Bank of America Premium Rewards card benefits guide

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Building credit

- • Credit card debt

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Bank of America® Premium Rewards® credit card offers a variety of travel benefits and protections, including trip delay reimbursement and emergency assistance services.

- The card also offers purchase protections and extended warranties that could give you peace of mind while shopping.

- Bank of America customers with a Preferred Rewards membership can maximize the card's potential and earn 25 percent to 75 percent more in rewards points.

Although the Bank of America® Premium Rewards® credit card isn’t as popular as other travel credit cards at this level, there are plenty of reasons to consider it. Not only does it offer 2X points on travel and dining purchases, but cardholders also earn a flat rate of 1.5X points on all non-bonus spending. Those who apply and are approved can also earn a generous welcome offer, 60,000 points after spending $4,000 in the first 90 days, and an array of Bank of America Premium Rewards card benefits — which can make the offer an even better deal.

If you’re curious about which perks you’ll get with the Bank of America Premium Rewards card and how everything works, read on to learn more.

Bank of America Premium Rewards credit card travel benefits

While the Bank of America Premium Rewards credit card doesn’t let you transfer your points to airline and hotel partners like some other travel credit cards do, you can redeem your rewards for cash back in the form of a statement credit , a deposit into an eligible Bank of America or Merrill account, gift cards or travel through the Bank of America Travel Center.

You also get a handful of helpful travel perks just for being a cardholder.

No foreign transaction fees

Up to $100 in statement credits for airline incidentals, up to $100 in statement credits for global entry or tsa precheck, bank of america premium rewards card travel protections.

The Bank of America Premium Rewards credit card also comes with a number of travel insurance benefits and protections, including the following:

Trip delay reimbursement

Trip cancellation and interruption insurance, baggage delay insurance, lost luggage reimbursement, travel and emergency assistance services, emergency evacuation and transportation coverage, secondary auto rental coverage, roadside dispatch, bank of america premium rewards card purchase protections.

The Bank of America Premium Rewards credit card offers quite a few purchase protections that will automatically apply to eligible purchases you charge to your card.

Purchase protection

Return protection, extended warranties, maximizing the bank of america premium rewards card.

Since the Bank of America Premium Rewards credit card bases the rewards you earn on your spending, maximizing its benefits involves using it for all of your purchases and bills. You should aim to use it for dining and travel purchases specifically, since you can earn an elevated rate of 2X points for each dollar spent. From there, using it for other purchases you need to make can help you rack up 1.5X points per dollar spent on a regular basis.

Also note that Bank of America Preferred Rewards members can earn 25 percent to 75 percent more rewards for using this card or other qualifying Bank of America rewards cards. Ultimately, this means eligible cardholders with the Bank of America Premium Rewards credit card could earn 2.5X to 3.5X points for every dollar spent on travel and dining purchases and 1.87X to 2.62X points for every dollar spent elsewhere.

This free program is for Bank of America customers who have an active, eligible Bank of America account and a three-month combined average daily balance of $20,000 or more in eligible Bank of America or Merrill accounts. Bank of America will automatically enroll you in the program once these requirements are met.

When it comes to using the Bank of America Premium Rewards card benefits shared in this guide, remember that you’ll need to pay with your credit card to qualify. If you pay with another credit card, you won’t be eligible for purchase protections or travel insurance benefits on those transactions.

The bottom line

The Bank of America Premium Rewards credit card isn’t as well known as some other travel cards, but there’s much more to it than meets the eye. In addition to its generous earning rate and welcome offer, cardholders will get quite a few perks along the way.

Even so, it never hurts to compare this card to the benefits offered by other top travel credit cards . With some basic research, you can find a travel credit card that checks off the boxes you care about the most.

Information about the Bank of America Premium Rewards credit card was updated on November 8, 2023.

Why I love the Bank of America Premium Rewards credit card

Is the Bank of America Premium Rewards card the travel card you should get?

Bank of America Premium Rewards credit card review

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

Bank of America Premium Rewards Credit Card — Full Review [2024]

Jarrod West

Senior Content Contributor

440 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

31 Published Articles 3106 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Bank of America ® Premium Rewards ® credit card

60,000 points

20.24% - 27.24% Variable

Good to Excellent (670-850)

The Bank of America Premium Rewards card is a great travel rewards card for those looking for a simple approach to earning and redeeming rewards.

The Bank of America ® Premium Rewards ® credit card is a great option for anyone looking for a travel rewards card with a simple approach to how you earn and redeem your rewards.

From travel and purchase protections to airline incidental and Global Entry credits, there is plenty to love about the Bank of America Premium Rewards card.

Plus, those that hold status in the Bank of America Preferred Rewards program can get even more value from the card by boosting their rewards by 25% to 75%!

Card Snapshot

Welcome bonus & info.

- Receive 60,000 online bonus points – a $600 value – after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases.

- If you’re a Bank of America Preferred Rewards member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- No limit to the points you can earn and your points don’t expire.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America ® accounts, credit to eligible Merrill ® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck ® /Global Entry Statement Credits of up to $100, every four years.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Card Categories

Credit card reviews.

- Travel Rewards Credit Cards

- 2x points per $1 on travel and dining purchases

- 1.5x points per $1 on all other purchases

- Up to $100 annual airline incidental statement credit

- Global Entry/TSA PreCheck statement credit

- No foreign transaction fees

- Travel protections

- Purchase protections

- Boost your rewards rate with the Bank of America Preferred Rewards program

- $95 annual fee

- Points are worth a fixed 1 cent per point, so it isn’t possible to get outsized redemptions via airline and hotel transfer partners

Great Card If

- You want an all-around travel rewards card

- You want a card with a simple rewards and redemption structure

- You have status in the Bank of America Preferred Rewards program

Don’t Get If

- You want a card that earns transferable rewards

- You want a card that offers premium benefits

Bank of America Premium Rewards Card — Is It Worth It?

If you’re looking for an all-around travel rewards card that is easy to earn points with and offers a simple approach when it comes time to redeem your rewards, then the Bank of America Premium Rewards card might be a perfect option for you.

The card has a very reasonable fee of $95. With that, you receive benefits like a $100 annual airline incidental credit, Global Entry credit, trip delay insurance, rental car insurance, return protection, and much more.

Further, the card is practically a no-brainer for those with Bank of America Preferred Rewards status who are able to earn an additional 25% to 75% more rewards on all of their card spend.

Bank of America Premium Rewards Card Top Benefits

Bank of america preferred rewards point boost.

One of the best benefits of the Bank of America Premium Rewards card is the ability to boost your credit card rewards through the Bank of America Preferred Rewards program .

The Bank of America Preferred Rewards program is the bank’s loyalty program that offers increased perks, benefits, and credit card rewards for those who meet certain asset thresholds in eligible Bank of America accounts.

Here is a look at what you need to quality for, and the credit card rewards boost you receive, at each status level.

While it requires a substantial level of assets on deposit with Bank of America, the ability to earn an uncapped 3.5x points per $1 on travel and dining and 2.625x points per $1 spent on all other purchases is pretty stellar.

Travel Benefits

Up to $100 annual airline incidental credit.

Each year, you’ll receive up to $100 in airline incidental statement credits towards purchases with airlines like seat upgrades, baggage fees, inflight services, and airline lounge fees. This benefit alone can easily help you offset the card’s $95 annual fee.

Global Entry/TSA PreCheck Credit

Cardholders also receive a $100 Global Entry / TSA PreCheck credit every 5 years. For those unfamiliar, TSA PreCheck provides an expedited security experience at U.S. airports, while Global Entry helps you speed through customs when you return to the U.S. from abroad.

We recommend you opt to use your credit for Global Entry as it includes TSA PreCheck.

Travel and Purchase Protections

The card also offers a plethora of travel and purchase protections to help keep you covered.

- Trip Delay Insurance: Provides coverage for you and family members for reasonable expenses if a covered trip is delayed for more than 12 hours.

- Baggage Delay Insurance: Coverage towards essential items like clothing when your bags are delayed for more than 6 hours.

- Lost Luggage Insurance: Covers you for the cost of items in your luggage if it is lost by the carrier or stolen.

- Trip Cancellation Insurance: Receive coverage for non-refundable passenger fares if your trip is canceled or cut short by sickness or other covered situations.

- Rental Car Insurance: Provides reimbursement for damage to your rental car due to collision or theft, but the coverage is secondary to your primary auto insurance.

- Purchase Protection: If an item purchased with the card is stolen or damaged within 90 days of purchase, you can receive coverage towards a repair or replacement.

- Extended Warranty Coverage: Extends the time period of the manufacturers’ warranty for eligible items purchased with your card.

- Return Protection: If you’ve purchased an item up to 90 days ago, and the retailer will not accept the return, you can receive coverage.

Best Ways To Earn and Redeem Your Premium Rewards Points

To earn as many points as possible, you’ll want to use your card for as many purchases as you can, especially since it earns 2x points per $1 on travel and dining purchases and 1.5x points per $1 on all other purchases.

That said, you can really take your rewards earning to the next level by gaining status in the Bank of America Preferred Rewards program, as doing so allows you to boost the number of points you earn on purchases by 25% to 75% depending on your status level.

The Bank of America rewards program is a fixed rewards program, allowing you to redeem all of your points through its own travel portal at a set rate of 1 cent per point. While there isn’t an opportunity to get outsized value here, the good news is that you can redeem points towards any travel purchase, including flights, hotels, rental cars, and more.

Alternative Cards to the Bank of America Premium Rewards Card

Chase sapphire preferred ® card.

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

- Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

The Chase Sapphire Preferred card is another great starter travel rewards card option . With it, you’ll earn 5x Ultimate Rewards points per $1 on travel purchased through the Chase travel portal , 3x points per $1 on dining, online grocery purchases, and select streaming services, plus 1x point per $1 on all other purchases.

You’ll receive many of the same travel and purchase protections as the Bank of America Premium Rewards card, but you’ll also have access to Chase transfer partners , and your points are worth 1.25 cents per point when redeemed through the Chase travel portal.

See how these 2 cards compare here: Bank of America Premium Rewards card vs. Chase Sapphire Preferred card .

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- 2x miles per $1 on all other purchases

- Global Entry or TSA PreCheck application fee credit

- No foreign transaction fees ( rates & fees )

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- APR: 19.99% - 29.99% (Variable)

Capital One Miles

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture vs Venture X

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Capital One Credit Cards

- Best Travel Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Best High Limit Credit Cards

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

With the Capital One Venture card , you’ll earn 5x Capital One miles per $1 on hotels and rental cars booked through Capital One Travel , and an unlimited 2x miles per $1 on all other purchases — making it one of the few travel rewards cards to offer such a high rewards rate for non-bonused purchases.

Plus the card offers 2 free visits to a Capital One Lounge or Plaza Premium Lounge each year, Hertz Five Star status , a Global Entry credit , and access to Capital One travel transfer partners .

The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Bank of America ® Premium Rewards ® credit card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Is the bank of america premium rewards card worth it.

If you’re looking for a travel rewards card with a straightforward earning structure and easy point redemption process, that also offers solid card protections, then the Bank of America Premium Rewards card would be a great option for you.

What are the benefits of the Bank of America Premium Rewards card?

There are many benefits of the Bank of America Premium Rewards card. Namely, you’ll receive up to $100 annual airline incidental credit and Global Entry credit, along with travel and purchase coverage protections. Plus, those in the Bank of America Preferred Rewards program can boost their card rewards 25% to 75%.

Does the Bank of America Premium Rewards card have rental car insurance?

Yes, the Bank of America Premium Rewards card offers rental car insurance, but it is secondary to your primary auto insurance coverage.

What credit score do you need to be approved for the Bank of America Premium Rewards card?

There is no set credit score that will guarantee your approval for the Bank of America Premium Rewards card, as there are other factors taken into consideration like your years of credit history and the amount of credit that may already be extended to you. That said, if you have a credit score of 700 or higher, you should have reasonably high approval odds for the card.

Does the Bank of America Premium Rewards card have travel insurance?

Yes, the Bank of America Premium Rewards card has trip delay insurance, trip cancellation insurance, baggage delay insurance, lost luggage insurance, and rental car insurance.

Does the Bank of America Premium Rewards card have an annual fee?

Yes, the Bank of America Premium Rewards card has a $95 annual fee.

About Jarrod West

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in outlets like The New York Times.

Top Credit Card Content

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![bank of america premium rewards travel insurance protection Bank of America Travel Rewards Credit Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2022/05/boatravelrewards.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

5 Things to Do When You Get the Bank of America Premium Rewards Credit Card

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

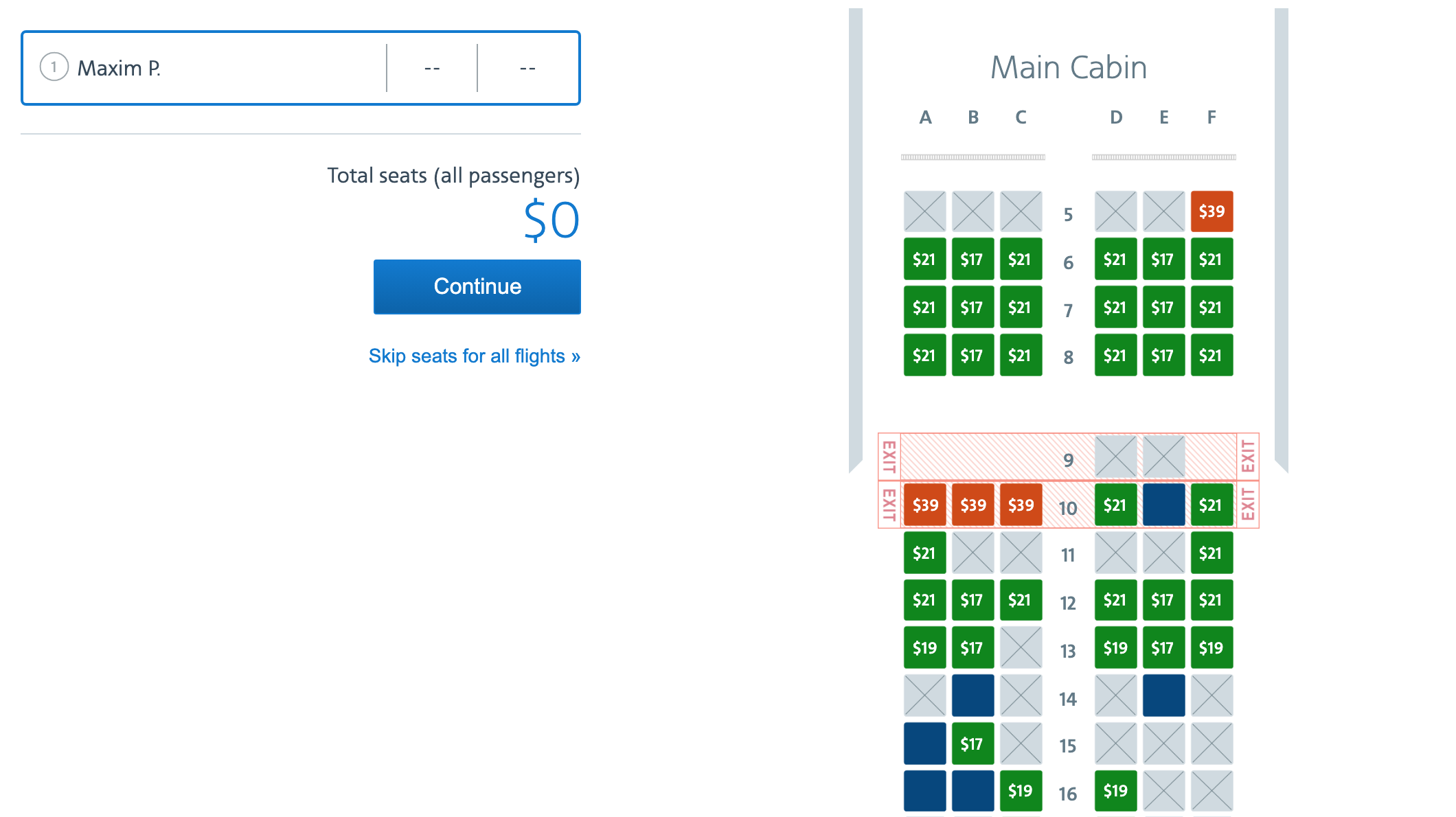

You've applied for the Bank of America® Premium Rewards® credit card and were accepted. Once you receive it in the mail, what should you do next?

What to do after getting the Bank of America® Premium Rewards® credit card

1. plan your next vacation over dinner.

Cardholders receive 2 points per $1 on travel and dining and 1.5 points per dollar on other spending. Enjoy a leisurely dinner and plan an exciting vacation to make the most of these points. In addition to the bonus points, the Bank of America® Premium Rewards® credit card comes with travel benefits like trip delay and cancellation/interruption protection, lost luggage reimbursement, travel accident insurance, emergency evacuation and transportation coverage, as well as rental car collision coverage.

Low on vacation time for the year? Plan a staycation. Bank of America has a generous definition of travel spending. In addition to hotels, airlines and travel agencies, you'll earn 2 points per $1 for tourist attractions like art galleries, amusement parks, carnivals, circuses, aquariums, zoos and more. Even if a staycation isn’t in the cards for you, earn 2 points per $1 on your morning commute, as toll fees and parking are also coded as travel.

» Learn more: Bank of America® Premium Rewards® credit card review: Big bonuses for B of A’s best customers

2. Join the Bank of America Preferred Rewards® program

Arguably the best perk for cardholders is the bonus perk for Bank of America customers with larger balances.

If you have a $20,000 combined balance, you can sign up for Bank of America Preferred Rewards® . You’ll get a 25% boost on your rewards points, resulting in 2.5 points per $1 for travel and restaurants and 1.85 points per $1 on all other spending. For those with balances over $50,000, the reward point boost is 50%, for 3 points per $1 on travel and dining and 2.25 on everything else. Those with balances over $100,000 receive a whooping 75% rewards points boost, making their travel and restaurant spending worth 3.5 points per $1 and all other spending 2.625 points per $1.

To receive these perks, you need to be a member of the Bank of America Preferred Rewards® program. If you have an eligible Bank of America personal checking account and 3 months with an average combined balance of $20,000 or greater in qualifying Merrill and Bank of America accounts, you can enroll in Bank of America Preferred Rewards® online.

Once you qualify for a tier, you’ll maintain it for 12 months. If you meet the minimum qualifications for the next tier, Bank of America will automatically bump you up and you’ll see the bonus reflected in your next statement.

» Learn more: Bank of America Preferred Rewards®: More rewards with every swipe

3. Get a generous sign-up bonus

The Bank of America® Premium Rewards® credit card has an annual fee of $95 and has the following sign-up bonus: Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening. You can redeem this sizable bonus a number of different ways.

Once you have at least 2,500 points, you can receive cash back to your statement or into your Bank of America account, deposit your credit to eligible Merrill accounts, redeem for gift cards or use your points at the Bank of America Travel Center.

4. Apply for Global Entry or TSA PreCheck

The Bank of America® Premium Rewards® credit card comes with a $100 Global Entry or TSA PreCheck application fee statement credit , valid every four years. Frequent travelers know the benefit of TSA PreCheck and Global Entry when it comes to speeding through security and shaving precious time off waiting in lines at the airport. Plus, the $100 reimbursement for this will cover the card’s $95 annual fee for the first year.

» Learn more: The most valuable perks of the Bank of America® Premium Rewards® credit card

5. Bring extra luggage and get paid to have this card

If the TSA PreCheck or Global Entry fee statement credit wasn’t enough to entice you, there’s also an annual $100 statement credit for airline incidental fees. This means you can bring extra bags on your trip, upgrade your seat, enjoy in-flight purchases, or relax in the airline lounge, knowing these fees will be covered with the $100 statement credit.

This perk, as well as your 2 points per $1 earned on travel, applies to airlines with specific merchant category codes, so be sure to read up before assuming your bag fee will be covered. The $100 statement credit is automatically applied to applicable purchases each year, essentially eliminating the expense of the $95 annual fee.

» Learn more: Airline credit cards that offer free checked bags

Still not sure if the Bank of America Premium Rewards card is for you? Look at our reviews of top travel credit cards to see other options.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Tom Werner / DigitalVision / Getty Images

Advertiser Disclosure

Bank of America Premium Rewards card benefits guide

For a mid-tier rewards card, the Bank of America Premium Rewards has a lot to offer

Published: December 2, 2021

Author: Ana Staples

Editor: Emily Sherman

Reviewer: Kaitlyn Tang

How we Choose

At a rather modest price, the Bank of America Premium Rewards Credit Card can provide excellent value, thanks to its impressive list of benefits.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

The Bank of America® Premium Rewards® credit card is a mid-tier travel credit card . At $95 per year, it earns 2 points per dollar on travel and dining purchases and 1.5 points per dollar on all other purchases.

The card also offers a few desirable perks, which can make it a solid choice for frequent travelers who don’t want to spend hundreds of dollars in annual fees on premium rewards cards . The benefits include TSA PreCheck or Global Entry credits, airline incidental credits, travel protections and more.

In this benefits guide, you’ll learn what the Bank of America Premium Rewards card has to offer and how you can use the card to maximize its value.

Bank of America Premium Rewards card benefits

For a credit card with a comparatively modest annual fee, the Bank of America Premium Rewards card has a few exciting things going on.

TSA PreCheck or Global Entry credits

Credits to reimburse the cost of a TSA PreCheck or Global Entry membership are a popular credit card perk among travelers. However, it’s typically associated with more expensive credit cards, such as the Chase Sapphire Reserve card , the Capital One Venture X Rewards Credit Card and The Platinum Card® from American Express .

See related : Best credit cards for expedited airport security screening

If like most travelers, you like the idea of expedited airport security screening, you can get up to $100 in statement credits for TSA PreCheck or Global Entry once every four years with the Bank of America Premium Rewards card. Considering that offsets the card’s fee, that’s an excellent deal.

Annual credits for airline incidentals

Another premium-level benefit on the Premium Rewards is statement credits for airline incidentals, such as checked bags and in-flight refreshments. Once again, this is a perk typically reserved for the most expensive travel card offerings.

The Amex Platinum, for instance, offers up to $200 in statement credits per calendar year on airline incidental charges. But Amex makes it somewhat complicated to use this benefit: You need to pick an eligible airline in January and stick to it throughout the year.

With the Bank of America Premium Rewards, on the other hand, you’ll get up to $100 in annual credit for airline incidentals which you’ll be able to use with any airline.

Not too bad for a mid-tier rewards card, especially considering the difference in annual fees – the Amex Platinum is a whopping $600 more expensive.

Travel protections

The Bank of America Premium Rewards also comes with some valuable travel protections, including:

- Trip delay reimbursement, which allows a cardholder and their family members to receive coverage for delays in eligible cases.

- Trip cancellation or interruption protection, which provides coverage for eligible prepaid travel expenses for canceled trips due to a covered reason.

- Baggage delay insurance, which covers essential items when bags are delayed.

- Lost baggage reimbursement, which covers luggage and its contents stolen or lost due to misdirection by an airline.

- Emergency evacuation and transportation coverage, which covers eligible medical services and transportation if a cardholder or their family member is injured or sick while traveling.

- Roadside dispatch program, which provides emergency roadside assistance.

- Rental car insurance, which kicks in when you decline the collision damage waiver offered by the car rental agency.

Better rewards for Preferred Rewards program members

The Preferred Rewards program is available to Bank of America and Merrill customers with large checking, savings and investment account balances. The program offers appealing benefits like discounts on fees, higher rewards rates and interest rates on savings and more.

There are three tiers in the Preferred Rewards program, based on combined qualifying balances:

- Gold – $20,000 to $49,999

- Platinum – $50,000 to $99,999

- Platinum Honors – $100,000

If your combined balances meet any of these thresholds, here are what your rewards rates on the Premium Rewards card may look like:

Simple rewards redemption

Speaking of rewards, the Premium Rewards card makes redeeming your points easy. You don’t have to worry about the point value – whichever redemption option you choose, you’ll get 1 cent per point.

You can redeem for travel, gift cards, statement credit or direct deposit. To pay for travel with points, you can use Bank of America’s Travel Center. Alternatively, you can get reimbursement for travel you’ve already purchased.

Unfortunately, Bank of America doesn’t have transfer partners, limiting your ability to maximize the point value. If you’re interested in transferring points, look into another mid-tier travel card, like the Chase Sapphire Preferred . At the same $95 per year, it offers outstanding perks and allows access to Chase Ultimate Rewards and the program’s excellent transfer partners.

No foreign transaction fees

The Bank of America Premium Rewards is also a good card to take with you abroad. Since it’s on the Visa network, it’s widely accepted internationally – and you won’t have to worry about foreign transaction fees.

Maximizing the Bank of America Premium Rewards card

Now that you know everything the Bank of America Premium Rewards card has to offer, you can get the most out of it.

Here are some tips to help you maximize the card’s potential:

- Use the Premium Rewards on dining and travel – unless you have another card that earns more in these categories.

- Use the card on general purchases outside of the bonus categories on your other cards to earn more than 1 point per dollar.

- Read through terms and conditions to understand all travel protections available to you, as they sometimes can save you hundreds or even thousands of dollars.

- Sign up for Global Entry or TSA PreCheck and make sure to use the Premium Rewards to pay for the membership.

- Have the card handy when you travel to pay for airline incidentals and take advantage of the annual $100 credit.

Bottom line

For an affordable travel card, the Bank of America Premium Rewards credit card has plenty to offer, from popular perks like TSA PreCheck or Global Entry credits to less flashy but valuable benefits like rental car insurance.

If you already have the card, it’s a good idea to keep these benefits in mind so you can use it to its full potential. If you’re still shopping around, make sure to consider your options and see what kind of perks other similar cards provide.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Ana Staples is a staff reporter and young credit expert reporter for CreditCards.com and covers product news and credit advice. She loves sharing financial expertise with her reader and believes that the right financial advice at the right time can make a real difference. In her free time, Anastasiia writes romance stories and plans a trip to the French Riviera she'll take one day—when she has enough points, that is.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

BankAmericard benefits guide

The BankAmericard offers many compelling rewards and benefits, including 18 billing cycles of 0% APR promotional financing on both new purchases and balance transfers (followed by 12.99% to 22.99% variable APR). You can also receive a $100 statement credit if you meet the spending requirement, plus access to other valuable benefits.

BankAmeriDeals program guide

Bank of America credit and debit card holders can earn extra cash back on everyday purchases with BankAmeriDeals.

Credit score needed for the BankAmericard

Is the BankAmericard credit card worth it?

Is the Bank of America Travel Rewards credit card worth it?

How to add an authorized user to a Bank of America credit card

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

- Sign in

Travel Rewards Credit Cards

Our Bank of America® travel rewards credit cards can get you closer to your next vacation.

From flexible travel points to cruise rewards to vacation packages or air miles, we've got a travel or cruise line credit card that's right for you. Start planning your next trip by applying for a Bank of America® travel rewards credit card online today.

We're sorry, this page is temporarily unavailable. We apologize for the inconvenience.

Unavailable

One or more of the cards you chose to compare are not serviced in English.

Continue in English Go back to Spanish

- Remove {CARD_NAME} from compare list

Bank of America ® Customized Cash Rewards

$200 online cash rewards bonus offer and 3% cash back in the category of your choice.

No annual fee †

Show More Show Less Bank of America ® Customized Cash Rewards credit card

- 3% cash back in the category of your choice, automatic 2% cash back at grocery stores and wholesale clubs (on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter) and unlimited 1% cash back on all other purchases Calculate rewards

- Choose which category you want to earn 3% cash back in: gas and EV charging stations ; online shopping, including cable, internet, phone plans and streaming ; dining; travel; drug stores and pharmacies; or home improvement and furnishings. To change your choice category for future purchases, you must go to Online Banking, or use the Mobile Banking app. You can change it once each calendar month, or make no change and it stays the same .

- 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the intro APR offer ends, a Variable APR that's currently 18.24% to 28.24% will apply. 3% † Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance transfers is 4% .

- Bank of America Preferred Rewards ® members earn 25%-75% more cash back on every purchase. That means the 3% choice category could earn 3.75% - 5.25% and the 2% at grocery stores and wholesale clubs could earn 2.50% - 3.50% , for the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter, and the 1% for all other purchases could earn 1.25% - 1.75% . Not enrolled? Learn more about Preferred Rewards Cash Rewards .

- This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. You can take advantage of this offer when you apply now.

† Terms & Conditions for Bank of America ® Customized Cash Rewards credit card

Bank of America ® Unlimited Cash Rewards

$200 online cash rewards bonus offer, show more show less bank of america ® unlimited cash rewards credit card.

- Earn unlimited 1.5% cash back on all purchases Calculate rewards

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open

- 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that, a Variable APR that's currently 18.24% to 28.24% will apply. 3% † Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance transfers is 4% .

- Bank of America Preferred Rewards ® members earn 25%-75% more cash back on every purchase. That means you could earn 1.87% - 2.62% cash back on every purchase. Learn More About Preferred Rewards .

† Terms & Conditions for Bank of America ® Unlimited Cash Rewards credit card

BankAmericard ®

Save on interest, show more show less bankamericard ® credit card.

- 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer ends, a Variable APR that's currently 16.24% - 26.24% will apply. 3% † Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance transfers is 4% .

- No Penalty APR. Paying late won't automatically raise your interest rate (APR). Other account pricing and terms apply † .

- Access your FICO ® Score for free within Online Banking or your Mobile Banking app.

† Terms & Conditions for BankAmericard ® credit card

Bank of America ® Travel Rewards

25,000 online bonus points offer (a $250 value) and no annual fee †.

No annual fee † and no foreign transaction fees †

Show More Show Less Bank of America ® Travel Rewards credit card

- Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points as long as your account remains open Calculate rewards

- Use your card to book your trip how and where you want with no blackout dates and pay yourself back with a statement credit towards travel and dining purchases

- Bank of America Preferred Rewards ® members earn 25%-75% more points on every purchase. That means you could earn 1.87 to 2.62 points for every $1 you spend, everywhere, every time. Not enrolled? Learn more about Preferred Rewards Travel Rewards

† Terms & Conditions for Bank of America ® Travel Rewards credit card

Bank of America ® Premium Rewards ®

60,000 online bonus points offer — a $600 value.

Low $95 annual fee † and no foreign transaction fees †

Show More Show Less Bank of America ® Premium Rewards ® credit card

- Earn unlimited points , that don't expire as long as the account remains open – 2 points for every $1 spent on travel and dining purchases and 1.5 points per $1 on all other purchases . Calculate Rewards Premium Rewards

- Get up to $200 in combined Airline Incidental and TSA PreCheck ® /Global Entry Statement Credits. Plus, access to world class travel benefits: travel and purchase protections, luxury hotel collection and concierge service.

- Redeem for cash back as a deposit into Bank of America ® checking or savings accounts, for credit to eligible Merrill ® accounts including 529 accounts, as a statement credit to your credit card, or for gift cards and purchases at the Bank of America Travel Center

- Bank of America Preferred Rewards ® members earn 25%-75% more points on every purchase. That means you could earn 2.5 to 3.5 points on travel and dining purchases and 1.87 to 2.62 points on all other purchases, for every $1 you spend. Not enrolled? Learn more about Preferred Rewards Premium Rewards

† Terms & Conditions for Bank of America ® Premium Rewards ® credit card

Bank of America ® Premium Rewards ® Elite

75,000 online bonus points offer — a $750 value.

$550 annual fee † and no foreign transaction fees †

Show More Show Less Bank of America ® Premium Rewards ® Elite credit card

- Earn unlimited 2 points for every $1 spent on travel and dining purchases , and unlimited 1.5 points for every $1 spent on all other purchases . No limit to the points you can earn and points don't expire as long as the account remains open. Calculate Rewards Premium Elite Rewards

- Bank of America Preferred Rewards ® members earn 25%-75% more points on every purchase. That means you could earn 2.5 to 3.5 points on travel and dining purchases and 1.87 to 2.62 points on all other purchases, for every $1 you spend.

- Get up to $550 in combined Airline Incidental, TSA PreCheck ® /Global Entry, and Lifestyle Statement Credits . Plus, a suite of luxury benefits to fit your lifestyle: full-service concierge, airport lounge and experience access, premier hotel amenities, travel and purchase protections.

- You choose how you want to be rewarded . Redeem points for travel, cash back, a statement credit, distinctive experiences or gift cards. Plus, save 20% on airfare when you pay with points through the Bank of America Travel Center.

- This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank . You can take advantage of this offer when you apply now.

† Terms & Conditions for Bank of America ® Premium Rewards ® Elite credit card

Bank of America ® Customized Cash Rewards for Students

3% cash back in the category of your choice, show more show less bank of america ® customized cash rewards credit card for students.

- 3% cash back in the category of your choice, automatic 2% cash back at grocery stores and wholesale clubs (on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter) and unlimited 1% cash back on all other purchases. Choose which category you want to earn 3% cash back in: gas and EV charging stations ; online shopping, including cable, internet, phone plans and streaming ; dining; travel; drug stores and pharmacies; or home improvement and furnishings To change your choice category for future purchases, you must go to Online Banking, or use the Mobile Banking app. You can change it once each calendar month, or make no change and it stays the same .

- Online $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO ® Score for free within Online Banking or your Mobile Banking app.

† Terms & Conditions for Bank of America ® Customized Cash Rewards credit card for Students

Bank of America ® Unlimited Cash Rewards for Students

Start building your financial future while earning unlimited cash back, show more show less bank of america ® unlimited cash rewards credit card for students.

- Earn unlimited 1.5% cash back on all purchases with no limit to the amount of cash back you can earn and cash rewards don't expire as long as your account remains open

† Terms & Conditions for Bank of America ® Unlimited Cash Rewards credit card for Students

BankAmericard ® for Students

Save on interest, a great choice when you’re just starting out, show more show less bankamericard ® credit card for students.

- Your card comes with our $0 Liability Guarantee and chip technology for additional security when used at chip-enabled terminals

† Terms & Conditions for BankAmericard ® Credit Card for Students

Bank of America ® Travel Rewards for Students

Start building your financial future.

No annual fee † and no foreign transaction fees †

Show More Show Less Bank of America ® Travel Rewards Credit Card for Students

- Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points as long as your account remains open. Use your card to book your trip how and where you want with no blackout dates and pay yourself back with a statement credit towards travel and dining purchases.

- 25,000 online bonus points after making at least $1,000 in purchases in the first 90 days of your account opening

† Terms & Conditions for Bank of America ® Travel Rewards Credit Card for Students

Bank of America ® Customized Cash Rewards Secured

Help build your credit while earning 3% cash back in the category of your choice, show more show less bank of america ® customized cash rewards secured credit card.

- 3% cash back in the category of your choice, automatic 2% cash back at grocery stores and wholesale clubs (on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter) and unlimited 1% cash back on all other purchases. Choose which category you want to earn 3% cash back in: gas and EV charging stations ; online shopping, including cable, internet, phone plans and streaming ; dining; travel; drug stores and pharmacies; or home improvement and furnishings. To change your choice category for future purchases, you must go to Online Banking, or use the Mobile Banking app. You can change it once each calendar month, or make no change and it stays the same.

- Open your account with a security deposit ($200-$5,000) . Upon credit approval your required deposit is used, in combination with your income and your ability to pay, to help establish your credit line. We'll periodically review your account and, based on your overall credit history (including your account and overall relationship with us, and other credit cards and loans), you may qualify to have your security deposit returned. Not all customers will qualify.

- Build up your credit history – use this card responsibly and over time it could help you improve your credit score.

- Your financial health. Our Priority. Bank of America – Outstanding Customer Satisfaction with Financial Health Support – Banking & Payments, 2 years in a row

- Secured card products are not eligible for a new account bonus offer, like a cash rewards bonus offer, and introductory APRs are not available.

† Terms & Conditions for Bank of America ® Customized Cash Rewards secured credit card

Bank of America ® Unlimited Cash Rewards Secured

Help strengthen or build your credit and earn unlimited cash back, show more show less bank of america ® unlimited cash rewards secured credit card.

- Build up your credit history — use this card responsibly and over time it could help you improve your credit score

† Terms & Conditions for Bank of America ® Unlimited Cash Rewards secured credit card

BankAmericard ® Secured

Help establish, strengthen - or even rebuild your credit with a card that's simple and convenient, show more show less bankamericard ® secured credit card.

- Open your account with a security deposit ($200-$5,000). Upon credit approval your required deposit is used, in combination with your income and your ability to pay, to help establish your credit line.

- We'll periodically review your account and, based on your overall credit history (including your account and overall relationship with us, and other credit cards and loans), you may qualify to have your security deposit returned. Not all customers will qualify.

- Secured card products are not eligible for a new account bonus offer, like a statement credit, and introductory APRs are not available.

† Terms & Conditions for BankAmericard ® secured credit card

Bank of America ® Travel Rewards Secured

Help strengthen or build your credit and earn unlimited points, show more show less bank of america ® travel rewards visa ® secured credit card.

- Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points as long as your account remains open. Use your card to book your trip how and where you want with no black out dates and pay yourself back with a statement credit towards travel and dining purchases.

- Open your account with a security deposit ($200-$5,000). Upon credit approval your required deposit is used, in combination with your income and your ability to pay, to help establish your credit line. We'll periodically review your account and, based on your overall credit history (including your account and overall relationship with us, and other credit cards and loans), you may qualify to have your security deposit returned. Not all customers will qualify.

- Build up your credit history — use this card responsibly and over time it could help you improve your credit score.

- Secured card products are not eligible for a new account bonus offer, like a bonus points offer, and introductory APRs are not available.

† Terms & Conditions for Bank of America ® Travel Rewards Visa ® secured credit card

Alaska Airlines Visa Signature ®

Limited time online offer: 70,000 bonus miles plus alaska's famous companion fare™, show more show less alaska airlines visa signature ® credit card.

- 70,000 Bonus Miles plus Alaska's Famous Companion Fare™ ($99 fare plus taxes and fees from $23) after you make $3,000 or more in purchases within the first 90 days of your account opening. Plus, celebrate your account anniversary with Alaska's Famous Companion Fare™ every year that you spend at least $6,000 on purchases with your card.

- Free checked bag for any cardholder who purchases airfare with their card, and up to 6 additional guests traveling on the same reservation. Plus you'll enjoy priority boarding when you pay for your flight with your card , so you can get to your seat quicker.

- Earn unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases. Earn unlimited 2 miles for every $1 spent on eligible gas, EV charging station, cable, streaming services and local transit purchases including rideshare. Earn unlimited 1 mile per $1 spent on all other purchases. Plus, earn a 10% rewards bonus on all miles earned on card purchases if you have an eligible Bank of America ® account.

- Flexibility with no blackout dates on Alaska Airlines flights when booking with miles or a companion fare.

- This online only offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

† Terms & Conditions for Alaska Airlines Visa Signature ® Credit Card

Susan G. Komen ® Customized Cash Rewards credit card

Help fight breast cancer and get a $200 online cash rewards bonus offer, show more show less susan g. komen ® customized cash rewards credit card.

- 3% cash back in the category of your choice, 2% cash back at grocery stores and wholesale clubs (on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter) and 1% cash back on all other purchases Calculate rewards Cash Rewards

- Bank of America Preferred Rewards ® members earn 25%-75% more cash back on every purchase. That means the 3% choice category could earn 3.75% - 5.25% and the 2% at grocery stores and wholesale clubs could earn 2.50% - 3.50% , for the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter, and the 1% for all other purchases could earn 1.25% - 1.75% . Not enrolled? Learn more about Preferred Rewards

† Terms & Conditions for Susan G. Komen ® Customized Cash Rewards credit card

Free Spirit ® Travel More World Elite Mastercard ®

Online offer: 50,000 bonus points + a $100 companion flight voucher.

$0 introductory annual fee for the first year. After that it's just $79 †

Show More Show Less Free Spirit ® Travel More World Elite Mastercard ®

- Earn 3 points per $1 spent on eligible Spirit purchases, 2 points per $1 spent on eligible dining and grocery store purchases and 1 point per $1 spent on all other purchases

- Earn 50,000 bonus points plus a $100 Companion Flight Voucher after making at least $1,000 in purchases within the first 90 days of account opening

- Receive a $100 Companion Flight Voucher each anniversary after making at least $5,000 in purchases within the prior anniversary year

- No limit to the points you can earn, no points expiration as long as your card account is open, and no redemption fees as a primary cardholder

† Terms & Conditions for Free Spirit ® Travel More World Elite Mastercard ®

Allways Rewards Visa ®

Online offer: 25,000 bonus points.

Low $59 annual fee † and no foreign transaction fees †

Show More Show Less Allways Rewards Visa ® card

- Winner: Best Airline Credit Card , USA Today's 10Best Readers Choice Awards!

- Online Offer: Earn 25,000 Bonus Points – equal to $250 off a future Allegiant trip when you redeem points, after you make $1,000 or more in purchases within the first 90 days of account opening

- 3 points per $1 on Allegiant purchases, 2 points per $1 on qualifying dining purchases and 1 point per $1 on all other purchases

- No blackout dates, no destination restrictions and no minimum points redemption

† Terms & Conditions for Allways Rewards Visa ® card

Air France KLM World Elite Mastercard ®

Online offer: 50,000 bonus miles after qualifying purchases.

Low $89 annual fee † and no foreign transaction fees †

Show More Show Less Air France KLM World Elite Mastercard ®

- Online Offer: 50,000 Bonus Miles after you make $2,000 or more in purchases within the first 90 days of your account opening

- 3 Miles per $1 spent directly on Air France, KLM Royal Dutch Airlines and SkyTeam member airlines purchases

- 1.5 Miles per $1 spent on all other purchases

- Get 60 XP upon approval to help advance to the next status for more generous perks

† Terms & Conditions for Air France KLM World Elite Mastercard ®

Royal Caribbean Visa Signature ®

Online offer: 25,000 bonus points, show more show less royal caribbean visa signature ® credit card.

- Get 25,000 MyCruise ® bonus points after making at least $1,000 in purchases in the first 90 days of your account opening, worth $250 in onboard credit

- Earn 2 MyCruise points for every $1 spent on qualifying purchases with Royal Caribbean® and our sister brand, Celebrity Cruises®

- Earn 1 MyCruise point for every $1 spent on all other purchases

- Redeem your points for onboard credit, stateroom upgrades and cruise vacations on Royal Caribbean ® and our sister brand, Celebrity Cruises ®

† Terms & Conditions for Royal Caribbean Visa Signature ® Credit Card

Norwegian Cruise Line ® World Mastercard ®

Online offer: 20,000 bonus points, show more show less norwegian cruise line ® world mastercard ®.

- Online Offer: 20,000 bonus points after you make $1,000 or more in purchases in the first 90 days of account opening. That's enough for a $200 onboard credit or $200 off your next Norwegian cruise .

- Earn 3 WorldPoints ® points per $1 spent on Norwegian purchases, 2 WorldPoints points per $1 spent on eligible air and hotel purchases and 1 WorldPoints point per $1 spent on all other purchases

- Redeem points for hundreds of rewards like cash, gift cards, hotels stays, car rentals or Norwegian redemptions

- Bank of America Preferred Rewards ® members earn a 25% - 75% points bonus on every purchase, applied to the base earn of 1 point per $1. Not enrolled? Learn more about Preferred Rewards Travel Rewards

† Terms & Conditions for Norwegian Cruise Line ® World Mastercard ®

Celebrity Cruises Visa Signature ®

Show more show less celebrity cruises visa signature ® credit card.

- Earn 2 MyCruise ® points for every $1 spent on qualifying purchases with Celebrity Cruises ® and our sister brand, Royal Caribbean ®

- Redeem your points for onboard credit, stateroom upgrades and cruise vacations on Celebrity Cruises ® , and our sister brand, Royal Caribbean ®

† Terms & Conditions for Celebrity Cruises Visa Signature ® Credit Card

Preferred Rewards makes your credit card even better

When you enroll in the Preferred Rewards program, you can get a 25% — 75% rewards bonus on all eligible Bank of America ® credit cards.

Plus, as a Preferred Rewards member, you enjoy real benefits and rewards on your everyday Bank of America ® banking and Merrill investment accounts. And as your qualifying balances grow, so do your benefits.

Learn more about Preferred Rewards

See if you’re pre-selected for card offers

Answer a few quick questions to see what offers are waiting for you.

It will only take a minute and won’t impact your credit score.

Check offers

Understanding credit is key to your financial health

Selecting a credit card.

Choosing a credit card can be overwhelming. We’ve compiled some important considerations to help you pick the best credit card for you.

Managing your credit card

Get the most out of your credit card. Find out how you can take advantage of all the opportunities that may be available to you as a cardholder.

Paying down your debt

By following a few simple steps, you can help ensure you’re headed in the right direction when it comes to managing your credit card debt.

Improving your credit

Better credit habits can lead to a better credit score. If you’re looking to improve your credit, check out some of our helpful tips.

Connect one on one with a credit card specialist

Everything you should know about Bank of America’s Preferred Rewards program

While it's wonderful to redeem your points and miles for travel arrangements, such as lodging and flights, there can be many other expenses involved in planning a trip, such as car rentals, train tickets, gas and campsite fees. Luckily, using cash-back rewards in combination with your points and miles can save you even more money on your next vacation.

With that in mind, let's examine the often-overlooked Bank of America Preferred Rewards® program . On top of the simple banking benefits members can expect, consolidating your finances with Bank of America can also boost your cash-back earnings with some of the best Bank of America credit cards .

That's because Bank of America designed its Preferred Rewards program to incentivize consumers to move their checking, savings, investment and retirement accounts to Bank of America and Merrill. The higher your balance of total assets with the bank, the more perks you can unlock, including with its credit cards. Depending on your holdings and the type of rewards you're looking to accumulate, it might be time to stop ignoring Bank of America Preferred Rewards.

Bank of America Preferred Rewards Program

How to qualify for bank of america's preferred rewards program.

To qualify for the Bank of America Preferred Rewards program, you must have both of the following:

- An active, eligible Bank of America checking account

- A three-month combined average daily balance of $20,000 or more in qualifying Bank of America deposit accounts and/or Merrill investment accounts

There are five Preferred Rewards tiers. You'll qualify for each based on your combined average daily balance:

- Gold: $20,000 or more in total assets

- Platinum: $50,000 or more in total assets

- Platinum Honors: $100,000 or more in total assets

- Diamond: $1,000,000 or more in total assets

- Diamond Honors: $10,000,000 or more in total assets

While not exorbitant, even the lowest level requires some pretty high figures. But don't throw in the towel straight away. If you have an emergency fund, a holiday account, a savings account and a checking account, combining all those balances may qualify you for a Preferred Rewards tier. Once you add in investment accounts, such as IRAs, you may even find that the Platinum or Platinum Honors tiers are within reach.

Your balance doesn't need to originate with Merrill or Bank of America to count toward each threshold. You can roll existing IRAs and investment accounts over to Merrill or Bank of America and immediately use those balances to begin establishing a three-month average to boost your tier. Of course, you'll have to consider other things like account management fees and available investment options to decide whether doing so is a good option.

How to move among Preferred Rewards tiers

You can rise from one rung to the next any month after your average daily balance for the three previous months reaches the threshold for the following tier. Once you reach a specific status level, you won't need to keep all your cash in the Bank of America basket. Instead, you'll maintain your Preferred Rewards tier status for a full year. If you no longer meet the qualification requirements after that year, you have a three-month grace period to do so. If you still don't meet the criteria after the three-month grace period, you'll either be moved to a lower tier or completely lose your Preferred Rewards benefits.

Benefits of Bank of America's Preferred Rewards Program

Here's a chart of the five Preferred Rewards tiers, along with the associated benefits of each:

Now, let's take a closer look at each of these benefits.

Savings Interest Rate Booster

You need to have a Bank of America Advantage Savings account and be an enrolled Preferred Rewards member to enjoy this benefit. If you have an existing savings account, it will not automatically convert to a Bank of America Advantage Savings account when you enroll in Preferred Rewards. Be sure to request the conversion when joining Preferred Rewards.

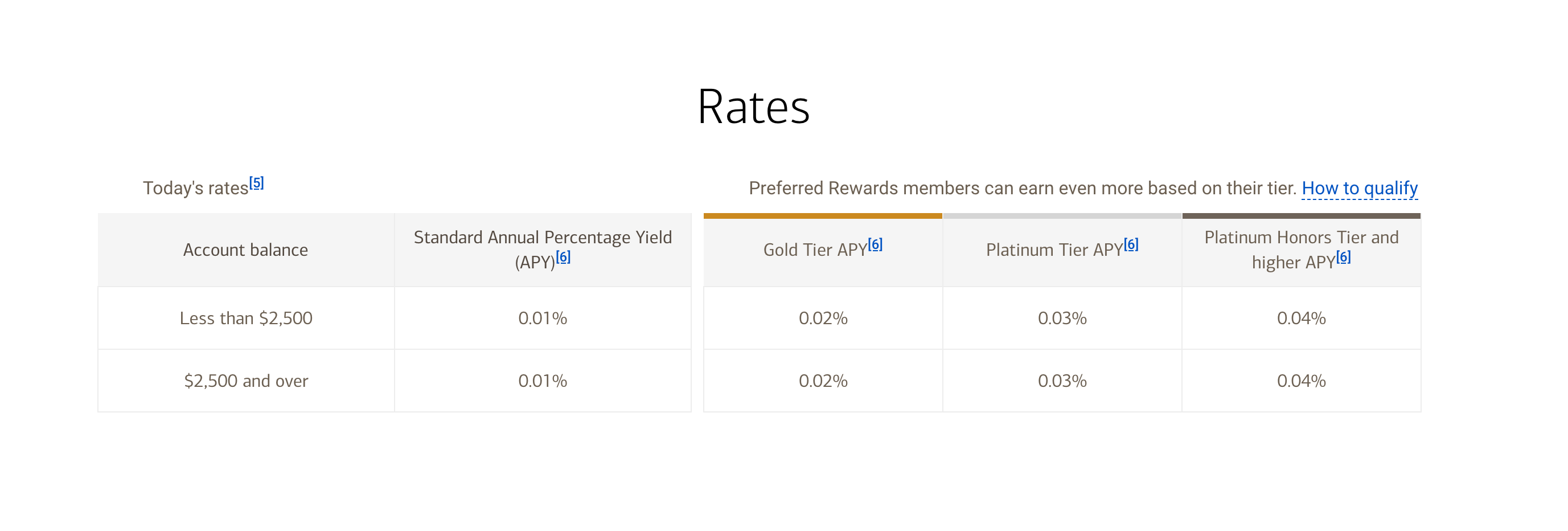

At Gold, the interest rate boost is 5%. That likely sounds better than what it is. As an example, if your interest rate is 1.00%, a 5% rate booster would increase the interest rate to 1.05%. Here's the current annual percentage yield on a Bank of America Advantage Savings account for a sample Florida resident to give you some perspective:

You can check how this boost would affect the current annual percentage yield on a Bank of America Advantage Savings account in your region here .

Credit card rewards bonus

Preferred Rewards members earn a 25%, 50% or 75% rewards bonus on select Bank of America cards . For credit cards that earn points or cash rewards, you will receive a rewards bonus on every purchase. Your earning rate is based on your Preferred Rewards tier when the purchase is posted to your account. We'll get into how this plays out with specific cards below.

You can earn the Preferred Rewards bonus on most Bank of America consumer-branded credit cards, including the Bank of America® Premium Rewards® credit card , the Bank of America® Travel Rewards credit card , the Bank of America® Unlimited Cash Rewards credit card and the Bank of America® Customized Cash Rewards credit card , among others.

Related: Chase Sapphire Preferred vs. Bank of America Travel Rewards — which should beginner travelers get?

Mortgage origination fee reduction