- Placement & Internship Reviews

- Insight Review

LBG Start Your Journey 2023 - Employability Review

by Lloyds Banking Group

- Reviews (1383)

- Case Studies (5)

- Webinars & Podcasts (1)

- Business Insight 4.0

- Culture 4.3

- Your Impressions 4.0

- 1. Please give an overview of the insight and what was involved on a day-to-day basis.

Worked in teams to create and present projects whilst having employability workshops for soft skills

- 2. Have you learnt any new skills or developed existing skills?

Developing the soft skills I already had like communication and teamwork

- How would you rate the training provided during your experience?

- How would you rate the knowledge learned around industry-specific skills during the experience?

- How would you rate the knowledge learned around personal or professional skills during the experience?

- Please rate how the knowledge learned has helped you with regards to your career development

Business Insight

- 3. What was it like understanding all about the business and potential roles available?

There was an introduction to LBG, and we were able to speak to employees in particular roles, however there wasn’t a large emphasis on the roles and functions or divisions.

- Please rate how insightful you found the insight

- How would you rate the structure of the insight

- How would you rate business leader involvement during the insight

- 4. What was the company culture and general atmosphere like?

All the employees seemed really friendly and happy to help, and the company culture also seemed relaxed and open. This was nice as larger banks tend to be extremely fast and stressful so this was a unique perspective

- How would you rate the inclusiveness of the culture?

- How would you rate the networking opportunities?

- Please rate how valued you felt during your insight?

Your Impressions

- 5. To what extent did you enjoy the insight?

I enjoyed the insight event as it was a good introduction to employability. It was nice working in teams and the activities were diverse and unique! I enjoy in-person events more so would have loved to meet people that way.

- Please rate your level of enjoyment on the insight

- Please rate how your experience met your expectations

- Please rate the future employment prospects at Lloyds Banking Group

- 7. Would you recommend Lloyds Banking Group to a friend?

- 8. What tips or advice would you give to others applying to Lloyds Banking Group

This Employability event was a good introduction to skills to be ‘employable’, but I would have loved an emphasis on how these skills would apply to a career in banking and finance. It was nice to get a certificate at the end and network after with other people on the insight event. It has also made me more open to joining LBG as a graduate

Insight / Vacation Scheme (< 4 Weeks)

International

August 2023

Customer insights

at Lloyds Banking Group

Internship (1 Month+)

Summer Analyst

People partnering intern, credit risk intern, assistant people advisor, risk analyst.

Placement (10 Months+)

Technology and Data Virtual Event

Start your journey employability 2023, employability, technology & data insight program.

- No idea what to do?

- Career path test

- Salary calculator

- Career path guides

- Top graduate employers

- Career profiles

- Further study

- A day in their life

- Find an internship

- Vacation schemes

- Deadline Tracker

- Internship Experience UK

- Find a graduate job

- Find an industrial placement

- STEM advice

- Aptitude & numerical tests

- Assessment centres

- Commercial awareness

- Core career skills

- Entering the world of work

- Bright Network events

- Employer events

- Previous event highlights

- Internship Experience Overview

- Business, Operations & Marketing

- Commercial Law

- Finance, Professional Services & Consulting

- For employers

- Work Experience

- Financial Services

Start Your Journey Events - Employability Event

Every career journey is different and you want to be as prepared as possible. If you’re starting to consider your next steps after university, our Start Your Journey virtual events will help you build the skills you need.

The events offer an introduction to the world of work, including insights into life at Lloyds Banking Group to help you decide the initial direction you want your career to take, and to prepare you for starting work.

If you already have a career plan in mind these sessions will help you hone your skills ready for making applications. If you’re still not quite sure, don’t worry - we’ll equip you with key employability skills and techniques to support your future career and help you to succeed.

What to expect:

This 3 day virtual event will give you the skills you need to start your career and transition into the workplace. You’ll gain confidence in communication and collaboration through working with others in interactive case studies, solving business issues and improving ways of working.

We’ll help you master your self-management, develop job application and interview techniques, discover your personal brand, manage your goal setting and uncover your full potential.

Both events will be held virtually on Zoom throughout June – September 2022.

Eligibility:

Our Start Your Journey events are open to all university students. We aren’t looking for students in specific subjects or with any prior knowledge of technology, banking or finance – we want to support open-minded, committed and passionate people to gain confidence when accessing the world of work.

- The application process consists of a short registration form, followed by an assessment which is likely to take around 30 minutes (please don’t worry about your score, we ask you to do this as part of your learning journey and these events are first come, first serve)

- Both events will be held virtually on Zoom throughout June-September 2022

If you have a long term health condition or disability and require reasonable adjustments to support your application, you can find out more here on our FAQ page.

Related Jobs

Your claims journey

Claims at Lloyd's

Policyholder claims journey

Learn about the stages your Lloyd’s policy claim goes through from loss to settlement.

Loss occurs

Your loss occurs.

Inform your broker

You’ll find your broker’s contact details on your insurance contract. Your broker will be your main contact, and will keep you informed every step of the way.

Broker submits electronic claim

Once the Lloyd’s market has been informed of the claim and a lead insurer appointed to deal with it, the lead will respond on behalf of all insurers to keep things simple. More complex claims may have two leads who jointly agree a response, offering all the benefits of their combined expertise.

Broker keeps you updated

Your broker will let you know how your claim is progressing and may ask for further details. Your insurer may appoint an expert in the area of your claim to help enable a swift decision.

Claim agreed and settled

Your broker will let you know when the insurer has settled, and will pay you promptly.

Want a second opinion?

We make it our priority to settle valid claims fairly and provide a positive claims experience for our customers. However, if you’re not happy with a decision, you can ask your broker to liaise with your insurer.

This journey is for illustrative purposes only – should you need to raise a claim, your broker or claims contact will give you full details specific to your case.

You can get started on your weight loss journey from the comfort of your own home

BloomMD specializes in treating the root causes of obesity. They offer medically-supervised and affordable weight-loss treatments.

But, what makes them different — is they help you from the comfort of your own home.

BloomMD offers same-day provider visits via telehealth and prescriptions can be given the same day.

They are delivered to your doorstep, and no insurance is needed.

BloomMD offers GLP1 medications like Semgalutide and Tirzepatide, which mimic a hormone naturally found in the gut and has many important functions for metabolic health.

It plays a crucial role by regulating blood sugar levels, promoting weight loss, and improving overall well-being.

BloomMD's experts customize your treatment, ensuring you get the exact strength and dosage for optimal results.

You can get started by visiting BloomMD.com .

Sign up for the Breaking News Newsletter and receive up to date information.

Now signed up to receive the breaking newsnewsletter..

Watch FOX 13 News on your favorite streaming device anytime, anywhere

- Accessibility statement [Accesskey '0'] Go to Accessibility statement

- Skip to Content [Accesskey 'S'] Skip to main content

- Skip to site Navigation [Accesskey 'N'] Go to Navigation

- Go to Home page [Accesskey '1'] Go to Home page

- Go to Sitemap [Accesskey '2'] Go to Sitemap

- Private Banking

- International Banking

- Lloyds Bank Logo

Everyday banking

Online services & more

How to get online

- Set up the Mobile Banking app

- Register for Internet Banking

- Log on to Internet Banking

- Reset your logon details

Mobile Banking app

- Setting up our app

- App notifications

Profile & settings

- Change your telephone number

- Change your address

- Open Banking

Card & PIN services

- View your card details

- Report your card lost or stolen

- Order a replacement card

- View your PIN

- Payments & transfers

- Daily payment limits

- Pay someone new

- Cancel a Direct Debit

- Pay in a cheque

- Send money outside the UK

Statements & transactions

- See upcoming payments

- Search transactions

- Download statements

Help & security

We're here for you

Fraud & security

- Latest scams

- Lost or stolen card

- Unrecognised transactions

Money management

- Understanding credit

- Managing someone's affairs

- Financial planning

- Personal Tax Services

Banking near you

Life events

- Buying a home

- Getting married

- Family finances

- Separation & divorce

- Bereavement

Difficult times

- Money worries

- Mental health support

- Financial abuse

- Serious illness

Customer support

- Support & wellbeing

- Banking online

- Accessibility & disability

- Banking with us

- Feedback & complaints

- Current accounts

Accounts & services

- Club Lloyds Account

- Classic Account

- Silver Account

- Club Lloyds Silver Account

- Platinum Account

- Club Lloyds Platinum Account

- Youth & student accounts

- Joint accounts

Travel services

- Using your card abroad

- Travel money

Features & support

- Switching to Lloyds Bank

- Everyday Offers

- Rates & charges

- Save the Change

- Current account help & guidance

- Mobile device trade in service

Already bank with us?

Existing customers

- Upgrade options

- Mobile banking

Club Lloyds

The current account with exclusive benefits. A £3 monthly fee may apply.

Cards, loans & car finance

Credit cards

- Credit card eligibility checker

- Balance transfer credit cards

- Large purchase credit cards

- Everyday spending credit cards

- World Elite Mastercard ®

- Cashback credit card

- Loan calculator

- Debt consolidation loans

- Home improvement loans

- Holiday loans

- Wedding loans

Car finance

- Car finance calculator

- Car finance options

- Car refinance

- Car leasing

- Credit cards help & guidance

- Loans help & guidance

- Car finance help & guidance

- Borrowing options

Already borrowing with us?

- Existing credit card customers

- Existing loan customers

- Existing car finance customers

Your Credit Score

Thinking about applying for credit? Check Your Credit Score for free, with no impact on your credit file.

Accounts & calculators

- First time buyer mortgages

- Moving home

- Remortgage to us

- Existing Lloyds Bank mortgage customers

- Buying to let

- Equity release

Mortgage calculators & tools

- Mortgage calculator

- Remortgage calculator

- Get an agreement in principle

- Base rate change calculator

- Overpayment calculator

- Mortgage help & guidance

- Club Lloyds offer

- Eco Home offers

- Mortgage protection

Already with us?

- Manage your mortgage

- Switch to a new deal

- Borrow more

- Switch deal & borrow more

- Help with your payments

- Learn about Home Wise

- Your interest only mortgage

Club Lloyds mortgage offer

Our Club Lloyds customers could be eligible for an exclusive discount on their initial mortgage rate.

Accounts & ISAs

Savings accounts

- Instant access savings accounts

- Fixed rate savings accounts

- Club Lloyds savings accounts

- Children's savings accounts

- Joint savings accounts

- Compare savings accounts

- Compare cash ISAs

- Help to Buy ISA

- Stocks & Shares ISA

- Investment ISA

- Savings calculator

- Save the Change®

- Savings help and guidance

- ISAs explained

- Savings interest rates

Already saving with us?

- Top up your ISA

- Transfer your ISA

- Tax on savings interest

- Your personal savings allowance

- Your ISA allowance

Club Lloyds Monthly Saver

Exclusive savings rate with our Club Lloyds current accounts.

Pensions & investments

- Compare investing options

- Share Dealing ISA

- Share Dealing Account

- Invest Wise Accounts (18 - 25 year olds)

- Ready-Made Investments

ETF Quicklist

- Introducing our ETF Quicklist

- View our ETF Quicklist

Guides and support

- Understanding investing

- Research the market

- Investing help and guidance

- Transfer your investments

- Trading Support

- ETF Academy

- Our Charges

Pensions and retirement

- Ready-Made Pension

- Combining your pensions

- Pension calculator

- Self-employed

- Pensions explained

- Top 10 pension tips

- Retirement options

- Existing Ready-Made Pension customers

Wealth management

- Is advice right for you?

- Benefits of financial advice

- Services we offer

- Cost of advice

Already investing with us?

- Log on to Share Dealing

Introducing the new Ready-Made Pension

A simple, smart and easy way to save for your retirement.

Show me how

Home, life & car

View all insurance products

Home insurance

- Get a home insurance quote

- Compare home insurance

- Buildings & contents insurance

- Contents insurance

- Buildings insurance

- Retrieve a home insurance quote

- Home insurance help & guidance

- Manage your home insurance policy

Car insurance

- Compare car insurance

- Car insurance help & guidance

- Log on to My Account to manage your car insurance

Life insurance

- Critical illness cover

- Mortgage protection insurance

- Life cover help & guidance

Other insurance

- Business insurance

- Van insurance

- Landlord insurance

- Make a home insurance claim

- Make a life insurance claim

- Make a car insurance claim

Already insured with us?

Support for existing customers

- Help with your existing home insurance

- Help with your existing life insurance

- Help with your existing car insurance

Get up to £100 cashback

Take care of what you value most, and we'll take care of you - a cashback reward with our range of insurance products: home, motor and life. T&Cs apply.

- Help & Support

- Branch Finder

- Accessibility and disability

- Search Close Close

Internet Banking

Keep me secure

- Youth and student

Smart Start

- In this section

- Getting started

- Saving tips

- Spending tips

- Learn about money

- Ways to earn

- Video transcripts

A Spending and Savings Account for 11-15 year olds.

Good money habits for your child start here.

It’s never too early to teach them about money. Smart Start gives 11-15 year olds their own Spending Account and Savings Account in one application. They learn how to manage their money, and you get oversight of their account - for peace of mind.

Benefits for your child

- They get their own Spending Account and Savings Account.

- They can use their contactless Visa debit card online, in shops and at cash machines.

- If they have a smartphone, they can add their debit card to Apple Pay or Google Pay (age restrictions apply).

- They can check their balance with our Mobile Banking app * or Internet Banking.

- Their Savings Account will earn 3.15% AER/3.11% gross variable interest on balances of £1 to £1,000. And 1.40% AER/1.39% gross variable interest on any money above £1,000.

- Smart Start guides and tips .

Benefits for you

- No monthly fees or charges.

- You can keep an eye on your child’s account through your own Mobile Banking app or Internet Banking.

- Easily pay pocket money into your child’s Spending Account.

- No arranged overdraft - they can only spend what's in their account.

- Help them set up their own contactless payment limit.

How Smart Start works

Your child gets two accounts with one application. Both accounts will be in your child’s name, and they’ll be able to access them using our Mobile Banking app and Internet Banking. You can keep an eye on their accounts through your own Mobile Banking app or Internet Banking.

- The Spending Account works just like a current account. They’ll enjoy having an account with a contactless Visa debit card to use in shops, online or at cash machines.

- The Saving Account is an instant access savings account. Having their own Savings Account can help them get into the habit of saving regularly.

We'll help your child learn how to manage their money with our Smart Start guides .

Who can apply

You can apply for Smart Start with your child if you:

- have a Club Lloyds Current Account and are registered for internet Banking

- have an existing Child Saver or Young Saver for the child or their proof of identity

- are 18 or over and your child is between 11 and 15 years old

- are a UK resident and live at the same address as your child.

Please read the summary box below and the account conditions (PDF, 315KB) before you start.

Applying on desktop

Log onto your account and:

- Select 'Savings & Investments' in the left-hand navigation bar

- Visit the 'Smart Start for children' page

- Select 'Get started' to apply.

Applying on mobile app

- Select 'Apply' in the bottom navigation bar

- Go to 'Savings and Investments'

- Tap 'Get started' to apply.

Summary box for the Savings Account

What is the interest rate expandable section.

3.15% AER/3.11% gross variable on balances from £1-£1,000.

1.40% AER/1.39% gross variable on any money above £1,000.

Interest is paid monthly.

Can Lloyds Bank change the interest rate? expandable section

Yes. As this account pays a variable rate of interest it can change over time. We’ll always let you know of any planned changes to the rate. Our terms and conditions (PDF, 315KB) explain when and how we do this. For example, we might review the interest rate if it costs us more to run this account for you.

What might the future balance be? expandable section

For example, if you put in £1,000.00 when you open the account, the balance after 12 months will be £1031.54 .

If you put in £2,000.00 when you open the account, the balance after 12 months will be £2045.28 .

This assumes that:

- you don’t take any money or interest out of the account

- the interest rate stays the same

- you put money in the day you open the account and don't add more money after that.

If you have more than £1,000 in your account, you’ll get two different interest rates on your balance, the higher rate applies to everything up to £1,000 and the lower rate to everything over £1,000.

How do I open and manage my account? expandable section

This account can only be opened online between the parent or legal guardian and a young adult, as part of applying for Smart Start. This means a Spending Account and a Savings Account will be opened.

When the accounts are open, the parent or legal guardian will be able to see them in Internet Banking and on our app, to help the young adult manage their money and transact on the accounts in an emergency. When the young adult is over 13 and decides it's the right time to remove this support they can do so in branch. If they're under 13, they can also do this, but will need the consent of their parent or legal guardian in branch.

The accounts can also be managed through Internet Banking, on our app and in branch.

Bear in mind:

- To open this account the parent or legal guardian must be 18 or over, resident in the UK and be registered for Internet Banking. The young adult must be aged 11-15.

- The parent or legal guardian must have one of our qualifying current accounts listed in the 'Additional Information' section below.

- The parent or legal guardian must have an existing Child Saver or Young Saver for the child or their proof of identity.

- To open the account, the young adult must be living at the same address as the parent or legal guardian.

- The young adult can only hold one Spending Account and one Savings Account.

- We'll remove the parent or legal guardian's ability to view and transact on the account after the young adult's 18th birthday, unless it's already been done.

- The Spending Account will mature to a Classic Account and Savings Account to an Easy Saver account before the young adult's 19th birthday. To make sure this happens, the young adult must provide us with additional identification such as a current UK/EU/EEA passport, photo driving licence or identity card.

Can I withdraw money? expandable section

Young adult:

- Yes. So long as there is money in the account, you can withdraw it anytime.

Parent/legal guardian:

- Only on behalf of the young adult where you believe the circumstances are an emergency.

Additional information expandable section

To open a Lloyds Bank Smart Start as parent or legal guardian, you must have one of our qualifying current accounts listed below.

- Club Lloyds Gold Account

- Club Lloyds Premier Account

- Club Lloyds Private Banking Current Account

- Club Lloyds Private Banking Premier Current Account

- Club Lloyds Mayfair Current Account

- Club Lloyds Mayfair High Interest Cheque Account

Gross rate means we won't deduct tax from the interest we pay on money in your account. You need to pay any tax you may owe to HM Revenue & Customs (HMRC).

AER stands for Annual Equivalent Rate. Whenever you see an advert for a savings account which shows an interest rate, you will see the AER. This means you can use the AER to compare accounts. It shows what the interest rate would be in your interest was paid and compounded once each year.

For more definitions, view our glossary .

Your questions about Smart Start

Can i open this account expandable section.

- have a Club Lloyds Current Account

- have an existing Child Saver or Young Saver for the child or their proof of identity

- are registered for Internet Banking

- live at the same address as your child

- are resident in the UK . If you or the child live outside the UK, you won’t be able to open an account.

Will my child get an overdraft? expandable section

No. There’s no option for your child to overspend. If there isn’t enough money in the account for them to make a purchase, it won’t go through. If something goes wrong and their account goes overdrawn by mistake, we won’t charge them – we’ll help to put their account right.

Is there a charge or fee for using the account? expandable section

No. Smart Start is free to use and doesn’t come with any monthly fees. For more information see our Fee Information Document (PDF, 192KB) .

What are the spending limits? expandable section

Your child can only spend money that’s in their Spending Account. To help them manage their money, we’ve set spending limits. That way you can be sure they don’t overspend.

How do you use my child’s personal information? expandable section

Protecting your child’s personal information online matters to us. This is why we want you and your child to understand how we’ll use their information and what rights they have. Find out how we use your child's data (PDF, 62KB) .

Your Smart Start guides

The Smart Start guides give you and your child the resources, tools and tips to manage their money. It will help them to: Save, Earn, Spend and Learn.

Get started with your accounts

- What to do next after applying for Smart Start.

- Manage your money on your mobile

- A-Z of banking terms

- How to prove who you are .

- Using their contactless Visa debit card

- Tips on budgeting

- Ways to make payments

- Information about part-time jobs

- Types of jobs for teens

- How to apply for a job

- Card freezing

- 5 ways to stay money safe

- Staying safe on social media

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries.

*For children under the age of 13, a parent or legal guardian will need to use ‘Family Sharing’ for Apple devices or ‘Family Link’ for Android devices, to approve the app download.

Save the Change® is a registered trademark and used under licence.

For more information about the fees associated for Payment Services with this account please see the Fee Information Document (PDF, 192KB) .

Financial Services Compensation Scheme

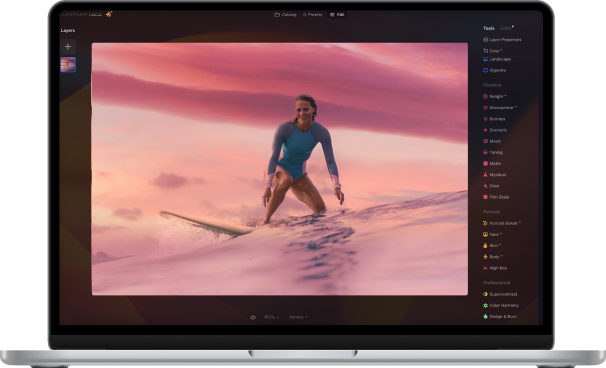

- Luminar Neo

- Luminar for iPad

- Portrait Background

- Structure AI

- Supercontrast

- Composition AI

- Studio Light

- Water Enhancer AI

- Twilight Enhancer AI

- See All 30+ Features

- Extensions Pack

- Supersharp AI

- Focus Stacking

- Background Removal AI

- Noiseless AI

- Magic Light AI

- Panorama Stitching

- Landscape Photography

- Wildlife Photography

- Portrait Photography

- Family Photography

- Wedding Photography

- Newborn Photography

- Photoediting for beginners

- AI Photo Editor

- Real Estate

- E-commerce Photography

- Food Photography

- About Skylum

- Technology Licensing

- Photo Tours

- Ambassadors

- Affiliate Program

New tools. New look. New possibilities.

Special offer: Up to 83% off

February 26, 2022

ACT NOW! SAVE UKRAINE. DEFEND DEMOCRACY.

Team Skylum

Photography

At 5 am on February 24, Russia began the full-scale military invasion of Ukraine. They are violently trying to steal our country.

Russian forces have invaded Ukraine, confirming our worst fears. At this very hour they are attacking us on the streets of many Ukrainian cities. We are at war.

Skylum was proudly founded in Ukraine, and our core development center is based in Kyiv. At this harrowing time, unfortunately we cannot guarantee the on-time delivery of updates to Luminar Neo. We strive for excellence in everything we do, and we will make sure to further develop and improve Neo and to keep you updated on any news.

However, today we ask our community for help and support. Here are some details on what has happened and how you can support Ukraine in this difficult time.

! At 5 am on February 24, Russia began the full-scale military invasion of Ukraine. They are violently trying to steal our country.

! Right now, there are missile strikes and bombardment of peaceful Ukrainian cities. We must hide our families in bomb shelters and protect our land with weapons in our hands as part of the territorial defense forces.

! This disastrous and entirely unprovoked Russian war has already taken the lives of 198 civilians. 33 children have been injured, and 3 have been killed.

! The Armed Forces of Ukraine, young and brave heroes, are fighting all over the country not only for Ukraine but for Peace and Clear Skies in Europe.

As we write to you from a city under attack, we want to be very clear: This war is not just something you see on TV. It is not happening in some distant lands. It is happening right now here in Ukraine, and the Russian forces who are invading our lands and threatening our families may come to your doorstep one day too if we do not stop them.

Sanctions that world governments are currently imposing are not enough. Russia must be completely isolated from all spheres of the civilized world: the financial system, technologies, sports, culture.

Here is a list of simple actions you can take to help Ukraine. We MUST unite to quite literally save the world before it’s too late:

- Contact your local representatives and pressure them to provide more support for Ukraine and stricter sanctions on Russia. We need military and humanitarian aid and Russia must be cut off from SWIFT.

- Donate money to humanitarian aid organizations. Find a full list over here: https://how-you-can-support-ukraine.super.site/

- Follow the news from official channels. Avoid fake news and disinformation!

Twitter: https://twitter.com/ZelenskyyUa

https://twitter.com/DmytroKuleba

https://twitter.com/Hromadske

https://twitter.com/DefenceU

https://twitter.com/backandalive

Telegram: https://t.me/Forbes_Ukraine_official

- Support the Ukrainian Army — Official Account of the National Bank of Ukraine

We stand together

Please share this information with your community.

#Ukrainians #NATO #Ukraine #StandWithUkraine

Experience the power of Luminar Neo

Did you enjoy this post.

Share it on your social media

Advanced yet easy-to-use photo editor

Most Popular

April 04, 2023

GIMP vs. Krita: which one is better for you?

December 02, 2023

GIMP vs Photoshop: Which Photo Editor Is Better?

May 25, 2023

Photography Composition Techniques: A Beginner's Guide

A special perk for our blog readers.

Get a 10% discount on Luminar Neo and dive into professional photo editing today!

I agree to my personal data being stored and used to received newsletters and commercial offers from Skylum.

Thank you for subscribing.

Your gift is waiting in your inbox!

Skylum Blog

The latest news and updates. direct from Skylum

Use Aurora HDR for free for 14 days.

Sent successfully!

Please check your inbox. We've sent you a copy via email.

Looks like you're subscribed already

This is sad. Looks like you’ve earlier unsubscribed from Skylum emails.

Thank you for downloading Aurora HDR

Preparing your download...

Did your download not start? Dont worry, just click here to try again.

Oops! Something went wrong. Don't worry, just click here to try again.

Step 1 Find & Open Aurora HDR Installer

Step 2 Follow the instructions to install Aurora HDR

Step 3 Enjoy new photo editing experience

Get started for free

Try out Luminar Neo for free for 7 days. No credit card needed.

Please check your email

Make sure it's a valid email address

Unlock Pro-Quality iPhone Photos with Our Free Guide! 📸

Gain instant access to simple yet powerful tips for enhancing composition, lighting, and editing—everything you need to transform your photos effortlessly!

👇 Fill out the form below to receive your guide directly via email.

Curiosity is the doorway to skill

Thank you for your interest! Discover the secrets to pro-quality photos in your guide, waiting in your inbox.

Try the request again later. If the error does not resolve, contact support.

- Our opportunities

- Technology and data

- Early careers hub

- Our apprenticeship programmes

- Our undergraduate programmes

- Our graduate schemes

The application process

Summer internships.

Get a taste of how you can build your career as part of our Group.

Applications for our Summer Internships have now closed - if you would like to receive updates from Lloyds Banking Group on future opportunities please register your interest below.

Register your interest

Eight weeks

£25,000 pro rata

Locations vary with each business stream and so you could be based in London, Bristol, Edinburgh, Manchester, Leeds, Halifax or Birmingham.

Discover what your next step could be

You might still be studying but it’s never too soon to start thinking about your career. Our in-person Summer Internship can give you the knowledge, insights, and confidence you need to start choosing the direction that’s right for you.

Across eight weeks, you’ll benefit from a solid learning and development programme, designed to help you develop the kind of skills that are critical to any career. Bite-sized learning sessions will help you understand more about our business and the industry it operates in. And through our group challenge, you’ll get the chance to collaborate with other interns developing your own solution to an important problem.

Come and explore the directions you can head in and start imagining what your next step could be at Lloyds Banking Group.

Is our Summer Internship for you?

You may be clear about the path you want to take or still considering options. Either way, our Summer Internship can help you kick start a successful career once you graduate.

From showing you the diverse range of roles available in an organisation as big and dynamic as ours, to giving you an in-depth look at everything our Graduate Schemes involve, to hearing from people who have built a career with us, you’ll get a valuable glimpse into what your future at Lloyds Banking Group could be.

If you're naturally inquisitive, keen to learn, and excited by our purpose of helping our customers, colleagues and communities prosper, this internship could be for you.

What you’ll learn on the Summer Internship programme

You can gain essential skills and experience working in one of the following business areas (you’ll get to tell us which area you’d prefer in your application).

Business and Commercial Banking

Learn how we build meaningful relationships and spot new opportunities to help our clients face their challenges on the frontline of the UK economy.

Corporate Banking and Markets

See how we work with organisations, including FTSE 100 companies, to optimise their transactions, better manage risks and become more sustainable.

Find out what it takes to become a qualified chartered accountant and future leader in a fast-changing industry.

Human Resources

Explore the wide range of skills involved in being a HR professional and how our teams are enabling everyone at Lloyds Banking Group to be at their best.

Start to understand the full range of elements involved in Risk Management and how this part of our business supports colleagues and customers to Help Britain Prosper.

Consumer Banking

Find out how personalised products and services are helping us meet more of our customers’ financial needs and putting our Values at the heart of every decision.

Gain insight into how we are creating strong, inclusive, sustainable brands that enhance our customers’ experience and support business growth.

Insurance, Pensions & Investments

See, up close, how we’re helping millions of customers with their long-term protection, retirement and investment needs.

Technology, Data & Operations

Bring your love of innovation to explore how our technology, data and operations teams are critical to how our organisation works, changes, innovates and grows. Roles could be in a range of teams from engineering to data to operations and more – all of which are helping to build our digital future.

What you could be doing

Discovering who we are and what to expect through our induction event, initial training and working with your assigned buddy

Getting a hands-on insight into one of our business areas, locations, and the graduate opportunities available within them

Meeting with current Lloyds Banking Group graduates to hear about their experience of working within the Group

Taking part in a Regional Internship Group Challenge

Working with a mentor (if you choose to) to get advice and guidance on starting your career

Is this for you?

What you need to apply.

Open for students in their penultimate or final year of study. We’re open to all subject areas because we value the fresh perspectives that come with diversity.

Closing date

Applications for our Summer Internships have now closed - if you would like to receive updates, please register your interest .

Our internships may close early if we receive a high number of applications, so it’s best to apply as soon as you can.

Our application process is designed to give all candidates the opportunity to excel. You’ll find everything you need to know, including stages of the process and tips to help you succeed, on our how to apply page.

We want our people to feel that they belong and can be their best, regardless of background, identity or culture.

How to apply

Ready to take the next step? Find out how to apply for our Summer internships here.

LBG intern Lin's 30 days in 30 seconds

Laptops, lounges and sliding doors. If you’ve got 30 seconds, intern Lin can show you what 30 days on an LBG internship looks like.

Want to explore more?

Diversity, equity and inclusion.

As a Group, we’re guided on how we do things by a clear set of values. Part of that involves creating a supportive environment for all our colleagues that is truly representative of modern-day Britain.

Looking for help with your application? Need to know more about the interview process? Search our FAQ page to find useful information, tips and support.

We're a financial services group, with millions of customers and a presence in almost every community. Our purpose is to help Britain prosper, by meeting our customers ever-changing financial needs.

Take a look at our upcoming virtual events and employer presentations.

Explore all of our Undergraduate schemes

Cookies consent

We have to collect some data while you use this website. We need this to make the site work, to keep it secure, and to comply with regulations.

We’d also like your consent to collect data while you use this website to help us:

- Study how people use our site and other services so we can improve them

- Decide which of our products, services and offers may be relevant for you

- Tailor the marketing you see on social media, apps and other websites.

Select Accept all if it's OK for us to use cookies. Select Manage consents if you’d rather choose which types of cookies we use.

You can change your mind about this at any time. Just click the 'Cookies' link at the end of any page.

Different types of cookies do different jobs on our website. Some are needed to make the website work. We need your consent to use others that are not essential. Choose here which we can use when you come to our website. You can change your choices at any time. Just click the 'Cookies' link at the end of any page. Or you can find out more in our Cookies policy

Please accept cookie policy!

IMAGES

COMMENTS

You'll get involved in interactive case studies alongside Lloyds Banking Group colleagues, take part in problem solving and coding activities and even attend a virtual hackathon! You'll develop the skills and confidence to support your transition into a tech workplace. Both events will be held virtually on Zoom throughout June - September ...

How it works. You're invited to join us on the first Tuesday of every month for our Careers Live experience - where you'll meet colleagues from across Lloyds Banking Group. Each colleague will have a unique experience to share, working in some of the high-demand and evolving roles that are shaping the future of financial services.

Employability Event. By Lloyds Banking Group. 24 Aug 2023. Virtual. These sessions are a 2-day virtual event, running from 9am-5pm. Dates available across June - August, with some dates filling up fast, so click 'apply now' to secure your place. After the success of our virtual work experience in Summer 2022, we're excited to expand our ...

Your learning and development. Learning is integrated in all we do, from the moment you join us through our onboarding portal to every step you take in your career with us. We encourage learning in the flow of work, whether that be on the job, formally or informally. We value difference and offer a variety of solutions that allow you to tailor ...

Technology and data at LBG. With over 18 million online customers, we're one of the UK's biggest digital banks. But there's still so much we want to achieve, and our on-going digital transformation gives you the chance to apply your skills to projects that will drive widespread change, open new doors and pioneer better, faster, safer ways ...

At Lloyds Banking Group, we aim to help make things that little be easier. Our Returner opportunities are designed to assist people returning to work after a career break of 18 months or more and our roles are permanent from the day one. We're focused on helping people settle back into employment, ensuring that they feel inspired and capable ...

Review of Start Your Journey 2023 - Employability at Lloyds Banking Group. Read previous student employee reviews and find opportunities with Lloyds Banking Group. Review 178225. ... Start your journey employability 2023. at Lloyds Banking Group. Insight / Vacation Scheme (< 4 Weeks) View Review. 5/5 Employability.

Imagine a future full of possibilities at Lloyds Banking Group. With brands including Bank of Scotland, Halifax, Lloyds Bank and Scottish Widows, the history of our Group stretches back 325 years. Yet, our ambitions couldn't be more future-focused. Which makes this an exciting time to start your career with us.

8. What tips or advice would you give to others applying to Lloyds Banking Group I would say firstly, research thoroughly by understanding the company's values, services, and recent developments to showcase your genuine interest; secondly, tailor your CV to different roles; thirdly, show cultural fit: Illustrate how your values align with Lloyds Banking Group's culture and commitment to ...

Careers at Lloyds Banking Group. We're changing financial services and we want you to join us. Take a look at the roles we have available now. We're changing financial services and we want you to join us. We're the largest UK retail and commercial financial services provider, with 26 million customers and a history stretching back more than 325 ...

Review of LBG Start Your Journey 2023 - Employability at Lloyds Banking Group. Read previous student employee reviews and find opportunities with Lloyds Banking Group. Review 177007.

Cards & PINs. Manage your cards, report one lost or stolen or view your PIN. Get answers to your everyday banking questions. Log on to our app or Internet Banking to get in touch. Our Mobile Banking app and Internet banking service offer a simple and safe way to bank with us. See your statement, pay bills and more.

With a Club Lloyds account, you could get an exclusive discount of 0.20% off the initial mortgage rate. Offer can be changed or withdrawn at any time. Exclusions apply. Club Lloyds current account required, £3 fee each month may apply. You could lose your home if you don't keep up your mortgage repayments.

With brands including Bank of Scotland, Halifax, Lloyds Bank and Scottish Widows, the history of our Group stretches back 325 years. Yet, our ambitions couldn't be more future-focused. Which makes this an exciting time to start your career with us. This is no ordinary journey. With 18 million online customers, we're the UK's largest ...

Events for first time buyers. From working out your budget to getting the keys to your first home, we're here to help. We're running free online events for first time buyers, available to everyone, you don't even need to be an existing Lloyds Bank customer. Journey to Completion: Valuations, surveys and the final stages to getting your keys.

If you're starting to consider your next steps after university, our Start Your Journey virtual events will help you build the skills you need. The events offer an introduction to the world of work, including insights into life at Lloyds Banking Group to help you decide the initial direction you want your career to take, and to prepare you ...

This year we have taken another important step on our open source journey by setting up a dedicated Open Source Program Office (OSPO) - a team of steadfast colleagues looking to further encourage the use of open source software across the Group. "Over the last few years, the digital landscape.

For your reference, if the toggle is blue, then you have allowed cookies and if the toggle is gray, then you have blocked cookies. Blocking some types of cookies may impact your experience with the site and the services we are able to offer. A preference cookie will be set, which will contain your preferences of blocking or allowing cookies.

We make it our priority to settle valid claims fairly and provide a positive claims experience for our customers. However, if you're not happy with a decision, you can ask your broker to liaise with your insurer. This journey is for illustrative purposes only - should you need to raise a claim, your broker or claims contact will give you ...

BloomMD can help you start your weight loss journey from the comfort of your own home. By: The PLACE Posted at 1:29 PM, Apr 29, 2024 . and last updated 2024-04-29 ...

They can check their balance with our Mobile Banking app * or Internet Banking. Their Savings Account will earn 3.15% AER/3.11% gross variable interest on balances of £1 to £1,000. And 1.40% AER/1.39% gross variable interest on any money above £1,000. Smart Start guides and tips.

Your assessment is not time-limited, so you are free to stop, start and take breaks as needed. We can't consider your application until you've submitted your online assessment. Some of the accessibility features of our online assessment include: closed captions on all audio content, which you can also pause

Invest in Sheriff Rao Early. A big aspect of Sand Land's early game involves a lot of combat with your tank.Spending Skill Points on Sheriff Rao can help make many of these encounters much easier as his active abilities all help with dealing damage, while his passive skills act as buffs for those abilities.

Start your photography journey with these practical tips for beginners. Learn the basics, improve your skills, and take better photos. Hello, this is E-M-W. I have compiled some tips and advice for beginners to improve their photography with digital SLRs and mirrorless cameras. And today I want to share these insights with you.

You might still be studying but it's never too soon to start thinking about your career. Our in-person Summer Internship can give you the knowledge, insights, and confidence you need to start choosing the direction that's right for you. Across eight weeks, you'll benefit from a solid learning and development programme, designed to help ...

Navigating the Cyber Elephant in the Boardroom: Embracing Cybersecurity as a Continuous Journey . Author: Mathieu Gorge Date Published: 29 April 2024. In today's advancing digital landscape, cybersecurity is an ever-growing concern for organizations worldwide. The escalating frequency and sophistication of cyberthreats have compelled ...