Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- The Extra Mile

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Member News AAA's Take KeeKee's Corner AAA Traveler Worldwise Foodie Finds Good Question Minute Escapes Car Reviews

WHAT’S COVERED, COSTS, AND TIPS ON FINDING THE BEST TRAVEL INSURANCE FOR YOUR NEEDS

March 28, 2024 | 5 min read.

Travel insurance can be an overwhelming expense to consider atop an already costly vacation. Admittedly, even as a seasoned travel industry professional with three decades of globe-trotting under my belt, I have a moment of pause each time I’m confronted with this. Ultimately, I almost always purchase some travel insurance coverage, especially when it’s a complex international trip. It’s primarily motivated by my aging parents—heaven forbid anything should happen to them—and wanting a safety net to return home at a moment’s notice without incurring massive out-of-pocket costs. This parental paranoia is just a small piece of the greater solace that travel insurance can provide, says AAA Tour Product Manager Randy Osborne. “Everyone can benefit from travel insurance,” he says. “The unexpected happens. It can provide peace of mind and reduce stress during a traumatic situation, as well as a contact to call when traveling abroad.” Osborne has seen it all. He works directly with AAA Travel Advisors and AAA’s preferred travel insurance provider, Allianz . It’s a vantage point that continually provides him with real-life cautionary travel tales. “I’ve never heard of anyone who needed and used travel insurance regretting having purchased it,” Osborne says. He says the biggest mistake people make is this: “Not getting it at all.” Here are some key things to keep in mind when navigating travel insurance

IT’S A FINANCIAL SAFETY NET FOR YOUR VACATION INVESTMENT There is no “one-size-fits-all” travel insurance plan, says Osborne, since available plans will be based on the trip cost, vacation destination(s) and age of the traveler(s). Most comprehensive travel insurance plans, however, will include varying degrees of coverage for the following:

- Trip Cancellation: This is a predeparture benefit that provides the ability to recoup travel costs if you cannot travel. It’s typically limited to specific reasons covered in the plan. Osborne advises understanding what these covered reasons are upfront when reviewing plan options.

- Trip Interruption: This helps if you need to cut your trip short. Covered reasons typically include an illness or injury during the trip, or a family emergency at home—which, as mentioned earlier, has always been this author’s primary motivator to purchase travel insurance.

- Travel Delays: This helps to cover expenses if your travel is delayed due to a covered reason. Osborne advises understanding what constitutes a “travel delay” within the travel insurance plans you are considering.

- Medical Expenses: This helps to cover unforeseen medical expenses while traveling to destinations where your U.S.-based health insurance may not work. “Frequently, the biggest covered amounts are for medical,” Osborne says.

- Emergency Evacuation Coverage: This typically helps to cover the cost of transportation (plus related medical services and supplies) to a medical facility if you’re seriously injured or ill. The best plans will provide up to $1 million per person for medical evacuation. This can seem high, but evacuation costs can exceed tens of thousands of dollars, especially if you’re traveling to a remote destination.

- Baggage Loss or Delays: This helps to recoup costs for lost luggage, as well as damaged or stolen baggage while you are on your trip.

COMPARE PLANS

In some cases, such as when booking a cruise or a guided group tour vacation, the travel provider may require you to purchase a certain level of travel insurance before you can join the excursion. In these situations, representatives often have options that allow you to bundle travel insurance into the cost of the vacation at the time of booking. Even if this is the case, however, Osborne says it pays to shop around and compare travel insurance plans to see if there is a policy that better suits your needs.

Most travel insurance companies, including Allianz Insurance, have easy-to-use websites that highlight several levels of travel insurance for your trip. These quotes can be used as baselines for building upon or removing elements. Gather a few online quotes, then speak over the phone with a representative to customize.

SEEK PROFESSIONAL GUIDANCE

Allow a AAA Travel Advisor to guide you through the process and identify a travel insurance policy that works for your needs, risk tolerance, and budget. The best part: This service is free.

PURCHASE EARLY FOR THE MOST BENEFITS

You’ll get the best and most comprehensive coverage if you purchase travel insurance within the first 14 days of making a trip deposit. (That clock starts ticking once you put a down payment on any part of the vacation.) The biggest benefits include:

- Trip Cancellation: The earlier you buy travel insurance, the sooner you are protected—even before you step on that plane, train, or cruise ship. “Often I get calls from travelers who didn’t expect to need insurance and then have a [medical] diagnosis before travel that prevents them from going,” Osborne says.

- Better Trip Cancellation Coverage Options: Many travel insurance companies offer more covered reasons for trip cancellation if you purchase it within 14 days of making an initial trip deposit.

- Pre-Existing Medical Conditions: If you have a pre-existing medical condition, most travel insurance will not cover medical situations due to this condition that arise during your travels— that is, unless you purchase comprehensive travel insurance coverage within the first 14 days of making a trip deposit.

ASSESS MEDICAL COVERAGE CAREFULLY, ESPECIALLY IF YOU HAVE A PRE-EXISTING CONDITION

Most U.S.-based health insurance plans won’t offer medical coverage on non-U.S. soil. Even if you have outstanding health insurance, it may not be very helpful during an international vacation where unexpected medical and health issues arise. This is certainly the case if you’re traveling to more remote areas with limited medical facilities or your vacation includes high-risk excursions and activities. Osborne says it’s important to understand whether travel insurance you’re considering offer primary or secondary medical coverage, and to assess which is best for you.

If you have a pre-existing medical condition or chronic health problems, medical coverage is an especially critical piece of the policy to scrutinize, Osborne says. He recommends consulting a travel insurance specialist so that you are covered accordingly.

UNDERSTAND WHAT IS NOT COVERED IN THE POLICY It’s easy to focus on what’s included when comparing trip insurance plans. Osborne recommends paying close attention to what is excluded from coverage, too.

Case and point: I recently read about a couple who booked a return flight home after their original flight had been cancelled. When the couple filed a claim with their insurance provider to recoup this cost of this new flight, they learned that this specific scenario was not covered under the policy. (The flight was cancelled due to crew not arriving on time, and the airline was able to rebook the couple on a less-desirable flight home, which the couple declined.)

Clearly understanding the exclusions—and this could be achieved with a simple phone call to the insurance provider’s customer service—could have prevented this financial oops. BE

Find An Agent

AAA Travel Advisors can provide vacation planning guidance to make your next trip unforgettable. Find a Travel Advisor

CAREFUL RELYING ON CREDIT CARD TRAVEL INSURANCE Just as you should not rely on your U.S.-based health insurance to cover you while traveling internationally, it’s wise to not make assumptions about a credit card that offers travel insurance as one of its perks. Osborne advises reviewing the credit card’s travel insurance coverage amount; the medical coverage policy; whether all trip purchases need to be made with that credit card; and if approved claims results in a cash refund or a travel credit.

EPIDEMIC AND PANDEMIC COVERAGE IS AVAILABLE The events of 2020 turned travel on its head, and also impacted the travel insurance industry. As a result, travel insurance companies evolved and most now offer epidemic and pandemic coverage options. “Having coverage for quarantine is at the forefront of people’s minds now,” says Osborne, pointing to the out-of-pocket costs that came with many travelers having to quarantine in a vacation destination when Covid-19 was at a peak. BUDGET FOR TRAVEL INSURANCE The average cost of travel insurance is 5% – 6% of your trip costs, according to Forbes Advisors’ analysis of travel insurance rates. If you’re planning an international, bucket-list vacation—and want to protect your investment in the unfortunate event that things go sideways—it’s wise to keep this cost in mind when creating your trip budget. “As much as we don’t want to think about the unexpected, things happen and having the coverage you need when you need it can be a huge benefit,” says Osborne. “If you need it, you will never regret having it.

- facebook share

- link share Copy tooltiptextCopy1

- link share Copy tooltiptextCopy2

Our Secret, Free Way to Get Through Airport Security Faster

3 Luggage Tracking Devices You Need to Know About

4 Ways to Tell if Travel Reviews are Trustworthy

Related articles.

What Does Cruise Insurance Cover?

Which Trusted Travel Program is Best For You?

How to Reduce the Chances Your Flight Will Be Canceled

Limited Time Offer!

Please wait....

Guide to Travel Insurance Options for AAA Members

AAA Membership is a smart investment for people taking road trips and needing help in an emergency. If you get stuck by the roadside you can call AAA!

Trip Insurance is a smart investment if you want to protect your trip from any unforeseen events like flight delays, trip cancellations, or trip interruption. If you are in a dire situation overseas you can call the concierge services if provided in your travel coverage.

A Trip Insurance policy also covers travel risks, medical risks, flight disruptions, etc. Having these risks covered adds an extra layer of protection against financial loss.

Medical Emergencies come un-invited. When you travel domestically within the United States your health insurance coverage options may protect you from such medical emergencies. During international travel, your domestic insurance may not protect you overseas, this is where travel insurance comes into play.

Travel insurance can relatively be inexpensive after taking into account how much you will have to pay out of your pocket if something goes wrong during your trip: trip cancellation, accidents, baggage loss, and medical expenses can quickly add up.

If you are still thinking if travel insurance is worth it then see The Top 10 Reasons to Buy Travel Insurance .

As a AAA member, you must be familiar with AAA Insurance, did you know that with AAA Insurance you can also consider buying AAA Travel Insurance?

Let’s get to know what is AAA, and what travel insurance options are they offering. This AAA Travel Insurance Review may help you in evaluating if this is a good option for your next trip.

For Costco Members, we have covered Costco Travel Insurance .

Table of Contents

What is AAA?

AAA (pronounced as ‘Triple A’) stands for American Automobile Association. It is a not-for-profit federation of 32 motor clubs with more than 1,000 offices throughout the United States. Established in 1902 by nine motor clubs with less than 1,500 members, AAA serves more than 61 million members today.

The AAA offers travel services such as hotels, cars, flights, cruises, and travel information, as well as member savings, automotive repair services, insurance, and financial services.

Since its founding, the association has been an advocate for motorists, safer roads and vehicles, better-educated drivers, and the rights of travelers.

Does AAA offer Travel Insurance?

Yes. AAA offers several travel insurance policies through its partnership with Allianz Global Assistance, a world leader in the travel insurance and assistance industry.

Allianz Global Assistance is a part of the Allianz Group. Allianz is of the world’s largest insurers, with 40 million customers in the United States, and operating in 35 countries.

You don’t have to be an AAA member to buy AAA travel insurance.

Note: Travelers who contracted COVID-19 before or during their trip can make use of temporary claim accommodations provided by AAA travel insurance partner Allianz Global Assistance. You can stay informed about the most recent coverage guidelines by consulting your AAA Trip Advisor. Always read the policy document carefully before you purchase travel insurance.

If you need assistance when traveling abroad, the Allianz travel insurance partner’s resources are available through the AAA Mobile app.

If you do have a AAA membership and plan to travel shortly or you are thinking of getting a AAA membership for its benefits, we cover AAA travel insurance options in this blog.

Compare Travel Insurance Plans

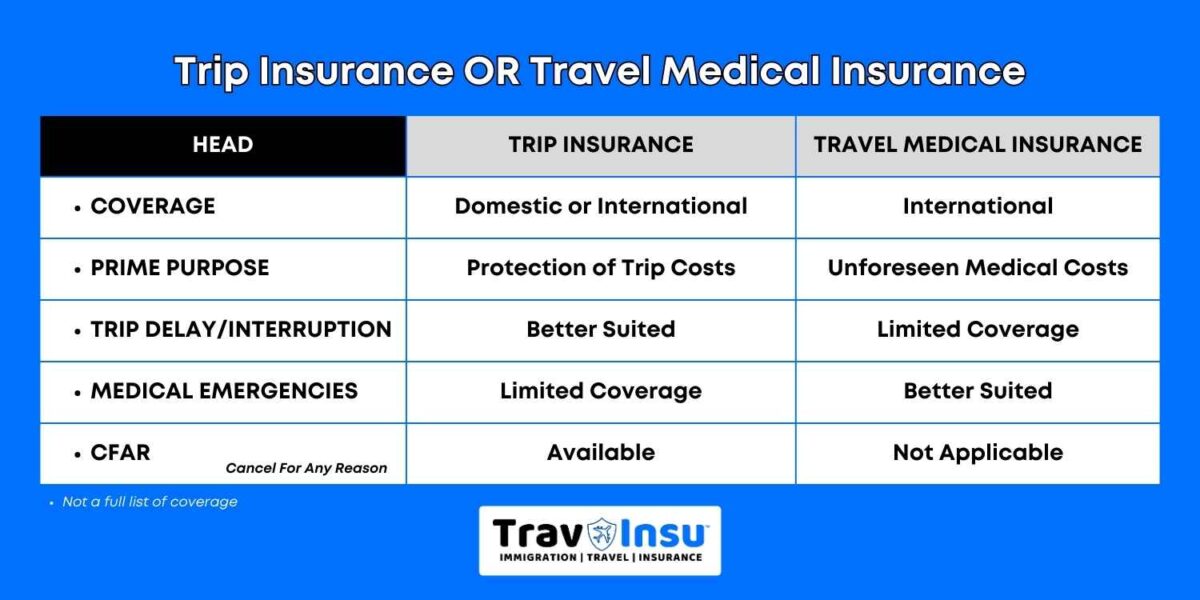

What is the Difference between Trip Insurance and Travel Insurance?

Trip Insurance and Travel Insurance are used interchangeably for buying insurance when you travel, but are these different?

There are some significant differences when it comes to Trip Insurance and Travel Insurance.

For Domestic travelers, Trip Insurance is a more suitable form of coverage option. Trip cancellation coverage and trip interruption coverage really come in handy when you need to use them.

The prime objective of TripInsurance is to offer protection to your financial investment in the Trip Costs, everything else follows.

The prime objective of Travel Insurance is to provide you protection against unforeseen medical expenses when you travel.

Travel Insurance is also known as Travel Medical Coverage or Travel Medical Insurance, it is also popularly known as Visitors’ Insurance.

You can buy either of these coverage options for a single trip or for multiple trips.

Best Travel Insurance Plans:

- Atlas America Insurance

- Safe Travels USA Comprehensive

- Safe Travels USA Cost Saver

- VisitorSecure Fixed Benefit Plan

Guide on How Travel Insurance Works? gives a detailed understanding of the benefits.

If your next trip is a group travel then our article on Travel Insurance for Groups may be of interest to you.

AAA Travel Insurance Plans and Costs

There are two types of AAA Travel Insurance Plans both for domestic and international travel:

- Single Trip Travel Insurance Plans

- Annual Travel Insurance Plans

The policies will differ by US state and the travel destination. So the plans available in your home state vary with other states. An annual plan is better suited for frequent travelers taking multiple trips a year.

Single Trip Plans

AAA’s single-trip plans will provide coverage for one trip where you are leaving home, traveling for a time (a month or less), domestic or international, and then returning home. It doesn’t matter if you go to multiple destinations as long as you leave your home and return home only once, it is considered a single trip.

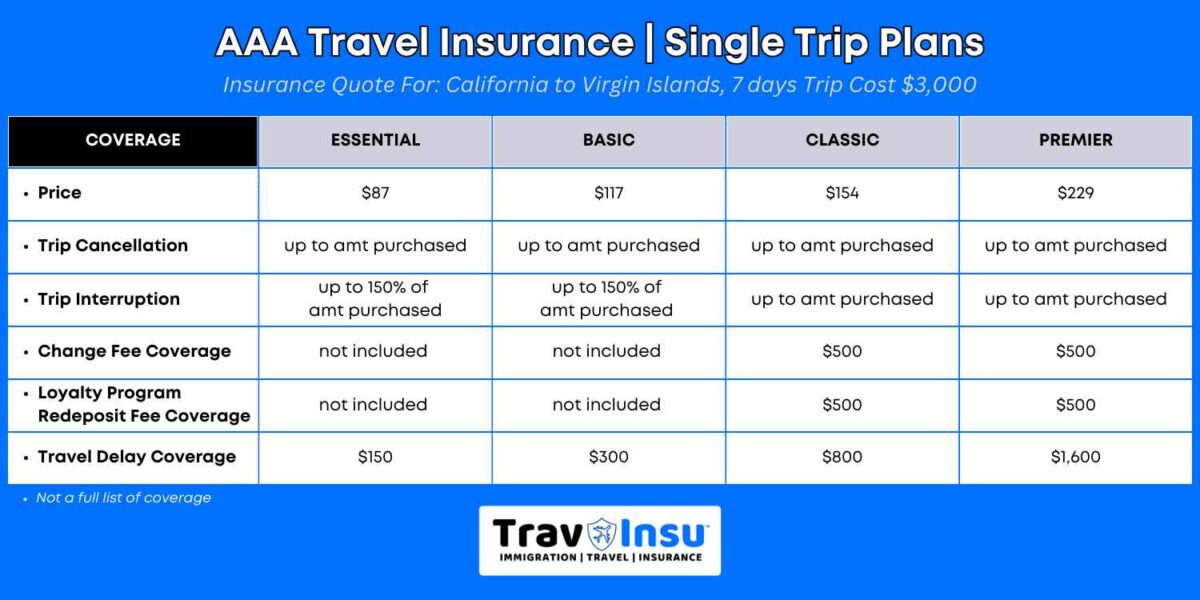

AAA offers 4 different Single-Trip Insurance Plans:

- Essential Plan

- Classic Plan

- Premium Plan

Let’s take a look at the pricing and coverage of each plan for a person aged 43-year-old traveling on a weeklong vacation from California to the Virgin Islands with a total trip cost of $3,000.

The Essential Plan ($87)

- Travel Delay: $150

The Essential Plan is AAA’s lowest-priced plan and hence ideal for the domestic traveler who just wants trip cancellation and trip interruption insurance but does not need other protection or benefits.

It has no medical coverage or evacuation benefits, and no baggage loss coverage.

If you already have health insurance in the U.S. and don’t have the plan to bring business equipment, this is a good travel insurance option.

The Basic Plan ($117)

- Travel Delay: $300

- Baggage Coverage: $500

- Emergency Medical Transportation: $50,000

- Medical Emergency/Dental Coverage: $10,000

The Basic Plan has all the features of the Essential Plan, plus medical coverage and increased coverage for baggage loss/delay and travel delays.

It offers $10k in Emergency Dental and Medical coverage which can be just enough for domestic travel if your health insurance can help out. And the $50k in Emergency Transportation may only be adequate for travel within the USA.

Out-of-state or international travel expenses could add up quickly.

This plan is an affordable option for weekend getaways and overnight trips and may not be sufficient for international destinations.

The Classic Plan ($154)

- Change Fee Coverage: $500

- Loyalty Program Redeposit Fee Coverage: $500

- Travel/Trip Delay: $800

- Baggage Coverage: $1000

- Baggage Delay Coverage: $300

- Emergency Transportation: $500,000

- Emergency Medical/ Dental Coverage: $50,000

The Classic Plan has increased coverage for Emergency Transport, baggage coverage, and travel delays, with additional features from the basic plan.

Another version of the Classic Plan is with RTW ($211.00) with the same benefits except the Medical Emergency/Dental coverage is lower at $25,000.

The Classic plan also offers a “Cancel For Any Reason – CFAR” optional upgrade at an extra cost.

The Premier Plan ($229)

- Travel/Trip Delay: $1600

- Baggage Coverage: $2000

- Baggage Delay Coverage: $600

- Emergency Transportation: $1,000,000

The Premier plan is almost identical to the Classic plan but with 2 times the Emergency Transport, baggage coverage, and limits for trip delays.

This plan is the most expensive since it offers the highest coverage options.

However, it would be beneficial to have higher medical coverage benefits. At least, $100k in medical coverage is preferable since hospitals can often charge an average of $4k per day. $50k in medical coverage will fly past quickly should you have a serious injury.

$1m in Emergency Transportation is extremely high. It is preferable to have more medical coverage instead.

Please Note: Coverage benefits and insurance premiums are subject to change, always check for current information in the plan document.

Annual Plans

The Annual Travel Insurance Plan which is also called Multi-Trip Insurance provides 365 days of domestic and international coverage from the date the policy starts (date the policy is effective).

The plan is designed for frequent travelers, especially business travelers. So if you plan to travel more than once a year, domestically or internationally, it is better to buy a multi-trip policy instead of buying separate travel insurance.

Traveling Domestic? Have you heard of Skiplagged ? Skiplagged is a travel hack used by savvy travelers to save money on their flights.

AAA Travel Insurance offers two different annual travel plans:

- Annual Deluxe

- Annual Executive

The Annual Deluxe Plan

The Annual Deluxe Plan is a good option if you don’t need business equipment protections or pre-trip cancellation benefits. But you want to have medical coverage while you are traveling abroad.

This plan is only sufficient if you already have some travel insurance through a credit card.

- Travel Delay: $600

- Baggage Delay: $200

- Emergency Transportation: $100,000

- Emergency Medical: $20,000

- Rental Car Damage & Theft: $45,000

- Travel Accident: $25,000

The Annual Executive Plan

The next three Annual Executive Plans are tier based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500, or $10,000). All the rest of the features under the Executive Plans are identical.

The three plans include business equipment coverage as well as business equipment rental and delay protections.

- Travel Delay: $1600

- Baggage Delay: $1000

- Business Equipment Coverage: $1000

- Business Equipment Delay/Rental: $1000

- Emergency Medical Transportation: $250,000

- Emergency Medical: $50,000

- Travel Accident: $50,000

If you are traveling for work frequently, these plans may be suitable for you. However, do note that a single trip in these four annual plans cannot exceed 45 days.

Rental Car Damage Protector Plan

This protector plan provides $1,000 of trip interruption and baggage loss coverage and $40,000 of car damage and theft coverage.

If the rental car is stolen or damaged, this protection will cover your expenses. If your baggage gets lost or damaged, you will also be compensated for the period of your trip that was not used. This is an alternative to purchasing car insurance coverage at the rental counter.

Which AAA Travel Insurance plan is the best?

The best AAA Travel insurance plan will depend on what type of coverage you are looking for.

Before shopping for a travel insurance policy, check what coverage you already have. Some premium credit cards offer travel insurance provided the bookings are made using the credit card. If you already have such a credit card and the coverage options are adequate, you may only need a standalone emergency health insurance policy.

For example, the Business Platinum Card from American Express offers $10,000 per trip and $20,000 per year in trip cancellation insurance. The Annual Executive Plan has a comparable level of trip cancellation coverage.

If the coverage provided by your credit card is not enough, or you don’t have credit card coverage, then you should get a comprehensive plan such as single or annual trip plans, depending on your travel needs.

AAA offers a few plans, but your choices will depend on whether you are looking for annual or single-trip insurance plans. And the rates and options will differ by state, so be sure to enter your details correctly when looking for the right plans.

If you are a Senior Traveler, you can get more information from this Senior Travel Insurance Guide .

What is not covered by Travel Insurance?

There are many benefits of buying travel insurance but you have to be aware that your insurer cannot cover you under all circumstances. Always read the policy documents carefully to understand the inclusions, exclusions, limits, and restrictions before you decide on the travel insurance policy.

You will have to pay attention to know exactly what type of coverage you are getting.

Here are some expected exclusions:

- Adventure Sports and Activities : Most travel insurance plans will not have coverage options for adventure sports like skydiving, rafting, mountaineering, bungee jumping, scuba diving, and other types of high-risk sporting activities that are life-threatening. You will be taking part in these activities at your own risk, some high-risk activity coverage may be available as add-on benefits.

- Natural Calamities: Travel insurance usually covers unpredictable natural calamities such as earthquakes, hurricanes, pandemics, etc. But if you bought the travel insurance policy after the event has already taken place or the government released the notice of the calamity, then you will not be eligible to claim for any loss or damage.

- Intentional Behavior: Losses brought on by self-inflicted harm, drug use, intoxication, and criminal activity are not part of the travel insurance coverage options.

It’s important to note that exclusions may differ depending on the policy and where you reside, so it’s always smart to read the fine print to make sure you understand what is and isn’t covered.

Frequently Asked Questions

Yes. AAA offers travel insurance in partnership with Allianz Global Assistance. However, the travel insurance coverage option will depend on your state of residence and the length of your trip. There are various options for single trips and annual trips.

Single-trip plans are the best choice for travelers who are going from their place of residence to another location (whether it’s domestic or international) and then returning. Annual trip plans are made for those who intend to take multiple travels in a year, regardless of how frequently they return home.

Is Travel Insurance included with AAA Membership?

There is no travel insurance be it international travel insurance or domestic travel insurance, included with membership, but you can purchase AAA travel insurance from their website. However, the AAA membership plan offers several benefits as we have discussed.

Does AAA offer International Travel Insurance?

Yes, international travel is covered by AAA’s travel insurance products through their partnership with Allianz Global. To check the plans that are best suited for you, you can visit the AAA travel insurance site and get a quote.

Does AAA provide international benefits?

Many international Motoring Clubs participate in AAA Global Discount Programs. Members of these clubs are eligible to get discounts when traveling internationally thanks to AAA’s international partnerships (attractions, museums, hotels, retail stores, and restaurants).

How much does AAA Travel Insurance cost?

The length of your trip, where you live, the destination you are visiting, your age, and the level of coverage you choose are just a few of the factors that influence how much your AAA Travel Insurance cost will be.

Do all Credit Cards come with Travel Insurance?

Travel insurance is not a given with all credit cards. In some cases, you might be able to pay extra to get policies like emergency medical coverage or trip cancellation and interruption through your credit card provider.

Depending on the card type and the credit card issuer, the credit card can offer a variety of insurance coverage. These are often high-end credit cards that provide travel insurance. You’ll receive information on all of the insurance’s features along with your credit card’s welcome package.

Do Trip Insurance and Travel Medical Insurance cover the same things?

Both trip insurance and travel medical insurance have similarities and distinctions between the two types of coverage. The purpose of trip insurance is to safeguard your financial investment in a trip, whereas travel insurance offers more options for medical coverage.

Does Travel Insurance Offer Coverage for Pre-Existing Medical Conditions ?

Travel insurance is designed to provide coverage for any new sickness or injury, most travel insurance plans do not cover pre-existing conditions. Some plans do offer coverage for the acute onset of pre-existing medical conditions.

Is it worthwhile to purchase Travel Insurance?

Yes, it can give you peace of mind that you will likely be covered financially if something goes wrong while on vacation. Your coverage will be useful in the event of a canceled flight, lost or damaged luggage, or medical attention in an emergency.

Most policies are not very expensive, so it is worth paying the premium to have some financial protection for your trip.

Although it’s never fun to anticipate unforeseen circumstances that can cause your trip to be cut short, think carefully before opting not to get a policy about how much risk you’re ready to accept. This will help you figure out if travel insurance is worth buying.

What is Emergency Medical Evacuation? Can I be sent to my home country during medical evacuation?

In a life-threatening situation, if you need medical evacuation, the cost of medical transportation to the nearest adequate medical facility where you can receive treatment is covered as part of your medical evacuation in an emergency. The medical evacuation generally is only to the nearest medical facility where you can receive treatment. Medical evacuation in an emergency is essential to save your life, read the policy document carefully to understand what circumstances are eligible for evacuation to your home country if your plan provides this benefit.

Is AAA membership worth it?

AAA membership offers a wide range of discounts and benefits. The perks stretch beyond automotive benefits with discounts and offers available for all types of travel including flights, hotels, vacation planning, and much more. Also, AAA offers a variety of insurance products, such as life, home, auto, and AAA travel insurance.

The main downside is that it may not be for everyone. If you are not a frequent traveler who is taking advantage of roadside assistance, emergency services, or travel discounts, the membership fee you are paying can be a waste of money. Also, the discounts are offered only by the AAA partners, so certain auto repair shops, hotels, and car rental services will not be offering discounts to AAA members.

Emergency roadside assistance may also be provided as a value-added service or an add-on at a nominal cost to your vehicle insurance policy do check with your insurance company.

Compare to the other insurers who are providing similar services, AAA insurance offerings tend to be costlier.

Ultimately, the worth of an AAA membership will depend on how frequently you plan to use their services. If you travel extensively and want to feel secure, AAA will provide you with the services you require quickly and affordably.

The Bottom Line

AAA is a great organization and they have a lot to offer. They have partnered with Allianz an insurance company of repute. Allianz is one of the world’s largest insurers and their plans are provided by AAA travel insurance. In the global insurance market, Allianz has one of the highest insurance ratings.

According to our AAA travel insurance review, the plans can be expensive and offer fewer travel medical benefits. We suggest that you shop around to find lower prices with more comprehensive travel insurance coverage. Many different insurers offer cheaper travel insurance with comparable or even greater travel perks.

Share this page:

Related articles.

Visitors Care Insurance Information, Benefits And Eligi

What Is Acute Onset Of Pre-Existing Conditions

International Travelers Guide To Optimal Travel Medical

- Popular Articles

Visitors Care Insurance Information, Benefits And Eligibility

A Complete Atlas America Insurance Review [2024]

Top 10 Busiest Airports In The World – March 2024

International travelers guide to optimal travel medical insurance.

INF Premier Insurance Information, Benefits And Eligibility

Best Visitors Insurance Plans For USA – [2024]

Accidental Death Travel Insurance – A Complete Guide

US Visitor Visa Interview Questions- B1/B2 Visa

TravInsu is here to help you with all your travel insurance needs. If you are planning an international trip or thinking of inviting your parents to visit you in the United States, TravInsu can help.

- Featured Articles

- Immigration

- Privacy Policy

- Disclaimer of Liability

© Copyright 2024. All Rights Reserved. TravInsu

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers, top credit cards with travel insurance, methodology, best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at no extra cost.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Special medical insurance for ship captains and crew members, international students and missionaries.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

Here is the list of travel cards offered by Chase that include various forms of travel insurance.

Having one of these in your wallet is a good start to protecting your travel investments and preventing expensive accidents; however, savvy travelers check card terms closely and sometimes supplement with a third-party policy, like from one of the companies above, to better protect themselves.

on Chase's website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 12 hours.

• Car rentals: Theft and collision damage for most cars in the U.S. and abroad.

• Trip cancellation: Up to $1,500 per person and $6,000 per trip.

• Trip interruption: Up to $1,500 per person and $6,000 per trip.

• Baggage delay: Up to $100 per day for three days.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Is AAA membership worth it?

I've been a AAA member for more than 15 years, and I can confidently say that the perks and benefits have come in handy — especially the well-known roadside assistance benefit.

Over the years, AAA has opened up its network to provide vast options and money-saving discounts for travelers beyond roadside assistance.

I'm also partial to the regional magazine AAA produces six times a year; Arizona's is called Via and California's is called Westways. Each issue is full of travel inspiration and valuable tips. AAA even has a travel service you can use to book vacations.

How I've used AAA benefits

Living in Arizona, you can expect that your car battery will not survive more than two years due to the heat. In my case, the two-year timing always seemed to happen in August — the hottest month of the year. I have called AAA on more than one occasion to take advantage of its mobile battery service , and workers have come to my location with a new car battery.

Usually, they will test your current battery power and sell you a new one on the spot if needed. Members receive a $25 discount on batteries purchased during the on-the-spot installation. They even offer a battery warranty, so there's a chance if you purchased your last battery from AAA, your replacement might be free.

It has been a fantastic time saver and more convenient than getting jumper cables and making it to the nearest auto shop. Additionally, AAA membership covers the individual, not just the vehicle. So, you can use your membership for a service call even if you're a passenger in a stalled car.

To request 24/7 roadside assistance , use the AAA online assistance tool, call 800-AAA-HELP (800-222-4357) or you can text HELP to that same phone number and follow the prompts from there.

According to the AAA website, response time varies depending on several factors including time of day, breakdown location, and severity of the issue, and that AAA strives to provide the fastest and most efficient service possible. If you make your request online, you can track the progress of your request and the location of your technician.

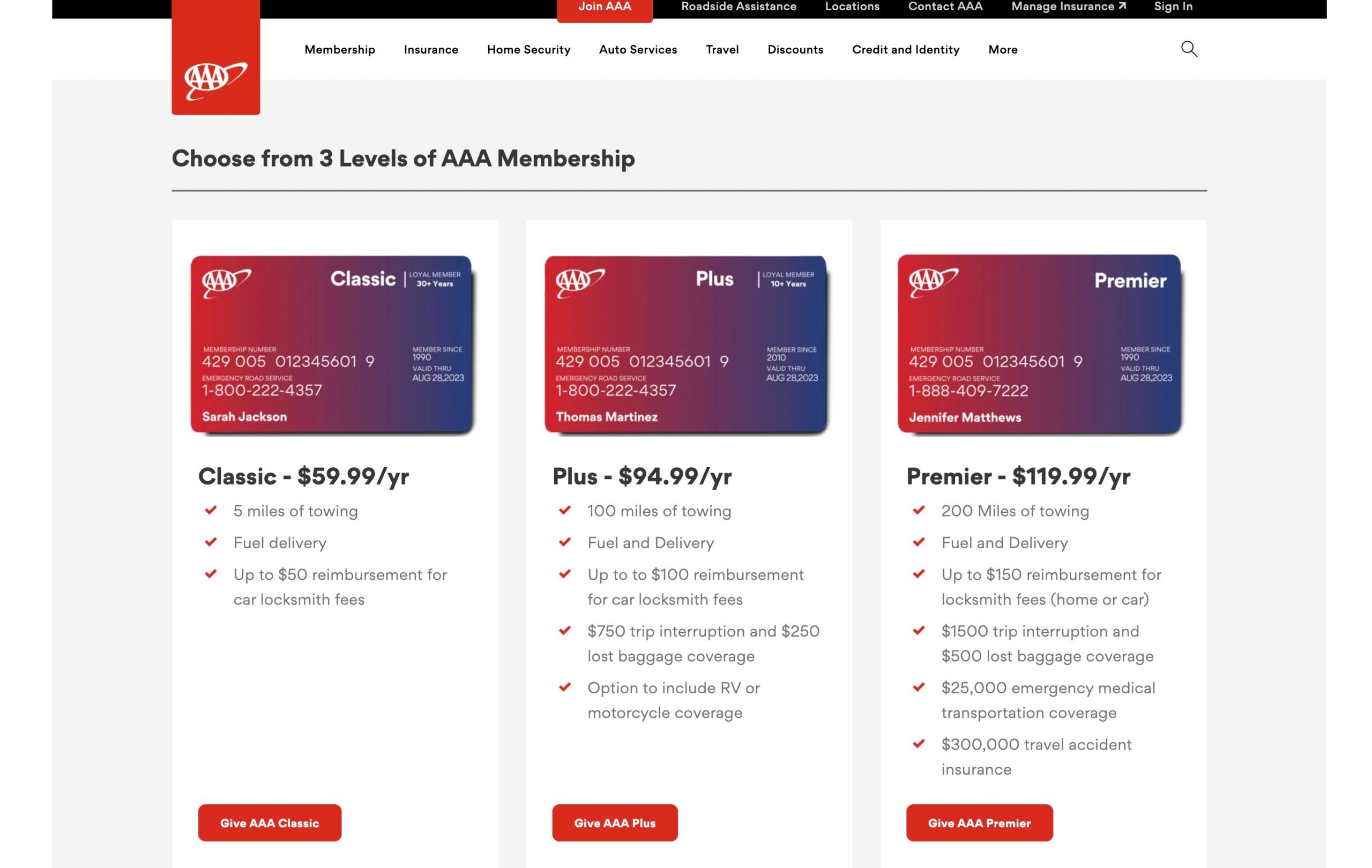

What does AAA membership cost?

Membership rates are determined by the local club and may vary, a AAA spokesperson confirmed. The pricing below is provided as an example and is based on Arizona's current club pricing.

There are three AAA membership levels based on the types of services included.

The entry-level "Classic" membership starts at just $59.99 per year. This basic option allows for 5 miles of towing, fuel delivery and up to a $50 reimbursement for locksmith fees.

The next membership level is called "Plus" and is $94.99 annually. This level will more than pay for itself if you had to use just the locksmith option which is up to $100 reimbursement. This option also includes 100 miles of towing, fuel and delivery, $750 trip interruption, $250 lost baggage coverage and an option to include RV or motorcycle coverage.

The third option, called "Premier" costs $119.99 annually and has upgraded levels of everything in the Plus membership, but also adds $25,000 of emergency medical transportation coverage and $300,000 of travel accident insurance.

Does AAA offer discounts and perks?

AAA can help you save on everything from theme park tickets to car insurance and car repair. AAA membership offers a vast network of discounts and perks when you show your card or make online reservations with certain companies that provide AAA member discounts.

Guide: 6+ unexpected travel discounts to save you money.

A quick look at the AAA merchant list for attractions, zoos, museums and tours reveals discounts for CityPass for some major U.S. cities, Legoland Discovery Centers, Busch Gardens, Six Flags Theme Parks, AMC Theatres and Regal Cinemas, to name a few. You can search by city on the website to narrow down your results.

As I navigated to the AAA website, my Rakuten browser extension popped up and offered me 8% back, so there are ways to stack offers while using your AAA membership.

AAA is a trusted name in the auto industry and not just for its roadside assistance. Auto repair shops can be AAA trust-certified which means as a consumer which means you can access this network and receive discounts on regular automotive service or repairs; the work carries a warranty for 24 months/24,000 miles. You will also get access to priority service and a minimum of 10% off labor costs.

Through AAA Smart Home you can save money on items for your home such as a home security system, smart door locks, energy-efficient thermostats and even home automation.

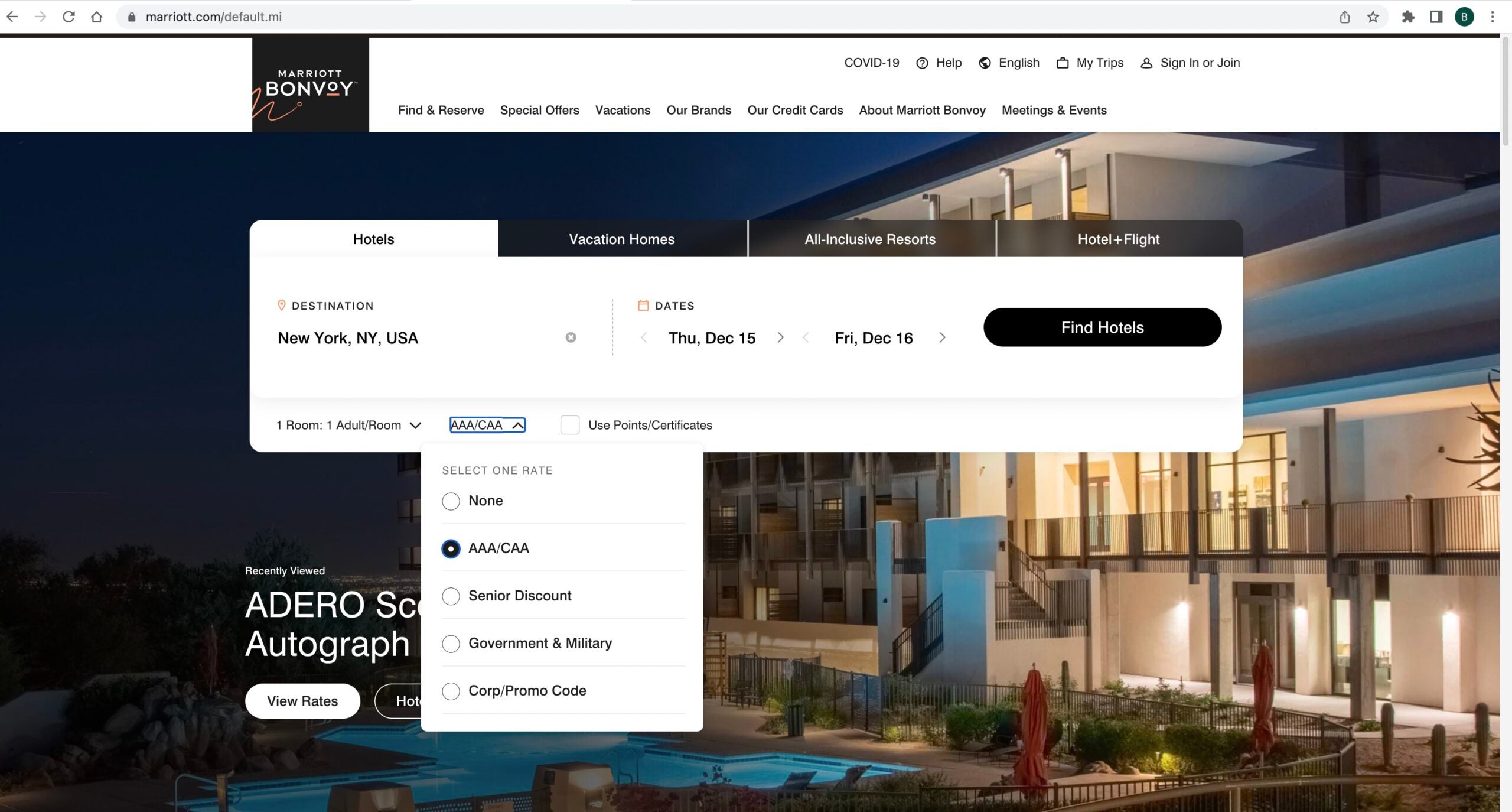

Many hotel companies offer AAA discounted rates which usually hover around 10% off the best available rate. If you click for rate options, you'll see a AAA rate option on many hotel booking websites.

Another way to utilize AAA perks is for car rentals — many rental companies offer AAA corporate rates which you can find using the AAA travel portal. If you are a renter under 25 , you can rent through Hertz, which specifically honors the AAA discount for younger drivers.

Can I gift AAA membership to a friend or family member?

According to the AAA website, gift memberships are available for purchase in some regions of the country: Northern California, Nevada, Utah, Arizona, Montana, Wyoming and Alaska. If the person you want to gift membership to lives in another region, you can search by zip code to find the local AAA club where they live.

Is AAA worth it?

If you enjoy saving money and getting additional home and travel perks, I recommend checking out AAA to see if it is a program you can benefit from. If you are a T-Mobile customer, see if your plan includes the Coverage Beyond program — this includes AAA membership free for customers (a $60 value).

Related: AAA tests program to allow California users to get Real ID

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

How to Calculate Trip Cost for Travel Insurance: The Simple Guide

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Money latest: Morrisons shoppers are going to notice two changes in stores

Morrisons has launched two major changes for shoppers – with stores offering travel money and trolleys now featuring advertisements. Read this and all the latest consumer and personal finance news below - and leave your thoughts in the box.

Thursday 25 April 2024 19:51, UK

- Halifax hikes mortgage rates - as entire market moves upwards

- Renters' Reform Bill signed off - but with indefinite delay to no-fault evictions ban

- Morrisons rolls out bureau de change and trolley adverts

Essential reads

- The world of dark tourism - what is it, is it ethical, and where can you go?

- Money Problem : I have a mortgage offer - will it change now rates are rising?

- Savings Guide : Why locking into fixed-rate bond could be wise move

- 'More important than a will': What are lasting power of attorneys and how much do they cost?

- Cheap Eats : Michelin chef's secret lasagne tip - and expensive ingredient you shouldn't use

Ask a question or make a comment

Halifax has become the latest major lender to up mortgage rates.

They are putting up a range of deals by 0.2%.

BM Solutions also announced increases today.

It follows similar moves by TSB, NatWest, Virgin, Barclays, Accord, Leeds Building Society, HSBC and Coventry last week.

Lenders are responding to swap rates - which dictate how much it costs to lend money - rising on the back of higher than expected US inflation data, and concerns this could delay interest rate cuts there.

US trends often materialise elsewhere - though many economists are still expecting a base rate cut from 5.25% to 5% in the UK in June.

This is what average mortgage rates look like as of today...

Justin Moy, managing director of EHF Mortgages, told Newspage: "Yet more bad news for mortgage borrowers, as two of the biggest lenders announce increases to their fixed-rate products.

"As mortgage rates creep up and past 5% even for those with the largest deposits, we seem to be lacking a clear strategy of the government or the Bank of England on how rates will eventually fall.

"Even 2% inflation may not be enough to reverse the recent trends in rates."

Morrisons has launched two major changes for shoppers – with stores now offering travel money and trolleys featuring advertisements.

Announcing their bureau de change service, Morrisons said customers could exchange currencies in select stores or could place their money orders online at Morrisonstravelmoney.com.

Using the online service means customers can either click and collect their cash in certain Morrisons stores or at any of Eurochange's 240 branches. Alternatively, they can go for home delivery.

Services director at Morrisons, Jamie Winter, said the service "will provide our customers with easy access to a wide range of currencies at competitive exchange rates".

So far, stores in the following areas have travel money kiosks:

- Basingstoke

In other news, the supermarket chain rolled out a new trolley advertising across 300 stores in a partnership with Retail Media Group.

A sweetener used in drinks, sauces, savoury and sweet foods and chewing gum can cause serious damage to people's health, according to a new study.

Neotame, a "relatively new" sweetener, could damage the intestine by causing damage to healthy bacteria in the gut, according to the study, leading it to become diseased and attack the gut wall.

The study by Anglia Ruskin University (ARU), published in the journal Frontiers in Nutrition, found the negative effect of neotame "has the potential to influence a range of gut functions resulting in poor gut health", potentially impacting metabolic and inflammatory diseases, neuropathic pain, and neurological conditions.

The illnesses this could lead to include irritable bowel disease or insulin resistance.

Read the full story here ...

As we reported yesterday, a pilot programme is coming into force in Venice today that means visitors have to pay a €5 (£4.28) charge to enter the city.

Authorities say the pilot programme is designed to discourage tourists and thin the crowds that throng the canals during peak holiday season, making the city more liveable for residents.

Pictures have been emerging this morning of people queueing to register for a QR code that will allow them to enter after they have paid the charge - and officials carrying out checks on people inside the city.

People found to be contravening the rules can be fined up to €300 (£257).

As detailed in our story , the move has been met with anger among some in the city.

Venice is the first city in the world to introduce a payment system for tourists - but comments from its most senior tourist official suggested it may become a more common practice for major tourist hotspots in Europe.

Simone Venturini revealed the pilot programme was being closely watched by other places suffering from mass tourism - including other Italian art cities and hugely popular weekend-break destinations Barcelona and Amsterdam.

More than 160,000 people switched to Nationwide from other providers at the end of 2023, when the building society was offering a huge cash switching incentive.

According to figures from the Current Account Switch Service (CASS), Nationwide had a net gain of 163,363 account switchers between October and December, after leavers were taken into account.

It was the highest quarterly gain since the same period in 2022, when 111,941 switched to Nationwide.

The building society launched a £200 switching bonus for new joiners in September last year - the biggest giveaway on offer at the time. It withdrew the offer just before Christmas.

The latest CASS figures, which show Nationwide had 196,260 total gains before accounting for leavers, suggesting it could have spent up to £39m on nabbing customers from other providers in the last three months of the year.

Barclays and Lloyds Bank saw more modest net gains of 12,823 and 5,800 respectively, while the rest of the UK's big banks reported net losses.

NatWest and Halifax fared worst, losing over 40,000 more switchers each than they gained.

This week saw the last remaining switching offer on the market withdrawn.

Sainsbury's is having technical issues again - with shoppers taking to social media to say their deliveries have been delayed or cancelled.

The supermarket has been replying to customers saying: "I'm really sorry about the tech issues this morning.

"We're aware of the situation and are working to sort it as quickly as possible. In the meantime, we'd advise you place a new order for a future date."

Customer Andrew Savage wrote: "Order has not been delivered and no confirmation email this morning."

Another, John B Sheffield, said: "So angry! Just got through to your customer line after 40 min WAIT.

"Tells me NO DELIVERIES TODAY! tech problem? I've NO FOOD IN! ANGRY!"

In a statement to Sky News, a Sainsbury's spokesperson says: "A small technical issue affected some groceries online orders this morning.