- United States

- United Kingdom

HBF overseas visitor cover review

Hbf offers three main types of cover for visitors who are in australia for work or leisure purposes. its most comprehensive policy can meet some of the costs of accommodation in a private room and pharmacy expenses..

In this guide

HBF OVHC: Our verdict

What types of health insurance does hbf ovhc offer, hbf health insurance complaints, hbf ovhc frequently asked questions.

Overseas Health

Overseas funds

- With three core plans to choose from, you're likely to find something that fits your need: whether that's the minimum to meet your visa requirements, or some added health cover.

- HBF had a lower rate of policy complaints (5.9%), compared to its overall market share (of 7.3%) in Australia. The Commonwealth Ombudsman figures were for 2022 and are the most recently available figures.

- You may be able to find other competitively priced options elsewhere .

This provider is not available via finder. You can visit www.hbf.com.au for more information or compare more options now.

Start comparing

HBF is good if:

- You need to meet condition 8501 of your visa.

- You want to avoid ambulance fees which aren't generally free in Australia.

- You aren't covered by a RHCA.

HBF is not great if:

- You aren't interested in some extras services like dental.

- You're a student – you'll need OSHC .

Review by our insurance and innovations editor Gary Ross Hunter

Hospital Coverage

HBF offers these plans:

- Standard Overseas Visitors cover . Policies start at $26.70* per week and cover you for benefits including urgent ambulance, in-hospital pharmacy and even insulin pumps.

- Working Visa Hospital cover . Policies start at $25.90* per week and provide you with a range of cover for benefits including joint replacements, heart treatments and IVF.

- Working Visa Hospital and Medical cover . Policies start at $42.30* per week and provide top-level cover with protection for the costs from accommodation in a private room and out-of-hospital pharmacy.

*Price is based on a single, in WA paying by direct-debit with 0% Australian Government Rebate on private health insurance and 0% Lifetime Health Cover loading price gathered 29/03/2021.

Extras coverage

You're also able to add extra cover to these hospital policies, which protect you from the costs from treatments like physiotherapy and massage. These include:

- Flex 50s. This pays 50% towards benefits including general dental, major dental, optical, physio, chiro and more.

- Complete 60s. This pays 60% towards most out-of-hospital services including general dental, major dental, optical, physio, acupuncture, healthy living programs and more.

Ambulance coverage

HBF OVHC policies can cover emergency ambulance transportation. This service isn't generally covered by Medicare in Australia.

We looked at the 2022 Ombudsman health insurance complaints. Here's how HBF stacked up:

- Proportionally, HBF had a strong complaints record compared to most other large health funds .

- HBF wasn't first place – it was behind other insurers including Mildura Health Fund, Queensland Country Health and Phoenix.

This chart shows the weighted volume of complaints received by each health fund, according to the Commonwealth Ombudsman. The lower the number, the better. Only non-restricted funds with a national market share of at least 0.1% are included here. HBF is sixth overall in this ranking. The weighting ensures that funds are compared fairly ; larger funds serve more customers so can potentially get more complaints.

Full table of data

What do the policies cover me for.

For necessary medical services, except those specifically excluded under each plan, you are able to receive treatments in a private hospital, following admission.

In all cases your health insurance will only cover shared-room hospital accommodation, so you will need to pay more for a private room, or will have to pay these costs out of pocket if you are admitted to a hospital that only has private rooms available.

The more comprehensive plans also cover you for a range of out-of-hospital services, such as doctor appointments and health check-ups.

It is important to note that you may not be covered for 100% of medical expenses. You should contact HBF prior to receiving treatment to find out if any out-of-pocket expenses are involved.

What are the limitations and waiting periods that apply?

Not all of these plans are suitable for working visas, and additional conditions or exclusions may apply. You are not necessarily covered for all private hospital treatments, and may be left with out-of-pocket expenses.

You are generally only covered for private hospital services in HBF-partnered private hospitals. The HBF network may be more expansive in Western Australia than other states, and as such this type of cover may be most suitable for those intending to reside in Western Australia.

If you will be living or working in a different state, you may want to compare other overseas visitor health cover options .

Waiting periods apply as follows:

- 12 months. Pre-existing conditions (except psychiatric, rehabilitation and palliative care), maternity care services

- 6 months. Repatriation

- 2 months. Rehabilitation, palliative care and psychiatric treatments

- None. Ambulance cover

- None. All other treatments and services

How can I make a claim?

If you are admitted to hospital while you are in Australia, the hospital can check your overseas visitor cover details, and may be able to bill HBF directly. You will need to pay any remaining expenses to the hospital or practitioner as applicable.

How are premiums paid?

You can pay premiums via direct debit from a bank account or credit card.

Gary Ross Hunter

Gary Ross Hunter is an editor at Finder, specialising in insurance. He’s been writing about life, travel, home, car, pet and health insurance for over 6 years and regularly appears as an insurance expert in publications including The Sydney Morning Herald, The Guardian and news.com.au. Gary holds a Kaplan Tier 2 General Advice General Insurance certification which meets the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

Find out who is eligible for the 188 Business Visa, how much it costs, the health and financial requirements, and age restrictions.

Have you just got your permanent residency? See how you're covered for healthcare in Australia and compare your options today.

Looking for visa-compliant OVHC that covers you during your stay in Australia? Find out more about whether Bupa is right for you.

Everything you need to know about the health insurance requirements of the 417 visa and how to find the right cover.

If you incur medical or hospital expenses overseas, will your Australian private health insurance cover the cost? Find out here.

View a range of NIB overseas visitors health insurance policies.

If you’re in Australia on a bridging visa, it’s important that you choose a suitable level of private health insurance cover.

HIF Overseas Visitors Health Cover provide varying levels of hospital and extras cover that complies with visa requirements for those coming to Australia for work or leisure.

Find an adequate level of private health insurance to cover any medical costs incurred during your trip to Australia on a subclass 600 visa.

HCF Overseas Visitor Health Cover offers hospital and optional extras cover for overseas visitors who are eligible to work in Australia but who are not covered by Medicare.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Privacy Policy

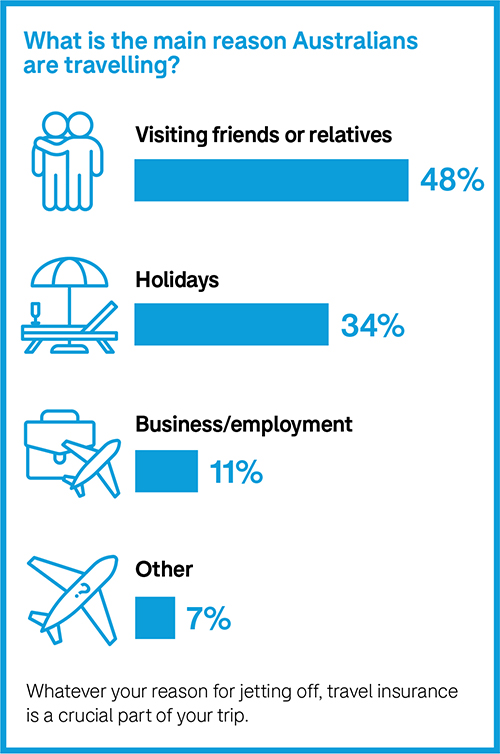

Travelers Plans How to Travelers Plans in The World

Hbf travel insurance.

Travelling is an exciting and enriching experience that everyone should indulge in. But sometimes, things don’t go as planned, and that’s where HBF Travel Insurance comes in. HBF Travel Insurance is designed to give you peace of mind by offering comprehensive coverage for all your travel needs. Whether you’re travelling domestically or internationally, HBF Travel Insurance has a plan that’s tailored to your needs.

What is HBF Travel Insurance?

HBF Travel Insurance is a product offered by HBF, a leading insurance provider in Australia. It offers a range of travel insurance plans that provide coverage for medical emergencies, trip cancellations, lost or stolen luggage, and more. HBF Travel Insurance is designed to give you peace of mind while you travel, knowing that you’re protected against unexpected events.

Why Choose HBF Travel Insurance?

There are many reasons why you should choose HBF Travel Insurance for your next trip. Here are just a few:

- Comprehensive coverage: HBF Travel Insurance offers comprehensive coverage for a wide range of travel-related emergencies.

- Flexible plans: HBF Travel Insurance offers a range of plans to suit your individual needs and budget.

- 24/7 support: HBF Travel Insurance offers 24/7 support, so you can get help anytime, anywhere.

- Easy claims process: HBF Travel Insurance offers an easy claims process, so you can get reimbursed quickly and hassle-free.

What Does HBF Travel Insurance Cover?

HBF Travel Insurance offers a range of coverage options, including:

- Medical Emergencies: HBF Travel Insurance covers medical expenses related to illnesses and injuries that occur while you’re travelling.

- Trip Cancellation: HBF Travel Insurance covers trip cancellations due to unforeseen circumstances, such as illness or death of a family member.

- Lost or Stolen Luggage: HBF Travel Insurance covers the cost of lost or stolen luggage and personal items.

- Travel Delay: HBF Travel Insurance covers expenses related to travel delays, such as accommodation and meals.

- Personal Liability: HBF Travel Insurance covers personal liability for damages and injuries caused to others while you’re travelling.

How to Purchase HBF Travel Insurance?

Purchasing HBF Travel Insurance is easy and can be done online or over the phone. Simply visit the HBF website or call their customer service team to get a quote and purchase your desired plan. You can also purchase HBF Travel Insurance through a licensed insurance agent.

Travelling is an exciting adventure, but it can also be unpredictable. That’s why having travel insurance is so important. HBF Travel Insurance offers comprehensive coverage and 24/7 support to give you peace of mind while you travel. So, the next time you plan a trip, make sure to include HBF Travel Insurance in your itinerary.

Q: Does HBF Travel Insurance cover pre-existing medical conditions?

A: HBF Travel Insurance may cover pre-existing medical conditions, subject to certain terms and conditions. It’s best to check with HBF customer service to see if your condition is covered.

Q: What should I do if I need to make a claim?

A: If you need to make a claim, simply contact the HBF claims team as soon as possible. They will be able to guide you through the claims process and help you get reimbursed for any eligible expenses.

Q: Can I purchase HBF Travel Insurance if I’m already travelling?

A: No, you must purchase HBF Travel Insurance before you start your trip.

Q: Can I cancel my HBF Travel Insurance policy?

A: Yes, you can cancel your HBF Travel Insurance policy at any time. However, you may not be eligible for a full refund, depending on when you cancel and the terms of your policy.

Q: Does HBF Travel Insurance cover adventure sports?

A: HBF Travel Insurance may cover certain adventure sports, such as skiing or bungee jumping, subject to certain terms and conditions. It’s best to check with HBF customer service to see if your activity is covered.

Search Smartraveller

Choice travel insurance buying guide.

Do you need travel insurance? How do you choose the right cover? What are you covered for?

CHOICE answers all the questions you need to know before leaving the country.

Download the CHOICE travel insurance buying guide [PDF 3.52MB] Download the CHOICE travel insurance cheat sheet [PDF 587KB] Who is CHOICE? Set up by consumers for consumers, CHOICE is the independent consumer advocate that provides Australians with information and advice, free from commercial bias. Visit choice.com.au .

Why travel insurance?

- Does travel insurance cover COVID-19?

How to get travel insurance

Before you buy, how to save money on travel insurance.

- How to read the product disclosure statement

What are you covered for?

- Credit card insurance

How to make a complaint

If you’re leaving Australia, travel insurance is just as essential as a passport.

Holidays don’t always go as planned.

If you’re leaving Australia, travel insurance is just as essential as a passport. Medical expenses are the number one reason to get insurance, but sometimes other things can go wrong, such as trip cancellations, delays, lost luggage or even the big stuff like natural disasters and pandemics. If you end up out of pocket because of these things, insurance can make up for that.

The Australian Government won’t pay your medical bills.

In an emergency, the Australian Government can only help so much. The Consular Services Charter describes what the government can and can’t do to help Australians overseas.

If you end up injured or sick while overseas, you’ll be footing the hospital bill and the cost of flying home. If you’re really unlucky, that could cost you or your family hundreds of thousands of dollars.

68% of travellers mistakenly believe the Australian Government would ensure they get medical treatment if they need it overseas, and 43% believe the government would pay their medical bills.

Some countries won’t let you in if you don’t have insurance.

Singapore and the UAE require you to have travel insurance. Not to mention all 26 European countries in the Schengen Area if you’re applying for a visa to visit. Read the Smartraveller travel advice for information about your destination.

Reciprocal healthcare Australia has reciprocal healthcare agreements with several countries: Belgium, Finland, Italy, Malta, the Netherlands, New Zealand, Norway, the Republic of Ireland, Slovenia, Sweden and the United Kingdom. If you have Medicare, you can get subsidised treatment for essential services only in these countries, which often leads people to ask whether they still need travel insurance. The answer is yes, for the following reasons. You’re usually only covered for urgent care that can’t wait until you get home. If you’re very ill, travel insurance can pay for a medical escort to bring you home to Australia. You still may have to pay fees for treatment and medication. For example, in New Zealand reciprocal health care doesn’t cover you for free or subsidised care by a general practitioner or ambulance. Travel insurance can cover you for cancellations, delays, stolen items and more.

Remember to take your Medicare card with you. You’ll need it, along with your passport, to prove you’re eligible for reciprocal health care. For more information, visit servicesaustralia.gov.au .

Marco* had breathing difficulties on his way home from Europe, causing his flight to be diverted to the UAE. Hospitals in the UAE won’t admit you unless you have insurance or can pay an upfront fee. Marco’s family had to pay thousands of dollars for his treatment. *To protect privacy we have changed names and some details

Do you need domestic travel insurance?

Most of us already have medical cover at home, be it Medicare or private health insurance or both. But there are still a few key reasons to consider domestic travel insurance.

- Cancellation: If you’ve spent a lot on your holiday, then it’s not too much extra to buy travel insurance in case of the unforeseen.

- Baggage cover: If you’re travelling with valuables, think about whether you want them covered for theft, loss or damage.

- Car hire excess: You can save money using travel insurance to cover your collision damage excess, rather than paying the car hire company’s extra charge.

Does international travel insurance cover COVID-19?

Many travel insurers now offer limited cover for COVID-19, but the available cover varies quite a lot. Some policies only cover medical and repatriation costs if you get COVID-19 overseas, while other policies provide limited cover for cancellation costs in addition to medical and repatriation costs.

You should always check the details of your insurance coverage, particularly how it applies to COVID-19 and travel disruptions.

Over 90% of travellers will look for insurance that covers them for cancellation and medical expenses caused by COVID-19.

If you’re planning to go on a cruise, be extra careful. Some travel insurers may not offer COVID-19 cover for multi-night cruises or they may restrict the cover provided on cruises.

Also, don’t rely on the travel insurance on your credit card unless you check it closely – it may not cover claims related to COVID-19.

There are cooling-off periods for COVID-19 cancellation cover, so it’s best to buy your travel insurance at the same time as you book your trip. Some insurers may only cover cancellation if you test positive to COVID-19 and the policy was purchased more than 21 days before your scheduled departure date.

Make your travel plans COVID-safe

You need to be prepared for your travel plans to be interrupted at short notice. As travel insurance may not protect you from government border closures, general lockdowns or quarantine requirements in your destination country, the key is to book only with providers that allow you flexibility should things change.

- Check the rules for travelling to your destination. For example, are there any entry requirements? What are the vaccination requirements? And what type of travel insurance do you need?

- Read the terms and conditions of your airline, accommodation and travel tours before you book. Will they refund you if you can’t travel due to COVID-19? If they only offer a reschedule or a credit, will you be in a position to redeem the credit in future?

- You can book flexible tickets for flights but be aware you usually have to pay the difference between the prices for the tickets you bought and the new tickets. So changing your flight dates at short notice can be very expensive.

- If you book through a travel agent or booking site, what are their terms and conditions? Will they refund you or provide a credit? Are there cancellation fees?

- If you pay by credit or debit card (and you selected ‘credit’ when you paid), you may have access to credit card chargebacks if something goes wrong.

- Keep on top of the latest travel advice and requirements at smartraveller.gov.au . Travel restrictions can change at short notice.

- If you do have to cancel, your travel insurer will ask you to claim what you can back from travel providers first. Read the CHOICE advice on how to get your money back on travel cancellations and ask your travel insurer if you can get a refund or partial refund of your travel insurance premium.

You can buy travel insurance from a travel insurer, travel agent, insurance broker, credit card provider, or even from your health, home or car insurer.

You can buy travel insurance online (direct from the insurer’s website, from a comparison site or through an airline booking site), over the counter or over the phone.

Buy travel insurance as soon as you know your travel dates. That way you’re covered if your trip is cancelled before you even leave or if you’re unable to travel at all.

You can certainly buy travel insurance quicker than it will take you to read this guide, but do you know what you’ll be covered for? Will you be covered if you trip over after having a drink? If you crash your scooter in Thailand? If you lose your wallet during a stopover? If you need to isolate because you contract COVID-19?

There are a lot of ‘what ifs’ to consider, depending on where you’re going and what you’ll be doing, so it’s worth reading the product disclosure statement (PDS) first to make sure you’ll be covered.

Will you use it? Hopefully not, but research by Smartraveller found that one in 4 Australian travellers experienced an insurable event on their last overseas trip. Most common insurable events Flight or tour cancelled Flight delayed more than 12 hours Received medical treatment Lost, damaged or stolen luggage Missed a connecting flight Lost, damaged or stolen cash or personal items Forced to cancel trip before departure What if the insurers don’t pay out? Australian travellers lodged almost 300,000 insurance claims in 2018–19, the last financial year before COVID-19 travel bans. Almost 90% of those were paid out. Top four reasons for declined claims Due to policy exclusions, or not included in the policy conditions Claim amount was below the excess Claim was due to a pre-existing medical condition Claim was for an item that was stolen while it was unattended

1. Where are you going?

The level of cover and the cost of travel insurance can vary depending on the region you’re travelling to, and some risks may be of greater concern than others. Not all travel insurance policies cover COVID-19 and other pandemics or epidemics such as SARS. And not all policies cover you for changing your plans due to a riot or civil commotion, for example. Travel insurance also may not be available for countries with travel alerts.

- Look up your destination on smartraveller.gov.au and make sure you’re aware of any risks or safety advice.

- Buy a policy that covers you for every country you’re travelling to or transiting through. If you’re going to Europe via a one-night stopover in the US, then get cover for the US and Europe. Usually a worldwide policy will cover this.

86% of travellers say they’re more cautious after the COVID-19 pandemic about travelling to places where it could prove harder to return home in a crisis.

You need different cover for different regions

Insurers sometimes apply policies to regions rather than having a policy for each destination.

Asia Pacific: Destinations such as New Zealand, Bali, Fiji and Papua New Guinea.

Asia: Destinations such as India, Indonesia, Thailand, Singapore and Malaysia.

Europe: Destinations such as the United Kingdom, Ireland and Western Europe.

Worldwide: All of the above as well as regions such as North America, South America, Japan and Africa.

These definitions differ for each insurer. For example, several insurers cover travel to Bali under their Pacific policy, while some will only cover travel to Bali under their Asian region policy.

2. How long are you going for?

Just a quick trip? Simply buy a standalone travel insurance policy for a set number of days.

Travel often? Consider an annual multi-trip policy or a credit card with complimentary travel insurance, but make sure it gives you the cover you need.

Tip: Annual multi-trip policies and credit card policies can restrict the length of each trip you take – anywhere from 15 to 365 days depending on your policy. Some allow you to pay for extra days.

3. What are you going to do there?

Cruising the open road on a moped? Carving up the ski slopes? Partying at a wedding? These things aren’t necessarily included in a travel insurance policy.

Scan the insurer’s list of included activities and those that you’ll have to pay extra for. And take it easy on the grog – if your alcohol or drug intake is the cause of an adverse event, it won’t be covered by your policy.

4. Are you taking any valuable items?

Do you need cover for a digital SLR camera or an expensive tablet or laptop? Cover for such valuables can vary from a few hundred dollars to thousands, and higher cover will often mean a higher premium.

Consider adding cover for portable valuables to your home insurance policy instead, but check on the excess and if the policy will cover you worldwide and not just in Australia.

Policies also vary when it comes to how they cover valuable items. Valuables in your check-in luggage often aren’t covered, while cover for baggage stored in your hire car is inconsistent. And baggage left unattended is never covered, which can include a bag that is stolen from the seat beside you in a restaurant while you’re looking the other way.

Make sure you have receipts for your valuables as travel insurance will not pay if you can’t prove you own them.

5. Do you have any medical conditions?

If you have a medical condition that existed before you bought your policy, it may not be covered. This can range from something as common as allergies or asthma through to diabetes, heart conditions and knee replacements.

If you’re not sure, the best thing to do is contact the insurer to ask whether they’ll cover your condition automatically or whether you need to do an assessment.

The Massoud family* was holidaying in Singapore when 13-year-old Nazreen had a recurrence of severe bronchitis, which had affected her in Australia before their trip. The family’s travel insurer refused to pay any hospital bills as Nazreen’s bronchitis was a pre-existing medical condition. As a result, the Massouds had to ask their friends to transfer the $17,000 they needed to cover Nazreen’s hospital expenses, additional accommodation and the cost of changing flights. *To protect privacy we have changed names and some details

It’s important to compare policies for cost and cover. Some travel insurance premiums increased by as much as 30% between March and June 2022.

Three-quarters (77%) of travellers are willing to pay more for insurance that covers pandemic-related claims.

The further out from your departure date that you buy travel insurance, the more you’re likely to pay for it, but you’ll be covered from the moment you buy your policy. For example, if you buy insurance 2 months before you fly, you effectively have cheap cover for any events that affect your travel plans in those 2 months.

If you pay for your trip in full 6 months in advance, but you only buy an insurance policy 2 weeks before you depart, you may not be covered for any cancellation costs if you contract COVID-19.

Left it until the last minute, or even later? Only a few insurers let you buy insurance once you’re already overseas (look for the ‘Have you already left Australia?’ checkbox when viewing policy options).

While not all policies offer online discounts, plenty do. Make sure you understand the policy and what it covers. Sometimes (but not always) a reduced price may mean reduced cover.

Tip: Check asic.gov.au/afslicensing to find out whether the agent has an Australian financial services (AFS) licence or is an authorised representative of a licence holder. Take the usual precautions when giving your credit card and other details over the internet.

Member discounts

Does your health, car or home insurance provider also sell travel insurance? Some companies give 10–15% discounts to existing members.

Shop around

Trying to negotiate with a website will probably get you nowhere, but if you’re buying over the phone or through a travel agent, give it a go. Travel agents pocket a commission when they sell you insurance, so if you find a better deal elsewhere, ask them if they can beat it.

Almost two-thirds (62%) of overseas travellers who buy insurance do so on or before the day of booking travel.

Use your credit card

Some credit cards come with ‘free’ travel insurance when you use them to buy a ticket, pay for other travel expenses or otherwise activate it (we say ‘free’ because you’ll pay a premium in fees for the card itself).

This type of insurance can sometimes be a money-saver, and the level of cover can be just as good or even better than standard insurance, but make sure it gives you the cover you need.

Compromise on cover

While good medical cover is always essential, you could save money on your premium by choosing a policy with lower or variable cover for cancellation, delays and lost baggage, especially if you aren’t spending big on your holiday or taking expensive items with you.

Have you read the Product Disclosure Statement (PDS)? According to research conducted in 2022, of those who bought travel insurance: 45% have skim-read the PDS 43% have read the PDS in detail 8% have left the PDS to another person on the policy to read 2% have not and will not read the PDS 2% don’t know

About that fine print

You’re about to click ‘buy’, so you may as well just tick this ‘I acknowledge I’ve read the product disclosure statement’ checkbox and bon voyage…

But wait – have you checked the fine print? In the insurance world, that ‘fine print’ is contained in the product disclosure statement, or PDS (that thing you said you’d read).

How to read the PDS

There are hundreds of policies out there and if you tried to read all the paperwork that comes with each policy, you’d have to extend your holiday just to recover.

If you don’t have time to read the whole PDS cover to cover, at least look for the following.

- The table of benefits is an overall summary of your cover.

- The policy cover section is essential reading and is generally split into ‘what we will pay for’ and ‘what we won’t pay for’.

- General exclusions are also essential reading – these are events that aren’t covered by any section of the policy.

- Pre-existing conditions can remind you of forgotten ailments and are essential reading for anyone with any kind of medical condition, no matter how mild.

- The word definition table might contain a few surprises – it’s a good place to check on the definition of a ‘relative’ or a ‘moped’, for example.

- The claims section lists some further pointers to be aware of (e.g. it’s a good idea not to admit fault or liability in the case of an accident) and the paperwork you may need to collect while you’re away if you need to make a claim, such as police reports.

- COVID-19 cover section – many policies have a special section listing medical, cancellation and other cover available for COVID-19.

- The 24-hour emergency assistance contact number (write it down and keep it handy).

The Weaver* family was relieved to have travel insurance when they needed to cancel their holiday. The family wanted to go skiing in New Zealand, but a few days before they were due to depart, 12-year-old Ruby had cold symptoms. A COVID-19 test showed she was positive. Ruby and her whole family had to isolate and their travel insurance paid their cancellation costs. *This is a fictitious but realistic example

The list of travel insurance disputes taken to the Australian Financial Complaints Authority (AFCA) reveals a battlefield of unread or misinterpreted terms and conditions. Between 1 July 2020 and 30 June 2021, AFCA received more than 2,000 travel insurance complaints related to COVID-19.

Not all travel insurance policies are the same, and the wrong policy can be almost as bad as none at all.

Peter* and his business partner had booked a business trip to South Korea and Japan from 21 February 2020 to 2 March 2020. On 20 February, Peter cancelled the trip on advice of his GP who said that due to the uncertainty of the extent of the COVID-19 outbreak, he should postpone the trip until it is safe to travel. Peter’s travel insurer denied his claim, saying the policy does not provide cover for cancellation due to medical advice. Peter made a complaint and AFCA ruled in his favour as COVID-19 had been publicly announced as an epidemic prior to Peter cancelling the trip and the doctor’s advice not to travel was prudent and reasonable. *To protect privacy we have changed names and some details

Checklist – Are you covered for COVID-19? Are your medical costs covered if you contract COVID-19? Are your extra expenses such as accommodation covered if you can’t travel or your stay gets extended because you or your travelling companion tests positive to COVID-19? What happens if you were going to stay with someone but they’ve contracted COVID-19? Or your accommodation or tour company gets closed down because of COVID-19? Are your additional expenses covered? If the Smartraveller alert level is raised to ‘Reconsider your need to travel’ or ‘Do not travel’ due to a COVID-19 outbreak at your destination after you took out travel insurance, are you covered if you cancel your trip? Are your cancellation costs covered if you can’t travel or can’t return on your booked flights because you or your travelling companion contracted COVID-19? Are you covered for cancellation costs if your business partner or a relative back home gets sick with COVID-19 and you need to return earlier than planned? If you’re planning to go on a cruise, be extra careful. Some travel insurers may not offer COVID-19 cover for multi-night cruises. Are you covered for claims caused by government travel bans, border closures, or mandatory quarantine or self-isolation requirements at your destination?

And what are the catches?

Cancellations, baggage and personal items, sports and activities.

This is the number one reason to buy international travel insurance. Look for the insurer’s benefits table, usually on the quotes screen online or near the front of their PDS, for a quick overview of what they’re offering. Most policies have an ‘unlimited’ sum insured.

Pre-existing conditions

Some insurers don’t cover pre-existing conditions at all. Some will only cover pre-existing conditions with an extra fee and sometimes a medical assessment. Some automatically cover pre-existing conditions listed in their PDS, although few will cover mental illnesses such as depression or anxiety.

Insurers exclude cover for certain pre-existing medical conditions and generally don’t provide cover for any illnesses or incidents that arise from these. This includes terminal illness or any illness that shortens your life expectancy as well as organ transplants.

Minor pre-existing medical conditions such as asthma, hypertension, diabetes, epilepsy, osteopenia and more are usually covered if:

the condition has been stable for more than 12 months

there is no planned surgery

you have not received treatment in the past 12 months.

Pre-existing condition spoiling your holiday plans? findaninsurer.com.au lists insurers that may provide cover for pre-existing conditions. Still having trouble finding cover? Enlist the help of an insurance broker.

Examples of conditions that usually need to be assessed before getting cover are coronary problems, lung disease, epilepsy, stroke or any surgeries in the last 2 years.

If in doubt, declare your condition to your insurer.

A disability shouldn’t prevent you from buying travel insurance, but it might make finding a good policy trickier and more expensive.

Is a disability a pre-existing condition?

It depends on the disability and the insurer. Many insurers will automatically cover travellers with limited mobility, cognitive impairments or vision/hearing impairments. But in some cases, this cover may come at an extra cost.

Check with the insurer, as some conditions will need to be assessed on a case-by-case basis.

Having trouble getting cover?

Under the Disability Discrimination Act, insurers must assess the actual risks, rather than make assumptions about disabilities. If you’re having trouble getting insurance, a letter from a medical professional might help, particularly if they can state that you’re not likely to need medical or hospital treatment while on your trip.

Cover for your equipment

If you’re travelling with a wheelchair, mobility aid or hearing aid, you’ll need to insure that as well. Check single item limits, which are usually between $750 and $1,000 per item. If you have a piece of medical equipment that exceeds this, you’ll need to specify it and insure it separately.

Many insurance policies exclude hearing aids, so check the fine print and take out extra insurance if necessary.

Cover for your carer

If you’re travelling with a carer, it’s a good idea to be on the same policy in case travel plans change for either of you – that way you’re both covered. If you have a paid carer, ask your insurer whether they’ll cover the cost of a replacement carer should yours be unable to travel.

Babymooning

If you’re travelling while pregnant, be sure to check the following.

- Are you covered for pregnancy complications? Some insurers don’t cover pregnancy at all.

- Up until which stage of pregnancy? Pregnancy complications are usually only covered up until a certain stage (often between 23 and 32 weeks, depending on the insurer).

- Childbirth: Not all insurers will cover childbirth. A premature birth in the US with intensive care and treatment could end up costing hundreds of thousands of dollars.

- IVF: Not all insurers will cover IVF pregnancies.

- Do you have to pay extra to be covered?

- Do you need medical approval to be covered?

Mental health

Many travel insurers won’t provide cover of any kind for hospitalisation, medication or missed travel caused by a mental health condition, whether that’s depression, anxiety or a psychotic episode.

Others will provide cover if you declare mental illness as a pre-existing condition and pay a higher premium. Check the PDS carefully; insurers may use different terms to describe the same mental health conditions, giving them wriggle room to deny a claim.

Insurers are highly unlikely to pay a mental health-related claim if they discover it was a pre-existing condition that you didn’t declare. The trouble is, an insurer might view a single visit to a therapist many years ago because of work stress, for example, as a pre-existing mental health condition.

Mental health and travel insurance have been a contentious issue for consumer rights groups including CHOICE – and it’s one that’s still evolving from a legal standpoint.

To find out if a travel insurance product includes mental health cover, check choice.com.au/travelinsurance , filtering for ‘mental illness related claims’. Then put the PDS under the microscope.

A woman in Victoria won a court case against her insurer after they declined her claim for the cancellation of an overseas trip due to depression. ‘We took out the travel insurance well in advance of the travel, and well before my depression. I was certainly under the impression that I was covered,’ she told CHOICE. ‘They just sent back a letter that said no.’ But her win (the Victorian Civil and Administrative Tribunal awarded her $4,292 for economic loss and a further $15,000 for non-economic loss) was an isolated ruling. It’s still being debated whether or not a general exclusion for mental health claims is legal.

Most policies have an age limit, ranging right up to the 100-year-old seasoned adventurer. There are quite a few catches for older travellers, though.

- Higher premiums: Insurers often charge older travellers more, and in some cases ‘older’ can be as young as 50.

- Higher excess: Travellers as young as 60 but more commonly over 80 may be subject to a higher excess because of their age. The normal excess of around $100 to $200 is often increased to an excess of $2,000 to $3,000 for travellers 80 years and over for claims that relate to injury or illness.

- Restricted conditions: Subject to medical assessment’, ‘reduced medical cover limits’, ‘reduced travel time’, ‘policy to be purchased 6 months in advance’ – all of these conditions can apply to travellers over a certain age.

You’ll probably want to be covered if your travel plans are cancelled for any reason, but be aware that insurers will come up with plenty of excuses to avoid paying up.

- Terrorism: Most insurers cover medical expenses but very few cover cancellation expenses in the event of terrorism.

- Pandemic or epidemic: Commonly excluded.

- Military action: Commonly excluded.

- Natural disaster: Covered more often than not.

- Travel provider/agent insolvency: Commonly excluded.

- Cancellation due to travel provider’s fault: Insurers commonly exclude cover for delays or rescheduling caused by the transport provider.

John* and his partner’s scheduled train service was delayed, seriously diverted, then terminated, which meant they missed their flight home by several hours. Re-booking fees, emergency accommodation and related fees cost them between $1,000 and $1,500, but the insurer wouldn’t pay the claim as it wasn’t in the policy. *To protect privacy we have changed names and some details

‘Unforeseen’

When an insurer refers to cover for ‘unforeseen circumstances’, it means something that wasn’t publicised in the media or official government websites when you bought the policy. Check the Smartraveller travel advice when you buy your travel insurance. If it became known before you bought the policy, you’re not covered. So the earlier you buy travel insurance, the more likely you are to be covered for the unexpected.

Exclusions and inclusions

When the Australian Financial Complaints Authority (AFCA) looks at a complaint about an insurer, they expect you to prove the claim is covered by the policy, while the insurer must prove the claim is excluded by the policy. Specifically, AFCA expects you to ‘establish on the balance of probabilities that you suffered a loss caused by an event to which the policy responds’. That is, do you have a valid claim?

This means that you need to understand if your claim is covered under the listed events of the policy, or that it is not specifically excluded by the policy.

If, for example, you have cover for COVID-19, you aren’t covered for every event caused by the pandemic, but just by what is specifically stated in the PDS.

Margaret and Peter* booked a cruise departing from Darwin in March 2021. Shortly before departure, the Northern Territory Government issued a directive no longer allowing cruises to depart from the NT. Margaret and Peter’s cruise company arranged for the cruise to depart from Broome and flew the passengers to Broome for a cost of $300 per person. As Margaret had bought a policy that included some cover for COVID-19, she made a claim for $600. But this was denied by her travel insurer and her subsequent complaint to AFCA was unsuccessful. AFCA said, ‘The cause of the loss was a government directive to not permit the cruise to operate through the NT port. The insurer’s policy provides no cover for these circumstances. It also excludes losses arising from government intervention, prohibition or regulation.’ *To protect privacy we have changed names and some details

Travel insurance and Smartraveller advice Smartraveller, managed by the Department of Foreign Affairs and Trade (DFAT), assigns an overall advice level to more than 175 destinations. This advice level can affect your travel insurance cover. The advice levels are: Level 1 – Exercise normal safety precautions. COVERED. Level 2 – Exercise a high degree of caution. COVERED. Level 3 – Reconsider your need to travel. CHECK. Level 4 – Do not travel. USUALLY NOT COVERED. Travel warnings can work in your favour. If an insurer excludes cover for an event, they may still cover you to change your plans in response to updated advice from Smartraveller. But beware when travelling to a destination that has a ‘Do not travel’ warning. Most standard policies won’t cover you for ‘Do not travel’ destinations, including for COVID-19. A week after a volcanic eruption made world news, Sameer* booked a trip to Bali. He assumed the emergency would be over by the time he was due to fly a month later. Unfortunately, the volcano continued to erupt and Sameer’s flight was cancelled. His insurer declined his claim because he’d bought the flight and insurance after Smartraveller issued a travel alert about the volcanic eruption, and after it had been in the news. *To protect privacy we have changed names and some details

Delays can be expensive, particularly if you have to pay for alternative transport or accommodation. And those extra expenses won’t always be covered.

- Transport delay is only covered after a certain number of hours, usually 6, but you may have to wait as long as 12 hours before your cover kicks in.

- Cover limits for transport delays are typically lower than other cover limits and are often limited per 24-hour period.

- Insurers often exclude cover for rescheduling caused by the transport provider but some may cover additional accommodation and travel expenses in this scenario for travellers who are en route.

Baggage cover varies widely, with travel insurance policies ranging from $0 to $30,000. So, if you’re not carrying expensive items, you may be able to save on your premium by selecting a policy that provides lower coverage.

- Individual items are subject to sub-limits that range from around $250 to as much as $5,000.

- Higher item limits usually apply for electronic items like laptops, cameras, smartphones and tablets.

- You can pay extra to specify items you want extra cover for (insurers are always happy for you to pay extra).

- Valuables locked in a car or checked in on an airline, train or bus may not be covered.

- Generally, any items left unattended may be excluded from cover, so keep your belongings close.

Jing* sat down to try on a pair of shoes in a busy London shoe shop, placing her handbag next to her on the seat. When she stood up to leave, she discovered her bag was gone. Her insurer refused to pay up because she had left her bag unattended in a public place. *To protect privacy we have changed names and some details

Lost luggage

If an airline loses your luggage temporarily and doesn’t compensate you for that loss, you may be able to claim expenses for clothing, toiletries and other necessities, depending on your policy.

- Cover usually only applies to luggage lost for more than 12 hours, though the minimum time limit varies per insurer, as does the level of cover.

- If your policy has an excess (a fee that’s deductible from your payout), remember that this applies once per claimed event, and items below the excess level can’t be claimed.

Angelo and Diane* tried to claim $112 for meals and drinks when their connecting flight to Hawaii was delayed by 8 hours. Although their policy technically covered them for the cost, they were liable for an excess of $250, so their claim was denied. *To protect privacy we have changed names and some details

If you don’t feel like paying the ‘extra insurance’ the car hire company charges, then use the collision damage excess cover in your travel insurance.

Tip: Stick with recognised car rental companies in this case since this cover only applies if the car hire company already has its own comprehensive insurance.

Do you have the right licence?

Some countries require you to have an international driving permit. If you have an accident while driving on the wrong licence (or breaking that country’s law in any other way), you may not be covered.

Cruise-specific insurance

Cruises aren’t automatically included in all travel insurance policies. If you’re going on a cruise, make sure you have the right cover.

The Department of Health says: ‘Cruise ships carry a higher risk for spreading disease compared to other non-essential activities and transport modes. COVID-19, influenza and other infectious diseases such as gastroenteritis spread easily between people living and socialising in close quarters.’

Check travel insurance policies to make sure medical cover for COVID-19 is included, as some policies exclude this cover. Erica* stumbled and broke her femur during stormy seas while on a cruise. Her insurer covered the cost of evacuation and a partial hip replacement at a hospital in Noumea. They also organised and paid for her son to fly to Noumea to help her recover and return home to Australia. Five months later, the well-travelled 82-year-old was boarding a plane to Croatia for her next (fully insured) adventure. *To protect privacy we have changed names and some details

Not leaving Australian waters?

You still need insurance. Doctors working on cruise ships don’t need Medicare provider numbers, so if they treat you, you can’t claim on Medicare or your private health insurance, even if you’re still in Australian waters.

Domestic travel insurance doesn’t cover medical costs, so you need either international travel insurance (check that it covers domestic cruises) or a domestic cruise policy.

Kerry* thought she’d done the right thing buying an annual multi-trip international travel insurance policy for a number of upcoming holidays, one of which was a round-trip cruise departing from and returning to Fremantle, Western Australia, with no port stops. When she had to cancel due to ill health, she discovered her policy wouldn’t cover her because the trip wasn’t considered an international one. *To protect privacy we have changed names and some details

When CHOICE compares travel insurers, we look at who covers which sports and adventure activities, such as skiing, ballooning, bungee jumping and scuba diving, to name a few.

But as always with insurance, the PDS may include some surprises. For example, several insurers we’ve reviewed will cover canyoning but they won’t cover abseiling, often a necessity in canyoning. Other policies in our comparison will cover abseiling, but not into a canyon.

If you’re planning on doing anything adventurous, check to make sure you’re covered. It’s not enough to simply look for the tick next to your chosen activity – you also need to check the definitions in the PDS.

Motorcycles and mopeds

Hiring a motorcycle or moped? Depending on which country you’re in, you might need a local or international motorcycle licence. You probably won’t be covered if you aren’t obeying the local law. And even if you are doing the right thing under local law, some policies still won’t cover you unless you have a motorcycle licence.

Are you wearing a helmet? Most countries say you need one by law, but that doesn’t mean it will be included in your hire. No helmet means no cover (in more ways than one).

Nhung* was injured after she rented a moped in Thailand only to find out the engine size was not covered by her insurance policy. Most insurers adopt the national standard for the definition of a moped – an engine capacity under 50cc. If the engine is bigger than that, it’s a motorcycle and you’ll need an Australian motorcycle licence. *To protect privacy we have changed names and some details

Skiing and snowboarding

Some insurers cover skiing, often for an extra premium, but not so many cover skiing off-piste (away from the groomed runs). So, if you’re tempted to slide off the beaten path next time you hit the slopes, make sure you have a policy that covers off-piste ski runs (or pay for the optional extra cover).

Otherwise, if you run into a tree and have to be evacuated from the mountains, you may need to think about selling your home to pay for it.

It’s worth remembering that travel insurance only covers overseas costs. So if you break a leg while you’re abroad, your insurer will likely pay your hospital fees, but they won’t cover your ongoing physiotherapy once you’re back home.

Marianna* fractured her leg in 3 places while skiing with her partner and children in Japan. Because the family had bought additional cover for winter sports, they were reimbursed $35,466 for medical expenses, additional transport and accommodation, the cost of a nanny to look after the children, and business class flights back to Australia. *To protect privacy we have changed names and some details

Alcohol and drugs

Overdoing it on vodka and float-tubing down a river isn’t likely to be covered by any policy. Insurers simply won’t pay for costs arising from you being under the influence of alcohol or drugs (except where taken under the advice of a doctor).

Even one or 2 drinks could be enough of an excuse for insurers to get out of paying.

Relatives can be relative Many policies cover the costs to travel home if one of your relatives dies or becomes sick. Bear in mind: an insurer’s definition of a ‘relative’ may differ from yours cover is usually dependent on the age of that relative, so the death of your 84-year-old grandma may not be covered your relatives are subject to the same pre-existing condition exclusions as you, so if your 84-year-old grandma died from a known heart condition, you may not be covered. you may be able to apply for your relative’s pre-existing condition to be assessed before you buy the policy. cover is limited to relatives that live in Australia, or in some cases New Zealand. So if your 84-year-old grandma is in China, you won’t be covered to fly there for her funeral. Amanda* and her husband had booked an overseas diving trip, but shortly before the trip Amanda’s mum passed away from pneumonia. They cancelled their trip and incurred cancellation costs and lost deposits of nearly $13,000. As the death of a parent was covered in their policy, Amanda made a claim. Their insurer denied the claim as Amanda’s mum lived in the United States and was undergoing treatment for lung cancer, so the insurer concluded that her death was caused by a pre-existing condition. *To protect privacy we have changed names and some details

So you’ve booked and paid for your holiday through a travel agent, but then the travel agent goes broke. You’ll get your money back, right? Not necessarily.

Only a few insurers will cover you for the insolvency of a travel provider, and that includes hotels, airlines and other transport companies that might go broke overnight (remember Ansett?). But there are a few ways to safeguard your hard-earned holiday.

- Check whether your insurer covers you for insolvency.

- Check whether your travel agent has insolvency insurance (this isn’t compulsory, so only some will have it).

- Pay with your credit card. Some banks allow a chargeback if you pay for something on your credit card and don’t end up actually getting it.

Tip: Don’t accept any dodgy contract terms that require you to give up your chargeback rights.

2 out of 3 travellers assume their travel insurance will cover insolvency, but in 2017 less than a third of insurers actually provided this cover.

Credit card travel insurance

Some credit cards come with complimentary travel insurance. They’ll cover you for all the usual things like medical emergencies, cancellation and protection for baggage and items. But they do differ from standalone policies, so it’s essential you check the fine print.

- Fees: You’ll pay a premium for these credit cards, usually between $100 and $450 per year.

- Excess: The excess on credit card policies tends to be fixed at a higher rate (usually around $250), whereas it’s more variable on standalone policies.

- Age limits: Some credit card policies have no age limit, which can be handy for older travellers.

- Regions: Credit card travel insurance is not based on location, which means you can travel from Europe to the US without having to worry if your policy covers both areas. Bear in mind though that some regions (such as countries under United Nations embargo) may be excluded, and sometimes with US underwriters, travel to Cuba is excluded.

- Baggage cover: Credit card insurance often offers higher coverage for baggage loss and damage.

- Trip duration: Credit card insurance policies vary in how many days of coverage they’ll give you per trip – anywhere from a few weeks to 365 days – so check your limit if you’re going on a long holiday.

- Pre-existing conditions: Chances are your credit card insurance won’t automatically cover your pre-existing condition. You’ll need to call your insurer and see if you need to pay an extra fee or premium.

- Domestic travel: Credit card insurance doesn’t apply to domestic travel, although some cards will reimburse expenses associated with domestic flight delays and missed connections to international flights.

- Making a claim: You may not be able to claim reimbursement unless you pay for purchases (such as emergency items after a baggage delay) with the same credit card.

27% of travellers who plan to buy travel insurance will get it through their credit card.

Is it activated?

Credit card insurance usually activates when you buy your air tickets (or sometimes other transport or accommodation expenses) using your card.

- Policies require a minimum spend to activate – usually around $500. So if you scored your tickets on sale for $499, you won’t be covered.

- If you want cover for your spouse or dependants, you must also buy their tickets on your card.

- Some policies only activate if you book a return ticket. A one-way flight, or even 2 one-way flights, will leave you uninsured.

- Some banks require you to notify them in order to get full coverage for each trip. While base coverage will still give you emergency medical treatment, you might not get coverage for property damage or luggage delays. Check whether you need to do anything to activate any extra features.

- Some cards will cover you if you use rewards points to buy your tickets. Others won’t.

Is it worth it?

If you already have a credit card and use it regularly, the free comprehensive travel insurance on your card can save you money. And if you’re a regular traveller without a credit card, it’s worth considering if you travel at least once a year or every second year internationally.

David* booked a trip to North America for himself and his family, including his 11-year-old daughter Petra. The trip was cancelled because Petra got pneumonia. Unfortunately, David only activated his credit card travel insurance about an hour before the family was scheduled to fly out of Australia. The travel insurer denied his claim for cancellation costs because he knew about his daughter’s illness when he activated the policy. *To protect privacy we have changed names and some details

Have you been knocked back on an insurance claim and want to dispute it?

Internal dispute resolution

Complain to the insurer first. They’ll usually keep you up to date about the progress of your complaint every 10 business days.

Once you’ve lodged your case and all the supporting information and documents, the insurer has 45 days to complete its internal dispute resolution process.

External dispute resolution

If you aren’t happy with the insurer’s decision, you can take your complaint to the Australian Financial Complaint Authority (AFCA). They’ll handle your case for free.

- The AFCA will mediate between you and the insurer to find a resolution.

- If mediation is unsuccessful, they may make a preliminary assessment or give a determination straight away on your dispute.

- A determination is legally binding on the insurer but not on you.

- There’s no appeal process with AFCA.

- For more information, visit afca.org.au .

Legal action

If you’re unhappy with the AFCA determination, you might want to consider taking legal action against the insurance company.

Keep your travel insurance details with you at all times while on your trip and share them with family or friends before you leave.

Related content

No matter who you are, where you're going and what you're doing, get travel insurance. Learn how to choose a policy that's right for you.

This page provides mature travellers with information to prepare for a hassle-free journey. Properly preparing before you travel will help you have a safe trip.

Browse our general advice pages on a range of travel topics, to learn what you need to know before you go.

- Membership & Benefits

- Discounts and special offers

- Competitions

- Become a member

- Have your say

- About your membership

- Change my details

- Pay or renew

- Member News blog

- Online shop

- Log into myRAC

- myRAC Frequently Asked Questions

- 5%* off purchases in-store and online

- Savings on gas for your home

- Save 4 cents per litre off fuel

- Car & Motoring

- Roadside Assistance

- Car insurance

- Caravan loans

- Motoring for businesses

- Motorcycle insurance

- Caravan & trailer insurance

- Car servicing & repairs

- Car Buying Service

- Electric vehicle products and services

- Electric SUVs available in Australia 2023

- WA's cheapest cars to own and run

- Some of the best cars for towing

- Home & Life

- Home insurance

- Boat insurance

- Life insurance

- Health insurance

- Home security

- Investments

- Personal loans

- Pet insurance

- Small business insurance

- Home services

- Pre-purchase building inspection benefits

- Learn to save a life in 30 minutes

- How secure is your home?

- Travel & Touring

- Our holiday parks & resorts

- Find a travel centre

- Travel & cruise deals

- Travel insurance

- Car hire & driving holidays

- WA holidays

- International driver’s permits

Cruise packages

- WA’s best road trips and long distance drives

- Endless things to see and do in Perth and WA

- WA’s top destinations and places worth visiting

Travel Insurance

Aliquam erat volutpat. Mauris eu velit nec neque finibus convallis eget at mi.

Our range of travel insurance plans are flexible to suit your needs and budget. Feel prepared, no matter where you choose to travel. Now with limited Covid-19 benefits for International and Domestic Comprehensive Cover and Cruise Cover. Get a quote today.

Relax and enjoy your holiday with RAC's premium travel insurance. Provides a wide range of benefits and the highest level of cover.

Cover for when you're travelling within Australia. Applies to travel 250km away from residential home.

Be prepared against unexpected medical costs, cancellations, lost or damaged luggage, and personal liability from the minute you step out your door until you return home.

Planning two or more trips this year? This policy could save you time and money.

There’s nothing more important than your health. Medical Only cover is unlimited # protection when you’re travelling overseas.

Renting a car or campervan? Don't risk unexpected costs # .

Compare our policies

Which cover is right for you?

You can also call 1300 655 179 or visit any of these metro RAC branches to get a quote. Travel insurance is also available from RAC regional branches : Bunbury, Albany, Kalgoorlie and Geraldton.

# Limits and sub-limits apply ^^ $unlimited means that generally there is no cap on the maximum dollar amount which may be paid out for this benefit, subject to the specific terms and conditions, sub-limits and exclusions that apply to this benefit. ** $unlimited means that generally there is no cap on the maximum dollar amount which may be paid out for this benefit, subject to the specific terms and conditions, sub-limits and exclusions that apply to this benefit. This benefit covers reasonable overseas medical and hospital costs as a result of an injury (including that arising from a terrorist act) or illness occurring which first shows itself during your period of insurance. Benefits may be paid up to 12 months from the time you received treatment for the injury or illness, but only for reasonable expenses incurred during that time. Medical treatments must be provided by a legally qualified medical practitioner. You must notify us as soon as practicable of your admittance to hospital. * This cover is per person listed in your policy ^ This cover is per policy

Terms and conditions apply. This advice is general advice only. Please refer to the Product Disclosure Statement before making a decision about this product and read the Target Market Determinations (TMDs) before determining whether this product is suitable for your circumstances. This product is issued by Tokio Marine & Nichido Fire Insurance Co., Ltd (ABN 80 000 438 291 AFSL 246548).

- Advocating change

- In the community

- Help centre

- Frequently asked questions

- Find a branch

RAC Products & Services

- Pay or Renew

- Holiday Parks and Resorts

- Home Security

- Car servicing & repair

- Home Services

Information & advice

832 Wellington Street, West Perth, Western Australia, 6005

This website is created by The Royal Automobile Club of WA (Inc.). © 2024 The Royal Automobile Club of WA (Inc.).

RAC acknowledges and pays respects to the Traditional Custodians throughout Australia. We recognise the continuing connection to land, waters and community.

- Accessibility

- RAC on Instagram

- RAC on Facebook

- RAC on Twitter

- RAC on LinkedIn

- " id="mainPhoneNumber">

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Seniors Travel Insurance

- Ski Travel Insurance

- Budget Direct

- Fast Cover Travel Insurance

- Insure4Less

- InsureandGo

- Simply Travel Insurance

- Ski-Insurance

- Travel Insurance Saver

- Travel Insuranz

- Wise Traveller

- Zoom Travel Insurance

- See more companies...

- Travel Insurance Tips

- Covid-19 Help

- Read Reviews

- Write a Review

Please Note - If you are cruising around Australia you need to select Pacific. With Regions, variances can apply for Bali, Indonesia, Japan and Middle East. You are not required to enter stop-over countries if your stop-over is less than 48 hours.

If you don’t know where you’re traveling to within the next 12 months, choose Worldwide to ensure you’re covered no matter where you go. If you’re travelling to multiple countries choose the region that you are visiting that is furthest away (excluding stopovers less than 48 hours). In most cases you will be covered for the closer regions as well. For example, if you choose Europe, you will also be covered in the Middle East, Asia and Pacific.

Worldwide means anywhere in the world

Americas means USA, Canada, South America, Latin America, Hawaii and the Caribbean

Europe means all European countries, including UK

Middle East refers to the area from Syria to Yemen; Egypt to Iran

Asia generally means Asia and the Indian subcontinent. For some insurers this excludes Japan*

Pacific means the South West Pacific, Australia and Indonesia/Bali*. Select Pacific for domestic cruises in New Zealand waters

New Zealand means domestic travel within New Zealand only

*Note: Variances apply for Bali, Indonesia, Japan and Middle East. Check that your destination is covered once directed to your chosen insurer’s site.

Best Travel Insurance

If you're looking for the best travel insurance options, you've come to the right place. There are loads of comparison sites out there, but what sets us apart is that we know travel insurance better than anyone else. Travel insurance is all we do, and we do it well. It’s what we live and breathe. But, enough about us, let's talk about you. Choose the best travel insurance | Compare the best travel policies | What does travel insurance cover? | Tips for high quality | Best travel cover FAQs | Reviews

how do I Choose the best travel insurance?

So how do you get the best travel insurance for your trip? This is not as simply answered as you may think! When it comes to travel insurance, finding the best travel insurance for your holiday requires you to think about the type of trip you are going on and the level of cover you need. It's about matching your needs and budget to the various travel insurance policies in the market and weighing up the options.

The following tips will guide travellers to find the best travel insurance for their next adventure:

1. Determine the type and level of cover you need

There are different levels of cover available to suit all needs and budgets. Holidaymakers should look at the cover available and work out what they need cover for and what they don’t. There is no point paying top dollar for luggage cover, if you're only travelling with a backpack and fresh undies. The best travel insurance is one that covers you for your particular trip. Whether that's a once in a lifetime trip around-the-world or a domestic weekend break. There's no need to pay more for cover than your trip requires.

Overseas medical cover is considered the most essential component of travel insurance. Medical expenses can be eye-watering when the government isn't fitting the bill, but thankfully, medical cover is standard in most basic travel insurance policies. A basic policy will usually include overseas medical expenses and personal liability, which keeps you covered should you become ill or injured, or cause harm to anyone else whilst overseas. Comprehensive policies will include additional cover for things like trip cancellation, family emergency and accidental death. If you have pre-paid flights, tours or accommodation where you have outlaid significant cash upfront, a comprehensive policy that includes cancellation cover is a wise choice as you'll be protected for any prepaid holiday expenses should something unforeseen stop you from taking your trip. A mid-range or comprehensive policy will also provide cover for your personal belongings. If you're travelling with electronic devices such as laptops, cameras or smartphones, check out the 'per item' limits and add high-value items where appropriate.

2. Compare, compare, compare

Comparing policies is a great way to find the right travel insurance for your needs. All insurers offer different benefits and pricing, so once you’ve identified what level of cover you need, the next step is to start comparing policies to bag yourself a bargain. Reading up on real customer experiences is also a great way to see which insurers travellers recommend. Unsurprisingly, our travel insurance reviews often reveal a different tale to testimonials featured on the insurers’ site.

3. Cheapest is not always the best

One of the biggest mistakes travellers make is purchasing a policy based on the cheapest price . Selecting the cheapest might seem like a bargain, but it might mean you're missing out on some valuable cover. The key is to get the right level of cover at the best price.

4. Not all policies are created equal

When shopping around for travel insurance in Australia, you may notice that many different brands are underwritten by one of a few big insurers, such as Allianz Australia Insurance Limited, Chubb Insurance Australia Limited, Great Lakes, Lloyds of London, QBE Insurance Limited and others. Whilst they look similar at first glance, they will almost certainly not be the same. Each insurer negotiates a product policy and chooses what to include or exclude. So think about your trip and planned activities that you need cover for and pay attention to general exclusions.

5. Get the best bang for your buck

With so many travel insurers in the market, how do you really know who covers more than the other? The ideal policy is one that provides you with the cover you need, at the right price. Some insurers definitely do cover more than others, but why pay for cover that you don't need!? Luckily, we've done the hard work for you. If you want to know who offers the best cover for expensive items, or who has the best single item limit - see who really covers more in our handy guide. Alternatively, if you're looking to compare travel insurance quotes fast, then use our quoting engine to compare travel insurance quotes now.

6. Read the print - small or not

Whilst it can be extremely boring, the fine print in any policy needs to be read and understood. Understanding the insurance exclusions and loopholes will help you to avoid or at least understand when you're placing yourself in a situation that your insurer will not cover.

which is the best travel insurance for COVID COVER?

Compare the best travel Insurance

Please note, the table above shows the listed insurer's most comprehensive policy - international trips only The information provided is of a general nature only and does not take into account any particular personal objectives, financial situation or needs. Before making a decision you should consider the appropriateness of the information having regard to your personal objectives, needs and circumstances. Cover levels could change at any time.

WHAT DOES TRAVEL INSURANCE COVER?

24/7 Medical assistance

Yikes, your mozzie bite has got infected and your lower leg has started going green...what to do!? Go to a hospital and all your bills will be covered by travel insurance – that’s what! Travel insurance covers your medical expenses for injury or illness including hospital stays, surgery, dental, prescription drugs and doctor visits.

Cancellation cover

Sometimes trips just don't go to plan! An accident before your holiday puts a spanner in the works, or a natural disaster puts a dampener on your dream location. Cancellation benefits cover the cost of rearranging or cancelling your trip due to a range of unforeseen circumstances.

Lost or damaged luggage

It's a real pain in the ar*e when your stuff is lost, stolen or doesn't show up. At least if disasters happen on your holiday your policy will replace or reimburse you for your baggage and personal items if they disappear or are damaged.

Travel delays

You’re flights delayed, your train is late… but that doesn’t mean you should be out of pocket. If your transport is postponed due to an unforeseen reason, your out-of-pocket accommodation, meals, and transport costs would be covered until you get back on track.

Family emergency

Going on holiday should be oh so much fun! But there can be apprehension when leaving loved ones behind. Have peace of mind knowing that if any family emergencies happen while you’re away you’re covered to get home and be by their side.

Personal liability

A lawsuit would put a downer on your holiday. Relax as you're covered in the event that you are found to be legally liable for accidental injury or damage you may have caused to another person or their property whilst on your trip.

How do I choose high-quality travel insurance?

Travel insurance faqs, which is the best travel insurance in australia.

The cover that is best suited to your trip depends entirely on you and your circumstances. If you're a backpacker on a strict budget, you might want a no-frills medical-only policy, while if you've paid a lot in deposits or if you have pre-existing health conditions, a more comprehensive policy might work for you. Create a quote to start comparing prices and features.

How do I choose the right travel insurance?

There are over a hundred different travel insurers in Australia, so we forgive you for feeling a little frazzled about your cover. A good way to wittle down your options is to read some reviews to find out what past customers are saying about their experiences. Then once you have a few brands in mind, compare some policies and see which ones give you the best bang for your buck.

Does travel insurance have age limits?