- Jump to Accessibility

- Jump to Content

Enjoy a range of exclusive travel perks and discounts

On this page:

What's included?

Your Premier Reward Black account offers a range of travel perks, including:

Worldwide family travel insurance

Access to over 1,100 airport lounges

No Non-Sterling Transaction Fee on debit card purchases abroad

Worldwide travel insurance

Travel cover for the whole family.

Our insurance provides cover for you and your eligible family for trips up to 90 days, including 31 days for winter sports.

Underwritten by AWP P&C SA and administered by AWP Assistance UK Ltd trading as Allianz Assistance

Who is covered.

Family cover includes you and your partner, plus any dependent children under age 18 at the start of the journey, (under 23 if they’re in full-time education). Children must be living at the home address (or with the other parent), and be neither married nor in a Civil Partnership.

Your partner is the person you, the account holder, live with at the same home address in a relationship, whether married or cohabiting.

Existing medical conditions

To find out if you can extend your travel insurance to include cover for any new or existing medical conditions please visit our travel insurance website . You may have to pay extra for this or you may find that your condition cannot be covered.

If Allianz Assistance are unable to offer you an upgrade to extend the level of cover you need, or your upgrade insurance premium is higher than you expected because you have medical conditions, help could still be available.

You may be able to obtain alternative travel insurance cover for pre-existing medical conditions by contacting one of the providers featured in the MoneyHelper Directory of specialist travel insurance providers for people with serious medical conditions. Do take time to study and compare the terms and conditions to ensure you have the cover you need.

Telephone: 0800 138 7777 Relay UK: 18001 0800 138 7777

Monday to Friday, 8am to 6pm Saturday, Sunday and Bank Holidays, closed

Cover for those aged 70 or over

If anyone covered by this policy is aged 70 or over, you will need to contact us to pay for a £75 annual age extension upgrade for each person insured aged 70 or over for cover to apply.

Call us on:

UK: 0345 266 8801 Relay UK: 18001 0345 266 8801

Lines are open 8am-8pm Monday - Friday, 9am-5pm Saturday, 10am-5pm Sunday and bank holidays. We are closed Christmas Day, Boxing Day, New Year's Day and Easter Sunday.

How do I make a claim?

To make a travel insurance claim please log in to membership services or call us:

UK: 0345 266 8801 Relay UK: 18001 0345 266 8801

Lines are open 9am-6pm Mon-Fri, and closed Saturday, Sunday and bank holidays.

In an emergency:

If you need emergency assistance whilst abroad call us on:

International: +44 (0)208 666 9277

Lines are open 24/7, 365 days a year. Charges may apply. Calls may be recorded.

Worldwide Airport Lounge Access

To pre-book visit the DragonPass app and follow the on-screen instructions. Not every lounge allows pre-booking and will be subject to availability. £5 pre-booking fee will apply.

Provided by Assurant (a trading name of Lifestyle Services Group Limited) and DragonPass International Limited.

Getting started with dragonpass premier+.

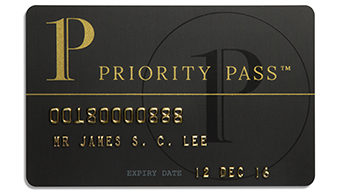

We’ll automatically send you a DragonPass Premier+ membership card in the post when you open or upgrade to a Premier Reward Black Account. The card will take around a week to arrive.

Download the DragonPass Premier+ app before you travel to check lounge listings, opening and closing times and any restrictions that may be in place. It also gives you information on restaurant and spa offers as well as the ability to pre-book certain lounges.

Download DragonPass Premier+ app

Getting access

Remember to take your DragonPass Premier+ membership card with you when you travel.

If you have a joint account and are travelling with the other account holders, you will both need to have your membership cards (either the plastic card or digital version available through the app) and present them upon arrival at a lounge.

Guests travelling with you, who don’t have a Premier Reward Black account, can use the lounge for a payment of £24 per person.

Enjoy additional airport discounts

You are also eligible to receive discounts at over 1,000 airport cafés and restaurants, a handy alternative where no lounge access is available.

DragonPass Premier+ also gives you access and exclusive discounts at airport spas to truly relax and unwind before your flight.

Relax in over 1,100 lounges across the globe

Your account comes with DragonPass Premier+ membership, giving you unlimited access to over 1,100 international airport lounges, including over 40 in the UK.

Using your debit card abroad

Use your debit card for purchases anywhere in the world.

- No Non-Sterling Transaction Fee when you make a payment outside the UK or payment in a foreign currency

- Not valid for ATM withdrawals, and local fees may apply

Check out our Life Moments Travel section for information on charges and tips for travelling abroad

Have an existing Travel Service booking?

The Travel Service was withdrawn on 1 March 2024. The Travel Service team are still available to support existing bookings, and you can continue to manage your booking, including making a payment, online.

Visit Membership Services or call us on 0345 266 8801 (Relay UK 18001 0345 266 8801).

Lines are open 8am-8.30pm Monday to Friday; 8am-6pm Saturday, Sunday and Public Holidays; closed on 25th December. Please be advised calls are recorded for training and quality assurance purposes.

Your Premier Reward Black account documents

Please take some time to review, print and/or save a copy of these.

- Account Benefit Terms (PDF, 519 KB)

Find answers in our FAQs

HelloSafe » Travel Insurance » Reviews by Travel Insurance Companies » Royal Bank of Scotland Travel Insurance

Royal Bank of Scotland Travel Insurance Review and Quotes

verified information

Information verified by Adeline Harmant

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

Table of Contents

It might be the least exciting thing about your journey. But travel insurance is a must-have when it comes to getting assistance from the other side of the world.

Are you aware of this and are here to know whether Royal Bank of Scotland is the right company to go on holidays with?

In this definitive Royal Bank of Scotland review, we will tell you everything you need to know about their travel insurance policies: coverage options, prices, contact details, cancellation or claim process and much more. Let’s dive in!

Is Royal Bank of Scotland the best travel insurance for you?

Always just going for the cheapest travel insurance might not be the best option when it comes to getting assistance or a refund abroad.

At Safe, we strive to help any people travelling from the UK to get the best travel insurance to leave home with complete peace of mind. This is why we’ve dug into Royal Bank of Scotland travel insurance policy booklet and attributed our own neutral rating based on five weighted criteria as shown below.

4,2 Safe overall rating for Royal Bank of Scotland

Royal Bank of Scotland travel insurance reviews by expert and consumers

To check if Royal Bank of Scotland is the right travel insurance for you, you can use our free travel insurance comparison tool and get quotes from main travel insurance companies in a few seconds only. 100% anonymous and free.

Find the best travel insurance in just a few seconds!

What does Royal Bank of Scotland travel insurance cover?

Royal Bank of Scotland travel insurance offers different travel insurance covers to suit any traveller needs, whether you’re leaving for three days alone in Scotland or six months in Antarctica with your partner or whole family.

RBS's travel insurance policies are available to individuals, couples and families.

Royal Bank of Scotland single-trip and annual multi-trip travel insurances

You will find below the limits breakdown per level of cover for single and annual multi-trip insurance policies at Royal Bank of Scotland:

Royal Bank of Scotland winter sports travel insurancet

The winter sports travel insurance is usually an option that you can take on top of your single or annual multi-trip policy.

Winter Sports Cover is included as standard across all account types at RBS and it comes with the following benefits:

- Up to £400 ski equipment cover

- Up to £250 ski pack cover

- Up to £200 avalanche cover

- Up to £930 piste closure cover.

What are the other travel insurance options available at Royal Bank of Scotland?

Due to Brexit, some outbound flights from international airports might be delayed or cancelled. We would advise you to call Royal Bank of Scotland before travelling and make sure you get the right compensation amount for your flight or journey if it is cancelled or delayed as well as for Schedule Airline Failure Cover.

How much is Royal Bank of Scotland travel insurance?

You'll find below indicative quotes per level of cover at Royal Bank of Scotland:

It is, however, quite difficult to give precise price ranges as Royal Bank of Scotland travel insurance policy quotes will depend on a range of factors such as:

- Your age at the time of travelling

- The length of your stay

- Your trip destination (Europe, North America, Worldwide)

- The period you wish to be covered for (single trip, annual multi-trip, extension)

- If you need specific insurance (cruise, ski, backpackers, gadget cover)

- Your medical condition before travelling

- Who is travelling with you (on your own, as a couple, as a family).

Can I get travel insurance discounts or promo codes at Royal Bank of Scotland?

There are no discounts mentioned on the website.

Use our travel insurance comparison tool to be aware of latest promo codes and vouchers available at Royal Bank of Scotland.

What else should I know about Royal Bank of Scotland travel insurance?

What are the general exclusions at royal bank of scotland travel insurance.

To be eligible for a travel insurance policy at RBS:

- You must be a UK resident

- You have to have a valid Reward Bank Account at RBS

- You must be transparent about any pre-existing medical conditions of everyone named on the policy

- You must not exceed the period of insurance unless you bought a trip extension cover

- You must be 69 years or below unless you bought an age extension cover

- You must be travelling with the intention to return home.

How do I get travel insurance quote from Royal Bank of Scotland?

Nothing easier. Use our 100% online travel insurance comparison tool to compare all policies in just a few seconds, without giving any personal details. If Royal Bank of Scotland is the right one for you, then just click on get quote and you'll be automatically directed through the company's sale channel.

Good to know

Shopping around while shopping for personal insurance and not auto-renewing is always the best way to get the best deal and benefit from new customers discounts.

How do I log in to Royal Bank of Scotland website?

Through the customer portal, you can learn about your benefits, use your benefits online, view your benefits usage history and also make claims. You can click on the customer portal link .

How to claim at Royal Bank of Scotland travel insurance?

There are 2 ways to make a claim and that is either online or through a phone call.

How do I contact Royal Bank of Scotland travel insurance?

Royal bank of scotland contact phone numbers, royal bank of scotland other contact details, how to cancel your annual royal bank of scotland travel insurance policy.

You will find below main information to cancel your travel insurance policy at Royal Bank of Scotland:

Our opinion on Royal Bank of Scotland travel insurance

RBS's travel insurance policies are underwritten by U K Insurance Limited which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

They offer Annual Multi Trip insurance policies as standard across their Reward Bank Accounts: Silver, Platinum and Black. Instead of paying an insurance premium, you only pay a monthly fee of maintaining your Reward Current Bank Account. The period of insurance varies across the levels of covers with Silver covering 22 days per trip, Platinum covering 31 days per trip, and Black covering 90 days per trip. Winter Sports Cover is included as standard across all 3 accounts. The Silver account offers European Travel Insurance while the Platinum and Black accounts offer Worldwide Travel Insurance.

In addition to the travel insurance, you can also enjoy the following benefits when opening a Reward Bank Account at RBS:

- Mobile phone insurance

- Debit card purchases abroad at no extra charge

- UK car breakdown cover

- Discounts on holidays when you book with Platinum Travel Service

- Two free UK airport lounge passes with each Platinum Travel Service holiday booking.

We would recommend Royal Bank of Scotland to anyone looking to open a current bank account that comes with a travel insurance cover as standard.

Alexandre Desoutter has been working as editor-in-chief and head of press relations at HelloSafe since June 2020. A graduate of Sciences Po Grenoble, he worked as a journalist for several years in French media, and continues to collaborate as a as a contributor to several publications. In this sense, his role leads him to carry out steering and support work with all HelloSafe editors and contributors so that the editorial line defined by the company is fully respected. and declined through the texts published daily on our platforms. As such, Alexandre is responsible for implementing and maintaining the strictest journalistic standards within the HelloSafe editorial staff, in order to guarantee the most accurate, up-to-date information on our platforms. and expert as possible. Alexandre has in particular undertaken for two years now the implementation of a system of systematic double-checking of all the articles published within the HelloSafe ecosystem, able to guarantee the highest quality of information.

Royalties Gold Service Guide - Royal Bank of Scotland

- Download HTML

- Download PDF

- Current Events

- Arts & Entertainment

- Uncategorized

- Government & Politics

- IT & Technique

- Food & Drink

- Hobbies & Interests

- Style & Fashion

You are using an outdated browser. Please upgrade your browser to improve your experience.

No results found

Try adjusting your search to see more results.

A company can partner with Smart Money People and invite their verified customers to leave a review. When they do this it’s labelled as "Verified source" on the Smart Money People website.

There are a number of automated invitation techniques available to businesses. All of which are trusted and ensure that only verified customers can leave reviews through them.

RBS: Black Current Account reviews

No new 5 star reviews, no new 1 star reviews, latest highest rating:.

Latest lowest rating:

About the Black Current Account

The RBS Reward Black Current Account charges a monthly fee and provides account holders access to a range of benefits. These include a 24/7 Concierge Service, family travel insurance, breakdown cover and other redeemable rewards. Only existing RBS current account holders can switch to the Reward Black Account. Before opening a new bank account, it’s important to do your research and be confident that it’s right for you. We collect RBS Reward Black Current Account reviews from genuine account holders. Make an informed decision about your new current account by reading the reviews on Smart Money People. Find out how long account holders have had their Reward Black Account. Learn more about the perks and benefits to decide if they’re right for you. Read about genuine experiences with the customer service team to find out how swiftly customer concerns get resolved. Find out what existing customers say the best part of the account is, and which aspects they feel could be improved. All of this and more can be found in our RBS Reward Black Current Account reviews. If you have an RBS Reward Black Account, share your experience with our Smart Money People community. What drew you to this current account, and have you been satisfied so far? Which of the benefits do you use the most? Would you say that the perks and benefits of the account are worth the monthly fee? If you use the RBS mobile banking app, which features are the most useful? Would you recommend this account to your family and friends? Whether good or bad, write an honest RBS Reward Black Current Account review today. Together, we can help people like you make better financial decisions.

Review RBS: Black Current Account now

Rbs black current account reviews ( 16 ), worst service, travel insurance service is appalling.

Great Account/Benefits and Service

Great mobile app.

Showing 4 of 16

Do you have a different RBS product?

There's still more to see!

Join smart money people.

Keep up to date on ratings of your favourite businesses. Find out about our awards and write new reviews with ease

News, guides and insight from our team

How customer reviews can help with SEO

Get your finances in shape: Ten things to check in 2024

The cost of having a baby in 2024

How to share customer feedback with senior managers

- BOOKING ENQUIRY

- Beginners guide

- Hotel reviews

- Flight reviews

- Airline Lounge Reviews

- Travel companies, luggage, travel tech & apps

- Destination Dining

- All other destinations

- Join our email list & data protection

- Youtube and Podcast

- Airport hotels

- American Airlines

- Black Friday 23

- British Airways

- British Airways Executive Club

- Business class

- competition

- Credit cards

- Destinations

- First class

- Heathrow and Gatwick

- London hotels

- Michelin star dining

- reader questions

- Reader review

- Star Alliance

- This Week in Travel

- UK country hotels

- Virgin Atlantic and Virgin Atlantic Flying Club

Which bank accounts offer travel benefits?

- 16 September 2017

Reader Andy wrote to me about some of the savings he was getting from his RBS account, so I thought it was worth a look at what you can get with some bank accounts for travel perks.

RBS Black Account

To qualify for an RBS Black account you need to be aged 18 or over, and a UK resident with either £100,000 sole income to be paid into the account, a Royal Bank mortgage of at least £300,000, or £100,000 in Royal Bank savings and investments. You can find more on the black account benefits here.

The account costs £27 a month which is pretty steep. For this you receive the following travel related benefits amongst others:

- Worldwide travel insurance

- Travel Service – discounts on flights and holidays

- Preferential Rates on Travel Money

- Worldwide Airport Lounge Access – Priority Pass

- Mobile phone insurance

- UK Car Breakdown Cover including Homecall

- 24/7 Concierge service.

There is also a slightly cheaper Platinum account which does not include the lounge access or Concierge.

Is it worth it?

As with all things, you need to work how much you, personally, would use all of the benefits weighed against the £324 a year. The travel service and the lounge access will be of most interest to frequent travellers. The Travel service actually has some good discounts such as 10% off Qatar Airways including sale fares and ex EU. It does, however, exclude the tax portion of the fare for the discount. If you were to buy 2 business class tickets a year using this it could potentially pay for the account fees on one trip.

The Priority Pass membership is worth around £259 on its own and is useful if you travel in economy, don’t have airline status, or travel with more people than you can guest in using your airline status. £15 to guest someone is pretty reasonable compared to most lounge charges of around £25-35 a visit. You could also get this benefit from the Amex Platinum card but that comes with a much steeper fee, albeit with a big miles bonus and some high tier hotel loyalty status.

HSBC Premier

The HSBC Premier account is pretty tricky to qualify for but if you can, or could qualify, it is worth considering. You need to

1) have savings or investments of at least £50,000 with HSBC in the UK; or 2) have an individual annual income of at least £100,000 and one of the following products with HSBC in the UK:

- a mortgage;

- an investment, life insurance or protection product;

Interestingly, there is no fee for the account but if you apply for the HSBC Premier World Elite Credit card, which is the main perk of the account, you will pay a £195 annual fee.

The main perks of the account are:

- Worldwide Travel Insurance Worldwide Travel Insurance available to the UK, the Channel Islands or the Isle of Man residents under the age of 70, to give you some peace of mind if the unexpected happens. Subject to status and meeting HSBC’s UK proof of address requirements.

- If your credit cards are lost or stolen, replacements within 36 hours. Or if your cash is lost or stolen, up to US $2,000 emergency cash transfer.

- Points that convert into Avios, Etihad Guest, Asia Miles and Singapore Airlines Krisflyer miles at 2 points to 1 mile

- Free lounge access with membership to the LoungeKey programme, with complimentary access to over 750 airport lounges worldwide just by showing your credit card

- Additional cardholders will receive unlimited airport lounge access for an annual fee of £60.

- Complimentary, unlimited Wi-Fi via iPass with over 50 million Wi-Fi hotspots,

- Receive a £20 Uber promo code every time you purchase airline ticket(s) (value of £500 and above) using your HSBC Premier World Elite Mastercard.

- 10% discount on selected hotels booked with your Premier Credit Card through Expedia and Agoda. Cardholders also benefit from 12 months complimentary Expedia+ Gold Membership.

- 40,000 Reward Points when you spend £12,000 or more on your Card within the first 12 months of card membership.

- A range of benefits applicable to the Mastercards UK Elite cards with exclusive privileges and elite benefits from over 40 global travel and lifestyle brands with VIP Status, Room Upgrades and Car Hire Upgrades, including Mandarin Oriental, Savoy, Raffles, Sofitel, Radisson, Hertz.

- Earn up to 1 point per £1 spent in Sterling. 2 points = 1 airline mile

The HSBC comes with one big advantage, the HSBC Premier World Elite Credit card. The card offers Avios at a much better rate for Mastercard than other UK Avios cards along with a host of other benefits.

The earning rates are as follows:

- Earn two points for every £1 of eligible spend in sterling currency and earn four points for every £1 of eligible spend in non-sterling and redeem against vouchers for frequent flyer miles. 2 points = 1 Avios

You can also receive points worth an extra 20,000 Avios if you spend a total of £12,000 in your first year. These only are paid into your account until after your 12 months of membership. Personally, if I was only spending £10-12k a year on credit cards and only really wanted the Avios from the card, I would go for the Premium BA Amex card as a 2-4-1 voucher would potentially save you a lot more than 12,000 Avios. However, the other perks and sign up bonus may make the difference.

The main perk is the Mastercard with a good miles earnings rate but it would only be worth it if you go are likely to need to spend a considerable amount on MasterCard instead of Amex. Most Amex cards offer a better miles earning rate. The lounge access is also valuable if you will use it but not as good as Amex Platinum where you get a free guest on every visit.

Barclays Travel Pack Plus

This is an add-on to an existing Barclays current account and comes with

- Worldwide multi-trip family insurance for you and your family

- UK and European RAC comprehensive breakdown cover

- 6 airport lounge passes

- Airport parking and hotels discounts

The fees are pretty hefty at £15.50 a month with a minimum of a 6 month sign up. If you would use all the benefits this may well just about justify the fee but it will be pretty close. Of course, you could just sign up for 6 months and use all 6 lounge visits before you cancel, making it better value. Free travel insurance often precludes many medical conditions so it is always worth seeing if the insurance is actually suitable for you. You can find more information here .

Out of the 3 accounts, I would probably be tempted to go for the HSBC account due to the lower costs and the additional Avios and the other benefits, but it is a tough criteria for most people to meet.

Do currently hold one of these accounts? Have you found the benefits to outweigh the costs of them? Let me know in the comments or via scoial media?

Disclaimer: Turning Left for less is a journalistic site and does not offer financial advice. Nothing here should be construed as financial advice, and it is your own responsibility to ensure that any product is right for your circumstances. TLFL does not feature all offers, bank accounts, credit cards etc and readers should do their own due diligence. Any credit cards or bank accounts featured are discussed solely in terms of the travel benefits to the reader and should not be construed as financial advice.

Related Topics

News & offers: Free night with Marriott and Etihad changes

- 15 September 2017

Gordon Ramsay’s new Plane Food Heathrow Terminal 5 review

- 17 September 2017

Input your search keywords and press Enter.

Travel Insurance

More coverage in more places ®.

Get out there and enjoy yourself knowing you have the right coverage and 24/7 access to a caring team who’s always on call—no matter how big or how small the emergency.

More Coverage In More Places™

- Coverage Types

- Submit Claim

Explore Your Coverage Options

Travel packages.

Coverage for the widest range of unexpected travel situations.

Travel Medical

Coverage to fill the gap left by my provincial health insurance.

Cancellation & Interruption

Coverage for non-refundable and/or non-transferable trip expenses if my trip is cancelled or interrupted.

Visitors to Canada

When visiting, immigrating to or studying in Canada and need emergency medical coverage.

Travel Insurance Advice by Trip Type

Choose from the topics below for some quick advice on the type of coverage that may be right for you:

Travel Insurance FAQs

Have a question about travel insurance? Get the answers you need here.

For questions about travel and COVID-19, please visit the COVID-19 page.

- Eligibility

- Emergencies

Our goal is to make affordable travel insurance coverage available to as many Canadians as possible. In general, any Canadian resident can purchase some form of coverage with us. Factors such as where you are travelling, your health and the length of your trip may affect the specific coverage(s) available to you.

Note : Non-residents travelling to Canada, immigrants to Canada or foreign students studying in Canada may be eligible to purchase one of our Visitors to Canada Plans.

Generally speaking, no. While your age can affect your eligibility for certain coverages, we have packages and plans that cover all age groups. If you are age 65 or older, we may ask you to answer a few questions about your health to make sure you have the most appropriate coverage.

Yes, you may purchase a policy for your parents. Simply call us at 1-866-896-8172 , buy online , or visit an RBC Insurance Store . Depending on their age, they may be required to complete health questions in order to obtain coverage. If this is not a requirement, please keep in mind that all terms and conditions apply to your parents, therefore we recommend that you review the insurance with them prior to purchase.

Possibly. Depending on your age, medical condition and, if applicable, your answers to our health questions, pre-existing medical conditions are covered if they are stable for a certain time period (as specified in your policy) before your policy's effective date.

Note: Please refer to the policy document for complete coverage details regarding pre-existing conditions.

Your answers to the health questions (if applicable) will be used to help determine the benefits you are eligible to receive under your insurance policy.

When answering the health questions:

- Take your time. The questions may take up to 10 minutes to complete.

- You (the applicant) should complete and sign the Medical Questionnaire. (If you have someone else complete the Medical Questionnaire on your behalf, it is still your responsibility to make sure the answers to the questions are correct.)

- Read and answer each question carefully and accurately. Review your answers to confirm they are correct. Incorrect answers may lead to your coverage being voided or your claim denied.

- Have your prescriptions or a description of your medications nearby for reference.

- If you are unsure about any questions regarding your medical condition or medications, please speak to your physician.

If necessary, a family member or close friend can complete the questions on your behalf. Please keep in mind, however, that it is still your responsibility to sign the form and make sure the answers are correct.

Yes, it is recommended that you buy coverage for your spouse as well.

This answer depends largely on your child's age.

- If your child is under 2 years old and you are purchasing the Deluxe Package or a TravelCare ® Package, then your child receives emergency medical coverage at no extra cost.

- If your child is 2 or older , you'll need to purchase emergency medical coverage for him or her.

- No matter how old your child is , if you've purchased an airline ticket or made a separate trip deposit for him or her, consider buying a travel insurance package or trip cancellation and interruption insurance .

The right coverage for your trip depends on several factors, including (but not limited to) where you're travelling to, how long you’ll be gone, the kind of transportation you'll be using and, in some instances, your overall health. View all of our travel insurance products now.

An accident, illness or medical emergency can happen anywhere, anytime. If you need medical care or treatment in another country, your government health plan may cover only a portion of the costs. Travel insurance starts where these plans leave off.

Plus, with our emergency medical coverage, you have access to the multilingual representatives of Allianz Global Assistance.

Yes, if you are travelling outside your home province or territory. There are several reasons why it's important to get travel medical insurance when you're travelling within Canada. One reason is that accidents can happen anywhere. Another is that government health insurance plans do have limits on reimbursement of emergency medical expenses incurred while you are in another province. For example, the ambulance, emergency dental treatment and prescription drugs might not be covered by some government health insurance plans.

You may extend your coverage if you extend your trip, subject to certain conditions of your policy.

If you've purchased a single trip plan, the following conditions apply:

- If you have not had a medical condition during your trip or while covered under your policy, you can request an extension by contacting us at 1-866-896-8172 before your original policy’s expiry date.

- If you have had a medical condition during your trip and while covered under your policy, you must request the extension by contacting Allianz Global Assistance before the expiry date of your original policy. Your extension is subject to the approval of Allianz Global Assistance.

- You must pay the required additional premium before your original policy’s expiry date.

- If we are unable to extend your particular policy's coverage due to the trip duration limits of your policy, you may be able to purchase a new policy from us.

If you've purchased a multi-trip annual plan, the following conditions apply:

You may purchase a top-up policy for the additional number of days beyond the duration covered by your multi-trip annual plan as follows:

- Before your effective date, you may contact us at 1-866-896-8172 to purchase top-up coverage.

- After your effective date and if you have not had a medical condition during your trip, you must contact us at 1-866-896-8172 before your original policy’s expiry date to purchase top-up coverage.

- After your effective date and if you have had a medical condition during your trip, you must contact Allianz Global Assistance before your original policy’s expiry date to request approval for and to purchase top-up coverage.

- The terms, conditions and exclusions of the new top-up policy apply to you.

- You must pay the required top-up premium on or before the effective date of the top-up period.

If you do NOT top-up your coverage for a trip, you will not be covered for any claims you make outside the period of insurance for that trip. If the top-up policy you are purchasing requires you to complete health questions, you must complete the health questions.

Please see the policy documents for complete coverage details regarding trip extensions.

It may, but not always. We recommend that you carefully review the travel insurance coverage provided by your credit card, as well as any special conditions or stipulations.

Do you have an RBC Royal Bank ® credit card?

To review the travel insurance coverage that comes with your RBC Royal Bank credit card, visit: www.rbcroyalbank.com/cards/documentation/index.html and click the "Insurance Certificate" link for your card.

We recommend that you carefully review your government health plan coverage. Government plans may not cover all emergency medical expenses once you leave your home province/territory and typically cover only a limited portion once you leave the country. In fact, the Canadian Government (Foreign Affairs, Trade and Development Canada) urges Canadians to purchase supplemental health insurance when leaving the country. They say:

Do not rely on your provincial or territorial health plan to cover costs if you get sick or are injured while abroad. Out-of-country health care can be costly, and your health plan may not cover any medical expenses abroad. It is your responsibility to seek information from your provincial or territorial health authority and to obtain supplementary travel insurance and understand the terms of your policy. 2

Plus, government health insurance plans don't guarantee coverage for special care (air ambulance or emergency dental services, for instance).

Unlike government health insurance plans, our insurance offers you:

- Unlimited coverage for eligible medical expenses 1

- Up-front payment of eligible medical expenses whenever possible

- 24-hour, multilingual emergency medical assistance—one toll-free phone call puts you in touch with a multilingual professional who will refer you to a local doctor or facility in order for you to receive the care you need

Government health insurance plans also don't provide coverage for situations such as lost, damaged or delayed baggage or trip cancellation and interruption. Our travel insurance can provide these coverages and more.

Yes, you do need travel insurance to protect yourself against the unexpected, even if you are going to the United States for a few days. An illness or accident can happen at any time, whether you're on the road for a few days, or a few months. And remember, the cost of health care is very expensive in the United States and very little of this cost would be covered by your government health insurance plan, credit card or company benefits plan. For a short trip, the cost of travel insurance is minimal, and it gives you the protection you need.

If you purchase trip cancellation and interruption insurance, it will help pay for your expenses to return home in the event of a covered emergency. There are a number of circumstances that qualify as an emergency (for example, the death or serious illness of a family member). The cost of cancelling a trip prior to departure can be very expensive, as most trips are non-refundable and/or non-transferable, especially if you have to cancel just before leaving on your trip. Having to return early from a trip can also be very expensive. Either way, trip cancellation and interruption insurance is very important to protect your travel investment.

You must purchase coverage before departing on your trip. You may benefit from purchasing coverage as soon as you make your initial trip deposit, especially if you are purchasing trip cancellation and interruption insurance —either as stand-alone coverage or as part of one of our insurance packages .

If you were to book your trip 6 months in advance, consider the unexpected situations that could occur in that time.

If you purchase travel insurance from RBC Insurance, we will pay the eligible bills directly to the hospital or physician whenever possible.

There are a number of sports that are not covered during your trip. For more details, see the Exclusions section of the individual policy document.

You may purchase a top-up policy for the extra number of days beyond the duration covered by your multi-trip annual plan. Here are the conditions:

- After your effective date and if you have had a medical condition during your trip, you must contact Allianz Global Assistance before your original policy’s expiry date to request approval for and purchase top-up coverage.

Please see the policy document for complete coverage details regarding top-up coverage.

If you purchase one of our travel medical insurance plans—either Classic Medical or TravelCare ® Medical—you can, subject to certain conditions:

- If you are travelling for more than 183 days, you may purchase single trip coverage for up to 365 days provided that you are covered under your government health plan for the full duration of your trip.

- If you are 40-74 years of age , you must also answer a few health questions, which will determine whether you are eligible to purchase coverage for trips beyond 183 days.

Yes, if you are travelling with your spouse/partner and children or other family members, you could save money with our family plan pricing.

The cost of a trip can be a significant financial investment. A lot can also happen in the time between booking your trip and departing—if a medical emergency or other unexpected event prevents you from going on your trip, you could potentially lose some (or possibly all) of the money you paid.

With trip cancellation and interruption insurance, you're protected when certain situations prevent you from travelling as planned. Examples include:

- You can't travel due to an illness, job loss or immediate family member's medical emergency

- You need to return home earlier than scheduled because of a family emergency or medical condition

Note : We strongly recommend that you purchase trip cancellation and interruption insurance at the time you pay your initial travel deposit. Please see the policy document for complete coverage details, including terms and conditions.

Yes! Tell them about our Visitors to Canada Plans , which offer affordable emergency medical protection to visitors, immigrants, foreign students and Canadians without government health plan coverage.

We strongly recommend you do. Your insurance policy is a valuable source of information and contains provisions that may limit or exclude coverage. Please read it before you go, keep it in a safe place and carry it with you when you travel.

RBC Insurance has appointed AZGA Service Canada Inc. (operating as “Allianz Global Assistance”) as the provider of all assistance and claims.

Whether you have a new claim or questions about an existing claim, representatives will work with you to make things as easy as possible. Visit the Travel Insurance Claims page for more details about how to submit a claim.

It's our goal to settle every claim as quickly as possible. While every claim is different, there are things you can do to speed things up:

- If you require emergency care on your trip , call our emergency contact number immediately, or at the earliest possible opportunity (someone else can call if you're unable to). If you do not, your coverage may be limited and your benefits could be reduced.

- If you need to cancel your trip prior to departing , call your travel agency, airline, tour company or the carrier immediately to cancel your trip no later than one business day after the cause of cancellation. Call Allianz Global Assistance the same day.

- For all claims , carefully read the instructions for submitting your claim. Make sure you fully complete any required claims forms and submit all required documentation at your earliest possible convenience. For example, you may need to provide information on your past health history if you are submitting an emergency medical claim or a trip cancellation claim due to a medical condition.

The documentation you need to provide will depend on the type of claim, the type of plan you purchased and the province/territory in which you live. Visit the Travel Insurance Claims page for more details about how to submit a claim.

No matter where in the world you are, we’ll be here for you. If you have an emergency, you can call Allianz Global Assistance toll-free 24 hours a day, 7 days a week at 1-855-947-1581 from the U.S. and Canada or (905) 816-2561 collect from anywhere in the world . Or as an alternative, you can email Allianz Global Assistance at: [email protected] . Disclaimer 3

The multilingual representatives of Allianz Global Assistance are ready 24 hours a day, seven days a week when you have a medical emergency. You can rely on them to refer you or (when medically appropriate) transfer you to one of the accredited medical service providers within the Allianz Global Assistance network, so you can receive the care you need as quickly as possible.

Because the representatives are multilingual and have 24-hour access to real-time translation services, they can provide the help you need in your own language—and also have someone to communicate on your behalf with medical personnel who may speak a different language.

Whenever possible, Allianz Global Assistance will also request for the medical service provider within the network to bill the covered medical expenses directly to us instead of you—reducing stress and hassle.

Yes, as soon as medically possible. There are several reasons to call the emergency contact number first:

The multilingual representatives of Allianz Global Assistance are experienced experts in coordinating emergency care for travellers in foreign lands.

They're available 24 hours a day, seven days a week.

If you don't call Allianz Global Assistance first, your benefits may be reduced and your coverage may be limited. As stated in your policy, if you do not contact Allianz Global Assistance at the time of your medical emergency or you choose to receive treatment from a medical service provider outside the Allianz Global Assistance network, you will be responsible for 30% of your medical expenses covered under your insurance and in excess of your medical expenses paid by your government health plan.

You can call Allianz Global Assistance toll-free 24 hours a day, 7 days a week at 1-855-947-1581 from the U.S. and Canada or (905) 816-2561 collect from anywhere in the world.

Of course, obtaining urgent care in an emergency is your #1 priority—and our representatives are here to help at our toll-free emergency contact number. However, if your medical condition Opens in new window prevents you from calling before seeking emergency treatment, then you must call as soon as medically possible.

Someone else (a family member, friend, hospital or physician's office staff, etc.) may call on your behalf–so it's a very good idea to carry your RBC Insurance travel insurance wallet card with you at all times.

They may call Allianz Global Assistance toll-free 24 hours a day, 7 days a week at 1-855-947-1581 from the U.S. and Canada or (905) 816-2561 collect from anywhere in the world.

Or as an alternative, they can email3 Allianz Global Assistance at: [email protected] .

We will pay your eligible medical bills directly to the medical provider or hospital for you whenever possible.

Travel together. Save together.

Travelling with a group of 10 or more? Save with a group discount and enjoy all the benefits of RBC ® Travel Insurance.

Reasons to Love RBC Travel Insurance

Coverage available for all ages.

If you are travelling with your spouse/partner and children or other family members, you could save money with our family plan pricing.

Simplified Medical Questionnaire

Age 65 or over? Buying travel insurance is faster than ever – no long, complicated medical questionnaires.

Variety of Coverages

Whether you’re going on an overseas adventure, or a quick jaunt to another province or state for the weekend, a variety of packages and plans are available to cover your travels.

24/7 Worldwide Emergency Medical Assistance

Experienced staff at the 24/7 assistance centre will provide:

- Caring, multilingual support

- Help finding local medical care

- Access to emergency air ambulances

- Access to expert medical professionals who will monitor your care

- Help with transportation to the nearest medical facility

For emergency medical and travel assistance

- See Emergency Contact Details

For questions about travel insurance or claims

- Speak to a Travel Advisor at 1-888-896-8172

- Get a Quote

View Legal Disclaimers Hide Legal Disclaimers

JavaScript is required to use this site.

IMAGES

VIDEO

COMMENTS

Reward Black and Black account. Family travel insurance for trips in the UK and worldwide up to 90 days, including 31 days for winter sports. Includes medical expenses cover, cancellations, baggage and more. Cover for you, your partner, and dependent children under 18 (or under 23 if in full time education) at the start of the journey.

Use your travel benefits including worldwide travel insurance, airport lounge access, and Black travel service. ... Remember to take your DragonPass Premier+ membership card with you when you travel. If you have a joint account and are travelling with the other account holders, you will both need to have your membership cards (either the ...

Frequently Asked Questions. Our customer services and claims handling teams have listened to your feedback and used their knowledge to put together a list of answers to your most frequently asked questions. The frequently asked questions do not replace the terms and conditions of the policy. If you're still unsure or can't find what you're ...

Travel Insurance: - Operation of cover - Changes to your insurance - Health Issues - Country And Trip Length Issues - Activities Issues - Other Issues 10 - - Medical Declaration 13 - - Included Activities and Hazardous Activities 13 - - Part 1 - Covers For Your trip A. Cancelling Your Trip B. Delayed Or Missed Departure

Insurance Terms. 234006094.indd 1 8/15/18 6:40 PM. Generated at: Wed Aug 15 19:39:58 2018. Welcome. to RBS Platinum Travel Insurance Underwritten by U K Insurance Limited. This booklet contains everything you need to know about your travel insurance. This booklet includes your policy. Keep the booklet safe for when you need it,

U K Insurance Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registration number 202810. The Financial Services Register can be accessed through www.fca.org.uk. Calls may be recorded.

1,6/5 based on more than 120 opinions. Consumer satisfaction rates on reviews for Royal Bank of Scotland holiday insurance. To check if Royal Bank of Scotland is the right travel insurance for you, you can use our free travel insurance comparison tool and get quotes from main travel insurance companies in a few seconds only. 100% anonymous and ...

to take it with you whenever you travel. If you would like to extend the cover to include longer holidays or other friends and family. members, call Royal Bank Insurance Services on 03705 62 55 55 (Minicom 03706 00 08 56). Making a claim. l u0007call The Royal Bank of Scotland Claims Service on 03705 62 55 55.

2y. The Royal Bank of Scotland replied. ·. 1 Reply. Paul Gibson. We are currently in our holiday home in the US in isolation. Your agents told us we must return to the UK at the time of our scheduled travel (early June) regardless of the risk involved and there is no option to extend health insurance coverage. We ….

4. I recently changed to a Reward Platinum account and have already used two of the membership benefits to save on travel bookings I needed to make. Having my travel insurance, car hire, and current account in one place is extremely convenient - and saves me money! Reviewed on: 31st May 2023. SmartSaver.

This Travel Insurance is underwritten by U K Insurance Limited. Registered office: The Wharf, Neville Street, Leeds LS1 4AZ Registered in England and Wales No. 1179980. U K Insurance Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

The RBS Reward Black Current Account charges a monthly fee and provides account holders access to a range of benefits. These include a 24/7 Concierge Service, family travel insurance, breakdown cover and other redeemable rewards. Only existing RBS current account holders can switch to the Reward Black Account.

To qualify for an RBS Black account you need to be aged 18 or over, and a UK resident with either £100,000 sole income to be paid into the account, a Royal Bank mortgage of at least £300,000, or £100,000 in Royal Bank savings and investments. You can find more on the black account benefits here. The account costs £27 a month which is pretty ...

Discover your world of benefits online. Benefits by account type. Black. Platinum. Silver.

For questions about travel insurance or claims. Speak to a Travel Advisor at 1-888-896-8172. Get a Quote. View Legal Disclaimers. Hide Legal Disclaimers. Get an online quote and buy travel insurance online, or call 1-866-896-8172. We offer affordable packages, travel medical plans, trip cancellation coverage and more.

Registered office: 36 A Andrew Square, Edinburgh, EH2 2YB. We offer packaged bank accounts with travel insurance. Including multi-trip, family, European and worldwide cover required you, choose trip and your property.

This Travel Insurance is underwritten by U K Insurance Limited. Registered office: The Wharf, Neville Street, Leeds LS1 4AZ Registered in England and Wales No. 1179980.U K Insurance Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.