- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

When Will Business Travel Return to Normal?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you’re a former jet-setter who hasn’t taken a business trip in years, continue to hang in there. Business travel dropped in 2020 and 2021, and it’s still not back.

U.S. hotel business travel revenue for 2022 is expected to be 23% below pre-pandemic levels, according to an April report from the American Hotel & Lodging Association, or AHLA, conducted with hotel analytics group Kalibri Labs.

And it’s not just hotel revenue that’s down. Research from the U.S. Travel Association, a nonprofit organization representing the travel industry, estimates that overall business travel spending will be down 24% in 2022 compared to 2019 levels.

The outlook for business travel

Some cities have been hit harder than others. AHLA released 2022 business travel revenue projections, and four major U.S. cities — San Francisco, New York, Washington, D.C., and San Jose, California — are expected to witness a more than 50% decrease in revenue versus 2019. San Francisco is being hit especially hard, with a nearly 70% decrease in revenue.

When will business travel return?

The U.S. Travel Association estimates that domestic business travel won’t recover to 2019 levels until 2024, and it’s only expected to reach 76% of its 2019 levels this year. International business travel could take even longer to recover (until 2025), and is only predicted to reach 72% of its pre-pandemic levels in 2022, per the organization’s forecasts.

For what it’s worth, there’s more business travel happening now than there was in 2020 or 2021. And the landscape of 2022 business travel is markedly different than pre-pandemic years. These days, there are fewer people attending conferences and in-person meetings with clients. But there’s an increase in other types of business travel.

Team travel, where multiple employees on the same team meet up for an offsite or event, is up more than 900% between January and May 2022, according to corporate travel agency TripActions.

TripActions data also shows that the number of travelers per company has increased. While previously, only a few employees might be constantly traveling to sales meetings and conferences, now a greater number of employees are traveling at least once for their jobs. A spokesperson for TripActions told NerdWallet that while in 2019, engineers made up 9% of bookings, these days they make up 13%. Meanwhile, salespeople previously made up 51% of bookings, but now make up just 45%.

TripActions data also shows that the number of team bookings made was 7% higher in April 2022 versus its pre-pandemic peak in 2019.

Changes to business travel: Good or bad for leisure travelers?

The drop-off in business travel (and its slow return) comes with its pros and cons for leisure travelers.

Con: Fewer opportunities to rack up loyalty points and status

For some, personal travel is funded all or in part by points earned through business travel.

Business travel can also generate opportunities to earn elite status levels that a person might otherwise be unlikely to attain through leisure travel alone.

Spend five nights per month in a hotel for a consulting gig, and that’s enough to earn Hyatt’s top-tier Globalist status .

How to use this to your advantage: You might not be able to rack up as many points and miles through work, but many brands have made it easier to earn or maintain status. Take a closer look at the loyalty programs you belong to , because you might be a lot closer to earning elite status than you thought. If you’re just one or two nights or flights short of status, paying for a mattress run might still be worth it.

Pro: Less competition with business travelers for availability

For Tim Leffel, editor of online travel magazine Perceptive Travel, the lack of competition for seats from business travelers has opened up more opportunities for deals.

“As a leisure traveler, I've been very happy to see business travel slow to come back, as it has meant more opportunities to buy business class seats for a good price,” he says. “During the pandemic, I ended up buying multiple business class tickets between Mexico and the U.S.”

Meanwhile, airlines typically offer upgrades based on elite status seniority. While a frequent business traveler might have ultra-high elite status, a leisure traveler with a low level of elite status might finally get granted that first class upgrade.

How to use this to your advantage: Consider credit cards that offer automatic elite status . Even if it’s not necessarily the highest tier, you’re likely not competing right now with as many business travelers as usual. (And business travelers are more likely than leisure travelers to have elite status.) With fewer business travelers, you’ve got a better chance of getting an elite status upgrade than you did in past years.

Con: Lack of business travel might be why prices are so high

Some indicators suggest that it’s business travel that actually makes leisure travel cheaper , in part because more business travel means more route availability overall. For leisure travelers, more route availability means less need to stop for a layover or to fly at undesirable times. Business flights also tend to generate more revenue for airlines as those fares tend to be booked last-minute, include more flexible cancellation policies, or be in a higher class of service (or some combination of the three).

How to use this to your advantage: Head to destinations that typically depend on business travel. While San Francisco is still expensive, it might be less expensive in 2022 versus 2019 given the decrease in business travel demand.

The bottom line

Business travel is slowly returning, but it’s far from fully back. It could likely take years for business travel to return. And when it does, it likely won’t look like it did pre-pandemic.

Expect more company-sponsored trips to meet up with teammates. Meanwhile, you might expect to attend fewer conferences or sales meetings. If you’re a former road warrior, you might find yourself traveling less than in your pre-pandemic days. But if you’ve never traveled on behalf of your company before, that might change — especially if you now have teammates distributed across the country.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Business travel, just like almost everything from pre-COVID life, is going back to normal

While consumers have fully returned to the skies, business travelers have been a bit scarcer in the post-pandemic years. But a new study by the Global Business Travel Association indicates the corporate road warriors are set to ride once more.

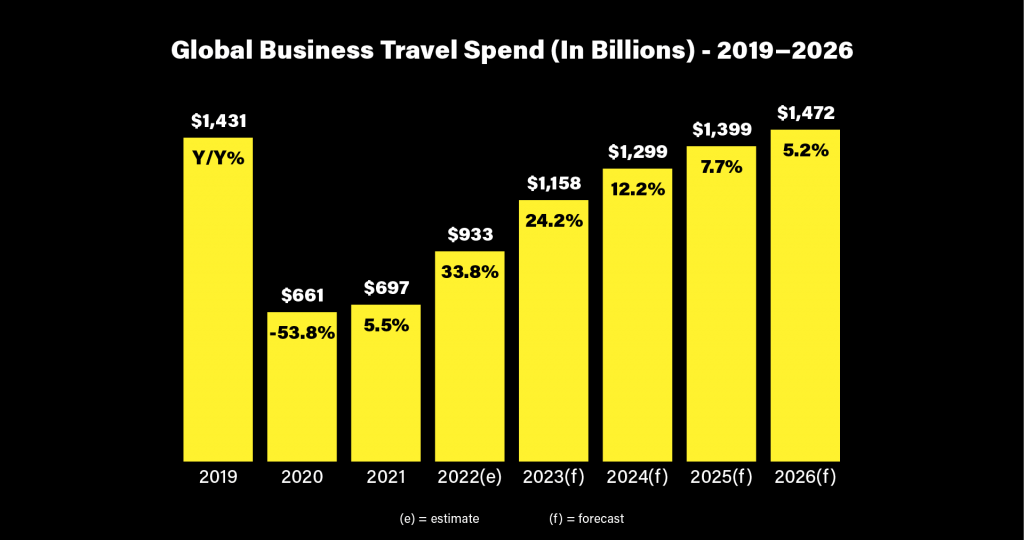

Overall spending on business travel is expected to surpass the pre-pandemic levels of $1.4 trillion in 2024—and grow to $1.7 trillion by 2027, the trade group forecasts. That’s a huge turnaround from recent years. In 2021, total spending on global business travel was a disappointing $697 billion , hampered by the Omicron variant and another spike in COVID cases.

Things began to pick up again last year, with spending coming in at $1.03 trillion. And the numbers are expected to grow another 32% this year, with an estimated total of over $1.3 trillion. That’s a big turnaround from bears who had claimed business travel would never return to normal .

While companies have had mixed luck in convincing workers to return to their desks, the fact that the oft-predicted recession has yet to arrive has spurred companies to send people back out on the road.

“The headwinds that were anticipated to impact the rebound of global business travel over the past year didn’t materialize and that is good news,” said Suzanne Neufang, CEO of the GBTA, in a statement . “This latest forecast now indicates an accelerated return to pre-pandemic spending levels sooner than anticipated as well as growth ahead in the coming years.”

Many other facets of life that once seemed unthinkable in the heart of the pandemic have once again become the norm, from dining at a restaurant to shaking hands with a stranger. Going to the movies and working five days a week in the office seem to be the major exceptions in post-pandemic life, but the surprise “ Barbenheimer ” blockbuster is challenging that view as well.

The travel industry relies heavily on business travelers, since they often book last-minute and are some of the industry’s biggest spenders when it comes to upgrades and perks, such as airport lounges.

Worldwide, Western Europe was the fastest growing region for business travel, with North America and Latin America also showing significant increases.

Latest in Finance

- 0 minutes ago

Mark Zuckerberg warns of stock volatility as Meta bets billions more on AI investment ‘before we make much revenue’

Flight attendants at Southwest Airlines seal deal for 22% pay hikes next month

Rubrik valued at $5.6 billion after massively oversubscribed IPO prices above range

IBM shares fall after flatlining sales in its second-largest business unit

Baby boomers are fearful of soaring costs for food and housing

Tesla driver said he was using Autopilot and looking at his phone before a crash that killed a motorcyclist

Most popular.

On a crucial earnings call, Musk reminds the world Tesla is a tech company. ‘Even if I’m kidnapped by aliens tomorrow, Tesla will solve autonomy’

The outlook for home prices has changed drastically in just the past month as Fed rate cuts look more and more distant

Spotify CEO Daniel Ek surprised by how much laying off 1,500 employees negatively affected the streaming giant’s operations

Three top executives at Tesla have resigned in two weeks, with the latest departure at the end of its earnings call

A 60-year-old worker in Texas says she’s dependent on apps that let her get paid early: ‘They get you hooked on having that money’

Your reusable water bottle may be a breeding ground for strep and fecal bacteria. Here’s how to keep it clean

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Business travelers face higher prices and packed flights, hotels

Business travel is back. The benefits of being a business traveler are not.

After two years of virtual meetings and remote work, “companies are getting back to doing interviews in person, and even conferences and conventions are coming back in full force,” said Nina Herold, the general manager of TripActions, a travel management company. Sales teams are hitting the road, and employees are starting to return to headquarters for team building, recognition events and orientation, she said.

The industry isn’t at pre-pandemic levels yet, and a recent study from Deloitte , a multinational accounting and consulting firm, predicts business travel overall won’t fully return to 2019 levels for at least a couple of more years.

When the perks of being a business traveler will return to pre-pandemic levels, however, is anybody’s guess.

“I don’t have any other words to describe business travel right now other than ‘frustrating’ and ‘inconvenient,’” said Ashley Davidson, a public relations consultant in Alexandria, Virginia.

For years, she flew nonstop between Washington, D.C., and Fort Lauderdale, Florida, where her company is located. Now, because of airline route cuts, she has to make a stop in Charlotte, North Carolina, and ticket prices are up by 34 percent over 2019. “I’ve had to forgo my strategy of sticking to one airline and have been booking whatever flight gets me to where I need to be on time and for the best price.”

Flying multiple carriers makes it harder to amass the hundreds of thousands of miles needed to reach elite flyer status and all the benefits that come with it, including upgrades to business or first-class seats, free checked bags and airline lounge access, and private car service between connecting flights.

“Elite status has been extended at some airlines,” said travel expert Gary Leff, the author of ViewfromtheWing.com . “But some people are starting from zero.” To help flyers regain their VIP status, he said, some airlines are offering bonuses and boosters that award extra points or miles for flights, and in a recent change, some are treating routine credit card purchases the same as miles.

But even for those who’ve held on to their elite status, the boom in air travel, combined with fewer flights overall, can mean “it can be hard to get seats at the last minute and harder to get first-class seats,” Leff said. Those who do snag seats may find that first- and business-class food and other amenities haven’t been restored to their pre-pandemic luxury.

At many airports, for instance, some club lounges are still closed and the open ones are packed. Frequent business travelers who are used to striding past gate hold rooms and directly to airline club lounges for free food, drinks, desk space and places to nap or shower may struggle to find places to sit down, or they may be turned away altogether.

“Leisure travel is higher than pre-pandemic times, and more people are upgrading to first-class tickets and paying for airline club access,” said Mike Daher, the vice chair of transportation, hospitality and services for the U.S. at Deloitte. Many high-fee travel credit cards also come with admission to airport lounges.

Once you’re at your destination, “good luck finding a rental car,” said travel expert Henry Harteveldt of the travel analytics firm Atmosphere Research Group. “And when you do, don’t be surprised if the cost is equal to your mortgage.”

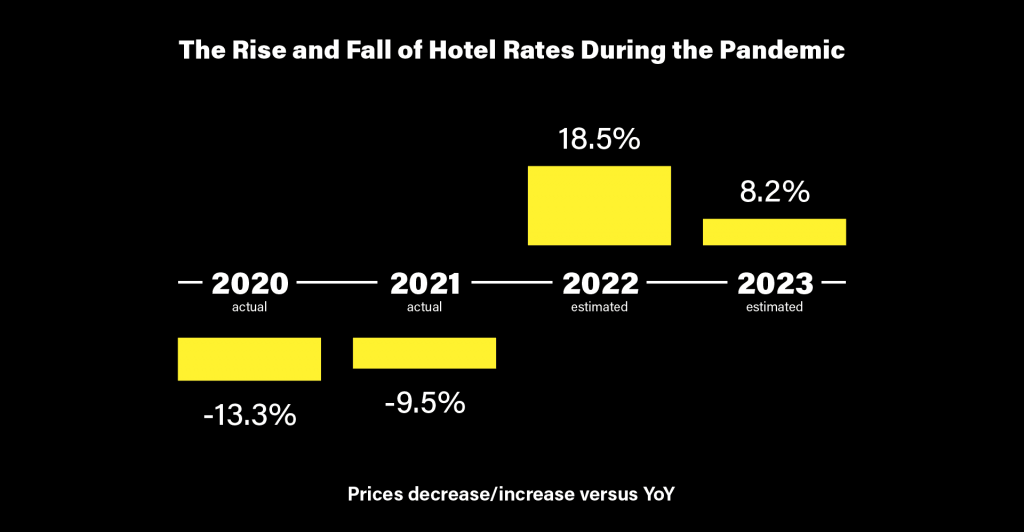

With record numbers of leisure travelers making up for lost time, hotel demand is way up, too. But because of labor shortages, rates have soared, and reservations can be harder to come by, he said. “In some cases, hotels are not making all their rooms available because they don’t have enough staff to clean them.”

In addition, many hotels haven’t reopened their concierge levels, and they have limited hours for restaurants and bars. Frequent guests accustomed to getting free full breakfast may instead be offered credits that barely cover the bill for eggs, coffee and a croissant in the hotel restaurant.

Ryan Chitwood, a forest products wholesaler from Annapolis, Maryland, recently sent a sales team to an annual trade show, where meetings were scheduled back to back in a hotel restaurant throughout the day. “Our tight schedule was derailed, because what should have been brief breakfasts and lunches ran way over because of staffing shortages,” he said. “Also, when you arrive late and want to check in and grab a burger at the bar or via room service and it’s not available, you either need to leave the property — or just go hungry.”

Daher said, “For a business traveler, it’s an unknown, and it’s not consistent by hotel brand but rather property by property.”

With virtual meetings an ever-present option, unhappy business travelers, who typically pay full fare, could cost the industry as it tries to bounce back. Before the coronavirus pandemic, business travel made up 20 percent of trip volume but accounted for 40 percent to 60 percent of all lodging, rental car and airline revenue in the U.S., according to the U.S. Travel Association .

“The airlines and hotels understand the value of these loyalty relationships,” Daher said. “They have armies of people analyzing that, and they’re not going to let those relationships go.”

Business travelers seeking workarounds to inconsistent hotel services may not get much help from their corporate travel programs. Deloitte’s study found that only 1 in 10 companies include nontraditional lodging, such as Airbnb, in their corporate booking tools and that only half reimburse employees for the charges.

Employees who relocated during the pandemic and want or need to reconnect with colleagues at headquarters may also find themselves paying their own way. Nearly one-third of companies are requiring employees to shoulder the cost themselves

Those and many of the other current pain points of business travel should ease eventually, Harteveldt said, but for now “it’s a very tough, very complicated, very stressful and very expensive landscape that is welcoming business travelers back in the summer of 2022.”

Harriet Baskas is an NBC News contributor who writes about travel and the arts.

clock This article was published more than 2 years ago

Will business travel ever be the same?

No one can guarantee when business travel will be back. but everyone agrees it has changed for good..

While vacations and family visits have come roaring back this summer, one segment of travel is still tiptoeing after a pandemic-forced hiatus: business travel.

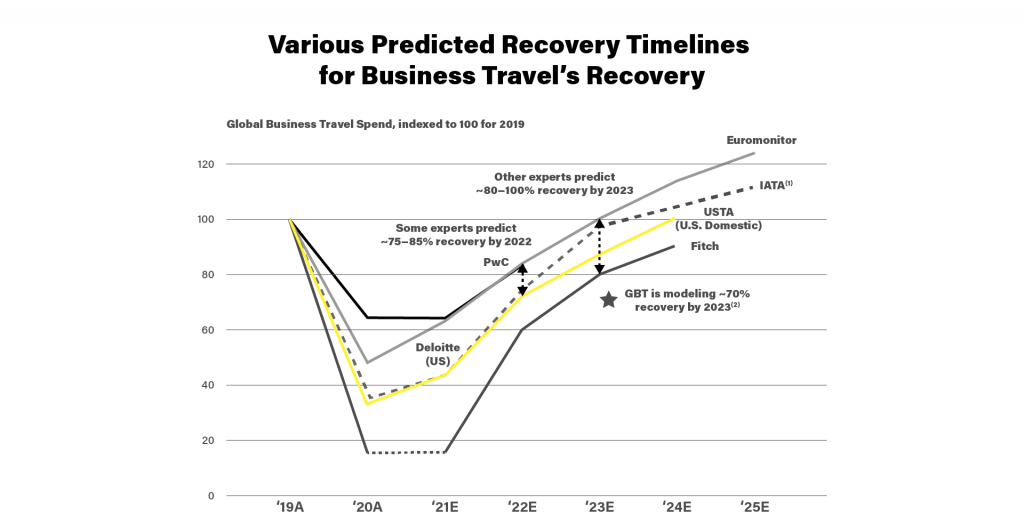

When will it resume in full? That seems to be anyone’s guess, though estimates stretch as far as 2025.

The emergence of the delta variant, uncertainty around border restrictions and the slow rollout of vaccinations to some parts of the world are variables that make it tough to predict when the old patterns of work travel will return, if ever.

In recent earnings calls, Delta and American said domestic business travel had reached 40 and 45 percent, respectively, of 2019 levels by June. Even with the business recovery fairly muted, the number of passengers at Transportation Security Administration checkpoints was up significantly compared with 2020, nearing or topping 2 million almost every day of the past month.

Meet the business travelers who can’t wait to get back on the road

But while it may be fine for a traveler to jet off to Hawaii or Mexico for a pleasure trip, it is trickier for a company to send an employee off into the pandemic.

“Businesses are much more risk averse,” said Suzanne Neufang, chief executive of the Global Business Travel Association.

Another issue, she said: Where would those travelers go?

“With so many offices not completely open, there’s no place to meet,” she said. “You can have coffee, but it’s hard to show a PowerPoint in a coffee shop.”

Experts say the return to office life, expected in the fall, will spur more business travel. But it is unclear whether the delta-variant-fueled surge in coronavirus cases will widely delay that comeback. Already, major corporations such as Apple, Google, Twitter and Uber have delayed their back-to-office plans.

Tori Emerson Barnes, executive vice president of public affairs and policy at the U.S. Travel Association, said the variant has added some uncertainty and anxiety to the outlook. The trade group’s forecast predicts that business travel will reach only about half of 2019 levels by the end of this year.

Airlines not feeling effect of rising virus cases amid scramble to recruit, retrain workers

Another stumbling block: Restrictions keep many would-be business travelers out of important markets — especially the United States. The country is still closed to travelers from many countries , including China, India, Brazil, the United Kingdom, Ireland and nations in the European Schengen area.

“Definitely government restrictions are the biggest barrier at this point in time,” said Paul Abbott, CEO of American Express Global Business Travel, which manages business travel, meetings and events for clients around the world. He said the company has seen numbers soar in places where the virus is well under control and workers can move about freely.

“Where travel is permitted and restrictions have been removed and there is trust and confidence in the processes, travel is returning in significant numbers and there’s very strong demand,” he said.

Steve Hafner, CEO of the travel search company Kayak — which launched a corporate travel tool earlier this year — said continued mask requirements and recommendations are also working against a return to business trips.

“No one wants to wear a mask on a plane for a long trip. No one wants to wear a mask in an office either,” he said. “As long as masking is out there, I think that’s going to be a head wind for business travel.”

Where should you wear a mask when traveling? What the CDC says about 14 top U.S. cities.

Both the U.S. Travel Association and Global Business Travel Association have predicted a full recovery by 2025. A recent report from professional services firm Deloitte projects U.S. corporate travel could reach a “new normal” of about 80 percent of pre-pandemic levels by the end of next year.

Bill Gates predicted that 50 percent of business travel would go away. An analysis by the Wall Street Journal was more generous, estimating that between 19 and 36 percent of business trips by air are likely to never return.

“I think this variant has done nothing more than to exacerbate the existing situation, which in my mind will never be the same as it was pre-covid,” said Robert Quigley, senior vice president and global medical director at International SOS, a medical and travel security firm. “It opened up our collective eyes to the idea that maybe we don’t need to be constantly traveling. Maybe we can Zoom.”

Those who are already traveling for work say their trips are meeting the needs that teleconferencing tools like Zoom just can’t.

Christine Choi, a New York-based partner at investment firm M13 , travels to Los Angeles quarterly or every other month to meet with team members, welcome new colleagues and see product demonstrations. She said being on Zoom meetings 12 hours a day reminded her how important face-to-face interaction was to get to know people and learn what they need.

“It’s hard to expect humans to lean so dramatically on the digital experience and the screen experience,” she said.

What the delta variant means for your summer vacation

Abbott said companies also realize they might need to get more workers on the road for competitive reasons.

“It’s all very well saying, ‘Could we continue to exist on Zoom?’ Yes,” he said. “But is the objective of your company ‘We want to continue to exist’ or is it ‘We want to grow, we want to win, we want to acquire new clients’?”

Still, even the biggest promoters of business travel acknowledge that the experience will be different, from the types of trips that people take to the length and frequency.

Abbott said he believes there will be a more dispersed workforce in the future, which means those spread-out employees will need to get together.

“That will absolutely create more business travel,” he said.

Travel was cheap when no one was traveling. That era is over.

Neufang, of the Global Business Travel Association, said the group has been emphasizing “the right travel in the right way.” She said some companies are linking their business travel comeback to new sustainability goals — for example, cutting back on single-day jaunts in favor of fewer but longer trips.

“Fewer takeoffs and landings: That is better for the planet,” she said.

Describing himself as an optimist, Hafner said he expects business travel to eventually surpass 2019 levels. But, he predicted, he expects to see “a lot fewer day trips and hopefully a lot more ‘bleisure’ ” — or the combining of leisure and business, sometimes with a partner or family.

“Now you know you can work from anywhere. Why make it a day trip?” he said. “Go more days.”

Choi said she has extended her trips as she navigates covid-era necessities like trying to avoid layovers, choosing hotels with outdoor spaces for meetings and implementing activities like outside coffees and walks into her visits.

“My trips are getting slightly longer because I want to make it worth the strange travel,” she said. “The complexities make me want to pack as much into my visits as possible.”

More travel news

How we travel now: More people are taking booze-free trips — and airlines and hotels are taking note. Some couples are ditching the traditional honeymoon for a “buddymoon” with their pals. Interested? Here are the best tools for making a group trip work.

Bad behavior: Entitled tourists are running amok, defacing the Colosseum , getting rowdy in Bali and messing with wild animals in national parks. Some destinations are fighting back with public awareness campaigns — or just by telling out-of-control visitors to stay away .

Safety concerns: A door blew off an Alaska Airlines Boeing 737 Max 9 jet, leaving passengers traumatized — but without serious injuries. The ordeal led to widespread flight cancellations after the jet was grounded, and some travelers have taken steps to avoid the plane in the future. The incident has also sparked a fresh discussion about whether it’s safe to fly with a baby on your lap .

- Share full article

Advertisement

Supported by

Business Travel Resumes, Hesitantly

Convention centers are reopening. Hotels and airlines report an uptick in bookings. But the rise in virus cases has tempered forecasts for a major recovery.

By Jane L. Levere

Business travel has started again, but in fits and starts.

Hotels and airlines have reported a rise in bookings for travel in the United States in the last couple of months.

The expanded Javits Convention Center , New York City’s main convention hall, reopened on Sunday and had a number of big events on its schedule for the rest of the year, including the New York International Auto Show. Then last week, as Covid-19 cases rose, the auto show’s organizers canceled it, though the center said it was keeping other events on its books. San Diego’s convention center, which reopened last week, is still expecting a series of shows this fall. (On the calendar for Thanksgiving weekend: a “special edition” of Comic-Con.)

But the spread of the Delta variant of the coronavirus is throwing a new wrench into businesses’ plans, and the question is whether the spike in cases will be brief or more long-lived.

Travel experts said they remained optimistic that business travel will pick up substantially later this year and early in 2022.

Or as Christopher J. Nassetta, the president and chief executive of Hilton, put it on an earnings call last month, “People have to meet.”

Leisure travel has come roaring back this summer. But the airline and hotel industries long depended on business travel for a substantial portion of their revenues because those customers, who often made their plans at the last minute, could be counted on to pay more for seats and rooms. Now that the pandemic has upended the notion that travel is necessary to do business, the question is how much it will resume, even when Covid is brought under control.

Even the experts who were most optimistic about the prospects for business travel a month or so ago have begun to temper their forecasts. The quick change was captured by a survey of 1,200 American travelers that Destination Analysts, a market research firm in San Francisco, conducted from July 21 to 23. Among business travelers, it found, nearly 25 percent expected the “coronavirus situation” to worsen in the next month, a jump from under 14 percent two weeks earlier. Conventiongoers’ personal health concerns also rose, while their confidence in their ability to travel safely fell.

The U.S. Travel Association said in late July that it continued to forecast “a modest return of business travel over the coming months, so the increase in cases has not materially affected our view.” It said it now expected that business travel would “only achieve 50 percent of 2019 levels in the fourth quarter of 2021.”

Scott Graf, global president of BCD Meetings & Events, said that in light of the spread of the Delta variant, “we’ll likely see some cancellations or certainly meetings being pushed out by weeks or months.”

“I may be optimistic,” he added, “but it is my hope that vaccination progress will increase dramatically over the next 60 to 90 days and that the fourth quarter and early 2022 will still be quite strong.”

Mr. Graf is among the few who believe that hybrid professional events, involving both in-person and virtual attendance, will disappear over the long run. Hybrid events “are not that efficient,” he said. “They’re more expensive and complex than if they’re just virtual or just face to face. And people have virtual fatigue.”

Peter Caputo, Deloitte’s U.S. hospitality sector leader, agreed that networking “is often invaluable” and difficult to replace by virtual means. But certain types of events, such as educational programming, can be successful online, he said.

Business travel started to return this summer. Delta Air Lines was “beginning to see a return of consulting and sales-related travel and higher volumes in traditionally business-heavy markets like New York City and Boston,” the carrier’s president, Glen Hauenstein, said in mid-July.

Both American and United Airlines also reported an uptick in business travel and said they expected it to continue to rise later this year.

“The majority of our corporate accounts have shared their expectation for travel to pick up moving into the fall, and we expect a full business travel recovery in 2022,” Rachel Warner , a spokeswoman for American, said last week.

After a rush of leisure travelers this summer, hotels said they were also starting to get more bookings for business travel for the fall. Before the pandemic, 20 percent of Hilton’s revenue was generated by groups and events of all types, including social events, and about 55 percent by individual business travelers, said Frank Passanante, senior vice president of Hilton Worldwide Sales, the Americas.

Mr. Passanante said he expected the “large-scale conference” business to continue to improve in the second half of 2021. “There is no replacement for live meetings,” he said. “Face-to-face will come back.”

On Hilton’s recent earnings call, Mr. Nassetta said he anticipated that business travel would return as “we get closer to next year and into next year.” He added: “There’s going to be a gargantuan amount of demand, and we can be a bit patient, I think, given what’s going on.”

Before the pandemic, 35 to 40 percent of Hyatt’s revenues were generated by meetings and events and the rest by individual leisure and business travelers, said Asad Ahmed, senior vice president of commercial services for the Americas. While leisure travel is currently the main source of Hyatt’s revenue, Mr. Ahmed said, he also believes that pent-up demand for meetings and events is immense, adding that Hyatt is seeing “strong demand” for in-person and hybrid events for the remainder of 2021 and 2022.

Among the most optimistic about prospects for professional meetings, conventions and events in the United States was Meeting Professionals International, a trade group.

“Recognizing that the Delta variant may impact near-term demand,” the group said in a statement that it “remains optimistic about the return of meetings and events.”

Large, in-person conferences originally scheduled for 2020 and the first half of 2021 have “mostly” been pushed to 2022, said Paul Van Deventer, president and chief executive of the group.

But the biggest challenge across the industry, he said, is staffing. Hotels are “struggling to bring staff back on board” after laying off or furloughing workers at the beginning of the pandemic, he said.

Marriott’s chief executive, Anthony Capuano, agreed that staffing was a major issue. “Labor may very well be the most significant challenge we all face,” he told a hotel industry meeting in late July. Marriott declined to further comment.

U.S. convention centers in major urban destinations are definitely seeing an increase in bookings. The Javits Convention Center, which is run by the New York Convention Center Operating Corporation, has booked a number of major events for the rest of the year, including the NY Now gift show, the Fancy Food Show and LightFair. A $1.5 billion expansion has added 1.2 million square feet.

“There continues to be a great demand for in-person meetings and events throughout the country,” Alan Steel, the president and chief executive of the corporation, said last week. “Our first major event since the pandemic, NY Now, is scheduled to open on Sunday, and we are working closely with event organizers to host a series of upcoming events in the fall.”

Events scheduled at the San Diego Convention Center include conventions for orthopedic and vascular surgeons, anesthesiologists , mortgage bankers and Realtors, plus home and art shows for the public.

So far, “we have not had any cancellations,” a spokeswoman for the center, Maren Dougherty, said.

Clifford Rippetoe, the president and chief executive of the San Diego Convention Center Corporation, said he expected attendance at events this year to be 40 to 50 percent of prepandemic levels, and next year to be 70 percent.

“Attendance is the biggest question mark at the moment,” he said. “We expect events with more U.S.-based membership and participation to be closer to previous years than those with a more international audience.”

Jan Freitag, national director for hospitality market analytics at CoStar, said he expected the U.S. lodging industry to recover first among leisure travelers, then among individual business travelers and last among corporate groups.

These warnings notwithstanding, Chris Capossela, chief marketing officer of Microsoft, said he still believed in “a role for thousands of people to come together physically.” He noted that hybrid meetings could reach “hundreds of thousands of people quite cheaply” — Microsoft has developed digital tools to conduct virtual meetings, and its employees have largely been working remotely since March 2020 — but added: “I think humans want to be together.”

Explore Our Business Coverage

Dive deeper into the people, issues and trends shaping the world of business..

TikTok Has Changed America: Has there ever been an app more American seeming than TikTok, with its messy democratic creativity, exhibitionism, utter lack of limits and vast variety of hustlers?

Subscribe. Watch. Cancel. Repeat.: Many more people are jumping from one streaming subscription to another, a behavior that could have big implications for the entertainment industry.

Manischewitz Courts a New Generation: The 136-year-old company’s products have been staples in American Jewish households for generations . After a major rebranding, the matzo ball soup comes with merch.

Inside Novo Nordisk: The company’s factories work nonstop turning out Ozempic and Wegovy, its blockbuster weight-loss drugs, but the Danish company has far bigger ambitions, including transforming a small Danish town .

Golden Visa Programs: Spain is the latest European country to end its program, which brought in billions of euros from real estate investors but worsened a housing crisis for locals.

Reshaping Discount Shopping: Pinduoduo, the Chinese discount shopping app , appeals to people seeking deals and “downgraded spending.”

'Things have changed': Business travel may never go back to the way it was before COVID-19

Of the 2 million people clogging airport security lines and gate areas again each day, one crowd is still largely missing: business travelers.

Their absence is noteworthy because they are a key source of revenue and profit, underpinning a record-breaking stretch of financial gain for U.S. airlines that ended with the coronavirus .

Business travelers tend to pay higher fares, and that is especially true on international flights, which are also still deeply depressed by the pandemic and travel restrictions around the globe. Because their fares subsidize other passengers, their absence is leading to higher leisure fares on many routes, experts say.

►US keeping travel restrictions for now: White House cites delta variant concerns

►Part-business, part-leisure: Bleisure getaways are on the rise

Recovery may take years

Business travelers also spend money on hotels , meals and other things. The U.S. Travel Association estimates that domestic and international business travelers spent more than $300 billion here in 2019. The group forecasts that dwindled to about $95 billion last year and won’t fully recover to 2019 levels until 2024.

During calls with Wall Street analysts last week, U.S. airlines said business travel has picked up in recent weeks but is still down more than half from this time in 2019.

Airlines have been hoping for a major boost in business travel in September, as schools and more offices reopen. Now, however, that optimism is being tempered by the rise in COVID-19 cases around the country fueled the delta variant .

“We are encouraged by the trends that we see out there, but we really are planning that a material amount of business travel won’t come back until after the October period,” Vasu Raja, American Airlines' chief revenue officer, said last week.

►Will mask mandate for flights continue?: Southwest Airlines CEO says airlines not pushing for it

"Zoom ... can only go so far"

Airline executives are counting on people like Vazar Lukovic, who owns a digital marketing agency and a production company near London. Lukovic says he is willing to put up with higher prices on some of his flights to places like Moscow and Belgrade, plus the cost of mandatory COVID-19 tests.

“You know, Zoom meetings , they can only go so far,” Lukovic said. “When you meet in person — whether it’s that energy or what they say about the feeling or the vibe — it’s just so much more personal.”

Unable to travel last year, many companies relied instead on video platforms, including Zoom. Opinions vary about how quickly corporate travel will recover, and whether some of it will be permanently replaced by videoconferencing.

►Zoom Apps: How the video conferencing experience is changing

"Things have changed"

Delta Air Lines says business travel was 20% of normal in the first quarter, 40% in the second, and will hit 60% in September. The airline isn't predicting whether business travel will ever return to pre-pandemic levels, but if it does, it won’t happen quickly. A Delta survey of its corporate customers finds that only 57% plan to be back to full travel by the end of 2023.

Delta CEO Ed Bastian says business travel will change.

“I do think that maybe 10% to 20% of the previous business travel will be lost, but I think you're going to find new forms of travel,” Bastian said in an interview. “There will be new reasons why people travel.”

Bastian says some things, like overnight trips to business meetings in Europe, will be dropped because they are an inefficient use of time. But he says there will be new demand to network by meeting people after being introduced on Zoom.

Aside from their own surveys, which airlines are often unwilling to disclose, there are few precise numbers about business travel. The industry trade group Airlines for America estimates that before the pandemic about 30% of trips were taken for business reasons, and that those travelers accounted for between 40% and 50% of airline revenue.

Some experts thinks business trips might be fewer and more carefully selected.

“Things have changed," says Brendan Drewniany, public-relations director for Black Tomato, a luxury-travel company. "There is less an expectation to have a volume of back-to-back meetings, and in general the trips themselves have been longer and not as rushed, which is actually a plus.”

In a survey conducted this month for the Global Business Travel Association, 50% of the 618 companies polled said they already allow non-essential business travel within their own country, with many others expecting to do so in the next three months. However, only 14% were traveling internationally with modest interest in soon resuming cross-border trips, which are more complicated because of travel restrictions, including quarantine requirements in many countries.

A separate survey by Bank of America suggests that business travel will recover more slowly than some would want but gives airlines and hotels hope for the long term. Nearly half of U.S. corporate travelers surveyed expect their next business trip won't happen until at least next year, but 56% expect to eventually travel more than they did before the pandemic, compared with 31% who expect to travel less, according to the bank.

Different kinds of travel

Denise Daniel, who manages travel for Domo Inc., says U.S. sales people are on the road while the business-research firm is doing little to no travel in Europe, Australia and Japan because of virus-related restrictions. The 800-employee company has tightened its process for approving travel because of liability concerns, although it is not requiring vaccination before travel.

Daniel believes that the pandemic will lead to different kinds of travel, but not necessarily less: fewer conferences, more chances for far-flung employees to get together on projects.

“We realized how much we value in-person meetings -- that collaborative dynamic when people are with each other -- but we don’t want people to travel for things that could or should be handled virtually,” Daniel says. “We have learned how to take care of non-essential meetings in probably a better way for the environment and a better way for the budget.”

Marie Swift, who runs a marketing-communications firm in Falls Church, Virginia, used to travel about every other week for consulting, conferences and speaking engagements, but during the pandemic she didn’t fly for 14 months.

Swift booked a flight to New York in early September for a gala where her company is up for an award. If the nation hasn’t reached “some sort of herd immunity” by then, Swift says, “I will be the double-masked lady with a ball cap and glasses on, air vents full-force ... wiping down my tray, armrests, and seat-belt buckle.”

She has nine more business trips scheduled between September and early November. Will she be on board, or will she cancel?

“We’ll see how it goes.”

In Search of Corporate Travel’s Elusive Recovery

Matthew Parsons , Skift

September 20th, 2022 at 2:30 AM EDT

Most industry forecasts point to an eventual recovery — even to the 2019 high of $1.4 trillion in annual spending — as business trips start to bounce back. But many underlying trends are emerging in a fragile global economy. How we travel, and for what purpose, is far from certain as we enter a new era of accountability.

Matthew Parsons

The one narrative for the post-pandemic travel rebound that largely remains in dispute now some two and a half years later, fueling prognostications from all sides, is the recovery of business travel.

Just as a flurry of new late summer forecasts for a full business recovery hit — again with no real consensus — a story was gaining a lot of attention that Google, once the giant of sending people out on the road in a Google-outsized kind of a way, was cutting back its travel budgets for what it called only “business critical” trips.

It was just another piece of evidence for business travel doubters that the industry will never be restored to its glory days. That’s because after a challenging couple of years (and counting in some countries) the business travel industry has been looking back, misty-eyed, to the better times of 2019, asking: When will it be like that again?

More specifically it’s been looking back at the $1.4 trillion that was spent on business travel, based on the Global Business Travel Association’s calculations.

We all know business travel is a high-margin game. Hotels, airlines and travel agencies have suffered following the prolonged absence of higher-paying corporate guests. The trickle-down effect of those company dollars and generous expense allowances to local restaurants, conference venues, taxi firms and others in the wider ecosystem also dried up.

What About That $1.4 Trillion Question

The $1.4 trillion figure has appeared extensively in the media, financial reports and investor pitch decks for several years.

But the magic number’s been more prominent recently as observers look to the end of summer as a kind of coronavirus cut-off point, with new forecasts attempting to pinpoint exactly when this “recovery” will take place.

Earlier this year, many people were looking to the fall as a true test for corporate travel’s resiliency as some doomsayers have said it will never return to its former vibrancy .

“Autumn is conference season — a time that has grown in importance following the pandemic, as an increasingly distributed workforce looks to make the most out of travel by meeting with colleagues, industry peers, and clients to advance business goals,” said TripActions in its Fall Business Travel Preview .

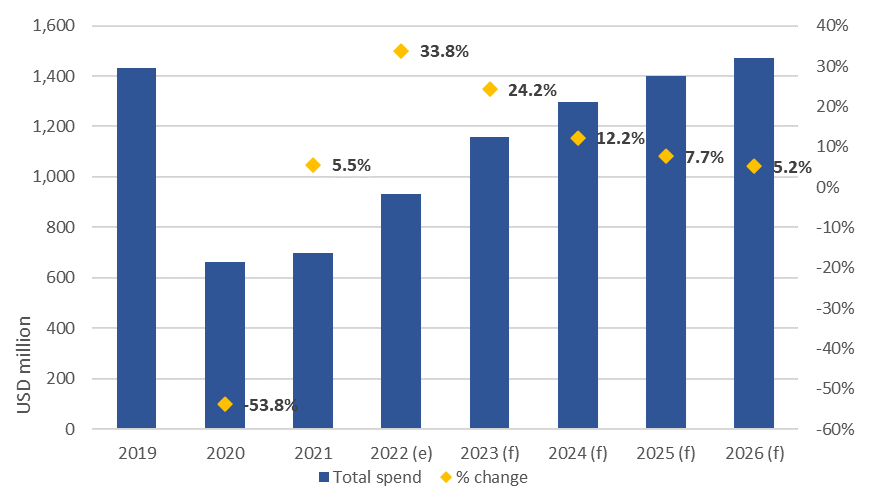

The Global Business Travel Association predicts the $1.4 trillion in spend will now return in 2026 ; there’s some way to go still considering the (relatively) low base of $661 billion spent on business travel in 2020, when Covid-19 was at its global peak.

This is how it thinks it will play out: an estimated $993 billion will be spent in 2022; $1.2 trillion is forecast for 2023; $1.3 trillion in 2024; $1.4 trillion in 2025; and $1.5 trillion in 2026.

Is Forecasting Even Relevant?

With so much global uncertainty impacting the business of travel, including inflation, the war in Ukraine, hybrid working and plenty others, are forecasts still relevant?

Yes and no is the answer.

There’s still a need for that baseline, but at the same time so much has changed, and continues to change, in the world of work, which by its nature impacts corporate travel.

“Somebody has to forecast, I’m glad they’re doing it,” Katharina Navarro, a travel manager at a large consultancy and president of the Global Business Travel Association in France, told Skift.

In fact the return of business travel demand has long been among the most difficult sectors for CEOs to predict .

“Honestly, if I go out to ask consultants for data points over the next three years, everybody’s being very hesitant. Nobody wants to say. But a forecast is a forecast. If it changes, I adapt, I correct my assumptions. I feel too many people now aren’t saying anything, and that’s not helpful.”

From a bird’s-eye view perspective, forecasts are there to help suppliers gauge future demand and markets, and travel management companies to manage resources. So yes it does matter, for example, that Latin America is forecast to grow 55 percent this year .

And many in the industry do look to the association’s annual outlooks, which it carries out with Rockport Analytics .

“Our view of the contribution to each country-sector combination has been established by analyzing trends in the business travel purchasing behavior of 44 sectors across 73 countries over a period of more than 20 years. By modeling trends of the level of business travel spending per dollar of industry sales (a measure of business travel productivity) over time, we are able to extend these factors into the future,” it says.

No one else is able to be as thorough, or distinguish between business and leisure activity, the association claims.

“By and large, it’s volume that’s the tide that we ride in this space,” said Nick Vournakis, executive vice president and chief customer officer at CWT . “That’s how the supply chain evaluates other businesses, and that’s how they think.”

Where Are We Now?

As leisure travel traffic slows after summer vacations, and schools and offices reopen, all eyes are watching the data for business trips as a sign of things to come. A natural bounce is expected because that pent-up demand is still very much there.

The positive trends for the first three quarters of 2022 provide a good base for a clearer picture 2023, according to Guy Snelgar, global business travel director of the Advantage Travel Partnership .

“We are seeing wide variations in corporate travel forecasts this autumn and winter,” noted Scott Davies, CEO of the UK’s Institute of Travel Management . “While some organizations are trying to limit travel to well below 2019 levels due to economic uncertainty and rising costs, many companies are playing catch-up by traveling extensively to support both internal and customer engagement.”

TripActions identified a “similar seasonal surge” in business travel, despite concerns about the macroeconomic environment. The startup corporate travel agency has seen a sixfold year-over-year increase in business travel bookings with a start date between September 1 and November 19, 2022, compared to an equivalent booking window and trip start date last year.

After Labor Day in the U.S. it said it had broken its largest booking and travel spend record, with a 28 percent increase week-over-week.

“There’s been a lot of consternation around this idea of September as a line of demarcation, because it’s the end of the summer holidays in the West. We see a tremendous amount of seasonality where there’s generally a natural dip in business travel in July and August, and a rebound from September to November,” added CWT’s Vournakis.

“We don’t expect this calendar year to behave any differently than that, but the idea that there’s going to be a mass exodus starting September 1, as it relates to business travel, I’m not sure we’ll see that come to fruition.”

Instead he predicts a healthy resurgence with a growth curve that will be slow but consistent: “We’re on a recovery trend, it won’t get steeper.”

The Difficult Task of Forecasting

Not everyone thinks the same. “Much of the annual 2022 travel budget expenditure has already concentrated in the first and second quarters of 2022, leaving challenging third and fourth budgets for the full year of anticipated spend,” warned Paul Tilstone, managing partner of consultancy Festive Road.

However, if the only way is up, now is probably the best time to reflect on how business travel is measured. The challenge will be predicting which types of companies will travel, how they do it and crucially why in the age of the Great Merging , where work, travel and life in general.

The future of work trends and the nascent generation of digital nomads — long-term travelers that live and work anywhere, and have the potential to be a small and mighty traveler type — is a vast-ranging topic itself .

But gathering new information, even up-to-the-minute trends, could help the travel industry adjust, react and recover perhaps more than charting patterns from the bigger companies.

A more urgent topic is exploring the sizes of companies now traveling, for newer purposes. Before the pandemic they were under the radar, but if larger companies do cut back on travel in the long term, for sustainability reasons or otherwise, they’re going to become a force to be reckoned with. (At an extreme micro level, what kind of significance does next generation hospitality company Selina’s partnership with freelancer network Fiverr have?)

“The bottom line is, we saw a quicker return to travel from the small and medium size market in the early parts of this year, but we’re seeing equal amounts of recovery in terms of slope and rate in the enterprise space now,” said CWT’s Vournakis. “In fact, some of our largest clients are outstripping the travel they did in 2019.”

Small firms probably benefited from having fewer corporate regulations and restraints. But as inflation and energy prices creep up, there’ll likely be a swing of the pendulum this year. “There’s more wariness around managing the inflationary pressures that come along with this resurgence in travel demand. You’ll see more sensitivity to that in the lower end of the market, compared to the higher end,” Vournakis added.

But size matters, and corporate card and expense management Ramp, which has raised $1.4 billion since it was founded in 2019 and is seeing huge growth in travel , is calling for change.

“Everyone in the business travel industry has been talking about managed travel for small and medium-sized enterprises forever. It’s never worked,” Ben Alderman, head of financial, travel and accounting partnerships, told Skift.

“No one has had any success, because it just doesn’t matter enough to (travel agencies) if they’re spending $50,000 or $100,000 a year on travel for them to manage that.”

Ramp’s expense platform allows companies to set policies, and Alderman said spend was a lagging indicator, but policy was a leading indicator. It June this year its clients had made an average 25 percent reduction in allocated employee travel budgets for the future , which could indicate more people were traveling, and that the employer simply wanted to rein things in; travel, as a proportion of card spend, is increasing at a double digit percentage.

There’s now value in tracking more of these on-the-fly trends. “The data coming out of large corporates is herd behavior,” Alderman said. “They all tend to do the same things, so you have similar feedback and metrics out of the large travel management companies. It’s very rare American Express Global Business Travel turns around and says something completely different to CWT. That just doesn’t happen.”

He said it’s worth tracking small and medium-sized enterprise behavior because they’re such a huge part of the economy.

“Traditional travel policies have been thrown out the window since Covid,” he added, because of erratic travel costs. “In the micro SME space, people just needed to get back out there again, and the policy they had sat in the draw from two years ago didn’t make sense any more.”

Units, Not Volumes

It’s also time to enhance the methodology.

One experienced travel manager, working for a large business consultancy specializing in the pharmaceutical sector, said that looking back to 2019 fails to recognize that businesses are in different shapes and sizes today. In some cases, a missing three years of growth should be factored in. The pandemic throttled most businesses, but many sectors thrived in those dark years, notably pharmaceutical and software companies.

“We quadrupled in size over the pandemic,” he said, preferring to remain anonymous. “Where most people might look at their return to travel levels and monitor it via business trips, I didn’t want to do that and just come up with a number. We’ve obviously seen a (travel) growth rate due to the fact that our company is a lot bigger than it used to be in terms of headcount.”

While travel spend had increased, he removed the growth element and calculated the proportion of employees who traveled in the first two quarters of 2019, versus those same quarters in 2022. Rather than how much they traveled, how many people traveled?

The result was that his company’s true “return to travel” figure was at 45.5 percent of 2019, meaning half as many employees were traveling for business.

A New Era of Accountability

Further ahead, travel managers are predicting the way they carry out their jobs change to reflect this change in work.

Justifying the purpose of travel in a little more details is becoming common, with Google one of the latest mega-companies to clamp down and ensure travel more “critical” than social .

With rising prices, there’s a renewed on data and a focus on explaining the reasons for any increases.

“As we’re coming to the end of the year, we’re having negotiations with our suppliers right now,” Navarro said. “We’re trying to understand the impact of inflation on the different categories. There’s a common understanding from finance that prices are going up, but the impact of procurement is to mitigate as much as we can to see how much of our program we can consolidate.”

She wants to better understand the breakdown. For air, how much is the fuel component, how much is labor contributing, for example. “For airlines, I can see more centralized data. It’s comparable between airlines, but for hotels it’s very different, depending on the ownership structure, brand or location. I can see hesitation and pushback. You have to be careful, some suppliers have tried to offload increases over the past couple of years. I’m confident of the prices I have right now, but I don’t want to lose my competitive edge.”

A recent USA Today article predicted hotel fees were now starting to change , with the next big charge set to be daily housekeeping fees. The previous uproar was over resort fees, which are also set to make a comeback.

With accountability comes the accountants. Skift argued that “corporate travel is now in the firm grip of the CFOs,” but one travel manager, working for a U.S. based TV production company, said it’s not so controlled. With travel programs not quite recovered, he’s seeing eye to eye a lot more due to the ongoing hesitancy to travel .

“For employees, there is an awareness they don’t need to travel,” he said. “We kind of agree this is the right level of spend. Travelers on the whole are more cautious and the disruption still continues. Trips for internal meetings are just not happening, and execs are meeting quarterly or yearly.”

Don’t Call It a Recovery

This natural correction seems to be here for the long term. Another travel manager, based in Europe and working for a recruitment firm, said his company’s leadership were coordinating in advance and combining meetings.

“I don’t have the confidence business travel is going to see the pick-up maybe that the industry is hoping for,” he said. “It’s going to be a slow burn, it’s not like it’s a quick snapback to reality after a few months, which is what we thought in the beginning.”

Further ahead, Navarro believes that in the future travel managers will be working with two currencies: the price of the ticket, and the carbon impact of the ticket. Microsoft already charges itself an internal penalty based on the carbon emissions that its travel generates . With increased scrutiny, more corporates may find their travel will need to shrink faster than expected.

“We won’t see it necessarily in 2023, but the idea that there might be carbon budgets to go along with spend budgets for travel is not that far off,” agreed CWT’s Vournakis. “It’s very conceivable that the more progressive corporates who lean into this will have clear carbon budgets starting in 2024.”

Tilstone’s snapshot, like many others, is that the remainder of 2022 won’t set the demand agenda for the future, with 2023 also set to remain in flux, as companies that moved to remote ascertain what value face-to-face brings, and when travel adds value.

“I struggle with the word recovery. Recovery means we’re going back to where we were before. We’re not. We’re going into a new way of traveling, and managing travel, with more focus on sustainability,” Navarro said. “It’s not a recovery, it’s a redesign of the industry.”

Her sentiments echo those of workforce strategist Mattison, who told delegates at Global Business Travel Association convention: “I talk to a lot of leaders. There is sometimes subtle, and sometimes not so subtle, ethos or mindset of: ‘We got through it (Covid), and now we can get back to normal,’” said workforce strategist Seth Mattison at the Global Business Travel Association convention in San Diego in August.

“I hate to be the bearer of bad news, but there is nothing to go back to. That world is gone. Why? Because we have changed as people, and we have changed as a society. We changed the way we work and the way we create value for our customers.”

His said travel managers now played such an important role in shaping the experiences of their colleagues.

“And guess what, the future of work is changing the future of business travel. We have a chance to rethink, design and reimagine what this can look like,” he said.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Tags: american express global business travel , business travel , coronavirus recovery , corporate travel , cwt , deep dives , expense management , google , hybrid meetings , remote work , tripactions

Photo credit: An empty conference room. IPGGutenbergUKLtd / Getty Images

After slow end to 2022, the business travel outlook is turning more positive for 2023

There is a growing sense that lower levels of business flying are here to stay, with many still expecting top executives to set corporate flying reduction targets, driven by cost savings, changing travel habits and sustainability needs.

Messaging regarding the recovery of the business travel segment remains mixed.

Since the onset of the COVID-19 pandemic, a number of the industry's leading voices have claimed that business travel will never fully recover due to changing working habits - namely, remote working and digital nomadism; company cost reduction; and a growing awareness of environmental issues.

Indeed, international business travel has been recovering at a much slower rate than leisure tourism.

- Recovery in business travel slowed in 2H2022...but rapid recovery is expected for 2023.

- Confidence in business travel nearly fully recovered to the levels from before the COVID-19 pandemic.

- Suppliers are highly optimistic about the outlook for business travel; higher spend trend echoed by travel buyers and procurement professionals.

- Customer meetings and new business prospects to hold weight of business travel investment.

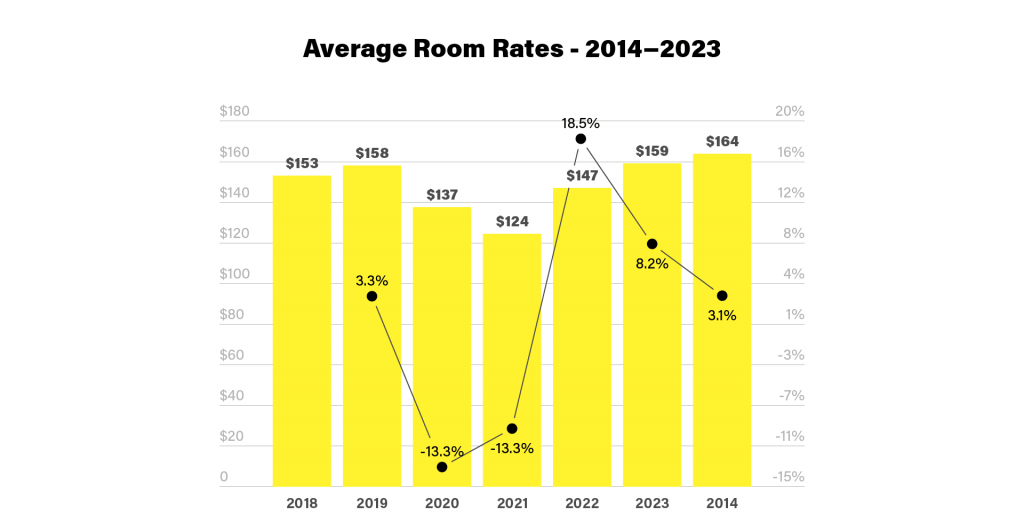

- A large part of the recovery in US business travel spending has been due to the growth of prices - such as for airfares, car rentals and accommodation.

- COVID-19 has produced a range of changes that have modified the landscape of demand for business travel globally.

- Hybrid and remote working arrangements have persisted for a large proportion of workforces globally.

- Additional layers of corporate travel approvals and duty of care arrangements introduced during the pandemic have proved stubborn to remove.

- Sustainability considerations are also weighing much more heavily on travel activity.

Recovery in business travel slowed in 2H2022...

The global recovery in business travel experienced a pause over much of 2H2022.

After a rapid bounce-back of business travel during 1H2022, the expectation had largely been that the sector would have a continued, if steady, recovery over the second half of the year. However, in the face of rising travel costs due to inflationary pressures, airline operational chaos across multiple regions, and wider concerns about the macroeconomic outlook - businesses revised their plans and travel and budgets were largely static.

This was clearly evident when listening to comments from some of the leading airlines in the US , where business travel recovery had been strong.

In early Dec-2022 United Airlines CEO Scott Kirby stated that business travel had "plateaued" in late 2022, adding that this was "indicative of pre-recessionary behaviour". Delta Air Lines President Glen Hauenstein reported at the start of Jan-2023 that corporate travel demand had been "steady" over 4Q2022, with domestic corporate sales recovering to 80% of 4Q2019 levels.

Alaska Airlines CEO Ben Minicucci reported that large Silicon Valley technology companies had largely "turned off" business travel in late 2022.

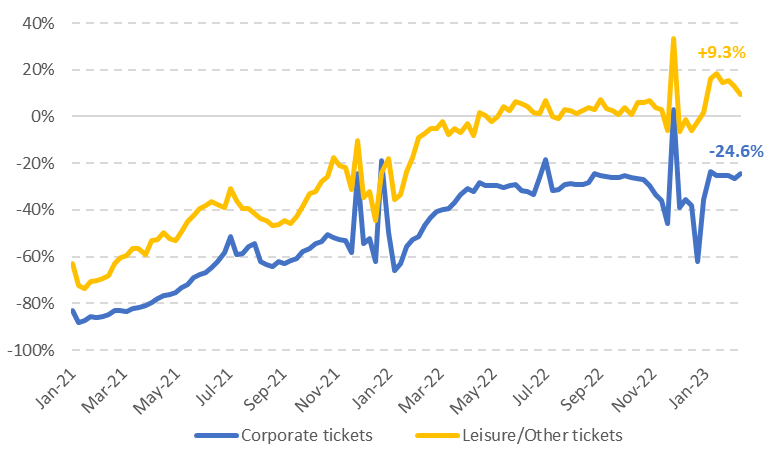

Airlines Reporting Corporation : US corporate and leisure ticket bookings (percentage vs 2019), 2021-2023

Source: Airlines Reporting Corporation .

...but rapid recovery expected for 2023

Despite the recent slowing performance, there is an increasing undercurrent of positive expectations for business travel for 2023.

Airlines, corporate travel management organisations, travel agencies and business travel associations are now pointing to a rapid recovery for 2023, particularly when it comes to business spending.

Global forward-ticketing data from Forward Keys indicates that after a slowing in business ticket sales over 2H2022, forward sales indicate that corporate air travel is due to accelerate through the early part of 2023.

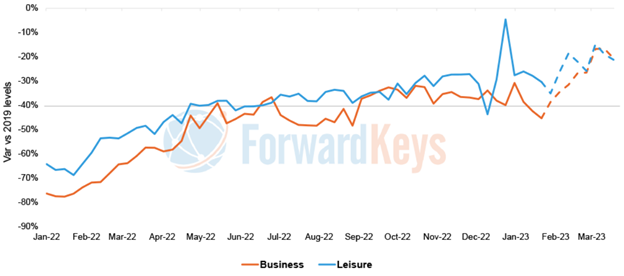

ForwardKeys: forward business and leisure air ticket data, 2022-2023

Source: ForwardKeys.

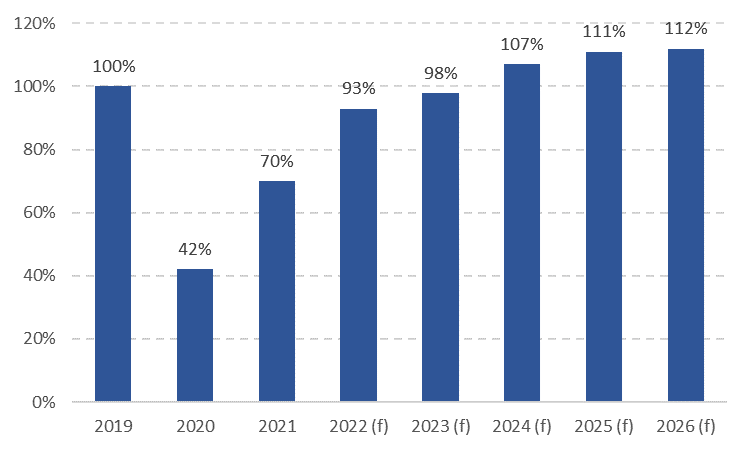

The Global Business Travel Association (GNTA) projects global business travel spending of just under USD1.2 trillion in 2023.

While this is still down, around USD273 billion down on 2019 levels (-19.1%), the outlook is for overall spending to increase 24.2% year-on-year for 2023.

GBTA : business travel spending outlook, 2019-2026

Source: Global Business Travel Association .

Confidence in business travel nearly fully recovered to levels before the pandemic

GBTA 's Business Travel Outlook Poll for 1Q2023 found expectations for business travel in 2023, with confidence nearly fully recovered to levels before the COVID pandemic.

Of travel buyers - 91% reported that they feel that employees at their company are now either 'somewhat willing' or 'very willing' to travel for work in the current environment.

This is up from just 64% of reported workers who were willing to travel in Feb-2022, and 86% in Oct-2022.

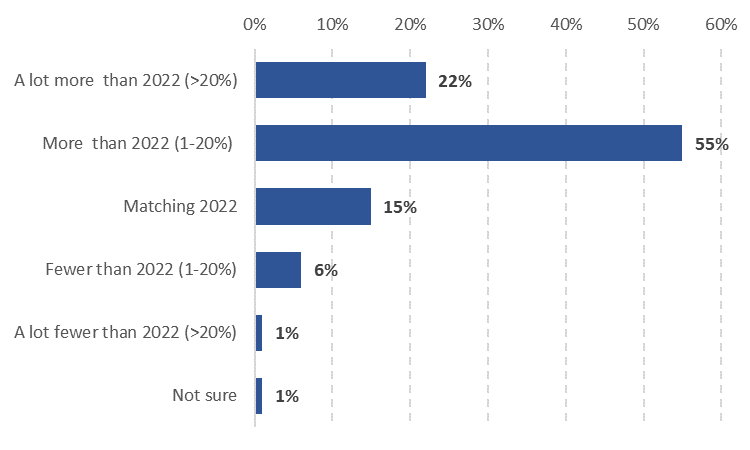

According to GBTA 's polling, 78% travel managers globally expect their companies will engage in more business travel in 2023.

Expectations about travel volumes increases are almost uniform between the North America , Latin America , Europe and the Asia Pacific regions.

Just 7% of travel managers expect reduced travel.

Reduced travel expectations are lowest with travel managers in North America (6%) and the Asia Pacific (7%), and higher with managers in Europe (10%) and Latin America (13%).

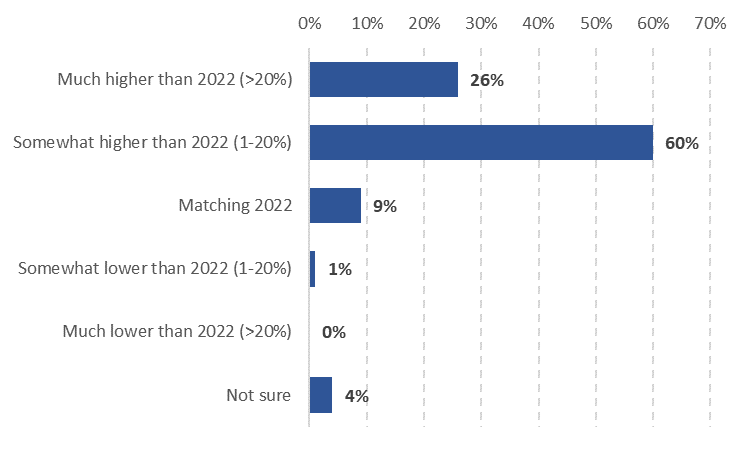

Travel buyer/procurement: professional expectations for 2023 business travel volumes

More travel suppliers expect increased spending on travel by their corporate customers

Further to this, GBTA 's data shows that 86% of travel suppliers expect spending on travel by their corporate customers will increase in 2023 - up from 80% in the association's Oct-2022 survey.

This confidence is high, regardless of region - all travel suppliers surveys in the Asia Pacific expect spending to be somewhat or much higher than it was in 2022, followed by 91% in Latin America , 90% in Europe and 85% in North America .

Just 1% expect reduced spending by corporate customers.

Travel supplier/travel management company: expectations for 2023 business travel spending

Suppliers are also highly optimistic about the outlook for business travel.

According to GBTA polling, 24% report feeling 'very optimistic' about the industry's path to recovery, and 65% are optimistic. Just 3% report they are pessimistic about the outlook.

Travel suppliers expectations about higher spend are echoed by travel buyers and procurement professionals. Of those polled, 46% expect a higher budget for travel programmes for 2023 when compared to 2022, while 41% expect budgets will be about the same as the previous year.

Customer meetings and new business prospects to hold weight of business travel investment

The key area for business travel spending in 2023 is expected to be for trips for sales staff or account managers to meet with customers or new business prospects.

On average, travel managers estimate that their companies will allocate 28% of their travel spend for these purposes in 2023. This is followed by spending on trips for internal company meetings (19%) and spending on attending conferences, trade shows and other industry events (18%).

North American business travel to return to close to normal in 2023

The US Travel Association (USTA) project that the volume of business travel by air will recover to around 98% of pre-pandemic levels in 2023, with recovery back above 100% in 2024.

Domestic travel is at or above pre-pandemic levels, but international arrivals are still in recovery mode.

For 2022, inbound arrivals by foreign nationals into the US were down 24% compared to 2109. This was chiefly due to the slow rebound of traffic from the Asia Pacific , as well as some sluggishness in the early part of the year in Europe and parts of Latin America .

As of the start of Feb-2023, arrivals from mainland China were down 97% when compared to 2019, and arrivals from Hong Kong were still down by 80%.

Inbound travel from Japan was down 41.6%, and from Australia it was down 30.4%.

From Europe , UK arrivals were down 18.5%, while arrivals from Italy were still 14.2% below pre-pandemic levels and German arrivals were down 7%. Of the main Latin American markets, arrivals from Brazil were still a third below 2019 levels.

USTA estimates for Dec-2022 were that US business travel spending would be USD97 billion, which was an increase of 3% compared to pre-pandemic levels.

US business travel forecast: volume, percentage of 2019 levels, 2019-2026

Source: US Travel Association.

A large part of the recovery in US business travel spending has been due to the growth of prices, such as for airfares, car rentals and accommodation.

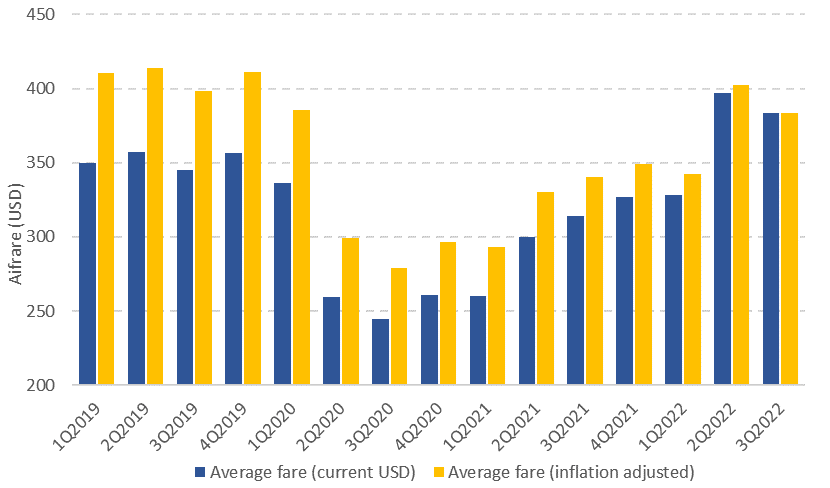

According to the USTA, airfares rose 28.5% year-on-year for the full year 2022.

US Bureau of Transport Statistics data shows US domestic fares averaged USD384 in 3Q2022. This is up from an (inflation adjusted) average domestic fare of USD279 in 3Q2020, an increase of 37.4% over the two-year period, and up 12.8% over the past 12 months.

US average domestic round trip airfares, by quarter, 1Q2019- 3Q2022

Source: US Bureau of Transportation Statistics.

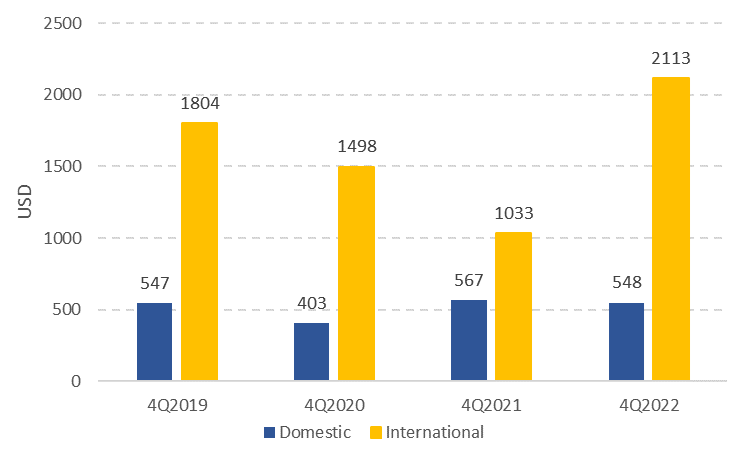

Data from the corporate travel solutions provider Emburse shows that average spend per round trip domestic business travel by air for 4Q2022 was USD548, putting it just ahead of 4Q2019 levels.

Spend per round trip on international business travel was significantly higher: USD2113 in 4Q2022, vs USD1804 in 4Q2019 (an increase of 17.1%).

Domestic and international air travel: average spend per round trip, 4Q2019-4Q2022

Source: Emburse.

New hope for full recovery in 2023

COVID-19 has produced a range of changes that have altered the landscape of demand for business travel globally - some of which have slowed the recovery, and others that are contributing to business travel coming back, albeit in modified form or with higher spending.

Hybrid and remote working arrangements have persisted for a large proportion of workforces globally, cutting into historical business travel volumes, while at the same time creating greater demand for 'bleisure' travel.

Although video conferencing technology became ubiquitous during the pandemic, enterprises continue to report strong demand for face-to-face meetings, particularly given the uncertainties in global supply chains and the need to train new staff working from remote locations.

Additional layers of corporate travel approvals and duty of care arrangements introduced during the pandemic have proved stubborn to remove - particularly in large corporations. The response has been to consolidate multiple smaller business trips into larger - and often more costly - single trips.

In this same vein, sustainability considerations are also weighing much more heavily on travel activity, but businesses have also shown greater willingness to spend money to be good corporate citizens and offset the impact of their travel.

Despite the structural trends and concerns about an economic slowdown in developed economies, business travel has renewed its upwards trend.

Although the recovery is happening more slowly than expected, and is still well below where most airlines would like it to be, there is renewed confidence in the recovery outlook for 2023.

Want More Analysis Like This?

- Marketplace

- Marketplace Morning Report

- Marketplace Tech

- Make Me Smart

- This is Uncomfortable

- The Uncertain Hour

- How We Survive

- Financially Inclined

- Million Bazillion

- Marketplace Minute®

- Corner Office from Marketplace

- Latest Stories

- Collections

- Smart Speaker Skills

- Corrections

- Ethics Policy

- Submissions

- Individuals

- Corporate Sponsorship

- Foundations

Business travel is coming back, but it looks different

Share now on:.

- https://www.marketplace.org/2022/07/21/business-travel-is-coming-back-but-it-looks-different/ COPY THE LINK

HTML EMBED:

Get the Podcast

- Amazon Music

If you’re looking for proof that, at least psychologically, we are mostly over the pandemic, look toward the skies.

On Wednesday, United Airlines reported more than $12 billion in revenue for the prior quarter, the most money the company has made in over a decade. Thursday, American Airlines told investors it made its first quarterly profit since the pandemic hit.

Those companies’ planes are mostly packed with pent-up demanders for vacation travel. But a more lucrative passenger is also returning to the skies: the business traveler.

Justin Strelow is generally thrilled to be traveling for business again. Although he’s not thrilled with every part of it.

“I do not eat at the airport. I am trying to drop a few pounds,” Strelow said. “I’m trying to drop my pandemic weight.”

Strelow is a co-founder of Insysiv, a Kansas City, Missouri-based company that makes software for hospital labs. In two weeks’ time, Strelow will be flying himself and three employees to Anaheim, California, for a trade show. Even without airport Cinnabons, the trip will cost his small business around $15,000.

“I am still kind of old school. I like face-to-face with folks,” Strelow said. “We’ve found the value of getting in front of people in person and really solidifying those relationships.”

That is music to the airline industry’s ears. Before the pandemic, business travel accounted for more than 50% of profits, said Ryan Mann with the consulting firm McKinsey.

“Business travelers tend to book at the last minute, and that’s when prices are the highest,” Mann said.

Business travel is about 70% of where it was in 2019, according to the aviation data company Arc.

Mann said Zoom has replaced smaller in-person meetings that used to involve travel, “but conferences, frankly, are filling the gap.”

As are corporate retreats and team-building trips where remote employees can finally see how tall their co-workers are.

While business travel is trending up, it’s an open question whether it will ever recover fully. A recession could make that more difficult.

“That’s an area where they can cost cut, and there’s a clearly proven alternative in Zoom,” said Chris Raite, an analyst at the investment research firm Third Bridge.

Plus, you don’t have to worry about your Zoom getting delayed because of a pilot shortage.

Stories You Might Like

With Americans itching to travel, the second new low-cost airline this year is taking to the skies

Travel slowing as Labor Day nears

The travel industry is still feeling the loss of business customers

Airlines, struggling with COVID-19 headwinds, tally their 2020 financial losses

As people start flying again, more are exploring the first-class cabin

A new airline is launching, focusing on smaller airports

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on . For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.

Also Included in

- Airline industry

- Business travel

Latest Episodes From Our Shows

The TikTok ban is poised to make the U.S.-China divide even starker

The WIC family food program is getting a refresh, but requirements are still tough to navigate

Why does the world want dollars? Because of high interest rates, thriving economy in U.S.

Recent college grads see rise in unemployment

US mandates new airline refund rules, fee disclosures

- Medium Text

Sign up here.

Reporting by David Shepardson; editing by Miral Fahmy and Aurora Ellis

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron