Welcome to BTSSS!

Veterans portal.

The Internet Explorer (IE) browser has been detected and is no longer supported by Microsoft Dynamics/Beneficiary Travel Self-Service System.

Please use another browser (e.g., Chrome, Edge or Safari) and try again.

Thank you for using the Veteran Portal to submit your travel claim to the Beneficiary Travel Self Service System (BTSSS).

In order to access the BTSSS interface you must log in using:

If you are a JAWS user, please refer to the JAWS Job Aid before using BTSSS.

Announcements

Eft information.

Claims approved for payment within this system are designed to use electronic funds transfer (EFT) to your checking/savings account or VA debit card. If your EFT information is not on file with Veterans Health Administration (VHA) Financial Management System (FMS) your approved payment may be delayed until the information is provided to process your claim or adjustments are made to allow for temporary payment by check. If you currently receive other benefit payments by EFT from the Veterans Benefits Administration (VBA) your EFT information is not on file with our system unless you have provided it previously to your local VA Medical Center. You can confirm if your EFT information is on file by reviewing your Veteran profile screen. If it is missing please contact your local BT office to update it. They will provide you with the necessary signature forms to have it added.

Facility for Payment

When entering claims, please identify the facility responsible for payment as the facility that provided your care or approved your care for care in the community. For example, if you submit a claim for care or services approved at a non-VA facility, you identify the care VA facility that authorized it as facility responsible for payment. In most situations this will be your preferred or home facility. If you receive care at a VA Community Based Outpatient Clinic (CBOC) this location will be available for selection as an associated facility of its larger parent VA Medical Center. You will see it when you select the location of your appointment.

The Paperwork Reduction Act of 1995 requires VA to notify you that this information collection is in accordance with the clearance requirements of Section 3507 of this Act. We anticipate the time expended by Individuals who must complete this form will average 10 minutes. This includes the time it will take to read instructions, gather the necessary facts and fill out the form. No person will be penalized for failing to furnish this information if it does not display a currently valid OMB control number. This information is collected under 38 CFR 70 and is intended to fulfill the need for Veterans and beneficiaries to claim Beneficiary Travel benefits and for VA to determine the individual’s eligibility for the benefit.

Privacy Act Information: VA is asking you to provide the information on this form under 38 U.S.C. Sections 111 to determine your eligibility for Beneficiary Travel benefits and will be used for that purpose. Information you supply may be verified through a computer-matching program. VA may disclose the information that you put on the form as permitted by law; possible disclosures include those described in the “routine use” identified in the VA systems of records 24VA19 Patient Medical Record-VA, published in the Federal Register in accordance with the Privacy Act of 1974. Providing the requested information is voluntary, but if any or all of the requested information is not provided, it may delay or result in denial of your request for benefits. Failure to furnish the information will not have any effect on any other benefits to which you may be entitled. If you provide VA your Social Security Number, VA will use it to administer your VA benefits. VA may also use this information to identify Veterans and persons claiming or receiving VA benefits and their records, and for other purposes authorized or required by law.

By submitting this form, you agree to our Terms of Use and Privacy Policy . All information provided will be kept strictly confidential.

Welcome to CRMJetty

If you have an account with us, please log in.

https://www.crmjetty.com/blog/online-travel-portal-the-future-travel-business/

Online Travel Portal: The Future of Travel Business

Sulabh Chauhan

When was the last time you visited a travel agency office to book your travel ticket? Or to understand holiday packages to pick from? Well, I am sure it was a long time back when the online travel business was in its nascent stage. This was a time when it wasn’t widely accepted and popular because people had apprehensions about such transactions being fraudulent.

Well, that time has passed and the online travel business is a thriving industry today. Big players like Airbnb, Expedia, Booking.com, etc., have revolutionized the travel industry. They have made online travel services reliable and secure and therefore gained people’s trust and support.

After a drop in 2020 due to COVID-19, the online travel agency sector worldwide is forecast to snowball again. According to Statista, it is forecast to touch $ 820.18 bn by 2023. It is clear that the online travel business is a booming industry and will continue to be so.

Rising to the occasion, even small travel agency owners are also looking to go online. For them, an online travel portal can be an ideal fit. It is because it lets them manage their agents, partners, and customers centrally and efficiently.

If you also run a travel company or are looking to start one, this post is for you. In this post, you are going to learn about the importance of an online travel portal in detail. You’ll also know the features you must seek in a travel portal.

Benefits of an Online Travel Portal

A travel portal based on your CRM can help manage your travel business easily. For example, a SuiteCRM customer portal for your travel business would be suitable if you use SuiteCRM. And Salesforce portal for Salesforce-based organization, and so on.

Reduced Running Costs

If you run a travel company, hiring several travel agents to explain tour packages and booking tickets may be costly. Instead, a SuiteCRM customer portal or any other portal for your travel business can save you expenses.

Moreover, you can also cut down the effort of maintaining records of all costumes in spreadsheets. This is because you can view all your customers’ and agents’ details centrally and manage them better with a travel portal.

Real-Time Access

A travel portal provides real-time access to all details like prices of tour packages, hotels, rental services, flights, etc. to your customers. Customers can also vet and compare the prices of hotels and packages during peak season and normal times. It helps them make a more informed choice of a tour package, hotel, etc.

Customer Care Support

A travel portal helps customers communicate and convey issues easily via a chat or call option. This helps customers get quick solutions to their travel-related issues or answers to queries. For providing the utmost customer satisfaction you can integrate these hotel API providers in your online travel portal.

They can also get help in selecting the right package for their tour plan via customer care support. This way, a travel portal eliminates the need to call or visit a travel agency office for every small issue or query.

Enhanced Transparency and Convenience

An online travel portal helps display accurate fares with any hidden costs. This helps build customers’ trust in your company and connect with you more. A complete comprehensive breakdown of applicable charges brings more transparency.

Besides, booking tickets and packages online is convenient. Customers don’t have to visit any office or branch to book their tickets, hotels, or bus rental services. They can do it all right from within the portal. Using a portal for this also helps get a much clearer view of comparison metrics like pricing, amenities, etc. This saves both their time and money and enhances their experience. Similarly, customers can also easily cancel or reschedule a booking without calling the company’s office or visiting there.

All this helps takes customers’ convenience, and booking experience, to the next level.

Large Variety of Options

An online travel portal helps gain access to a large list of hotels, rental cars , flight or bus tickets, and tour packages. Customers can get numerous options to choose from unlike in the case of an offline travel agency.

All this is not feasible with a travel agent due to time constraints and limited knowledge available on the internet.

Features to Look for in a Travel Portal

The travel portal you pick should be easily accessible to the admin, agents, and customers.

A. For Admin

As the business owner and admin, you should have control over the complete management of your customers and agents. For that, there are a few admin features below that you must look for when picking a travel portal:

1. As an admin, the travel portal should allow you to view, manage, and update customers’ booking details on the fly.

2. You should also be able to manage hotel bookings easily and efficiently from within the travel portal. The portal should provide a centralized view of all bookings to help you get better visibility and avoid any errors.

3. There should be a built-in process for the online identification of customers within the portal. It will help you avoid the hassle of manual identity verification after check-ins.

4. The portal should allow you to manage tour packages and their details like prices in real-time. You should offer the best tour package recommendations based on your customers’ preferences and budget.

B. For Agents

If you provide an online travel service that supports individual travel agents and associates; your travel portal should have the following features:

1. Individual hospitality agents and associates should be able to manage their commission for every booking. The portal should also let them track total bookings and negotiate the commission to pay to you.

2. The portal should let travel and hospitality associates and agents implement the credit systems for customers. It will help increase repeat bookings and expand the customer base.

3. The portal should also facilitate offering discounts on bookings for agents to attract more online bookings. This way, they can also adjust the commission fee according to the overall profitability of your company.

C. For Customers

Last but not least, the travel portal you pick should be user-friendly for your customers.

1. The portal should make the booking experience seamless for customers. It should let them check for the availability of travel tickets on specific dates and book them.

2. There should be a choice of multiple payment options to book. The portal should also provide the option to save a payment method for future bookings for fast transactions.

3. There should be an exhaustive list of hotels, ratings, charges, and facilities displayed. Comparison and filter options should be there to allow customers to vet and pick a package carefully.

4. Your travel portal should let customers view travel booking history and update booking details. They should get to update, cancel, or reschedule their bookings without hassle.

Launch Your Travel Portal with CRMJetty

If you own a travel company and are looking for a travel portal, we’ve got you covered. Our development team can help you develop a travel portal based on your CRM.

We provide ready-to-integrate industry-specific SuiteCRM client portal, Salesforce portal, WordPress portal, etc. If you want to expand your existing portal’s capabilities, we can help you with that also. We can discuss your portal requirements, analyze the feasibility of development or customization, test limitations, and deliver the final portal.

All product and company names are trademarks™, registered® or copyright© trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Read Related Blogs About SuiteCRM

How to enhance customer experience with suitecrm customer portal, streamlining your small business for the holiday season with suitecrm customer portal, the future of self-service depends on technology: use it well.

- (866) 645-8400

- [email protected]

The Advantages of Using Online Travel Booking Portals

- March 22, 2023

Share This Post

Online travel booking portals have revolutionized the travel industry by giving customers the convenience and flexibility to book travel arrangements from their homes. These portals have also brought significant benefits to travel businesses. This article will discuss the benefits of online travel booking portals for businesses.

Increased Visibility and Reach

One of the significant benefits of online travel booking portals is the increased visibility and reach businesses can achieve. Travel portals have millions of users worldwide visiting their websites to book travel arrangements. By listing their services on these portals, businesses can increase their visibility and reach a broader audience, attracting more customers to their services.

Improved Customer Engagement

Online travel booking portals allow businesses to engage with customers in real-time. These portals allow businesses to communicate with their customers through chatbots, emails, and notifications, providing them with up-to-date information about their travel arrangements. This engagement level helps businesses build strong customer relationships, improve customer satisfaction, and increase customer loyalty.

Streamlined Booking Process

Online travel booking portals have simplified the booking process for customers, making it easy for them to research, compare, and book travel arrangements. This streamlined process has resulted in increased sales for businesses. Customers can easily browse different travel options, compare prices and book travel arrangements with just a few clicks. This convenience has increased customer satisfaction and the likelihood of repeat business for travel businesses.

Increased Revenue

One of the most significant benefits of online travel booking portals for businesses is the increased revenue that they can generate. By listing their services on these portals, businesses can reach a broader audience and attract more customers. This increased visibility can increase bookings, resulting in higher revenue for businesses. Additionally, many online travel booking portals offer businesses the option to upsell their services, such as room upgrades, travel insurance, and airport transfers, further increasing their revenue.

Improved Marketing Strategy

Online travel booking portals allow businesses to improve their marketing strategy. These portals have a wealth of customer behavior and preferences data, which businesses can use to tailor their marketing campaigns. Businesses can create targeted marketing campaigns that resonate with their customers by analyzing customer data, leading to increased bookings and revenue.

Reduced Operating Costs

Online travel booking portals can help businesses to reduce their operating costs significantly. These portals provide businesses with a platform to list their services, eliminating the need for traditional marketing and advertising methods. Additionally, these portals automate many of the booking processes, reducing the need for manual intervention and reducing staffing costs.

Improved Operational Efficiency

Online travel booking portals can help businesses to improve their operational efficiency. These portals automate many of the processes involved in booking travel arrangements, such as reservations, payments, and confirmations. This automation helps businesses to reduce errors, eliminate redundant tasks, and improve the speed of their operations. As a result, businesses can provide their customers with a better experience, leading to increased customer satisfaction and loyalty.

Online travel booking portals have significantly benefited the travel industry, providing customers with convenience, flexibility, and a streamlined booking process. By leveraging these benefits, travel businesses can improve their marketing strategies, increase operational efficiency, and provide customers with a better experience, increasing customer satisfaction and loyalty.

Are you looking for online travel booking portal services in Washington, PA ? Globeo is here to make your business trips easy, manageable, and stress-free. Contact us today to learn more about our online booking portal!

More To Explore

Safe, Healthy Crew: Optimizing Health and Safety Measures for Corporate Travel

The pandemic has significantly impacted how we approach corporate travel and ensure our crews’ health and safety. As businesses adapt to the new normal, it

Embrace Sustainable Travel: Eco-Friendly Corporate Accommodation Options for Crews

sustainable practices into their daily operations, the area of corporate travel is no exception. In various industries requiring regular crew travel, such as oil and

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to the Citi ThankYou Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the Citi ThankYou travel portal?

The baseline value of citi thankyou points, how to book travel in the citi thankyou rewards travel portal, benefits of booking in the citi thankyou travel portal, what else you need to know about citi travel portal, how good is the citi travel portal.

Citi has rolled out big changes to its online travel portal that will have a sizable impact on how its credit cardholders search and book travel — whether they’re paying for a trip or redeeming points.

In March 2023, Citi launched its revamped booking platform, officially called Citi Travel with Booking.com. Certain cardholders can book everything from flights and hotels to rental cars and experiences through the portal.

The booking website now offers some 1.4 million hotel options worldwide, including a growing list of properties in Citi’s two new hotel portfolios: the Hotel Collection and Luxury Collection. Bookings in these collections come with special perks such as property credit, free breakfast and more.

The changes give members more options to use Citi ThankYou points. In addition to redeeming ThankYou points for travel, members can also redeem points for cash back or transfer them to airline or hotel partners. In fact, members sometimes extract a higher value from their points by transferring them.

However, applying them toward travel in the Citi’s online travel portal can be a compelling option, particularly given some of the perks available at the platform’s two hotel collections and the current promotion: Now through Dec. 31, 2025, Citi Rewards+® Card cardholders can earn a total of 5x ThankYou Points on hotel, car rentals and attractions booked on CitiTravel.com through Dec. 31, 2025.

In this guide, we’ll go over which cards that members can use the Citi ThankYou travel portal, what the points are worth and when redeeming points through the Citi Travel portal can make sense.

Most cards that earn Citi ThankYou Points offer members access to the Citi Travel portal, including:

AT&T Access Card from Citi (not open to new applications).

AT&T Access More Card from Citi (not open to new applications).

Citi Custom Cash® Card .

Citi Premier® Card .

Citi Prestige® Card (not open to new applications).

Citi Rewards+® Card .

Citi Double Cash® Card .

The portal offers cardholders perks like same-day booking opportunities, a 24-hour cancellation window for full refunds and flexible payment options.

Cardholders can redeem Citi ThankYou points between 1 cent to 1.25 cents through the Citi Travel portal or when redeemed for cash back. So, 1 cent per point should be your baseline redemption rate when deciding whether you should transfer points to one of Citi's airline or hotel partners .

If the booking you are considering gives you less than a 1-cent-per-point redemption rate, consider getting cash back instead. Then, pay for that same booking in cash. This may be more optimal than redeeming your ThankYou points at a lower rate.

» Learn more: Plan your next redemption with our credit card points tool

1. Log into your Citi account

One of the benefits of Citi’s new travel portal is that you can book a trip and manage your credit card account with just a single login. Eligible ThankYou members can access the new travel portal directly .

You can redeem Citi ThankYou Points at a rate of 1 cent to 1.25 cents toward the following travel purchases: flights, hotel rooms, car rentals and activities. The Citi Travel portal is powered by Booking.com and Rocket Travel by Agoda, and works like the online travel agencies you’ve likely used before.

» Learn more: How to earn miles through online travel agencies

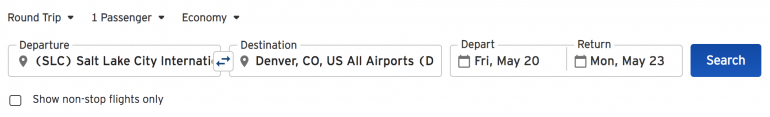

2. Search your travel dates and destinations

Let’s say you want to book a flight. Select the “Flights” tab and begin your search. Select your trip type (round trip, one way or multicity), and enter the number of passengers and preferred class of service. Input your departure and destination cities and travel dates. Check the nonstop box if necessary and select “Search.”

Review your flight options on the following page. To further filter the search results, you can sort by price, travel duration, as well as departure and arrival time. You can also filter results by the number of stops and operating airlines.

3. Choose to pay with cash, points or a combination of both

Once you select the fare, you’ll have the option to select a payment method: using ThankYou Points or a Citi credit card. If you choose to redeem points, you can either pay in full or redeem for a partial payment.

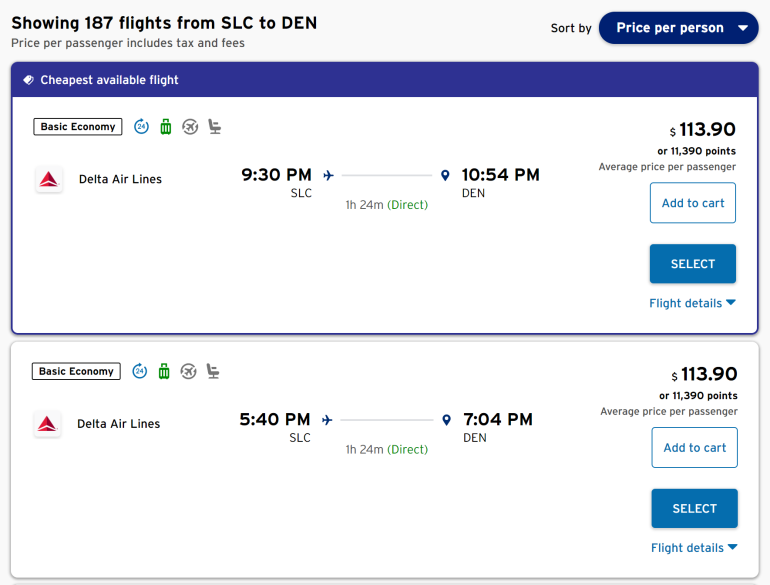

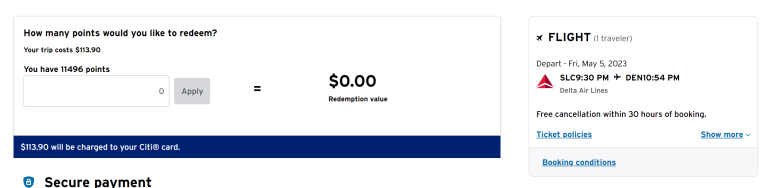

Here’s an example of a flight booking through the portal: a flight from Salt Lake City to Denver aboard Delta Air Lines. You can see, it’s available for $113.90 or 11,390 ThankYou points — a 1 cent-per-point rate.

You can also type in the number of points you want to apply toward the cost of the flight, select “Apply” and pay attention to the payment summary. If the points cover only part of the fare, use your credit card to pay the remaining amount. Then, enter passenger information and complete your booking.

Follow the same process online to make reservations for hotel rooms, car rentals and activities.

» Learn more: The best travel credit cards you might not have

Historically, transferring ThankYou points to one of Citi’s partners, like airlines or hotel loyalty programs, sometimes results in a higher value for your rewards (in that they are likely to be worth more than 1 cent apiece). In a recent NerdWallet analysis , we value Citi ThankYou points between 1 cent to 1.3 cents per point. However, there are a few reasons you might consider booking travel through the ThankYou Travel portal instead.

Book flights on the dates you want

Let’s get real for a moment: Award travel is great when everything goes according to plan. But what if you want to travel on specific dates and can’t find available seats using miles with a specific airline? In that case, you have to be flexible and pick less convenient travel dates or times.

You can reserve any open seat on a plane by booking your flight through the Citi ThankYou Rewards travel portal because there are no blackout dates.

You might use slightly more points at a fixed redemption rate of 1 cent to 1.25 cents per point, but at least you can fly on your preferred dates. This option works best with inexpensive economy flights.

Book non-chain hotels with points

When you participate in hotel loyalty programs , you end up staying at chains. But what if you want to book that bewitching beachfront bed-and-breakfast and still take advantage of credit card rewards? Well, the good news is if it shows up in the portal search results, you can redeem points to reserve it.

In the Citi Travel portal, hotel reward bookings aren’t limited to chain hotels, which means you can book all kinds of properties outside of popular brands. This benefit is all the more noteworthy now that Citi has bolstered its property offerings through its Booking.com partnership.

Keep money in your pocket

If you’ve amassed a large collection of Citi ThankYou points, you might have more points than you know what to do with. And now that you’re ready to book a trip, you want to make use of your points instead of spending cash — essentially avoiding paying out of pocket for the same expense.

Though you’ll get a redemption rate of 1 cent to 1.25 cents per point, your trip will be paid for entirely with points. This can be a smart money move for the right situation.

Citi Hotel Collection and Luxury Collection

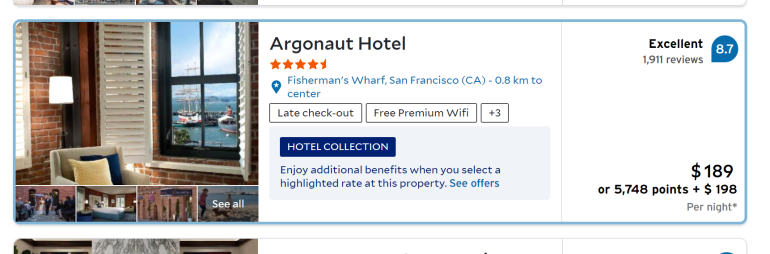

Perhaps the most significant change unveiled as part of the revamped Citi Travel with Booking.com portal is the addition of two hotel portfolios, at which eligible cardholders can enjoy added perks, not to mention, savings in some cases.

Citi is in the process of rolling out its new Hotel Collection and Luxury Collection — both bookable through its new platform. This may sound like a familiar concept. It’s similar to what other major credit card companies have offered through their travel portals, such as American Express Travel’s Hotel Collection and Fine Hotels and Resorts.

Citi’s Hotel Collection is available to all eligible ThankYou credit cardmembers. Guests who book one of these properties will enjoy a host of perks, including free breakfast for two, complimentary Wi-Fi and early check-in and late checkout (when available).

Here’s one property in San Francisco — the Argonaut Hotel, not far from Fisherman’s Wharf — available as part of the Hotel Collection. As you can see, the listing explicitly mentions late checkout and free premium Wi-Fi as a perk for this booking.

Meanwhile, the higher-end Luxury Collection portfolio is available only for ThankYou members who carry the Citi Prestige® Card or Citi Premier® Card . On top of the same perks offered as part of the Hotel Collection, eligible members who book one of these properties will also enjoy room upgrades (when available) and a $100 experience credit, which can be used for on-property purchases ranging from food and beverages to spa treatments, depending on the hotel.

Citi’s initial rollout of the Hotel Collection and Luxury Collection is confined to the U.S., Mexico and the Caribbean, but the company plans to expand the two portfolios to new destinations around the world over the next year.

Complimentary fourth night on certain hotel bookings

Both the Citi Prestige® Card and Citi Premier® Card offer a fourth night free on eligible bookings, twice per year. One of the best ways to maximize use of Citi’s travel portal is to combine this card benefit with the perks offered as part of the Hotel and Luxury Collections.

To use this benefit, filter your hotel search results in the portal to display hotels designated as “Complimentary 4th Night Eligible.” Book at least four nights and look closely at checkout to confirm that the system applied the savings.

Bonus points for bookings

Extra points are certainly a way to sweeten any deal when it comes to booking, and Citi is offering a hefty promotion in concert with the new portal.

Between now and June 30, 2024, the Citi Prestige® Card and Citi Premier® Card members can earn a total of 10 points per dollar when booking hotels, rental cars or eligible attractions through Citi Travel.

Citi ThankYou® Preferred Card and Citi Rewards+® Card members can earn a total of 5 points per dollar on those bookings.

Earn airline miles

Similar to other credit card travel portals like American Express or Chase, Citi members earn airline miles even when booking through the portal. Just add your airline frequent flyer number to the reservation.

On the other hand, a notable downside of Citi’s new portal is that, at least for now, members cannot add their hotel loyalty numbers. So, for instance, if you book a stay at a Hilton property through Citi Travel, you would earn ThankYou points for the purchase, but not Hilton Honors points for the stay.

The Citi Travel with Booking.com portal includes 24/7 customer service, which can assist with reservation and rebooking needs.

Members with existing travel booked through the old ThankYou Travel Center (prior to March 19, 2023) can access their reservation at ThankYou.com. Select “Travel” and then “My trips."

Despite improvements as part of the revamped Citi Travel portal, it likely won’t appeal to points and miles enthusiasts whose main objective is to maximize value.

However, for others who simply want to use their ThankYou points, it offers plenty of options. And there are certain situations where booking through Citi Travel can be even more beneficial than transferring points, particularly as the company continues to expand the Hotel Collection and Luxury Collection.

The opportunity for certain cardmembers to earn up to 5 or 10 points per dollar on purchases through the portal doesn’t hurt, either. Plus, using the portal can help you travel on dates with limited award availability and expand your lodging selection.

Although the value of your rewards won’t always reach its ceiling, you’ll keep money in your pocket by using ThankYou points for travel.

The information related to the AT&T Access More Card from Citi and Citi Prestige® Card has been collected by NerdWallet and has not been reviewed or provided by the issuer or provider of this product or service.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- American AAdvantage

- United MileagePlus

- Delta SkyMiles

- British Airways Executive Club

- Southwest Rapid Rewards

- JetBlue TrueBlue

- Alaska Mileage Plan

- Marriott Bonvoy

- Hilton Honors

- IHG One Rewards

- World of Hyatt

- Accor Live Limitless

- Radisson Rewards

- Chase Ultimate Rewards

- Amex Membership Rewards

- Citi ThankYou Rewards

- Capital One Rewards

- Brex Rewards

- Bank Rewards Cards

- Airline Cards

- Hotel Cards

- Business Cards

- Cashback Cards

- 0% APR & Balance Transfer Cards

- Best Cards for Everyday Spending

- Best Cards for Dining

- Best Cards for Groceries

- Best Cards for Gas

- Best Cards for Travel

- Best Cards for Purchase Protection

- Best Cards for Elite Status

- Best Cards for Lounge Access

- How a Signup Bonus Works

- Types of Card Benefits

- Credit Card Application Rules

- Managing Your Credit Score

- Meeting Spending Requirements

- Buy Points and Miles Promotions

- Types of Reward Points

- Airline Partners & Alliances

- Which Flights Are Bookable With Miles

- Finding Award Availability

- Miles Needed for a Free Flight

- Track Your Points

- Mile Transfer Times

- Merchant Lookup Tool

- Reverse Merchant Lookup

- Credit Card Spend Analysis

- Transaction Analyzer

- Travel Trends

- Advertiser Disclosure

Everything You Need To Know About the Citi Travel℠ Portal

AwardWallet receives compensation from advertising partners for links on the blog. Terms Apply to the offers listed on this page. The opinions expressed here are our own and have not been reviewed, provided, or approved by any bank advertiser. Here's our complete list of Advertisers .

Being able to redeem my rewards in a variety of ways is one of my favorite aspects of collecting flexible points currencies like Citi ThankYou ® Points. I'll always argue that the best way to use ThankYou ® Points is by transferring them to Citi's 19 travel partners . But you also can use them to book several types of travel directly, including flights, hotel stays, rental cars, and activities. How? By using the Citi Travel SM portal.

Although you won't get the same value for your points that you could by transferring them to partner loyalty programs, the flexibility offered by the Citi Travel portal is excellent. It's also easy to use. We'll dig into all the details here, including a walkthrough of how to book various types of travel using the portal.

Page Contents

What Is the Citi Travel Portal?

Earning citi thankyou points, booking hotels, booking flights, basic economy, booking rental cars, booking activities and attractions, when it makes sense to book through the citi travel portal, when to avoid using the citi travel portal, final thoughts, what is the phone number for citi travel, do flights booked with thankyou points earn miles, who has access to the citi travel portal.

The Citi Travel portal — officially Citi Travel with Booking.com — is a one-stop-shop online travel portal that lets you book flights, hotel stays, rental cars, and activities. It's similar to the Chase Travel and Amex Travel portals, if you're familiar with those. You can book trips using an eligible Citi credit card, or you can redeem Citi ThankYou Points for your travel.

As of early 2023, Citi Travel is powered by third-party provider Booking.com and functions similar to Booking.com's online travel agency (OTA), although the user interface isn't quite the same. The options presented won't be exactly the same as what you will find with Chase Travel or other OTAs (e.g., Expedia). However, if you've navigated any of these before, finding your way around Citi Travel will be easy enough.

The only requirement to be able to use the Citi Travel portal is that you hold a card earning Citi ThankYou Points.

How Much Are ThankYou Points Worth Through Citi Travel?

Citi ThankYou points are worth 1 cent each when redeemed through the Citi Travel portal. This low value per point is one of the downsides of using Citi Travel. Unlike when you book through the Chase Travel portal , having a specific premium credit card will not get you any extra value for your points.

Contrast this with the average 2.04¢ per point that AwardWallet users get from their ThankYou Points. This is because our users overwhelmingly redeem their points by transferring them to Citi's transfer partners and redeeming them for premium travel with airlines and hotels. However, it can be a lot more work to get this sort of value out of your points.

If you value simple, straightforward redemption options — especially a one-stop-shop where you can potentially book all the travel you need — the Citi Travel portal is still worth using.

Citi offers a nice array of ways to earn ThankYou Points . If you're looking to boost your points balance, consider one of the cards below. The Citi Premier ® Card has been a mainstay in my wallet for several years. The Citi Double Cash ® Card is an excellent choice as well, as you earn 2% cash back on all purchases: 1% when you buy plus 1% as you pay. But these earnings come in the form of ThankYou Points, which you can use in several ways, including redemptions for travel that are worth more than using your earnings for cash back. Plus, the card doesn't charge an annual fee.

Other cards that provide access to the Citi Travel portal include:

- Citi Premier ® Card

- Citi Double Cash ® Card

- Citi Custom Cash ® Card

- Citi Rewards+ ® Card

- Citi ThankYou ® Preferred Card (no longer open to new applicants)

- Citi Prestige ® Card (no longer open to new applicants)

Related: Build a Winning Combo of Citi ThankYou Rewards Cards

How To Book Using the Citi Travel Portal

You'll need to log into Citi Travel using your normal Citi account credentials; you can access the login page here . If you have more than one ThankYou Point-earning card, the first thing you'll be asked to do is select which one you'd like to use to book travel. Select a card and click “Search for Travel” at the bottom of the page.

It is at this moment that I must comment on Citi's website functionality. While I generally don't have issues accessing my card accounts, successfully logging into my account and beginning a search through Citi Travel didn't always happen without a hitch. I'd often land on an error page. Know that if this happens to you, you're not alone. This is honestly the most frustrating aspect of using Citi Travel.

Assuming login and card selection are successful, you'll land at the main Citi Travel search page. Here, you can select whether to book hotels, rental cars, flights, or attractions. This landing page is similar to other travel portals and should look familiar.

Now, let's dive into how to search for hotels and other accommodations.

Booking hotels and other accommodations with Citi Travel is straightforward. Simply select “Hotels” on the main search page, and then enter your destination, dates, and the number of guests. You'll be presented with a list of accommodation options bookable through the travel portal.

It's important to note that you're not stuck with only hotels. In my searches, there were often bed and breakfasts, serviced apartments, and hostels. There are certainly not the vacation rental options you'd find with Airbnb, for example, but you'll find more than just hotels.

Below are the top results for a sample Citi Travel Portal hotel search for properties in New York City. If you've booked hotels with other OTAs, navigating the search should be pretty intuitive. The default sorting option is “Best Match,” which seems to prefer Hotel Collection properties (more on those below). You can see the price in both points and cash, top featured amenities, and the average guest rating. I did notice that the guest ratings for each property are not identical to those you'll see at Booking.com. It seems Citi Travel has its own ratings .

There are numerous filter options in the panel to the left of the results, including property type, neighborhood, star rating, guest rating, and room amenities. It's easy to change the sorting and filtering to find properties to your liking.

If you select a particular hotel, you can view photos and explore its features and amenities.

From here, you can scroll down to select a particular room. Since the Citi Travel Portal is powered by Booking.com, all available room types should show up. This gives you a lot more flexibility than booking with many hotel loyalty programs, where you're restricted to base-level rooms or must fork over additional points for an enhanced room or suite.

How does pricing compare to other booking channels?

When you initially search, you may notice that the cash prices displayed exclude taxes and fees but the points prices (often shown as a combo of points and cash) include taxes and fees. Unfortunately, to do a price comparison with other sites, you'll have to add the stay to your cart to see the final price after including taxes and fees.

It's important to note that you may not be provided the best price through Citi Travel. The first comparison I made was between Citi Travel and Booking.com, the site that powers the Citi Travel portal. One would think both sites would offer the same price, but that wasn't the case.

Here is Citi Travel's price for a stay at the Royalton New York, a random property I selected from the search results. Ignoring the current hotel savings offer, the four-night stay costs $1,810.19.

Through Booking.com, the cost is $1,590.62. Citi Travel is charging ~$220 more! This is for the same room type and a similar cancellation policy.

Here is a second example of price shopping among sites for a four-night stay at The Westin New York at Times Square:

- Citi Travel: $1,927.77

- Booking.com: $1,927.80

- Expedia.com: $1,522.95

In this case, the Citi Travel and Booking.com prices are nearly identical. But they are substantially more than Expedia's price. Make sure you compare the Citi Travel portal price against other sites. You might get a better deal elsewhere.

Hotel Collection benefits

As part of revamping the travel portal and switching its provider to Booking.com, Citi launched two hotel programs: Hotel Collection and Luxury Collection. Eligible Citi cardholders can enjoy exclusive savings and perks at these properties, including free breakfast for two, free Wi-Fi, and early check-in and late check-out, when available. With Luxury Collection bookings, guests are eligible for room upgrades at check-in, based on availability, and receive a $100 on-property credit for use during their stay.

Luxury Collection and Hotel Collection bookings are available only to those with the Citi Prestige Card or Citi Premier . These programs are similar to other luxury hotel programs, such as American Express' Fine Hotels + Resorts and Chase's Luxury Hotel & Resort Collection.

Related: How To Receive Elite Hotel Benefits Without Elite Status

As you peruse the Citi Travel portal, you may notice that Hotel Collection and Luxury Collection properties usually get first billing in the list of results. Click on “See offers” to see the perks you can enjoy and the terms of each.

If you want to specifically filter for Hotel Collection or Luxury Collection properties, these are conveniently located at the top of the many filters in the left panel.

However, there's a catch: You have to book a specific rate to receive the Hotel Collection or Luxury Collection benefits. Sometimes, the premium simply isn't worth it for what you receive. Consider this rate difference for a stay at the Mondrian South Beach in Miami. An additional $195 plus taxes per night for Hotel Collection perks? There's no way that's worth it for early check-in and daily breakfast.

Will I get hotel elite status benefits booking through the Citi Travel portal?

If you book through the Citi Travel portal, you likely won't receive hotel elite benefits with major chain hotels. Bookings with Citi Travel are treated as third-party reservations, and most hotels don't honor elite benefits for these. This is a big downside compared to booking directly with a hotel. I often count on hotel elite status perks to add substantial value to my stay. Free breakfast for a family can add up to a lot of daily savings! Plus, you won't receive stay credit on these bookings, which means it won't help your progress toward qualifying for elite status.

There are plenty of hotels available in the Citi Travel portal that aren't associated with major chains, though. If you don't have loyalty to a particular chain, this loss of benefits isn't a worry. Booking hotels through Citi Travel also remains useful if you're specifically looking for properties outside what is offered by major chains (e.g., boutique bed and breakfasts) or if you're looking for hotels in an area devoid of major chains.

Using the Citi Premier‘s $100 annual hotel perk

If you have the Citi Premier , make sure you select that card on the landing page before starting your hotel search. This will automatically apply the annual hotel savings benefit — $100 off a booking of $500 or more, excluding taxes and fees — offered by the card. You can use this benefit once per year and must book through Citi Travel to enjoy this credit.

Using the Prestige Card‘s fourth-night free benefit

Those who still hold the Prestige Card (which isn't available to new applicants) get a fourth night free on hotel bookings, available twice each year when booking through Citi Travel. If you have this card, ensure you select it on the first page before beginning your searches; otherwise, you won't enjoy this benefit.

Now that we've covered how to book lodging, let's move on to booking flights through Citi Travel. You can use the portal to book flights similar to how you'd use any other OTA. To search for a flight, simply select the “Flights” option on the search screen and key in your origin, destination, whether you want one-way or round-trip travel, flight date(s), number of passengers, and cabin class. You also can select whether you want “Direct only,” which will eliminate flight options with connections.

Citi Travel will present a list of flight options based on your search criteria. At this point, you can sort and filter in various ways. The default sorting is “Best Overall,” which is somewhat subjective but typically includes a shorter travel time with fewer connections. You can filter by carrier, departure or arrival time, number of stops, and price, among other options.

Flight availability

You can book most flights on major domestic and international carriers using the Citi Travel portal. You'll have more options at your fingertips when searching for flights through Citi Travel rather than restricting yourself to using award miles. Mixed-carrier itineraries that normally aren't available using award miles are sometimes an option with Citi Travel.

It's important to note, however, that there are some low-cost carriers that can't be booked in the portal. Some are available with a phone call, while others aren't available at all. Here's a look at low-cost carriers you can and cannot book with Citi Travel:

- Book online: Flybe, JetBlue, and WestJet

- Book via phone: Air Asia, GOL, Pegasus, Southwest

- Cannot book at all: Spirit, Frontier, Sun Country

To book over the phone, contact the ThankYou Service Center at 833-737-1288 .

Related: Can You Book Low-Cost Carriers with Amex, Capital One, Chase, or Citi Points?

Flight pricing

Flight pricing should be similar and competitive to what you find when booking directly with airlines, barring the use of any discount codes or other promotions currently available. Pricing should mirror other OTAs, as well. You'll sometimes see a bigger variation with international carriers than with U.S. airlines. Remember that you'll get 1 cent per ThankYou Point when using points to book flights. Therefore, a $200 ticket will cost 20,000 ThankYou Points.

You'll get the biggest bang for your buck booking economy flights with Citi ThankYou Points. This is because the redemption value you get from economy award flights (booked via the airlines' loyalty programs) is often less than what you can get out of business-class awards — but not always. It pays to check for award flights to see if there are any Citi ThankYou transfer partners you can use to book the flight you want.

Related: The Best Citi ThankYou Point Sweet Spots for Flights in North America

Do flights booked with ThankYou Points earn miles?

Yes. Unlike an award ticket, when you book a ticket through Citi Travel using ThankYou Points, your ticket will earn miles based on the carrier's earning methodology. This is because you're actually booking a cash ticket and then redeeming your ThankYou Points at 1 cent each to cover the cost. Make sure you enter your frequent flyer number to earn miles on any tickets booked.

You also should consider the fact that you earn award miles when comparing the cost of an award ticket to that of a ticket booked through Citi Travel. This may affect which booking method you choose. If you're chasing elite status, this is something else to factor in, as well. Paid tickets can earn elite miles, segments, qualifying dollars, and/or points that help you qualify for status. Award tickets typically don't.

Example economy flight comparison: Citi Travel portal vs. transfer partner

Consider this itinerary from San Francisco (SFO) to Newark (EWR). It is available for $163.90 cash or 16,390 Citi ThankYou Points when booked in the Citi Travel portal.

You can book this as an award using Avianca LifeMiles — one of the Citi ThankYou transfer partners. At first glance, paying 13,500 LifeMiles seems like the better deal. However, make sure you consider the taxes and fees, plus any miles earned by your ticket. LifeMiles charges a redemption fee, so the total cost of the flight would be 13,500 Citi ThankYou Points (transferred to LifeMIiles) plus $30.60. Now it's close to a wash.

Doing a little digging, this cash fare would be a United Airlines K-class ticket. Crediting this ticket to LifeMiles, you'd earn 1,282 miles. You'd give these up if you booked an award ticket. Now the math clearly shows that booking through the Citi Travel portal is the better option.

Related: Citi's No Annual Fee Cards and the Strategy Behind How to Get Them

Be careful: Citi will present Basic Economy flight options for some carriers. These are clearly labeled, however, so it should be easy to avoid them. If you're looking at a Basic Economy itinerary, it'll clearly say so. However, you'll need to know each carrier's name for their Basic Economy equivalent. No matter what it's called, it'll be displayed within a rectangle above the carrier name.

One gripe I have with Citi Travel is that Basic Economy cannot be filtered out of the search . This is problematic. At times, I'd like to eliminate all Basic Economy flights from the results to compare the cheapest economy fares that are not Basic. Instead, you have to select a flight, and then choose a different fare class on the booking screen. If you're wondering why all your options are Basic Economy, this is the reason. Don't worry: You still can book a normal economy fare. You just need to do so after selecting a flight option.

Like searching for hotels and flights, searching for rental cars in the Citi Travel portal is straightforward. Enter your pick-up and drop-off location(s), the dates and times of both, the driver's age, and you're off and running. One of the nicest aspects of the rental car search — unlike searching for hotels — is that the total price is displayed up front.

You can filter the search results by vehicle type, rental agency, and whether free cancellation is offered. I like that the initial search is sorted by the lowest price first. You also can see whether the reservation offers free cancellation or is non-refundable.

Here are a few things to be aware of when renting a car through Citi Travel:

- Primary auto rental collision damage waiver: Many premium credit cards offer rental car coverage that covers your rental car in the event of a collision. However, Citi's own credit cards do not offer this. This means that rentals made through the Citi Travel portal will never be covered — a major downside — unless you purchase this additional coverage.

- Rental agency “skip the counter” programs: Some rental agencies, such as National and Hertz, offer “skip the counter” programs where you can go straight to the lot to pick out a car. If you rent through Citi Travel, you may not receive these benefits. I can attest that I have received my elite status benefits on many third-party bookings, however, so you may be fine. You may need to contact the rental agency after making a booking and get them to add your loyalty number manually.

- Use of discount codes: If you book through Citi Travel, you won't be able to apply corporate (or any other) discount codes to reduce the cost of your rental.

Attractions are the final category of travel you can book through Citi Travel. There is a multitude of options to pick from, including tours, transportation, events, food experiences, outdoor experiences, cultural experiences, and more. What you can find through Citi Travel is what you would expect to find through an OTA like Expedia or Orbitz — or through a site like Tripadvisor or Viator.

To search for attractions, simply start typing a city name into the search bar. If you type in a country name (or the name of a U.S. state), you'll be prompted with a list of cities to choose from. Once you search for a particular location, you can filter the results by price, star rating, and/or duration. You also can sort by price and popularity. Attractions are also grouped into categories, and you can filter the results by selecting each in the top ribbon.

Attractions is the one type of travel where it seems Citi Travel has a slight edge over making reservations through Booking.com. You'd expect the two sites to have exactly the same price for the same experience. However, I found that Citi Travel was often 3%–5% cheaper than Booking.com. Not huge savings, but certainly something to note. As with everything else in the Citi Travel portal, your ThankYou Points are worth 1 cent each when redeemed for attractions.

Not all locations will have attractions available to book. I tried to enter the towns in my rural area, and none of them showed up in the options. That being said, you should be able to find something in the vast majority of major cities, plus some other areas. It's worth noting that you won't find Disney park tickets in the portal, unfortunately.

Related: Tips for Saving Money at Disney World With Points and Miles

Is It Worth Using the Citi Travel Portal?

This is the big question. With ThankYou Points worth only 1 cent each when redeemed through Citi Travel, it isn't generally worth redeeming them through the portal. Unlike Chase Ultimate Rewards, where you can get 1.25 to 1.5 cents per point — which is more comparable to their value when transferred to loyalty partners — Citi doesn't offer any bonus value. Given that AwardWallet users redeem ThankYou Points for an average of 2.04¢ each when using transfer partners, we recommend that you use them this way.

That being said, there are times when booking through Citi Travel will get you more value than transferring your points. This is most common with economy airfare.

If you're also trying to save money and would rather spend reward points than cash for travel where transfer partners aren't an option, this is another time when using the Citi Travel portal will be worth it. The same goes for those who want to book all their travel in one place. It takes time to understand the ins and outs of loyalty programs; for some, the simplicity Citi Travel provides is a major selling point.

Finally, you always can use the Citi Travel portal to book paid travel. There are some clear reasons to do so. Being able to take advantage of the Citi Premier‘s annual $100 off $500 hotel booking benefit is one of them. Promotions such as 5X or 10X points on booking through Citi Travel (through June 30, 2024) could also be worth utilizing. Don't write off the Citi Travel portal entirely. It's a great option to have in certain situations.

Using the Citi Travel Portal is generally a good idea:

- When you don't want to worry about travel blackout dates or availability for award travel.

- If you prioritize simplicity and would rather book all your travel in one place.

- When booking an award flight would yield a similar value per point; remember that flights booked through the Citi Travel Portal are revenue fares that earn miles!

- When you can take advantage of certain benefits (e.g., Citi Premier Card annual hotel benefit) or bonus earning promotions.

- If you want to use ThankYou Points to book attractions.

These are the times you'll want to avoid using the Citi Travel portal:

- When booking premium cabin flights, as you'll nearly always do better booking these using award miles from transfer partners.

- When it costs fewer points to transfer them to a loyalty partner and book your travel that way.

- For booking hotels where you want to receive elite benefits.

- When you want travel flexibility; award travel usually has better change and cancellation policies than paid travel.

- For any car rentals; these aren't covered by a primary auto rental collision damage waiver through Citi.

Whether you see the Citi Travel portal as a key tool in planning your travel and redeeming your points or view it as a low-value option you don't care for, it's at least an option to have in your back pocket. The biggest upside I see for some travelers is being able to book your entire trip using one tool. There's also the perk of using points to pay for things where transfer partners aren't an option, such as guided tours or attraction tickets.

Personally, I won't get much value out of the Citi Travel portal. If I'm trying to limit the amount of cash I'm spending on a trip, I may consider using it to book attractions. The low 1-cent-per-point value, though, is a huge turn-off — almost too much for me to stomach. I try to get over 2 cents per ThankYou Point through partners like LifeMiles , Flying Blue , and Turkish Airlines Miles & Smiles .

You can call Citi Travel at 1-833-737-1288.

Yes. Flights booked through Citi Travel are revenue fares, so they will earn award miles. Citi just lets you redeem your ThankYou Points to cover the cost.

Anyone with a credit card earning ThankYou Points has access. However, cards issued by Citi that earn other rewards, such as American Airlines miles, don't provide access to the portal for booking travel.

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Click here to cancel reply.

Notify me of followup comments via e-mail Notify me of followup posts via e-mail

Can the 4th night free combine with the $100 credit for Citi Prestige? Thanks!

Unfortunately, you can’t combine the Prestige and Premier credits because you have to use a single payment method at checkout.

9 things to consider when choosing to book via a portal vs. booking directly

MSN has partnered with The Points Guy for our coverage of credit card products. MSN and The Points Guy may receive a commission from card issuers.

Editor’s note: This is a recurring post, regularly updated with the latest information.

When it comes to travel, you have a lot of options.

You can book directly through the website of an airline, hotel, rental car company or other travel provider. You can also use online travel agencies like Expedia or Skyscanner. And many banks offer their own portals, such as Capital One Travel and Chase Travel .

While there are some horror stories from cancellations associated with portals, booking with one linked to a credit card in your wallet can be an attractive option.

Consider asking yourself these nine questions to determine the best approach for planning your next trip. They will help you decide whether to book directly, use an online travel agency or utilize a credit card portal for your next vacation.

Will you forfeit status perks and status earnings?

When booking a hotel room through online travel agencies like Hotels.com or Expedia , you may not receive your stay credit from the hotel brand (e.g., Marriott Bonvoy ). Any nights that would typically contribute toward your status won’t be counted.

Moreover, as a member with elite status, you often won’t receive the usual perks during your stay — like free breakfast or room upgrades. This applies to all major hotel loyalty programs . Many hotels offer a best-price guarantee, allowing you to request a match to a better price you find elsewhere, even if it’s on an online travel agency. With this guarantee, you can enjoy loyalty benefits without spending more than necessary.

The decision becomes less straightforward if you want to leverage perks that require booking through a credit card travel portal — which can include bonus rewards or statement credits. You must prioritize what matters most: receiving elite perks and night credits or earning more credit card points and benefiting from automatic discounts for your stay.

However, it’s worth noting that flights booked through third-party sites generally qualify as ordinary revenue tickets and are thus eligible to earn points or miles in the given airline’s loyalty program. However, be sure to read the terms carefully to avoid booking restrictive basic economy fares .

Related: Why you don’t earn hotel points when booking through an online travel agency

Do you have travel credits you can use from your credit card?

Several credit cards offer travel credits on your statements when you book through their travel portals.

For example, the Capital One Venture X Rewards Credit Card (see rates and fees) offers $300 in annual credits when you reserve flights, hotels and rental cars through the Capital One Travel portal .

Similarly, anyone with The Platinum Card® from American Express can enjoy various benefits of the Amex Platinum , including an annual hotel credit worth up to $200 for prepaid reservations at Fine Hotels + Resorts properties or The Hotel Collection (the latter of which requires a two-night minimum). The perk is issued as a statement credit to your account. Like the Capital One credit, the only way to receive the Amex credit is to book an eligible stay through the American Express Travel portal .

Those with a Chase Sapphire Preferred Card also receive a comparable credit for hotel reservations, though it’s significantly lower at $50 per year. Simply book through the Chase Ultimate Rewards portal to have the annual credit appear on your account.

If you have a travel credit you have yet to use, take advantage of it before it expires. But carefully consider its rules to ensure your booking qualifies for reimbursement.

Related: The top 11 credit cards with annual travel statement credits

What will cost you the fewest points?

If you have accumulated enough points in credit card portals like American Express Membership Rewards or Citi ThankYou points , you should carefully consider which redemption option will require the fewest points for your upcoming trip.

Sometimes, transferring your points to a partner program and booking through their website may be the most cost-effective option.

On the other hand, it may be cheaper in some situations to keep your points in your credit card account and use them through the card’s travel portal. This is especially true for hotels, as transferring points to a partner hotel loyalty program may provide less value than redeeming them directly through your credit card issuer.

This can also make sense for boutique properties that don’t participate in a loyalty program.

Always compare both redemption options before transferring your points to ensure that you get the best value .

Related: How (and why) you should earn transferable points

What will get you the most points on your credit card?

Regarding travel expenses, you should consider which credit card offers the best rewards for each purchase .

For instance, the Capital One Venture X card provides 10 miles per dollar spent on hotels and rental cars booked through Capital One Travel. Additionally, you earn 5 miles per dollar spent on flights booked this way. Comparing these rates to the 2 miles per dollar earned on purchases made outside the Capital One Travel portal, it’s clear which option is more advantageous.

Chase follows a similar pattern. If you have the Chase Sapphire Reserve and book through the Ultimate Rewards portal, you will earn 10 points per dollar spent on hotels and rental cars and 5 points on flights. These rates are significantly better than the 3 points per dollar earned on travel booked through other methods.

The Amex Platinum card presents a more drastic example. It offers 5 points per dollar for prepaid hotels booked through the Amex Travel portal. You also receive 5 points per dollar spent on flights booked directly with an airline or through Amex Travel (up to $500,000 in flights per calendar year, then 1 point per dollar spent). However, for hotel reservations booked directly with a hotel, you only earn 1 point per dollar spent. While you can choose either option for airfare, booking hotel stays through Amex Travel is best to maximize your earnings — though again, you’ll likely give up the opportunity to earn hotel points by doing so.

Related: What are points and miles worth?

Do you have to choose between rental car loyalty perks and a better price?

Online travel agencies and portals are popular because they offer convenience. You can visit a single website and compare results from various rental car companies.

However, there is a trade-off to consider.

When you see a lower price on an online travel agency or credit card portal than a rental car website, you usually won’t receive any elite benefits associated with a rental car loyalty program . This is because most online travel agencies and credit card portals do not provide an option to add your rental car loyalty number to the reservation (though there are exceptions ). Even if they do, the rental agency often doesn’t honor the associated benefits, such as skipping the line during car pickup.

In such situations, you must decide whether booking the lower price or receiving perks is more important. Ultimately, the decision may come down to the price difference.

Related: Get automatic rental car elite status through your credit card

Will the hotel give preference to guests who booked directly?

In short: Possibly. You may not receive the same perks when booking a hotel through a third-party website instead of directly with the hotel.

For example, a TPG staffer faced this issue while staying at Universal’s Cabana Bay Beach Resort in Orlando. He booked through the Capital One Travel portal to earn miles with his Capital One Venture Rewards Credit Card (see rates and fees). However, this meant he couldn’t use the mobile check-in feature and had to wait in a long line at check-in. Additionally, he was assigned a less desirable room near noisy areas like the service elevators and housekeeping storage.

If you’re not a light sleeper or prefer in-person check-in, these drawbacks may not be significant concerns. Nevertheless, it’s worth considering these factors when deciding how to make your hotel booking.

Related: The best ways to book hotels through online travel agencies and bank portals

Can you get free perks from hotels booked via a portal?

Why not add free perks to the deal if you’re paying cash for a hotel?

With American Express, you can enjoy extras by booking through Amex Fine Hotels + Resorts or The Hotel Collection . However, you will not get these benefits if you book directly with the hotel.

Capital One and Chase offer similar programs through the Capital One Premier Collection , Capital One Lifestyle Collection and Chase Luxury Hotel & Resort Collection . When you book with these programs, you can expect to receive perks that could include free breakfast, a welcome gift or space-available room upgrades.

Related: 6 surprising ways to use your on-property credits at hotels

Will you get free nights added to a hotel booking?

Adding free nights to your hotel reservation could be a huge differentiator.

For example, the Citi Prestige® Card offers a fourth-night-free benefit . But there are some restrictions and nuances to using this benefit. There’s a limit of two uses per year and you must book through Citi ThankYou Rewards to receive it.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Likewise, you can get a fourth or fifth night free when redeeming select types of hotel points for award stays — which could lead you to book directly with a hotel program.

Related: Can I mix hotel points and free night certificates to get a 4th or 5th night free?

What if something goes wrong with your flights?

Unlike rental car and hotel reservations made through portals and online travel agencies, flights booked outside airline websites will still earn you miles and frequent flyer status credits.

This is good news, but it gets even better when you realize you can stack rewards by booking flights through online travel agencies . This means you can earn points on your credit card, miles from flying, shopping portal bonuses and rewards from the loyalty programs of online travel agencies .

However, there is a potential issue to consider if unexpected problems arise before or during your trip.

When you book directly with an airline and your flight gets canceled, you can deal with the carrier directly. They will reimburse or rebook you based on their change or cancellation policy . However, this may not be the case for portals and online travel agency bookings.

If the airline cancels your flight due to bad weather, they may instruct you to purchase new tickets for a later flight through your credit card portal or the online travel agency you booked with. If you have a schedule change or want to adjust your reservation, you often need to go back to the third-party site for support instead of contacting the airline directly. This can be a significant drawback when booking flights through a third-party option, particularly if your trip carries a high risk of weather-related issues or you think there’s a possibility that you’ll need to change (or cancel) your trip.

Related: Flight canceled or delayed? Here’s what to do

Bottom line

Having various options for booking trips is great. You can compare prices and use your points and miles effectively. You might even get extra perks that other websites don’t offer.

However, having too many options can be overwhelming and confusing.

To simplify the process, consider these nine questions before making your booking. By considering factors such as your travel credits and how the booking will impact your elite status strategy, you can avoid surprises during your trip and make the most out of the rewards you earn.

Additional reporting by Kyle Olsen.

SPONSORED: With states reopening, enjoying a meal from a restaurant no longer just means curbside pickup.

And when you do spend on dining, you should use a credit card that will maximize your rewards and potentially even score special discounts. Thanks to temporary card bonuses and changes due to coronavirus, you may even be able to score a meal at your favorite restaurant for free.

These are the best credit cards for dining out, taking out, and ordering in to maximize every meal purchase.

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

- English (UK)

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

The 10 best online travel agencies in 2024

The top 10 online travel agencies.

- Booking.com

- Lastminute.com

Best online travel agencies for business travel

1. travelperk.

Main offerings and features:

- Industry-leading travel inventory

- Flexible booking with FlexiPerk

- Safety alerts with TravelCare

- Integrated travel policy & approval flows

- Centralized invoicing

- Easy & real-time expense reports

- Carbon offsetting with GreenPerk

- 24/7 fast customer support in target 15s

- VAT reclaim

- Integration with 3rd party tools , such as expense management or HR software like Expensify and BambooHR

Save time and money on your business travel with TravelPerk

2. sap concur.

?)

- Works with some of the biggest brands

- Easy tracking and reporting of expenses for expense reports

- Many connected apps, such as Uber and Airbnb for cars and hotels

- One solution for a variety of business travel spending

Click below to compare both platforms’ features and benefits

?)

- Ample integrations

- Award-winning mobile app

- Employee-centric travel management

Click below for a more detailed comparison between both platforms:

Best online travel agencies for leisure travel, 1. booking.com.

?)

- Intuitive booking tool and website

- Flight + Hotel booking for easily planning trips with no cross-referencing travel websites

- Simple car rental options and taxi hire

- Available in over 40 different languages and offers over half a million properties across 207 countries

- You can book experiences in your destination city to entertain you on your travels

- Genius rewards program

?)

- Simple interface and booking tool

- Deals when making more than one booking

- 38 different languages and offers a 24-hour, multilingual customer support service

- Free cancellation within 24 hours of booking

- Millions of reviews to help make your decision

3. Lastminute.com

?)

- Filter hotels according to budgets, star ratings, guest ratings, board types, and more

- ATOL protection on flight + hotel bundles

- Flash sales for last-minute deals

- Payment plans to spread out the cost of travel

- Extra entertainment booking for your trips, like theatrical productions and day trips

- Gift cards for gifting travel

?)

- Expedia rewards for hotels, cars, and more

- Experienced support

- Compare cruise lines

- Big savings when booking flights, hotels, and car rentals

- Operates in nearly 70 countries and in over 35 different languages

- Luxury travel options

?)

- Book hotels, flights, cars, and bundles

- 24/7 support

- Lower prices on the app

- Great last-minute deals for spontaneous travel

6. Bookmundi

?)

Best online travel agencies for flights

1. skyscanner.

?)

- Super flexible booking filters

- Cheaper flights and hotels than other OTAs

- Price alerts for travel routes of interest

- Easy-to-use booking tool and UI

- Hundreds of location and currency options

- One-way, return, and multi-city travel options

2. Kiwi.com

?)

- Simple flight booking tool

- Partnerships with Booking.com and Rentalcars.com

- Discover deals anywhere with the option to open up your search

- Easy-to-use app

How do online travel agencies work?

What are the advantages of booking through an online travel agency.

- Access to comparison tools

- Peer reviews to help you with your decisions

- Flexible cancellation policies

- All your travel in one place

- Local flights and deals

Rewards programs

Comparison tools, peer reviews, flexible cancellation.

?)

Flexiperk: Cancel anytime, anywhere. Get a minimum of 80% of your money back.

One account for all of your travel needs, a local approach to global travel, wrapping up.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

Speak to a travel expert

?)

10 Most impactful travel technology companies in 2024

?)

5 best corporate travel management apps

?)

The 8 best business travel management companies in Europe

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

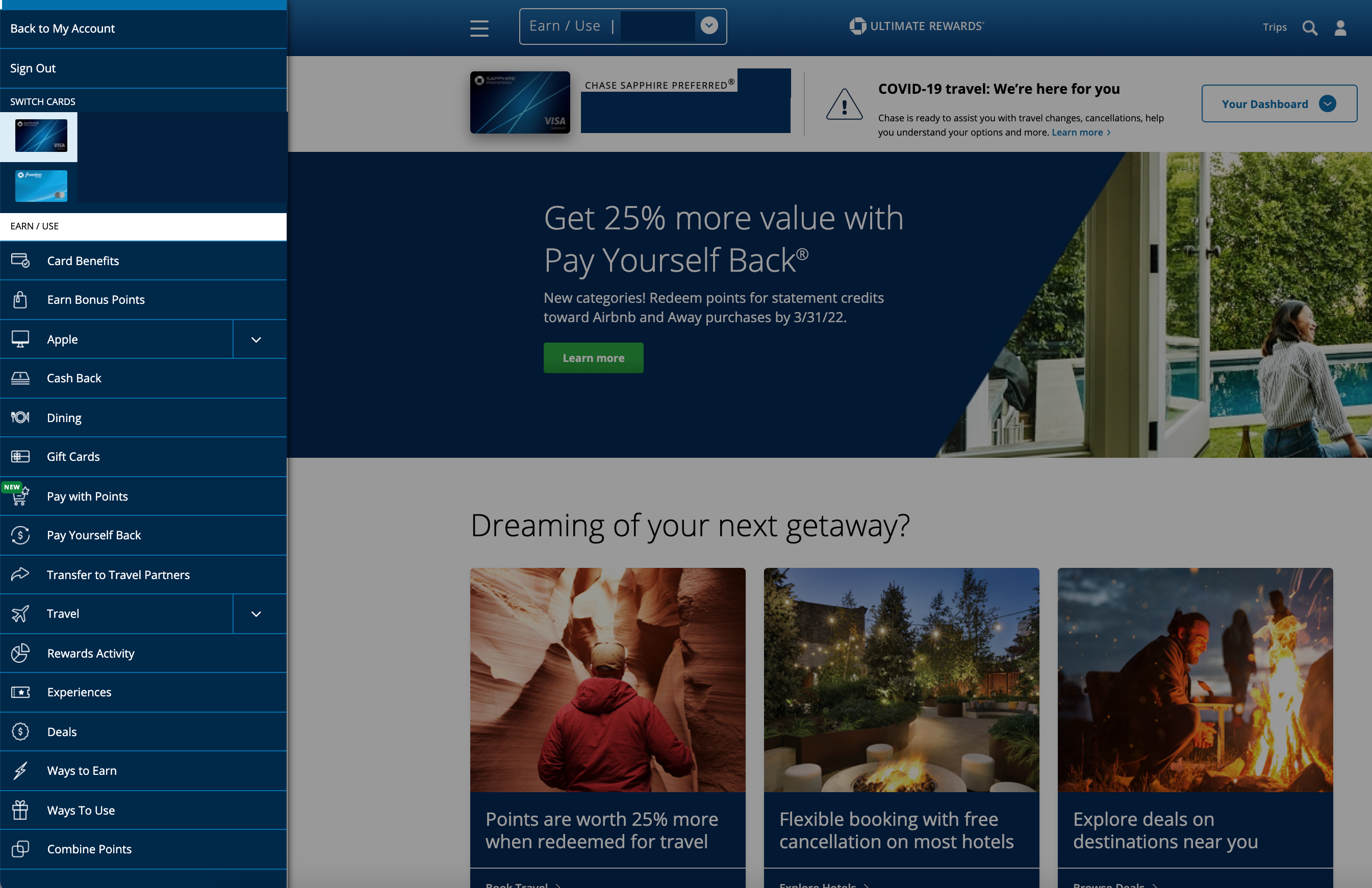

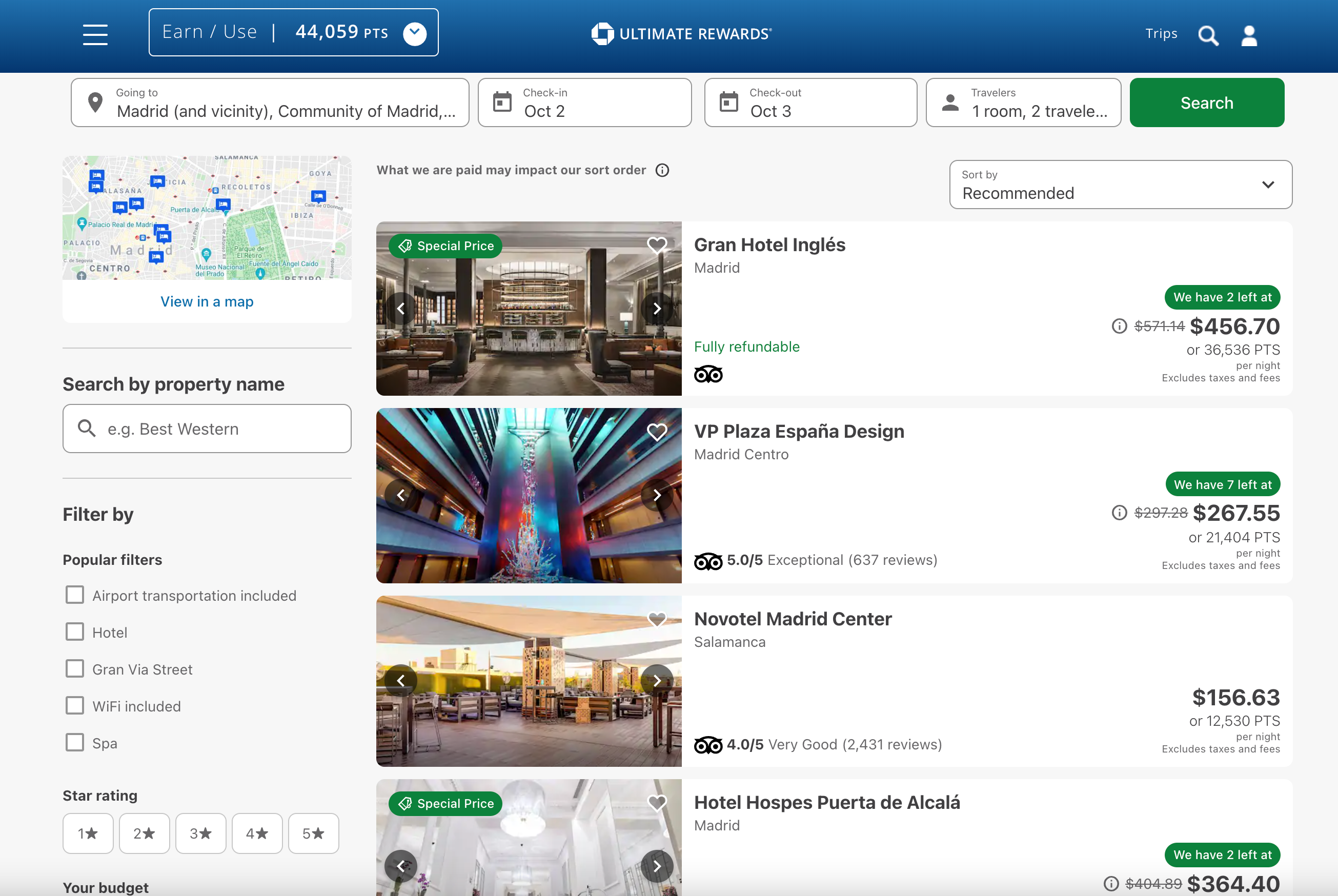

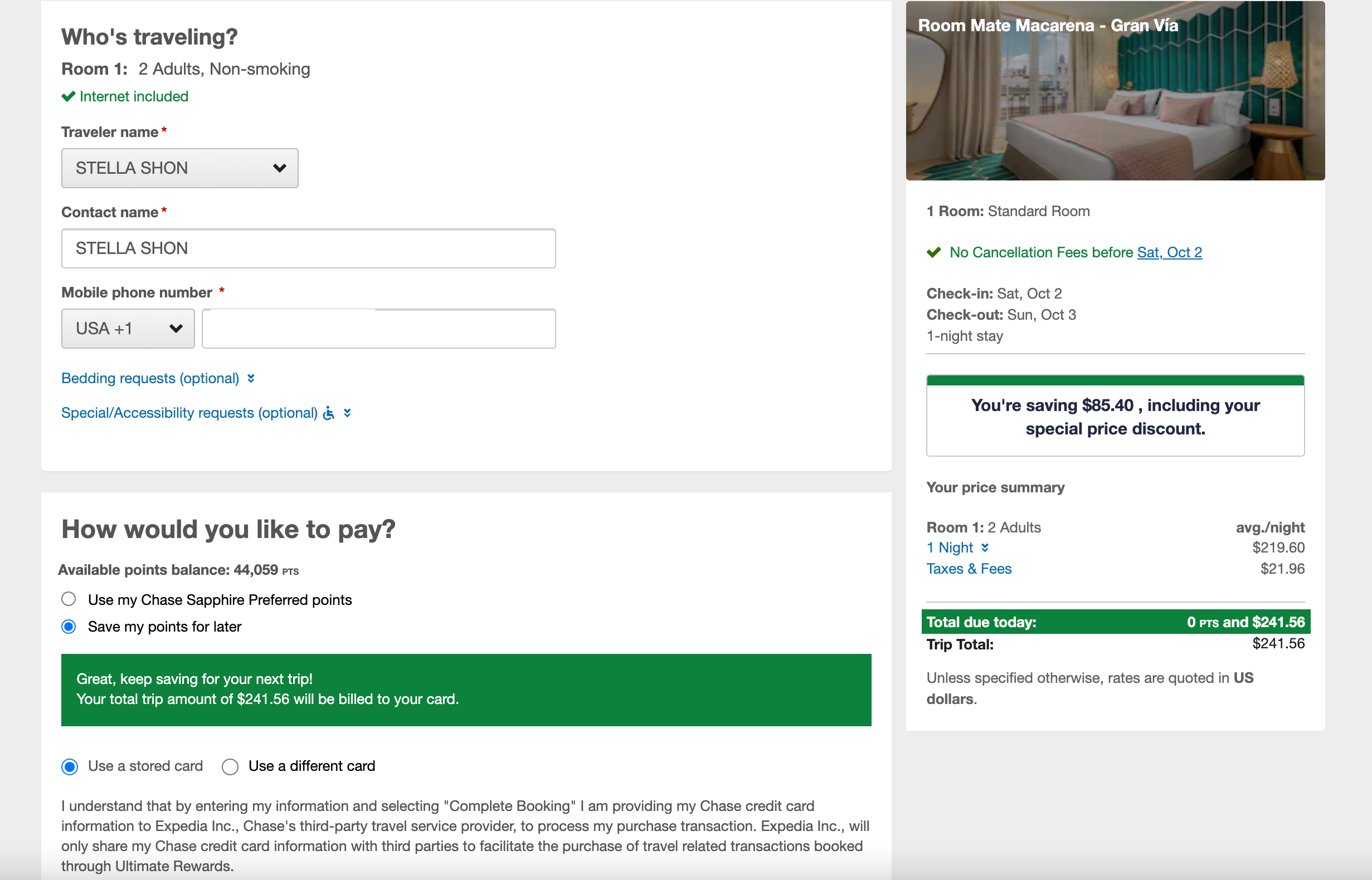

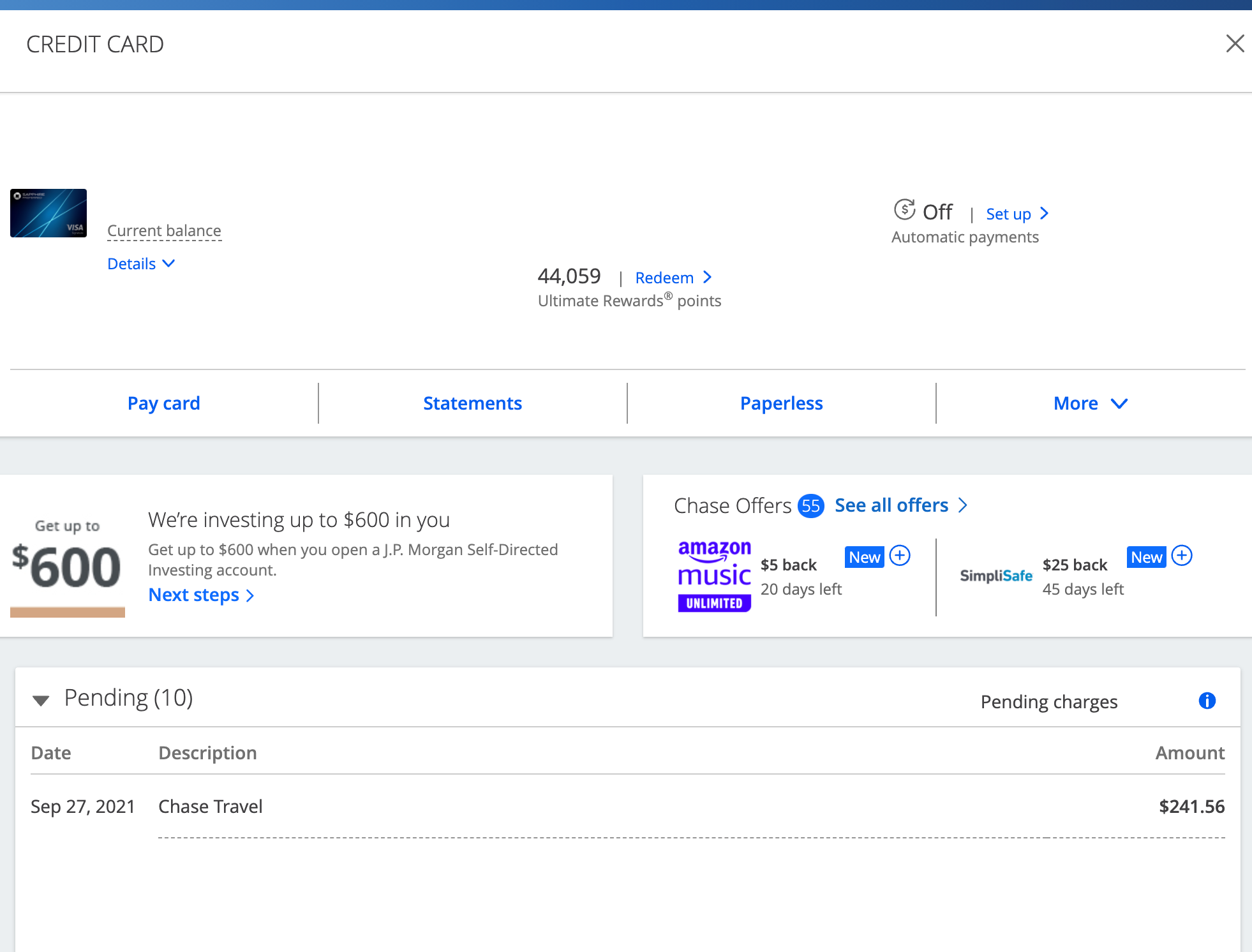

How to use the chase travel portal.

One of the many perks of using a Chase branded credit card is the opportunity to earn and redeem points for travel-related purchases. What’s more, did you know that you could maximize your points value and reap even more rewards points by booking through the Chase Travel portal?