- Medical Plan

- Medical + Cancellation Plan

- Cancellation Plan

- Annual Medical Plan

- Visitors to Canada Plan

- Seeking medical treatment

- How to file a claim

- Access Claims Portal

- Complaint resolution process

- Understanding travel insurance

- Choosing travel insurance

- Before your trip

- On your trip

- Travel Tips

- Get a quote online

Cambridge 700 Jamieson Parkway Cambridge, ON, N3C 4N6 Canada

Toll free phone: 1-800-461-1079 Local phone: 1-519-742-2800 Fax: 1-519-742-2581

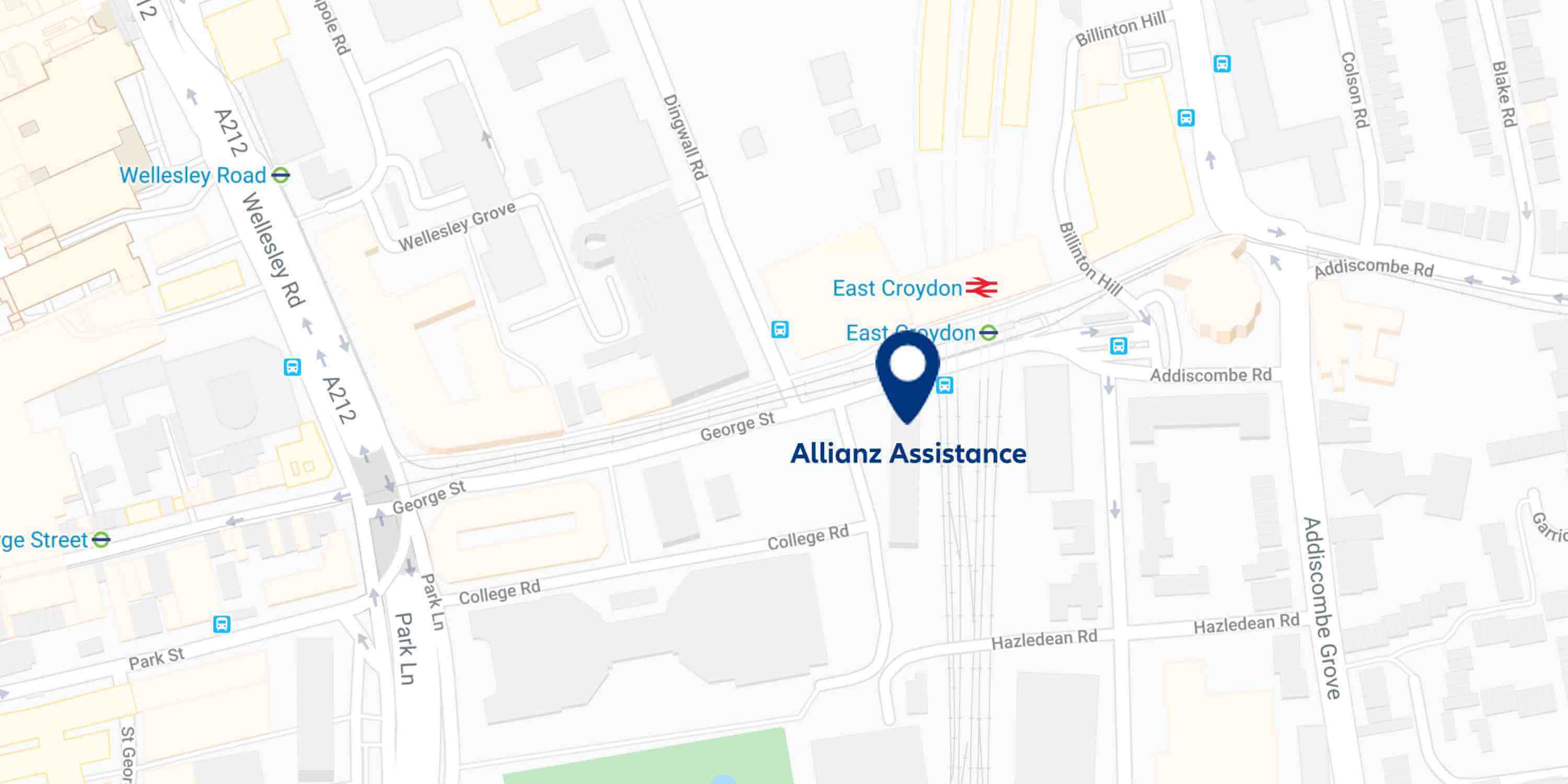

How to reach Allianz Global Assistance

Please don't hesitate to contact us for any questions, anytime.

We're here to assist with:

• Questions about our products and services • Purchasing a policy • Emergency travel assistance • Filing or questions about your claim

…or anything else you require support for.

Thank you for contacting us! Your message has been successfully submitted and we will get in touch with you shortly. In the meantime, feel free to check our FAQ section, available at the bottom of your screen. For immediate assistance, please call us at 1-844-310-1578.

Apologies, we are currently unable to handle your request. Please try again.

Warning - The E-Mail Address configured for this form is either unverified or invalid. Please verify the E-Mail Address and try again later.

A verification E-Mail was sent to the following E-Mail addresses:

Kindly check the corresponding inbox for a verification E-Mail and verify it.

Warning - Please add an email field in the form to proceed without any errors

Warning - The page URL seems to be incorrect. Kindly check the URL and try again.

Error Mandatory field

Please enter a valid phone number.

Error Invalid

Error The email addresses are not the same

Warning! Your mobileNumber field is not set up with the right component. Please use Textfield component with phone number validation, in order to avoid any errors when transporting data to Adobe Campaign

Enter the text from the box. 60 seconds remaining. Can't read the text? Reload text

This message can't be sent right now. Please try again later.

Sorry, that does not match the text in the box. Please try again.

Warning - This form has 100 fields, which is over the maximum allowed field count: 75. Form submissions will fail if this page is published.

Warning - The technical field name is duplicated in more than one location. This will cause information loss when delivering the form submission. Please remove the duplicated field or rename its field name.

Warning! Please upload a file with the correct file type to proceed.

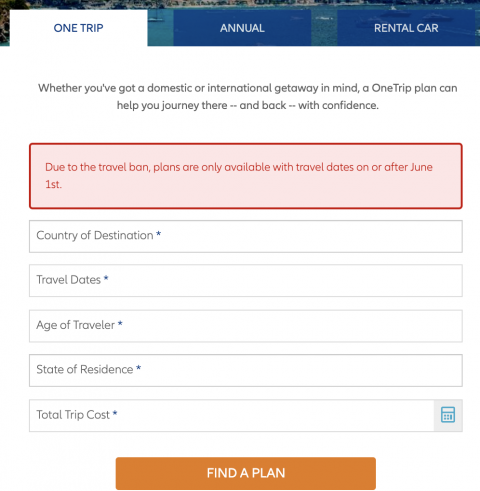

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

If you don't see what you're looking for, feel free to email us with questions.

For questions related to COVID-19, please visit our COVID-19 FAQ's .

+ - i'm experiencing a travel emergency. what should i do.

If you’re having a medical emergency, or if you’re the victim of a crime, first call local emergency services.

To get help anytime, Allianz Global Assistance customers can call 24-Hour Hotline Assistance .

- Within the United States, Canada, Puerto Rico and the U.S. Virgin Islands call toll free: 1-800-654-1908

- Outside of the United States, call collect: 1-804-281-5700

- Or, simply dial 0170 to reach an international operator. Say the number you wish to call, and you’ll be connected.

+ - Why do I need travel protection?

Travel is inherently risky, and so insurance can safeguard you from certain financial losses that often occur while traveling. If you have to cancel your beach rental for a covered reason, for example, trip cancellation/interruption benefits can reimburse you for your non-refundable, pre-paid trip costs (up to the amount of your plan limits). If your snowboarding gear gets stolen during your winter vacation, baggage loss/damage benefits can reimburse you for the loss. Depending on the plan you choose, travel insurance also can reimburse eligible medical costs in case of a covered medical or dental emergency; reimburse you for losses caused by a covered travel delay or baggage delay; protect you from paying for rental car damage or loss; and help in other situations as well.

Read more: Travel Insurance 101: How Travel Insurance Works

+ - Why do I need rental car insurance?

When you’re renting a car, even a tiny fender-bender can get really expensive. You may have to pay the deductible on your own collision insurance, as well as a loss of use charge from the rental car company — not to mention the higher insurance rates following an at-fault accident. The OneTrip Rental Car Protector can cover costs up to $50,000 if a car you're renting is stolen or is damaged in a covered accident or while it's left unattended. There’s no deductible and no need to file a claim with your car insurance company. You also get trip interruption benefits and baggage loss/damage benefits up to $1,000.

(The OneTrip Rental Car Protector does not include liability insurance. Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/coverage may vary by state, and sublimits may apply.)

+ - What is included in non-refundable trip costs?

Non-refundable costs include pre-paid trip deposits/payments that would be lost if you had to cancel for a covered reason prior to trip departure. Some examples may include vacation rental costs, campground fees; rental car fees; tickets for tours or events; and hotel and airline ticket costs. Be sure to consult your travel suppliers to determine which costs are non-refundable for your particular trip, as cancellation policies vary.

+ - What do travel protection plans cover?

Depending on the plan you choose, travel insurance can provide benefits for a number of situations that may occur before or during your trip. These benefits may include:

- Trip Cancellation

- Trip Interruption

- Emergency Medical Transportation

- Emergency Medical / Dental

- Lost / Stolen / Delayed Baggage

- Travel Delay

- Change Fee Coverage

- Loyalty Program Redeposit Fee Coverage

- Rental Car Protection

- 24-Hour Hotline Assistance

For definitions of these terms, please click here .

Note: Not all plans include each benefit listed here. Please see the Certificate of Insurance/Policy for terms, conditions, and exclusions.

+ - How do I know which travel protection plan to buy?

That depends on your budget, your destination and your specific situation. If your biggest worry is protecting your vacation investment in case of a last-minute cancellation or trip interruption, then you need a plan with trip cancellation/interruption benefits. If you’re more concerned about mishaps that occur while traveling — such as baggage loss or delay, or trip delays — look for a plan with post-departure benefits. And to protect yourself in case of a medical emergency while traveling, we recommend a plan that includes emergency medical and emergency medical transportation benefits.

Read more: Compare Travel Insurance: How to Pick the Perfect Plan

+ - Who is covered by my travel protection plan?

Your travel insurance plan covers only people who are named insured — that is, named in the plan. Family members and/or travel companions are not covered unless they’re named in your plan documents. If you purchase the OneTrip Prime or OneTrip Premier plan, kids 17 and under are covered free when traveling with a parent or grandparent (not available on policies issued to Pennsylvania residents). The AllTrips Premier plan also can cover an entire household on a single plan.

Read more: Who’s Covered By My Travel Insurance Benefits?

+ - Do travel protection plans cover pets?

Your travel insurance benefits do not cover pets. However, we include service animals (as defined by the Americans with Disabilities Act) in our definition of “family members,” so any benefits that apply to family members would also apply to service animals. Emotional support animals or therapy animals are not considered service animals by the ADA.

+ - Do travel protection plans cover pregnancy?

Travel insurance from Allianz Global Assistance does not cover losses resulting from normal pregnancy or childbirth, except as expressly covered under Trip Cancellation Coverage. Specifically, if you find out that you are pregnant after purchasing your travel insurance plan, that can be considered a covered reason for trip cancellation.

While normal pregnancy and childbirth are not covered, unforeseen pregnancy complications may be a covered reason for trip cancellation or interruption. The medical condition you’re experiencing must be disabling enough to make a reasonable person cancel their trip, and a doctor must advise you to cancel it. If your plan includes emergency medical benefits, your insurance may reimburse you for the cost of emergency medical care that you received for those covered complications while traveling.

Read more: Travel During Pregnancy: What Does Travel Insurance Cover?

+ - Does my health insurance cover me overseas?

Before traveling overseas, it’s wise to ask your health insurance provider if your coverage travels with you. Medicare generally does not offer coverage overseas, and hospitals in other countries often require cash payments up front. Also, very few health insurance companies pay for your medical evacuation back to the United States, as the U.S. Department of State explains . This is why it’s so important to have travel insurance with emergency medical and emergency medical transportation benefits.

Read more: Do I Need Travel Insurance If I Have Health Insurance?

+ - My destination requires proof of travel insurance. Can you help?

We're happy to provide a summary letter that describes your travel insurance plan benefits, also called Proof of Insurance. Click here to request Proof of Insurance (please allow up to 48 hours for a response).

To make sure the information provided in the Proof of Insurance satisfies the requirements of your destination, we recommend that you or your travel advisor contact the nearest embassy or consulate of that country to confirm.

+ - I'm traveling overseas. Where can I find information about COVID-19 travel restrictions and other entry requirements for my destination?

Our interactive map shows current information on travel requirements and entry restrictions for international destinations, including COVID-19 testing, vaccination policies, necessary travel documents and quarantine periods. Check your destination’s entry requirements here. (Content is provided by Sherpa, an affiliated third party).

If your destination requires proof of travel insurance, we're happy to provide a summary letter that describes your travel insurance plan benefits, also called Proof of Insurance. Click here to request Proof of Insurance (please allow approximately 48 hours for a response).

+ - Can travel insurance cover trip cancellation or interruption if I don't meet the COVID-19 entry requirements for my destination?

Failing to meet a country’s entry requirements, whether for COVID-19 or any other reason, is not a covered reason for trip cancellation or interruption. It’s the responsibility of the traveler to check international entry requirements before booking a trip.

Before you book, and before you travel, use our interactive map to see current information on travel requirements and entry restrictions for international destinations, including COVID-19 testing, vaccination policies, necessary travel documents and quarantine periods. (Content is provided by Sherpa, an affiliated third party).

+ - What can 24-Hour Hotline Assistance do for me?

You can call 24-Hour Hotline Assistance anytime to reach a team of multilingual specialists who can help you with many types of travel problems, from reporting lost baggage to finding emergency medical providers. Our Hotline Assistance team has helped road-trippers locate a lost wallet and RVers find emergency boarding for their dog, among other feats. They can also help you replace passports and essential travel documents, refer you to legal assistance, secure cash from home in case of emergency, and may be able to guarantee payment when you need to be admitted to a hospital, if you have a covered medical emergency while traveling.

Read more: Secret Superpowers of the 24-Hour Hotline Assistance Team

+ - Am I able to change my flight through Allianz Global Assistance?

We can’t change your travel arrangements for you. Instead, call your airline, travel agent or other travel supplier. If you need help making alternate travel arrangements due to a covered trip interruption, travel delay or other covered situation, call 24-Hour Hotline Assistance .

+ - How do I call Allianz Global Assistance internationally?

You can call Allianz Global Assistance collect when traveling abroad. The easiest way to reach us is to download the free Allyz ® TravelSmart app . Or, simply dial 0170 to reach an international operator. Say the number you wish to call, and you’ll be connected:

- 1-866-884-3556 for customer service

- 1-804-281-5700 for 24-Hour Hotline Assistance outside the U.S.

Within the United States, Canada, Puerto Rico and the U.S. Virgin Islands, call toll free:

- 1-800-654-1908 for 24-Hour Hotline Assistance

+ - If I cancel my trip, do I get my money back?

Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents. If a hurricane floods your beach house; if a family member falls ill right before your vacation; or if you fracture your ankle right before your golf getaway, those all can be covered reasons for canceling your trip and getting reimbursed.

Other examples of covered reasons may include: sudden covered medical emergencies; the birth of a family member’s child; the death of a travel companion or family member; financial default of a covered airline, cruise line or tour operator; legal separation or divorce; or jury duty. Some reasons for cancellation aren't covered, such as changing your mind about taking a trip or other things not named in your Certificate of Insurance/Policy.

If you cancel your trip for a covered reason, you must notify your travel supplier(s) within 72 hours of the cancellation. Not all plans include trip cancellation benefits. Please see the Certificate of Insurance/Policy for terms, conditions, and exclusions.

Read more: Trip Cancellation Insurance: Covered Reasons Explained

+ - Do you offer "cancel for any reason" travel insurance?

“Cancel for any reason” insurance is not available for purchase online. If you are interested in this type of travel insurance, please talk to your travel agent about your options.

+ - How do you determine the cost of travel protection plans?

The cost of travel insurance generally depends on a few key factors: the age of the traveler(s), the cost of the trip, and the level of coverage desired. The cost is not affected by your destination or your prior medical or claims history. There is a per diem cost for trips over 30 days in length.

Read more: What Factors Determine the Cost of Travel Insurance?

+ - Who provides the insurance for these programs?

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A-” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected].

+ - My travel plans have changed. How can I change my plan coverage dates?

We are happy to help you change your coverage dates to match your new trip dates. Your new return date must be within 770 days of when you purchased your policy.

If you have not already departed on your trip or filed a claim, you may update your plan through the online plan management tool .

If the travel dates have passed, and you have not started your trip or filed a claim, just send us the following information:

- Proof of cancellation for your existing trip, such a copy of the cancellation email[s] from your travel supplier, or screenshots from the supplier website.

- A copy of your new itinerary showing the traveler name[s], trip dates, and new total cost of your trip.

Forward your documents to [email protected] . Please include “Date Change Request” and your plan number in the subject line of the email. You can also fax the documents to (804) 673-1598. Please include your plan number on all documents. Once we receive these items, our team will review your request within 3-5 business days.

Please note, if your trip cost or duration changes, the cost of your travel protection plan may also change. We will let you know if that is the case.

If your trip is extended because of a covered travel delay, trip interruption, medical emergency or other covered reason, you don’t have to request a change to your coverage dates. We will extend your coverage period until the earlier of when you are able to return home or to your point of origin, or until you arrive at a medical facility for further care following a medical repatriation or trip interruption.

+ - Can I change the details of my insurance plan?

As long as you have not already departed on your trip or filed a claim, you may be able to change certain details (such as adding trip costs). For fastest service, visit our online plan management tool .

+ - How do I get another copy of my policy documents?

You can request an additional copy of your policy documents by visiting our online policy management tool .

+ - How do I know what my coverage limits are?

Refer to your plan documents for all the details of your plan, including benefits, coverage limits, covered reasons for trip cancellation/trip interruption and exclusions. Benefit limits are listed on the Declarations page.

+ - How do I access my plan documents?

When you purchase your plan, we’ll email you your plan documents. You can obtain an additional copy by visiting our online plan management tool . For full mobile access to your plan, download the free Allyz ® TravelSmart app .

+ - How do I cancel my travel protection plan?

For the fastest service, you can cancel your plan by visiting our online plan management tool . For a full refund of your premium, you must cancel within 15 days of your plan purchase (depending on your state of residence) and must not have filed a claim or departed on your trip. Premiums are non-refundable after this period.

+ - What should I do if I'm having a technical issue with your website?

Please let us know! On the Contact Us page, select "Technical issue with the website" from the drop-down menu. Let us know which page you were on and describe the issue (e.g. the page did not load properly, you received an error message, etc.).

+ - How do I file a claim?

The fastest and easiest way is to file a claim on our website . To get started, you'll need your email address or policy number, as well as your departure date or policy purchase date.

Documentation to support your claim is required before a claim examiner can review your claim. Find a list of supporting documents you may need here . Once you have filed your claim, you will receive a confirmation email.

You can also use the free Allyz ® TravelSmart app to file a claim . Or, email us at [email protected], fax your claim to us at 804-673-1469, or mail it to:

Allianz Global Assistance P.O. Box 71533 Richmond, VA 23255-1533

Please include your name and policy number with any documentation submitted by mail or fax. Processing times may be longer than for claims submitted online.

After your claim has been submitted, you can check your claim status 24 hours a day by visiting our online claim management tool or using the Allyz TravelSmart app. You can get help filing or checking a claim anytime by calling customer service at 1-866-884-3556.

For more details on the claims process, click here .

+ - How do I check on the status of a claim?

For the quickest service, check the status of your claim online or in the free Allyz ® TravelSmart app . You also can reach customer service by calling 1-866-884-3556.

+ - How long will it take for my claim to be reviewed?

The time required to process a claim depends on the type of claim, the circumstances of the claim and the documentation required. We'll begin processing your claim once we receive your claim form and all the required supporting documentation . If we have to request more documents or more information, then the claim processing time will be extended.

For the fastest service, please submit your claim and all documentation on our website or in the Allyz ® TravelSmart app . Claims submitted by email, mail or fax may take longer to process.

+ - How long does it take to receive payment for a claim?

The timeline for receiving payment for a claim depends on two things: the time required to process your claim (see above) and the payment method you choose. We recommend choosing debit disbursement (sending money to your debit card electronically) or direct deposit (sending money to your bank account electronically) as your payment option, if your claim is eligible.

- If you're filing online, select debit or direct deposit on the payment info page.

- On the phone, ask Customer Service to select debit or direct deposit for your reimbursement.

- If you're submitting a claim via email, mail or fax, mark debit or direct deposit on the claim form.

If your claim is eligible for payment, debit disbursements may be received immediately, the next day, or within two to five business days, depending on your bank's processing times. Direct deposit takes two to five business days, based upon bank processing times.

We can also mail you a check if you'd prefer, but please note that it can take 10 to 14 days to receive it.

+ - Where do I find a list of all the required claim documents?

On the Required Documents page , select your claim type to see a list of the documentation that may be required to support your claim. For the fastest service, please gather these documents before you start your claim.

In some cases, your claims examiner may ask you to submit an additional piece of documentation that's not included in this list. If you have questions about the documents you need to submit, please call us at 1-866-884-3556.

+ - If my claim is approved, can I receive the payment electronically?

Whether you file a claim online or offline, you will have the option to select direct deposit/ACH or debit disbursement to receive your claim payment. On the phone, ask Customer Service to select debit or direct deposit for your reimbursement.

Depending on the nature of your claim, you'll see the payment originating from AGA Service Company or Jefferson Insurance Company .

+ - Are there limits on electronic claim payments?

Payments can only be made in US dollars. There is a $10,000 maximum limit for debit disbursements ($50,000 per month). If you select electronic payment and your refund is over the maximum limit, then we will mail you a check. Please allow 10-14 days for it to arrive.

+ - Can I receive a claim payment on my credit card? Can I receive claim payment to a business account or to multiple accounts?

We cannot make claim payments to a credit card or a prepaid card at this time. Additionally, we unfortunately cannot send claim payments to a business account or split claim payments among multiple bank accounts. The total claim payment will need to go to one personal account.

+ - Why do I have to provide my email for claim processing?

Email addresses are required for all electronic payments in order to electronically send your explanation of benefits. If you don’t have an email address, or choose not to provide it, we’ll mail you a check.

+ - I opted to receive electronic payment, but I received a check. Why did this happen?

Even if you've selected electronic reimbursement, we may instead mail a check if:

- Your claim reimbursement amount exceeds the maximum limit for electronic disbursement.

- There was an error in the electronic payment details (e.g. account or routing number).

- There was a processing error with the bank.

- You did not enter an email address.

+ - Can I change my preferred payment option?

Please call customer service at 1-866-884-3556. If your claim payment has not already been processed, we will happily update it for you.

+ - How can I make the claims process go smoothly?

To help us process your claim as quickly and efficiently as possible, please gather all the requested documentation and information before you begin filing your claim. You’ll need to describe what happened, provide exact dollar amounts for each of your losses, and include documentation, such as receipts or doctor’s notes, to support your claim.

Watch a quick video that shows you how to file a claim .

Learn more about how the claims process works .

+ - Why do I need to submit documentation?

Supporting documentation helps us to verify your claim, and it is required in order for us to assign your claim to an examiner. The documentation required depends on your claim type and reason. It may include photos, receipts, communications, and invoices from your travel suppliers, medical records, police reports, etc. To see examples of what might be required for your claim, please see the Required Documentation page .

Remember, we’re always here to help you navigate the claims process! Call Customer Service anytime at 1-866-884-3556.

+ - How do I upload additional documentation for my claim?

If you don't have all your documents at the time of filing, that's OK! You can start your claim and come back later to add documents. Click Check a Claim to look up your claim and add documentation. Please remember that your claim can't be processed until all required documentation has been submitted.

Submitting documents online will result in the fastest claim processing. If you are unable to upload your documents, you may also send them by:

- Email: [email protected]

- Fax: 804-673-1469

- Mail: Allianz Global Assistance Claims Department, PO Box 72031, Richmond, VA 23255

Please include your claim number on any documentation submitted at a later date.

+ - When do I have to turn in my documentation?

Supporting documentation helps us to verify your claim, and it is required in order for your claim to be assigned to an examiner. For the fastest processing, please submit your documentation at the time of filing. If you need more time to gather your documentation, you can start your claim online, then come back at any time to add documents. We ask that you notify us of your claim within 90 days of the date of loss or as soon as reasonably possible (except as otherwise allowed by law).

+ - Why was my claim denied?

If your claim has been denied, a claim examiner will provide the reason specific to your situation. Some common reasons for claim denials:

- Your claim reason does not meet the requirements stated in your plan documents

- Your claim reason is listed under "General Exclusions" in your plan documents

It's important to read your plan documentation before you travel or file a claim to understand what is and is not covered. If you have questions about why your claim was denied, please call Customer Service at 1-866-884-3556.

Read more: 5 Reasons Your Trip Cancellation Insurance Won’t Cover You

+ - Does it matter if I file a claim by mail, by fax or electronically?

For the fastest processing, we recommend filing your claim online. However, the manner in which you submit your documentation does not affect the outcome of your claim. You can also file a claim via email, mail, fax or phone.

+ - What do I do if I receive both a refund from my travel supplier and a reimbursement from Allianz Partners?

If you receive additional reimbursement for this claim, please contact our Recovery Department and reference your claim number in your correspondence. Unless prohibited by law, you may be required to return excess funds if they exceed your total amount of loss. We and your plan's underwriter(s) each reserve our respective rights, remedies, and defenses under this plan and applicable law.

Recovery Department PO Box 72032 Richmond, VA 23294 [email protected]

Pre-Existing Medical Condition Coverage

+ - what is a pre-existing medical condition.

We define a pre-existing medical condition as an injury, illness, or medical condition that, within the 120 days prior to and including your plan purchase date:

- Caused a person to seek medical examination, diagnosis, care, or treatment by a doctor;

- Presented symptoms; or

- Required a person to take medication prescribed by a doctor (unless the condition or symptoms are controlled by that prescription, and the prescription has not changed).

The illness, injury, or medical condition does not need to be formally diagnosed in order to be considered a pre-existing medical condition.

+ - If I have a pre-existing medical condition can I still purchase travel protection?

Yes. If your plan includes the Pre-Existing Medical Condition Exclusion Waiver, you may be covered for losses due to a pre-existing medical condition if you meet all the following requirements:

- Your plan was purchased within 14 days of the date of the first trip payment or deposit;

- You were a U.S. resident when the plan was purchased;

- You were medically able to travel when the plan was purchased; and

- On the plan purchase date, you insured the full non-refundable cost of your trip with us. This includes trip arrangements that will become non-refundable or subject to cancellation penalties between the plan purchase date and the departure date.

If you incur additional non-refundable trip expenses after you purchase your plan, you must insure them with us within 14 days of their purchase. If you do not, those expenses will still be subject to the pre-existing medical condition exclusion. Coverage limits may vary based upon your chosen plan. Please see your Certificate of Insurance/Policy for terms, conditions, and exclusions.

Even if you don't purchase protection that covers existing medical conditions, or if you don't meet the requirements for that coverage, you can still purchase travel protection; just be aware that any loss due to an existing medical condition will be excluded.

Covered Suppliers

+ - what is supplier default.

Some travel protection plans include supplier financial default as a covered reason for trip cancellation and trip interruption. This means a covered supplier — such as a tour operator, airline, or cruise line — ceases all operations due to its financial condition, with or without filing for bankruptcy. Coverage applies to non-refundable payments and deposits you made before your trip was canceled, less any published refunds you're entitled to receive.

+ - How do I determine if I have supplier default coverage?

Please review your plan's terms, conditions and exclusions to see if the financial default of a travel supplier is listed as a covered reason for trip cancellation and trip interruption. To be eligible, the following conditions must apply:

a. Your plan was purchased within 14 days of the date of the first trip payment or deposit;

b. The cessation of operations occurs more than seven days after your plan’s Coverage Effective Date;

c. Your plan was not purchased directly through the tour operator, airline, or cruise line ceasing operations, or an affiliate of that entity; and

d. The tour operator, airline, or cruise line was included in our list of covered suppliers on your plan’s Coverage Effective Date. A list of these covered suppliers can be found by clicking here .

Share this Page

- {{errorMsgSendSocialEmail}}

Coverage Alerts

Please feel free to contact us with any questions or comments:

1-866-884-3556

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Pet Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Allianz Travel Insurance review: Is it a good option for your next trip?

With plenty of options to choose from, allianz likely has the right coverage for your trip..

Travel insurance can offer peace of mind — and financial protection — when you travel. Whether you want minimal coverage for emergencies or are looking for a more comprehensive plan, Allianz Travel Insurance probably has an option that will work for your situation.

CNBC Select breaks down the types of coverage Allianz includes in its policies, the features it offers and other providers you should consider.

Allianz Travel Insurance review

Other insurance offered, how it compares, bottom line, allianz travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

24/7 assistance available

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Allianz Travel Insurance is a global insurance provider. It partners with airlines, travel agencies, resorts, credit card issuers and other companies to offer worldwide travel coverage. The insurer currently offers 10 trip coverage plans, giving travelers plenty of options that range from single-trip plans to plans that cover all your travel for a year.

For example, OneTrip Prime provides trip cancellation/interruption, emergency transportation, baggage loss or delay and other key benefits for a single trip up to 180 days. AllTrips Executive, on the other hand, is a multi-trip plan designed for business travel with higher trip cancellation and interruption limits and coverage for business equipment. You can also opt for OneTrip Rental Car Protector if you need primary car rental coverage against collision, loss and damage.

These plans let you easily tailor your insurance to your situation. Here are the types of coverage that Allianz Travel can include in your plan:

- Trip cancellation

- Trip interruption

- Emergency medical (this covers medical and dental emergencies that happen during your trip)

- Emergency medical transportation

- Baggage loss/damage

- Baggage delay

- Travel delay

- Travel accident

- SmartBenefits℠ (this includes automatic and no-receipts payments for trip delays and no-receipts claims for baggage delays)

- Change fees (this coverage can reimburse you for the fees the airline charges when you have to change the dates of your flight)

- Loyalty program redeposit fee coverage (with this coverage, you can get reimbursement for frequent flyer mile redeposit fees if your trip is canceled or interrupted)

- 24/7 hotline assistance

- Concierge services

- Rental car collision damage waiver

- Existing medical condition (this benefit waives the pre-existing medical condition coverage exclusion)

The types and limits of coverage benefits you can get vary by plan.

Many travel cards provide travel insurance benefits . To avoid duplicate coverage, go through your card's terms and conditions and see what your issuer already offers.

One of the features that helped Allianz Travel land a spot on our list of the best travel insurance is the Cancel Anytime benefit. Included with OneTrip Prime and OneTrip Premier plans, Cancel Anytime can reimburse 80% of your unused, pre-paid, non-refundable trip costs if you have to cancel your trip for just about any unexpected reason.

Additionally, the insurer offers 24/7 global assistance to refer you to a prescreened hospital during your trip.

Policyholders can also use the TravelSmart TM app and check for flight status updates, the latest travel advisories and restrictions for their destination, local emergency services and hospitals and more. The app allows travelers to pull up their protection plan whenever they need and file a claim online.

As of writing, Allianz Travel doesn't advertise any discounts. That said, discounts aren't as common with this type of coverage, especially compared to home and auto insurance .

Allianz is a large global company offering a wide range of financial products and services. In the U.S., that includes travel insurance, life insurance and business insurance.

Allianz Travel can be a solid choice if you're looking to purchase travel insurance. However, it's always a wise idea to compare multiple options to ensure you're getting a good deal.

For instance, AXA Assistance USA travel insurance is also a good provider. You can pick from three plans with the most affordable one starting at just $16, according to the company's website. The most comprehensive option is the Platinum plan which comes with the option to cancel for any reason.

AXA Assistance USA Travel Insurance

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

Travel Guard® Travel Insurance also offers a selection of plans, ranging from last-minute options to an annual travel plan. Or you can request a specialty plan, but you'll need to speak to a representative to do so.

Travel Guard® Travel Insurance

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

With 10 available plans to choose from, Allianz Travel makes it easy to get the right travel insurance coverage for your upcoming trip. Multi-trip plans are also available for those who frequently travel, including for business. Still, we recommend gathering several quotes and comparing plans before you purchase travel insurance. Just like with any financial product, it pays to shop around for this type of coverage.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every travel insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- Here are the best commercial auto insurance companies Liz Knueven

- Kasasa bank accounts: Get up to 6% APY with this high-yield checking account Elizabeth Gravier

- Pets Best pet insurance review and price Liz Knueven

- Our history

- Allianz Advantage

- Global footprint

- Social responsibility

Travel protection

- Tuition protection

- Event ticket protection

- Bankcard services

- Assistance services

- Technology solutions

- Allianz Fusion

- Allianz TravelSmart

- Stories & insights

- In the news

- Press releases

- Vacation confidence index

- Internships

When the world calls, help your customers answer with confidence.

Looking for a travel insurance plan, get a quote at allianztravelinsurance.com ..

Benefits to help travelers explore reassured.

Expert assistance means travelers are never alone.

Industry-leading technology for the future of travel.

Travel safe. Travel simple. Allianz TravelSmart.

Our free Allianz TravelSmart TM app puts your customers’ travel protection plan at their fingertips, making it easy to check their coverage benefits, connect to our 24/7 assistance, or file a claim on the go.

What makes Allianz TravelSmart even smarter? We’ve loaded it with safety features to help customers explore more securely, including timely alerts about events that may impact their travels, a locator for nearby emergency assistance, medical translations, and more.

“I cannot even begin to tell you how wonderful my experience was with Allianz!! I had a terrible ski accident in France and every single Allianz person was unbelievably helpful. I now recommend Allianz to everyone I know and I will NEVER travel overseas without it. I am so very grateful for all the support I received.”

- Lindsay T., MN, 2021

“So often when you buy warranty or insurance it’s hard to actually get it to do what it’s supposed to do, but Allianz worked as it should. The cost for travel insurance is so negligible that it’s a no brainer to add to your trip.”

- Kyle Y., GA, 2021

“When I filed my claim your company made the process very easy. And you did not try to avoid your contract responsibilities like many other insurance companies with whom I have had to work with. I have recommended you to all of my travel friends.”

– Scott H., IL, 2021

Have questions about our products or services?

contact us — we’re here to help. .

- Assurance Vacances

- Assurance Multi Voyages

- Assurance Courts Séjours

- Assurance Jeunes à l'étranger

- Assurance Voyages Long Séjour

- Assurance visa Schengen

- Assurance Voyages d'Affaires

- Assurance PVT

- Assurance Voyages en Groupe

- Assurance séjours en France

- Assurance Expatriés

- Assurance Voyage

Assurance Annulation

- Les frais médicaux

- Assurance Rapatriement

- Téléconsultation Voyageurs

- Assurance Retour Anticipé

- Assurance Bagages

- Assurance Responsabilité Civile

- Assurance Retard de Transport

- Assurance Rachat de Franchise

- Assurance Retour Différé

- Voyager à l'étranger

- Demander un visa

- Vivre à l'étranger

- Etudier à l'étranger

- Partir en PVT

- Destinations

- Covid-19 – FAQ

Pourquoi me couvrir en annulation ?

Annulation : comment ça marche ?

- En option dans l' assurance Vacances et Court séjour

- En option dans l' assurance Voyage d'Affaires

- Systématique dans les offres Multi-Voyages (à durée ferme ou à tacite reconduction)

- En fonction de la date à laquelle survient l’annulation . Les frais d’annulation ne seront pas nécessairement les mêmes si j’annule mon voyage deux mois avant ou bien dans la semaine qui précède le départ de mon séjour ou mon voyage. Généralement plus on se rapproche de la date du voyage, plus les frais non remboursés par le/les prestataire(s) sont élevés.

- Et/ou en fonction du type de tarif / billet réservé : tarif flexible ou non-flexible. Certains types de billets et/ou de tarifs permettent de modifier ou annuler à moindre frais, mais ce n’est pas toujours le cas, loin de là. Nombreux sont les cas de figure où les prestations réservées ne sont pas modifiables ou annulables, y compris plusieurs semaines avant le départ.

Dans quels cas l'assurance annulation ne fonctionne pas ?

Pourquoi faut-il souscrire la garantie annulation le jour de la réservation de votre voyage , comment est calculé le prix de ma garantie annulation , sans assurance annulation, avec assurance annulation.

Montant remboursé = 1 670 €

Montant restant à ma charge = 30 €*

À quoi sert une assurance annulation vol ?

Quelles sont les conditions de prise en charge par allianz travel .

- Décès, accident, maladie (y compris liée à une épidémie/pandémie) de l’assuré ou de l’un de ses proches

- Motif professionnel (mutation professionnel, obtention d’un emploi, licenciement économique)

- Convocation à un examen de rattrapage

- Circonstances exceptionnelles (émeutes, attentat, catastrophe naturelle…) dans la ou les villes de destination

Comment fonctionne l’assurance annulation vol ?

- Un certificat médical ou de décès,

- Un bulletin d’hospitalisation,

- Une lettre de l’employeur,

- Une convocation à un examen,

- Une copie de la facture acquittée des frais d’annulation,

- Une copie du billet d’avion

Suis-je remboursé en cas d’annulation du vol par la compagnie aérienne ?

Comment choisir parmi toutes les assurances annulation , a lire aussi.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

Allianz offers four different annual/multi-trip plans.

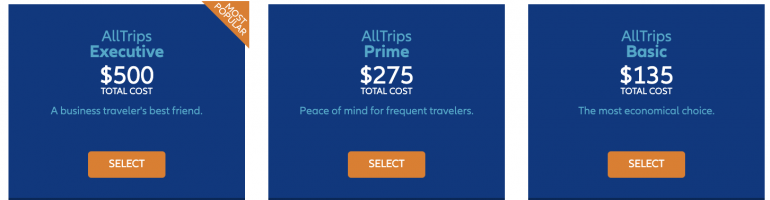

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Sign in to start your session

Allianz Contacts

Find your contact, allianz worldwide.

- Corporate contacts

- Social media

Allianz provides insurance and asset management products to customers worldwide. Please find your local Allianz contact here.

Get quick access for Allianz USA .

- Asia-Pacific

- Middle-East & Africa

Corporate Contacts

For information about our insurance services please get in touch directly with the Allianz company located in your country .

You are looking for corporate contacts at the Allianz headquarters? You will find contacts here for Careers, Media, Investor Relations, Sustainability and Economic Research.

Allianz headquarters

Contact for customers, investor relations, allianz sustainability, economic research, allianz social media.

Swipe to view more

- Worldwide Presence

- Our History

- Corporate Social Responsibility

- TripWise Mobile App

- Seeking medical treatment

- How to file a claim

- Access Claims Portal

- Complaint resolution process

- Coverage Alerts

- Archived news

- Work With Us

Helpful tips for filing a travel insurance claim

Seeking medical treatment , how to file a claim , claims resolution process .

Online Claims Portal

Travel insurance

Find the right travel insurance policy with allianz assistance.

AWP Assistance UK Ltd , trading as Allianz Assistance and Allianz Global Assistance , is a subsidiary company of Allianz Partners SAS. AWP Assistance UK Ltd is authorised and regulated by the Financial Conduct Authority in the United Kingdom to provide insurance products and services.

Please note that, whilst AWP and Allianz Insurance are part of the global Allianz SE group of companies, AWP and Allianz insurance are separate companies and not part of the same group of companies in the UK. Any communications regarding Allianz Assistance services should therefore be addressed to AWP .

A range of cover options are available including single and multi-trip, 24/7 medical cover, backpacker, winter sports and more.

Whatever type of trip you're taking, Allianz Assistance will help you find a plan that covers the "what ifs?".

Extended Car Warranty

Allianz Assistance is the trusted car warranty provider for ten of the UK’s leading car brands. Find out more on Allianz Assistance about the three levels of car warranty that are available.

Not what you were looking for?

Pet insurance, musical insurance, home insurance.

Déclarer un sinistre

Comment faire ma déclaration ?

Nous vous accompagnons.

- Single trip insurance

- Annual travel insurance

- Schengen travel insurance

- Travel cancellation insurance

- Course cancellation insurance

- Excess insurance

- Holidays in Switzerland

- Download-Center

- Travel tips

- Inspiration

- Preparing for your trip

- Schengen entry

24h emergency call center Allianz Travel +41 44 202 00 00

Our emergency call centre is always available for you and offers fast and expert help worldwide around the clock, report the emergency immediately , contact our emergency call centre as soon as possible to provide details about the emergency. the emergency call centre is available round the clock., have important information ready at hand , have all necessary information ready so that we can provide rapid and effective help: insurance documents, name of the hospital and of the doctor handling the case, telephone number(s) of contact person(s), trip details, etc., do not hand over your passport or travel documents, do not hand over your passport to a third party if you can avoid it a copy is fully sufficient., notify the local travel rep, notify the tour company representative at your destination – where available – about the illness or accident., if a damage event occurs which does not constitute an emergency, please refer to the general terms and conditions of insurance (gtc) regarding the steps to be taken and notify us of the event as soon as possible on your return and in writing. click here for further information about claim notification., customer portal, access your insurance documents with just one click our self service portal allows you to access, download and adjust your policies worldwide and around the clock. you can also easily manage your personal data. use your policy number to log in. with our new customer portal, we offer you a secure and fast online experience. try it out. it's easy, service center, if you have any questions about our products or would like to choose the travel insurance that best suits your needs, we will be happy to help you. please contact our service center at +41 44 283 32 22 or by e-mail . opening hours service center: monday to friday 08:00 - 18:00., for general questions you can also use our contact form use., would you like to share a positive or negative experience with us it is always important to us to continuously improve our services and tailor them to the needs of our customers. you can send us your feedback directly by email directly., please note: we do not sell insurance in our business premises at richtiplatz. you can conveniently take out our travel insurance policies online . thank you very much. chliessen . vielen dank., allianz partners switzerland.

Allianz Travel Switzerland (formerly Allianz Global Assistance and ELVIA) is part of the Allianz Partners Group, the world's leading provider of travel cancellation insurance and travel protection and assistance services. With more than 21,900 employees on five continents and a network of over 900,000 specialists, Allianz Partners Group is available to its customers around the globe, 365 days a year, around the clock. Allianz Travel offers individual travelers insurance for couples or families, and assistance solutions that are tailor-made to your personal requirements. Annual travel insurances are comprehensive plans and offer immediate help in case of emergency, thanks to Allianz Travel's many years of experience. There can be problems as early as in the run-up to a trip. Here you can get help if you have taken out travel cancellation insurance and protection against heavy financial loss.

Swiss 24-hour emergency call centre friendly and professional. telemedical consultations and medical assistance around the clock worldwide in the event of illness or accident. trip cancellation insurance unbureaucratic and customer-oriented. accident and breakdown assistance in switzerland and throughout europe. high sums insured including assumption of health care costs abroad up to chf 1 million . travel baggage coverage including cover for cameras, laptops and sports equipment. travel insurance from allianz travel protects you against the consequences of unplanned events and ensures that you can enjoy your holiday carefree..

- Single Trip

- Annual Multi-Trip

- Winter Sports & Ski

- Collision Damage Waiver

- Sport & Leisure

- Medical Conditions

- Travel Insurance for Non-UK Residents

- Group Travel Insurance

- Travel Insurance for Couples

- Covid-19 travel insurance

- About Our Travel Insurance

- Holiday Cancellation Insurance

- Emergency Medical Assistance Cover

- Emergency Medical Cover for Travel Insurance

- Repatriation Insurance

- Baggage Cover

- Travel Insurance for Under 18s

- Comprehensive

- What's Covered

- Excluded Vehicles

- Range Rover

- Car Hire Excess Insurance

- Policy Information

- File a Claim

- Insurance Glossary

- Coronavirus - Annual Multi-trip Policy

Contact Allianz Assistance

File a travel claim via phone

Use our online service to file a travel claim.

Travel Insurance

Customer services.

Breakdown Cover

Extended Warranty

0345 600 2205 (Mon-Fri 9am-5pm)

Frequently Asked Questions

Make a claim, policy documents.

Introduction to AXA Travel Insurance

- Coverage Options Offered by AXA

- AXA Assistance USA Cost

AXA Customer Service Reviews

Compare axa travel insurance.

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions , which is free for Gold and Platinum plans as long as you purchase your plan within 14 days of your trip deposit.

Specialized Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

If you're traveling within the Schengen Territory, which is made up of 27 European countries, you may eligible for Schengen Travel Insurance, which covers you in all 27 countries. This option is only available for Gold and Platinum travelers and coverage lasts up to 90 days.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate AXA's coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following AXA travel insurance quotes:

- AXA Silver: $83

- AXA Gold: $107

- AXA Platinum: $127

Premiums for AXA plans are between 2.7% and 4.2% of the trip's cost, well below the average cost of travel insurance. It's also relatively cheap compared to many of its competitors

AXA provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- AXA Silver: $109

- AXA Gold: $128

- AXA Platinum: $153

Once again, premiums forAXA plans are between 3.6% and 3.8%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following AXA quotes:

- AXA Silver: $392

- AXA Gold: $462

- AXA Platinum: $550