Virgin Voyages Help & Support for Pre-Voyage Policies

- Help & Support

- / Before You Sail

- / Pre-Voyage Policies

Pre-Voyage Policies

Other topics related to "pre-voyage policies".

- Port Information

- Travel Requirements

- Voyage Protection

Need help getting the As to your Qs?

Hit the big, red button below and reach out to our sailor services crew..

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Virgin Voyages Travel Insurance - 2024 Review

Virgin voyages travel insurance - review.

- Strong Insurance Partner

- Easy To Buy At Check Out

- Poor Medical And Evacuation Cover

- Few Cancellation / Interruption Reasons

Sharing is caring!

Virgin Voyages offers cruises to adults aged 18 and up (no children allowed) that feature high tech amenities, low environmental impact, and complimentary drinks and dining. Although Virgin Voyages offers a variety of cruises, cabin types, and dining options, they only offer a single option for travel insurance, which is their Voyage Protection plan.

Arch Insurance Company, a strong insurance partner, underwrites Virgin’s Voyage Protection plan, while Aon Affinity administers policy service and handles claims.

Like most major cruise lines, the Voyage Protection plan carries dangerously low limits for Medical Insurance and Medical Evacuation. It also lacks many of the important features of quality travel insurance policies found on the wider market, such as a Pre-Existing Medical Condition Waiver and a comprehensive list of reasons for Trip Cancellation and Trip Interruption.

The one redeeming element of Virgin Voyages’ travel insurance is that you can easily purchase it at checkout when booking your cruise online. Before you buy, check out this review to find out if the Voyage Protection plan is right for you.

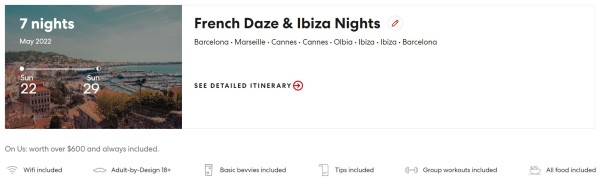

Our Cruise: French Daze & Ibiza Nights

For our review, we selected the French Daze & Ibiza Nights cruise. Our sample couple, ages 55 and 60, will be staying in The Insider suite, sailing from 5/22/22-5/29/22. The cruise begins and ends in Barcelona, with stops in Marseille, Cannes, Olbia, and Ibiza along the way. The total cost of the cruise comes to $2,600 after taxes and fees.

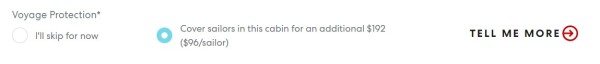

Conveniently, Virgin Voyages offers the option to purchase travel insurance at checkout.

To Virgin Voyages’ credit, their website is incredibly user friendly and easy to navigate. And obviously, it’s a simple click of “Yes” or “No” to purchase their travel insurance plan. But before you add it into your shopping cart, you need to know what your $192 is really buying - and what it’s not.

Virgin’s insurance provides travelers with $10k of medical coverage and $25k of medical evacuation coverage. Let’s see how this compares to other travel insurance in the wider travel insurance marketplace.

Comparison Quotes

When we review cruise line travel insurance plans, we always compare them to other options available on the wider travel insurance marketplace. This way, you can see what the cruise line offers, and determine whether it fits your needs or is a good value for your money.

We recommend all travelers leaving the US have ample emergency insurance in case of an overseas catastrophe. This saves you the headache and heartache of paying for medical treatment out of pocket, and a 6-figure transportation fee to return home in a worst-case scenario.

Therefore, Cruise Insurance 101 advocates carrying a minimum of $100k Medical Insurance, $250k Emergency Medical Evacuation, and a Waiver of Pre-Existing Medical Conditions whenever possible . This is the primary benchmark we use to determine if a cruise line’s travel insurance is suitable for travelers.

Using the details of the trip, we ran a sample quote to show you how Virgin Voyages’ travel insurance plan compares with two policies available at Cruise Insurance 101 .

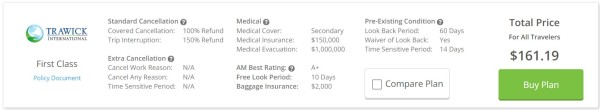

First, we’ll compare it to Trawick First Class for $161.19, because this is the least expensive comprehensive trip insurance plan that includes our recommended minimums for Medical Insurance, Medical Evacuation and Pre-Existing Condition Waiver.

Then, we’ll compare it to the least expensive plan that meets our minimum recommendations, includes a Pre-Existing Condition Waiver, and also offers Cancel For Any Reason benefits, which happens to be the John Hancock Silver (CFAR 75%) for $262.50.

How Does Virgin Voyages Compare to the Competition?

As you can see, the Voyage Protection plan offers extremely limited coverage for the $192 cost. Like many cruise line travel insurance plans, the Medical Insurance and Medical Evacuation coverage have disappointingly low limits. Furthermore, the policy does not cover Pre-Existing Conditions nor provide a Cancel For Any Reason option.

In comparison, Trawick First Class costs $30.81 less than the Voyage Protection plan on our sample quote. While this is not a significant savings, Trawick First Class provides adequate coverage for travel outside of the US, with $150k in Medical Insurance and $1m in Medical Evacuation coverage. It also covers Pre-Existing Conditions if purchased within 14 days of your initial payment or deposit towards the trip.

Our sample couple could have Cancel For Any Reason protection by purchasing the John Hancock Silver (CFAR 75%) for $70.50 more than the Voyage Protection plan. In addition to the standard cancellation coverage, our two travelers would have the option to cancel their trip for any reason and still receive a significant portion of their trip cost back. They’d also be properly protected with $100k of Medical Insurance and $500k in Medical Evacuation coverage.

We’ll discuss the importance of these coverages further below.

Trip Cancellation Reimburses You If You Can’t Travel

Travelers value Trip Cancellation benefits because the coverage allows you to get a full reimbursement of your pre-paid, non-refundable trip costs in the event you must cancel your trip for a covered reason. Of course, the more covered reasons a policy has for cancellation, the better.

Disappointingly, Virgin’s cruise insurance covers a mere 6 cancellation reasons:

- Your, a Family Member’s, a Traveling Companion’s, or a Traveling Companion’s Family Member’s death, that occurs before departure on Your Trip; or

- Your, a Family Member’s, a Traveling Companion’s or a Traveling Companion’s Family Member’s covered Sickness or Injury, that: a) occurs before departure on Your Trip; b) requires Medical Treatment at the time of cancellation; and c) as certified by a Physician, results in medical restrictions so disabling as to cause Your Trip to be cancelled;

- You or Your Traveling Companion being hijacked, quarantined, required to serve on a jury (notice of jury duty must be received after Your Effective Date), served with a court order to appear as a witness in a legal action in which You or Your Traveling Companion is not a party (except law enforcement officers);

- Your or Your Traveling Companion’s primary place of residence is made Uninhabitable and remains Uninhabitable during Your scheduled Trip, by fire, flood, or other Natural Disaster, vandalism;

- You or Your Traveling Companion being directly involved in a traffic accident, substantiated by a police report, while en route to Your scheduled point of departure;

- You or Your Traveling Companion who are military, police or fire personnel being called into emergency service to provide aid or relief for a Natural Disaster.

While covered cancellation can vary by policy, most policies cover all the above reasons and more, including but not limited to:

- A documented theft of passports or visas

- Permanent transfer of employment of 250 miles or more

- Involuntary termination or layoff

- An unannounced strike causing a complete cessation of services

- Inclement weather causing a complete cessation of services

- Revocation of previously granted military leave due to war

- Bankruptcy or default of airline, cruise line, tour operator

By comparison, both Trawick First Class and John Hancock Silver (CFAR 75%) offer 14 covered cancellation scenarios. The John Hancock Silver (CFAR 75%) also includes Cancel For Any Reason, which allows you to cancel for any reason not otherwise covered by the policy and still receive a 75% reimbursement of your trip cost.

Another important factor to consider is that the Voyage Protection plan only covers travel arrangements booked through Virgin Voyages. Any travel arrangements booked elsewhere, such as independently booked airfare and accommodations for travel time ahead of or after the cruise, would not be covered. This is typical of cruise line travel insurance plans but leaves you at risk of losing those costs if you cancel your trip.

Alternatively, third-party travel insurance plans, like Trawick First Class and John Hancock Silver (CFAR 75%), insure all of your pre-paid and non-refundable trip costs, regardless of who your travel arrangements were booked through.

Cancel For Any Reason

Cancel For Any Reason coverage is exactly what it sounds like – it allows you to cancel for any reason that’s not covered under the policy and still receive a reimbursement of your trip cost.

Many major cruise lines offer Cancel For Any Reason , which assigns a future cruise credit to the travelers if they cancel their cruise for any reason not listed on the policy. Surprisingly, Virgin Voyages doesn’t offer anything of the sort. While a future cruise credit is far from preferable, it’s better than nothing.

On the other hand, some third-party travel insurance plans, like John Hancock Silver (CFAR 75%) have Cancel For Any Reason benefits built into the policy. Instead of offering future credit, the policy gives you a cash reimbursement for a portion of the trip cost.

However, Cancel For Any Reason has a few rules. The coverage reimburses 50% -75% (depending on policy) of your pre-paid and non-refundable trip costs, provided you:

- Purchase the policy within 10-21 days (depending on the policy) of your initial payment or deposit towards the trip. For the John Hancock Silver (CFAR 75%), this timeframe, called the Time Sensitive Period, is 14 days.

- Insure 100% of your pre-paid and non-refundable trip costs, and add any subsequent payments to the policy’s trip cost within the Time Sensitive Period

- Cancel your trip no later than 48 hours prior to departure

Trip Interruption Refunds the Unused Portion of Trip

Similar to Trip Cancellation, Trip Interruption reimburses you for the missed portion of your trip if you have a covered disruption. Covered reasons for Trip Interruption mimic those of Trip Cancellation. For example, if you unexpectedly fell ill during your cruise and had to seek treatment off the ship for two days, that’s a covered Trip Interruption (along with a Medical Insurance claim).

In some cases, your Trip Interruption may allow you to return to the trip after missing a portion of it. Other times, you might have to go home early to tend to a family emergency. In the same fashion, a Trip Interruption could delay your arrival to the cruise.

In any event, travel insurance reimburses you up to your trip cost for the unused, pre-paid, non-refundable expenses for your travel arrangements, plus the additional transportation cost paid to either:

- Join your trip if you must depart after your scheduled departure date or travel via alternate route of travel; or

- Rejoin your trip from the point where your trip was interrupted or return home early

While Virgin’s barebones policy offers only 100% trip cost refund for a covered interruption, both Trawick First Class and John Hancock Silver (CFAR 75%) cover up to a 150% refund. The extra 50% helps cover the added cost of transportation.

Trip Interruption coverage that exceeds 100% is a hallmark of a robust and comprehensive travel insurance policy.

Medical Insurance When Traveling Overseas

Sometimes travelers are more focused on Trip Cancellation and overlook the risks of traveling overseas without proper Medical Insurance .

American travelers often have the false impression that countries with socialized medicine will treat them for free, but this is not the case. In fact, countries with universal health care programs only offer those services to their residents, who pay taxes for this privilege, whereas travelers must pay full price for health care. Inpatient care at a hospital can run $3,000 to $4,000 per night, plus treatments and surgeries.

Also, Medicare does not pay for your treatment outside the US. In addition, many private healthcare plans only reimburse for emergencies. For example, although some Medicare supplements cover up to $50k of emergency treatment abroad, it’s a lifetime limit and you must pay a 20% co-pay out of pocket. These policies falsely lead you to believe you’re safely covered, but they leave your retirement savings exposed to the risk of a sudden, catastrophic financial loss.

Furthermore, the US State Department does not provide any medical support to Americans traveling overseas, which is why carrying adequate Medical Insurance is critical when leaving the country.

Thus Cruise Insurance 101 recommends each traveler carry at least $100k in Medical Insurance when leaving the US. This is enough coverage to assure you’re properly treated without paying off medical bills for years to come.

Getting back to Virgin Voyages’ travel insurance, the Voyage Protection plan includes only $10k of Medical Insurance. That’s simply not going to help you in an emergency.

On the other hand, Trawick First Class includes $150k Medical Insurance and John Hancock Silver (CFAR 75%) covers $100k. These levels of coverage are much better suited for seniors cruising outside of the US.

Emergency Medical Evacuation Brings You Home

Have you ever seen a helicopter land on a cruise ship to pick up a sick passenger, or heard of someone being flown home in a private medical jet? These things happen more frequently than you think.

Specifically, Medical Evacuation coverage pays for transportation from the place of injury or illness to a local hospital. Once you’re stable and the physician treating you determines it’s necessary, Medical Evacuation returns you home. If your condition is critical and you require ongoing care by a medical team to return home, an air ambulance outfitted as a flying ICU might be most appropriate.

Private air transportation such as this can cost $15k to $25k per flight hour and coming back to the US from overseas can get very expensive, very quickly.

In addition, many travelers assume their private health insurance pays for Medical Evacuation so they can get home. In fact, private health insurance plans, including Medicare supplements, do not include Medical Evacuation benefits beyond a limited amount for a ground ambulance to the hospital. So, that medical flight cost comes out of your pocket and could cost as much as a house.

For these reasons Cruise Insurance 101 recommends all travelers leaving the US carry a minimum of $250k Emergency Medical Evacuation coverage. Travelers venturing even further from home, to destinations such as Africa, Asia, or beyond, should carry a minimum of $500k.

Virgin’s Voyage Protection plan only provides a minimal $25k Medical Evacuation benefit. Meanwhile, Trawick First Class has a benefit of $1m per person for Medical Evacuation and the John Hancock Silver (CFAR 75%) covers $500k per person.

Pre-Existing Medical Conditions

Pre-Existing Conditions are an understandable concern for many senior travelers.

In the world of travel insurance, a Pre-Existing Condition does not mean anything that’s ever happened to you in your entire medical history. Instead, travel insurance companies only concern themselves with your more recent medical history.

Most policies are only concerned about the 60-180 days prior to the day you purchased your policy. This means any conditions older than 60-180 days will be covered if none of the following has occurred within that timeframe:

- New conditions or change or worsening of previous conditions

- Treatment, testing, or examinations that have occurred or been recommended

- New or changes in medication, including dosage changes

If any of the above did occur during to 60-180-day window prior to purchasing travel insurance, it would be excluded from coverage.

Luckily, if you purchase your policy early in the booking process, within 14-21 days of making your initial payment or deposit towards your trip, many travel insurance policies include coverage for Pre-Existing Conditions with a Waiver. Once those 14-21 days pass, however, Pre-Existing Conditions aren’t covered. Instead, they’re subject to the Look Back period, the time between when you bought the policy and the 60-180 days prior.

To make life easier and give you peace of mind Cruise Insurance 101 recommends travelers buy travel insurance that includes a Pre-Existing Condition Waiver whenever possible. It’s simple to get, just by purchasing your travel insurance policy shortly after making a deposit. The Voyage Protection plan does not cover Pre-Existing Conditions at all. They do not offer a waiver, so regardless of when you buy their insurance, they won’t cover it. One good thing in Virgin Voyages’ favor is that their policy only looks back 60 days into your medical history, rather than 90 or 180 days.

Alternatively, both policies we compared from Cruise Insurance 101 to Virgin’s Voyage Protection plan offer a Waiver of Pre-Existing Conditions, if the policies are purchased within 14 days of your initial payment or deposit.

Virgin Voyages offers contemporary cruising experiences, but minimal travel insurance. Their policy is deficient in critical areas such as Trip Cancellation, Medical Insurance, Medical Evacuation and covering Pre-existing Conditions. It also lacks a Cancel For Any Reason option. Overall we rate it a 7 out of 10.

Trawick First Class is one of many Cruise Insurance 101 policies that provides outstanding value for the money, with a savings of $30.81 over the Voyage Protection plan, for exponentially better coverage.

While a higher tiered plan like John Hancock Silver (CFAR 75%) costs $70.50 more than the Voyage Protection plan, it offers many of the features and flexibility anyone would want in a travel insurance policy and is a better value for your money.

In addition, you cannot insure your other travel arrangements with Virgin Voyages’ policy, but you can insure them under a policy purchased in the wider travel insurance marketplace. You’ll find more value for your money working with Cruise Insurance 101 .

Did you know you won’t find lower prices on the same policy anywhere else, not even with the insurance company directly? At Cruise Insurance 101 , we take the nation’s top travel insurance carriers and bring them in our marketplace where you can shop and compare different plans.

Visit Cruise Insurance 101 first to see your options before committing to the first travel insurance policy you’re offered. Stop by and have a chat, send an email or give us a call at +1(786) 751-2984 . Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Peter was very helpful and answered all…

Peter was very helpful and answered all our questions.

Choosing a plan was quick and easy

Choosing a plan was quick and easy. The questions did not take long at all to answer and a plan was recommended in a short period of time.

Lady Coinbits

My agent, Shanna was awesome. Helped me find the best policy or my needs and explained everything to me.

Cruise travel insurance: What it covers and why you need it

What does cruise travel insurance cover? And does it pay to buy cruise travel insurance?

The answer is not always clear-cut, as we'll discuss in this guide. But consider this: It's not always smooth seas when it comes to cruising. Even the best-laid plans for a cruise vacation can sometimes be thrown off course by an unexpected event.

You might need to cancel a cruise in advance due to the sudden onset of an illness, such as COVID-19 or the flu. Or, maybe you fall ill during the cruise and need emergency medical attention. Maybe your flight to your ship gets canceled, and you miss the vessel's departure. Or your ship is late arriving in port at the end of a voyage, and you miss your flight home.

In all of these situations, you might benefit from having cruise travel insurance — keyword "might."

Cruise insurance policies vary widely, and not every policy covers every type of mishap. That's why it always pays to read the fine print in a travel insurance policy before you purchase it to know what you're getting in advance.

It's also why you should read this introduction to everything you need to know about cruise insurance. It has many details, but the next time something unexpected happens on your cruise vacation, you'll be glad to be educated and covered by a comprehensive travel insurance policy.

What does travel insurance cover when you cruise?

The typical cruise insurance policy covers a wide range of circumstances that can go wrong in conjunction with a vacation at sea — both before and during the sailing.

For starters, policies often will reimburse you for the cost of canceling a cruise due to a last-minute crisis. They will also often cover costs related to an interruption of a cruise (maybe your ship breaks down, requiring you to fly home mid-voyage ). These two elements are known as trip-cancellation and trip-interruption insurance, and they are bundled into a typical travel insurance policy.

Some policies will also cover out-of-pocket costs related to a flight delay or cancellation that results in you missing your cruise departure (for instance, the cost of catching up to the ship at its next port). Expenses related to baggage delays and loss are often covered as well.

But perhaps most importantly, many travel insurance policies will cover medical expenses you incur while on a cruise. Some will even cover the cost of evacuating from a foreign destination if you are in the midst of a medical crisis.

Travel insurance giant Allianz Global Assistance reports that 53% of all cruise-related "billing reasons" for claims are because of illness for the insured person, while 14% are for an injury. Another 8% are for the illness of a family member, 4% for the death of a family member and 4% for the illness of a traveling companion, among other reasons.

Those percentages include illness and accidents that happen to cruisers just before a trip, making travel impossible. But, in many cases, such claims result from illness and injuries that occur during voyages.

"People often take risks during vacation that they might not take back home, whether riding a jet ski, zipping around on a motorized scooter in a city they don't know well or hiking unfamiliar terrain," James Page, senior vice president and chief administration officer of AIG Travel, told TPG .

Some policies also cover the financial default of a travel provider. In such cases, if your cruise line goes out of business before you sail, you could get all — or at least some — of your money back.

Cruise travel insurance policies don't cover everything. For instance, standard travel insurers generally will not reimburse you for the cost of a cruise you cancel due to worries about an outbreak of an illness. That's true even if a U.S. government agency such as the U.S. Centers for Disease Control and Prevention issues a recommendation that you don't cruise due to an illness outbreak, as it did during the COVID-19 pandemic .

If you want the ultimate flexibility to cancel for such a reason or any other, you'll want to look into a more expensive cancel for any reason travel insurance upgrade.

Related: Avoiding outbreaks isn't covered by most travel insurance policies

Where to find a cruise travel insurance policy

You can buy a travel insurance policy directly from your cruise line when booking your trip or through your travel agent (if you're using one, which often is a good idea when booking a cruise). You also can go directly to a third-party travel insurance provider or a travel-insurance aggregator site, such as InsureMyTrip or TravelInsurance . Your credit card might even give you some travel protections.

Here's what you need to know about each type of cruise travel insurance.

Third-party insurance companies

Third-party insurance companies that specialize in writing travel insurance include AIG Travel, Allianz Travel Insurance, Travelex Insurance and American Express Travel Insurance.

One reason to use a travel agent or a travel aggregator: They can help you find a policy that offers added coverage specific to cruising.

Related: The Points Guy's guide to the best travel insurance companies

"Many plans now offer benefits that will specifically appeal to cruise travelers, such as missed connection, missed port-of-call and cruise disablement coverage," Stan Sandberg, cofounder of TravelInsurance.com, said.

Missed connection coverage reimburses cruisers for a set dollar amount if they need to rebook travel to catch up with their cruise at the next port. Missed port-of-call coverage pays a benefit if the cruise ship misses a scheduled port of call due to weather, a natural disaster or a mechanical breakdown.

Cruise disablement coverage pays a benefit if the traveler is confined on a ship for more than five hours without power, food, water or restrooms.

As noted, policies vary widely. It's a good idea to compare plans and make sure the one you buy has the elements that are most important to you. One size doesn't fit all.

Credit cards with travel benefits

Some premium credit cards offer valuable travel protections comparable to what you might get from a standard travel insurance plan. For example, the travel insurance provided when you pay for travel with select cards can reimburse you for expenses if your baggage is damaged, you're stranded overnight due to a flight delay or cancellation, or you have to return home to handle a family medical emergency.

The Chase Sapphire Reserve card, for example, offers trip delay reimbursement, trip cancellation and interruption insurance, emergency medical coverage and even medical evacuation coverage , among other benefits. And yes, cruise lines are considered common carriers just like airlines.

If you're planning to rely on a card like the Chase Sapphire Reserve or The Platinum Card® from American Express * (among others) for travel insurance, just be sure to recheck your card's benefits and limits carefully against regular travel insurance. You must pay for at least part — and sometimes all — of the trip with that credit card to take advantage of its protections.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

Related: The best credit cards for booking cruises

Find out if your credit card protection includes travel accident insurance or covers preexisting medical conditions, and figure out when it will pay you back. Other questions to ask: What are the coverage limits? Will you have to pay for a foreign hospital bill upfront and then seek reimbursement later?

Cruise lines

Cruise lines often ask consumers booking a cruise to buy the line's own protection at the time of purchase. If specifics about the coverage are lacking, always ask the line for details in advance, review coverage perks and limits; then, compare those to one or two independent travel insurance policies or your credit card's insurance benefits.

Related: A beginners guide to picking a cruise line

Cruise line travel insurance policies sometimes have quirks. Many cruise companies will only offer a travel voucher or credit for future use in the event of a covered cancellation, not an outright refund.

Also, financial default may not be a covered event in a cruise line-sold policy, but it's typically covered with plans from third-party travel insurance companies.

Cruise line policies also can be more restrictive.

"Cruise line insurance seems to have become better and has more widespread coverage than in the past, but it typically won't cover air or pre- and post-travel [arrangements] unless those elements are purchased through [the line]," said Debra Kerper, a Cruise Planners travel adviser from Carrollton, Texas, who books travel and sells private insurance. "This is when private insurance coverage becomes so very important."

How much does cruise insurance cost?

Expect to pay anywhere from 4% to 8% of your total prepaid, nonrefundable trip expenses for a travel insurance policy. That's a wide range, we know, but it reflects the wide range of products out there.

You'll also find some basic plans that cost even less than 4% of your trip expenses, while some super-premium plans that cover just about any conceivable issue can cost as much as 12% of your trip expenses.

Related: What's included in your cruise fare?

All reputable insurance companies will offer a "free-look period" during which you can receive a 100% refund on your premium. This allows you to review the policy you've selected and return it for any reason within the period allotted — usually for a small administration fee of less than $10.

Under normal circumstances, you don't need to purchase a so-called "cancel for any reason" add-on to your cruise travel insurance policy unless you really need the flexibility. The upgrades are significantly more expensive.

You can receive a quote and purchase a policy online in minutes with any credit card. Although you may think travel insurance should code as "travel" when paid on a credit card and thus be eligible for bonus points on certain cards, that isn't always the case. Your points earnings will depend on the individual underwriter's merchant code. When in doubt, expect the purchase to fall under the insurance category for earnings.

Should I buy travel insurance for a cruise?

Whether you buy travel insurance is a personal decision that will depend on many factors. Would you be willing to absorb the loss of canceling a cruise on short notice due to an illness or accident? Could you afford an evacuation flight from a far-off port if you suddenly became seriously ill? Only you can answer those sorts of questions.

Here are some things to consider as you make that decision.

You might not be covered by regular medical insurance while cruising

If you're a U.S. citizen traveling internationally (which will be the case for most cruises), you may find that most private medical insurance plans in the U.S. won't cover you.

Additionally, Original Medicare only covers people traveling outside U.S. borders in limited circumstances.

While certain Medicare Supplement Plans do have some foreign emergency medical benefits, not all do. Be sure to talk to your Medical Supplemental Plan provider to see if you're covered, what's covered, what the limits are and how the bill is paid.

Also note that, in some countries (particularly those in Central and South America), travelers may not be discharged from a hospital until their bill is paid in full.

Related: Trip wrecked: 7 ways to prepare for any kind of travel disaster

Plus, if you have a medical incident overseas, you could find yourself stuck in a shared hospital room without air conditioning or a private bathroom. The level of care may not be what you expect.

"For people traveling internationally, it's crucial to know beforehand where to go for any treatment … and how they're going to pay for that treatment," Page said.

Getting evacuated for a medical condition is expensive

Most airlines won't accept seriously ill passengers, those carrying bulky medical equipment or those requiring a full medical team.

Even a low-cost weekend getaway on a cruise to the Bahamas out of Miami can turn costly if you suffer a serious accident or illness requiring medical treatment or an emergency medical evacuation.

Related: Do cruise ships have doctors, nurses, medical centers or hospitals?

Being flown back to the U.S. from a far-flung overseas location in a private, medically equipped aircraft, with a professional medical team on board, can run between $70,000 and $180,000, according to Mike Hallman, president and CEO of Medjet, a medical transport membership company.

"Domestic transports, which we cover as well, can cost upwards of $30,000," Hallman said.

Without proof of medical evacuation coverage, foreign providers will also want that money upfront. Hallman said that regular travel insurance will typically get you to an acceptable overseas hospital and even to a higher-level care facility if "medically necessary." Alternatively, medical evacuation coverage means you can fly home to your own hospital, doctors and family — without claim forms, cost caps on transports or surprise bills.

The tandem approach — buying both travel insurance and a separate medevac transport membership — is a good option, Hallman said.

"We always recommend travel insurance, as it covers trip interruption, which is important, as well as medical coverage for the hospital and treatment costs," he said. "We pick up where they leave off."

You can't predict the weather

Cruising is a great way to explore multiple destinations in one trip. But it's good to remember that unexpected delays, interruptions or cancellations due to weather can happen during cruises, particularly during hurricane seasons in places such as the Caribbean and Asia (where hurricanes are called typhoons).

During a typical hurricane season (June 1 to Nov. 30), Allianz pays about 6,000 claims from customers whose travel plans in the Caribbean, Gulf of Mexico and southeastern U.S. are affected by the storms, according to a spokesperson for Allianz Global Assistance USA.

If you're hoping to insure against a storm-related disaster, it's good to buy travel insurance as early as possible. Once a storm or hurricane is named, it's too late to buy travel insurance to cover it.

Of course, cruise lines will move ships away from a weather threat. When the port lineup is adjusted or the cruise shortened, the company will offer the guest an onboard credit, onboard gift or future cruise credit rather than any refund. It depends on the circumstances of that specific voyage. You won't be able to make a claim on your cruise travel insurance policy just for a minor itinerary change .

Related: Everything you need to know about cruising during hurricane season

Costs can mount quickly when things go wrong

Even if the cruise line does provide a full or partial refund or cruise credit for an itinerary change or some other interruption, travelers could have to swallow the cost of other travel elements not purchased through the line. That could include nonrefundable flights , prepaid resort or hotel nights, nonrefundable tour fees and more.

Travel insurance can cover those, plus help with flight delays or cancellations, baggage loss or theft.

If a winter storm causes you to miss your flight to where the ship is boarding , "travel insurance could help you get to the next port to join the cruise, so you don't miss your entire trip," Page said.

In fact, 13% of "billing reasons" for claims to Allianz are for common carrier delays (such as a flight delay), while weather and natural disaster-related claims account for about 3%.

The government probably won't bail you out

While cruise ships have medical facilities, they're usually not equipped to treat serious illnesses. If you experience a serious medical problem on a vessel, you may have to get off the ship in a foreign port to seek treatment at a hospital. In such a case, if you don't have medical evacuation insurance, you may then find yourself stranded in that port awaiting a medical evacuation.

Don't expect Uncle Sam to step in and help foot the bill.

The U.S. Department of State's Bureau of Consular Affairs clearly states the importance of buying travel insurance.

"The U.S. government does not provide medical insurance for U.S. citizens overseas," the bureau says on the website. "We do not pay medical bills. You should purchase insurance before you travel."

You may need more assistance than you think

If you're injured or become severely ill during a cruise, especially in a foreign country, it may be difficult to access help without the assistance of trained professionals that comes with many insurance plans.

Many travel insurance companies provide around-the-clock assistance with locating overseas clinics and pharmacies, getting to a doctor or hospital, refilling lost or depleted prescriptions, assisting with up-front payments to hospitals, and arranging flight changes so you can get home.

Travel insurance companies also can arrange for an air ambulance, a nurse escort, oxygen and a lie-flat seat on a flight home if your medical condition warrants it.

You want to be careful if you have preexisting conditions

When you cruise, it's important to be fully covered, which means having comprehensive medical coverage that includes any preexisting conditions. Otherwise, if you head into a doctor's office overseas, have any tests completed, or visit an urgent care center or emergency room, you might not be covered.

Here, timing is extremely important. Cruisers seeking coverage of preexisting conditions, as well as cancel for any reason insurance, generally must book within seven to 21 days of the first payment they make for a trip. The timing varies by insurer.

Bottom line

Cruise insurance isn't for every traveler — or even for every sailing. It's not inexpensive. However, it can bring a lot of peace of mind if you're about to head out to sea. Do your homework, compare plans and always assess the risks.

Planning a cruise? Start with these stories:

- The 5 most desirable cabin locations on any cruise ship

- The 8 worst cabin locations on any cruise ship

- A quick guide to the most popular cruise lines

- 21 tips and tricks that will make your cruise go smoothly

- Top ways cruisers waste money

- 12 best cruises for people who never want to grow up

- The ultimate guide to what to pack for a cruise

- Privacy Policy

Travelers Plans How to Travelers Plans in The World

Virgin voyages travel protection.

If you’re planning a cruise with Virgin Voyages, you may be wondering if you need travel insurance or protection. While it’s not a requirement, it’s always a good idea to have some form of coverage to protect you in case of unexpected events. That’s where Virgin Voyages Travel Protection comes in.

What is Virgin Voyages Travel Protection?

Virgin Voyages Travel Protection is a comprehensive insurance program designed specifically for Virgin Voyages guests. It provides coverage for travel issues such as trip cancellation, trip interruption, emergency medical services, baggage delay, and more.

Offered by Arch Insurance Company, Virgin Voyages Travel Protection is available for purchase at the time of booking your cruise. It’s a great way to add peace of mind to your vacation and protect yourself from unexpected events.

What are the Benefits of Virgin Voyages Travel Protection?

Virgin Voyages Travel Protection offers a number of benefits to guests, including:

These benefits can provide peace of mind and financial protection in case of unforeseen circumstances that may disrupt your travel plans.

What are the Coverage Options for Virgin Voyages Travel Protection?

Virgin Voyages Travel Protection offers two options for coverage:

1. Standard Coverage: This coverage includes trip cancellation and interruption, baggage delay and loss, emergency medical services, and 24/7 travel assistance services.

2. Cancel for Any Reason Coverage: This coverage includes all benefits of the Standard Coverage, as well as the ability to cancel your trip for any reason, up to 48 hours before departure. This coverage is only available if purchased within 14 days of making your initial trip deposit.

How Much Does Virgin Voyages Travel Protection Cost?

The cost of Virgin Voyages Travel Protection varies depending on the cost of your cruise and the coverage option you choose. Standard Coverage typically ranges from $89 to $199 per person, while Cancel for Any Reason Coverage ranges from $199 to $329 per person.

It’s important to note that the cost of travel protection is non-refundable, and that cancellation fees may still apply even if you have purchased coverage.

How Do I Purchase Virgin Voyages Travel Protection?

Virgin Voyages Travel Protection can be purchased at the time of booking your cruise. Simply select the coverage option that best meets your needs and add it to your reservation.

If you have any questions or concerns about travel protection, be sure to contact Virgin Voyages’ customer service team for assistance.

If you’re planning a cruise with Virgin Voyages, consider purchasing travel protection to provide peace of mind and financial protection in case of unexpected events. With two coverage options to choose from and a range of benefits, Virgin Voyages Travel Protection is a great way to ensure that your vacation is stress-free and enjoyable.

Where are you flying from?

- London Heathrow

- Manchester International

- Inverness Airport

- Cardiff Airport

- Norwich Airport

- Humberside Airport

- London City Apt

- Belfast International

- Leeds Bradford Airport

- Bristol Airport

- Teesside Airport

Our new direct Virgin Atlantic service commences 22nd October 2023.

Please remember when searching for your holiday to add an additional night, as we operate an overnight service on our outbound flight.

i.e. For a 7 night holiday please search for 8 nights.

Our new direct Virgin Atlantic service commences 30th October 2023.

We will operate from London Heathrow four times a week on Mondays, Tuesdays, Thursdays and Saturdays.

Our seasonal Virgin Atlantic service with up to 4 direct flights, will operate until the 19th May 2024.

Our seasonal direct service will recommence on the 28th October 2024.

Our Virgin Atlantic service operates on Mondays, Wednesdays and Sundays.

Flights include a short touchdown in Barbados.

Our Virgin Atlantic service operates on Tuesdays, Fridays and Saturdays until 29th March 2024. From the 2nd April, this service will reduce to Tuesdays and Saturdays.

Our seasonal service will recommence on the 29th October 2024, with flights operating on Tuesdays, Fridays and Saturdays

Our seasonal Virgin Atlantic service with up to 3 direct flights, will operate until the 11th May 2024. Flights will commence from 23 May 2024 - 24th October 2024 on Thursdays and include a short touchdown.

Our seasonal direct service will recommence on the 29th October 2024.

Daily direct flights from London Gatwick to New York with our partner airline, Delta, operates between 10th April and 26th October 2024.

Our Virgin Atlantic service with direct flights, will operate on Wednesdays and Sundays until the 30th March 2024.

Our direct service will operate on Tuesdays and Thursdays from the 2nd April 2024.

1 room / 2 adults

Please enter all child ages

There must be 1 adult per child under two years of age travelling, please adjust your passenger number

To book online please select a maximum of 9 passengers, to book 10 adults or more please call 0344 557 3978

Please note: Drivers must be over the age of 21 to hire a car unless otherwise specified. Drivers between 21 and 24 years of age may be subject to additional costs.

Holiday insurance tailored to your next adventure

We know it's hard to concentrate on Seizing the Holiday without first having peace of mind.

Whether you are taking the children or grandchildren to Disneyland, tying the knot in Vegas, or relaxing on a Caribbean cruise we've got a policy to cover you. Booking your travel insurance through Virgin Atlantic gives you the reassurance that we have you covered from the start to finish of your holiday.

Get your Travel Insurance Quote today

Single Trip - Travel Insurance

Need travel insurance for your family holiday? Our Single Trip Travel Insurance offers great value cover at an affordable price.

Single Trip - Cruise Insurance

Our specialist cruise policy offers additional benefits including: Cruise connection, Missed port, Cabin confinement, Excursions cover.

Providing peace of mind whilst on holiday:

- COVID-19 - cover for medical expenses and cancellation if you become ill or have to quarantine due to COVID-19

- Up to £15m medical assistance cover in the event of illness or an accident while away

- Up to £5k cancellation cover or if you have to cut your trip short

- Up to £2k in the event of loss, theft or damage to your personal possessions

You may also like...

Sorry, we’re working on our website.

We’ll be back up and running shortly..

Code: AKM-CYB-WEB-1

Error: 18.97645e68.1714385076.1de68264

- Motorcycles

- Car of the Month

- Destinations

- Men’s Fashion

- Watch Collector

- Art & Collectibles

- Vacation Homes

- Celebrity Homes

- New Construction

- Home Design

- Electronics

- Fine Dining

- Aston Martin

- L’Atelier

- Les Marquables de Martell

- Reynolds Lake Oconee

- 672 Wine Club

- Sports & Leisure

- Health & Wellness

- Best of the Best

- The Ultimate Gift Guide

The 5 Best Ways to Insure Your Luxury Cruise

These five plans all offer robust coverage for emergency medical treatment and medical evacuation in the case of illness or injury., erica lamberg, erica lamberg's most recent stories.

- 5 Tips for Buying Travel Insurance

- Travel Insurance for Sports Equipment: Everything You Need to Know

- The Travel Insurance You Need for a Multi-Destination Vacation

- Share This Article

We may receive payment from affiliate links included within this content. Our affiliate partners do not influence our editorial opinions or analysis. To learn more, see our Advertiser Disclosure .

If you were an avid cruiser before cruises were suspended due to the pandemic, you may be ready to stretch your sea legs again. Or you could be an aspiring cruiser ready to snag a great deal as cruise lines begin to sail again from select U.S. ports, the Caribbean and Europe.

Related Stories

Kering’s shares are down 18%, and it’s hitting françois pinault’s pocket book, lvmh vs kering: inside bernard arnault and françois-henri pinault’s battle to conquer hollywood, meet hollywood power couple david and jessica oyelowo.

If you’re planning a voyage on the open sea, make sure to check insurance and Covid testing requirements. Some cruise lines are mandating that you buy travel insurance if you are not vaccinated.

Whether you’re required by insurance for a cruise or not, having the right protection in place before you go is smart. Here’s a look at the best cruise insurance plans.

GoReady Choice Plan

Why we picked it: The Choice plan from GoReady has a wide range of benefits at an excellent value.

Travelers can upgrade the Choice plan to $500,000 per person for both emergency medical expenses and medical evacuation coverage. Travel delay coverage can be upgraded to $2,000 per person.

If you are still on the fence about traveling, you can add “cancel for any reason” coverage to your plan. This will allow you to get a portion of your non-refundable trip payments if you change your mind before departure.

Potential drawbacks: Baggage delay coverage of $200 after a 24-hour delay is skimpy compared to many other competitors. And if you want more than $500 of baggage loss coverage per person you’ll also have to upgrade from the basic Choice plan.

HTH Worldwide TripProtector Preferred Plan

Why we picked it: The TripProtector Preferred Plan comes with top-notch benefits and coverage limits at a good price.

If you are the type of traveler looking for generous policy limits, the Preferred Plan is worth considering. You’ll get $500,000 in emergency medical expenses and $1 million for medical evacuation per person. The plan also includes $50,000 per person for accidental death and dismemberment.

The Preferred Plan has excellent coverage for trip mishaps like travel delay ($2,000 per person) and baggage loss ($2,000 per person). You will also find trip interruption coverage of 200 percent of the trip cost more generous than competitors. And if you want even more peace of mind, you can add “cancel for any reason” coverage to the policy.

Potential drawbacks: Baggage delay coverage of $400 per person after a 12-hour delay is on the low end compared to other top competitors.

Related: Compare Travel Insurance Quotes for 2021

Nationwide Cruise Choice Plan

Why we picked it: Nationwide’s Cruise Choice has valuable benefits at a good price.

You will get $100,000 for emergency medical expenses and $500,000 for emergency medical evacuation per person. The plan also includes $25,000 per person for accidental death and dismemberment coverage during the trip.

Nationwide’s Cruise Choice plan includes top notch baggage loss coverage of $2,500 per person. And the missed connection coverage is generous at $1,500 per person after a delay of only three hours.

Travelers who want more flexibility can add “cancel for any reason” coverage. If you want higher policy limits, upgrade to Nationwide’s Prime or Cruise Luxury plans.

Potential drawbacks: You might find $750 per person for travel delay coverage on the low end.

Seven Corners RoundTrip Choice Plan

Why we picked it: The RoundTrip plan comes with a solid selection of benefits at an excellent price.

In addition to $100,000 in emergency medical coverage and $500,000 in emergency medical coverage per person, you will get $20,000 in non-medical evacuation coverage per person. The Choice Plan also includes $1,500 of missed connection coverage per person.

If you want even more flexibility, you can add “cancel for any reason” coverage.

Potential drawbacks: Baggage delay coverage ($500 per person) is somewhat low compared to other top competitors.

Trawick International Safe Travels Voyager Plan

Why we picked it: The Safe Travels Voyager plan has a wide range of top-notch benefits at a competitive price.

You will get $250,000 for emergency medical expenses and $1 million in medical evacuation coverage per person. The plan also includes generous travel delay coverage of $2,000 per person after a six hour delay. If your baggage is lost, you’ll have ample coverage of $2,500 per person.

Potential drawbacks: We found no major drawbacks with this plan.

What Insurance Should You Get for a Cruise?

It’s often a good idea to purchase a comprehensive travel insurance plan before any type of international travel, including a cruise. A solid travel insurance plan will financially protect you for a wide variety of travel problems:

If you need to cancel your trip for a reason covered by the policy, like injuring yourself right before the trip, you’ll want trip cancellation coverage. Also, if weather or an airline delay make you late for your cruise or if you need to cut your trip short due to a family emergency at home, both trip delay and trip interruption insurance will prove very valuable.

Baggage loss benefits can help if your luggage doesn’t make it on board your ship or if your personal belongings are stolen.

Travel medical insurance may be the most important coverage in light of the Covid pandemic. Plans that include Covid coverage can reimburse you if you contract the virus before the trip and have to cancel, or if you become sick during the trip.

Medical evacuation coverage can pay to transport you to the nearest adequate medical facility for your condition, whether it’s illness or injury.

This coverage is essential if your U.S.-based health plan has limited medical coverage outside the U.S. And Medicare doesn’t apply to health care outside the U.S. except in very limited cases.

Do You Want the Option to Cancel for Any Reason?

Meghan Walch, a spokesperson at travel insurance comparison provider InsureMyTrip, notes that standard travel insurance policies do not allow you to cancel a trip because you have worries about Covid. You also can’t cancel under a standard travel insurance policy for a change of heart, a big fight with your travel companion or a fear of getting seasick.

If you want the highest-tier of cancellation flexibility for your travel plans, splurge for a “cancel for any reason” (CFAR) coverage add-on. It adds an average of 50 percent to your insurance cost. With this upgrade you can cancel for any reason up to 48 hours before the trip. Reimbursement under a CFAR claim is generally 75 percent of the trip cost, not 100 percent.

“This is really the only way for you to recoup some of your pre-paid, non-refundable trip costs if you decide not to travel because of a spike in Covid cases,” explains Walch.

Check Travel Requirements

Check with your cruise line on requirements for vaccination, Covid testing and/or travel insurance. Rules are changing frequently.

Carnival requires unvaccinated guests on ships sailing from Florida and Texas to show proof of travel insurance. Each unvaccinated guest must have a minimum of $10,000 in medical expense coverage and $30,000 in coverage for emergency medical evacuation, both including Covid coverage. This requirement is waived for children under age 12.

Even if you’re fully vaccinated, it may be in your best interest to have a solid travel insurance policy in place. “InsureMyTrip highly recommends all cruisers purchase a travel insurance policy. Cruises can be expensive, and with the multi-leg nature of a cruise, travel insurance can help to protect your investment,” Walch says.

Erica Lamberg is a personal finance and travel writer based in suburban Philadelphia. She is a regular contributor to USA Today and her writing credits include NBC News, U.S. News & World Report, Business Insider, Oprah Magazine and Creditcards.com .

Read More On:

- FBS Marketplace

More Lifestyle

How Zendaya’s New Movie Levels Up the Luxury Product Placement Game

Culinary Masters 2024

MAY 17 - 19 Join us for extraordinary meals from the nation’s brightest culinary minds.

Give the Gift of Luxury

Latest Galleries in Lifestyle

VIP Perks at America’s Top Sports Arenas in Photos

The History of Luxury in 50 Objects, From Cleopatra’s Barge to Louis Vuitton Trunks

More from our brands, miranda lambert goes bold and blue in denim jumpsuit with turquoise, rhinestones and fringe for stagecoach 2024, performs with reba mcentire, mlbpa rips nike amid changes to controversial uniforms, luna carmoon’s venice winner ‘hoard’ acquired for u.s. and canada by sunrise films (exclusive), dani levinas, art enthusiast who ‘collected collectors,’ dies at 75, the best yoga mats for any practice, according to instructors.

Virgin Money and Virgin Red offer exclusive Travel Insurance rewards for Virgin Red members

We know taking travel insurance out can be one of the least exciting ‘To Dos’ when planning for a trip, but that's all about to change with Virgin Red and Virgin Money . Virgin Red members will be rewarded for taking out travel insurance, so you can explore the world feeling safe and spoiled.

Virgin Money Annual Multi-trip Travel Insurance

If you’ve got a few trips coming up, Virgin Money’s annual multi-trip travel insurance will give you the peace of mind you need to truly relax.

What could be more relaxing than that? 3,500 Virgin Points that's what, from your friends at Virgin Red.

With Virgin Money’s Annual Multi-Trip insurance , you can choose up to 94 days’ worldwide cover per trip, with everything you care about covered – from your gadgets to your health.

Added benefits

Covid cover included - cancellation and medical expenses are covered by Virgin Money, as standard, if you’re diagnosed with Covid-19.*

Gadget cover as standard, plus optional extras - from Enhanced Gadget and Enhanced Covid Cover – to cover for winter sports, car hire excess, and more (fees apply).

On hand to help, 24 hours a day, 365 days a year - help is just a phone call away with Virgin Money’s worldwide medical emergency assistance helpline.

Your policy at your fingertips - looking after your policy is now a breeze, thanks to Virgin Money’s handy new online portal – from downloading docs to making a claim, all in one place.

*Please check your policy wording for full details and any exclusions.

The Virgin Money travel insurance has three levels of cover : Red, Silver and Gold, so you can choose which suits you and your needs best.

Managing your travel insurance is a breeze. Simply register online then unwind knowing you can do anything from updating your personal details, to making a claim, all in one place.

The fun part - spending your points

Virgin Red members are rewarded for everyday spending, and with everything from the biggest brands in retail, travel and entertainment to smaller treats or exciting new start-ups, there are so many different rewards which anyone would enjoy. Members can also use Virgin Points for good by supporting a number of different charities or helping develop technology to remove carbon from the atmosphere.

What will you put your points towards? Your next flight, getaway or holiday? Navigating the world of Virgin Wines? Or another Virgin Red treat, experience or exclusive? Enjoy deciding.

Buy your travel insurance today with Virgin Red and Virgin Money and earn 3,500 Virgin Points.

Terms and conditions

Who can take up this offer?

Virgin Red Members who are 18+ and resident in the UK.

How do you take up this offer?

It’s important that you follow these steps to make sure you are eligible for this offer. If you don’t, you might not get your points... and we don’t want that!

Buy a Virgin Money Annual Multi Trip Policy (the Policy) via the offer in the Virgin Red app or Virgin Red website.

You’ll see the offer listed in the “Earn Points” section of the Virgin Red app and website.

Just click on “Get Points” when you want to go ahead. This will link you to the offer page on the Virgin Money website.

From there, click on ‘Get a quote’ and fill in your policy requirements to receive a quote.

Make sure you choose the Annual Multi-trip Policy. The Policy start date must be within 45 days of buying the Policy.

When you’re happy to go ahead, pay for the Policy. o You will receive a confirmation email from Virgin Money.

You need to hold the Policy for at least 45 days to be eligible for the Offer before points are credited to your Virgin Red account. If you or Virgin Money cancel the Policy before 45 days, you won’t be eligible for points.

This offer can’t be used in conjunction with any other offer. Points are only offered in year one of the policy.

What is the offer?

If you meet the offer conditions, we’ll give you a Virgin Red promo code. You can redeem this code with our friends at Virgin Red to get 3,500 Virgin Points.

We’ll send you an e-mail with your promo code within 28 days of you meeting the offer conditions. We’ll send your code to the e-mail you gave when you bought the Policy. The email will provide instructions on how to redeem the code within the Virgin Red app or website.

Your Virgin Red promo code can be used until 30 April 2023. Make sure to redeem your code before then.

Only one Virgin Red promo code will be generated per eligible Policy.

After you’ve redeemed your Virgin Red promo code, the points are added to your Virgin Red account. There is no specific expiry date for using the points. You’ll be free to use them in line with Virgin Red’s programme terms. You can find the terms here [ http://policies.red.virgin.com/terms ].

We thought we should highlight a few key things from Virgin Red’s terms:

the points don’t have a cash value and they can’t be swapped for cash;

the available offers can change from time to time; and

the points cost for each offer can change too.

Although we’ll be working closely with our friends at Virgin Red on this promotion, we aren't responsible for their terms, their marketing, or any of the offers available through their app. Just contact Virgin Red or the relevant offer provider if you have any questions about these topics.

When can you take up the offer?

The offer will be available on an ongoing basis until we withdraw it. We can withdraw the offer without giving you any advance notice, but we’ll try to give some notice if we can.

The offer is subject to availability. This means we will definitely withdraw it when we’ve used up our stock of Virgin Red promo codes.

You don’t need to worry if we withdraw the offer when you’re part way through meeting the offer conditions. As long as you've bought the Policy before we withdraw the offer, you can still qualify. You’ll just need to continue to meet the rest of the conditions.

What else do you need to know?

You can only benefit from this offer once.

We’ll use your personal information to help us run the offer.

English law applies to the offer.

Standard Virgin Money Travel Insurance Policy conditions apply.

If something goes wrong, we’ll try to fix it. If we can’t because it’s something we can’t control, or it’s not our fault, then we may have to change the offer. This includes suspending the offer or ending it early. We can make such changes without giving you notice. However, we’ll try our best to avoid making changes. And we’ll try to minimise any disappointment to you when we make changes.

Who is the promoter?

We are Clydesdale Bank PLC trading as Virgin Money.

Our company number is SC001111.

Our registered office is 30 St Vincent Place, Glasgow, G1 2HL.

Virgin Red and Virgin Money give new customers 20,000 reasons to switch

Unlock Virgin Red: How to earn Virgin Points with a Virgin Money M Plus Account or Club M Account

Who wants to be a virgin points millionaire.

- Fly with Virgin Atlantic

- Upgrades and Extras

- Travel Insurance

Travel insurance

Selecting Allianz Travel Insurance at checkout is the easiest way to protect your investment, giving you more freedom to embrace your entire travel experience.

If you've already booked your flights, you can still find a plan to protect your trip.

Provides reimbursement for your prepaid, non-refundable travel expenses if your trip is cancelled, interrupted or extended due to a covered reason.

Provides benefits for losses due to covered medical and dental emergencies that occur during your trip.

Arranges and pays for medically necessary transportation following a covered injury or illness to an appropriate medical facility, return of dependents and more.

Provides reimbursement for eligible meals, accommodations and more when your trip is delayed for 6 or more consecutive hours for a covered reason.

Provies reimbursement for covered losses due to damaged, stolen or lost luggage and personal effects.

Provides reimbursement for the purchase of covered essential items during your trip if your luggage is delayed for 24 hours or more.

Award-winning, multilingual, travel experts here to help you deal with unexpected travel hiccups around the clock. We can help you find local medical and legal professionals, help with missed connections or lost/stolen travel documents, and more.

Free Look period

If you are not completely satisfied, you have 15 days (or more depending on your state of residence) to request a refund of your plan, provided you haven't started your trip or initiated a claim. Premiums are non-refundable after this period.

File a claim

Upload documents, track your claim status, and more through the convenient online portal .

- United States

- United Kingdom

Virgin Travel Insurance Review

Round-the-clock emergency assistance and unlimited cover for trip cancellations are just 2 reasons to choose virgin travel insurance..

In this guide

Compare your travel insurance quotes

Summary of virgin money's comprehensive cover policy, what cover options are available from virgin and what exactly do they provide, 1. international travel cover, 2. virgin domestic travel insurance, 3. virgin multi-trip travel insurance, looking for some extra cover for your trip additional options you may want to consider, what are the benefits and what are the drawbacks of virgin travel insurance, what is the maximum age i can still get travel cover, if something happens how do i make a claim, faqs about virgin, why choose virgin for your trip.

Destinations

Our Verdict

- Virgin Travel Insurance is one of the few providers we found that regularly offers discounts on its products, including for existing customers. Keep an eye out for the latest deals on their website.

- This provider offers a flexibility with its travel plans, with 6 cover types including 2 for domestic travel.

- We compared 10 leading travel insurance brands and found that Virgin Travel Insurance offered comparatively limited seniors cover, with a maximum age of 74 on some of its policies (correct as of June 2021).

Virgin Money Australia has expanded its insurance portfolio and now offers comprehensive travel insurance plans for both domestic and international trips to suit a range of needs and budgets.

You can compare the features of various Virgin Travel Insurance policies by using the table below and get a free quote.

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Who underwrites Virgin Travel Insurance?

Table updated August 2021 *Note: 'Unlimited' means that there's no capped dollar sum insured, however, other conditions and exclusions may still apply.

How can this page help me decide if Virgin Money Travel Insurance is right for me?

- What cover options are available from Virgin?

- Additional options you may want to consider

- What are the benefits and what are the drawbacks?

- How much excess do I have to pay when I claim?

- Frequently asked questions about Virgin

Whether you are a one-off or regular traveller, globetrotting around the world or keeping it local, you may be able to find suitable travel insurance cover with Virgin that you can more closely tailor with a range of extras.

If you are looking to secure a travel insurance plan for a single overseas trip, Virgin offers different levels of cover available to single travellers and family. For international travel, there are three cover levels that you can choose from:

- Comprehensive

How does each level of cover compare with another?

Table updated August 2021

Virgin Travel Insurance also provides comprehensive protection cover for applicants looking to take a trip locally in Australia. Going for a snowy adventure or hitting the golf clubs to practice your tee shot? You can take up additional sports cover to help protect yourself against loss or damage of sports equipment. Domestic cover from Virgin is available as a single or family plan.

What is covered under domestic travel insurance policies?

If you regularly travel overseas or locally, either for work or holiday purposes, you can take advantage of Virgin Multi-Trip insurance that provides cover for unlimited journeys within a 12-month period. Virgin Multi-Trip Travel Insurance cover is available as a single plan. However, if you take your spouse/de facto partner and/or children with you on these trips, they will be covered automatically.

What is covered under multi-trip travel insurance policies?

- Overseas emergency medical assistance

- Overseas emergency medical and hospital expenses

- Accidental death

- Permanent disability

- Cancellation fees and lost deposits

- Additional travel and accommodation expenses

- Travel delay expenses

- Alternative transport expenses

- Travel documents, credit card and cheques

- Theft of cash

- Loss of luggage and personal effects

- Luggage and personal effect delay expenses

- Personal liability

- Rental vehicle excess

Going away for a Ski Trip? Learn more about Ski Travel Cover

With Virgin Travel Insurance, you have the flexibility to tailor your policy of choice with additional cover options. These options will incur additional premiums:

- 24/7/365 Emergency Assistance. Virgin Travel Insurance is underwritten by Allianz who provide emergency assistance with Allianz Global Assistance.

- Claims process is quick. With Virgin Money you can access guidance for the travel insurance claims process – you call it up and the claims team can guide you through the claims process.

- Cooling off period. Virgin Travel insurance has a 14-day cooling-off period in case you change your mind or travel plans.

- No increased cover for expensive items. You cannot purchase increased cover for jewellery or Snow Sport Equipment.

- No one-way policies. Virgin Travel Insurance only covers trips that start and end in Australia.

- No already overseas option. You cannot take out cover after you have begun your trip.

- Limited seniors cover. Some Virgin Money travel insurance policies have a maximum age of 74 for policyholders.

Check if there are any active Virgin Travel Insurance coupon codes

You can make a claim by downloading a claim form and submitting your claim with the appropriate supporting documents

What documents will I need to provide with my claim?

- Police reports

- Medical reports

- Original receipts or proof of purchase and ownership

How long will it take for claim to be processed?

Questions about applying, q. who can purchase virgin money travel insurance policy.

- A. You are eligible for cover if:

- You are an Australian resident.

- You are taking out cover prior to the start of your journey.

- Your trip begins and ends in Australia.

Q. Which age group is eligible for Virgin Travel Insurance cover?

- A. The age limits will vary depending on type of cover you are looking to apply for:

- Single Comprehensive and Domestic – 16 years old and over

- Multi-Trip and Basic – 16 to 74 years old

- Essentials – 16 to 69 years old

Q. When should I buy my travel insurance policy?

- A. You may want to take out Virgin Travel Insurance cover as soon as you put down a deposit or fully paid for your trip, or up to 12 months before your departure date.

Q. When will my travel insurance cover start?

- A. Your policy will be active on the date you purchase your cover. You will receive an email confirmation and Certificate of Insurance after application.

Questions about cancelling policies

Q. can i cancel my virgin travel insurance policy.

- A. You can cancel your cover within the 14-day cooling off period and you will get a full refund of premiums paid. Conditions apply.

Questions about coverage

Q. will i be covered if i have a pre-existing medical condition.

- A. Virgin Travel Insurance Australia provides cover for pre-existing conditions specified on the policy. Conditions may apply depending on the nature of the condition.

Q. Does Virgin Travel Insurance cover one-way trips?

- A. No. For Australia, Virgin Money Travel Insurance only provides cover for trips that start and end in Australia.

- Travel with one of Australia’s largest general insurance providers. Despite being a newcomer to the travel insurance market, Virgin Money Australia is one the nation’s leading financial institutions. Virgin Travel Insurance policies are underwritten by Allianz Australia, one of the largest travel insurance groups in the country.

- Different options to suit many travellers. Virgin Travel Insurance has developed a variety of travel plans with features and benefits to suit different kinds of travellers and their needs. Looking for a basic cover? Virgin Travel Insurance offers Basic or Essentials cover for when you travel abroad. Want top level cover? The Comprehensive cover might be a suitable solution for overseas trips. Domestic travellers can also benefit from two levels of travel cover available through Virgin.

- Tailor your policy to more ideally suit your needs. You can customise your travel protection plan by adding different options to suit your needs. Depending on the type of cover that you opt for, you can choose to add sports cover, get extra cover for your valuables and luggage, or increase your rental vehicle excess.

- 24/7 emergency assistance no matter where you are in the world. With the support from Allianz Global Assistance, you can benefit from global emergency assistance with access to doctors, nurses and support staff; available 24/7 to Virgin Travel Insurance policyholders.

- 14-day cooling off period. Once you have purchased your Virgin Money Travel Insurance policy, you have 14 days to be sure that you have made the right decision. You can cancel your cover within this period and you will receive a full refund as long as you have not commenced your trip or made a claim.

- Cover for 36 pre-existing medical conditions at no extra cost. If you have a pre-existing medical condition, Virgin Travel Insurance provides cover for applicants with any one of the 36 listed on your policy at no extra cost. Virgin may offer full cover as long as you have not been admitted to a hospital for the elected condition in the 24 months prior to your policy’s commencement date. Some of the pre-existing medical conditions that Virgin travel insurance will cover include:

- Carpal Tunnel Syndrome

- Diabetes Type I and II

- Hypertension

- Hypothyroidism

- Macular Degeneration

Jessica Prasida

Jessica Prasida is a travel insurance expert for Finder. She lives and breathes travel, having worked as a travel agent and branch manager at STA Travel for over 4 years, then writing about travel insurance with Finder for another 5 years. Jess has a Bachelor of Business from the University of Technology, Sydney and a Tier 1 General Insurance qualification.

More guides on Finder

Virgin offers high quality, affordable insurance policies for your travel needs. Discover deals and offers on Virgin Travel Insurance from finder.com.au.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

18 Responses

I’m looking for travel insurance. I’m on a 12-month visa here in Australia and I’d like to get comprehensive insurance for 12 months to cover my trip to the US in April. Can I get insurance for all my stay here in Australia? I’m from Ireland and I’m 68 years, healthy no illnesses.

Thank you for getting in touch with Finder.

General eligibility requirements for inbound travel insurance include:

- You must be a non-resident of Australia travelling to Australia for a temporary period and then returning to your home country

- You must be under 81 years of age at the time the policy is issued (age limits vary between insurers)

- Your trip must include travel within Australia

- You must have purchased cover less than 12 months prior to arriving in Australia

Since you have arrived in Australia and considering getting travel insurance for your trip to the US in April, you can check some non-resident travel insurance . I suggest that you contact your chosen insurer directly to know your cover well before leaving for your trip.

I hope this helps.

Thank you and have a wonderful day!

Cheers, Jeni

Can I book travel insurance outside of Australia? I am currently working in Japan then travelling to Thailand and UK. I am an Australian citizen.

Thank you for reaching out to Finder.

I’m afraid you may not be qualified to get one from Virgin Travel Insurance. Their insurance is backed by Allianz and they require that your journey should commence and end in Australia. You may want to check travel insurance for Australian expats to check your options. The page also discusses the types of cover that may be available for expatriates, coverage FAQs, etc.

Hope this helps and don’t hesitate to contact us back if you require further assistance.

Kind Regards, Mai

Hi, does this insurance cover cruises in Europe – italy/croatia/greece?

Hi Rosemary,

Thank you for leaving a question.

Yes, Italy, Croatia and Greece are covered by Virgin International Travel Insurance. Hope this helps!

Cheers, Reggie

What about disaster insurance cover for Bali?

Thank you for your inquiry.