India USA Travel

10+ best travel insurance for usa from india (expert reviews).

So, you’re almost ready to trade your daily dose of masala chai for a steaming Starbucks, eh? Planning that dream journey from India to the sprawling horizons of Uncle Sam’s land, are we?

Now, while you’re dreaming about gazing at the Grand Canyon or shopping in New York City, there’s a little (big) thing you might be forgetting – travel insurance .

Now, I know what you’re thinking.

Travel insurance is as confusing as trying to assemble furniture with instructions that might as well be written in hieroglyphics. You may even think of it as that uninvited party guest, crashing your travel budget .

But pause for a moment! What if I told you that the right travel insurance could actually be your unsung superhero, swooping in to save the day in case of unexpected events?

From minor inconveniences like delayed luggage (who needs clean clothes, right?) to more serious issues like medical emergencies (ouch!), the right travel insurance can make all the difference.

And guess what? You’ve hit the jackpot!

After years of world exploration, policy deep-dives, and countless trial and error, we’ve put together a list of the very best travel insurances for all you eager-beavers planning a USA escapade from India.

In this all-in-one guide, we’re about to unleash more than 10 fantastic travel insurance options, each put under our microscope and reviewed by our experts who’ve seen it all and lived to tell the tale.

With clear analysis, handy tips, and a no-nonsense verdict for each, we guarantee this won’t be another yawn-fest insurance guide.

So, strap in, grab your masala chai (or Starbucks if you’re practicing already), and prepare for a deep dive into the world of travel insurance. Together, we’ll find that one policy that’ll be your travel buddy throughout your American adventure.

Ready to give your dream trip an extra layer of security and peace of mind? Let’s roll!

Get ready, because every scroll is a step closer to discovering that perfect travel insurance plan for your upcoming USA extravaganza. Let the fun begin!

In this article…

What is the best health insurance for visitors to USA from India?

So, let me break it down for you.

Firstly, if you’re planning to bring your aged parents along, I’d recommend looking into insurance plans like Atlas America, which offers coverage for individuals aged 70 and above.

For young folks, I’d recommend the Patriot America plan or the Visitors Care plan. These plans cover basic necessities and aren’t too expensive .

If you have any pre-existing medical conditions, I’d suggest going for a plan that covers them. Atlas America is one such plan. It covers pre-existing medical conditions up to a certain limit.

Be prepared to pay a bit more for such plans, though.

Now, if you’re worried about your budget, check out the cheapest health insurance plans from companies like IMG, Tokio Marine or Seven Corners. These are great for short trips and cover all the basics.

But, if you’re willing to splurge, you can consider plans like Liaison Majestic, that offer comprehensive coverage.

If you’re planning a long trip, it’s best to get a plan that covers you for the entire duration. Atlas America and Patriot America offer comprehensive coverage for long-term visits.

Remember, it’s always better to be prepared beforehand than to regret it later.

So, choose the insurance plan that works best for you and have a happy and safe trip!

Recommended Plans ⭐⭐⭐⭐ Atlas America 100% Coverage, Comprehensive plan ⭐⭐⭐ Safe Travels USA 100% Coverage, Comprehensive plan ⭐⭐ Patriot America Plus 100% Coverage, Comprehensive plan

Compare Plans

Indian Companies Offering Travel Insurance to USA from India

American companies offering travel insurance to usa from india, what is covered under travel insurance for usa.

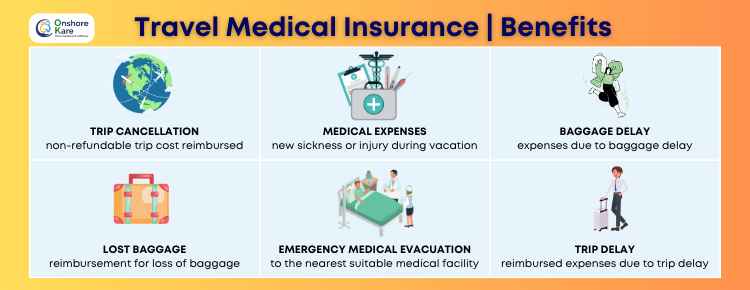

International travel insurance for the USA typically covers the following:

1. Medical emergencies

This includes coverage for unexpected illnesses and injuries that require medical treatment . 2. Trip cancellations or interruptions

If you have to cancel your trip or cut it short due to unforeseen circumstances (such as natural disasters or sickness), your travel insurance may reimburse you for any prepaid expenses.

3. Baggage and personal effects

If your luggage or personal items get lost, stolen, or damaged during your trip, travel insurance may provide coverage for their replacement or repair.

4. Emergency evacuation

If you need to be evacuated due to a medical emergency or natural disaster, travel insurance can cover the associated expenses.

5. Accidental death and dismemberment

In the unfortunate event of accidental death or dismemberment, travel insurance can provide financial support to your beneficiaries.

Why Do You Need Travel Insurance When Traveling from India to USA?

“But why?”, you might ask, wondering if this is another scheme to drain your hard-earned travel budget. Well, my friend, let me paint you a picture.

Imagine you’re at the majestic Grand Canyon, clicking a storm of photos to flood your Instagram feed.

Suddenly, you lose your footing and twist an ankle. Ouch!

Without travel insurance, that twisted ankle could become a massive pain in your…wallet.

The USA’s healthcare system is one of the most expensive globally, with a simple visit to the doctor’s office potentially costing hundreds of dollars.

Now, wouldn’t it be nicer if you could focus on getting better instead of worrying about medical bills? That’s where travel insurance steps in!

Or, let’s say you’re strolling through New York City, thrilled about the shopping spree you’re about to embark upon. But oh no! Your wallet’s been stolen, along with your credit cards and cash.

Well, guess what?

A good travel insurance policy can provide coverage for stolen possessions, helping you to get back on track without a massive hit to your travel fund.

But wait , it’s not just about medical mishaps or stolen wallets.

What if you need to cancel your trip last-minute due to an emergency back home, or you miss your flight because of a delay in your connecting flight from Delhi to Mumbai?

Yup, you guessed it, travel insurance can cover those unexpected expenses too!

So, why do you need travel insurance from India to the USA? It’s simple, really. Travel insurance provides that crucial peace of mind that lets you enjoy the adventure and handle the curveballs that life might throw at you.

After all, wouldn’t you rather be calculating how many souvenirs you can fit into your suitcase, rather than the potential medical bills or replacement costs for lost belongings?

We thought so too.

So, before you take that leap across the pond, make sure you’ve got your trusty travel insurance by your side.

For more details on the benefits of travel insurance , don’t forget to check out our comprehensive guide on Travel Insurance Benefits to make an informed decision.

When Can Travel Insurance for the USA be Helpful?

There are a few scenarios where travel insurance for the USA can be a real lifesaver.

Think of it as your trusty travel sidekick, standing by your side, ready to jump into action when things don’t go according to plan. But when exactly can travel insurance be beneficial?

Let’s delve into some scenarios where having travel insurance can make all the difference.

1. Trip Cancellations:

Imagine planning your dream trip to the USA, right down to the last detail, only to have to cancel due to an unexpected emergency.

Non-refundable bookings for flights , hotels, or tours can result in a significant financial loss. Fortunately, travel insurance can help recover these costs.

For instance, if you have to cancel your trip due to a family member’s illness, your travel insurance would cover the non-refundable expenses, minimizing your financial loss.

2. Medical Emergencies:

The cost of healthcare in the USA can be quite high. If you were to fall sick or have an accident during your trip, the medical expenses could create a significant dent in your budget.

That’s where travel insurance comes in.

For example, if you contract food poisoning from trying out a new cuisine or sprain your ankle during a hike in Yosemite National Park, your travel insurance will cover the medical costs, saving you from unexpected expenditures.

3. Baggage Loss or Delay:

Losing your luggage or experiencing a delay in receiving it can be a major inconvenience. It could mean being without your essentials and needing to purchase replacements.

Travel insurance can help in such situations. If your baggage is delayed for more than a specific period (typically 12-24 hours), your insurance policy can reimburse you for the purchase of essential items like toiletries and clothing.

In the case of lost luggage, you’ll be compensated for the loss up to the maximum limit specified in your policy.

4. Flight Delays or Cancellations:

Flight delays or cancellations can disrupt your travel plans significantly. For example, if you’ve planned a tour of the Grand Canyon but your flight gets delayed due to bad weather, causing you to miss the tour, your travel insurance can cover the cost of the tour.

Similarly, if your flight gets canceled and you need to book a last-minute hotel for the night, your travel insurance would cover these unexpected costs.

5. Legal Assistance:

In an unfamiliar country, legal troubles can be quite daunting. If you’re involved in a legal issue, your travel insurance policy can help by providing coverage for legal expenses and advice.

This could be in a situation where you accidentally damage someone’s property or in a traffic violation.

In conclusion, having travel insurance can significantly reduce the financial risk associated with travel uncertainties. It’s like having a safety net, providing you peace of mind to enjoy your journey fully.

To find the best insurance suited to your needs, check out our expert reviews on the Best Travel Insurance for USA from India .

Remember, your adventures should be filled with joy and excitement, not worries and stress.

Please note that the situations mentioned are for illustrative purposes and actual coverage depends on the specifics of your insurance policy. Always read your policy carefully to understand what is and isn’t covered.

Is it Mandatory to Get Travel Insurance in the USA?

While there are countries like Schengen countries where travel insurance is compulsory for visa approval, in the case of the USA, it’s a different story.

The United States government does not mandate travel insurance for visitors.

When you’re applying for a visa to the USA, there’s no requirement listed by the U.S. Department of State to have travel insurance.

So, technically, you could travel to the USA without any travel insurance.

However, it’s strongly recommended to have one. Why?

Because the cost of healthcare in the USA is one of the highest in the world.

According to data from the Healthcare Cost and Utilization Project (HCUP) , an emergency room visit’s median cost can go up to $1,389, and that’s without factoring in any additional treatment or hospitalization.

A serious accident or illness could result in medical bills amounting to tens of thousands of dollars, if not more.

Furthermore, travel insurance provides coverage beyond just medical emergencies. It covers you for instances like trip cancellation, lost luggage, and flight delays.

Such unforeseen circumstances can arise, disrupting your plans and potentially causing substantial financial loss. Having travel insurance helps mitigate these risks, providing you with a financial safety net.

While it’s not legally mandatory , certain tour operators or travel agencies may require you to have travel insurance as part of their booking conditions.

So it’s always best to check the conditions before making any reservations.

In conclusion, while travel insurance is not compulsory for travel to the USA, it’s strongly recommended due to the high healthcare costs and potential for other unforeseen expenses.

It’s about ensuring that you can enjoy your trip with peace of mind, knowing that you’re financially protected against any unexpected incidents.

To understand more about the benefits of travel insurance and how to choose one that suits your needs, do refer to our in-depth guide on the Best Travel Insurance for USA from India .

And remember, it’s always better to be safe than sorry!

What is the Cost for Travel Insurance for USA from India?

When it comes to the cost of travel insurance for the USA from India, there is a range of options available, tailored to fit various budgets and needs.

It’s essential to remember that cost is just one factor in your decision; the level of coverage is just as, if not more, critical.

Travel insurance premiums are influenced by factors like the length of your trip, your age, any pre-existing medical conditions, the type of coverage you choose, and sometimes even your destination in the USA.

Let’s look at some hypothetical scenarios to help you better understand how these factors can affect the cost of your travel insurance.

Scenario 1: Basic Coverage

Suppose you are a 30-year-old planning a two-week vacation to the USA and decide to go for a basic travel insurance plan.

Such a plan typically covers only emergency medical expenses and perhaps some additional benefits like emergency evacuation . You’re looking at an approximate premium starting from $40-$50.

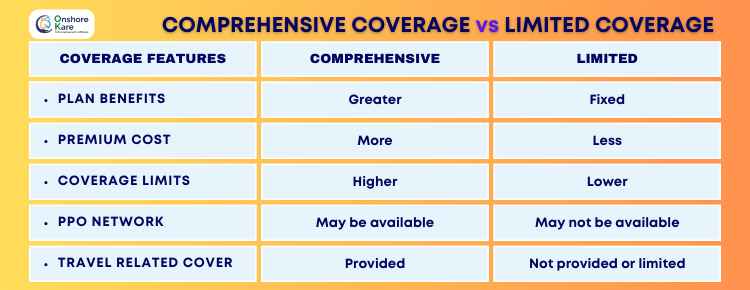

Scenario 2: Comprehensive Coverage

Now, let’s say you’re the same 30-year-old, but this time, you opt for a more comprehensive plan.

Comprehensive plans often include coverage for trip cancellations, trip interruption, baggage loss or delay, in addition to emergency medical expenses. For such extensive coverage, your premium could range anywhere from $80-$100.

Scenario 3: Pre-existing Condition Coverage

Now, if you’re a 60-year-old traveler with a pre-existing condition, such as diabetes or hypertension, and looking for coverage that includes these conditions, your premium would be significantly higher due to the increased medical risk.

You might be looking at costs around $150-$200 or even more, depending on the severity of your condition.

Scenario 4: Adventure Sports Coverage

Suppose you are an adventure enthusiast and plan to indulge in activities like skiing, bungee jumping, or scuba diving.

In that case, you might want to consider a plan that provides coverage for adventure sports, which typically come with a higher premium due to the inherent risk involved. Depending on the specific activities covered, the premium could range from $100-$150.

In conclusion, the cost of travel insurance for the USA from India varies widely depending on your specific requirements and risk factors.

It’s crucial to assess your needs, understand what each plan offers, and choose accordingly. After all, peace of mind while travelling is priceless.

To get more details on the cost and coverage details of various travel insurance plans, have a look at our expert reviews on the Best Travel Insurance for USA from India .

Please note: The above prices are indicative and can vary based on the insurance company and specific policy terms. Always read the policy document carefully to understand the coverages and exclusions.

Buy Travel Insurance For USA From Indian Companies or Online

The question of whether to buy travel insurance for the USA from an Indian company or online can depend on your preferences, needs, and comfort level with digital platforms. Both options come with their own set of advantages and disadvantages.

Buying from Indian Insurance Companies:

Let’s take the example of an established Indian insurance company. A physical office presence can offer you a sense of security and trust.

You can walk into an office, speak to an insurance advisor face-to-face, clarify your doubts, and get guidance on the best plan for you. For many, especially those less comfortable with technology, this can be a huge benefit.

Advantages:

- Personalized service: Face-to-face interaction can provide personalized service. You can explain your specific needs and get recommendations accordingly.

- Paperwork Assistance: They can also help you navigate the sometimes complex world of insurance paperwork.

Disadvantages:

- Limited Choices: Physical companies may have limited offerings compared to what’s available online. This could mean you may not get a policy best suited for your needs.

- Higher Costs: Traditional insurance companies often have higher operational costs, which may reflect in their premium rates.

Scenario: Suppose you’re a 50-year-old man planning to visit your son in the USA. You’re not tech-savvy and prefer in-person assistance for understanding the insurance plans. You decide to go with a renowned Indian insurance company with a local branch office. The advisor there recommends a plan which costs INR 8000 ($110) for your 1-month stay.

However, the plan doesn’t cover trip cancellations and delay, something you would have preferred given the unpredictability of your work schedule.

Buying Travel Insurance Online:

On the other hand, buying travel insurance online offers a host of advantages, the primary one being convenience. You can compare and purchase policies at the click of a button, without leaving the comfort of your home.

- Wide Variety: Online platforms allow you to compare a wide range of policies from different companies, helping you to find the one that best fits your needs.

- Lower Costs: Online companies often have lower operational costs, leading to competitive premium rates.

- Convenience: You can purchase a policy anytime, anywhere, making it a hassle-free process.

- Impersonal: It can feel impersonal as most of the process is automated.

- Confusing: With such a vast array of options, choosing the right policy can be overwhelming.

Scenario: Suppose you’re a 30-year-old software engineer planning to visit the USA for a tech conference . You’re comfortable with digital platforms and decide to purchase your travel insurance online.

After comparing several plans, you opt for a comprehensive plan covering emergency medical expenses, trip cancellations, and delay for INR 5000 ($70) for your 1-week trip.

In conclusion, whether you choose to buy from an Indian insurance company or online depends on your comfort level, your understanding of insurance plans, and your specific requirements.

Always make sure to read the policy document thoroughly and understand the coverage and exclusions before purchasing.

Buying Travel Insurance from American Companies Vs. Indian Companies: A Comparison

When planning a trip to the USA from India, one critical decision is where to buy your travel insurance: from an American company or an Indian one? Each has its own advantages and drawbacks, which we’ll explore below.

Buying from American Insurance Companies:

Purchasing travel insurance from American companies can come with benefits that cater specifically to travelers in the USA.

- Localized Services: American companies have a better understanding of their own country’s medical costs and local emergency services, which can result in more precise coverage amounts.

- Easy Claim Process: In case of a medical emergency, American insurance companies often have a direct billing agreement with hospitals in the USA, which means the hospital bills them directly, sparing you out-of-pocket expenses.

- Comprehensive Plans: They often provide more comprehensive coverage options, including trip interruption, baggage delay, acute onset of pre-existing conditions , etc.

- Cost: Premiums from American insurance companies can be significantly higher compared to Indian insurance companies.

- Purchase Process: Buying insurance from an American company might be a bit more complex for an Indian traveler, given the differences in systems and processes.

Example Scenario: Let’s say you are a 45-year-old Indian woman traveling to the USA for a six-month stay. You decide to go with an American insurance company.

Your insurance policy, which covers high medical expenses, trip cancellation, and baggage delay, costs around $300.

In case of a medical emergency, the hospital directly sends the bill to your insurance company, leaving you worry-free.

Purchasing travel insurance from an Indian company offers advantages that can be appealing to Indian travelers.

- Cost-effective: Indian insurance companies usually offer lower premiums compared to American counterparts.

- Familiarity: Buying insurance from an Indian company means dealing with familiar systems, language, and customer service, which can simplify the purchase process.

- Reimbursement Basis: Most Indian insurance companies operate on a reimbursement basis. This means in case of a medical emergency, you’ll need to pay out-of-pocket first, and then the company will reimburse the expenses.

- Coverage: Some Indian companies might not offer as comprehensive coverage as American companies.

Example Scenario: Now, if you’re a 30-year-old man planning to attend a two-week conference in the USA, you might prefer to buy insurance from an Indian company due to lower premiums.

You choose a policy costing INR 2000 ($30), covering basic medical emergencies. In case of any medical exigency, you’ll need to pay upfront and then claim reimbursement.

In conclusion, the decision between an American and Indian insurance company will depend on factors like your budget, the coverage you need, your comfort with the claims process, and the length of your stay.

To better understand different travel insurance plans, you can refer to our comprehensive guide on Best Travel Insurance for USA from India .

Disclaimer: The above scenarios are fictional and provided for illustrative purposes. Actual costs and coverage may vary.

Key Features to Look for in a Good Travel Insurance Policy for Indians Visiting the USA

Navigating the plethora of travel insurance options can be a bit overwhelming, especially when you’re planning a trip from India to the USA.

However, understanding the key features to look for can make the process smoother and more effective. Here are some essential factors to consider when choosing the best travel insurance policy for your trip to USA from India:

1. Comprehensive Medical Coverage: Given the high healthcare costs in the USA, it’s crucial that your travel insurance offers comprehensive medical coverage. This includes outpatient, inpatient, and surgical treatments, ambulance services, and even dental emergencies.

2. Pre-Existing Conditions Coverage: If you have a pre-existing health condition, check whether the policy covers any acute onset or sudden recurrence. This article can help you understand more about health insurance plans that cover pre-existing conditions.

3. Emergency Evacuation and Repatriation: In severe cases, you might require immediate medical evacuation or repatriation. An ideal travel insurance policy should cover the costs associated with these situations.

4. Personal Liability and Legal Expenses: This feature covers legal costs in case you’re held legally liable for causing injury to a third party or damaging their property. It’s a useful feature to have, given the high legal expenses in the USA.

5. Baggage and Personal Effects Coverage: Losing your luggage or personal belongings can be stressful. An ideal travel insurance policy should cover lost, stolen, or damaged personal effects and baggage.

6. Trip Cancellation and Interruption Coverage: Unforeseen circumstances may force you to cancel or interrupt your trip. A good policy will reimburse you for the non-refundable expenses in such cases.

7. 24/7 Customer Support: When you’re in a different time zone, having access to 24/7 customer support can be a lifesaver. Make sure your policy includes round-the-clock customer service.

8. Direct Billing vs. Reimbursement: As discussed in our comparison of [American and Indian insurance companies , the process of claim settlement is crucial. Check whether the company operates on a direct billing or reimbursement basis.

9. Ease of Purchase and Renewability: The process of buying and renewing the policy should be straightforward and convenient. Online purchase and renewability are highly desirable features.

10. Policy Cost: Finally, compare the policy’s cost with the coverage provided. Sometimes, cheaper policies might not offer comprehensive coverage, and pricier ones may include benefits you don’t need.

These key features can guide you in choosing the right travel insurance policy for your trip to the USA. Always remember to read the policy document carefully to understand the coverage limits, exclusions, and terms and conditions.

Disclaimer: This article provides general advice, and individual needs may vary. Always consult with an insurance expert or the provider directly to understand what policy would best suit your specific requirements.

What are the Travel Documents Required While Travelling from India to the USA?

Journeying from the diverse landscapes of India to the broad horizons of the USA can be a thrilling adventure. However, it can also feel like you’re gearing up for a mission if you’re not well-prepared with the right documents .

Don’t fret! We’ve got you covered with a comprehensive checklist of all the travel documents you’ll need when jet-setting from India to the USA.

Buckle up, because we’re about to deep-dive into the world of passports, visas , and everything in between!

1. Passport:

Your passport is your primary ticket to international travel. Ensure that your passport is valid for at least six months beyond your period of stay in the USA. For Indian citizens, there are two types of passports – a 36-page regular passport or a 60-page jumbo passport.

If you’re a frequent traveler or planning a long stay, opt for the jumbo passport for extra visa pages. Check out the difference between the 36-page and 60-page Indian passports for more detailed insights.

As an Indian citizen , you’ll need a valid US visa , unless you are eligible for visa exemption or traveling under the Visa Waiver Program (VWP), which unfortunately, doesn’t apply to Indian citizens as of the time of writing.

The type of visa you’ll need depends on the purpose of your visit. You might need a B2 visa for tourism, an F1 visa for studying, or an H1B visa for work. Each of these visas has a different application process and requirements, which you can check out on our dedicated Visa Page ).

3. Visa Interview Confirmation:

Once you’ve applied for your visa, you’ll be given an interview appointment at a US embassy or consulate . Keep a printout of this confirmation handy, as you might need to present it at the embassy or consulate.

4. I-94 Form:

The I-94 Form is a record of your arrival and departure in the US. This document is usually filled out on the plane and given to immigration officers when you land. It’s a crucial document that proves your legal entry into the country.

5. Visa Supporting Documents:

Carry all the supporting documents you used during your visa application process. These documents could include bank statements, employment letters, invitation letters from US contacts, travel itinerary, and more. Always carry originals and copies of these documents.

6. Medical and Travel Insurance:

Remember, healthcare in the US can be tremendously expensive. It’s advisable to have medical and travel insurance that covers unexpected medical expenses, trip cancellation, lost baggage, and more.

For more insights on this, refer to our article on the Best Travel Insurance Plans for Visitors to the USA from India .

7. Prescriptions and Medical Documents:

If you’re carrying prescription medication, ensure that you have a letter from your doctor explaining your condition, the medication you’re on, and contact information for verification.

Always carry medication in the original packaging to avoid any issues at customs.

8. Proof of Accommodation and Travel Itinerary:

Proof of accommodation (hotel bookings, invitation letter if staying with friends or family) and your travel itinerary are essential to show that you’ve planned

your stay and have a place to live during your visit.

9. Financial Proof:

Carrying proof of your financial ability to support your travel and stay is essential.

This proof can include bank statements, income tax returns, pay slips, or a letter of support from a sponsor if someone else is financing your trip.

10. Emergency Contact Information:

Always keep a list of emergency contact information, including the contact details of the nearest Indian Embassy or Consulate in the US, friends or relatives living in the country, and emergency helpline numbers.

Preparation is key to a smooth journey from India to the USA. Ensuring you have all the required documents in place will save you from unnecessary stress and help make your trip a memorable one.

For additional travel tips, head over to our comprehensive USA Travel Tips section. Happy travels!

Note: This information is accurate at the time of writing. However, travel requirements can change rapidly, so it’s crucial to stay updated by checking the latest information on official government websites.

Which is the Best Time to Visit the USA?

1. Spring (March to May):

Spring is a delightful time to visit the USA, with mild temperatures, fewer crowds, and nature in full bloom. It’s a fantastic time to visit national parks like Yellowstone and cities such as New York, Washington DC, and San Francisco.

However, this is also the season when allergies, particularly pollen allergies, are at their peak. Ensure your Travel Insurance covers any health issues you might encounter during your trip.

2. Summer (June to August):

Summer is peak tourist season in the USA. Attractions are crowded, and prices are usually higher, but you’ll get to experience popular events like Independence Day celebrations on July 4th.

If you’re planning to visit regions like Arizona or Texas, be prepared for high temperatures. Ensure your travel insurance covers conditions related to heat, such as heatstroke or dehydration.

3. Fall (September to November):

Fall in the USA is a spectacular sight, especially in regions like New England, where you can witness stunning fall foliage. The temperatures are cooler, and the summer crowds have thinned out.

However, keep in mind that this is also hurricane season for some parts of the USA. An apt Travel Insurance can cover any trip cancellations or delays due to severe weather conditions.

4. Winter (December to February):

Winter in the USA means snow in many parts, making it a great time for winter sports like skiing and snowboarding.

But if you’re not a fan of cold weather, regions like Florida or California offer milder winters.

It’s also the season of Christmas and New Year celebrations. However, winter can bring severe weather conditions like snowstorms or blizzards.

nsuring your travel insurance covers such instances can bring peace of mind during your winter travels.

In the end, the best time to visit the USA depends on your preferences and the regions you’re planning to explore.

And regardless of the season, ensure you’re equipped with a suitable travel insurance plan to cover any unexpected surprises during your adventure.

Check out our expert review on the Best Travel Insurance for USA from India to make an informed decision.

Frequently Asked Questions

Is it mandatory to have travel insurance while visiting the USA from India?

While it’s not legally required, it’s highly recommended due to the high cost of healthcare in the USA. Not having travel insurance can result in significant out-of-pocket expenses in case of a medical emergency.

What is the best travel insurance for USA from India?

The “best” policy depends on individual needs and circumstances. However, factors such as comprehensive medical coverage, pre-existing condition coverage, emergency evacuation and repatriation, baggage loss, and trip cancellation coverage are important to consider.

What is the cost of travel insurance for USA from India?

The cost of travel insurance varies based on factors like the traveler’s age, trip duration, coverage selected, and whether you have any pre-existing medical conditions. Costs can range from $50 to several hundreds of dollars.

Does travel insurance from India cover COVID-19 related expenses in the USA?

Many insurance companies have started offering coverage for COVID-19 related medical expenses. However, you should check this specifically before buying a policy.

Should I buy travel insurance from an Indian company or an American company?

Each has its pros and cons. Indian companies usually offer lower premiums, while American companies may provide a smoother claim process and comprehensive coverage. Check out our article comparing the two here .

Does travel insurance cover trip cancellation?

Yes, many travel insurance policies provide coverage for trip cancellation due to unforeseen circumstances such as illness, injury, or death of the traveler or a close family member.

What if I have a pre-existing medical condition?

Some insurance policies cover acute onset or sudden recurrence of pre-existing conditions. Always check this aspect before purchasing a policy.

Can I renew my travel insurance policy if my stay in the USA gets extended?

Most insurance companies allow policy extension or renewal , but you should confirm this at the time of purchase.

Does travel insurance cover baggage loss?

Yes, most travel insurance policies cover lost, stolen, or damaged baggage and personal belongings.

What is the claim process for travel insurance?

The claim process differs from one insurance company to another. Some companies work on a reimbursement basis, where you pay upfront and then file a claim for reimbursement, while others may have direct billing agreements with healthcare providers.

Can I use my Indian health insurance in USA?

While some Indian health insurance providers offer international coverage, it’s typically limited and may not cover all the potential costs in the USA, due to the higher cost of healthcare.

Additionally, claim settlement may be more complicated. It’s recommended to purchase a dedicated travel insurance policy that provides comprehensive coverage for your stay in the USA.

Always check your policy details or consult with your insurance provider for specific information.

Key Takeaways

- Travel Insurance is Essential: Travel insurance isn’t mandatory when visiting the USA from India, but it’s highly recommended due to high medical costs in the USA. It provides coverage for unexpected incidents like medical emergencies, trip cancellations, lost luggage, and more.

- Choose Wisely: Selecting the right insurance depends on individual needs. Important considerations include coverage for pre-existing conditions, claim settlement process, cost, and extent of coverage.

- Cost Varies: The cost of travel insurance varies based on factors like age, trip duration, selected coverage, and pre-existing conditions.

- Purchase Source Matters: Buying insurance from Indian companies can be cheaper, but American companies often provide a smoother claim process and comprehensive coverage.

- COVID-19 Coverage: Amid the ongoing pandemic, ensure your chosen insurance policy provides coverage for COVID-19 related medical expenses.

- Document Requirement: Be aware of the essential travel documents required for travel from India to the USA.

- Best Time to Visit the USA: Timing your visit during the shoulder seasons (spring and fall) can result in a more pleasant trip and potentially lower insurance premiums.

- Key Features: Look for essential features in a travel insurance policy such as comprehensive medical coverage, emergency evacuation and repatriation, coverage for lost/damaged baggage, and trip cancellation coverage.

Remember, travel insurance is your safety net when you are thousands of miles away from home. Don’t underestimate its importance. Happy and safe travels!

Recommended Plan For Your Travel

Safe Travels

Best for Visitors Economical Plan COVID19 included Covers Medical Pre-Existing Conditions First Health Network

Atlas America

Rated “A – Excellent” COVID19 included Covers Medical Covers Dental Trip Cancellation Full Refund on Cancel

About the Author

Mani Karthik

Ex “NRI” and Founder of the “Back to India” movement. I share my experience about immigrating to USA here.

USA Travel Checklist – Items to Carry & Things To Do

Forms to fill when traveling from india to usa, vaccinations for us citizens traveling to india.

[…] Related: Best Health Insurance for Visitors to USA […]

Hi, I am travelling to USA on visitor visa and plan to stay for 5 months. I am confused as to where I have to buy travel insurance. Whether from India or from USA. If from USA how do I get it. I am 58 years old. If from India , which one is good. Can I ask my relative in USA to get it on my behalf. Please mail in detail. Thank you.

It’s not mandatory Anu but good to get because medical care is super-expensive in USA. Why take risk? And I don’t recommend buying from India as most of those products are just good on paper. You can buy it online. Here are some good travel insurance plans for you .

Hope it helps.

Hi…my name is Edward..my friend will be sponsoring me on a visitor Visa…. Putting aside his status of living or eligibility to sponsor me what other or how much amount does he have to pay??

Thanks for doing this Mani. Great research and findings! I am buying a travel insurance for my parents and this helped a lot.

Thanks Ashwin.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Travel Insurance For USA From India

Travel insurance for usa.

Travel Insurance for the USA should be one of your primary considerations when travelling from India.

The United States of America (USA) is one of the most visited countries across the globe. With its wide expanse covering a majority of the North American continent, the USA has varied landscapes, cultures, and experiences that attract visitors from different parts of the world. From some of the world’s most treasured historical monuments to iconic global landmarks, the USA has no dearth of diverse destinations. Whether it is the semi-Arctic terrain of Alaska in the North or the serene beaches of Florida and Hawaii in the South, the USA has something to offer to all ilks of travellers.

Visiting the USA ought to be on your bucket list and you must secure this unique journey with travel insurance for the USA.

The main benefits of a travel insurance USA plan :

- Travel assistance

- Cover against personal liability

- Cover for accident and sickness

- Assistance for loss or delay pertaining to baggage

- Hijack cover

- Automatic extension of your travel insurance USA plan for 60 days in the event of hospitalisation abroad

Expert's Guide to USA Visa

Places to visit in usa, travel insurance for usa from india.

In order to have a stress-free and memorable trip to the USA, you must ensure that adequate planning and advanced bookings are in place, including a viable travel insurance plan for the USA. However, irrespective of the level of planning you engage in, there may be unforeseen circumstances that can derail your plans. The recent Covid-19 pandemic, for instance, has brought the entire world and international travel to an indefinite standstill, with most countries having limited inbound flights and stringent entry restrictions.

It is, therefore, critical to purchase suitable travel insurance for USA visitors and ensure that you are financially protected against any unanticipated events during your visit to the USA. Your travel insurance USA plan will serve as a protective shield and enable you to enjoy your vacation sans worry. You can compare travel insurance plans to pick the one that suits you the most, in terms of coverage amount & premium.

Why Do You Need Travel Insurance from India to the USA?

Since life has no dearth of uncertainties, it is important to be as prepared as possible for any eventualities. Therefore, if you are planning to travel to the USA, you should consider buying travel insurance for your USA trip. A travel insurance USA policy will assist you if you are faced with any adverse circumstances during your stay in the USA. For instance, if you fall sick before or during the trip or lose your baggage at any of the airports you pass through your journey, a travel health insurance policy for the USA would be handy. Therefore, it is recommended to invest in an online Travel Insurance policy for the USA and financially safeguard your trip against any untoward incidents that can potentially ruin your trip. With our wide range of plans for visitor insurance in the USA, you can plan for a hassle-free trip to the USA.

Some of the benefits included in the Tata AIG travel insurance USA plan have been discussed below.

Journey Cover Cover for flight delays and cancellations, hotel booking cancellations, and loss of passport

Baggage Cover Compensation on the loss or delay of check-in baggage

Medical Coverage 1.Covid-19 cover to cover the costs associated with testing Covid positive during the trip 2.Travel medical insurance to the USA to provide you financial support if you fall sick or meet with an accident during the trip

Other benefits of travel insurance USA policies 1.The option to pay in Indian Rupees and get coverage in United States Dollars 2.Affordable travel insurance USA policies with a premium as low as ₹60.32 per day 3.Instant purchase of online travel insurance for the USA without extensive health check-ups

For Additional Information If you are a Student Traveling to the USA for your Studies, check our Student Travel Insurance If you are traveling for a Leisure or Business Trip, check our International Travel Insurance

USA Visa and Entry Information

Non-immigrant Visas : Indian nationals travelling to the USA can apply for various types of visas under the umbrella of a non-immigrant visa. Here are some of the major types of non-immigrant US visas Indian citizens can apply for.

B1/B2 Visa : If you are visiting the USA for a temporary stay with a business-related objective, you ought to apply for a B1 visa. If, however, the reason behind your temporary visit to the United States of America is personal, a B2 visa is the right category of visa for you. The aforementioned visa is for travel objectives such as tourism, medical treatment, visit with family or friends, etc.

F1 and M1 Student Visa : Applicants who have been accepted to educational institutions in the United States of America are eligible to apply for a student visa for their academic programme. The aforementioned visa can, in certain cases, also be granted for practical training in specific fields.

H-1 B Work Visa : The H1-B visa is granted to foreigners employed in the USA. Sponsored by the employers, the aforementioned visa is usually valid for a three-year term that can be extended for a further three years. Non-US citizens are permitted to bring their families to the USA under the aforementioned visa but the process of visa approval is extremely stringent.

H-2 B Work Visa : Unskilled non-US workers hired to work in the USA are eligible to apply for an H2-B visa that is required to be sponsored by their US-based employer.

J-1 and Q-1 Exchange Visitor Visas : A J-1 visa accommodates individuals travelling to the USA for pre-approved exchange programmes. The aforementioned category of visitors includes students, business trainees, research scholars, and government-assigned visitors.

Immigrant Visas : Individuals who wish to immigrate to the USA on a permanent basis can apply for an immigrant visa to the country. The aforementioned visa usually needs to be sponsored by an employer or a permanent resident of the USA who is a relative of the applicant. However, persons with exceptional abilities and skills, including investors and some specific categories of immigrants, can apply for this visa themselves.

Entry information for Indian citizens

Covid Guidelines : In the wake of the ongoing global pandemic, most non-immigrant travel to the USA has been suspended. Only student visas are still being granted on a limited basis.

According to the US embassy in India, students with an I-20 programme beginning after August 1st, 2021 can apply for a student visa to the USA and travel there 30 days prior to the beginning of their respective programmes without requiring a national interest exception.

The aforementioned rule also applies to students who wish to travel to the USA to continue their ongoing academic enrolments at US institutions. It is advisable to have medical insurance for visitors to the USA.

USA Visa application process

You can apply for a visa to the USA by following the steps mentioned below.

Determine the type of visa you wish to apply for. For non-immigrant visas, you can refer to the 'Common Non-Immigrant Visas' guidelines.

Fill the electronic application form (Form DS-160) to apply for a non-immigrant visa to the USA.

Make the payment of your visa application fee.

Create a profile and retain your receipt number to schedule your visa appointment.

Schedule an appointment with the US Embassy or consulates in India within 48 hours of submitting your DS-160 form online.

Be on time for your appointment and carry the relevant identification documents and credentials.

After the second visa interview, your application shall either be accepted or declined by the immigration authorities.

US Embassy and consulates in India : The US Embassy in India is located in New Delhi and the consulates are located in Kolkata, Mumbai, Chennai, and Hyderabad.

How to request expedited visa appointments

If you qualify to travel to the USA under the ‘national interest exception’, you can request an expedition of your visa appointment here.

Travel Documents Required while Travelling from India to the USA

It is advisable to buy health insurance for visitors to the USA. There are also several other essential travel documents that are required for travelling to the USA from India. The aforementioned documents have been listed below.

- A valid Indian passport (valid for a minimum of six months from the date of arriving in the USA)

- A pre-approved visa

- A letter detailing the reason for your visit to the USA

- Confirmed travel tickets

- Prescription for specific medications, if necessary

- USA travel health insurance, including Covid-19 coverage.

- The particulars of the people with whom you will stay in the USA along with their addresses

- The applicable financial documents

- The proof of the funds you are carrying to the USA

USA Travel: Safety and Precautionary Measures to be Undertaken

- Keep your passport safe at all times.

- Protect your belongings, especially when you are in crowded places and tourist hotspots.

- Use official commercial means of transport and avoid seeking private help.

- Respect the country’s laws and regulations.

- Avoid travelling to unfamiliar or remote areas, particularly during the night.

- Do not participate in any unlawful activities.

- Do not violate public decorum through your words, actions, or a combination of the two.

- Choose from the best travel insurance for the USA to financially secure yourself against any unanticipated events.

Covid-19 specific guidelines:

- Wear a mask over your nose and mouth, particularly while using public transport.

- Practise social distancing.

- Monitor yourself for Covid-19 symptoms and self-isolate and get tested if you develop any of the symptoms.

The Indian Embassy in the USA

The Indian Embassy in the United States of America is located at the following address.

Chancery-I, 2107 Massachusetts Avenue, NW, Washington, D.C., United States of America.

Present Ambassador : Ambassador Taranjit Singh Sandhu

Working Hours : Monday to Friday, 09:30 AM - 06:00 PM EST

Consular Services Timings : Monday to Friday, 10:00 AM to 12:30 PM

Contact details of the embassy :

Website : Embassy of India, Washington D.C., United States of America

Telephone number : (202) 939-7000

Fax number : (202) 265-4351

For Visa-related queries : Telephone: (202) 939 9888

Email : [email protected]

For queries regarding passport and miscellaneous services: Telephone : (202) 939 9864

Email: [email protected]

International airports in the USA

There are several major international airports in the United States of America, some of which are as follows.

- John F Kennedy International Airport, New York City (JFK)

- Washington Dulles International Airport, Washington D.C. (IAD)

- San Francisco International Airport, San Francisco (SFO)

- ‘OHare International Airport, Chicago (ORD)

- Salt Lake City International Airport, Utah (SLC)

Currency and Foreign Exchange

The currency of the United States of America is the United States Dollar (USD), which is commonly referred to as the US Dollar and represented by the $ sign. It is advisable to carry a sufficient amount of USD before embarking on your trip to the USA.

The exchange rate of the United States Dollar ($) with respect to the Indian National Rupee (₹) fluctuates on a daily basis. Therefore, it is important to monitor the applicable exchange rate before travelling to the USA.

USA Tourist Places

The USA has no dearth of tourist attractions, ranging from beaches to mountains, museums to amusement parks, movie studios to art galleries. Whether you are a scholar or an adventure seeker, the country has a lot to offer you. Here are some of the destinations you must not miss whilst visiting the USA.

New York City : No visit to the USA is complete without visiting New York City. Considered to be amongst the centres of modern civilisation and innovation, the big apple is home to some of the most iconic landmarks in the world, including the Statue of Liberty, the Empire State Building, Broadway, the Rockefeller Plaza, and the world-renowned Times Square. The city also houses Wall Street and 5th avenue, thereby simultaneously being the financial and fashion capital of the world.

Washington D.C .: The national capital of the United States of America is a cultural and financial epicentre and home to the U.S. Capitol, the Lincoln Memorial, the White House, and the Smithsonian. Adorned with museums and historic universities alike, the city has roots in history, branches in the present workings of the international power structure, and forces that play a significant part in shaping the future of the world.

The Grand Canyon : The Grand Canyon is one of the most spectacular natural wonders of the world and a tourist hotspot. Averaging ten miles across and a mile in-depth, the canyon has vast and seemingly endless expanses that unequivocally capture nature’s might and engender awe and reverence amongst visitors. The Grand Canyon is a day’s trip away from Las Vegas and Phoenix.

Los Angeles : Home to Beverly Hills and Hollywood, the city of angels is a cultural and cinematic force to be reckoned with. Los Angeles is regarded as the heart of California and the US movie industry. The city is adorned with picturesque beaches and incredible vistas. While in LA, you must also visit La Brea Tar Pits which contains fossils of prehistoric animals.

Las Vegas : Las Vegas is widely considered more of an experience than a tangible point on the global map. With its world-famous casinos, sound and light shows, musical theatre performances, and diverse entertainment options, Vegas has been a tourist favourite for decades. And, as popularly quoted, “What happens in Vegas, stays in Vegas!”

And, to enjoy all these places completely and explore the US with peace of mind, it is crucial to get a travel insurance USA plan from Tata AIG. To know more, check our guide on the places to visit in USA

Best Time to Visit the USA

The best time to visit the United States of America is either March to May (spring) or late September to late October (autumn). During spring, most parts of the country have mild and pleasant temperatures, thereby making it the ideal time to visit the nation. Since the summer months of May to September usually witness the highest footfalls from international tourists to the USA, it is advisable to plan your trip to this diverse country during spring or fall.

Visit the USA today and safeguard your international journey with online travel insurance for the USA from TATA AIG Insurance. With our wide range of travel insurance plans, you can select the best travel insurance for the USA for yourself. We also offer insurance for parents visiting the USA. Visit our website to know more about USA travel insurance costs and benefits.

Information last updated June 20. While this information is sourced reliably, visa requirements can change. For the most current visa details, visit the official Consulate/Embassy website.

Other Destinations

Disclaimer / tnc.

Your policy is subjected to terms and conditions & inclusions and exclusions mentioned in your policy wording. Please go through the documents carefully.

Related Articles

Why senior citizens travel insurance is must?

Going for a vacation. Here are five reasons you need travel insurance

5 Myths of Travel Insurance

How can i get a travel insurance usa plan.

To buy travel insurance for the USA, you must visit our website and select international travel insurance. On the aforementioned page, you must enter the required personal information and choose the extent of the coverage, including the following factors.

- Medical coverage

- Baggage coverage

After customising your travel insurance for the USA plan, you need to proceed with the payment to complete the purchase. Your travel insurance USA policy will be issued immediately and available in your email inbox.

How much should I pay for a travel insurance USA plan?

The cost of your travel insurance USA plan is contingent upon the duration of your stay and several other important factors. Therefore, it is critical to have an adequate sum assured in your travel insurance for the USA plan to ensure that you have sufficient protection during the course of the trip. If you are travelling with your family, you must opt for a higher sum assured to provide them adequate coverage.

Is it mandatory to buy a medical travel insurance USA plan?

Yes, it is mandatory to have a valid travel medical insurance USA plan. Buying the aforementioned policy can help you financially safeguard your trip.

Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to TATA Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. 2008, TATA AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CIN: U85110MH2000PLC128425. IRDA of India Regn. No. 108. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] . Category of Certificate of Registration: General Insurance.

2008, Tata AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CINNumber : U85110MH2000PLC128425. Registered with IRDA of India Regn. No. 108. Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to Tata Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] .

Travel Insurance for USA from India – Buyer’s Guide

Written and researched by Michael Kays (Travel Insurance Expert) | Fact Checked by Danya Kristen (Insurance Agent).

So, you’ve decided to embark on an epic adventure from India to the land of stars, stripes, and supersized everything – the USA! As you prepare for your journey, one question likely lingers in your mind: “Do I really need travel insurance?”

In this article, we’ll dive headfirst into the world of travel insurance, peppered with humor and a dash of NRI spice, to help you weigh the pros and cons and make an informed decision.

Travel insurance is one of the most important things to have when traveling, especially if you’re going to be visiting a country like the United States.

There are many different types of travel insurance, and it can be confusing to know which one is right for you. That’s why we’ve put together this guide to help you choose the best travel insurance from India to USA for your next trip.

In this article...

Why You Need Travel Insurance for Your Trip to the USA

When planning a trip from India to the United States, it’s important to consider purchasing travel insurance.

There are many reasons why travel insurance is a good idea, including the high cost of medical care in the U.S., the risk of being injured or becoming ill while traveling, and the possibility of losing money if your trip is canceled or interrupted.

Medical care in the United States is very expensive, even if you have health insurance at home. If you become injured or ill while on your trip, travel insurance can help cover the cost of medical treatment. Even if you don’t end up needing medical care, travel insurance can provide peace of mind knowing that you’re covered in case of an emergency.

The risk of being injured or becoming ill while traveling is always present, no matter where you’re going. If you’re planning a trip to the U.S., travel insurance can help cover the cost of medical treatment if you’re injured or become sick while on your trip.

There’s also the possibility that your trip will be canceled or interrupted due to unforeseen circumstances beyond your control. If this happens, travel insurance can reimburse you for non-refundable trip expenses, like airfare and hotel reservations. Travel insurance can also provide coverage if your luggage is lost or stolen.

If you’re an international traveler to the U.S., it’s important to compare travel insurance options that are available for visitors from other countries. If you’re not eligible for regular traveler’s insurance, some companies offer coverage specifically for international travelers.

Recommended Plans

✅ Atlas America

Up to $2,000,000 of Overall Maximum Coverage, Emergency Medical Evacuation, Medical coverage for eligible expenses related to COVID-19, Trip Interruption & Travel Delay.

✅ Safe Travels Comprehensive

Coverage for in-patient and out-patient medical accidents up to $1 Million, Coverage of acute episodes of pre-existing conditions, Coverage from 5 days to 364 days (about 12 months).

✅ Patriot America Platinum

Up to $8,000,000 limits, Emergency Medical Evacuation, Coinsurance for treatment received in the U.S. (100% within PPO Network), Acute Onset of Pre-Existing Conditions covered.

Issues faced by visitors from India in USA

There are a number of issues faced by Indian visitors to the USA. One of the main issues is the high cost of living in the USA. This can be a shock for many Indians who are used to a much lower cost of living in their own country. Another issue is the difficulty in getting around in the USA.

The public transport system is not as developed as in India, and this can make it difficult for visitors to get around. Additionally, the culture shock of being in a completely different country can be overwhelming for some visitors.

Finally, the language barrier can be a problem for many Indians who do not speak English fluently. ( Source )

There are a number of health risks also that visitors to the USA face. These include:

The risk of contracting a disease from a mosquito or other insect bite.

Diseases such as Zika virus, West Nile virus, and Lyme disease are all present in the USA.

The risk of contracting a foodborne illness.

This is particularly a risk if you eat food that has not been properly cooked or that has been left out in the sun for too long.

The risk of being injured in a car accident.

The USA has a high rate of motor vehicle accidents, so it is important to be cautious when driving.

The risk of being a victim of crime.

The USA has a high crime rate, so it is important to be aware of your surroundings and to take precautions when traveling in unfamiliar areas.

The risk of being exposed to hazardous materials.

The USA has a number of industries that use hazardous materials, so it is important to be aware of the risks of exposure and to take precautions when necessary.

What does travel insurance cover?

Some health risks that travel health insurance may cover when visiting the USA include:

- Medical expenses in the event of an accident or illness

- Emergency evacuation and repatriation

- Coverage for lost or stolen baggage

- Trip cancellation or interruption

- Missed connection coverage

- 24/7 access to a team of medical and travel professionals

Best Travel Insurance from India to USA

There are many travel insurance companies in India that offer insurance for travel to the USA. Some of the best travel insurance companies in India that offer insurance for travel to the USA are Bajaj Allianz , HDFC Ergo, ICICI Lombard, and Reliance General Insurance.

There are many different types of travel insurance available in the United States, and it can be difficult to determine which one is the best for your needs.

Some factors to consider include the type of trip you are taking, the length of your trip, and the activities you will be participating in while on your trip. It is also important to consider whether you need comprehensive coverage or just basic protection.

One of the best ways to find the best travel insurance for your needs is to compare different policies and companies. There are a number of websites that allow you to do this, and they will often provide you with quotes from multiple insurers. This can help you to get a good idea of the prices and coverage options that are available.

When you are looking at different policies, it is important to read the fine print carefully. Some policies may exclude certain activities or destinations, and you need to make sure that you are aware of these exclusions before you purchase a policy. You should also be aware of any deductibles that apply, as this can impact the overall cost of the policy.

Once you have compared different policies and companies, you should select the one that offers the best coverage for your needs at the most affordable price.

There are many travel insurance plans available for visitors to the USA, but some of the best include:

Safe Travels USA Cost Saver

Safe Travels USA Comprehensive

Patriot Platinum

Visitors Care

Patriot International

Patriot America

Patriot America Plus

Atlas America

Additionally, you might also consider these plans.

- Travelex Insurance Services TravelSafe

- Allianz Global Assistance Classic

- Generali Global Assistance Basic

- AXA Schengen

- Beazley Blue

- Cigna Global Explorer

- GeoBlue Voyager Choice

- HTH Worldwide TravelGap Explorer

- iTravelInsured LX

- John Hancock Travel Protection Essential

- MH Ross Travel Protector Basic

1. Do your research

There are many factors to consider when researching travel insurance. Some important things to think about include:

-What type of coverage do you need? -How much coverage do you need? -What is your budget? -What is the policy excess?

Some other things to keep in mind when researching travel insurance include reading the policy terms and conditions carefully, understanding what is and is not covered by the policy, and find out if there are any exclusions.

It is also a good idea to get quotes from a few different insurers to compare coverages and prices.

2. Consider your needs

When considering travel insurance, it is important to think about what kind of coverage you need. Do you need medical coverage? Do you need coverage for lost luggage? Do you need trip cancellation insurance?

Once you know what kind of coverage you need, you can compare different policies to find the one that best meets your needs. Be sure to read the fine print so that you understand what is and is not covered by your policy.

3. Compare policies and prices

When you are buying travel insurance, it is important to compare policies and prices in order to get the best coverage for your needs. There are a variety of factors to consider when choosing a policy, and by comparing policies you can be sure to find the one that best meets your needs. In addition, by shopping around for travel insurance, you can be sure to get the best price possible.

4. Read the fine print

When you are buying travel insurance, it is important to read the fine print so that you know what is and is not covered. For example, some policies may not cover you if you have to cancel your trip due to a medical emergency. Others may only cover you for a certain amount of money if you lose your luggage.

It is also important to know what exclusions there are in your policy. For example, some policies may not cover you if you are participating in an adventure activity such as bungee jumping.

Make sure you understand all the terms and conditions of your policy before you buy it. That way, you can be sure that you are getting the coverage you need.

5. Check reviews

When you are buying travel insurance, it is important to check the reviews to see what other people’s experiences have been. This can help you decide if the company is reputable and if the policy is right for you. It is also a good way to find out if there have been any problems with claims or customer service.

6. Determine coverage for preexisting conditions

When considering travel insurance, it is important to determine if your policy will cover preexisting conditions. A preexisting condition is any medical condition that you have before buying a policy. Many policies exclude coverage for preexisting conditions, so it is important to read the fine print and understand the limitations of your policy. If you have a preexisting condition, you may still be able to get coverage by purchasing a policy that includes a waiver for preexisting conditions.

7. Find out what’s not covered

When you are buying travel insurance, it is important to find out what is not covered in the policy. This can help you to avoid any surprises when you need to make a claim. For example, many policies will not cover you for lost or stolen items, so if this is a concern for you, you will need to find a policy that does cover this.

8. Compare deductibles

When you are buying travel insurance, it is important to compare deductibles. The deductible is the amount of money you will have to pay out of pocket before your insurance policy kicks in. A higher deductible means that you will have to pay more out of pocket if something happens, but it also means that your premiums will be lower. You should consider how much you are willing to pay out of pocket and how much coverage you need when you are comparing deductibles.

9. Consider your trip length

When you are buying travel insurance, it is important to consider the length of your trip. This is because the length of your trip will affect the type and amount of coverage you need. For example, if you are going on a long trip, you will need more coverage than if you are going on a short trip.

What to Look for When Buying Travel Insurance

When you are buying travel insurance, there are a few things you should look for in order to get the best coverage for your needs. First, you should make sure that the policy covers medical expenses in the event that you become ill or injured while on your trip. It is also important to check what the policy covers in terms of lost or stolen luggage, as well as cancellations or delays.

You should also make sure that the policy covers any activities you plan to do on your trips, such as hiking or skiing. Finally, it is a good idea to read the fine print of the policy to make sure you understand all of the exclusions and limitations.

Benefits of Travel Insurance when traveling from India to USA

If you’re planning a trip from India to USA, you may need to purchase visitors medical insurance. This type of insurance is different from regular health insurance and is designed to cover medical expenses while you’re traveling. Short-term health insurance may also be an option if you’re only planning to be away for a short period of time.

There are many benefits to having travel insurance when traveling from India to the USA. Travel insurance can cover medical expenses, trip cancellation, lost or stolen luggage, and other unforeseen expenses. It can give you peace of mind knowing that you and your family are protected while traveling.

How to Make Sure You’re Covered by Travel Insurance

When you’re planning a trip, it’s important to make sure you’re covered by travel insurance in case of any emergencies. Here are a few tips to help you choose the right policy:

- Make sure you understand what is and isn’t covered by your policy. Some policies only cover certain types of emergencies, so it’s important to know what you’re covered for.

- Choose a policy with a reputable company. There are many travel insurance companies out there, so make sure you choose one that is reputable and has a good track record.

- Make sure you read the fine print. Many policies have exclusions and limitations, so it’s important to read through the policy carefully to make sure you understand what’s covered.

- Get quotes from multiple companies. Once you know what you’re looking for, get quotes from several different companies to compare prices.

- Buy your policy early. Some policies have a waiting period before they go into effect, so it’s important to buy your policy well in advance of your trip.

Following these tips will help you make sure you’re covered by travel insurance in case of an emergency.

Why buying travel insurance from USA is better

There are a few reasons why buying travel insurance from USA is better than buying travel insurance from Indian companies. One reason is that the insurance companies in USA are more experienced and have been in business for longer.

This means that they are more likely to be able to provide better coverage and assistance if you need it. Another reason is that insurance companies in USA are subject to stricter regulations than those in India. This means that they have to meet higher standards in terms of the cover they provide and the service they offer.

Finally, buying travel insurance from a US company usually gives you access to a wider range of benefits and assistance services than you would get from an Indian company.

No matter where you’re traveling, be sure to purchase travel insurance. It’s always better to be safe than sorry, and you never know when an emergency might occur. If you’re planning a trip to the USA from India, be sure to read this guide to choosing the best travel insurance for your needs.

Healthcare costs in India are much lower than in developed countries, making it a popular destination for medical tourism. However, Indian insurance providers generally do not cover international patients, so it is important to purchase travel insurance before traveling to USA from India.

If you’re an Indian citizen traveling abroad , you should know that your regular health insurance policy probably won’t cover you in the event of a medical emergency.

That’s why it’s a good idea to purchase travel insurance, which will cover medical emergencies as well as other travel-related problems like lost luggage or trip cancellation. There are many different travel insurance plans available, so be sure to compare a few before choosing one that’s right for you.

If you are an Indian origin traveling internationally, it is important to have travel medical insurance in case of any emergencies. Travel medical insurance can help cover the cost of medical treatment and evacuation if you need it while you are traveling.

Get Free Consultation

January 24, 2020

January 23, 2020

January 22, 2020

January 21, 2020

January 16, 2020

Nationwide Prime Travel Insurance Review

September 21, 2023

Nationwide Luxury Cruise Travel Insurance Review

Nationwide choice cruise travel insurance review, nationwide universal cruise travel insurance plan review, nationwide essential travel insurance plan review, all clear travel insurance – all you need to know.

August 4, 2023

CoverMore Travel Insurance: Everything You Need to Know

Staysure travel insurance: everything you need to know, post office travel insurance – everything you need to know, argentina expatriate health insurance – ultimate guide.

August 2, 2023

Visitcover.com is a travel insurance review portal that will help you choose the right travel insurance plan for your next trip. By bringing you unbiased, fact-checked, verified information about travel insurance companies, plans, claim processes, and everything that's usually mentioned in the fine print. Make informed decisions, with us!

Opening hours

09.00 - 22.00

09.00 - 18.00

09.00 - 16.00

4422 Flamingo Villas, Ajman Media City, United Arab Emirates

Call Us: +1-972-985-4400

© 2023 VisitCover.com

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

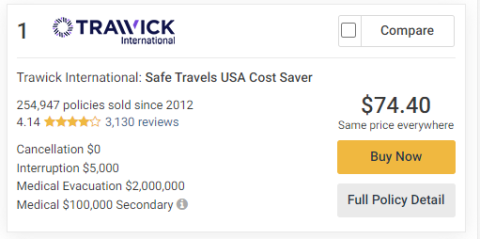

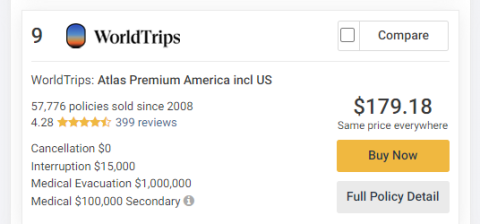

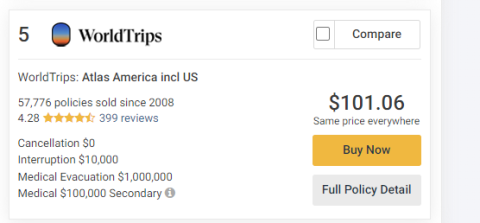

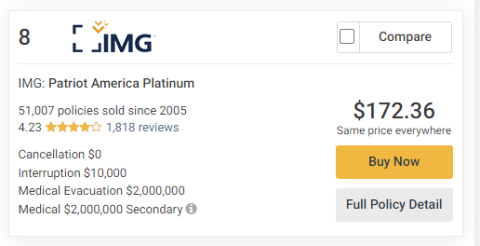

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?