a country).

In the first instance customers with travel booked to areas that the FCO have advised against travel to should contact their airline or tour operator in order to obtain a refund or arrange an alternative holiday.

If I am stuck abroad due to the Coronavirus and cannot come home on my planned return date, will my travel insurance be extended to cover me until I can get home?

Depending on your policy, cover may be extended for the following reasons:

- If you are hospitalised, require medical treatment and are unable to fly.

- If your transport is disrupted or delayed.

- If you cannot return home for any reason beyond your control

If I am quarantined due to the Coronavirus, what cover is in place?

If you are admitted to hospital with the virus your policy will usually provide medical emergency cover and assistance with returning home when you have been discharged.

Please contact our Assistance Team if you are admitted to hospital.

If you are confined to your trip accommodation in a quarantine situation, Ageas policies will not cover any additional accommodation or other additional costs, the local governments and authorities imposing quarantine should be assisting with these costs.

What happens if I arrive at my holiday destination and they refuse entry due to the virus?

If you travel to an area which the FCO advise against travel to, there would be no cover under the travel insurance policies as this would be considered as a known event.

If you travel to an area and the FCO advice changes after leaving home, you should contact your travel agent or tour operator for information on the availability of flights or refunds in the first instance.

If you are refused entry at passport/border control, you should contact your airline or transport provider to arrange changing your return ticket to allow you to come home early.

Will I be covered if I want to cut my trip short due to the Coronavirus?

Travel insurance policies have different terms and conditions regarding what is and what is not covered in regards to cutting short a trip.

This type of event is usually not covered across the travel insurance industry for cutting short a trip. This is because most policies have specific reasons for cutting short your trip and the “fear of an epidemic, pandemic, infection or allergic reaction” is not one of those reasons.

We would advise travellers who have booked package holidays to a destination affected by the viral outbreak and looking to cut your trip short they should contact their travel agent or tour operator for information on the availability of flights in the first instance.

If you are travelling independently from a tour operator or travel agent, you should make your own arrangements to leave by either altering return tickets where possible or booking onto an alternative commercial flight or mode of transport. Claims for independent traveller’s additional expenses in returning home earlier than planned, where medically justified, will be assessed on a case-by-case basis.

If I go out on an excursion for the day and then am not allowed back to my travel accommodation (or cruise ship) due to quarantine, what cover do I have?

You should follow any instructions issued by the local authorities as it is more than likely that you will have to enter some form of quarantine.

Traveller’s should contact their travel agent or tour operator for assistance in the first instance.

If I have a stop-over in an area which the FCO advises against travel to, am I still covered?

Yes, but where possible should remain at airport.

Can my policy be changed to suit a ‘new/different’ holiday or trip?

Yes, policy can be transferred to an alternative booking if you are unable to go on your trip, but Tour Operator is happy to transfer holiday to alternative destination/dates.

What can I do with my policy if I am no longer travelling and have received a refund for my holiday?

You may cancel your insurance policy within 14 days of purchase without penalty and we will provide a full refund providing that you have not made a claim during the 14 days. After 14 days, you may cancel the policy at any time but you will not receive a refund.

How many days winter sports cover do I have?

If you are an Annual Multi-trip policy holder, you are entitled to winter sports cover if you have paid the appropriate additional premium. This is limited to 14 days if you have purchased Economy cover, or 18 days for Standard & Premier cover.

Am I covered for piste closure, avalanche or landslide and loss or theft of my ski pass?

Yes, provided you have paid the additional winter sports premium, to the amounts outlined in your policy wording.

Am I covered for off-piste skiing?

Yes, when accompanied by a local guide in areas that are designated safe by resort management.

What activities are covered for winter sports?

Provided you have paid the Winter Sports upgrade, you are covered whilst participating in the following winter sports:

Cat skiing (with guides) Snow blading (no jumping tricks) Cross country skiing Snow bobbing Glacier skiing Snow scooting Langlauf (cross country skiing) Snow shoe walking Monoskiing (not for time trials/speed skiing or racing) Snow shoeing Skiing on piste Snow tubing Skiing or snowboarding off piste (within local ski patrol guidelines) Snow blading Sledging/tobogganing Snow boarding on piste

The following activities will be covered but there will be no cover in respect of any Personal Accident or Personal Liability claims: Kite snowboarding Snow carting Snow go karting Snowmobiling Skidoo Snowmobile safari

What age can I get winter sports cover up to?

Provided you are 64 or under, you can purchase our Winter Sports upgrade at the tailor your policy stage of our quote process.

Am I Covered for Scuba Diving?

Yes, you are covered for scuba diving at no additional premium on bigbluecover.com policies up to 18m, within the terms and conditions of sports and activities.

Now get covered with our Single Trip Travel Insurance or Annual Multi Trip Travel Insurance .

What does no cover in respect of personal accident and personal liability mean?

Personal Accident – No cover will apply, if you suffer Accidental Bodily Injury during the Trip, which within 12 months is the sole and direct cause of death or disablement.

Personal Liability – No cover will apply, if in the course of a Trip you become liable for accidental bodily injury to or the death of, any person and/or accidental loss of or damage to their property.

Does BigBlueCover.com cover sports?

Please see the policy wording for the full list of sports and activities that are covered by the policy.

If you are partaking in a sport or activity that you do not see listed in the policy wording then please contact our friendly Customer Services Team on 0343 658 0225 and they will assist you.

How do I make a claim?

In the event that you need to make a claim, please contact International Medical Rescue on 02380 177286, or visit www.imr-claims.com to submit a claim online.

What do I do if I need medical assistance when travelling?

You must contact the Medical Emergency team before you incur any expenses over £500. If you are unable to contact them immediately then you (or someone representing you) must contact them within 48 hours of the event.

In the event of an emergency please contact International Medical Rescue on 00 44 (0) 2380 644633, quoting your policy number.

Am I covered if I am Pregnant?

Yes, cover is provided for complications of pregnancy. Pregnancy itself is not deemed to be an illness or pre existing medical condition. Cover will only arise if a complication of pregnancy occurs. Please refer to the meaning of words in the policy wording for the definition of complications of pregnancy. Please note that if the due date coincides with the time of travel there is no cover under this policy.

How much Medical Cover does BigBlueCover.com offer?

BigBlueCover.com offers a range of policies to suit everyone’s needs. Our policies cover up to a comprehensive £10 million for Medical Emergency and Repatriation.

Does BigBlueCover.com cover Pre-existing Medical Conditions?

You will not be covered under this policy for any claims arising directly or indirectly from a pre-existing medical condition unless it has been declared to us and accepted by us in writing for cover. Call us on 0343 658 0225 to declare your pre-existing conditions and confirm if cover is available.

Can non UK residents be covered under your policy?

No, only UK residents can purchase the BigBlueCover.com policy.

What is classed as a UK resident?

This policy is only available to you if you are permanently a resident in the United Kingdom, Channel Islands or the Isle of Man and registered with a medical practitioner in one of these areas.

What is the Maximum Age you can insure up to?

For Single Trip policies we insure up to 85 – should you require a single trip and you over 85 then please contact our call centre team on 01293 855787 and they will help you. Or visit Goodtogoinsurance.com now for a great value quote including the option to add pre-existing medical conditions.

For Annual multi-trip policies we insure ages up to 75 – should you require an Annual multi-trip and are over 75 then please contact our call centre team on 01293 855787 and they will help you. Or visit Goodtogoinsurance.com now for a great value quote including the option to add pre-existing medical conditions.

Winter Sports – 64 years at time of purchasing your insurance.

What is a policy Excess?

Most sections of the policy carry an Excess and this works exactly the same as car insurance. This is the first amount of any claim that you will have to pay. The amount may vary depending on the level of cover you have chosen. It is applicable per person per section of the policy. If we agree to a claim for medical expenses which has been reduced by you using an EHIC you will not have to pay the excess amount under the Medical Expenses section.

Am I covered for Cancellation?

You are covered for the cancellation of your holiday for the reasons stated in the policy wording. You may be able to claim (subject to the policy terms and conditions) for any travel or accommodation costs that you have either already paid or are contracted to pay, that you cannot reclaim from the tour operator.

Can I extend my stay whilst away?

Unfortunately, you are unable to extend your policy whilst you are away; therefore you need to ensure that you are purchasing the correct policy. However if due to unforeseen circumstances such as the flight being cancelled or delayed due to no fault of your own, the policy will be automatically extended for you.

Can I update my details?

If you need to change names and/or your address, please contact us on 01293 855787.

What are my Cancellation Rights?