- Help Home keyboard_arrow_right

About Travel insurance

Should you purchase travel insurance for your vacation rental?

Vacation rentals booked through Airbnb and its alternatives have become popular holiday destinations for all types of travelers, from extended families staying in large beachfront homes to couples vacationing in swanky city apartments.

But what happens if these rental properties, especially ones worth millions of dollars, get damaged before you arrive or if your plans unexpectedly change, causing you to need to cancel or shorten your stay?

While the exact outcome will depend on the situation, if you purchase travel insurance , you may find you're eligible for compensation.

So how do you know if it's worth the investment before your next trip? TPG dug into the details to determine what standard travel insurance policies may cover you for when staying at home rentals — and when you may want to purchase some additional coverage.

For more TPG news and tips delivered each morning to your inbox, subscribe to our daily newsletter .

What travel insurance covers for vacation rentals

Traditional travel insurance policies offer features that will cover you and your invested travel costs, whether you're staying at a hotel , friend's house or rental property. Although the exact benefits for vacation rentals may vary slightly depending on the policy you choose, there are a few situations that most will cover.

Your vacation is canceled due to sickness, injury or an emergency

Many hotels offer free cancellations until two or three days before arrival so long as you book your rooms with flexible rates. However, this is rarely the case for vacation rentals, which often have strict cancellation policies requiring 30 to 60 days of advance notice to cancel without penalty. Some even go so far as to have completely nonrefundable deposits, regardless of the cancellation circumstances.

Fortunately, there's a workaround to this conundrum if you find yourself in an unexpected situation involving your health or the health of someone close to you: trip cancellation coverage. If you have insurance with trip cancellation coverage and cannot complete your trip as planned due to select health-related issues, you'll be able to recoup up to 100% of your nonrefundable costs.

While the exact cases that are eligible for complete reimbursement vary by policy, know that many pertaining to health are covered. For example, World Nomads ' trip cancellation insurance policy will cover you in the event you need to cancel your vacation, including any stays at home rentals, due to illness, injury or a death in the family.

You have to cut your vacation short due to a medical reason or natural disaster

In addition to helping you out when you need to cancel your entire vacation, insurance can reimburse you for early departure fees when you find yourself needing to cut your vacation rental stay short. Know, though, that you'll need to have a policy offering trip interruption protection to be eligible for this perk.

Covered reasons for ending your stay early will vary from plan to plan, but typically, policyholders can expect reimbursement due to health-related issues and natural disasters like hurricanes, wildfires and blizzards. For instance, IMG's travel insurance covers sickness, injury and natural disaster evacuations when cutting vacation rental stays short.

You cannot stay at the rental due to it being uninhabitable

If you book a vacation rental that is not fit for human habitation, then the booking company or owner should refund all your costs. However, there are rare occasions when this does not happen, so it's important to have travel insurance as a backup.

To qualify for reimbursement from your travel insurance provider due to uninhabitable conditions, you'll need to read the fine print of your chosen policy. Allianz , for example, defines uninhabitable as "a natural disaster, fire, flood, burglary or vandalism that has caused enough damage (including extended loss of power, gas or water) to make a reasonable person find their home or destination inaccessible or unfit for use."

Other situations, such as having an unpleasant or dirty vacation rental , would not be enough to trigger this coverage.

Should you have to find another property or cancel your trip completely due to uninhabitable conditions at your original rental, your travel insurance plan will cover the added costs you incur.

Related: 13 mistakes to avoid on your next vacation home rental

What travel insurance won't cover for vacation rentals

As you may expect, there are some situations when travel insurance won't cover extra expenses related to stays at rental properties. To have a solid understanding of what to expect, be sure to read the fine print of any insurance product you choose. Only circumstances listed in the policy will be covered. The following are two key reasons why you wouldn't be covered.

You accidentally damage the property during a typical stay

Most travel insurance policies will not cover the costs of damage you incur at a rental property, even if it was done by accident. As a result, you must pay for a replacement or repair to any item you accidentally break or damage, such as a work of art, a garage door or wine glasses. Depending on the item in question, this can quickly add up.

If you have a homeowners or renters insurance policy, know that it may include protection beyond regular limits called "umbrella" coverage, which can help cover damage caused at a rental property. Keep in mind, though, that you'll have to pay your deductible first. Additionally, your home insurance rate may rise if you submit a claim for vacation rental damage.

Should you wish to stick with travel insurance, you may be able to add extra vacation rental coverage to a traditional policy to assist with accidental damage. Faye's travel insurance , for example, has an add-on feature that offers "coverage if you unintentionally damage the vacation rental property you're staying in or its contents, while in-trip." It costs about 10% of what you'll spend on the main policy itself.

You damage the property while hosting a party

Across the board, travel insurance policies are much more strict about damage caused during parties. If you host an unapproved party or event at a rental property and damage any part of the rental, you will be responsible for covering costs associated with repairs and replacements.

Even approved events are not entirely off the hook for any damage caused to the property. Should you decide to use a vacation rental for an approved event like a wedding or family reunion, expect the booking company or owner to require you to purchase an event-specific insurance policy that covers guest liability, home damage and other items that may be specific to the location.

Related: 6 truths and myths about 'cancel for any reason' travel insurance

Bottom line

Home rentals can be a great lodging solution when you're on vacation, especially if you're traveling with family or friends. However, the high cost of some vacation properties and the cancellation policies often in place mean you should probably purchase some kind of travel insurance to protect your investment.

Typical travel insurance policies will offer coverage for your vacation rental costs should your trip be canceled or delayed for events covered under the policy, but you may be on the hook for other scenarios. As a result, it's vital you pay careful attention to your policy's terms. Doing so will ensure you know what to expect should you face an unexpected situation while enjoying your temporary home away from home.

Related: 7 things to look out for when buying travel insurance, according to an expert

Home » Online Shopping » Vacation Rentals » How Does Vrbo Insurance Work?

How Does Vrbo Insurance Work for Travellers and Property Owners?

Having insurance to protect yourself and your assets is essential. Whether you are a guest or a host renting your property to travellers, unexpected and unfortunate accidents can happen to anyone.

In this article we will be getting into the nitty gritty of what Vrbo insurance covers for hosts and guests, so that both parties have one less thing to worry about. To learn more about how Vrbo works before you plan your next vacation, we’ll cover everything you need to know about Vrbo property and traveler insurance.

What is covered in this article

Vrbo insurance for owners and renters, vrbo insurance for travelers.

To help you book your next vacation with confidence, we’ll teach you all there is to know about Vrbo insurance.

Vrbo’s $1M liability insurance provides owners and property managers with liability protection for all stays that are processed online through the HomeAway checkout, giving them $1,000,000 in primary liability coverage at no additional cost. From a renter’s point of view, they are insured to be reimbursed for the accident that happened at the host’s property.

How Vrbo insurance protects owners

The following types of scenarios describe what Vrbo’s insurance coverage includes for owners so that they don’t have to spend any money out of their pocket.

- Injury claims made by traveler s: If a traveller staying at your property injured themselves (by say falling down the stairs or burning their hand while cooking), the owner can file a claim with Generali to cover the medical bills against the $1M liability insurance plan.

- Property damage claims : If a traveller staying at your property causes damage to your property (such as damaging furniture, flushing something down the toilet that messes with the plumbing system, etc.), then the liability insurance would cover the cost of fixing it up to a maximum of $1 million.

How Vrbo owner insurance works

Vrbo’s $1 million liability coverage comes in handy, as most homeowners’ plans do not provide protection if the property is used as a vacation rental. In a situation where an owner doesn’t have liability coverage for their property, Vrbo’s liability insurance will provide the basic liability coverage. If someone already has a liability policy, Vrbo insurance will act as additional coverage on top of what they already have.

This insurance program applies to Vrbo properties listed anywhere in the world, and homeowners are not obliged to use it. However, any reservations processed through HomeAway checkout are automatically protected at no additional cost.

Vrbo offers insurance that travelers can purchase to protect the booking of their upcoming stay against unexpected cancellations, delays, and interruptions. A traveller can be reimbursed for non-refundable fees or any other out-of-pocket expenses if there is a problem with their stay for a reason that is covered under the Vrbo travel insurance.

Vrbo travel insurance

While making a booking on Vrbo, the traveller will be given the option to buy the Vrbo travel insurance at checkout and also after their booking is confirmed, in case they decide to buy it then. If the traveller is not satisfied with the plan for any reason, they can cancel their coverage within 10 days of buying for a full refund. If their trip is cancelled and they won’t be needing the insurance, all they need to do is call Generali at 877-880-0975 to cancel their Travel Insurance plan.

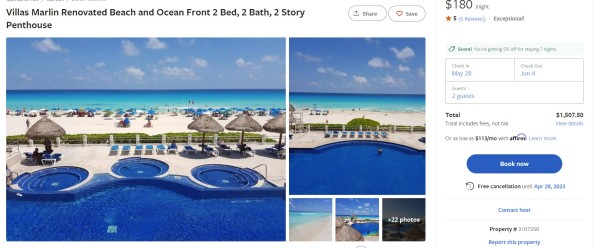

Vrbo Accidental Damage Protection

The Accidental Damage Protection plan provides guests with coverage for any accidental damage that could take place at the vacation rental during the period of their stay. If the owner holds the damage deposit or more money is owed to cover the loss, then Damage Protection can reimburse them for the difference.

Like all other coverages on Vrbo, Generali Global Assistance has an accidental damage protection insurance plan that travelers can purchase 24 hours before check-in. Vrbo recommends damage protection to their travelers with children, pets, and when visiting in a large group.

Let us look at the different types of policy options that a traveler can purchase:

- $59 for $1500 coverage

- $79 for $3000 coverage

- $99 for $5000 coverage

Travelers get the option to buy the Accidental Damage Protection at checkout or when they make the payment on their booking. They can also directly purchase this on the Generali site . If the traveler(s) choose to purchase this protection, they will receive an email confirmation after their purchase containing the certificate of insurance and a copy of the policy.

For any reason, if the traveler decides that they don’t want this plan, they can request a refund as long as it is before their check-in date. They must call Generali before their scheduled date of arrival to receive a refund. The policy is also eligible for a full refund, if the reservation is cancelled.

We hope we have been able to help you understand everything there is to know about Vrbo insurance from a host and a guest’s point of view. You may also check out more articles in our Vrbo series to learn if Vrbo is safe and reliable and our overall review of Vrbo .

More Great Related Articles

Best 5 Sites Like Angi to Hire Home Contractors

Best 7 Sites Like HomeAway for Booking the Best Home Rentals

What Is Bitcoin and How Does It Work?

What Are Ethereum and Ether, and How Do They Work?

Vrbo Insurance: a Comprehensive Guide for Hosts

- May 20, 2022

- STR Life , Vrbo

By The Hospitable Team

When you list your property on Vrbo, you put someone in charge of taking care of your house or apartment while you are not there. You can’t be sure that all your guests will treat your home like their own, so there’s no guarantee that you can avoid unpleasant surprises that may cost you a fortune.

That means you need to protect yourself beforehand with the right insurance. In this guide, we’ll talk about how Vrbo insurance works. We hope that this information will help you protect your vacation rental property in the way that works best for you.

If you list your property on several platforms, you may also want to learn more about Airbnb insurance .

Vrbo Insurance for Owners: Why Do You Need Special Insurance for Your Rental?

Most people who choose real estate side hustle to earn passive income have a homeowner insurance policy, but it has significant coverage gaps. Homeowner insurance is designed for an owner-occupied property, but vacation rentals are different. They are used for rental guest stays and owner’s vacations throughout the year, and there are periods when they aren’t unoccupied.

That’s why relying on it to cover the short-term rental you list on Vrbo, Airbnb, Booking.com , or other OTA website s is a misinformed choice. You need a vacation rental insurance policy that can cover all three uses. And if you regularly rent your vacation property, you need business insurance. Without it, you’re vulnerable to the costs of property damage and liability suits.

Vrbo recommends Proper Insurance as their preferred home insurance vendor in the US because the company’s insurance policy is comprehensive. It’s also designed to address the unique exposure of vacation rentals.

So what does Vrbo insurance cover? It provides coverage for your building, contents (including furniture and small appliances), loss of income, and liability. Vrbo insurance for owners from Proper Insurance is offered in all 50 states.

It’s critical for you as a host to ensure that your property is appropriately covered with a comprehensive insurance policy because it will give you peace of mind and confidence. Then you’ll be able to focus on what you can do best—providing an amazing experience for your guests, and that’s impossible without effective communication.

You should be available to your guests almost 24/7 and answer all their questions as fast as possible to make them happy. It’s a challenge, but you can automate this process with tools like Hospitable.com.

Have conversations with your guests even when you sleep.

Vrbo liability insurance.

While vacation rental guests are on your property, you’re immediately liable for their safety . But typical homeowner policies may not provide liability protection when your house is used as a vacation rental. That’s why it’s critical to have appropriate coverage for liability issues that may arise when you rent out your home to a guest.

To help protect your financial well-being, Vrbo provides $1M Liability Insurance for owners and property managers. Vrbo Liability Insurance program is offered at no additional cost to you. It provides protection for every reservation processed through the platform, no matter where in the world your rental property is located.

If you don’t have liability insurance for your rental, this policy responds first if someone makes a claim against you. If you already have a liability policy for your vacation rental, the program gives you $1,000,000 per year in added protection.

What Does Vrbo Insurance Cover?

Wondering how you’re protected? The program may provide coverage for claims made against you

- If a traveler is accidentally injured while staying in your rental property;

- If a traveler accidentally damages the property of a third party, for example, a neighbor while staying in your rental property, and the third party sues you for that damage.

But you should keep in mind that $1M Liability Insurance doesn’t cover damage caused by a traveler to your property. For such situations, you need a business insurance policy that would cover property damage costs.

Vrbo Damage Insurance: What Are the Alternatives?

What else can you do to protect your Vrbo property from potential damage? Extensive damage to a rental property is rare, but smaller damage, such as broken glass or scuffled furniture, can occur occasionally.

So although there’s no Vrbo damage insurance, the platform provides hosts with several mechanisms to protect their rentals. Hosts can require travelers to purchase Property Damage Protection or pay for their damages with their own money.

To minimize the risk of potential damage, you should clearly communicate your expectations regarding events, pets, children, and smoking in your house rules . Besides, you can require that travelers sign a legal rental agreement that details how they are expected to treat your property during their stay. This can help eliminate guests’ possibility of filing a dispute if you need to file a Vrbo damage claim.

Vrbo Damage Deposit

You can set a damage deposit amount that your guests will be responsible for if they cause damage to your rental property. You’ll have up to 14 days after a guest checks out to file a claim. Vrbo will charge this amount on your behalf to the traveler’s credit card that they used for the booking (it’s the default option).

Another option is an upfront refundable damage deposit that your guest will be charged when booking. Vrbo will hold it throughout the booking process and the guest’s stay. If no claim is filed, the Vrbo damage deposit will be refunded to the guest after 14 days.

Vrbo Damage Protection

Property Damage Protection is an optional insurance that you may allow your guests to purchase. It’s intended to protect Vrbo guests up to the coverage amount if accidental damage to the rental property occurs during their stay.

Guests will see the property damage protection charge during the booking process, just like the refundable deposit. Guests can also purchase additional travel insurance that includes Vrbo cancellation insurance. It protects their trip’s costs if they need to cancel or have an issue with booking or boarding.

Hosts can suggest an insurance plan level, but it’s up to travelers to decide whether they should go ahead with this option during the booking process. Guests can also pay the Vrbo damage protection amount as a refundable damage deposit instead of the non-refundable amount.

Hosts determine the amount required across all types of damage deposits. And guests can see the amount in the “house rules” section of the listing and during the checkout process before they officially book the rental.

The Vrbo guests are responsible for treating your property with respect. But you should remember that you are also responsible for making sure your rental space is well maintained and guest-ready before each stay. That’s a lot of work, so you may want to hire a team to help you with cleaning and maintenance .

And vacation rental software like Hospitable.com will help you assign new tasks to all your team members automatically. Moreover, with Hospitable, you can automate almost all your operations and manage listings on multiple platforms as easily as one.

All your STR business in one convenient window

How to file vrbo damage claim.

If you want to file a Vrbo damage claim, you must provide a brief description of the damages. Vrbo will share this description with the guest to inform them about it. You are not required to provide any photos or other evidence of the damages.

Vrbo also encourages hosts to contact the guest directly before filing the claim, using their messaging platform. This open conversation allows you to discuss the damages, the amount you intend to charge and provide the guest with any evidence, such as before and after photos. If you do so, it can help reduce the chances that the guest will file a dispute.

Here is what you need to do to initiate the claim:

- Log in to your account and select the listing if you have more than one rental property.

- Click Inbox and select the traveler’s name. You can use the All Messages drop-down menu to filter your conversations.

- Go to the Damage protection section and click Report damage.

- Enter the Damage amount you want to claim for the damage (it can’t exceed your damage deposit).

- Enter a description of the damage (this information will be sent to your guests).

- Finally, click Confirm.

Vrbo Damage Waiver Fee

A damage waiver fee is a prepaid, non-refundable fee included in a rental home’s total price. It covers accidental damages to your rental property during the guests’ stay. But it doesn’t cover intentional damage, for example, caused by parties, and damage caused by the violation of the house rules, such as violating a “no smoking” policy.

Damage waiver fees are standard in many vacation rental homes and are included in rental agreements. They protect guests from paying upfront for minor damages, such as broken furniture, spills, scratches on surfaces such as walls or doors, and stains. Many guests prefer paying extra for a damage waiver fee because it doesn’t require them to put down a large security deposit before their stay.

Final thought

It’s essential to have insurance to protect yourself and your assets when renting your property to travelers because unexpected and unfortunate accidents can happen to anyone. Keep in mind that your homeowner insurance may not cover renting out your home to guests as a business.

Vrbo insurance for hosts provides only basic liability protection and doesn’t cover damages caused by travelers to your property. So before you list your rental space on Vrbo, you should analyze what you want to protect and find additional vacation home insurance that suits your short-term rental business.

Rental Property Maintenance: Guide for Airbnb Hosts

One of the biggest responsibilities facing any host or property manager is vacation rental property maintenance. If you have been struggling to meet all your maintenance responsibilities, this post is for you. It will help you understand the basic steps you need to take to avoid costly repairs.

Vrbo Taxes: a Guide for Hosts in the US

Starting on Vrbo is easy, but if you want to succeed as a Vrbo host, you should treat this as a business. And an important part of operating a short-term rental business is taking care of lodging taxes. In this guide, we cover the basics of Vrbo taxes that you need to know to get started.

Vrbo Rules for Owners: a Starter’s Guide

Before you create a listing on Vrbo, it’s essential to review the laws that apply to short-term rentals in your area. Then you should examine the Vrbo hosting rules and prepare to follow the best practices. Don’t feel overwhelmed, and let this article guide you.

Join the best!

Get it now!

To boost your STR revenues

Wait! You are missing out!

Hospitable.com helps you automate messaging, team, and operations management, and run all your Airbnb, Booking.com, Vrbo, and Google properties from one convenient dashboard.

Best thing?

You can start totally free!

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 6 Best Vacation Rental Travel Insurance Plans

Allianz Travel Insurance »

Seven Corners »

AXA Assistance USA »

AIG Travel Guard »

Nationwide Insurance »

Red Sky Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Vacation Rental Travel Insurance Plans.

Table of Contents

- Rating Details

- Allianz Travel Insurance

- Seven Corners

When you're planning an affordable yet fun-filled vacation, a rental home can be a great lodging option. By booking a vacation rental that's a condominium, a rustic cabin or a private villa instead of a hotel or resort, travelers get to enjoy more of the comforts of home during a trip, such as a living space and a kitchen to make meals in.

But you can't plan for everything, so you don't necessarily want to skip over a travel insurance policy in case something goes wrong. Investing in vacation rental travel insurance is the best protection you have against inclement weather or a natural disaster ruining your trip or forcing you to evacuate your vacation home before the end of your rental period.

The best travel insurance plans also offer additional coverage for travel delays, baggage loss, emergency medical expenses, emergency evacuation and other perils. Before you book a vacation property directly from an owner or through a platform like Airbnb, Vacasa or Vrbo, read on to learn about the best travel insurance policies for this type of trip and what they include.

- AXA Assistance USA

- AIG Travel Guard

- Nationwide Insurance

- Red Sky Travel Insurance

Best Vacation Rental Travel Insurance Plans in Detail

Customizable coverage that works well for vacation rentals at any price point

Kids 17 and younger covered for free with some plans

OneTrip Basic plan may have insufficient coverage for your needs

- Trip cancellation coverage worth up to $100,000

- Trip interruption coverage worth up to $150,000

- Trip change protector worth up to $500

- $50,000 in coverage for emergency medical expenses

- Up to $500,000 for emergency medical transportation

- Baggage loss and damage coverage worth $1,000

- Baggage delay insurance up to $300

- Travel delay coverage worth up to $800 ($200 per day)

- 24-hour travel hotline assistance

Broad selection of plans to choose from

Ideal vacation rental coverage for domestic trips available

Domestic plans with Air Travel Bundle come with low limits for baggage and personal effects

- Trip delay coverage worth up to $300 ($100 per day)

- Travel inconvenience coverage worth up to $150

- Baggage coverage worth up to $500 ($250 maximum per item)

- Baggage delay coverage worth up to $250 (up to $100 per day)

- Emergency accident and sickness coverage worth up to $50,000

- Coverage for emergency evacuation and repatriation of remains worth up to $250,000

- Emergency dental expense coverage worth up to $250

Offers comprehensive coverage based on your needs

Customize your policy with available add-ons

Optional CFAR coverage only available with Platinum Plan

- Trip cancellation coverage worth up to 100% of the total trip cost

- Trip interruption coverage up to 100%

- Trip delay coverage up to $500 ($100 limit per day)

- Missed connection coverage up to $500

- Emergency medical coverage up to $25,000

- Emergency evacuation coverage up to $100,000

- Accidental death and dismemberment coverage up to $10,000

- Common carrier accidental death and dismemberment coverage up to $25,000

- Baggage delay coverage up to $200

- Baggage and personal effects coverage up to $750

Customizable coverage with high limits

Cancel for any reason coverage available

Low medical expense limits for Essential Plan

- Trip cancellation coverage worth up to 100% of the trip cost

- Trip interruption coverage worth up to 150% of the trip cost

- Up to $1,000 in coverage for lost baggage

- Baggage delay coverage worth up to $300

- Travel medical expense insurance worth up to $50,000

- Up to $500,000 in emergency medical evacuation protection

10-day review period available

Preexisting conditions can be covered

Nationwide does not offer single-trip plans without medical or baggage insurance

- Up to $30,000 in trip cancellation insurance

- Trip interruption coverage worth up to 200% of the total trip cost (maximum benefit of $60,000)

- Trip delay coverage worth up to $250 per day ($2,000 maximum)

- Missed connection and itinerary change coverage worth up to $500

- Secondary coverage for baggage and personal effects worth up to $2,000

- Baggage delay coverage worth up to $600 for delays of 12 or more hours

- Accident and sickness medical expense coverage worth up to $150,000

- Emergency dental coverage worth up to $750

- $1 million in insurance for emergency medical evacuation

- Coverage for terrorism in a vacation destination

Choose from tailor-made plans for vacation rentals

Can only be purchased directly through vacation rental companies

Limited coverage options available (no option for rental cars or CFAR)

- Up to $100,000 in reimbursement for vacation rental expenses

- Trip delay coverage worth up to $750 (maximum of $200 per day)

- Coverage for emergency medical expenses and emergency medical evacuation (policy limits vary)

- Baggage delay insurance worth up to $1,000 per day ($200 per day)

- Emergency roadside assistance

- Worldwide emergency assistance services

Frequently Asked Questions

Vacation rental travel insurance works like any other type of travel insurance coverage. You pay a premium for the policy upfront, and you get varying levels of protection for trip cancellation or interruption, emergency medical expenses, emergency medical evacuation, lost or delayed baggage, and more.

You may not need certain types of travel insurance for trips in the U.S., such as coverage for emergency medical expenses if your own health insurance still applies. You may also choose to skip rental car insurance if you're using your own car and insurance for your trip. That said, it can still be beneficial to pay for travel insurance that covers trip cancellation and interruption, emergency medical evacuation, and more.

You can buy travel insurance online from top insurance companies. You may also be able to secure coverage with your vacation rental provider. Compare plans on TravelInsurance.com .

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel and travel insurance for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries, some of which have included vacation rentals within the U.S. and all over the world. Johnson lives in Indiana with her two children and her husband, Greg – a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

The Most Romantic Weekend Getaways in the U.S.

Amanda Norcross

You don't have to travel far for a romantic escape.

25 Top Family Weekend Getaways in the U.S.

Kyle McCarthy and Timothy J. Forster

Explore destinations for memory-making vacations with loved ones.

Your Quick Guide to Vrbo Travel Insurance

While you are supposed to unwind on a holiday, traveling does come with some risk. Enter travel insurance.

Travel plans change. Trips get canceled . Property can break.

To ensure that both hosts and guests have a memorable experience, Vrbo offers a number of ways that they can safeguard themselves against most unfortunate events. Without insurance, you run the risk not only of incurring unexpected costs, but also to end up feeling like you have been cheated out of your money.

Continue reading to find out more about the insurance options offered by Vrbo to their guests and hosts. While you are at it, do not leave it there. Third-party insurance providers also deserve your attention and this article will explain why.

How Does VRBO Insurance Work?

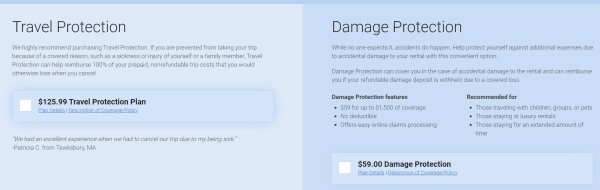

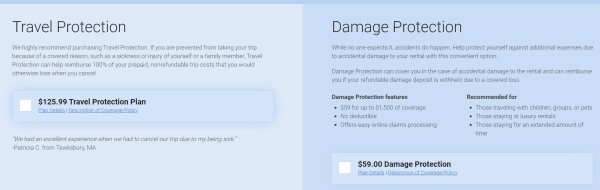

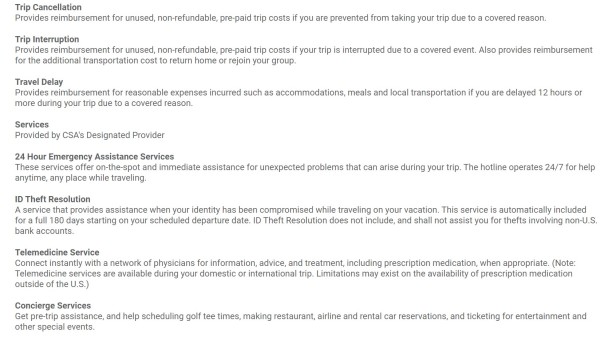

Vrbo travel insurance (aka Travel Protection) is aimed at guests. It is offered by CSA and underwritten by Generali US Branch.

When a guest books accommodation on Vrbo, they will be given the option to buy additional travel insurance when they pay for their booking via the site. This insurance will help to keep them protected against trip delays, cancellations (this applies only to covered reasons), and interruptions. Examples of covered reasons are sickness or injury.

While 100% of the cost will be covered in the case of trip interruption, the reimbursement for travel delay is limited. It is capped at $600 per plan and there is also a daily limit of $150 per plan.

Guests will also be reimbursed for prepaid, non-refundable fees related to their trip and other reasonable, out-of-pocket expenses like local transportation, accommodation, and meals.

If guests did not select to buy travel insurance at the time of paying for the booking, it is not the end of the world. They will still have a chance to add this option at a later stage via the booking confirmation page or post-booking confirmation emails. Alternatively, they can also go to the online portal of Generali.

Without this Travel Protection plan, guests would lose what they have paid thus far in the event that they should cancel.

In addition to reimbursing prepaid costs in the event of trip cancellation, interruption, or delay, the plan also includes other helpful services like:

- 24-hour emergency assistance services

- ID theft resolution

- Telemedicine service

- Concierge services

Vrbo also offers a Damage Protection plan. In the event of accidental damage to the vacation rental property, the Damage Protection option offered by Vrbo can help to safeguard guests against extra expenses .

Not only is it convenient, but also affordable. For only $59, guests can get coverage of up to $1,500. This way, guests are also covered in case the property that they were staying at was damaged accidentally and the refundable deposit is withheld. All in all, this option is ideal for big groups or families traveling with kids (or fur babies). It is also strongly recommended for guests that have booked a long-term stay or will be staying at a luxury rental.

In the unfortunate event that you need to claim, rest assured that the process is easy. All you need to do is to complete a claim form, attach the necessary documentation, and send it to the claims department at Generali.

What’s more, those who are unhappy with the Vrbo travel insurance can also cancel the coverage. To receive a full refund, it needs to be canceled within 10 days of purchase.

Is Vrbo Travel Insurance Worth It?

Opting for travel insurance is always the better choice. In the case of Vrbo travel insurance, guests can rest assured knowing that it is offered by a very reputable insurance provider.

That said, online reviews have mentioned that the coverage options tend to be limited, especially when you consider the cost. For example, it does not allow guests to cancel for any reason. This means that if you are worried about the coronavirus, you can’t use this as a reason unless you have contracted it.

It is important to keep in mind when evaluating this insurance option that there will always be limitations. That is the name of the insurance game. Even if the coverage options can be better, it is still a lot better than having no insurance whatsoever.

While Vrbo travel insurance might not cover all possible situations, it does offer an additional damage protection program that includes personal liability for accidental property damage. Guests will have a hard time finding this option with a third-party insurance provider. This is just one more reason why Vrbo travel insurance is worth it.

How Can Hosts Protect Themselves?

While Vrbo travel insurance is aimed at protecting guests , there are other ways in which hosts can safeguard their short-term rental business. Here are two available options for Vrbo hosts:

A refundable damage deposit

In short, a Vrbo damage deposit can be used to cover property damage that occurred during a guest’s stay. As host, you have the option to decide on the amount that your guests will be charged upon booking. It won’t add any confusion to the booking process as the fee will be listed just like the cleaning fee, service fee, and any other additional fees.

Guests will have to pay this refundable damage deposit upfront. Vrbo will then hold the amount for the duration of the guest’s stay.

In the event that there was unfortunately property damage, hosts will have up to 14 days after guest checkout to send a damage claim. If no claim for damage gets submitted to the platform within this time period, the amount will simply be returned automatically to the guest.

As for amounts claimed, Vrbo will generally process the payment within a week. If the amount that you claimed was less than the total of the damage deposit, the rest will be returned to the guest.

The only real downside to charging a refundable damage deposit is that it might discourage guests from making a booking. That said, most guests understand the reason for doing so and understand that unless something goes wrong, the amount charged will be returned to them promptly.

Keep a card on file

This approach is currently the default damage deposit policy of Vrbo. Basically, by opting to keep a card on file, the vacation rental platform will save the credit card details of a guest on their system.

Similarly to when a refundable damage deposit was charged, a host will then have up to 14 days after checkout to submit a damage claim. If a claim was filed, Vrbo will take it upon them to notify the guest by sending them an email with the amount that is claimed as well as a description of the property damage.

If you are worried about how secure this option is, you can rest assured knowing that Vrbo will cover the damage if the credit card has reached its limit or has expired.

Should Hosts Get Extra Third-party Insurance for Vacation Rentals?

In addition to charging a refundable damage deposit or asking Vrbo to keep a card on file, short-term rental hosts are strongly urged to invest in additional third–party vacation rental insurance.

The reason for this is that neither of these approaches offer total protection. Also, while Vrbo offers an attractive liability insurance for damage to another person’s property or traveler injury, this, too, has a number of exclusions.

In the US, the platform officially endorses Proper Insurance as their preferred comprehensive home insurance. In the hosting community, Proper is also one of the most popular insurance providers. However, many hosts have commented that they are quite expensive. If Proper does not fall within your budget, you can also try:

- Farmers Insurance

- RentalGuardian

Wrapping Things Up

Both guests and hosts are encouraged to sign up for insurance. It might be an extra cost, but it can prevent many tears and headaches.

When you are making the wise choice by signing up for an insurance policy, also remember to read your terms and conditions carefully. The reality is that no insurance plan is perfect and you will always find that it lacks coverage in certain areas. By doing your homework, you can possibly get an extra policy or at least know beforehand in which event you won’t be covered.

Guests often think only about the travel cost. However, when they are renting a vacation rental property, there is also a chance that the property might get damaged. As this can have a direct impact on hosts, it is also a good idea that hosts urge their guests to take advantage of the property damage protection program offered by Vrbo.

No spam. Only valuable info and tips. We promise.

Ready to Start Automating Your Business and Join Thousands of Hosts?

Unlock Your Hosting Potential

Do You Need Vrbo Insurance?

Last updated: March 2024

Whether you’re new to listing on Vrbo or a seasoned host, understanding your insurance options will help you protect your investment and provide a safe experience for your guests. Here’s what you need to know about Vrbo’s insurance policies as well as the benefits of having adequate insurance to cover your property and the people who book it.

Don’t see the form to download our Ultimate Guide to Listing on Vrbo? Click here .

Benefits of having Vrbo Insurance

Having Vrbo insurance offers a layer of protection that hosts can’t afford to ignore. It not only safeguards your property against potential damages but also provides coverage for unforeseen circumstances that could impact your rental income.

What about your homeowner’s insurance or personal protection policy? Most vacation rental owners have homeowners or landlord insurance policies. Both of these are great to have, but they both come with their own gaps due to the fact that the rental property doesn’t necessarily fall into either of these categories.

With Vrbo insurance or your own additional rental property insurance, you’re investing in peace of mind, knowing that you’re shielded from financial losses while providing a safe and secure environment for your guests. It’s a small step that brings significant benefits to your hosting business.

What is Vrbo’s insurance policy?

Vrbo’s $1M Liability Insurance program , included at no extra charge, covers liability claims such as traveler injuries or damage to another person’s property. However, it’s crucial to note that this coverage applies only to reservations made online via Vrbo’s checkout.

In the U.S., Vrbo endorses Proper Insurance as their preferred provider for comprehensive home insurance. This policy, designed specifically for vacation rentals, is an annual commercial homeowners insurance that completely supersedes your existing homeowners or landlord insurance policy. It’s tailored to offer extensive protection, catering precisely to the unique needs of the vacation rental industry.

Should you get additional vacation rental property insurance?

While Vrbo’s insurance programs provide a substantial level of coverage, you may still want to consider the specific requirements and risks associated with your property.

Namely, you’ll want to check the mandatory insurance requirements in your state or locality . These regulations vary widely and may necessitate additional coverage beyond what Vrbo provides.

Additionally, consider the potential costs and benefits. Additional insurance often involves an extra financial investment, but it can also offer greater peace of mind and financial protection. This can be especially important if you’re renting a luxury villa or if your rental includes expensive furniture or amenities you’d like to protect.

Ultimately, the best course of action is to thoroughly evaluate your unique situation and risk tolerance. Consulting with an insurance professional can also provide insights tailored to your specific needs.

- Help Home keyboard_arrow_right

- Getting Started

Vacation rental insurance policy information

What we recommend, vacation rental insurance, additional information.

- Vrbo doesn’t permit Property Managers to market their own damage insurance and/or travel insurance on our platform.

- Some insurance carriers will offer a rider that allows for “occasional” rentals and offer limited property and liability coverage. The problem is limited coverage, and most vacation rental properties have guests “regularly” not “occasionally”, so virtually any claim could be denied and is subject to carrier interpretation. If you regularly rent your vacation property, you need business insurance.

- The Proper Insurance policy is comprehensive. This means there’s full coverage in place whether it's being rented, vacant, and/or being used by the owner or their guests. It is designed for vacation rentals that are either second homes or that double as primary residences. It entirely replaces a landlord or homeowner policy. If you carry the Proper policy, there would be no reason to keep your other insurance in place as you would be "double" insured.

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

VRBO Travel Insurance - 2024 Review

Vbro travel insurance review.

- Reputable Insurance partner

- No medical insurance

- No Cancel For Any Reason option

- No Pre-existing Condition benefit

Sharing is caring!

VRBO is an online marketplace for vacation rentals and is owned by Expedia Group.

VRBO advises customers to purchase travel insurance after booking the rental property. Generali US underwrites the VRBO policy, which offers a trip cancelation policy and a property damage add-on policy.

The damage protection program add-on policy covers $1,500 in property damage liability if you accidentally damage the property. Most travel insurance policies do not cover liability since it's not a standard travel hazard.

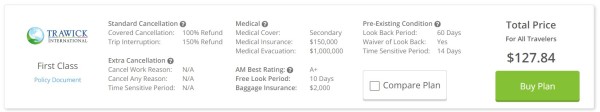

However, at TripInsure101 , we offer the Trawick First Class , which includes a $5,000 Accommodation Property Damage benefit. It provides reimbursement for direct physical damage to covered real or personal property within the unit occupied by the insured during the trip.

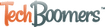

Our VRBO Booking

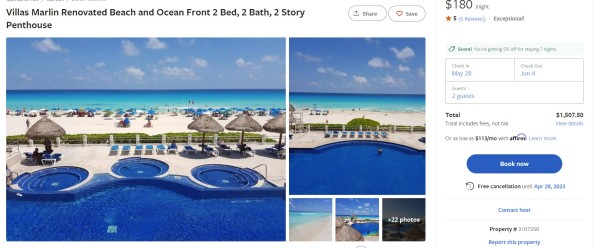

For this review, our sample couple aged 55 and 60 have booked a beachfront rental in Cancun, Mexico, from May 28 – June 4.

The cost of the rental is $1,799.87 with the cleaning fee, service fee and taxes.

Here is the offer from VRBO's travel insurance page:

If they insure the condo rental through VRBO trip insurance, the cost is $125.99 and they can add $1,500 of damage protection for an additional $59 bringing the total insurance cost to $184.99.

Is this a good value? Let's find out.

What Does VRBO Insurance Include?

The policy provides trip cancellation and trip interruption as well as travel delay but medical coverage is not offered.

Is anything more comprehensive available in the open marketplace? Let’s see…

A Quote From TripInsure101

Inputting our trip details into the quoting system at TripInsure101 , we’re presented with 28 quotes to choose from.

Since we’re traveling internationally, TripInsure101 recommends having at least $100,000 of medical coverage and $250,000 of medical evacuation coverage – coverage not even offered in the VRBO policy.

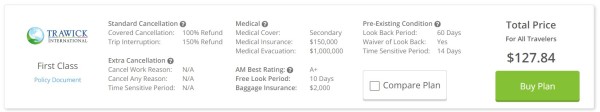

The least expensive plan on our quote with adequate coverage is the Trawick First Class for $127.84.

The policy provides $150,000 of medical coverage and $1 million of medical evacuation coverage as well as trip cancellation, trip interruption and a waiver of pre-existing medical conditions if the policy is purchased within 14 days of the initial trip payment or deposit date. This plan also includes $5,000 of property damage.

The Trawick policy is $54 LESS than the VRBO policy with the added damage protection and includes medical coverage and medical evacuation! Also, we can include other non-refundable costs such as airfare and tours to the trip cost and have those covered as well.

If we cancel for a listed reason in the policy, such as illness or injury, we’ll receive 100% of our trip costs back.

What if we want to have maximum flexibility to cancel our trip for ANY reason and not just the reasons listed in the policy?

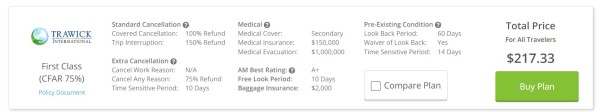

For maximum cancellation flexibility, we’ll need to look at a different policy – a Cancel For Any Reason (CFAR) policy.

TripInsure101 – Cancel For Any Reason (CFAR) Policies

As the name suggests, Cancel For Any Reason (CFAR) policies allow you to cancel for any reason whatsoever and receive a partial refund of trip costs – either 50% or 75% depending on the policy purchased. These policies allow maximum cancellation flexibility.

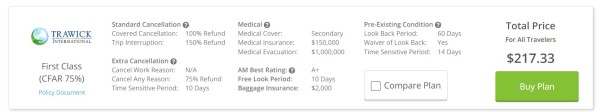

Looking at the quote from TripInsure101, the least expensive CFAR policy with adequate coverage for our trip is the Trawick First Class (CFAR 75%) for $217.33.

The policy provides the same coverage as the standard Trawick First Class policy of $150,000 of medical coverage and $1 million of medical evacuation coverage as well as provides a waiver to cover pre-existing medical conditions if the policy is purchased within 10 days of the initial trip payment or deposit date. Pricewise the policy is $32 more than the VRBO policy with the added damage protection, but includes medical coverage, medical evacuation and a waiver of pre-existing medical conditions which the VRBO policy doesn’t have.

If we cancel for a listed reason such as illness or injury, we’ll get a 100% refund of our trip costs but if we use a non-listed reason, we’ll get a 75% refund.

VRBO Insurance Summary

First, VRBO travelers save over $50 on travel insurance by working with TripInsure101 and enrolling in the Trawick First Class policy. Not only do they save money, but they also get much more coverage than the VRBO policy provides, including medical and medical evacuation coverage.

If more cancellation flexibility is desired, for a few dollars more, they can get a Cancel For Any Reason policy. It allows cancellation with a refund for any reason not listed in the plan and adds excellent medical and medical evacuation coverage.

We would not recommend any VRBO insurance option because it does not offer a Waiver of Pre-existing Conditions , nor does it offer medical or medical evacuation coverage. We advise anyone taking out travel insurance shop the open marketplace to see what other options are available.

Get an Insurance Quote For Your VRBO Rental

When you shop at TripInsure101 you can compare quotes and policies from many top-rated travel insurance carriers.

Speak with one of our licensed travel insurance experts at +1(650) 397-6592, by email or by live chat .

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Gary Esbeck

quick easy and much less costly…

quick easy and much less costly insurance options than what I was quoted at the travel agent

Irene Carranza

Easy to compare and purchase travel….

Easy to compare and purchase travel Insurance. Great rates and coverage. Thank you making it easy for us at an affordable rate.

Excellent Customer Service!

Felica (on Chat) and Amanda, who spoke to me on the phone and walked me through the steps needed to download my policy and ID cards were both great! Very friendly and didn't waste time trying to talk me into something that I did not need. I really appreciate that!

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

VRBO Travel Insurance - 2024 Review

Vbro travel insurance review.

- Reputable Insurance partner

- No medical insurance

- No Cancel For Any Reason option

- No Pre-existing Condition benefit

Sharing is caring!

VRBO is an online marketplace for vacation rentals and is owned by Expedia Group.

VRBO advises customers to purchase travel insurance after booking the rental property. Generali US underwrites the VRBO policy, which offers a trip cancelation policy and a property damage add-on policy.

The damage protection program add-on policy covers $1,500 in property damage liability if you accidentally damage the property. Most travel insurance policies do not cover liability since it's not a standard travel hazard.

However, at TravelDefenders , we offer the Trawick First Class , which includes a $5,000 Accommodation Property Damage benefit. It provides reimbursement for direct physical damage to covered real or personal property within the unit occupied by the insured during the trip.

Our VRBO Booking

For this review, our sample couple aged 55 and 60 have booked a beachfront rental in Cancun, Mexico, from May 28 – June 4.

The cost of the rental is $1,799.87 with the cleaning fee, service fee and taxes.

Here is the offer from VRBO's travel insurance page:

If they insure the condo rental through VRBO trip insurance, the cost is $125.99 and they can add $1,500 of damage protection for an additional $59 bringing the total insurance cost to $184.99.

Is this a good value? Let's find out.

What Does VRBO Insurance Include?

The policy provides trip cancellation and trip interruption as well as travel delay but medical coverage is not offered.

Is anything more comprehensive available in the open marketplace? Let’s see…

A Quote From TravelDefenders

Inputting our trip details into the quoting system at TravelDefenders , we’re presented with 28 quotes to choose from.

Since we’re traveling internationally, TravelDefenders recommends having at least $100,000 of medical coverage and $250,000 of medical evacuation coverage – coverage not even offered in the VRBO policy.

The least expensive plan on our quote with adequate coverage is the Trawick First Class for $127.84.

The policy provides $150,000 of medical coverage and $1 million of medical evacuation coverage as well as trip cancellation, trip interruption and a waiver of pre-existing medical conditions if the policy is purchased within 14 days of the initial trip payment or deposit date. This plan also includes $5,000 of property damage.

The Trawick policy is $54 LESS than the VRBO policy with the added damage protection and includes medical coverage and medical evacuation! Also, we can include other non-refundable costs such as airfare and tours to the trip cost and have those covered as well.

If we cancel for a listed reason in the policy, such as illness or injury, we’ll receive 100% of our trip costs back.

What if we want to have maximum flexibility to cancel our trip for ANY reason and not just the reasons listed in the policy?

For maximum cancellation flexibility, we’ll need to look at a different policy – a Cancel For Any Reason (CFAR) policy.

TravelDefenders – Cancel For Any Reason (CFAR) Policies

As the name suggests, Cancel For Any Reason (CFAR) policies allow you to cancel for any reason whatsoever and receive a partial refund of trip costs – either 50% or 75% depending on the policy purchased. These policies allow maximum cancellation flexibility.

Looking at the quote from TravelDefenders, the least expensive CFAR policy with adequate coverage for our trip is the Trawick First Class (CFAR 75%) for $217.33.

The policy provides the same coverage as the standard Trawick First Class policy of $150,000 of medical coverage and $1 million of medical evacuation coverage as well as provides a waiver to cover pre-existing medical conditions if the policy is purchased within 10 days of the initial trip payment or deposit date. Pricewise the policy is $32 more than the VRBO policy with the added damage protection, but includes medical coverage, medical evacuation and a waiver of pre-existing medical conditions which the VRBO policy doesn’t have.

If we cancel for a listed reason such as illness or injury, we’ll get a 100% refund of our trip costs but if we use a non-listed reason, we’ll get a 75% refund.

VRBO Insurance Summary

First, VRBO travelers save over $50 on travel insurance by working with TravelDefenders and enrolling in the Trawick First Class policy. Not only do they save money, but they also get much more coverage than the VRBO policy provides, including medical and medical evacuation coverage.

If more cancellation flexibility is desired, for a few dollars more, they can get a Cancel For Any Reason policy. It allows cancellation with a refund for any reason not listed in the plan and adds excellent medical and medical evacuation coverage.

We would not recommend any VRBO insurance option because it does not offer a Waiver of Pre-existing Conditions , nor does it offer medical or medical evacuation coverage. We advise anyone taking out travel insurance shop the open marketplace to see what other options are available.

Get an Insurance Quote For Your VRBO Rental

When you shop at TravelDefenders you can compare quotes and policies from many top-rated travel insurance carriers.

Speak with one of our licensed travel insurance experts at +1(786) 321 3723, by email or by live chat .

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Canada trip…

Maranda was very helpful in explaining our options for purchasing travel insurance. She was very professional and articulate in her explanation of our options.

Easy inrolment

Great site for travel insurance

There was an explanation of the different features for the insurance. Then each company was listed with its features and cost. Having already looked for travel insurance, I knew the costs were better than I had found. Excellent site

There goes the neighborhood: What's covered when renting on Airbnb and VRBO?

- Medium Text

Jumpstart your morning with the latest legal news delivered straight to your inbox from The Daily Docket newsletter. Sign up here.

Erin Mindoro Ezra manages Berger Kahn's South Orange County office in Lake Forest, Calif., focusing on insurance coverage and labor and employment. She represents and advises clients in insurance coverage matters, particularly liability insurance, and counsels clients in connection with wage and hour disputes, investigations, discrimination, retaliation, and other employment matters. She can be reached at [email protected].

Jamie L. Rice is a senior associate with the firm’s South Orange County office, focusing on insurance coverage, Examinations Under Oath, and labor and employment. She advises and represents insurance companies in connection with coverage disputes under personal and commercial policies and defends employers against discrimination, wrongful termination, and wage and hour allegations. She can be reached at [email protected].

Madeline E. Ong is an associate with Berger Kahn's South Orange County office, primarily focusing on insurance coverage and labor and employment. She counsels clients regarding insurance obligations under personal and commercial lines and represents employers in employment litigation matters, including discrimination, retaliation, wage and hour disputes, and other employment matters. She can be reached at [email protected].

Read Next / Editor's Picks

Industry Insight Chevron

Mike Scarcella, David Thomas

Karen Sloan

Henry Engler

Diana Novak Jones

Luxury rental prices for Paris Olympics slashed by half or more as demand comes in weak

Parisians hoping to rent out their splashy apartments at a premium during this summer’s Olympics are starting to temper their lofty ambitions, as they come to terms with a tepid demand and an oversaturated market.

Real estate agencies, which can help Parisians list their permanent homes as temporary rentals for vacationers , say they’re cutting prices for luxury rentals in chic neighborhoods and tempering expectations of owners who’d hoped to ride the wave of visitors coming to the capital.

“The supply is there, but we don’t have as much demand as we thought,” says Omar Meniri, head of Paris rentals at Engel and Völkers. “Unfortunately, right now it’s not up to par with what I was hoping for.”

It’s not just agents who are disappointed by the overblown hype. Many overeager owners listed their apartments at three or four times the usual nightly rate, only to find that few people were willing to shell out.

Nathalie Garcin, co-president of real estate firm Emile Garcin, says that she has slashed prices to half of what owners had initially sought while also becoming more selective about what she lists.

“We’re only taking very beautiful apartments that are in perfect shape,” Garcin says, with new bedding and tasteful decorations. “We’re reasoning with owners” about how to set prices, she adds.

High-end, 100-square-meter (1,100-square-foot) primary residences are currently asking around €10,000 per week, according to data shared by multiple real estate firms. Some had been going for €20,000 or €30,000 as recently as a few months ago.

As of mid-April, two-thirds of the total available nights in four- and five-bedroom apartments in Paris during the Games were still up for grabs, according to short-term rental data provider AirDNA . (The company’s data reflect the more conventional vacation rental platforms such as Airbnb and Vrbo.) The average rate paid for those properties comes in at 1108€ per night—a 15% markup over the average rates that have been booked for the two-week window before the games. For listings that remain unbooked, the average available rates during the Olympics period reflects a 35% markup compared to the two weeks before.

At Barnes, only 10% to 20% of the firm’s Olympics portfolio has been rented, with most of the bookings finalized in January, says Benjamin Brjost, vacation rental director for the Paris region.

“We’re seeing a big slowdown,” Brjost says, with hope that the bookings rush he anticipated in April may still transpire in May.

Some experts warned that current listings might continue to languish, as most well-heeled visitors traveling to Paris booked lodgings a year ago, when they got their Olympics tickets . There’s also a risk that people might cancel bookings if they see prices coming down and find something cheaper.

Christophe Ouvrieu, head of the Breteuil branch of real estate firm Junot, put his own home—a 150-square-meter apartment near the Place de l’Europe in the 8th arrondissement—on Airbnb last July, hoping to turn a profit during the Olympics. Shortly after, it was rented for the duration of the Games.

“At the time, people were saying that you could rent at triple your usual rate, but my wife and I decided to double,” Ouvrieu says. “We saw people listing at absolutely crazy prices because they thought, ‘Why not me?’”

But for many high-end homeowners, the cost of readying their apartment for vacationers simply won’t be worth it if they have to lower prices, leaving experts to guess that they will abandon the prospect entirely before slashing their rental fees.

“These are clients who are well off enough that they can afford to not rent out at all,” said Baptiste Albot, head of Left Bank rentals at Emile Garcin. “No one wants to rent at €5,000 a week. They’re leaving on vacation anyway and don’t care whether it’s rented or empty.”

Latest in Lifestyle

- 0 minutes ago

Nobel laureate Esther Duflo proposes taxing 3,000 billionaires to protect the world’s poorest from climate change—and most Americans likely agree with the plan

Gen Z’s obsession with a $10 naked baby figurine is causing a worldwide shortage: ‘Some customers come every day, for three days straight’

Paid parental leave at schools is so dire that teachers must hoard their sick days and time their pregnancies around summer vacation

Taylor Swift surprises fans with announcement of a new double album

‘It’s a phenomenon’: How 4/20 grew organically from a group of Northern California high schoolers into marijuana’s holiday

Most popular.

Former HGTV star slapped with $10 million fine and jail time for real estate fraud

Your reusable water bottle may be a breeding ground for strep and fecal bacteria. Here’s how to keep it clean

Exclusive: Mercedes becomes the first automaker to sell autonomous cars in the U.S. that don’t come with a requirement that drivers watch the road

A dot-com entrepreneur who once lost $6 billion in one day has made billions from the Bitcoin rally and his company’s surging shares

Joe Lewis’ $250 million superyacht, ranked among the world’s 25-most valuable, sets sail after he pays US fine

Wealthy Norwegians flee to Switzerland to evade high wealth taxes, with their bankers following

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Complete Guide to Student Hotel Deals

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Generally, student life provides the unique opportunity to travel more freely. A common hurdle that students encounter while traveling is cost. This is particularly true for big-ticket expenses, like lodging.

If you’re eager to find affordable accommodations, here are sites where you can find student discount hotels and hostels on a budget.

Best websites for hostels and hotels at student discounts

Major travel platforms, such as Kayak and Expedia , can generally be a good starting point to find cheap hotels. However, there are sites designed specifically for students’ lifestyle, schedules and wallets that might land you a room more suited to your needs.

1. CheapOair

Although its name might suggest it offers cheap airfare only, students might also uncover hotel savings on CheapOair , too. It features lodging of all types, including affordable hotels and budget motels. It also has a dedicated page for last-minute hotel deals for a spontaneous weekend getaway.

You can browse available accommodations on the CheapOair website or on its mobile app. You also can call an agent at 845-848-0154 to explore your options and book your room.

UNiDAYS is a site dedicated to offering various student discounts from hotels, clothing stores, grocers, gyms and more.

To access these deals, you must be a current student and sign up to be a member online. Membership is free, but UNiDAYS might accept commissions on hotel bookings you make through its platform.

It partners with popular hotel and vacation rental sites to offer student members additional discounts. For example, if using UNiDAYS to book a room on Hotels.com, you might receive up to 40% off and an extra 8% off on hotels.

» Learn more: Are Airbnbs cheaper than hotels?

Hostelz gathers data from other booking sites so you can easily run price comparisons for your preferred room.

It pulls rates and traveler reviews from Hostelworld.com, Booking.com and Hostelclub.com. The platform offers the largest worldwide database of hostels, giving its customers access to a comprehensive list of available rooms around the world.

Searching its database is free, and according to the site, it offers an average savings of 10.6%, and up to 60% for some bookings. Its reviews show full transparency and aren’t guided by Hostelz’s commissions or screened by the hostels.

4. StudentUniverse

StudentUniverse is a site devoted to students and travelers under 30 years old that are from the U.S., the U.K., Australia and Canada. Its hotel database has more than 200,000 hotel and vacation properties worldwide, and students can access discounts of up to 60% off on hotel reservations.

The deals on StudentUniverse are exclusive for its members. To sign up, you’ll need to provide your name, date of birth, email address, and your school and expected graduation year.

When browsing available stays, keep in mind that the prices shown don’t include taxes and fees. Make sure you account for these added costs before finalizing your reservation.

Tips for finding student discount hotels

With so many details to work out, planning a trip on a shoestring budget might feel chaotic and costly. Taking some extra steps while sorting out logistics for your next stay can help you keep both to a minimum.

Stay flexible

If you’re on a tight budget or need a last-minute reservation, you’ll find more options by keeping an open mind. This includes check-in or checkout dates and room features.

The least glamorous room type at a hotel is likely its cheapest option. This might mean accepting a room with a tight square footage, a view of a parking structure or one that is close to a noisy elevator or staircase.

Call the hotel or hostel directly

Student hotel deal websites are a solid place to start your search for cheap stays; however, as a third-party aggregator (or online travel agency), these sites often tack on additional fees that add up.

Once you’ve found a room you like on a deals site, call the hotel or hostel directly to compare its rate for that room type.

You might be able to secure a reservation with the agent on the phone, or through the lodging’s website, at a lower total price.

Look up promos before checkout

Sometimes the hotel’s rates are about the same as the hotel’s student discount price. See if you can find extra discounts for the deal site you’re booking through.

If you’re booking the reservation around a major holiday, or are a new customer on the platform, you might find a promo code for an extra discount.

Book with a credit card

Using a credit card to pay for your stay offers additional benefits during and beyond your trip. Some will let you earn an unlimited 5% cash back for hotel reservations made in certain online travel booking portals.

Booking your hotel or hostel lodgings through a credit card also builds your credit history. Just ensure that you can afford repaying any purchases placed on the account to avoid accumulating debt. Before reserving your next accommodations, compare the best college student credit cards .

» Learn more: The best hotel credit cards right now

Don’t forget about safety

Finding cheap lodging can have the biggest impact on your travel budget, but cost savings should never compromise your personal safety. Do your due diligence by checking whether the building has secured entry during late hours and whether there’s on-site security personnel or cameras in common areas, like lobbies and hallways.

Also, read reviews of each hotel or hostel under consideration and what other students have to say about the surrounding area.

Hotels with student discounts, recapped

When you’re on a student budget, taking advantage of ways to travel affordably is essential. Using deal websites for student discount hotels is a good way to uncover a low-cost yet comfortable haven to return to during your trip.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

COMMENTS

About Travel insurance. Travel insurance is available for purchase when you book and pay through our site. It helps safeguard your trip from delays, interruptions, and cancellations for covered reasons, and you can be reimbursed for the resulting out-of-pocket expenses and non-refundable trip fees. Travel insurance is provided by CSA and ...

Read this article for information on Vrbo travel insurance options to consider for your trip. ... This plan will reimburse 100% of the trip's cost. Below are the three travel insurance plans that are all underwritten by the Generali U.S. Branch. Prime Plan. Source: Pexels.

Here is the offer from VRBO's travel insurance page: If they insure the condo rental through VRBO trip insurance, the cost is $125.99 and they can add $1,500 of damage protection for an additional $59 bringing the total insurance cost to $184.99.

Cancel Travel insurance If you're not satisfied, you can cancel coverage within 14 days of purchase and receive a full refund. If the reservation is canceled by the owner, regardless of when coverage was purchased, contact Europ Assistance at +44 203 7888 652 or via email [email protected] to receive a refund .

Cancel Travel insurance. If you're not satisfied, you can cancel coverage within 10 days of purchase and receive a full refund. If the reservation is canceled by the owner, regardless of when coverage was purchased, contact Generali at 877-880-0975 to receive a refund . File a claim. You can file a claim with Generali Travel Protection by ...

Learn more about VRBO travel insurance and how to cover yourself and your trip costs if you are renting a vacation home for your next trip. 1-877-906-3950 or Not from ?

VRBO Travel Insurance helps protect travelers in a variety of situations, including trip interruption, trip cancellation, and emergency assistance. ... guests must ensure that they purchase sufficient coverage to protect the full value of their rental costs. VRBO Travel Insurance benefits also include coverage for emergency assistance services ...

Typical travel insurance policies will offer coverage for your vacation rental costs should your trip be canceled or delayed for events covered under the policy, but you may be on the hook for other scenarios. As a result, it's vital you pay careful attention to your policy's terms. Doing so will ensure you know what to expect should you face ...

Vrbo insurance for owners and renters. Vrbo's $1M liability insurance provides owners and property managers with liability protection for all stays that are processed online through the HomeAway checkout, giving them $1,000,000 in primary liability coverage at no additional cost. From a renter's point of view, they are insured to be ...

Whether you're booking a weekend getaway or a longer trip, opting for a vacation rental property over a hotel has its perks. ... 50% to 75% of your travel costs. And adding CFAR coverage to an ...