- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase Transfer Partners

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Chase airline transfer partners

Chase hotel transfer partners, which chase sapphire transfer partners are the best, chase points calculator, how to earn chase ultimate rewards® points, chase travel cards with transfer partners, how do you transfer chase points, using chase transfer partners: is it worth it.

Chase Ultimate Rewards® are some of the most valuable transferable points available. Called Chase Ultimate Rewards® points, they can be redeemed for travel through Chase's travel portal for 1 cent each on certain cards. However, they can be redeemed at a higher value of 1.25 cents each if you have a Chase Sapphire Preferred® Card or an even more impressive 1.5 cents each if you have a Chase Sapphire Reserve® . That type of exchange on its own makes for an excellent way to redeem Chase Ultimate Rewards® points .

However, that's not necessarily the best way to redeem Chase points because three specific Chase cards available in 2024 offer what might be potentially far more value.

The cards at play here are the:

Chase Sapphire Preferred® Card .

Chase Sapphire Reserve® .

Ink Business Preferred® Credit Card .

» Jump to learn more about these card options .

With those cards, you have the additional option to send those points to one of Chase's transfer partners , which are generally hotel chains and airlines. And assuming you hold (or someone in your household owns), one of those three Chase cards, you'll very likely unlock even greater value out of your spending rewards when you use one of the Chase Ultimate Rewards® transfer partners. That's because converting Chase points to hotel points or airline frequent flyer miles can often maximize their value.

Here's a summary of each Chase transfer partner and how you can get the most from your Chase points.

» Learn more: The best travel credit cards right now

Of the 14 Chase Ultimate Rewards® transfer partners, 11 are airline mileage programs, which are:

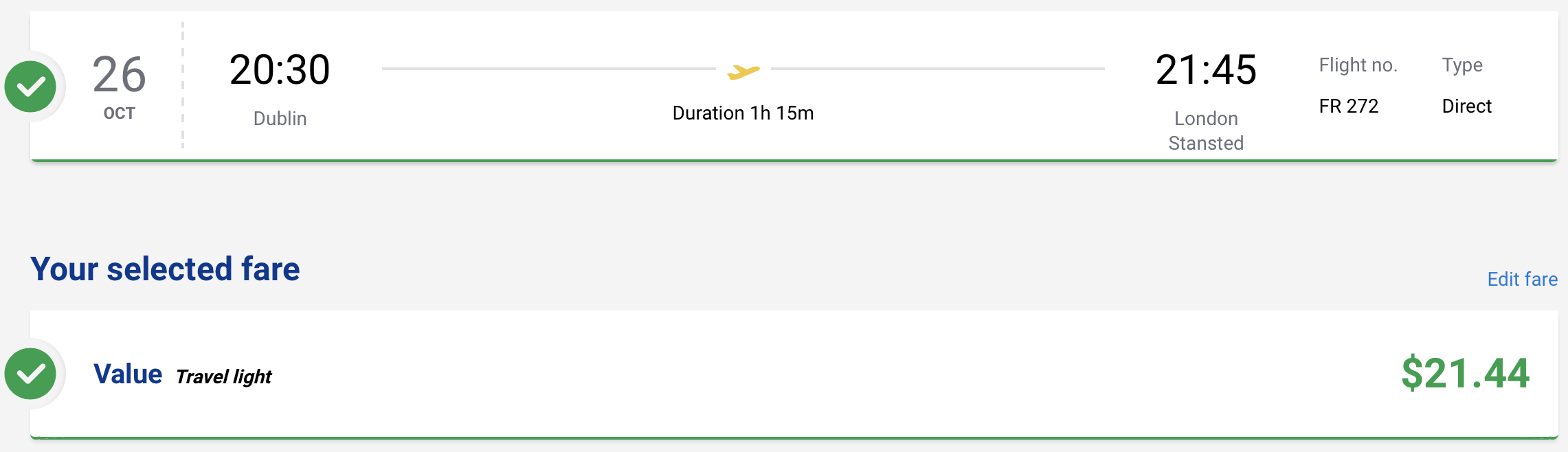

Aer Lingus AerClub

Aer Lingus AerClub became one of the Chase travel partners in 2017. While not officially part of the Oneworld alliance, Aer Lingus partners with several Oneworld airlines — most notably British Airways, Iberia and Qatar .

Air Canada Aeroplan

There are plenty of reasons not to overlook Aeroplan — the newest of the Chase Sapphire airline partners. Air Canada is a Star Alliance member, so you can use Aeroplan points to book award flights on any Star Alliance airline, including United.

Seek out those Aeroplan sweet spots to help boost the value of Aeroplan points to 1.4 cents for award tickets.

» Learn more: A guide to Air Canada’s Aeroplan rewards loyalty program

Air France-KLM Flying Blue

Flying Blue is the loyalty program of Air France, KLM, Kenya Airways and a few smaller airlines. Because many Flying Blue airlines are members of the SkyTeam alliance , you can transfer points from Chase to Flying Blue to book award flights on other SkyTeam member airlines, such as Delta Air Lines.

The Flying Blue program offers a monthly Promo Rewards promotion that discounts certain routes by up to 50% — which can make Flying Blue sweet spots even a better deal.

» Learn more: A points collector’s guide to Air France-KLM Flying Blue

British Airways Executive Club

Most travelers might think of flights to London when thinking about British Airways. However, that's not where the value of British Airways Avios lies. In fact, most British Airways Avios sweet spots don't involve flying British Airways.

Instead, use this Chase transfer partner to book inexpensive awards on American Airlines, Alaska Airlines and other Oneworld partners — including flying to the Caribbean .

» Learn more: The complete guide to the British Airways Avios program

Emirates Skywards

Dubai-based Emirates Airlines is best known for its glitzy business- and first-class products. And while premium cabins command huge cash prices, paying with miles through the Emirates Skywards loyalty program is possible and considered the best use of miles (as opposed to using miles to book in the Emirates economy class ). A NerdWallet analysis found that you only get about 0.6 cent per mile in value for Emirates economy, but the value of Emirates miles jumps up if you redeem an award in Emirates business class.

Unfortunately, the Emirates Skywards sweet spots are limited — particularly on partner airlines. That said, the Skywards program is one of only a few ways to book Emirates first class with points since the airline restricts award availability through partner airlines.

» Learn more: The guide to Emirates Skywards

Iberia Plus

Just like British Airways, Iberia is a member of the Oneworld alliance and uses the Avios program. And after Iberia's recent overhaul to its award chart , award rates to book American Airlines flights match the British Airways Executive Club’s rates on partner airlines. However, other Iberia sweet spots include some incredible gems. Iberia often offers among the cheapest business class awards to Europe .

» Learn more: What to know about Iberia Airlines Plus loyalty program

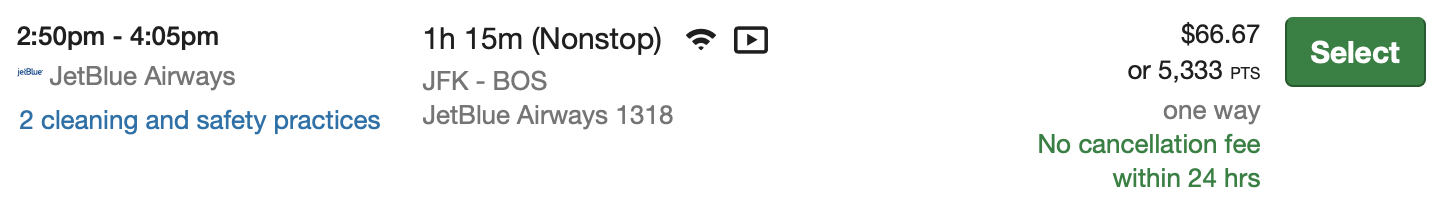

JetBlue TrueBlue

JetBlue uses a revenue-based TrueBlue points program in which the required number of points for an award roughly equates to the cash price of the flight. That means you can't get outsized value from redeeming TrueBlue points.

However, just because the program doesn't have an upside doesn't mean JetBlue isn't a good Chase transfer partner. TrueBlue points are worth 1.5 cents per point — making it a valuable currency for economy flights among U.S. airlines.

» Learn more: The complete guide to the JetBlue TrueBlue rewards program

Singapore Airlines KrisFlyer

Singapore Airlines is another Star Alliance Chase travel partner that can provide excellent premium cabin redemptions. Singapore KrisFlyer sweet spots include flights to Europe and Hawaii, and flights within the continental U.S. Luxury travelers also flock to KrisFlyer, as it's typically the only way to book the award-winning Singapore first class product with points.

» Learn more: The guide to Singapore Airlines’ KrisFlyer frequent flyer program

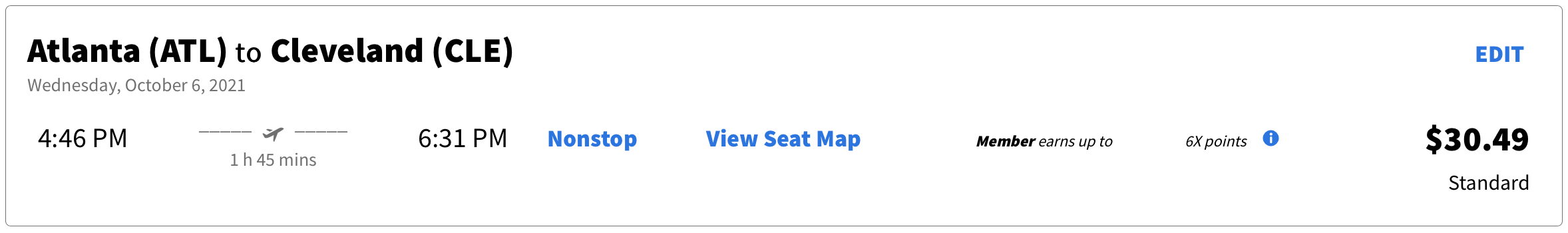

Southwest Airlines Rapid Rewards

Like JetBlue, Southwest uses a revenue-based redemption program, where points prices correlate with cash prices. This means you don't have to seek out sweet spots to get good value from your Southwest Rapid Rewards points.

Instead, the value of Southwest Rapid Rewards is a predictable 1.5 cents per point when redeemed for Southwest flights. Steer clear of other Rapid Rewards redemptions for hotels, rental cars or merchandise though, as the redemption value can drop to 0.6 cents per point.

» Learn more: The complete guide to Southwest Rapid Rewards

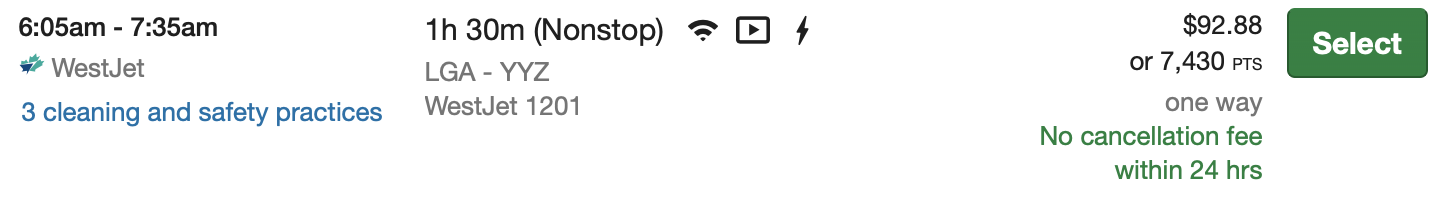

United MileagePlus

United joins JetBlue and Southwest as the three U.S.-based Chase Sapphire airline partners. MileagePlus miles are worth around 1.2 cents per mile when redeemed for United economy flights .

In addition to redeeming miles on United, you can redeem United MileagePlus miles for award flights on other Star Alliance partners. Just keep in mind that United can charge more miles for partner awards.

» Learn more: The complete guide to United MileagePlus program

Virgin Atlantic Flying Club

London-based Virgin Atlantic is a member of the SkyTeam alliance and it uses a different redemption chart for each partner, meaning the Flying Club sweet spots are just as diverse as its partners.

» Learn more: The guide to Virgin Atlantic Flying Club

Chase has just three hotel loyalty program parters, which are:

IHG One Rewards

The IHG loyalty program is good, but it's generally a weak Chase transfer partner.

NerdWallet values IHG points at 0.8 cent each. But since Chase points transfer to IHG One Rewards at the same 1:1 transfer ratio as all other partners, that makes for a pretty bad transfer that can actually devalue your points. Unless you find a killer IHG redemption, only transfer points from Chase to IHG to top off your account if you're a few points shy of booking a hotel you want with the rest of your IHG points. Otherwise, you’re generally better off booking IHG hotels via Chase's portal.

» Learn more: What you need to know about IHG One Rewards

Marriott Bonvoy

Marriott Bonvoy is one of the largest hotel loyalty programs around. You can redeem Bonvoy points for free nights and room upgrades at over 7,000 properties across more than 30 brands.

However, bigger isn't always better. When NerdWallet analyzed the value of Marriott Bonvoy points , we found that points were worth around 0.8 cent each. That puts Marriott in the same category as IHG, where points often lose their value when you transfer them from Chase to Marriott Bonvoy.

Considering Chase points can be redeemed for 1.25 cents or 1.5 cents each (depending on which Sapphire card you have), make sure that you're getting at least this much value before transferring Chase points to Marriott Bonvoy — which is unlikely. With that, save Bonvoy transfers only for situations where you find an outstanding hotel deal, or if you need just a few more points to book using your existing Bonvoys.

» Learn more: The complete guide to the Marriott Bonvoy program

World Of Hyatt

World of Hyatt is undoubtedly Chase's most valuable hotel transfer partner — and perhaps its most valuable travel partner overall, too. In NerdWallet's analysis, World of Hyatt points are worth 2.3 cents each when used for award stays.

Hyatt is one of a few hotel loyalty programs that still publishes an award chart . That means predictability in planning how many points an award stay may cost. Award nights start at 3,500 points, meaning you can really stretch out your Chase points at Hyatt hotels.

» Learn more: The complete guide to the World of Hyatt loyalty program

So that's a list of all the transfer partners — but which ones are the best? After all, some Chase travel partners are far better than others.

Before we dig into the best Chase Sapphire transfer partners, here's a complete overview of their estimated value, sorted in alphabetical order:

Using that estimated value stated above, here's the ultimate NerdWallet power ranking of the six best Chase transfer partners (with No. 1 being the best) are:

World of Hyatt.

Virgin Atlantic Flying Club.

JetBlue TrueBlue.

Southwest Airlines Rapid Rewards.

Air Canada Aeroplan.

Air France/KLM Flying Blue.

Best airline partner for Chase points

As far as Chase's airline transfer partners go, Virgin Atlantic Flying Club is Chase' best airline transfer partner. Even still, you can easily get more than 1 cent per point in value from Chase points when you transfer points from Chase to fixed-value programs like Southwest Rapid Rewards and JetBlue TrueBlue.

Other airline transfer partners can be hit-and-miss, such as Emirates, which is generally a miss when points are transferred to book Emirates economy class . But, it's usually a massive hit if you can transfer Chase points to be used for booking the incredibly-swanky Emirates business class on points.

Best Chase hotel transfer partner

Meanwhile, World of Hyatt comes out on top as the best Chase hotel partner. And not only is it the best hotel partner, but it's the best travel partner period given that eye-popping value over 2 cents.

NerdWallet's estimated value is exactly that — an estimate. You might find individually great redemptions while using other Chase transfer partners for specific trips.

Is it worth transferring Chase points to united?

While you might book hotels and airfares with cash or through Chase’s travel portal , it’s clearly often a better deal to put in the extra effort and transfer your points to one of Chase’s transfer partners — especially those named above. That said, folks seeking to maximize value should always calculate the value of the Chase Ultimate Rewards® points relative to the price to pay for airfare or hotel rooms in cash.

Use NerdWallet’s Chase points calculator below to determine the value of your points, based on both the baseline and NerdWallet estimated values:

With a little bit of research, you can get even more value through other Chase Ultimate Rewards® transfer partners versus using them to book travel directly through Chase's travel portal.

The most common way to earn Chase Ultimate Rewards® points is through spending on a Chase credit card that participates in Chase Ultimate Rewards®. You might earn points through taking advantage of introductory offers — where you can get a windfall of points upon meeting a certain threshold within a window of time upon card approval — and via ongoing spending.

Just note that not all Chase credit cards earn transferable Ultimate Rewards® points. That said, Chase cards that do earn transferable Ultimate Rewards® points include:

Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

Chase Freedom Flex℠

Chase Freedom Unlimited®

Ink Business Preferred® Credit Card

Ink Business Cash® Credit Card

Ink Business Unlimited® Credit Card

Some of these cards offer bonus points in certain categories, so someone seeking to maximize their points earning might have multiple cards in their wallet to use depending on the transaction. To maximize points, you might use the Chase Sapphire Preferred® Card to pay at restaurants (it earns 3 points per $1 spent on dining), the Chase Freedom Flex℠ to pay at drugstores (it earns 3% back at drugstores) and the Ink Business Cash® Credit Card to pay the monthly internet bill (it earns 5% back on internet, cable and phone services, up to a combined $25,000 in annual spending).

Even though the latter two cards don't let you transfer your rewards directly to any of the above airline or hotel partners, you can transfer them to another card that you hold (or that someone in your household holds), as long as that card is one of the cards that allows for transfers to partner airline and hotel brands.

The three Chase travel cards with transfer partners are the Chase Sapphire Preferred® Card , the Chase Sapphire Reserve® and the Ink Business Preferred® Credit Card .

on Chase's website

Annual fee: $95 .

Earning rates:

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Bonus offer: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Annual fee: $550 .

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Bonus offer: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Bonus offer: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠.

Use this guide to learn how to transfer Chase points between two credit cards you own.

Here's how to to transfer Chase points to family member or spouse .

Once you've got all the points you need in one account, you're ready to then send them to the actual airline or hotel loyalty program you want to convert your Chase points into. Learn how to transfer Chase Ultimate Rewards® points to travel partners here.

Chase may lag other transferable bank point currencies like American Express, Capital One and Citi when it comes to the raw number of transfer partners. But some say that size matters not (at least in terms of number of transfer partners).

It's more about their value — and some Chase travel partners are particularly valuable. Just look at Hyatt as an example. Using this Chase hotel partner can morph a point that might be worth a measly 1 cent each when exchanged for Chase to something worth more than 2 cents when used for a Hyatt hotel room. That offer becomes even more tantalizing when you consider that NerdWallet ranks World of Hyatt among the most valuable hotel rewards programs out there.

With that, Chase Ultimate Rewards® points rank among the most valuable transferable points available.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Chase Ultimate Rewards Transfer Partners and How To Use Them [2024]

Jarrod West

Senior Content Contributor

439 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Jessica Merritt

Editor & Content Contributor

83 Published Articles 480 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3126 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![chase travel partner transfer points Chase Ultimate Rewards Transfer Partners and How To Use Them [2024]](https://upgradedpoints.com/wp-content/uploads/2018/09/Emirates-First-A380-3.jpg?auto=webp&disable=upscale&width=1200)

Aer Lingus AerClub

Air canada aeroplan, air france-klm flying blue, british airways executive club, emirates skywards, iberia plus, jetblue trueblue, singapore airlines krisflyer, southwest rapid rewards, united mileageplus, virgin atlantic flying club, ihg one rewards, marriott bonvoy, world of hyatt, chase shopping portal, how to transfer ultimate rewards, should you transfer to a partner or book through chase, other ways to use your points, combining ultimate rewards from different accounts, redeeming ultimate rewards, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Chase Ultimate Rewards points are perhaps the most valuable points out there. Thanks to their flexibility and transfer options, we regularly give Chase Ultimate Rewards one of the best valuations in our monthly valuations . There are plenty of great ways to earn Ultimate Rewards points and even more fun ways to redeem them for award flights and hotel stays.

In this post, we’ll show you all of Chase’s transfer partners, how to transfer Ultimate Rewards to these partners, and much more. After reading our guide, you’ll be ready to book an amazing getaway!

Chase Airline Transfer Partners

The Chase Ultimate Rewards program currently has 11 airline transfer partners — the latest program, Air Canada Aeroplan, was added in August 2021.

Points transfer to all these airlines at a 1:1 ratio, which is one of the reasons Ultimate Rewards points are so valuable.

Major Hub: Dublin (DUB)

Airline Alliance: None, but has airline partners

Aer Lingus is a part of the International Airlines Group (IAG), which also includes British Airways, Iberia, and Qatar Airlines, so you’ve got some flexibility when it comes to how you redeem your Aer Lingus AerClub Avios . That said, its award chart isn’t quite as valuable as many of the other Chase Ultimate Rewards transfer partners.

However, it does offer a couple of solid sweet spots for those looking to travel to The Emerald Isle. On off-peak dates, you can book a one-way ticket from the U.S. East Coast to Dublin for 13,000 Avios in economy or 50,000 Avios in business class.

Major Hubs: Calgary (YYC), Montréal (YUL), Toronto (YYZ), and Vancouver (YVR)

Airline Alliance: Star Alliance

Air Canada Aeroplan is easily one of the best Chase transfer partners for premium cabin award tickets thanks to its lucrative partner award chart .

For instance, you could fly one-way in business class to South America or most European destinations for 60,000 points. If you prefer to fly to Asia in business class, that would be 85,000 points so long as the distance covered is less than 11,000 miles.

Further, Aeroplan can be exceptional for award bookings because of its low taxes and fees on many partner tickets, and you can add a stopover on any itinerary for just 5,000 more points.

Major Hubs: Paris (CDG), Amsterdam (AMS)

Airline Alliance: SkyTeam

Another excellent option for economy and business class tickets between the U.S. and Europe is the Flying Blue program . Redemption rates are already quite reasonable, with solid award availability as well. You can often find one-way economy tickets to Europe for as low as 22,500 miles and one-way business class tickets for 56,500 miles.

While those rates are decent on their own, the Flying Blue program offers Promo Rewards each month that can drop the award ticket price for select routes by 25% to 50%, allowing you to get stellar value out of Flying Blue miles.

Major Hubs: London Heathrow (LHR), London Gatwick (LGW)

Airline Alliance: Oneworld

British Airways Executive Club gets a lot of flack in the points in miles community due to the large fuel surcharges for both economy and business class tickets between the U.S. and Europe. However, British Airways Avios can be incredibly useful for short-haul tickets that can often be relatively expensive.

For instance, U.S. domestic nonstop flights under 1,150 miles on American Airlines and Alaska Airlines cost just 9,000 Avios in each direction, along with low taxes of just $5.60. This can take you between destinations like New York and Miami, Chicago and Houston, or Seattle and Los Angeles.

Major Hub: Dubai (DXB)

While Emirates Skywards offers some of the most sought-after award redemptions for business and first class on its signature A380, and more recently its game-changer first class on the 777 , the airline has also gone through a recent string of devaluations that have made this award more expensive through higher fuel surcharges .

Fortunately, one great sweet spot remains that allows you to fly Emirates’ fifth freedom routes between the U.S. and Athens or Milan, for 85,000 miles in first class one-way, or an incredible 90,000 miles round-trip in business class, with significantly lower taxes and fees.

Major Hub: Madrid (MAD)

Another entry into the Avios family is Iberia Plus . Unsurprisingly, its award program has a decent amount of overlap with the others, but its award pricing between the U.S. and Spain presents an incredibly sweet spot for award travelers.

It’s common to see many U.S. carriers charge 30,000 points to fly between the U.S. and Europe in economy class, but Iberia charges just 34,000 Avios to fly between the U.S. and Madrid in business class on off-peak dates — one of the cheapest ways to get across the pond in business class.

Major Hubs: New York (JFK), Boston (BOS)

JetBlue is a low-cost U.S. carrier that is known for its great inflight product both in economy and its Mint business class seats.

However, since its TrueBlue loyalty program ties award redemptions to the cash cost of the ticket, you’ll usually receive just 1.1 cents per point towards Mint redemptions , and 1.3 to 1.4 cents per point on economy tickets.

This can be a better deal than booking through the Chase Travel portal for Chase Sapphire Preferred cardholders with a 1.25 cent per point redemption rate, but a poor choice for Chase Sapphire Reserve cardholders with a 1.5 cent per point redemption rate. That said, you can often get much more value out of your Chase Ultimate Rewards points using other transfer partners.

Major Hub: Singapore (SIN)

While you might overlook Singapore Airlines KrisFlyer as an option for domestic travel, as a Star Alliance partner it offers great award pricing on domestic United flights, including 17,500 miles for flights between the U.S. mainland and Hawaii, and 27,500 miles for flights between the U.S. and Europe.

Singapore miles are also your only option if you want to book a highly sought-after ticket in Singapore Suites class between the U.S. and Singapore or its fifth freedom route between the U.S. and Frankfurt.

Major Hubs: Atlanta (ATL), Baltimore (BWI), Chicago (MDW), Dallas (DAL), Denver (DEN), Houston (HOU), Las Vegas (LAS), Los Angeles (LAX), Oakland (OAK), Orlando (MCO), Phoenix (PHX)

Airline Alliance: None

Southwest is the world’s largest low-cost carrier with an award program in Rapid Rewards that’s similar to JetBlue in that it operates on fixed value redemptions, allowing you to usually get between 1.3 to 1.4 cents per point on your redemption that is tied to the cash cost of the ticket.

Since you can often get much more value out of your Chase Ultimate Rewards points than this, we generally advise against transferring to Southwest. However, one sweet spot is for those who have the Southwest Companion Pass , as your redemption value doubles on tickets where your companion flies with you for free.

Major Hubs: Chicago (ORD), Denver (DEN), Houston (IAH), Los Angeles (LAX), Newark (EWR), San Francisco (SFO), Washington DC (IAD)

In addition to being one of the most well-known Chase transfer partners for U.S. flyers, United MileagePlus also benefits from being able to book award travel on fellow Star Alliance airlines with low taxes and fees. In terms of booking tickets on its own metal, now that United has moved to dynamic pricing, getting outsized value using its currency isn’t quite as easy as it once was.

However, it does offer the incredibly valuable United Excursionist Perk , which allows you to tack on a free one-way flight on round-trip bookings for no added miles, so long as the flight is within the same region. For example, you could fly from the U.S. to Istanbul, Istanbul to London, and London back to the U.S., and your Istanbul to London leg (a 4-hour flight covering 1,500 miles) costs no added miles.

Major Hub: London Heathrow (LHR), Manchester (MAN)

The second largest carrier based out of the U.K., Virgin Atlantic doesn’t participate in an airline alliance but offers several great partnerships that award travelers can take advantage of.

One of which is booking Delta One business class awards between the U.S. and Europe for just 50,000 miles one-way, which is far less than what Delta would charge using its own miles to book these awards. You can also book ANA first class awards between the U.S. and Japan for as low as 55,000 miles one-way.

Chase Hotel Transfer Partners

Ultimate Rewards can also be transferred to 3 hotel rewards programs. Like Chase’s airline partners, all transfers to hotel partners occur at a 1:1 ratio.

Headquarters: Denham, England

Number of Properties: ~6,000

The IHG One Rewards program recently went through a revamp, but as a dynamically-priced program, it seldom makes sense to transfer your Chase Ultimate Rewards points.

For instance, we value IHG One Rewards points at 0.5 cents per point, so any redemptions above that level are generally considered to be a good value. Given that, it wouldn’t make sense to transfer Chase Ultimate Rewards points, which are worth a minimum of 1.25 cents per point through the Chase Travel portal, to a program where getting half of that value would be considered a good deal.

Headquarters: Bethesda, Maryland

Number of Properties: ~8,500

As with IHG, we seldom advise against transferring your hard-earned Chase Ultimate Rewards points to Marriott Bonvoy where nights at top-tier hotels can cost upwards of 85,000 to 100,000 points per night. Not only is it fairly easy to get more value out of other Chase partners, but you’ll also find that you’d likely be better off booking a Marriott hotel through the Chase Travel portal than transferring to Marriott directly.

Headquarters: Chicago, Illinois

Number of Properties: ~1,200

If you thought Hyatt would be similar to the other 2 hotel programs, think again. The World of Hyatt program is one of the best Chase Ultimate Rewards transfer partners and a darling in the points of miles community thanks to the value its award chart offers.

While the program recently went through a devaluation with the addition of peak pricing, even the most expensive award nights in the portfolio don’t exceed 45,000 points per night. This means you can book free nights at top-tier Hyatt hotels for roughly half of what programs like Marriott and Hilton often charge for similar hotels.

Hot Tip: Use our transfer partner tool to see how many points you’ll get when you transfer your Chase Ultimate Rewards to partner airlines and hotels!

Earning Ultimate Rewards

With several Chase card options available, there are ample opportunities to earn Ultimate Rewards points that can help you book your next trip.

Recommended Chase Cards (Personal)

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

Chase Freedom Unlimited ®

This all-purpose cash-back card offers great bonus categories, including bonus points for every purchase you make!

The Chase Freedom Unlimited ® is easily one of the best cash-back credit cards on the market. There aren’t many no-annual-fee credit cards that offer multiple great bonus categories like 5% back on travel purchased through Chase, 3% back on dining and drugstore purchases, and 1.5% back on all other purchases.

When paired with other Chase cards in the Ultimate Rewards family, you can transfer that cash back into points if you wish – making it one of the most lucrative cards in your wallet.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- 5% back on travel purchased through Chase Travel

- 3% back on dining and drugstore purchases

- 1.5% back on all other purchases

- No annual fee

- Earn big on travel purchased through Chase Travel

- Everyday bonus on dining and drugstores

- Straightforward cash-back on all other purchases

- Ability to pool points

- 3% foreign transaction fee

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited ® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- APR: 0% Intro APR for 15 months on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- Foreign Transaction Fees: 3% of each transaction in U.S. dollars

- Cash Back Credit Cards

- No Annual Fee Cards

- Benefits of the Chase Freedom Unlimited

- Chase Freedom Unlimited Requirements and Credit Score

- Car Rental Benefits of the Chase Freedom Unlimited

- Chase Freedom Unlimited vs Chase Freedom Flex

- Amex Blue Cash Everyday vs Chase Freedom Unlimited

- Best 0% Interest Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Bills and Utilities

- Best Instant Use Credit Cards

Chase Freedom Flex℠

The Freedom Flex card is an excellent no-annual-fee card that still earns big with 5% cash-back on travel and other bonus categories.

The Chase Freedom Flex℠ sure does pack quite a punch — especially for a no-annual-fee card.

The Freedom Flex card is an incredible option for those looking for a well-rounded cash-back card, or a powerful point-earner when paired with a premium card in the Ultimate Rewards family.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

- Powerful cash-back earner: 5% back on quarterly categories and travel purchases through Chase Ultimate Rewards, 3% back on dining and drugstore purchases, and 1% back on all other purchases

- Excellent cell phone insurance

- Mastercard World Elite benefits

- 3% foreign transaction fees in U.S. dollars

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- 5% cash back on travel purchased through Chase Ultimate Rewards ® , our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- No annual fee - You won't have to pay an annual fee for all the great features that come with your Freedom Flex℠ card

- Keep tabs on your credit health - Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more.

- APR: 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

- Benefits of the Chase Freedom Flex

- Amex Blue Cash Everyday vs Chase Freedom Flex

- Best 5% Cash Back Credit Cards

- Best Credit Cards for Cell Phone Protection

- Best Chase Credit Cards

Business owner? See our list of the best Chase business credit cards .

You can also shop through the Shop through Chase portal to earn extra Ultimate Rewards points when making purchases online. This is an easy way to boost your earnings on purchases you would make anyway.

Once you have some Ultimate Rewards points and are ready to transfer them to a partner to book your next big vacation, here are the simple steps to make the transfer process easy.

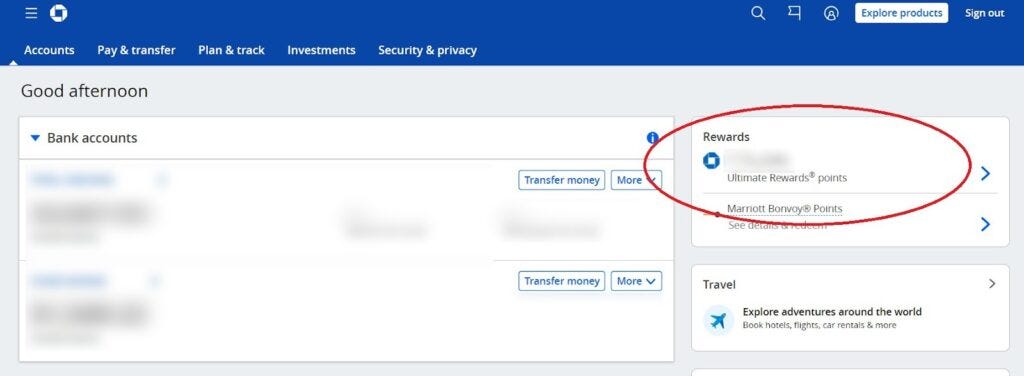

Step 1: After logging into the Ultimate Rewards site , select the appropriate card. If you want to transfer points, you will need to select a premium Ultimate Rewards card with an annual fee — these include the Chase Sapphire Reserve card , Chase Sapphire Preferred card , and the Ink Business Preferred ® Credit Card . You can combine Ultimate Rewards points under your chosen card from others that don’t have annual fees.

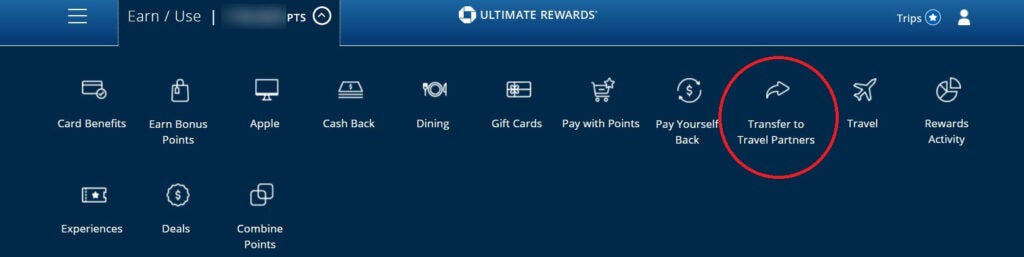

Step 2: Select Transfer to Travel Partners under the Earn / Use drop-down menu.

Step 3: Choose your desired airline and select Transfer Points .

You can also select from Chase’s hotel partners using the same steps.

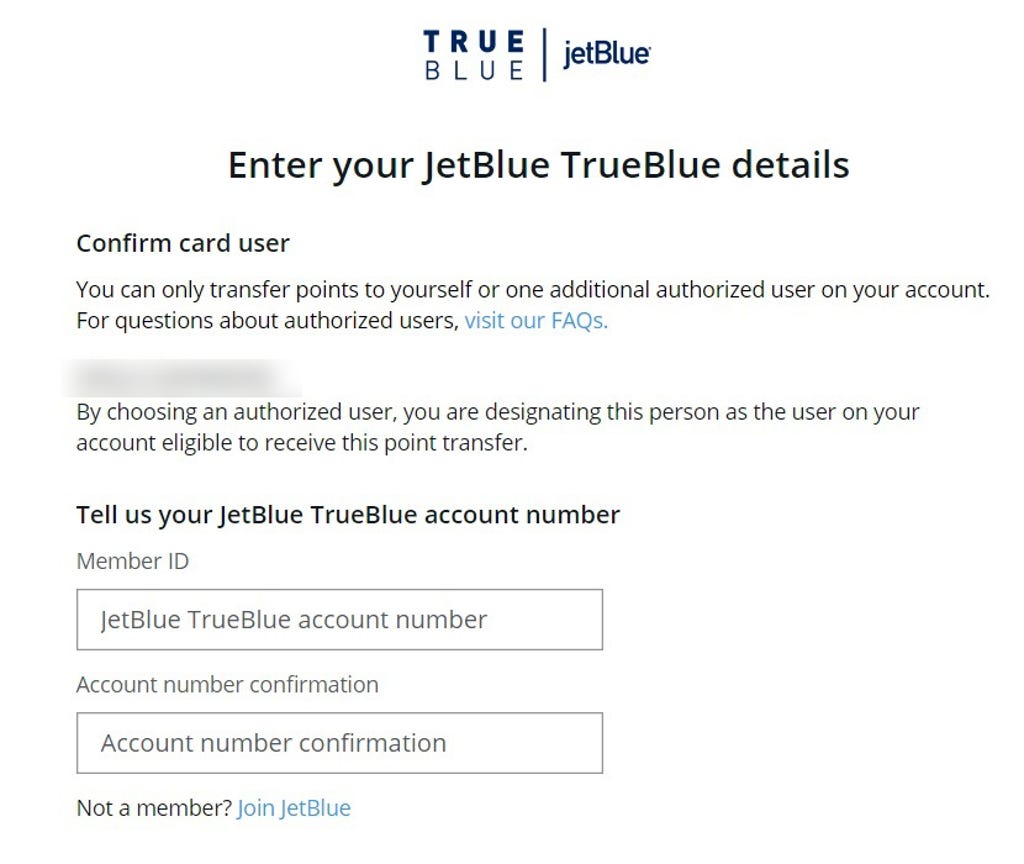

Step 4: If you haven’t already added your frequent flyer number or hotel rewards number, you will be prompted to do so.

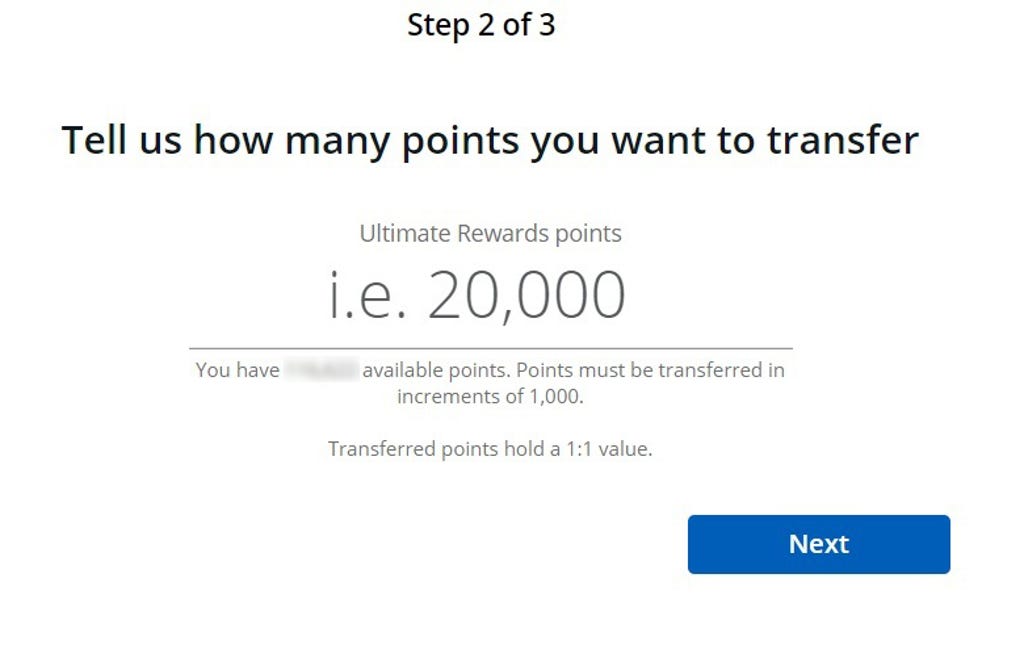

Step 5: Once you have linked your airline or hotel account to your Ultimate Rewards account, choose how many points you would like to transfer. Transfers must be done in increments of 1,000.

Step 6: Confirm the number of points you’re transferring and complete to transfer.

Step 7: Head over to the appropriate airline or hotel program’s website to book your award flight or award stay.

Booking Travel With the Chase Travel Portal

Sometimes, making your flight or hotel booking through the Chase travel portal can make a lot of sense. With the Chase travel portal, the points needed for specific redemption are tied to the cash cost. So, if a flight or hotel stay is relatively inexpensive, to the point where the point cost ends up being less than going through a transfer partner, then the Chase travel portal is a perfect option.

If you have the Chase Sapphire Reserve card, each Ultimate Rewards point is worth 1.5 cents when booking through the portal. If you have a Chase Sapphire Preferred card or Ink Business Preferred card, each point is worth 1.25 cents when booking with the Chase travel portal.

Similar to the transfer process, you simply select Travel under the Earn / Use Points drop-down menu.

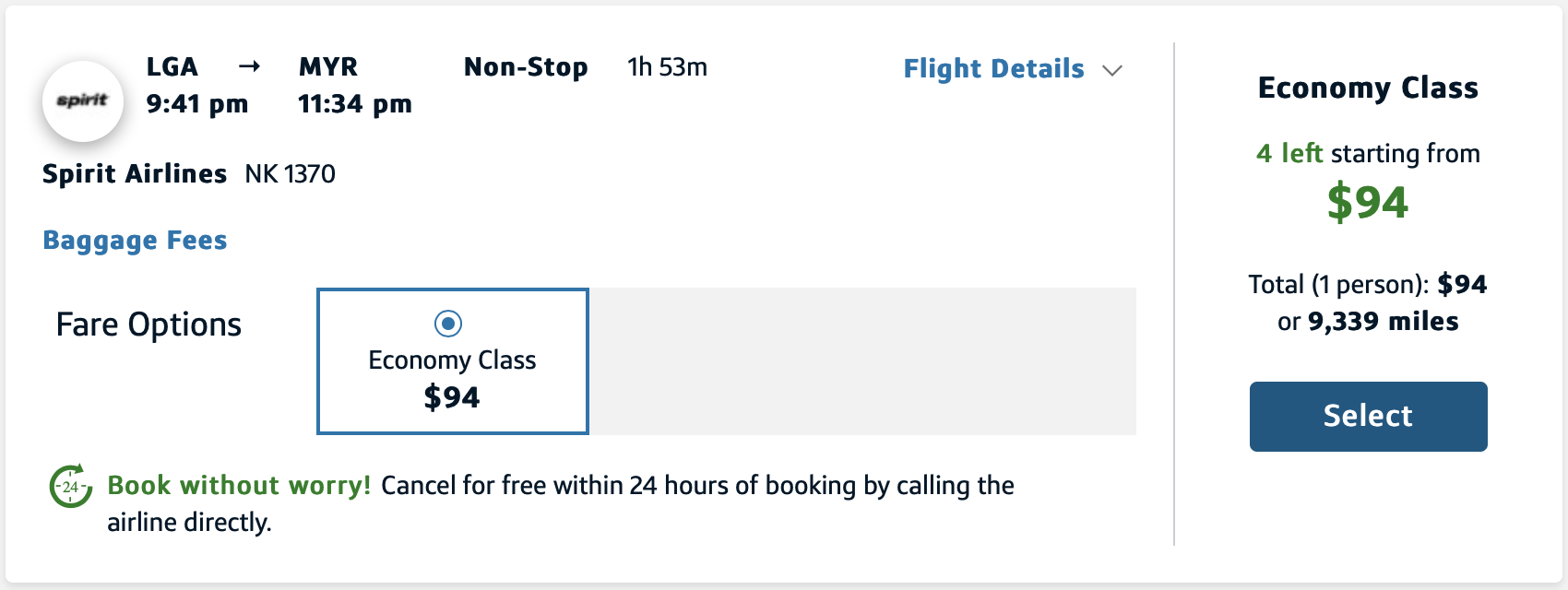

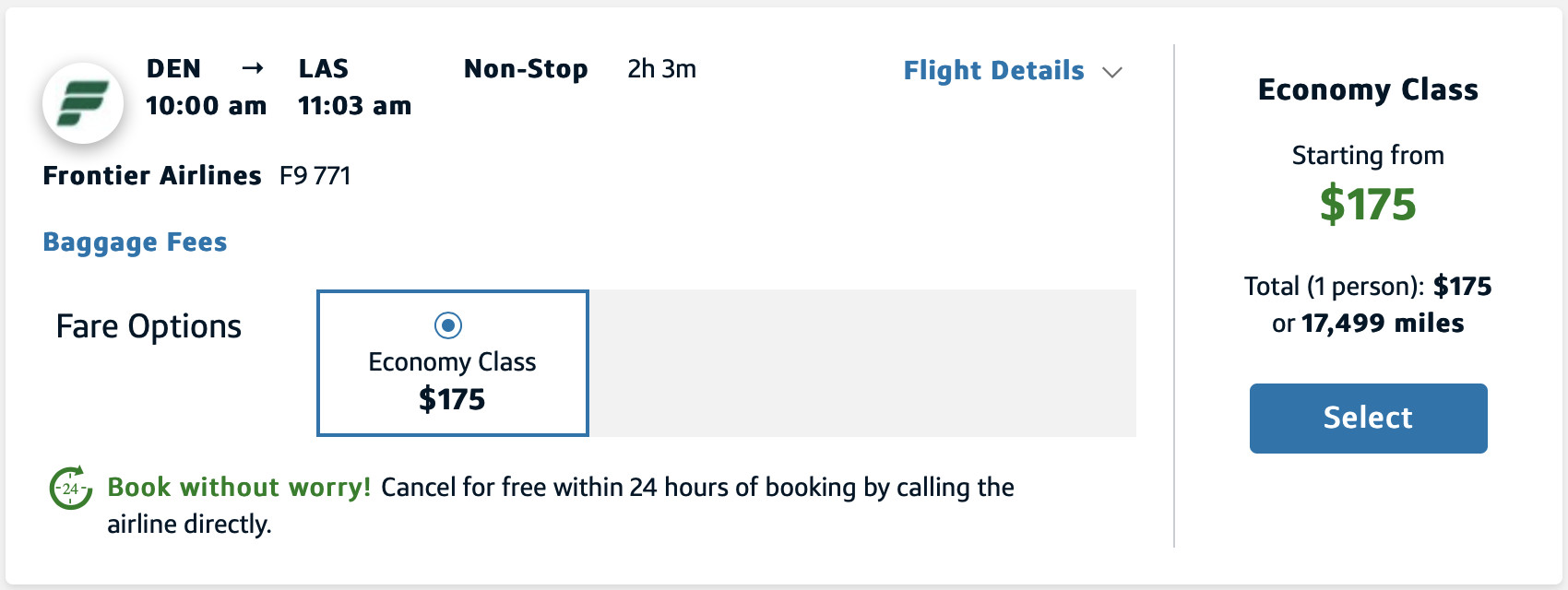

Check out an example of a travel portal booking below:

This round-trip economy class booking with Star Alliance airline United from San Francisco (SFO) to Honolulu (HNL) costs as few as 7,900 Ultimate Rewards points.

Let’s think about the booking discussed above. If you were to book this same itinerary by transferring the points to Chase partner United Airlines, it would cost 12,500 miles. In this case, booking through the portal would be a much better deal.

Bottom Line: To ensure you get the most out of your points, it’s important to check both the portal and transfer options when searching for flights.

The Chase travel portal allows you to book hotels at the same 1.5 cents per point for cardholders of the Chase Sapphire Reserve card or 1.25 cents per point with the Chase Sapphire Preferred card or Ink Business Preferred card.

You can also redeem your points for gift cards to merchants including Airbnb , Lowe’s, Home Depot , and Amazon . Additionally, you can redeem your points for statement credits. Unfortunately, these options are a very poor use of points in terms of value, and we do not recommend them!

Combining Ultimate Rewards from your different Chase accounts is a simple process. In the menu bar, you will see the points you have earned on your selected card. If you hover over the points available, you will see a drop-down menu of your cards and the available points from each.

Select Combine Points to consolidate your points under a single card. If you have the Chase Sapphire Reserve card, keep your Ultimate Rewards points there since they’ll be worth a minimum of 1.5 cents each.

Hot Tip: You can also combine points with 1 other household member . This is a great way to pool points with your significant other for a great redemption.

Using your Ultimate Rewards points for travel is the best way to get the most value out of them. With multiple transfer partners and countless ways to redeem points for travel, it can be overwhelming!

We’ve compiled multiple lists of the best ways to use your Chase Ultimate Rewards for some incredible travel experiences. See below:

- The Best Ways To Use Ultimate Rewards Points

- The Best Ways To Use 10,000 (Or Fewer) Chase Ultimate Rewards Points

- The Best Ways To Use 100,000 Ultimate Rewards Points

The Chase Ultimate Rewards program should be a staple in your points-earning strategy. If you are just starting your miles and points journey, we recommend earning Ultimate Rewards initially. Check out our Beginner’s Guide to get started on the right track.

Chase Ultimate Rewards points are easy to earn, easy to redeem, and can get you excellent value when you use them properly. Before you know it, you’ll be taking a trip of a lifetime … and then doing it again!

The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

What airlines can chase ultimate rewards points be used for.

There are multiple airline and hotel partners that you’re able to transfer your Ultimate Rewards points to. Refer to our table in this post for the most up-to-date transfer partners!

Can you transfer Chase Ultimate Rewards to another person?

You can transfer your Chase Ultimate Rewards to another person as long as they are a member of your household.

Can you transfer points between Chase credit cards?

Yes, but only to another Chase card that earns Ultimate Rewards points belonging to you or 1 member of your household.

Can you transfer points from an airline to Chase Ultimate Rewards points?

You cannot transfer miles or points from an airline to Chase Ultimate Rewards points. You also cannot get back any Ultimate Rewards points that you have already transferred to an airline partner — all transfers are final.

Do Ultimate Rewards points expire?

Your Ultimate Rewards points will not expire as long as your account remains open and in good standing.

How much are Ultimate Rewards points worth?

Generally, your Ultimate Rewards points will be worth 1 cent toward cash-back, 1.25 to 1.5 cents through the Ultimate Rewards travel portal (depending on which card you hold), or 2+ cents for redemptions made through transfer partners.

Was this page helpful?

About Jarrod West

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in outlets like The New York Times.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![chase travel partner transfer points How To Earn 100k+ Chase Ultimate Rewards Points [In 90 Days]](https://upgradedpoints.com/wp-content/uploads/2023/01/Chase-bank-branch-new-york.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

How to use chase ultimate rewards® for travel.

Whether you're a longtime cardholder or just starting your credit card journey with Chase, you may be wondering: What is the best way to use Chase points ? The answer will be different for everyone, but if you like to travel, you may find that using your points on your trips is your favorite way to spend them. Learning how to use Chase Ultimate Rewards to make the most of your points could help you pack in a few extra adventures when planning your next getaway.

How to earn Chase Ultimate Rewards points

Chase Ultimate Rewards points are redeemable points you can earn through welcome bonus offers or when making purchases with your Chase-branded cards, such as:

- Chase Sapphire

- Chase Freedom

- Chase Ink Business

You may also earn Ultimate Rewards at an accelerated rate on certain purchases or bonus categories — the typical rate is one point earned per dollar spent.

Redeeming Chase Ultimate Reward points

As a general rule of thumb, one point equates to $0.01 in redeemable value. This can fluctuate, however, depending on how you decide to redeem your points. When it comes to travel there are three main ways to redeem Ultimate Rewards points:

- Booking travel directly through the Chase travel portal.

- Transferring your points to Chase travel partners, such as airlines and hotels.

- Redeeming your points for gift cards or statement credits.

Using Ultimate Rewards points for travel

If you decide to redeem your Chase Ultimate Rewards to book travel, you may want to know what your options are. The main way you can redeem your points is through the Chase travel portal. There, you can directly find, book and pay for travel expenses such as flights, hotels, car rentals, cruises, tours and other activities or transfer points to hotel and airline partners.

When transferring your Ultimate Rewards to Chase travel partners, i.e. airlines and hotels, the transfer ratio is typically 1:1. That means that however many Ultimate Rewards points you have, you'll have the same amount in partner points with whichever Chase Ultimate Rewards travel partner you choose.

Why book through Chase Travel portal?

Something to note when using the portal is that the value of your points can change depending on which card you have.

For instance, if you have the Chase Freedom Unlimited ® card, your points are worth one cent each. With the Chase Sapphire Preferred ® or Ink Business Preferred ® cards, your points are each worth 1.25 cents. You'll get the highest value with the Chase Sapphire Reserve ® , as points are worth 1.5 cents each in the travel portal with that card.

If you have multiple eligible cards, you can combine your points to get the most out of them.

One of the benefits of booking through the Chase travel portal is that you can earn points on paid reservations. For instance, with Chase Sapphire Reserve ® you can earn 5x points on airfare and 10x points on hotels and rental cars booked through the portal.

You can book flights, hotels and rental cars directly through the travel portal, but if you want to book a cruise using Ultimate Rewards points, you'll have to call Chase directly.

There's no right or wrong when it comes to how to redeem Chase Ultimate Rewards points. However, if you've been bitten by the travel bug, you may find the best way to use them is by transferring them to Chase partners or booking through the Chase travel portal. Take some time to compare points transfers and the travel portal and see which one helps you make the most out of your points.

- card travel tips

- credit card benefits

What to read next

Rewards and benefits frequent flyer programs: a guide.

Frequent flyer programs offer a variety of perks. Learn more about what frequent flyer programs are and what to consider when choosing one.

rewards and benefits Are frequent flyer credit cards worth it?

Frequent flyer credit cards help frequent flyers earn and redeem points or miles towards the cost of their future travel plans. Learn more about their risks and rewards.

rewards and benefits Chase Sapphire Events at Miami Art Week

Learn about the exclusive events a Chase Sapphire Reserve cardmember can experience at Miami Art Week.

rewards and benefits How to choose a credit card to earn travel points

There are many things to consider when choosing a credit card with travel points - how travel points work, how to earn them, and so on. Learn more here.

Chase Ultimate Rewards transfer partner list

How to earn chase ultimate rewards points, best chase credit cards to earn ultimate rewards for travel, should you book through chase or transfer points to a partner, how to transfer chase ultimate rewards points, chase ultimate rewards transfer partners 2024: the best ways to redeem your chase points for travel.

These transfer partners can help you get more value from Chase Ultimate Rewards points.

Holly Johnson

Contributor

Holly Johnson is a credit card expert and writer who covers rewards and loyalty programs, budgeting, and all things personal finance. In addition to writing for publications like Bankrate, CreditCards.com, Forbes Advisor and Investopedia, Johnson owns Club Thrifty and is the co-author of "Zero Down Your Debt: Reclaim Your Income and Build a Life You'll Love."

Raina He is an editor at CNET Money. She writes and edits articles about personal finance, with a focus on credit cards, banking and loans. She graduated from the University of North Carolina at Chapel Hill with a B.A. in Media and Journalism. Before coming to CNET Money, she was an editor at NextAdvisor, a personal finance news site that shared a parent company with CNET Money.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

For Chase cardmembers, Chase Ultimate Rewards is one of the most popular travel rewards programs out there. However, not all cards that earn points in this program offer the same redemption options.

There are three Chase Ultimate Rewards credit cards that let you move your rewards to airline and hotel partners at a 1:1 ratio: the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® and the Ink Business Preferred® Credit Card .

Here’s everything you need to know about transferring your rewards with Chase Ultimate Rewards.

All of Chase’s travel partners allow 1:1 transfer values in increments of 1,000. This means 1,000 Chase Ultimate Rewards points can turn into 1,000 airline miles or 1,000 hotel points with any of the partner programs.

Note that all of Chase’s point transfers are one-way, meaning you can’t change your mind and move your points back after a transfer.

So once you transfer your rewards to an airline or hotel partner, your points then belong entirely to that program and become subject to the program’s expiration policies and other fine print. While Chase Ultimate Rewards points never expire as long as your account is open, many airline and hotel currencies expire after 12 or 24 months of inactivity.

In total, Chase has 14 transfer partners -- 11 airlines and three hotels. Although that number is less than what American Express, Citi and Capital One offer, Chase has a few valuable transfer partners that the other three rewards programs don’t. These include Southwest Airlines Rapid Rewards and World of Hyatt.

While program transfer partners can change over time, here’s the current list of Chase’s partner frequent flyer programs and hotel loyalty programs.

Airline travel partners

Aer lingus, aerclub, air canada aeroplan, british airways executive club, emirates skywards, air france-klm flying blue, iberia plus, jetblue trueblue, singapore airlines krisflyer, southwest airlines rapid rewards, united mileageplus, virgin atlantic flying club, hotel transfer partners, ihg one rewards, marriott bonvoy, world of hyatt.

Aer Lingus is the national airline of Ireland, and the Aer Lingus AerClub program is its official loyalty program. This airline partners with a range of airlines like United and American, and it isn’t part of an official alliance.

Many frequent flyers use Aer Lingus rewards currency, called Avios, for cheap flights within Europe. For example, it can cost as little as 4,000 Avios to fly from Dublin to Paris or 8,500 Avios to fly from Dublin to Malaga, Spain.

It’s worth noting that British Airways and Iberia also use the Avios rewards currency, though each airline has its own loyalty program. You can freely transfer Avios between Aer Lingus AerClub, British Airways Executive Club and Iberia Plus.

Air Canada Aeroplan is a founding member of the Star Alliance, which includes partners like Lufthansa, Turkish Airlines and United Airlines. This means you can use miles in this program to fly to more than 1,250 airports in 195 countries around the world.

British Airways Executive Club is part of the oneworld Alliance, which includes partners like Alaska Airlines, American Airlines, Cathay Pacific and Iberia. Like Aer Lingus Aerclub and Iberia Plus, this program also uses the Avios rewards currency, which is redeemable with the airline and its partners to more than 900 destinations in 170 countries.

While British Airways is headquartered in England, many frequent travelers use this program to book partner awards on domestic flights with American Airlines.

Emirates is one of the major airlines of the United Arab Emirates, and it’s not part of any of the major airline alliances. That said, this program lets you redeem miles for flights around the world, as well as for upgrades to a premium cabin and even luxury hotel stays.

The Flying Blue program is the frequent flier program of Air France and KLM, which are part of the SkyTeam airline alliance along with Delta Air Lines and Virgin Atlantic. This means earning Flying Blue miles paves the way to booking award flights with any of these participating airlines to 1,050 destinations in 166 countries. The Flying Blue program is also known for its cheap flights to Europe, both in economy and in business class.

Based out of Madrid, Spain, Iberia Plus is another airline that’s part of the oneworld Alliance. Like Aer Lingus AerClub and British Airways Executive Club, Iberia Plus also uses Avios as its rewards currency. This rewards program is popular among travelers who are looking for cheap award fares to and from Europe.

JetBlue isn’t a member of any of the major airline alliances, but it does partner with Hawaiian Airlines and Qatar Airways. JetBlue TrueBlue points are redeemable for award flights with JetBlue to more than 100 destinations in the US, Europe, the Caribbean, Mexico, Central America and South America, as well as for hotel stays, vacation packages and more.

Singapore Airlines is part of the Star Alliance alongside United, and it’s easy to rack up miles in this program since it’s a partner of Chase Ultimate Rewards, American Express Membership Rewards and Capital One Miles. Miles in this program can be redeemed for award tickets with Singapore Airlines and partners, upgrades to a premium cabin, merchandise, experiences and more.

Southwest Rapid Rewards is another airline that’s not part of an alliance, yet this Chase travel partner is incredibly popular with families. Not only do all travelers who fly with Southwest get two free checked bags and fee-free flight changes, but the program uses a cost-based award system that lets you fork over fewer points for awards when prices drop. Overall, Southwest Airlines flies to 121 destinations in the US, the Caribbean, Central America and Mexico.

United MileagePlus is one of the biggest carriers in the US, and it’s known for offering decent flight awards with no fuel surcharges on United-operated flights. This program doesn’t offer an award chart and can occasionally charge a lot more miles than competitors for various itineraries. However, there are still exceptional deals to be had, and you can redeem miles for flight awards, upgrades to a premium cabin, gift cards, merchandise and more.

Virgin Atlantic Flying Club is the newest member of the SkyTeam alliance, which means you can use points for flight awards on partners like Air France, Delta and KLM. You can use Flying Club points for award flights, upgrades to a premium cabin, Virgin Atlantic Holidays vacation packages and more. The program also offers a “ reward seat checker ” that lets you get an estimate of how many points you’ll need for a flight based on your home airport, travel destination, preferred airline (whether Virgin or its partners) and travel dates.

IHG One Rewards is the hotel loyalty program of Intercontinental Hotels Group, and it lets members redeem points for stays at more than 6,000 global destinations. This program doesn’t have any blackout dates, and members get automatic perks like free internet access and late check-out (based on availability) when they stay with the brand. Free night awards with IHG One Rewards start at just 5,000 points per night.

The Marriott Bonvoy program features nearly 8,700 hotels and resorts across 30 brands in 139 countries and territories around the world. While redemption rates vary, you can redeem points at traditional hotels and resorts, budget properties, all-inclusive resorts, and luxury properties around the world.

World of Hyatt is probably the most valuable hotel loyalty program available today, and you can rack up rewards in this program with paid hotel stays, Chase Ultimate Rewards credit cards or co-branded credit cards like the World of Hyatt Credit Card. You can redeem World of Hyatt points for stays at traditional hotels and resorts and all-inclusive properties. Free night awards over off-peak dates start at just 3,500 points per night.

Now that you know all about Chase transfer partners, you’re probably wondering how you can earn Chase Ultimate Rewards points.

Most of Chase’s cards, excluding co-branded ones, operate in the Ultimate Rewards ecosystem. You can earn Ultimate Rewards points by making purchases or earning a welcome bonus with any of the following cards:

- Chase Freedom Unlimited®

- Chase Freedom Flex℠ *

- Ink Business Unlimited® Credit Card

- Ink Business Cash® Credit Card

Chase Sapphire Preferred® Card

Chase sapphire reserve®, ink business preferred® credit card.

While all these cards earn Ultimate Rewards points, not all offer the same redemption options. The Freedom Unlimited, Freedom Flex, Ink Business Unlimited and Ink Business Cash allow you to redeem your Ultimate Rewards only as cash back, travel through Chase Travel℠ or a few other non-travel options. To transfer your Ultimate Rewards points to hotel and airline partners, you’ll need one of Chase’s premium travel cards: the Chase Sapphire Preferred ($95 annual fee), the Chase Sapphire Reserve ($550 annual fee) or the Ink Business Preferred Credit Card from Chase ($95 annual fee).

One great thing about Chase’s Ultimate Rewards ecosystem is that you can pool your points from multiple cards , both personal and business, into a single card account. That means as long as you have one of the three premium travel cards, you can pool the points from any Ultimate Rewards-earning cards to the premium card’s account to transfer to travel partners.

For example, if you have 10,000 points on your Chase Freedom Flex, 30,000 points on your Ink Business Cash and 60,000 points on your Chase Sapphire Preferred, you can pool all your points onto your Sapphire Preferred card and transfer a total of 100,000 points to travel partners.

Chase’s premium travel credit cards offer a flat rate redemption bonus when you use them to book travel through Chase Travel. The Chase Sapphire Preferred and the Ink Business Preferred give you 25% more value for your points, whereas the Chase Sapphire Reserve gives you 50% more value when you redeem points for airfare, hotel stays and more through the portal.

This is part of the reason you’ll want to compare pricing options for various awards before you transfer your points. In some cases, you can get a better rewards value for booking through the Chase Travel. This is more commonly the case for hotel stays, but it can also be the case for airfare.

Consider this example:

We searched for award nights in Miami with the IHG One Rewards program and found free night awards at the Hotel Indigo Miami Brickell starting at 27,000 points per night over dates in fall of 2024.

On the exact same nights we searched, however, the same hotel would set you back only 12,882 Chase Ultimate Rewards points if you booked through the portal and had the Chase Sapphire Reserve. In this case, it makes a lot more sense to book the hotel through Chase for less than half of the cost in points.

That said, you should never assume a specific booking will be a better value without taking the time to check. For example, we searched the World of Hyatt program for available properties in Miami on the same dates and found that you can book the Hyatt Regency Miami for 18,916 points per night through Chase with the Chase Sapphire Reserve.

However, the same hotel is only 12,000 World of Hyatt points for the same dates, so you would definitely want to move your Chase points to your World of Hyatt account to make this booking directly.

While the cost of a booking is likely the most important factor in your decision, there are other considerations as well. Point transfers to an airline or hotel’s loyalty program let you book directly through that hotel or airline, potentially making it easier to get help if you need to make changes or if something goes wrong with your booking. By contrast, booking through the Ultimate Rewards portal means you may have to go through Chase’s customer support instead of dealing directly with the airline or hotel.

If you have an eligible Chase credit card and want to transfer your rewards to partners, here are the steps you need to take:

Step 1: Log into your credit card account at Chase.com . From there, you’ll click on the part of your online account interface that displays your rewards balance.

Step 2: Click where it says “Earn/Use” then where it says “Transfer to Travel Partners.” At that point, you’ll see a list of the Chase travel partners we listed in this guide.

Step 3: Choose the travel partner you want to transfer points to. Chase lets you save your loyalty account information for partners you have transferred points to in the past. Otherwise, you’ll need to fill in information to facilitate the transfer, including your loyalty account number.

Step 4: Enter your transfer amount. Enter the number of Chase points you want to transfer to a partner. Keep in mind that points must be transferred in increments of 1,000.

Once you have completed the final step, your points will move from your Chase account to the airline or hotel program. Some point transfers are instant, meaning you can log into your loyalty account and use them right away. Others can take up to 48 hours or even up to seven days.

Chase transfer partners include Aer Lingus AerClub, Air Canada Aeroplan, British Airways Executive Club, Emirates Skywards, Air France-KLM Flying Blue, Iberia Plus, JetBlue TrueBlue, Singapore Airlines KrisFlyer, Southwest Airlines Rapid Rewards, United MileagePlus, Virgin Atlantic Flying Club, IHG One Rewards, Marriott Bonvoy and World of Hyatt.

Chase credit cards that allow point transfers include the Chase Sapphire Preferred, Chase Sapphire Reserve and Ink Business Preferred Credit Card from Chase.

Chase Ultimate Rewards points don’t transfer to Delta Airlines, but they do transfer to other SkyTeam alliance partners, including Virgin Atlantic, AirFrance and KLM. You can transfer your Chase points to one of those airlines and book Delta flights indirectly.

Chase Ultimate Rewards points don’t transfer to American Airlines, but they do transfer to other oneworld alliance partners, including British Airways and Iberia. You can transfer your Chase points to one of those airlines and book American Airlines flights indirectly.

*All information about the Chase Freedom Flex has been collected independently by CNET and has not been reviewed by the issuer.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

Your guide to Chase transfer partners: Everything to know

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Chase Ultimate Rewards are perhaps the most valuable transferable points. With instant or short transfer times and strong transfer partners like United Airlines, Southwest and Hyatt, you can travel nearly anywhere in the world on points.

Chase travel credit cards are also some of the best on the market. There are several direct Chase transfer partners, but you can also access indirect partners. That gives you lots of ways to travel for pennies on the dollar.

Chase Ultimate Rewards points are easy to earn with big sign-up offers and bonus categories. By transferring to the right partners, you could get even more value from your Chase points via a single welcome bonus.

Here are all the details about Chase’s transfer partners and what you should know before you book award travel.

Chase transfer partners

Chase transfer partners include airlines and hotels, all of which have a 1:1 transfer ratio. That means when you transfer 1 Chase Ultimate Rewards point, you’ll earn 1 mile or point in the program you send them to. Transferring your points to travel partners is the best way to use Chase points .

Chase Airline transfer partners

There are 11 direct Chase Ultimate Rewards airline transfer partners:

British Airways

Flying blue (loyalty program of air france and klm), singapore airlines, united airlines, virgin atlantic.

Through these airlines, you can book award seats through all three major airline alliances, including:

- Oneworld airlines (British Airways and Iberia)

- SkyTeam airlines (Flying Blue)

- Star Alliance airlines (Singapore Airlines and United Airlines)

Knowing how to work through the major alliances is your ticket to dozens of airlines beyond the 10 direct airline partners. Note that you can use Chase points to book award travel on other partner airlines which aren’t part of any alliance. For example, you can use British Airways Avios points to book an award ticket with Alaska Airlines, or Virgin Atlantic miles to fly on Hawaiian Airlines.

Knowing Chase’s airline partners — and then each partner’s partners — can unlock nearly limitless award opportunities.

Chase hotel transfer partners

The Chase Ultimate Rewards program has three direct hotel transfer partners: