- Register/Activate

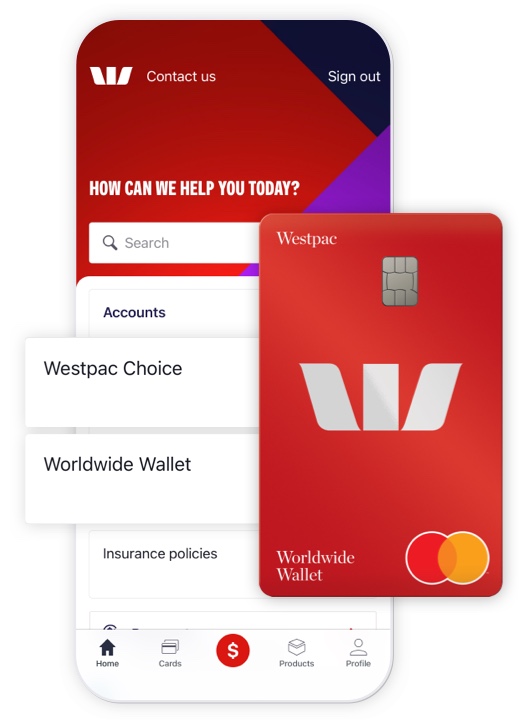

- Mobile Banking

- Business Banking Online

- Internet Banking

- Directshares platform

- Margin Lending

- connections online

- PaymentsPlus

- Auto & Equipment Finance

International

Travel money card

The Worldwide Wallet is a prepaid Mastercard® that lets you lock in your exchange rates before you travel or shop. Pay no foreign transaction fees when you use your card to spend and enjoy access to Flight Delay Pass.

A smart and safe way to pay in foreign currencies

How it works, before you leave.

1. Order a Worldwide Wallet online or pick one up in branch

2. Activate your cards in Internet Banking

3. Transfer AUD to your card and convert into your choice of up to 10 currencies to lock in your rates.

Logon and order now

While you're away

- Pay for things using the local currency loaded on your card

- Avoid ATM fees at Global ATM Alliance partners 5

- Reload your card as you go using the St.George App, with no load or reload fees.

When you get home

- Convert leftover currency back to AUD or another available currency, with no unload fees

- Remember , you can avoid foreign transaction fees while shopping online by paying with your Worldwide Wallet.

Save on fees

- Avoid ATM withdrawal fees Through our Global ATM Alliance and overseas partner ATMs which you can find using the ATM locator in the St.George app.

- No foreign transaction fees Avoid a 3% foreign transaction fee whenever you use your Worldwide Wallet to shop online or in person.

- No load or unload fees Reload your account on the go, whenever you need.

- No account keeping fees You won’t pay any inactivity or account keeping fees, so any funds left in your account will be there ready for your next trip or purchase.

Other fees may apply. Read the Product Disclosure Statement (PDF 1MB) for full list of fees.

Did you know you can use a St.George Worldwide Wallet to avoid foreign transaction fees when shopping online?

You can avoid a 3% foreign transaction fee when you shop online in available foreign currencies, plus lock in your budget by converting your currency ahead of time. You can also shop worry-free from fraudulent transactions with Mastercard Zero Liability protection. 1

Complete visibility and control

All in one view.

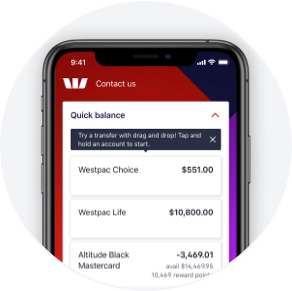

See your account balance and transactions in your Mobile Banking app or in Internet Banking.

Move money easily

Transfer money to and from your Worldwide Wallet and convert AUD into foreign currencies while you’re on the go in your Mobile Banking app.

More ways to pay

Add your Worldwide Wallet to Google Pay™ or Samsung Pay™, or use your card to tap and go.

A spare card for peace of mind

Both cards give you access to the same funds and can be locked and unlocked instantly at your convenience via Mobile Banking. 6

Add up to 11 currencies

Lock in your rate head of time by converting currency in advance.

You'll still be able to spend in currencies not listed here and avoid Westpac's 3% foreign transaction fee.

Use our currency converter to view the latest foreign exchange rates.

- AUD - Australian Dollar

- USD - United States Dollar

- GBP - British Pound

- NZD - New Zealand Dollar

- CAD - Canadian Dollar

- JPY - Japanese Yen

- THB - Thai Baht

- ZAR - South African Rand

- SGD - Singapore Dollar

- HKD - Hong Kong Dollar

Order online or pick up in branch

Order online.

You can open your travel money card account online and we’ll mail your cards to your address in 5-8 business days.

Pick up in branch

If you need your cards within 8 business days its best to pick them up in branch and activate them online.

Already have your cards? Activate now

A St.George Worldwide Wallet is a prepaid travel money card that can help you save on foreign transaction fees and give you control over your spending. With the St.George Worldwide Wallet, there are no load, reload or unload fees, or ATM withdrawal fees at Westpac Group ATMs and over 50,000 ATMs overseas. 5

Before you shop or travel, you can also choose to convert your loaded AUD into any of the following currencies: USD, EUR, GBP, CAD, JPY, THB, ZAR, SGD, NZD and HKD. By locking in your exchange rate in advance and knowing exactly how much of a foreign currency is loaded on your card, the St.George Worldwide Wallet can make it easy for you to stay on top of your spending. When you sign up to a St.George Worldwide Wallet, you’ll also get access to exciting Mastercard travel and shopping perks - Flight Delay Pass , Priceless Cities and Mastercard Travel Rewards .

With the St.George Worldwide Wallet, you can avoid a 3% foreign transaction fee when you shop online in available currencies.

You can shop safely by loading only what you need into any of the following currencies: USD, EUR, GBP, CAD, JPY, THB, ZAR, SGD, NZD and HKD. By knowing exactly how much of a foreign currency is loaded on your card, you can stay on top of your spending.

You’ll also benefit from Mastercard Zero Liability protection, 1 so you can shop worry-free from fraudulent transactions.

To apply for a St.George Worldwide Wallet, you must be aged 14 years or older and be an existing St.George customer who is registered for Internet Banking. If you haven’t registered for Internet Banking, see this helpful guide to learn how to get started. If you’re new to St.George and would like to apply for a Worldwide Wallet, you’ll need to become a customer first by opening a St.George savings or transaction account and meeting our identification requirements. You can visit stgeorge.com.au/personal/bank-accounts/tools/customer-identification for more information on how we identify you.

If you have insufficient funds to complete a transaction in a currency loaded on your account, or the transaction is in a currency not loaded on your account, the transaction will be automatically processed by drawing down from another currency in your account (provided that there are sufficient funds available in one or more other currencies to complete the transaction). Funds will be withdrawn according to the drawdown sequence, and the applicable exchange rate will apply. See the Product Disclosure Statement (PDF 1MB) for the drawdown sequence.

Yes, you can withdraw money or check your balance at overseas ATMs using your Worldwide Wallet. The balance displayed will be in the currency of the country you are visiting. You won’t pay an ATM withdrawal fee when using a Global ATM Alliance ATM. 5 However, fees may apply if you use an ATM outside of the Global ATM Alliance network.

We recommend you download our app as we may send you important notifications about your Worldwide Wallet while you are travelling. Using the St.George Mobile Banking app makes it easy for you to get these notifications while you’re on the go. You can also use the app to:

- Instantly transfer AUD between your savings and transaction St.George account/s and your travel money card

- Convert between your loaded AUD and up to 10 different foreign currencies at any time to lock in your exchange rate

- View your currency balances and transactions

- Access your Worldwide Wallet account’s BSB and account number as well as your eStatements

- Block your card/s if they have been lost or stolen

If you’re new to Mobile Banking, learn more about how to get started .

See all FAQs

Get started

Order online and have your cards delivered to you.

Worldwide Wallet 24/7 support

1300 277 103

in Australia or +61 2 9155 7803 from overseas.

Find a branch

Visit your local branch and pick up cards.

Important information

St.George Worldwide Wallet

AUD, USD, EUR, GBP, NZD, CAD, JPY, THB, ZAR, SGD, HKD

Atm withdrawal fee

Minimum load, upper limit, monthly inactivity fee, customer reviews.

This product does not currently have any community reviews. Be the first to write one.

About Mozo’s Editorial Star Ratings

Mozo’s Editorial Star Ratings are a score out of 5 stars arrived at by the author of the review after careful consideration of a product’s rates, fees and features when compared with other products that offer similar features.

As a guide, this is how the Editorial Star Ratings should be interpreted:

- 5 stars - a best in class blend of great value and features

- 4 stars - excellent value and features overall

- 3 stars - good value and features overall

- 2 stars - below average, but may be worth considering for some people

- 1 star - well below average

Ratings are just one factor you may want to consider when choosing a financial product. Our ratings have been determined without considering your personal objectives, and a product with a high rating may not be the best one for you.

Important information on terms, conditions and sub-limits

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

Who we are and how we get paid

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace business, we do earn money from advertising and this page features products with Go To Site links and/or other paid links where the provider pays us a fee if you go to their site from ours, or you take out a product with them. You do not pay any extra for using our service.

We are proud of the tools and information we provide and unlike some other comparison sites, we also include the option to search all the products in our database, regardless of whether we have a commercial relationship with the providers of those products or not.

'Sponsored', 'Hot deal' and 'Featured Product' labels denote products where the provider has paid to advertise more prominently.

'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

St. George Global Currency Card Review

Learn about the St. George Global Currency Card in this review to help you decide whether this is the card for you.

- Reloadable Prepaid Visa Money Card

- Load up to 5 of 11 available currencies

- Lock in exchange rates

- Use easy St. George Global Currency card app

- No ATM withdrawal fee at over 50,000 ATMs globally

Pros and cons of using St. George Global Currency Card

- Change your PIN online

- App available to Apple and Android

- Up to $3000 emergency cash transfer

- Only open to existing customers

- Can only load AUD and convert

- Only 5 wallets can be active

Benefits of the St. George Global Currency Card

- Chip and PIN protected

- Visa Zero Liability Policy

- Back-up card issued with separate PIN

Convenience

- Have up to 5 out of 11 currencies available at any one time

- All your currencies on one simple prepaid card

- Free card and free replacement

- No initial fund reload

- No ATM withdrawal or balance enquiry fee at over 3,000 Westpac Group ATMs in Australia and over 50,000 ATMs globally via Global ATM Alliance partners

- Avoid the 3% St. George foreign transaction fee when shopping or getting cash in a currency loaded on the card

Manage Your Money

- Load funds instantly online or through the mobile banking app or BPAY

- Organise all your required currencies into a ‘wallet’ system

- Check balance online, via the app, phone or ATM

- Influence and determine the priority of your wallets

All prices are in AUD

* No fee is applicable. The rate applicable to the conversion is the retail foreign exchange rate at the time of the conversion.

Currencies and Countries

Currencies supported.

- Australian dollars (AUD)

- US dollars (USD)

- Great British pounds (GBP)

- New Zealand dollars (NZD)

- Hong Kong dollars (HKD

- Canadian dollars (CAD)

- Singapore dollars (SGD)

- Thai baht (THB)

- Japanese yen (JPY)

- South Africa (ZAR)

Load Amounts

- Minimum Load: $50

- Maximum Load: $50,000

Transaction Limits

- ATM Withdrawal Limit (24 hours) : AUD 2,000 (or currency equivalent)

- POS Transaction Limit (24 hours): AUD 10,000 (or currency equivalent)

- St. George Bank International Transfer Fees

Harry is Australian and banks with St. George. He has booked a trip to the USA with his friends and noticed that St. George has a Travel Card exclusively open to existing customers. When Harry goes abroad, he usually converts his AUD into cash, but there has been occasions where he has lost money from his wallet and had to consequently draw out more, and incurring those pesky charges. When he researched about the St. George Global Currency card, he found out that he could easily apply online with no purchase or loading fee. He could simply convert his AUD into USD for his trip, and avoid ATM withdrawal charges abroad. He could also have top security with the automatic back-up card provided with a separate PIN. That way, if he ever lost his card he was still secure and safe.

Online Tools

Save time and let our online tools crunch the numbers for you.

Currency converter

Burning to know what the exchange rate is? Check today’s exchange rate on any amount.

View tool ⟶

Travel money comparison tool

Heading overseas? Find the best rates for exchanging currency online or find a store near you.

Knowledge centre

Learn the ins and outs of currency

Money transfer comparison tool

Finding the best deal can be nightmare. We bring together all your options by highlighting the fees and rates.

- United States

- United Kingdom

St.George credit card complimentary travel insurance

Got a st.george credit card with travel insurance here’s what you need to know about cover and how to make a claim..

In this guide

Which St.George credit cards have complimentary travel insurance?

- What’s covered by St.George complimentary international travel insurance?

- What do I need to do to use St.George’s credit card international travel insurance?

Pre-existing medical conditions

How to make a claim through your st.george credit card complimentary international travel insurance policy, other types of st.george complimentary credit card travel insurance, st.george credit card complimentary insurance for shopping, st.george business credit card complimentary insurance options, frequently asked questions.

St.George offers complimentary insurance on its platinum and signature credit cards, with policies that cover domestic and international trips, as well as cover for some of the things you buy with your card. The actual policies are underwritten by Allianz Australia Insurance Limited (Allianz).

Just like any insurance policy, there are conditions you need to meet to get cover and successfully make a claim. That's why it's always best to read the policy document. But we know reading terms and conditions can be hard, so we have pulled out the key details to give you a better picture of St.George’s complimentary credit card insurance.

Have a question or need to make a claim right now? Call Allianz Global Assistance on 1800 091 710 (Australia) or +61 7 3305 7468 (overseas).

As you can see, St.George offers complimentary international travel insurance for 4 cards but it separates them into Level 1 and Level 2 categories. The key difference between these levels is the length of cover you get for international travel insurance, as we’ve shown in the table.

Have a St.George credit card that’s not on this list? Check the terms and conditions available on the St.George website to see if your card is eligible.

What’s covered by St.George complimentary international travel insurance?

The cover you get is broken down into “benefits” based on what you can and can’t claim. It includes cover for medical and dental emergencies, cancellation and luggage, with selected COVID-19 cover from 30 June 2022. Some claims also have an excess you need to pay before you’ll get any money back (if your claim is approved).

To help you understand the cover available, we’ve put the key options for different types of claims and situations into a table. But remember: you should always read the insurance policy booklet for complete details of the cover.

Medical, dental and emergencies cover with a St.George credit card

St.george complimentary international travel insurance for cancellation, delays and transport, luggage and personal items cover offered with st.george credit card complimentary insurance, hijacking, kidnap and personal liability cover offered with st.george complimentary credit card travel insurance, st.george credit card complimentary international travel insurance for death and funerals, st.george complimentary international travel insurance and covid-19.

From 30 June 2022, St.George complimentary international travel insurance has select cover for COVID-19 and other known pandemics and epidemics. This includes for:

- Overseas emergency assistance

- Overseas emergency medical

- Medical evacuation and repatriation

- Cancellation

- Additional expenses

To make a claim, you need to be positively diagnosed with COVID-19 (or another pandemic/epidemic disease) and meet all the other requirements for a claim. It also applies if a travel companion is positively diagnosed. But it won’t apply if you’re travelling against government advice or if the mass media have published details of advice or warnings against travel.

As there are specific conditions to meet for this type of cover, make sure you read the amended policy booklet or call Allianz on 1800 091 790 before you travel.

What’s not covered?

Every insurance policy has details of when you will and won’t get cover. These details can be very specific, which is why it is important to always check your insurance policy documents.

To give you an idea, here are some of the key things you won’t be covered for with St.George credit card complimentary international travel insurance:

- Issues that come up because of alcohol or non-prescription drugs

- Travel that’s for the purpose of medical treatment

- If you’re a crew member or pilot of any of the transport

- If you’re over 81 or anyone relating to a claim is over 81

- Changes to your plans due to government restrictions

- If you or your partner gives birth during the trip, or there are complications arising after week 26 of the pregnancy

- Dangerous activities including rock climbing (with equipment), white water rafting, bungy jumping, off-piste snowboarding or skiing, and quad or motorbike riding on a vehicle that has an engine capacity of 200cc or more

Want cover for a skiing trip, bungy jumping or other overseas adventures? Check out adventure sport travel insurance costs and conditions.

What do I need to do to use St.George’s credit card international travel insurance?

At the moment, countries and regions around the world all have their own restrictions and guidelines around the coronavirus pandemic. These can change, so it’s worth checking where you can travel before booking anything.

Then, to get international travel insurance cover through your St.George credit card, you’ll need to meet the following requirements:

- Travel bookings. You need to use your St.George credit card to pay for at least $500 of your travel expenses before the start of the trip. An easy way to do this is to use your card to pay for your overseas flights or accommodation.

- Australian residency. You must live in Australia, and start and end your trip in Australia.

- Age. You’ll be covered if you’re under 81 years of age. If you’re over 81 and want overseas travel insurance, there are some policies you can buy that give you cover up to the age of 100 .

Does St.George credit card travel insurance cover family members?

Yes, if you meet the eligibility requirements for cover on an upcoming trip, your spouse and dependants (i.e. your children) can get cover under this policy when they’re travelling with you for at least half of your trip and meet the following requirements:

- They need to live in Australia, and start and end their journey in Australia

- They need to have a return travel booking before they leave

- At least $500 of their travel costs need to be paid for with your St.George credit card before the start of the trip

- They need to be under 81 years of age at the time they become eligible for the insurance

They also need to meet the same age requirements and other conditions of the insurance policy.

This complimentary international travel insurance only covers a few pre-existing medical conditions, with very specific circumstances.

Here, we’ve summarised the key details for conditions that are covered. If you have any pre-existing conditions, you should also look at the insurance document for full details or call Allianz on 1800 091 710.

🔥 Hot tip: The easiest way to find details in the insurance policy booklet is to open your digital copy and use the find tool (Ctrl+F or Cmd+F) to search for the terms (for example, “Pre-existing medical conditions”).

What if I don’t meet the requirements or have a different pre-existing condition?

In simple terms, you won’t get cover if you don’t meet the requirements for a pre-existing medical condition or if you have another pre-existing medical condition.

This means you won’t be able to make a related claim if you've previously seen a doctor or other qualified professional about a condition that ends up causing issues overseas. It's the same for any physical, medical, mental or dental condition that you’re aware of before you travel.

If you’re not sure whether your pre-existing medical condition will be covered, call Allianz on 1800 091 710 to check if you can get cover. You can also apply to get written confirmation from Allianz that a pre-existing medical condition is covered, although be aware that additional fees may apply.

Need cover for a pre-existing health condition? Check out travel insurance policies that offer cover for conditions including high blood pressure, high cholesterol and physical disabilities.

Pre-existing medical condition definition for St.George credit card insurance

Travel insurance policies all have specific ways of looking at pre-existing medical conditions, so it’s really important you’re aware of the actual definition they use.

As well as the summary above, we have included the definition that’s in the current St.George card insurance policy document, effective from 1 March 2023 (page 18):

“A condition of which a reasonable person in the circumstances, should have been aware at the time eligibility for the cover available was met, including:

- Any dental condition; or

- Any physical condition; or

- Pregnancy; or

- Any lifelong illness; or

- Any chronic illness; or

- Any mental illness; or

- Was treated by surgery (including day surgery); or

- Required regular medication; or

- Required on-going treatment; or

- Was referred to a specialist medical adviser; or

- Had regular reviews or check-ups; or

- Caused admission to hospital; or

- Was treated at a hospital emergency department or out-patient clinic”

Your first step should be to contact Allianz Global Assistance as soon as you think you might need to make a claim so that they can give you specific information.

You can do this by calling 1800 091 710 in Australia, or from overseas by calling the emergency assistance number: +61 7 3305 7468. You can also email [email protected] but may have to wait longer for a response. `

There are 2 main ways you can submit your claim:

You will hear back about your claim within 10 business days, according to the online claims website.

What to include in your claim

With insurance claims, it’s always good to include as much detail and supporting documentation as possible. It makes it easier for the insurer to look at the claim and your eligibility for a payout.

So when you're travelling overseas with this cover, try to get as much written or photo evidence as you can for any claim you need to make. This could include:

- A referral or letter from a doctor or other professional you see in relation to a claim

- Official medical reports

- Police reports

- Photos of damaged items

- Emails or letters from airlines that relate to a claim

- Receipts or other proof of purchase

When you fill in the online claim form, you’ll also be asked for some key personal details, including part of your St.George credit card number (to confirm you’re eligible for cover).

Overseas transit accident insurance

- What is it? Cover for accidents that happen when you're travelling overseas on a plane, train, cruise ship, bus or other eligible vehicle. You also get cover for related accidents that happen when you're boarding or leaving the transport.

- When can I use it? If you have paid for the entire trip with your eligible St.George credit card before you leave. If your partner or dependants are travelling with you, they'll also get cover.

- Is there an excess cost? No, you don't need to pay an excess for any claims but there are limits to how much you can get paid out. For example, the loss of 1 hand or foot has a maximum benefit of $250,000.

Interstate flight inconvenience insurance

- What is it? Cover for specific issues that come up when you're travelling to a different state or territory in Australia. This can include costs relating to cancelled return flights, flight delays of 4 hours or more, delayed or lost luggage and funeral expenses.

- When can I use it? You’ll get cover for up to 14 days in a row if you have paid for the entire trip with your eligible St.George credit card. Your spouse and any dependants can also get cover when you have used your St.George card to pay for their travel and they will be with you for at least half the trip.

- Is there an excess cost? There is a $300 excess for claims that relate to cancellation or luggage (except for delayed luggage). There are no excess costs for other claims.

Rental vehicle excess in Australia insurance

- What is it? Cover for damage or theft of a car or other vehicle you have hired in Australia, up to a maximum of $5,500 (or less if the amount specified in your rental vehicle agreement is lower).

- When can I use it? If you have paid for the vehicle hire with your eligible St.George credit card and the vehicle hire agreement lists an excess cost.

- Is there an excess cost? There is a $300 excess for each claim, including when you submit more than 1 claim at a time.

How to make a claim under one of these policies

Call Allianz on 1800 091 710. You can also get a claim form online at https://travel.agaassistance.com.au/nacb2c/stgeorge/make-a-claim and email it to [email protected] .

St.George credit cards give you access to other types of insurance, which are also provided by Allianz. Below is a snapshot of the different types.

Purchase protection insurance

- What is it? Cover for the cost of a new item that is stolen, accidentally damaged or lost. It covers most household and personal items such as laptops, shoes, jewellery and glasses. Exclusions include second-hand items, perishables, cash, computer software, vehicles and items you’ve accidentally left in a hotel after checking out.

- When can I use it? If you use your eligible St.George credit card to pay for covered items, this insurance will apply for the first 4 months from when you get them. This cover is available for personal items bought anywhere in the world. If the item was a gift for someone else, that person needs to be a permanent Australian resident for the cover to apply.

- How can I make a claim? You need to show proof that you own the item and report the loss, theft or damage to the local police or relevant authorities (such as the office of a transport company). Ideally, you should get written confirmation of this report. Then, call Allianz on 1800 091 710 or submit your claim through the Allianz online claim portal.

- Is there an excess cost? An excess of $300 per claim applies. There are also maximum claim amounts, which vary depending on the item, with a yearly maximum of $135,000 for all claims.

Extended warranty insurance

- What is it? Cover that doubles the manufacturer's warranty for items bought in Australia, up to a maximum period of 12 months. For example, if you bought a laptop with a 12-month manufacturer's warranty and it stopped working for no reason after 12 months, you could make a claim under this cover.

- When can I use it? If you used your eligible St.George credit card to pay for an item worth up to $20,000 and it came with an Australian manufacturer’s warranty of between 6 months and 5 years. You can make a claim if something happens after the original warranty period has ended.

- How can I make a claim? Call Allianz on 1800 091 710 or submit your claim through the Allianz online claim portal at https://claims.agaassistance.com.au/ .

- Is there an excess cost? An excess of $300 per claim applies. There are also maximum claim amounts, which vary depending on the item.

Don’t have complimentary insurance on your credit card yet? Compare St.George credit cards or check out other cards that offer insurance .

St.George business credit cards offer complimentary unauthorised transaction insurance to help protect you if an additional cardholder uses the account for something that's not allowed.

The St.George Amplify Business Card also offers complimentary overseas transit accident insurance if you have used it to pay for the entire overseas trip.

Want a credit card for your business? Compare a wide range of cards that offer insurance, rewards and other perks.

Does St.George credit card international travel insurance cover coronavirus?

Yes, some cover is available for COVID-19 and other pandemics or epidemics, including for overseas emergency medical and cancellation claims. There are very specific conditions you need to meet to make a claim, so it’s important to read the complimentary insurance policy document or call Allianz on 1800 091 710.

If you want more details about COVID-19 travel insurance, Finder also has a whole guide covering questions about this pandemic and travel insurance .

Can I get proof of my cover?

Yes. If you’re going on a cruise or tour that requires proof of insurance, you can get a letter of eligibility online at http://www.checkyourcover.com.au/stgeorge .

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald.

More guides on Finder

This card offers a low ongoing purchase interest rate and up to $400 cashback offer.

New St.George Amplify Qantas Platinum cardholders can earn up to 70,000 bonus Qantas Points plus save with a balance transfer offer, a first-year annual fee discount and complimentary insurance cover.

The St.George Amplify Qantas Signature Credit Card offers 90,000 bonus Qantas Points plus complimentary insurance covers.

The St.George Amplify Business is suited to smaller businesses, offering expense tracking tools and a $0 first-year annual fee.

Designed especially for larger businesses, the St.George Corporate Mastercard offers unlimited cards for employees and a suite of finance management tools.

The St.George Amplify Signature offers huge value to point-seekers, with a 0% balance transfer offer, a first-year annual fee discount and 150,000 points.

This platinum card offers bonus Amplify points, a 0% p.a. introductory balance transfer offer and complimentary travel and purchase insurance.

As well as a $0 annual fee, the St.George No Annual Fee credit card offers a 24/7 security and the convenience of contactless payments.

Get up to 99 additional cards for employees, detailed monthly statements and a competitive purchase rate with the St.George BusinessVantage Visa.

Offers a 0% introductory rate on balance transfers for 28 months (with a 1% BT fee) and a competitive purchase rate.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

18 Responses

Does my Vertigo Platinum complimentary travel insurance cover my husband and I if we have a 21-day mediterranean cruise included in our Europe trip, also we are taking our 19-year-old granddaughter with us can we include her in our policy as a dependent?

Usually an insurance policy through your credit card covers you and your travelling spouse, but may not cover any dependants. It would be worth contacting them to see if there is an option to add your granddaughter.

Their terms and conditions don’t specify whether their cover provides coverage for a cruise. You can contact them for clarification on 1800 091 710.

Does visa platinum complimentary travel insurance cover south pacific cruise?

Hi Daniela, If you’re going on a cruise or tour that requires proof of insurance, you can check your eligibility and cover online at http://www.checkyourcover.com.au/stgeorge . I hope this helps.

I have Advantage Platinum Visa card from St George, amI intitled to complementary travel insurance to travel to USA

Hi Nada, Yes, the St.George Platinum Advantage Credit Card offers complimentary international travel insurance for up to 3 months as it’s listed as a Level 2 card on the St.George website . To get cover, you’ll need to use your St.George credit card to pay for at least $500 of travel before you leave, have a return booking Australia and live in Australia, and be under 81 years of age. This guide has an overview of the cover but it’s important to read the insurance policy document for full details. Or call the insurance provider, Allianz Global Assistance, on 1800 091 710. I hope that helps.

Because I am stay overseas 7 months and I have with my amplify card 3 months can I pay for the 4 months..

Hi Georgia,

According to the current St.George Credit Cards Complimentary Insurance policy information booklet ( pdf ), you can’t extend this cover period. If you have questions about it, you can call Allianz on 1800 091 710.

Alternatively, you can compare other travel insurance policies on Finder to see if one fits with your travel plans. I hope that helps.

The current terms and conditions of the St George travel insurance dated Oct 2018 notes that not all cards have all the insurance cover and that each must be checked for each benefit. Overseas travel for instance does NOT include the Amplify Platinum. It was in the previous version dated 2015. The insurer says it does cover as a Level 2 card. St George says it is a Level 2 card in its card ads. But its policy doc does not include it. How to fix? I have contacted St George and Alliance to no effect.

Thanks for your message. Sorry to hear there is confusion on which terms and conditions to follow for the St. George complimentary insurance. I wish I could help you out however, while we review St. George in our pages, it’s helpful to know that we neither work with them or answer for their company. It would be best to contact the customer service support of Allianz directly for further assistance.

Hope this clarifies and we hope they find a quick resolution for you!

With care, Nikki

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

St. George Complimentary Credit Card Insurance and COVID-19 (Coronavirus) FAQ

Information for st george eligible cardholders regarding covid-19.

Information on this page is correct as of 30 June 2022 .

Stay up to date on Travel Information for COVID-19 from the Department of Foreign Affairs and Trade (DFAT) Smartraveller website and World Health Organisation (WHO) and Department of Home Affairs .

Always consult the smartraveller.gov.au website prior to any travel. In addition to visas, COVID-19 testing, and proof of vaccination requirements, many countries now have compulsory insurance and medical cover proof conditions. Check with the nearest embassy, consulate or immigration department of the destination you are entering. If you require additional documentation regarding the complimentary international travel insurance policy due to international entry requirements, please contact us on 1800 091 710.

Information for Westpac Eligible Cardholders regarding COVID-19

From 30 June 2022, if during the period of your cover, you (and your spouse/dependents, if they’re eligible for cover) are positively diagnosed as suffering a sickness recognised as an epidemic or pandemic (such as COVID-19), cover may be available under the following sections:

- 1.1 Overseas Emergency Assistance

- 1.2 Overseas Emergency Medical

- 1.4 Medical Evacuation & Repatriation

- 2.1 Cancellation

- 3.1 Additional Expenses

If your travel companion is positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, such as COVID-19, which impacts your journey, cover may be available to you under the following sections:

Note, you won’t be covered while travelling against advice or warnings issued by the Australian government and you did not take reasonable care to avoid contracting the sickness, for example by delaying travel to the country listed in a warning.

The above is a summary only, please refer to St. George Credit Card Complimentary Insurance Policy Information Booklet for eligibility criteria, full terms, conditions, limits and exclusions.

A General Exclusion for epidemic/pandemic applies for all claims relating to any epidemic/pandemic outside of the select benefits in the applicable policy information booklet St. George Credit Card Complimentary Insurance Policy Information Booklet Please note, terms, conditions, limits and exclusions apply.

To receive a formal outcome, Eligible St George Cardholders must submit a claim.

Eligible St George travellers who meet the eligibility criteria should be aware that other General Exclusions have the potential to apply.

What is a General Exclusion?

A General Exclusion is an exclusion which will be applied across all sections of an insurance policy, and applies regardless of when eligibility for cover was gained. Should a General Exclusion apply, this means that your complimentary credit card travel insurance excludes cover for the event, activities or circumstances (specified in the exclusion) that causes your claim.

To understand what is excluded from the St George Complimentary Insurance covers, please refer to Part D – Excesses & General Exclusions section and the section specific exclusions of the relevant St George Policy Information Booklet for which your eligible St George card is applicable under: St. George Credit Card Complimentary Insurance Policy Information Booklet .

Other exclusions may apply depending upon the circumstances of an individual claim. General Exclusions include but are not limited to:

- by the Australian government (when a ‘Reconsider your need to travel’ or ‘Do not travel’ alert is in place), which can be found on www.smartraveller.gov.au ; or

- which was published in a reliable mass media source.

- any interference with your travel plans by any government, government regulation or prohibition or intervention or official authority. For example, if Smartraveller has a warning, ‘Do not travel’ or ‘Reconsider your need to travel’ due to the risk of COVID-19 infection for a destination, and a cardholder chooses to ignore the warning and is infected with COVID-19, cover may be excluded. Or if a government closes its borders to inbound travellers due to COVID-19 and you are unable to enter and follow your planned travel across the closed border, cover may be excluded.

What if a St George Eligible Cardholder has booked travel and needs to cancel due to contracting COVID-19?

If you are unable to travel as a result of contracting COVID-19, Cancellation cover may be provided to eligible travellers, if you or your travel companion are positively diagnosed as suffering a sickness recognised as an epidemic or pandemic such as COVID-19, and cover is expressly included under the Cancellation section of the relevant St George Policy Information Booklet for which your eligible St George card is applicable under: St. George Credit Card Complimentary Insurance Policy Information Booklet .

If you are unable to travel as a result of an Epidemic or Pandemic related event which does not include you or your travel companion being positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, for example a border closure, there may be no provision to claim as a general exclusion for epidemic and pandemic applies. A General Exclusion for epidemic/pandemic applies for all claims relating to any epidemic/pandemic outside of the cancellation benefits in the applicable policy information booklet. Please note, terms, conditions, limits and exclusions apply.

You therefore need to consider your own personal circumstances. We are not able to provide you with a cover decision before submitting a claim. To receive a formal outcome, St George Eligible Cardholders must submit a claim.

You should also contact your travel agent or travel service provider (airline, cruise line or Tour Company, etc) as they may be able to support you in obtaining refunds, credits or travel re-scheduling.

Can St George Eligible Cardholders make a claim for consideration?

Every St George Eligible Cardholder can submit a claim and have their individual circumstances considered in accordance with the eligibility criteria which includes the terms, conditions, limits and exclusions that apply as set out in the St. George Credit Card Complimentary Insurance Policy Information Booklet .

If you would like to claim, we encourage you to claim online via insurance.agaassistance.com.au/stgeorge .

Call the Allianz Global Assistance Claims team

- Frequently Asked Questions

- waste time waiting

- or spend time relaxing

Relax and enjoy complimentary access to select airport lounges worldwide if your flight is delayed.

Mastercard® Flight Delay Pass

In partnership with Worldwide Wallet issued with Westpac, BankSA, St.George, and Bank of Melbourne.

The number of people flying for leisure along with it, flight delays has increased over the years. Rather than let one upset your travel plans, safeguard your time with Mastercard Flight Delay Pass.

Should you encounter a delay for 120 minutes or more, you could be eligible for complimentary access to over 1,000 airport lounges in more than 100 countries with Mastercard Flight Delay Pass. Alternatively, if a lounge is unavailable, you could benefit from special dining offers at selected cafes and restaurants*. You are required to register for your flight prior to the flight's actual departure. Each leg of a multi-leg journey requires its own, separate, flight registration.

*The lounge access pass gives free access to select airport lounges, alternatively cardholders can use their lounge access pass to offset a dollar amount off the total bill at select dining options. This will vary based on location and affiliated LoungeKey Partners at the time. Click here for the list of LoungeKey airport lounge and/or dining options based on your departure airport, and the applicable terms and conditions. Once your flight has been registered, your LoungeKey pass will be sent to you via email and SMS in the event of a qualifying delay and can be used at any of the LoungeKey establishments at your departure airport.

Who does this service cover?

This exclusive service is complimentary for Worldwide Wallet cardholders. You can enjoy unlimited flight registrations on the Mastercard Flight Delay Pass program. In addition, you may invite one companion who is also travelling on the same flight — to join you in the lounge. If you are under 18 years old, you must be accompanied by an adult (over 18 years of age) to enter participating lounges.

AIRPORT LOUNGE ACCESS

Airport lounge access.

Besides providing you with a quiet and comfortable space to relax in, airport lounges offer a wide array of amenities*:

- Complimentary snacks and refreshments

- Free newspapers and magazines

- Free Wi-Fi and device charging stations

- Conference and business facilities

HOW IT WORKS

How does it work.

- To activate Mastercard® Flight Delay Pass, simply register your flight online for yourself and your travel companion(s).

- Flight registration must take place no later than the flight's actual departure time. You will need to register any additional or return flights separately. You will receive a confirmation email to acknowledge your registration.

- Should you change your mind, you may de-register your flight at any point before your actual departure.

- In the event of a flight delay** announcement of 120 minutes or more, we will immediately send you an email and SMS with your Mastercard Flight Delay Pass which will entitle you to complimentary airport lounge access. This service is also available in the case of rolling delays, eventually adding up to 120 minutes or more.

- Simply present your lounge access email or SMS at any eligible lounge to redeem your complimentary admission.

* Amenities may vary depending on the lounge.

** Delay must be officially announced by the airline as outlined and reported to our flight status data service provider

Department of Defense Travel Card Benefits

Progress informed from the past, and inspired by the future, cardholder guide.

Official travel for the Department of Defense just became easier with the Citi Department of Defense Travel Card. When you are preparing to use your new card, please read What To Do When I First Receive My New Card . For more information regarding your new card, please read the Department of Defense Cardholder Guide .

Department of Defense Travel Insurance

As a cardholder, you will receive global travel accident and lost luggage insurance so you feel safe and secure wherever you travel with a Citi ® Commercial Card.

- Travel Accident Insurance Guide

- Lost Luggage Insurance Guide

Visa Guide to Benefits

In addition to the card benefits provided by Citi, Visa provides card benefits such as Car Rental Insurance and Travel and Emergency Assistance. For full details, please read the Visa Guide to Benefits .

Travel Tips

For more information on your Citi Department of Defense Travel Card, please read What to do Before, During and After travel .

Online Tools

Citi's global online tool, CitiManager ® , enables you to manage business expenses from anywhere around the globe from your computer or mobile device; you can view statements online, confirm account balances, sign up for email and SMS alerts, and much more. If you have not already signed up for the CitiManager ® tool, please log on to www.citimanager.com/login and click on the 'Self registration for Cardholders' link. From there, follow the prompts to establish your account.

For more information on the CitiManager ® tool, view our CitiManager ® Cardholder Quick Reference Guide .

Best travel credit cards of April 2024

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Travel credit cards make it possible for you to earn free and discounted travel with your everyday spending. What's more, some of the best travel credit cards also offer valuable perks that elevate your trip experience.

At the same time, each card has its own set of rewards rates, intro bonuses, annual fees and other terms, so take your time picking one that aligns well with your travel and spending habits.

The best travel credit cards of April 2024

- Best premium card: Capital One Venture X Rewards Credit Card

Best flat-rate rewards card: Capital One Venture Rewards Credit Card

- Best mid-range card: Chase Sapphire Preferred ® Card

- Best for lounge access: The Platinum Card® from American Express

- Best for airline loyalists: United Explorer Card

- Best for hotel loyalists: IHG One Rewards Premier Credit Card

- Best $0 annual fee travel card: Bilt Mastercard

Best 0% intro APR card: Capital One VentureOne Rewards Credit Card

- Best for earnings: U.S. Bank Altitude® Connect Visa Signature® Card

Best for fair credit: Credit One Wander

- Best for credit building: Capital One Quicksilver Secured Cash Rewards Credit Card

Best premium card: Capital One Venture X Card

The Venture X packs a lot of travel rewards into a card that costs hundreds of dollars less than its competitors.

Why we like it: The Capital One Venture X Rewards Credit Card offers rich rewards and travel perks, and unlike many other premium travel credit cards, the Venture X doesn't make you jump through many hoops to earn back the cost of its steep annual fee. In addition to a Capital One Travel credit and bonus miles each year, you'll also get complimentary access to a number of airport lounge networks with more than 1,300 locations around the world.

The card also offers ultimate flexibility when it comes to redeeming your rewards for travel. You can book with miles through Capital One Travel, or if you want more options, you can use your card to pay for travel-related expenses and request a statement credit. If you're feeling ambitious, you can even transfer your rewards to various frequent flyer and hotel rewards programs and potentially get more value from your miles.

The Venture Card puts the power into your hands by earning miles that you can either use against your travel purchases or transfer to travel partners.

Travel rewards can get complicated, which is why the Capital One Venture Rewards Credit Card feels like a breath of fresh air. The card offers a high, flat rewards rate on your everyday spending, so you don't need to keep track of different bonus rewards categories. It also offers extra miles on select travel booked through the Capital One Travel platform.

You can redeem your miles by booking travel through Capital One Travel or by using your card to pay for travel on your own and requesting a statement credit. Alternatively, you can transfer your miles to airline and hotel rewards program partners for more dynamic redemptions. The card also comes with complimentary Hertz Five Star status, which lets you skip the rental counter and get access to a wider selection of vehicles. When you use it to pay the application fee for Global Entry or TSA PreCheck, Capital One will reimburse you.

Best mid-level card: Chase Sapphire Preferred ® Card

The Chase Sapphire Preferred offers both robust earnings on travel and a useful suite of travel protections. Plus, Chase's dozen-plus transfer partners offer flexibility in travel redemptions.

Why we like it: If you're looking for a way to maximize your travel rewards without paying a steep annual fee, look no further than the Chase Sapphire Preferred ® Card . The card offers an impressive welcome bonus and several opportunities to earn bonus points on your everyday spending. Annual perks include a $50 credit toward hotel stays booked through Chase Ultimate Rewards, a 10% points bonus on your spending throughout the year and benefits with partners like Lyft, DoorDash, Instacart, and Peloton.

The card offers flexible redemption options, including cash back, but you'll get 25% more value if you use your points to book travel through Chase. Alternatively, you can transfer your rewards to one of the card issuer's airline or hotel rewards program partners and potentially squeeze more value out of your points.

Best for lounge access: The Platinum Card® from American Express

Why we like this card.

The Platinum Card® from American Express charges an annual fee that some will find hard to stomach. But if you're a frequent flyer, it may well become your favorite travel companion. The card offers access to more airport lounge networks than any other credit card. At larger airports, you may even have your pick among several lounge options.

The card also comes packed with more than $1,500 in annual travel and lifestyle credits, elite status with select hotel and car rental rewards programs and many other perks that touch just about every aspect of your travel experience. That said, many of the credits are doled out in increments and are for specific vendors, making them harder to redeem.

Pro tip: Credits only have value if you use them in your daily life. If a credit or benefit is causing you to make purchases you don't usually make, you might want to reconsider whether it is worth it for you.

Best for airline loyalists: United SM Explorer Card

The United Explorer card makes sense if you are one of the over 140 million passengers that flew United last year.

Why we like it: If you like the idea of enjoying rewards and perks with an airline rather than general travel rewards and benefits, you can't go wrong with the United Explorer Card . The card offers a sizable welcome bonus and a few different bonus rewards categories, and with a strong domestic and international presence, you'll have plenty of options when it comes to redeeming your miles for award flights.

You'll get some standard airline card benefits, such as a free checked bag for you and a companion, priority boarding, and a discount on select inflight purchases. But you'll also get some perks that most mid-tier airline cards don't offer, including expanded access to Saver award tickets, premier upgrade eligibility on award tickets, two one-time passes to the United Club lounge each year, and an application fee credit toward Global Entry or TSA PreCheck.

Best for hotel loyalists: IHG One Rewards Premier Card

The IHG One Rewards Card offers a free night upon card renewal along with a slew of other benefits, making it well worth the modest annual fee

Why we like it: If you want to focus your efforts on earning free hotel stays, the IHG One Rewards Premier Credit Card offers an impressive array of benefits. The card makes it easy to earn points quickly, though it also requires a lot of points to get free stays with IHG.

Where it really shines, though, is in its perks, which offer value that far outweighs the card's modest annual fee. You'll get a free night reward each year worth up to 40,000 points, plus a $100 statement credit and 10,000 bonus points if you spend $20,000 in a calendar year. When you stay at IHG hotels, you'll enjoy Platinum Elite status, which includes perks like the fourth night free on award bookings, reward night discounts, complimentary upgrades, and a welcome amenity. You'll also get an application fee credit toward Global Entry, TSA PreCheck, or NEXUS.

Best $0 annual fee card: Bilt Mastercard

The Bilt Mastercard not only has no annual fee, it has a robust set of travel transfer partners. Even better, it lets you earn rewards for paying rent.

Why we like it: While it technically isn't billed as a travel credit card, the Bilt Mastercard®—the only credit card that offers rewards on rent payments—offers travel benefits that are hard to ignore. Most importantly, the card allows you to transfer your points to several airline and hotel loyalty programs, a rare feature for a travel card with no annual fee. You'll also pay no foreign transaction fees and get a few trip protections, including trip cancellation and interruption reimbursement, trip delay protection and auto rental collision damage waiver.

If your vacation plans stretch farther than your budget, the VentureOne has an extended 0% APR period on purchases so you can enjoy the sun without getting burned with interest.

Most travel credit cards don't offer introductory 0% APR promotions, but if that feature is a top priority and you don't want a cash-back card, the Capital One VentureOne Rewards Credit Card may be worth a look.

The card offers an introductory 0% APR promotion on both purchases and balance transfers, giving you plenty of time to pay off a large chunk or all of a significant purchase or high-interest debt from another card.

The card's rewards rate isn't very exciting, but it does offer flexible travel redemption options, including access to transfer partners.

Best for earning on travel: U.S. Bank Altitude Connect

If cash back is your preference, the U.S. Bank Altitude Connect has a robust rewards rate on travel purchases plus a selection of perks unusual for a sub-$100 annual fee card.

Interestingly enough, many travel credit cards don't offer great rewards on travel spending unless you're booking through the card issuer's travel portal. If you want a card that offers best-in-class rewards on all of your travel spending, the U.S. Bank Altitude® Connect Visa Signature® Card is your best bet.

The card also offers great rewards on other everyday spending categories, along with four free visits to Priority Pass lounges each year, an application fee credit toward Global Entry or TSA PreCheck, and an annual bonus when you use your card to pay for an eligible streaming service.

The Credit One Wander card flies under the radar but is worth a look for its strong earnings on travel, dining and gas in addition to its more lenient credit score requirements.

Why we like it: You typically need good or excellent credit to qualify for one of the best travel credit cards, but if you're not quite there yet, the Credit One Bank Wander® Card should be on your radar. The card offers great rewards on select travel purchases and other everyday spending.

Points can be redeemed in a variety of ways, but to get a consistent redemption rate, statement credits are your best option.

Best for credit building: Capital One Quicksilver Secured Card

You aren't out of options if you need to build your credit score before getting a standard travel card. The Capital One Quicksilver Secured Card is a rewarding option while you get on track.

Why we like it : If you're looking to build or rebuild, you'll be hard-pressed to get approved for a true travel credit card. However, the Capital One Quicksilver Secured Cash Rewards Credit Card can be a solid alternative until you have the chance to establish a good credit score.

The card doesn't charge foreign transaction fees, making it a good choice for international travel, and you'll earn a solid rewards rate on every purchase you make. While you need to make a security deposit equal to your desired credit limit when you get started, you don't have to wait to close your account to get your money back. With responsible use, you can start earning unsecured credit line increases after six months, and you can also qualify for an upgrade to an unsecured Quicksilver card down the road, at which point you'll get a deposit refund.

Our methodology

The Fortune Recommends TM team analyzed more than 50 travel credit cards across various issuers to come up with the top picks.

Here are the key elements we ranked each card by:

- Annual fee: Some card issuers require cardholders to pay an annual fee for cards with rewards and extra features or benefits. For most of our rankings, we rated cards with lower or zero-dollar annual fees higher.

- Rewards: Travel cards typically provide rewards in the form of points or miles. For some rankings, we rated cards with better rewards rates higher on our list.

- Insurance and protections: When you use your card to make purchases, you may be eligible for different types of protections on those purchases. Some cards offer insurance on travel-related expenses, like trip cancellation insurance, baggage delay insurance, trip delay reimbursement, and more. Some cards also provide non-travel-related reimbursements like cell phone protection. For some rankings, we rated cards higher based on the number of protections they offered.

- Welcome bonus: When you sign up for a new credit card, you may be eligible for a one-time welcome bonus in the form of points or miles. You’ll need to spend a certain amount within a few months of card opening to earn the bonus. We ranked cards with higher bonuses and lower spending requirements higher on our list.

- Perks: Travel credit cards may offer a variety of perks—like statement credits for TSA PreCheck, airport lounge access, a free checked bag, and more. We rated cards with more perks higher for some of our rankings.

- Foreign transaction fees: Some cards charge a flat rate on purchases when you use your card abroad. We rated cards with no foreign transaction fees higher.

How do travel credit cards work?

Unlike cash-back rewards, which tend to work the same regardless of the card issuer, travel rewards can get complicated quickly. Ultimately, your redemption options and the value of your points and miles will vary depending on the rewards program.

Flexible travel rewards

Flexible travel rewards credit cards offer points or miles through the card issuer's proprietary rewards program. Some examples include Chase Ultimate Rewards, American Express Membership Rewards, Citi ThankYou Rewards, and Capital One Miles.

With flexible travel rewards, you'll typically get several redemption options, and your rewards are worth a set amount — usually between 0.5 cents and 1.5 cents apiece — depending on how you redeem them. Travel redemptions typically get more value, but that can vary by program.

Many of these programs also allow you to transfer your points to airline and hotel loyalty programs, giving you access to more dynamic redemptions. If you're savvy enough, you could get more value with a transfer partner than if you were to redeem through the card issuer's rewards program.

Airline rewards

Airline miles , or points in some cases, are designed primarily to help you earn award flights with your favorite airline, such as United, Delta , or Southwest. But unlike general points or miles, airline rewards typically don't have a set value.

In some cases, the number of points or miles required for a flight may be linked to the cash value of the ticket, but they may be unrelated. As a result, the value of your rewards will vary based on your flight dates, itinerary, cabin choice, and other factors.

In some cases, you may be able to redeem your airline rewards in other ways, but you typically won't get as much value that way.

Hotel rewards

Hotel points allow you to book free hotel stays with a single hotel chain, such as IHG, Hilton, or Marriott. Like airline rewards, hotel points have dynamic value, so your redemption rate will vary based on your destination, the property, your stay dates, and other variables.

Hotel loyalty programs may also allow you to redeem your rewards in other ways, but it's generally best to stick to free nights.

Should you pick a travel credit card?

If you frequently travel or you're looking for opportunities to travel more in the future, a travel credit card can make it easier to earn free or discounted flights, hotel stays, rental cars, and more.

What's more, some of the top travel credit cards also offer perks that can save you more money or give you a better overall experience at the airport, in flight, or throughout your trip.

That said, most travel credit cards don't offer as much redemption flexibility as cash-back credit cards. If you're not sure you want to go all in on travel rewards, a cash-back credit card may be a better choice.

Also, most of the top travel credit cards charge an annual fee. While many of them make it easy to offset that cost with rewards and perks, the fee is still an out-of-pocket cost. If you're on a tight budget or you're generally fee-averse, think carefully about whether you can afford that yearly cost and make sure you can get enough value from a card to make its annual fee worthwhile.

How to choose the best travel credit card

With so many different options available, there's no single travel credit card that's best suited for all travelers. To determine which one is best for you, you'll want to think about your travel habits, spending profile, and general preferences.

Travel habits

Consumers who travel frequently may benefit more from a premium travel card that offers a broad range of perks, while more casual travelers may be better off with a mid-tier or no-annual-fee travel card.

If you're loyal to a specific airline or hotel chain, it could make sense to get an airline or hotel credit card, but if you don't want to be tied down to a single brand, a general travel card might be the right move.

You'll also want to think about how you travel and which travel card benefits would give you the best experience. For example, if your home airport has one or more airport lounges, it can make sense to get a card that offers lounge access.

Spending profile

Most travel credit cards offer tiered rewards, meaning you'll earn bonus rewards on certain spending categories. If you spend a lot in certain areas of your budget, try to find a card that will reward you more for those purchases.

However, if you don't spend a lot in any single category or you don't want to earn a low rewards rate on most of your spending, consider a card that offers a high, flat rewards rate on everything.

General preferences

Consider other features you're looking for in a travel credit card. Options may include transfer partners, straightforward benefits, redemption options, 0% APR promotions, and more.

As you research and compare travel credit cards, familiarize yourself with all of their benefits to determine which one feels like the best fit based on your needs and preferences.

Frequently asked questions

Which card is better for international travel.

Generally speaking, you'll want a credit card that doesn't charge a foreign transaction fee. With cards that do charge this fee, you'll typically pay an extra 3% on all of your purchases made abroad.

Additionally, Visa and Mastercard credit cards tend to be better for international travel because they're more widely accepted than American Express and Discover credit cards. If you have an Amex or Discover card, consider bringing a Visa or Mastercard as a backup.

Is Visa or Mastercard better for travel?

Mastercard boasts acceptance in more than 210 countries, while Visa says it operates in more than 200 countries. So, if you're traveling to a country that's off the beaten path, so to speak, Mastercard may be a better choice. But for most major international destinations, you're likely fine with either Visa or Mastercard.

What is the best credit card to accumulate travel miles?

Miles have historically been associated with airline frequent flyer programs, but some card issuers, including Capital One and Discover, use the miles nomenclature for their rewards currency.

With that said, the best miles credit card for you depends on your travel habits and preferences. If you want to earn miles with a particular airline, check out that airline's co-branded credit cards to see which one offers the best fit. If you want more general rewards, consider a card that offers miles or points with more flexible redemption options.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

This story was originally featured on Fortune.com

- Today's news