Introduction to the Capital One Travel Portal

Utilizing rewards for bookings, how to use capital one travel, what is the capital one premier collection.

- Cards that are eligible for the travel portal

Capital One Miles Value in the Capital One Travel portal

Capital one travel portal: your guide to booking and rewards.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Capital One Venture X Business Card†, Capital One Savor Cash Rewards Credit Card†, Capital One Spark Miles for Business†, Capital One Spark Miles Select for Business†, Capital One Spark Cash Plus†, Capital One Spark Cash Select for Excellent Credit†, Capital One Spark 1% Classic†, Capital One Walmart Rewards® Mastercard®†, Journey Student Rewards from Capital One†. The details for these products have not been reviewed or provided by the issuer.

The Capital One Travel portal is an online travel platform that allows customers to book flights, hotels, and rental cars. The site provides exclusive travel deals, discounts, and tools to help you save on your next vacation. Select Capital One credit card customers can earn elevated rewards for every purchase made through the portal or redeem them for bookings. It's a great tool that lets you make all your travel reservations in one place and takes the guesswork out of redeeming miles.

However, Capital One Travel also has several downsides. You're giving up loyalty rewards with those programs by booking hotels and rental cars through Capital One. The Price Freeze function also doesn't work as promised and redeeming Capital One miles for travel bookings may not be the best way to maximize your rewards.

Overview of the Portal

The Capital One Travel Portal offers excellent value for money and flexibility, with various travel options to suit any budget. It also provides a range of rewards, discounts, and tools to help you save on your travels.

With the added convenience of booking flights, hotels, and car rentals all in one place, it is the perfect choice for anyone looking to book their next trip. While some of its features are more gimmicky than others, the fact remains that this portal provides ease and convenience for travelers who don't want to deal with multiple booking platforms and loyalty programs.

The Capital One Travel portal is a travel booking platform powered by Hopper, an app that helps travelers pick the best times to book and travel at the lowest prices. Capital One Travel offers competitive prices, exclusive discounts, and access to a wide selection of flight, hotel, and rental car options for Capital One cardholders. Customers can use the portal to earn and redeem rewards on travel bookings.

Additionally, the portal provides helpful tools such as a price calendar to find the cheapest airfares and price drop protection that will refund the fare difference if it drops post-booking. The portal also has a price freeze feature, which allows users to "freeze" a specific airfare for up to $25 or 2,500 miles.

Benefits of Booking Through the Portal

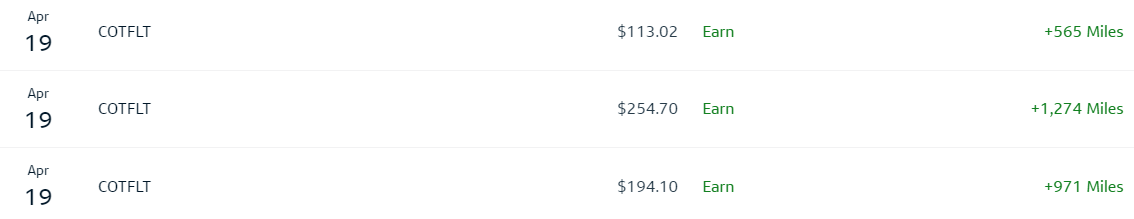

One of the key benefits of using the Capital One Travel portal is that certain types of bookings will earn you higher rewards when you pay with an eligible Capital One credit card. For example, the Capital One Venture X Rewards Credit Card earns 10 miles per dollar on hotels and rental cars and 5 miles per dollar on flights booked through Capital One travel. And with the Capital One Venture Rewards Credit Card , you'll earn 5 miles per dollar on hotels and rental cars booked through the portal.

This works out well for Capital One Venture X Rewards Credit Card cardholders' flight bookings since Capital One lets you enter your frequent flyer number on the booking page. You'll not only earn elevated Capital One miles, but you'll also earn airline miles and elite-qualifying miles through your chosen frequent flyer program. You won't get the same benefits on hotel or rental car bookings, so that's worth weighing into your booking decision.

Above all else, the Capital One Travel portal provides convenient and easy travel booking. You can use it to compare airfare from multiple airlines at once, helping you find the best deal on your next trip. Additionally, you can use your Capital One miles to pay for travel bookings at a rate of 1 cent per mile, or get discounted rates on certain flights or hotel stays. Finally, customers have access to customer service representatives who can answer questions and assist with bookings.

How to Use Capital One Miles

The Capital One Travel portal can be a great way to earn elevated rewards and enjoy extra perks. Booking flights through this portal can make sense since you can double-dip, earning rewards with your credit card and frequent flyer miles from airlines. However, you won't earn hotel points or elite night credits on Capital One bookings, which means you'll miss out on possible elite benefits with major hotel loyalty programs. Depending on how often you travel, this could be a significant downside.

Transferring Capital One miles to one of the 18 airline or hotel partners can be a much better value proposition. If you redeem your miles for business and first-class travel, you'll usually get more than the 1 cent per mile your rewards are worth through the Capital One Travel portal. For example, a sample of fun, valuable ways to use the Capital One VentureOne welcome bonus of 20,000 miles after spending $500 on purchases within three months from account opening.

However, not all card members want to learn the ins and outs of various loyalty programs to get the most value. Some people want simplicity and the Capital One Travel portal offers just that. If you prefer convenience over value, booking with the Capital One Travel portal is a smart move. But if you're willing to put in the legwork for a high-value redemption, transferring Capital One miles to an airline or hotel program is the best option.

Using the Capital One Travel Portal is straightforward. Simply head to travel.capitalone.com and log into your account. From here, you can select between a flight, hotel, or rental car tab. Enter your destination and travel dates, then browse through the available options.

You can filter results by price, airline, hotel type, and more to find the best deal. Once you've made your selection, you can book directly with Capital One and either pay with your eligible Capital One card or use miles to pay for all or part of your trip.

Before booking anything, check out the travel offers section underneath the tabs mentioned above. Here, you'll find travel credits in select target markets. If you make a qualifying booking, you'll get a travel credit that's applicable toward future bookings.

How to Book Flights Through the Capital One Travel Portal

You can book flights with both domestic and international airlines through the Capital One travel portal. On the Capital One Travel homepage, select the "Flights" tab and enter the number of travelers, departure city, destination, and travel dates. You can book both one-way and round-trip flights.

When you select your travel dates, a color-coded calendar will show the cheapest and most expensive travel dates. This is great when your travel dates are flexible and you just want to find the lowest fare.

Choose your outbound and return dates on the calendar and select "done." Next, select the blue "search flights" button to generate your search results. On the results page, you can sort by price, departure time, arrival time, number of stops, and duration. You can also filter results by fare class, stops, airline, time, and price.

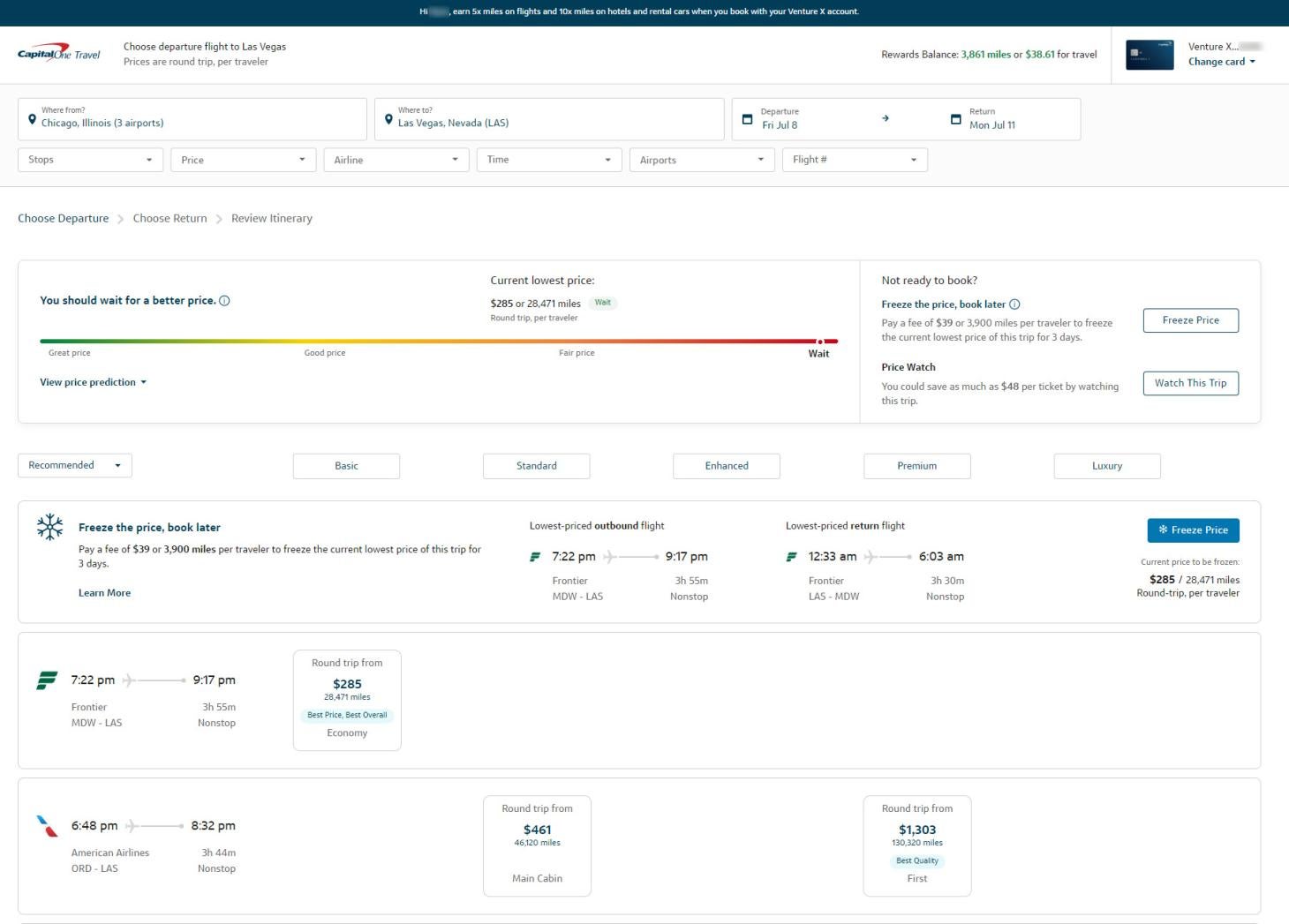

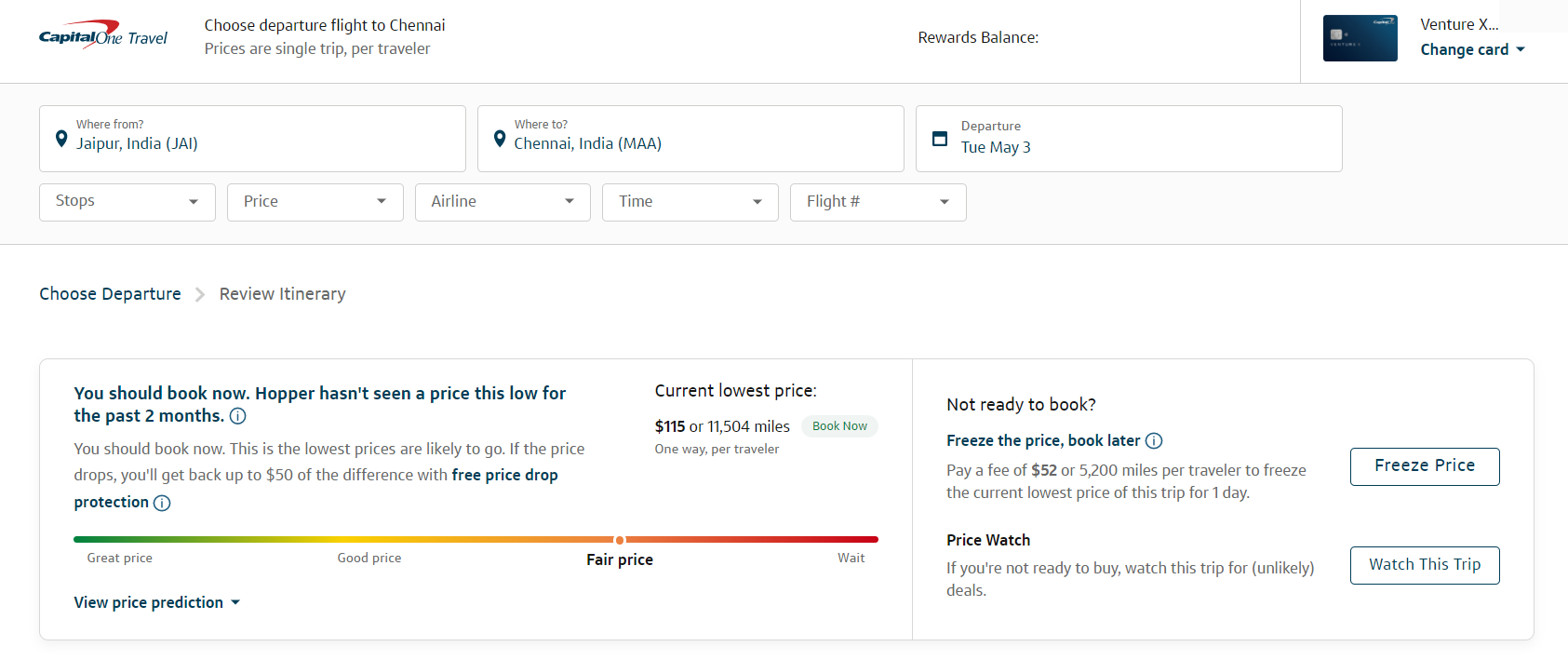

Capital One offers a price predictor tool at the top of the page, recommending whether it's a good time to book a particular price. You'll also get the option to freeze a specific price and book it later, though this feature isn't reliable in my experience. If you're not ready to book, you can select "watch this trip" to receive alerts when fares drop.

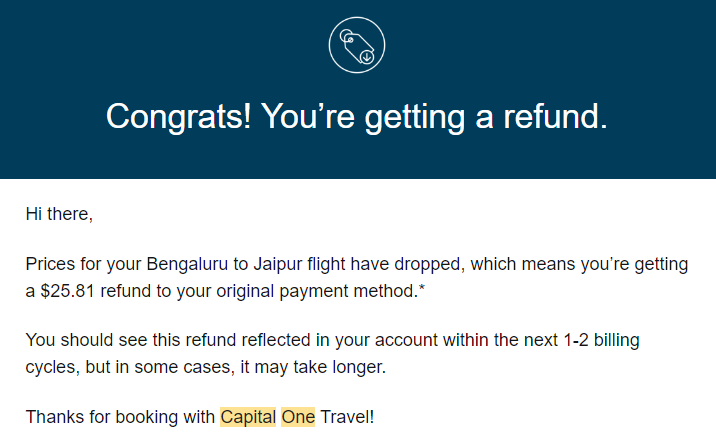

You'll also get the option to purchase cancel for any reason insurance (CFAR travel insurance) during the flight booking process. And, if Capital One Travel recommends you buy a specific flight now, it will apply free price drop protection to that flight for 10 days. If the price drops within that time period, Capital One will credit you the difference in fare, up to a maximum of $50.

How to Book Hotels Through the Capital One Travel Portal

Booking hotels through Capital One Travel is similar to booking flights. On the top of the Capital One Travel page, select the "Hotels" tab. Enter your destination, travel dates, number of travelers, and rooms, then select "Search Hotels."

Unlike the flight search tool, there is no calendar function displaying the lowest rates. However, the hotel search tool does have a city map to help you narrow down your options and find the cheapest rates. Hotel search results can also be filtered by star rating, amenities, price, and amenities. You can also sort results by price and star rating.

Once you select your room and rate, you'll be directed to the checkout page to see your total amount due in miles or cash. You can choose to pay either the cash rate or redeem miles. Note that some hotels charge additional service fees at check-in. These will be displayed on the checkout page, but you won't pay them until you get to the hotel.

How to Book Rental Cars Through the Capital One Travel Portal

To book a rental car, select the "Rental Cars" tab on the Capital One Travel portal and enter your pick-up and drop-off location, rental dates, pick-up and drop-off time, and driver age. Drivers under the age of 25 may be subject to additional fees. Click "Search Cars" to be redirected to the results page.

You can filter results by vehicle type, price per day, rental car company, cancellation policy, and other factors. As with flights and hotel bookings, Capital One displays both the total cash rate and mileage redemption rate (including taxes and fees). Once you've selected your vehicle, you'll get to a booking page displaying your total. During booking, you'll pay the rental cost minus taxes. The taxes will be collected at pick-up.

The Capital One Premier Collection is a curated list of luxury hotels and resorts worldwide that eligible cardholders can access via the Capital One Travel portal. Each property offers special benefits and includes bonus points and money-saving extras, including daily breakfast for two, experience credits, and room upgrades when available.

In addition to earning bonus points, eligible cardholders can also redeem Capital One miles toward their Premier Collection bookings. That's a huge plus, considering some of the properties in the collection are quite pricey. For example, Montage Hotels often have room rates of $1,000 per night or higher. Being able to redeem miles for these stays is a great way to save on upscale hotel bookings.

Capital One Premier Collection Hotels

Some Premier Collection hotels are operated by major hotel chains, while others are independent. Regardless of the hotel's affiliation, booking through the Premier Collection can help you secure added benefits typically reserved for elite members or those willing to pay extra for them.

There are currently seven major hotel chains represented in the collection. They include upscale brands like 1 Hotels, Design Hotels, Leading Hotels of the World, Montage, Preferred Hotels & Resorts, Small Luxury Hotels of the World, and Viceroy Hotels.

Some of these names may be more familiar than others. They include high-end hotels like the Montage Laguna Beach, Viceroy Los Cabos, Hotel Cafe Royal London, and the Wittmore in Barcelona.

Who Can Book the Capital One Premier Collection?

The only Capital One credit cards that have access to the Premier Collection are the Capital One Venture X Rewards Credit Card and Capital One Venture X Business Card† . Both of these are premium cards with high annual fees; for example, the Capital One Venture X Rewards Credit Card costs $395 per year ( rates and fees ) but comes with an annual $300 travel credit you can apply toward Premier Collection bookings. In addition to all the hotel-specific benefits, cardholders who book a Premier Collection stay will earn 10 miles per dollar spent — the highest travel booking payout of any transferable points card.

The Capital One Venture X Business Card was previously known as the Capital One Spark Travel Elite, and it's very similar to the Venture X. It has the same $395 annual fee, $300 travel credit, and 10,000 annual bonus miles.

Both cards are great for travel enthusiasts and those looking to earn generous rewards on their daily spending. While the Premier Collection access is not enough reason to get a Venture X card (the list of participating hotels is limited), it is an excellent addition to the various other benefits these cards offer.

Capital One Premier Collection Benefits

Booking through Premier Collection provides travelers with various perks, including special amenities and bonus miles. The following benefits are available at Premier Collection properties worldwide:

- 10 miles per dollar on hotel bookings

- $100 experience credit per stay

- Daily breakfast for two

- Space-available room upgrade

- Early check-in and late check-out

- Complimentary Wi-Fi

The experience credit will vary by property, but you'll need to charge the qualifying expense to your room to receive it. The hotel will then apply the credit to your folio upon checkout.

The daily breakfast can be especially valuable in high-priced destinations like the Maldives, where the remote setting often translates to breakfast charges of $50 or more per person. Having breakfast included in the cost of your stay, along with $100 toward some of the most expensive spa treatments in the world, is an excellent value in exchange for booking a stay through Capital One's Premier Collection.

Capital One Credit Cards That Are Eligible for the Travel Portal

You don't necessarily need a high-priced travel credit card to use the Capital One Travel portal. The platform is open to many Capital One cardholders, including those who carry a student credit card or small-business credit card issued by Capital One.

Over a dozen options are available, ranging from no-annual-fee credit cards like the Capital One Quicksilver Cash Rewards Credit Card to the Capital One Venture X Rewards Credit Card, a premium credit card :

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One QuicksilverOne Cash Rewards Credit Card

- Capital One Quicksilver Student Cash Rewards Credit Card

- Capital One Quicksilver Secured Cash Rewards Credit Card

- Capital One Savor Cash Rewards Credit Card†

- Capital One SavorOne Cash Rewards Credit Card

- Capital One SavorOne Student Cash Rewards Credit Card

- Capital One Spark Miles for Business†

- Capital One Spark Miles Select for Business†

- Capital One Spark Cash Plus†

- Capital One Spark Cash Select for Excellent Credit†

- Capital One Spark 1% Classic†

- Capital One Walmart Rewards® Mastercard®†

- Journey Student Rewards from Capital One† (no longer available to new applicants)

At 10 miles per dollar spent on hotels and rental cars and 5x on flights booked through the portal, Capital One Venture X Rewards Credit Card cardholders will earn the most rewards on Capital One Travel bookings. The Capital One Venture X Rewards Credit Card includes $300 per year in credits toward Capital One Travel bookings, which helps offset much of the card's $395 annual fee.

Capital One miles are worth 1 cent each in the Capital One Travel Portal. This is pretty generous, considering miles are earned at a rate of 2 to 5 per dollar spent with the Capital One Venture Rewards Credit Card and 2 to 10 miles per dollar on the Capital One Venture X Rewards Credit Card.

However, it's possible to get more value from your miles by skipping the portal and instead transferring rewards to Capital One's transfer partners . You can transfer miles to 18 airline and hotel loyalty programs to book award travel.

Business Insider's points and miles valuations peg the value of Capital One miles at 1.7 cents each, because it's possible to get outsized value from transferring miles to partners and booking award flights or stays. Be sure to read Insider's guide on how to earn and redeem Capital One miles to find out more about maximizing your rewards.

Yes, the Capital One Travel Portal allows you to book a wide range of airlines and hotels, offering the flexibility to use your miles without blackout dates or restrictions.

Yes, you can earn Capital One miles on bookings made through the portal, further increasing your rewards.

The portal provides tools to predict price trends for flights and flexible booking options that allow you to filter searches based on free cancellation policies, offering you peace of mind and potential savings.

Yes, Capital One offers the flexibility to pay with a combination of cash and miles, giving you more options to utilize your rewards.

For changes or cancellations, you can either manage your booking directly through the portal or contact Capital One's customer support for assistance.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

***Terms, conditions, and exclusions apply. Refer to your Guide to Benefits for more details. Travel Accident Insurance is not guaranteed, it depends on the level of benefits you get at application.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Capital one's new travel portal includes cancel-for-any-reason coverage and price protection tools, capital one's new travel portal will debut packed with money-saving benefits..

The offers below may no longer be available.

Capital One unveiled the details of their brand new travel booking portal — Capital One Travel. It's a unique platform to book travel using your Capital One credit card , whether you are booking with miles or cash.

This news comes as the bank recently announced upgraded travel benefits, including new transfer partners for Capital One miles and opening three Capital One airport lounges.

Now, Capital One is delivering an all-in-one travel portal where consumers can book flights, hotels and car rentals — and also access several exciting features to save money on travel and make booking a hassle-free experience.

Capital One Travel's new features

American Express and Chase are famous for their travel rewards credit cards , along with their travel portals where you can use their respective points. Now, Capital One has built its own proprietary portal with a slew of unique features.

However, this portal is still in 'beta' and is not yet accessible to Capital One cardholders. The live version will be rolling out to Capital One Venture Rewards Credit Card, Capital One VentureOne Rewards Credit Card, Capital One Spark Miles for Business, Capital One Spark Miles Select for Business and Capital One Walmart Rewards® Mastercard® cardholders in the coming weeks.

The portal will include these features when it first launches:

- Price prediction technology: Earlier this year, Capital One announced a partnership with Hopper, a tech company with airfare price prediction technology. Using historical data, this tool will predict when flights are at their highest or lowest price. This can help inform the timing of when you should purchase a flight if you want to get it for the best price.

- Price drop protection: If a flight price is found lower than the one you paid, Capital One will offer a refund for the difference. This can be a huge money saver for consumers who regularly travel, and the best part is that it's automatically refunded.

- Price match guarantee: If you find a better price for a flight, hotel or rental car on another site within 24 hours of booking, Capital One Travel will refund the difference.

Later this year Capital One will add these benefits to its travel portal:

- Integrated travel insurance to 'cancel for any reason' : For a small fee, consumers can book their travel with a 'cancel for any reason' clause. This is typically a premium if you are to purchase a traditional travel insurance policy . You can cancel a flight for any reason 24 hours before departure and get 80% of your ticket cost back.

- Freeze your price: If you find a price you like, but aren't fully ready to book, you have the option to freeze the price and complete the purchase at a later time. Capital One will cover the difference if the flight price is higher than when you instituted the freeze; if the price has dropped, you will be able to purchase it at the lower price. There will be a small fee for this feature.

Lastly, sustainable travel has become a priority for many who are hitting the road. Booking.com's 2021 Sustainable Travel Report revealed that 61% of travelers stated the pandemic has influenced them to want to travel more sustainably. In response, Capital One is launching a partnership with Eden Reforestation to plant four trees for every flight, hotel, or rental car booking in order to help with forest restoration.

Compared to other bank's travel portals, Capital One Travel will provide a very unique and potentially valuable tool. The other travel booking platforms do not include nearly any of the same purchase protections or travel insurance policies.

And with transfer bonuses becoming more lucrative for consumers who earn transferable points, there is often less incentive to use a bank's travel portal. But with Capital One's new product, travelers have more tools to try and get the best price for their upcoming adventure.

Best Capital One credit cards

If the new Capital One Travel portal is intriguing, consider applying for one of the many Capital One credit cards.

Here are their current cards and their welcome offers:

- Capital One Venture Rewards Credit Card: 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

- Capital One VentureOne Rewards Credit Card: 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening

- Capital One SavorOne Cash Rewards Credit Card: A one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Capital One Savor Cash Rewards Credit Card: A one-time $300 cash bonus once you spend $3,000 on purchases within the first 3 months from account opening

- Capital One Quicksilver Cash Rewards Credit Card: A one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Capital One Spark Miles for Business: 50,000 miles bonus once you spend $4,500 in the first 3 months from account opening.

Bottom line

Booking through a credit card's travel portal has several upsides, mainly the ability to earn and burn your miles all in one place. But the new benefits of the Capital One Travel portal make the card issuer stand out from other bank's booking platforms.

- Best sole proprietorship business credit cards Jason Stauffer

- This is the best budgeting app to help investors track their money Jasmin Suknanan

- 5 best credit cards with pre-approval or pre-qualification Jason Stauffer

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Capital One Travel: Your Guide To Booking Flights, Hotels & Car Rentals

Carissa Rawson

Senior Content Contributor

250 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3106 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Book Travel Through Capital One Travel?

What are capital one miles worth, how to access capital one travel, how to book a flight through capital one travel, how to book a hotel through capital one travel, how to book a rental car through capital one travel, rental cars, other ways to use capital one miles, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Trying to figure out how to use your rewards? Whether you’re a longtime fan of Capital One Miles or you’ve just jumped on the Capital One Venture X Rewards Credit Card train, there’s a lot to love about this flexible point currency.

Although it’s possible to transfer your Capital One miles out to a variety of partners, you can also use Capital One Travel to earn and redeem rewards for your stays. Let’s take a look at Capital One Travel, how it works, and when you should use it.

Capital One is heavily pushing its customers toward its travel portal — and for good reason. There’s a lot to love about Capital One Travel, and if you’re the kind of person who values simplicity and high rewards over elite status, it could be a good match for you.

Earn Miles or Points by Paying With a Credit Card

There are 2 ways in which you’ll earn miles or points when booking through Capital One Travel.

As a Capital One cardholder, you’ll earn a varying amount of miles depending on which card you use to pay:

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

Financial Snapshot

- APR: 19.99% - 29.99% (Variable)

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Capital One Miles

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture vs Venture X

- Capital One Venture X vs Amex Platinum

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards with Priority Access

- Best Credit Cards for Airport Lounge Access

- Best Capital One Credit Cards

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Best High Limit Credit Cards

- Choice Privileges Loyalty Program Review

The Capital One Venture X card earns 10 miles per $1 spent on hotels and rental cars booked through Capital One Travel, 5 miles per $1 spent on flights booked through Capital One Travel, and 2 miles per $1 spent everywhere else.

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- Global Entry or TSA PreCheck application fee credit

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Travel Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

The Capital One Venture card earns 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel and 2 miles per $1 spent on everything else.

Capital One Spark Miles for Business

The Capital One Spark Miles card is a low-annual-fee business card that earns 2x transferable miles on every $1 you spend. (Information collected independently. Not reviewed by Capital One.)

The Capital One Spark Miles for Business is a great option for business owners looking for an uncomplicated rewards card that earns double miles on every purchase they make and offers access to transfer partners, all for a low annual fee.

- Unlimited 2x miles per $1 spent on all purchases

- 5x miles per $1 spent on hotel and rental cars purchased through Capital One Travel

- 2 complimentary visits to a Capital One Lounge per year

- Up to a $100 Global Entry or TSA PreCheck credit

- No foreign transaction fees

- Free employee cards

- Extended warranty coverage

- Annual fee: $0 intro for the first year, $95 after that

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry

- $0 intro annual fee for the first year; $95 after that

- Free employee cards which also earn unlimited 2X miles from their purchases

- APR: 26.24% (Variable)

- Business Credit Cards

- Best Capital One Business Credit Cards

- Best Ways To Redeem Capital One Miles

- Capital One Miles Program Review

- Capital One Transfer Partners

- How Much Are Capital One Miles Worth?

- Best High Limit Business Credit Cards

The Capital One Spark Miles card earns 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel and 2 miles per $1 spent on everything else.

Capital One Venture X Business Card*

Capital One Venture X Business Card

The Capital One Venture X Business card offers at least 2x miles on all purchases, and comes packed with premium perks.

The information regarding the Capital One Venture X Business card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The Capital One Venture X Business card is a great all-around premium rewards card that helps you rack up miles on all of your business expenses.

From 2x miles on all purchases, airport lounge access, an annual travel credit, complimentary employee cards, and more, there is plenty to love about the Capital One Venture X Business card.

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and Priority Pass lounges

- No-additional-fee employee cards ( rates and fees )

- No preset spending limit

- No foreign transaction fees ( rates and fees )

- $395 annual fee ( rates and fees )

- 10x and 5x bonus categories are limited to Capital One Travel bookings

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- This card has no preset spending limit, so you get purchasing power that adapts to your spending needs. The annual fee on this card is $395

- Earn 150,000 bonus miles once you spend $30,000 in the first 3 months from account opening

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Earn unlimited 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel, where you’ll get the best prices on thousands of options

- Every year, you’ll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings through Capital One Travel

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry. Then enjoy unlimited complimentary access to Capital One Lounges and a network of 1,300+ lounges worldwide, including Priority Pass™ and Plaza Premium Group lounges

- This is a pay-in-full card, so your balance is due in full every month

- Elevate your stay at luxury hotels and resorts from the Premier Collection with a $100 experience credit and other premium benefits on every booking

- APR: All charges made on this account are due and payable in full when you receive your periodic statement. The minimum payment due is the New Balance as indicated on your statement.

The Capital One Venture X Business card earns 10 miles per $1 spent on hotels and rental cars booked through Capital One Travel, 5 miles per $1 spent on flights booked through Capital One Travel, and 2 miles per $1 spent everywhere else. *(Information collected independently. Not reviewed by Capital One.)

You’ll still earn points even when paying with a different credit card; cards including the Chase Sapphire Reserve ® will earn you 3 Chase Ultimate Rewards points per $1 on all travel, even when using Capital One Travel to book.

Earn Points With Your Loyalty Program

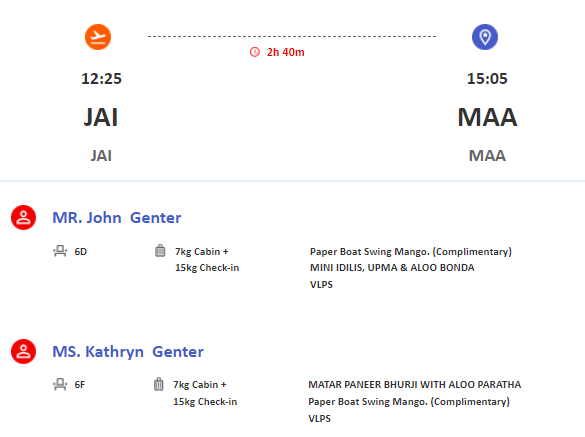

Flights booked through Capital One Travel are counted as paid tickets . This is true whether you use your Capital One miles for a redemption or use cash. Because of this, you’ll be able to earn frequent flyer miles on any flights that you book. Signing up is free and easy — there’s no reason for you to miss out on these miles!

The same can’t be said of hotel programs. Nearly all hotel chains will skip out on benefits if you don’t book your stay directly with the hotel . Not only will you miss out on your perks, but you’ll also lose the ability to earn elite night credits for your stays, which can be a real blow if you’re trying to earn elite status. Keep this in mind when you’re using Capital One Travel for hotel bookings.

Ease of Use

If you’re not a huge points and miles geek, it can make sense for you to book with Capital One Travel. This is because it’s simple; you simply log in, look for the flights/hotels/rental cars that you need, and then book. You won’t have to sift through endless programs trying to find the best rates, and it’s especially easy when you’re looking to redeem your Capital One miles. They’ll always be worth 1 cent each when used for travel via Capital One Travel , which is a solid redemption. It’s not the best, however, as you’ll see later on.

Price Match Guarantee

In a bid for your business, Capital One offers a price match guarantee on all of its hotel bookings . If you find a publicly available price within 24 hours that is better than the one you’ve booked, Capital One will match it.

Capital One also offers price-drop protection for its flights . If the Capital One price prediction tool recommends you purchase a flight and you do, the same tool will automatically keep monitoring the cost of the flight. If prices drop again, you’ll get a refund on some or all of the price difference.

Bottom Line: There are a lot of reasons to book with Capital One Travel, though you’ll want to be wary of limitations that arise from booking with a third party.

We value points and miles according to a variety of factors, including how easy they are to use and redeem. Although you can use your Capital One miles for travel on Capital One Travel, there are plenty of other ways they can be redeemed.

The most valuable use of your miles occurs when you transfer them to any one of Capital One’s hotel and airline partners. In these cases, you can get outsized value for every mile. This is why we consider Capital One miles to be worth 1.8 cents each — nearly double the amount you’ll get when redeeming them within Capital One Travel.

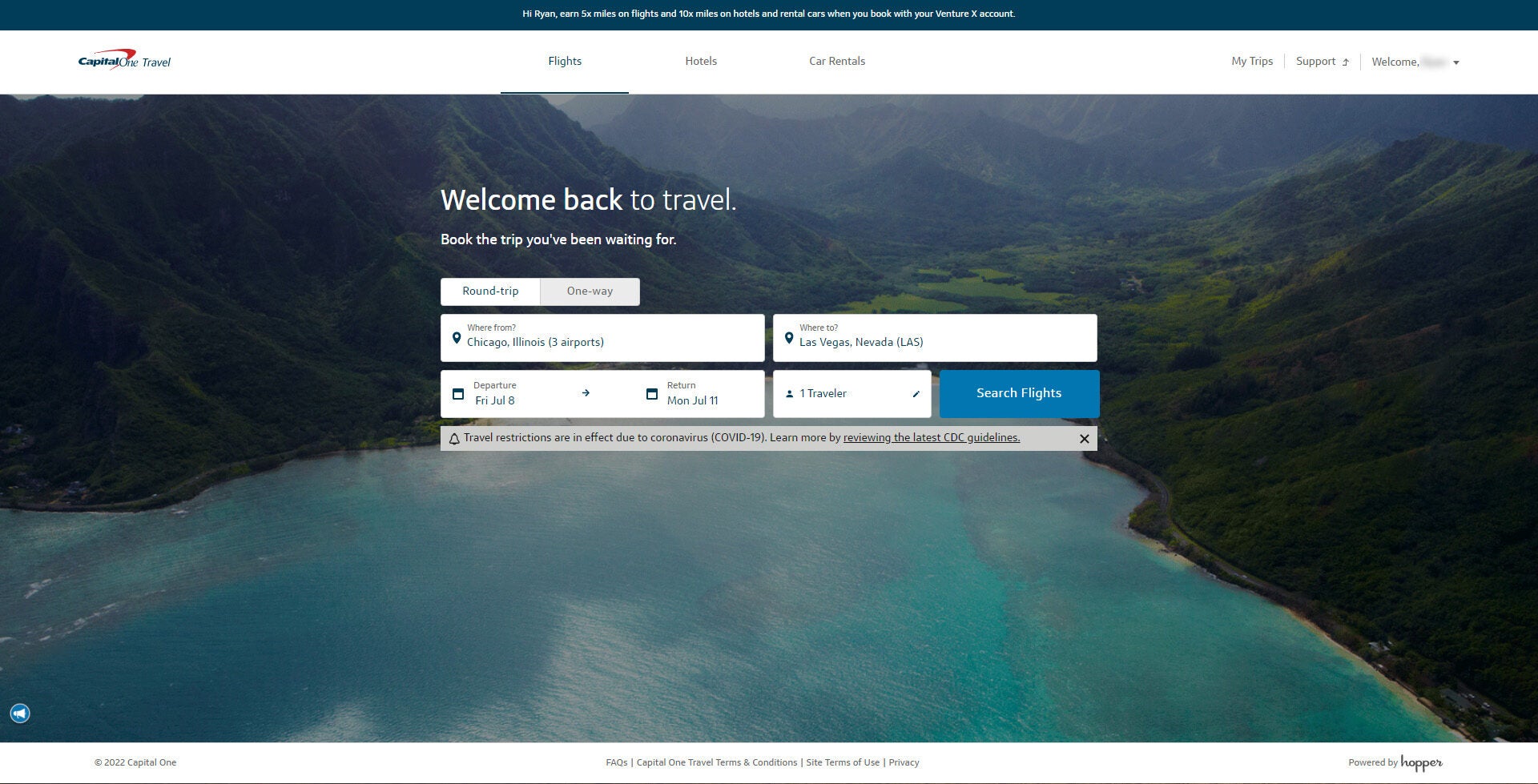

You need to be a Capital One cardholder in to access Capital One Travel . Once on the page, you’ll log in to your account. After logging in, you’ll be brought to the portal’s home page:

From here, you can choose to book flights, hotels, or rental cars.

Booking a flight through Capital One Travel is fairly intuitive. After you log in and reach the landing page, you’ll want to select Flights in the toolbar up top:

This will bring you to the search page for flights. You’ll want to input all your information, including departure airport, destination, and dates of travel:

Like Google Flights , Capital One Travel will give you an estimation of price within a calendar feature:

Unlike Google Flights, however, Capital One has partnered with the booking site Hopper to tell you when you should book. You’ll be presented with detailed information regarding price predictions :

As you can see in the screenshot above, you have the option to freeze your price or set a price watch alert. If you’re looking to book immediately, you’ll want to scroll down, where Capital One will give you a list of results:

When selecting a flight, Capital One Travel will also give you a breakdown of information and the ability to book economy or first class tickets:

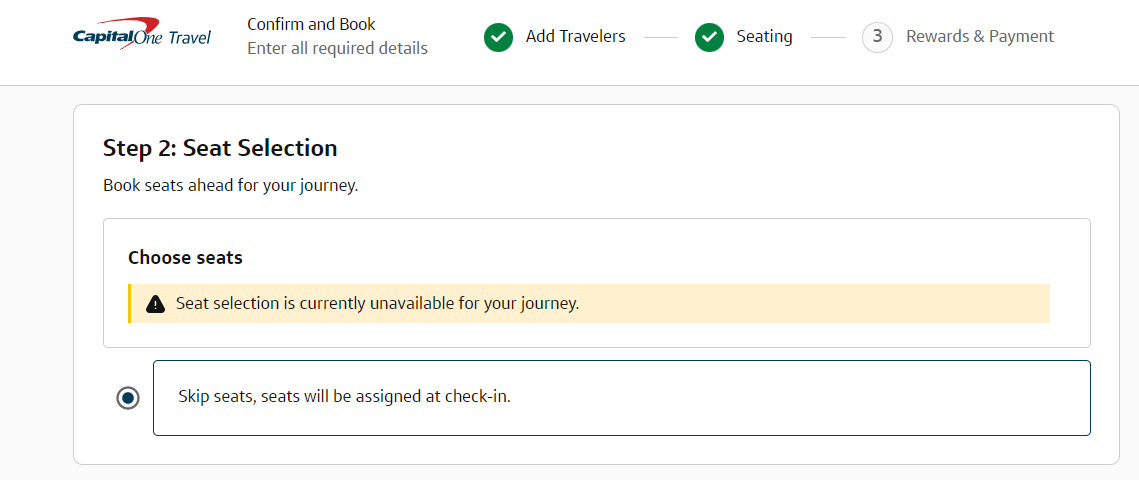

Once you’ve selected your outbound flight, you’ll pick the return. If booking a one-way, you’ll be taken to the checkout page.

Hot Tip: Capital One’s price drop protection automatically monitors the cost of flights you purchase and refunds you if prices fall.

As is normal with checkout pages, you’ll need to fill in your passenger information and credit card information. You can also select seats and choose whether or not you’d like to redeem miles. Capital One will give you 1 cent per point of value when using your miles through Capital One Travel . While this isn’t terrible, there are much better uses of those miles — such as transferring to a partner and booking a reward seat.

Once you’ve input all your info, you’ll hit Confirm and Book . That’s it!

Bottom Line: Booking flights through Capital One Travel is both intuitive and easy. Plus, you’ll be able to earn frequent flyer points on your booking.

If you’re looking to book a hotel through Capital One Travel, the process is simple. As before, you’ll start by logging into your account. Once you’ve hit Capital One Travel’s landing page, you’ll select Hotels in the top toolbar:

You’ll be taken to Capital One’s hotel search bar, where you can put in your travel destination and dates:

Once you select Search Hotels , you’ll be taken to a results page featuring an interactive map:

Along with filtering by rating and price, Capital One offers a variety of ways to narrow down your search:

As we mentioned above, Capital One Travel offers a hotel price match guarantee , which means you won’t find cheaper prices elsewhere. If you do happen to stumble across one on a publicly available site within 24 hours of booking, you can submit a price match request and, if approved, Capital One Travel will drop the cost down to the rate you’ve found.

Selecting a hotel from the search results will open a new tab where you can alter your information:

Scrolling down, you’ll be able to select the room type you prefer:

Once you’ve picked your room, you’ll be taken to the checkout page where you’ll fill out your traveler and payment information. You can also choose to use your Capital One miles for a value of 1 cent per point towards your booking:

Hot Tip: Be aware that booking hotels through Capital One Travel counts as a third-party booking — which means you won’t receive any elite status benefits or credit towards earning elite status when booking this way.

Once everything is filled in, you simply need to select Confirm and Book .

Just as with flights and hotels, you’ll log in to your account. From the landing page, you’ll select Car Rentals from the top toolbar:

You’ll be taken to the rental car search page where you can enter your information, including dates of travel and location:

Once you’ve hit Search Cars , you’ll be taken to the results page:

You can choose from a variety of filters, including the rental car company you’ll be booking, what type of car you prefer, and the cancellation policy of your booking. After picking the car you’d like to reserve, you’ll have the chance to review your booking:

If everything is correct, you’ll hit Reserve , which will take you to the checkout page where you can enter driver information and your method of payment:

As with hotels and flights, you can apply your Capital One miles to your rental car booking at a rate of 1 cent each. Again, there are better ways to use your miles, which we’ll discuss below.

Hot Tip: Check out our handy guide on how to save money on car rentals , including options with points, upgrades, cash savings, and more!

How Do the Prices Compare to Other Sites?

Is it actually worth it to book through Capital One Travel rather than other sites? How do the prices compare? Let’s take a look.

Here’s a flight from Los Angeles (LAX) to London (LHR) in mid-May 2022:

Interestingly, Capital One Travel notes that this isn’t the best time to book. The cheapest options available are $715, and they’re all nonstop. However, Google Flights comes back with very different results:

Not only does Google suggest that prices are currently low, but it also returns an option that is nearly $200 less than what Capital One Travel is offering . A closer look reveals that although Capital One Travel has the outbound leg available of this cheap flight for $736 roundtrip, it doesn’t offer the same returns. Here’s what’s available from Google:

Meanwhile, here are the options you can get on Capital One:

Bottom Line: While Capital One allows you to book flights through its Capital One Travel portal, its prices aren’t always competitive with other offerings. Make sure to check a few other websites for flights to ensure you’re getting the best deal.

So how do hotels on Capital One fare when compared to other booking options? This is especially pertinent as Capital One has its own price guarantee.

Here’s a night at the all-inclusive Secrets the Vine Cancun in early June from Hotels.com :

Booking with Hotels.com will earn you 1 stamp towards a free night stay . After 10 stamps you’ll get a free night, which can be especially valuable when booking costly stays.

And here are the results from Priceline , an online travel agency:

Bookings with both Priceline and Hotels.com can also be stacked with shopping portals . Using Rakuten with Priceline, for example, will earn you 5% back on your booking; this can either come in the form of $25.35 or 2,535 American Express Membership Rewards .

Booking Directly

Here’s how much it costs when booking directly with the hotel:

Secrets the Vine Cancun is a member of AMR Resorts , which was recently purchased by Hyatt. Although you can’t earn or redeem points with the property until later in 2022, Hyatt is offering a promotion for its cardholders for many new all-inclusive properties, including this one. Now through May 15, 2022, eligible cardholders will receive 10 points per $1 spent at these hotels.

This means that booking and paying with your The World of Hyatt Credit Card will earn you 5,070 World of Hyatt points. We value World of Hyatt points at 1.5 cents each, which means you’ll be getting $76.05 worth of points back on this booking.

Capital One Travel

Finally, here’s the rate within Capital One Travel:

With the 3 other sites we compared charging $507, Capital One Travel is a few dollars cheaper. But saving $15 doesn’t match the benefits other options are providing, like Hotels.com’s $200 resort credit.

There is, however, one case where booking via Capital One Travel is your best option. First, you won’t want to use Capital One Travel unless you don’t care about elite status — as we’ve mentioned above — so boutique properties can be a good option to book .

Second, as we mentioned above, those who hold the Capital One Venture X card earn 10 miles per $1 spent on hotels booked through Capital One Travel. In this situation, you’d earn 4,915 Capital One miles on your booking. We value Capital One miles at 1.8 cents each, which means you’ll earn $88.47 worth of miles . All in, you’ll net $403.53, which wins out compared to most other options.

How good are rental car prices compared across multiple sites? The results are less exciting. Here’s what a 5-day rental from Los Angeles looks like at Capital One Travel:

RentalCars.com offers nearly the same price:

AutoSlash, meanwhile, saves you a full $65 on the cheapest rental car:

Bottom Line: The Capital One Venture X card offers 10 miles per $1 on rental cars booked through Capital One Travel and it comes with some nice car rental insurance coverage too.

Of course, redeeming your miles through Capital One Travel is just one way that they can be used. There is a multitude of uses for those miles.

Transfer to Travel Partners

Nearly always, the best use of your Capital One miles comes from transferring to hotel and airline partners. Capital One has many transfer partners from which to choose:

Hot Tip: Check out our guide on the best ways to redeem Capital One miles for max value .

Cover Travel Purchases

Just as when using your miles at Capital One Travel, Capital One will allow you to redeem your miles for recent travel purchases at a rate of 1 cent each .

Redeem for Cash-back

You can redeem your Capital One miles for cash-back, but this is a terrible use of miles. Capital One will only give you 0.5 cents of value per mile when redeeming to cash.

Get Gift Cards

There are a variety of gift cards available using your Capital One miles, but these still aren’t a great redemption. Your value will vary — and can even be as high as 1 cent per mile , but transferring to other partners will still give you better value.

Shop With Amazon

You can use your miles on a linked Capital One card, which will give you a value of 0.8 cents per mile .

Pay With PayPal

Paying with your Capital One miles through PayPal will net you 1 cent per mile , just the same as redeeming your miles within Capital One Travel.

Bottom Line: You can redeem your Capital One miles in a variety of ways, but only transferring them to hotel and airline partners will grant you more than 1 cent per mile in value.

Capital One Travel is robust — and can be a good option for eligible cardholders who aren’t concerned about elite status. However, you’ll find better value for your miles when transferring to one of Capital One’s many travel partners. Regardless, you can find good deals within the travel portal, and the best price guarantee, combined with price drop protection, can make this portal tempting for many travelers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture X Business Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding The World of Hyatt Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Information regarding the Capital One Spark Miles for Business was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

How do i book travel with capital one.

You can go to Capital One Travel to book travel with Capital One.

What airline can I use my Capital One miles on?

Capital One miles can be used with virtually any airline, whether you’re booking through Capital One Travel or booking directly with the airline.

How do I see my trips on Capital One?

After logging in to Capital One Travel , you’ll find your trips in the My Trips section in the upper left-hand corner of the page.

Can you book Southwest through Capital One Travel?

Unfortunately, you cannot book Southwest flights through Capital One Travel . You can, however, book flights directly with Southwest and pay with your Capital One card. You can then redeem miles against your purchase within 90 days via Purchase Eraser.

Does Capital One use Expedia?

No, Capital One uses a proprietary blend of search tools for its Capital One Travel portal.

Was this page helpful?

About Carissa Rawson

Carissa served in the U.S. Air Force where she developed her love for travel and new cultures. She started her own blog and eventually joined The Points Guy. Since then, she’s contributed to Business Insider, Forbes, and more.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![capital one travel app Booking Travel With Orbitz – Everything You Need to Know [2023]](https://upgradedpoints.com/wp-content/uploads/2017/09/orbitz-computer.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

MoMo Productions/Getty Images

Advertiser Disclosure

Booking a trip through Capital One Travel

The platform offers a simple way to redeem Capital One miles

Published: May 30, 2022

Author: Emily Sherman

Editor: Kaitlyn Tang

Reviewer: Barri Segal

How we Choose

Capital One’s new travel booking platform is incredibly straightforward and offers excellent price prediction and protection tools. However, it might not be the best value for every cardholder.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

Capital One miles are known for their flexibility – as you can redeem them for just about any purchase. You can even use miles to cover the cost of travel you book on any site without sacrificing any of their value.

But Capital One Travel cardholders have another option for booking their next vacation . Capital One offers its own, freshly revamped travel portal – Capital One Travel.

Booking a trip through Capital One Travel has its pros and cons, but it can be particularly lucrative for some cardholders. For example, the Capital One Venture X Rewards Credit Card offers an up to $300 annual credit for travel you book with Capital One Travel; it also earns 10X miles on hotels and rental cars and 5X miles on flights you book through the portal. Some of the other eligible cards offer extra rewards on certain bookings through the portal, too.

Read on to learn more about why booking through Capital One Travel may or may not be the best option for you.

- What is Capital One Travel?

Capital One Travel is the Capital One’s travel booking site. Now powered by Hopper, it offers qualifying cardholders the opportunity to reserve flights, hotels or car rentals. You can pay for these bookings using miles, cash or a combination of the two.

You can use the Capital One Travel portal if you carry a:

- Capital One Spark Miles for Business

- Capital One Spark Miles Select for Business *

- Capital One VentureOne Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Walmart Rewards® Mastercard®

These cards have also been added to access the portal:

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One Quicksilver Student Cash Rewards Credit Card

- Capital One Savor Cash Rewards Credit Card *

- Capital One SavorOne Cash Rewards Credit Card

- Capital One SavorOne Student Cash Rewards Credit Card

- Capital One Spark Cash Plus

- Capital One Spark Cash Select – $500 Cash Bonus

- Capital One Spark Cash Select Intro APR Card

- Journey Student Rewards from Capital One

- How to book with Capital One Travel

To access the Capital One Travel portal, visit your eligible card account either online or on the mobile app and click “View Rewards.” You can select “book a trip” to be redirected to the travel portal.

Capital One Travel looks and works much like most third-party booking sites, allowing cardholders to search for flights, hotels or car rentals. You can pay for your trip with miles, cash or a combination of the two.

Booking flights

To book a flight via the Capital One Travel portal, just enter your travel dates and departure and arrival destinations. If you have a particular airline you prefer, you can also filter the results by carrier, as well as by price, the number of stops and more.

The portal now allows you to see whether it’s a good time to book or if you should wait for a better price. You can also set up a price watch to receive an alert when Capital One Travel determines it’s the best time to book.

Booking hotels

You can search hotels on Capital One Travel by location and date. The search results page is a little different from flights, however, as it includes the price per night, total price for your trip and the TripAdvisor rating of that particular property.

Capital One Travel makes it easy to get a full snapshot of hotels, without having to separately search reviews of affordable options. You can also filter to properties with specific amenities, like a bar or parking.

Booking car rentals

Finally, Capital One Travel also offers a car rental booking service. After entering your pickup and drop-off information, you can review results and filter them by car rental company, price and other specifications.

Price protection and flexible cancellation

The updated Capital One Travel portal also offers valuable price protection tools, as well as options for flexible cancellation.

Price drop protection enables cardholders who purchase airfare based on Capital One’s recommendation to get a refund if the price drops after booking. There’s also a price match guarantee, which allows customers who find a better price for a flight, hotel or rental car on another site within 24 hours of booking to receive a refund for the difference.

Additionally, customers can “freeze the price” of a flight if they find a good deal but aren’t ready to make a purchase. If the price increases after the freeze, Capital One will cover any increase, up to a refund limit. And if the price goes down, the customer will pay the lower price.

For a small, upfront fee, the portal offers the option to cancel flights for any reason up to 24 hours before the first scheduled departure and receive most of the airfare cost back.

Drawbacks of booking with Capital One Travel

Booking through Capital One Travel is simple, but there are a few drawbacks to keep in mind.

No travel packages

Many similar issuer booking platforms, like Wells Fargo Rewards , allow cardholders to book full travel packages in addition to individual flights and hotels. For some travelers, this takes the stress out of organizing several different reservations.

Capital One Travel does not have the option to book such packages. It does, however, let you group your hotel, flight and car rentals into an itinerary and pay for them together.

No hotel elite status

Capital One Travel is a third-party booking site, which means that you likely won’t be able to take advantage of any hotel elite status you might carry. For the most part, hotels require you to book directly with them to unlock elite perks like free breakfast or room upgrades.

Is booking with Capital One Travel worth it?

In some cases, booking with Capital One Travel can be the easiest way to plan your next trip. Plus, all the price prediction and protection tools can help you save on airfare. However, there are a few things to consider before deciding if it is the best platform for you.

Capital One Travel rates compared to other booking sites

For the most part, Capital One Travel has competitive rates. We compared a flight from Austin, Texas, to London and found nearly identical costs on Capital One Travel and the United site.

However, we also found a few cases where prices varied across different booking sites – with Capital One lagging behind. As you can see below, a four-night stay at a hotel in the U.K. is showing different rates on different sites, and Capital One is not always the best price.

For this reason, we recommend that you always comparing rates across multiple sites before you book through the portal.

Spending miles

Capital One miles are incredibly flexible, and you can use them to cover the cost of travel you book on any website at the same value. That means there is no benefit to choosing one platform over the other to try to stretch your miles further.

Added rewards with Capital One credit cards

Previously, Capital One was only accessible to Venture and Spark Miles cardholders. However, now the issuer has increased availability of its travel portal to most of its cash back cards, including the Quicksilver, Savor, Spark Cash and Student cards.

To top it off, the cash back cards now earn unlimited 5% cash back on hotels and rental cars you book through Capital One Travel. The Venture and Spark Miles cards still earn bonus miles on bookings you make at the travel portal.

When shopping around different booking sites, be sure to factor in the price difference and the rewards you’d earn if you used your Capital One credit card .

Tips for maximizing Capital One Travel

- Take advantage of price protection and prediction tools to make sure you get the best prices on airfare.

- Pay the small cancellation fee when booking airfare. You get until 24 hours before your departure to cancel for any reason, and you may receive a refund of 70% to 90% of the ticket. Not many other booking sites offer this level of flexibility.

- Compare rates on flights, hotels and car rentals with other booking sites to ensure you’re getting the best deal. You can always redeem miles to cover an outside travel purchase.

- Combine miles and cash if you don’t have enough rewards to cover the cost of your reservation.

Bottom line

The updated Capital One Travel portal offers cardholders an easy booking and miles redemption process, as well as some incredibly useful tools for securing the best airfare prices. However, before you use it to book travel – especially at hotels – compare prices on various platforms to ensure you’re getting a good deal.

*All information about the Capital One Spark Miles Select for Business and the Capital One Savor Cash Rewards Credit Card*has been collected independently by CreditCards.com and has not been reviewed by the issuer.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Emily Sherman is a senior editor at CreditCards.com, focusing on product news and recommendations. She is also one of the founders of To Her Credit, a biweekly series of financial advice by women, for women. When she's not writing about credit cards, she's putting her own points and miles to use planning her next big vacation.

On this page

- Cons of booking with CO Travel

- Is booking with CO Travel worth it?

- Tips for Capital One Travel

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

How much are Capital One miles worth?

Capital One miles have a value of 1 cent per mile, but that value can fluctuate based on how they are redeemed.

Capital One miles rewards guide

Learn the best ways to earn and redeem your Capital One miles to get the most out of the rewards program.

Capital One transfer partners

Capital One Platinum Credit Card benefits guide

Credit score required for the Capital One SavorOne Cash Rewards card

How to maximize your Capital One Venture Rewards Credit Card

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

Everything you need to know about the Capital One mobile app

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit cards

- • Rewards credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.