Find The Best Travel Insurance Policy For Your Needs & Avoid Costly Surprises!

Compare 2024's Best Travel Insurance Companies. Get Yourself Peace Of Mind.

Compare and Buy Travel Insurance

Standard single trip policies.

- The most popular and comprehensive travel insurance plan

- Covers cancellations, medical emergencies, delays, and luggage

- Protection from the time you purchase to the date you return

Annual / Multi Trip Policies

- Cost-effective option for travelers taking multiple trips a year

- Includes common medical, delay, and luggage benefits

- May require add-ons from trip cancellation or interruption

Cruise Insurance Policies

- Offers comprehensive trip protection on land and at sea

- Includes high travel medical insurance coverage limits

- Protects against hurricanes, inclement weather, and more

Adventure & Sports Policies

- Essential for travelers partaking in high-risk activities

- Provides protection for lost or delayed sports equipment

- Strong coverage for cancellations and medical emergencies

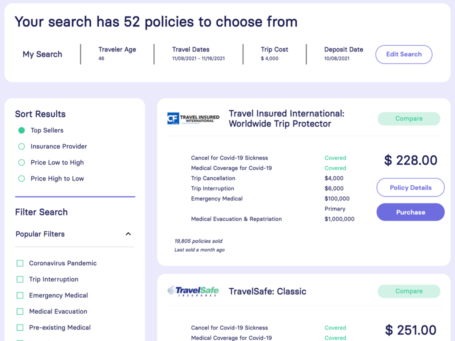

Compare and Save in Minutes

Whether you’re heading abroad or staying local, we make it easy to find the best travel insurance plan for your next adventure. No bias. No hidden fees. Just the best trip protection quotes from the country’s leading providers.

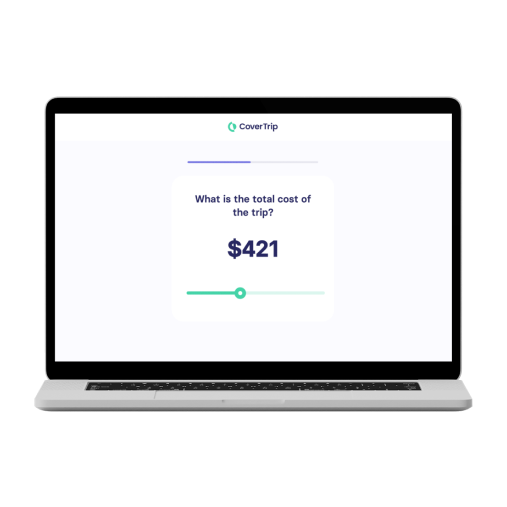

Tell us some basic information about your next trip. We’ll use these details to help narrow your search and show the plans that best fit your needs.

Easily see how plans from the best travel insurance providers compete on cost and coverage. Use filters and sort results to uncover the right plan for you.

Get peace of mind at the lowest possible price. We partner with leading providers to offer you the best policies at the best value, guaranteed.

Why Trust Squaremouth?

When selecting a travel insurance provider, it's crucial to compare options. Obtain quotes from three to five insurers to ensure the best coverage and value. While it may seem time-consuming, this process can result in significant savings.

That's why we're here – over the past two decades, our industry-leading comparison engine has helped millions of travelers find highly-rated insurance plans and protect their trip expenses.

Our industry-leading comparison platform , enriched by customer reviews, displays unbiased results based on your specific trip details. If you run into any trouble, our multi-award-winning customer service team is just a phone call away.

- Helped more than 3 million travelers

- 20+ years serving the travel community

- Intuitive & user-friendly comparison engine

- More plans and top-rated providers than the competition

- Prices are regulated by law; you won't find a lower price anywhere else

- Multi award-winning customer service team

- 140,000+ customer reviews

Save With Squaremouth

Squaremouth has helped more than 3 million travelers find the best policy for their trip.

Key Travel Insurance Benefits

Most trip insurance policies are comprehensive, including coverage for cancellations, medical emergencies, travel delays, and lost luggage, among other benefits.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Great Experience!

"The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others."

Savannah from NC 03/26/2024

Great Coverage and Price

"Getting a travel insurance quote online was easy. We have used Squaremouth before and have been pleased each time. It's peace of mind for our travel needs."

Rhonda from IN 03/20/2024

Easy to Use!

"I always use Squaremouth simply because it is so easy to use and offers plans that are affordable to me."

Emily from AZ 03/08/2024

Very pleased!

"They give great service, and the website is so easy to navigate to find just the right insurance plan. I always appreciate working with them."

Don from UT 03/07/2024

The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others.

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

What Type of Insurance Do I Need?

Plans can range in terms of cost and coverage, so it’s important to identify your specific needs before comparing options. Discover the different types of travel insurance policies you should consider for your upcoming trip.

How to Buy Travel Insurance on Squaremouth

If you’re new to Squaremouth, this quick guide can help you identify your needs, start your first quote, and compare your results. If you need additional help, our customer service team is just a phone call away.

Travel Insurance FAQs

Here are some of the most frequently asked questions from travelers like you.

Is Travel Insurance Mandatory for International Travel?

While rare, some countries or organized tours may require proof of travel insurance that lasts for the duration of your trip. Our Destination Center is a good starting point to learn about entry requirements and travel insurance recommendations.

While it is typically not mandatory, travelers should consider buying insurance if they want to protect themselves financially from unforeseen events that may impact their travel plans. Many Americans and U.S. residents purchase travel insurance when planning international or high cost trips. View our list of the top international travel insurance providers .

What Does Travel Insurance Cover?

Comprehensive travel insurance is designed to cover common disruptions that may impact a trip. Most policies will provide coverage for trip cancellations , medical emergencies , travel delays , missed connections , accidental death and dismemberment , and lost luggage . Travelers that experience financial loss as a result of a covered disruption may be eligible for reimbursement through their insurance policy.

How Much Does Travel Insurance Cost?

In general, a comprehensive policy with Trip Cancellation typically costs between 5% and 10% of the total trip cost. The cost of a policy depends on four primary factors: trip cost, traveler age, trip length, and coverage amounts. A policy without an insured trip cost will be significantly less expensive. We recommend comparing plans from multiple providers to find the best priced plan for your trip.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: Travel insurance benefits outline what situations are covered under each plan. Make sure each plan you’re considering includes coverage for what’s important to you.

- Coverage Limits: Plans will set limits to how much reimbursement you’re eligible for, and can vary significantly. Higher coverage limits can result in less out of pocket expenses in the event of a claim.

- Exclusions: Travel insurance companies will list specific activities, equipment, and scenarios that are not covered by their plans in the event of a claim.

- Premium: Higher priced insurance products do not always equate to better coverage. We recommend choosing the most affordable plan that offers the travel protection you need.

- Provider Reputation: All providers on Squaremouth have been carefully vetted and offer 24-Hour Assistance services. Customers are also encouraged to share honest reviews about their experience before, during, and after their trips.

Does Travel Medical Insurance Cover International Trips?

In many cases, primary health care plans, such as Medicare or a policy you have through your employer, are not accepted overseas. If you’re not covered, you may be responsible for unforeseen medical expenses if you get sick or injured while traveling.

To avoid out-of-pocket expenses if you need medical care in the event of an emergency, many travelers opt for travel medical insurance. These plans can cover the cost of treating unexpected medical conditions incurred during your international trip.

Are Pre-Existing Conditions Covered by Travel Insurance?

Coverage for pre-existing conditions varies among travel insurance policies. While many plans won’t offer coverage for existing injuries or illnesses, some plans may offer Pre-Existing Condition waivers if certain conditions are met, such as purchasing the policy within a specified time frame from booking the trip.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance policies cover trip cancellations under specified circumstances, such as sudden illness, injury, or death of the insured or a family member, natural disasters, or unexpected work obligations. Most policies that include the Trip Cancellation benefit offer 100% reimbursement for all prepaid, non-refundable trip costs.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers a specific journey for a set duration, offering protection for that trip only. This is the most popular type of travel insurance among Squaremouth users. In contrast, Annual Travel Insurance provides coverage for multiple trips within a year. Annual plans can be cost-effective for frequent travelers and less of a hassle than purchasing multiple single-trip plans.

What's the Process for Filing a Travel Insurance Claim?

To file a trip insurance claim, follow these steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Submit supporting documents: Attach all required documents to substantiate your claim.

- Keep records: Maintain copies of all submissions and correspondence for your records.

- Follow up: Stay in touch with the insurer for updates on your claim status.

- Be honest and thorough: Provide clear and truthful information to expedite the process.

Remember, the process may vary by insurer, so review your policy or contact your insurance provider for specific instructions. Learn more about what can be covered and how to file a travel insurance claim .

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Travel insurance prices are regulated by law, meaning the price of one specific policy must be the same regardless of where it is sold, whether it’s purchased from Squaremouth or directly from the provider.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers, top credit cards with travel insurance, methodology, best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at no extra cost.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Special medical insurance for ship captains and crew members, international students and missionaries.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

Here is the list of travel cards offered by Chase that include various forms of travel insurance.

Having one of these in your wallet is a good start to protecting your travel investments and preventing expensive accidents; however, savvy travelers check card terms closely and sometimes supplement with a third-party policy, like from one of the companies above, to better protect themselves.

on Chase's website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 12 hours.

• Car rentals: Theft and collision damage for most cars in the U.S. and abroad.

• Trip cancellation: Up to $1,500 per person and $6,000 per trip.

• Trip interruption: Up to $1,500 per person and $6,000 per trip.

• Baggage delay: Up to $100 per day for three days.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Is It Worth It?

World Nomads Travel Insurance: Is It Worth It? (Updated 2020)

by Jason Moore

Is $2 a Day and World Nomads Travel Insurance Really Enough to Protect Your Next Big Adventure?

You may have landed here because you’re looking for a World Nomads Travel Insurance review to help decide if this company (or any travel insurance for that matter) is really worth it.

Even though you know that travel insurance is the best way to protect yourself and your stuff while you travel, when it comes to buying travel insurance…

Comparing endless plans, entering your information 30 times in those little search windows, and obsessing about all the things that can go wrong aren’t how I like to spend time before my next adventure.

And that’s just the start. What about reading through pages of legal jargon and arbitrary exclusions, and oh yeah— paying $200 for a trip that won’t happen for three months .

No one wants to buy travel insurance. I get it.

But shopping for travel insurance doesn’t have to be that way. This guide will help you:

- Find a plan you can afford

- Compare popular budget insurance providers

- Understand confusing jargon that can save you hundreds of dollars if you ever have to make an insurance claim.

So get excited, because this dive goes deep .

And if you’d more information while you’re reading you can listen to my interview with travel insurance expert Phil Sylvester:

Here’s what we’ll cover in this article:

Table of Contents

- Why You Need Travel Insurance- Yes, this really happened to me

Why World Nomads is the Best Travel Insurance

- What Travel Insurance Covers (and what it doesn’t)

- Types of Coverage —Basic, Comprehensive, and “Adventure”

- How to Choose the Best Travel Insurance for YOUR Trip (RTW, Spring Break, Family vacation, Extreme Sports, etc.)

What Does Travel Insurance Really Cost?

World nomads vs 3 budget travel insurance options.

- Travel Insurance Tips & Best Practices —How to extend your coverage or file a claim, plus when to buy insurance and when to upgrade

But first, I’m going to read your mind. Here’s a real-life example to answer the question I know you’re wondering right now:

Do I really need to pay for travel insurance?

Why You Need Travel Insurance

“I just need to send a few emails then I’ll be finished, it’ll only take five minutes,” I said to my girlfriend and travel partner at the time.

This internet café pit stop was intended to be a quickie. After all, who wants to stare at a screen for more than 10 minutes when you’re in one of the most gorgeous places on earth?!

We’d been traveling through Argentinian Patagonia for roughly six weeks, hiking our brains out. Since we spent our northern hemisphere summer working, we decided to head south of the equator in November for a summer of fun.

I didn’t know I’d get this close to a volcano in Patagonia, good thing I had travel insurance.

It was an elegant cycle: go on an epic multi-day trek in pristine wilderness, return to civilization, eat good food, drink some beer, relax, travel some more (or not), go on an epic multi-day trek in pristine wilderness…

Rinse and repeat.

Nature was our top priority. Hiking trips were often supplemented with adventure activities like biking, rafting, kayaking or whatever else fit our mood.

Biking on a dirt road in Argentina

Back in the café, I set our daypack next to my leg and began firing off emails. As promised, around ten minutes later I reached down to grab my pack.

I thought I was imagining things, but nope; it was all gone.

A crafty someone had crawled under the desk across from me and discreetly removed the bag from right next to my leg.

Our camera— gone .

Six weeks of memories– gone .

Vanished like an ice cream cone on a humid day.

Not to mention our fancy-pants polarized sunglasses, books, journals, and many more personal items. I don’t remember the exact value of the stolen goods, but all told, it was a surprising dollar amount.

We’d never be able to get our memories back, but we could get reimbursed for our stolen items. Thanks to our travel insurance, we did.

Bottom line: Travel insurance is important, and you need it. In some cases, it’s even mandatory (work and holiday visas or studying abroad).

So to understand this shifting minefield of fine print, obscure providers, insurance…y words, and who covers what, Zero to Travel presents… * blaring trumpet sound *

The Ultimate Guide to Travel Insurance!

Too many plans to choose from.

Contrary to the popular myth, there are a lot of travel insurance companies to choose from besides World Nomads.

A 2-minute search for travel insurance for a one-month trip to Italy this summer yielded 46 different travel insurance plans from more than a dozen companies —most of which I’d never heard of.

To save you time, I’ll give you my recommendation upfront. Then, keep reading to find out what travel insurance really covers and for an honest comparison of three other insurance options.

Disclaimer : It’s impossible to give 100% accurate quotes for every type of trip and traveler. You’re all unique snowflakes. In the examples provided below, I used the following super sensitive personal information to generate sample quotes and rates. Please don’t steal my hypothetical identity:

Case Study: Travel Insurance Quote Example (rates calculated for an American citizen)

- Name (Shawn)

- Location (Boston, MA)

- Destination (Italy)

- Trip Cost ($2,000)

- Trip Length (1 month)

- Existing Health Insurance? (Yes)

Honestly, I hate worrying about my stuff while I travel. World Nomads gives me the peace of mind I need when it comes to gear. When my bag got stolen in Argentina, we took the proper steps by filing a police report and submitting our paperwork and they covered our losses. No muss, no fuss. It was great.

Plus, their One-Call 24-Hour Assistance Services offer multilingual pros to help you find a local doctor, dentist, or hospital abroad, and they can even arrange transportation to get you there.

World Nomads Insurance Price Quote Case Study

Standard Plan: $120.07

Explorer Plan: $211.51

Standard Plan vs Explorer Plan

- Medical coverage is the same ($100,000) and trip cancellation is pretty similar (Standard: $2,500 / Explorer: $10,000). The biggest difference is how much gear is covered.

- Standard Plan covers $1000 of gear , while Explorer goes up to $3000 . Again, if you have expensive camera gear, laptop or smartphone, it’s worth upgrading to the Explorer plan.

Pre-existing conditions aren’t covered on either plan, and Standard doesn’t include rental car coverage, but my Chase Sapphire credit card does so no worries there.

Plus Side: World Nomads is known for its adventure sports coverage . Explorer covers 100+ activities like : skydiving, scuba diving, base jumping, and even shark cage diving. So that’s sweet. Standard covers almost as many including, climbing and canoeing. Both plans also include dental coverage ($750), which is way better than nothing.

When you travel you never know what adventurous activities you’ll end up doing. I LOVE that I am covered for adventurous travel.

Here I am trekking in Nepal and feeling at ease knowing I’m covered by travel insurance.

To read more about what World Nomads covers, jump ahead here.

To compare World Nomads with 3 other budget options, jump ahead here.

Buying World Nomads travel insurance is simple. I’ve been using World Nomads travel insurance relentlessly over 15+ years of travel while trekking in Nepal and Patagonia, backpacking through Central America and living in Norway among many other adventures. Plus, its trusted by established brands we all recognize like Lonely Planet and Eurail, so you know you’re in good hands.

You can get a quote for your trip right here:

World Nomads Travel Insurance. Simple & Flexible.

Or watch this video to learn how to get a quote on the World Nomads Travel Insurance website :

How to Make a Claim with World Nomads

You can make a claim online from anywhere

The part we all dread:

Actually having to make a claim when something goes wrong on a trip.

Luckily, World Nomads makes this simple as well. They list ten straightforward steps to guide you through the claims process :

- Gather your receipts.

- Sign-in to your World Nomads account.

- Make a new claim.

- Tell them what happened.

- List your expenses.

- Send supporting documentation.

- Upload your documentation, receipts, invoices or other proof of your expenses.

- Review your claim.

- Submit your claim.

- Communicate with the claims team

Keep in mind that saving your receipts is the real first step, as you’ll need them to begin making a claim.

So, what events can you submit a claim for?

What Does Travel Insurance Really Cover?

First things first: Travel insurance is not medical insurance.

Medical coverage is an important part, but “travel insurance” breaks down into three broad areas of coverage:

- Medical Expenses —Hospital bills

- Property —Luggage and their contents

- Travel —Accommodation and trip expenses

That’s it. You could add a fourth category—emergency evacuation fees and repatriation expenses (shipping your body home if you die)—but those typically fall under medical and they’re super depressing to think about.

Even though we fixate on the medical expenses side of travel insurance—and it can be the most costly emergency expense while you’re abroad—you are far more likely to use your insurance (make a claim) for lost or stolen items and trip interruptions .

Medical Expenses

While travel insurance isn’t medical insurance like you get at home, many plans do cover some medical expenses for accidents that occur on your trip. Here are some of the most common.

Emergency Accident & Sickness Medical Treatment

The keyword here is an emergency . This will be better defined in each policy’s fine print, but this covers medically necessary (a bit open to interpretation, I know) treatment for an accident or illness that occurs during the trip .

Here’s what you can typically expect from World Nomad’s (including dental coverage).

Coverage for medical emergencies

Coverage for travel accidents

Emergency Evacuation & Repatriation

Is it super depressing to think of your accidental death on a trip? Yep.

But it’s also naive to think it couldn’t happen, and it’s better to be prepared. This covers expenses for return home if you become extremely ill or pass away abroad.

It may also cover the cost of bringing a relative to see you or to send your children home if you get stuck in a hospital abroad for a longer stay.

As stated on their website:

“If our medical teams believe it’s necessary to bring you home for treatment or ongoing care, there’s cover in all of our policies for:

- Air Ambulance

- Sea Level Aircraft

- Helicopter evac

- Ground Ambulance

- Flight changes, upgrades or just more space

- Flight upgrade + medical staff.

Property Coverage: Insuring Your Gear

Even a small number of electronics can add up to big dollars. As a media producer and digital nomad, I carry a lot of expensive gear with me when I travel. This could include: a DSLR camera, Rode microphone, laptop, external hard drive, iPhone —the list goes on. I want to know that if my bag is lost in transit (I usually fly carry on, so that’s not gonna happen), or I get robbed, that I’ll get some money back for the tools I use to make a living.

That’s why I always choose travel insurance with solid coverage up to $3,000 .

Here’s what World Nomads typically offers according to their website:

“There’s cover to claim up to the policy limits if:

- Your luggage and personal effects are stolen, accidentally damaged or lost on your trip.

- Your checked-in luggage is stolen, lost or damaged by a common carrier (like an airline or bus company).

- Your travel documents, traveler’s checks or passport are stolen, accidently lost or used fraudulently.

- Sporting equipment when lost by the carrier or if it’s damaged (while not in use) or stolen.

The maximum amount you can claim for all your luggage and personal effects is $3,000 per insured person with a maximum claim amount of $500 per item for an Explorer policy, or $1,000 per insured person with a maximum claim amount of $500 per item for a Standard policy.”

It’s Ok to be Basic…Sometimes

Typically, most “Basic” packages have a claim limit of $1,000 , which just isn’t enough for all my stuff. But it all depends on you. If you’re a t-shirt and paperback traveler, skip the spinning rims and stick with Basic—the medical coverage is usually about the same ($50,000-$100,000), and you’ll save a few bucks not insuring gear you don’t even have.

Per Article Limit: You Sneaky, Bastard

If you do opt for more coverage, make sure you watch out for one insidious insurance term:

Per Article Limit.

I can’t stress this enough: Baggage loss/damage sections are super complicated and at the same time brutally specific. Know the wording of your policy.

A low per article limit—say, $100—means that even though you may be covered up to $5,000 (a very high limit), you can only claim $100 for each lost or stolen item:

- $1,500 MacBook Pro? You get $100

- $2,500 Canon 5D Mark III: You get $100

Watch out for per article limits!

Trip Coverage: Cancellation, Interruption, Delay, and Missed Connection

Nothing ever goes as planned. Planes are late, cabs get lost, and donkeys wander off. Most travel snafus are logistical—especially if you’re stupid inexperienced enough to plan the entire trip in advance.

The right travel insurance can reimburse you thousands of dollars for pre-paid accommodation and travel, but only if you know the difference between these three important terms:

Trip Cancellation

Trip interruption, missed connection.

“Cancellation” occurs before you travel, and usually involves sickness, injury, death of a family member, or inclement weather and natural disasters (your Fiji hotel gets hit by a hurricane, for example).

A good cancellation policy ($10,000) is the best reason to buy insurance months in advance. However, if you’re looking to save a few bucks, and have flexible travel dates, you can get low (or no) coverage in this section without it affecting your trip at all because the second you start your trip, this section becomes worthless.

“For US residents, there’s coverage in both Standard and Explorer plans for the transport and accommodation expenses you’ve already paid for if you can’t travel because:

- The doctor certifies that you’re medically unfit to travel

- You, your travel buddy or a close relative is hospitalized or dies

But we know more than illness can stop you from traveling, so we also provide coverage in cases like these:

- You or your travel buddy are required to serve on a jury

- Unforeseen weather stops all services for at least 24 hours and keeps you from reaching your destination

- A terrorist attack occurs in your scheduled destination within 30 days of your departure date”

This is when your trip hits a snag during your travels, and c overage is related to natural disasters.

Benefits related to other things you might consider “interruptions” like medical emergencies and accidents are listed in their website.

A flood carries your ferry away. A tornado closes your airport. With Trip Delay coverage, you’re all good.

This covers expenses like unused, prepaid accommodations when you get delayed 6 hours en route to or from your trip.

You’ll want to read the fine print on this one like your plan’s exact definitions of “hazards” or the Maximum Daily benefit-the limit they’ll payout per each day you’re delayed.

In their words

“If you experience delayed or missed flights, your reasonable and necessary additional expenses – such as local taxis and transport and accommodation costs during your delay – are covered up to the plan limits if:

- The missed flight is not any fault of yours. For example, when en route to a departure you’re delayed by a traffic accident in which you or a traveling companion are not directly involved.

- Your flight is delayed at least six hours or canceled due to severe weather, natural disaster, hijacking or strike, including if it causes you to miss a connecting flight.”

This one is also super tricky, so read the fine print. Often times the only missed connection reimbursements are for cruises, with rare air travel thrown in. Seriously. Cruises are apparently quite unreliable.

A missed connection claim typically only works if the reason you miss your flight/cruise is because of bad weather. So if you oversleep, you’re probably S.O.L.

Types of Coverage

It might seem like travel insurance companies offer a wealth of options, but travel insurance typically falls into two simple categories: Basic or premium. That’s it.

Companies add a lot of bells and whistles—like 24-hour emergency assistance support lines—but the difference is almost always a bigger monetary limit for damage (to your gear) and trip interruption claims as well as more medical coverage that you might not use ($100,000 vs. $250,000).

Basic Coverage

This varies between providers, but basic travel insurance policies typically cover:

- $1,000 Baggage

- $2,000 Trip cancellation

- $1,000 Trip interruption

- $50,000 Medical care

- $50,000 Medical evacuation

Basic plans typically don’t cover:

- Rental car collision waivers

- Missed connections

- Delayed baggage

- Pre-existing medical conditions

Premium Coverage

No matter what they call it—’Luxe, Preferred, Platinum, or “Special Little Someone”—premium coverage offers all the same protections as basic plans, with increased limits in nearly every category.

Premium coverage often includes:

- $3,000 Baggage

- $10,000 Trip cancellation

- $10,000 Trip interruption

- $1,000 Missed connection

- $100,000 Medical care

- $500,000 Medical evacuation/repatriation

- $50,000 Dental

- $35,000 Rental car collision waiver

Pay attention to wording, but the biggest difference between upgrades is usually your total trip cost (your estimated trip value). Most providers ask for your best guess when you’re browsing, and the number you come up with will definitely affect your quote.

If you’re a hostel backpacker traveling by bus, basic is almost always the way to go. Be honest about your low trip cost. A higher trip cost won’t give you better coverage; it’ll just cost you more money.

Adventure Activities Exception

The one big exception is if you’re an adrenaline junky. Adventure sports and the inherent medical risk they entail require customized travel insurance plans. Don’t rely on a quick online quote. Consult an insurance expert, or contact the company directly to get all the details just right.

Here are a few things that can affect adventure activities coverage:

- Countries visited (Europe, Asia, Australia, Africa-wherever you adventure, you’ll want to make sure you’re covered)

- Particular sports or activities

- Are you competing in a sponsored event?

- Are you a pro athlete?

- Are you traveling with a tour company or going solo?

Each variable matters and it only takes one wildcard to void even premium coverage.

World Nomads has you covered better than any other travel insurance company when it comes to adventure sports.

Check out a pdf list of World Nomad’s covered adventure activities for each plan (note: these results are for US citizens).

Hidden Benefits: Your Credit Card

Credit card insurance is an extra bonus that some travelers don’t even know about. Your credit card company may cover things like trip cancellation and rental car insurance, making those unnecessary travel insurance benefits. Take a look at your credit card policy before you travel.

For example, I carry the Chase Sapphire Preferred card because I love Chase Ultimate Rewards points. However, Chase also doesn’t charge foreign transaction fees and they cover car rental and trip cancellation ! You can learn more about my favorite travel credit cards here.

How to Choose the Best Travel Insurance

There is no one perfect insurance plan. Every traveler is different. So the best way to buy travel insurance that actually covers you (and your stuff)—for an affordable price—is to simply decide what one thing is most important to you.

Medical Matters

If medical coverage—hospital bills, medical evacuation, and zero deductible emergency care—is all that matters, get a well-reviewed insurance package with at least $250,000 in medical coverage . There are plenty of options. If you break your arm, good medical coverage will keep you from breaking the bank.

Fear for Your Gear

If you work on the road (like me), and your stuff is your livelihood, find a plan with no Per Article Limits and high Baggage Loss/Theft coverage($3,000-$5,000 ). Then you can swing your camera over your shoulder and hike out to the middle of nowhere with a bounce in your step, secure in the knowledge that you’re covered against theft and damage.

I don’t know many photographers worth their salt that don’t have at least $3000 in gear coverage.

Itinerary Idiot

If you’ve pre-booked your entire trip, and some connections are tight, or monsoon season is on the horizon, make sure you have an ironclad Trip Cancellation clause (some companies even reimburse you for more than 100% of your trip if weather ruins things)!

Trip Interruption is also clutch. And don’t forget good Missed Connection coverage if you’re taking a cruise.

Your journey is one-of-a-kind; make sure your travel insurance is the same. There really is a travel insurance plan for everyone, and it can cost as little as $2 a day.

Finally, down to the nuts and bolts. What is travel insurance going to cost me?

This is where most travelers start and end their travel insurance search, and while the price is a huge consideration—especially for budget travelers—you really do get what you pay for with travel insurance.

Shop. Around.

Hopefully, you never have to use your insurance, but if you break your arm, smash your camera (like the time I dropped a brand new lens hiking in the Italian Riviera), or get marooned in Bangkok for three weeks by a monsoon, the extra $2/day for real coverage will save you thousands in medical bills, replacement costs, and cancellation fees.

Travel Insurance Price Comparison

While World Nomads is my go-to travel insurance provider, it may not fit for everyone. To help you decide, I crunched the numbers for a one-month trip to Italy (January 2020) using three other recommended budget travel insurance providers I could find (you might even recognize a few of them, so that’s cool).

Below are the price breakdowns and some notes about coverage.

HTH Travel (or GeoBlue, if you’re eligible)

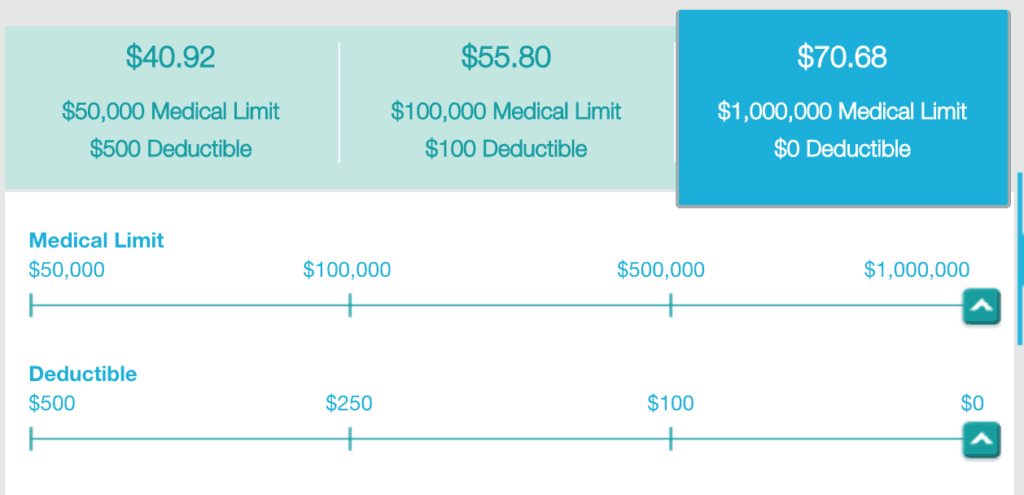

Choice Option:

$50,000 limit/$500 deductible: $40.92

$100,000 limit/$100 deductible: $55.80

$1,000,000 limit/$0 deductible: $70.68

Essential Option:

$50,000 limit/$500 deductible: $36.58

$100,000 limit/$100 deductible: $49.91

$1,000,000 limit/$0 deductible: $57.66

- Standard Trip cancellation (sliding scale from $5,000 up to $50,000)

- No “ missed connection ” reimbursement for the economy package

- Only Preferred provides car rental insurance coverage, so you’ll need to provide your own on the other two packages.

Plus Side: Each option includes more than 100% reimbursement (125%, 150%, and 200%) for “trip interruption .”

That basically means, that HTH understands that missing out on an activity is about more than just the money out of pocket—it’s about putting a price on missing out on a once-in-a-lifetime experience. Also, the minimal cost difference it takes to drastically lower your deductible and limit almost make it a no-brainer to go with the full-on coverage, unless you’re on a really stringent budget.

Well done, guys.

OneTrip Premier: $148

OneTrip Prime: $110

OneTrip Basic: $84

The Difference Between Premier, Prime, and Basic

- Medical emergency coverage slides from $10k – $50k (a little low)

- Baggage loss/damage is on the low side as well ($500, $1,000, and $2,000). If you travel with a laptop, DSLR, etc. consider an upgrade

- Basic coverage doesn’t provide reimbursement for missed connections , and travel delay coverage is low ($300)

Plus Side: Pre-existing conditions are covered on every plan.

Generali Global Assistance (formerly CSA)

Standard: $97.57

Preferred: $122.89

Premium: $156.80

The Premium option is built for more expensive, high-end travel including cruises and guided tours, stuff that costs a lot upfront. This is good news for backpackers – there’s no need to feel cheap or unprepared by choosing the cheaper options. The Preferred option includes stuff like outdoors gear (skis, camping equipment, etc.) and is ideal for adventure travel.

Plus Side: Their plans include dental in the medical coverage (up to $50,000), which is a big deal if you chip your tooth on a Red Bull can. That being said, I’ve got my teeth cleaned in Hanoi Vietnam for around $20 USD – a fraction of the cost for a cleaning back in the states. Paying out of pocket is always an option but with serious dental damage insurance is key.

Travel Insurance Tips & Best Practices

Now that you have a feel for the cost of travel insurance—typically $2-$6/day—and what it covers, as well as the pitfalls and jargon, the final question is:

How can I hack buying insurance to get the sweetest deal?

Surprisingly, honesty helps save money on travel insurance. Really think about how much your gear is worth today ( not what you paid for it five years ago). A 4-year old laptop is worth $100, even if it was $899 back in the day. A point and shoot camera might not even be worth that much, even though it retailed for $229. If you go through your stuff item by item, you might discover that you really don’t need premium coverage. And that’ll save you money every day.

Don’t Insure Your Entire Trip

Warning: This is a “break glass in case of emergency” kind of hack and isn’t for the faint of heart, but a great way to save money is to only insure half of your trip. Let me finish.

Flexibility

I travel on one-way tickets all the time—I like the flexibility to stay put, go somewhere spur of the moment, or even call it a day and head home. I’ve headed out for what was originally a 3-month trip, only to have it go south and be back home after a month. I’ve also had the same trip extend into a two-year RTW romp. Isn’t travel awesome!

World Nomads Travel Insurance makes is incredibly easy to extend your insurance with just a few clicks, so save money up front and only purchase what you know you’ll use. You can always extend as you go. The last thing you want is to pay for travel insurance while you’re safe and sound on the couch at home.

Split the Cost

In the hypothetical trip to Italy this June, I might stay on for an additional month to hike the Camino de Santiago in Spain. That’s a totally different trip than photographing idyllic cafes and vineyards in Tuscany. It requires different medical coverage, less gear coverage (I don’t hike with a laptop), and possibly extreme adventure coverage for mountain climbing.

So instead of paying for two months of very expensive comprehensive coverage for the whole trip (Italy and Spain), I’ll insure my first month of travel with World Nomad’s Basic Plan , then extend the basic plan if I stay in Italy sunning myself, or re-up with a new provider, or expand on my existing coverage for my Spanish hiking expedition.

Here’s an insider travel secret from the pros: Travel Insurance companies want you to buy more coverage.

Extend Your Coverage As You Go

Generally, insurance companies make it easy to extend your coverage, and they’ll drool if you want to up your protection mid-trip.

World Nomads Travel Insurance even sends you an email reminder when your travel insurance is a week away from expiring so there’s no lapse in coverage if you forget. It’s awesome.

The one thing you can’t do is downgrade your plan.

If penny-pinching is a huge concern, or you haven’t nailed down your budget and the thought of spending cash upfront bums you out, get Basic coverage for the first leg of your trip and see how it goes.

Try before you buy. You can always get more.

Travel Insurance Is Important: Don’t Skip It!

Travel insurance is part of how we travel today. Everyone has a smartphone worth hundreds of dollars, cameras worth even more, laptops, hard drives, and gizmos. Everyone is a rock climber or spelunker (which is kind of awesome), and everyone has plans that fall through from time to time.

It sucks to travel in fear that something might go wrong, because, spoiler alert: it totally will.

Travel is all about the unexpected and unpredictable. If you get the right coverage you won’t sweat it when things go wrong and you can go back to enjoying what an amazing, wonderful, exciting world we live in!

Disclosure: Some of the links above are affiliate links which means I’ll earn a small commission if you decide to make a purchase with no additional cost to you. I recommend products I use and love and any money earned goes back into supporting this website and community and keeping the content ad-free. Thank you!

You're almost there!

Drop your email below so we can send your FREE course!

Success! Now check your email to confirm your subscription.

There was an error submitting your subscription. Please try again.

Want to Travel More?

You need a plan. Sign up to access this mini-course, get exclusive content and join our amazing community of travelers. It’s all FREE!

You're in! Check your email for your free guide!

Jason – On your (earlier) recommendation I purchased a few days ago a World Nomads policy for a trip our son is taking to South America this summer (He’s flying from Peru to Argentina literally as I type this). While I don’t think World Nomads is the cheapest policy out there, I can’t imagine any insurer making the process easier. So simple! Also, their coverage looked very comprehensive. The peace of mind is definitely worth the few dollars.

That’s great Earl, they’ve always been good to me over the years. Insurance is one of those necessary evils so it’s nice that they make it easy. Awesome to hear that your son is headed south, I’m sure he’ll have a blast! Thanks for reading this and taking the time to comment. Cheers! Jason

Thanks Jason, this really set my mind at ease as I just realized that I need to get travel insurance in the next month, and didn’t have a clue where to look.

Awesome! Glad it helped!

Well written break down of travel insurance issues.

One of the most common ‘fine print’ issues I encounter are ‘delayed’ baggage and flight compensations. Lots of people get excited about that, when it often turns out that you’d have to be something like 12 hours late on an intercontinental flight for that to get triggered.

Another interesting point is cash: There are actually travel insurance providers (to my surprise) that insure cash you carry. I always thought that would be too open to abuse, but it does exist.

Last but not least: If stuff gets stolen, it’s important to file a police report in the country where it got stolen. Many insurance companies won’t reimburse losses from criminal activity unless there is at least a police report.

Great points Karsten, and I had no idea that some providers will even insure cash. Thanks for sharing

Recent Posts

- The World’s Most Traveled Person on the Ethics of Gamifying Travel, Best Regions in the World, and Why To Keep Traveling With Harry Mitsidis of NomadMania

- Greatest Hits: Adventure and Conservation – A 6,000 km Tuk-Tuk Journey Through Africa

- Bicycling Across the USA Without Money in Search of Human Connection With Daniel Troia

- Greatest Hits: Sustainable Travel 101 (How to Be A Better Traveler) With Richard Hammond

- New Zealand: Top 10 Hidden Gems, Campervan Lifestyle (Tips and Tricks), and Doing Life Differently With Lisa Jansen

Recent Comments

- nck crack without box on Road Tripping Europe To India : Daily Life On A Land Rover Overland Adventure

- Nora on Turn Travel Into A Lifestyle With Goats On The Road

- Jason Law on Top 10 Road Trip Albums

- Svanna Clariot on Atlas Obscura: Curious World Wonders

- Kylie on Hitchhiking: Myths, Facts and Beyond

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- Destinations & Culture

- Digital Nomad

- Inspiration

- Travel Hacking

- Travel Jobs

- Travelosophy

- Uncategorized

- Entries feed

- Comments feed

- WordPress.org

You need a plan. Sign up to access this mini-course The 3 Best Ways To Save Money For Travel , get exclusive content and join our amazing community of travelers. It’s all FREE!

You're signed up! Check your email to access the mini-course!

Top Picks for Trip Insurance

Expert picks from a licensed agent so you can find the the best plans fast.

You want to understand it, before you buy it

Browse guides and 100’s of expert articles covering everything you need to know about travel insurance.

Get no-nonsense advice on:

- Why you should purchase travel insurance

- What travel insurance covers

- How much travel insurance costs

Expert picks for the best travel insurance plans. I dig in to find the coverage details that matter and explain it simply.

Check out our list of Best Travel Insurance policies .

- Best Overall

- Best for Covid-19

- Best for Cruises

Get quotes from all major companies and save time. Compare plans to find the best coverage.

Just enter a few trip details and get instant quotes

- Instant quotes from all companies

- Easily compare plans to find the best coverage and price

- Guaranteed lowest price regulated by law

Protect your trip

Get the right coverage to keep you, your family, and your belongings safe. Our policies cover you from a wide range of travel mishaps. Pick the plan that’s right for you.

- Trip Cancellation

- Medical Emergencies

- Emergency Evacuation

- Lost & Stolen baggage

- Flight Delays and More

Trustworthy and reputable insurance providers

We only work with trustworthy companies. The Zero Complaint Guarantee is a promise that the travel insurance policy you purchase through our partner is from a reputable provider who will handle your claim fairly and honestly.

- Licensed claims adjusters to mediate on your behalf

- Insurance rates are regulated by law

- You can’t find the same insurance plans for a lower price anywhere else

Get instant quotes from all major providers in minutes

Tell us about your trip

Answer a few simple questions about your destination, travel dates, travelers, and trip cost

Get instant quotes

We help you compare coverage, cost, and identify the best policies by focusing on your priorities and making it easy to understand

Purchase in minutes

Fast and easy checkout with immediate email confirmation of coverage

Learn travel insurance from the experts

Travel insurance for…